A Decision-Making Model for Selecting Product Suppliers in Crop Protection Retail Sector

Abstract

1. Introduction

2. Literature Reviews

2.1. Agricultural Crop Protection Industry and Distribution Market

2.2. Critical Factors Affecting Product Retail

3. Materials and Methods

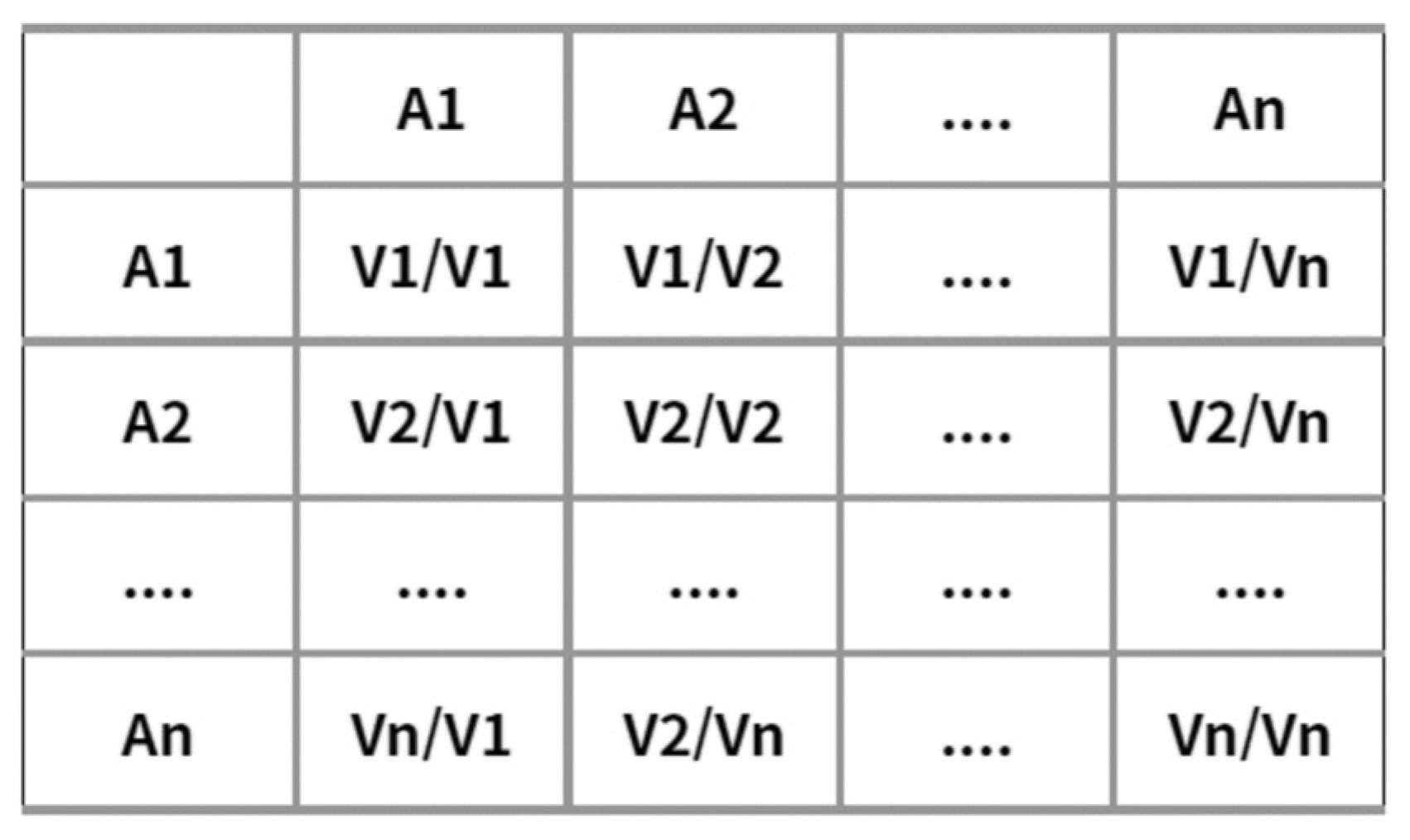

3.1. Analytic Hierarchy Process (AHP)

