It Is Time for Anti-Bribery: Financial Institutions Set the New Strategic “Roadmap” to Mitigate Illicit Practices and Corruption in the Market

Abstract

1. Introduction

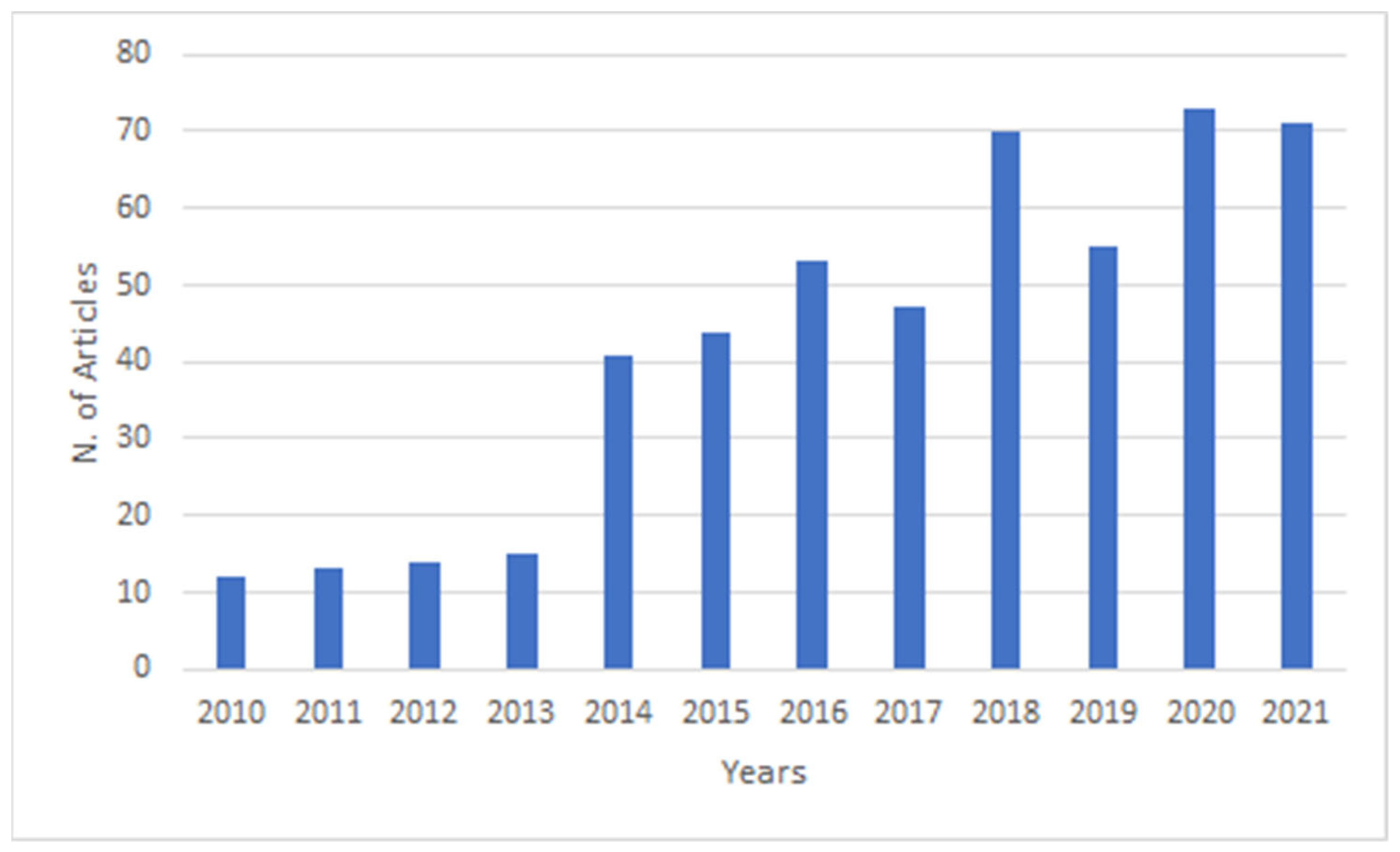

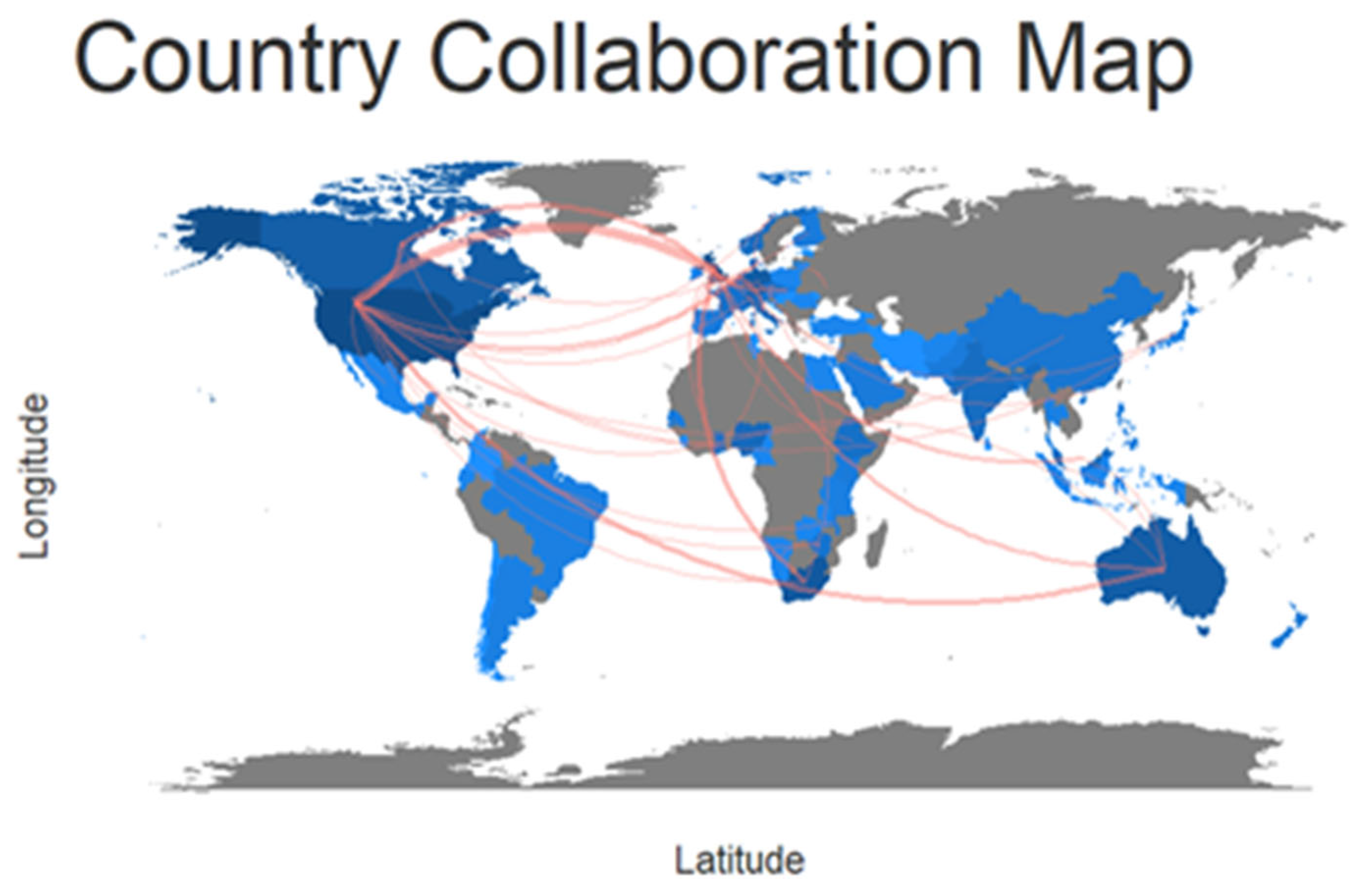

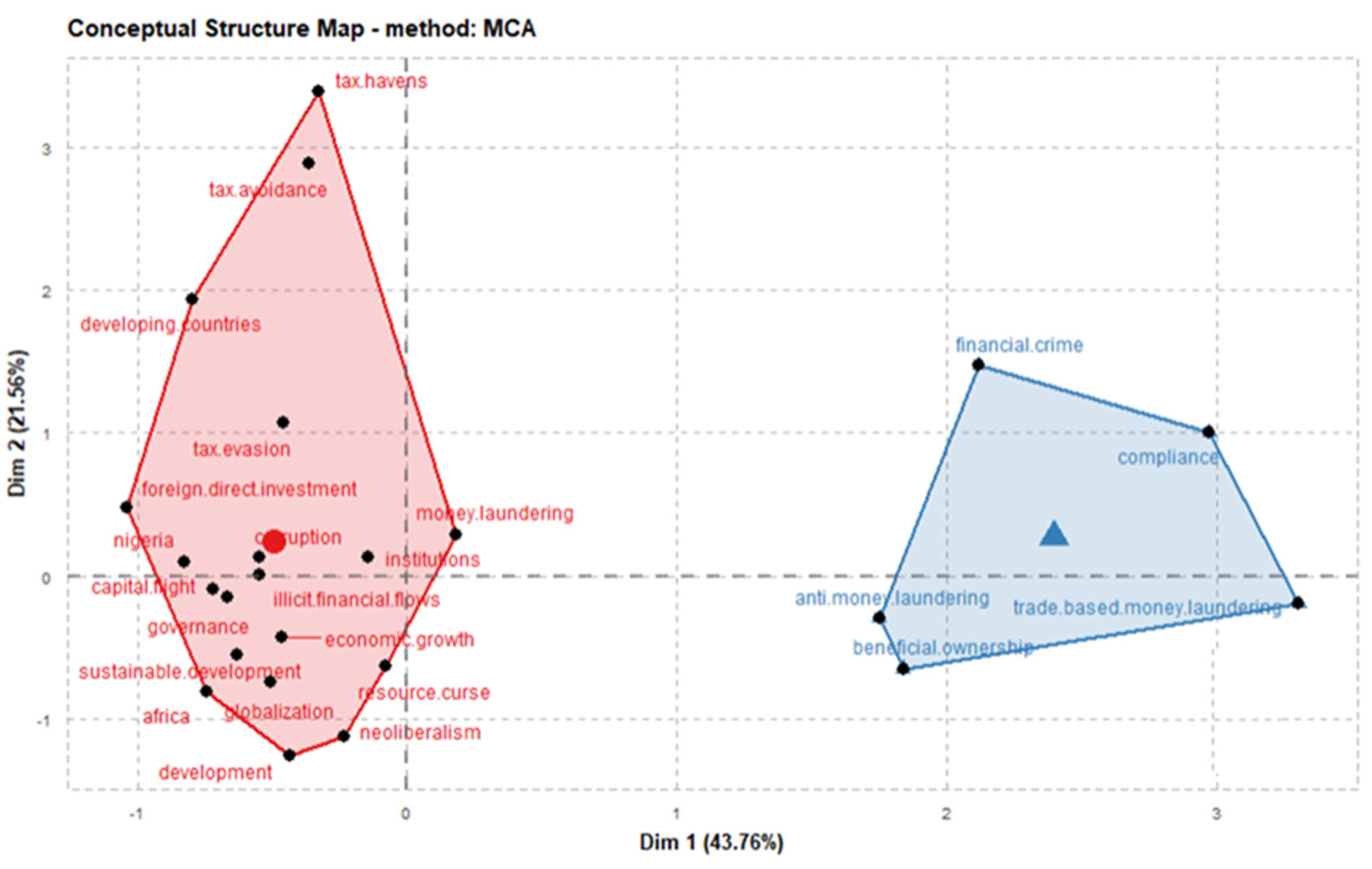

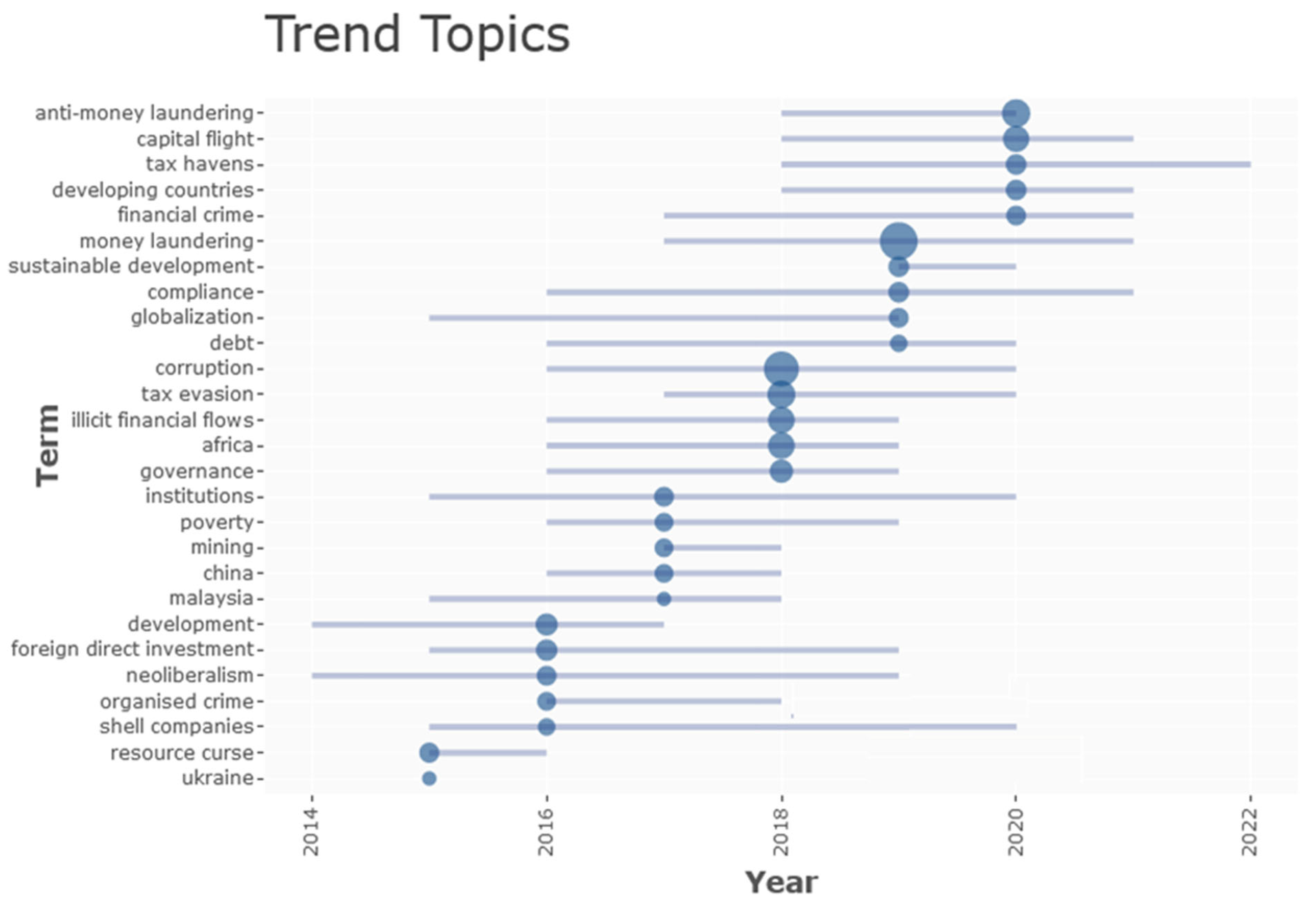

2. Literature Review

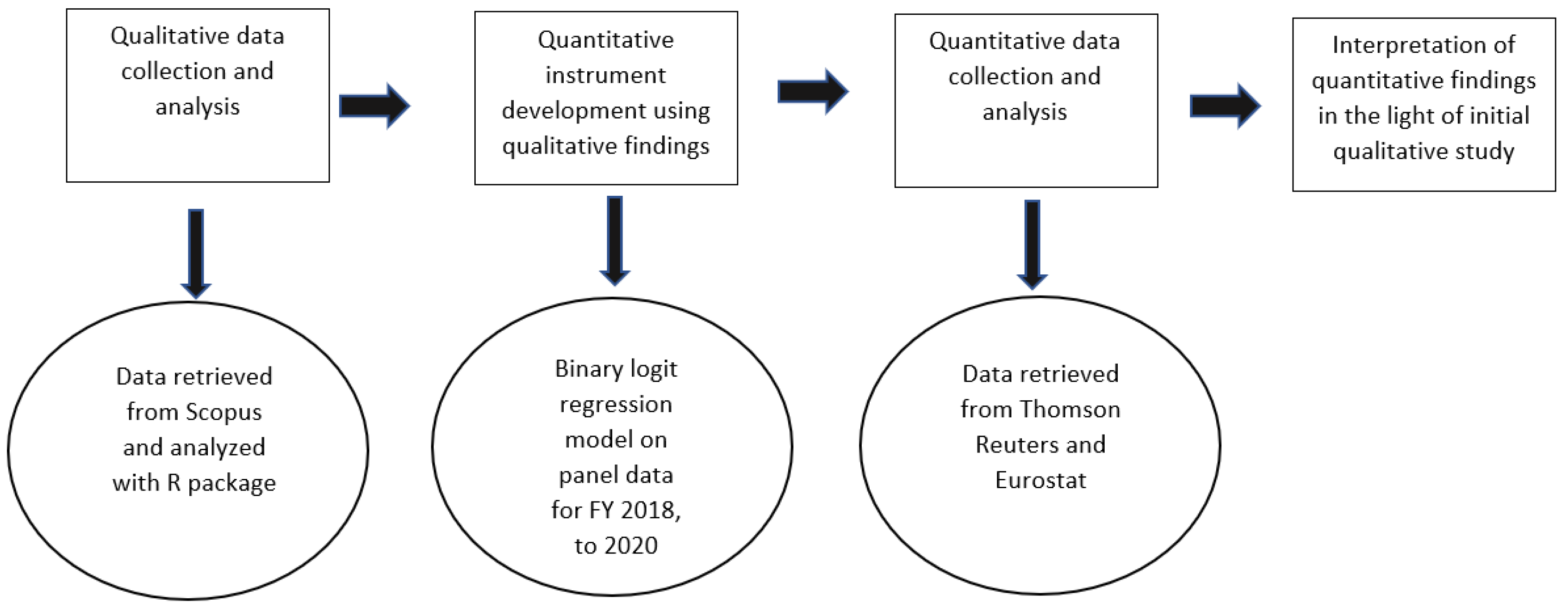

3. Materials and Methods

3.1. Fitting Binary Logit Regression Model on Panel Data

| Constant Variable | Yp | Bribery Corruption and Fraud Controversies |

| Dependent variables | ESGSC | ESG Score |

| SOCSC | Social Pillar Score | |

| RESOURC | Resource Use Score | |

| EMISSC | Emissions Score | |

| ENINSC | Environmental Innovation Score | |

| WORKSC | Workforce Score | |

| HUMRISC | Human Rights Score | |

| MANAGESC | Management Score | |

| ENERGPROD | Energy productivity (euro per kilogram of oil equivalent) | |

| RENEWA | Share of renewable energy in gross final energy consumption by sector (%) | |

| RDPERSOSC | R&D personnel by sector (%) | |

| VHCN | High-speed internet coverage by type of area (%) | |

| GINI | Income distribution (ratio) | |

| HUMRES | Human resources in science and technology (%) | |

| COMPUSK | Individuals’ level of computer skills (% of individuals) | |

| ITSPECWORK | Enterprises that employ ICT specialists (enterprise size and Nace Rev. 2) | |

