Liberalization for Sale: Corporate Demands and Lobbying over FTAs

Abstract

:1. Introduction

2. Corporate Political Activities

3. Heterogeneous Firms and Corporate Trade Interests

4. Lobbying for Trade Liberalization

5. Examining Firm Heterogeneity and Lobbying over FTAs

6. The 2011 Colombia, Korea, and Panama FTAs

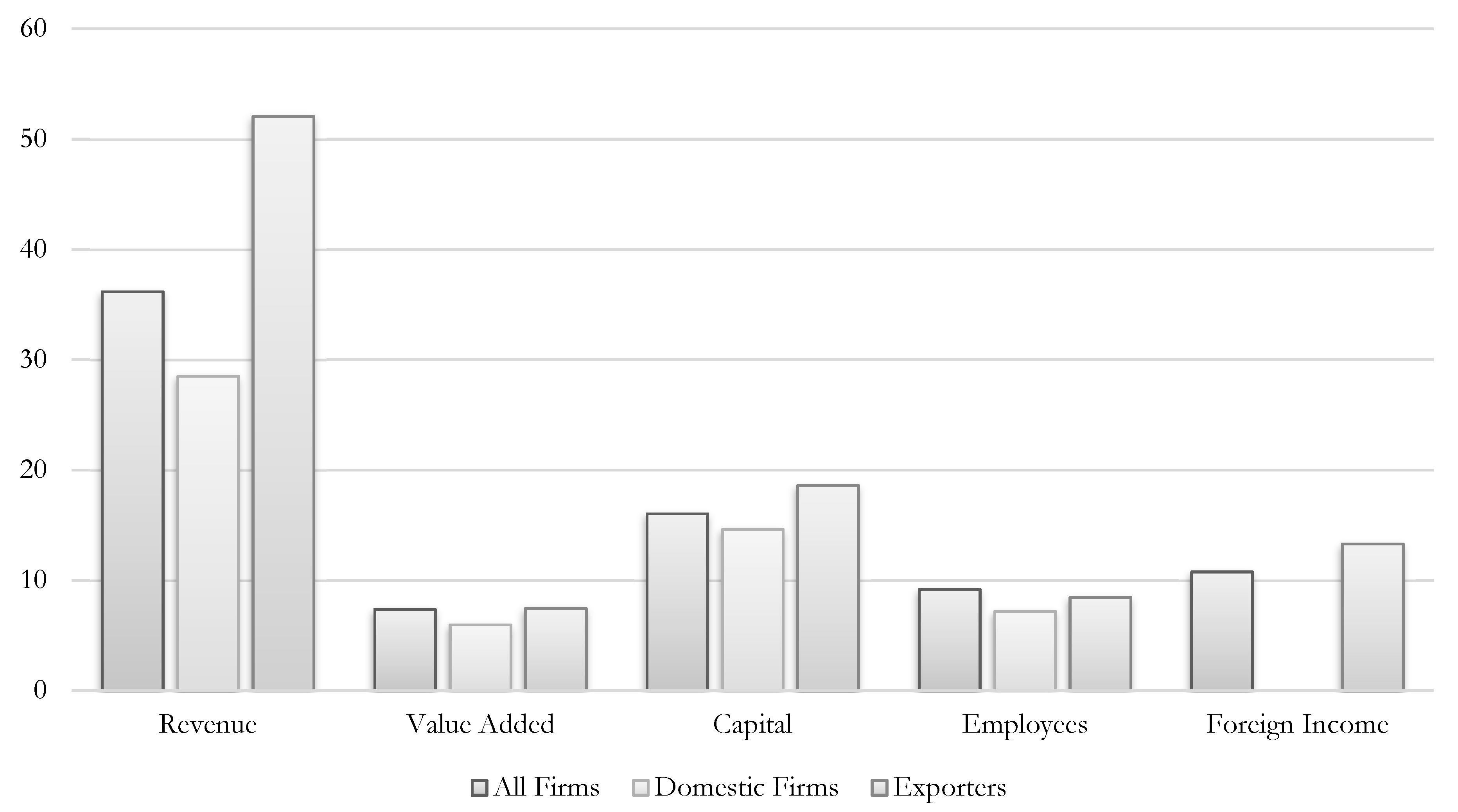

