Three Horizons of Technical Skills in Artificial Intelligence for the Sustainability of Insurance Companies

Abstract

1. Introduction

2. Literature Review

2.1. Artificial Intelligence (AI)

2.2. AI Technical Skills

2.3. AI for the Sustainability of Insurance Companies

3. Materials and Methods

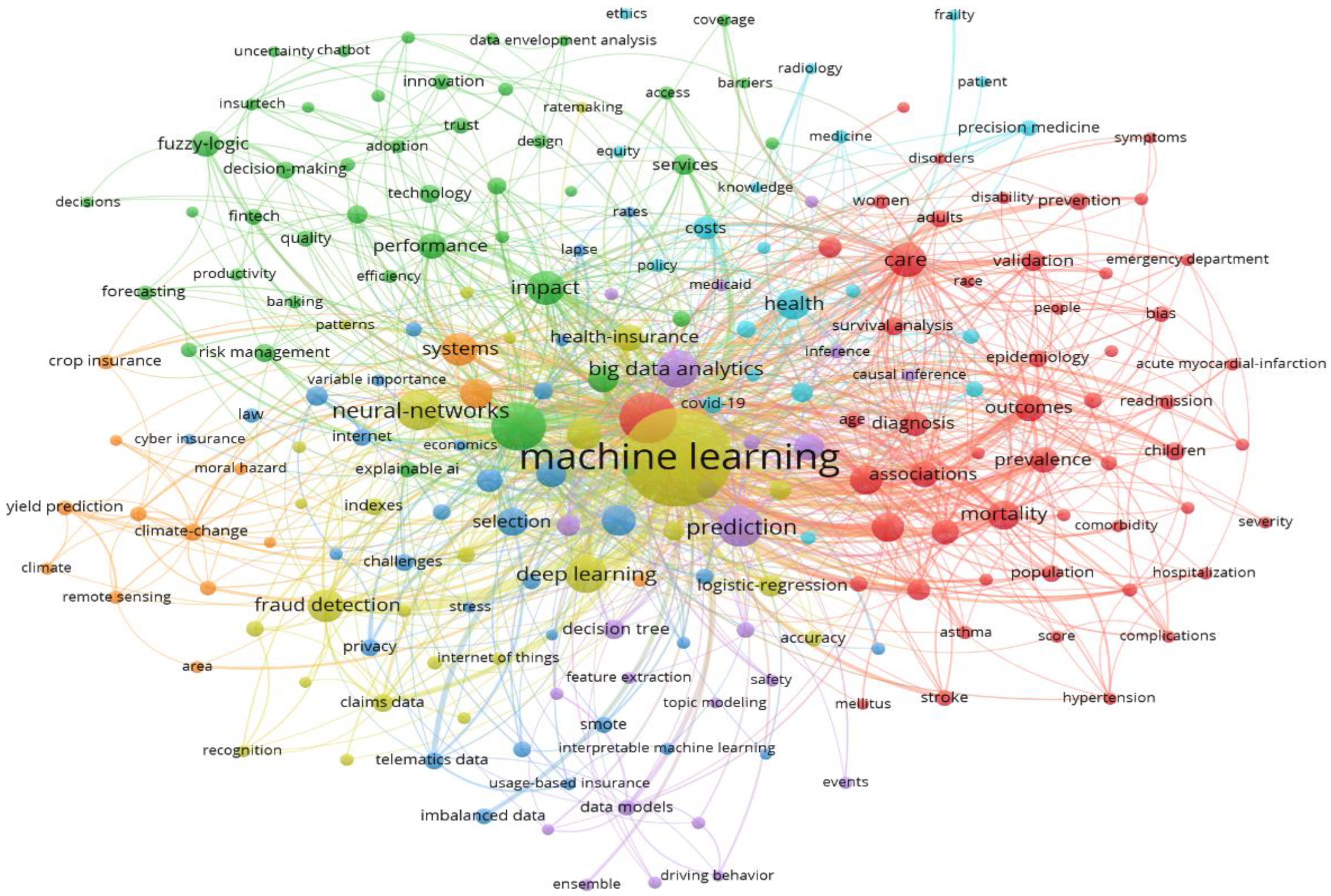

3.1. Stage 1: Defining the State-of-the-Art

3.1.1. Technology Surveillance

3.1.2. Criteria for Publication Selection

3.1.3. Normalization Processes

3.2. Stage 2: Identifying Technical Skills and Their Strategic Prevalence

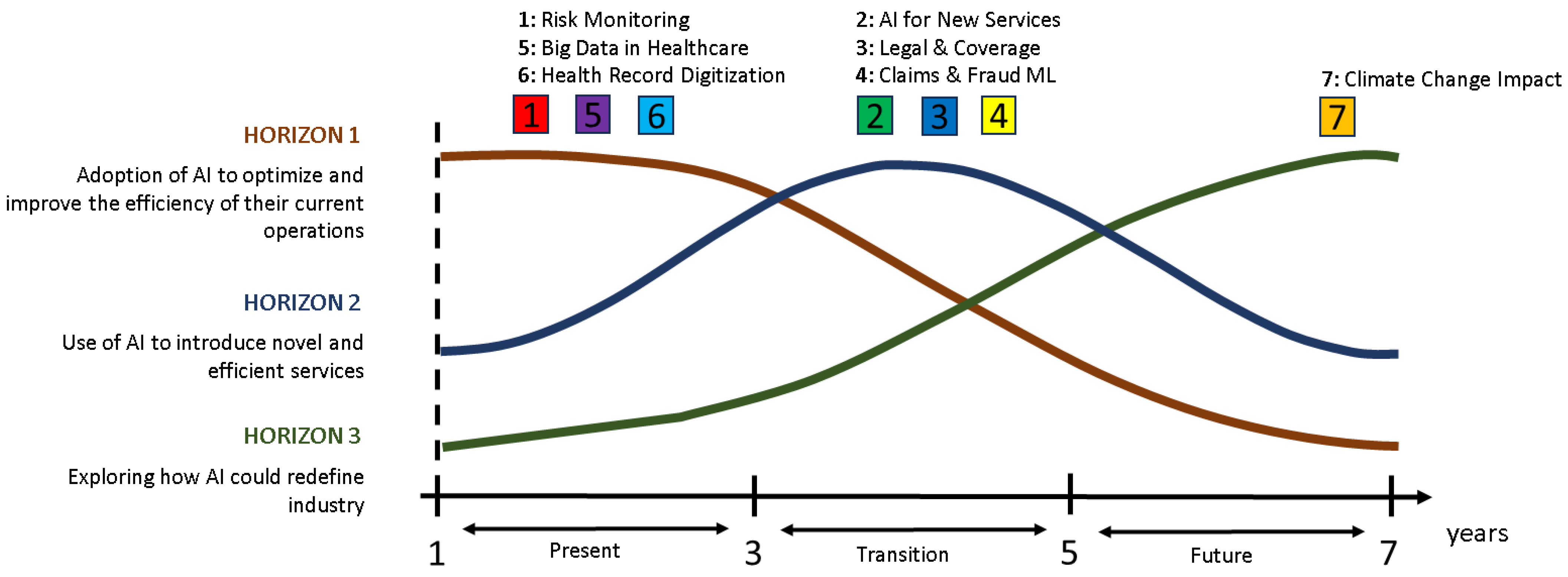

Specific Steps for Applying the Three Horizons Framework

- Horizon 1 (H1): Analysis of the current dominant system or practice, its proven efficacy, and the sustainability of its underlying assumptions amidst evolving environmental and societal demands. The analysis encompasses an exploration of sustained innovations designed to strengthen the existing system without fundamentally changing its core principles.

- Horizon 2 (H2): Examination of transitional innovations and their role in shaping the trajectory towards a transformative future. It includes both H2− innovations, which extend the lifespan of H1 systems through incremental improvements, and H2+ innovations, which prepare the foundation for a fundamentally new system by challenging and eventually displacing the status quo.

- Horizon 3 (H3): Exploration of transformative visions proposing radical departures from H1 systems, focusing on their potential to address unmet needs and emerging challenges more effectively. The analysis aims to identify new actors, technologies, and paradigms signaling a shift towards this future horizon while highlighting the conditions and drivers that could facilitate or hinder their realization.

4. Results

- CLUSTER 1 (red): monitoring risk factors and prevalence of chronic diseases/use of epidemiological tools.Where studies are developed to describe and analyze the prevalence—the proportion of people in a population who suffer from a specific disease or condition at a given time—of chronic diseases such as diabetes, hypertension, or cardiovascular disease.

