3.1. Human Resource Management and Compensation and Benefits Importance

Human capital is considered the most important investment, and it determines the future course of the organization. Human Resources are considered a valuable resource for the company, and as such contribute to increasing its performance. According to

Peráček (

2020), “one of the most important prerequisites for success are human resources and their motivation to work”, and wage is one of the most effective drivers of human resources in the company.

Borgatti and Li (

2009) stated that earlier studies on human capital management had emphasized the role of the individual (thoroughness, dependability) (

Dudley et al. 2006;

Iddekinge and Ployhart 2008) and job characteristics (skill variety, task significance, and identity) (

Grant 2007) in the results of employees, such as their performance, absenteeism, turnover, etc. Despite those correlations, the necessity of having a Human Resources department should not be disregarded (

Hollenbeck and Jamieson 2015).

The steps of having the best employee possible are developing and implementing strategic human resources plans, figuring out the personnel needs, recruiting employees and selecting the right one, training, evaluating through performance appraisals, and of course motivating to ensure employee retention. An important step is also offering a Compensation and Benefits Package (

Portolese 2018).

According to

Dessler (

2014,

2019), employee compensation and benefits include all forms of pay going to employees and arising from their employment, besides their regular wages or salaries. They are comprised of direct financial payments (the 13th payment, bonuses, profit-sharing, etc.) and indirect financial payments (medical coverage, health insurance, paid vacations, etc.). To

Leibowitz (

1983), benefits are classified into three categories. The first one is nontaxable for private utilization and includes health insurance, sponsored lunches in the firm (also known as a brown bag), etc. The second and third categories are taxable. In the second category are benefits such as life insurance, which the employer can offer at a low cost, due to the quantity rebates, while the third category comprises paid time off.

Mura and Svec (

2018), as stated in

Peráček (

2020), use the term ‘remuneration’ which they argue means not only the salary or other cash remuneration but also other forms of indirect compensation of employees for the work done by them. It also includes formal recognition, promotion, and employment benefits provided by the employer to employees, not depending on their work, but derived from working relations in the organization.

Benefits are an important element of employees’ aggregate compensation, so they affect their welfare and financial well-being (

Kristal 2017). Although the job itself might be a motivator to continue working and increase the company’s performance, most of the employees would choose not to. Another option would be to only choose jobs that are enjoyable for the employee but not essentially required by the community (

Lazear 2018).

The compensation factor is very crucial, both in the recruiting and retention phase. A study showed that professors who received incentives when the school year started but had to give them back if they did not perform according to school goals, were more motivated and performed even better than the ones who were promised the reward at the end of the school year if the goals were met (

Fryer et al. 2012).

How knowledgeable are employees about compensation and benefits?

Studies have shown that employees do not have a full understanding of every type of benefit. Sixty percent admitted to having a very good knowledge of the health benefits they received, while only fifty-one percent of the non-health benefits. Both types have experienced an increase in understanding in the year 2018.

Regarding the different industries, some offer more benefits than others. Specifically, manufacturing, finance and insurance, and public administration and governance lead the industries which offer the most. Employees who work in the retail and accommodation and food industries receive far fewer benefits (

Greenwald and Fronstin 2019). While

Mabaso and Dlamini (

2021) conclude that higher education institutions must improve their compensation strategy to boost employees’ dedication will enable commitment, while efficiently delivering outstanding results.

3.2. Employee Preference on Compensation and Benefit Types

- RO1:

To identify what type of Compensation and Benefits Albanian employees receive.

As discussed by several authors, there are numerous considerations to take into account before devising a payment plan such as company strategy, equity, legislation, and unions.

Employers cannot design the pay plans according to their likes. Some laws dictate things such as minimum wages, overtime rates, pension plans, and benefits. The 1963 Equal Pay Act declares that “employees of one sex may not be paid wages at a rate lower than that paid to employees of the opposite sex for doing roughly equivalent work. Specifically, if the work requires equal skills, effort, and responsibility and involves similar working conditions, employees of both sexes must receive equal pay, unless the differences in pay stem from a seniority system, a merit system, the quantity or quality of production, or any factor other than sex” (

Dessler 2014, p. 283).

In Albania, employment relationships are regulated by the Labor Code of the Republic of Albania, no.7961, date 12.07.1995, amended by several laws, in the private sector; and by Law No. 152/2013, amended by law no. 178/2014 and law 41/2017 “For the civil servant”.

