1. Introduction

Each of us has been aware of the exponential pace of change in the time in which we live in recent years. The first electronic computer was made in 1946, weighed 30 tons and had several thousand tubes. Today, almost 80 years later, the performance of the computer has increased several times, the weight and size have decreased several times, and the cost of operation has also decreased. These rapid changes in technology are attractive to consumers and it is the role of companies to understand the consumer’s requirements correctly and deliver the product that the company is interested in. Today, inside organizations, there is pressure to ensure that organizational structures are flat, that employees have the necessary skills, that new innovations are created all the time, etc. Although these aspects are very important, they cannot be applied unless the context of the organization is understood—the historical development of the organization and management of work (

Hoag and Cooper 2006). Competition brings many challenges for companies operating on the market, moreover, today we can talk about competition in a global sense. Today’s businesses need to re-engineer their business models to bring something efficient and smart to the market at the same time. These characteristics are typical for Industry 4.0, which is adopted by more and more organizations. The Industry 4.0 concept responds to the challenges brought about by the current global competition. Based on this, it is necessary to change business models and value chains in organizations so that they can integrate technological innovations supporting the creation of values, which is mainly based on the use of available data (

Martínez-Olvera and Mora-Vargas 2019). The model must be based on an underlying process that creates value for the customer. Industry 4.0 affects many activities that create value. Digitalization affects all industries in which it increases efficiency. The concept of Industry 4.0 and the value chain model enable the integration of business and production processes from supplier activities to the customer, and therefore businesses should build business models based on their characteristics (

Ajayi and Laseinde 2021). We live in a digital society, which has its advantages, but also pitfalls. We have access to a wealth of information and services. Artificial Intelligence helps us solve challenging medical, engineering and environmental problems. When we look back 2 decades and then imagine the next 2 decades, we can definitely say that we will be living, working and communicating in a different world. Digital transformation brings with it many challenges that need to be appropriately responded to and prepared for (

Dastbaz and Cochrane 2019).

2. Literature Review

The term Industry 4.0 is no longer new to our society and originated in Germany, while this country also became a leader in the transition to this concept. Industry 4.0 is based on the concept of “Internet of Things and Internet of Services”, which means that every object (machine, product, component) contains embedded digital technology, thanks to which interaction with another object or person takes place. Half of the industrial enterprises in Germany are involved in this concept, and by 2030, German enterprises should operate on the internet industry system (

Pozdnyakova et al. 2019).

Romanova and Kuzmin (

2021) claim that Industry 4.0 is based on cyber-physical systems, the Internet of Things, 3D printing and networks. We know 4 groups of important technological systems: digital technologies, advanced materials, biotechnologies and technologies focused on environmental protection and new energy. The Fourth Industrial Revolution promotes institutions that create networked structures of commerce, science, education, and a network of producers of individual products. Economic systems are being transformed into dynamic network systems with a flexible structure of internal relations thanks to ICT (

Fedushko et al. 2020), digital platforms and digital technologies. Systems can respond promptly to changes in the environment and disruption, which allows the company to adapt to the current market situation with new technologies (

Romanova and Kuzmin 2021). Industry 4.0 arose as a result of the discovery of new technologies—digital and Internet. These technologies are part of automated processes that interact with each other without human intervention (

Sukhodolov 2019). For organizations that have built a modern IT infrastructure, the transition to Industry 4.0 will be easier and they expect an opportunity rather than a threat. Linking processes through IT infrastructure leads to higher efficiency of the production process—intelligent machines will be able to communicate with each other. The challenge for organizations is to find a workforce that has the knowledge needed to implement such a production flow. This process will change the relationships between organizations, suppliers and customers, i.e., the entire value chain. Production will be more flexible, adapted to customer needs (

Sima et al. 2020).

Industry 4.0 is a model of advanced production that is slowly being adopted by all countries in all industries. The concept calls for thinking about impacts, analysis of options and practical studies carried out with academic and business partners. A complete transition to Industry 4.0 requires the necessary knowledge (

Pereira Carvalho and Cazarini 2020).