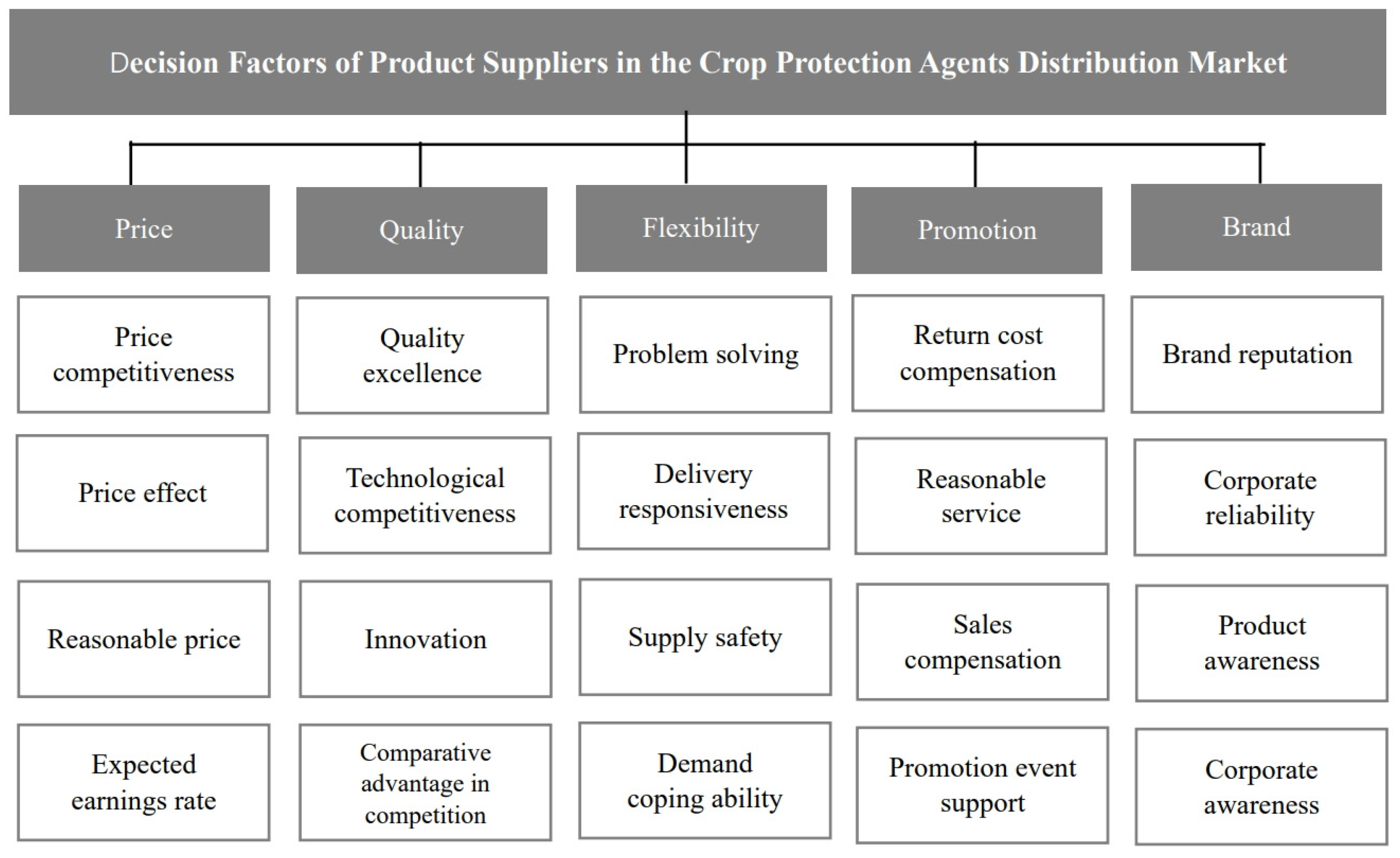

3.2. Research Framework and Variables

3.3. Research Process and Data Collection

4. Results

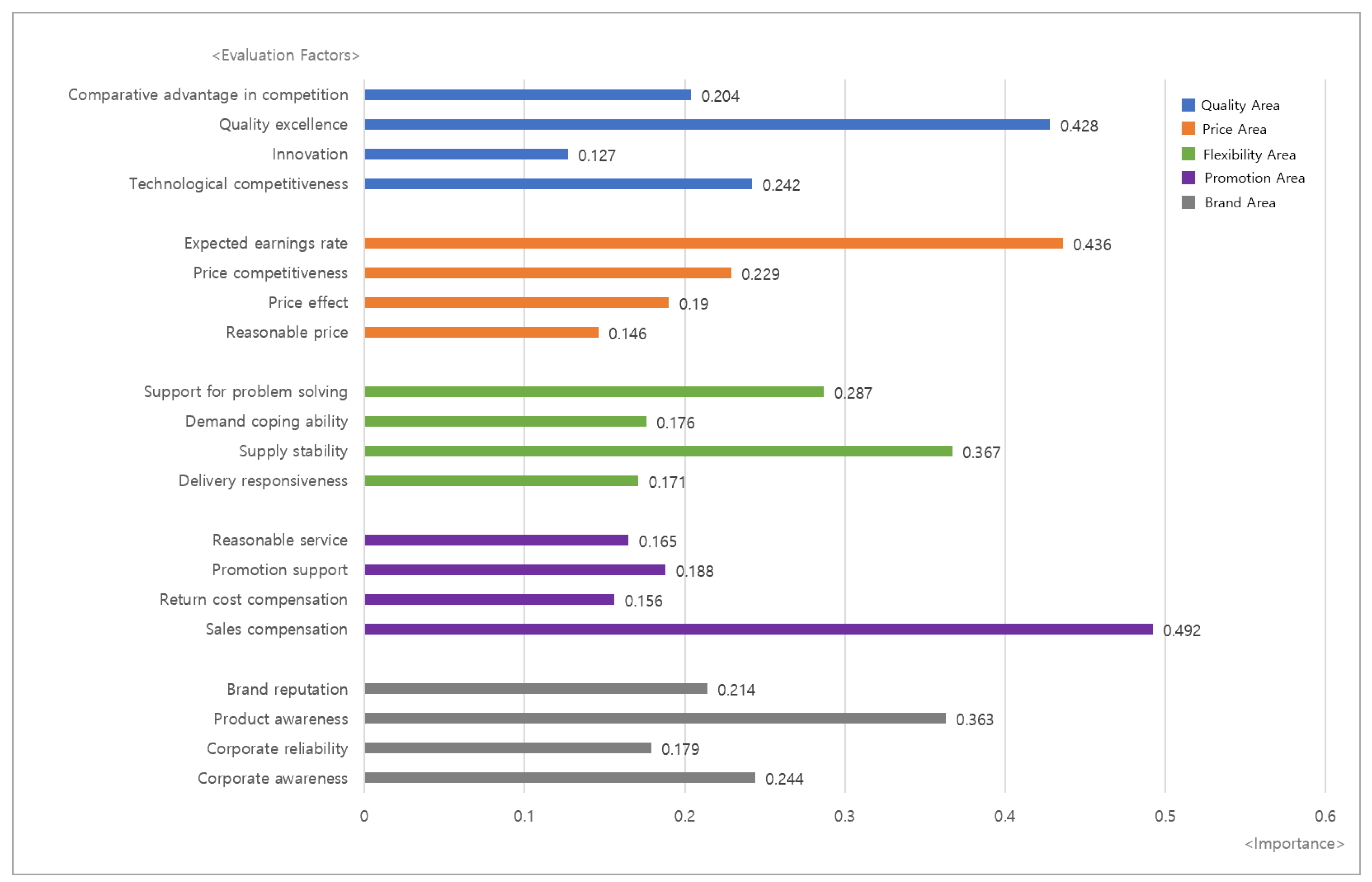

4.1. Comparison of Evaluation Variables

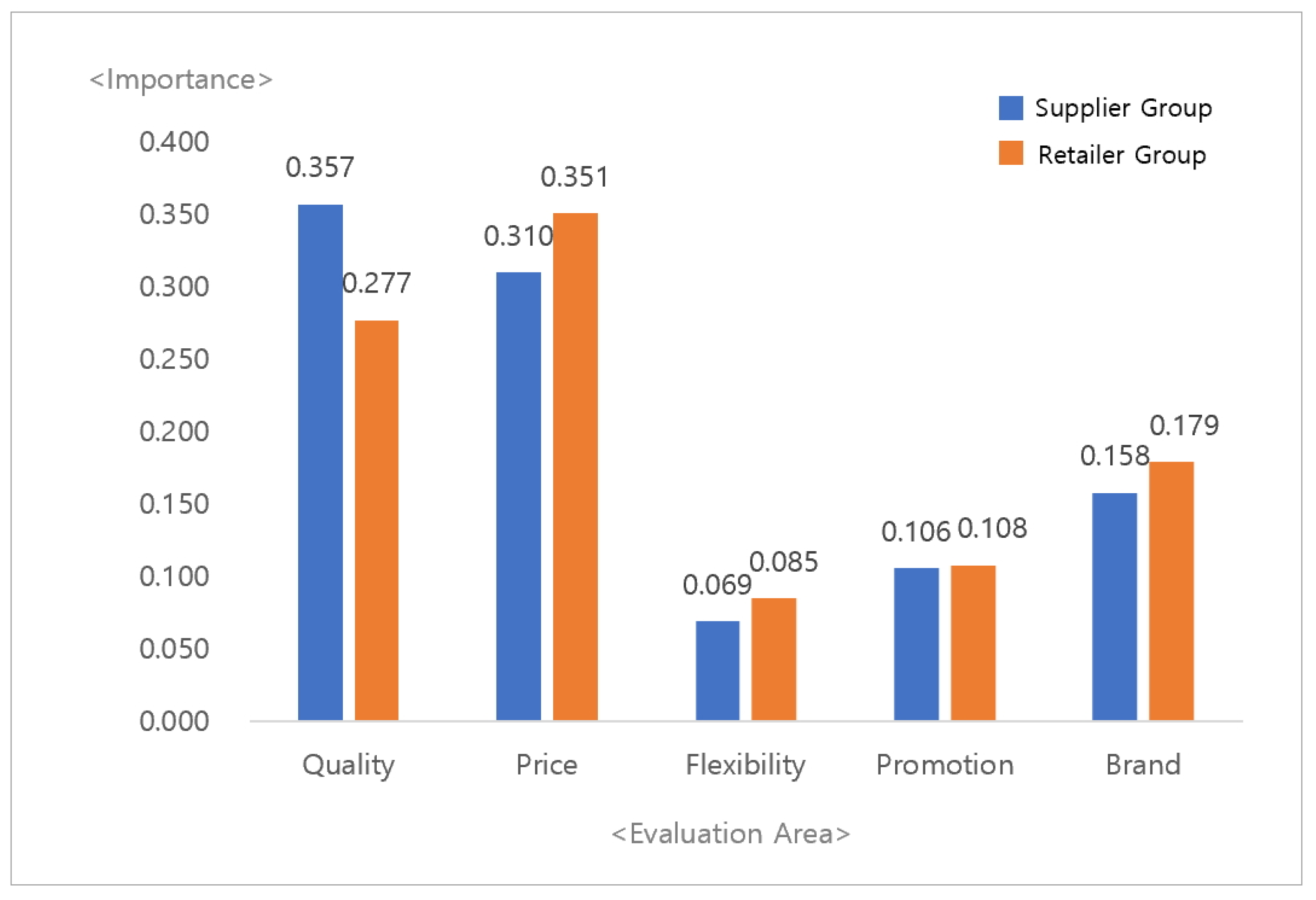

4.2. Comparison of Evaluation Areas between Retailer and Supplier Groups

4.3. Comparison of Evaluation Factors between Retailer and Supplier Groups

5. Conclusions

5.1. Findings and Discussion

5.2. Research Implications

5.3. Research Limitations and Future Plans

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abhilash, Purushothaman Chirakkuzhyil, and Nandita Singh. 2009. Pesticide use and application: An Indian scenario. Journal of Hazardous Materials 165: 1–12. [Google Scholar] [CrossRef]

