1. Introduction

Over the last few years, the European Commission has undertaken several initiatives aimed at reducing the shortcomings of voluntary reporting on social and environmental issues, which often offers an unbalanced, little transparent, low-quality, incomparable, and even misleading picture of the company (

Boiral 2013;

Diouf and Boiral 2017;

García-Sánchez and Araújo-Bernardo 2020). On several occasions, the EU has highlighted the need to enhance corporate transparency and performance and encouraged European companies to develop a more sustainable approach (

EU Commission 2014). The most extensive development in mandatory general transparency was undertaken with the adoption of the Directive 2014/95/EU, amending Directive 2013/34/EU as regards the disclosure of nonfinancial and diversity information by large undertakings and groups. Specifically, the EU Directive mandates public interest entities (PIEs) to draw up a nonfinancial statement including information related to “environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters” (

EU Commission 2014, par. 1). Therefore, Directive 2014/95/EU has led to a new European scenario for corporate reporting where nonfinancial information (NFI) disclosure changes from voluntary to mandatory. Italy was one of the first states to transpose the Directive into its legal system by Legislative Decree 254/2016, which entered into force on 25 January 2017. Although Italy had already envisaged the mandatory drafting of social reports for certain types of companies, numerous studies have shown a low propensity to voluntarily disclose social and environmental information and limited experience in the field of sustainability reporting (

Mio and Venturelli 2013;

Venturelli et al. 2017;

Doni et al. 2019). These premises highlight, on the one hand, the potential contribution of the EU directive to NFI disclosure in Italy (

Venturelli et al. 2019) and, on the other hand, the great difficulty that Italian companies could face in implementing the new requirements (

Doni et al. 2019). Spain, on the contrary, was one of the last Member States to implement the EU Directive. The national transposition started through Royal Decree-Law 18/2017 on 24 November 2017, almost one year after the deadline (

Curtó-Pagès et al. 2021). In this early stage, the implementation process did not include additional requirements beyond the EU provisions (

Sierra-Garcia et al. 2018;

Andrades et al. 2019). One year later, an extension of the Royal Decree-Law 18/2017 was established, leading to the publication of Law 11/2018 on 28 December 2018. This law incorporated the EU Directive into Spanish legislation by raising the level of rigorousness and transparency of NFI to be disclosed (

Montesinos and Brusca 2019).

The decision in this study to focus on Italy and Spain comes from the consideration that although the transposition of the Directive in these two countries took place at different times, both countries have demonstrated strong communication and professionalism over time and taken leading ranks in terms of the rate of sustainability reporting diffusion by maturity (

KPMG 2011,

2020). Moreover, only limited research has studied the EU Directive’s impact at the cross-country level, with little analysis of NFI published before and after the new law (

Mion and Loza Adaui 2019;

Artene et al. 2020;

Nicolò et al. 2020,

2021). No study has yet focused on the comparison between Italy and Spain in the transposition of the Directive. Therefore, to date, this is the first study aimed to analyse the effects of the Directive on both countries over three years. Indeed, the primary purpose of this study is to investigate the differences in the levels of NFI disclosed by Italian and Spanish listed companies over three years, namely, the year before the publication of the Directive, the year before its adoption into national legislation and the first year of its entry into force. Indeed, it is necessary to analyse the period before and after the introduction of a new law to understand its real impact (

Doni et al. 2019;

Mion and Loza Adaui 2019). This study aims to answer the following three research questions: (1) How did the new regulation influence companies’ disclosure levels in Italy and Spain? (2) What are the sustainability indicators that companies of both countries are currently using to meet the Directive’s demands compared with those used previously for reporting? (3) Did the NFI Directive’s implementation lead to substantial changes in the adoption of assurance practices and, where already applied, in their characteristics?

This study uses institutional theory (

DiMaggio and Powell 1983;

Meyer and Rowan 1977) to assess the early phases of the institutionalisation of the new mandatory reporting practices of Italian and Spanish listed companies. Through institutional theory, it is possible to explore how institutional pressures related to coercive, normative, and mimetic forces produce effects on practices, values, and beliefs that became institutionalised within companies.

To this aim, a qualitative content analysis was performed on sustainability reports, integrated reports, and NFI disclosure drawn up by companies before and/or after the adoption of the EU directive. We explored only reports drawn up according to GRI standards or guidelines, focusing our attention on the sustainability indicators disclosed and the assurance practices of the companies in the sample.

This study contributes to both the theoretical and empirical literature on mandatory NFI reporting and the use of sustainability performance indicators. First, using the institutional theory lens, we want to contribute to understanding Italian and Spanish companies’ responses to the new regulation and, more generally, enrich cross-country literature on the adoption of the new law. Only a limited number of studies have investigated how the shift from voluntary to mandatory NFI disclosure has influenced corporate disclosure performance by focusing on the extent of GRI indicators reported by companies (

Sierra-Garcia et al. 2018;

Raucci et al. 2020;

Tarquinio et al. 2020). In addition, this is one of the few studies to evaluate the effects produced by legal provisions on the assurance procedures of nonfinancial disclosure. Indeed, as highlighted above, both Italian and Spanish transposition laws require the external verification of nonfinancial statements. Furthermore, the literature has often emphasised the positive relationship between the assurance of nonfinancial reports and the information disclosure level (

Venturelli et al. 2017;

Tarquinio et al. 2018;

Caputo et al. 2020).

This study has practical implications for policymakers assessing the new law’s effectiveness in promoting nonfinancial reporting during the first stage of its implementation. Therefore, our findings can support the formulation of strategies useful for improving the transparency and harmonisation of NFI disclosure practices, with benefits for investors and stakeholders. Moreover, the focus on using sustainability performance indicators might support standard setters in evaluating and rethinking the type and characteristics of the indicators under this new scenario for NFI reporting.

The remainder of this paper consists of sections presenting the regulatory background and theoretical framework, literature review, methodology and method, results, discussion and conclusion.

2. Regulatory Background and Theoretical Framework

The Spanish and Italian regulatory contexts differ significantly. In Spain, mandatory regulations on social and environmental disclosure were applied before the Directive was adopted, albeit with little success. In 1998, the Spanish government introduced a law requiring companies to disclose environmental information in corporate financial statements, but as

Bebbington et al. (

2012) showed, a considerable level of noncompliance was detected. A significant step was taken through the publication of the Sustainable Economy Law 2/2011 (SEL), intended to reach meaningful progress in the area of sustainability reporting. Indeed, this Spanish law has been cited, together with the 2008 Act amending the Danish Financial Statement Act, as a precedent for the EU Directive (

Garcia-Torea et al. 2020). Specifically, the SEL mandated companies exceeding 1000 employees to publish a sustainability report and submit it to the State Council on Corporate Social Responsibility (SCCSR) (

Luque-Vílchez and Larrinaga 2016). However, again, regulation on sustainability reporting failed to produce a real impact on the disclosure practices of Spanish companies (

Luque-Vílchez and Larrinaga 2016;

Sierra-Garcia et al. 2018).

In Italy, mandatory reporting on social and environmental issues did not exist until 1997, when it was envisaged only for certain types of not-for-profit organisations. More generally, Italian companies showed a low propensity to voluntarily disclose social and environmental information, resulting in limited experience in sustainability reporting (

Mio and Venturelli 2013;

Venturelli et al. 2017;

Doni et al. 2019). These premises highlight, on the one hand, the potential contribution of the EU directive to NFI disclosure in Italy (

Venturelli et al. 2019) and, on the other hand, the great difficulty that Italian companies could face in the implementation of the new requirements (

Doni et al. 2019).

The NFI Directive granted the Member States some discretion when transposing the law into national legislation. It established a minimum set of mandatory disclosure requirements, but in some respects, it also provided a list of options to choose from (

Aureli et al. 2020;

Pizzi et al. 2020). The aim was to ensure the law’s implementation across the Member States by accounting for the national context and any existing NFI disclosure requirements (

CSR Europe and GRI 2017). Specifically, the options given refer to the location of NFI, the use of reporting standards or guidelines, the external verification of information by an independent assurance provider, the possibility for companies to omit information seriously prejudicial to their commercial position (Safe Harbour Principle), and the application of non-compliance penalties (

EU Commission 2014). Moreover, Member States could use discretion to set requirements that exceeded the Directive provisions while remaining within the EU objectives (

Aureli et al. 2020). Several Member States adapted and expanded the definitions of “large undertakings” and “PIEs”, thus increasing the scope of the Directive (

CSR Europe and GRI 2017). The specific national requirements set by the Italian and Spanish laws are shown in

Table 1.

Numerous studies have highlighted the role of legal provisions in the disclosure of NFI (

Moseñe et al. 2013;

García-Sánchez et al. 2016;

Martínez-Ferrero and García-Sánchez 2017;

Dagilienė and Nedzinskienė 2018;

Tiron-Tudor et al. 2019;

Aureli et al. 2020;

Tarquinio et al. 2020). These studies have used institutional theory as a conceptual framework, showing how the institutional environment in which companies operate influences corporate disclosure practices (

Shabana et al. 2017;

Lombardi et al. 2021). According to institutional theory, companies are influenced by their socio-institutional environment, to which they conform to gain legitimacy and ensure survival. One of the main components of institutional theory is the concept of isomorphism. Coercive, mimetic, and normative isomorphic processes influence organisations to conform to the recognised socially constructed systems of values, beliefs, norms, and definitions (

Meyer and Rowan 1977;

DiMaggio and Powell 1983;

Suchman 1995). Coercive pressures stem from the regulatory legal system and societal expectations; normative pressures are associated with the professional norms and values defining a specific field; mimetic pressures refer to the imitation of successful or leading companies as a response to uncertainty (

DiMaggio and Powell 1983). In this study, the EU Directive is seen as a coercive factor that, by making NFI mandatory, could affect corporate reporting practices, even in companies disclosing NFI even before its introduction. Indeed, regulation is considered one of NFI reporting’s most influential drivers (

de la Cuesta and Valor 2013;

Tiron-Tudor et al. 2019). However, companies’ response to coercive pressures is not uniform, but it can vary according to different factors, such as the national context (

Dumitru et al. 2017;

Rahman et al. 2019;

Aureli et al. 2020). Therefore, our study aims to explore differences in the disclosure of NFI both over time, verifying the effects of the new law, and between two different countries to examine the role of national legislation in the transposition of the Directive and the implementation of pre-existing regulations in this area.

3. Literature Review

The introduction of the European Directive has stimulated scientific research on the effects of mandatory reporting on the quality and quantity of NFI.

The idea that regulation alone could increase NFI levels was initially widely spread in the academic literature (

Venturelli et al. 2017;

Caputo et al. 2020). In this sense, governments’ imposition of specific rules and reporting models could harmonise NFI disclosure by facilitating benchmarking, enhancing the credibility of NFI, and increasing its accuracy and comprehensiveness (

Allini and Manes-Rossi 2007;

Crawford and Williams 2010;

Caputo et al. 2020). On the other hand, some authors argued that better disclosure practices could not be achieved only through mandatory requirements (

Bebbington et al. 2012;

Luque-Vílchez and Larrinaga 2016;

Doni et al. 2019). Regulation reduces the flexibility that is useful for capturing business-specific nonfinancial aspects (

Allini and Manes-Rossi 2007;

Venturelli et al. 2017) and could lead companies to exhibit responsible behaviour merely aiming at compliance (

Tarquinio et al. 2020). Stronger dedication and commitment could be guaranteed by voluntary reporting practices, which confer more legitimacy on companies (

Venturelli et al. 2017;

La Torre et al. 2018). However, consensus has not yet been reached regarding mandatory or voluntary NFI reporting (

Mazzotta et al. 2020). Indeed, several drawbacks are associated with voluntary disclosure, such as lack of accuracy, neutrality, objectivity, and comparability (

Hąbek and Wolniak 2016;

Caputo et al. 2020).