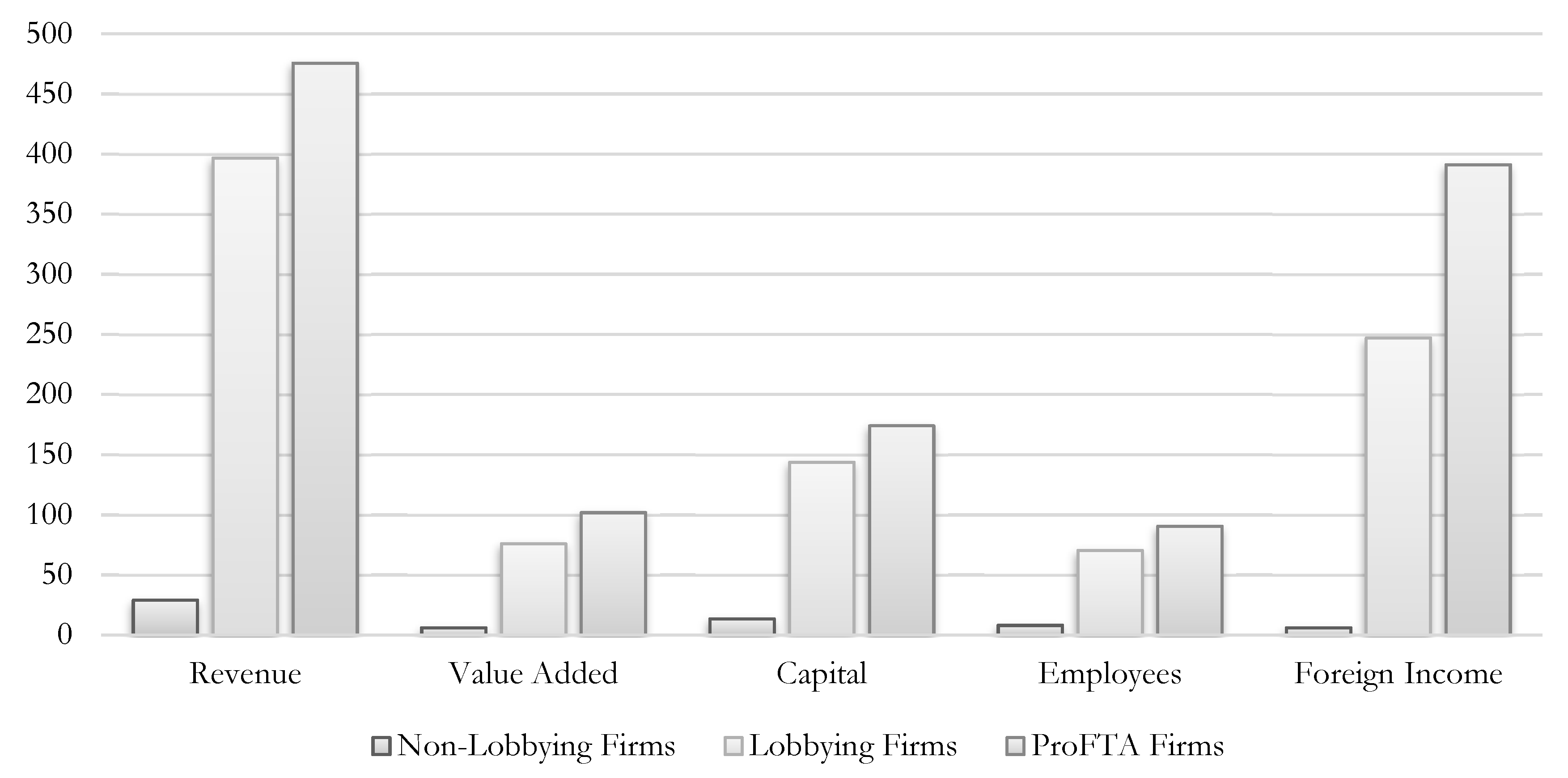

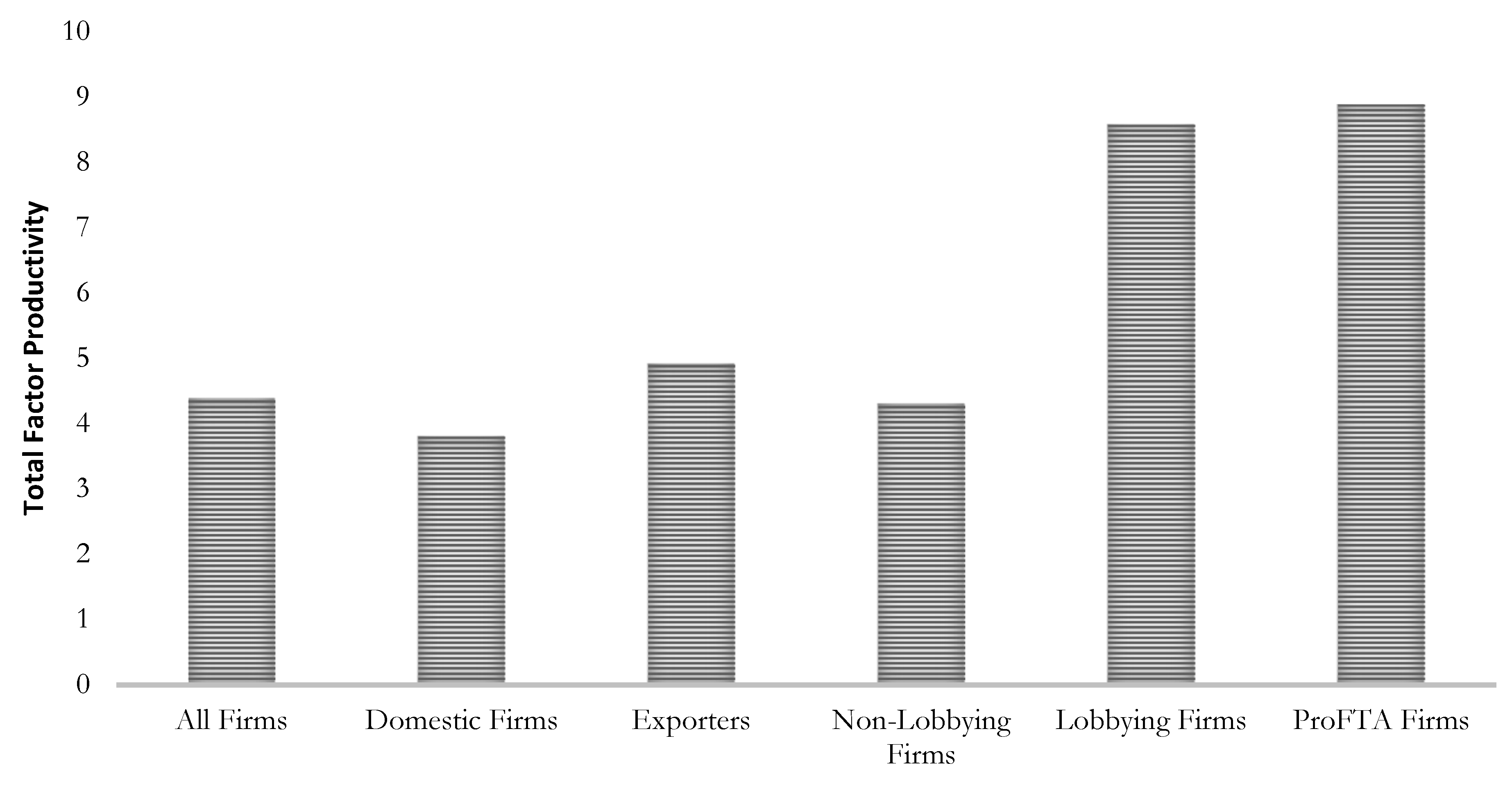

7. Firm-Level Financial and Political Data

8. Estimating Productivity

9. Producer Lobbying over the Korea, Colombia, and Panama FTAs

10. Results

11. Conclusions and Implications

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Abbott Laboratories | Cisco Systems | Motorola Solutions |

