Abstract

At the intersection of digitization and sustainability, the current article explores the application of environmental, social, and corporate governance (ESG) in the service sector in India. The analysis draws on findings collected through questionnaires and interviews (mixed methods) with managers at middle, senior, and top levels of the hierarchy. The findings suggest that technology can both facilitate and hinder the sustainability effort; therefore, the implications on internal stakeholders, such as workers and managers, can be both positive and negative. Additionally, technologies that are taken for granted in certain parts of the world may be inappropriate in the Indian context. As a result, sustainability frameworks are implemented selectively rather than holistically. The adoption of an ESG framework has a largely positive impact on investors. While companies do not place much emphasis on employees’ wellbeing and ‘human rights’, they still link ESG to ‘Supply Chain Sustainability’. Contributing to the signaling theory, there is also evidence of firms’ motivation to adopt ESG practices for the purposes of legitimacy and forming external stakeholders’ perceptions. The current study is both timely and important due to the high interest in the application of tools facilitating sustainability performance. The study contributes to both the literature and practice, since it adds to our understanding concerning the challenges faced by firms in implementing ESG practices, whereas it also enables administrators to identify areas for the further development of sustainable practices.

1. Introduction

Within the framework provided by the United Nation’s Sustainable Development Goals, there is a concept known as environmental, social, and corporate governance (ESG). Coined by the United Nations in 2005, ESG is a form of corporate social responsibility, which provides metrics to stakeholders for evaluating how each organization performs across three very important pillars, namely, the environment, society, and governance (United National 2005). Environmental factors concern the methods applied by an organization to protect the environment, maintain environmental policies, present proper environmental performance results, decrease environmental costs, and disclose environmental information, among others (e.g., Zhao et al. 2020; García-Sánchez et al. 2021). Social factors include the management of relationships between the organization, employees, suppliers, customers, and the communities in which it operates, along with programs of corporate social responsibility, which often contribute to the brand image of a firm (Araújo et al. 2023). Company’s leadership, executive pay, internal controls, audits, and shareholder rights fall under the category of governance (Camilleri 2021).

Moreover, while the links between ESG and SDGs are becoming increasingly prevalent in recent studies (e.g., Chien 2023), some deficiencies and theory–practice gaps still exist. For instance, ESG assessments often focus on short-term performance, which overlooks organizations’ long-term strategic sustainability. Therefore, this paper aims to examine ESG performances in relation to each organization’s strategic sustainability framework. Additionally, in the existing literature, there are no direct links between ESG and organizations’ investment decisions and financial models; however, there is also a lack of specific metrics to enable organizations to measure environmental and social impacts in a standardized way (Oikonomou et al. 2021). Towards this end, this paper aims to explore a related concept, which is known as socially responsible investment (SRI). This is a framework of ethical, environmental, and financial goals (Aldowaish et al. 2022) within the broader context of sustainability and finance (Bisogno et al. 2017). In addition, according to Eyraud et al. (2013), green investment is used to reduce greenhouse gas and air pollution emissions, without reducing the production and consumption of non-energy goods. SRIs should therefore be considered by organizations while devising ESG parameters, as part of their broader sustainability strategy.

An organization’s strategic sustainability framework allows firms to be change-ready and adapt to the non-linear and demanding environment (Aldowaish et al. 2022). In doing so, the needs and expectations of an organization’s stakeholders need to be taken into consideration. For example, let us consider an important stakeholder group, namely, ‘investors’. When decisions are made towards ESG-investor integration, the process often results in lower risks, bringing about improvements to the investment process (Cappucci 2018). Therefore, although there are also negative effects during investor integration (e.g., a lack of consideration to core issues on business models and finance, the absence of clear standards, and poor quality of data), ESG and ethical practices tend to receive support from investors (Friede 2019). An interesting example here is the Bank of India (SBI), which was the first institution in the country to enter the market of green housing. It has introduced the ‘Green Home Loan’ as a new product, offering a home loan with a 5% reduction in margin, no processing charges, and an interest rate of only 0.25% (Mir and Bhat 2022). At the same time, investments supported by fossil fuels, or those having a negative impact on the environment, are not encountered by investors positively (Turek et al. 2021).

In the spirit of the abovementioned ideas, it is important to mention (even briefly) the importance of each organization’s stakeholders. For example, ‘managers’ and ‘administrative personnel’ use ESG reporting for a variety of reasons, such as to reduce risks and integrate investment strategies (Sciarelli et al. 2021; Przychodzen et al. 2016). ‘Customers’ also have a role to play in encouraging and promoting a firm’s sustainability (Gong et al. 2019). Customers often consider the environmental impact of a product or service prior to purchasing it (Kulczycka and Wernicka 2015). Moreover, corporate sustainability tends to enhance the motivation of another stakeholder group, namely, ‘employees’ (Engert and Baumgartner 2016). The same applies for ‘business partners’. Multinational corporations (MNCs) tend to decide to work with business partners and suppliers adhering to ESG (environmental and social) standards. The objective is to nurture sustainable best practices, all through the supply chain. Moreover, the latest studies suggest that ESG is increasingly important to logistics services, strategic sourcing, and e-commerce activities.

Additionally, as mentioned earlier, within the frameworks of sustainability and digitization (e.g., Thrassou et al. 2022a, 2022b) exists the so-called green technological innovation and green information technology systems (Imasiku et al. 2019). The concept has attracted the attention of experts around the world since it contributes to SDGs by suggesting the production of green products, reducing carbon emissions, and making economic activities environmentally friendly (Cai et al. 2021; Shao et al. 2021). The concept, which was first proposed by Braun and Wield (1994), suggests a breakaway from traditional innovation practices and green technological innovations, whereas the latter focuses primarily on lowering the degree of environmental pollution.

