Abstract

The sustainable development goals (SDGs) are a guide for caring for the planet, guaranteeing the fundamental rights of its inhabitants and shaping sustainable economic growth. In the current context, characterised by great challenges and geopolitical conflicts, the figure of the CEO is key to driving the necessary transformation of companies and the prioritisation of their commitment to the current challenges of the world we live in. In this regard, the aim of this paper is to deepen current knowledge on the role of CEO visionary leadership in shaping inclusive and sustainable business models aligned with the goals of the 2030 Agenda. For the period 2019–2022, we study the information reported by the top 3910 companies worldwide on their contributions to the SDGs and analyse whether these commitments are determined by the structural power of the CEO within these companies. The results obtained confirm previous arguments, contradicting some of the previous evidence. In this sense, our findings show that the information disclosed by companies in relation to projects aligned with the SDGs is positively associated with leadership figures who wield power that allows them to influence the agenda and decisions made by the board of directors. The influence of leaders is reinforced in scenarios where companies excel in sustainability performance.

1. Introduction

The emergencies associated with COVID-19, rapid climate change and the context of confrontation and instability that we are experiencing are events that seem to want to wipe out humanity, but which, on the contrary, have turned us into a society that is called to be resilient and supportive in order to achieve sustainable development. However, the report of United Nations Global Compact and Accenture (2023) highlights the significant challenges facing society today in achieving the sustainable development goals (SDGs). In this sense, the report concludes that companies are key actors in achieving the goals of the 2030 Agenda and, nevertheless, the actions they have put in place lead to progress that can be improved (Leal Filho et al. 2023).

Correcting these situations requires a public commitment from business leaders. This commitment is the necessary starting point for the design and implementation of policies that promote the alignment of business sustainability strategies with the SDGs. This is the path that the UN proposes to enhance the impact that the private sector has to follow and that, according to the results of the report, would be very present in the agenda of large companies.

Previous studies have predominantly focused on explaining the heterogeneity of business commitments to the 2030 Agenda and the information disclosed by studying institutional drivers (i.e., Rosati and Faria 2019a) and the corporate governance mechanisms associated with the board of directors, ownership structure and other external actors (i.e., García-Sánchez et al. 2020d, 2023a, 2022b). On the other hand, the literature focusing on the role played by internal actors is very residual, with the study by García-Sánchez et al. (2023a) addressing the role of the gender composition of the TMT in the development of projects focused on contributing to the SDGs. In addition, current research is heavily focused on the study of personality traits that lead managers to drive certain transparency policies, with existing knowledge on the role of CEOs’ structural power in sustainability disclosures being residual and contradictory (i.e., Pucheta-Martínez and Gallego-Álvarez 2021; Muttakin et al. 2018) or integrated reporting (García-Sánchez et al. 2020c).

Power is a relevant research area because it gives the CEO discretion to determine which objectives and pressures to prioritise; and the authority to mobilise the necessary resources to address the priorities set (Resick et al. 2023; Palau-Pinyana et al. 2023; Walls and Berrone 2017) or, on the other hand, to go for a ceremonial approach (Steinberg et al. 2022). In this vein, several authors have highlighted the key role that CEOs should play in corporate transparency (Li et al. 2023; Lewis et al. 2014).

Thus, to contribute to the previous literature, this article focuses on the analysis of internal drivers, investigating the effect that the structural power of the CEO has on the disclosure of information on corporate commitments to the 2030 Agenda. To this end, we posit that CEOs with greater board-level power will be more likely to report more information on the projects and initiatives their companies are undertaking to contribute to, accelerate and achieve the 2030 Agenda.

In this vein, the findings of the UN Global Compact and Accenture report suggest that executives’ interpretation of external pressures for their corporations to commit to the 2030 Agenda will lead them to a favourable strategic choice because of their personal understanding, interest in the issue at hand and their ability to address these challenges. According to the literature, the CEO’s decision should be sufficiently influential to go against the opinion of other forces, including the views of the board of directors (Haynes and Hillman 2010), and we understand that their ability to positively influence this body will to a large extent be associated with the structural power that executive directors possess over its composition.

For a balanced panel dataset of 3910 large companies globally over the period 2019–2022 (15,640 observations), we contrast how the engagement of top executives intensifies the information their companies disclose about initiatives with a significant impact on people, the planet and the business models they promote. Specifically, we observe that CEOs with high structural power favour greater corporate transparency regarding business practices and performance aligned with our society’s main challenges and current information demands, such as those set out in the 17 SDGs of the 2030 Agenda. This effect disappears for scenarios with low–medium structural power because of the difficulty the current executive would have in determining the agenda of the topics to be discussed at meetings and correcting the opposition observed for independent directors.

In this regard, we contribute to the previous literature with new evidence regarding the essential role that CEOs play in corporate strategic decisions (Gull et al. 2023; García-Sánchez et al. 2020c). Previous studies have particularly focused on the role they play with respect to the social, environmental and good governance dimensions (ESG) (i.e., Zhang et al. 2022; Aibar-Guzmán and Frías-Aceituno 2021; Pucheta-Martínez and Gallego-Álvarez 2021), the level of decoupling between what they say and do (Gull et al. 2023) or their commitment to integrated reporting (García-Sánchez et al. 2020c). Our research thus contributes to expanding the existing knowledge on strategic leadership by determining whether more powerful CEOs are more likely to inform their stakeholders about their commitment to the 2030 Agenda, in other words, to the preservation of the planet and social well-being.

In addition, the findings obtained partially contradict previous empirical evidence due to the consideration of several factors. The first is the configuration of gradual structural power scenarios, a different conceptualisation to that considered in previous studies. To this end, we consider different situations in which the current CEO (incumbent CEO) and executives can take seats and assert their influence within the board of directors. This approach allows us to observe that the roles played by active CEOs (incumbent CEO) differ from those professionals with previous experience (former CEO), who adopt an opposite role within the boards of directors they chair, more aligned with the opinion of the external directors.

The second is the consideration of an uncertain time scenario such as the period analysed, from 2019 to 2022, characterised by the health, economic and social consequences of COVID-19 and a growing number of geopolitical conflicts. All these events have led to demands for solidarity from public institutions, organisations and society in general, leading to changes in the business priorities that these CEOs believe they must address.

In this vein, we attend the call that Gümüsay and Reinecke (2022) make, regarding the need to contribute to making it possible to empirically analyse the future in an environment characterised by higher uncertainty, an increase in inequality and climate emergency situations, among other instabilities and challenges; and to the research gap identified by Comoli et al. (2023) regarding current pending concerns around the world, which highlights the relevance of the SDGs of the 2030 Agenda.

2. Theoretical Framework and Research Hypothesis

2.1. Studies on the 2030 Agenda and Sustainable Development Goals (SDGs)

The literature focusing on the study of the determinants and impacts of the information of business projects aligned with the 2030 Agenda is prolific in recent years. The studies have mainly focused on the analysis of the effect of institutional factors (Bose and Khan 2022; Calabrese et al. 2022; Rosati and Faria 2019a), corporate governance structures (i.e., Toukabri and Mohamed Youssef 2022; Pizzi et al. 2021; Rosati and Faria 2019b) and ownership (Patuelli et al. 2022; García-Sánchez et al. 2020a, 2020b) on the disclosure of the SDGs.