- CLUSTER 2 (green): use of AI algorithms for the optimization of insurance services.This research front studies how the implementation of AI in financial and accounting management has radically transformed the way organizations in the insurance sector conduct their operations. For example, because of its ability to process large volumes of data quickly and accurately, AI streamlines tasks such as account reconciliation and real-time financial reporting. Similarly, AI algorithms enable effective automation and greater efficiency in critical areas such as anomaly and fraud detection.

- CLUSTER 3 (blue): legal and coverage aspects in life and accident insurance.Although life insurance and accident insurance are different products, both are related to financial protection in adverse situations.On the one hand, life insurance provides financial compensation to the beneficiaries designated by the policyholder in the event of his or her death (the cause of death does not matter, it can be for any reason). In addition to death coverage, life insurance can also include benefits for absolute and permanent disability.Regarding accident insurance, these insurances cover expenses arising from specific accidents, i.e., they are only activated if the insured’s injuries or death are the result of an accident (depending on the coverage chosen in the policy). In addition to accidents, some accident insurance policies may also cover total or partial disability due to accidents, as well as temporary disability.

- CLUSTER 4 (yellow): machine learning applied to claims management and fraud detection.This research front explores how the insurance industry uses various statistically based methodologies and machine learning algorithms to analyze and detect fraudulent claims. These algorithms can identify anomalous patterns in financial data, helping to recognize suspicious activity and prevent fraud.