- Agarwal, Ashish, Ravi Shankar, and Manoy Kumar Tiwari. 2006. Modelling the metrics of lean, agile and leagile supply chain: An ANP-based approach. European Journal of Operational Research 173: 211–25. [Google Scholar] [CrossRef]

- Agarwal, Upasna A., and Sushmita A. Narayana. 2020. Impact of relational communication on buyer–supplier relationship satisfaction: Role of trust and commitment. Benchmarking: An International Journal 27: 2459–96. [Google Scholar] [CrossRef]

- Agus, Arawati, and Mohd Shukri Hajinoor. 2012. Lean production supply chain management as driver towards enhancing product quality and business performance: Case study of manufacturing companies in Malaysia. International Journal of Quality and Reliability Management 29: 92–121. [Google Scholar] [CrossRef]

- Ahn, Byungok, Boyoung Kim, and Jongpil Yu. 2022. Effects of supplier ’s competitive factors on relationship performance and product recommendation in crop protection retail sector. Journal of Risk and Financial Management 15: 540. [Google Scholar] [CrossRef]

- Aksoy, Aslı, and Nursel Öztürk. 2011. Supplier selection and performance evaluation in just-in-time production environments. Expert Systems with Applications 38: 6351–59. [Google Scholar] [CrossRef]

- Alphonce, Christian B. 1996. Application of the analytic hierarchy process in agriculture in developing countries. Agricultural Systems 53: 97–112. [Google Scholar] [CrossRef]

- Ayhan, Mustafa Batuhan, and Huseyin Selcuk Kilic. 2015. A two stage approach for supplier selection problem in multi-item/multi-supplier environment with quantity discounts. Computers and Industrial Engineering 85: 1–12. [Google Scholar] [CrossRef]

- Bellver, J. Aznar, and V. Caballer Mellado. 2005. An application of the analytic hierarchy process method in farmland appraisal. Spanish Journal of Agricultural Research 3: 17–24. [Google Scholar] [CrossRef]

- Bettencourt, Lance A., Stephen W. Brown, and Scott B. MacKenzie. 2005. Customer-oriented boundary-spanning behaviors: Test of a social exchange. Journal of Retailing 81: 141–57. [Google Scholar] [CrossRef]

- Bianchi, Constanza, and Md Abu Saleh. 2020. Investigating SME importer–foreign supplier relationship trust and commitment. Journal of Business Research 119: 572–84. [Google Scholar] [CrossRef]

- Boyer, Kenneth K., and Marianne W. Lewis. 2002. Competitive priorities: Investigating the need for trade-offs in operations strategy. Production and Operations Management 11: 9–20. [Google Scholar] [CrossRef]

- Celuch, Kevin G., John H. Bantham, and Chickery J. Kasouf. 2006. An extension of the marriage metaphor in buyer– seller relationships: An exploration of individual level process dynamics. Journal of Business Research 59: 573–81. [Google Scholar] [CrossRef]

- Croxton, Keely L., Douglas M. Lambert, Sebastián J. García-Dastugue, and Dale S. Rogers. 2002. The demand management process. The International Journal of Logistics Management 13: 51–66. [Google Scholar] [CrossRef]

- Damalas, Christos A. 2009. Understanding benefits and risks of pesticide use. Scientific Research and Essay 4: 945–49. [Google Scholar]

- Dongó, Eleni, Gabriella Beliczai-Marosi, Ane Stensønes Dybvig, and Levente Kiss. 2018. The mechanism of action and role of hydrogen sulfide in the control of vascular tone. Nitric Oxide 81: 75–87. [Google Scholar] [CrossRef] [PubMed]

- Emamat, Mir Seyed Mohammad Mohsen, Caroline Maria de Miranda Mota, Mohammad Reza Mehregan, Mohammad Reza Sadeghi Moghadam, and Philippe Nemery. 2022. Using ELECTRE-TRI and FlowSort methods in a stock portfolio selection context. Financial Innovation 8: 11. [Google Scholar] [CrossRef]

- Ganesan, Shankar. 1994. Determinants of long-term orientation in buyer-seller relationships. Journal of Marketing 58: 1–19. [Google Scholar] [CrossRef]

- Gulati, Ranjay, and Maxim Sytch. 2007. Dependence asymmetry and joint dependence in inter-organizational relationships: Effects of embeddedness on a manufacturer’s performance in procurement relationships. Administrative Science Quarterly 52: 32–69. [Google Scholar] [CrossRef]

- Gupta, Varun, Dmitry Ivanov, and Tsan-Ming Choi. 2021. Competitive pricing of substitute products under supply disruption. Omega 101: 102279. [Google Scholar] [CrossRef]