However, green technological innovation is not without its criticisms. According to the commentators, while green technology can reduce carbon emissions and improve energy utilization, it also enhances output levels and the economies of scale, which again requires more energy (Abdouli and Hammami 2017). Thus, there is an increase in energy consumption, which in turn increases carbon emissions. Likewise, lithium mining, which is a raw material for electric vehicle batteries, is water intensive, causing soil degradation, contamination, water shortages, air pollution, and a loss of biodiversity in the areas where mining occurs. Some prevalent examples of environmental destruction concern lithium mining areas in India, Chile, Argentina, and Bolivia (2023). Thus, eco-innovations and green technologies can truly have a negative impact on the environment (Braungardt et al. 2016), unless they are designed to reduce environmental pollution through a reduction in carbon emissions (Tobelmann and Wendler 2020).

Moreover, discussions on carbon emissions give rise to the concept of the carbon footprint. The concept originates from another concept, known as the ecological footprint, which is the impact that humans have on the Earth’s ecology and environment. In simple words, an ecological footprint is humans’ demands from the Earth’s ecosystems versus what ecology can provide and its capacity to regenerate. Carbon footprints are the measure of carbon dioxide emissions (Gao et al. 2014). An organizational carbon footprint measures the greenhouse gas emissions (GHGs) from all activities across the organization, including the energy used in buildings, industrial processes, and company vehicles (Finkbeiner 2009). When measuring the carbon footprint, the direct and indirect activities by the latter is considered. Direct emissions can be due to fuel combustion and technological processes that firms undertake, indirect emissions can be a resultant effect of electricity consumption throughout the production process; the indirect emissions caused by, for example, the production and transportation of raw materials or semi-finished products and their use by customers, contribute to indirect emissions (Turek et al. 2021). Technology sectors’ carbon footprints cover mobile, fixed networks, data centers, corporate networks, and all devices, such as phones, computers, routers, switches, Internet of Things devices, and more.

For organizations, it is also a matter of selecting the right technology for the right purpose. The example of information and communication technology (ICT) is helpful here. On the one hand, ICT enables a reduction in the use of paper and allows for video conferencing instead of traveling to work. Thus, ICT helps reduce air pollution, which is usually caused by road and air traffic. Additionally, ICT facilitates the application of smart grids to reduce electricity consumption. However, ICT consumes excessive amounts of electricity, leading to an increase in the carbon footprint, owing to the emissions of carbon dioxide and other greenhouse gases. Therefore, instead of using their own servers, cloud computing seems tend to be a good environmental alternative for organizations, since it uses far fewer machines, which entail an 84% reduction in the required power.

The examples mentioned above provide a brief overview of ESG and the sustainability development goals that ought to be pursued by organizations in the present day. They also present the achievement of firms regarding such goals and their effects on the various internal and external stakeholders. Within this context, the present article goes a step further and tests the specific theories and tools, along with their potential applications in the service sector in India. The objective of the study moves in the trajectory of identifying the firms in the service sector in India that have adopted the best sustainability practices and their effects on the stakeholders. Drawing on the findings of questionnaires and interviews (mixed methods) with managers at the middle, senior, and top levels of the hierarchy, the article is among the very few works to explore ESG and technology diffusion in India through actual research in the field.

2. Results

The analysis drew on the responses of 25 survey respondents and 17 interview participants. As presented in Table 1, the individuals taking part in the study worked in a wide range of service organizations, ranging from IT-enabled services and information technology (IT) to financial services and E-commerce, among others. Additionally, Table 2 presents the size of the organizations where the respondents worked.

Table 1.

Industries where respondents and participants work.

Table 2.

Size of respondents’ and participants’ organizations.

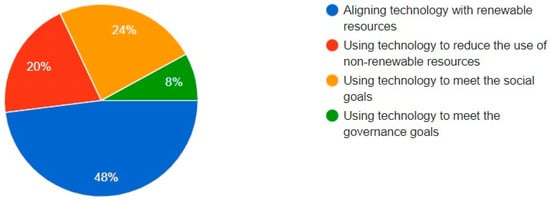

In line with the purpose, scope, and conceptualization of the study, Figure 1 reports on the percentage of technology used in 25 organizations.

Figure 1.

Links between technology and sustainability.

With respect to understanding sustainability and its standards, the authors received mixed responses, with some firms using technology to meet sustainable goals while others merely worked towards energy saving. When contemplating an ESG framework, all the respondents and participants responded positively. Each organization had its own method of working on the implementation of ESG, including setting and overviewing the progress of goals, engaging with ESG compliance, allocating budgets, and more. Additionally, regardless of the industry, each organization had different sustainability standards for understanding, prioritizing, and addressing stakeholders’ needs. Stemming from these findings, the sustainability framework of most organizations did not concern individual areas or departments within each firm. Additionally, no particular stakeholder group was considered. Rather, the approaches were generic and descriptive, similar to a blanket approach that covers organizations as a whole.

Furthermore, as presented in Figure 1, 48% of respondents reported that technology was being used in their firm in relation to renewable resources. Another 20% (5 out of 25 respondents) uses technology to reduce non-renewable resources. Interestingly, 24% (6 out of 25 respondents) uses technology to address goals relating to social aspects, such as diversity and philanthropy. Only 8% (2 out of 25 respondents) uses technology to meet governance goals. This percentage depicts the absence of links between private organizations and governmental services, and the possible lack of infrastructure to enable collaborations in the field of technology between private firms and the government. Additionally, despite the lack of specialized sustainability schemes in individual departments, the findings reveal a degree of sustainability awareness among top managers in firms in the Indian service sector, hence the existence of generic sustainability frameworks.