Several studies have verified the impact of the EU Directive at the single-country and cross-country levels. We focused on the studies that have investigated companies’ reporting practices before or after their adoption of the Directive, and on those that have compared NFI disclosed before and after the new law entered into force.

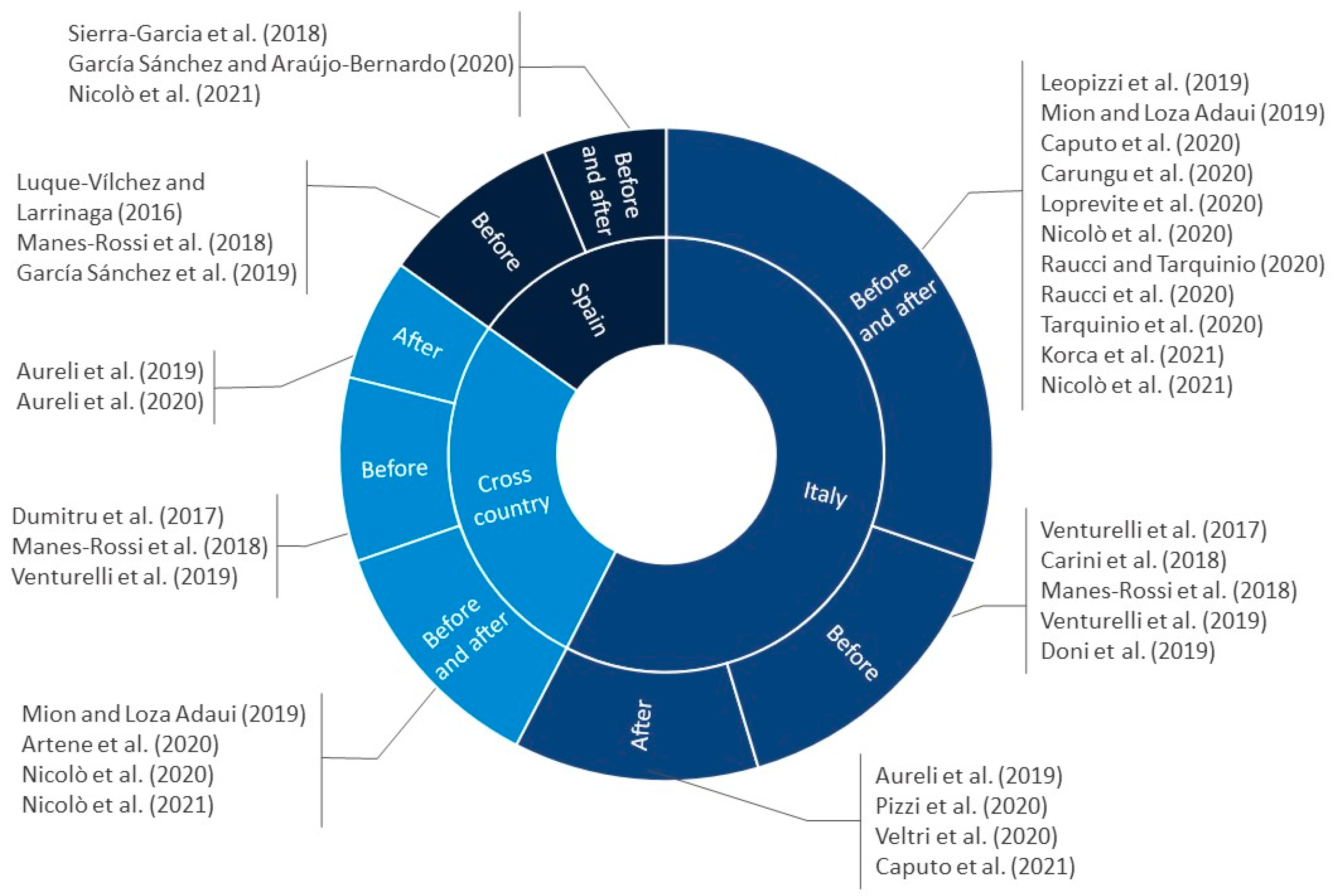

Figure 1 shows the studies that examine the effects produced by the implementation of the Directive in Italy, Spain, and at the cross-country level, grouped according to the above research streams identified in the academic literature.

With reference to the Italian case, most of the studies compared NFI before and after the decree, showing, on the one hand, an increase in the quality of disclosure (

Leopizzi et al. 2019;

Mion and Loza Adaui 2019;

Caputo et al. 2020;

Nicolò et al. 2021) and, on the other hand, a general reduction in the number of sustainability indicators disclosed by Italian companies (

Loprevite et al. 2020;

Raucci and Tarquinio 2020;

Raucci et al. 2020;

Tarquinio et al. 2020). On the contrary,

Korca et al. (

2021) found a significant increase in the quantity but not in the quality of NFI. Other authors, instead, did not find a decisive influence of the Directive on disclosure levels (

Carungu et al. 2020;

Nicolò et al. 2020). Post-implementation analyses focused on subtopics of NFI, identifying a positive association between the quality of nonfinancial risk information and market value (

Veltri et al. 2020), showing that corporate governance and report characteristics affect environmental information (

Caputo et al. 2021), and revealing high heterogeneity in the quality of SDG reporting (

Pizzi et al. 2021). Previous studies have analysed the information gap and the consequential adjustment required by the Directive based on the NFI disclosed before its implementation in national law (

Venturelli et al. 2017;

Carini et al. 2018;

Manes-Rossi et al. 2018;

Venturelli et al. 2019;

Doni et al. 2019).

Studies on the impact generated by legislative changes in Spain are less numerous than studies related to the Italian case. Most of the Spanish studies aimed to explore the mandatory reporting of NFI by analysing the reporting behaviour of Spanish companies before the Directive’s adoption (

Luque-Vílchez and Larrinaga 2016;

Manes-Rossi et al. 2018;

García Sánchez et al. 2019). In addition, longitudinal analyses have been carried out to investigate changes in the impression management techniques used in nonfinancial reports (

García-Sánchez and Araújo-Bernardo 2020) and in the location of NFI (

Sierra-Garcia et al. 2018). Effects at the NFI level were only analysed with respect to reports drawn up after the publication of the Spanish adaptation, identifying a relationship between the level of regulatory compliance and the business sector (

Sierra-Garcia et al. 2018).

As shown in

Figure 1, limited studies have investigated the EU Directive’s impact at the cross-country level, scarcely analysing the NFI published before and after the new law’s introduction. To address this gap, our study examines the evolutionary path of NFI in the EU Directive scenario through an analysis of the pre- and post-implementation of the Directive by Italian and Spanish listed companies.

4. Methodology and Method

To investigate how Directive 2014/95/UE has affected the NFI disclosed by Italian and Spanish listed companies, we performed a content analysis to verify the quantity and typology of Global Reporting Initiative (GRI) performance indicators disclosed in the nonfinancial reports produced by companies. Content analysis is a research technique frequently used in the literature to examine the extent of sustainability disclosures (

Guthrie and Farneti 2008;

Fonseca et al. 2011;

Roca and Searcy 2012;

Tarquinio et al. 2015). We focus our analysis on companies adopting the GRI standards because they are generally deemed as the most detailed and structured set of standards proposing analytical requirements for nonfinancial reporting information (

Skouloudis et al. 2009). Moreover, GRI standards are the dominant global standards for reporting on nonfinancial information (

KPMG 2020).The analysis is based on the reports published by Italian companies in 2013, 2016, and 2017 and the reports issued by Spanish companies in 2013, 2017, and 2018. We referred to different years considering the different timing of the EU Directive’s transposition into Italian and Spanish regulations. Indeed, this study’s primary purpose is to analyse the differences in disclosure levels before and after the publication of the Directive and its adoption into the two national legislations.

4.1. Sample Selection

As a starting sample, we selected the 40 Italian companies belonging to the FTSE MIB Index and the 35 Spanish companies included in the IBEX 35 Index updated to October 2019. The FTSE MIB Index consists of the most liquid and highly capitalised stocks listed on the Italian Stock Exchange, and the IBEX 35 Index is composed of the most liquid stocks traded on the Spanish Stock Exchange. Consequently, the comparison was made among the nonfinancial reporting practices of the most representative Italian and Spanish companies.

To evaluate the impact of the Directive on NFI disclosure, it was necessary to verify how many companies belonging to our sample fulfilled the requirements of Italian Decree 254/2016 and Spanish Law 11/2018 by producing a nonfinancial statement in 2017 (in the Italian case) and in 2018 (in the Spanish case). All Spanish companies in our sample published their nonfinancial statements following national law. However, this is not the case for the Italian sample. Consequently, 9 Italian companies were excluded from the analysis because their nonfinancial statements were not prepared in accordance with the Italian Decree. Therefore, the final sample consists of 35 Spanish companies and 31 Italian companies, for a total of 66 companies.