- CLUSTER 5 (purple): use of big data for decision-making in healthcare.The benefits of using big data in healthcare are reported in the field of diagnosis and prediction, where medium-to-high levels of accuracy have been recorded in the analysis of large datasets to diagnose and predict clinical outcomes and complications associated with chronic diseases such as diabetes mellitus and mental health disorders, including the prediction of suicidal behaviors; real-time support through big data analysis that allows healthcare professionals to assess patient data, medical literature, and best practices; and improvement of patient-centered care by contributing to the detection of health threats, improved disease monitoring, and reduced waste of resources.The intensive use of this technology presents some challenges such as the existence of fragmented or incompatible records, data security with sensitive patient information, and storage costs and data bias.

- CLUSTER 6 (light blue): impact of digitization of health records on health policy (especially cancer management).The digitalization of health records has a significant impact on healthcare and health policies. Examples include telemedicine and digital health applications that enable virtual consultations; the integration, collection, and analysis of large amounts of data and evidence-based decision-making; drug discovery and genomics; and cost reduction (electronic records speed up diagnosis and reduce the need for duplicate testing).In the specific context of cancer management, the digitalization of records enables more accurate patient monitoring, early identification of risks, and optimization of treatments.

- CLUSTER 7 (orange): impact of climate change on agriculture and health, and the moral hazard involved.This research front explores the implications of climate change on agriculture, which could create situations in which adaptation or mitigation measures create a moral hazard. For example, one possible scenario is that if farmers receive compensation for crop losses due to climate change, they might not take preventive measures to reduce their vulnerability.

- Analysis of results for personalization of insurance products and services. Creating insurance products and services for personalization falls within the first horizon, as the insurer incorporates AI-driven results analysis methods to gain opportunities by improving and extending its current offerings. In this context, insurers have incorporated AI into their product and service creation processes, enabling them to analyze large volumes of data and obtain the most important characteristics of their customers, allowing them to offer policies that can be tailored to the needs of the customers. Studies have highlighted the use of AI in insurance personalization, focusing on predicting client longevity and associated risks through the analysis of biomarkers and health data. This enables insurers to offer personalized health interventions, improving the quality of life for policyholders (Zhavoronkov et al. 2021). Another case is the implementation of usage-based insurance programs, where telematics devices installed in vehicles collect detailed data on driving habits, such as speed and braking. This data is analyzed to adjust insurance premiums, reward safe drivers with lower rates, and provide recommendations to improve road safety for higher-risk drivers (Adeoye et al. 2024). Both cases demonstrate how AI can optimize personalization and efficiency in the insurance industry, offering solutions tailored to individual needs.

- Techniques for risk prevention and management. The importance of managing risk for insurers is a priority, and the development of techniques to use AI to manage and prevent risks situates it in the first horizon. In this context, the use of technology to efficiently improve risk prevention and management allows insurers to achieve promising results. In the study by Serrano et al. (2018), predictive models were used to identify the risk of chronic social exclusion in various regions. They analyzed more than 16,000 cases using modeling techniques, achieving high precision in risk prediction. These models help social workers intervene early and prevent exclusion from becoming chronic, utilizing a tool that calculates risk on mobile devices. Majeed and Lee (2020) explored AI techniques to protect customer data privacy, essential for preventing data loss and improper disclosure. They examined how AI-based digital assistants can balance efficiency and privacy, addressing concerns about the ethical and secure use of AI in managing sensitive data. These cases highlight the importance of risk management in the insurance industry, focusing on both prevention and mitigation of associated risks.

- Techniques for claims management. Achieving operational efficiency using AI techniques for claims management also allows for the assessment of claims and options for their prevention. Therefore, the use of AI techniques for claims management focuses on improving precision and efficiency. Zhang et al. (2021) demonstrated that neural networks could detect gastric lesions with greater accuracy than traditional diagnostics, suggesting a potential application in medical claims evaluation. Abdelhalim and Ibrahim (2023) highlighted how intelligent algorithms and blockchain technology could detect fraud and enhance data integrity in the insurance sector, optimizing service quality. Guinney and Saez-Rodriguez (2018) developed advanced models for claims management and health risk assessment, emphasizing AI’s ability to optimize these processes and prevent accidents. These studies illustrate how AI can transform the insurance industry by improving claims management and operational efficiency.

- AI learning methods applied to insurance subscriptions. Developing AI learning methods is important for insurers, as reflected in the subscription process, where it is necessary to understand the determining characteristics for obtaining the policy and learning from them. Arumugam and Bhargavi (2023) explored the use of AI to personalize the insurance subscription process, specifically in detecting aggressive driving behaviors. Using GPS and heart rate data, they developed a system to classify drivers as good, unhealthy, prone to road rage, and always bad. This allows for adjusting insurance premiums based on individual risk, improving the accuracy of risk assessment and driving practices. Guinney and Saez-Rodriguez (2018) presented advanced models for claims management and health risk assessment, highlighting AI’s ability to optimize these processes and prevent accidents. These studies demonstrate how AI can transform the insurance sector by enhancing claims management and promoting safer driving.