These studies are addressed for specific countries, geographic regions and industries (i.e., Gyimah et al. 2023; Lenort et al. 2023; Perello-Marin et al. 2022; Ike et al. 2019; Avrampou et al. 2019) and for samples from large multinationals (Bose et al. 2024). Thus, they allow for a comprehensive overview of the SDGs’ information disclosed (Subramaniam et al. 2023), its relevance to stakeholders (García-Sánchez et al. 2023b; Hummel and Szekely 2022) and their economic (García-Sánchez et al. 2020a), social and bio-atmospheric impacts (Dinçer et al. 2024).

In this sense, empirical evidence points to the existence of different levels of disclosure of information on the SDGs, in terms of quantity and quality. On the one hand, Tsalis et al. (2023), Heras-Saizarbitoria et al. (2022) and van der Waal and Thijssens (2020) find low levels of information disclosure, being alienated to little substantive engagement. The evidence of Weerasinghe et al. (2023a, 2023b) indicates a long way to go in the organisation and dissemination of the SDGs.

On the other hand, the findings of Song et al. (2022) indicate that companies located in Europe lead the way in business engagement with the SDGs. García-Sánchez et al. (2020a) point out that companies, through their disclosures, present a real and transcendent development of specific actions aimed at achieving the SDGs, and ultimately advancing the full enjoyment of human rights in the global territory.

In addition, the previous literature indicates that the volume and quality of information disclosed on the SDGs has been positively determined by high ESG performance (Nicolo’ et al. 2024), by the increased presence of women in corporate management and in supervisory bodies (García-Sánchez et al. 2022a; Mazumder 2024) and by cultural contexts characterised by a trade-off between leniency and restraint and a greater long-term orientation (Pizzi et al. 2022). However, the diversity of the management team has contradictory effects according to the evidence of Weerasinghe et al. (2023b).

Additionally, Suhrab et al. (2024), Arora-Jonsson (2023) and Khemani and Kumar (2022) show the vital importance of the mobility of economic and intellectual resources by companies in the generation of positive, direct and immediate impacts on social groups in vulnerable conditions, being relevant to the convergence of the efforts of local governments and the business fabric for the effective achievement of sustainability (Di Vaio et al. 2023; Krasodomska et al. 2022; Silva 2021; Calabrese et al. 2021; Gunawan et al. 2020).

However, the literature is less prolific in studying the role that CEOs can play. In this sense, top managers can lead the company to better or worse results (Riaz et al. 2023), define strategies, manage risks and allocate resources to ESG areas according to their individual characteristics, perception or orientation (Resick et al. 2023) but, in any case, it is determined by his or her power in the company. If the characteristics, perception or orientation are positively related to the sustainability approach, his/her power may lead him/her to maximise actions in the companies; or in cases where it is negatively associated, the CEO may treat it as a ceremonial procedure (Steinberg et al. 2022).

2.2. CEOs and Sustainability Disclosures

CEO decisions on what information to disclose in sustainability reports is an issue to pay attention to when talking about organisational leadership and transparency (Nonet et al. 2022; Harrison et al. 2020). In addition, the pressure from different stakeholders and the configuration of power organs can determine the content and form of the information reported (Higgins et al. 2020).

In this sense, previous empirical evidence provides mixed results on the characteristics of CEOs and board situations that are conducive to higher or lower levels of information disclosure, as well as on its quality. García-Sánchez et al. (2022a) and Shahab et al. (2020) found that attributes such as a research, financial or sustainability background and the experience of CEOs have positive effects on a higher quality of SDG and sustainability reporting in the absence of institutional pressures. Khan et al. (2021) showed an inverted U-shaped relationship between CEO tenure and sustainability disclosure, with the first years of CEO tenure being the most data-rich periods. In addition, Hussain et al. (2023) note that the presence of a female CEO has a positive and significant impact on the dissemination of information on environmental sustainability.

Additionally, Garrido-Ruso et al. (2023), Lassoued and Khanchel (2023), Bachrach et al. (2022) and Chen et al. (2021) show that the country of origin, higher educational level and narcissistic behaviour of CEOs are personal attributes that individually or jointly influence positively and significantly the disclosure of information on the SDGs or in relation to social and governance issues. Likewise, the findings of Mahmoudian et al. (2021) indicate that the high risk tolerance of CEOs, consistent with their personality traits (i.e., conscientiousness, neuroticism, agreeableness, openness or extraversion) is related to a lower readability of sustainability reports and to a lower volume of information.

According to Graham et al. (2020), simultaneous situations such as the increased presence of directors or insiders on the board and the duality of the CEO nurture and strengthen the corporate management through constant feedback, enabling them to achieve a strong business performance and disclosure of their sustainability implications. Also, Lassoued and Khanchel (2023) find a positive moderation of CEO duality in relation to CEO personality attributes and sustainability disclosure. In addition, Pucheta-Martínez and Gallego-Álvarez (2021) and Tuggle et al. (2010) indicate that CEO duality and good business performance interactively affect sustainability performance reporting and the board monitoring function (i.e., when CEO duality exists and business performance is good, sustainability reporting has a positive tone and board monitoring is weak). On the other hand, Maswadi and Amran (2023), Oware and Awunyo-Vitor (2021), Tibiletti et al. (2021), Khlif et al. (2020), Lin et al. (2020), Lagasio and Cucari (2019) and Gul and Leung (2004) evidence that CEO duality negatively affects sustainability disclosures, and Muttakin et al. (2018) observed that the CEO’s discretion harms transparency on sustainability issues, evidence that was confirmed by García-Sánchez et al. (2020c) for integrated reporting and for different corporate incentives.

2.3. Powerful CEOs and SDG Disclosures: Research Hypothesis

CEOs are key and unquestionable figures in the implementation of innovative visionary strategies aligned with inclusive and sustainable economic growth as set out in the SDGs of the 2030 Agenda. In the current context, characterised by an increase in business challenges due to COVID-19, post-pandemic recovery and the emergence of new geopolitical conflicts, corporate humanism or the sustainable engagement of companies is vital for today’s society. While business competitiveness and resilience will come from purposeful long-term value creation and the excellent management of intangibles, companies do not have to solve all current problems but should identify where a meaningful and coherent contribution can be made, taking into account the purpose of each organisation. This is the advice that Larry Fink, CEO of BlackRock, proposes to the CEOs of the companies in which its investment group has a shareholding.

Given the concentrated efforts of all stakeholders to achieve a more sustainable world, the CEO’s job is to integrate the SDGs into the corporate strategy and business model. The involvement of these actors is unquestionable because an organisation cannot adopt any kind of transformation without the support of its leaders and managers. However, the commitment should not be reduced to supporting specific initiatives or projects but should promote the necessary values and cultural changes, as well as the unification of the company’s interests with those of society and the generation of shared value.

To this end, the structural power of the CEO can play an essential role both in terms of the actions to be taken and the information to be reported, since, as managers, they are the ones most responsible for the company’s resources and their allocation (Cai et al. 2020; Muttakin et al. 2018; Fabrizi et al. 2014) and the fact that his presence on the board of directors, especially when he is the chairman of the board of directors, leads to an influence on the decision-making and monitoring processes being exercised by a single person (Yu 2023; Muttakin et al. 2018; Lu et al. 2015).

In the previous literature, the approaches to CEOs’ decision-making and structural power are contradictory, identifying a dual role associated with managerial opportunism and stewardship activities related to the alignment of their interests with the company, a unity that is reinforced by greater authority. More specifically, according to agency theory, their presence on the board of directors weakens the board’s monitoring of their managerial performance and may threaten corporate legitimacy (Lu et al. 2015), negatively affecting corporate transparency. Moreover, the structural power they possess gives them great discretion in the use of resources, and they often over-invest in sustainable projects in order to reinforce their prestige and personal image (Jiraporn and Chintrakarn 2013; Surroca and Tribó 2008).

