Abstract

Industry 4.0 has the potential to cause both evolutionary (operational) and revolutionary (strategic) changes, but assessing the readiness of companies towards Industry 4.0 has largely been a challenge. Industry 4.0 readiness is also important as it is the first step for companies that want to adopt Industry 4.0 technologies. This paper pilot surveys 100 technology companies in Malaysia to understand their overall readiness towards Industry 4.0. In particular, this research paper contributes to the assessment of Industry 4.0 readiness in terms of seven key areas: (i) Market pressure, (ii) risk-taking, (iii) knowledge, (iv) management support, (v) competencies, (vi) motivation and (vii) freedom. These findings can act as stepping stones for managers and companies that are aiming towards the implementation of Industry 4.0 readiness.

1. Introduction

Industry 4.0 has been a novel topic for research for multiple independent research centers, institutes, universities, and companies in the world (Cividino et al. 2019; Rodríguez-Abitia and Bribiesca-Correa 2021). Since the topic has gained momentum, there are a good number of reputed working groups discussing vision and mission of Industry 4.0 and its related technologies. McKinsey stated that 90 percent of firms visualize Industry 4.0 as an opportunity and not a threat (Saucedo-Martínez et al. 2018). Yet there are barriers to implementing Industry 4.0 (Sharma and Gandhi 2018). These barriers include coordination difficulty, resistance, lack of talent, cyber security, lack of benefits, technology uncertainty, data acquisition and restricted technology diffusion (Slusarczyk 2018). Interestingly, in the era of Industry 4.0, objects are intelligent, and processes are smart (Sommer 2015; Hizam-Hanafiah et al. 2020). As per Hermann et al. (2016), there are two unique perspectives on Industry 4.0. First, this is the first revolution of industrial revolutions that is predicted, and is not being discussed based on what has already been executed. Next, this revolution has created a humongous impact on businesses and economies, improving their business models and operational effectiveness. Overall, Industry 4.0 needs to be studied at micro (between people and machines), meso (across systems or partners) and macro levels (across factories or companies) (Kim 2018).

This paper is based on findings from a pilot that was conducted on 100 technology companies in Malaysia. Technology companies were selected as they have better standing in terms of Industry 4.0 technologies adoption, and hence they are more ready for Industry 4.0 (Govindarajan and Kopalle 2006; Ismail et al. 2014). This in turn can be a good starting point to identify insights, particularly in terms of a pilot study. Likewise, Malaysia provides a good context to the study of this paper as Malaysia was identified as one of the Top 25 countries well-positioned to take benefit of Industry 4.0 as per the World Economic Forum in January 2018. Malaysia’s economy is the fourth largest in Southeast Asia, catching after Thailand, Indonesia and Philippines (August 2019, New Straits Times Newspaper). Although Malaysian Government has undertaken reasonable measures to leverage the Industry 4.0 benefits, yet some of the economists’ fear that emerging economies like Laos, Cambodia and Vietnam will outrun Malaysia in the race of Industry 4.0 (January 2020, The Star Newspaper). Furthermore, Malaysia has a vision of becoming a high-tech-based manufacturing hub, for which more technology companies and technology solutions are needed (June 2020, The Star Newspaper). Therefore, a pilot study on technology companies in the context of Malaysia through this research study offers great value for Malaysia as well other regional countries in Asia Pacific.

This paper captures the current standing of Industry 4.0 readiness amongst the technology companies in Malaysia. In terms of contribution, this research paper shares findings and insights on the assessment of Industry 4.0 readiness as a function of seven constituents in the context of Malaysia: (i) Market pressure, (ii) risk-taking, (iii) knowledge, (iv) management support, (v) competencies, (vi) motivation and (vii) freedom. In brief, the research objective of this paper is to assess the readiness of Industry 4.0 of technology companies in Malaysia. In terms of theoretical contribution, this paper empirically studied technology companies alone, whereas the previous studied have studied both technology and non-technology companies (Ghobakhloo 2019; Sony 2019). This contributes to the literature of Industry 4.0. In terms of contextual contribution, this research was based on companies in Malaysia, which offers a unique positioning in terms of Industry 4.0 technologies adoption.

This paper has five sections: Section 1 as introduction sets the context and research objectives, Section 2 presents the theoretical background, Section 3 highlights the research methods, Section 4 elaborates on the results and the discussion, and Section 5 concludes this paper with study contributions and implications.

2. Theoretical Background

2.1. Industry 4.0 and Industry 4.0 Readiness

Industry 4.0 is defined as the digital transformation driven by connected technologies to build a cyber-physical organization (Roblek et al. 2016; Rodríguez-Abitia and Bribiesca-Correa 2021). Thereby, Industry 4.0 readiness is termed as the degree to which organizations are able to exploit and derive benefits from Industry 4.0 technologies (Stentoft et al. 2019). Gartner forecast presumes that 26 billion things will be connected to the Internet in the year 2020, and hence dependence on Industry 4.0 technologies will be higher than ever. Kamarul Bahrin et al. (2016) study suggested Industry 4.0 technologies will be intensely used in the new manufacturing age, to be called as Smart Factory or Smart Manufacturing. Moreover, as the vision of Industry 4.0 is real-time digitalization with value addition, hence it is considered as revolutionary and not just evolutionary (Neugebauer et al. 2016). Combining all these technologies and concepts, the consulting firm called Boston Consulting Group (BCG) identified nine pillars of Industry 4.0 in 2016 (Sandner et al. 2020). These nine pillars of Industry 4.0 are Advanced Manufacturing, Additive Manufacturing, Augmented Reality, Simulation, Horizontal/Vertical Integration, Industrial Internet, Cloud, Cyber-security and Big Data Analytics. However, the challenge companies need to understand is the current standing of their processes, procedures and philosophy to tap it with these technologies. Similarly, the question that Industry 4.0 theorists deal with on a continuous basis is ‘how do we get from where we are now to where we want to be?’ (Nick and Pongrácz 2016; Dassisti et al. 2017).

2.2. Malaysia and Industry 4.0 Readiness

Malaysia is classified as an emerging economy by the World Bank. Likewise, as per the United Nations, Malaysia is a More Economically Developed Country (MEDC). On all counts, the country has been an industrialized economy with decent reliance on technology. In the context of Malaysian economy, technology companies are particularly important as they directly contribute to the digital economy of Malaysia (Azlina et al. 2011). Attracting international investors and foreign companies, technology companies have long played a central role in the industrial development of Malaysia (Saleh and Ndubisi 2006). As well, in terms of technology spending, technology products and services are in high demand in Malaysia favoring the emergence of technology companies (Basl 2018). Overall, this establishes the role and importance of technology companies in the context of Malaysian economy. Moving forward in terms of technology, Malaysia does not want to lose any spot in term of Industry 4.0. Thereon, achieving Industry 4.0 readiness for companies in Malaysia is imperative. In the context of Malaysia, Ex-Prime Minister Tun Dr Mahathir Mohamad in the beginning of 2019 stated that Malaysia risks losing out with untapped talent in Industry 4.0 (February 2019, The Star Newspaper). Later in the same year, his statement further escalated mentioning that Malaysia has no choice but to adapt and master Industry 4.0 disruptive technologies (July 2019, The Star Newspaper). Thereby, this pilot study of Industry 4.0 readiness for Malaysia in terms of technology companies is both relevant and important.