2.1. The Concept of Value Chain

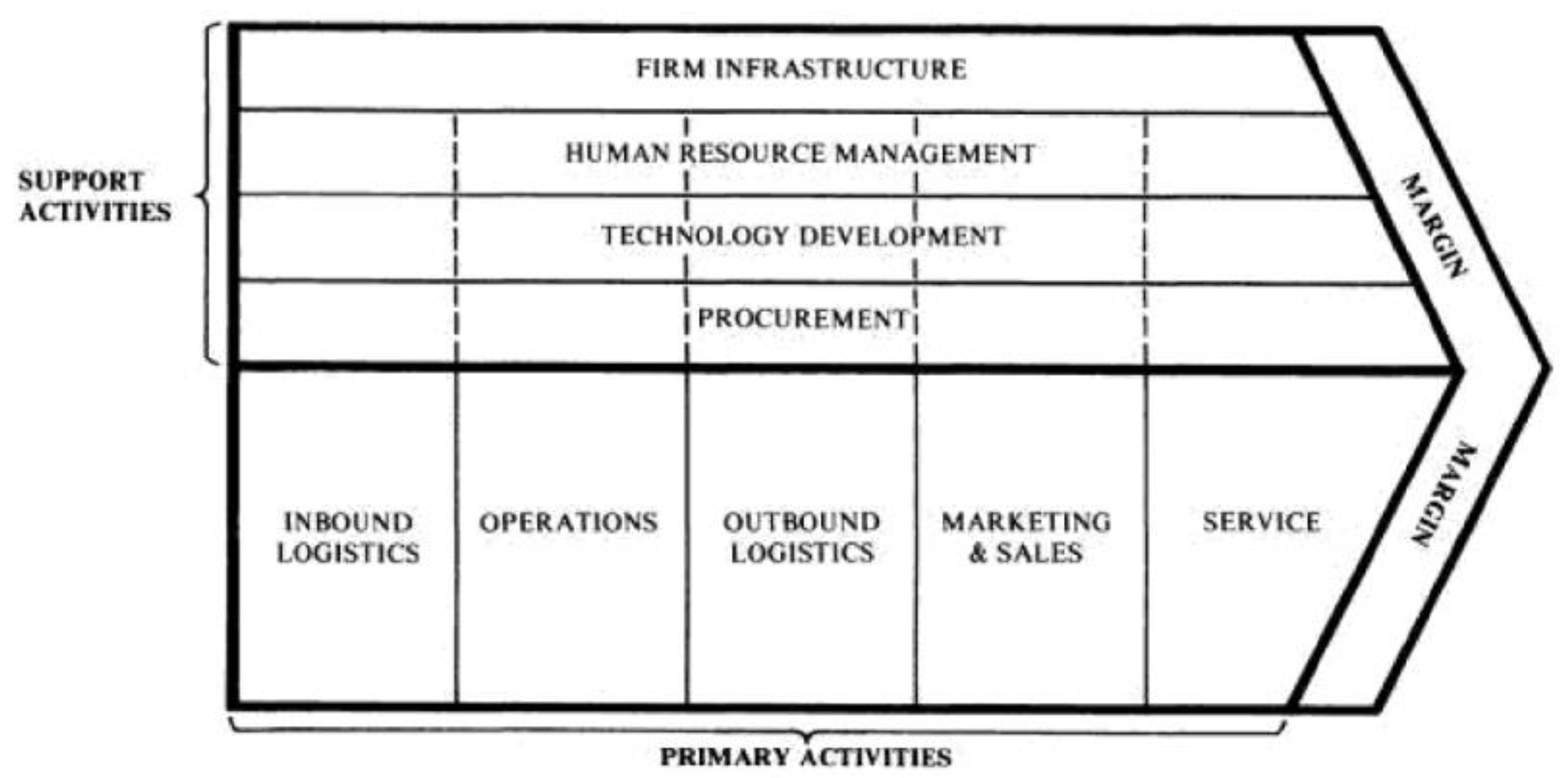

Porter introduced the concept of “value creation” into management theory, which was used in economics and from this concept the “value chain” arose. It serves as a strategic tool suitable for analyzing and planning activities in organizations (