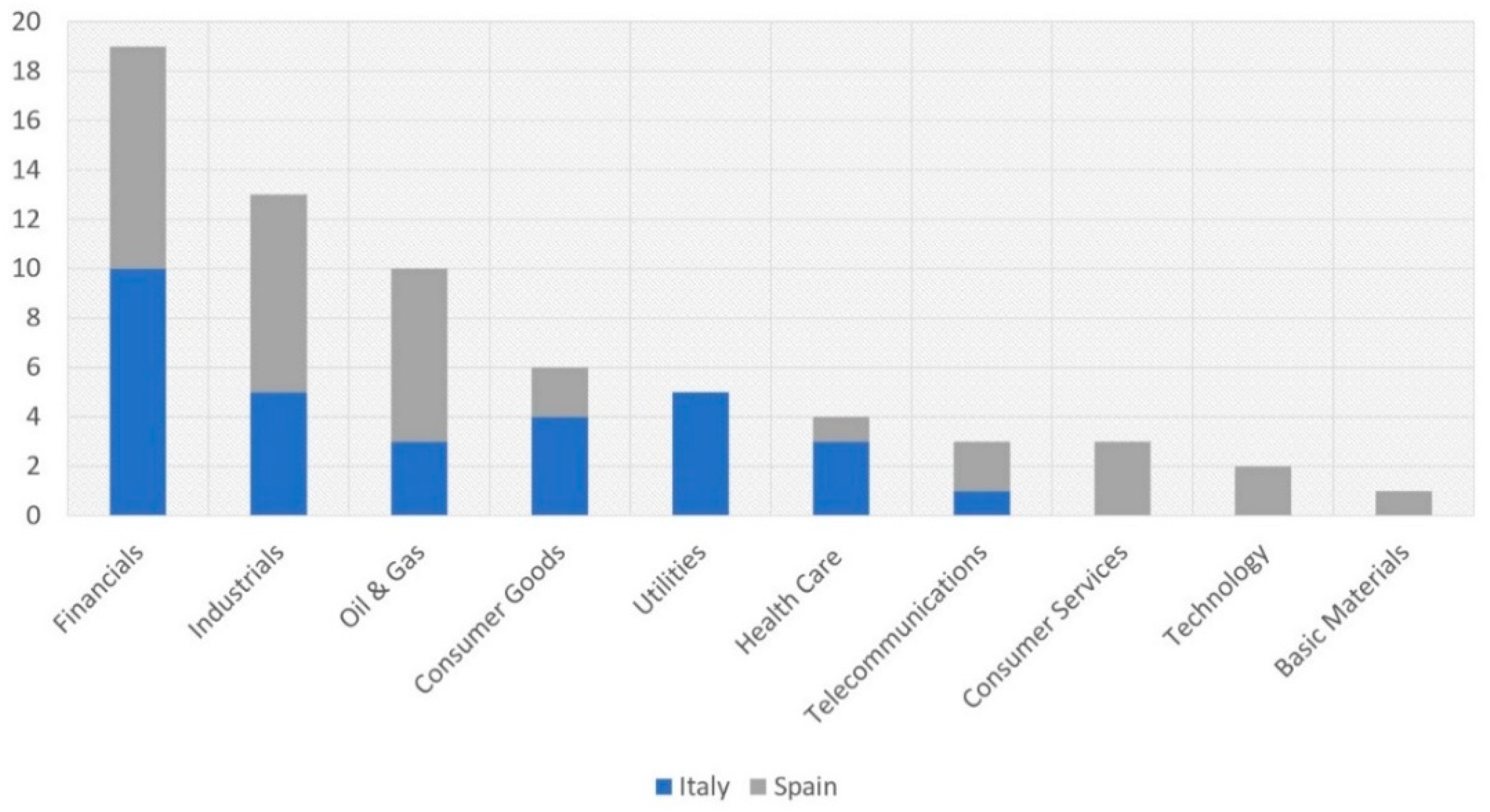

Figure 2 shows the 66 companies analysed, classified according to their industrial sector. Since the Italian and Spanish Stock Exchanges do not equally define all sectors, we subdivided companies using the

Industry Structure and Definitions document provided by the Industry Classification Benchmark (ICB). Most companies belong to the financial sector, followed by the industrial and the oil & gas sectors.

4.2. Data Collection

The analysis was carried out by collecting data from GRI-based NFI disclosures published by the sampled companies. To identify the performance indicators disclosed, we used the GRI Content Indexes attached to the nonfinancial reports or the websites. The GRI Content Index is a navigation tool that provides a complete, accurate, and transparent overview of the disclosures addressed in a GRI-based report by indicating the adoption and position of each GRI indicator (

GRI 2012).

However, it was not possible for some companies to find the GRI Index in the NFI report or on the company’s website. Consequently, these companies were not considered in the analysis for the year in which the GRI Index was not available.

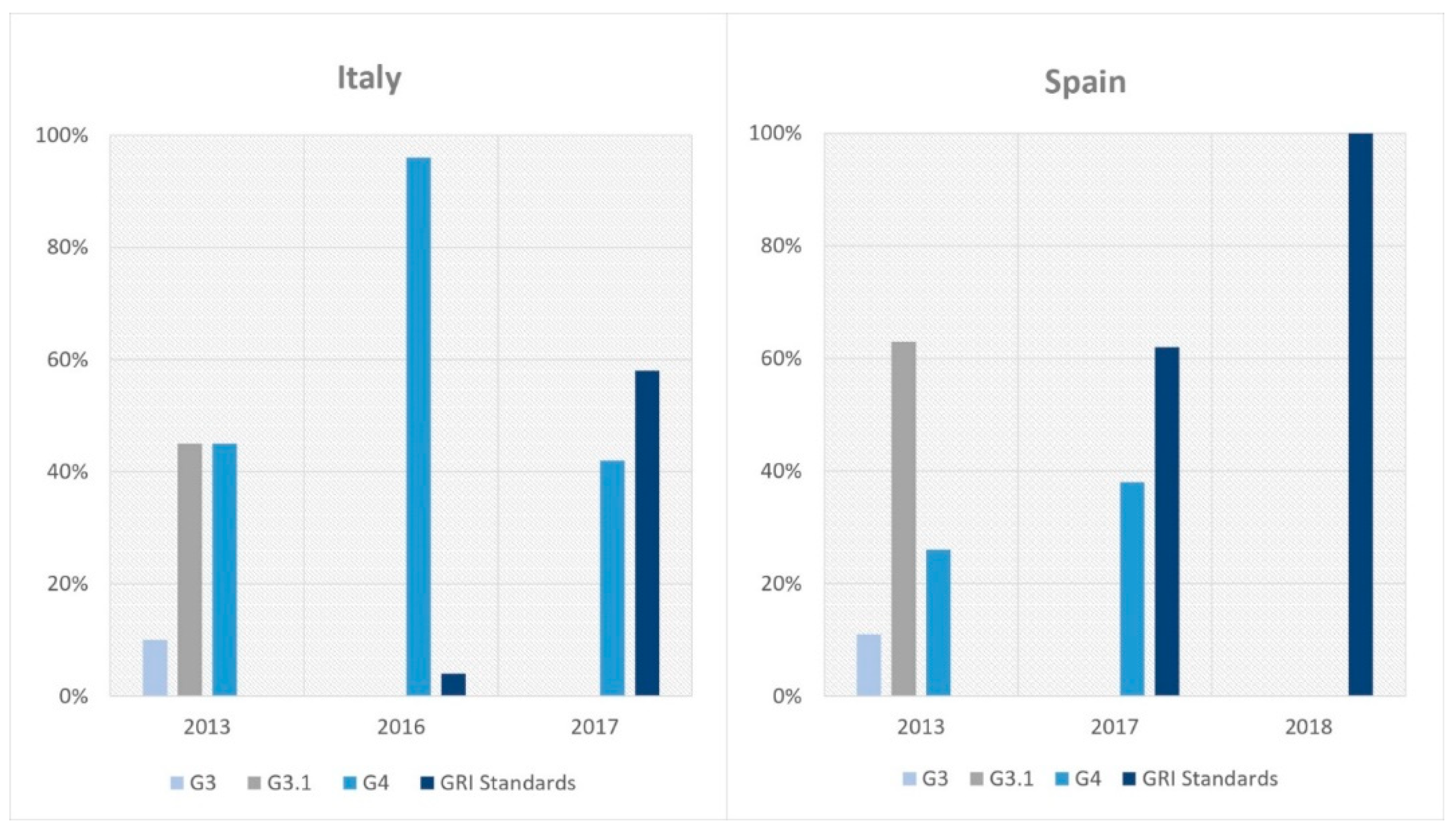

The companies used different versions of the GRI guidelines over the years analysed. As shown in

Figure 3, in 2013, the companies used versions G3, G3.1, and G4. In 2016, 2017, and 2018, the G4 and GRI Standards were adopted.

The adoption of different GRI versions required the use of a conversion table (see

Table 2). Indeed, the various ways in which indicators are named and organised would not have allowed us to carry out an objective and reliable comparison between the quantity of NFI disclosed before and after the regulatory intervention.

Table 2 integrates the information in the GRI’s three mapping tools to offer an overview of the changes in indicators that occurred from G3 to G3.1, from G3.1 to G4 and from G4 to GRI Standards (

GRI 2012,

2013,

2017a). In line with the purposes of our analysis,

Table 2 focuses on the new indicators introduced and on those deleted in the transition from one version to another. Moreover, the link between the G4 indicators and the GRI Standard disclosures is provided. Changes applied in terms of content and requirements were not taken into consideration in the conversion table.

Specifically, to verify the quantity and typology of NFI reported by companies, we considered the sustainability performance indicators included in Part 2 Standard Disclosures of the G3 and G3.1, in the Specific Standard Disclosures section of the G4 and in the Topic-specific Standards (200, 300 and 400 series) of the GRI Standards. In all four versions, these indicators are classified into Economic (EC), Environmental (EN), and Social (SOC) categories. In the G3, G3.1, and G4, social indicators are further subdivided into four subcategories: labour practices and decent work (LA), human rights (HR), society (SO), and product responsibility (PR). The conversion table also allowed us to apply this classification to the GRI Standards.

We checked for the presence or absence of the NFI reports’ assurance before and after adopting the EU Directive. We gathered information about assurance providers, standards adopted, and the level of assurance by the companies’ assurance statements over the years observed.

4.3. Disclosure Index

The level of NFI disclosure was scored using the disclosure index proposed by

Cooke (

1989). The disclosure index methodology consists of calculating the number of information-related items in a report based on a predefined list of the total items that could be disclosed (

Cooke 1989). Consequently, the first step in the construction of the disclosure index was the selection of items. As mentioned above, the index applied in this analysis included items based on GRI performance indicators. Numerous studies have adopted GRI indicators to measure the amount of disclosure (

Guthrie and Farneti 2008;

Roca and Searcy 2012;

Tarquinio et al. 2018). The indicators we considered in developing the NFI disclosure index are presented in

Table 2.

Subsequently, it was necessary to establish rules for coding the data. To this aim, we followed a dichotomous procedure where “1” was assigned if an indicator was fully or partially disclosed and “0” if absent. We used an unweighted approach where each indicator was deemed equally important (

Cooke 1989) to reduce the possible bias resulting from a subjective weighting (

Raffournier 1995). To ensure the reliability and consistency of the analysis, GRI indexes were verified by two separate researchers. For the collection of the data, an excel sheet was prepared. The researchers compared the data collected with reference to a sample of 10 nonfinancial reports under investigation. Then, the data were compared, and the discrepancies found were discussed, leading to an adjustment of the data collection form. The final dataset was then built.

The disclosure index was obtained by dividing the number of GRI indicators disclosed by a company in the nonfinancial report by the GRI’s total number of indicators. Formally:

where

M = number of GRI indicators disclosed by company j, M ≤ n

= (“1” if the GRI indicator was disclosed)

(“0” if the GRI indicator was not disclosed)

= total number of GRI indicators

= disclosure index for company j, 0 ≤ ≤ 1

As shown in

Table 2, the economic (EC), environmental (EN), and social (SOC) categories contain different numbers of GRI indicators, which depends on the version of the GRI guidelines used by the company. Consequently, in formulas (1) and (2), the total number of indicators a company is expected to report (n) varies according to the category under consideration and the GRI version adopted (see

Table 3).

To understand the effects of Directive 2014/95/UE, we calculated the index and the descriptive statistics for each year under analysis, and then we compared the results obtained over time.

5. Results

Our study explored the evolution of NFI disclosure levels after the transposition of Directive 2014/95/EU into Italian and Spanish regulations by constructing a disclosure index. The disclosure index measured the extent of NFI disclosed based on the quantity of GRI indicators reported by the sampled companies before and after adopting the Directive. Indeed, the use of GRI indicators enables companies to meet all requirements of the new law by offering a full and balanced overview of their performance and the related impacts (

GRI 2017b). To answer the first research question, we examined the effects of the EU legislation on overall economic, environmental, and social disclosure performance, focusing on indicator changes.

Figure 4 introduces the disclosure analysis by showing the percentage of Italian and Spanish companies, sorted by industrial sector, that have produced a nonfinancial report over the three years analysed.