However, stewardship theory argues that CEOs are responsible and ethical professionals whose interests are aligned with the company’s mission and strategies (Bernstein et al. 2016; Sundaramurthy and Lewis 2003; Davis et al. 1997; Donaldson and Davis 1991). In this respect, their structural power provides an integrated vision of the company in the different corporate bodies that favours unity towards the firms’ vision, reinforced by the effect that authority can have on conflict resolution (Sundaramurthy and Lewis 2003). Therefore, CEOs with greater structural power would have sufficient authority to align business strategy with the SDGs, responsibly allocate corporate resources to these ends and foster transparency regarding the business contribution to the 2030 Agenda in order to strengthen corporate reputation and resilience.

Considering that the structural power of the CEO consists in the ability of executives to determine which choices can be made due to being in a high formal position in companies (Harrison and Malhotra 2023; Finkelstein 1992), it is inevitable that this power will also influence the dynamics of choice and decision about the information that can be disclosed in the reports, especially in relation to the strategic goals of the ONU Agenda 2030. Another factor is that the pressure from stakeholders about the alignment of companies with the Agenda should increase the interest of CEOs in executing these goals efficiently and quickly, so that they stand out as excellent in their respective management, seeking to remain in their positions for longer, recognition in the firm or the achievement of greater bonuses (Varriale 2023).

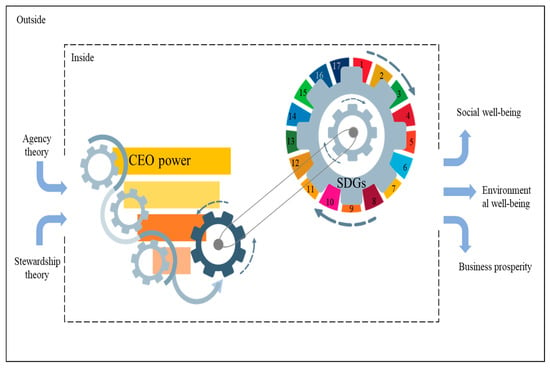

In addition to the information that can be disclosed in sustainability reports, one study (Bukalska et al. 2021) reinforces that the power of the CEO in companies also influences which financial strategies can be executed so that the goals of the 2030 Agenda and the sustainable development goals are experienced in a real way by companies (according to stewardship theory arguments). On the other hand, the prioritisation of budgetary resources or the restructuring of capital that meets the deliberations of the 2030 Agenda do not occur as they should, despite their sustainability reports highlighting the achievement of the SDGs as a priority (agenda theory arguments). Figure 1 graphically depicts the framework of analysis proposed thus far). In this sense, we set out our research hypothesis.

H1:

The CEO’s structural power positively impacts corporate disclosure of information on the sustainable development goals set out in the 2030 Agenda.

Figure 1.

Graphical representation of the proposed theoretical framework, CEO power at work.

3. Method

3.1. Sampling Approximation

The population selected for the testing of the proposed research hypothesis corresponds to the large companies worldwide whose information is available in the Refinitiv database (García-Sánchez et al. 2020a, 2020b). According to these authors, these corporations have significant resources that can be allocated to projects aligned with the SDGs and capabilities that facilitate the integration of these commitments into business strategy and management. In addition, the CEOs of these companies are ideal for testing the effect that their structural power has on the decisions analysed (García-Sánchez et al. 2020c).

In this regard, the initial population corresponded to 8905 companies whose economic–financial and ESG information is available in the indicated database for the period 2019–2022. These companies meet our first search criterion regarding having information for the ESG score in at least one of the years of the period.

However, in order to estimate our model, it is necessary that companies have promoted sustainability initiatives linked to the SDGs. In this sense, the second criterion applied to determine the sample is that the companies have information on the variables associated with the 17 SDGs. The application of this second criterion has led to the elimination of those observations that did not have information on the SDGs.

The absence of information for the variables associated with the SDGs has led to sampling disparity and, in this sense, we have required that the information be available during the four years that make up the selected period. This search criterion guarantees that the identified companies have implemented sustainability strategies aligned with the 2030 Agenda and that these are linked to a stable commitment over time. That is, they are not specific initiatives in one or several years.

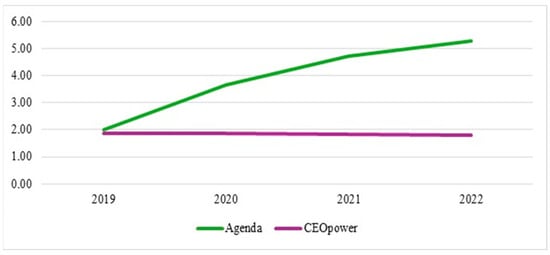

These two last criteria led us to use a balanced panel of data comprising 3910 companies for the period indicated, with 15,640 observations. The companies analysed come from 71 countries belonging to 8 geographical regions. Figure 2 allows us to visualise the increasing evolution of SDG information and the structural power of the CEO in the selected companies for the period 2019–2022.

Figure 2.

Dynamic evolution of SDGs disclosure and CEO power.

3.2. Empirical Model

The testing of the research hypothesis regarding the impact of CEO structural power on the disclosure of information on corporate commitments to the 2030 Agenda will be addressed through the explanatory model defined in Equation (1). The hypothesis H1 would be accepted if due to implying that CEOpower has a positive and significant impact on Agenda.

- i ranges from firm 1 to 3910;

- t ranges from year 2016 to 2022;

- are the coefficients from the constant and explanatory variables.

The dependent variable Agenda is a score created from the information that companies disclose about their commitments to the SDGs. For this purpose, we have used the available information of SDGs in the Refinitiv database. The information corresponds to 17 variables that take values of 0 or 1. Each variable is associated with 1 of the 17 SDGs and the value 1 implies that the company has carried out some initiatives associated with that specific SDG and that the company discloses information that allows us to understand these activities; the value is 0 otherwise. Initially, we have created an unweighted score by the addition of the 17 dichotomic items in an absolute approach.

To obtain robust results, we adopted the relative measurement of Bose et al. (2024) and determined the arithmetic mean of all SDGs items disclosed by a company multiplied by 100. This approach guarantees the internal consistency of the score, confirming that it captures the underlying constructs and that a higher score implies higher levels of disclosure.

The CEOpower variable has been designed to measure the structural power of the CEO by including new criteria in addition to the proposal of García-Sánchez et al. (2020c), taking values between 0 and 4. In this vein, we modified the proposal of previous authors and we included the consideration of a former CEO chairing the meetings of the board of directors because of his previous work as a CEO. Trinh et al. (2023) have observed that his/her presence improves environmental and social performance, especially during the COVID-19 pandemic, due to the alignment with executives’ interests.

In this sense, a score of 0–3 or 0–4 has been initially configured by adding the dichotomous variables: (i) the CEO sits on the board of directors (value 1); (ii) the presence of executive directors is above average (value 1); and (iii) the chairman of the board of directors is a former CEO (value 1) or the current CEO (value 2). The duality of the CEO has double value compared to the presence of a former CEO as chair of the board because the literature has shown that in addition to creating a welcoming environment for executives, he/she may be reluctant to question changes in strategy, policies or initiatives. which he/she launched during his mandate (Andres et al. 2014). This last situation would never occur under the current CEO.

