Industry 4.0 Readiness of Technology Companies: A Pilot Study from Malaysia

Abstract

1. Introduction

2. Theoretical Background

2.1. Industry 4.0 and Industry 4.0 Readiness

2.2. Malaysia and Industry 4.0 Readiness

2.3. Technology Organization Environment Theory

2.4. Instrument

3. Methods

3.1. Sampling

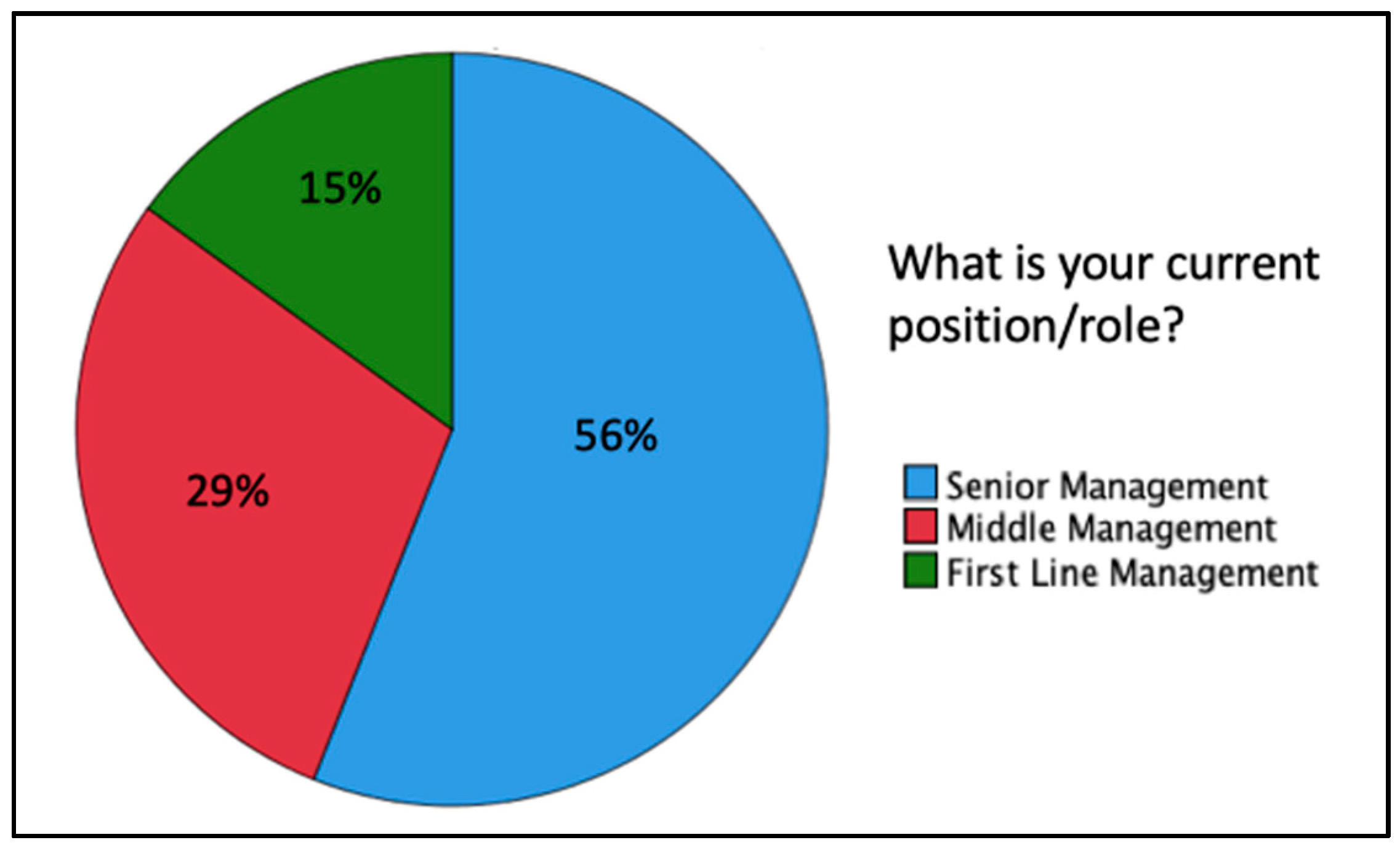

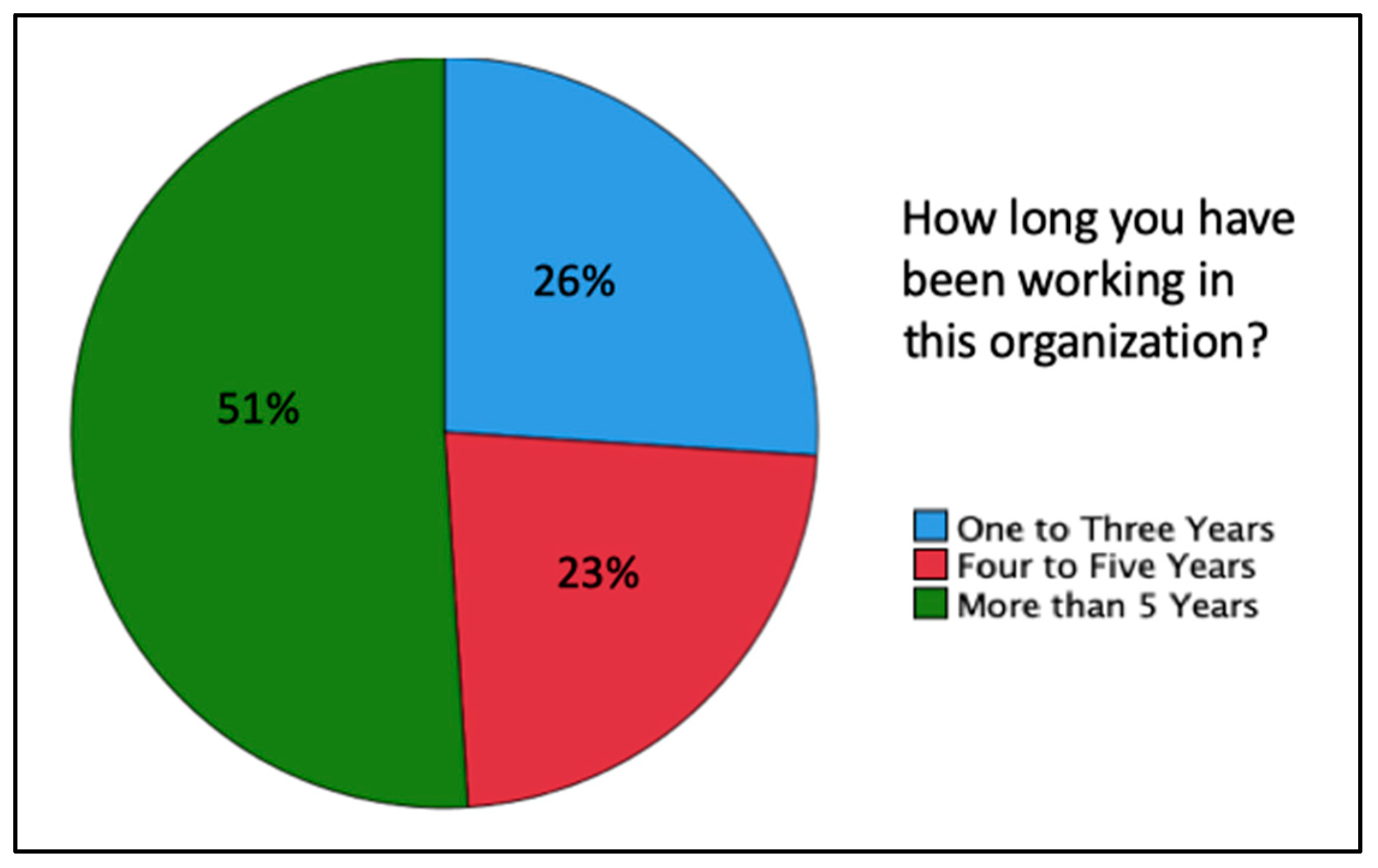

3.2. Demographics of Respondents