2.3. Technology Organization Environment Theory

The fundamental ideology of this paper can be explained through the Technological, Organizational and Environmental (TOE) framework which was conceived by Tornatzky and Fleischer in 1990 (Tornatzky and Fleischer 1990). Overall it focusses on the adoption of innovations, from need identification to deployment. Technological context emphasizes on how technological efforts can transform an entity (Manavalan and Jayakrishna 2019). The organizational context consists of scope, firm size, managerial structure, human resources and decision making. The environmental context considers relevant parties like competitors and customers. The TOE framework has been tested under different domains for theoretical strength and empirical support, especially in evaluating adoption and implementation of technology driven innovations. For instance, Kuan and Chau (2001) used it with IS innovations, Srivastava and Teo (2006) used TOE theory for Information and Communication Technology (ICT), and Ardito et al. (2018) used TOE theory for Small and Medium Enterprises (SMEs). Furthermore, TOE framework has been employed to study e-businesses and examining the adoption of technology based systems like Enterprise Resource Planning (ERP), Electronic Data Interchange (EDI) and Customer Relationship Management (CRM) (Haddara and Elragal 2015; Kuan and Chau 2001). TOE theory has also been linked with Technology Readiness Index (TRI) to examine e-maintenance readiness, or organizational readiness to new innovations. From a managerial perspective, TOE theory provides managers a frame of reference to explore company’s condition before taking technology initiatives like Industry 4.0.

2.4. Instrument

Industry 4.0 readiness is operationalized as the degree to which organizations are able to exploit and derive benefits from Industry 4.0 technologies (Stentoft et al. 2019). The measurement of this construct for this paper was adopted from Stentoft et al. (2019, 2020). Aligning with the operational definition of Industry 4.0 readiness, item 1 assesses pressure to adopt Industry 4.0, item 2 deals with willingness to take risk regarding Industry 4.0, item 3 evaluates knowledge pertaining to Industry 4.0, item 4 seeks to confirm the management support, item 5 assesses the possession of needed competencies, item 6 evaluates motivation, and item 7 ascertains the freedom to work on Industry 4.0 technologies. The measurement items of Industry 4.0 readiness adapted/adopted from Stentoft et al. (2019) have reliability and validity tested, published in high impact journal named Production Planning & Control journal. This measurement has also been used by various past researchers, including Madsen (2019); Wamba and Queiroz (2020) and Poór et al. (2020). The original study by Stentoft et al. (2019) used a 5-point Likert scale which has been used likewise in constructing the research instrument for this study. Thereon, the 5 scales used are: 1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree. All items used to measure Industry 4.0 readiness construct in this study are listed in Table 1.

Table 1.

Measurement for Industry 4.0 Readiness.

3. Methods

A pilot study is important as it adds precision to the study instrument (Zikmund 2003). It involves data collection from a smaller sample that is in line with the main data collection activity (Zikmund 1984). According to Abbott and Bordens (2011), a pilot study helps to detect the performance of research instrument. Pilot study helps in multiple ways. For example, it identifies mistakes and weaknesses in instrument (Cooper and Schindler 2011). It assists in the preliminary reliability and validity of the instrument (Ghauri and Grønhaug 2010). In terms of questionnaire, a pilot study helps in rectifying questionnaire wording issues (Lee and Lings 2010), understanding and clarity issues (Saunders and Tosey 2012), adequacy of instructions or directions issues (Bryman 2008), layout and attractiveness issues, and timing and length of questionnaire issues (Saunders and Tosey 2012). In summary, pilot testing is beneficial as it improves the instrument (Bryman 2008), and adds to the reliability and validity of instrument (Ghauri and Grønhaug 2010). Therefore, this paper with pilot testing is noteworthy for research findings.

The pilot study in this paper used a 5-point Likert scale. A Likert scale is an interval scale commonly used in survey research employing questionnaire for data collection (Voleti 2019). Likert items have equal distance with each other (Marwah and Sharma 2015). Likert scale captures the intensity of respondents’ feelings regarding the questionnaire items (Burns and Bush 2010). The 5 scales used are: 1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree. Moreover, as English is the widely used language in Malaysian firms, the questionnaire was presented in English language only. Cronbach’s Alpha value was calculated as it is a popular and widely used indicator of reliability in social science studies (Gven et al. 1999). The Cronbach’s Alpha value for all seven items of instrument were above 0.70, hence confirming the internal consistency or reliability of the instrument (Hair et al. 2019; Nunnally and Bernstein 1994). The remaining part of this section first shares the sampling details of the pilot study and then provides the demographics of respondents and companies which are important to understand before proceeding to the findings of this paper.

3.1. Sampling

The number of respondents or sample size is a popular concern for a pilot study, which often has differing and conflicting opinions. Saunders and Tosey (2012) recommends a minimum of 10 respondents, Aaker and Keppel (2006) recommends 15 to 25 respondents, Taylor et al. (2010) recommended 15 to 30 respondents, Johanson and Brooks (2010) recommended that minimum 30 respondents as a reasonable count for sample size for pilot study in a quantitative/survey research setting. On the contrary, Schindler (2005) is of the view that pilot test sample is not to be statistically selected. Based on these insights, purposive sampling technique was used on 100 companies as a pilot study. The higher number was selected to increase the rigorousness of findings. The responses were then filtered, and feedback from respondents was duly examined. It is important to note that though this study used purposive sampling which is based on the subjective selection by the researcher, it ensured that the sample studied well represents the population. Moreover, the sample selected was representative in line with the technology companies in Malaysia, as in it included Information Technology (IT) companies, Information and Communication Technology (ICT) companies, software houses, digital technology companies and high-tech companies. To ensure that sample adequately represents the population, the companies studied for this pilot study were drawn from the PIKOM (The National Tech Association of Malaysia). The reference of PIKOM was considered as it is the prime association representing the technology industry in Malaysia.

3.2. Demographics of Respondents

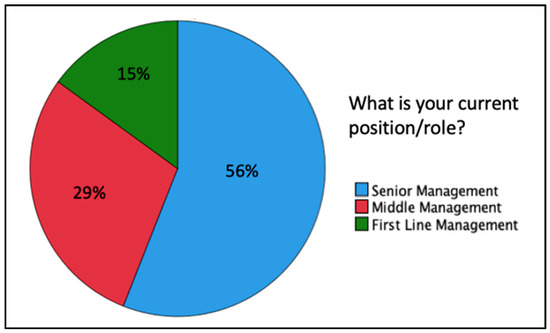

There were 100 respondents who participated in this pilot study. Their split in terms of their position/role and how long they have been working in the organization can be seen in Figure 1. Based on this pie chart, 56 respondents (56 percent) were part of senior management, 29 respondents (29 percent) were part of middle management, and 15 respondents (15 percent) were part of first line management. Majority of the respondents had senior management profiles, which supports the research aims of this paper.