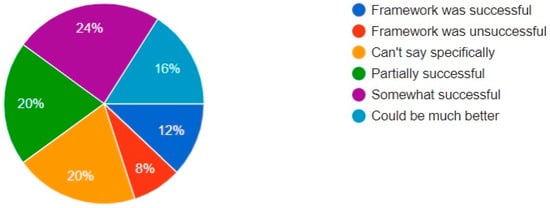

Moreover, Figure 2 shows the success rate of the ESG framework being used in the respective organizations. Regarding the question on standards connected to sustainability, all 25 respondents provided a positive response. Six managers responded to the framework being ‘somewhat successful’, whereas five respondents reported that it was ‘partially successful’. Combined, they comprise about 40% of the survey sample. Another five respondents reported that they ‘cannot say specifically’, showing that they were doubtful of the success of the sustainability framework. This response was seconded by four others, who responded that it ‘could be much better’, and another two from ‘IT-enabled-services firms’, who declared the framework adopted in their organization to be unsuccessful.

Figure 2.

The success rate of the ESG framework in the Indian service sector.

It is also interesting to mention that three of the respondents who declared the ESG framework as being successful in their respective firms also responded to the previous question (Figure 1) concerning their firms’ use of technology to meet social goals (2 from financial services firms and 1 from an IT-enabled-services firm). Additionally, one respondent from the IT-enabled-services firm claimed that the company was ‘using technology to meet governance goals’. The same person responded to the framework adopted in their organization to be ‘somewhat successful’. At the same time, a respondent from a banking firm reported that it ‘could be much better’ in the governance aspect. All respondents who selected ‘aligning technology to renewable resources’ were from e-commerce and supply chain firms. However, three respondents claimed that the framework ‘could be much better’ (two in e-commerce and one in the supply chain). Only three responded to the framework being ‘somewhat successful’ (all three in supply chain firms). Additionally, three respondents in supply chain firms claimed that they ‘cannot say specifically’. Three respondents from e-commerce firms reported that the framework was ‘partially successful’. A respondent from an IT firm reported that the framework for ‘Social Goals’ was ‘somewhat successful’.

Drawing on the findings collected via interviews, several participants (from IT-enabled services at middle-level management) mentioned that ESG was about managing the firm’s environmental impact. The participants explained that the organizations they worked for at present were trying to reduce the use of plastic. The corporate effort to reduce plastic waste is common at present (e.g., Cai et al. 2021; Shao et al. 2021; Aldowaish et al. 2022). However, concerning the question of environmental sustainability through increased technology use, several participants expressed themselves negatively. For example, three participants working in the middle-level management of banks vehemently stressed that, when technology was used, environment sustainability was compromised due to the e-waste generated in the process over a certain period. They further explained that when everyone moves to an online platform, more space for data storage is needed; therefore, data centers are not sustainable owing to their energy consumption levels and the heat that is generated during the process. Hence, all three participants had doubts concerning the entire concept of environmental sustainability in relation to technology—and ongoing digitization.

In a similar vein, another participant (middle-level management in a bank) stressed that when bitcoins were used, non-renewable sources, such as coal, were rampantly used, owing to the energy that is required by large computers. On the one hand, technology is changing the scenario of trading in financial markets. On the other, there is an overconsumption of non-renewable resources, such as coal. A top manager in an IT-enabled-services firm also mentioned that the ‘continuous dependence on being paperless is not the solution’. Likewise, another participant (a senior manager in an IT firm) mentioned that all his colleagues had a smartphone and used kindles, iPads, and computers, and he wondered if ‘given the energy being consumed, how is this sustainable?’ Such findings contradict the existing literature, stating that cloud computing helps reduce carbon emissions (e.g., Turek et al. 2021).

Moreover, a participant working in a bank (senior-management level) stated that, although they got used to using paper cups, they still used a printer and photocopier, and their desks were made from some kind of non-biodegradable material, which will take an long time to disintegrate. She also questioned the use of water and electricity in the bank. The abovementioned examples reveal a sustainability effort that falls short, since it fails to adopt a holistic approach to environmental conservation. Recently, other studies reported similar findings while explaining that technological progress does not suffice to reducing environmental pollution (e.g., Tobelmann and Wendler 2020; Cai et al. 2021; Abdouli and Hammami 2017). However, despite the hopelessness over the use of technology and sustainability in terms of the environment, there were 16 respondents and 7 participants who mentioned the positive applications that they adopted in their organizations.

Furthermore, it seems that the practice of ‘working from home’ has become permanent. Senior management in a business consulting firm mentioned that the company had a policy where all departments, including the board, conducted a single meeting every month, which, again, was conducted online. The office was used only by the technical support team, from which two members only were present on a given day, plus the two security guards and one cleaner. The rest of the office works from home, thus saving water and electricity. Since the COVID-19 outbreak (e.g., Thrassou et al. 2022c; Vrontis et al. 2022), they have continued with the policy of working from home; hence, the time spent by personnel on using the system was reduced. In this manner, their organization contributed to the environmental and social wellbeing of people, since employees worked only for 5 h/5 days a week.

However, a middle-level manager in an IT firm provided a contradictory view of the practice of working from home. She mentioned that when 100 people worked on a firm’s premises, a small number of air conditioning (AC)units were operated that may also be operated using solar power. However, when those 100 people worked from 100 different homes, 100 different AC units and/or fans forced an increase in energy consumption levels; thus, the pollution levels increase. On the other hand, the vehicles of all those employees saved on petrol and emissions. Therefore, it is similar to trying to cut down in one area, while another area is compromised (also see Erdoğan et al. 2020).

Concerning the ESG framework, one participant (top-management position in an IT firm) mentioned that its implementation enabled the implementation of sustainability assurance reports (e.g., Martínez-Ferrero et al. 2018) and provided great value to stakeholders. The framework was applied to the governance aspect of ESG, with an emphasis on three specific parameters: ethics, risk compliance, and human rights. One manager of an IT firm (middle-level management) and one of finance services (junior-level management) mentioned that their organizations commenced with training their employees to communicate effectively with their customers, suppliers, and other stakeholders. Eight respondents (three junior-level managers in IT-enabled services; one middle-level manager in a bank; one top-level manager in a consulting firm; two senior managers in IT and supply chain businesses, respectively; and one junior-level manager in a bank) stated that weaknesses were identified concerning employees’ communication with customers, suppliers, investors, and other stakeholders. Following the stakeholders’ feedback, their organizations decided to offer training sessions, focusing on effective communication and relevant skills. The training sessions targeted those individuals who were in direct contact with various stakeholders.