To avoid bias in the results, the control vector comprises nine variables related to the resources and capabilities of the companies analysed, their ownership structure and the effectiveness of their board of directors. According to García-Sánchez et al. (2020a, 2020c) or Pizzi et al. (2021, 2022), the access to higher volumes of capacity is related to firms’ size, economic profitability, leverage and investment. The other control variables represent the corporate governance mechanisms that guarantee greater supervision by the independence, diversity and size of the board of directors, as well as the presence of institutional investors in the ownership. We also introduced the four numerical variables of industry, country, region and year that control the sector and the geographic and temporal heterogeneity. Table 1 reflects its definition and descriptive statistics.

Table 1.

Statistical descriptive and definition of variables.

In order to obtain robust results, we adopt several methodological changes in our initial model. The first is the use of different methodological specifications in relation to the econometric models. In this vein, Equation (1) will be estimated using linear regression for panel data. This approach allows the existing relationships to be determined with great precision and simplicity, evaluating the fit of the model to the data. Furthermore, it is versatile and flexible, and it can be used for different types of data with confidence and robustness by controlling noise and outliers (Hair et al. 2017). However, given the censored nature of the variable Agenda, Tobit regressions for panel data will be used. This econometric specification allows us to confirm that the results obtained through linear regression are maintained when it is controlled that the values of the dependent variable present a lower and upper limit that they cannot exceed.

In addition to these changes in the methodological specifications, modifications will be considered in the configuration of the dependent variable with the use of relative values and in the independent variable, through the breakdown of the CEOpower values discussed above.

Moreover, the use of panel data methodologies ensures that unobservable heterogeneity is controlled for, avoiding the error associated with the omission of some variable that cannot be observed, but that may be correlated with the observable variables.

Endogeneity refers to the problem of correlation between the explanatory variables and the error term in a regression model, which can lead to biased and inconsistent estimates. In our model, endogeneity is controlled by the use of a time lag on the independent and control variables. These instruments allow us to correct the problem by finding variables that are correlated with the endogenous variable but not with the error term. All models will be estimated with Stata software (https://www.stata.com).

4. Results

4.1. Basic Results

Table 1 shows the descriptive statistics for the variables that make up the empirical proposal. It can be seen that the average Agenda score is 4 out of 17 points. There are differences between geographical regions according to Table 1. The CEO’s structural power has an average of 1.84 out of 4 points.

Table 2 shows the correlation matrix, showing the absence of multicollinearity problems.

Table 2.

Bivariate correlations.

Table 3 shows the basic and robust models proposed to test the hypothesis H1. The first column presents the basic model predicted in Equation (1) for estimation with linear regression. The second column presents the results for changes in the methodological specifications controlling for censoring of the dependent variable, using Tobit regressions for panel data. In the third column, the robust model assumes the modification of the Agenda variable, initially set in absolute values, by the relative approximation.

Table 3.

Results for the effect of CEO power on SDG disclosures.

Commenting on the results reflected in the first column, we observe that the CEO’s structural power has a significant impact, at a 95% confidence level, and of a positive nature on the information that companies report on their commitments to the SDGs. More concretely, the impact of the CEOpower variable is of , for a p-value < 0.05. This effect is confirmed in the robust models shown in the other two columns of Table 3.

The evidence obtained allows us to accept the hypothesis H1, confirming that the power of CEOs within the organisation they lead is essential to foster greater commitment to the 2030 Agenda and to report information on the different initiatives they have put in place with respect to each of the 17 sustainable development goals. This evidence would reinforce the findings of Pucheta-Martínez and Gallego-Álvarez (2021). It would, however, be in opposition to the evidence of García-Sánchez et al. (2020c) or Muttakin et al. (2018), who observed that CEOs with great power were opposed to publishing sustainability or integrated reports, a decision that is independent of the companies’ incentives. These differences with previous literature could be explained by the fact that the period under analysis is characterised by the emergence of a global pandemic with major health, social and economic consequences that fostered a greater spirit of solidarity among the world’s inhabitants. In addition, the recovery from this shock has been accompanied by major geopolitical conflicts that require great solidarity, causing CEOs to understand that there are challenges to which they must contribute (Raimo et al. 2021; United Nations Global Compact and Accenture 2023).

With regard to the control variables, we find that company size and ESG performance are a clear determinant of the alignment of the sustainability strategy with the goals set out in the 2030 Agenda. In this regard, works such as that of García-Sánchez et al. (2023a) have observed that these firms have large amounts of resources that they can allocate to solidarity projects, closely related to the main challenges of today’s society, reporting greater volumes of information in this regard (i.e., Rosati and Faria 2019a, 2019b).

With respect to corporate governance mechanisms, we identified that while the activity of the board of directors reinforces the business practices analysed, the independence of this body plays the opposite role. These results are partially in line with previous literature (i.e., Graham et al. 2020; Zampone et al. 2022). Additionally, in line with García-Sánchez et al. (2020b, 2022b), we note that the presence of institutional investors in the shareholding, when analysed as a whole, is not a determinant of corporate transparency practices.

4.2. Complementary Findings

The evidence obtained, diverging from previous studies, generates interest in analysing whether this is a consequence of changes in the measure used to represent CEO power. In this respect, our proposal differs from that of García-Sánchez et al. (2020c) and Muttakin et al. (2018) because we consider different items to measure structural power. In this regard, we posed Equation (2), in which, considering the existence of different levels of structural power, we divided the initial CEOpower score taking values between 0 and 4 based on two types of board configuration. The first, the one that would carry the most power, would assume that the incumbent CEO chairs the board of directors and has an executive presence in this body, so that it can determine the agenda in terms of dates, meetings and issues to be addressed: a situation that we have called highCEOpower. In the second scenario, the board of directors is chaired by a former CEO and there is a strong executive influence due to the fact that the CEO and part of his management team occupy a significant number of seats: a situation that we have called mediumCEOpower.

- i ranges from firm 1 to 3910;

- t ranges from year 2016 to 2022;

- are the coefficients from the explanatory variables.

Thus, the results in Table 4 show the opposite effect that both levels of structural power have on business decisions regarding the disclosure of information on business projects and initiatives aligned with the 17 SDGs. Specifically, the variable highCEOpower has a positive impact of for a confidence level of 95%. On the contrary, the variable mediumCEOpower shows a negative and significant effect of , for a 99% confidence level. Thus, the complementary evidence suggests that while CEOs with high structural power encourage corporate transparency, as we observed in the previous analyses, the consideration of a medium structural power scenario shows a preference for opacity, in line with the view of independent directors. Therefore, our findings allow us to extend the existing knowledge on the role of CEO power in decision-making processes, identifying divergent power scenarios that lead to different decisions conditioned by the opinion of external directors.

Table 4.

Complementary analysis for CEO power disaggregation.

Additionally, the positive and significant impact of the ESG variable in all models does not lead us to consider the economic theories of corporate disclosure as a decision that can lead to tangible and intangible benefits (i.e., Clarkson et al. 2008; Cho and Patten 2007). In this respect, these paradigms argue that the best-performing companies, in this case in terms of sustainability, have a strong interest in reporting their performance because of the difficulties that other companies have in catching up or imitating their performance. Disclosures would therefore allow them to gain comparative advantages. In contrast, underperforming companies tend to opt for the strategy of silence, a behaviour that will lead financial experts to place them as average companies. With this strategy, they would benefit from the fact that they would not be penalised by comparative information analysis. Thus, the following two equations have been proposed, in which the structural power of the CEO, aggregated or disaggregated in the high and medium scenarios, would interact with the sustainability performance, the ESG variable.