Figure 1.

Respondent Position.

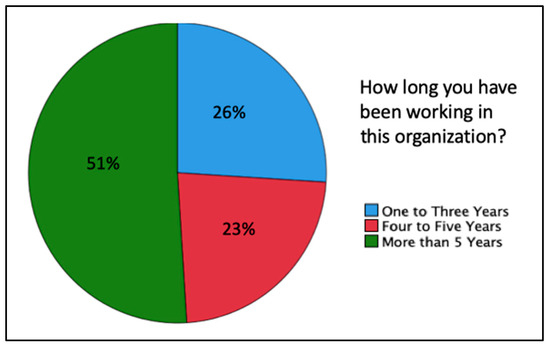

Likewise, in terms of respondent working years, Figure 2 presents that 26 respondents (26 percent) had working experience of one to three years with the current organization, and 23 respondents (23 percent) had working experience of four to five years, and 51 respondents (51 percent) had working experience of more than 5 years. Thereon, majority of respondents were part of the respective assessed company for more than 5 years, which implies that their contextual understanding of the organization is more than satisfactory.

Figure 2.

Respondent Working Years.

3.3. Demographics of Companies

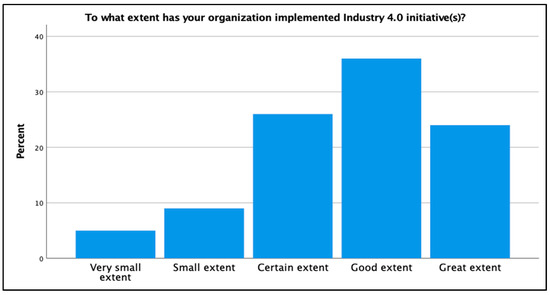

All the 100 respondents for this pilot had two screening questions to be answered before becoming a part of this study. The first question confirmed whether they have taken any initiative on Industry 4.0. The second question assessed whether they are a technology company, in the manner that they use technology as an advantage in their internal and external operations. So, the companies who answered both these questions in positive were considered for pilot study. Further demographics of companies can be seen in the bar and pie charts below. Based on Figure 3, 5 companies (5 percent) have implemented Industry 4.0 to very small extent, 9 companies (9 percent) have implemented Industry 4.0 to small extent, 26 companies (26 percent) have implemented Industry 4.0 to certain extent, 36 companies (36 percent) have implemented Industry 4.0 to good extent, and 24 companies (24 percent) have implemented Industry 4.0 to great extent.

Figure 3.

Company Implementation Extent.

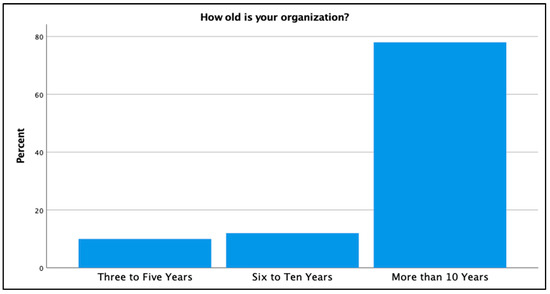

Next, referring to Figure 4, 78 companies (78 percent) are over 10 years old, 12 companies (12 percent) are six to ten years old, and 10 companies (10 percent) are three to five years old. Thereby, most of the organizations are established, with existence of more than 10 years.

Figure 4.

Company Age.

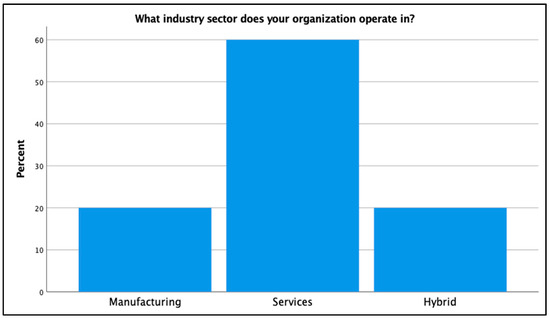

Furthermore, based on Figure 5, 60 companies (60 percent) belong to the service industry/sector 20 companies (20 percent) belong to the manufacturing industry/sector, and again 20 companies (20 percent) belong to the hybrid industry/sector. Combining manufacturing and hybrid firms, results in almost the same strength as services sector companies, which is balanced overall.

Figure 5.

Company Industry Sector.

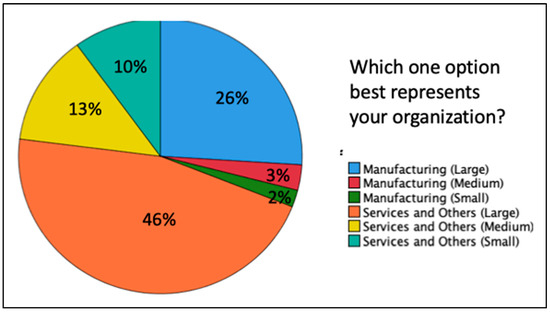

Finally, referring to Figure 6, within the service sector, 46 companies (46 percent) are large in size, 13 companies (13 percent) are medium in size, and 10 companies (10 percent) are small in size. Similarly, within the manufacturing sector, 26 companies (26 percent) are large in size, 3 companies (3 percent) are medium in size, and 2 companies (2 percent) are small in size. Here again, it confirms that majority of the organizations are services large and manufacturing large.

Figure 6.

Company Industry Sector Split.

4. Results and Discussion

This section presents eight findings on Industry 4.0 readiness based on the pilot study of 100 technology companies in Malaysia. The first finding highlights the overall readiness of Industry 4.0, and the remaining seven findings focus on the individual functions that are important contributors for the readiness assessment of Industry 4.0. The flow of this section is as follows: (i) overall Industry 4.0 readiness, (ii) market pressure, (iii) risk-taking, (iv) knowledge, (v) management support, (vi) competencies, (vii) motivation and (viii) freedom in terms of Industry 4.0 readiness.

4.1. Overall Industry 4.0 Readiness

The first finding of this pilot study is in terms of overall Industry 4.0 readiness of technology companies in Malaysia. The instrument used for this pilot study had 5-point Likert scale (1 being Strongly Disagree and 5 being Strongly Agree). This paper confirms that mean value of Industry 4.0 Readiness variable is above 3, implying that most of the respondents have indicated their response towards agreement with the question items from 1 to 7. As all the seven statements used in the measurement of Industry 4.0 readiness are positive, the higher the mean, the higher is the readiness towards Industry 4.0. This finding is in line with World Economic Forum 2018 report portraying Malaysia as one of the Top 25 countries that have potential to implement Industry 4.0 technologies. Furthermore, amongst the measurement items of Industry 4.0 readiness, companies are most ready in terms of motivation, and least ready in terms of market pressure. This implies that most of the organizations are motivated to play their role on Industry 4.0 in Malaysia. However, most of the organizations do not face high market pressure to adopt Industry 4.0 technologies. The mean value for all items is shown in Table 2.