Two top managers (one in a mid-sized IT-enabled-service firm and one in a supply distributor firm) identified weaknesses in communication between managers and their teams. The weaknesses became known through feedback collected from employees at various hierarchical levels. Weak communication had a negative impact on employee morale and overall performance. Both firms decided to train employees who held senior-, middle-, and junior-level management positions. Participants also mentioned that separate training was practiced at each hierarchical level. More feedback was collected six months after the training, and more training sessions were offered in areas where weaknesses persisted, especially during the COVID-19 lockdowns—a period where they had to be on their toes since the supply chain was engaged with fast-moving consumer goods (FMCGs). The participants also mentioned that, during the lockdown, training sessions were delivered online, something that forced firms to invest in technology. The technology they invested in during the lockdown was cloud-based and adhered to the environmental aspect of the ESG. Additionally, in the supply chain firm, the technology installed was cloud-based, similar to salesforce’s sustainability cloud to track and report sustainability performance, reduce waste, and carbon emissions. They also used GT Nexus to collaborate with their suppliers and optimize transportation routes.

The firms also used Zendesk technology, which offered the opportunity to collect feedback from suppliers, customers, and employees. However, the IT-enabled-services firm chose ‘Survey Monkey’, a cloud-based market analysis and online survey building software, which enabled managers to circulate questionnaires to stakeholders’ lists (e.g., to collect employee feedback data, as suggested by Vidal 2023). The participants stated that they had already observed the results, although at a nascent stage. The changes were obvious where the employees’ rights were protected and efforts were made to ensure a positive work environment.

Five firms from the IT-enabled services, one e-commerce firm, and three firms from the supply chain sector utilized Google Forms for communication with their stakeholders and to enhance the feedback process. All firms were able to identify the initial gaps after analyzing the results derived from Google Forms, which helped them decide on actions in terms of internal changes, process improvements, and different types of training. Then, after certain intervals (6 months after the initial training in a financial-services firm and 4 months in a business consulting firm), the forms enabled them to collect data on change processes and identify additional gaps.

Then, four respondents mentioned that they had no strategies relating to employees’ wellbeing and ‘human rights’. However, ‘Supply Chain Sustainability’ and the selection of vendors with an ESG focus were stressed, whereas the ‘Social’ parameter of ESG was considered. They also focused on choosing the right kind of suppliers and devised a checklist to check on sustainability related ‘Supplier’ standards. At the same time, resembling the studies of Villena and Gioia (2020) and Cai et al. (2021), ten respondents stressed that making suppliers follow sustainable practices was not devoid of issues relating to employee health and safety. Four respondents (two senior managers in IT firms and two senior managers in business consulting firms) stated that the adoption of the ESG framework by their organizations had both positive and negative impacts on their investors.

Three top managers in IT-enabled firms stated that they took the initiative to follow a sustainable direction and it was well-received by the investors. They could view the change when they went for a public offer and received a positive response owing to the sustainable framework being portrayed on their company’s website and prospectus. This example depicts the investor-based integration of ESG, also mentioned by Aldowaish et al. (2022). Additionally, two senior-level managers in IT firms reported a positive investor response and attributed the sharp increase in their market shares to the firm’s ESG initiative. Another two participants, holding senior-management positions in e-commerce firms, explained that the firm’s positive image, which is linked to its sustainable framework, helped them received finance from venture funds.

On the other hand, two participants stated that investors did not believe the firm’s proclaimed pledge towards sustainable practices. This was because the firm had a bad reputation due to weak social practices and employees’ working conditions. Hence, their investors decided not to invest in the firm’s planned growth.

Moreover, seven respondents and four participants in supply chain firms stated that their organizations used renewable energy resources as part of their ESG framework, thus improving the sustainability of the supply chain. This led to a reduction in costs with the use of technology, which, in turn, helped uplift managers’ motivation. They also spoke about the way their firms used technology for sustainable best practices. They stated that their firms owned warehouses and transportation vehicles. One firm decided to install solar panels. Energy storage technologies were used to ensure a continuous electricity supply. For the storage, they used batteries that stored excess solar energy during the day and released it during times of low or no sunlight. Similarly, power electronics were used to manage the flow of electricity between solar panels. Additionally, monitoring and control systems were used to track the performance and output of solar panels and energy storage systems. Thus, the deployment of advanced solar panel technology made the solar power cost effective. This helped managers to manage their costs and enhance their performance in the long term. This helped in engaging their managers for a good cause and enhancing their trust in top-level management.

However, there is more to the story. Newly installed technologies are not without their negative implications. For example, three senior-level managers in the banking industry stated that the already existing infrastructure of their systems was not compatible with the newly installed sustainable technology. The process only enhanced the complexities and started affecting the daily operations of the banks, resulting in customer complaints. One of them stated that his team had to put in additional hours on a daily basis, including working on Sundays and holidays for over a period of 6 months; yet, the result was still discouraging. Another participant mentioned data breaches since the existing system became vulnerable due to the installation of cloud computing services to store sustainability related data. The training, again, was improper and haphazard. He recollected his team members becoming utterly confused about the new processes put in place. He stated, ‘the entire sustainability effort only enhanced costs, owing to the additional equipment and software’. He further stated that, at present, the management was deciding to de-install the equipment and software, which, to his mind, was going to be another cumbersome process. He reiterated that ‘his team’s morale is at its lowest’.