Focusing on the years of experience gained by the sampled companies in NFI disclosure, EU regulation has significantly impacted Italy. In 2013, only 56% of Italian companies drew up a sustainability report, compared to 95% of Spanish companies. Moreover, a year before the EU law was implemented in national legislation, all Spanish companies had already published a nonfinancial report. In contrast, this percentage was reached in Italy until after the entry into force of Decree 254/2016. In both countries, the companies included in the financial sector were the most active in disclosing NFI since 2013, followed by companies belonging to the utilities sector in Italy and those belonging to the industrial sector in Spain. In Italy, the introduction of the Directive led to an increase in NFI disclosure practices mainly in the financial and health care sectors (from 19% in 2013 to 32% in 2017 and from 0% to 10%, respectively). In Spain, the financial and telecommunications sectors were the most influenced, presenting slight increases of 2% and 3%, respectively.

5.1. Disclosure Index

The disclosure index was calculated for each category and subcategory of indicators set by the GRI. Furthermore, a total disclosure index was obtained by considering the GRI indicators in the economic (EC), environmental (EN), and social (SOC) categories altogether. The disclosure index can take values from 0 to 1. The higher the value assumed by the index is, the higher the level of NFI disclosed.

Table 4 provides descriptive statistics on the Italian and Spanish samples’ disclosure index before and after the EU Directive and its adoption into the respective legislations.

In 2013, although Spanish companies were more active than Italian companies in publishing sustainability reports (see

Figure 4), the level of NFI disclosed by the former was significantly lower. GRI indicators were better represented in Italian companies’ reports, with an average index equal to 0.86 for the economic category, followed by the social (0.77) and environmental (0.70) categories. The most disclosed social indicators were those related to labour practices, with an average of 0.92. The EN and SOC indicators featured a higher standard deviation than the EC indicators, indicating greater contrast among companies in the reporting of environmental and social topics. Specifically, indicators about human rights had the highest standard deviation, equal to 0.41. All categories had median values greater than the related mean, revealing that the number of indicators disclosed for each category by most of the Italian companies was higher than the average. Overall, the average value of 0.75 highlights a higher level of NFI disclosure among Italian companies than among Spanish companies, which, on average, achieved a total index of 0.34. In Spain, the social indicators were those more frequently reported, with an average index amounting to 0.36 and particular attention to indicators concerning human rights (0.39). Moreover, the least reported category was the economic category (0.28). Unlike the case in Italy, in Spain, the economic indicators had the lowest concentration around the average (standard deviation of 0.37). All categories had median values lower than their average values, except the indicators related to product responsibility, for which the opposite result was found.

In 2016, we registered a general decrease in the level of disclosure of Italian companies, which obtained, on average, a total index equal to 0.54. This reduction involved all the indicator categories, especially the EC indicators. Nevertheless, compared with the EN and SOC categories, the economic category (with an average value of 0.57) was the most reported. It had the highest standard deviation (0.28), suggesting a greater dispersion among Italian companies in the disclosure of these indicators. Indicators regarding labour practices, with an average index of 0.68, represented the most general social category and, together with indicators related to product responsibility, were the only ones that still had median values higher than the average.

In contrast to the Italian case, in 2017, the average index increased in all categories disclosed by Spanish companies, resulting in a total average value of 0.58. The indicators presenting the greatest increase were those related to EC, representing the most common category, with an average value of 0.61. Particularly interesting are the values assumed by indicators related to human rights. In Italy, these indicators were less frequently disclosed before the new law (average index of 0.35). In contrast, in Spain, they represented, on average, the most mentioned social category (0.68). They presented the widest gap between the average (0.68) and the median (0.89) values, signalling less symmetry in their distribution. Moreover, a considerable difference among Spanish companies in reporting the EN indicators is suggested by a standard deviation of 0.38.

After the adoption of Decree 254/2016, Italian companies further reduced the amount of NFI disclosed in all categories, achieving, on average, a total index equal to 0.42. EC indicators, with an average index of 0.42, were the most diminished over the previous year and constitute the only category for which the median value exceeds the average, with the smallest gap between the two values (0.44 and 0.42, respectively). The SOC category had the highest average index (0.46), and indicators related to labour practices were again the most cited social indicators (0.58). Insufficient attention continued to be paid to human rights indicators, which presented, on average, an index of 0.29. The environmental category featured a larger concentration around the average value (standard deviation of 0.22). The economic category, on the other hand, had the largest standard deviation (0.31). With the entry into force of Royal Decree-Law 18/2017, Spanish companies reduced their levels of NFI disclosure compared to the previous year, but they maintained a higher level than 2013 (with a total index amounting to an average of 0.52). This applied to all categories of indicators and notably to the social category, whose index decreased from 0.59 in 2017 to 0.52 in 2018. A significant reduction can be seen for indicators concerning labour practices, from 0.56 to 0.45. In addition, these indicators have the largest difference between the average value (0.45) and the median (0.31). The most disclosed category is still related to EC, with an average index of 0.55 and the highest standard deviation (0.38) compared with the EN and SOC categories, for which the values of the average index (0.52 in both cases) and the standard deviation (0.35 and 0.34, respectively) are very similar.

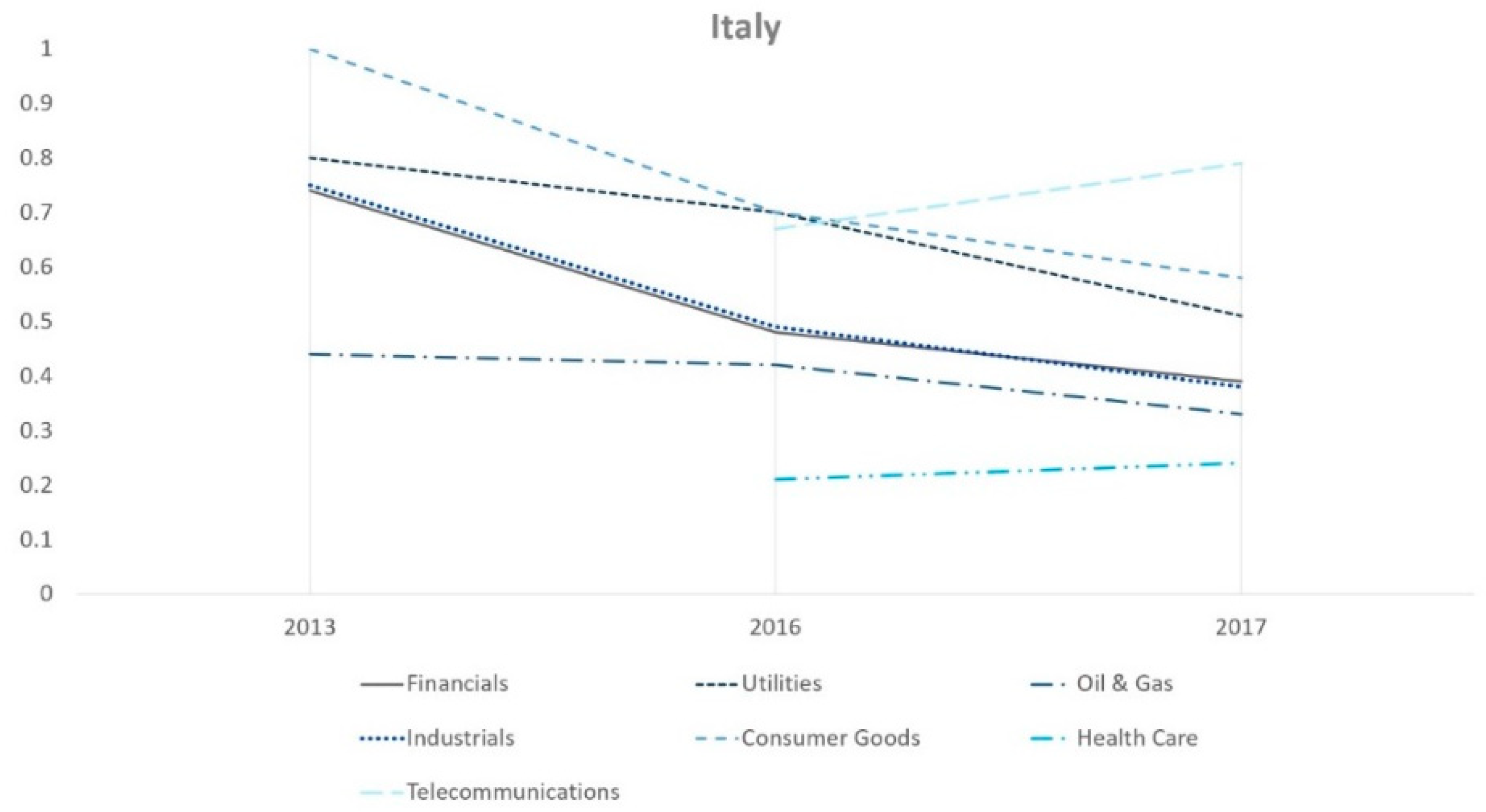

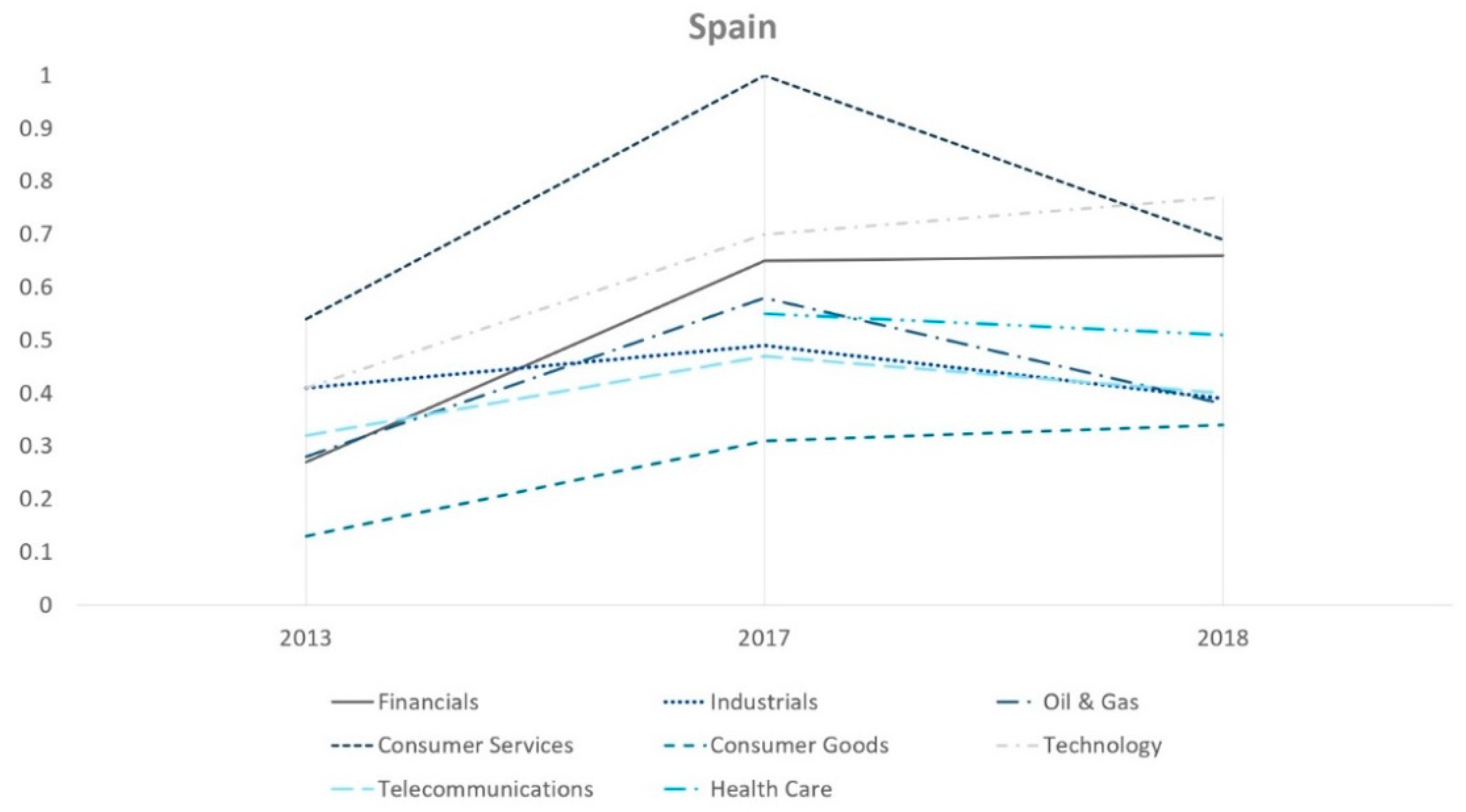

Figure 5 and

Figure 6 show, by industrial sector, the average trends of the total disclosure indexes of Italy and Spain, respectively, throughout the analysed years.

