Innovation’s Performance: A Transnational Analysis Based on the Global Innovation Index

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Institutions

2.2. Human Capital and Research

2.3. Infrastructure

2.4. Market Sophistication

2.5. Business Sophistication

3. Methodology

3.1. Description of Variables

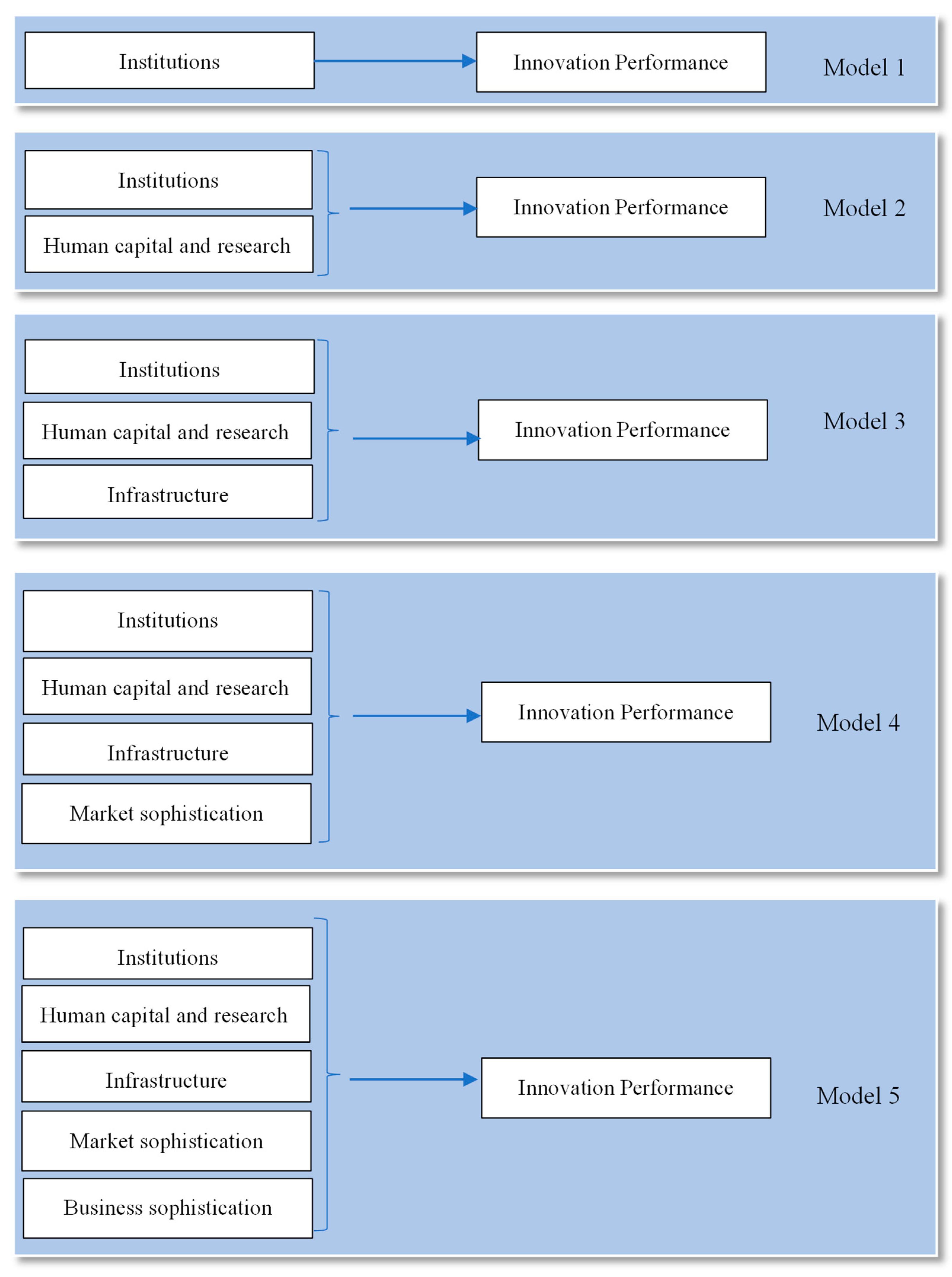

3.2. Model Description

4. Results and Discussion

5. Conclusions and Implications

Limitations and Suggestions for Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Countries | |