- Advanced data analysis techniques for decision-making. The use of AI reinforces insurers’ decision-making based on data, representing an important technical competency in H1. The study by Majeed and Lee (2020) highlights how the application of advanced data analysis techniques, focused on privacy, enables informed decision-making regarding data protection, an important aspect of improving insurance offerings to customers. These researchers developed a data anonymization algorithm that preserves community privacy by assessing the susceptibility of user attributes, thereby mitigating the risk of exposing sensitive information in published data. Meanwhile, Tsagris (2021) introduced a Bayesian network-based algorithm, called PCHC, which provides an efficient tool for interpreting complex economic data, aiding insurers in adapting and making decisions based on specific data. This approach not only enhances the accuracy of risk assessment but also optimizes the personalization of services. Both cases underscore the relevance of integrating advanced data analysis techniques and Bayesian networks to enhance decision-making and data protection in the insurance sector, illustrating the value of these technologies in improving operational efficiency and market competitiveness.

- Advanced algorithms for fraud prevention. Fraud prevention demonstrates the capability to interpret complex risk dynamics, enabling the detection of anomalies. Agarwal (2023), in his study on fraud detection in medical insurance, uses machine learning algorithms such as K-means clustering to identify fraud patterns. This method allows for the classification of medical claims as legitimate or potentially fraudulent, improving detection accuracy and reducing false positives. Ming et al. (2024) propose a novel approach for fraud detection in auto insurance and credit card transactions, integrating convolutional neural networks (CNNs) with machine learning algorithms such as SVM, KNN, and decision trees. This integration enables deeper feature extraction and greater accuracy in fraud detection. Cheng et al. (2020) present an innovative approach to assess the probability of ruin in risk models using intelligent algorithms. Although not directly focused on fraud prevention, this study emphasizes the importance of identifying unconventional risk patterns, which are crucial for detecting fraudulent behaviors in insurers. This approach is situated in H2, demonstrating the transition towards incorporating emerging technologies and more complex analysis methods.

- Models for customer loyalty and retention. Utilizing AI models to satisfy and retain customers falls within H2, as it also emphasizes the application of emerging technologies to meet insurers’ requirements. Soliño-Fernandez et al. (2019) highlight how wearable devices, integrated with AI, can promote healthier lifestyles, which is crucial for customer loyalty and retention in the insurance sector. These devices enable real-time health monitoring and offer personalized feedback, aligning the health goals of clients with those of insurers, thereby strengthening the relationship between both parties. This not only improves the well-being of the insured but also increases customer loyalty by ensuring relevant and beneficial health interventions. Soni et al. (2023) emphasize the importance of transparency in AI decision-making in healthcare, particularly in understanding how AI models reach their conclusions. This transparency is essential for building trust among the insured, ensuring that AI-driven decisions, such as those related to health insurance claims or premium adjustments, are based on clear and understandable criteria. This approach not only enhances customer satisfaction but also reinforces their loyalty to the service. Together, these studies demonstrate how the integration of advanced AI technologies in insurance can significantly improve customer loyalty and retention, ensuring clear and transparent communication that fosters customer trust and satisfaction.

- Ethical governance. Addressing challenges and ethical considerations, and how to confront them with AI, are relevant for insurers in H2. The study by Erdmann et al. (2021), focusing on precision measurement, indicates the most important ethical issues, such as data privacy and customer consent, emphasizing the need to handle insured individuals’ health data with great care to ensure their protection and ethical use in developing new AI-based insurance products and services. Furthermore, Eitel-Porter (2021) highlights the importance of establishing ethical boundaries for those who develop and apply AI in the insurance industry. Therefore, these insurers applying AI in their processes indicate the need to integrate ethical considerations into technological innovation processes, promoting a balance between the adoption of emerging technologies and the ethical challenges facing the company.

- Automation of customer services. From the perspective of H2, the technical capabilities of AI in insurers are aimed at continuously enhancing automation and customer services, underscoring their pivotal role in customer experience. The study presented by Maedche et al. (2019) highlights the extensive opportunities and challenges associated with AI-based digital assistants, emphasizing their potential to enhance customer relationships through chatbots and virtual assistants. These assistants are designed to better understand user needs, enabling more efficient and personalized interactions. The study discussion emphasized the necessity of addressing not only the design and behavior of these AI-based digital assistants but also their interconnections and their impact on user experience. Cheng et al. (2020) present a case in which the application of computer vision for detecting automobile damage facilitates the automation of claims processing. This approach not only improves accuracy in damage assessment but also streamlines the claims management process, resulting in significantly improved customer experience. These findings demonstrate how automating customer service through the integration of AI can enhance the efficiency, accuracy, and personalization of services, significantly elevating the overall customer experience.

