Abstract

The financial system in the Kingdom of Saudi Arabia (KSA) has a history of relative soundness, particularly in banking, due to comparatively strict and enforced domestic supervision, and supported by what has been for the most part a reasonably robust economy. However, the sector is facing challenges of a sluggish economy, need for reform and negative effects of the COVID-19 pandemic. This paper strives to assess how well the government thus far has responded to the challenges in the financial sector. The working hypothesis is that the insurance industry has improved its position, resulting in higher efficiency and profitability and lower risk. This is an industry historically plagued by too many players, financial issues and less than adequate controls. The analysis undertaken bears out the hypothesis, as revealed by the enhanced contribution made by the industry since the pandemic. Analysis suggests that strides have been made in that industry in terms of helping to diversify the economy with the onset of the pandemic. Moreover, evidence is provided that the sensitivity to changes in oil volumes (rather than to changes in oil prices) is a key risk factor for the financial sector in the KSA. These findings have implications for policy makers in terms of leveraging the pandemic conditions as an opportunity to drive further reform and diversify the economy with lower risk.

JEL Classification:

E5; G21

1. Introduction

Di Lorenzo and Sibillo (2020) stressed the role of insurance companies in protecting against macroeconomic scenarios impacting on families and firms. The COVID-19 pandemic could push towards “reward mechanisms for those companies that correctly implement strategies protecting the health and well-being of the community. Doing so would engender a virtuous cycle, able to stimulate the correct fulfilment of the rules imposed on companies for the protection of health. It would also contribute to verifying investments, especially when it comes to the funds that states allocate to economic recovery”. Thus, “as has already been the case with Environmental, Social, and Governance (ESG) risks and consistent with an Enterprise Risk Management (ERM) approach, insurance companies will be able to expand the analysis of financial risks and returns in a Social Finance perspective, generating, that is, social impact with their products”.

While the insurance industry has experienced financial difficulties and is affected by a number of issues, banking and financial supervision in the Kingdom of Saudi Arabia (KSA), within its rather closed economy, has demonstrated relative strength and stability over the past few decades Parkinson (2016); Ramsdale and Sakhri (2020). This period has also been relatively economically robust for the Kingdom Dyck (2016); Diron and Perjessey (2019). Severe challenges to the current stable and straightforward system have emerged, however, as the national economy slows, primarily due to depressed oil revenues Friederich and Krustins (2020). This slowdown has been recently compounded by the COVID-19 pandemic. Teresiene et al. (2021) found that “the spread of the COVID-19 pandemic has a statistically significant negative effect on banking sector credit risk, financial distress, banking sector profitability, and solvency”. In addition, “while the overall financial distress decreased and banking sector liquidity increased, the profitability and solvency decreased”. The Saudi government is trying to take measures to diversify and open the economy, still so reliant on domestic hydrocarbon production and government spending, and to make it more efficient. This is needed to promote growth and reduce a growing budget deficit. While ambitious and long term with regard to expected results, some of these measures may prove counter productive in the short term, and are more likely to put pressure on the economy and the financial system Friederich and Krustins (2020). There have already been signs of regulatory easing, including an injection of liquidity and some loosening of lending criteria, which over time could threaten the stability of the system Sharif (2016); Nereim and Al Othman (2020). This problem is exacerbated by economic weakness brought on by the COVID-19 pandemic, as many businesses shut down to comply with government restrictions. Borrowers, affected most severely in the SME sector, will have difficulty servicing their loans, despite government measures to aid them OECD (2020); Hussain et al. (2020). At the same time, the authorities are thoroughly addressing a poorly structured insurance industry, which still has too many players and less than adequate controls, resulting in financial problems for many of the insurance players Fadaak and Alghamdi (2016); Toskas and Coutts (2020). Since key drivers of financial stability are the diversity, openness and efficiency of the economy, it is incumbent on the authorities to accelerate financial, economic and social reforms, and to open the economy faster and further, so that the Gulf region’s largest economy has a chance of gaining competitiveness on a regional and international scale McKinsey (2015). Otherwise, the nation will be left further behind in the ever dynamic race for investment and progress, continuing to rely on a dwindling resource base and pilgrimage center, which ultimately could lead to serious financial and social disruption.

Demirguc-Kunt et al. (2020), by investigating a large dataset of more than 3000 financial companies, claim that a key risk factor is their exposure to oil prices. However, the statistical evidence is somehow weak. For this reason, in the panel data analysis presented here, this idea was retained but declined differently. This paper, through both a quantitative and quantitative analysis, investigates the resilience of the financial sector to the COVID-19 pandemic and results of diversification efforts, particularly induced by the insurance sector. The suggestion is that, during the crisis, systematic effects (i.e., membership of the banking or insurance groups) prevail over idiosyncratic characteristics of each company. Furthermore, by identifying a key risk factor in oil volumes, exceptions are identified to the said rule for those instances in which idiosyncrasy still dominates group effects, which has policy implications. In particular, it is shown that the diversification induced by the insurance industry has benefited the economy during the COVID-19 pandemic, which could be used as an opportunity to consolidate players in the industry.

The rest of this paper is structured as follows: Section 2 contains an overview of the financial system in the KSA starting from the Sharia law. Section 3 and Section 4 provide, respectively, an account of insurance and banking in the KSA with regard to profitability, competition, capital, risk, etc. Section 5 describes the regulation and related issues. Section 6 provides a quantitative analysis illustrating how the insurance industry (traditionally perceived as a laggard) had beneficial effects in terms of diversification of the economy and identifies in variations of oil volumes, rather than prices, a key risk factor. Section 7 discusses the results and Section 8 presents the conclusions.

2. Overview of the Financial Systems

2.1. Background to Financial System: Sharia

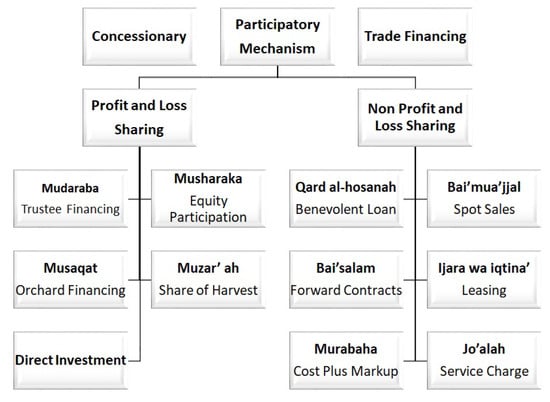

Sharia is a religious law derived from the religious precepts of Islam, particularly the Quran and the hadith. Islamic financial institutions should comply with Sharia, which basically prohibits interest and usury (riba) and requires the sharing of profit and loss. Figure 1 reports the different types of contracts existing in Islamic finance.

Figure 1.

Types of Islamic financial contracts, authors’ elaboration.

KSA is governed by Sharia law, conforming to strict principles of Islam, which is not always aligned to principles of capitalism and wealth creation Vogel (2000). It can be argued that KSA’s relative prosperity stemmed to a large extent from the windfall of its hydrocarbon reserves, first discovered in the 1930s. The combination of the religious and cultural factors and the easily exploited resource endowment has not consistently supported innovation and entrepreneurship, at least among the domestic population. As a relatively closed and conservative society, with an economy based largely on domestic consumption, it perhaps is no surprise that international competitiveness has not been strong. The domestic financial system, however, has been governed in a reasonably sound and stable way, based on a simple framework, on a strong social consensus and on Western models. Besides retail and corporate banking, insurance and asset management, based mainly on local equities and real estate, other markets, such as fixed income and derivatives, remain relatively undeveloped, as is true of the Gulf region in general. The nation faces a challenge in increasing its financial sophistication to support ambitious plans during a period of economic sluggishness, and in an environment not historically renowned for innovative flair.