Friedrichsen and Mühl-Benninghaus 2013). The model (

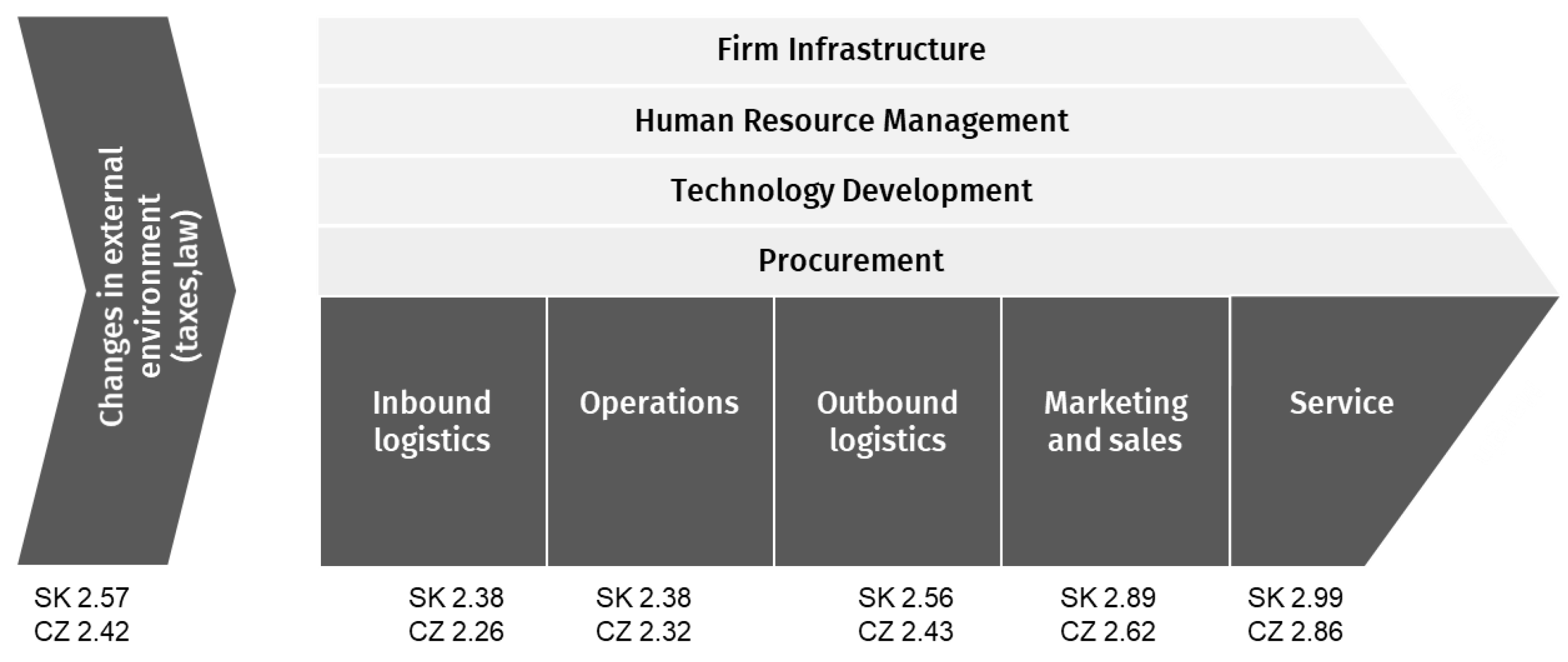

Figure 1) includes the activities that a business must undertake to bring a product or service from its conception to its final use, recycling or reuse (

Ponte et al. 2019). Activities are divided into 2 categories: primary, which physically affect the creation of a product or service, its sale to the consumer, and the performance of after-sales services, and secondary, which either add value by themselves or through primary activities and other support activities (

Rao et al. 2008). Secondary activities are related to procurement, corporate infrastructure, technological development and human resources management. The value chain is based on the transformation process, starting with the insertion of production factors into the “inbound logistics” process, they are transformed, formed by “operations” into products, then stored “outbound logistics”, promoted, sold and distributed by “marketing and sales” and finally there are activities related to customers and warranty “service” activities (

Friedrichsen and Mühl-Benninghaus 2013). Each activity in the chain incurs costs, connects assets, is assigned operating costs, and a cost estimate is made for each activity (

Ike 2017). The creation of the value chain results from the industry in which the company operates. Even if the value chains of companies operating in the same industry are similar, there are still differences between them that are a source of competitive advantage. The difference can be in items in the product line, in different consumers, geographical area, distribution channels, etc. (

Porter 1985). The value chain helps managers answer the question “what is the company good at”, but on the other hand, it does not answer the question “what is the company better than the competition” (

Dyer et al. 2017).

