4.2.1. Description of Variables

- (1)

Skill premium (W)

The studies on regional skill premiums often classify workers based on their job functions. Specifically, workers engaged in scientific and technological activities are typically categorized as high-skilled labor, while those involved in production activities are defined as low-skilled labor (

Shao & Liu, 2011). With reliable data availability, this method has been widely used and established in academic research in China. This paper follows this method. Thus, the skill premium (W) is expressed as follows:

where W

H denotes the average wage of skilled labor, and W

L represents the average wage of unskilled labor. The average wage of skilled labor is proxied by dividing the personnel labor cost included in the intramural expenditures of R&D by the full-time equivalent (FTE) of R&D personnel in each region. For unskilled labor, the average wage is calculated by subtracting the total wages of skilled labor from the total wages of employees in urban non-private units, and dividing this residual by the number of unskilled workers, obtained as the difference between the total number of employees in urban non-private units and the number of R&D personnel.

In addition, to conduct robustness tests, we revise the measurement of the skill premium by distinguishing skilled and unskilled workers on the basis of educational attainment. Using micro-level labor market data from the China General Social Survey (CGSS), which provides detailed wage information, we classify individuals with more than a high school degree as skilled labor, while those with a high school degree or less are classified as unskilled labor. To construct the provincial-level skill premium (SP), we first compute average wages separately for skilled and unskilled workers within each province, and then aggregate them according to their region of residence. The limitation for this measurement is that the time range that meets the research criteria is only five years: 2011, 2013, 2015, 2017, and 2019, due to the CGSS database release reports every two years.

- (2)

Import Competition (IPW)

The core explanatory variable is import competition (IPW). Due to data limitations. We do not employ weighted import tariff indicators as a proxy for import competition, since the sample coverage and the variation in weighted tariffs across provinces and years are relatively small during the study period. Following

Bernard et al. (

2006) and

Federico (

2014), we measure import competition using import penetration, where a higher penetration ratio indicates stronger exposure to international competition. The calculation is defined as:

Here,

and

are provincial trade flows obtained from the China Customs Database.

refers to gross industrial output sourced from the China National Bureau of Statistics (NBS).

is the import penetration rate of each province used to measure import competition (IPW). In addition, the endogeneity issue for using import penetration rates as a measure of import competition may lead to an underestimation of the labor market effects of trade shocks. Referring to

Autor et al. (

2013), we construct an instrumental variable

for import competition in China using changes in U.S. imports

:

According to this methodology, changes in total imports of the U.S. in each year are allocated to different regions r based on their employment share , where represents the employment of region r in the lagged year t − 1.

Using changes in imports from external countries to address endogeneity issues has been widely accepted in academic circles. These external instruments allow researchers to account for global shifts in trade dynamics that influence domestic industries, while ensuring that the instruments do not directly affect the regions’ wage structures or skill premiums. Using changes in U.S. imports satisfies the key conditions for a valid instrument: relevance and exogeneity. On the one hand, the United States is the largest importer in the world, and changes in its import demand have large effects on global supply chains. Specifically, changes in U.S. imports are closely linked to China’s exports. For example, fluctuations in U.S. imports of high-tech products, consumer goods, and machinery directly impact China’s market share and competitiveness in these industries. Changes in U.S. imports influence China’s export demand, which in turn affects China’s import competition levels. Therefore, U.S. import changes are a natural and effective instrument for capturing fluctuations in import competition faced by China, reflecting shifts in global trade that directly impact China’s competitive environment. On the other hand, U.S. import changes serve as a valid instrument for China’s import competition because they satisfy the exclusion restriction: they influence China’s competitive environment through trade but do not directly affect regional skill premiums. While changes in U.S. import demand can influence China’s production and export levels, they do not directly impact labor market dynamics or skill premiums within specific regions in China. Skill premiums are primarily determined by domestic factors such as education levels, technological progress, and labor market structures, which are not directly influenced by U.S. import demand. Therefore, using U.S. import changes as an instrument allows us to avoid endogeneity issues while ensuring the instrument’s exogeneity.