- Ilyas, Gunawan Bata, Sir Rahmi, Hasmin Tamsah, Abdul Razak Munir, and Aditya Halim Perdana Kusuna Putra. 2020. Reflective model of brand awareness on repurchase intention and customer satisfaction. The Journal of Asian Finance, Economics and Business 7: 427–38. [Google Scholar] [CrossRef]

- Johnston, David A., David M. McCutcheon, F. Ian Stuart, and Hazel Kerwood. 2004. Effects of supplier trust on performance of cooperative supplier relationships. Journal of Operations Management 22: 23–38. [Google Scholar] [CrossRef]

- Kannan, Vijay R., and Keah Choon Tan. 2002. Supplier selection and assessment their impact on business performance. Journal of Supply Chain Management 38: 11–21. [Google Scholar] [CrossRef]

- Kannan, Vijay R., and Keah Choon Tan. 2006. Buyer-supplier relationships: The impact of supplier selection and buyer-supplier engagement on relationship and firm performance. International Journal of Physical Distribution & Logistics Management 36: 755–75. [Google Scholar]

- Kim, Woodong, and Boyoung Kim. 2020. The critical factors affecting the consumer reselling of limited edition products: A case in the Korean fashion sector. Sustainability 12: 8181. [Google Scholar] [CrossRef]

- Kou, Gang, Özlem Olgu Akdeniz, Hasan Dinçer, and Serhat Yüksel. 2021. Fintech investments in European banks: A hybrid IT2 fuzzy multidimensional decision-making approach. Financial Innovation 7: 39. [Google Scholar] [CrossRef] [PubMed]

- Krause, Daniel R., Mark Pagell, and Sime Curkovic. 2001. Toward a Measure of Competitive Priorities for Purchasing. Journal of Operations Management 19: 497–512. [Google Scholar] [CrossRef]

- Kurttila, Mikko, Mauno Pesonen, Jyrki Kangas, and Miika Kajanus. 2000. Utilizing the analytic hierarchy process AHP in SWOT analysis: A hybrid method and its application to a forest certification case. Forest Policy Economics 1: 41–52. [Google Scholar] [CrossRef]

- Li, Sali, Anoop Madhok, Gerhard Plaschka, and Rohit Verma. 2006. Supplier-switching inertia and competitive asymmetry: A demand-side perspective. Decision Sciences 37: 547–76. [Google Scholar] [CrossRef]

- Lu, Jye-Chyi, Yu-Chung Tsao, and Chayakrit Charoensiriwath. 2011. Competition under manufacturer service and retail price. Economic Modelling 28: 1256–64. [Google Scholar] [CrossRef]

- Matthews, Graham A. 2008. Attitudes and behaviors regarding use of crop protection products: A survey of more than 8500 smallholders in 26 countries. Crop Protection 27: 834–46. [Google Scholar] [CrossRef]

- Monroe, Kent B., and William B. Dodds. 1988. A research program for establishing the validity of the price-quality relationship. Journal of the Academy of Marketing Science 16: 151–68. [Google Scholar] [CrossRef]

- Mungra, Yogesh, and Prabhat Kumar Yadav. 2019. The mediating effect of satisfaction on trust-commitment and relational outcomes in manufacturer–supplier relationship. Journal of Business & Industrial Marketing 35: 219–30. [Google Scholar]

- Ng, Eric. 2012. An empirical study on the success factors of supplier-distributor relationships. Contemporary Management Research 8: 161–79. [Google Scholar] [CrossRef]

- Nishimoto, Ray. 2019. Global trends in the crop protection industry. Journal of Pesticide Science 22: 141–47. [Google Scholar] [CrossRef] [PubMed]

- Oerke, Erich-Christian. 2006. Crop losses to pests. The Journal of Agricultural Science 144: 31–43. [Google Scholar] [CrossRef]

- Palmatier, Robert W., Rajiv P. Dant, and Kenneth R. Evans. 2006. Factors influencing the effectiveness of relationship marketing: A meta-analysis. Journal of Marketing 70: 136–53. [Google Scholar] [CrossRef]

- Pesonen, Hanna-Leena, Tomas Ekvall, Günter Fleischer, Gjalt Huppes, Christina Jahn, Zbigniew S. Klos, Gerald Rebitzer, Guido W. Sonnemann, Alberto Tintinelli, Bo P. Weidema, and et al. 2000. Framework for scenario development in LCA. The International Journal of Life Cycle Assessment 5: 21–30. [Google Scholar] [CrossRef]

- Piercy, Nigel F. 2009. Strategic relationships between boundary-spanning functions: Aligning customer relationship management with supplier relationship management. Industrial Marketing Management 38: 857–64. [Google Scholar] [CrossRef]

- Prado, Lucas Sciencia do, and Dante Pinheiro Martinelli. 2018. Analysis of negotiation strategies between buyers and sellers: An applied study on crop protection products distribution. RAUSP Management Journal 53: 225–40. [Google Scholar] [CrossRef]

- Rao, Akshay R., and Kent B. Monroe. 1989. The effect of price, brand name, and store name on buyers’ perceptions of product quality: An integrative review. Journal of Marketing Research 26: 351–57. [Google Scholar]