Unions and labor relations laws impact the Pay Plan. The core topic of their bargaining is the wage rate, but they also negotiate additional concerns, such as paid time-off, health care benefits, etc. Unfortunately, in Albania, after the fall of the communist regime, labor unions are very few, as listed by (

International Labor Organization n.d.), with two main confederations: the United Independent Albanian Trade Unions (BSPSh) and the Confederation of Trade Unions (KSSh). But from a practical point of view, they are almost inexistent. Furthermore, according to Nikollaj K., president of the KSSH confederation, Albania lacks laws on trade unions, collective bargaining, and conflict (

IndustriALL Global Union 2019).

In the last decade, employees are thinking more about the work-life balance, and this has caused a growth in the number of contingent workers. To the U.S. Bureau of Labor Statistics (

BLS 2005, p. 2) “contingent workers are those who do not have an implicit or explicit contract for ongoing employment. People who do not expect to continue in their jobs for such personal reasons as retirement or returning to school are not considered contingent workers, provided that they would have the option of continuing in the job were it not for these reasons”. They are comprised of: part-time employees and temporary employees (

Martocchio 2017, p. 281). “Part-time employment is normally defined as systematic wage employment where the hours of work are less than ‘normal’” (

Thurman and Trah 1990, p. 23). In the U.S. the normal working time is 35 h/week, in Canada and U.K., 30 h for part-time, and in Germany no more than 36 h/week. In Albania, according to the Labor Code, the standard working hours are 40 h/week and 8 h a day, while employees younger than 18 years old should work no more than 6 h/day. Temporary employees are the ones who may substitute a sick, or on maternity leave employee, or simply complete an assignment that is needed for a short period. The temps provide their services to the same employer from only a few days to some months, depending on what is required of them (

Vosko 1997). Regarding the benefits, firms usually do not offer optional benefits to part-time workers, but this practice may vary on the industry, company size, and on the fact whether it is a private or public firm. In 2014, only 37% could obtain retirement benefits compared to 74% of full-timers, and even fewer received medical care benefits. This happens, because employers are not legally required to offer protective insurance. A positive factor is that the ones who receive medical care and retirement benefits are covered by the Consolidated Omnibus Budget Reconciliation Act. To benefit from it the individual has to be more than 20 years old, and have worked for 1000 h or more in 12 months. Firms normally do not offer optional benefits to temporary employees either, because they want to reduce the cost of it. Nevertheless, these employees are entitled to receive pension benefits (

Martocchio 2017).

In Albania, mandatory compensations and benefits such as overtime, paid time off, parental leave, and other leaves are regulated by national laws. The maximum allowed additional working hour is 200 h/year. The minimum wage currently is 32,000 Albanian Lek or around 300

$, according to Order (

VKM 2022) No. 158 date 12 March 2022. Social security benefits in Albania are provided by the Social Insurance Institute (

ISSH n.d.) and are regulated by Law no. 7703. There is some supplementary compensation to pensions and unemployment benefits for dependent children and family members, financed from the state budget.