|---|---|

| Albania | Luxembourg |

| Argentina | Malaysia |

| Armenia | Malta |

| Austria | Mexico |

| Australia | Montenegro |

| Belgium | Morocco |

| Brazil | Netherlands |

| Bulgaria | New Zealand |

| Canada | Norway |

| Chile | Panama |

| China | Poland |

| Colombia | Portugal |

| Croatia | Republic of Korea |

| Cyprus | Romania |

| Czech | Russian Federation |

| Denmark | Serbia |

| Estonia | Singapore |

| Finland | Slovakia |

| France | Slovenia |

| Germany | South Africa |

| Greece | Spain |

| Hong Kong | Sweden |

| Hungary | Switzerland |

| Iceland | Thailand |

| India | Tunisia |

| Indonesia | Türkiye |

| Ireland | Ukraine |

| Israel | United Arab Emirates |

| Italy | United Kingdom |

| Japan | United States of America |

| Latvia | Uruguay |

| Lithuania | Vietnam |

References

- Akhmadi, Saltanat, and Mariza Tsakalerou. 2023. Shades of innovation: Is there an East-West cultural divide in the European Union? International Journal of Innovation Science 15: 260–78. [Google Scholar] [CrossRef]

- Andrijauskiene, Meda, Daiva Dumciuviene, and Jovita Vasauskaite. 2021. Redeveloping the National Innovative Capacity Framework: European Union Perspective. Economies 9: 201. [Google Scholar] [CrossRef]

- Bate, Adisu Fanta, Esther Wanjiru Wachira, and Sándor Danka. 2023. The determinants of innovation performance: An income-based cross-country comparative analysis using the Global Innovation Index (GII). Journal of Innovation and Entrepreneurship 12: 1–17. [Google Scholar] [CrossRef]

- Bielińska-Dusza, Edyta, and Monika Hamerska. 2021. Methodology for Calculating the European Innovation Scoreboard-Proposition for Modification. Sustainability 13: 2199. [Google Scholar] [CrossRef]

- Boiko, Kseniia. 2022. R&D activity and firm performance: Mapping the field. Management Review Quarterly 72: 1051–87. [Google Scholar] [CrossRef]

- Castaño-Martínez, María-Soledad, María-Teresa Méndez-Picazo, and Miguel-Ángel Galindo-Martín. 2015. Policies to promote entrepreneurial activity and economic performance. Management Decision 53: 2073–87. [Google Scholar] [CrossRef]

- Castro-Silva, Hugo, and Francisco Lima. 2023. The struggle of small firms to retain high skill workers: Job duration and the importance of knowledge intensity. Small Business Economics 60: 537–72. [Google Scholar] [CrossRef]

- Costa, Joana, Ana Rita Neves, and João Reis. 2021. Two Sides of the Same Coin. University-Industry Collaboration and Open Innovation as Enhancers of Firm Performance. Sustainability 13: 3866. [Google Scholar] [CrossRef]

- Costa, Joana, and António Carrizo Moreira. 2022. Public Policies, Open Innovation Ecosystems and Innovation Performance. Analysis of the Impact of Funding and Regulations. Journal of Open Innovation: Technology, Market, and Complexity 8: 210. [Google Scholar] [CrossRef]

- Coutinho, Evelina Maria Oliveira, and Manuel Au-Yong-Oliveira. 2023. Factors Influencing Innovation Performance in Portugal: A Cross-Country Comparative Analysis Based on the Global Innovation Index and on the European Innovation Scoreboard. Sustainability 15: 10446. [Google Scholar] [CrossRef]