| ICTCOMPS | Employed ICT specialists—total (% of total employment) | |

| TRAIPERICT | Enterprises that provided training to develop/upgrade the ICT skills of their personnel (enterprise size) | |

| ICTEDU | Persons with ICT education by labor status | |

| ICTTOTVA | Percentage of the ICT sector in GDP | |

| ICTSPEC | Percentage of the ICT personnel in total employment | |

| INTERIND | E-banking and e-commerce | |

| CORRIND | Corruption Perceptions Index | |

| TOTASS | Total Assets | |

| TOTDE | Total Liabilities | |

| TOTPROF | Retained Earnings | |

| EBIT | Earnings BEF Interest and Taxes | |

| NESAS | Net Sales of revenue | |

| TOTSHAST | Market capitalization |

3.2. Data

3.3. Variables

3.4. Modelling Procedure

4. Results

4.1. Descriptive Statistics Results

4.2. Bibary Logit Regression Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abbink, Klaus, and Kevin Wu. 2017. Reward self-reporting to deter corruption: An experiment on mitigating collusive bribery. Journal of Economic Behavior and Organization 133: 256–72. [Google Scholar] [CrossRef]

- Adam, Isabelle, and Mihály Fazekas. 2021. Are emerging technologies helping win the fight against corruption? A review of the state of evidence. Information Economics and Policy 57: 100950. [Google Scholar] [CrossRef]