- i ranges from firm 1 to 3910;

- t ranges from year 2016 to 2022;

- are the coefficients from the explanatory variables.

The results reflected in Table 5 show that the effect of CEO power on the decision to report information on projects and initiatives aligned with the SDGs is greater in companies with a higher sustainability performance. In this regard, in the second column of Table 5 it can be seen that the impact of CEOpower, would increase by . This effect holds for the business scenario where structural power is high. In this case, the impact of highCEOpower, For the scenario in which the CEO would have medium structural power, the consideration of sustainability performance allows for a slight correction of its opposition to SDG disclosure. Thus, will be reduced by

Table 5.

Complementary results for ESG performance.

5. Conclusions

In this paper, we analyse corporate transparency practices related to the information that companies disclose about their projects and initiatives related to the 17 SDGs of the 2030 Agenda. In the results obtained for a full panel dataset of 3910 companies over the period 2019–2022, we observe that the most powerful CEOs embrace sustainability to build long-term resilience in the current context of disruption, reporting higher volumes of information than companies with more independent boards.

These results are contrary to previous literature in the field of non-financial and integrated reporting, which had observed that top leaders used their power to reduce public disclosure of the ESG performance of the companies they lead. Thus, the theoretical implications derived from our work would not support the agency theory postulates that the presence of executives and duality of roles damages the legitimacy of companies by negatively affecting board decision-making and monitoring processes.

On the contrary, our findings show, in line with stewardship theory, that CEOs, far from acting opportunistically, make decisions aligned with the objectives of the companies they lead and institutional pressures. According to Donaldson and Davis (1991), their structural power enables them to act effectively insofar as they have recognised authority, unambiguity in their role and leadership and the necessary influence to integrate external demands regarding the SDGs into the company’s strategy and report the necessary information for stakeholders to assess their level of commitment.

In this sense, the duality of functions and the presence of executives on the board of directors favours the inclusion, debate and approval of these issues on the board’s agenda. On the other hand, the consideration of a medium–low structural power scenario in our complementary analyses provides new evidence to the controversial debate on the presence of former CEOs on the board of directors because, while their experience would serve as a guarantee of an effective advisory, monitoring and supervisory process, on the other hand, their presence may entail a favourable and lenient scenario for executives (Andres et al. 2014). Thus, our evidence confirms that obtained by these authors regarding shareholders’ interests, observing that their presence on the board of directors is not associated with the second scenario proposed in the literature for sustainability decisions affecting different stakeholders.

In addition, we confirm the prevalence of the approaches of economic disclosure theories, noting that both CEOs, incumbent and former, opt for more extensive disclosures to stakeholders when the company shows a higher ESG performance, a decision that allows it to gain comparative advantages over other companies with lower levels of sustainability. In this sense, the latter corporations would avoid being penalised by less transparent positions in relation to actions aligned with the 2030 Agenda.

Our results are subject to a number of limitations, mainly related to the analysis of firms across a large number of countries and industries, and further research is needed to confirm this evidence by analysing firms in specific countries with homogeneous institutional pressures. Moreover, industrial differences must be considered, an approach that has been used in several papers like Tanguy et al. (2023). In addition, future work should address whether CEO power differs according to various diversity traits of the top manager, such as gender or nationality.

Author Contributions

Writing—review & editing, I.-M.G.-S., D.-J.C.-A., V.A.-E. and S.-Y.E.-A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Junta de Castilla y León y Fondo Europeo de Desarrollo Regional under Grant CLU-2019-03, Unidad de Excelencia “Gestión Económica para la Sostenibilidad” (GECOS) and by Servicio Público de Empleo Estatal (SEPE): Programa Investigo 2021.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset is subject to commercial restrictions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Aibar-Guzmán, Beatriz, and José-Valeriano Frías-Aceituno. 2021. Is It Necessary to Centralize Power in the CEO to Ensure Environmental Innovation? Administrative Sciences 11: 27. [Google Scholar] [CrossRef]

- Andres, Christian, Erik Fernau, and Erik Theissen. 2014. Should I stay or should I go? Former CEOs as monitors. Journal of Corporate Finance 28: 26–47. [Google Scholar] [CrossRef]

- Arora-Jonsson, Seema. 2023. The sustainable development goals: A universalist promise for the future. Futures 146: 103087. [Google Scholar] [CrossRef]

- Avrampou, Anna, Antonis Skouloudis, George Iliopoulos, and Nadeem Khan. 2019. Advancing the Sustainable Development Goals: Evidence from leading European banks. Sustainable Development 27: 743–57. [Google Scholar] [CrossRef]

- Bachrach, Daniel G., Maria João Guedes, Peter D. Harms, and Pankaj C. Patel. 2022. CEO narcissism, top management team transactive memory systems, and firm performance: An upper echelons perspective on CEO admiration and rivalry narcissism. European Journal of Work and Organizational Psychology 31: 61–76. [Google Scholar] [CrossRef]

- Bernstein, Ruth, Kathleen Buse, and Diana Bilimoria. 2016. Revisiting Agency and Stewardship Theories. Nonprofit Management and Leadership 26: 489–98. [Google Scholar] [CrossRef]

- Bose, Sudipta, and Habib Zaman Khan. 2022. Sustainable development goals (SDGs) reporting and the role of country-level institutional factors: An international evidence. Journal of Cleaner Production 335: 130290. [Google Scholar] [CrossRef]

- Bose, Sudipta, Habib Zaman Khan, and Sukanta Bakshi. 2024. Determinants and consequences of sustainable development goals disclosure: International evidence. Journal of Cleaner Production 434: 140021. [Google Scholar] [CrossRef]

- Bukalska, Elżbieta, Marek Zinecker, and Michał Bernard Pietrzak. 2021. Socioemotional Wealth (SEW) of Family Firms and CEO Behavioral Biases in the Implementation of Sustainable Development Goals (SDGs). Energies 14: 7411. [Google Scholar] [CrossRef]

- Cai, Xiangshang, Ning Gao, Ian Garrett, and Yan Xu. 2020. Are CEOs judged on their companies’ social reputation? Journal of Corporate Finance 64: 101621. [Google Scholar] [CrossRef]

- Calabrese, Armando, Roberta Costa, Massimo Gastaldi, Nathan Levialdi Ghiron, and Roberth Andres Villazon Montalvan. 2021. Implications for Sustainable Development Goals: A framework to assess company disclosure in sustainability reporting. Journal of Cleaner Production 319: 128624. [Google Scholar] [CrossRef]

- Calabrese, Armando, Roberta Costa, Nathan Levialdi Ghiron, Luigi Tiburzi, and Roberth Andres Villazon Montalvan. 2022. Is the private sector becoming cleaner? Assessing the firms’ contribution to the 2030 Agenda. Journal of Cleaner Production 363: 132324. [Google Scholar] [CrossRef]

- Chen, Jing, Zhe Zhang, and Ming Jia. 2021. How CEO narcissism affects corporate social responsibility choice? Asia Pacific Journal of Management 38: 897–924. [Google Scholar] [CrossRef]

- Cho, Charles H., and Dennis M. Patten. 2007. The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society 32: 639–47. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Yue Li, Gordon D. Richardson, and Florin P. Vasvari. 2008. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society 33: 303–27. [Google Scholar] [CrossRef]