- Daniels, Lisa, and Nicholas Minot. 2020. An Introduction to Statistics and Data Analysis Using STATA: From Research Design to Final Report. Thousand Oaks: SAGE Publications, Inc. ISBN 9781506371832. [Google Scholar]

- De Silva, Muthu, Jeremy Howells, and Martin Meyer. 2018. Innovation intermediaries and collaboration: Knowledge-based practices and internal value creation. Research Policy 47: 70–87. [Google Scholar] [CrossRef]

- Dobni, C. Brooke. 2010. The Relationship Between an Innovation Orientation and Competitive Strategy. International Journal of Innovation Management 14: 331–57. [Google Scholar] [CrossRef]

- Dobni, C. Brooke, and Mark Klassen. 2021. The decade of innovation: From benchmarking to execution. Journal of Business Strategy 42: 23–31. [Google Scholar] [CrossRef]

- Ferreira, Jorge, Arnaldo Coelho, and Luiz Moutinho. 2020. Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation 92: 102061. [Google Scholar] [CrossRef]

- Ferreira, Jorge, Arnaldo Coelho, and Luiz Moutinho. 2021. Strategic alliances, exploration and exploitation and their impact on innovation and new product development: The effect of knowledge sharing. Management Decision 59: 524–67. [Google Scholar] [CrossRef]

- Hadad, Shahrazad. 2017. Knowledge Economy: Characteristics and Dimensions. Management Dynamics in the Knowledge Economy 5: 203–25. [Google Scholar] [CrossRef]

- Hofstede, Geert. 2001. Culture’s Consequences: Comparing Values, Behaviours, Institutions, and Organisations across Nations, 2nd ed.Thousand Oaks: Sage. [Google Scholar]

- Jovovic, Radislav, Mimo Draskovic, Milica Delibasic, and Miroslav Jovovic. 2017. The concept of sustainable regional development-institutional aspects, policies and prospects. Journal of International Studies 10: 255–66. [Google Scholar] [CrossRef]

- Kirikkaleli, Dervis, and Alper Ozun. 2019. Innovation capacity, business sophistication, and macroeconomic stability: Empirical evidence from OECD countries. Journal of Business Economics and Management 20: 351–67. [Google Scholar] [CrossRef]

- Klett, Tomas Casas, and Guido Cozzi. 2023. Elite Quality Report 2023. Country Scores and Global Rankings. The Sustainable Value Creation of Nations. Measuring Long-Term Economic and Human Development Prospects. St. Gallen: Foundation for Value Creation. Available online: https://ssrn.com/abstract=4418550 (accessed on 10 May 2023).

- Lafley, Alan G., and Roger Martin. 2013. Playing to Win—How Strategy really Works. Boston: Harvard Business Review Press. [Google Scholar]

- Lam, Long, Phuong Nguyen, Nga Le, and Khoa Tran. 2021. The Relation among Organizational Culture, Knowledge Management, and Innovation Capability: Its Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 66. [Google Scholar] [CrossRef]

- Manpower Group Global QMR Q2. 2022. Quarterly Market Report. Global Market Report—Q2 2022 | ManpowerGroup Talent Solutions. Available online: https://workforce-resources.manpowergroup.com/workforce-analytics/global-market-report-q2-2022 (accessed on 27 April 2023).

- Manpower Group Global QMR Q1. 2023. Quarterly Market Report. Global Market Report—Q1 2023 | ManpowerGroup Talent Solutions. Available online: https://workforce-resources.manpowergroup.com/white-papers/q1-2023-manpowergroup-employment-outlook-survey (accessed on 27 April 2023).