- Arayankalam, Jithesh, Anupriya Khan, and Satish Krishnan. 2021. How to deal with corruption? Examining the roles of e-government maturity, government administrative effectiveness, and virtual social networks diffusion. International Journal of Information Management 58: 102203. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Bakre, Owolabi M. 2007. The unethical practices of accountants and auditors and the compromising stance of professional bodies in the corporate world: Evidence from corporate Nigeria. Accounting Forum 31: 277–303. [Google Scholar] [CrossRef]

- Binhadab, Nouf, Michael Breen, and Robert Gillanders. 2021. Press freedom and corruption in business-state interactions. Economic Systems 45: 100922. [Google Scholar] [CrossRef]

- Broadstock, David, and Xiaoqi Chen. 2020. Corporate site visits, private monitoring and fraud: Evidence from China. Finance Research Letters 40: 101780. [Google Scholar] [CrossRef]

- Chan, Kenneth S., Vinh Q. T. Dang, and Tingting Li. 2019. The evolution of corruption and development in transitional economies: Evidence from China. Economic Modelling 83: 346–63. [Google Scholar] [CrossRef]

- Cole, Rebel, Sofia Johan, and Denis Schweizer. 2021. Corporate failures: Declines, collapses, and scandals. Journal of Corporate Finance 67: 101872. [Google Scholar] [CrossRef]

- Eurostat. 2021. Enterprises That Provided Training to Develop/Upgrade ICT Skills of Their Personnel. Available online: https://ec.europa.eu/eurostat/databrowser/view/ISOC_SKE_ITTN2/default/table?lang=en&category=isoc.isoc_sk.isoc_skt (accessed on 7 November 2022).