- Automation in parametric insurance. Automation in parametric insurance represents a disruptive transformation in how processes are managed by insurers. Volosovych et al. (2021) highlight the rapid adoption of parametric insurance during the COVID-19 pandemic, noting how AI algorithms facilitate the automatic activation of payments based on predefined parameters. This approach not only improves the speed and efficiency of the claims process but also ensures transparency and customer satisfaction by eliminating the typical uncertainty and subjectivity in individual claims evaluation. Pang and Choi (2022) employ a deep sigma point process, a Bayesian neural network technique, to enhance the accuracy of risk models in parametric insurance, using residential internet connectivity disruptions in the U.S. as a case study. Their research demonstrates that combining multiple climatic factors enables the construction of highly accurate risk models, which is particularly relevant in the context of climate change. These innovations underscore how integrating advanced technologies, such as machine learning and AI, is redefining the operational models of insurers, providing more agile and forward-looking solutions for risk management and claims processing.

- Regulation and compliance. Adhering to regulatory requirements is a crucial domain where AI plays a transformative role. Böffel (2023) examines how insurance regulation and financial innovation can effectively converge with the incorporation of emerging technologies such as AI. Although regulations are designed to protect consumers, integrating AI into insurance processes can facilitate compliance with these regulations, enhancing transparency and operational efficiency. The reform of laws such as California’s rate-making law, which seeks to balance innovation with the protection of proprietary information, illustrates how insurers can use AI to adapt to new regulatory demands more smoothly and effectively. Rousset and Ducruet (2020), while focusing on the impact of external shocks on maritime networks, provide valuable insight into the role of AI in quickly adapting to regulatory changes and crises. AI’s ability to analyze large volumes of data and forecast risks enables insurers to respond with greater agility and precision, ensuring regulatory compliance and improving resilience to unforeseen events. These innovations not only facilitate adherence to existing regulations but also prepare insurers for future regulatory challenges, promoting a culture of compliance and proactivity in risk management. This positive outlook highlights how AI can be a crucial tool for meeting regulatory requirements more efficiently, protecting both the company and consumers.

- Cybersecurity is an emerging pillar particularly evident in protection against cyberattacks in an increasingly digitized era. The study by Singh and Akhilesh (2019) examines the cybersecurity challenges faced by the insurance industry, highlighting the crucial role of artificial intelligence (AI) in detecting and preventing digital risks. The implementation of AI enables insurers to anticipate potential cyberattacks, thereby enhancing digital security for both customers and providers. This approach is essential for maintaining trust and integrity in insurers’ operations, representing a significant advancement in future risk management. Similarly, Talesh and Cunningham (2021) present an empirical study that explores how big data and emerging technologies are transforming the insurance sector, particularly in the areas of cybersecurity and privacy. Their research, which is based on interviews and quantitative data analysis, reveals that the “technologization of insurance” is changing how insurers underwrite policies, set prices, and manage risks. These studies underscore that proactive adoption of AI in cybersecurity is not only necessary for insurers in the digital age but also provides a significant competitive advantage. This approach has the potential to deeply transform industry practices and products, ensuring a safer and more reliable environment for all stakeholders involved.

5. Findings and Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdelhalim, Abeer Mahmoud M., and Nahla Mohamad El Sayed Ibrahim. 2023. The Impact of Using Smart Algorithms and Blockchain Technology on the Profits’ Quality in Saudi Financial Market. In From the Internet of Things to the Internet of Ideas: The Role of Artificial Intelligence. Paper Presented at Conference on Management & Information Systems, EAMMIS 2022, Coventry, UK, May 13–14. Cham: Springer. [Google Scholar]

- Adeoye, Omotayo Bukola, Chinwe Chinazo Okoye, Onyeka Chrisanctus Ofodile, Olubusola Odeyemi, Wilhelmina Addy, and Adeola Ajayi-Nifise. 2024. Integrating artificial intelligence in personalized insurance products: A pathway to enhanced customer engagement. International Journal of Management & Entrepreneurship Research 6: 502–11. [Google Scholar]

- Agarwal, Shashank. 2023. An Intelligent Machine Learning Approach for Fraud Detection in Medical Claim Insurance: A Comprehensive Study. Scholars Journal of Engineering and Technology 11: 191–200. [Google Scholar] [CrossRef]

- Arumugam, Subramanian, and R. Bhargavi. 2023. Road Rage and Aggressive Driving Behaviour Detection in Usage-Based Insurance Using Machine Learning. International Journal of Software Innovation 11: 1–29. [Google Scholar] [CrossRef]

- Böffel, Lukas. 2023. The Influence of Artificial Intelligence and Emerging Technologies on the Regulation of Insurance Companies in the U.S.—An Exemplary Analysis of California’s Rate Making Law. Berkeley Business Law Journal, 254–315. [Google Scholar]

- Callon, Michel, Jean-Pierre Courtial, William A. Turner, and Serge Bauin. 1983. From translations to problematic networks: An introduction to co-word analysis. Social Science Information 22: 191–235. [Google Scholar] [CrossRef]

- Campbell, Colin, Sean Sands, Carla Ferraro, Hsiu-Yuan Tsao, and Alexis Mavrommatis. 2020. From Data to Action: How Marketers Can Leverage AI. Business Horizons 63: 227–43. [Google Scholar] [CrossRef]