| Ace Ltd. | Cummins | Network 1 Financial Group |

| Aegon NV | Daimler AG | News Corp. |

| Alcatel-Lucent | Ebay | Occidental Petroleum Corp. |

| Americredit Corp. | Emerson Electric Co. | Pfizer |

| Apple | Exxon Mobil | PPG Industries |

| Applied Materials | FMC | Procter & Gamble |

| AT&T | General Electric Cap. Corp. | Prudential Financial |

| BASF SE | General Electric Capital Svc. | Qualcomm |

| Baxter International | General Motors Co. | Seaboard Corp. |

| Bayer AG | Halliburton | Textron Financial Corp. |

| Boston Scientific Group | Hewlett-Packard | Time Warner Inc. |

| Bunge Ltd. | Honeywell International | Tyco International Ltd. |

| Campbell Soup Co. | Intel | Tyson Foods Inc. |

| Caterpillar | International Business Machines | United Parcel Service |

| Chevron Corp. | Lockheed Martin | United Technologies |

| Chubb Corp. | Microsoft | Xerox |

| Motorola Mobility Holdings Inc. |

| Abbott Laboratories | Ebay | Motorola Mobility Holdings Inc. |

| Ace Ltd. | Emerson Electric Co. | Motorola Solutions |

| Aegon NV | Entegris | Nestle SA/AG |

| Alcatel-Lucent | Exxon Mobil | Network 1 Financial Group |

| AmeriCredit Corp. | Fluor | News Corp. |

| Apple | FMC | Nokia |

| Applied Materials | Ford Motor Co. | Nucor |

| ArcelorMittal | General Electric Cap. Corp. | Occidental Petroleum Corp. |

| AT&T | General Electric Capital Svc. | Pfizer |

| BASF SE | General Motors Co. | Philip Morris Intl. |

| Baxter International | Globe Specialty Metals | Potlatch Corp. |

| Bayer AG | Goldman Sachs Group | PPG Industries |

| Boeing Capital Corp. | Procter & Gamble | |

| Boston Scientific Group | Halliburton | Prudential Financial |

| Braskem SA | Hanesbrands | Qualcomm |

| Bunge Ltd. | Hewlett-Packard | Raytheon |

| Campbell Soup Co. | Hexcel Corp. | Rhodia |

| Caterpillar | Honeywell International | Rockwell Collins |

| Chemtura Corp. | Hospira | Royal Dutch Shell PLC |

| Chevron Corp. | Huntsman | Seaboard Corp. |

| Chubb Corp. | Intel | TE Connectivity Ltd. |

| Cisco Systems | International Business Machines | Texas Instruments Inc. |

| Columbia Sportswear Co. | Kraft Foods | Textron Financial Corp. |

| ConocoPhillips | L-3 Communications | Time Warner Inc. |

| Corning Inc. | LaFarge SA | Timken Co. |

| Covidien | Leggett & Platt | Titanium Metals Corp. |

| Cummins | Liberty Media Capital Group | Tyco International Ltd. |

| Daimler AG | Lockheed Martin | Tyson Foods Inc. |

| Dean Foods Co. | LyondellBasell Industries | United Parcel Service |

| Deere & Co. | Marsh & McLennan Cos. | United States Steel Corp. |

| Delta Air Lines | Masco | United Technologies |

| Du Pont | MeadWestVaco | Weyerhauser Co. |

| Eastman Chemical Co. | Microsoft | Xerox |

| Variable | N | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Lobby | 4935 | 0.020 | 0.140 | 0 | 1 |

| Pro-FTA | 4935 | 0.011 | 0.102 | 0 | 1 |

| Productivity | 4675 | 4.375 | 2.530 | −0.051 | 11.831 |

| Export Sales | 4951 | 0.115 | 0.765 | 0 | 9.289 |

| Foreign Income | 4951 | 2.416 | 3.372 | 0 | 10.731 |

| Trade Balance | 2524 | −21,988.44 | 69,233.12 | −262,454.00 | 49,474.00 |

| RCA | 1540 | 1.529 | 1.092 | 0.128 | 7.167 |

| K Intensity | 2377 | 9.283 | 0.989 | 6.531 | 10.995 |

| Sigma | 2547 | 4.460 | 10.991 | 1/148 | 108.19 |

| 4-Firm Concentration | 4288 | 38.656 | 18.936 | 1.4 | 99.9 |

| Grubel–Lloyd Index | 1744 | 0.649 | 0.291 | 0.003 | 0.980 |

Appendix A.1. Data for TFP Estimation

| Coefficients (Bootstrapped Standard Errors) | |

|---|---|

| Capital Stock | 0.087 *** (0.006) |

| Labor | 0.016 * (0.010) |

| Materials | 0.849 *** (0.009) |

| Industry | 8.58 × 10−5 *** (5.13 × 10−6) |

| Age | 0.004 (0.003) |

| Year | 0.017 ** (0.007) |

| Revenue | Capital Stock | Labor | Productivity | Export Sales | Foreign Income | |

|---|---|---|---|---|---|---|

| Revenue | 1.000 | |||||

| Capital Stock | 0.834 | 1.000 | ||||

| Labor | 0.845 | 0.767 | 1.000 | |||

| Productivity | 0.939 | 0.869 | 0.857 | 1.000 | ||

| Export Sales | 0.093 | 0.091 | 0.078 | 0.103 | 1.000 | |

| Foreign Income | 0.323 | 0.261 | 0.319 | 0.291 | 0.106 | 1.000 |

| Trade Balance | RCA | K Intensity | Sigma | 4-Firm Concentration | Grubel–Lloyd Index | |