- Ellegaard, Ole, and Johan A. Wallin. 2015. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 105: 1809–31. [Google Scholar] [CrossRef]

- Ferris, Stephen P., Jan Hanousek, and Jiri Tresl. 2021. Corporate profitability and the global persistence of corruption. Journal of Corporate Finance 66: 101855. [Google Scholar] [CrossRef]

- Ferris, Stephen P., Murali Jagannathan, and Adam C. Pritchard. 2003. Too Busy to Mind the Business? Monitoring by Directors with Multiple Board Appointments. Journal of Finance 58: 1087–112. [Google Scholar] [CrossRef]

- Ganda, Fortune. 2020. The influence of corruption on environmental sustainability in the developing economies of Southern Africa. Heliyon 6: e04387. [Google Scholar] [CrossRef] [PubMed]

- Gillies, Alexandra. 2020. Corruption trends during Africa’s oil boom, 2005 to 2014. Extractive Industries and Society 7: 1171–81. [Google Scholar] [CrossRef]

- Gou, Xiaoqing, Hui Liu, Yujie Qiang, Zhihui Lang, Haining Wang, Dong Ye, Zhiwen Wang, and Han Wang. 2022. In-depth analysis on safety and security research based on system dynamics: A bibliometric mapping approach-based study. Safety Science 147: 105617. [Google Scholar] [CrossRef]

- Guo, Ying, Lifang Wang, and Qian Yang. 2020. Do corporate environmental ethics influence firms’ green practice? The mediating role of green innovation and the moderating role of personal ties. Journal of Cleaner Production 266: 122054. [Google Scholar] [CrossRef]

- Hauk, Esther, Mónica Oviedo, and Xavier Ramos. 2022. Perception of corruption and public support for redistribution in Latin America. European Journal of Political Economy 74: 102174. [Google Scholar] [CrossRef]

- Hilal, Waleed, S. Andrew Gadsden, and John Yawney. 2022. Financial Fraud: A Review of Anomaly Detection Techniques and Recent Advances. Expert Systems with Applications 193. [Google Scholar] [CrossRef]

- Hope, Kempe Ronald. 2020. Channels of corruption in Africa: Analytical review of trends in financial crimes. Journal of Financial Crime 27: 294–306. [Google Scholar] [CrossRef]

- Jain, Ritika. 2020. Bribery and firm performance in India: A political economy perspective. Journal of Asian Economics 68: 101181. [Google Scholar] [CrossRef]

- Jha, Chandan Kumar. 2019. Financial reforms and corruption: Evidence using GMM estimation. International Review of Economics & Finance 62: 66–78. [Google Scholar] [CrossRef]

- Jha, Chandan Kumar. 2020. Financial Reforms and Corruption: Which Dimensions Matter? International Review of Finance 20: 515–27. [Google Scholar] [CrossRef]

- Khan, Anupriya, and Satish Krishnan. 2021. Moderating effects of business-systems corruption on corruption in basic national institutions and electronic government maturity: Insights from a dynamic panel data analysis. International Journal of Information Management 59: 102349. [Google Scholar] [CrossRef]

- Korpysa, Jarosław, Marcin Halicki, and Andreas Uphaus. 2021. New financing methods and ICT versus logistics startups. Procedia Computer Science 192: 4458–66. [Google Scholar] [CrossRef]

- Lakshmi, Geeta, Shrabani Saha, and Keshab Bhattarai. 2021. Does corruption matter for stock markets? The role of heterogeneous institutions. Economic Modelling 94: 386–400. [Google Scholar] [CrossRef] [PubMed]

- Lalmi, Abdallah, Gabriela Fernandes, and Souad Sassi Boudemagh. 2022. Synergy between Traditional, Agile and Lean management approaches in construction projects: Bibliometric analysis. Procedia Computer Science 196: 732–39. [Google Scholar] [CrossRef]

- Li, Dan, and Manuel Portugal Ferreira. 2011. Institutional environment and firms’ sources of financial capital in Central and Eastern Europe. Journal of Business Research 64: 371–76. [Google Scholar] [CrossRef]

- Lino, André Feliciano, Ricardo Rocha de Azevedo, André Carlos Busanelli de Aquino, and Ileana Steccolini. 2021. Fighting or supporting corruption? The role of public sector audit organizations in Brazil. Critical Perspectives on Accounting 83: 102384. [Google Scholar] [CrossRef]

- Malanski, Leonardo Köppe, and Angela Cristiane Santos Póvoa. 2021. Economic growth and corruption in emerging markets: Does economic freedom matter? International Economics 166: 58–70. [Google Scholar] [CrossRef]

- Mangoma, Arinao, and Anthony Wilson-Prangley. 2019. Black Tax: Understanding the financial transfers of the emerging black middle class. Development Southern Africa 36: 443–60. [Google Scholar] [CrossRef]

- Mirtsch, Mona, Knut Blind, Claudia Koch, and Gabriele Dudek. 2021. Information security management in ICT and non-ICT sector companies: A preventive innovation perspective. Computers and Security 109: 102383. [Google Scholar] [CrossRef]

- Papík, Mário, and Lenka Papíková. 2022. Detecting accounting fraud in companies reporting under US GAAP through data mining. International Journal of Accounting Information Systems 45: 100559. [Google Scholar] [CrossRef]

- Park, Byung Il, and Shufeng(Simon) Xiao. 2021. Doing good by combating bad in the digital world: Institutional pressures, anti-corruption practices, and competitive implications of MNE foreign subsidiaries. Journal of Business Research 137: 194–205. [Google Scholar] [CrossRef]

- Rojas-Lamorena, Álvaro J., Salvador del Barrio-García, and Juan Miguel Alcántara-Pilar. 2022. A review of three decades of academic research on brand equity: A bibliometric approach using co-word analysis and bibliographic coupling. Journal of Business Research 139: 1067–83. [Google Scholar] [CrossRef]

- Rose, Kalle Johannes. 2020. Introducing the missing 11th principle of the United Nations Global Compact to reach sustainability—Follow the money…. Journal of Money Laundering Control 23: 355–67. [Google Scholar] [CrossRef]

- Saha, Shrabani, Rukmani Gounder, and Jen Je Su. 2009. The interaction effect of economic freedom and democracy on corruption: A panel cross-country analysis. Economics Letters 105: 173–76. [Google Scholar] [CrossRef]

- Salahuddin, Mohammad, Nick Vink, Nicholas Ralph, and Jeff Gow. 2020. Globalisation, poverty and corruption: Retarding progress in South Africa. Development Southern Africa 37: 617–43. [Google Scholar] [CrossRef]

- Samerei, Seyed Alireza, Kayvan Aghabayk, Nirajan Shiwakoti, and Amin Mohammadi. 2021. Using latent class clustering and binary logistic regression to model Australian cyclist injury severity in motor vehicle—Bicycle crashes. Journal of Safety Research 79: 246–56. [Google Scholar] [CrossRef]

- Silke, Andrew. 1998. In defense of the realm: Financing loyalist terrorism in Northern Ireland—Part one: Extortion and blackmail. Studies in Conflict and Terrorism 21: 331–61. [Google Scholar] [CrossRef]

- Soans, Aaron, and Masato Abe. 2016. Bribery, corruption and bureaucratic hassle: Evidence from Myanmar. Journal of Asian Economics 44: 41–56. [Google Scholar] [CrossRef][Green Version]

- Suh, Joon Bae, and Hee Sub Shim. 2020. The effect of ethical corporate culture on anti-fraud strategies in South Korean financial companies: Mediation of whistleblowing and a sectoral comparison approach in depository institutions. International Journal of Law, Crime and Justice 60: 100361. [Google Scholar] [CrossRef]

- Tabak, Benjamin Miranda, Thiago Christiano Silva, Marcelo Estrela Fiche, and Tércio Braz. 2021. Citation likelihood analysis of the interbank financial networks literature: A machine learning and bibliometric approach. Physica A: Statistical Mechanics and Its Applications 562: 125363. [Google Scholar] [CrossRef]

- Timoneda, Joan C. 2021. Estimating group fixed effects in panel data with a binary dependent variable: How the LPM outperforms logistic regression in rare events data. Social Science Research 93: 102486. [Google Scholar] [CrossRef]

- Uberti, Luca J. 2021. Corruption and growth: Historical evidence, 1790–2010. Journal of Comparative Economics 50: 321–49. [Google Scholar] [CrossRef]

- Vian, Taryn. 2020. Anti-corruption, transparency and accountability in health: Concepts, frameworks, and approaches. Global Health Action 13: 1694744. [Google Scholar] [CrossRef] [PubMed]

- Wang, Yuwei, Zongyao Sha, Xicheng Tan, Hai Lan, Xuefeng Liu, and Jing Rao. 2020. Modeling urban growth by coupling localized spatio-temporal association analysis and binary logistic regression. Computers, Environment and Urban Systems 81: 101482. [Google Scholar] [CrossRef]

- Yang, Dan, Hao Jiao, and Roger Buckland. 2017. The determinants of financial fraud in Chinese firms: Does corporate governance as an institutional innovation matter? Technological Forecasting and Social Change 125: 309–20. [Google Scholar] [CrossRef]