2.2. Structure of the Financial System

Regulation of insurance, banking and other financial services in KSA fall under the responsibility of two government entities. One is the Central Bank of Saudi Arabia (known as the Saudi Arabian Monetary Authority, or SAMA, established in the 1950s). SAMA has the function of issuing the national currency, supervising banks, managing foreign exchange reserves, ensuring price and exchange rate stability (the Saudi Riyal, or SAR, has been pegged to the US$ for the past three decades), maintaining the soundness of the financial system and operating a number of cross-bank electronic financial systems. The second is the Capital Market Authority of Saudi Arabia (CMA), which regulates capital markets/the Saudi Stock Exchange by setting rules and making sure they are followed) Capital Market Authority (2015). The CMA is a government organization nominally with financial, legal, and administrative independence, and has direct links with the Prime Minister (i.e., the King). The senior officials of SAMA, all Saudi nationals, are appointed by Royal Decree, based on the approval of the Council of Ministers, which is dominated by the Saudi royal family (and all council ministers are appointed by royal decree). Unlike such officials in many developed economies, SAMA officials tend to come from public sector backgrounds, rather than the industry SAMA (2020b). The same characteristics prevail in the Capital Market Authority (CMA) Capital Market Authority (2020). Much of the financial regulation has derived from systems prevalent in the US and UK. The most important laws regulating the financial sector are the Capital Markets Law (CML) and Cooperative Insurance Law (CIL), which aim to achieve compliance with the International Organization of Securities Commissions (IOSCO) and the International Association of Insurance Supervisors (IAIS) principles. Another important law is the Capital Market Law (Royal Decree No. (M/30) dated 2/6/1424H, or 31/7/2003), which formally brought into existence the Capital Market Authority (CMA) and the Banking Control Law (BCL). As can be observed, these laws have recently been enacted, compared with many major economies, which suggests that KSA is still on a rather steep learning curve around financial regulation and sophistication. Until the mid-twentieth century, Saudi Arabia lacked a proper money and banking system. The Bank Control Law was issued in 1966, and the stock exchange was created in 1983. Originally, the exchange was limited to domestic investors as a vehicle for long-term investments, and this lasted for decades. The situation changed dramatically after the 1990–1991 Persian Gulf War (which cost the Saudi government US$60 billion, depleting the country’s financial reserves at the time) and the search for short-term returns attracted more investors. Between 1990 and 2005, the value of shares traded grew from SAR 97 million to SAR 2.44 billion Saudi Arabian Monetary Agency (2009). Despite the impressive growth, the percentage of shares traded as a percentage of total market value of shares outstanding was estimated as less than 10%, i.e., very low by international standards. This implies that a high proportion of shares is concentrated in the hands of a few institutions rather than spread out across many individuals. As reported by Tradingeconomics (2020), the Saudi Arabia Stock Market, or Tadawul (TASI), reached an all time high of 20,634.86 in February of 2006 and a record low of 1140.57 in May of 1995. Nowadays, the Saudi Arabia Index TASI has a market capitalization of around USD 2.2 trillion and fell 20% during the last twelve months (July 2019 vs. July 2020). The cataclysmic drop in the index in 2006 was the consequence of an asset bubble and inadequate regulation of the stock market, in which many retail investors suffered. As a result, the authorities instituted further protective measures. This included opening the market further to international investors, placing some restrictions on domestic investors and boosting disclosure requirements Alkhaldi (2015).

While Saudi Arabia’s economy is dominated by state-owned energy and government services sectors, this is only recently reflected in the stock market where manufacturing and financial services have been the biggest sectors Tadawul (2020). The USD25 billion domestic IPO of Saudi oil company Aramco, the world’s largest, changed this profile in early December 2019. The Saudi stock market is the largest in the Middle East, still with room to grow World Bank (2020). The listing of Aramco has contributed to this growth Oilprice.com (2021), but multiple listings are still required for a company whose value has been estimated at close to two trillion dollars. Recently, a parallel market Tadawul (2017) has been established for small companies, where many are expected to be listed (at least ten so far), available to institutional investors Tadawul (2019). The fact remains that reforms continue to progress slowly, and the public sector still dominates the economy, which may not leave the nation well positioned for dramatic transformations.

Saudi Arabia’s gross debt to revenue and to GDP still remain robust compared to peers, with negative net debt, although the government has had to resort to more borrowing in order to plug the budget deficit. Annual interest payments have crept up to a bit above 2% of revenue. The nation enjoys good credit ratings in the A category, having recently experienced a downgrade in 2019, due to the fiscal pressures stemming from low oil revenues Friederich and Krustins (2020). The budget deficit (4.5% of GDP) is compelling the government to accelerate reforms such as privatisations and taxation IMF (2019b). Moreover, the current account balance in 2019 exceeded 5% of GDP (vs. negative 4% in the UK). Government spending consistently is matched by current account outflows, which exit the economy altogether, putting additional pressure on FX reserves. KSA derives over 90% of its revenue and export earnings from hydrocarbons, which also make up over half of GDP. One of Vision 2030’s goals is to diversify the economy further away from hydrocarbons KSA (2017). Every long-term plan, since the first in 1970, has had the same goal, with marginal success experienced thus far House (2013). The plan to reduce the budget deficit involves more non-oil investment and increased efficiency, which has its limitations. Among the multiple challenges related to the economic and social system are maintaining per capita GDP growth, improving education and employability, stimulating the private sector and housing, and reducing corruption and inequality. Well over a third of KSA’s workers are foreigners, and observers point to constrained social and economic development inhibited by lack of personal freedom, inadequate education, lack of meritocracy, and exclusion of women Long (2005). A large proportion of the population is under 25 Murphy (2012). The process of Saudization (replacing foreign workers with natives) is slowed by the lack of skills among local hires. Bureaucracy tends to be a feature of life. Poverty and housing availability are also said to be problems.

2.3. Economic Transformation to Resulting in More Privatisations, Financial Reform?

The National Transformation Program (NTP) was published in June 2016, as a key part of the Vision 2030, the government’s long-term strategic plan released in April of that year. In addition to diversifying the economy, reducing wages and subsidies and stabilizing debt, objectives also include strengthening sectors outside oil and gas, and improving the overall business environment. Along with other Gulf Cooperation Council (GCC) member states, Saudi Arabia has introduced a 5% value added tax in 2018, and may also levy taxes on expat workers or charges on remittances. The NTP includes plans to privatize state owned enterprises, including the huge state oil company Aramco (5% floated in December 2019). There are still meaningful obstacles, however, for instance around transparency requirements and insufficient depth of the domestic market. With capitalisation of about USD 2 trillion,1 5% of Aramco was estimated to be worth USD 100 billion Ambrose (2016); Blas (2016). According to the The World Bank, which provides data from 2009 to 2015, the average capitalization for Saudi Arabia during that period was 393.7 billion U.S. dollars with a minimum of 318.73 billion U.S. dollars in 2009 and a maximum of 421.06 billion U.S. dollars in 2015 The Global Economy (2016) This great untapped potential gives CMA considerable work ahead to better adapt to investor demands, in order to help realise the NTP.

2.4. Key Facts on the Insurance and Banking Sector

Important developments were that, in April 2019, Saudi Arabia issued its first domestic sovereign 30-year sukuk and that, in the same year, the country was included in global equity and bond market indices. The expectation is that this will increase inflows into the equity market as well as demand for debt. As mentioned by the IMF, “significant reforms have taken place in the domestic debt market including the introduction of a primary dealer system and the extension of the government yield curve to long-dated maturities. Over time, this should help deepen the private debt market and provide savers with a broader range of instruments” IMF (2019b). In addition, the CMA indicated that work is underway to launch a derivatives market by year end as part of reforms to further deepen domestic financial markets IMF (2019b).

2.5. GDP and COVID-19 Pandemic

COVID-19 has negatively impacted on Saudi Arabia further compounded by lower oil prices, increased public spending and reduction of economic activity (see Table 1). The IMF projections for 2020 are a 6.8% fall in real GDP and 0.9% inflation. For an account of mitigations and governmental initiatives, see Nurunnabi (2020).

Table 1.

Annual growth rates of gross domestic product by kind of economic activity at constant prices (2010 = 100). Source GASTAT (2021).

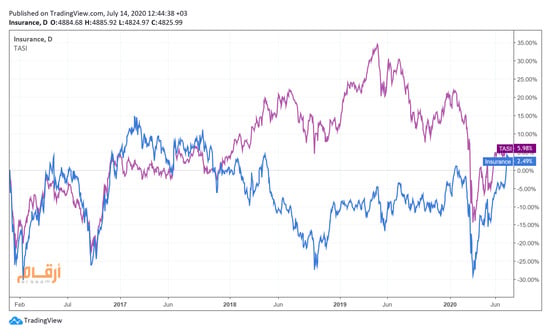

Demirguc-Kunt et al. (2020) reports that “the crisis and the countercyclical lending role that banks are expected to play have put banking systems under significant stress, with bank stocks underperforming their domestic markets and other non-bank financial firms”. Figure 2 confirms those findings regarding banks but shows that the insurers, that traditionally were underperforming, have significantly overperformed.

Figure 2.

TASI vs. Insurance and Banking sectors since beginning 2019. In violet Tadawul index, in red the banking stock index, in blue the insurance stock index. Notice that banking (4.61%) underperformed the index (10.81%) while insurance strongly overperformed (40.71%). Source Argaam (2021).