|---|---|---|---|---|---|---|

| Trade Balance | 1.000 | |||||

| RCA | 0.099 | 1.000 | ||||

| K Intensity | −0.173 | 0.230 | 1.000 | |||

| Sigma | −0.095 | −0.073 | −0.152 | 1.000 | ||

| 4-Firm Concentration | 0.130 | −0.029 | 0.104 | −0.039 | 1.000 | |

| Grubel–Lloyd Index | 0.419 | 0.351 | −0.090 | 0.0016 | −0.086 | 1.000 |

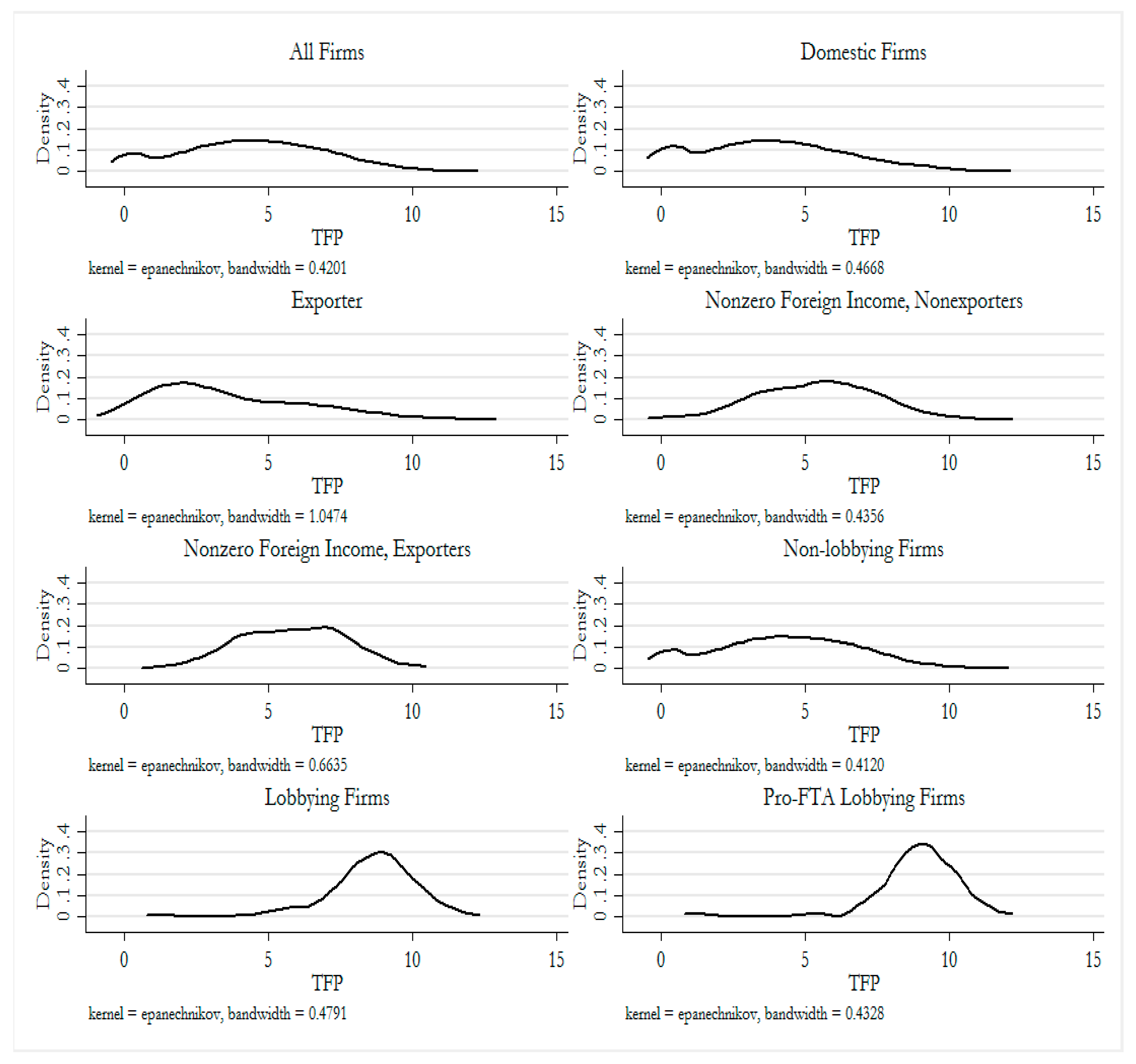

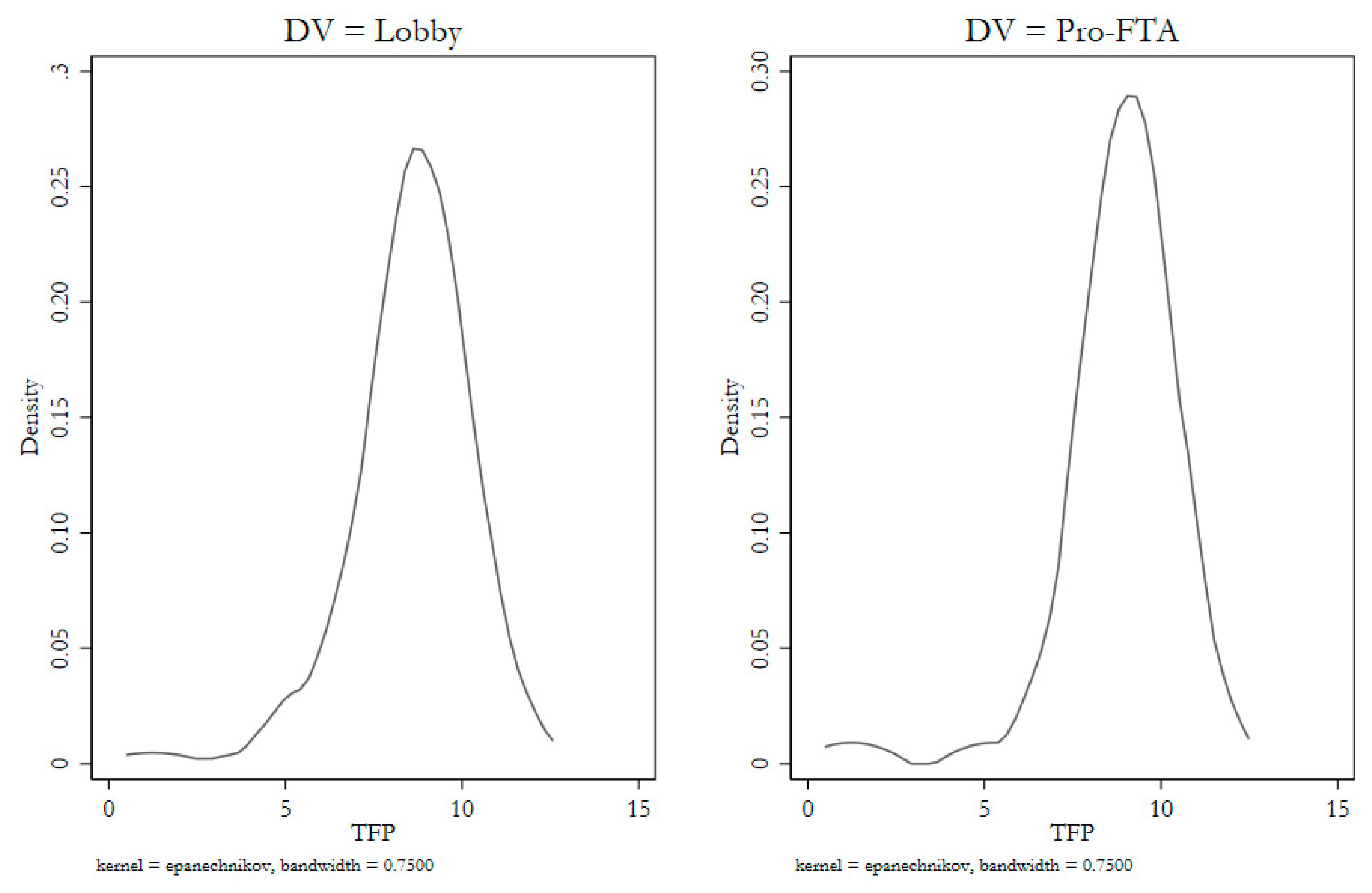

Appendix A.2. Kernel Density Plots for TFP

Appendix A.3. Scobit Estimator

Appendix A.4. Robustness Tests

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA | |

| TFP | 0.016 *** | 0.009 *** | 0.016 *** | 0.009 *** | 0.015 *** | 0.009 *** | 0.015 *** | 0.008 *** | 0.015 *** | 0.008 *** |

| (0.002) | (0.002) | (0.02) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| Export Status | 0.026 ** | 0.006 | ||||||||

| (0.012) | (0.010) | |||||||||

| Export Sale | 0.003 *** | 0.001 | 0.002 *** | 0.001 | ||||||

| (0.001) | (0.001) | (0.001) | (0.001) | |||||||

| Foreign Income | 0.004 *** | 0.003 *** | 0.004 *** | 0.003 *** | ||||||

| (0.001) | (0.001) | (0.001) | (0.001) | |||||||

| Constant | −10.09 *** | −11.35 *** | −10.21 *** | −11.38 *** | −41.60 *** | −11.36 *** | −11.52 *** | −13.04 *** | −11.55 *** | −13.06 *** |

| N | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 |

| Pseudo R2 | 0.33 | 0.33 | 0.34 | 0.33 | 0.34 | 0.33 | 0.39 | 0.41 | 0.40 | 0.41 |

| Wald χ2 | 118.73 *** | 68.35 *** | 113.00 *** | 72.35 *** | 136.65 *** | 69.49 *** | 109.69 *** | 61.70 *** | 126.85 *** | 62.54 *** |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.014 *** | 0.009 *** | 0.014 *** | 0.009 *** | 0.014 *** | 0.009 *** | 0.012 *** | 0.007 *** | 0.012 *** | 0.007 *** |

| (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | |

| Export Status | 0.012 | 0.003 | ||||||||

| (0.016) | (0.011) | |||||||||

| Export Sales | 0.008 | 0.003 | 0.007 | 0.002 | ||||||

| (0.006) | (0.005) | (0.006) | (0.005) | |||||||

| Foreign Income | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** | ||||||