- Comoli, Maurizio, Patrizia Tettamanzi, and Michael Murgolo. 2023. Accounting for ‘ESG’ under Disruptions: A Systematic Literature Network Analysis. Sustainability 15: 6633. [Google Scholar] [CrossRef]

- Davis, James H., F. David Schoorman, and Lex Donaldson. 1997. Davis, Schoorman, and Donaldson reply: The distinctiveness of agency theory and stewardship theory. Academy of Management. The Academy of Management Review 22: 611–13. [Google Scholar]

- Di Vaio, Assunta, Luisa Varriale, Maria Lekakou, and Matteo Pozzoli. 2023. SDGs disclosure: Evidence from cruise corporations’ sustainability reporting. Corporate Governance: The International Journal of Business in Society 23: 845–66. [Google Scholar] [CrossRef]

- Dinçer, Hasan, Ahmad El-Assadi, Mohsen Saad, and Serhat Yüksel. 2024. Influential mapping of SDG disclosures based on innovation and knowledge using an integrated decision-making approach. Journal of Innovation & Knowledge 9: 100466. [Google Scholar] [CrossRef]

- Donaldson, Lex, and James H. Davis. 1991. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16: 49–64. [Google Scholar] [CrossRef]

- Fabrizi, Michele, Christine Mallin, and Giovanna Michelon. 2014. The Role of CEO’s Personal Incentives in Driving Corporate Social Responsibility. Journal of Business Ethics 124: 311–26. [Google Scholar] [CrossRef]

- Filho, Walter Leal, Laís Viera Trevisan, Izabela Simon Rampasso, Rosley Anholon, Maria Alzira Pimenta Dinis, Luciana Londero Brandli, Javier Sierra, Amanda Lange Salvia, Rudi Pretorius, Melanie Nicolau, and et al. 2023. When the alarm bells ring: Why the UN sustainable development goals may not be achieved by 2030. Journal of Cleaner Production 407: 137108. [Google Scholar] [CrossRef]

- Finkelstein, Sydney. 1992. Power in Top Management Teams: Dimensions, Measurement, and Validation. The Academy of Management Journal 35: 505–38. [Google Scholar] [CrossRef] [PubMed]

- García-Sánchez, Isabel-María, Beatriz Aibar-Guzmán, Cristina Aibar-Guzmán, and Francisco-Manuel Somohano-Rodríguez. 2022a. The drivers of the integration of the sustainable development goals into the non-financial information system: Individual and joint analysis of their influence. Sustainable Development 30: 513–24. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Beatriz Aibar-Guzmán, Cristina Aibar-Guzmán, and Lázaro Rodríguez-Ariza. 2020a. “Sell” recommendations by analysts in response to business communication strategies concerning the Sustainable Development Goals and the SDG compass. Journal of Cleaner Production 255: 120194. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Cristina Aibar-Guzmán, Miriam Núñez-Torrado, and Beatriz Aibar-Guzmán. 2022b. Are institutional investors “in love” with the sustainable development goals? Understanding the idyll in the case of governments and pension funds. Sustainable Development 30: 1099–16. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Cristina Aibar-Guzmán, Miriam Núñez-Torrado, and Beatriz Aibar-Guzmán. 2023a. Women leaders and female same-sex groups: The same 2030 Agenda objectives along different roads. Journal of Business Research 157: 113582. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Lázaro Rodríguez-Ariza, Beatriz Aibar-Guzmán, and Cristina Aibar-Guzmán. 2020b. Do institutional investors drive corporate transparency regarding business contribution to the sustainable development goals? Business Strategy and the Environment 29: 2019–36. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Nicola Raimo, and Filippo Vitolla. 2020c. CEO power and integrated reporting. Meditari Accountancy Research 29: 908–42. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Víctor Amor-Esteban, and David Galindo-Álvarez. 2020d. Communication Strategies for the 2030 Agenda Commitments: A Multivariate Approach. Sustainability 12: 10554. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Víctor Amor-Esteban, Cristina Aibar-Guzmán, and Beatriz Aibar-Guzmán. 2023b. Translating the 2030 Agenda into reality through stakeholder engagement. Sustainable Development 31: 941–58. [Google Scholar] [CrossRef]

- Garrido-Ruso, María, Beatriz Aibar-Guzmán, and Óscar Suárez-Fernández. 2023. What kind of leaders can promote the disclosure of information on the sustainable development goals? Sustainable Development 31: 2694–710. [Google Scholar] [CrossRef]

- Graham, John R., Hyunseob Kim, and Mark Leary. 2020. CEO-board dynamics. Journal of Financial Economics 137: 612–36. [Google Scholar] [CrossRef]

- Gul, Ferdinand A., and Sidney Leung. 2004. Board leadership, outside directors’ expertise and voluntary corporate disclosures. Journal of Accounting and Public Policy 23: 351–79. [Google Scholar] [CrossRef]

- Gull, Ammar Ali, Nazim Hussain, Sana Akbar Khan, Rizwan Mushtaq, and René Orij. 2023. The power of the CEO and environmental decoupling. Business Strategy and the Environment 32: 3951–64. [Google Scholar] [CrossRef]

- Gümüsay, Ali Aslan, and Juliane Reinecke. 2022. Researching for Desirable Futures: From Real Utopias to Imagining Alternatives. Journal of Management Studies 59: 236–42. [Google Scholar] [CrossRef]

- Gunawan, Juniati, Paulina Permatasari, and Carol Tilt. 2020. Sustainable development goal disclosures: Do they support responsible consumption and production? Journal of Cleaner Production 246: 118989. [Google Scholar] [CrossRef]

- Gyimah, Prince, Kingsley Opoku Appiah, and Kwadjo Appiagyei. 2023. Seven years of United Nations’ sustainable development goals in Africa: A bibliometric and systematic methodological review. Journal of Cleaner Production 395: 136422. [Google Scholar] [CrossRef]

- Hair, Joseph Franklin, G. Tomas M. Hult, Chistian M. Ringle, and Marko Sarstedt. 2017. A Primer on Partial Least Square Structural Equation Modeling (PLS-SEM), 2nd ed. New York: Sage Publishing. [Google Scholar]

- Harrison, Joseph S., and Shavin Malhotra. 2023. Complementarity in the CEO-CFO interface: The joint influence of CEO and CFO personality and structural power on firm financial leverage. The Leadership Quarterly 35: 101711. [Google Scholar] [CrossRef]

- Harrison, Joseph S., Gary R. Thurgood, Steven Boivie, and Michael D. Pfarrer. 2020. Perception Is Reality: How CEOs’ Observed Personality Influences Market Perceptions of Firm Risk and Shareholder Returns. The Academy of Management Journal 63: 1166–95. [Google Scholar] [CrossRef]

- Haynes, Katalin Takacs, and Amy Hillman. 2010. The effect of board capital and CEO power on strategic change. Strategic Management Journal 31: 1145–63. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, Urbieta, Laida Iñaki, and Olivier Boiral. 2022. Organizations’ engagement with sustainable development goals: From cherry-picking to SDG-washing? Corporate Social Responsibility and Environmental Management 29: 316–28. [Google Scholar] [CrossRef]

- Higgins, Colin, Tang Samuel, and Wendy Stubbs. 2020. On managing hypocrisy: The transparency of sustainability reports. Journal of Business Research 114: 395–407. [Google Scholar] [CrossRef]

- Hummel, Katrin, and Manuel Szekely. 2022. Disclosure on the Sustainable Development Goals—Evidence from Europe. Accounting in Europe 19: 152–89. [Google Scholar] [CrossRef]