Additionally, Figure 1 shows how technology can be used to implement the ESG framework. However, a more detailed analysis of Figure 2 depicts that, although technology is used to manage the various aspects akin to ‘Renewable Resources’, which forms a part of the ESG’s ‘Environmental’ parameter, there are mixed responses from the respondents concerning the success rate of the framework. To further analyze our findings, we referred to the chi-squared test, which was used for categorical, qualitative, and descriptive data. The chi-squared test was applied using the data received from the survey in relation to the ‘Usage of Technology’ and ‘Success Rate of the ESG Framework’. Table 3 depicts the chi-squared test results for the ‘Effect of Technology on the various parameters of ESG’.

Table 3.

Chi-squared test.

While calculating the chi-squared test results, the overall success rate of the framework, as depicted in Figure 2, was considered with the effect of technology on various parameters pertaining to ESG as per Figure 1, leading to the test results presented in Table 3. For the chi-squared test, the authors considered the following null hypotheses:

H0.

There is no significant effect of technology on the various parameters of the ESG framework.

H1.

There is a significant effect of technology on the various parameters of the ESG framework.

Other than the governance goals (chi-squares test = 9.504), the results in Table 3 portray that the null hypothesis is true, depicting that, despite using technology, the governance goals of the framework need to be explored further for a substantial success rate. This could also be attributed to the responses received from the two respondents in mid- and small-sized organizations, where the percolation of the ESG framework is probably in progress and is an assumption that can be made.

Moreover, when aligning renewable resources (chi-squared test = 26.50) to technology, using technology for a reduction in the use of non-renewable resources (chi-squared test = 16.50) and its use for achieving social goals (chi-squared test = 18.19), the alternate hypothesis was proved to be true, completely negating the null hypothesis with significant chi-squared test results. This also showed that technology aided these ESG parameters to a certain extent.

Figure 1 also shows that, out of 25 respondents, only 2 respondents (1 from a small-sized bank and another from a mid-sized IT-enabled-services firm) mentioned that technology was being used to meet governance goals. Considering Figure 1 in conjunction with Figure 2, two respondents mentioned that technology met the governance goals; however, they did not award marks to the success rate of the ESG framework, with one stating that it ‘could be much better’, and the other mentioning it to be ‘somewhat successful’. This proves and explains the insignificant chi-squared test result of 9.504 in the case of the use of technology meeting governance goals.

On the other hand, out of six respondents who stated that technology was used to meet social goals, two (from small- and a mid-sized IT enabled services firms, respectively) mentioned that the ESG framework was ‘unsuccessful’. At the same time, one respondent (from a large IT firm) presented it as ‘somewhat successful’. Three respondents clearly stated that the ESG framework had been ‘successfully’ implemented. These three respondents (one from a small-sized IT-enabled services firm and two from small-sized financial services firms) were the ones who clearly mentioned that technology was successfully used for meeting social goals.

Owing to such mixed responses, while showing a ‘significant’ result and proving the null hypothesis to be false, the chi-squared test result concerning the ‘usage of technology to meet social goals’, and compared to the result for ‘Renewable Resources’, was lower. Additionally, some mentioned that small firms achieved a successful result, which led to the presumption that managing an ESG framework in smaller organizations was much easier compared to implementing and managing it in mid-sized or larger organizations. Of course, had the sample size been larger, there probably would have been better information regarding the implementation, management, and overall success rate of the framework.

Out of the five respondents who addressed technology use for reducing the usage of non-renewable resources, two (one from a small-sized IT firm and one from a mid-sized bank) stated that the ESG framework was ‘partially successful’. Two others (one from a small-sized IT firm and one from a large-sized IT-enabled-services firm) mentioned that nothing ‘specifically’ could be stated about its success, whereas one (from a small IT firm) mentioned that it was ‘somewhat successful’. Since two respondents mentioned that it was ‘partially successful’ and one mentioned that it was ‘somewhat successful’, it was assumed that the chi-square test result of 16.50 for ‘usage of technology for reducing non-renewable resources’ was proven. It can also be assumed that technology in their organizations played a successful role in reducing the use of non-renewable resources, thus replacing them with renewable ones.

In addition, it was quite clear that those referring to it as ‘partially successful’ and those referring to it as ‘somewhat successful’ worked in small organizations, reiterating the point mentioned above that smaller firms were better equipped to manage the framework.

When aligning technology to renewable resources, there were twelve respondents (three from mid-sized, one from large, and one from small e-commerce firms, and five from mid-sized and two from large-sized supply chain firms) whose responses provided mixed results concerning the success rate of ESG. This was because three respondents (two from a mid-sized e-commerce firm and one from a large supply chain firm) stated it: ‘could be much better’. Additionally, three of them (from a mid-sized supply chain firm) mentioned that they ‘cannot say specifically’ whether it was successful or not. Three of them (two from a mid-sized supply chain firm and one from a large supply chain firm) stated that it was ‘somewhat successful’, whereas three respondents (one from a small-sized IT firm, one from a small-sized e-commerce firm, and one from a mid-sized e-commerce firm) mentioned that it was ‘partially successful’. Based on these results, we may assume a 50% success rate. Hence, while the significant chi-squared test result may be 26.50 m, it was achieved from a mixed response.

Another factor that can be precariously pointed out from the abovementioned analysis is that all the respondents who selected the framework as being ‘successful’, ‘partially successful’, and ‘somewhat successful’ mostly belonged to small-sized firms. On the other hand, all those who responded to the framework as being ‘unsuccessful’, ‘cannot say specifically’, and ‘could be much better’ belonged to mid-sized and larger organizations. Such results signify that smaller organizations can implement, manage, and move forward successfully with the framework in comparison to the mid-sized and the larger ones. Again, a blanket approach could not be applied with regard to the smaller organization, creating a success out of the framework, since there were two respondents from small-sized firms who responded that the framework was ‘unsuccessful’ and ‘cannot say specifically’.