- Zhang, Xinyuan, Qing Xie, and Min Song. 2021. Measuring the impact of novelty, bibliometric, and academic-network factors on citation count using a neural network. Journal of Informetrics 15: 101140. [Google Scholar] [CrossRef]

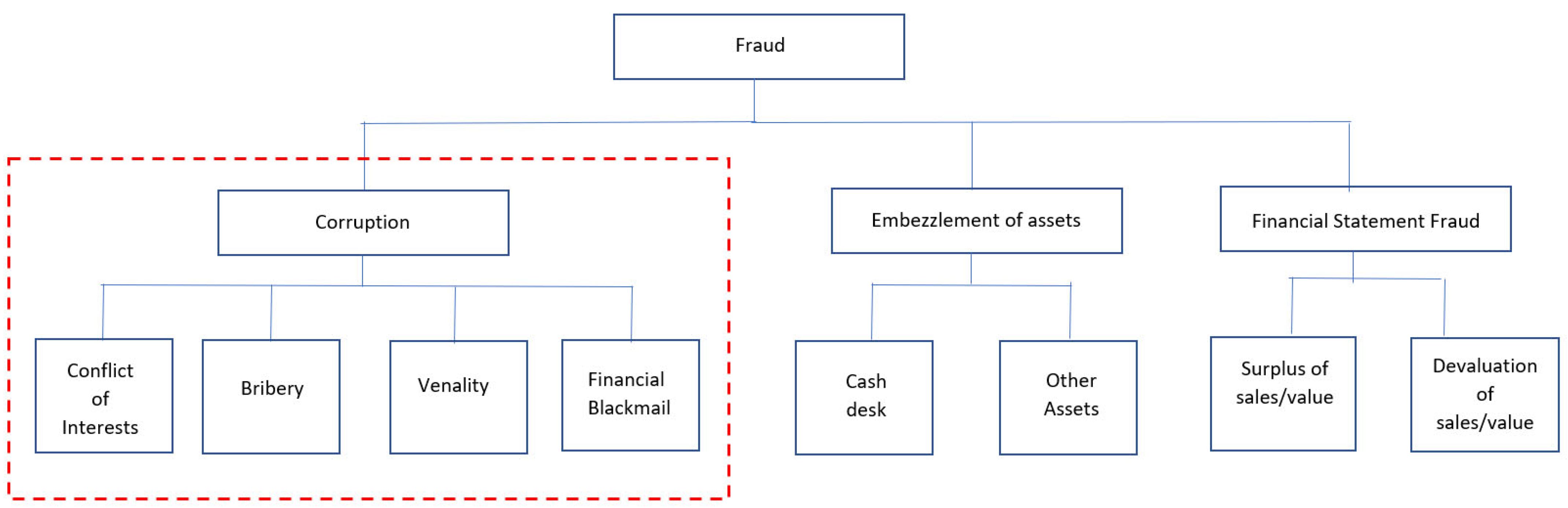

| Forms of Corruption | Definition |

|---|---|

| Conflict of interests | A situation in which an employee has a private interest that could unduly affect the performance of his or her duties and responsibilities (Lino et al. 2021). |

| Bribery | A situation in which a person intentionally offers, promises, or gives an unjustified advantage to an official or executive responsible for making decisions, for him to act or to avoid acting, to the performance of his duties (Binhadab et al. 2021; Jain 2020; Soans and Abe 2016). |

| Venality | A practice in which bids are manipulated in a tender. For example, potential bidders agree to offer higher prices or degrade the quality of the products/services offered provide tenders among themselves (Soans and Abe 2016). |

| Financial blackmail | A practice that refers to the illegal use of a person’s position to extort money in exchange for an unfair financial advantage (Mangoma and Wilson-Prangley 2019; Silke 1998). |

| Sources | Number of Articles |

|---|---|

| World Development (3 ***—Abs List 2021) | 321 |

| American Economic Review (4 ****—Abs List 2021) | 210 |

| Journal of Public Economics (3 ***—Abs List 2021) | 156 |

| Third World Quarterly (2**—Abs List 2021) | 115 |

| Quarterly Journal of Economics (4 ****—Abs List 2021) | 109 |

| Journal of Political Economy (4 ****—Abs List 2021) | 97 |

| Journal of Business Ethics (3 ***—Abs List 2021) | 91 |

| Journal of Economic Perspectives (4 ****—Abs List 2021) | 91 |

| Journal of Development Studies (3 ***—Abs List 2021) | 89 |

| Review of African Political Economy (2 **—Abs List 2021) | 84 |

| Review of International Political Economy (3 ***—Abs List 2021) | 84 |

| Antipode (3 ***—Abs List 2021) | 75 |

| Development and Change (3 ***—Abs List 2021) | 75 |

| Resources Policy (2 **—Abs List 2021) | 75 |

| Economic Journal (4 ****—Abs List 2021) | 65 |

| Journal of International Economics (4 ****—Abs List 2021) | 65 |

| Public Choice (3 ***—Abs List 2021) | 60 |

| Economy and Society (3 ***—Abs List 2021) | 58 |

| Journal of Comparative Economics (3 ***—Abs List 2021) | 56 |

| Journal of African Economies (2 **—Abs List 2021) | 54 |

| International Journal of Disclosure and Governance (2 **—Abs List 2021) | 53 |

| Journal of International Development (2 **—Abs List 2021) | 53 |

| Journal Of International Money and Finance (3 ***—Abs List 2021) | 53 |

| Type | Variables | Description | Measurement Level | Source |

|---|---|---|---|---|

| Dependent variable | BRIBCORR | This index describes if a company is under the spotlight of the media because of a controversy linked to bribery, corruption, political contributions, improper lobbying, money laundering, parallel imports, or any tax fraud | Binary | Thomson Reuters (Datastream) |

| Independent variables | ESGSC | ESG Score is an overall company score based on self-reported information in the environmental, social, and corporate governance pillars (Thomson Reuters Eikon n.d.). ESG factors have been selected as the most crucial factors contributing to mitigating market corruption. The focus on environmental, social, and governance (ESG) issues continues to grow rapidly. One of the main drivers fueling this ongoing attention to ESG monitoring and reporting is the fact that investors desire and are increasingly seeking to make socially responsible investments that will be characterized by transparency too | Continuous | Thomson Reuters (Refinitiv Eikon) |

| SOCSC | The social pillar measures a company’s capacity to generate trust and loyalty with its workforce, customers, and society, through its use of best management practices. It reflects the company’s reputation and the health of its operating license, which are key factors in determining its ability to generate long-term shareholder value (Thomson Reuters Eikon n.d.). The reason for the investigation of the relationship between corruption and social pillar score is similar to the investigation of ESG score and corruption. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| RESOURC | It reflects a company’s performance and capacity to reduce the use of materials, energy, or water and to find more eco-efficient solutions by improving supply chain management. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| EMISSC | The Emissions Score measures a company’s commitment to and effectiveness in reducing environmental emissions in the production and operational processes (Thomson Reuters Eikon n.d.). The relationship between emissions and corruption is complicated, and its investigation is more nuanced than one may think. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| ENINSC | Environmental Innovation Score reflects a company’s capacity to reduce its customers’ environmental costs and burdens, thereby creating new market opportunities through new environmental technologies and processes or eco-designed products. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| WORKSC | Workforce Score measures a company’s effectiveness towards job satisfaction, a healthy and safe workplace, maintaining diversity and equal opportunities, and development opportunities for its workforce. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| HUMRISC | Human Rights Score measures a company’s effectiveness in respecting the fundamental human rights conventions. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| MANAGESC | This score measures a company’s commitment and effectiveness towards following best practice corporate governance principles (Thomson Reuters Eikon n.d.). The principles of good corporate governance, such as transparency, can contribute not only to the improvement of the operational efficiency of a company but can also decrease the level of corruption through the enforcement of constraints that mitigate both the corrupt officials and the corruptors from the private sector. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| ENERGPROD | The indicator measures the economic output produced per unit of gross available energy. The gross available energy represents the quantity of energy products necessary to satisfy all demands of entities in the geographical area under consideration. The economic output is either given in the unit of Euros in chain-linked volumes to the reference year 2010 at 2010 exchange rates or in the unit PPS (Purchasing Power Standard). The former is used to observe the evolution over time for a specific region, while the latter allows comparing Member States in a given year. | Continuous | Eurostat | |

