The Effect of Payment Delay on Consumer Purchase Intention

Abstract

1. Introduction

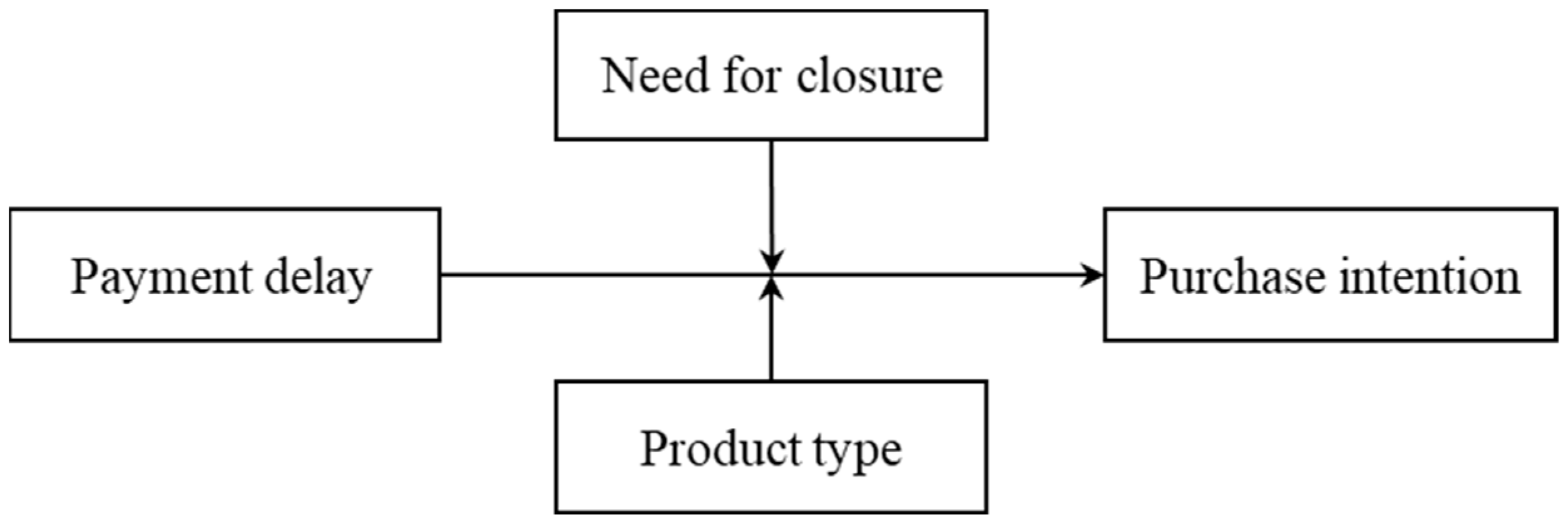

2. Theoretical Background and Hypotheses

2.1. Payment Delay

2.2. Construal Level Theory: Temporal Perspective in Payment Situation

2.3. NFC (Need for Closure)

2.4. Temporal Construal Theory: The Role of Desirability and Feasibility

3. Study 1

3.1. Method

3.1.1. Pretest

3.1.2. Procedure

3.2. Results

3.2.1. Manipulation Checks

3.2.2. Hypothesis Test

3.3. Discussion

4. Study 2

4.1. Method

4.1.1. Pretest

4.1.2. Design and Participants

4.1.3. Procedure

4.2. Results

4.2.1. Manipulation Checks

4.2.2. Hypothesis Test

4.3. Discussion

5. Study 3

5.1. Method

5.1.1. Pretest

5.1.2. Procedure

5.2. Results

5.2.1. Manipulation Checks

5.2.2. Hypothesis Test

5.3. Discussion

6. General Discussion

6.1. Conclusions

6.2. Theoretical Contributions

6.3. Practical Implications

6.4. Limitations and Future Research

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aiken, Leona S., and Stephan G. West. 1991. Multiple Regression: Testing and Interpreting Interactions. Newbury Park: Sage. [Google Scholar]

- Bagchi, Rajesh, and Lauren G. Block. 2011. Chocolate cake please! Why do consumers indulge more when it feels more expensive. Journal of Public Policy & Marketing 30: 294–306. [Google Scholar] [CrossRef]