Similarly, with respect to mid-sized and larger organizations, there were responses that tilted towards the framework being ‘somewhat successful’ and ‘partially successful’. Hence, those firms were also able to implement the framework and were successful in carrying it forward to a certain extent. Here, it can be stated that their size enabled them to gain access to more resources and necessary infrastructures to steer them in the right direction.

The foregoing analysis provides some useful data concerning the efforts of firms in the Indian service sector to become sustainable amidst digitization. The survey and interviews of administrative sciences offered some interesting insights, which enabled us to understand the difficulties and unique characteristics in this particular context.

3. Materials and Methods

The analysis drew on mixed methodology and methods. The first method concerned 17 personal interviews with participants in the same number of organizations, whereas the second method was a survey questionnaire with 25 respondents in the same number of organizations. The sample for both methods concerned managers and administrative personnel across the service sector in India. The mix of organizations included IT, insurance services, banking, financial services, e-commerce, accounting, and other firms, whereas the use of technology was recognized by all organizations as a determinant of change towards an adherence to sustainable standards.

The survey examined respondents’ managerial positions, Industry, organization size, number of years in operation, areas and standards linked to sustainability, sustainability awareness, links of technology to sustainability, and possibility of sustainability strategic frameworks. Additionally, the study explored the value assigned by firms to technology, sustainability, and ESGs as the main operational components. In addition, the study explored how organizations dealt with stakeholders’ expectations, along with their role in the success or failure of sustainability strategies.

The nature of the data collected was descriptive, as it described the framework in which sustainability and technology coexisted within organizations. It also presented the impact on the stakeholders of firms due to their decision to adopt sustainable practices. The sampling frame included the following population parameters: the service sector and India. For the survey, a sampling mix of purposive, convenient, and snowball methods were used. The survey questionnaire was created using Google Forms. Convenient sampling was used to circulate the questionnaire through WhatsApp and LinkedIn to contacts known to the authors due to their capacity as consultants in the service sector. Then, the contacts forwarded the links to their contacts through what is known as a snowball sampling method. International ethical standards for anonymity and confidentiality were applied to both the survey and interviews.

The data received through questionnaires concerning questions pertaining to ‘How technology can be used to implement the ESG Framework’ and ‘What has been the success rate of the ESG framework applied by the organizations’ were further analyzed using the chi-squared test. The variables were selected based on the literature review, designed research model, and experience of the authors as consultants in the service sector. The low number of responses was justified on the basis that the adoption of ESG by firms in the Indian service sector, at present, in its nascent stage. Hence, many of the authors’ immediate contacts (known through their capacity as consultants), to whom the survey questionnaire was initially distributed, mentioned that they were not able to provide clear details on the practices relating to ESG.

Following the survey–questionnaires, 17 interviews were conducted to understand in detail the way in which the ESG framework was applied, implemented, and sustained in the respective organizations, and to validate the results of the chi-squared tests. Concerning the number of interviews, it is important to mention that the fieldwork ended when the findings seemed to be repetitive and homogenous. In qualitative research, the repetitiveness of findings is often considered to be a point of saturation (Bryant and Charmaz 2019), whereas additional interviews would not necessarily signify new findings. Moreover, as mentioned earlier, firms are still in the stage of planning ESG processes and, therefore, not all invitees could be interviewed for the study.

4. Concluding Discussion

The present analysis provided us with the latest report on the intersection of sustainability and technology diffusion in the Indian service sector. Drawing on the findings of survey–questionnaires and interviews with managers at different levels, the paper explored the application of ESG across different fields, including the impact of technology adoption, strategy, and local digitized sustainability frameworks. First, while interpreting such findings, it was important to adopt a realistic approach to different business contexts. For example, while the installation of solar panels is a standard practice in European countries, there are countries in Asia and other parts of the world where sustainable energy is, at present, in its infancy. This is revealing of the intended effort as well as the obstacles of fully subscribing to a sustainability framework in certain contexts.

Then, concerning the links between sustainability and technology usage, it seemed that Indian service firms were not ready to fully adopt digitization methods. Such technology is mainly used for the reduction in plastic usage and sustainable energy. Additionally, while the market in India is changing (e.g., cryptocurrency transactions, such as bitcoin), the consumption of energy and resources that are necessary for supporting technology is very discouraging. Recently, other studies reported similar findings while explaining that technological progress does not suffice to reduce environmental pollution (e.g., Tobelmann and Wendler 2020; Cai et al. 2021; Abdouli and Hammami 2017). Hence, we suggested that technology can both facilitate and hinder the sustainability effort, whereas the implications for internal stakeholders could be both positive and negative.

Moreover, some attempts remain underdeveloped, rather than being holistic. For example, technology is used to reduce paper use in the office, while, at the same time, offices continue operating printers, photocopy machines, and using excessive water and electricity. In addition, it seems that working from home is indeed a threat to the environment, since 100 colleagues working from home results in the operation of 100 air conditioning units, instead of three or four on a firm’s premises.

However, while companies do not place too much emphasis on employees’ wellbeing and ‘human rights’, they still link ESG with ‘Supply Chain Sustainability’, the selection of vendors, and broader society. Additionally, some of the companies at present focus on choosing the right kind of suppliers and devised a checklist to check on sustainable-related ‘Supplier’ standards. Such findings offer insights into firms’ motivations for the adoption of ESG for the purposes of legitimacy and forming the perception of external stakeholders, in line with the principles of the so-called ‘signaling theory’ (coined by Spence 1973). The process involves the communication of information regarding the firm’s adoption of certain ESG practices, as part of an effort to convey a positive image to investors and wider society. Such signals improve the reputation of the company, attract new investors, and signal to wider society a turn towards sustainability. This is an interesting contribution to the theoretical premises of the signaling theory at the intersection of strategic sustainability and technology diffusion in the Indian service sector.