2.6. Corporate Governance in the Context of COVID-19

As described in Nicola et al. (2020), the COVID-19 pandemic turned into a humanitarian and economic crisis. Indicators such as the United Nations’ Sustainable Development Goals (UN SDGs) provide a multifaceted framework for valuing the impact of the pandemic as well as a tool for measuring the progress in responding to the crisis. In fact, in the literature, it is well documented that Islamic banks are affected by a lack of compliance towards adopting the UN SDGs in terms of sustainable business practices Platonova et al. (2018); Platonova et al. (2018); Jan et al. (2018); Jan et al. (2019), etc. With the onset of the COVID-19 pandemic, Jan et al. (2021) suggested how “to establish the link of key Islamic banking sustainability indicators with the United Nations’ Sustainable Development Goals (UN SDGs) as a policy recommendation for sustainable development and to mitigate the distressing impacts of the COVID-19 pandemic on the triple bottom line (people, planet, and profit)”.

Deliu (2020), by identifying in the pandemic a systemic risk, explores how a combination of corporate governance (CG) and knowledge management (KM) could efficiently respond to uncertainty. Thus, she proposes a framework “in which knowledge management governance (KMG) can conduct to positive delivery of KM strategic benefits and the critical issues relating to it”.

3. Insurance

According to Lester (2011), insurance life and non-life premiums, as well as assets, are very low relative to expected levels given per capita income and demographic characteristics in the Middle East and North African (MENA) region. Among the causes, there are “the absence of mandatory insurance in key areas, the predominant presence of the state in some countries, gaps in regulation and supervision, unsupportive tax regimes, fragmented market structures, a chronic lack of suitably skilled people, as well as the absence of products that conform with cultural/religious preferences, especially in the case of life insurance” Lester (2011). This underdevelopment is a matter of concern because the sector is not contributing to financial and economic development. For example, Khan and Bhatti (2008) point to the fact that Saudi Arabia is considered one of the most strict followers of Islamic religion, suggesting that takaful could have a primary role for growth in that country. However, this was not the case mostly because of regulatory frictions as regulation was developed on the basis of conventional insurance models. When special regulations were adopted such as in Malaysia and UAE, the insurance industry there developed more rapidly. Ahmad et al. (2010) concurred with Lester (2011) regarding the shortage of human resources as one of the major issues for insurance companies in Saudi Arabia. Visser (2019) stressed the hurdles imposed by the bureaucratic processes involved in developing and getting approval for the various insurance or takaful products (see Section 3.1). Nonetheless, even though the insurance industry in Saudi Arabia has not reached a size that may be expected in such an economy, the industry in the country has seen rapid growth and transformation. For example, in 1999, a new law made mandatory health insurance for the entire population (including expatriates and their families). In addition, a new independent authority was created to regulate health insurance called the Council of Cooperative Health Insurance (CCHI), whereby the introduction of an independent authority for health insurance brought more complexity into the regulatory system, see Jaffer (2007).

3.1. Takaful

Takaful is an Islamic form of insurance based on the risk sharing between policyholders who agree to pool their contributions and share their liabilities. The risk is not passed to the takaful business and, at the end of a financial year, the policyholders share the surplus. In case of loss, the cost is “funded by an interest-free loan from the shareholders’ fund. The shareholders’ fund is then repaid the loan from any future surpluses of the policyholders’ fund. The shareholders cannot access the capital from the policyholders’ fund except when the interest-free loan is being repaid” Ahmad et al. (2010). Forbidden investments are those not compliant with Shariah law such as gambling, alcohol, weapons, or assets that pay interest.

This form of insurance was approved in 1985 by the Grand Counsel of Islamic scholars in Makkah, Saudi Arabia. The operating models may vary from a pure mutual insurance to hybrid forms in which, in addition to policyholders, there are shareholders funding and managing the takaful. Operating models are mudharaba, wakala-waqf, or hybrid.

3.1.1. Mudharaba Model

Mudharaba is an Islamic contract based on a financial partnership where the investor provides funds to a fund manager with the purpose of investing them. The two parties share the profits (pre-agreed quota share) but only the investor bears the risk.

The shareholders of a takaful company, in this model, provide both the funding and the management service, and their compensation is based on a pre-agreed proportion of policyholders’ contributions plus a proportion of any income deriving from the invested policyholders’ assets. The policyholders are called the rab-al-mal (silent investors) and they exclusively bear the risk.

3.1.2. Wakala–Waqf Model

The wakala-waqf is a model where whoever operates the business (takaful operator) acts as an agent (wakil) of the takaful participants. In this model, shareholders provide both the funding and the management service, and their compensation is based on a pre-agreed proportion of policyholders’ contributions. In case of loss, the shareholders provide an interest-free loan to the policyholders that needs to be repaid out of future surpluses prior to any profit distribution.

3.1.3. Hybrid Model

The combination model of the Mudharaba (partnership) and the wakala-waqf principal–agent relationship is the most common and is such that, according to the wakala model, the takaful company acts as an agent for the fund management and receives a fee for underwriting the fund. Moreover, based on the mudaraba, the takaful company manages the investments and shares the profit for the investment of the takaful fund.

3.1.4. Reinsurance

Reinsurance on takaful is called retakaful. Because of a lack of retakaful companies in the market, sharia scholars do allow dispensation to takaful insurers to reinsure on a conventional basis when no Islamic compliant alternatives are available. The retrocession from takaful companies ranges from some 10% in the Far East where takaful companies have relatively smaller commercial risks (so far), to the Middle East where up to 80% of risk is reinsured on a conventional basis (see Ahmad et al. (2010)).

3.2. Insurance Market and Financials

Insurance contracts technically must comply with Sharia law, hence some of the net surplus of an insurer must be returned to policyholders annually (either directly or in the form of a reduction in premia). Assets of insurance companies in 2018 amounted to USD 18 billion, policyholders’ assets USD 10 billion and shareholders’ assets USD 4 billion. The number of insurance company employees reached 9682, of whom 59% were Saudis.

With regard to capital, Saudi insurance (respectively reinsurance) companies must have a minimum paid up capital requirement of SAR 100 million (resp. SAR 200 million), but there are plans to raise these levels five fold. They must set aside at least 20% of their annual profits as a statutory reserve until this reserve is equal to 100% of paid up capital and, finally, they have to provide a statutory deposit of 10% of paid up capital (subject to an additional 15% if SAMA deems it is required because of the company’s risk profile). Insurers and reinsurers cannot undertake non-insurance business unless it is strictly needed/complementary to the business. There is no prohibition on insurers from conducting general and life insurance business on a composite basis; however, a certain segregation of activities is required (Table 2).

Table 2.

All Saudi insurance companies’ 2019 statistics (million Riyals). Source SAMA (2020a).

The KSA insurance market is the largest in the GCC and has the world’s primacy for Sharia-compliant insurance lines. In Saudi Arabia, there are 32 companies operating in the insurance market, but, despite this fragmentation, in 2019, the first two generated 51% of GWP (Gross Written Premium). In 2019, the top six insurance companies generated 75% of the insurance market’s GWP, while the remaining 26 insurance companies accounted for the other 25% of total market premiums (Saudi Arabian Monetary Authority The General Department of Insurance Control The Saudi Insurance Market Report 2019) SAMA (2020a). This is a consequence of the rapid expansion that led to intense competition which resulted, in 2019, in net losses for 10 of the sector’s 32 listed companies. In 2014, the regulator intervened requiring insurers to apply actuarial pricing to their policies. The effect was that, from a loss in 2013 of more than SAR 1.7 billion, in 2019, the aggregate underwriting result was a positive SAR 1.2 billion. SAMA continues to suspend underwriting activities for some insurance companies in order to bring more order to the market. Further consolidation seems to be needed, but a meaningful progress has been made.

The top insurance companies in Saudi Arabia are The Company for Cooperative Insurance, or Tawuniya; Bupa Arabia for Cooperative Insurance; and the Mediterranean & Gulf Cooperative Insurance & Reinsurance (MedGulf). The shares of the first two companies in 2015 rose by 59% and 36%, respectively, while MedGulf lost 44% because of a deterioration in the capital position. Saudi Arabia’s insurance market showed premiums worth USD 10 billion in 2019 Toskas and Coutts (2020), and it is expected to overtake the UAE as the largest insurance market in the Arabian Gulf region within the next decade.

In 2019, the insurance industry grew at around 20% with a value of SAR 19 billion for health insurance and SAR 16.5 billion for general insurance (where the latter accounted for 45% of total insurance market). In 2019, Gross Written Premiums (GWP) in the Saudi insurance market reached SAR 37 billion, up from SAR 35 billion in 2018. This represents an increase of 4%, compared to a 19.7% growth rate in 2016. Motor insurance represented 60% of General insurance GWP, in which it has decreased from SAR 9.4 billion in 2018 down to SAR 8.6 billion in 2019 SAMA (2020a). Substantial government welfare payments negate the demand for insurance products across many lines Fitch Solutions (2020).