Finally, drawing on

Qu and Li (

2023), we choose regional import volume (IM) as a substitute indicator for import competition in the robustness test. Regional import volume, defined as the total value of imports within a given region, captures the intensity of competition from global markets and the degree to which foreign goods penetrate local markets. This measure thus serves as an effective proxy for import competition, particularly well-suited for examining trade exposure at the regional level (e.g., provinces). First, it directly reflects the magnitude of foreign presence in local markets, making it possible to assess the extent of external competition domestic industries face. Second, by observing how imports expand or contract over time, this indicator provides a dynamic perspective on shifts in trade exposure, allowing researchers to evaluate both short-term shocks and longer-term structural changes. Third, at the regional level, import volume not only reveals the market share captured by foreign products but also sheds light on their broader impact on production structures, industrial upgrading, and labor market outcomes, such as employment displacement or wage adjustments. Moreover, compared to other proxies—such as tariff reductions, foreign penetration indices, or sector-specific import shares—the regional import volume has the advantage of encompassing the cumulative effect of trade liberalization, global supply chain integration, and consumer demand shifts. This holistic measure captures the real exposure of local economies to international competition without relying solely on policy-driven variables or narrowly defined sectoral data.

- (3)

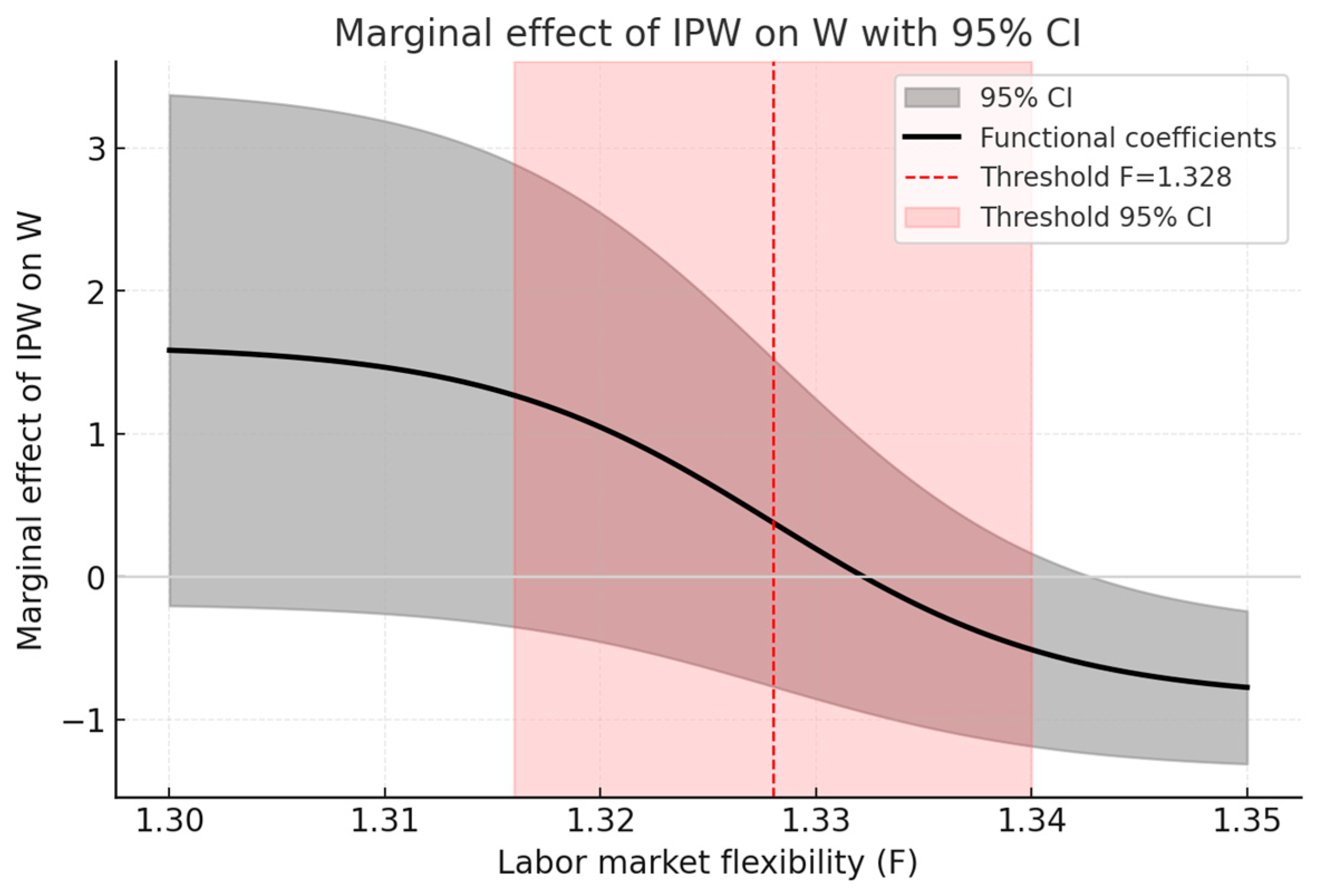

Labor Market Flexibility (F)

Regarding labor market flexibility indicators (F), the empirical literature mainly includes the labor market indicators proposed by