Table 2.

Summary of Industry 4.0 readiness measures.

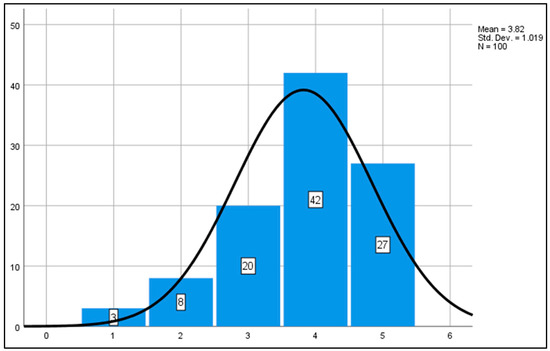

4.2. Market Pressure as a Function of Industry 4.0 Readiness

The second finding of this pilot study is in terms of market pressure as a function of Industry 4.0 readiness. Here, the responses on Likert scale are shown on x-axis (1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree). Vertical axis represents the number of companies. Figure 7 confirms that majority of companies (42 percent, which also means 42 out of 100 companies) somewhat agree that their organization experiences a pressure to work on Industry 4.0 from market, followed by 27 percent who strongly agree. This favors the argument that some external influence creates a positive push that drives implementation, particularly in terms of new technologies like Industry 4.0 (Sony 2019; Onufrey and Bergek 2020). In the absence of this pressure which can arise from markets, customers and industry players, Industry 4.0 readiness is considered slow and sluggish (Agarwal and Brem 2015).

Figure 7.

Market pressure and Industry 4.0 readiness.

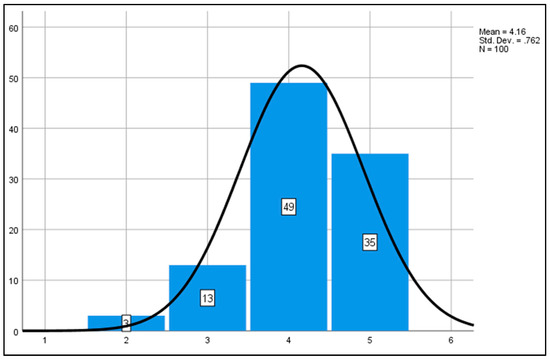

4.3. Risk-Taking as a Function of Industry 4.0 Readiness

Moving on, the third finding of this pilot study is in terms of risk-taking as a function of Industry 4.0 readiness. Likewise, the responses on Likert scale are shown on x-axis (1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree) and vertical axis represents the number of companies. Figure 8 portrays that majority of the companies (84 percent, based on 49 percent with somewhat agree responses and 35 percent with strongly agree responses) are willing to take risks to experiment with the new technologies of Industry 4.0. This confirms that technology companies are largely bold and fast-forward in taking calculated risks towards new technologies like Industry 4.0. This also resonates with the fast-moving pace of technology industry, and the reason why frequent updates on technological developments are a norm, setting market and customer expectations (Kane et al. 2015; Kazancoglu and Ozkan-Ozen 2018).

Figure 8.

Risk-taking and Industry 4.0 readiness.

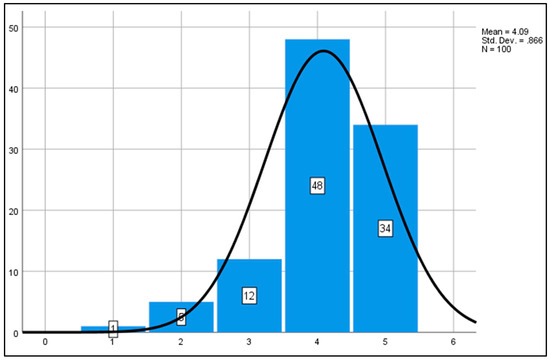

4.4. Knowledge as a Function of Industry 4.0 Readiness

Awareness and knowledge has been one of the first determinants on Industry 4.0. Thereon, the fourth finding of this pilot study is in terms of knowledge as a function of Industry 4.0 readiness. Figure 9 reflects that majority of companies (82 percent, based on 48 somewhat agree and 34 strongly agree) consider that they have the desired and necessary knowledge on Industry 4.0 and its technologies. Thus, only few companies have ranked their knowledge on Industry 4.0 as low. This supports the argument that Industry 4.0 initiatives knowledge-sharing has been successfully practiced in Malaysia (Haddara and Elragal 2015; Kaltenbach et al. 2018). This also confirms that accessibility of knowledge has been reasonably promoted by regulatory agencies in Malaysia.

Figure 9.

Knowledge and Industry 4.0 readiness.

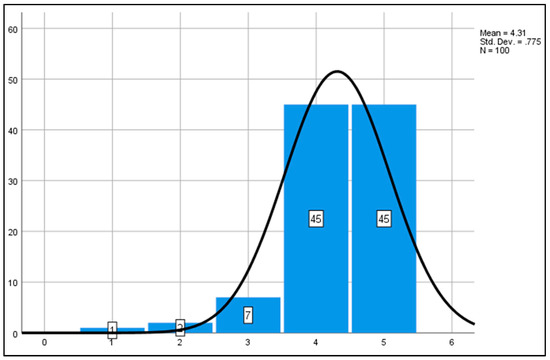

4.5. Management Support as a Function of Industry 4.0 Readiness

The fifth finding of this pilot study is in terms of management support as a function of Industry 4.0 readiness. It can be seen through Figure 10 that equal number of companies (45 percent) have ranked that their management support as somewhat agree and strongly agree. In both cases, this totals to 90 percent in agreement that respondents think that they have good management support to drive Industry 4.0 initiatives. It has been witnessed that managers in organizations which trust their senior management for back-end support and encouragement, do well with the implementation of Industry 4.0 initiatives (Tortorella and Fettermann 2017; Fayyaz et al. 2020). As the uncertainty and failure probability is high with Industry 4.0, reliance for positive support mechanism is rated high as needed leadership element in organizations (Salkin et al. 2018).

Figure 10.

Management support and Industry 4.0 readiness.

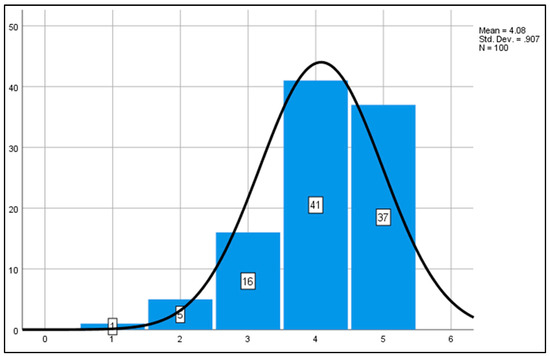

4.6. Competencies as a Function of Industry 4.0 Readiness

This pilot study rendered a sixth finding in terms of competencies as a function of Industry 4.0 readiness. Competency is the ability to do something efficiently. The responses on Likert scale are shown on x-axis (1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree). Figure 11 confirms that 41 percent companies somewhat agree and slight lower than that 37 percent companies strongly agree that they have the needed competencies for Industry 4.0. This favors the argument that competencies are important before the rollout of Industry 4.0 projects, and in the absence of that, right competencies should be developed (Uygun 2018). In this respect, there are multiple competencies that can be important for Industry 4.0, like decision making, problem solving and communication (De Felice et al. 2018).