Nonetheless, insurance penetration stood at below 2% in 2019, while insurance density per capita declined to SAR 1127 (USD 300), meaning that the current level is far below that of developed countries, which no doubt derives in part from cultural factors.

3.3. Competition

The insurance industry is still remarkably concentrated, as two companies seized 51% of the market. In fact, Tawuniya and Bupa Arabia hold a market share of 28.2% and 22.7%, respectively. Regulatory changes were introduced in 2013 that required insurers to apply actuarial pricing to their motor and medical policies. That meant, for those insurers that lacked economies of scale, the regulation could spell the end of selling policies at a loss Oxford Business Group (2013). However, the result of a prudent pricing regime by SAMA indirectly was “further entrenching the competitive advantages of the largest players in an insurance market that is already dominated by a small number of large companies” Oxford Business Group (2013). In fact, in 2017, it was noted that “the high degree of concentration in the insurance market indicates a weak competition among insurance companies. Therefore, the insurance industry is still in need of further reform and development to reduce the risk of concentration, as well as setting policies that may help increase competition, and encourage acquisition, which achieve comparative advantages of the combined entities” Fadaak and Alghamdi (2017). In 2020, as shown in Table 3, this problem was not yet solved.

Table 3.

Top 30 insurance companies’ financial performance. Source Noor (2020) and authors’ elaboration.

3.4. Profitability and Capital

After two years of contraction reflected in the performance on the capital market (see Figure 3), in 2019, the Saudi market recovered in both gross written premium (GWP) and aggregate pre-zakat (mandatory charitable contribution according to Sharia) profits. This was the effect of enhanced pricing which increased profits before zakat by over 108% to SAR 1.25 bn from SAR 600 m in the previous year. Net profits have also jumped to SAR 883.6 m from SAR 224.4 m in 2018 (294%) Noor (2020).

Figure 3.

TASI vs. the Insurance sector—in violet, the Tadawul index, in blue, the insurance stock index. Source Argaam (2020).

The aggregate premium income for thirty insurers was SAR 36.93 bn in 2019 against SAR 34 bn the previous year, which corresponds to an increase of 8.6%.

However, there is still a large variation with regard to individual performance of insurance companies, as Al Tawuniya and Bupa Arabia (the largest two companies) together accounted for 89% of the sector’s net profits and 50% of GWP (see Table 3).

Due to the new regulations designed to enhance minimum capital and solvency requirements, and the incorporation of actuarial based pricing and reserving, many insurance players experienced dramatic declines in operating performance and risk-adjusted capital. Despite these short-term adverse impacts, these regulatory changes are sorely needed and will much better position the insurance markets for greater financial stability. The Saudi insurance market is judged to have a moderate risk, according to credit ratings firm Fitch Toskas and Coutts (2020), in line with most GCC countries.

Credit ratings tend to hover around the investment grade borderline for the industry. The better capitalized, more sophisticated companies will survive and prosper, as the gap between larger and smaller players widens. While it is not clear to what extent regional regulators will actively monitor the market, in the long term, improvements in insurance regulation ought to result in greater stability and confidence, which is much needed.

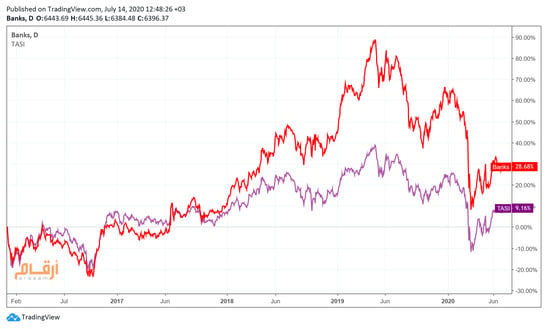

4. Banking

The banking sector is the largest segment of the Saudi financial system with total assets equivalent to 65% of GDP (cf. UK at 378%). Total assets expanded to SAR 2.4 trillion in 2018 (10% 10-year CAGR). Bank credit to the private sector (both consumers and corporates) totalled SAR 1.4 trillion in 2018. However, credit is concentrated (over 70%) in three sectors: Commerce, Manufacturing and Processing, and Building and Construction, and the balance has not changed significantly. There are 13 domestic banks, along with another 12 foreign banks operating in KSA, so, on a per capita basis, the system is quite concentrated Bikker and Haaf (2002). This helps the sector’s profitability but also increases contagion risk. Higher profitability is reflected in the stock market as the banking sector has recently overperformed the general stock index (see Figure 4).

Figure 4.

TASI vs. the Banking sector—in violet, the Tadawul index, in red, the banking stock index. Source Argaam (2020).

In its efforts to maintain financial stability while stimulating the economy, SAMA has made a number of prescriptions to try to limit consumer credit risk:

- Debt Service to Income (DTI) ratio (i.e., a monthly deduction cap) capped at a maximum of 33% of borrower’s monthly salary and 25% of borrower’s pension

- Loans limited to five years maximum tenor

- Loan to value limits on mortgage lending raised from 70% to 85%

Real estate lending in 2014 reached 12% of total bank credit and its weight in terms of non-oil GDP amounted to 9.3%. SAMA previously introduced a cap on the loan-to-value (LTV) of 70%, now raised to 85%. The stipulated leverage ratio (equity to assets) at 12% is well above the minimum level of 3% set by the Basel Committee. Saudi Arabia currently has among the highest average equity to assets in the region and globally (around 15% at the end of 2019), along with the highest tier 1 and total capital ratios Ramsdale et al. (2020). Liquidity risk is regulated by the loan to deposit (LTD) ratio which should be a maximum of 85%, while deposits must be a minimum 125% of the total bank credit. Recently, SAMA raised the LTD ratio to 90%, in an effort to stimulate bank lending. In addition, SAMA has set the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to 60% and 100%, respectively, in line with Basel standards. Saudi banks currently have one of the lowest loan to deposit ratios in the region (around 85% at end 2018), though these are set to rise. The average customer deposits to total funding ratio is the highest in the region (over 90% end 2018). Many deposits also pay no interest. The broad money indicator in KSA is only about 75% of GDP, compared with the UK’s 125%, and broad money growth has been declining. This is indicative of lower liquidity throughout the system. Over the past years, there has been a noticeable drop in savings rates in KSA, to below 2%, putting further pressure on bank deposit funding and liquidity. Wholesale deposits from large government entities have also dropped, due to government spending, which budget cuts have been instituted to address Ramsdale et al. (2020). Nonetheless, the Saudi population are active users of bank debt, with an average 174 of 1000 people borrowing from commercial banks (vs. 60 in the UK). This is despite only nine commercial bank branches per 100,000 adults in KSA, compared with 25 in the UK. As fiscal pressures mount, there is a consensus that NPLs (non performing loans) will rise, and may already be under-reported. Domestic credit to the private sector is about 57% of GDP, vs. 134% in the UK, indicative of a smaller private sector. Nonetheless, according to Damak (2021) at S&P Global, domestic credit losses are going to double from 0.7% in 2017 to 1.4% in 2021, thus requiring better credit risk management Orlando and Haertel (2014).

4.1. Profitability and Assets

The banking sector traditionally has benefited from increasing non-interest bearing bank deposits (which continue to serve as the primary source for funding and had an average annual growth of around 7% from 2008–2018) that reached SAR 1.7 trillion in 2018. This was supported by both a strong private sector and accelerated public spending. Saudi depositors traditionally have often appeared indifferent to earning a return on their bank deposits, in line with Sharia. Nonetheless, SAMA has had to inject liquidity into the system, in order to boost credit supply (see Carpinelli and Crosignani (2015), as an example). This emergency action needed to be taken in order to meet minimum liquidity needs. In addition, SAMA introduced 7 and 28 day repo facilities, having previously relaxed the maximum loan to funding ratio to 85% from 90% Friederich (2017). In contrast to some OECD banks, whose net interest income (NII) as a percentage of total has declined, Saudi Arabian banks derive from NII two thirds of their total income on average. The relatively wide NII margin has been sustaining the profitability of the banks, in the absence of major loan loss provisions. Return on Equity (ROE) and Return on Assets (ROA) for the Saudi banks averaged around 11% and 2%, respectively, in 2019. Capital Adequacy Ratio (CAR) was around 15% and the NPL (non performing loan) ratio rose to 2.5% in 2019 from below 2% in 2018 (for a comparison, see Orlando and Pelosi (2020)). Average reserve coverage of impaired loans is still adequate at 117% (end 2019). Impairment charges to loans has also been relatively low at around 1% but is creeping upwards. Saudi banks show a cost to income ratio of an average 35%, comparable to the rest of the region, due to relatively small retail networks, universal bank models and high margins. Stress tests are carried out under the scenarios of interest rates rising by 25 or 50 basis points. Customers are covered up to SAR 200,000 of the deposit amount by the Saudi Arabian Deposit Protection Fund (DPF). Banks have proven relatively resilient despite the weakening Saudi macroeconomic environment. Domestic liquidity has tightened as deposits have declined while credit is still growing (hence liquidity injections), but reported non-performing loans (NPLs) are still comparatively low and capital adequacy ratios remain high. This situation is likely to deteriorate as oil prices remain depressed, aggravated by the economic fallout of the COVID-19 pandemic Ramsdale et al. (2020). The Saudi banks are big buyers of domestic government debt, with holdings estimated at over SAR 48 billion.