- Cheng, Yang-Jin, Muzhou Hou, and Juan Wang. 2020. An improved optimal trigonometric ELM algorithm for numerical solution to ruin probability of Erlang (2) risk model. Multimedia Tools and Applications 79: 30235–55. [Google Scholar] [CrossRef]

- Curry, Andrew, and Anthony Hodgson. 2008. Seeing in Multiple Horizons: Connecting Futures to Strategy. Journal of Futures Studies 13: 1–20. [Google Scholar]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Marc Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Duan, Yanqing, John S. Edwards, and Yogesh K. Dwivedi. 2019. Artificial Intelligence for Decision Making in the Era of Big Data–Evolution, Challenges and Research Agenda. International Journal of Information Management 48: 63–71. [Google Scholar] [CrossRef]

- Dwivedi, Yogesh K., Laurie Hughes, Elvira Ismagilova, Gert Aarts, Crispin Coombs, Tom Crick, Yanqing Duan, Rohita Dwivedi, John Edwards, Aled Eirug, and et al. 2019. Artificial Intelligence (AI): Multidisciplinary Perspectives on Emerging Challenges, Opportunities, and Agenda for Research, Practice and Policy. International Journal of Information Management 57: 101994. [Google Scholar] [CrossRef]

- Eckert, Christian, and Katrin Osterrieder. 2020. How digitalization affects insurance companies: Overview and use cases of digital technologies. Zeitschrift für die gesamte Versicherungswissenschaft 109: 333–60. [Google Scholar] [CrossRef]

- Eitel-Porter, Ray. 2021. Beyond the promise: Implementing ethical AI. AI and Ethics 1: 73–80. [Google Scholar] [CrossRef]

- Eling, Martin, Davide Nuessle, and Julian Staubli. 2022. The impact of artificial intelligence along the insurance value chain and on the insurability of risks. The Geneva Papers on Risk and Insurance—Issues and Practice 47: 205–41. [Google Scholar] [CrossRef]

- Erdmann, Anke, Christoph Rehmann-Sutter, and Claudia Bozzaro. 2021. Patients’ and professionals’ views related to ethical issues in precision medicine: A mixed research synthesis. BMC Med Ethics 22: 116. [Google Scholar] [CrossRef]

- Erem Ceylan, Işıl. 2022. The Effects of Artificial Intelligence on the Insurance Sector: Emergence, Applications, Challenges, and Opportunities. In The Impact of Artificial Intelligence on Governance, Economics and Finance, Volume 2. Accounting, Finance, Sustainability, Governance & Fraud: Theory and Application. Edited by Sezer Bozkuş Kahyaoğlu. Singapore: Springer. [Google Scholar]

- Fjeld, Jessica, Nele Achten, Hannah Hilligoss, Adam Nagy, and Madhulika Srikumar. 2020. Principled Artificial Intelligence: Mapping Consensus in Ethical and Rights-Based Approaches to Principles for AI. Cambridge, MA: Berkman Klein Center Research Publication, No. 2020-1. [Google Scholar]

- Galanos, Vassilis. 2019. Exploring Expanding Expertise: Artificial Intelligence as an Existential Threat and the Role of Prestigious Commentators, 2014–2018. Technology Analysis & Strategic Management 31: 421–32. [Google Scholar]

- Guinney, Justin, and Julio Saez-Rodriguez. 2018. Alternative models for sharing confidential biomedical data. Nature Biotechnology 36: 391–92. [Google Scholar] [CrossRef] [PubMed]

- Gupta, Somya, Wafa Ghardallou, Dharen Kumar Pandey, and Ganesh P. Sahu. 2022. Artificial intelligence adoption in the insurance industry: Evidence using the technology–organization–environment framework. Research in International Business and Finance 63: 101757. [Google Scholar] [CrossRef]

- Kajwang, Ben. 2022. Insurance Opportunities and Challenges in an Artificial Intelligence Society. European Journal of Technology 6: 15–25. [Google Scholar] [CrossRef]

- Kaplan, Andreas M., and Michael Haenlein. 2019. Digital transformation and disruption: On big data, blockchain, artificial intelligence, and other things. Business Horizons 62: 679–81. [Google Scholar] [CrossRef]

- Kelley, Kevin H., Lisa M. Fontanetta, Mark Heintzman, and Nikki Pereira. 2018. Artificial Intelligence: Implications for Social Inflation and Insurance. Risk Management and Insurance Review 21: 373–87. [Google Scholar] [CrossRef]

- Koster, Olivier, Ruud Kosman, and Joost Visser. 2021. A Checklist for Explainable AI in the Insurance Domain. In Computers and Society. Paper Presented at International Conference on the Quality of Information and Communications, Algarve, Portugal, September 8–11; QUATIC 2021 Conference. pp. 1–11. [Google Scholar]

- Leon, Linda A., Kala Chand Seal, Zbigniew H. Przasnyski, and Ian Wiedenman. 2017. Skills and Competencies Required for Jobs in Business Analytics: A Content Analysis of Job Advertisements Using Text Mining. International Journal of Business Intelligence Research 8: 374–84. [Google Scholar] [CrossRef]