| RENEWA | According to the Renewable Energy Directive, the indicator measures the share of renewable energy consumption in gross final energy consumption. The gross final energy consumption is the energy used by end-consumers (final energy consumption) plus grid losses and self-consumption of power plants. This indicator is calculated based on Directive 2009/28/EC on the promotion of the use of energy from renewable sources. The calculation is based on data collected in the framework of Regulation (EC) No 1099/2008 on energy statistics and complemented by specific supplementary data transmitted by national administrations to Eurostat. In some countries, the statistical systems are not yet fully developed to meet all requirements of Directive 2009/28/EC, with respect to ambient heat captured from the environment by heat pumps. | Continuous | Eurostat | |

| RDPERSOSC | R&D and innovation are major drivers of competitiveness and employment in a knowledge-based economy. Greater investment in R&D provides new jobs in business and academia, increasing demand for scientists and researchers in the labor market. | Continuous | Eurostat | |

| VHCN | This indicator measures the share of households with fixed, very high-capacity network (VHCN) connections. This type of network is referred to as either an electronic communications network that consists entirely of optical fiber elements at least up to the distribution point at the serving location or an electronic communications network capable of delivering, under usual peak-time conditions, similar network performance in terms of available downlink and uplink bandwidth, resilience, error-related parameters, and latency and its variation. The Internet can be characterized as a useful technology in controlling corruption. So, examining the relationship between high-speed internet and corruption is important. | Continuous | Eurostat | |

| GINI | In economics, the Gini coefficient, also known as the Gini index or Gini ratio, is a measure of statistical dispersion intended to represent income or wealth inequality within a nation or a social group. | Continuous | Eurostat | |

| HUMRES | Human resources in science and technology, abbreviated as HRST, refers to those persons who fulfill one or the following conditions: completed education at the third level OR not formally qualified at the Third Level but is employed in an S&T occupation where the above qualifications are normally required. | Continuous | Eurostat | |

| COMPUSK | The indicator was developed in cooperation with users in the European Commission based on the Digital Competence Framework. It describes general digital literacy and skills in using the internet over time. Aspects of accuracy, reliability, timeliness, and comparability for the general population are satisfactory. | Continuous | Eurostat | |

| ITSPECWORK | Expresses the number of organizations that recruit ICT specialists. | Continuous | Eurostat | |

| ICTCOMPS | ICT specialists are defined as persons who can develop, operate, and maintain ICT systems, and for whom ICTs constitute the main part of their job. This index measures the number of ICT specialists. | Continuous | Eurostat | |

| TRAIPERICT | Measures the number of enterprises that provide their employee’s training to develop or upgrade their ICT skills (Eurostat 2021). ICT has emerged as a vital tool in fighting corruption. Specifically, ICT has added a new dimension to the efforts of businesses to mitigate corruption, as information can be retrieved in a matter of minutes. So, the investigation of the relationship between ICT and corruption is vital. | Continuous | Eurostat | |

| ICTEDU | This indicator describes those with ICT education in the labor force by their employment status (worker, employee, self-employed, director, or contractor) (Eurostat 2021). Corruption within a company related to Human Resources may occur at different employment statuses, so investigating the relationship between persons with ICT education (classified by their labor status) and corruption issues is crucial. Only employees and directors were considered in the current study regarding employment status. | Continuous | Eurostat | |

| ICTTOTVA | At the heart of economic changes for more than two decades, the ICT sector acts as a key determinant of the competitive power in the knowledge economy, attracting investments and creating innovation. By generating new technologies applicable to a wide range of other sectors, the Information and Communication Technologies (ICT) sector plays a strategic role in promoting growth, innovation, and competitiveness across European economies. Indeed, the impact of ICT industries is crucial for increased productivity and efficiency. The value of production is measured using the Value-Added Concept and expressed as the weight of the ICT sector in Total Value Added. The percentage share is calculated by dividing the value added in the ICT sector by the value added in all sectors (all NACE activities). | Continuous | Eurostat | |

| ICTSPEC | Number (expressed in percentage) of people who are employed as ICT specialists. | Continuous | Eurostat | |

| INTERIND | The percentage of individuals using the Internet for online banking and shopping. | Continuous | Eurostat | |

| CORRIND | The Corruption Perceptions Index ranks countries by their perceived levels of corruption per economic sector. Generally, this index defines corruption as an abuse of entrusted power for private gain. | Continuous | Transparency International | |

| TOTASS | Total assets are all the assets, or items of value, a small business owns. They are included in total assets: cash, accounts receivable (money owed to you), inventory, equipment, tools, etc. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| TOTDE | It measures the combined debts and obligations an individual or company owes to outside parties. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| TOTPROF | The amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes, and dividends to shareholders. That represents the portion of the company’s equity that can be used, for instance, to invest in new equipment, R&D, and marketing. However, retained earnings can be changed and characterized as a significant revision to a business’s accounting configuration. So, investigating the relationship between corruption and retained earnings is crucial. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| EBIT | EBIT (earnings before interest and taxes) is a company’s net income before income tax and interest expenses are deducted. EBIT is used to analyze the performance of a company’s core operations without the costs of the capital structure and tax expenses impacting profit. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| NESAS | The result of gross revenue minus applicable sales returns, allowances, and discounts. | Continuous | Thomson Reuters (Refinitiv Eikon) | |

| TOTSHAST | Illustrates the total value of all a company’s shares of stock. The investigation of the relationship between corruption and economic factors and its consequences for economic development has attracted the interest of many economists in recent years globally. | Continuous | Thomson Reuters (Refinitiv Eikon) |

| Variables | N | Range | Minimum | Maximum | Mean | Std. Deviation | Variance | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|---|