The Saudi riyal three-month interbank rate (SAIBOR) had risen to 2.4% by October 2017, from 0.8% a year earlier, while the policy rate (reverse repo rate) rose by just 0.25% in December 2015, and again by another 0.25% in December 2016. The rise reflected tighter liquidity due to a decline of 3.3% year on year in June 2017 in public and private deposits, continued expansion of private sector credit (up 8% in June 2017) and acceleration of claims on the public sector. To reduce the impact, SAMA lowered the value of outstanding SAMA bills by SAR 83 billion during the first half of 2017. According to media reports, SAMA also provided banks with term deposits. However, the banking system remains reasonably solid despite the tougher environment. Three month SAIBOR in March 2020 had fallen to 1%, a response to COVID-19.

The performance and financial metrics of the Saudi banks have remained relatively sound up to now, due to some business growth and still manageable impairment charges. However, prospects for the Saudi economy are under pressure due to the effect of lower oil prices on government spending and the impact of this on the overall economy, and this is already beginning to show in bank metrics. This more difficult economic environment can be expected to continue for the next couple of years at least, as GDP growth slows largely because of lower oil revenues. This is reflected in slower loan growth, around 3% in 2019, versus 5% in 2018, and double digit before that. Strong capitalization, however (15% core capital), should largely prevail, due to lower than expected loan growth. Asset quality metrics have generally been strong, but are likely to be pressured over the next couple of years. Slower loan growth also means that loan portfolios season more quickly. Banks eventually must tighten underwriting standards, especially in more stressed sectors such as contracting and construction, but also retail. This will be a delicate balancing act as they try to promote loan growth. High borrower and sector concentrations remain, exposing the banks to event risk. Funding benefits from good access to low cost non-commission-bearing deposits, which alleviates pressure on margins. Customer deposits are short term but are behaviourally “sticky”. Loan to deposit ratios are among the lowest in the region but are on the rise. Liquidity tightened a bit in 2020 with less government-related deposits. The banks further benefit from large volumes of liquid assets. The sovereign has a strong capacity to support the banking system, sustained by its sovereign wealth funds and ongoing revenues, mostly from hydrocarbon production, and the moderate size of the banking sector compared to the nation’s GDP. However, this ability to support is weakening due to significant deterioration in the fiscal position. Saudi Arabia is a Financial Stability Board/G20 member country and has implemented Basel III. Resolution legislation is therefore being implemented.

4.2. Risk and Liquidity

Credit volumes are important to Saudi banks, which are heavily reliant on net interest income to support revenue growth. Slacker loan growth is set to pressure overall profitability. Banks are striving to offset lower lending contribution with further improvements in efficiency, which represents a further challenge Ramsdale and Sakhri (2020). Slower loan growth also means that loan portfolios start to season more quickly, placing upward pressure on impaired loans and bringing down high coverage levels. In response, banks will be compelled to tighten underwriting standards, especially in more stressed segments such as construction. Saudi banks’ loan books and operations are essentially domestic, which links them closely to the economy of a single operating market, but has historically shielded them from troubles elsewhere in the region and globally. Overseas risk stems mainly from the investment portfolios of some banks. Some banks have subsidiaries abroad, but such operations are a relatively small part of the banks’ balance sheets. A shift of strategic focus abroad seems unlikely but could be coming, as the nation tries to raise its international profile. Labor market reforms are also improving employment, which should grow the number of bankable retail customers who meet lending criteria. SAMA appears to be a competent, conservative and hands-on regulator. Lending caps, salary assignment for personal lending, a well-established credit bureau, conservative debt burden limits (33% on personal lending) and limits on loan to deposit ratios (now 90%) have helped to ensure financial stability and avoid build up of asset bubbles compared with other jurisdictions. SAMA has implemented a minimum general reserve of 1% of total loans and 100% minimum of NPLs. From January 2016, SAMA imposed a maximum allowed exposure for a single grouped obligor at 15% (from 25% previously) Bank for International Settlements (2018). Regulatory capital ratios under Basel III have not changed significantly from Basel II. One reason is that SAMA still requires banks to calculate their risk weighted assets under the standardized method. Therefore, any changes in the ratio are from the composition of capital (which is mostly high quality common equity and reserves). The main difference for Saudi banks is that they are now able to include interim retained earnings in reported capital ratios. Lower dividend payouts and solid earnings have helped enhance capital ratios in recent years. Concentration risk remains a key issue for Saudi banks due to their strong domestic focus and a highly concentrated market, dominated by conglomerates, family-owned groups and government-related entities. The defaults of the Saad and Al Gosaibi groups in 2009 clearly highlighted the vulnerability of banks to concentration risk. High concentrations also exist on the funding side, but the public sector nature of the largest depositors of most banks mitigates this risk. Liquidity has tightened slightly, with marginally less quasi-government deposits in the banks. Maturities vary from 5 to 10 years, giving banks an alternative to traditional and less remunerative short-term treasury bills. Many of the banks’ largest depositors, such as the General Organization for Social Insurance, The Public Pension Agency and Public Investment Fund are buying government securities and somewhat reducing deposits with the banks as a result, taking some liquidity out of the market. No bank is dependent on interbank funding. Long-term debt plays only a minor role in the banks’ funding profile. The Saudi regulator has been very supportive in providing liquidity to the banking system when needed Shahina et al. (2016). Most banks would gladly replace less remunerative government Treasury bills with higher yielding government bonds, but there is no liquidity impact as all are fully repoable with SAMA in case of need. Saudi Arabia is likely to maintain its peg to the dollar (about SAR 3.75 per US$) and increase rates in line with US Fed rises. This would push up rates on domestic commercial and consumer lending, potentially permitting the banks to widen margins because a large proportion of deposits are not remunerated and this has typically been the case through rate rising cycles. Nonetheless, with oil conceivably representing a declining proportion of GDP going forward, KSA may consider abandoning its peg to the USD. With markedly higher inflation than the US, this brings about a pressure to devalue Raghu (2016).

Concentration risk is being somewhat lowered by the rule (fully implemented by 2019) to limit single exposure from 25 percent to 15 percent of the bank’s capital and reserves. On the ALM (asset-liability management) side, in 2018, long-term bank loans totaled 46%, while short-term credits predominated. Average loan growth, while modest at about 3%, has still well exceeded real GDP growth, which has slowed from double digits to below 0%.

Widening asset liability gaps remain a risk. The contractual maturity of Saudi banks’ deposit bases has shortened significantly in recent years, while the proportion of medium and long term loans has been increasing. However, the development of maturity mismatches is less pronounced on a behavioral basis, especially as the proportion of contractually short term but sticky non-commission-bearing deposits has increased steadily, making up around two thirds of the banks’ deposit bases. The amount of loans banks can extend for facilities requiring longer term funds could be constrained if mismatches continue to develop adversely. Availability of longer term funding could reduce lending opportunities, especially in light of the mortgage law, which has restricted loan to value to 85%. To address this issue, the authorities are establishing a new state-owned securitization company that should help tackle the asset liability mismatch for local banks caused by increased tenor lending, particularly mortgages, financed mainly by short-term deposits. The retail sector, which accounts for around 25% of credit, continues to have growth opportunities, due to the nation’s young and fast growing population. The banks making operating losses from retail banking have incurred high investment costs in developing retail networks, which should break even as efficiencies increase. The consumer lending rules introduced by SAMA in 2014 set maximums for loan tenor and lending limits. They also restricted fees to the lower of 1% of the loan amount or SAR 5000. This has affected the earnings of some banks, especially those with large retail franchises. However, the banks have quickly found alternative fee income, such as ATM charges, to replace the retail lending fees. Islamic finance is a mature and developed industry in Saudi Arabia representing about two thirds of total bank financing, with about 38% coming from Islamic banks and 28% from the Islamic windows of conventional banks Parkinson (2016). Of the 11 biggest licensed commercial banks in Saudi Arabia, four are fully Sharia compliant with the remainder providing a mix of Sharia-compliant and conventional banking products and services. Due to the largely Islamic finance nature of the lending market in Saudi Arabia, the performance and credit metrics of both Islamic and conventional banks are largely similar Sillah et al. (2015).