Figure 11.

Competencies and Industry 4.0 readiness.

4.7. Motivation as a Function of Industry 4.0 Readiness

The seventh finding of this pilot study is in terms of motivation as a function of Industry 4.0 readiness. Figure 12 suggests that piloted organizations are motivated to work on Industry 4.0. On the contrary, in some countries, organizations are not ready for Industry 4.0 as they lack motivation and drive to implement the latest Industry 4.0 technologies. As a contra argument, Industry 4.0 technologies require specialized knowledge and skills, and hence the motivation of companies is low until they acquire suitable talent and equipment (Kang et al. 2016). However, the argument in support, which reflects the pilot study is that companies are eager to be the first-movers in technology adoption, for sustainability of their business (Leyh et al. 2018; Ruppert et al. 2018).

Figure 12.

Motivation and Industry 4.0 readiness.

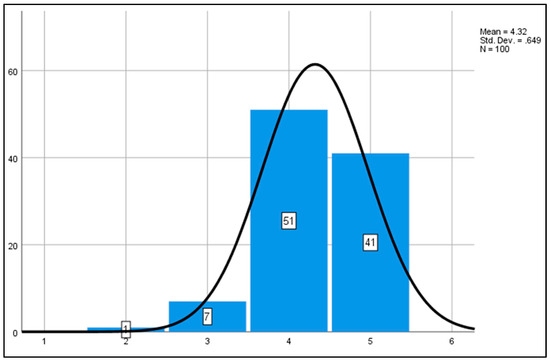

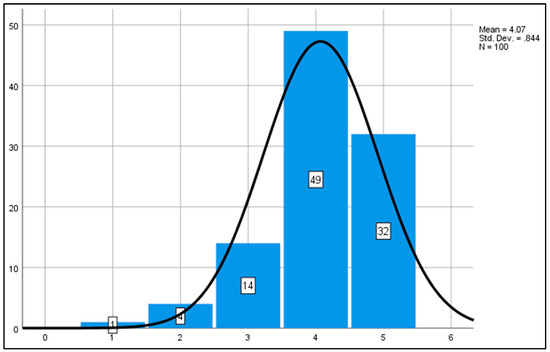

4.8. Freedom as a Function of Industry 4.0 Readiness

Finally, the last and eighth finding of this pilot study is in terms of freedom as a function of Industry 4.0 readiness. Here again, the responses on Likert scale are shown on x-axis (1-Strongly Disagree, 2-Somewhat Disagree, 3-Neutral, 4-Somewhat Agree and 5-Strongly Agree). Vertical axis represents the number of companies. Figure 13 confirms that majority of companies (49 percent) somewhat agree that they have freedom to work on Industry 4.0. It is perceived and sometimes witnessed that a large number of managers in organizations do not have the liberty to initiate Industry 4.0 actions, until the senior management is fully aligned (Keramati et al. 2016; Mittal et al. 2018). However, results from the pilot surveyed organizations reflect that technology companies in Malaysia enjoy good freedom to work on Industry 4.0. Hence, this freedom to work on Industry 4.0 is important for developing Industry 4.0 readiness of companies (Bauer et al. 2019; Sony 2019).

Figure 13.

Freedom and Industry 4.0 readiness.

5. Conclusions

The trend of Industry 4.0 for digitalization of businesses is increasing for both manufacturing and service companies (Fuchs 2018; Kaltenbach et al. 2018; Roblek et al. 2020). However, there is little shared understanding in terms of evaluating the Industry 4.0 readiness for organizations (Silva et al. 2020; Soomro et al. 2020a, 2020b). This has been hampering and delaying organizations in preparing them for Industry 4.0 technologies (Schwab 2016). Thereon, this research paper adopted measurement of Industry 4.0 readiness to evaluate the Industry 4.0 readiness of technology companies in Malaysia. In a broad perspective, the pilot results reflect that majority of technology companies in Malaysia are ready for Industry 4.0. From a specific perspective, this research paper shared findings and insights on the assessment of Industry 4.0 readiness as a function of seven constituents: (i) Market pressure, (ii) risk-taking, (iii) knowledge, (iv) management support, (v) competencies, (vi) motivation and (vii) freedom. To recapitulate the background of this study, Malaysia’s progression in terms of economic development has predominantly relied on the technology sector. The technology companies also comprise as the major contributors to the tax revenue. The year 2020 particularly was a capstone year as the technology sector in Malaysia responded quickly and decisively to the ongoing pandemic (COVID-19). However, many manufacturers have delayed or halted production on account of the pandemic and prevailing uncertainty, which has negatively affected the technology companies in Malaysia (February 2021, The Edge Markets Periodical).

In this vein, based on the 100 technology companies in Malaysia, this study confirms that: (i) 69 percent of organizations feel the pressure to work on Industry 4.0. Technology companies in Malaysia under the regulation of government agencies like Ministry of International Trade and Industry (MITI) are encouraged to adopt Industry 4.0 technologies. Moreover, funding support is also provided for the firms that have a vision for Industry 4.0. These factors in part create an informal obligation for the firms to participate in Industry 4.0 initiatives. (ii) 84 percent of organizations are willing to take risk on Industry 4.0. Technology companies in Malaysia have enjoyed a low-interest-rate environment which has given enough fuel for risk taking and promotion of new investments. Hence, this finding is aligned with the financial indicators of technology companies in Malaysia. (iii) 82 percent of organizations have the necessary knowledge of Industry 4.0. Many multinational companies have setup their headquarters and regional stations in Malaysia. This has helped in improving the knowledge, expertise and skillset, particularly in terms of new technologies in the arena of Industry 4.0. (iv) 90 percent of organizations have support of top management in rolling out Industry 4.0 initiatives. Many of the technology firms in Malaysia started small but they have over a period of time demonstrated a passion for entrepreneurship. Thereon, employees working in technology firms are encouraged to launch new products and services, and often get good top management support and senior executive direction. (v) 78 percent of organizations have the desired competencies for Industry 4.0. Malaysian technology firms have several specific niches. These differentiate end-products that emerge through these companies. Some extend knowledge and advisory services, whereas others supply spare parts like electronic chips and semiconductors. (vi) 92 percent of organizations are motivated to work on Industry 4.0. This fits well with the fact that the number of companies and startups in Malaysia in the Information Technology space have increased gradually. This has maintained healthy competition amongst the Malaysian technology companies. (vii) 81 percent of organizations have the needed freedom to work on Industry 4.0. Needless to say, the demand for technology companies in Malaysia is inevitable and gradually increasing, even in the present pandemic times. Thereon, the finding of this study resonates with the contextual landscape of technology companies in Malaysia.