If an organization wants to gain a competitive advantage, its value chain must be managed as a system, not as a set of separate activities (

Porter 1990).

2.2. The Value Chain in the Conditions of Industry 4.0

Before the introduction of modern technologies, activities in the value chain were carried out through manual processes and verbal communication. The first wave of IT took place in the 1960s and 1970s, causing automation in some value chain activities such as order processing, invoice payment, computer-assisted activities. The second wave of transformation took place in the 1980s and 1990s, when the Internet entered the market, enabling ubiquitous connectivity. Thanks to the Internet, activities were coordinated and integrated, which was reflected in cooperation with external suppliers, customers and other countries. These two waves caused an increase in productivity thanks to the transformation of the value chain, but the products themselves were not so much affected by the transformation. It brought a lot of innovations, an increase in productivity and economic growth to a higher degree than the previous two. Product manufacturing has changed the value chain in product design, marketing, manufacturing, after-sales service, and new activities such as product data analysis and product security have emerged (

Porter and Heppelmann 2014). Due to the influence of Industry 4.0, value chains are changing from mass production to products tailored to the customer. The customer is perceived as a partner and can choose which material will be used in the production of the product and also which technology will be used (

Weking et al. 2020). Information technology is changing products, they have become complex systems combining hardware, software, sensors, data storage, microprocessors and connectivity in different ways. The products are smart and connected, they go through many improvements in the production itself, they include wireless connection, thus starting a new era of competition. The products contain new functionalities, are more reliable, usable and better than traditional products. The new nature of products disrupts traditional value chains and forces organizations to react and reorganize processes (

Porter and Heppelmann 2014). Digital transformation affects the overall reengineering of organizations. Technologies build vision across the value chain and are the foundation for automation to enable efficiency and competitiveness. When building a business strategy, the organization must therefore consider the alignment of digital and information systems. Several studies present that adaptive and digitally oriented organizations are more profitable and generate higher sales (

Ribeiro 2019). Research conducted by

Nagy et al. (

2018) investigated the impact of Industry 4.0 on the development of the business strategy of the value chain. The authors found that Hungarian companies that use CPS, CPPS and Big Data technologies have a higher level of logistics services, more efficient processes, higher financial and market performance and are more competitive. Hungarian companies also emphasize the systematic analysis of the data they produce. Over the next period, research respondents plan to invest in IoT. The study also found that optimization of production processes is a fundamental aspect to achieve optimal production and economies of scale (

Nagy et al. 2018).

Based on the findings, we can claim that in the digitalization environment there is a need to change the value chain in the area of research and development, production and sales in such a way that it adapts to the dynamic market. The impact of digital transformation on the value chain does not only concern the specific value chain, but also emphasizes the role of data in the virtual value chain, which emerges as a new element in it. The premise of a virtual value chain is data generation. As part of the digital transformation, data permeates all primary and secondary activities of the value chain, thereby affecting each link of value creation. Thus, the virtual value chain originates in the physical value chain and is part of it. Therefore, it is important for companies to analyze the impact of digital transformation on the value chain from a data life cycle perspective (

Li et al. 2022).

3. Materials and Methods

The aim of this study is to analyze the impact of Industry 4.0 on companies from the perspective of value chain model. Further through deeper analysis we aim to examine the focus of current and planned activities for development of organizational specifics and areas, namely focus on technological advance and automation and digitalization. This original research was conducted on 1164 companies from Slovak Republic and Czech Republic in 2020/2021. Research was conducted through electronic questionnaire that was distributed to managers and owners of Slovak and Czech companies. Within the questionnaire, respondents were asked a control question regarding their involvement and understanding of organizational strategy. Final sample consisted of respondents who are involved and understand strategy of the company. The sample consisted of 591 CZ companies and 573 SK companies, while in each group we have covered the sectoral distribution, size and maturity diversity (

Table 1). For the purpose of data representativeness and generalization of results for statistical population, each sample group (SK, CZ) consists of more than 384, with confidence level 95% and confidence interval 5.