4.3. Banks’ Assets

Saudi Arabia has the largest Islamic bank asset base of any country that allows commercial banks to operate alongside Islamic banks. All banks are subject to a single supervisory authority and the same disclosure requirements. SAMA regulates Sharia compliant banks in the same way as it regulates conventional banks. No special treatment is applied to Islamic products and no additional support is given to Islamic banks. However, as a predominantly Muslim market, and now that similar retail products exist in both conventional and Sharia compliant form, Islamic banking is seeing the fastest growth. As noted earlier, Saudi banks benefit from large volumes of local currency liquid assets, including government securities and deposits with SAMA. However, one of the main differences between conventional and Islamic banks is the structure of their liquidity/investment portfolios. This is because Islamic banks have fewer Sharia compliant investment options. These are mainly cash and central bank deposits, such as “mutajara” or “murabaha”, which are therefore relatively low risk and low return. Investments also include sukuk issued by other Islamic banks Lone and Alshehri (2015). Stand-alone credit ratings on Saudi banks are clustered in the BBB category, but ultimate ratings, averaging in the A category, benefit from the perception of strong sovereign support.

4.4. Competition

Recently, there has been some consolidation in the industry. Last year, SABB merged with Alawwal to create KSA’s fourth largest bank. A merger between KSA’s largest bank, NCB, with Samba, the fifth largest bank, is on the cards. A larger bank is required to facilitate the massive investment needed in the Vision 2030 plan, in which KSA’s Public Investment Fund (PIF) is the key player, and is the largest shareholder in NCB and Samba.

As noted, the Saudi banking sector is comprised of thirteen domestic banks with high barriers to entry in an attractive market. They typically enjoy sound liquidity and funding, low cost deposits and healthy margins, which help limit competition. There are another seventeen foreign banks represented in the Kingdom, including Deutsche Bank and BNP, and Citibank has re-entered the market (after yielding SAMBA to local ownership). JP Morgan has a market presence. Greater foreign presence should heighten competition, which is needed in the increasingly dynamic environment. A merger between SABB and Alawwal has been consummated, with another large one between NCB and Samba on the horizon. As observed, loan growth has slowed due to low oil prices and reduced investor confidence. There is continued emphasis on state projects, as the state has high ambitions despite lower oil revenues. The growth in the non-oil sector is set to continue, but will likely be insufficient to counteract government spending, due to the high reliance on oil.

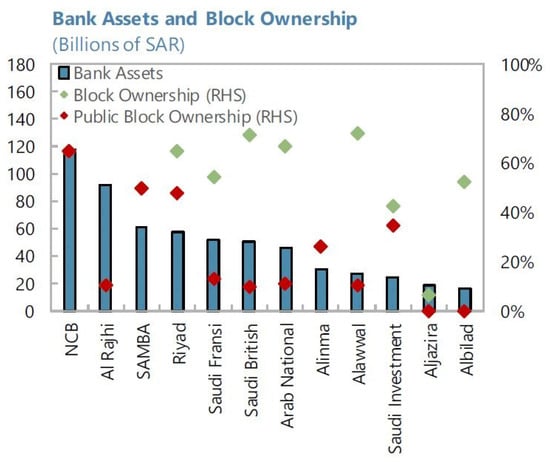

Government entities, such as PIF (Public Investment Fund) and the two state pension funds, have significant ownership stakes in Saudi banks, and this may reduce incentives to compete (see Figure 5). This view is based on the assumption that firms act to maximize profits for their owners, so that they are reluctant to compete against other firms with the same owners. Schmalz (2018) challenge this view as investors strive to diversify their investments, and it is increasingly common for the ownership of firms to overlap. This has cast doubts on the benefits from portfolio diversification. Empirical findings are that, when common ownership is significant, in the bank industry, depositors get lower interest rates as well as in transportation, where airlines charge higher prices. To increase competitiveness, the entry of of additional foreign banks is under way IMF (2019a).

Figure 5.

Block ownership is the fraction of shares held by all block owners (with stakes above 5 percent). Public block ownership is the fraction held by the PIF, GOSI, and PPA. Source IMF (2019a).

5. Regulation

5.1. Saudi Arabian Monetary Agency (SAMA)

The central bank of the Kingdom of Saudi Arabia (KSA), the Saudi Arabian Monetary Agency (SAMA) was established in 1372H (1952), and its main functions are: dealing with the banking affairs of the Government; minting and printing the national currency (the Saudi Riyal); strengthening the Saudi currency and stabilizing its external and internal value, in addition to strengthening the currency’s cover. It also manages the Kingdom’s foreign exchange reserves and manages monetary policy for maintaining the stability of prices and exchange rate, currently pegged to the USD. It is responsible for promoting the growth of the financial system and ensuring its soundness, and, in this respect, it supervises commercial banks and exchange dealers, as well as cooperative insurance companies and the self-employment professions relating to insurance. It also supervises finance companies and credit information companies.

5.2. Depositors Protection Fund

SAMA issued final Depositors Protection Fund (DPF) Rules 51 on 14 April 2015, and it came into effect on 1 January 2016. DPF Rules were issued under Article 3(d) of SAMA Charter issued by Royal Decree No.23 dated 23-5-1377H (15 December 1957G) and Article 16(3) of the Banking Control Law issued by Royal Decree No. M/5 dated 22-2-1386H (11 June 1966 G) (see FSB report 2015 FSB (2015)).

This protection scheme covers depositor per member bank, including principal and accrued commission/return and “would fully insure 97% of bank depositors and 31% of the value of eligible deposits or 23% of the value of total deposits” FSB (2015) but does not cover some individuals/institutions specifically mentioned in Rules 51 such as members of the board of directors and senior management of a bank (including their family members), other banks or financial institutions, shareholders holding in excess of 5% shares in the bank, etc.

The DPF follows the recommendation from FSB (see FSB (2012b, 2012a)) to avoid an overstretched, unregulated ‘implicit’ deposit guarantee. In fact, the Supreme Economic Council’s statement in 2008, “is perceived to provide an implicit full coverage to all depositors and is inconsistent with the objective of setting up a limited deposit protection system that promotes market discipline and avoids moral hazard. In view of the entry into force of the DPF, the authorities need to decide how best to withdraw this implicit guarantee without any adverse impact on depositor confidence” FSB (2015).

5.3. Consumer Rights in KSA

SAMA has a department dedicated to consumer protection and deals with both bank and insurance complaints. This is in accordance with ‘General Principles for Financial Consumer Protection’ as defined by SAMA.

5.4. Capital Market Authority of Saudi Arabia (CMA)

The Capital Market Authority was established under the Capital Market Law (CML), Royal Decree No. (M/30) 2/6/1424H (31/7/2003), to supervise and regulate the Saudi capital market, reinforce transparency, and to protect the investors and dealers. It has financial, legal, and administrative independence and reports directly to the President of the Council of Ministers. The CMA is entrusted with the following duties: to regulate and develop the capital market and promote appropriate standards and techniques for all sections and entities involved in Securities Trade Operations; to protect investors and the public from unfair and unsound practices involving fraud, deceit, cheating, manipulation, and inside information trading; and to maintain fairness, efficiency, and transparency in transactions of securities. CMA also is charged with developing appropriate measures to reduce risks pertaining to transactions of securities; developing, regulating, and monitoring issuance of securities and under-trading transactions. CMA regulates and monitors the activities of entities working under it; it regulates and monitors full disclosure of information related to securities and issuers. The parties subject to CMA’s supervision are: The Saudi Stock Exchange Co. (Tadawul); Authorized Persons (APs) i.e., persons authorised to carry on securities business by the Authority; listed companies; capital market dealers/participants; Special Purpose Entities (SPEs); and credit rating agencies and companies.

5.4.1. Strategic Priorities

Among the strategic priorities of CMA, as listed in their annual report (Capital Market Authority 2015, 2018), there are: Facilitating Funding, Encouraging Investment, Promoting Confidence, and Building Capabilities. They aim to do this through: Supporting Authorized Persons’ development; raising awareness regarding CMA’s role and the financial investment culture in the capital market; building the capabilities of capital market participants; promoting the regulatory environment and stability of the capital market; raising the level of governance, transparency and disclosure in the capital market; supporting the growth of asset management and promoting institutional investment; raising market attractiveness to foreign investors; diversifying investment products and mechanisms available in the capital market; deepening the capital market and raising its role in creating capital; developing the sukuk and debt instruments market; and promoting the role of mutual funds in financing the national economy.