- Rauyruen, Papassapa, and Kenneth E. Miller. 2007. Relationship quality as a predictor of B2B customer loyalty. Journal of Business Research 60: 21–31. [Google Scholar] [CrossRef]

- Roch, Sylvia G., and Linda R. Shanock. 2006. Organizational justice in an exchange framework: Clarifying organizational justice distinctions. Journal of Management 32: 299–322. [Google Scholar] [CrossRef]

- Rogers, Dale S., Douglas M. Lambert, Keely L. Croxton, and Sebastián J. García-Dastugue. 2002. The returns management process. The International Journal of Logistics Management 13: 1–18. [Google Scholar] [CrossRef]

- Rosenzweig, Eve D., Aleda V. Roth, and James W. Dean, Jr. 2003. The influence of an integration strategy on competitive capabilities and business performance: An exploratory study of consumer products manufacturers. Journal of Operations Management 21: 437–56. [Google Scholar] [CrossRef]

- Roy, Pranith Kumar, and Krishnendu Shaw. 2021. A multicriteria credit scoring model for SMEs using hybrid BWM and TOPSIS. Financial Innovation 7: 77. [Google Scholar] [CrossRef]

- S&P Global. 2023. Preliminary Analysis by S&P Global Commodity Insights’ Crop Science. Agriculture Market. Available online: https://www.marketplace.spglobal.com/en/datasets/platts-market-data-agriculture-(76) (accessed on 15 January 2023).

- Saaty, Thomas L. 2008. Decision making with the analytic hierarchy process. International Journal of Services Sciences 1: 83–98. [Google Scholar] [CrossRef]

- Santos, Gilberto, Federica Murmura, and Laura Bravi. 2019. Developing a model of vendor rating to manage quality in the supply chain. International Journal of Quality and Service Sciences 11: 34–52. [Google Scholar] [CrossRef]

- Scheer, Lisa K., C. Fred Miao, and Robert W. Palmatier. 2015. Dependence and interdependence in marketing relationships: Meta-analytic insights. Journal of the Academy of Marketing Science 43: 694–712. [Google Scholar] [CrossRef]

- Schweidel, David A., Eric T. Bradlow, and Peter S. Fader. 2011. Portfolio dynamics for customers of a multiservice provider. Management Science 57: 471–86. [Google Scholar] [CrossRef]

- Selnes, Fred, and James Sallis. 2003. Promoting relationship learning. Journal of Marketing 67: 80–95. [Google Scholar] [CrossRef]

- Shukla, Suwarna, Rohit Kapoor, Narain Gupta, and Deepak Arunachalam. 2022. Knowledge transfer, buyer-supplier relationship and supplier performance in agricultural supply chain: An agency theory perspective. Journal of Knowledge Management 27: 738–81. [Google Scholar] [CrossRef]

- Sparks, Thomas C., Frank J. Wessels, Beth A. Lorsbach, Benjamin M. Nugent, and Gerald B. Watson. 2019. The new age of insecticide discovery-the crop protection industry and the impact of natural products. Pesticide Biochemistry and Physiology 161: 12–22. [Google Scholar] [CrossRef] [PubMed]

- Taherdoost, Hamed, and Aurélie Brard. 2019. Analyzing the process of supplier selection criteria and methods. Procedia Manufacturing 32: 1024–34. [Google Scholar] [CrossRef]

- Tan, Yomgso, Shuang Geng, Sotaro Katsumata, and Xiong Xiong. 2021. The effects of ad heuristic and systematic cues on consumer brand awareness and purchase intention: Investigating the bias effect of heuristic information processing. Journal of Retailing and Consumer Services 63: 102696. [Google Scholar] [CrossRef]

- Ting, Shin-Chan, and Danny I. Cho. 2008. An integrated approach for supplier selection and purchasing decisions. Supply Chain Management: An International Journal 13: 116–27. [Google Scholar] [CrossRef]

- Wilson, Elizabeth J., and Charles C. Nielson. 2001. Cooperation and continuity in strategic business relationships. Journal of Business-to-Business Marketing 8: 1–24. [Google Scholar] [CrossRef]

- Wu, Chen-Fong. 2002. Business Should be its own Therapist: Observing the Governance Ethics of Taiwanese Enterprises. Journal of Business Ethics 40: 363–71. [Google Scholar] [CrossRef]

- Wu, Wen-Kuei, and Singa Wang Chiu. 2016. The impact of guanxi positioning on the quality of manufacturer–retailer channel relationships: Evidence from Taiwanese SMEs. Journal of Business Research 69: 3398–405. [Google Scholar] [CrossRef]

- Xiao, Hui, Yao Zhang, Gang Kou, Si Zhang, and Juergen Branke. 2023. Ranking and selection for pairwise comparison. Naval Research Logistics 70: 284–302. [Google Scholar] [CrossRef]

- Yoo, Seok-Keun, and Bo-Young Kim. 2018. A decision-making model for adopting a cloud computing system. Sustainability 10: 2952. [Google Scholar] [CrossRef]