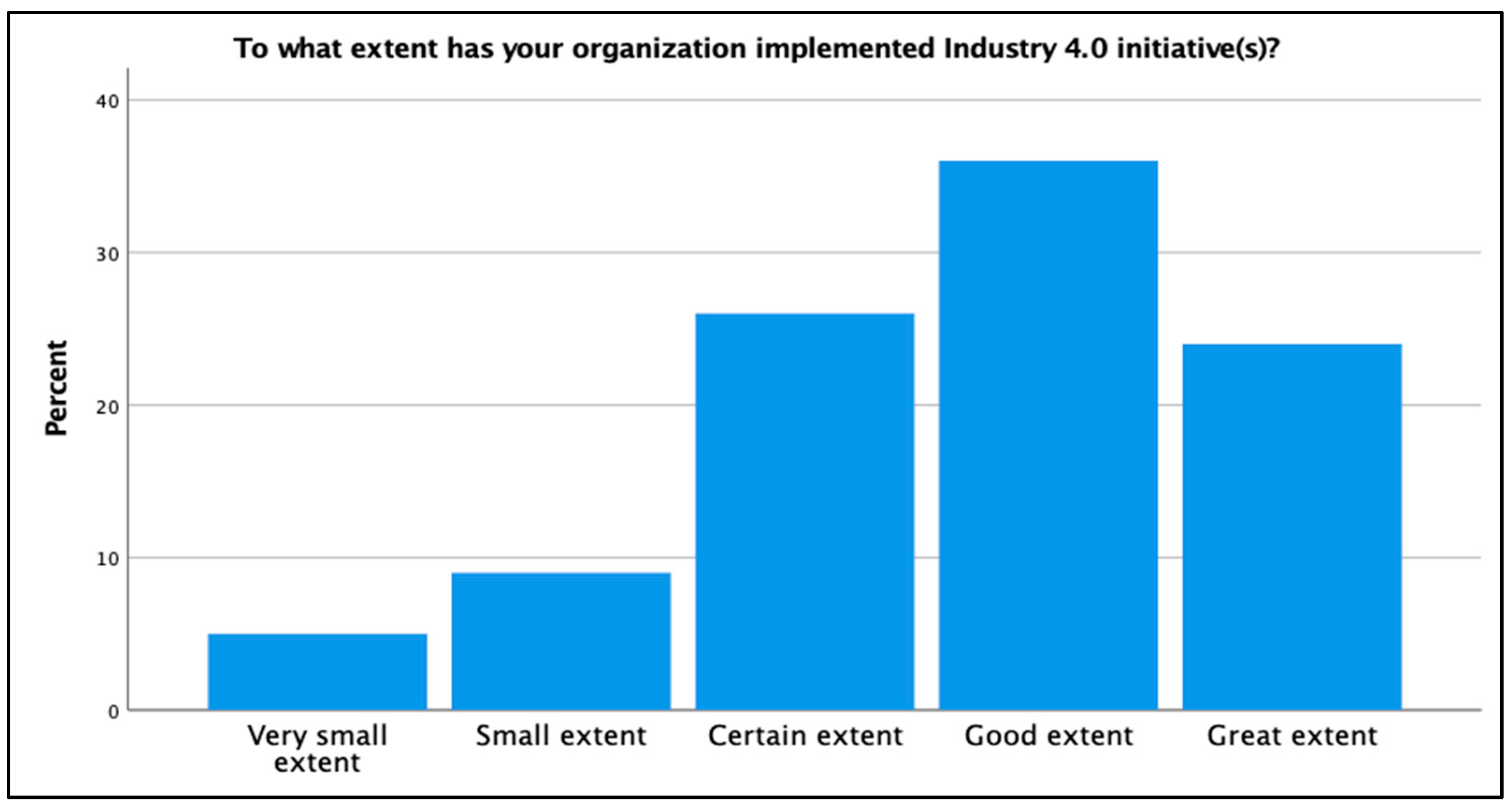

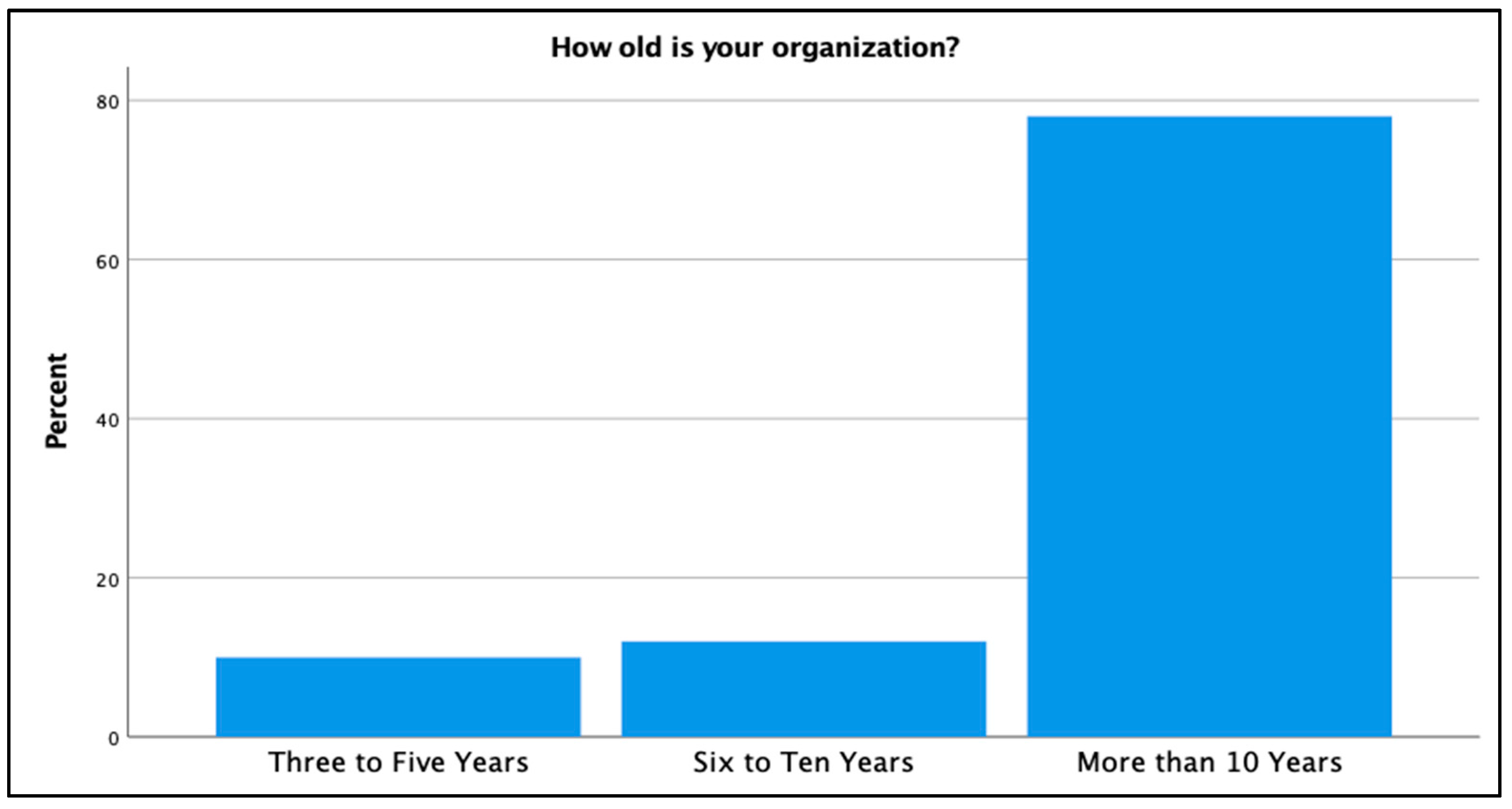

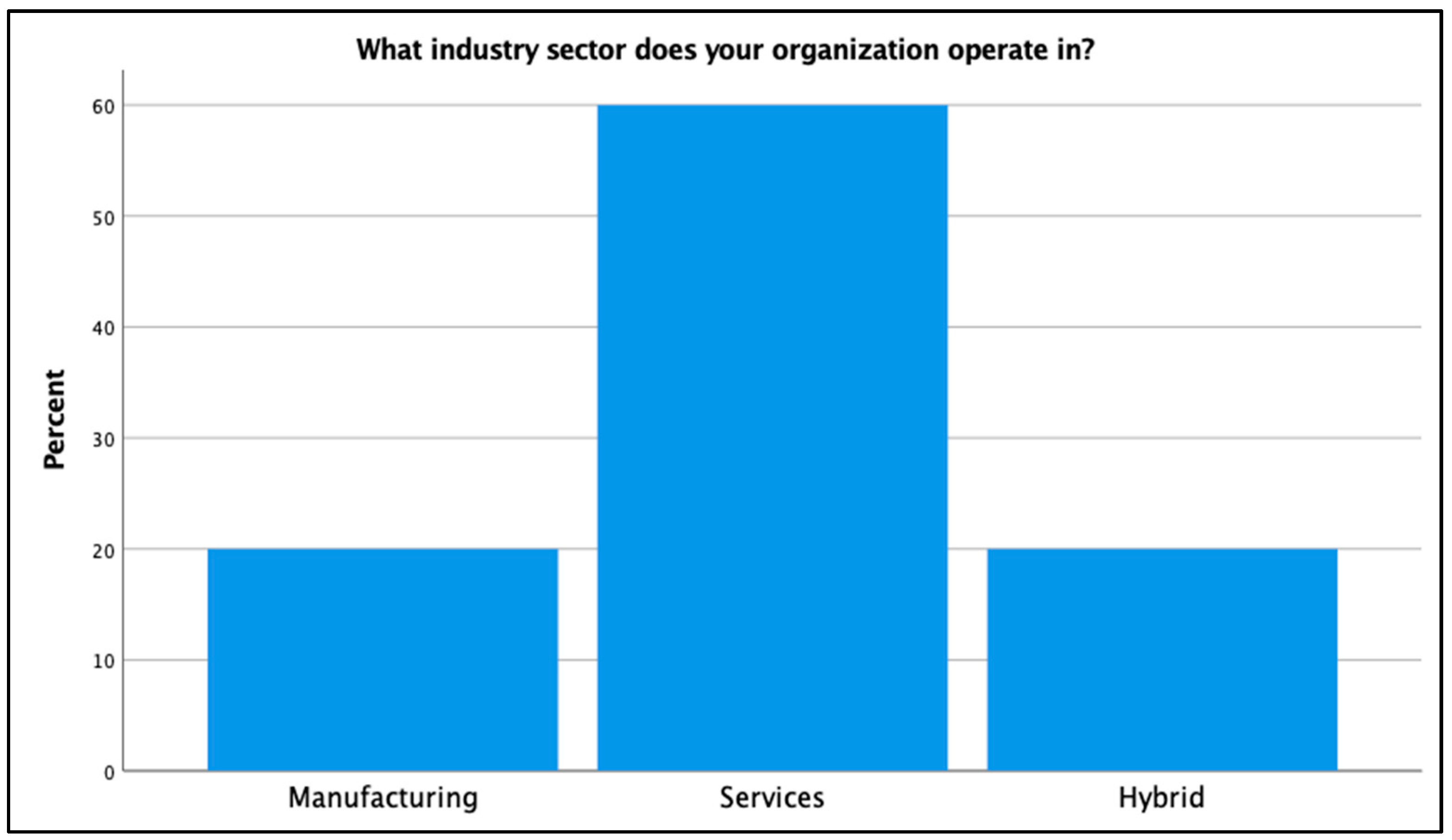