In Italy, the highest levels of NFI disclosure over the period studied were reached by companies belonging to the consumer goods and utilities sectors, except in 2017, when the only company in the telecommunications sector obtained the highest index. Companies in the health care sector presented the lowest average values of disclosure. The overall level of disclosure decreased in most of the sectors analysed, except for the telecommunications and health care sectors, where the later adoption of NFI reporting practices is associated with an average increase in the total index. Moreover, very similar trends are documented between the industrial and financial sectors.

In Spain, the highest number of total indicators was reported in the consumer services and technology sectors, while the lowest number was reported in the consumer goods sector. The same trend identified in

Table 4 was registered for most sectors, except for the technology, financial, and consumer goods sectors, where the average value of the total index steadily increased. As in the Italian case, we observed that the health care sector began to disclose NFI only after the Directive’s publication.

To strengthen the validity of the results, we have compared NFI disclosure levels before and after the adoption of the EU Directive using a t-test. The t-test analysis aims to determine whether the differences between disclosure levels are statistically significant. As shown in

Table 5, significant differences in Italian disclosure levels are found between 2013 and 2016, 2013 and 2017 (significant at the 1% level), and between 2016 and 2017 (significant at the 5% level). Our results also reveal significant differences in Spanish disclosure levels between 2013 and 2017, and between 2013 and 2018 (significant at the 1% level). The differences observed in disclosure levels of Spanish companies between 2017 and 2018 were instead statistically insignificant. This may be due to the two-steps process by which the transposition of the Directive took place in this country.

5.2. The Disclosure of GRI Indicators before and after the Directive 2014/95/EU

The second research question was addressed by investigating the changes in the quantity of NFI produced by the EU Directive referring to each GRI indicator. To this end, the disclosure index was calculated by dividing the number of companies that disclosed the GRI indicator under consideration by the total number of companies included in our sample that published a nonfinancial report in the same year.

5.2.1. GRI Economic Indicators

The economic dimension of sustainability relates to a company’s impact on stakeholders’ economic conditions and on economic systems at the local and global levels. Consequently, the economic category of GRI indicators provides information on the creation and distribution of economic value and supports the understanding of whether and how companies create wealth for their stakeholders (

GRI 2016).

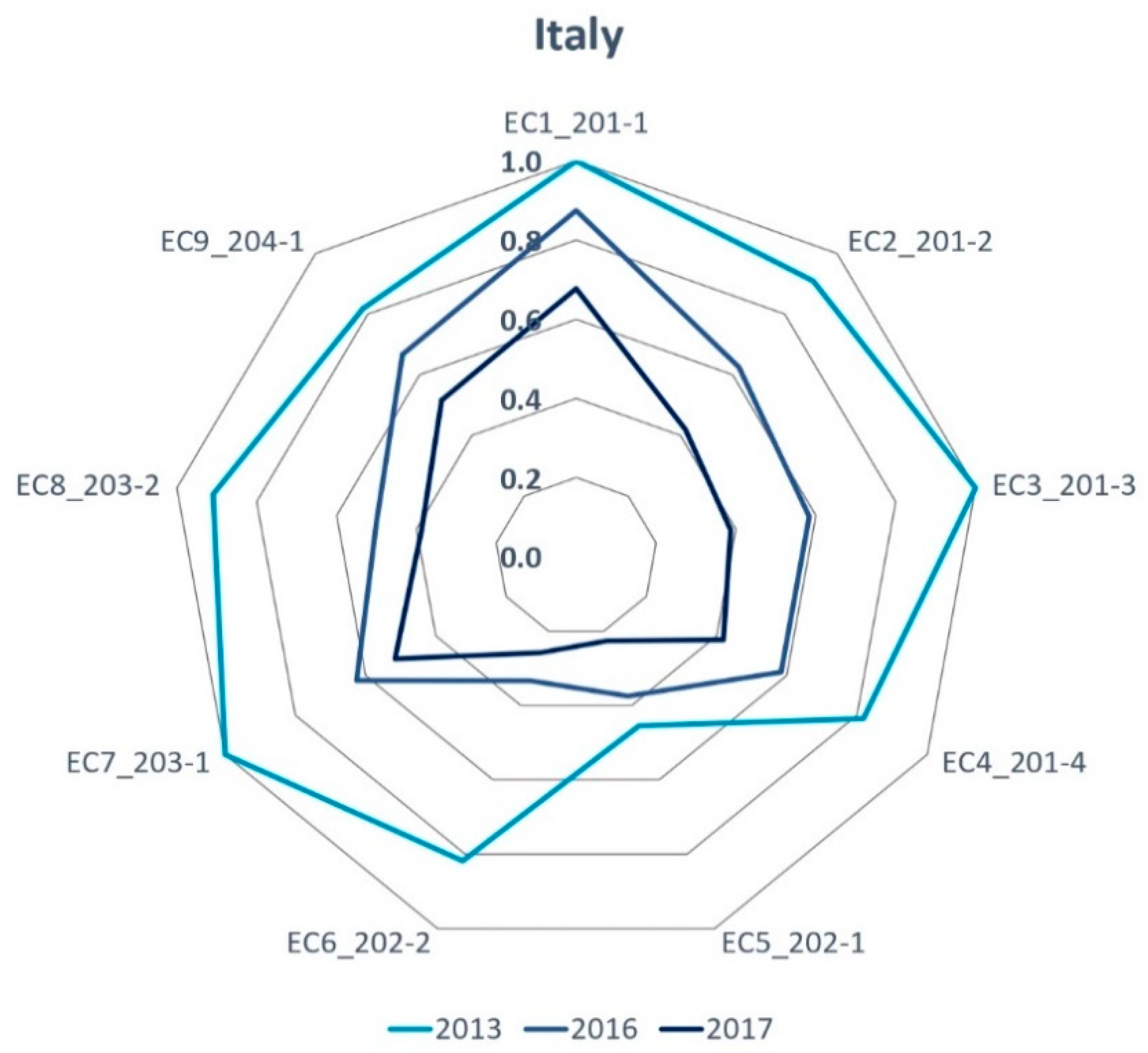

In Italy, we observed a progressive decrease in the disclosure of all EC indicators over the years studied (see

Figure 7). In 2013, all economic indicators were reported by more than half of the Italian companies, while in 2017, this was the case only for the indicator providing information on the economic value generated and distributed (EC1; 201-1). This last indicator, together with the indicator related to the indirect economic impacts (EC7; 203-1), was the most reported before and after the Directive’s implementation. Previous studies have explained the extensive use of this indicator with the greater availability of related data in corporate accounting systems (

Tarquinio et al. 2018;

Raucci and Tarquinio 2020). In contrast, the indicator relating to market presence (EC5; 202-1) was always the least communicated within its category. Moreover, the indicator referring to benefit plan obligations and other retirement plans (EC3; 201-3) suffered the most significant reduction, with an index equal to 1 in 2013 and 0.4 in 2017.

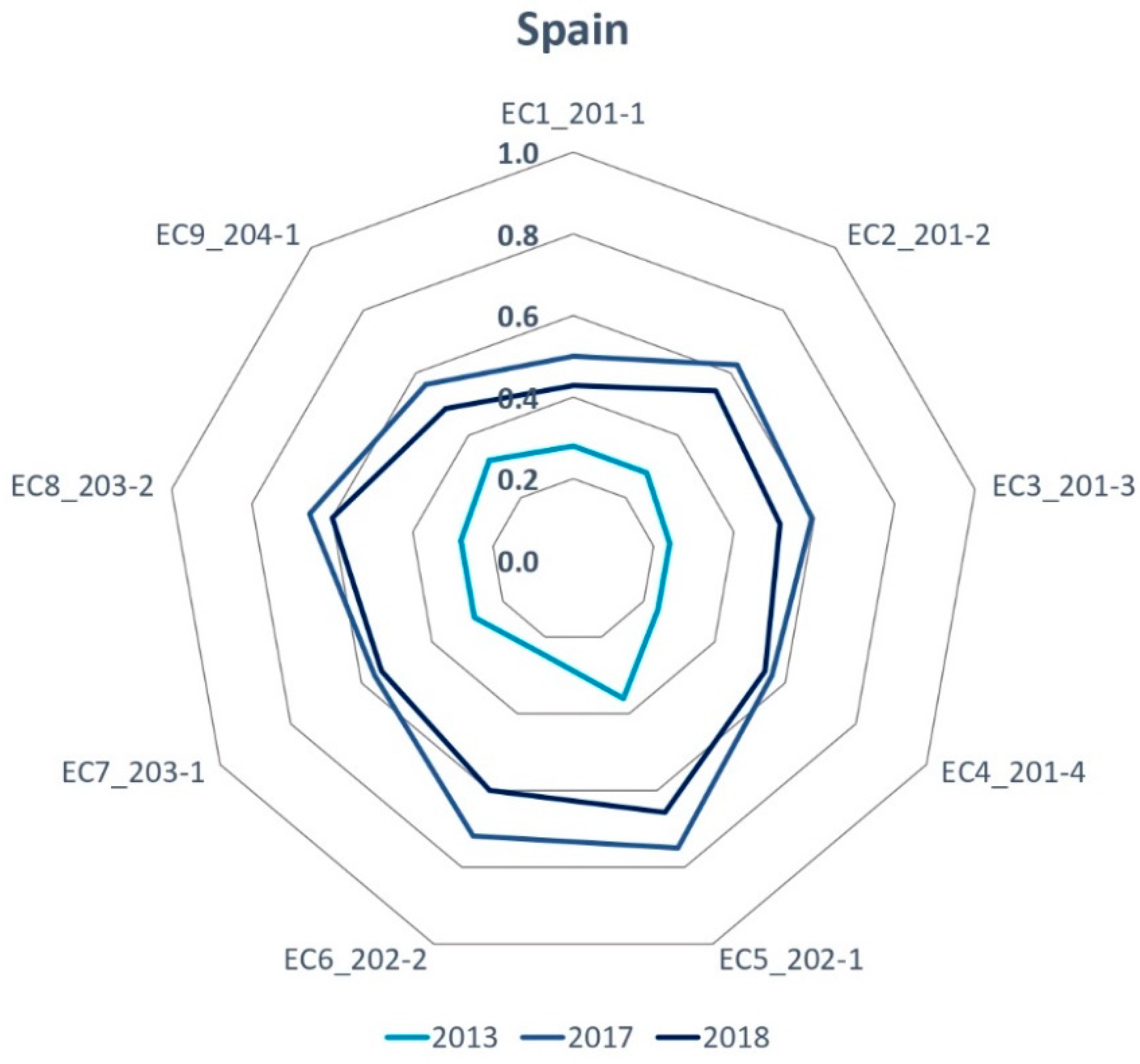

As shown in

Figure 8, in 2017, we detected an increase in all the EC indicators reported by Spanish companies, followed by a general decrease in 2018. The increase especially involved the indicator related to the proportion of senior management hired from the local community (EC6; 202-2), while in 2018, the index diminished in approximately equal measure for all indicators. Interestingly, the use of the EC indicators differs significantly between Spanish and Italian companies. Indeed, different from the case for Italian companies, the indicator concerning market presence (EC5; 202-1) was always the most reported by Spanish companies, and the indicator referring to the economic value generated and distributed (EC1; 201-1) was the least reported in 2017 and 2018.