The CMA announced measures designed to help deepen domestic markets. Qualified foreign investors (QFIs) are allowed to invest in IPOs. The value of global assets under management required to qualify as a QFI is reduced to USD 1 billion from USD 5 billion and the maximum share that a QFI can take in a company is raised to 10% from 5%, while the ceiling on combined ownership of the domestic market by QFIs of 10% is abandoned.

5.4.2. Staff, Qualification, Training and Development

Of over 638 employees, 64% have a bachelor’s degree or less; therefore, CMA has offered training opportunities through training programs and scholarships. In 2015, 378 employees enrolled in 22 in-house training programs while 696 employees participated in 428 international training programs. Anecdotally as one measure, there are around 250 CFAs (Chartered Financial Analysts) in Saudi Arabia, compared with close to one thousand in the Emirates, which suggests a large potential for increased financial sophistication.

6. Quantitative Analysis and the Exposure to Oil

In this section, a quantitative analysis of the performance of Saudi banks and insurers before and during the COVID-19 pandemic is carried out, and against the backdrop of oil prices.

6.1. Data

The database consists of stock price and trading volumes for 22 insurance and bank companies since March 2010 as retrieved from Bloomberg and Yahoo Finance. The companies (by number, name and code) pandemic are: [1] Gulf Union Alahlia (8120), [2] Bupa (8210), [3] Malath Coop. Ins. 8020, [4] Allianz Saudi Fransi (8040), [5] Arabian Shield 8070, [5] Salama (8120), [6] Walaa Coop. Ins. (8060), [7] Al-Etihad (8170), [8] Al Rajhi Ins. (8230), [9] AXA Coop. Ins. (8250), [10] Wataniya Ins. (8300), [11] Riyad Bank 1010, [12] Wataniya Ins. (8300), [13] Bank AlJazira (1020), [14] Saudi Inv. Bank (1030), [15] Banque Saudi Fransi (1050), [16] Saudi British Bank (1060), [17] Arab National Bank (1080), [18] Samba Financial Group (1090), [19] Al Rajhi Bank (1120), [20] Bank Albilad (1140), [21] Alinma Bank (1150), [22] National Comm. Bank (1180). Notice that the insurance companies are numbered from 1 to 11 and banks are from 12 to 22.

By including 22 names, we practically consider all financial institutions in the KSA because what we want to show is the difference between pre-COVID 19 and during COVID-19 for the whole economy. Notice that some factors (such as firm size) do not play a role in our analysis as they are invariant before and during the pandemic. In the remainder of this section, we will prove that the pandemic has caused a separation between banks and insurers or, in less technical words, that the pandemic has prompted a diversification in the economy.

In addition to the above-mentioned data, for the same period, the time series of the Tadawul (coded as Tasi) and the Brent crude oil spot prices (BZ = F) traded at the New York Mercantile market have been retrieved for the same period.

6.2. Cluster Analysis

The database has been divided into two parts: from November 2014 to December 2018 and from the beginning of January 2019 to end of January 2021. This is to analyse what happened during the COVID-19 pandemic.

(Z) returns the inconsistency coefficient for each link of the hierarchical cluster tree Z generated by the linkage function. The algorithm calculates the inconsistency coefficient for each link by comparing its height with the average height of other links at the same level of the hierarchy. The larger the coefficient, the greater the difference between the objects connected by the link. Notice that we use Ward linkage because it performs well in separating clusters when there is noise between clusters. The drawback of the Ward linkage is mainly related to its complexity of , making it not particularly scalable. However, this is not a problem in the context of this paper because the dataset is composed only by 22 financial institutions.

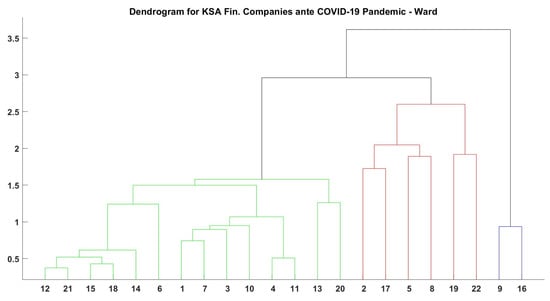

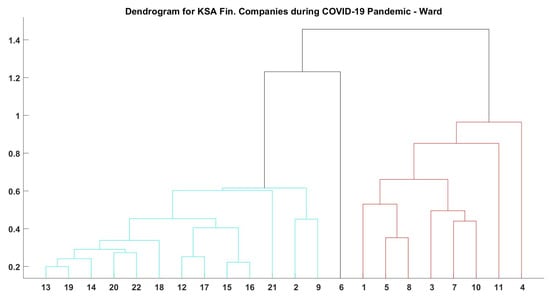

Figure 6 displays the related dendrogram (i.e., a hierarchical cluster tree), and, as shown, there is no clear distinction between banks and insurance companies. As shown in Figure 7, the situation changed substantially during the COVID-19 pandemic as insurers and banks are rather distinguishable and the inconsistency coefficient is lower Jain and Ubes (1988).

Figure 6.

Ante COVID-19 pandemic hierarchical cluster tree on the performances of insurances (first 11 time series) and banks (from 11 to 22). Distance metric = Euclidean, linkage = Ward, mean of inconsistency coefficient (excluding zeros) = 0.8554. There is no clear distinction between banks and insurers.

Figure 7.

COVID-19 pandemic hierarchical cluster tree on the performances of insurances (first 11 time series) and banks (from 11 to 22). Distance metric = Euclidean, linkage = Ward. Mean of inconsistency coefficient (excluding zeros) = 0.8127. The pandemic has created a separation between banks and insurers.

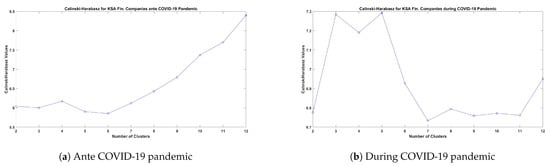

Thus far, hierarchical clustering has been applied to show how the same analysis produced different results before and during the pandemic. The result is that the pandemic produced a separation between banks and insurances. To measure the quality of clustering results, recurrence made the Caliński and Harabasz (1974) Index defined as

where k is the number of clusters, N is the total number of observations, is the overall within-cluster variance, and is the overall between-cluster variance. Figure 8 confirms that, while before the COVID-19 pandemic there was no clear-cut result on the number of clusters, the pandemic caused such a separation.

Figure 8.

Calinski–Harabasz Index with Ward linkage. The figure to the left shows no clear-cut result on the number of clusters. The figure to the right shows that the optimal number of clusters is either 3 or 5.

6.3. Correlation

While the economy of Saudi Arabia is clearly exposed to oil prices, the financial sector has its own rules. In Figure 2, it was already shown that, despite the recession caused by the pandemic, the performance of banks, insurers and the Tadawul stock market was positive. However, this varies considerably among periods and companies. For this reason, a Kendall (1948) rank correlation was run by to measure the ordinal association between the financial companies and both the Tadawul and the Brent price index. Table 4 shows that what really matters in terms of risk is the “oil exposure”. In fact, while correlation with the index is not a clear separator, the correlation with oil provides a clearer picture: only the two banks with a correlation lower than 0.5 over performed significantly. On the other hand, insurers seem in general to be less correlated to both the stock market and oil.

Table 4.

Kendall correlations for insurances and banks next to performances (from the beginning of January 2019 to end of January 2021).

Notice that Walaa Coop. Ins. before 2019 was the only insurer with a correlation above the threshold of 0.5. Arab National Bank, National Comm. Bank, Bank Albilad and Al Rajhi Bank were the only four banks below the threshold. Notwithstanding, while the first two increased the correlation (and underperformed), the other two did not (and had positive performances). This result is also explained by the fact that Arab National Bank, National Comm. Bank and Bank Albilad were just below the threshold while Bank Albilad and Al Rajhi Bank were well below it.

6.4. Econometric Analysis

Let us define the extra-(log)return of the company i at the time t with respect to the market as

where is the market return, and are the intercept and slope coefficients, respectively, of the OLS regression carried out over our sample.

As mentioned, a key risk factor is the exposure to oil of financial companies. This has been reported in a study over 3043 firms (896 commercial banks and 2147 non-bank financials) by Demirguc-Kunt et al. (2020). The hypothesis is that volumes of both stocks and oil contracts represent a proxy of liquidity, volatility and macroeconomic situation. For this reason, the econometric model intended to be tested is the linkage between extra-returns and log-returns of trading volumes of each stock , those of the Brent crude oil contracts and the interaction between trading volumes of each stock and trading volumes of oil (all in terms of log-returns). That is,

where for are the variables’ coefficients and the error. The idea is that, in our case, individual effects are correlated with the explanatory variables (i.e., ), which motivates the use of the fixed-effects within estimation. In this way, unobserved heterogeneity Baltagi (2008) can be captured.