- Marule, Nontombi Pearl. 2022. The Role of Technology Commercialization in the Operationalization of Innovation and Industrial Policies in South Africa. Triple Helix 9: 119–37. [Google Scholar] [CrossRef]

- Minto-Coy, Indianna, and Maurice McNaughton. 2016. Barriers to entrepreneurship and innovation: An institutional analysis of mobile banking in Jamaica and Kenya. Social and Economic Studies 65: 99–131. [Google Scholar]

- Mohamed, Maha Mohamed Alsebai, Pingfeng Liu, and Guihua Nie. 2022. Do Knowledge Economy Indicators Affect Economic Growth? Evidence from Developing Countries. Sustainability 14: 4774. [Google Scholar] [CrossRef]

- Nawrocki, Tomasz L., and Izabela Jonek-Kowalska. 2022. Is Innovation a Risky Business? A Comparative Analysis in High-Tech and Traditional Industries in Poland. Journal of Open Innovation: Technology, Market, and Complexity 8: 155. [Google Scholar] [CrossRef]

- Nunes, Sérgio, Raul Lopes, and Nerys Fuller-Love. 2019. Networking, Innovation, and Firms’ Performance: Portugal as Illustration. Journal of the Knowledge Economy 10: 899–920. [Google Scholar] [CrossRef]

- Nyarku, Kwamena Minta, and Stephen Oduro. 2018. Effect of legal and regulatory framework on SMEs growth in the Accra Metropolis of Ghana. International Journal of Entrepreneurship and Innovation 19: 207–17. [Google Scholar] [CrossRef]

- O’Connell, Vincent, Naser AbuGhazaleh, Yasean Tahat, and Garvan Whelan. 2022. The Impact of R&D Innovation Success on the Relationship between R&D Investment and Financial Leverage. Journal of Open Innovation: Technology, Market, and Complexity 8: 129. [Google Scholar] [CrossRef]

- Öber, Christina. 2019. The role of business networks for innovation. Journal of Innovation & Knowledge 4: 124–28. [Google Scholar] [CrossRef]

- OECD/Eurostat. 2018. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed. The Measurement of Scientific, Technological and Innovation Activities. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Okrah, James, and Marzena Hajduk-Stelmachowicz. 2020. Political stability and innovation in Africa. Journal of International Studies 13: 234–46. [Google Scholar] [CrossRef]

- Papa, Armando, Alice Mazzucchelli, Luca Vincenzo Ballestra, and Antonio Usai. 2022. The open innovation journey along heterogeneous modes of knowledge-intensive marketing collaborations: A cross-sectional study of innovative firms in Europe. International Marketing Review 39: 602–25. [Google Scholar] [CrossRef]

- Pereira, Leandro, António Fernandes, Mariana Sempiterno, Álvaro Dias, Renato Lopes da Costa, and Nélson António. 2021. Knowledge Management Maturity Contributes to Project-Based Companies in an Open Innovation Era. Journal of Open Innovation: Technology, Market, and Complexity 7: 126. [Google Scholar] [CrossRef]

- Popa, Simona, Pedro Soto-Acosta, and Daniel Palacios-Marqués. 2022. A discriminant analysis of high and low-innovative firms: The role of IT, human resources, innovation strategy, intellectual capital and environmental dynamism. Journal of Knowledge Management 26: 1615–32. [Google Scholar] [CrossRef]

- Powell, Walter W., and Kaisa Snellman. 2004. The Knowledge Economy. Annual Review of Sociology 30: 199–220. [Google Scholar] [CrossRef]

- Puertas, Rosa, Patricia Carracedo, Marta Garcia, and Virginia Vega. 2022. Analysis of the determinants of market capitalization: Innovation, climate, change policies and business context. Technological Forecasting & Social Change 179: 121644. [Google Scholar] [CrossRef]

- Queirós, Maria, Vítor Braga, and Aldina Correia. 2019. Cross-country analysis to high-growth business: Unveiling its determinants. Journal of Innovation & Knowledge 4: 146–53. [Google Scholar] [CrossRef]

- Scaliza, Janaina Aparecida Alves, Daniel Jugend, Charbel Jose Chiappetta Jabbour, Hengky Latan, Fabiano Armellini, David Twigg, and Darly Fernando Andrade. 2022. Relationships among organizational culture, open innovation, innovative ecosystems, and performance of firms: Evidence from an emerging economy context. Journal of Business Research 140: 264–79. [Google Scholar] [CrossRef]