| (0.001) | (0.001) | (0.001) | (0.001) | |||||||

| σu | 0.108 | 0.041 | 0.108 | 0.051 | 0.107 | 0.051 | 0.108 | 0.051 | 0.107 | 0.051 |

| σe | 0.132 | 0.098 | 0.132 | 0.098 | 0.132 | 0.098 | 0.131 | 0.098 | 0.131 | 0.098 |

| ρ | 0.402 | 0.214 | 0.401 | 0.214 | 0.397 | 0.212 | 0.401 | 0.213 | 0.397 | 0.212 |

| Constant | −0.041 *** | −0.027 *** | −0.041 *** | −0.027 *** | −0.041 *** | −0.027 *** | −0.041 *** | −0.027 *** | −0.041 *** | −0.027 *** |

| N | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.015 *** | 0.009 *** | 0.015 *** | 0.009 *** | 0.015 *** | 0.009 *** | 0.015 *** | 0.008 *** | 0.015 *** | 0.008 *** |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| Export Status | 0.021 | 0.004 | ||||||||

| (0.011) | (0.007) | |||||||||

| Export Sales | 0.003 ** | 0.001 | 0.002 ** | 0.001 | ||||||

| (0.001) | (0.001) | (0.001) | (0.001) | |||||||

| Foreign Income | 0.004 *** | 0.002 *** | 0.004 *** | 0.003 *** | ||||||

| (0.001) | (0.001) | (0.001) | (0.001) | |||||||

| Constant | −9.99 *** | −11.44 *** | −10.02 *** | −11.40 *** | −9.97 *** | −11.34 *** | −11.52 *** | −13.02 *** | −11.49 *** | −12.98 *** |

| N | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 | 4659 |

| lnα | −1.664 | −2.157 | −1.487 | −2.080 | −1.498 | −2.040 | −0.811 | −0.904 | −0.546 | −0.699 |

| α | 0.189 | 0.116 | 0.226 | 0.125 | 0.224 | 0.130 | 0.444 | 0.405 | 0.579 | 0.497 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 3.074 *** | 3.165 *** | 3.080 *** | 3.165 *** | 3.068 *** | 3.156 *** | 3.028 *** | 3.080 *** | 3.028 *** | 3.078 *** |

| (0.479) | (0.701) | (0.481) | (0.696) | (0.479) | (0.695) | (0.579) | (0.881) | (0.581) | (0.889) | |

| Export Status | 1.978 | 1.711 | ||||||||

| (1.049) | (1.151) | |||||||||

| Export Sales | 1.117 | 1.083 | 1.082 | 1.088 | ||||||

| (0.081) | (0.100) | (0.092) | (0.093) | |||||||

| Foreign Income | 1.212 *** | 1.319 *** | 1.208 *** | 1.318 *** | ||||||

| (0.064) | (0.123) | (0.064) | (0.123) | |||||||

| N | 1936 | 1572 | 1936 | 1572 | 1936 | 1572 | 1936 | 1572 | 1936 | 1572 |

| Groups | 63 | 37 | 63 | 37 | 63 | 37 | 63 | 37 | 63 | 37 |

| Groups Dropped | 335 | 361 | 335 | 361 | 335 | 361 | 335 | 361 | 335 | 361 |

| Pseudo R2 | 0.45 | 0.48 | 0.45 | 0.49 | 0.45 | 0.49 | 0.49 | 0.55 | 0.49 | 0.55 |

| Wald χ2 | 51.86 *** | 27.05 *** | 51.89 *** | 28.00 *** | 52.10 *** | 28.98 *** | 33.62 *** | 15.47 *** | 33.47 | 15.77 *** |

| Lobby | Pro-FTA | |

|---|---|---|

| TFP | 0.007 *** | 0.008 *** |

| (0.001) | (0.002) | |

| Export Sales | 0.001 ** | 0.001 |

| (0.001) | (0.001) | |

| Foreign Income | 0.001 *** | 0.003 *** |

| (3.68 × 10−4) | (5.46 × 10−4) | |

| Constant | −10.98 *** | −13.81 *** |

| N | 4675 | |

| Pseudo R2 | 0.35 | |

| Wald χ2 | 132.86 *** | |

| Model 1 | Model 2 | Model 3 | Model 4+ | Model 5 | Model 6+ | |

|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.021 *** | 0.012 *** | 0.019 *** | 0.009 *** | 0.023 *** | 0.012 *** |

| (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | |

| Export Sales | 0.002 | −2.81 × 10−4 | 1.35 × 10−4 | 1.32 × 10−4 | 0.002 | 0.001 |

| (0.001) | (0.001) | (0.002) | (0.001) | (0.001) | (0.001) | |

| Foreign Income | 0.005 *** | 0.003 *** | 0.005 *** | 0.004 *** | 0.004 *** | 0.004 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Trade Balance | 3.44 × 10−8 | 1.98 × 10−9 | ||||

| (3.73 × 10−8) | (3.48 × 10−8) | |||||

| Revealed Comparative Advantage | 2.56 × 10−4 | −0.001 | ||||

| (0.006) | (0.004) | |||||

| Capital Intensity | −0.001 | 0.002 | ||||

| (0.004) | (0.003) | |||||

| Constant | −12.33 *** | −29.19 | −12.61 *** | −13.69 *** | −12.30 *** | −16.052 *** |

| N | 2482 | 2482 | 1517 | 1517 | 2341 | |

| lnα | −1.064 | −3.071 | −1.255 | −1.378 ** | ||

| α | 0.345 | 0.046 | 0.285 | 0.252 |

| Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | |

|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.022 *** | 0.011 *** | 0.022 *** | 0.012 *** | 0.025 *** | 0.013 *** |

| (0.003) | (0.002) | (0.004) | (0.003) | (0.003) | (0.002) | |

| Export Sales | 0.002 | 7.47 × 10−4 | 6.52 × 10−4 | 2.22 × 10−5 | 0.003 | 7.12 × 10−4 |

| (0.001) | 6.62 × 10−4 | (0.002) | (0.001) | (0.002) | 7.83 × 10−4 | |

| Foreign Income | 0.004 *** | 0.003 *** | 0.005 *** | 0.003 ** | 0.004 *** | 0.003 *** |

| (0.001) | (5.83 × 10−4) | (0.001) | (8.95 × 10−4) | (0.001) | (6.75 × 10−4) | |

| Group, RE Parameter | SIC, Trade Balance | SIC, RCA | SIC, Capital Intensity | |||

| Industry Effect | 3.26 × 10−17 | 1.758 * | 0.762 * | 2.76 × 10−18 | 0.113 * | 0.557 * |

| Industry Coefficient | 1.234 * | 6.642 * | 0.349 * | 6.714 * | 0.971 * | 6.041 * |

| Constant | 4.19 × 10−7 *** | 4.45 × 10−14 *** | 6.57 × 10−7 *** | 4.05 × 10−12 *** | 4.96 × 10−7 *** | 1.55 × 10−12 *** |