Rama and Artecona (

2002), the World Bank’s labor market flexibility index, and the methodology for constructing the Employment Protection Legislation (EPL) index in the “Global Competitiveness Report.” Due to the limited scope of these indicators,

Rodgers (

2007) adjusted them to four indicators measuring labor market flexibility. They are, respectively, employment protection relating to the freedom for employers to hire and dismiss employees; wage flexibility, including minimum wage regulations, union activity, and the overall bargaining power of labor over wages; internal or functional flexibility mainly focused on production or dynamic efficiency, referring to the ability of companies to organize and reorganize their internal production and labor processes; and supply-side flexibility, where workers may require flexible working hours to manage work and family responsibilities or the ability to freely switch jobs.

Venn (

2009) refined the EPL as three sub-indicators; they are, respectively, regular employment, short-term employment, and collective dismissals, thus improving the labor market flexibility and security index.

Due to the lack of related indicator research on China’s transitional labor market, the “China Market Economy Development Report 2008” laid the foundation for labor market research. Based on this, and referencing the indicator selection methods for industry market flexibility designed by

Venn (

2009) and the construction methods of technical indicators by

Portela (

2001), China’s regional labor market flexibility index was developed. Chinese scholars

Zhou and Yang (

2012) borrowed the employment protection index (EPL) when constructing China’s labor market flexibility indicators. This index consists of three parts: indicators protecting regular employees from dismissal, indicators for special requirements for collective dismissals, and indicators for regular temporary employment.

The regional labor market flexibility indicator possesses distinct Chinese characteristics, as it is tailored to China’s specific social, economic, and cultural context. It has been widely recognized and applied in the Chinese academic community, and a growing body of research in China has demonstrated the applicability and validity of the labor market flexibility index in various contexts.

Jiang et al. (

2025) showed that higher flexibility improves firms’ adaptability to technological change.

Zhang et al. (

2018) found that it facilitates export upgrading by enhancing the technological sophistication of exports.

Li et al. (

2017) reported that FDI inflows tend to reduce labor market flexibility, with pronounced regional disparities.

Zhang et al. (

2013) further confirmed that trade liberalization enhances labor market flexibility. Together, these studies provide strong empirical support for the index’s reliability and underscore its broad applicability in analyzing labor market dynamics and economic development in China.

Therefore, we follow the method proposed by Zhou Shen and Yang Hongyan and update the data to construct the regional labor market flexibility indicators as follows:

In Equation (28), the natural logarithmic form and a 0.5 correction were used to ensure that each indicator falls between 0.5 (when the indicator is infinitesimally small) and 1.5 (when the indicator is infinitely large). Additionally, the logarithmic distribution ensures that the indicators fluctuate around the median.

Fit refers to the labor market flexibility in province i at time t, used to measure the labor market flexibility indicator (F). represents the share of labor’s net income in total wage income, which reflects the degree of wage flexibility in the dual labor market. A higher value of this indicator indicates greater wage self-determination and flexibility within the dual labor market.

denotes the share of employment in non-state enterprises as a percentage of total employment in region i during year t, similar to the temporary employment indicator in Employment Protection Legislation (EPL). This indicator reflects the degree of employment flexibility and primarily captures the market-oriented reforms of China’s labor market. Non-state enterprises hire labor based on the supply and demand of the labor market and the market criterion of maximizing enterprise profits. A higher value of this index indicates greater flexibility in labor employment within enterprises.

is the unemployment rate, which serves as an indicator of employment freedom within the labor market. A higher volatility of this rate suggests greater flexibility in the labor market, indicating that enterprises have more freedom to hire and dismiss employees.

- (4)

The Controlled Variables (Xit)

is a vector of the controlled variables. With reference to the relevant theory of skill premium determination, we include the following controlled variables:

Total Factor Productivity (TFP) is measured using the DEA-Malmquist productivity index. Three indicators are used in this measurement. They are provincial gross output, labor, and physical capital stock. Gross output is measured by provincial real GDP, deflated by the GDP deflator with 2010 as the base year. Labor is measured by the number of workers employed at the end of the year in the region, while physical capital stock is calculated using the perpetual inventory method.

Skill Intensity (H/L) is measured using the ratio of skilled labor to unskilled labor employed at the end of each year in each province.

Foreign Direct Investment (FDI) is measured using the foreign direct investment in each province.

Economic Development (GDP) is captured using the real GDP of each region for each year, adjusted for inflation based on the GDP deflator with 2010 as the base year.

Human Capital (HC). Considering that the development of human capital in China is heavily influenced by government financial input, we measure it using the proportion of national financial education funds relative to total financial expenditure.