- Brizi, Ambra, and Alessandro Biraglia. 2021. Do I have enough food? How need for cognitive closure and gender impact stockpiling and food waste during the COVID-19 pandemic: A cross-national study in India and the United States of America. Personality and Individual Differences 168: 110396. [Google Scholar] [CrossRef] [PubMed]

- Chandran, Sucharita, and Geeta Menon. 2004. When a day means more than a year: Effects of temporal framing on judgments of health risk. Journal of Consumer Research 31: 375–89. [Google Scholar] [CrossRef]

- Chatterjee, Promothesh, and Randall L. Rose. 2012. Do Payment Mechanisms Change the Way Consumers Perceive Products? Journal of Consumer Research 38: 1129–39. [Google Scholar] [CrossRef]

- Choi, Hanbyul, Jonghwa Park, Junghwan Kim, and Yoonhyuk Jung. 2020. Consumer preferences of attributes of mobile payment services in South Korea. Telematics and Informatics 51: 101397. [Google Scholar] [CrossRef]

- Dahlberg, Tomi, Niina Mallat, Jan Ondrus, and Agnieszka Zmijewska. 2008. Past, present and future of mobile payments research: A literature review. Electronic Commerce Research and Applications 7: 165–81. [Google Scholar] [CrossRef]

- Dhar, Ravi, and Klaus Wertenbroch. 2000. Consumer choice between hedonic and utilitarian goods. Journal of Marketing Research 37: 60–71. [Google Scholar] [CrossRef]

- Feinberg, Richard A. 1986. Credit cards as spending facilitating stimuli: A conditioning interpretation. Journal of Consumer Research 13: 348–56. [Google Scholar] [CrossRef]

- Fujita, Kentaro, Marlone D. Henderson, Juliana Eng, Yaacov Trope, and Nira Liverman. 2006. Spatial distance and mental construal of social events. Psychological Science 17: 278–82. [Google Scholar] [CrossRef]

- Giacomantonio, Mauro, Carsten K. W. De Dreu, and Lucia Mannetti. 2010. Now you see it, now you don’t: Interests, issues, and psychological distance in integrative negotiation. Journal of Personality and Social Psychology 98: 761–74. [Google Scholar] [CrossRef]

- Hirschman, Elizabeth C. 1979. Differences in consumer purchase behavior by credit card payment system. Journal of Consumer Research 6: 58–66. [Google Scholar] [CrossRef]

- Hoelzl, Erik, Maria Pollai, and Herbert Kastner. 2011. Hedonic evaluations of cars: Effects of payment mode on prediction and experience. Psychology & Marketing 28: 1115–29. [Google Scholar] [CrossRef]

- Houghton, David C., and Rajdeep Grewal. 2000. Please, let’s get an answer—Any Answer: Need for consumer cognitive closure. Psychology & Marketing 17: 911–34. [Google Scholar] [CrossRef]

- Jonas, Kai J., and Pascal Huguet. 2008. What day is today? A social–psychological investigation into the process of time orientation. Personality and Social Psychology Bulletin 34: 353–65. [Google Scholar] [CrossRef]

- Kardes, Frank R., David M. Sanbonmatsu, Maria L. Cronley, and David C. Houghton. 2002. Consideration set overvaluation: When impossibly favorable ratings of a set of brands are observed. Journal of Consumer Psychology 12: 353–61. [Google Scholar] [CrossRef]

- Keese, Matthias. 2012. Who feels constrained by high debt burdens? Subjective vs. objective measures of household debt. Journal of Economic Psychology 33: 125–41. [Google Scholar] [CrossRef]

- Kim, Changsu, Mirsobit Mirusmonov, and In Lee. 2010. An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior 26: 310–22. [Google Scholar] [CrossRef]

- Kim, Hyeongmin. 2013. How variety-seeking versus inertial tendency influences the effectiveness of immediate versus delayed promotions. Journal of Marketing Research 50: 416–26. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Anat Keinan. 2006. Repenting hyperopia: An analysis of self-control regrets. Journal of Consumer Research 33: 273–82. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Itamar Simonson. 2002a. Earning the right to indulge: Effort as a determinant of customer preferences toward frequency program rewards. Journal of Marketing Research 39: 155–70. [Google Scholar] [CrossRef]

- Kivetz, Ran, and Itamar Simonson. 2002b. Self-control for the righteous: Toward a theory of precommitment to indulgence. Journal of Consumer Research 29: 199–217. [Google Scholar] [CrossRef]