| N | 2842 | 2842 | 1517 | 1517 | 2341 | 2341 |

| Groups | 204 | 204 | 105 | 105 | 214 | 214 |

| Wald χ2 | 76.37 *** | 14.03 *** | 39.83 *** | 10.98 ** | 74.63 *** | 16.34 *** |

| LR Test vs. Logit (χ2) | 14.92 *** | 19.82 *** | 7.26 * | 7.94 * | 16.49 *** | 17.83 *** |

| Model 1 | Model 2 | Model 3 | ||||

|---|---|---|---|---|---|---|

| Lobby | Pro-FTA | Lobby | Pro-FTA | Lobby | Pro-FTA | |

| TFP | 0.010 *** | 0.011 *** | 0.009 *** | 0.009 *** | 0.011 *** | 0.012 *** |

| (0.002) | (0.003) | (0.003) | (0.003) | (0.002) | (0.003) | |

| Export Sales | 0.001 | 0.001 | 0.001 | 4.46 × 10−5 | 0.002 | 0.001 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Foreign Income | 0.002 ** | 0.004 *** | 0.002 *** | 0.004 *** | 0.001 * | 0.004 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Trade Balance | 1.06 × 10−7 | −3.83 × 10−8 | ||||

| (7.16 × 10−8) | (2.30 × 10−8) | |||||

| Revealed CA | −9.47 × 10−4 | −9.65 × 10−4 | ||||

| (0.005) | (0.004) | |||||

| Capital Intensity | −0.003 | 0.002 | ||||

| (0.004) | (0.003) | |||||

| Constant | −10.60 *** | −15.72 *** | −10.93 *** | −14.89 *** | −8.88 *** | −16.95 *** |

| Industry Clusters | 204 | 105 | 214 | |||

| N | 2494 | 1527 | 2352 | |||

| Pseudo R2 | 0.40 | 0.39 | 0.39 | |||

| Wald χ2 | 96.07 *** | 104.72 *** | 94.70 | |||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.021 *** | 0.012 *** | 0.016 *** | 0.009 *** | 0.018 *** | 0.010 *** |

| (0.004) | (0.003) | (0.003) | (0.002) | (0.004) | (0.004) | |

| Export Sales | 0.002 | −1.80 × 10−4 | 0.002 ** | 7.22 × 10−4 | 0.001 | −4.84 × 10−4 |

| (0.001) | (0.001) | (0.001) | (8.73 × 10−4) | (0.002) | (0.002) | |

| Foreign Income | 0.005 *** | 0.003 *** | 0.004 *** | 0.003 *** | 0.005 *** | 0.003 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| Product Differentiation | −0.002 | −0.006 * | ||||

| (0.005) | (0.004) | |||||

| 4-Firm Concentration | 1.22 × 10−4 | 6.49 × 10−5 | ||||

| (1.13 × 10−4) | (7.29 × 10−5) | |||||

| Grubel–Lloyd Index | −0.009 | −0.013 | ||||

| (0.017) | (0.016) | |||||

| Constant | −12.693 *** | −25.661 *** | −11.728 *** | −13.381 *** | −12.412 *** | −15.604 |

| N | 2502 | 2502 | 4038 | 4038 | 1717 | 1717 |

| lnα | −1.305 * | −2.840 *** | 0.064 | 0.077 | −1.163 | −1.708 |

| α | 0.271 | 0.058 | 1.066 | 1.080 | 0.312 | 0.181 |

| Model 12 | Model 13 | Model 14 | Model 15 | Model 16 | Model 17 | |

|---|---|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.024 *** | 0.012 *** | 0.016 *** | 0.009 *** | 0.022 *** | 0.011 *** |

| (0.003) | (0.002) | (0.002) | (0.002) | (0.003) | (0.003) | |

| Export Sales | 0.003 | 6.84 × 10−4 | 0.002 | 6.18 × 10−4 | 0.002 | −2.52 × 10−5 |

| (0.001) | 7.40 × 10−4 | (0.001) | 7.33 × 10−4 | (0.002) | (0.001) | |

| Foreign Income | 0.004 *** | 0.003 *** | 0.003 *** | 0.002 *** | 0.005 *** | 0.003 *** |

| (0.001) | (0.001) | (0.001) | (5.27 × 10−4) | (0.001) | (0.001) | |

| Group, RE Parameter | SIC, Product Differentiation | NAICS, Concentration | SIC, Grubel–Lloyd Inde × | |||

| Industry Effect | 1.24 × 10−9 | 1.32 × 10−12 | 0.041 * | 0.045 * | 1.656 * | 6.92 × 10−7 |

| Industry Coefficient | 1.200 * | 6.564 * | 0.766 * | 0.980 * | 2.86 × 10−19 | 6.773 * |

| Constant | 3.93 × 10−7 *** | 1.57 × 10−12 *** | 1.99 × 10−6 *** | 2.00 × 10−7 *** | 2.91 × 10−7 *** | 1.55 × 10−12 *** |

| N | 2502 | 2502 | 4038 | 4038 | 1717 | 1717 |

| Groups | 223 | 223 | 647 | 647 | 190 | 190 |

| Wald χ2 | 77.94 *** | 18.41 *** | 117.17 *** | 65.26 *** | 51.74 *** | 11.51 *** |

| LR Test vs. Logit (χ2) | 15.84 *** | 17.16 *** | 9.10 * | 5.79 | 10.52 ** | 9.33 *** |

| Model 1 | Model 2 | Model 3 | ||||

|---|---|---|---|---|---|---|

| Lobby | Pro-FTA | Lobby | Pro-FTA | Lobby | Pro-FTA | |

| TFP | 0.010 *** | 0.011 *** | 0.007 *** | 0.009 *** | 0.008 *** | 0.009 *** |

| (0.002) | (0.003) | (0.001) | (0.002) | (0.002) | (0.002) | |

| Export Sales | 0.002 * | 0.001 | 0.002 ** | 7.73 × 10−4 | 0.002 | 3.35 × 10−5 |

| (0.001) | (0.001) | (0.001) | (6.90 × 10−4) | (0.001) | (0.001) | |

| Foreign Income | 0.002 ** | 0.003 *** | 0.002 *** | 0.003 *** | 0.002 *** | 0.004 *** |

| (0.001) | (0.001) | (4.00 × 10−4) | (0.006) | (5.85 × 10−4) | (0.001) | |

| Differentiation | 0.004 | −0.006 * | ||||

| (0.003) | (0.003) | |||||

| Concentration | 5.49 × 10−5 | 6.58 × 10−5 | ||||

| 9.00 × 10−5 | 7.22 × 10−5 | |||||

| Grubel–Lloyd Index | 0.005 | −0.017 * | ||||

| (0.010) | (0.009) | |||||

| Constant | −10.799 *** | −15.356 *** | −11.044 *** | −14.199 *** | −11.069 *** | −14.477 *** |