- Zhang, Jonathan Z., George F. Watson IV, Robert W. Palmatier, and Rajiv P. Dant. 2016. Dynamic relationship marketing. Journal of Marketing 80: 53–75. [Google Scholar] [CrossRef]

| Researcher | Evaluation Factor |

|---|---|

| Krause et al. (2001) | quality, cost, delivery, flexibility, innovation |

| Boyer and Lewis (2002) | low cost, quality, flexibility, delivery |

| Kannan and Tan (2002) | product development, technology diffusion, problem solving, manufacturing competence, honesty, promotion support, cost, quality, delivery, productivity |

| Johnston et al. (2004) | reliability, cooperative supplier relationship |

| Palmatier et al. (2006) | business satisfaction, continuity of business relationship, support for problem-solving, and joint decision making |

| Li et al. (2006) | price, quality, delivery consistency, product innovation, marketing |

| Ting and Cho (2008) | purchasing cost, product quality, reliability, partnership, customer service, financial status |

| Aksoy and Öztürk (2011) | quality, timely delivery, location, price |

| Ayhan and Kilic (2015) | price, quality, delivery, sales performance |

| Santos et al. (2019) | total quality, continuous improvement, environment, welfare, problem solving, quality, service, cost reduction, financial performance |

| Taherdoost and Brard (2019) | performance, quality assurance, claim policy, repair, reliability, communication, reputation, industry ranking, risk factor, CSR, quality, price, supply, service |

| Evaluation Area | Evaluation Factor | Definition | References |

|---|---|---|---|

| Quality | Quality excellence | Competitiveness level depending on supplier’s new product offering capability, product diversity, and differentiation of product composition | Krause et al. (2001) Bettencourt et al. (2005) Ting and Cho (2008) Schweidel et al. (2011) Ayhan and Kilic (2015) |

| Technological competitiveness | Technology level that a supplier has on the product related to crop protection agent development | ||

| Innovation | Differentiated innovation level of the product held by a product supplier revealed in comparison with competitors’ products | ||

| Comparative advantage in competition | Effectiveness and quality level of the crop protection agents supplied by a product supplier in comparison with competitors’ products | ||

| Price | Price competitiveness | Higher margin and market competitiveness securing possibility due to prices, compared to competitors’ prices | Boyer and Lewis (2002) Wu (2002) Li et al. (2006) Zhang et al. (2016) Agarwal et al. (2006) Aksoy and Öztürk (2011) Gupta et al. (2021) |

| Price effect | Price excellence level in the market depending on effectiveness vs. product price | ||

| Reasonable price | Reasonable pricing in comparison with the same level products of competitors | ||

| Expected return | Earnings rate and profit level expected by retailers due to the product suppliers’ product prices | ||

| Flexibility | Problem solving | Level of collaboration activities supporting retailers’ problem solving, including response service to customer claims or inventory losses | Kannan and Tan (2002) Johnston et al. (2004) Palmatier et al. (2006) |

| Delivery responsiveness | Level of product supplier’s delivery deadline compliance and product delivery service | ||

| Supply stability | Retailer’s responsible supply of order-received quantities and stable production and supply capabilities | ||

| Demand coping ability | Level of fast and flexible ability to respond to urgent demand of customers or retailers | ||

| Promotion | Return cost compensation | Support level for retailers on returned products handling, due to customer claims or abnormal products | Rogers et al. (2002) Croxton et al. (2002) Selnes and Sallis (2003) Palmatier et al. (2006) Piercy (2009) |

| Reasonable service | New and differentiated service offering level for product sales promotion occurring in the transaction process | ||

| Sales compensation | Sales compensation and incentive payment level for retailers | ||

| Promotion event support | Support level for retailers’ PR, events, and free gifts for product sales | ||

| Brand | Brand reputation | Reputation level on the reliability, satisfaction, and recommendation intention of the supplied crop protection agent brand | Roch and Shanock (2006) Gulati and Sytch (2007) Bianchi and Saleh (2020) |

| Corporate reliability | Reliability, honesty, and fairness level of suppliers in the market | ||

| Product awareness | Level of awareness and being famous of the supplied crop protection agents in the market | ||

| Corporate awareness | Awareness level of the suppliers producing and supplying crop protection agents |

| Characters | Frequency | Ratio (%) | |

|---|---|---|---|

| Gender | Male | 40 | 95.2 |

| Female | 2 | 4.8 | |

| Total | 42 | 100 | |

| Age | 30s | 5 | 11.9 |

| 40s | 20 | 47.6 | |

| 50s | 13 | 31.0 | |

| 60s | 4 | 9.5 | |

| Total | 42 | 100 | |

| Work Experience | 10–20 years | 22 | 52.4 |

| 21–30 years | 14 | 33.3 | |

| 31–40 years | 6 | 14.3 | |

| Total | 42 | 100 | |

| Professional Area | Supplier group | 21 | 50.0 |

| Retailer group | 21 | 50.0 | |

| Total | 42 | 100 | |

| Evaluation Areas | The Weights of Areas | Evaluation Factors | The Weights of Evaluation Factors | |||

|---|---|---|---|---|---|---|

| Importance | Importance (Local *) | Priority | Importance (Global **) | Priority | ||