Results of the Analysis

As mentioned, in the work by Demirguc-Kunt et al. (2020), panel data analysis on banks tries to relate their extra-performance with bank’s liquidity, capital, size, ownership and oil price. In that paper, Table 2 reports some results for the months of January, February, March and April. The highest (0.163) R-squared is in March and the lowest (0.027) is in April. In addition, while the estimated coefficients corresponding to oil and liquidity risk have very low p-value in March, in the other months, risk factors do not seem to be statistically significant. From those considerations, it seems that the model proposed by Demirguc-Kunt et al. (2020) can only capture the risk for a specific month.

Table 5 and Table 6 report the analysis performed (with the toolbox by Álvarez et al. (2017)) on the model in Equation (2). As shown, the regression is consistent across periods in terms of R-squared and p-values of the estimated coefficients. Individual effects are listed in Appendix A. Notice that, in order to check whether collinearity was introduced (which implies that estimates are unstable and have high standard errors), the test suggested by Belsley et al. (2005) is used. The so-called condition indices include the largest which indicates weak dependencies when it is around 10, the average when it is around 30 and high when it is larger than 100. In our case, the Belsley collinearity diagnostics gives values below between 1 and 2.

Table 5.

Relationship between extra return, oil and trading volumes before the COVID-19 pandemic.

Table 6.

Relationship between extra return, oil and trading volumes during the COVID-19 pandemic.

7. Discussion

The initial assumption of this work is that, while the financial system in the Kingdom of Saudi Arabia (KSA) has a history of relative soundness, the sector is facing challenges of a sluggish economy, need for reform and negative effects of the COVID-19 pandemic. The objective is to assess how well the government thus far has responded to the challenges in the financial sector. This entails analysis of the performance of both banks and insurers. The working hypothesis is that the insurance industry has improved in efficiency and profitability and that its contribution has become evident during the pandemic.

The analyses in Section 3 and Section 4 provide a comprehensive assessment of insurance and banking in the KSA. >From that perspective, it is evident that, especially insurers, have improved in all considered aspects (profitability, competition, capital, risk, etc.).

In addition to the above, quantitative analysis has expressively targeted the risk for the KSA financial system. For achieving this goal, we performed cluster, correlation, and panel data analysis. All the above confirm the working hypothesis that the insurance industry has improved its position, resulting in higher efficiency and profitability and lower risk. Indeed, the obtained results prove that progress has been made in that industry in terms of helping to diversify the economy with the onset of the pandemic.

Cluster analysis confirms the induced diversification in the economy by insurers. This is because, while before COVID-19 pandemic there was no clear-cut result on the number of clusters, the pandemic caused such a separation. Such application to the financial industry in the KSA is new in literature.

To complement cluster analysis, we have added a correlation analysis to measure the risk that the economy of Saudi Arabia faces because of its exposure to oil. It is observed that insurers have contributed to the diversification of the economy as they appear much less correlated to oil than banks, thus reducing the risk of the whole KSA financial system. Once again, such a result is new in literature. Still, in terms of exposure to oil for the KSA economy, an econometric analysis was carried out on panel data. In contrast to Demirguc-Kunt et al. (2020), it is shown that the risk factor for the financial sector in the KSA is changes in oil volumes rather than changes in oil prices.

8. Conclusions

In line with the KSA’s economic transformation programme, reform and refinement of the financial system remain paramount. All financial sectors, including banking, insurance and asset management, need to adapt to the challenge of a more demanding economic and customer environment.

The quantitative analysis presented has shown how the diversification induced by the insurance industry has benefited the economy especially during the COVID-19 pandemic where the separation between banks and insurers has become clearer. It is established that the COVID-19 pandemic presents an opportunity to consolidate players in the industry, with the result of contributing further to economic diversification. In this sense, the policy implication for the government, regulators and supervisors is that the pandemic, having created a more competitive and ‘level’ playing field, has highlighted those players who have demonstrated best performance and practice, in an idiosyncratic fashion, setting them apart from the systemic effects of the health crisis. From this, the authorities can extract elements of this best practice, in order to apply it in a more widespread manner across the industry. Moreover, it is established that it is in the interests of the KSA government to monitor changes in oil production volumes more so than those in oil prices, as the former have a greater economic impact.

The Kingdom’s ambitious transformation plans require the underpinning and support of a more transparent, sophisticated and innovative financial sector, which possesses the capacity to help drive economic growth while managing risks adequately. On this score, the current framework would benefit from a more competitive, open and outward looking approach. Progress can be made by building on the relatively solid base achieved so far, but just as the nation as a whole must openly confront its challenges, so the financial system must also play its part in adapting to transformation in an open and progressive way. Going forward, there are significant challenges for KSA and its financial system, as long-term economic growth slows with lower oil revenues, the budget deficit expands, and productivity gains are realized only slowly. This has been exacerbated by the COVID-19 crisis. The government is attempting to meet these challenges through its Vision 2030 program, but, as the Middle East’s biggest economy, KSA has to work hard to ward off loss of competitiveness and to attract and manage the considerable investment required. However, it may become a case of too little, too late. Well directed reforms need to be implemented quickly, and Vision 2030, while a laudable initiative, has to be accompanied by increased openness and improved skills if KSA is not to be left behind among the Gulf nations as a financial economy of importance.

Further research could be conducted to study key initiatives undertaken by the government and the regulator to strengthen the financial sector and to reduce its sensitivity to shocks. Monitoring the progress in diversification of the economy with a suitable set of key performance indicators is also a further step to take. More generally, the entire financial industry in the KSA needs to adapt to the challenge of a more demanding economic and customer environment.

Author Contributions

Conceptualization, G.O.; methodology, G.O.; software, G.O.; validation, G.O. and E.B., formal analysis, G.O.; investigation, G.O.; resources, G.O.; data curation, G.O.; writing—original draft preparation, G.O.; writing—review and editing, G.O. and E.B.; visualization, G.O. and E.B.; supervision, G.O.; project administration, G.O. Both authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on referenced datasets and on request from the corresponding author.

Acknowledgments

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Panel Analysis

Table A1 and Table A2 show the statistics of the individual effects by company before and during the COVID-19 pandemic, respectively.

Table A1.

Relationship between extra return, oil and trading volumes before the COVID-19 pandemic.

Table A1.

Relationship between extra return, oil and trading volumes before the COVID-19 pandemic.

| Panel: Individual Effects by Company | ||||

|---|---|---|---|---|

| ID | Ieffect | Std. Error | t-Stat | p-Value |

| 1010 | −0.249415 | 0.02593 | −9.6186 | 0 *** |

| 1020 | −0.016858 | 0.02593 | −0.6501 | 0.516 |

| 1030 | −0.073187 | 0.025947 | −2.8206 | 0.005 *** |

| 1050 | −0.044353 | 0.025936 | −1.7101 | 0.088 * |

| 1060 | 0.004819 | 0.025928 | 0.1859 | 0.853 |

| 1080 | −0.02256 | 0.025929 | −0.8701 | 0.384 |

| 1090 | 0.03074 | 0.025937 | 1.1852 | 0.236 |

| 1120 | 0.022084 | 0.02593 | 0.8517 | 0.395 |

| 1140 | −0.027879 | 0.025972 | −1.0734 | 0.283 |

| 1150 | −0.125308 | 0.025941 | −4.8305 | 0 *** |

| 1180 | 0.005621 | 0.025941 | 0.2167 | 0.828 |

| 8020 | −0.153727 | 0.02593 | −5.9285 | 0 *** |

| 8040 | −0.087692 | 0.025931 | −3.3818 | 0.001 *** |

| 8050 | 0.014213 | 0.025929 | 0.5482 | 0.584 |

| 8060 | −0.053373 | 0.025934 | −2.058 | 0.04 ** |

| 8070 | −0.021558 | 0.025934 | −0.8313 | 0.406 |

| 8120 | −0.120458 | 0.025928 | −4.6458 | 0 *** |

| 8170 | 0.005591 | 0.025928 | 0.2156 | 0.829 |

| 8210 | 0.051687 | 0.025943 | 1.9923 | 0.047 ** |

| 8230 | 0.013024 | 0.025955 | 0.5018 | 0.616 |

| 8250 | −0.070516 | 0.025932 | −2.7193 | 0.007 *** |

| 8300 | −0.177277 | 0.02593 | −6.8367 | 0 *** |