5.2.2. GRI Environmental Indicators

Companies can use the GRI category of environmental indicators to report information about the impacts generated by corporate activity on living and nonliving natural systems and how these impacts are managed (

GRI 2016). Specifically, in the context of the EU Directive, companies are required to disclose energy consumption; discharge of emissions into the atmosphere; water withdrawal, use, and discharge; land use and biodiversity protection; use of materials; and contributions to resource conservation (

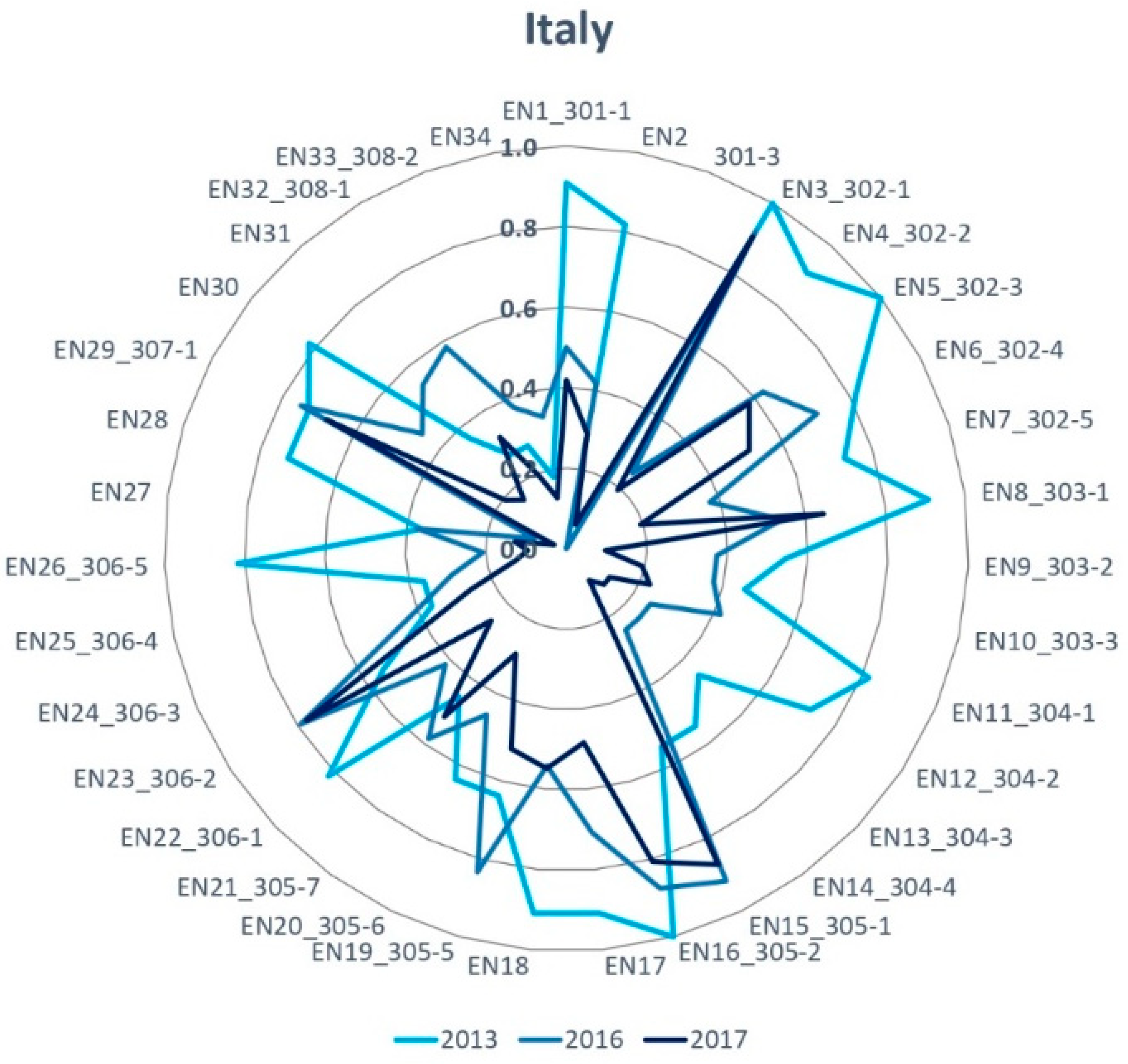

GRI 2017b).

Figure 9 shows the reduction of almost all the environmental indicators in the reporting by Italian companies. However, the indicators related to greenhouse gas (GHG) emissions (EN15; 305-1) and to the management of waste-related impacts (EN23; 306-2) increased from 0.5 in 2013 to 0.9 and 0.8 in 2017, respectively. The disclosure index notably decreased for the indicator of energy consumption outside of the organisation (EN4; 302-2), with values of 0.9 in 2013 and 0.2 in 2017, and for the indicator related to wastes directed to disposal (EN26; 306-5), from 0.8 to 0.1. The most-reported environmental indicators concerned, both before and after the Directive, energy and emissions aspects (EN3;302-1, EN5;302-3, EN15;305-1, EN16;305-2). In 2013, the least communicated indicators were those relating to the supplier environmental assessment (EN32;308-1, EN33;308-2), while in 2017, they referred to biodiversity and waste disposal issues (EN12;304-2, EN13;304-3, EN14;304-4, EN25;306-4, EN26;306-5).

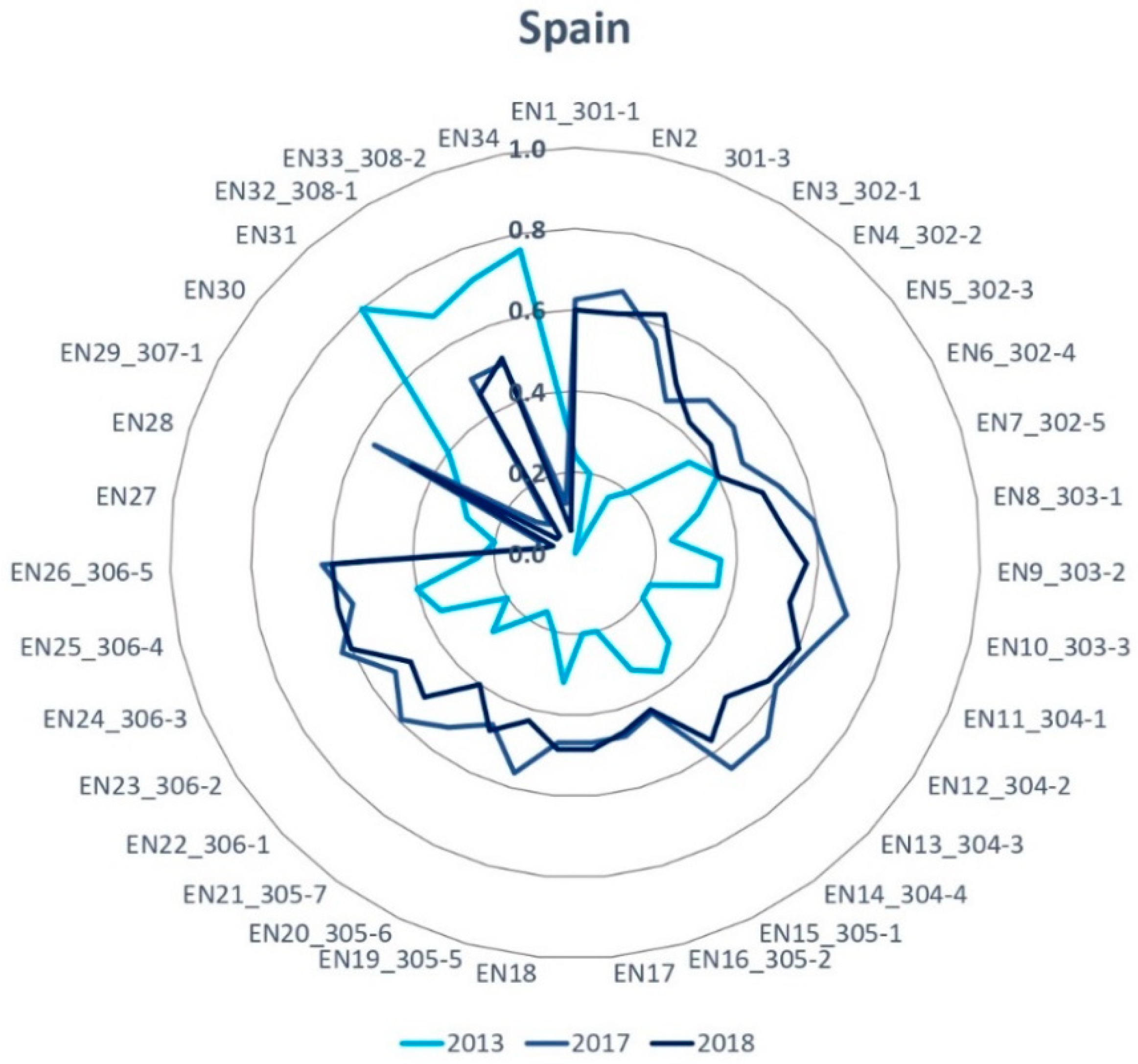

Spanish companies differ significantly from Italian companies in the disclosure of environmental topics (see

Figure 10). In 2017, the index increased for almost all the environmental indicators. A larger rise was found for indicators related to the use of materials (EN1; 301-1), biodiversity (EN11; 304-1, EN12; 304-2), and waste disposal (EN26; 306-5), from 0.2 in 2013 to 0.6 in 2017 and 2018. Compared with the general trend shown in

Table 4, for most of the environmental indicators, the index did not decrease after the transposition of the Directive, but it maintained the same value achieved the previous year. In 2013, indicators relating to the supplier environmental assessment were among those most used by Spanish companies, with an index amounting to 0.7. After the Directive, they mainly focused on reporting materials, water, biodiversity, and waste topics, whose respective indicators obtained index values between 0.5 and 0.6. Indicators concerning energy consumption (EN3; 302-1, EN4; 302-2) and emissions (EN16; 305-2, EN19; 305-5, EN20; 305-6, EN21; 305-7) were among the least reported in 2013, with an index of 0.2. In 2018, less attention continued to be paid to specific energy and emissions aspects, such as energy intensity and reduction in its consumption (EN5; 302-3, EN6; 302-4) and direct GHG emissions (EN15; 305-1), whose indexes were equal to 0.4.