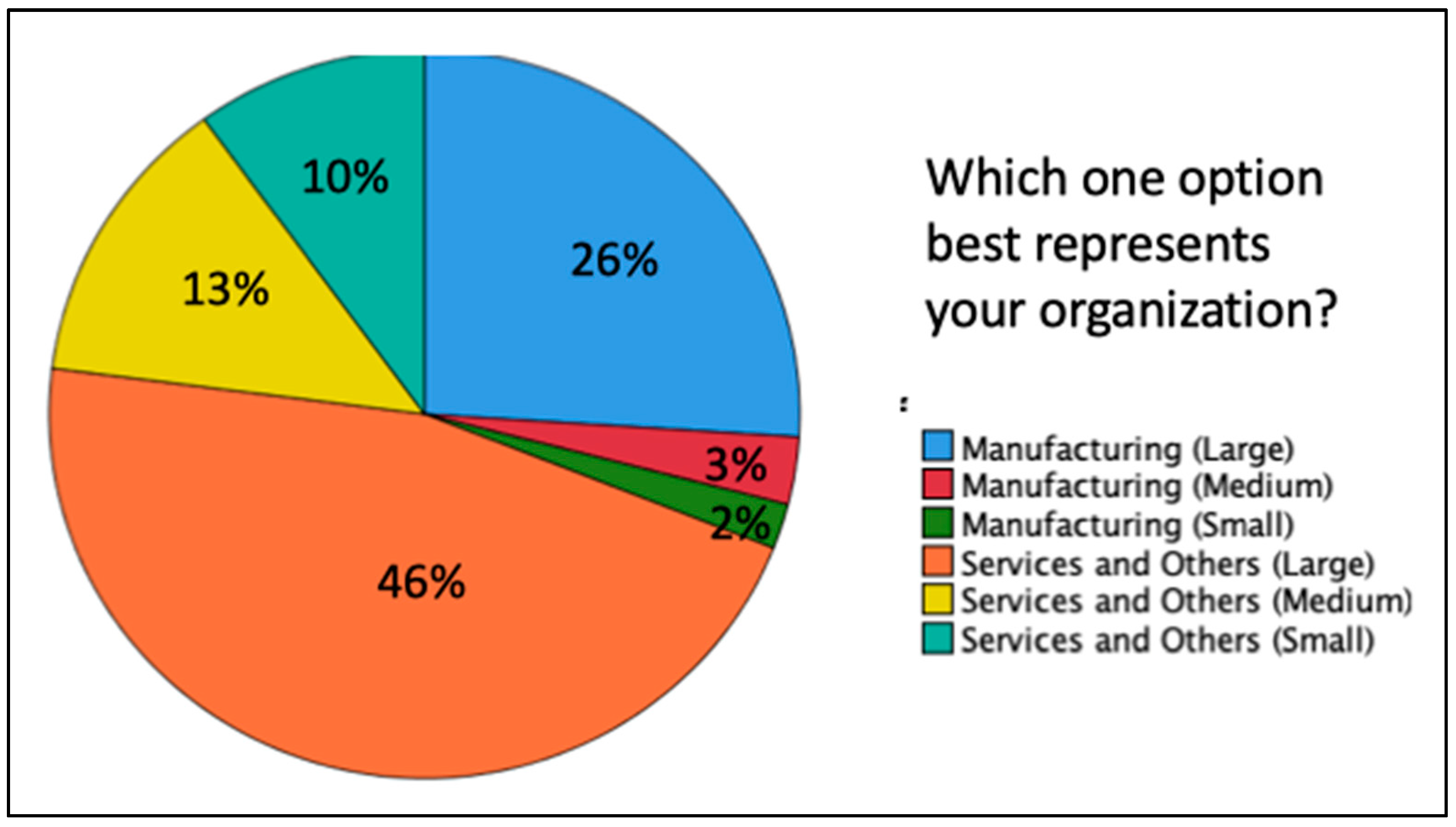

3.3. Demographics of Companies

4. Results and Discussion

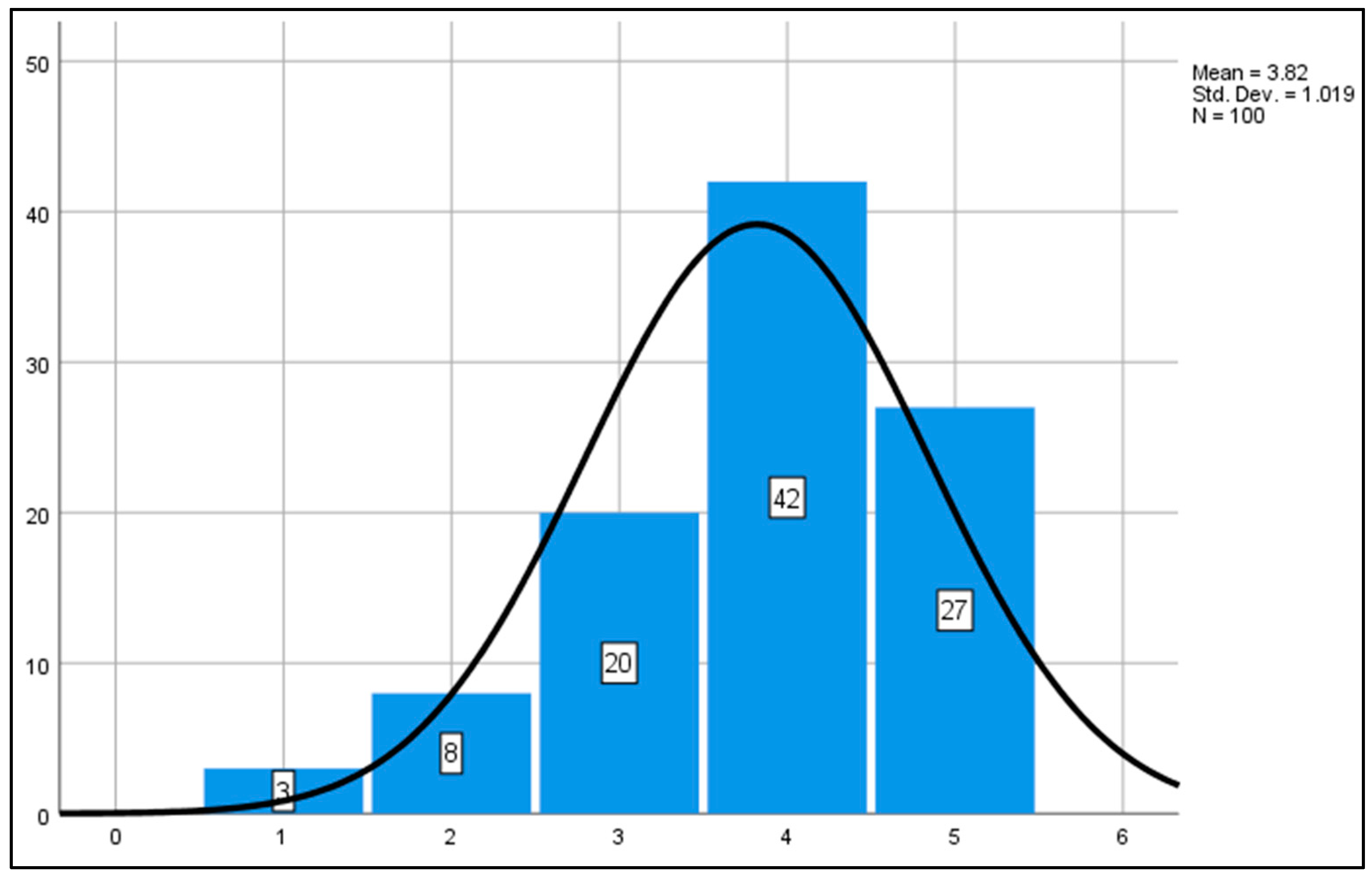