| BRIBCORR | 1008 | 1.00 | 0.00 | 1.00 | 0.2054 | 0.40416 | 0.163 | 1.461 | 0.135 |

| ESGSC | 1008 | 92.00 | 1.80 | 93.80 | 47.4164 | 20.34816 | 414.048 | 0.074 | −0.576 |

| SOCSC | 1008 | 95.90 | 0.60 | 96.50 | 51.0146 | 21.07920 | 444.333 | −0.153 | −0.454 |

| RESOURC | 1008 | 99.90 | 0.00 | 99.90 | 41.3101 | 30.55491 | 933.602 | 0.260 | −0.933 |

| EMISSC | 1008 | 99.90 | 0.00 | 99.90 | 44.0504 | 32.01070 | 1024.685 | 0.048 | −1.207 |

| ENINSC | 1008 | 99.50 | 0.00 | 99.50 | 32.4422 | 33.43982 | 1118.221 | 0.639 | −0.957 |

| WORKSC | 1008 | 98.90 | 0.90 | 99.80 | 63.4137 | 24.55322 | 602.860 | −0.678 | −0.322 |

| HUMRISC | 1008 | 96.20 | 0.00 | 96.20 | 37.2813 | 32.75454 | 1072.860 | 0.313 | −1.277 |

| MANAGESC | 1008 | 99.60 | 0.10 | 99.70 | 50.8354 | 28.17437 | 793.795 | 0.072 | −1.080 |

| ENERGPROD | 1008 | 15.50 | 4.10 | 19.60 | 10.1754 | 2.71260 | 7.358 | −0.489 | 0.600 |

| RENEWA | 1008 | 49.00 | 7.40 | 56.40 | 19.1141 | 14.09274 | 198.605 | 1.913 | 2.099 |

| RDPERSOSC | 1008 | 0.80 | 0.50 | 1.30 | 0.9090 | 0.21371 | 0.046 | 0.533 | −0.460 |

| VHCN | 1008 | 92.40 | 1.40 | 93.80 | 31.2344 | 26.86868 | 721.926 | 0.813 | −0.657 |

| GINI | 1008 | 3.20 | 3.30 | 6.50 | 4.9571 | 0.67088 | 0.450 | −0.191 | −0.608 |

| HUMRES | 1008 | 24.60 | 37.00 | 61.60 | 55.4142 | 5.88920 | 34.683 | −1.725 | 2.233 |

| COMPUSK | 1008 | 31.00 | 45.00 | 76.00 | 62.7937 | 6.00803 | 36.096 | −0.859 | 0.783 |

| ITSPECWORK | 1008 | 19.00 | 13.00 | 32.00 | 23.8958 | 4.56445 | 20.834 | −0.646 | −0.554 |

| ICTCOMPS | 1008 | 4.60 | 3.00 | 7.60 | 5.2646 | 1.00511 | 1.010 | −0.278 | 0.343 |

| TRAIPERICT | 1008 | 13.00 | 6.00 | 19.00 | 11.3323 | 2.43070 | 5.908 | 0.394 | 1.859 |

| ICTEDU | 1008 | 497.50 | 23.10 | 520.60 | 268.6827 | 127.180 | 16,174.908 | −0.504 | −0.313 |

| ICTTOTVA | 1008 | 6.50 | 0.00 | 6.50 | 5.4269 | 1.23959 | 1.537 | −2.327 | 6.547 |

| ICTSPEC | 1008 | 2.70 | 2.20 | 4.90 | 3.6346 | 0.62121 | 0.386 | 0.513 | 0.166 |

| INTERIND | 1008 | 60.00 | 34.00 | 94.00 | 76.4216 | 11.09818 | 123.170 | −2.016 | 5.066 |

| CORRIND | 1008 | 36.00 | 52.00 | 88.00 | 78.2768 | 7.06684 | 49.940 | −2.222 | 5.983 |

| TOTASS | 1008 | 35,992.80 | 0.00 | 35,992.8 | 339.344 | 2046.29 | 4,187,321 | 13.171 | 195.451 |

| TOTDE | 1008 | 31,096.30 | 0.00 | 31,096.3 | 307.081 | 1798.51 | 3,234,670 | 12.751 | 184.598 |

| TOTPROF | 1008 | 4600.60 | −11.70 | 4588.9 | 23.8333 | 228.019 | 51,992.7 | 17.722 | 324.876 |

| EBIT | 1008 | 1240.40 | −13.60 | 1226.8 | 6.2114 | 63.6450 | 4050.68 | 17.141 | 304.994 |

| NESAS | 1008 | 3188.00 | −14.50 | 3173.5 | 22.2922 | 181.977 | 33,115.8 | 14.828 | 233.930 |

| TOTSHAST | 1008 | 5845.20 | 0.00 | 5845.2 | 30.7394 | 285.066 | 81,262.8 | 18.096 | 340.512 |

| BRIBCORR | ESGSC | SOCSC | RESOURC | EMISSC | ENINSC | WORKSC | HUMRISC | MANAGESC | ENERGPROD | RENEWA | RDPERSOSC | VHCN | GINI | HUMRES | COMPUSK | ITSPECWORK | ICTCOMPS | TRAIPERICT | ICTEDU | ICTTOTVA | ICTSPEC | INTERIND | CORRIND | TOTASS | TOTDE | TOTPROF | EBIT | NESAS | TOTSHAST | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BRIBCORR | 1.000 | |||||||||||||||||||||||||||||

| ESGSC | −0.025 | 1.000 | ||||||||||||||||||||||||||||

| SOCSC | −0.026 | −0.747 | 1.000 | |||||||||||||||||||||||||||

| RESOURC | 0.028 | −0.272 | 0.214 | 1.000 | ||||||||||||||||||||||||||

| EMISSC | −0.039 | −0.238 | 0.175 | −0.363 | 1.000 | |||||||||||||||||||||||||

| ENINSC | 0.010 | −0.448 | 0.153 | −0.105 | −0.019 | 1.000 | ||||||||||||||||||||||||

| WORKSC | −0.021 | −0.150 | −0.279 | −0.026 | −0.209 | 0.195 | 1.000 | |||||||||||||||||||||||

| HUMRISC | 0.060 | −0.090 | −0.203 | −0.197 | −0.015 | 0.055 | 0.077 | 1.000 | ||||||||||||||||||||||

| MANAGESC | 0.025 | −0.900 | 0.664 | 0.157 | 0.224 | 0.421 | 0.046 | 0.095 | 1.000 | |||||||||||||||||||||

| ENERGPROD | 0.031 | 0.022 | −0.015 | −0.021 | −0.030 | 0.013 | −0.018 | 0.034 | −0.029 | 1.000 | ||||||||||||||||||||

| RENEWA | 0.199 | −0.005 | 0.010 | −0.017 | 0.001 | 0.041 | −0.065 | 0.037 | 0.024 | −0.073 | 1.000 | |||||||||||||||||||

| RDPERSOSC | −0.326 | −0.055 | 0.059 | 0.003 | 0.028 | 0.022 | 0.032 | −0.047 | 0.033 | 0.104 | −0.666 | 1.000 | ||||||||||||||||||

| VHCN | 0.110 | 0.076 | −0.041 | −0.083 | −0.047 | −0.027 | −0.013 | 0.014 | −0.055 | −0.045 | −0.307 | −0.239 | 1.000 | |||||||||||||||||

| GINI | −0.743 | 0.019 | −0.028 | −0.083 | 0.064 | 0.013 | 0.013 | 0.001 | −0.025 | 0.042 | 0.097 | 0.124 | −0.390 | 1.000 | ||||||||||||||||

| HUMRES | −0.321 | 0.001 | −0.007 | −0.036 | 0.064 | −0.009 | 0.007 | −0.009 | 0.000 | −0.183 | 0.270 | −0.327 | −0.005 | 0.282 | 1.000 | |||||||||||||||

| COMPUSK | 0.121 | 0.040 | −0.002 | 0.076 | −0.059 | −0.039 | −0.089 | 0.019 | −0.020 | −0.401 | 0.079 | −0.199 | 0.438 | −0.321 | −0.255 | 1.000 | ||||||||||||||

| ITSPECWORK | −0.215 | −0.061 | 0.071 | 0.015 | 0.017 | 0.014 | 0.014 | −0.009 | 0.031 | −0.249 | 0.011 | 0.139 | 0.134 | −0.155 | 0.014 | 0.188 | 1.000 | |||||||||||||

| ICTCOMPS | 0.382 | −0.004 | −0.046 | 0.007 | −0.037 | 0.018 | 0.097 | −0.014 | −0.004 | 0.223 | −0.327 | 0.045 | 0.014 | −0.326 | −0.504 | −0.298 | −0.154 | 1.000 | ||||||||||||

| TRAIPERICT | 0.169 | 0.048 | −0.035 | −0.074 | −0.004 | 0.024 | 0.002 | 0.018 | −0.019 | 0.037 | 0.467 | −0.434 | −0.197 | 0.204 | 0.244 | −0.185 | −0.535 | −0.182 | 1.000 | |||||||||||

| ICTEDU | 0.472 | 0.028 | −0.014 | −0.070 | −0.017 | 0.045 | 0.010 | −0.021 | −0.017 | 0.166 | 0.439 | −0.247 | −0.193 | −0.278 | 0.073 | −0.286 | −0.200 | 0.241 | 0.496 | 1.000 | ||||||||||

| ICTTOTVA | 0.091 | 0.006 | 0.016 | 0.045 | −0.057 | 0.012 | −0.028 | 0.028 | 0.007 | −0.208 | −0.520 | 0.441 | 0.385 | −0.320 | −0.527 | 0.478 | −0.025 | −0.013 | −0.333 | −0.430 | 1.000 | |||||||||