- Hussain, Muhammad Jameel, Gaoliang Tian, Adnan Ashraf, Muhammad Kaleem Khan, and Lu Ying. 2023. Chief executive officer ability and corporate environmental sustainability information disclosure. Business Ethics, the Environment & Responsibility 32: 24–39. [Google Scholar] [CrossRef]

- Ike, Masayoshi, Denis Donovan Jerome, Topple Cheree, and Eryadi Kordi Masli. 2019. The process of selecting and prioritising corporate sustainability issues: Insights for achieving the Sustainable Development Goals. Journal of Cleaner Production 236: 117661. [Google Scholar] [CrossRef]

- Jiraporn, P., and P. Chintrakarn. 2013. How do powerful CEOs view corporate social responsibility (CSR)? An empirical note. Economics Letters 119: 344–47. [Google Scholar] [CrossRef]

- Khan, Talat Mehmood, Bai Gang, Zeeshan Fareed, and Anwar Khan. 2021. How does CEO tenure affect corporate social and environmental disclosures in China? Moderating role of information intermediaries and independent board. Environmental Science and Pollution Research 28: 9204–20. [Google Scholar] [CrossRef]

- Khemani, Purnima, and Dilip Kumar. 2022. Is financial development crucial to achieving the “2030 agenda of sustainable development”? Evidence from Asian countries. International Journal of Emerging Markets 18: 5009–27. [Google Scholar] [CrossRef]

- Khlif, Hichem, Khaled Samaha, and Ines Amara. 2020. Internal control quality and voluntary disclosure: Does CEO duality matter? Journal of Applied Accounting Research 22: 286–306. [Google Scholar] [CrossRef]

- Krasodomska, Joanna, Paweł Zieniuk, and Jadwiga Kostrzewska. 2022. Reporting on Sustainable Development Goals in the European Union: What drives companies’ decisions? Competitiveness Review 33: 120–46. [Google Scholar] [CrossRef]

- Lagasio, Valentina, and Nicola Cucari. 2019. Corporate governance and environmental social governance disclosure: A meta-analytical review. Corporate Social Responsibility and Environmental Management 26: 701–11. [Google Scholar] [CrossRef]

- Lassoued, Naima, and Imen Khanchel. 2023. Voluntary CSR disclosure and CEO narcissism: The moderating role of CEO duality and board gender diversity. Review of Managerial Science 17: 1075–123. [Google Scholar] [CrossRef]

- Lenort, Radim, Pavel Wicher, and František Zapletal. 2023. On influencing factors for Sustainable Development goal prioritisation in the automotive industry. Journal of Cleaner Production 387: 135718. [Google Scholar] [CrossRef]

- Lewis, Ben W., Judith L. Walls, and Glen W. S. Dowell. 2014. Difference in degrees: CEO characteristics and firm environmental disclosure. Strategic Management Journal 35: 712–22. [Google Scholar] [CrossRef]

- Li, Zelong, Adnan Khurshid, Abdur Rauf, Sadia Qayyum, Adrian Cantemir Calin, Laura Andreea Iancu, and Xinyu Wang. 2023. Climate change and the UN-2030 agenda: Do mitigation technologies represent a driving factor? New evidence from OECD economies. Clean Technologies and Environmental Policy 25: 195–209. [Google Scholar] [CrossRef]

- Lin, Ping, Boqiang Lin, and Fu Lei. 2020. Influence of CEO Characteristics on Accounting Information Disclosure Quality—Based on the Mediating Effect of Capital Structure. Emerging Markets Finance and Trade 56: 1781–803. [Google Scholar] [CrossRef]

- Lu, Yingjun, Indra Abeysekera, and Corinne Cortese. 2015. Corporate social responsibility reporting quality, board characteristics and corporate social reputation. Pacific Accounting Review 27: 95–118. [Google Scholar] [CrossRef]

- Mahmoudian, Fereshteh, Jamal A. Nazari, Irene M. Gordon, and Karel Hrazdil. 2021. CEO personality and language use in CSR reporting. Business Ethics, The Environment & Responsibility 30: 338–59. [Google Scholar] [CrossRef]

- Maswadi, Laila, and Azlan Amran. 2023. Does board capital enhance corporate social responsibility disclosure quality? The role of CEO power. Corporate Social Responsibility and Environmental Management 30: 209–25. [Google Scholar] [CrossRef]

- Mazumder, Mohammed Mehadi Masud. 2024. An empirical analysis of SDG disclosure (SDGD) and board gender diversity: Insights from the banking sector in an emerging economy. International Journal of Disclosure and Governance, 1–17. [Google Scholar] [CrossRef]

- Muttakin, Mohammad Badrul, Arifur Khan, and Dessalegn Getie Mihret. 2018. The Effect of Board Capital and CEO Power on Corporate Social Responsibility Disclosures. Journal of Business Ethics 150: 41–56. [Google Scholar] [CrossRef]

- Nicolo’, Giuseppe, Giovanni Zampone, Serena De Iorio, and Giuseppe Sannino. 2024. Does SDG disclosure reflect corporate underlying sustainability performance? Evidence from UN Global Compact participants. Journal of International Financial Management & Accounting 35: 214–60. [Google Scholar] [CrossRef]

- Nonet, G. Abord-Hugon, T. Gössling R. Van Tulder, and J. M. Bryson. 2022. Multi-stakeholder Engagement for the Sustainable Development Goals: Introduction to the Special Issue. Journal of Business Ethics 180: 945–57. [Google Scholar] [CrossRef] [PubMed]

- Oware, Kofi Mintah, and Dadson Awunyo-Vitor. 2021. CEO characteristics and environmental disclosure of listed firms in an emerging economy: Does sustainability reporting format matter? Business Strategy & Development 4: 399–410. [Google Scholar] [CrossRef]

- Palau-Pinyana, Erola, Josep Llach, and Llorenç Bagur-Femenías. 2023. Mapping enablers for SDG implementation in the private sector: A systematic literature review and research agenda. Management Review Quarterly, 1–30. [Google Scholar] [CrossRef]

- Patuelli, Alessia, Jonida Carungu, and Nicola Lattanzi. 2022. Drivers and nuances of sustainable development goals: Transcending corporate social responsibility in family firms. Journal of Cleaner Production 373: 133723. [Google Scholar] [CrossRef]

- Perello-Marin, M Rosario, Raúl Rodríguez-Rodríguez, and Juan-Jose Alfaro-Saiz. 2022. Analysing GRI reports for the disclosure of SDG contribution in European car manufacturers. Technological Forecasting and Social Change 181: 121744. [Google Scholar] [CrossRef]

- Pizzi, Simone, Francesco Rosati, and Andrea Venturelli. 2021. The determinants of business contribution to the 2030 Agenda: Introducing the SDG Reporting Score. Business Strategy and the Environment 30: 404–21. [Google Scholar] [CrossRef]

- Pizzi, Simone, Mara Del Baldo, Fabio Caputo, and Andrea Venturelli. 2022. Voluntary disclosure of Sustainable Development Goals in mandatory non-financial reports: The moderating role of cultural dimension. Journal of International Financial Management & Accounting 33: 83–106. [Google Scholar] [CrossRef]

- Pucheta-Martínez, María Consuelo, and Isabel Gallego-Álvarez. 2021. The Role of CEO Power on CSR Reporting: The Moderating Effect of Linking CEO Compensation to Shareholder Return. Sustainability 13: 3197. [Google Scholar] [CrossRef]