| Quality | 0.356 | Technological competitiveness | 0.242 | 2 | 0.086 | 3 |

| Innovation | 0.127 | 4 | 0.045 | 10 | ||

| Quality excellence | 0.428 | 1 | 0.152 | 1 | ||

| Comparative advantage in competition | 0.204 | 3 | 0.072 | 5 | ||

| Price | 0.333 | Reasonable price | 0.146 | 4 | 0.049 | 8 |

| Price effect | 0.190 | 3 | 0.063 | 6 | ||

| Price competitiveness | 0.229 | 2 | 0.076 | 4 | ||

| Expected earnings rate | 0.436 | 1 | 0.145 | 2 | ||

| Flexibility | 0.081 | Delivery responsiveness | 0.171 | 3 | 0.014 | 18 |

| Supply stability | 0.367 | 1 | 0.030 | 12 | ||

| Demand coping ability | 0.176 | 3 | 0.014 | 18 | ||

| Support for problem solving | 0.287 | 2 | 0.023 | 14 | ||

| Promotion | 0.103 | Sales compensation | 0.492 | 1 | 0.051 | 7 |

| Return cost compensation | 0.156 | 4 | 0.016 | 17 | ||

| Promotion support | 0.188 | 2 | 0.019 | 15 | ||

| Reasonable service | 0.165 | 3 | 0.017 | 16 | ||

| Brand | 0.127 | Corporate awareness | 0.244 | 2 | 0.031 | 11 |

| Corporate reliability | 0.179 | 4 | 0.023 | 14 | ||

| Product awareness | 0.363 | 1 | 0.046 | 9 | ||

| Brand reputation | 0.214 | 3 | 0.027 | 13 | ||

| Total | 1.000 | 5.000 | 1.000 | |||

| Evaluation Areas | The Weights of Areas | |||

|---|---|---|---|---|

| Supplier Group | Retailer Group | |||

| Importance | Priority | Importance | Priority | |

| Quality | 0.357 | 1 | 0.277 | 2 |

| Price | 0.310 | 2 | 0.351 | 1 |

| Flexibility | 0.069 | 5 | 0.085 | 5 |

| Promotion | 0.106 | 4 | 0.108 | 4 |

| Brand | 0.158 | 3 | 0.179 | 3 |

| Total | 1.000 | 1.000 | ||

| Evaluation Factors | The Weights of Evaluation Factors | Priority of Factors (Global) | ||||

|---|---|---|---|---|---|---|

| Importance (Local) | Importance (Global) | |||||

| Supplier Group | Retailer Group | Supplier Group | Retailer Group | Supplier Group | Retailer Group | |

| Technological competitiveness | 0.500 | 0.205 | 0.179 | 0.057 | 1 | 6 |

| Innovation | 0.249 | 0.105 | 0.089 | 0.029 | 4 | 14 |

| Quality excellence | 0.172 | 0.455 | 0.061 | 0.126 | 6 | 2 |

| Comparative advantage in competition | 0.079 | 0.234 | 0.028 | 0.065 | 12 | 5 |

| Reasonable price | 0.425 | 0.091 | 0.132 | 0.032 | 2 | 13 |

| Price effect | 0.305 | 0.147 | 0.095 | 0.052 | 3 | 7 |

| Price competitiveness | 0.168 | 0.195 | 0.052 | 0.069 | 8 | 3 |

| Expected earnings rate | 0.102 | 0.566 | 0.032 | 0.199 | 10 | 1 |

| Delivery responsiveness | 0.450 | 0.115 | 0.031 | 0.010 | 11 | 20 |

| Supply stability | 0.297 | 0.270 | 0.020 | 0.023 | 15 | 15 |

| Demand coping ability | 0.175 | 0.156 | 0.012 | 0.013 | 18 | 19 |

| Support for problem solving | 0.078 | 0.459 | 0.005 | 0.039 | 20 | 10 |

| Sales compensation | 0.524 | 0.436 | 0.056 | 0.047 | 7 | 8 |

| Return cost compensation | 0.209 | 0.154 | 0.022 | 0.017 | 14 | 18 |

| Promotion support | 0.166 | 0.201 | 0.018 | 0.022 | 16 | 17 |

| Reasonable service | 0.100 | 0.209 | 0.011 | 0.023 | 19 | 16 |

| Corporate awareness | 0.425 | 0.210 | 0.067 | 0.038 | 5 | 11 |

| Corporate reliability | 0.323 | 0.183 | 0.051 | 0.033 | 9 | 12 |

| Product awareness | 0.162 | 0.366 | 0.026 | 0.066 | 13 | 4 |

| Brand reputation | 0.089 | 0.240 | 0.014 | 0.043 | 17 | 9 |

| 5.000 | 5.000 | 1.000 | 1.000 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahn, B.; Kim, B. A Decision-Making Model for Selecting Product Suppliers in Crop Protection Retail Sector. Adm. Sci. 2023, 13, 97. https://doi.org/10.3390/admsci13040097

Ahn B, Kim B. A Decision-Making Model for Selecting Product Suppliers in Crop Protection Retail Sector. Administrative Sciences. 2023; 13(4):97. https://doi.org/10.3390/admsci13040097

Chicago/Turabian StyleAhn, Byungok, and Boyoung Kim. 2023. "A Decision-Making Model for Selecting Product Suppliers in Crop Protection Retail Sector" Administrative Sciences 13, no. 4: 97. https://doi.org/10.3390/admsci13040097

APA StyleAhn, B., & Kim, B. (2023). A Decision-Making Model for Selecting Product Suppliers in Crop Protection Retail Sector. Administrative Sciences, 13(4), 97. https://doi.org/10.3390/admsci13040097

_김_(김).png)