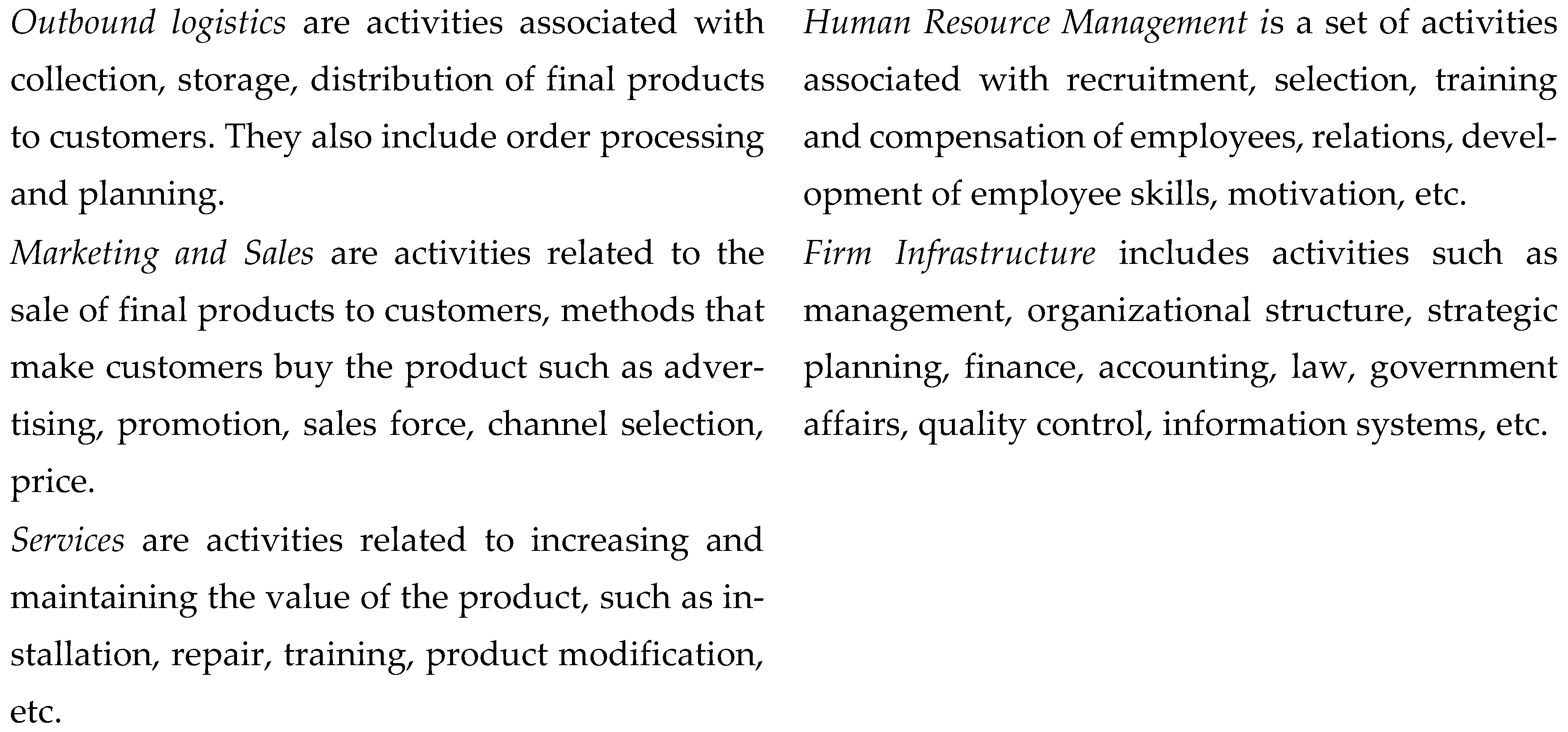

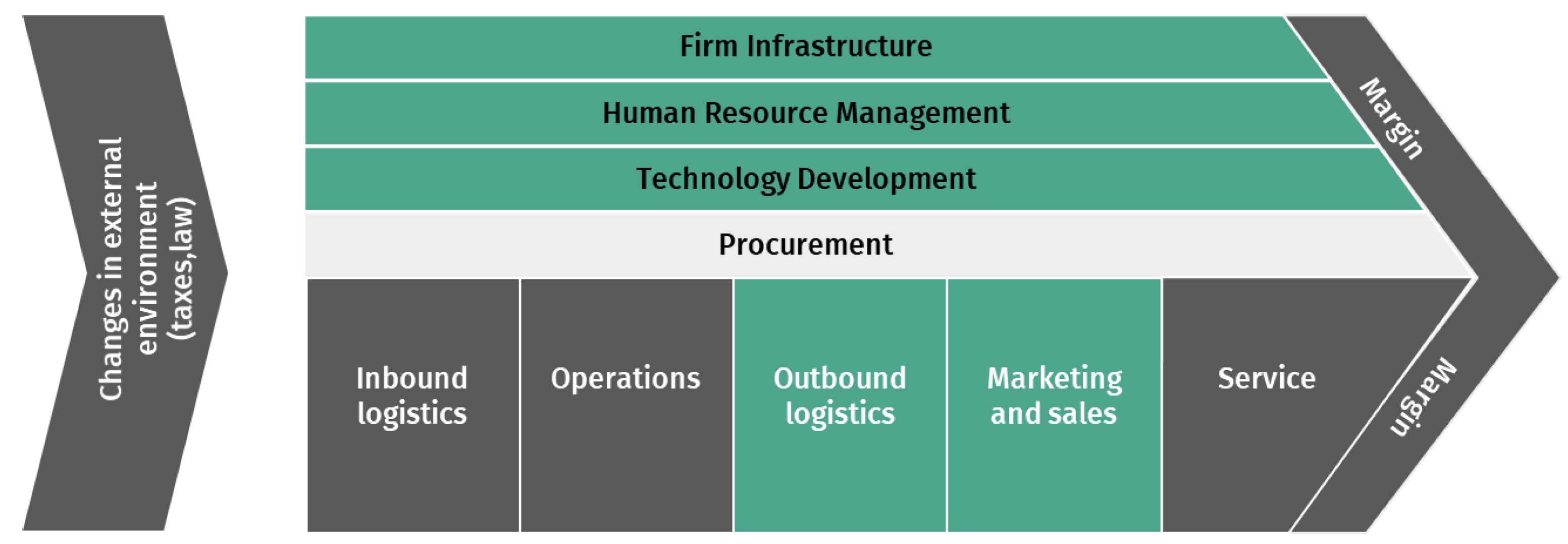

Industrial and service sectors were analyzed and compared within research questions to acquire a deeper understanding on how Industry 4.0 challenges effect different sectors. Research questionnaire was a part of large research project focused on transforming the management paradigm under the influence of Industry 4.0 and consisted of total number of 19 questions. For the purpose of this research, we have focused on 8 questions, while 5 of them focused on categorization of the research sample, and three questions on the topic of the research. The main research question was based on the proposed value chain model (

Figure 3), where we questioned the respondents about “What significant impacts of Industry 4.0 (changes) do you expect within your organization in the following areas?” with options based on value chain model:

Company’s internal environment (management, finances, administrative processes)

Human resources management

Technology, technological development

Purchasing and procurement (relationship with business partners)

Inbound logistics and supply

Main production processes

Outbound logistics (order processing)

Marketing and sales (customer interface)

Services (customer service)

Changes in the external environment (taxes, regulations, laws)

Respondents could answer on a scale 1–4, where 1 represented no expected impact and 4 represented very strong impact.

Based on the Industry 4.0 literature review and current state of the knowledge, we further build upon activities, that companies are currently carrying out in their organization. “How much activity is carried out in the organization for the development of the following factors?”

Quality of human resources

Optimization and efficiency of processes

Knowledge sharing among employees

Generating innovation

Building the brand and image of the organization

Relations with customers

Relations with other external entities

Technology—hardware, devices

Technology—applications, software, licenses

Automation, digitalization

Respondents could answer on a scale 1–4, where 1 represented no activities are currently carried out for development and 4—activities are carried out for development.