- Raimo, Nicola, Angela Rella, Filippo Vitolla, María-Inés Sánchez-Vicente, and Isabel-María García-Sánchez. 2021. Corporate Social Responsibility in the COVID-19 Pandemic Period: A Traditional Way to Address New Social Issues. Sustainability 13: 6561. [Google Scholar] [CrossRef]

- Resick, Christian J., Sucheta Nadkarni, Jenny Chu, Jianhong Chen, Wan-Chien Lien, Jaclyn A. Margolis, and Ping Shao. 2023. I Did It My Way: CEO Core Self-Evaluations and the Environmental Contingencies on Firm Risk-Taking Strategies. Journal of Management Studies 60: 1236–72. [Google Scholar] [CrossRef]

- Riaz, Salman, Rizwan Ali, Saria Hussain, and Ramiz Ur Rehman. 2023. Chief executive officer attributes, stock’s liquidity, and firm’s performance. Managerial and Decision Economics 44: 3397–408. [Google Scholar] [CrossRef]

- Rosati, Francesco, and Lourenço G. D. Faria. 2019a. Addressing the SDGs in sustainability reports: The relationship with institutional factors. Journal of Cleaner Production 215: 1312–26. [Google Scholar] [CrossRef]

- Rosati, Francesco, and Lourenço Galvão Diniz Faria. 2019b. Business contribution to the Sustainable Development Agenda: Organizational factors related to early adoption of SDG reporting. Corporate Social Responsibility and Environmental Management 26: 588–97. [Google Scholar] [CrossRef]

- Shahab, Yasir, Collins G. Ntim, Yugang Chen, Farid Ullah, Hai-Xia Li, and Zhiwei Ye. 2020. Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Business Strategy and the Environment 29: 1–16. [Google Scholar] [CrossRef]

- Silva, Samanthi. 2021. Corporate contributions to the Sustainable Development Goals: An empirical analysis informed by legitimacy theory. Journal of Cleaner Production 292: 125962. [Google Scholar] [CrossRef]

- Song, Lan, Xiaojiao Zhan, Huahan Zhang, Ming Xu, Jianguo Liu, and Chunmiao Zheng. 2022. How much is global business sectors contributing to sustainable development goals? Sustainable Horizons 1: 100012. [Google Scholar] [CrossRef]

- Steinberg, Philip J., Sarosh Asad, and George Lijzenga. 2022. Narcissistic CEOs’ dilemma: The trade-off between exploration and exploitation and the moderating role of performance feedback. Journal of Product Innovation Management 39: 773–96. [Google Scholar] [CrossRef]

- Subramaniam, Nava, Suraiyah Akbar, Hui Situ, Sophia Ji, and Nirav Parikh. 2023. Sustainable development goal reporting: Contrasting effects of institutional and organisational factors. Journal of Cleaner Production 411: 137339. [Google Scholar] [CrossRef]

- Suhrab, Muhammad, Pinglu Chen, and Atta Ullah. 2024. Digital financial inclusion and income inequality nexus: Can technology innovation and infrastructure development help in achieving sustainable development goals? Technology in Society 76: 102411. [Google Scholar] [CrossRef]

- Sundaramurthy, Chamu, and Marianne Lewis. 2003. Control and Collaboration: Paradoxes of Governance. Academy of Management Review 28: 397–415. [Google Scholar] [CrossRef]

- Surroca, Jordi, and Josep A. Tribó. 2008. Managerial Entrenchment and Corporate Social Performance. Journal of Business Finance & Accounting 35: 748–89. [Google Scholar] [CrossRef]

- Tanguy, Audrey, Lisa Carrière, and Valérie Laforest. 2023. Low-tech approaches for sustainability: Key principles from the literature and practice. Sustainability: Science, Practice and Policy 19: 2170143. [Google Scholar] [CrossRef]

- Tibiletti, Veronica, Pier Luigi Marchini, Katia Furlotti, and Alice Medioli. 2021. Does corporate governance matter in corporate social responsibility disclosure? Evidence from Italy in the “era of sustainability”. Corporate Social Responsibility and Environmental Management 28: 896–907. [Google Scholar] [CrossRef]

- Toukabri, Mohamed, and Mohamed Ahmed Mohamed Youssef. 2022. Climate change disclosure and sustainable development goals (SDGs) of the 2030 agenda: The moderating role of corporate governance. Journal of Information, Communication and Ethics in Society 21: 30–62. [Google Scholar] [CrossRef]

- Trinh, Vu Quang, Aly Salama, Teng Li, Ou Lyu, and Savvas Papagiannidis. 2023. Former CEOs chairing the board: Does it matter to corporate social and environmental investments? Review of Quantitative Finance and Accounting 61: 1277–313. [Google Scholar] [CrossRef]

- Tsalis, Thomas A., Maria Terzaki, Dimitrios Koulouriotis, Konstantinos P. Tsagarakis, and Ioannis E. Nikolaou. 2023. The nexus of United Nations’ 2030 Agenda and corporate sustainability reports. Sustainable Development 31: 784–96. [Google Scholar] [CrossRef]

- Tuggle, Christopher S., David G. Sirmon, Christopher R. Reutzel, and Leonard Bierman. 2010. Commanding board of director attention: Investigating how organizational performance and CEO duality affect board members’ attention to monitoring. Strategic Management Journal 31: 946–68. [Google Scholar] [CrossRef]

- United Nations Global Compact and Accenture. 2023. Global Private Sector Stocktake: Through the Eyes of the Private Sector. Available online: https://info.unglobalcompact.org/sdg-stocktake (accessed on 10 January 2024).

- van der Waal, Johannes W. H., and Thomas Thijssens. 2020. Corporate involvement in Sustainable Development Goals: Exploring the territory. Journal of Cleaner Production 252: 119625. [Google Scholar] [CrossRef]

- Varriale, Matthew. 2023. The Impact of Leadership on Human Resources Activities. SSRN, 4371239. [Google Scholar] [CrossRef]

- Walls, Judith L., and Pascual Berrone. 2017. The Power of One to Make a Difference: How Informal and Formal CEO Power Affect Environmental Sustainability. Journal of Business Ethics 145: 293–308. [Google Scholar] [CrossRef]

- Weerasinghe, Thanya, Dileepa Samudrage, and Nuwan Gunarathne. 2023a. The influence of top management team diversity on Sustainable Development Goals (SDG) reporting: Evidence from Sri Lanka. Business Strategy and the Environment 32: 5922–34. [Google Scholar] [CrossRef]

- Weerasinghe, Thanya, Nuwan Gunarathne, and Dileepa N. Samudrage. 2023b. Sustainable development goals disclosures: Evidence from Sri Lanka. Corporate Social Responsibility and Environmental Management 31: 993–1010. [Google Scholar] [CrossRef]

- Yu, Mei. 2023. CEO duality and firm performance: A systematic review and research agenda. European Management Review 20: 346–58. [Google Scholar] [CrossRef]

- Zampone, Giovanni, Giuseppe Nicolò, Giuseppe Sannino, and Serena De Iorio. 2022. Gender diversity and SDG disclosure: The mediating role of the sustainability committee. Journal of Applied Accounting Research 25: 171–93. [Google Scholar] [CrossRef]

- Zhang, Yang, Jian Li, Yaling Deng, and Yi Zheng. 2022. Avoid or approach: How CEO power affects corporate environmental innovation. Journal of Innovation & Knowledge 7: 100250. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).