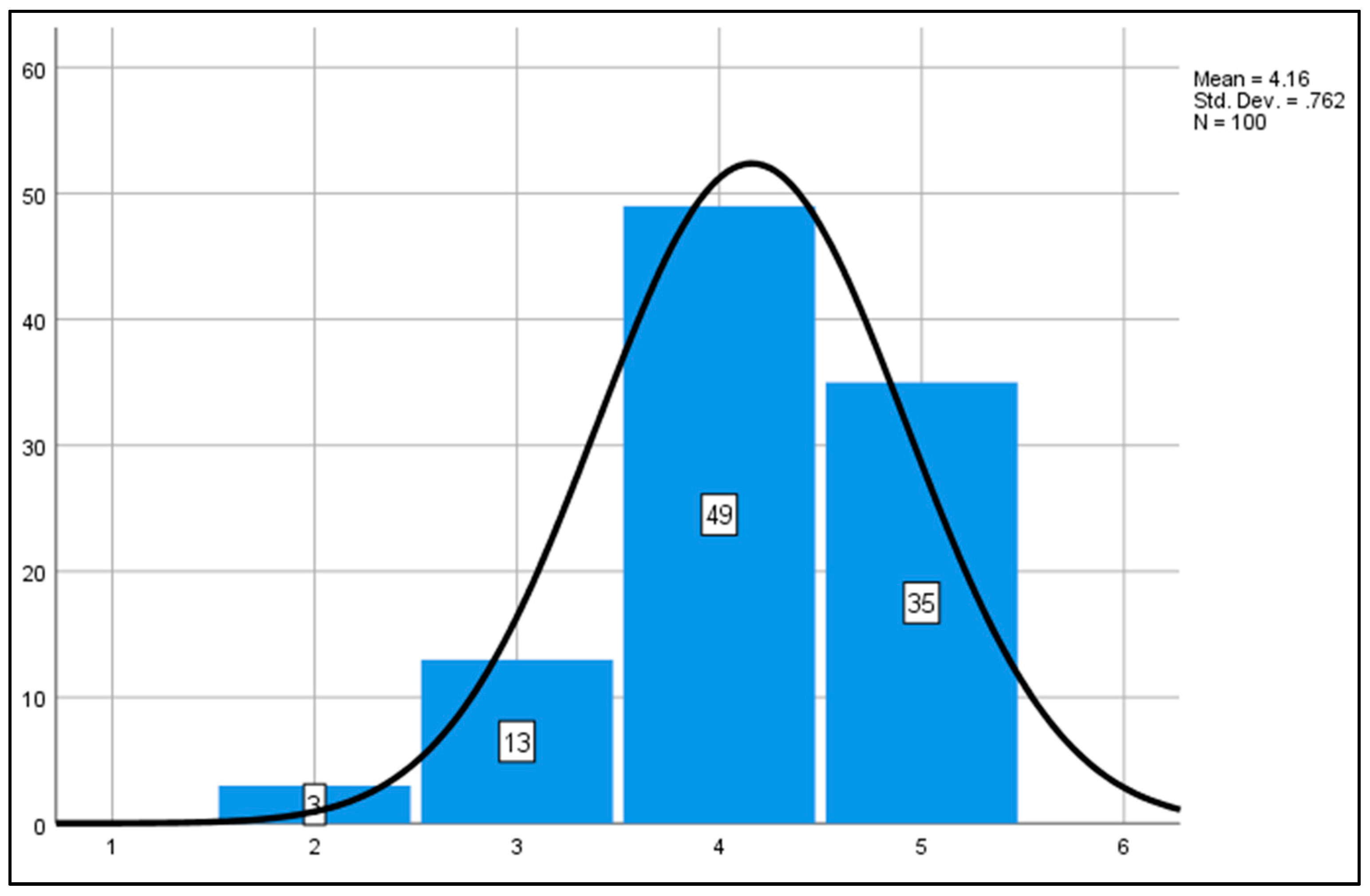

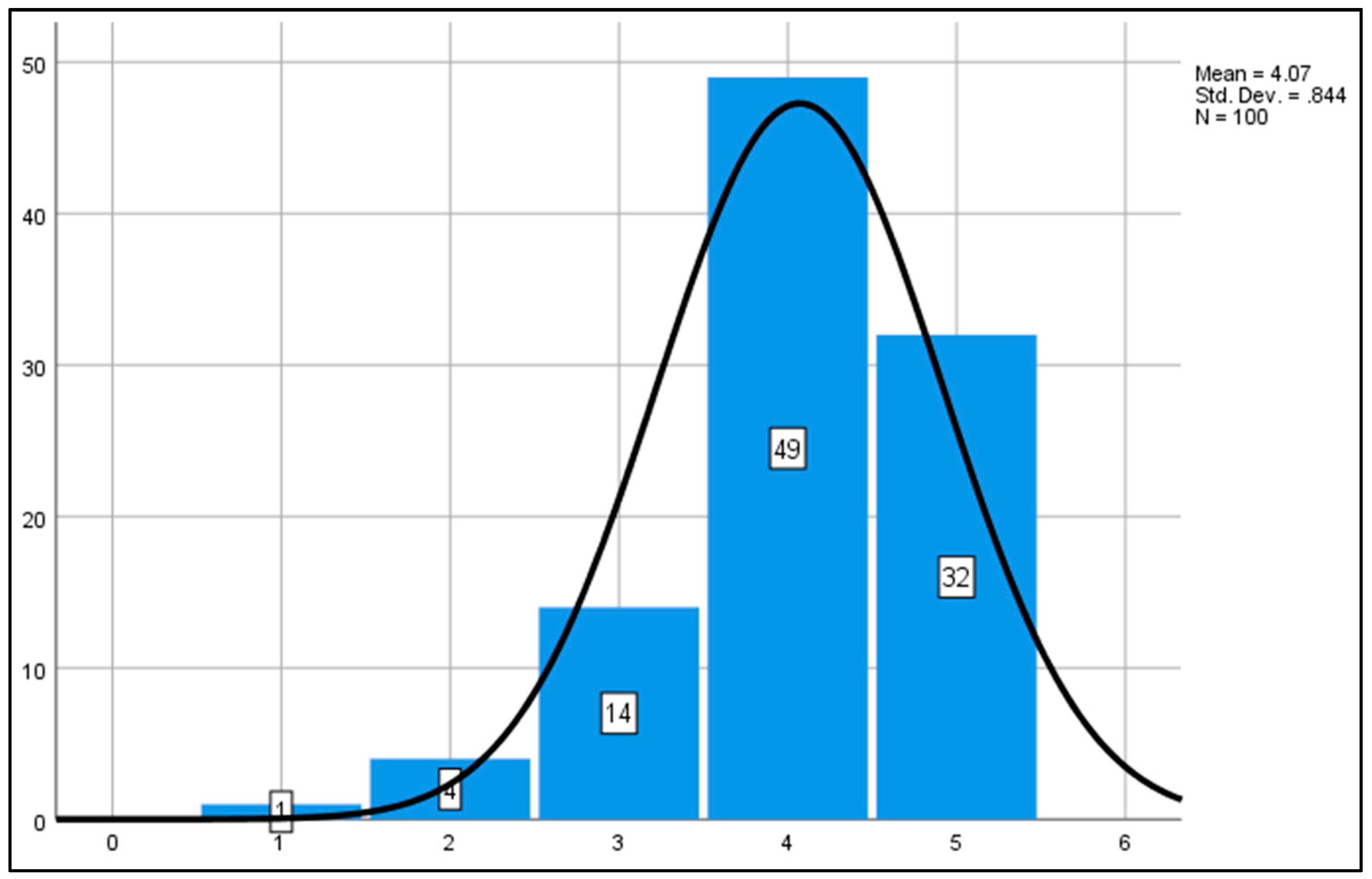

4.1. Overall Industry 4.0 Readiness

4.2. Market Pressure as a Function of