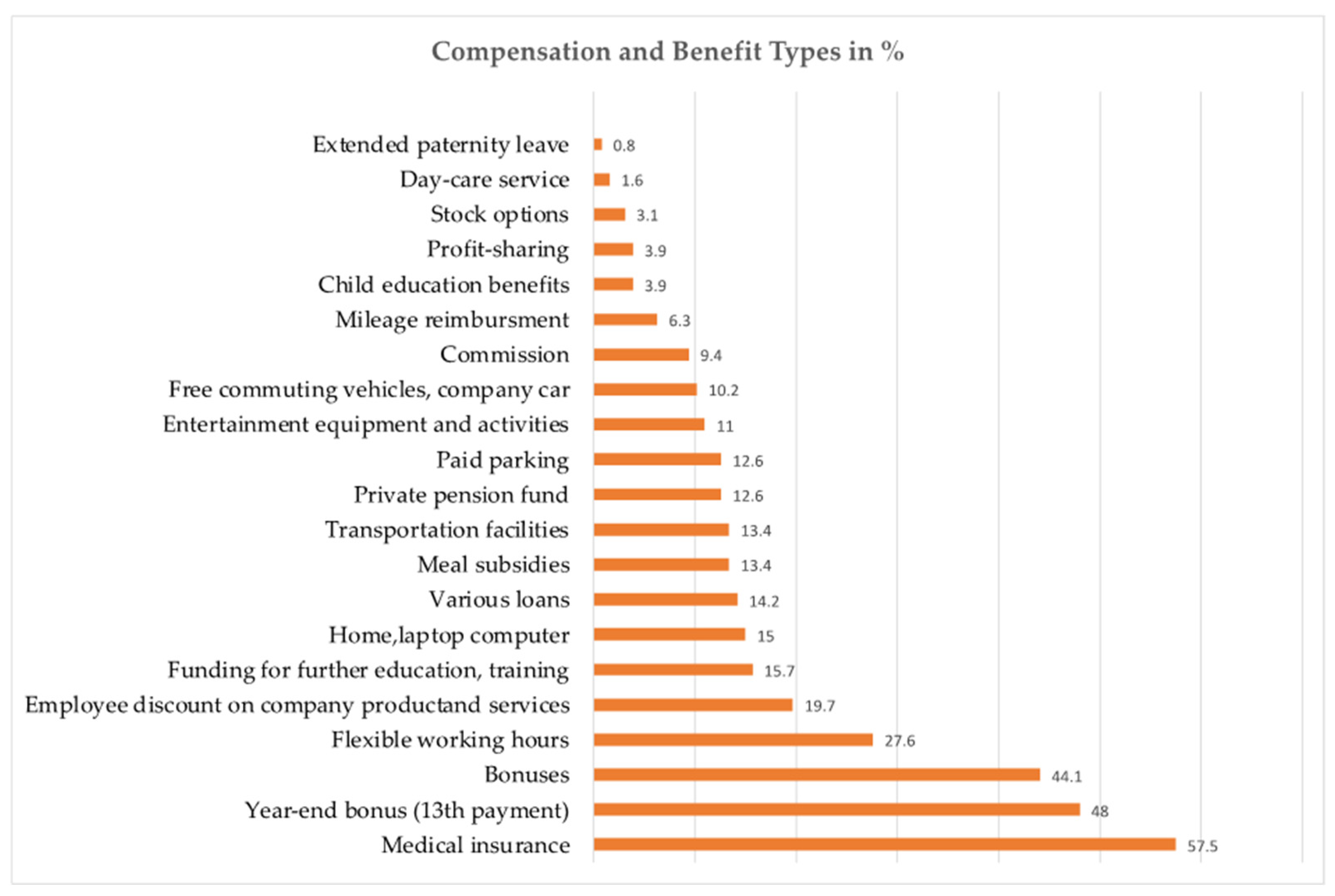

Hong et al. (

1995), conducted a study to see what benefits the employees’ favor compared to what was given by the employer. The benefits program was comprised of 27 types: foreign travel subsidies; entertainment equipment and activities; transportation facilities; opportunity for further education/training; subsidies for further education/training; counseling measures; day-care service; maternity and paternity leave; group and dependent insurance; various loans; dividends; year-end bonuses; savings subsidies; traditional and emergency subsidies; pensions; vocational disease and damage compensations; child-education benefits; individual annual vacations, national holidays, paid leave; discounted goods supply; dormitories and housing benefits; food/drink equipment and meal subsidies; barbering/hairdressing and laundry service; medical equipment and subsidies; free commuting vehicles; commuter subsidies; flexible working time; part-time working. The results showed that financial benefit programs were more favored by the employer and employee to give and receive (end year bonus, pensions, etc.), but there still was a gap in understanding what the employees truly wanted. Dividends were ranked number 2 in the order of importance for employees, but for employers, their worth was no. 21 out of 27. The same goes for saving subsidies and having flexible working time.