- Leydesdorff, Loet. 1997. Why words and co-words cannot map the development of the sciences. Journal of the American Society for Information Science 48: 418–27. [Google Scholar] [CrossRef]

- Lin, Xiaoying, and Wei Ruan. 2023. Research on the Marketing Transformation of Insurance Industry Under Generative Artificial Intelligence Technology. Paper presented at 2nd International Conference on Public Management, Digital Economy and Internet Technology, ICPDI, Chongqing, China, September 1–3. [Google Scholar]

- Maedche, Alexander, Christine Legner, Alexander Benlian, Benedikt Berger, Henner Gimpel, Thomas Hess, Oliver Hinz, Stefan Morana, and Matthias Söllner. 2019. AI-Based Digital Assistants: Opportunities, Threats, and Research Perspectives. Business and Information Systems Engineering 61: 535–44. [Google Scholar] [CrossRef]

- Majeed, Abdul, and Sungchang Lee. 2020. Attribute susceptibility and entropy-based data anonymization to improve users community privacy and utility in publishing data. Applied Intelligence 50: 2555–74. [Google Scholar] [CrossRef]

- McCarthy, John, Marvin L. Minsky, Nathaniel Rochester, and Claude E. Shannon. 2006. A proposal for the Dartmouth summer research project on artificial intelligence, August 31, 1955. AI Magazine 27: 12. First published 1955. [Google Scholar]

- Ming, Ruixing, Osama Abdelrahman, Nissren Innab, and Mohamed Hanafi Kotb Ibrahim. 2024. Enhancing fraud detection in auto insurance and credit card transactions: A novel approach integrating CNNs and machine learning algorithms. PeerJ Computer Science 10: e2088. [Google Scholar] [CrossRef]

- Moore, Gordon E. 1965. Moore’s Law. Electronics Magazine 38: 114. [Google Scholar]

- Nilsson, Nils J. 1983. Artificial intelligence prepares for 2001. AI Magazine 4: 7. [Google Scholar]

- Pang, Subeen, and Chanyeol Choi. 2022. Data-driven Parametric Insurance Framework Using Bayesian Neural Networks. arXiv arXiv:2209.05307. [Google Scholar]

- Pelau, Corina, Irina Ene, and Mihai-Ionut Pop. 2021. The Impact of Artificial Intelligence on Consumers’ Identity and Human Skills. Amfiteatru Economic 23: 33–45. [Google Scholar] [CrossRef]

- Pisoni, Galena, and Natalia Díaz-Rodríguez. 2023. Responsible and human centric AI-based insurance advisors. Information Processing & Management 60: 103273. [Google Scholar]

- Rousset, Laure, and César Ducruet. 2020. Disruptions in Spatial Networks: A Comparative Study of Major Shocks Affecting Ports and Shipping Patterns. Networks and Spatial Economics 20: 423–47. [Google Scholar] [CrossRef]

- Russom, Philip. 2011. Big Data Analytics. TDWI Best Practices Report. Renton, WA: Fourth Quarter, pp. 1–40. [Google Scholar]

- Sai, Siva, Aanchal Gaur, Revant Sai, Vinay Chamola, Mohsen Guizani, and Joel J.P.C. Rodrigues. 2024. Generative AI for Transformative Healthcare: A Comprehensive Study of Emerging Models, Applications, Case Studies, and Limitations. IEEE Access 12: 31078–106. [Google Scholar] [CrossRef]

- Schoech, Dick, Hal Jennings, Lawrence L. Schkade, and Chrisan Hooper-Russell. 1985. Expert Systems: Artificial Intelligence for Professional Decisions. Computers in Human Services 1: 81–115. [Google Scholar] [CrossRef]

- Serrano, Emilio, Pedro del Pozo-Jiménez, Mari Carmen Suárez-Figueroa, Jacinto González-Pachón, Javier Bajo, and Asunción Gómez-Pérez. 2018. Predicting the risk of suffering chronic social exclusion with machine learning. In Distributed Computing and Artificial Intelligence, 14th International Conference. DCAI 2017. Advances in Intelligent Systems and Computing. Cham: Springer, vol. 620. [Google Scholar]

- Sharpe, Bill. 2014. Three Horizons and working with change. APF Compass, 26–28. [Google Scholar]

- Singh, Apoorva, and Kumar Akhilesh. 2019. The Insurance Industry—Cyber Security in the Hyper-Connected Age. In Smart Technologies: Scope and Applications. Singapore: Springer, pp. 201–19. [Google Scholar]

- Singh, Sushant K., and Muralidhar Chivukula. 2020. A Commentary on the Application of Artificial Intelligence in the Insurance Industry. Trends in Artificial Intelligence 4: 75–79. [Google Scholar]

- Soliño-Fernandez, Diego, Alexander Ding, Esteban Bayro-Kaiser, and Eric L. Ding. 2019. Willingness to adopt wearable devices with behavioral and economic incentives by health insurance wellness programs: Results of a US cross-sectional survey with multiple consumer health vignettes. BMC Public Health 19: 1649. [Google Scholar] [CrossRef]