- Serban, Octavian. 2022. The Multilevel Knowledge Economy Pyramid Model as a Flexible Solution to Address the Impact of Adverse Events in the Economy. Sustainability 14: 12332. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Sascha Kraus, Mrinalini Srivastava, Ritika Chopra, and Andreas Kallmuenzer. 2022. The changing role of innovation for crisis management in times of COVID-19: An integrative literature review. Journal of Innovation & Knowledge 7: 100281. [Google Scholar] [CrossRef]

- Szalacha-Jarmużek, Joanna, and Krzysztof Pietrowicz. 2018. Missing causality and absent institutionalization. A case of Poland and methodological challenges for future studies of interlocking directorates. Economics and Sociology 11: 157–72. [Google Scholar] [CrossRef]

- Townsend, David M., and Lowell W. Busenitz. 2015. Turning water into wine? Exploring the role of dynamic capabilities in early-stage capitalization processes. Journal of Business Venturing 30: 292–306. [Google Scholar] [CrossRef]

- Tubbs, Michael. 2007. The Relationship Between R&D and Company Performance. Research-Technology Management 50: 23–30. [Google Scholar] [CrossRef]

- Wang, Chengqi, Mario Kafouros, Jingtao Yi, Junjie Hong, and Panagiotis Ganotakis. 2020. The role of government affiliation in explaining firm innovativeness and profitability in emerging countries: Evidence from China. Journal of World Business 55: 101047. [Google Scholar] [CrossRef]

- Wang, Lu, Gong-li Luo, Arif Sari, and Xue-Feng Shao. 2020. Technological forecasting & social change what nurtures the fourth industrial revolution? An investigation of economic and social determinants of technological innovation in advanced economies. Technological Forecasting & Social Change 161: 120305. [Google Scholar] [CrossRef]

- Wang, Qing’E., Luwei Zhao, Alice Chang-Richards, Yuanyuan Zhang, and Hujun Li. 2021. Understanding the Impact of Social Capital on the Innovation Performance of Construction Enterprises: Based on the Mediating Effect of Knowledge Transfer. Sustainability 13: 5099. [Google Scholar] [CrossRef]

- Wellalage, Nirosha Hewa, and Viviana Fernandez. 2019. Innovation and SME finance: Evidence from developing countries. International Review of Financial Analysis 66: 101370. [Google Scholar] [CrossRef]

- Wiklund, Johan, and Dean Shepherd. 2005. Entrepreneurial Orientation and Small Business Performance: A Configurational Approach. Journal of Business Venturing 20: 71–91. [Google Scholar] [CrossRef]

- Wilson, Grant Alexander, and C. Brooke Dobni. 2022. Which Innovative Methodologies and Technologies Help Improve Firm Performance? A Global Study of SMEs. Research-Technology Management 65: 50–60. [Google Scholar] [CrossRef]

- Wilson, Grant Alexander, Tyler Case, and C. Brooke Dobni. 2023. A global study of innovation-oriented firms: Dimensions, practices, and performance. Technological Forecasting & Social Change 187: 122257. [Google Scholar] [CrossRef]

- WIPO. 2022. Global Innovation Index 2022: What Is the Future of Innovation-Driven Growth? Geneva: World Intellectual Property Organization. [Google Scholar] [CrossRef]

- Xie, Zuomiao, Shiqi Yuan, Jinjing Zhu, and Alistair Palferman. 2023. Dynamic value sharing based on employee contribution as a competitiveness-enhancing device. Humanities and Social Sciences Communication 10: 1–13. [Google Scholar] [CrossRef]

- You, Shuyang, Kevin Zheng Zhou, and Liangding Jia. 2021. How does human capital foster product innovation? The contingent roles of industry cluster features. Journal of Business Research 130: 335–47. [Google Scholar] [CrossRef]