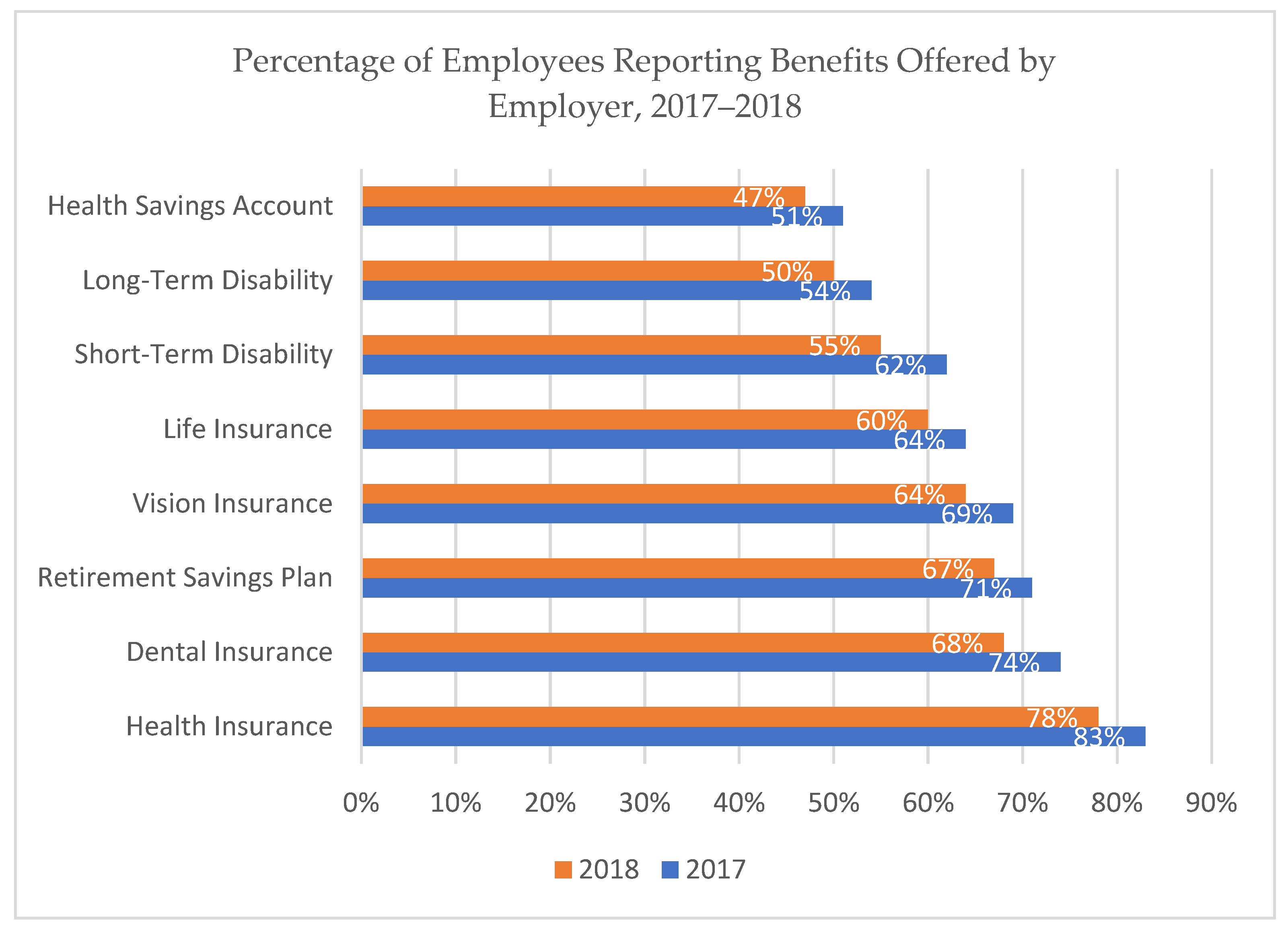

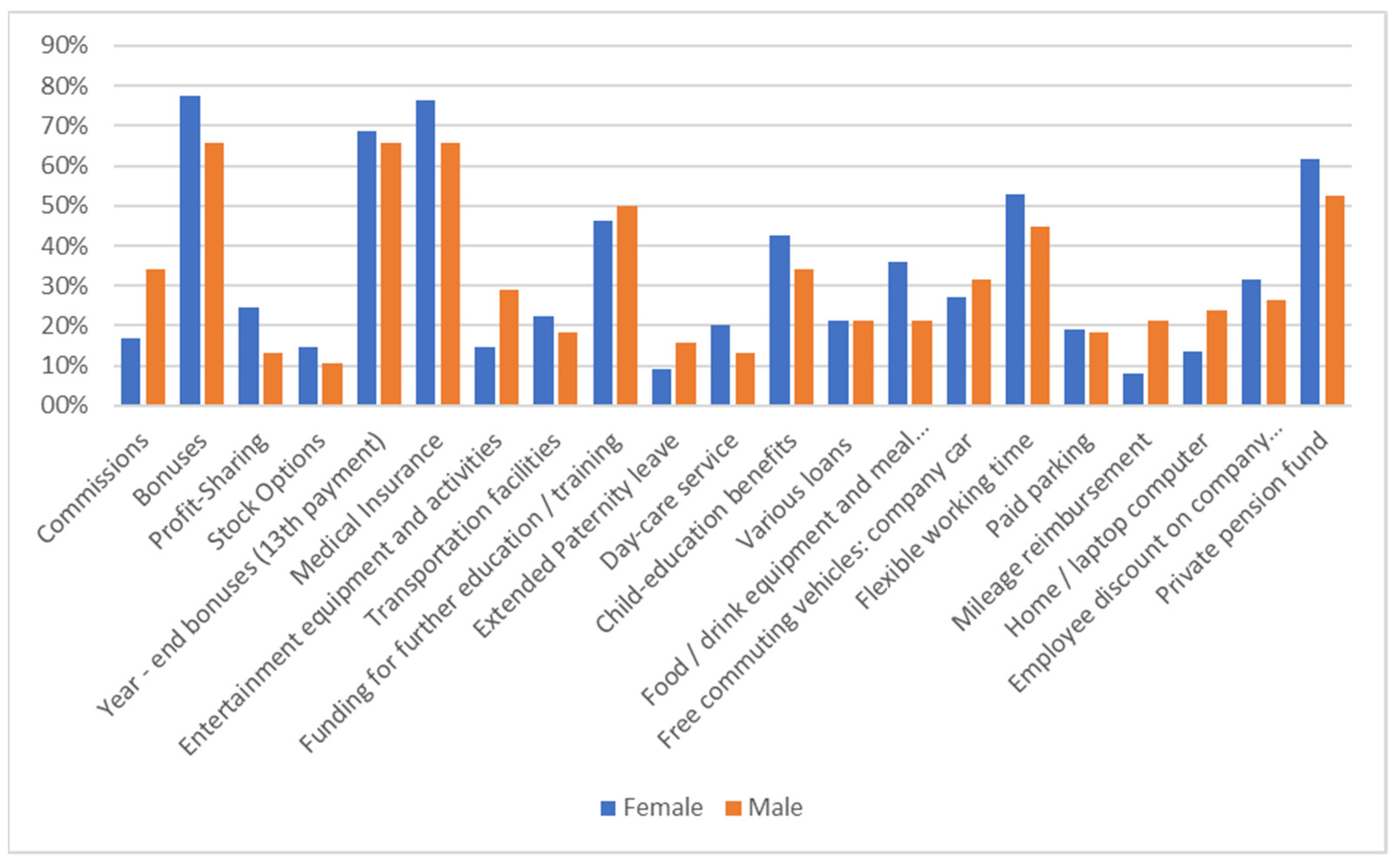

In 2018, a survey conducted by EBRI and Greenwald and Associates indicated that employees are receiving fewer benefits compared to the year 2017, as shown in

Figure 1 below.

They did not find specific reasons but made allegations that elements such as the destabilization of the insurance markets and the shift of the workforce from Baby Boomers to Millennials have affected the type and quantity employers offer benefits. This is especially since the new generation declared that they receive fewer basic benefits such as health, dental, and vision insurance. Despite this, workers are pleased with their compensation packet. Regarding those who were extremely satisfied, more unbelievable is the fact that they were more content in 2018 (51%) compared to 2017 (48%). 30% were somewhat satisfied, while only 9% were relatively low with their benefits package (

Greenwald and Fronstin 2019).

The hypothesis of the study: Employees are considerably satisfied with their benefits package.

3.3. A Compromise between Wages and Benefits

This section of the literature review contributed to drawing survey questions related to the second research objective of the study.

- RO2:

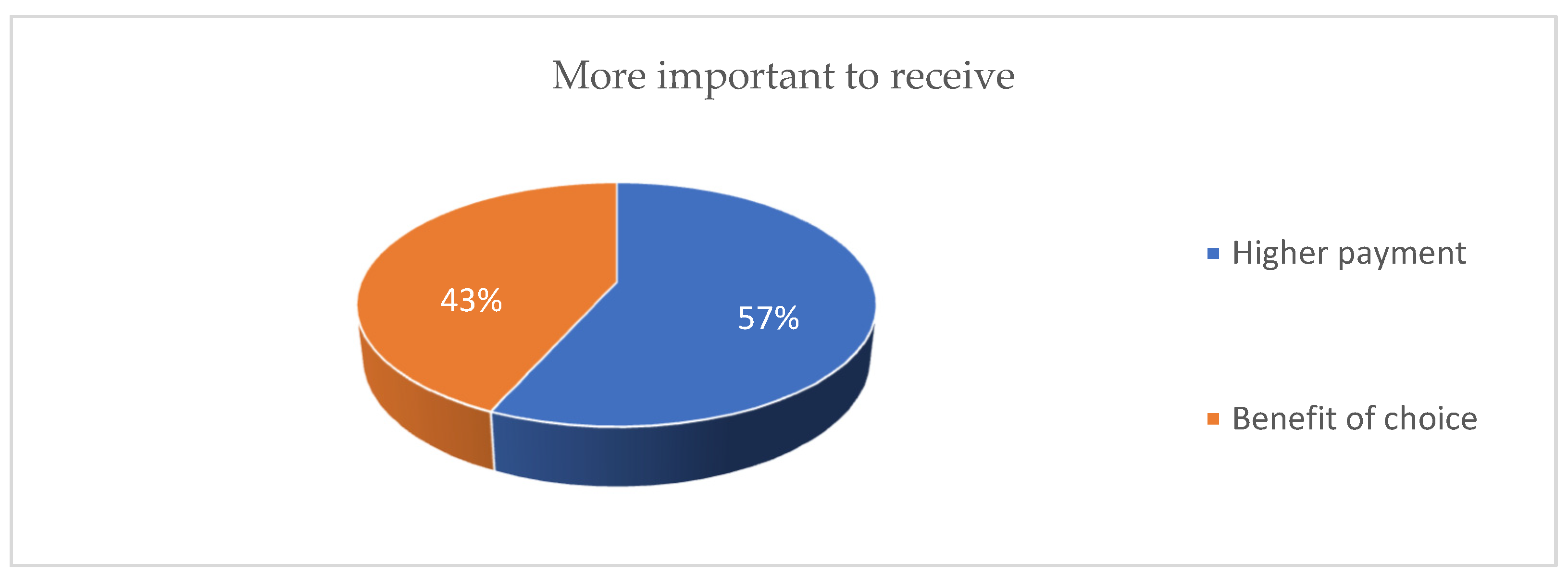

To explore if employees in Albania value a higher payment, or decide on what benefits to receive.

The simplest model assumes that all employees have the same liking concerning benefits and it measures the curve of indifference between wages and benefits. It was suggested that wages will be reduced if health care coverage and pensions increase (

Ehrenherg and Smith 1981). The correlation between wage and health care was approved by

Olson (

2002), who stated that employees have to give up 20% of their wages to move from a company that does not offer health insurance to one which does. On the other hand, Dorantes and Mach contradicted the negative link between wages and pension (

Dorantes and Mach 2003). They stated that while workers might sacrifice their insurance package to get paid more, this normally is not an option with retirement plans, which is associated with higher pay for both genders. One reason for this to happen is the restricted transferability of some pension plans from one company to another. So, for the worker to benefit from it, he or she has to work hard to maintain a healthy, long-term relationship with the company, which also increases the amount of money they earn. More recent studies contradicted those findings. Some employees might trade higher wages for more benefits, but that is not the norm (

Weathington 2008).