| Industry Clusters | 223 | 647 | 119 | |||

| N | 2514 | 4052 | 1727 | |||

| Pseudo R2 | 0.39 | 0.35 | 0.41 | |||

| Wald χ2 | 92.67 *** | 109.93 *** | 155.81 *** | |||

| 1 | |

| 2 | (Bernard et al. 2012) provide an overview. |

| 3 | Only one producer that lobbied individually on the trade bills in this study and was a privately held textile firm. |

| 4 | Table A1 in the appendix provides a list of these firms. |

| 5 | (Olley and Pakes 1996; Yasar et al. 2008) describe the Stata implementation of the routine. |

| 6 | The variables used in the estimation routine are described in the appendix. |

| 7 | TFP values between the years of this sample are very highly correlated (98–99%), and results are not substantively impacted when different years are substituted. |

| 8 | (Nagler 1994; Achen 2002). A technical definition of the scobit model is presented in the appendix. |

| 9 | Single-level scobit models relying on the raw data produce comparable results, available in Appendix A. |

| 10 | The formula for the calculation is included in Appendix A. |

| 11 | Correlation coefficients for all of the industry-level variables are available in the Appendix A in Table A4. |

| 12 | The data can be found here: https://www.census.gov/econ/concentration.html (accessed on 18 October 2023). |

| 13 | This follows (Eisfeldt and Papanikolaou 2013). |

| 14 | |

| 15 | In addition to this, the probit’s reliance on the cumulative normal distribution makes it particularly unsuited for application in this case. |

References

- Achen, Christopher H. 2002. Toward a New Political Methodology: Microfoundations and ART. Annual Review of Political Science 5: 423–50. [Google Scholar] [CrossRef]

- Aranda-Ordaz, Francisco J. 1981. On Two Families of Transformations to Additivity for Binary Response Data. Biometrika 68: 357–63. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Bauer, Raymond A, Ithiel de Sola Pool, and Lewis Anthony Dexter. 1972. American Business and Public Policy: The Politics of Foreign Trade. Chicago: Aldine-Atherton, Inc. [Google Scholar]

- Bernard, Andrew B., J. Bradford Jensen, Stephen J. Redding, and Peter K. Schott. 2007. Firms in International Trade. Journal of Economic Perspectives 21: 105–30. [Google Scholar] [CrossRef]

- Bernard, Andrew B., J. Bradford Jensen, Stephen J. Redding, and Peter K. Schott. 2012. The Empirics of Firm Heterogeneity and International Trade. Annual Review of Economics 4: 283–313. [Google Scholar] [CrossRef]

- Bernard, Andrew B., Jonathan Eaton, J. Bradford Jensen, and Samuel S. Kortum. 2003. Plants and Productivity in International Trade. American Economic Review 93: 1268–90. [Google Scholar] [CrossRef]

- Blanchard, Emily, and Xenia Matschke. 2015. US Multinationals and Preferential Market Access. Review of Economics and Statistics 97: 839–54. [Google Scholar] [CrossRef]

- Bombardini, Matilde. 2008. Firm Heterogeneity and Lobby Participation. Journal of International Economics 75: 329–48. [Google Scholar] [CrossRef]

- Bombardini, Matilde, and Francesco Trebbi. 2012. Competition and Political Organization: Together or Alone in Lobbying for Trade Policy? Journal of International Economics 87: 18–26. [Google Scholar] [CrossRef]

- Brasher, Holly, and David Lowery. 2006. The Corporate Context of Lobbying Activity. Business and Politics 8: 1–23. [Google Scholar] [CrossRef]

- Broda, Christian, and David Weinstein. 2006. Globalization and the Gains from Variety. Quarterly Journal of Economics 121: 541–85. [Google Scholar] [CrossRef]

- Chamberlain, Gary. 1980. Analysis of Covariance with Qualitative Data. Review of Economic Studies 47: 225–38. [Google Scholar] [CrossRef]

- Destler, Irving M., John S. Odell, and Kimberly A. Elliott. 1987. Anti-Protection: Changing Forces in United States Trade Politics. Washington, DC: Institute for International Economics. [Google Scholar]

- Drope, Jeffrey M., and Wendy L. Hansen. 2006. Does Firm Size Matter? Analyzing Business Lobbying in the United States. Business and Politics 8: 1–17. [Google Scholar] [CrossRef]

- Eisfeldt, Andrea L., and Dimitris Papanikolaou. 2013. Organization Capital and the Cross-Section of Expected Returns. Journal of Finance 68: 1365–1406. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Elhanan Helpman. 1994. Protection for Sale. American Economic Review 84: 833–50. [Google Scholar]

- Grubel, Herbert G., and Peter John Lloyd. 1975. International Trade in Differentiated Products. London: Macmillan. [Google Scholar]

- Kerr, William R., William F. Lincoln, and Prachi Mishra. 2014. The Dynamics of Firm Lobbying. American Economic Journal: Economic Policy 6: 343–79. [Google Scholar]

- Kim, In Song. 2017. Political Cleavages within Industry: Firm-Level Lobbying for Trade Liberalization. American Political Science Review 111: 1–20. [Google Scholar] [CrossRef]

- Kim, In Song, Helen V. Milner, Thomas Bernauer, Iain Osgood, Gabriele Spilker, and Dustin Tingley. 2019. Firms and Global Value Chains: Identifying Firms’ Multidimensional Trade Preferences. International Studies Quarterly 63: 153–67. [Google Scholar] [CrossRef]

- Kim, Jin-Hyuk. 2008. Corporate Lobbying Revisited. Business and Politics 10: 1–23. [Google Scholar] [CrossRef]

- Lohmann, Susanne. 1995. Information, Access, and Contributions: A Signaling Model of Lobbying. Public Choice 85: 267–84. [Google Scholar] [CrossRef]

- Madeira, Mary Anne. 2016. New Trade, New Politics: Intra-Industry Trade and Domestic Political Coalitions. Review of International Political Economy 23: 677–711. [Google Scholar] [CrossRef]

- Melitz, Marc. 2003. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica 71: 1695–725. [Google Scholar] [CrossRef]

- Milner, Helen. 1988. Resisting Protectionism: Global Industries and the Politics of International Trade. Princeton: Princeton University Press. [Google Scholar]

- Nagler, Jonathan. 1994. Scobit: An Alternative Estimator to Logit and Probit. American Journal of Political Science 38: 230–55. [Google Scholar] [CrossRef]

- Olley, G. Steven, and Ariel Pakes. 1996. The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 64: 1263–97. [Google Scholar] [CrossRef]

- Osgood, Iain. 2016a. Differentiated Products, Divided Industries: Firms and the Politics of Intra-Industry Trade. Economics and Politics 28: 161–80. [Google Scholar] [CrossRef]

- Osgood, Iain. 2016b. The Breakdown of Industrial Opposition to Trade: Firms, Product Variety and Reciprocal Liberalization. World Politics 69: 184–231. [Google Scholar] [CrossRef]

- Osgood, Iain. 2018. Globalizing the Supply Chain: Firm and Industrial Support for US Trade Agreements. International Organization 72: 455–84. [Google Scholar] [CrossRef]