This paper is of theoretical and contextual significance. In terms of theoretical contribution, previous studies did not focus much on the unique strata and specific nature of technology companies (Ghobakhloo 2019; Sony 2019). Most of the studies on Industry 4.0 were focused on manufacturing sector, which combined both technology and non-technology companies (Kamarul Bahrin et al. 2016; Powell et al. 2018). Thereon, the findings from this paper add to the literature of Industry 4.0. In terms of contextual contribution, this research was based on companies in Malaysia only. There is lack of empirical evidence on the current situation of companies in Malaysia in their drive of navigating the journey of Industry 4.0 readiness. Hence, the empirical findings of this paper can help in gaining insights that can assist organizations in Malaysia, in developing their Industry 4.0 readiness. This study can also be used pragmatically by managers in Malaysia in identifying strengths and weaknesses on the rollout of their Industry projects. In terms of government agencies, these empirical findings can provide areas of improvement for policy making on Industry 4.0. From the government perspective, Industry 4.0 plays a direct role in improving the state of small, medium and large size organizations, leading to economic revival of Malaysia. From the industry perspective, Ministry of International Trade and Industry (MITI) has emphasized that Malaysia needs a national policy on Industry 4.0 (November 2018, MITI). Likewise, Malaysian Investment Development Authority (MIDA) considers Industry 4.0 as a crucial step towards sustainability of Malaysian economy. Therefore, the topic of Industry 4.0 readiness is important from the theoretical perspective of technology companies as well as the contextual perspective of Malaysia.

In terms of study limitations, this study was survey based, and hence based on perceptions of respondents, which are subjective in nature. In terms of future research, these findings from Malaysia can be compared and contrasted with other regional countries, particularly in Asia Pacific. In terms of ethnic diversity and language, Malaysia can be compared with Singapore. However, in terms of digitalization, Singapore fares better than Malaysia. Though technology companies in Singapore are more ready towards Industry 4.0, the contextual findings from this paper from Malaysia can be benchmarked with Singapore for additional insights. Likewise, this study can be replicated for technology centric economies in Asia Pacific like Hong Kong and South Korea. On the contrary, countries like Philippines, Indonesia and Vietnam are progressing less than expected in achieving Industry 4.0 readiness, and hence they can draw some policy actions and improvement areas from this pilot study research.

Author Contributions

Conceptualization, M.H.-H. and M.A.S.; methodology, M.A.S. and M.H.-H.; software, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J.; validation, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J.; formal analysis, M.A.S. and M.H.-H.; investigation, M.A.S., M.H.-H.; resources, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J.; data curation, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J.; writing—original draft preparation, M.H.-H. and M.A.S.; visualization, M.A.S. and M.H.-H.; supervision, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J.; funding acquisition, M.H.-H., M.A.S., N.L.A., M.H.A. and M.S.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Malaysian Technology Development Corporation (MTDC), grant number EP-2019-014, awarded to Universiti Kebangsaan Malaysia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to restrictions by MTDC.

Acknowledgments

The authors are grateful to the editors and reviewers for their invaluable contribution.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Aaker, David A., and Geoffrey Keppel. 2006. Design and Analysis: A Researcher’s Handbook. Journal of Marketing Research 13: 318. [Google Scholar] [CrossRef]

- Abbott, Bruce Barrington, and Kenneth S. Bordens. 2011. Research Design and Methods: A Process Approach, 8th ed. New York: McGraw-Hill Education. [Google Scholar] [CrossRef]

- Agarwal, Nivedita, and Alexander Brem. 2015. Strategic Business Transformation through Technology Convergence: Implications from General Electric’s Industrial Internet Initiative. International Journal of Technology Management 67: 196–214. [Google Scholar] [CrossRef]

- Ardito, Lorenzo, Antonio Messeni Petruzzelli, Umberto Panniello, and Achille Claudio Garavelli. 2018. Towards Industry 4.0: Mapping Digital Technologies for Supply Chain Management-Marketing Integration. Business Process Management Journal. [Google Scholar] [CrossRef]

- Azlina, Rahim, Atan Ruhaya, and Kamaluddin Amrizah. 2011. Intellectual Capital Reporting in Malaysian Technology Industry. Asian Journal of Accounting and Governance 2: 51–59. [Google Scholar] [CrossRef][Green Version]

- Basl, Josef. 2018. Companies on the Way to Industry 4.0 and Their Readiness. Journal of Systems Integration 3: 3. [Google Scholar] [CrossRef]

- Bauer, Wilhelm, Bastian Pokorni, and Stefanie Findeisen. 2019. Production Assessment 4.0—Methods for the Development and Evaluation of Industry 4.0 Use Cases. Basingstoke: Springer Nature, vol. 793, pp. 501–10. [Google Scholar] [CrossRef]

- Bryman, Alan. 2008. Social Research Method, 3rd ed. Oxford University Press: Oxford. [Google Scholar]

- Burns, C. Alvin, and F. Ronald Bush. 2010. Marketing Research, 6th ed. London: Pearson Prentise Hall. [Google Scholar]

- Cividino, Sirio, Gianluca Egidi, Ilaria Zambon, and Andrea Colantoni. 2019. Evaluating the Degree of Uncertainty of Research Activities in Industry 4.0. Future Internet 11: 196. [Google Scholar] [CrossRef]

- Cooper, Donald R., and Pamela S. Schindler. 2011. Business Research Methods, 11th ed. New York: McGraw Hill. [Google Scholar]

- Dassisti, Michele, Hervé Panetto, Mario Lezoche, Pasquale Merla, Antonio Giovannini, Michela Chimienti, and Michele Dassisti. 2017. Industry 4.0 Paradigm: The Viewpoint of the Small and Medium Enterprises. Paper Presented at 7th International Conference on Information Society and Technology ICIST 2017 Efficiency, Kopaonik, Serbia, March 12–15. [Google Scholar]

- De Felice, Fabio, Petrillo Antonella, and Zomparelli Federico. 2018. A Bibliometric Multicriteria Model on Smart Manufacturing from 2011 to 2018. IFAC-PapersOnLine 51: 1643–48. [Google Scholar] [CrossRef]

- Fayyaz, Ayesha, Beenish Neik Chaudhry, and Muhammad Fiaz. 2020. Upholding Knowledge Sharing for Organization Innovation Efficiency in Pakistan. Journal of Open Innovation: Technology, Market, and Complexity 7: 1–16. [Google Scholar] [CrossRef]

- Fuchs, Christian. 2018. Industry 4.0: The Digital German Ideology. TripleC 16: 280–89. [Google Scholar] [CrossRef]

- Ghauri, Pervez, and Kjell Grønhaug. 2010. Research Methods in Business Studies, 4th ed. Berlin: Prentice Hall Europe. [Google Scholar]

- Ghobakhloo, Morteza. 2019. Industry 4.0, Digitization, and Opportunities for Sustainability. Journal of Cleaner Production 252: 119869. [Google Scholar] [CrossRef]