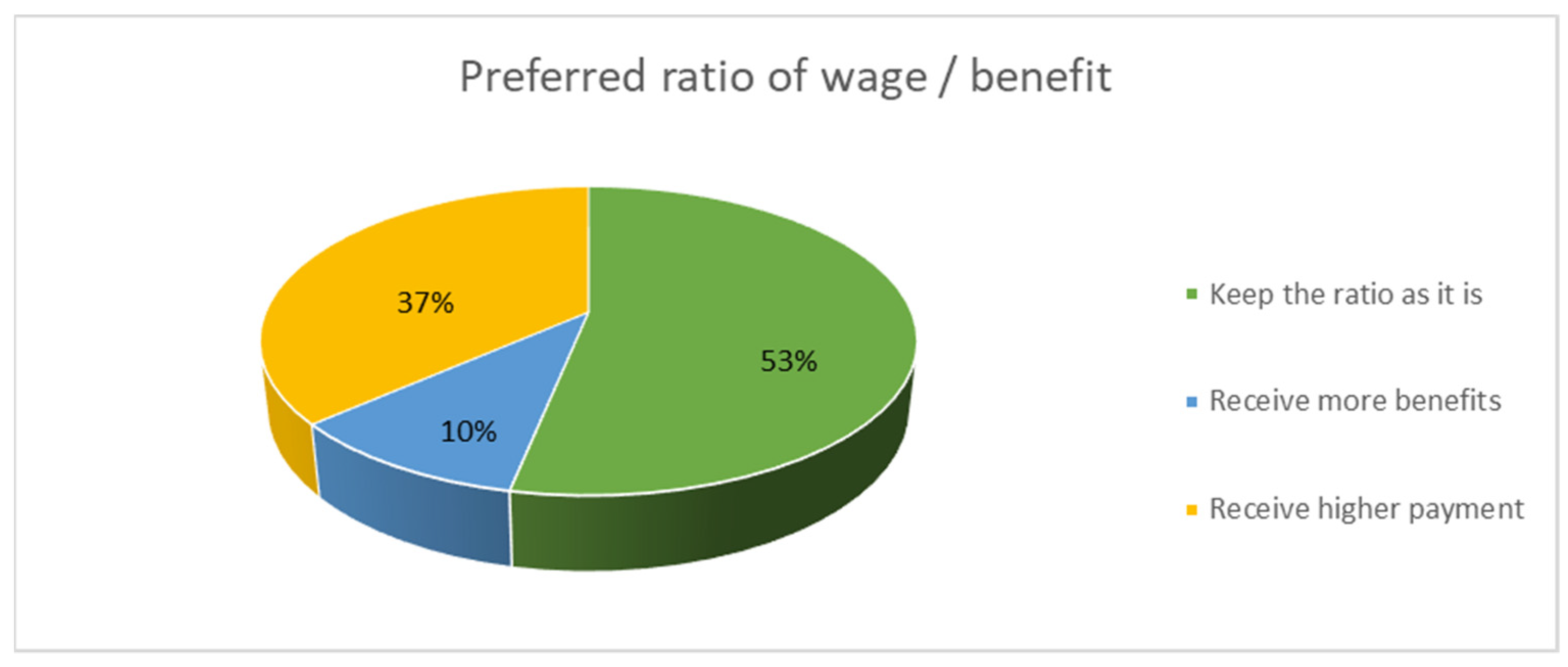

Tetrick et al. (

2010) conducted a study with 76 students from a big urban University in the US., to prove if there was any relation between being paid more money in return for accepting a lower number of benefits when applying for work. The result showed that applicants did not consider benefits and pay as a substitute for one another. An increase of

$10,000 per year would not counterbalance a decrease in paid time-off, having to contribute more to health insurance or other related to pension plans. A more recent study, conducted by EBRI and Greenwald and Associates Institute strived to find out how employees trade-off their salary with benefits. They organized an online survey with 1025 employees between the age of 21–65. The workers were asked if they would keep the wage-benefit rapport as it currently was, if they would prefer fewer benefits for a higher wage, or whether they would accept a lower payment to receive more benefits. The results showed that 58% would prefer to stay in the current benefit-wage situation, 24% wanted a higher wage even if they received fewer benefits, and only 18% accepted receiving less money but being rewarded in terms of incentives (

Greenwald and Fronstin 2019).

3.4. Compensation and Benefits in the Pandemic

- RO3:

To investigate the impact of COVID-19 on the Compensation and Benefits package.

After the pandemic started, studies emerged in the field of HR to investigate the COVID-19 impact. Authors such as Baskin and her colleagues preface the review with consideration of employment trends leading into 2020, including modifications to the traditional 40-h, Monday-Friday workweek, adjustments in minimum and subminimum wage, and growth in the gig economy. Next, they examine the response to COVID-19 in the US, summarizing legislation that has examined the opportunities of suggesting intervention opportunities for HRM professionals concerning the traditional workweek, worker classification, employee benefits, and workplace safety.

According to

Abston and Bryant (

2021) compensation and benefits area will be impacted by lost revenue and increased costs because of the pandemic. “The flexibility to work remotely has, of course, been a major point of discussion, and employees are also looking for increased paid time off (PTO) options” (

Hampton 2020). While,

Kilgour (

2020) says that pension plans, especially those that were already struggling will face a stormy sea due to the pandemic.

Lester et al. (

2021) summarizing legislation has examined the opportunities of suggesting intervention opportunities for HRM professionals concerning the traditional workweek, worker classification, employee benefits, and workplace safety.