5.2.3. GRI Social Indicators

The GRI social indicators concern companies’ effects on the social systems within which they operate (

GRI 2016). Companies can adopt these indicators to respond to regulatory requirements on the disclosure of information related to the relationship with local communities, respect for human rights, employment, and working conditions (

GRI 2017b).

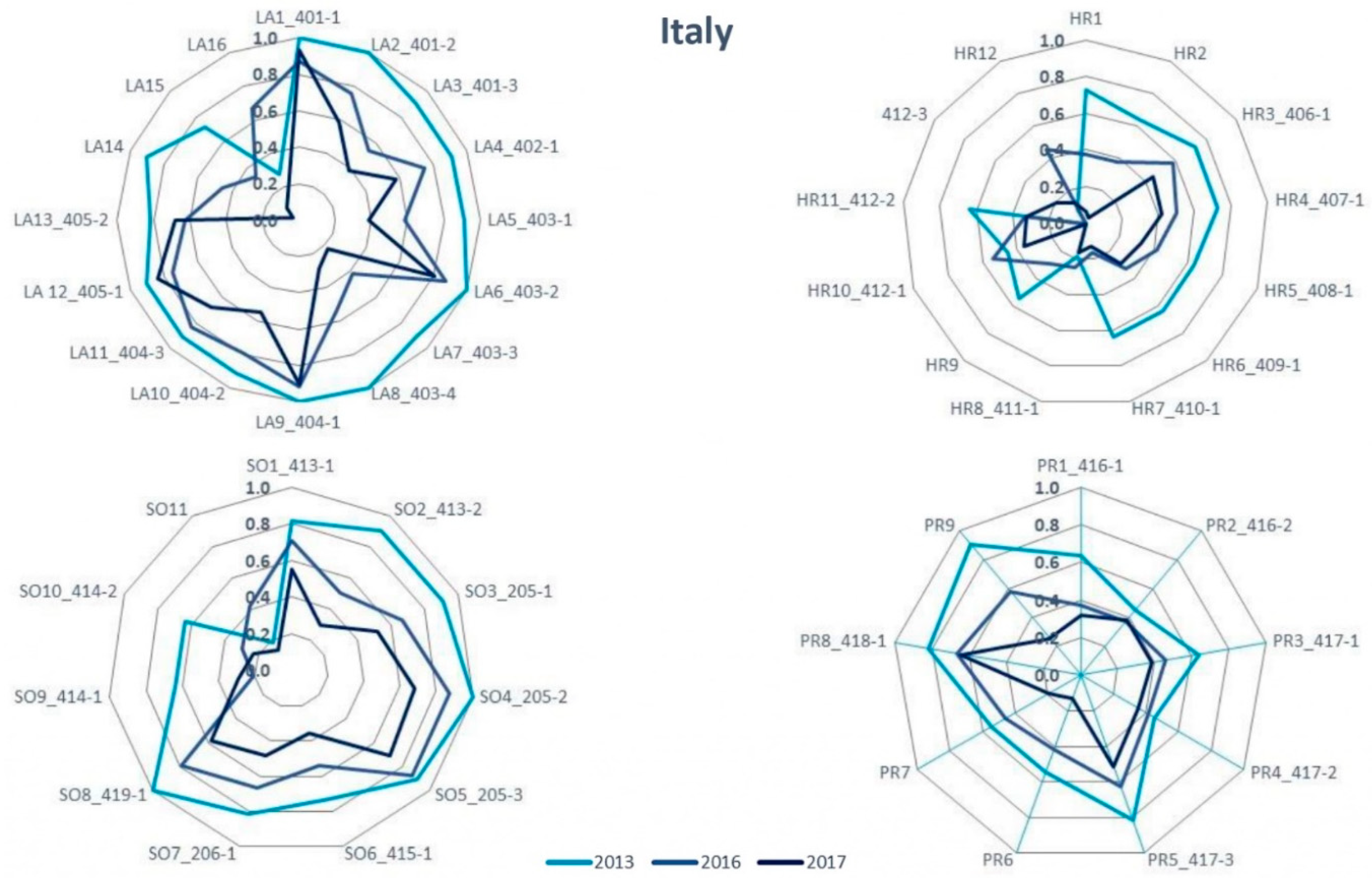

Figure 11 shows the ongoing decrease that, over the years, characterised all the social indicators disclosed by Italian companies, except for those referring to grievance mechanisms in the areas of human rights (HR12), labour practices (LA16) and impacts on society (SO11), which first increased in 2016 and then decreased in 2017. The greatest reduction was found in the use of the indicators relating to occupational health services (LA7; 403-3), from 0.9 in 2013 to 0.2 in 2017, and to worker participation in occupational health and safety matters (LA8; 403-4), from 1 to 0.3. In 2013, indicators about labour practices and society were among the most common social indicators. In particular, the highest value of the index (equal to 1) was achieved by the indicators referring to employment (LA1; 401-1, LA2; 401-2), occupational health and safety (LA6; 403-2, LA8; 403-4), training and education (LA9; 404-1), socioeconomic compliance (SO8; 419-1), and communication and training about anticorruption (SO4; 205-2). In 2017, indicators on labour practices remained the most communicated, with an index of 0.9 for the indicators LA1; 401-1 and LA9; 404-1. Before and after the regulatory intervention, indicators related to human rights issues were among the least disclosed. Specifically, indicator HR12 was the least reported in 2013, and the indicator referring to security practices (HR7; 410-1) was the least reported in 2017 (both with a value of 0.1). These results are in accordance with the results of previous studies that analysed the use of GRI indicators in Italy (

Tarquinio et al. 2018,

2020).

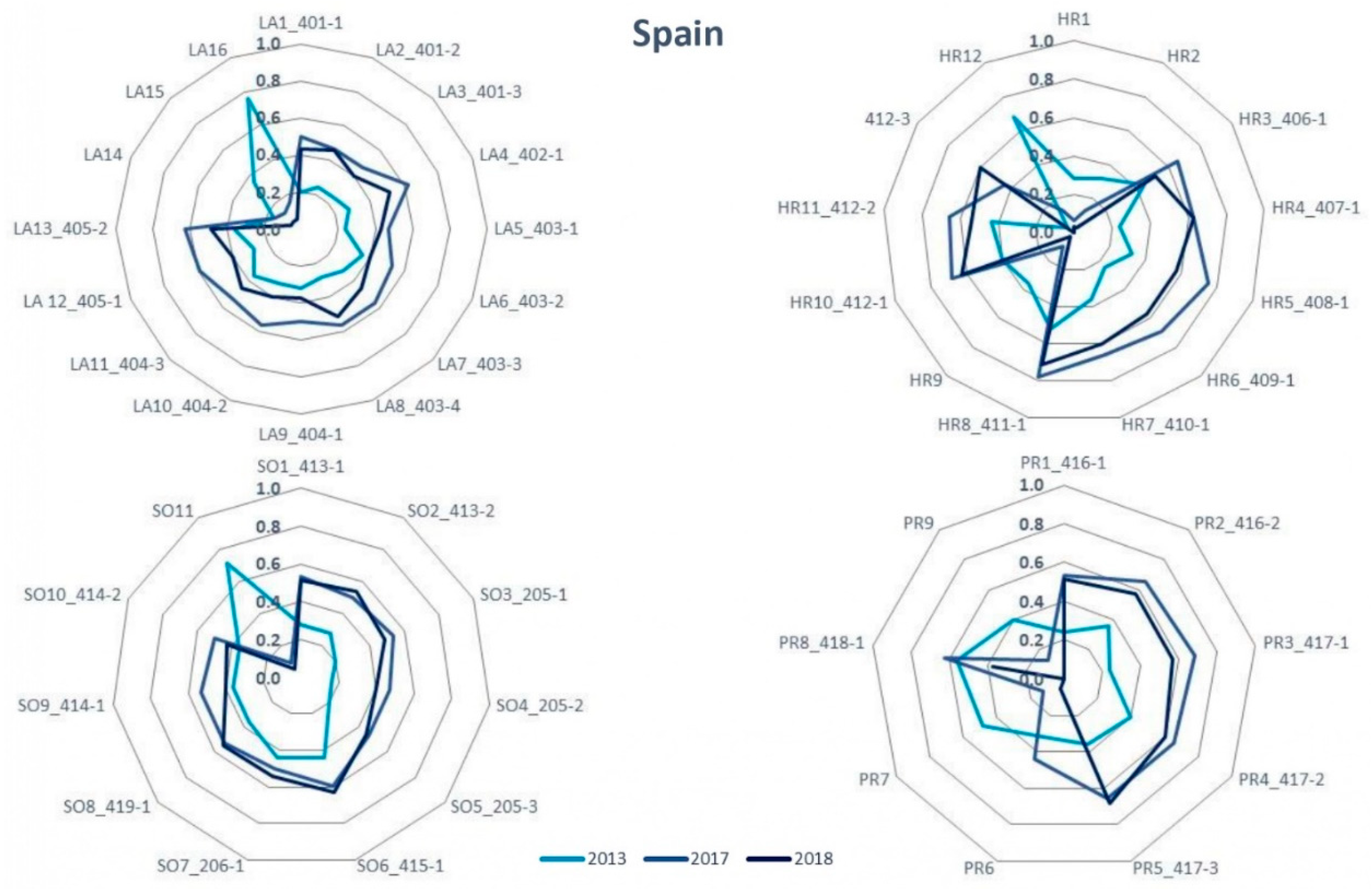

In line with the trend identified in

Table 4, we first registered an expansion in the adoption of social indicators by Spanish companies, followed by a slight reduction in 2018 (see

Figure 12). However, this did not occur for most indicators relating to society, whose indexes maintained, in 2018, the same value achieved before the implementation of the Directive into national law. Unlike the case in Italy, and consistent with

Gallego (

2006), in 2017, we found that Spanish companies gave higher attention to indicators concerning human rights, such as HR4; 407-1, HR5; 408-1, and HR6; 409-1. In 2018, the largest reduction involved the indicator related to customer policy (PR8; 418-1), from 0.65 in 2017 to 0.4. In 2013, the most reported social indicators were LA16, HR12 and SO11 (index of 0.7). In 2018, the highest values were reached for the indicator about the rights of indigenous peoples (HR8; 411-1) and the indicator concerning incidents of non-compliance in marketing communication (PR5; 417-3). The least disclosed social indicators largely pertained, over the whole period analysed, to the topic of labour practices. The indicators regarding employee hire and turnover (LA1; 401-1), parental leave (LA3; 401-3), and worker representation (LA5; 403-1) were among the least commonly used indicators both before and after the introduction of mandatory NFI disclosure.