- Osgood, Iain, Dustin Tingley, Thomas Bernauer, In Song Kim, Helen V. Milner, and Gabriele Spilker. 2017. The Charmed Life of Superstar Exporters: Survey Evidence on Firms and Trade Policy. Journal of Politics 79: 133–52. [Google Scholar] [CrossRef]

- Plouffe, Michael. 2012. Liberalization for Sale: Heterogeneous Firms and Lobbying Over FTAs. Paper presented at the Annual Convention of the International Studies Association, San Diego, CA, USA, April 2. [Google Scholar]

- Plouffe, Michael. 2015. Heterogeneous Firms and Policy Preferences. In The Oxford Handbook of the Political Economy of International Trade. Edited by Lisa Martin. Oxford: Oxford University Press, pp. 196–209. [Google Scholar]

- Plouffe, Michael. 2017. Heterogeneous Firms and Trade-Policy Stances: Evidence from a Survey of Japanese Producers. Business and Politics 19: 1–40. [Google Scholar] [CrossRef]

- Plouffe, Michael. 2023. Politically Endogenous Trade-Policy Attitudes: Evidence from the 2016 US Presidential Election Cycle. Preprint, Submitted on August 10. Available online: https://osf.io/e4q5f/ (accessed on 11 August 2023).

- Prentice, Ross L. 1976. A Generalization of the Probit and Logit Methods for Dose Response Curves. Biometrics 32: 761–68. [Google Scholar] [CrossRef]

- Richter, Brian Kelleher, Krislert Samphantharak, and Jeffrey F. Timmons. 2009. Lobbying and Taxes. American Journal of Political Science 53: 893–909. [Google Scholar] [CrossRef]

- Schattschneider, Elmer E. 1935. Politics, Pressure, and the Tariff. New York: Prentice Hall. [Google Scholar]

- Schott, Peter K. 2003. One Size Fits All? Heckscher-Ohlin Specialization in Global Production. American Economic Review 93: 686–708. [Google Scholar] [CrossRef]

- Wernerfelt, Birger. 1984. A Resource-Based View of the Firm. Strategic Management Journal 5: 171–80. [Google Scholar] [CrossRef]

- Yasar, Mahmut, Rafal Raciborski, and Brian Poi. 2008. Production Function Estimation in Stata using the Olley and Pakes Method. Stata Journal 8: 221–31. [Google Scholar] [CrossRef]

| Revenue | Capital Stock | Employees | TFP | Export Sales | Foreign Income | |

|---|---|---|---|---|---|---|

| Revenue | 1.000 | |||||

| Capital Stock | 0.834 | 1.000 | ||||

| Employees | 0.845 | 0.767 | 1.000 | |||

| TFP | 0.939 | 0.869 | 0.857 | 1.000 | ||

| Export Sales | 0.093 | 0.091 | 0.078 | 0.103 | 1.000 | |

| Foreign Income | 0.323 | 0.261 | 0.319 | 0.291 | 0.106 | 1.000 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | ||

|---|---|---|---|---|---|---|

| Scobit | Scobit | Conditional Logit | Conditional Logit | Multinomial Logit | ||

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.015 *** | 0.008 *** | 0.053 *** | 0.055 *** | 0.006 *** | 0.008 *** |

| (0.002) | (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | |

| Export Sales | 0.002 * | 5.27 × 10−4 | 0.004 | 0.004 | 0.001 * | 7.16 × 10−4 |

| (0.001) | (8.16 × 10−4) | (0.004) | (0.004) | (6.16 × 10−4) | (6.51 × 10−4) | |

| Foreign Income | 0.004 *** | 0.003 *** | 0.009 *** | 0.014 *** | 0.001 *** | 0.003 *** |

| (0.001) | (0.001) | (0.002) | (0.003) | (3.68 × 10−4) | (5.46 × 10−4) | |

| Constant | −11.49 *** | −57.99 *** | −10.982 *** | −13.806 *** | ||

| N | 4659 | 4659 | 1936 | 1572 | 4675 | |

| lnα | −0.546 | −0.699 | ||||

| α | 0.579 | 0.497 | ||||

| Industries | 398 | 398 | 63 | 37 | 398 | |

| Industries Dropped | 335 | 361 | ||||

| Pseudo R2 | 0.49 | 0.55 | 0.35 | |||

| Wald χ2 | 33.47 *** | 15.77 ** | 132.86 *** | |||

| AIC | 570.14 | 331.28 | 246.17 | 130.26 | 700.32 | |

| Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|

| (Lobby) | (Pro-FTA) | (Lobby) | (Pro-FTA) | |

| TFP | 0.023 *** | 0.011 *** | 0.023 *** | 0.014 *** |

| (0.004) | (0.003) | (0.003) | (0.004) | |

| Export Sales | 5.11 × 10−4 | 1.06 × 10−4 | 0.002 | −1.74 × 10−4 |

| (0.002) | (0.001) | (0.002) | (0.001) | |

| Foreign Income | 0.005 *** | 0.003 ** | 0.005 *** | 0.004 ** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Second-Level Variables | Comparative Advantage | |||

| Trade Balance | 2.92 × 10−18 | 1.746 * | ||

| RCA | 1.248 * | 1.25 × 10−13 | ||

| Capital Intensity | 3.60 × 10−17 | 2.12 × 10−14 | ||

| New Trade | ||||

| Product Differentiation | 3.81 × 10−13 | 1.865 * | ||

| Concentration | 2.15 × 10−14 | 1.510 * | ||

| Grubel–Lloyd Index | 1.554 * | 9.20 × 10−12 | ||

| Industry Coefficient | 0.091 * | 6.821 * | 6.92 × 10−14 | 1.09 × 10−7 |

| Constant | 6.33 × 10−7 *** | 2.26 × 10−13 ** | 4.20 × 10−7 *** | 6.94 × 10−13 *** |

| N | 1510 | 1510 | 1524 | 1524 |

| Groups (SIC Industry) | 105 | 105 | 117 | 117 |

| Wald χ2 | 44.27 *** | 9.28 * | 49.71 *** | 11.70 ** |

| LR Test vs. Logit (χ2) | 8.29 | 9.80 * | 9.88 * | 10.59 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Plouffe, M. Liberalization for Sale: Corporate Demands and Lobbying over FTAs. Adm. Sci. 2023, 13, 227. https://doi.org/10.3390/admsci13100227

Plouffe M. Liberalization for Sale: Corporate Demands and Lobbying over FTAs. Administrative Sciences. 2023; 13(10):227. https://doi.org/10.3390/admsci13100227

Chicago/Turabian StylePlouffe, Michael. 2023. "Liberalization for Sale: Corporate Demands and Lobbying over FTAs" Administrative Sciences 13, no. 10: 227. https://doi.org/10.3390/admsci13100227

APA StylePlouffe, M. (2023). Liberalization for Sale: Corporate Demands and Lobbying over FTAs. Administrative Sciences, 13(10), 227. https://doi.org/10.3390/admsci13100227