- Yu, Qi, Sumaira Aslam, Majid Murad, Wang Jiatong, and Nausheen Syed. 2022. The Impact of Knowledge Management Process and Intellectual Capital on Entrepreneurial Orientation and Innovation. Frontiers in Psychology 13: 772668. [Google Scholar] [CrossRef] [PubMed]

| Type of Variable | Pilar | Indicators/Variables | Hypothesis | |

|---|---|---|---|---|

|

Independent (inputs) | Institutions | Political environment | (pol) | H1 |

| Regulatory environment | (reg) | |||

| Business environment | (bus) | |||

| Human capital and research | Education | (ed) | H2 | |

| Tertiary education | (ted) | |||

| Investment in R&D | (rd) | |||

| Infrastructure | Information and communication technologies | (ist) | H3 | |

| General infrastructure | (geinf) | |||

| Ecological sustainability | (ecosus) | |||

| Market sophistication | Credit | (cred) | H4 | |

| Investment | (invest) | |||

| Trade, diversification, and market size | (trade) | |||

| Business sophistication | Highly qualified work | (kw) | H5 | |

| Innovation partnerships | (inlink) | |||

| Knowledge absorption | (kabs) | |||

|

Dependent (outputs) | Knowledge and technology results | Knowledge creation | (kcreat) | |

| Impact of knowledge | (kimpct) | |||

| Spreading knowledge | (kdif) | |||

| Creativity results | Intangible assets | (intasst) | ||

| Creative products and services | (cgs) | |||

| Creativity online | (olc) | |||

| Hypotheses | βkt | Rkt2 | βc | Rc2 |

|---|---|---|---|---|

| H1. There is a positive and statistically significant relationship between institutions and innovation performance. | 0.621 | 0.382 | 0.604 | 0.423 |

| H2. There is a positive and statistically significant relationship between human capital and research and innovation performance. | 0.799 | 0.651 | 0.723 | 0.579 |

| H3. There is a positive and statistically significant relationship between infrastructure and innovation performance. | 1.171 | 0.500 | 1.070 | 0.486 |

| H4. There is a positive and statistically significant relationship between market sophistication and innovation performance. | 0.622 | 0.387 | 0.649 | 0.492 |

| H5. There is a positive and statistically significant relationship between business sophistication and innovation performance. | 0.849 | 0.707 | 0.726 | 0.602 |

| Pillars | βkt | pkt | βc | pc |

|---|---|---|---|---|

| Constant | −0.2112 | 0.998 | −6.487 | 0.369 |

| Institutions | −0.292 | 0.023 * | −0.127 | 0.333 |

| Human capital and research | 0.269 | 0.051 | 0.241 | 0.090 |

| Infrastructure | 0.197 | 0.341 | 0.231 | 0.284 |

| Market sophistication | 0.070 | 0.474 | 0.253 | 0.015 * |

| Business sophistication. | 0.718 | 0.000 *** | 0.340 | 0 029 * |

| R2 | 0.7496 | 0.6846 | ||

| R2 adjusted | 0.7280 | 0.6575 |

| Independent Variables | Regressions | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | ||

| Constant | −11.131 | −0.738 | −2.748 | −9.945 | −9.612 | |

| Institutions | Political environment | 0.470 * | 0.112 | 0.039 | 0.136 | 0.001 |

| Regulatory environment | 0.149 | 0.072 | −0.0178 | −0.033 | −0.378 | |

| Business environment | 0.047 | −0.003 | 0.028 | −0.006 | −0.016 | |

| Human capital and research | Education | 0.321 * | 0.329 * | 0.298 * | 0.252 | |

| Tertiary education | −0.151 | −0.161 | −0.163 | −0.118 | ||

| Research and development | 0.318 *** | 0.335 *** | 0.321 *** | 0.176 | ||

| Infrastructure | Information and communication technologies | 0.018 | 0.050 | −0.002 | ||