Furthermore, there are some important implications for organizations and their stakeholders. In fact, firms may gradually expand their sustainability framework to include employees’ wellbeing and human rights. Moreover, some aspects of work, such as training, already contribute to employee’s skills development and career advancement.

Along with the important implications, the current study also had a number of limitations. The sample of the survey could have been larger to adopt a broader geo-graphical reach. While the findings are useful, future research should conduct a larger study, with a wider range of service sectors. Concerning the interview, it is important to mention that the fieldwork was completed when the researchers achieved repetitive findings. In qualitative research, a repetitiveness of the findings is often considered to be a point of saturation (Bryant and Charmaz 2019). Thus, additional interviews would not necessarily result in new findings. However, future research may add interviews from different service sectors, whereas the study may also consider additional stakeholders to cross-examine sustainability efforts.

Author Contributions

Conceptualization, A.K. and S.K.; Methodology, A.K.; Collection of Findings, S.K.; Analysis of Findings, L.E., A.K. and S.K.; Concluding Discussion, L.E.; Review and Editing, L.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and submitted to the University of Nicosia Research Ethics Committee (UREC)/ UREC/2003/8.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data will be destroyed after publication in line with International Research Ethics’ standards, and as outlined in the Informed Consent Form.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdouli, Mohamed, and Sami Hammami. 2017. The Impact of FDI Inflows and Environmental Quality on Economic Growth: An Empirical Study for the MENA Countries. Journal of the Knowledge Economy 8: 254–78. [Google Scholar] [CrossRef]

- Aldowaish, Alaa, Jiro Kokuryo, Othman Almazyad, and Hoe Chin Goi. 2022. Environmental, Social, and Governance Integration into the Business Model: Literature Review and Research Agenda. Sustainability 14: 2959. [Google Scholar] [CrossRef]

- Araújo, Joana, Inês Veiga Pereira, and José Duarte Santos. 2023. The Effect of Corporate Social Responsibility on Brand Image and Brand Equity and Its Impact on Consumer Satisfaction. Administrative Schiences 13: 118. [Google Scholar] [CrossRef]

- Bisogno, Marco, Beatriz Cuadrado-Ballesteros, and Isabel María García-Sánchez. 2017. Financial Sustainability in Local Governments: Definition, Measurement and Determinants. In Financial Sustainability in Public Administration. Edited by Manuel Rodríguez Bolívar. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Braun, Ernest, and David Wield. 1994. Regulation as a Means for the Social Control of Technology. Technology Analysis & Strategic Management 6: 259–72. [Google Scholar] [CrossRef]

- Braungardt, Sibylle, Rainer Elsland, and Wolfgang Eichhammer. 2016. The Environmental Impact of Eco-Innovations: The Case of EU Residential Electricity Use. Environmental Economics and Policy Studies 18: 213–28. [Google Scholar] [CrossRef]

- Bryant, Antony, and Kathy Charmaz, eds. 2019. The SAGE Handbook of Current Developments in Grounded Theory. Thousand Oaks: Sage. [Google Scholar]

- Cai, Aixin, Shiyong Zheng, LiangHua Cai, Hongmei Yang, and Ubaldo Comite. 2021. How Does Green Technology Innovation Affect Carbon Emissions? A Spatial Econometric Analysis of China’s Provincial Panel Data. Frontiers in Environmental Science 9: 813811. [Google Scholar] [CrossRef]

- Camilleri, Mark Anthony. 2021. The market for socially responsible investing: A review of the developments. Social Responsibility Journal 17: 412–28. [Google Scholar] [CrossRef]

- Cappucci, Michael. 2018. The ESG Integration Paradox. Journal of Applied Corporate Finance 30: 22–28. [Google Scholar] [CrossRef]

- Chien. 2023. The role of corporate governance and environmental and social responsibilities on the achievement of sustainable development goals in Malaysian logistic companies. Economic Research-Ekonomska Istraživanja 36: 1610–30. [Google Scholar] [CrossRef]

- Engert, Sabrina, and Rupert J. Baumgartner. 2016. Corporate sustainability strategy—Bridging the gap between formulation and implementation. Journal of Cleaner Production 113: 822–34. [Google Scholar] [CrossRef]

- Erdoğan, Seyfettin, Seda Yıldırım, Durmuş Çağrı Yıldırım, and Ayfer Gedikli. 2020. The Effects of Innovation on Sectoral Carbon Emissions: Evidence from G20 Countries. Journal of Environmental Management 267: 110637. [Google Scholar] [CrossRef] [PubMed]

- Eyraud, Luc, Benedict Clements, and Abdoul Wane. 2013. Green investment: Trends and determinants. Energy Policy 60: 852–65. [Google Scholar] [CrossRef]

- Finkbeiner, Matthias. 2009. Carbon footprinting—Opportunities and threats. The International Journal of Life Cycle Assessment 14: 91–94. [Google Scholar] [CrossRef]

- Friede, Gunnar. 2019. Why don’t we see more action? A metasynthesis of the investor impediments to integrate environmental, social, and governance factors. Business Strategy and the Environment 28: 1260–82. [Google Scholar] [CrossRef]

- Gao, Tao, Qing Liu, and Jianping Wang. 2014. A comparative study of carbon footprint and assessment standards. International Journal of Low-Carbon Technologies 9: 237–43. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-María, Nicola Raimo, and Filippo Vitolla. 2021. Are Environmentally Innovative Companies Inclined towards Integrated Environmental Disclosure Policies? Administrative Sciences 11: 29. [Google Scholar] [CrossRef]

- Gong, Mengfeng, Yuan Gao, Lenny Koh, Charles Sutcliffe, and John Cullen. 2019. The role of customer awareness in promoting firm sustainability and sustainable supply chain management. International Journal of Production Economics 217: 88–96. [Google Scholar] [CrossRef]