Industry 4.0 Readiness

4.3. Risk-Taking as a Function of Industry 4.0 Readiness

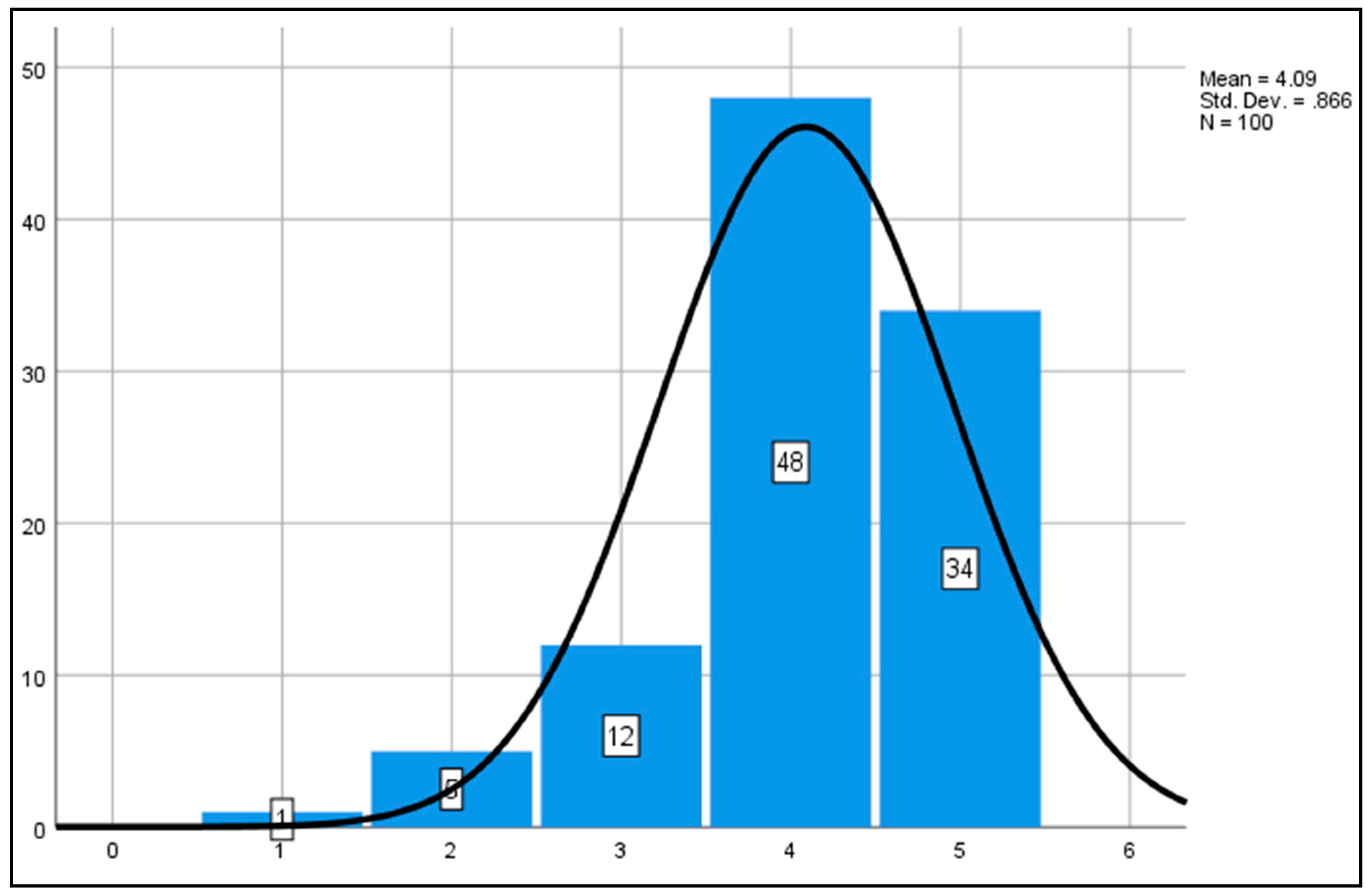