- Kruglanski, Arie W., and Donna M. Webster. 1991. Group members’ reactions to opinion deviates and conformists at varying degrees of proximity to decision deadline and of environmental noise. Journal of Personality and Social Psychology 61: 212–25. [Google Scholar] [CrossRef] [PubMed]

- Kruglanski, Arie W., and Donna M. Webster. 1996. Motivated closing of the mind: “Seizing” and “Freezing”. Psychological Review 103: 263–83. [Google Scholar] [CrossRef] [PubMed]

- Kruglanski, Arie W., and Tallie Freund. 1983. The freezing and unfreezing of lay inferences: Effects of impressional primacy, ethnic stereotyping, and numerical anchoring. Journal of Experimental Social Psychology 19: 448–68. [Google Scholar] [CrossRef]

- Liberman, Nira, and Yaacov Trope. 1998. The role of feasibility and desirability considerations in near and distant future decisions: A test of temporal construal theory. Journal of Personality and Social Psychology 75: 5–18. [Google Scholar] [CrossRef]

- Loewenstein, George. 1987. Anticipation and the valuation of delayed consumption. Economic Journal 97: 666–84. [Google Scholar] [CrossRef]

- Lynch, John G., Jr., Richard G. Netemeyer, Stephen A. Spiller, and Alessandra Zammit. 2010. A generalizable scale of propensity to plan: The long and the short of planning for time and for money. Journal of Consumer Research 37: 108–28. [Google Scholar] [CrossRef]

- McCall, Michael, and Heather J. Belmont. 1996. Credit card insignia and restaurant tipping: Evidence for an associative link. Journal of Applied Psychology 81: 609–13. [Google Scholar] [CrossRef]

- Nowlis, Stephen M., Naomi Mandel, and Deborah Brown McCabe. 2004. The effect of a delay between choice and consumption on consumption enjoyment. Journal of Consumer Research 31: 502–10. [Google Scholar] [CrossRef]

- Okada, Erica Mina. 2005. Justification effects on consumer choice of hedonic and utilitarian goods. Journal of Marketing Research 42: 43–53. [Google Scholar] [CrossRef]

- Patrick, Vanessa M., and C. Whan Park. 2006. Paying before consuming: Examining the robustness of consumers’ preference for prepayment. Journal of Retailing 82: 165–75. [Google Scholar] [CrossRef]

- Prelec, Drazen, and Duncan Simester. 2001. Always leave home without it: A further investigation of the credit-card effect on willingness to pay. Marketing Letters 12: 5–12. [Google Scholar] [CrossRef]

- Prelec, Drazen, and George Loewenstein. 1998. The red and the black: Mental accounting of savings and debt. Marketing Science 17: 4–28. [Google Scholar] [CrossRef]

- Raghubir, Priya, and Joydeep Srivastava. 2008. Monopoly money: The effect of payment coupling and form on spending behavior. Journal of Experimental Psychology: Applied 14: 213–25. [Google Scholar] [CrossRef] [PubMed]

- Ramanathan, Suresh, and Patti Williams. 2007. Immediate and delayed emotional consequences of indulgence: The moderating influence of personality type on mixed emotions. Journal of Consumer Research 34: 212–23. [Google Scholar] [CrossRef]

- Roets, Arne, Arie W. Kruglanski, Malgorzata Kossowska, Antonio Pierro, and Ying-yi Hong. 2015. The motivated gatekeeper of our minds: New directions in need for closure theory and research. In Advances in Experimental Social Psychology. Cambridge: Academic Press, vol. 52, pp. 221–83. [Google Scholar]

- Rook, Dennis W. 1987. The buying impulse. Journal of Consumer Research 14: 189–99. [Google Scholar] [CrossRef]

- Seldal, M. M. Naeser, and Ellen K. Nyhus. 2022. Financial vulnerability, financial literacy, and the use of digital payment technologies. Journal of Consumer Policy 45: 281–306. [Google Scholar] [CrossRef]

- Soman, Dilip. 2001. Effects of payment mechanism on spending behavior: The role of rehearsal and immediacy of payments. Journal of Consumer Research 27: 460–74. [Google Scholar] [CrossRef]

- Soman, Dilip. 2003. The effect of payment transparency on consumption: Quasi-experiments from the field. Marketing Letters 14: 173–83. [Google Scholar] [CrossRef]