- Govindarajan, Vijay, and Praveen K. Kopalle. 2006. Disruptiveness of Innovations: Measurement and an Assessment of Reliability and Validity. Strategic Management Journal 27: 189–99. [Google Scholar] [CrossRef]

- Gven, Çaglar, Robert Y. Cavana, Jac A. M. Vennix, Etienne A. J. A. Rouwette, Margaret Stevenson-Wright, and Joy Candlish. 1999. Operational Research from a Critical Viewpoint. Paper Presented at the 17th International Conference of the System Dynamics Society and 5th Australian & New Zealand Systems Conference, Sydney, Australia, November 20–23. [Google Scholar]

- Haddara, Moutaz, and Ahmed Elragal. 2015. The Readiness of ERP Systems for the Factory of the Future. Procedia Computer Science 64: 721–28. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hermann, Mario, Tobias Pentek, and Boris Otto. 2016. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the Annual Hawaii International Conference on System Sciences. Berlin: IEEE, pp. 3928–37. [Google Scholar] [CrossRef]

- Hizam-Hanafiah, Mohd, Mansoor Ahmed Soomro, and Nor Liza Abdullah. 2020. Industry 4.0 Readiness Models: A Systematic Literature Review of Model Dimensions. Information 11: 364. [Google Scholar] [CrossRef]

- Ismail, Salim, Michael S. Malone, and Yuri van Geest. 2014. Exponential Organisations: Why New Organisations Are Ten Times Better, Faster, and Cheaper than Yours (and What to Do about It). New York: Diversion Publishing Corp. [Google Scholar]

- Johanson, George A., and Gordon P. Brooks. 2010. Initial Scale Development: Sample Size for Pilot Studies. Educational and Psychological Measurement 70: 394–400. [Google Scholar] [CrossRef]

- Kaltenbach, Fabian, Patrick Marber, Clarissa Gosemann, Tom Bolts, and Ansgar Kuhn. 2018. Smart Services Maturity Level in Germany. Paper Presented at 2018 IEEE International Conference on Engineering, Technology and Innovation (ICE/ITMC), Stuttgart, Germany, June 17–20; pp. 1–7. [Google Scholar] [CrossRef]

- Kamarul Bahrin, Mohd Aiman, Mohd Fauzi Othman, Nor Hayati Nor Azli, and Muhamad Farihin Talib. 2016. Industry 4.0: A Review on Industrial Automation and Robotic. Jurnal Teknologi 78. [Google Scholar] [CrossRef]

- Kane, Gerald C., Doug Palmer, Anh Philips Nguyen, David Kiron, and Natasha Buckley. 2015. Strategy, Not Technology, Drives Digital Transformation. Cambridge: MIT Sloan Management Review & Deloitte. [Google Scholar]

- Kang, Hyoung Seok, Ju Yeon Lee, Sangsu Choi, Hyun Kim, Jun Hee Park, Ji Yeon Son, Bo Hyun Kim, and Sang Do Noh. 2016. Smart Manufacturing: Past Research, Present Findings, and Future Directions. International Journal of Precision Engineering and Manufacturing—Green Technology 3: 111–28. [Google Scholar] [CrossRef]

- Kazancoglu, Yigit, and Yesim Deniz Ozkan-Ozen. 2018. Analyzing Workforce 4.0 in the Fourth Industrial Revolution and Proposing a Road Map from Operations Management Perspective with Fuzzy DEMATEL. Journal of Enterprise Information Management 31: 891–907. [Google Scholar] [CrossRef]

- Keramati, Abbas, Masoud Afshari-Mofrad, Iman Behmanesh, and Reihaneh Gholami. 2016. The Impact of Information Technology Maturity on Firm Performance Considering the Moderating Role of Relational Maturity: An Empirical Research. International Journal of Business Information Systems 23: 23–43. [Google Scholar] [CrossRef]

- Kim, Junmo. 2018. Are Countries Ready for the New Meso Revolution? Testing the Waters for New Industrial Change in Korea. Technological Forecasting and Social Change 132: 34–39. [Google Scholar] [CrossRef]

- Kuan, Kevin K. Y., and Patrick Y. K. Chau. 2001. A Perception-Based Model for EDI Adoption in Small Businesses Using a Technology-Organization-Environment Framework. Information and Management 38: 507–21. [Google Scholar] [CrossRef]

- Lee, Nick, and Ian Lings. 2010. Doing Business Research: A Guide to Theory and Practice. By Nick Lee and Ian Lings. Library and Information Science Research 3: 231. [Google Scholar] [CrossRef]

- Leyh, Christian, Stefan Martin, and Thomas Sch. 2018. Analyzing Industry 4.0 Models with Focus on Lean Production Aspects. Springer International 311: 114–30. [Google Scholar] [CrossRef]

- Madsen, Dag Øivind. 2019. The Emergence and Rise of Industry 4.0 Viewed through the Lens of Management Fashion Theory. Administrative Sciences 9: 71. [Google Scholar] [CrossRef]

- Manavalan, Ethirajan, and Kandasamy Jayakrishna. 2019. A Review of Internet of Things (IoT) Embedded Sustainable Supply Chain for Industry 4.0 Requirements. Computers and Industrial Engineering 127: 925–53. [Google Scholar] [CrossRef]

- Marwah, Nikhil, and Rajesh Sharma. 2015. Chapter-83 Research Methodology. In Textbook of Pediatric Dentistry. New Delhi: Jaypee Publishers. [Google Scholar] [CrossRef]

- Mittal, Sameer, Muztoba Ahmad Khan, David Romero, and Thorsten Wuest. 2018. A Critical Review of Smart Manufacturing & Industry 4.0 Maturity Models: Implications for Small and Medium-Sized Enterprises (SMEs). Journal of Manufacturing Systems 49: 194–214. [Google Scholar] [CrossRef]

- Neugebauer, Reimund, Sophie Hippmann, Miriam Leis, and Martin Landherr. 2016. Industrie 4.0—From the Perspective of Applied Research. Procedia CIRP 57: 2–7. [Google Scholar] [CrossRef]

- Nick, Gabor, and Ferenc Pongrácz. 2016. How To Measure Industry 4.0 Readiness of Cities. Scientific Proceedings International Conference on Industry 4.0 2016 2: 64–68. [Google Scholar]

- Nunnally, Jum C., and Ira H. Bernstein. 1994. Psychometric Theory, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Onufrey, Ksenia, and Anna Bergek. 2020. Transformation in a Mature Industry: The Role of Business and Innovation Strategies. Technovation, 102190. [Google Scholar] [CrossRef]

- Poór, Peter, Maja Trstenjak, and Josef Basl. 2020. Maintenance Ideal Model in Industry 4.0—A Transformation Strategy Roadmap to Readiness Factor Calculation. Hradec Economic Days 2020. [Google Scholar] [CrossRef]