| General infrastructure | 0.030 | 0.046 | −0.092 | |||

| Ecological sustainability | 0.238 * | 0.257 * | 0.180 | |||

| Market sophistication | Credit systems | −0.155 | −0.044 | |||

| Investment | 0.077 | −0.325 | ||||

| Trade, diversification, market | 0.08 | 0.114 | ||||

| Business sophistication | Qualified work | 0.064 | ||||

| Innovation partnerships | 0.377 *** | |||||

| Knowledge absorption | 0.164 | |||||

| R2 | 0.404 | 0.712 | 0.740 | 0.765 | 0.810 | |

| R2 adjusted | 0.374 | 0.682 | 0.697 | 0.710 | 0.750 | |

| ΔR2 | 0.404 | 0.308 | 0.028 | 0.025 | 0.045 | |

| F | 13.56 | 23.52 | 17.08 | 13.85 | 13.60 | |

| ΔF | 13.56 | 9.96 | −6.44 | −3.23 | −0.25 | |

| Independent Variables | Regression 1 | Regression 2 | Regression 3 | Regression 4 | Regression 5 | |

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | ||

| Constant | −9.658 | −5.473 | −23.820 | −25.873 | −23.543 | |

| Institutions | Political environment | 0.343 | 0.039 | −0.031 | −0.004 | −0.137 |

| Regulatory environment | 0.149 | 0.052 | −0.037 | −0.056 | −0.042 | |

| Business environment | 0.133 | 0.108 | 0.139 | 0.104 | 0.102 | |

| Human capital and research | Education | 0.364 * | 0.387 ** | 0.427 ** | 0.446 ** | |

| Tertiary education | −0.066 | −0.110 | −0.086 | −0.589 | ||

| Research and development | 0.226 *** | 0.242 *** | 0.164 * | 0.096 | ||

| Infrastructure | Information and communication technologies | 0.295 | 0.170 | 0.079 | ||

| General infrastructure | −0.091 | −0.101 | −0.212 | |||

| Ecological sustainability | 0.206 * | 0.206 * | 0.157 | |||

| Market sophistication | Credit system | 0.132 | 0.197 * | |||

| Investment | 0.050 | −0.0318 | ||||

| Trade, diversification, market | 0.117 | 0.133 | ||||

| Business sophistication | Qualified work | −0.033 | ||||

| Innovation partnerships | 0.233 | |||||

| Knowledge absorption | 0.285 * | |||||

| R2 | 0.426 | 0.647 | 0.695 | 0.723 | 0.764 | |

| R2 adjusted | 0.397 | 0.609 | 0.644 | 0.657 | 0.690 | |

| ΔR2 | 0.426 | 0.221 | 0.048 | 0.028 | 0.041 | |

| F | 14.84 | 17.38 | 13.66 | 11.07 | 10.35 | |

| ΔF | 14.84 | 2.54 | −3.72 | −2.59 | −0.72 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coutinho, E.M.O.; Au-Yong-Oliveira, M. Innovation’s Performance: A Transnational Analysis Based on the Global Innovation Index. Adm. Sci. 2024, 14, 32. https://doi.org/10.3390/admsci14020032

Coutinho EMO, Au-Yong-Oliveira M. Innovation’s Performance: A Transnational Analysis Based on the Global Innovation Index. Administrative Sciences. 2024; 14(2):32. https://doi.org/10.3390/admsci14020032

Chicago/Turabian StyleCoutinho, Evelina Maria Oliveira, and Manuel Au-Yong-Oliveira. 2024. "Innovation’s Performance: A Transnational Analysis Based on the Global Innovation Index" Administrative Sciences 14, no. 2: 32. https://doi.org/10.3390/admsci14020032

APA StyleCoutinho, E. M. O., & Au-Yong-Oliveira, M. (2024). Innovation’s Performance: A Transnational Analysis Based on the Global Innovation Index. Administrative Sciences, 14(2), 32. https://doi.org/10.3390/admsci14020032