Second part of the analysis looked at the specifics regarding technological transformation, meaning expected effect on technology by Industry 4.0 as well as activities carried out for development of automation and digitalization. For the purpose of explaining the current status, we have questioned the respondents about “Which arguments would you use to promote digital transformation in your organization?” with possible choices:

The level of future risks (risks if digitalization were not carried out)

Immediate return (profit support, ROI)

The need for progress (KPIs, company ambitions)

Because the competition does it (general argument)

Because it is written about, it is discussed everywhere

The purpose of this questions was to analyze whether the current activities and expectations of organizations have the impact on their arguments in favor for digital transformation. To examine the links between analyzed factors in our research we have used correlation analysis based on Pearson’s correlation coefficient and non-parametric Chi-square test to examine the significance of differences in our sample. For the purpose of analyzing qualitative data, we follow

Rimarčík (

2007), where correlation strength is defined as follows: 0.1–0.3 as low, 0.3–0.5 as moderate and more than 0.5 as high. According to this assessment, we have highlighted correlations with highest outcome in

Table 2 and

Table 3 for better clarity of results. Chi square test results were significant at

p = 0.05. Research findings provide detailed view on current Industry 4.0 challenges in companies and their approach to sustainable development through using technologies and their implementation for future success.

4. Results

Value Chain Model assessment in our research presents an important aspect in examining the impact of Industry 4.0 on companies. It is possible to assess the primary as well as supporting activities of businesses. In our sample of 1164 companies in Central Europe, we can observe, that the highest average assessment of expected impacts of Industry 4.0 is on Technology Development (both countries SK and CZ with similar response), followed by impact on Customer Service, with average assessment of 2.99 out of 4 for SK companies and 2.89 out of 4 for CZ companies (

Figure 4). The lowest expectation of Industry 4.0 impacts can be observed in primary activities such as Inbound logistics and operations.

In regard to expected changes, companies have been active in many areas of organization, in order to cope with changing environment as well as to sustain and gain competitive advantages. Following

Table 2 presents correlation analysis of activities carried out by companies in context of supporting activities in Value Chain Model. Results of correlation analysis point to the importance of developing quality of human resources, optimizing processes, idea generation and also technologies in business supporting activities. Looking specifically in automation and digitalization we observe moderate correlation for company´s internal environment (infrastructure), HRM and Technology.

Next table presents the correlation in the context of primary processes in Value Chain Model. One of the highest correlations was found for Marketing and sales and the importance of idea generation, brand image and customer relations. Automation and digitalization correlates mostly with outbound logistics in our research.

Presented results show, that companies in our sample carry out activities for development in selected areas mainly to cope with challenges of Industry 4.0 that effect supporting activities (

Figure 5).

Recent research in the literature has pointed out the fact that Industry 4.0 does not affect only industrial companies, but all of companies including service sectors. Following on that, we have compared industrial sectors in our sample with service sectors to analyze exact differences in the context of expectations and activities presented in

Table 4. In the Value Chain Model, only small differences occur in supporting activities, where industrial sectors expect slightly stronger impact of Industry 4.0 in average. Larger differences can by observed in

primary activities, mainly logistics and production processes, which are more common in context of industry and production.

Similarly in the context of current activities for development, we observe only small differences in average assessment. In the research sample 33% of companies expect very strong impacts in technology and technological development, as well as in customer services. Followed by 36% of companies in both cases expect quite strong or moderate impacts. Most of the companies in both examined groups (90%) carry out activities to develop relations with customers.

It is interesting to see, that

service and industrial sectors do not show great differences in their attitude towards Industry 4.0 challenges (

Table 5). It is unquestionable that by taking advantages of Industry 4.0 technologies and challenges companies can gain important lead in their industry. However, we still observe, that Slovak and Czech companies lack behind in country rankings and economic development compared to other EU countries (

Čajka and Abrhám 2019) and are not the leaders in this transformation. One of the reasons may be the understanding behind what Industry 4.0 brings, and what are the actual challenges that company needs to face. In this context we have examined the

main arguments for digital transformation in the organization. First in the context of expected impacts of Industry 4.0 on technologies (

Table 6) and second in context with activities in automation and digitalization (

Table 7).