- Powell, Daryl, David Romero, Paolo Gaiardelli, Chiara Cimini, and Sergio Cavalieri. 2018. Towards Digital Lean Cyber-Physical Production Systems: Industry 4.0 Technologies as Enablers of Leaner Production. Cham: Springer International Publishing, vol. 536. [Google Scholar] [CrossRef]

- Roblek, Vasja, Maja Meško, and Alojz Krapež. 2016. A Complex View of Industry 4.0. SAGE Open 6: 215824401665398. [Google Scholar] [CrossRef]

- Roblek, Vasja, Maja Meško, Mirjana Pejić Bach, Oshane Thorpe, and Polona Šprajc. 2020. The Interaction between Internet, Sustainable Development, and Emergence of Society 5.0. Data 5: 80. [Google Scholar] [CrossRef]

- Rodríguez-Abitia, Guillermo, and Graciela Bribiesca-Correa. 2021. Assessing Digital Transformation in Universities. Future Internet 13: 52. [Google Scholar] [CrossRef]

- Ruppert, Tamás, Szilárd Jaskó, Tibor Holczinger, and János Abonyi. 2018. Enabling Technologies for Operator 4.0: A Survey. Applied Sciences 8: 1650. [Google Scholar] [CrossRef]

- Saleh, Ali Salman, and Nelson Oly Ndubisi. 2006. An Evaluation of SME Development in Malaysia. International Review of Business Research Paper 2: 1–14. [Google Scholar] [CrossRef]

- Salkin, Ceren, Mahir Oner, Alp Ustundag, and Emre Cevikcan. 2018. A Conceptual Framework for Industry 4.0. Cham: Springer International Publishing, pp. 3–23. [Google Scholar] [CrossRef]

- Sandner, Philipp, Anna Lange, and Philipp Schulden. 2020. The Role of the CFO of an Industrial Company: An Analysis of the Impact of Blockchain Technology. Future Internet 12: 128. [Google Scholar] [CrossRef]

- Saucedo-Martínez, Jania Astrid, Magdiel Pérez-Lara, José Antonio Marmolejo-Saucedo, Tomás Eloy Salais-Fierro, and Pandian Vasant. 2018. Industry 4.0 Framework for Management and Operations: A Review. Journal of Ambient Intelligence and Humanized Computing 9: 789–801. [Google Scholar] [CrossRef]

- Saunders, By Mark, and Paul Tosey. 2012. The Layers of Research Design. Rapport: The Magazine for NLP Professionals 4: 58–59. [Google Scholar]

- Schindler, John R. 2005. Defeating the Sixth Column: Intelligence and Strategy in the War on Islamist Terrorism. Orbis 49: 695–712. [Google Scholar] [CrossRef]

- Schwab, Klaus. 2016. The Fourth Industrial Revolution: World Economic Forum. Zulfu Dicleli: The Optimist Publications 91: 15. [Google Scholar]

- Sharma, Suresh, and Pankaj Jayantilal Gandhi. 2018. Journey Readiness of Industry 4.0 from Revolutionary Idea to Evolutionary Implementation: A Lean Management Perspective. International Journal of Information and Communication Sciences 3: 96–103. [Google Scholar] [CrossRef][Green Version]

- Silva, Felipe, David Resende, Marlene Amorim, and Monique Borges. 2020. A Field Study on the Impacts of Implementing Concepts and Elements of Industry 4.0 in the Biopharmaceutical Sector. Journal of Open Innovation: Technology, Market, and Complexity, 1–8. [Google Scholar] [CrossRef]

- Slusarczyk, Beata. 2018. Industry 4.0—Are We Ready? Polish Journal of Management Studies 17: 232–48. [Google Scholar] [CrossRef]

- Sommer, Lutz. 2015. Industrial Revolution—Industry 4.0: Are German Manufacturing SMEs the First Victims of This Revolution? Journal of Industrial Engineering and Management 8: 1512–32. [Google Scholar] [CrossRef]

- Sony, Michael. 2019. Key Ingredients for Evaluating Industry 4.0 Readiness for Organizations: A Literature Review. Benchmarking: An International Journal. [Google Scholar] [CrossRef]

- Soomro, Mansoor Ahmed, Mohd Hizam-Hanafiah, and Nor Liza Abdullah. 2020a. Top-Down Orientation on Fourth Industrial Revolution: A Literature Review. Systematic Reviews in Pharmacy 11: 872–78. [Google Scholar]

- Soomro, Mansoor Ahmed, Mohd Hizam-Hanafiah, and Nor Liza Abdullah. 2020b. Digital Readiness Models: A Systematic Literature Review. Compusoft 9: 3596–605. [Google Scholar]

- Srivastava, Shirish C., and Thompson S. H. Teo. 2006. Facilitators for E-Government Development: An Application of the Technology-Organization-Environment Framework. Paper Presented at Association for Information Systems—12th Americas Conference On Information Systems, AMCIS 2006, Acapulco, Mexico, August 4–6. [Google Scholar]

- Stentoft, Jan, Kent Adsbøll Wickstrøm, Kristian Philipsen, and Anders Haug. 2020. Drivers and Barriers for Industry 4.0 Readiness and Practice: Empirical Evidence from Small and Medium-Sized Manufacturers. Production Planning and Control, 1–18. [Google Scholar] [CrossRef]

- Stentoft, Jan, Kent Wickstrøm Jensen, Kristian Philipsen, and Anders Haug. 2019. Drivers and Barriers for Industry 4.0 Readiness and Practice: A SME Perspective with Empirical Evidence. Paper Presented at 52nd Hawaii International Conference on System Sciences, Maui, HI, USA, January 8–11, vol 6, pp. 5155–64. [Google Scholar] [CrossRef]

- Taylor, Kevin, Sarah Nettleton, Geoffrey Harding, and St Bartholomew’s. 2010. Social Research Methods. In Sociology for Pharmacists. London: Taylor & Francis Group. [Google Scholar] [CrossRef]

- Tornatzky, Louis, and Mitchell Fleischer. 1990. The Process of Technology Innovation. Lexington: Lexington Books. [Google Scholar] [CrossRef]

- Tortorella, Guilherme Luz, and Diego Fettermann. 2017. Implementation of Industry 4.0 and Lean Production in Brazilian Manufacturing Companies. International Journal of Production Research 7543: 1–13. [Google Scholar] [CrossRef]

- Uygun, Yilmaz. 2018. Human Resources Requirements for Industry 4.0. Journal of Open Innovation: Technology, Market, and Complexity 3: 1–20. [Google Scholar]

- Voleti, Sudhir. 2019. Data Collection. In International Series in Operations Research and Management Science. Cham: Springer. [Google Scholar] [CrossRef]

- Wamba, Samuel Fosso, and Maciel M. Queiroz. 2020. Blockchain in the Operations and Supply Chain Management: Benefits, Challenges and Future Research Opportunities. International Journal of Information Management. [Google Scholar] [CrossRef]

- Zikmund, William G. 1984. Business Research Methods. Cengage: Thomson Learning. [Google Scholar]

- Zikmund, William G. 2003. Business Research Methods/William G. Zikmund. Nashville: South-Western Publishing. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).