| ICTSPEC | −0.147 | 0.011 | 0.004 | −0.005 | 0.039 | −0.004 | −0.038 | −0.005 | −0.005 | −0.140 | 0.229 | −0.188 | −0.038 | 0.153 | 0.332 | 0.249 | 0.076 | −0.425 | 0.491 | 0.244 | −0.340 | 1.000 | ||||||||

| INTERIND | 0.279 | 0.038 | −0.007 | −0.017 | −0.064 | 0.009 | −0.010 | −0.014 | −0.030 | 0.066 | 0.179 | 0.167 | −0.366 | 0.076 | −0.476 | 0.130 | −0.529 | −0.009 | 0.275 | 0.218 | 0.272 | −0.121 | 1.000 | |||||||

| CORRIND | −0.378 | −0.040 | 0.011 | 0.010 | 0.043 | −0.003 | 0.042 | −0.018 | 0.016 | 0.278 | −0.381 | 0.267 | −0.063 | 0.210 | 0.007 | −0.596 | 0.193 | 0.355 | −0.484 | −0.357 | −0.103 | −0.624 | −0.464 | 1.000 | ||||||

| TOTASS | 0.094 | 0.101 | −0.083 | 0.056 | −0.046 | 0.057 | −0.125 | 0.084 | −0.047 | 0.023 | 0.069 | −0.044 | 0.042 | −0.100 | −0.013 | 0.108 | −0.044 | −0.080 | 0.036 | 0.055 | 0.075 | −0.014 | 0.085 | −0.123 | 1.000 | |||||

| TOTDE | −0.100 | −0.107 | 0.088 | −0.054 | 0.047 | −0.058 | 0.122 | −0.085 | 0.054 | −0.025 | −0.069 | 0.046 | −0.048 | 0.105 | 0.009 | −0.109 | 0.049 | 0.081 | −0.037 | −0.060 | −0.076 | 0.015 | −0.087 | 0.127 | −0.999 | 1.000 | ||||

| TOTPROF | −0.104 | −0.040 | 0.019 | −0.074 | 0.036 | −0.091 | 0.124 | −0.060 | 0.002 | 0.024 | −0.086 | 0.061 | −0.034 | 0.114 | 0.050 | −0.136 | 0.003 | 0.072 | −0.037 | −0.026 | −0.099 | 0.021 | −0.098 | 0.128 | −0.673 | 0.655 | 1.000 | |||

| EBIT | 0.049 | −0.051 | 0.091 | 0.004 | 0.113 | −0.057 | −0.035 | 0.042 | 0.070 | −0.025 | −0.034 | 0.025 | 0.059 | −0.050 | 0.038 | −0.021 | −0.009 | 0.002 | −0.015 | 0.072 | 0.015 | −0.003 | −0.022 | −0.021 | −0.303 | 0.292 | 0.184 | 1.000 | ||

| NESAS | −0.074 | −0.029 | −0.027 | −0.068 | −0.037 | −0.014 | 0.160 | −0.051 | −0.040 | 0.009 | −0.024 | −0.009 | −0.051 | 0.097 | 0.006 | −0.083 | 0.003 | 0.074 | 0.002 | −0.068 | −0.071 | −0.006 | −0.038 | 0.095 | −0.685 | 0.672 | 0.579 | −0.308 | 1.000 | |

| TOTSHAST | 0.110 | 0.118 | −0.101 | 0.000 | −0.101 | 0.079 | −0.022 | −0.025 | −0.133 | 0.045 | 0.023 | −0.066 | 0.079 | −0.097 | 0.006 | 0.100 | −0.048 | −0.052 | 0.026 | 0.033 | 0.057 | −0.031 | 0.081 | −0.120 | 0.393 | −0.414 | −0.478 | −0.441 | 0.010 | 1.000 |

| R-Square | |||||

|---|---|---|---|---|---|

| Cox and Snell | 0.152 | ||||

| Nagelkerke | 0.238 | ||||

| Variables | Coefficient | S.E. | Wald | Sig. | Odd Ratio |

| ESGSC | −0.013 | 0.027 | 0.230 | 0.632 | 0.987 |

| SOCSC | 0.008 | 0.014 | 0.276 | 0.600 | 1.008 |

| RESOURC | 0.002 | 0.006 | 0.176 | 0.675 | 1.002 |

| EMISSC | 0.007 | 0.005 | 1.752 | 0.186 | 1.007 |

| ENINSC | 0.002 | 0.004 | 0.260 | 0.610 | 1.002 |

| WORKSC | −0.002 | 0.008 | 0.094 | 0.759 | 0.998 |

| HUMRISC | 0.001 | 0.004 | 0.065 | 0.798 | 1.001 |

| MANAGESC | −0.016 | 0.009 | 2.955 | 0.050 | 1.016 |

| ENERGPROD | −0.069 | 0.063 | 1.185 | 0.276 | 0.933 |

| RENEWA | 0.017 | 0.028 | 0.379 | 0.538 | 1.017 |

| RDPERSOSC | −2.376 | 1.673 | 2.018 | 0.155 | 0.093 |

| VBCN | −0.020 | 0.009 | 4.702 | 0.030 | 0.981 |

| GINI | 0.466 | 0.319 | 2.136 | 0.144 | 1.594 |

| HUMRES | 0.166 | 0.064 | 6.702 | 0.010 | 1.181 |

| COMPUSK | −0.025 | 0.064 | 0.158 | 0.691 | 0.975 |

| ITSPECWORK | −0.098 | 0.057 | 2.919 | 0.038 | 0.907 |

| ICTCOMPS | 0.056 | 0.316 | 0.032 | 0.859 | 1.058 |

| TRAIPERICT | 0.305 | 0.134 | 5.153 | 0.023 | 1.356 |

| ICTEDU | −0.001 | 0.002 | 0.081 | 0.776 | 0.999 |

| ICTTOTVA | −0.485 | 0.232 | 4.355 | 0.037 | 0.616 |

| ICTSPEC | 1.687 | 0.648 | 6.770 | 0.009 | 5.405 |

| INTERIND | −0.100 | 0.036 | 7.755 | 0.005 | 0.905 |

| CORRIND | 0.040 | 0.073 | 0.300 | 0.584 | 1.041 |

| TOTASS | −0.006 | 0.009 | 0.459 | 0.498 | 0.994 |

| TOTDE | 0.008 | 0.009 | 0.824 | 0.364 | 1.008 |

| TOTPROF | 0.013 | 0.010 | 1.506 | 0.220 | 1.013 |

| EBIT | −0.028 | 0.035 | 0.665 | 0.415 | 0.972 |

| NESAS | −0.004 | 0.007 | 0.287 | 0.592 | 0.996 |

| TOTSHAST | −0.030 | 0.008 | 13.629 | 0.000 | 0.971 |

| Constant | −9.587 | 3.017 | 10.100 | 0.001 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ragazou, K.; Passas, I.; Garefalakis, A. It Is Time for Anti-Bribery: Financial Institutions Set the New Strategic “Roadmap” to Mitigate Illicit Practices and Corruption in the Market. Adm. Sci. 2022, 12, 166. https://doi.org/10.3390/admsci12040166

Ragazou K, Passas I, Garefalakis A. It Is Time for Anti-Bribery: Financial Institutions Set the New Strategic “Roadmap” to Mitigate Illicit Practices and Corruption in the Market. Administrative Sciences. 2022; 12(4):166. https://doi.org/10.3390/admsci12040166

Chicago/Turabian StyleRagazou, Konstantina, Ioannis Passas, and Alexandros Garefalakis. 2022. "It Is Time for Anti-Bribery: Financial Institutions Set the New Strategic “Roadmap” to Mitigate Illicit Practices and Corruption in the Market" Administrative Sciences 12, no. 4: 166. https://doi.org/10.3390/admsci12040166

APA StyleRagazou, K., Passas, I., & Garefalakis, A. (2022). It Is Time for Anti-Bribery: Financial Institutions Set the New Strategic “Roadmap” to Mitigate Illicit Practices and Corruption in the Market. Administrative Sciences, 12(4), 166. https://doi.org/10.3390/admsci12040166