- Soni, Tanishq, Deepali Gupta, Mudita Uppal, and Sapna Juneja. 2023. Explicability of Artificial Intelligence in Healthcare 5.0. Paper presented at International Conference on Artificial Intelligence and Smart Communication (AISC), Greater Noida, India, January 27–29; pp. 1256–61. [Google Scholar]

- Spinak, Ernesto. 1998. Indicadores cienciometricos. Ciência da Informação 27: 141–48. [Google Scholar] [CrossRef]

- Talesh, Shauhin A., and Bryan Cunningham. 2021. The Technologization of Insurance: An Empirical Analysis of Big Data and Artificial Intelligence’s Impact on Cybersecurity and Privacy. Utah Law Review, No. 5, 2021, forthcoming UC Irvine School of Law Research Paper No. 2021-21. Available online: https://ssrn.com/abstract=3841045 (accessed on 21 May 2024).

- Teleaba, Forian, Sorin Popescu, Marieta Olaru, and Diana Pitic. 2021. Risks of Observable and Unobservable Biases in Artificial Intelligence Predicting Consumer Choice. Amfiteatru Economic 23: 102–19. [Google Scholar] [CrossRef]

- Tsagris, Michail. 2021. A New Scalable Bayesian Network Learning Algorithm with Applications to Economics. Computational Economics 57: 341–67. [Google Scholar] [CrossRef]

- Van Eck, Nees Jan, and Ludo Waltman. 2007. Bibliometric mapping of the computational intelligence field. International Journal of Uncertainty, Fuzziness and Knowlege-Based Systems 15: 625–45. [Google Scholar] [CrossRef]

- Van Eck, Nees Jan, and Ludo Waltman. 2010. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84: 523–38. [Google Scholar] [CrossRef]

- Volosovych, Svitlana, Iryna Zelenitsa, Diana Dondratenko, Wojciech Szymla, and Ruslana Mamchur. 2021. Transformation of insurance technologies in the context of a pandemic. Insurance Markets and Companies 12: 1–13. [Google Scholar] [CrossRef]

- Waltman, Ludo, and Nees Jan Van Eck. 2007. Some comments on the question whether co-occurrence data should be normalized. Journal of the American Society for Information Science and Technology 58: 1701–3. [Google Scholar] [CrossRef]

- Zarifis, Alex, Christopher P. Holland, and Alistair Milne. 2023. Evaluating the impact of AI on insurance: The four emerging AI- and data-driven business models. Emerald Open Research 1: 15. [Google Scholar] [CrossRef]

- Zhang, Liming, Yang Zhang, Li Wang, Jiangyuan Wang, and Yulan Liu. 2021. Diagnosis of gastric lesions through a deep convolutional neural network. Digestive Endoscopy 33: 788–96. [Google Scholar] [CrossRef] [PubMed]

- Zhavoronkov, Alex, Evelyne Bischof, and Kai-Fu Lee. 2021. Artificial intelligence in longevity medicine. Nature Aging 1: 5–7. [Google Scholar] [CrossRef]

- Zupic, Ivan, and Tomaž Čater. 2014. Bibliometric Methods in Management and Organization. Organizational Research Methods 18: 429–72. [Google Scholar] [CrossRef]

| Horizons | Research Fronts |

|---|---|

| Horizon 1 Adoption of AI to optimize and improve the efficiency of their current operations | CLUSTER 1 CLUSTER 5 CLUSTER 6 |

| Horizon 2 Use of AI to introduce novel and efficient services | CLUSTER 2 CLUSTER 3 CLUSTER 4 |

| Horizon 3 Exploring how AI could redefine industry | CLUSTER 7 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Acosta-Prado, J.C.; Hernández-Cenzano, C.G.; Villalta-Herrera, C.D.; Barahona-Silva, E.W. Three Horizons of Technical Skills in Artificial Intelligence for the Sustainability of Insurance Companies. Adm. Sci. 2024, 14, 190. https://doi.org/10.3390/admsci14090190

Acosta-Prado JC, Hernández-Cenzano CG, Villalta-Herrera CD, Barahona-Silva EW. Three Horizons of Technical Skills in Artificial Intelligence for the Sustainability of Insurance Companies. Administrative Sciences. 2024; 14(9):190. https://doi.org/10.3390/admsci14090190

Chicago/Turabian StyleAcosta-Prado, Julio César, Carlos Guillermo Hernández-Cenzano, Carlos David Villalta-Herrera, and Eloy Wilfredo Barahona-Silva. 2024. "Three Horizons of Technical Skills in Artificial Intelligence for the Sustainability of Insurance Companies" Administrative Sciences 14, no. 9: 190. https://doi.org/10.3390/admsci14090190

APA StyleAcosta-Prado, J. C., Hernández-Cenzano, C. G., Villalta-Herrera, C. D., & Barahona-Silva, E. W. (2024). Three Horizons of Technical Skills in Artificial Intelligence for the Sustainability of Insurance Companies. Administrative Sciences, 14(9), 190. https://doi.org/10.3390/admsci14090190