5.3. Assurance Practices of NFI

To answer the third research question, we verified the differences in the adoption of assurance practices and, where already applied, in their characteristics before and after the introduction of the NFI Directive (see

Table 6). The number of companies that assured their NFI reports grew in both Italy and Spain after the transposition of the Directive into the two national regulations. The mandatory provision of assurance is a coercive force that has produced a relevant impact on assurance dissemination. Accounting assurance providers (AAPs) dominate the assurance market of NFI in both Italy and Spain, similar to the results presented in other studies on the assurance of NFI (

KPMG 2008;

Kolk 2010;

Romero et al. 2010;

Martínez-Ferrero and García-Sánchez 2018).

Different studies have shown that ISAE 3000 and AA1000AS are the standards most commonly used to conduct assurance and are frequently adopted in combination (

Simnett et al. 2009;

Perego and Kolk 2012;

Cooper and Owen 2014). The use of the ISAE 3000 has gradually increased from 79% to 100% in Italy and from 45% to 74% in Spain, while the combined use of the ISAE 3000 and the AA1000AS has decreased over time. Regarding the levels of assurance provided, this study found that the limited/moderate assurance level increased in both countries, reaching the totality of NFI reports in Italy. The use of different assurance levels (i.e., limited and reasonable) for different matters of the same NFI report was found only in Spanish assurance statements, although their adoption was very low compared to the use of the limited/moderate assurance.

6. Discussion and Conclusions

This study aimed to investigate the effects produced by the new NFI regulation focusing on two European countries, Italy and Spain. These countries are characterised by similar legal systems (positive law), the same territorial context (Mediterranean countries), and similar civil law systems but with different regulatory backgrounds relating to nonfinancial disclosure.

We used content analysis to verify the level of NFI disclosed by Italian and Spanish listed companies before and after the publication of the Directive and its implementation in the two national legislations. Changes in disclosure levels were examined by constructing a disclosure index based on the quantity of GRI indicators disclosed by the sampled companies in their nonfinancial reports. The index measured the economic, environmental, and social disclosure performance achieved by companies over three years (2013, 2016, and 2017 for Italy; 2013, 2017, and 2018 for Spain), making it possible to identify differences between the two countries in the disclosure of NFI during the transition stage marked by the introduction of the new law.

Our analysis shows that before the Directive’s publication, Italian companies were less active in publishing sustainability reports than Spanish companies, among which 95% had already disclosed NFI. This result can be explained by the prior legislation on sustainability reporting introduced by the Spanish government and by the strong commitment and leading position taken by Spain in this area (

de la Cuesta and Valor 2013;

Reverte 2015;

Sierra-Garcia et al. 2018). The maturity of the NFI reporting process in Spain might justify the belated transposition of EU requirements into national law, which probably indicates a lack of urgency in this regard (

Sierra-Garcia et al. 2018). Consequently, the Directive’s introduction represented an opportunity to promote NFI disclosure practices more in Italy than in Spain. According to

Venturelli et al. (

2019), the Directive would have produced greater benefits in countries that were less proactive in the nonfinancial reporting field. Despite the widest experience observed in Spain, in 2013, the quantity of NFI voluntarily disclosed by Italian companies in their reports was significantly higher than that disclosed by Spanish companies. On the one hand, this finding could stem from the greater flexibility and the interest in satisfying stakeholders’ information needs that typically characterise the voluntary approach (

Meek et al. 1995;

Boesso and Kumar 2007). On the other hand, as

Andrades et al. (

2019) suggested, a higher quantity of information does not necessarily imply greater transparency.

The longitudinal analysis reveals different trends in the disclosure index of Italian and Spanish companies, suggesting different responses to the new regulation. In Italy, we detected a progressive reduction in disclosure levels that involved the three indicator categories, especially the economic category. The same trend was found in previous studies that analysed the dynamics in the use of GRI indicators before and after the entry into force of the Italian Decree (

Loprevite et al. 2020;

Raucci and Tarquinio 2020;

Tarquinio et al. 2020). This reduction might be regarded as the need to report only information considered material according to the Decree, leading to the identification of a factor of razionalisation in the new regulation that supports more effective communication with stakeholders (

Raucci and Tarquinio 2020;

Tarquinio et al. 2020). This interpretation is consistent with previous research, according to which a lower quantity of information is not associated with a decrease in quality (

Crawford and Williams 2010;

Loprevite et al. 2020). Furthermore, considering the provision of mandatory assurance of NFI, the reduced amount of NFI might suggest a prudent approach to disclosure that induces companies to review the content of their NFI reports (

Raucci and Tarquinio 2020;

Tarquinio et al. 2020). A similar behaviour could also be associated with a “tick-box” mentality under which companies exhibit an apparently responsible behaviour, simply aimed at compliance (

Caputo et al. 2020;

Tarquinio et al. 2020).

In contrast to the case for Italian companies, Spanish companies expanded the quantity of NFI disclosed following the Directive’s implementation. Specifically, in 2017, we observed a significant increase in the average value of the disclosure index, followed by a slight decrease in 2018. This last reduction was probably due to Law 11/2018, which enforced Royal Decree-Law 18/2017, introducing relevant changes in the implementation of the Directive. In particular, the inclusion of more specific guidance on the topics to be reported, as well as the mandatory assurance of NFI, could explain a more cautious approach to reporting and, therefore, the reduced level of disclosure. This trend could also result from the lack of specification of noncompliance penalties in Law 11/2018, which might induce companies to omit certain information.

Nevertheless, the higher disclosure levels reached from the period preceding the publication of the Directive suggest an opposite impact on Spanish reporting compared with that produced in Italy. The increase in disclosure levels can be interpreted in different ways. On the one hand, as suggested in the literature, it could be the expression of the positive attitude towards compliance that generally drives companies operating in countries with prior regulation (

Crawford and Williams 2010;

Dumitru et al. 2017;

Venturelli et al. 2019). On the other hand, given the ineffectiveness of the previous regulation (

Luque-Vílchez and Larrinaga 2016;

Sierra-Garcia et al. 2018), there was still an information gap in the reports of Spanish companies, making it necessary to broaden their content to comply properly with the new law. Moreover, greater disclosure levels could be associated with the IBEX-35 companies’ aim to be included in sustainability indexes and thus enhance their reputation (

de la Cuesta and Valor 2013). Indeed, the NFI Directive has represented a great opportunity for sustainable competitiveness (

Matuszak and Różańska 2017), requiring companies to make greater efforts to distinguish themselves in the rankings.

The results on the evolution of NFI disclosure levels show that the EU Directive has had an impact on Italian and Spanish NFI reporting practices. Using the institutional theory lens, we can assume that NFI disclosure is affected not only by company-specific factors (

Dyduch and Krasodomska 2017;

Tarquinio et al. 2018;

Mion and Loza Adaui 2019;

Tiron-Tudor et al. 2019) but also by coercive pressures from the regulatory environment. Previous research has suggested that an increase in the amount of nonfinancial disclosure following the introduction of a mandatory regime indicates a movement towards normativity (

Chauvey et al. 2015), considered by

Bebbington et al. (

2012) to be the degree to which rules and practices become accepted and standardised in a country. Based on our results, mandatory NFI reporting has reached higher levels of normativity in Spain than in Italy. Indeed, the production of normativity not only depends on formal legislation but also stems from structural elements, such as the congruence of legislation with previous practices and the existence of prior norms (

Bebbington et al. 2012;

Luque-Vílchez and Larrinaga 2016). In Spain, the new requirements set by the EU Directive fit with the existing reporting landscape, where governmental initiatives had already been taken to support the development of responsible practices among companies. The

Spanish strategy on companies’ corporate social responsibility practices 2014/2020 paved the way for the consolidation of an authentic sustainability culture in Spain, complementing previous laws (e.g., the SEL) and orienting other similar initiatives around Europe, even in the area of sustainability reporting (

Reverte 2015). The provision of informal rules on making and applying the law represents another important source of normativity (

Bebbington et al. 2012). Law 11/2018 references the use of the GRI Standards as a reporting framework, suiting the established reliance of Spanish companies on GRI reporting guidelines and laying further grounds for becoming a norm (

Luque-Vílchez and Larrinaga 2016). These structural elements contribute to creating the normative climate necessary to enforce the law and introduce effective institutional changes (

Luque-Vílchez and Larrinaga 2016). In contrast, certain conditions render the Italian scenario less supportive of the path towards NFI reporting normativity. For example, the Italian transposition law has gone beyond EU provisions, including more prescriptive requirements in relation to the ESG factors to be reported. This additional demand not only fails to reflect the limited experience of Italian companies in the field but is also not supported by the provision of specific guidance on which performance indicators should be used to measure and disclose such ESG factors (

Jeffwitz and Gregor 2017).

The sectorial analysis over the whole period analysed underlined relevant discrepancies in the reporting of NFI among companies in different sectors, in accordance with other studies that showed how the company sector is an important determinant of disclosure performance (

Sierra-Garcia et al. 2018;

Caputo et al. 2020;

Raucci and Tarquinio 2020). Consumer goods was the best performing sector in Italy, while the consumer services sector reached the highest performance in Spain. The lowest values of the disclosure index were observed in the health care sector in Italy and the consumer goods sector in Spain.

Furthermore, our results revealed a decrease in the wide gap previously observed between the quantity of information reported in the two analysed countries. In 2013, the disclosure index assumed average values equal to 0.75 in Italy and 0.34 in Spain. After the Directive’s implementation, Italian companies achieved an average index of 0.42, and Spanish companies achieved an average index of 0.52. This supports the hypothesis that regulation can support an alignment in NFI levels, leading to the harmonisation of information disclosed by European companies (

La Torre et al. 2018;

Mion and Loza Adaui 2019;

Caputo et al. 2020). In this way, mandated disclosure can be seen as “a kind of magical minimalism that delivers significant rewards” (

Hess 2019, p. 7).

Our paper has theoretical and practical implications. It contributes to the literature on the effects of mandatory NFI, increases the understanding of companies’ reporting practices before and after the Directive, and provides insights into the main strengths and weaknesses of mandatory nonfinancial disclosure. Moreover, the cross-country analysis enables us to evaluate companies’ responses to the new regulation considering different previous reporting experiences.

Our study may also have implications for policymakers, helping them assess the effectiveness of the European intervention in promoting nonfinancial reporting during the first stage of the implementation of the new law. Our findings can support the definition of strategies useful for improving the harmonisation of NFI disclosure practices and for establishing global sustainability reporting standards, as foreseen in the agenda of the “Group of Five” standard-setting organizations (CDP, the Climate Disclosure Standards Board, GRI, the International Integrated Reporting Council, and the Sustainability Accounting Standards Board). Furthermore, under this new scenario for NFI reporting, it might be of interest for standard setters to have high quality and comparable data on sustainability performance. Therefore, the development and/or refinement of performance indicators on sustainability issues will become important.

Our study also has some limitations that pave the way for future research. First, the comparative analysis is limited to the Italian and Spanish cases; therefore, the impact of the Directive on the harmonisation of NFI could be investigated more deeply by considering other European countries. Future studies may assess companies’ disclosure index in the years following the first adoption of the Directive to better appreciate the evolutionary path of compulsory NFI disclosure in Europe. It would also be interesting to examine changes produced by regulatory requirements in the quantity and quality of information and test the relationship between NFI disclosure levels, corporate performance, and country-specific factors.