Companies that perceive high level of impact from Industry 4.0 on technologies used mostly the argument of need for progress (69%), followed by level of future risks (54%). Companies that perceive low level of impact on technology from Industry 4.0, use both arguments significantly less that the first group. Only small percentage of companies see the argument as general, or because the topic is being discussed in the outside world.

Companies that show high activity in automation and digitalization also use the argument of need for progress significantly more (68%) than companies that show low activity (60%). Similarly, 55% use the argument of future risks, compared to 44% among those that show low activity. Statistical significance was observed also in case of immediate return, which was used more as an argument in group of high activity in automation and digitalization. On the other hand, the general arguments are used more often by companies that show low activity in automation and digitalization, precisely by 20%.

5. Discussion and Conclusions

The concept of Industry 4.0 and its challenges was first presented ten years ago and has been an important aspect of many decision-making processes in organizations. While many challenges are often spoken in context of technology such robotization and automation of production, these challenges go far behind and effect not only industrial companies but service companies as well. The understanding and seeing the necessity for implementation of new challenges is very similar in both industrial and service sector, as our results present. This is also confirmed by analyzing Value Chain Model in context of Industry 4.0 impacts in our research. The most activities conducted by companies in our research sample are to reflect challenges effecting

supporting activities of companies such as

internal environment (firm’s infrastructure) and supporting processes,

human resource management and

technology. Within primary activities, we observed strong focus on marketing in correlation with activities such as building brand image, relations with customers and external subjects, which could be affected also by COVID-19 pandemic, that has led companies to shift their marketing activities and strategies to cope with new conditions. This is in line with results of

Tittelbachová et al. (

2022) study on Czech companies. This stronger focus on customer through new marketing channels and e-commerce driven by Industry 4.0 and global pandemic will create new challenges in context of customer protection (

Peráček 2022) and needs to be a subject of future research in context of Industry 4.0 challenges.

Within primary activities we observed correlation in activities focused on automation and digitalization in link to outbound logistics. In general, however, research results point to stronger importance of supporting activities for companies in context of copying with Industry 4.0 challenges that of primary activities.

Furthermore, in context of technology, correlation analysis presents several activities that companies conduct in link to technological development such as: optimization and efficiency of processes, generating innovations, introducing new hardware and software and digitalization, automation. Activities regarding automation and digitalization are carried out in large to medium extend by 62% of companies in our sample, while 32% of companies do not carry out these activities at all, or only a little. These results are in line with digitalization ranking of European countries. One of the possible explanations is presented by our research findings, by examination of used arguments for digital transformation.

Companies that do not conduct many activities in automation and digitalization in their company, see significantly less the possible high level of

future risks as well as the inevitable need for constant progress. On the other hand, these companies use significantly more arguments that are general, and do not reflect the connection between Industry 4.0 and specific company and their operations. In this context we strongly highlight the importance of the ability to identify trends, analyze them and respond to them, which has been linked to stronger and better performance results in companies (

Stachová et al. 2019). Furthermore, coping with Industry 4.0 challenges often includes many activities and is carried out in small to large projects, that are time and cost consuming. Ability to implement specific technologies or for instance to pass from traditional processes to business process automation, company needs to use specific innovation management skills and idea generation processes to find the best possible solution. These activities are in leading companies carried out often with the support of other entities such combined business units, research parks and institutions, universities, business partners, supplier or customers or even competitors. Innovations in technological revolutions now and in history required lot of new knowledge, experiments and resources. In many cases for domestic and local companies it is hard to gain all these components without cooperation with external partners. Likewise, large companies operating in specific environment may use the

local knowledge to better address the specific regional needs of customers or processes. University-industry collaboration offers such knowledge in many ways from providing knowledge and up to date information on technological development, common research and development activities and patents, or support and coaching in implementation processes. The need to address Industry 4.0 challenges is not decreasing, but increasing instead. We observe, that not only technology and processes have change in leading organizations so far, but this transformation brings new and new approaches to transforming business models, management practices or organization of work. It is necessary to understand and capture the ongoing changes and just then to be able to find specific solutions suitable for the company to survive in this ever-changing market.