- Thomas, Manoj, Kalpesh Kaushik Desai, and Satheeshkumar Seenivasan. 2011. How credit card payments increase unhealthy food purchases: Visceral regulation of vices. Journal of Consumer Research 38: 126–39. [Google Scholar] [CrossRef]

- Trope, Yaacov, and Nira Liberman. 2000. Temporal construal and time-dependent changes in preference. Journal of Personality and Social Psychology 79: 876–89. [Google Scholar] [CrossRef] [PubMed]

- Trope, Yaacov, and Nira Liberman. 2003. Temporal construal. Psychological Review 110: 403–21. [Google Scholar] [CrossRef] [PubMed]

- Trope, Yaacov, and Nira Liberman. 2010. Construal-level theory of psychological distance. Psychological Review 117: 440–63. [Google Scholar] [CrossRef]

- Trope, Yaacov, Nira Liberman, and Cheryl Wakslak. 2007. Construal levels and psychological distance: Effects on representation, prediction, evaluation, and behavior. Journal of Consumer Psychology 17: 83–95. [Google Scholar] [CrossRef] [PubMed]

- Verkijika, Silas Formunyuy. 2018. Factors influencing the adoption of mobile commerce applications in Cameroon. Telematics and Informatics 35: 1665–74. [Google Scholar] [CrossRef]

- Vermeir, Iris, and Patrick Van Kenhove. 2005. The influence of need for closure and perceived time pressure on search effort for price and promotional information in a grocery shopping context. Psychology & Marketing 22: 71–95. [Google Scholar] [CrossRef]

- Webster, Donna M. 1993. Motivated augmentation and reduction of the overattribution bias. Journal of Personality and Social Psychology 65: 261–71. [Google Scholar] [CrossRef]

- Webster, Donna M., and Arie W. Kruglanski. 1994. Individual differences in need for cognitive closure. Journal of Personality and Social Psychology 67: 1049–62. [Google Scholar] [CrossRef]

- Wilcox, Keith, Lauren G. Block, and Eric M. Eisenstein. 2011. Leave home without it? The effects of credit card debt and available credit on spending. Journal of Marketing Research 48: S78–S90. [Google Scholar] [CrossRef]

- Zhang, Shi, Frank R. Kardes, and Maria L. Cronley. 2002. Comparative advertising: Effects of structural alignability on target brand evaluations. Journal of Consumer Psychology 12: 303–11. [Google Scholar] [CrossRef]

| β | t-Value | p-Value | |

|---|---|---|---|

| (Constant) | 34.59 | 0.00 | |

| Payment delay | 0.35 | 5.04 | 0.00 |

| NFC | −0.31 | −4.49 | 0.00 |

| Payment delay × NFC | −0.17 | −2.46 | 0.02 |

| β | t-Value | p-Value | |

|---|---|---|---|

| (Constant) | 86.12 | 0.00 | |

| Payment delay | −0.13 | −3.43 | 0.00 |

| Product type | −0.27 | −7.07 | 0.00 |

| NFC | 0.04 | 1.09 | 0.38 |

| Payment delay × product type | 0.01 | 0.16 | 0.87 |

| Payment delay × NFC | −0.28 | −7.03 | 0.00 |

| Product type × NFC | −0.17 | −4.28 | 0.00 |

| Payment delay × product type × NFC | −0.29 | −7.45 | 0.00 |

| β | t-Value | p-Value | |

|---|---|---|---|

| (Constant) | 13.05 | 0.00 | |

| Product type | 0.05 | 0.63 | 0.53 |

| NFC | 0.02 | 0.21 | 0.83 |

| Product type × NFC | −0.36 | −3.58 | 0.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choy, M. The Effect of Payment Delay on Consumer Purchase Intention. Adm. Sci. 2024, 14, 226. https://doi.org/10.3390/admsci14090226

Choy M. The Effect of Payment Delay on Consumer Purchase Intention. Administrative Sciences. 2024; 14(9):226. https://doi.org/10.3390/admsci14090226

Chicago/Turabian StyleChoy, Minkyung. 2024. "The Effect of Payment Delay on Consumer Purchase Intention" Administrative Sciences 14, no. 9: 226. https://doi.org/10.3390/admsci14090226

APA StyleChoy, M. (2024). The Effect of Payment Delay on Consumer Purchase Intention. Administrative Sciences, 14(9), 226. https://doi.org/10.3390/admsci14090226