- Imasiku, Katundu, Valerie Thomas, and Etienne Ntagwirumugara. 2019. Green Information Technology Systems as a Global Greenhouse Gas Emission Game-Changer. Administrative Sciences 9: 43. [Google Scholar] [CrossRef]

- Kulczycka, Joanna, and Małgorzata Wernicka. 2015. Zarządzanie śladem węglowym w przedsiębiorstwach sektora energetycznego w Polsce—BarIery i korzyści. Polityka Energetyczna—Energy Policy Journal 18: 61–72. [Google Scholar]

- Martínez-Ferrero, Jennifer, Isabel-María García-Sánchez, and Emiliano Ruiz-Barbadillo. 2018. The quality of sustainability assurance reports: The expertise and experience of assurance providers as determinants. Business Strategy and the Environment 17: 1181–96. [Google Scholar] [CrossRef]

- Mir, Ajaz Akbar, and Aijaz Ahmad Bhat. 2022. Green banking and sustainability—A review. Arab Gulf Journal of Scientific Research 40: 247–63. [Google Scholar] [CrossRef]

- Oikonomou, Ioannis, Chris Brooks, and Stephen Pavelin. 2021. Theories of corporate social responsibility: A comprehensive bibliometric review. Journal of Business Ethics 173: 589–626. [Google Scholar]

- Przychodzen, Justyna, Fernando Gómez-Bezares, Wojciech Przychodzen, and Mikel Larreina. 2016. ESG issues among fund managers-factors and motives. Sustainability 8: 1078. [Google Scholar] [CrossRef]

- Sciarelli, Mauro, Silvia Cosimato, Giovanni Landi, and Francesca Iandolo. 2021. Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. The TQM Journal 33: 39–56. [Google Scholar] [CrossRef]

- Shao, Xuefeng, Yifan Zhong, Wei Liu, and Rita Yi Man Li. 2021. Modeling the Effect of green Technology Innovation and Renewable Energy on Carbon Neutrality in N-11 Countries? Evidence from advance Panel Estimations. Journal of Environmental Management 296: 113189. [Google Scholar] [CrossRef]

- Spence, Michael. 1973. Job Market Signaling. The Quarterly Journal of Economics 87: 355–74. [Google Scholar] [CrossRef]

- Thrassou, Alkis, Demetris Vrontis, Leonidas Efthymiou, and Naziyet Uzunboylu. 2022a. An Overview of Business Advancement Through Technology: The Changing Landscape of Work and Employment. In Business Advancement through Technology Volume II. Palgrave Studies in Cross-Disciplinary Business Research, in Association with EuroMed Academy of Business. Edited by Demetris Vrontis, Jacob Yaakov Weber, Alkis Thrassou, S. M. Shams and Evangelos Tsoukatos. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Thrassou, Alkis, Demetris Vrontis, Leonidas Efthymiou, and Naziyet Uzunboylu. 2022b. An Overview of Business Advancement Through Technology: Markets and Marketing in Transition. In Business Advancement through Technology Volume I. Palgrave Studies in Cross-disciplinary Business Research, in Association with EuroMed Academy of Business. Edited by Demetris Vrontis, Jacob Yaakov Weber, Alkis Thrassou, S. M. Shams and Evangelos Tsoukatos. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Thrassou, Alkis, Naziyet Uzunboylu, Leonidas Efthymiou, Demetris Vrontis, Yaakov Weber, S. M. Riad Shams, and Evangelos Tsoukatos. 2022c. Editorial Introduction: Business Under Crises: Organisational Adaptations. In Business Under Crisis, Volume II. Palgrave Studies in Cross-disciplinary Business Research, In Association with EuroMed Academy of Business. Edited by Demetris Vrontis, Jacob Yaakov Weber, Alkis Thrassou, S. M. Shams and Evangelos Tsoukatos. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Tobelmann, Daniel, and Tobias Wendler. 2020. The Impact of Environmental Innovation on Carbon Dioxide Emissions. Journal of Cleaner Production 244: 118787. [Google Scholar] [CrossRef]

- Turek, Tomasz, Damian Dziembek, and Marcin Hernes. 2021. The Use of IT Solutions Offered in the Public Cloud to Reduce the City’s Carbon Footprint. Energies 14: 6389. [Google Scholar] [CrossRef]

- United National. 2005. United Nations Environment Programme Initiative. Freshfields Report. October. Available online: https://www.unepfi.org/fileadmin/documents/freshfields_legal_resp_20051123.pdf (accessed on 12 April 2023).

- Vidal, D. 2023. T-Mobile Capitalizes on Real-Time Feedback in the Age of Immediacy. Available online: https://www.medallia.com/customers/t-mobile/ (accessed on 1 March 2023).

- Villena, Verónica H., and Dennis A. Gioia. 2020. A More Sustainable Supply Chain. Harvard Business Review Magazine (March–April 2020). Available online: https://hbr.org/2020/03/a-more-sustainable-supply-chain (accessed on 1 March 2023).

- Vrontis, Demetris, Alkis Thrassou, Leonidas Efthymiou, Naziyet Uzunboylu, Yaakov Weber, S. M. Riad Shams, and Evangelos Tsoukatos. 2022. Editorial Introduction: Business Under Crisis—Avenues for Innovation, Entrepreneurship and Sustainability. In Business Under Crisis, Volume III. Palgrave Studies in Cross-disciplinary Business Research, in Association with EuroMed Academy of Business. Edited by Demetris Vrontis, Jacob Yaakov Weber, Alkis Thrassou, S. M. Shams and Evangelos Tsoukatos. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Zhao, Jun, Qingzhe Jiang, Xiucheng Dong, and Kangyin Dong. 2020. Would Environmental Regulation Improve the Greenhouse Gas Benefits of Natural Gas Use? A Chinese Case Study. Energy Economics 87: 104712. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).