4.4. Knowledge as a Function of Industry 4.0 Readiness

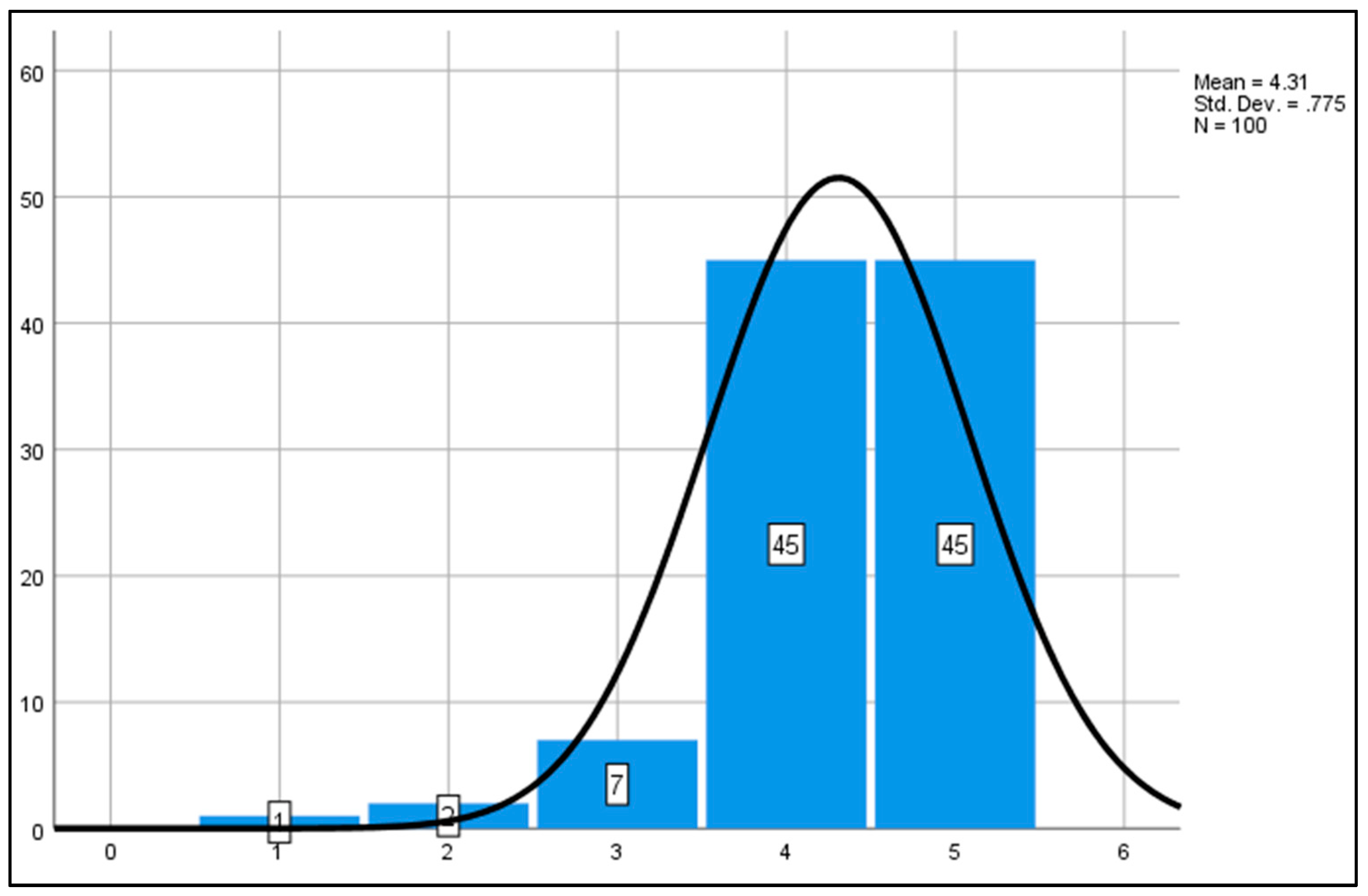

4.5. Management Support as a Function of Industry 4.0 Readiness

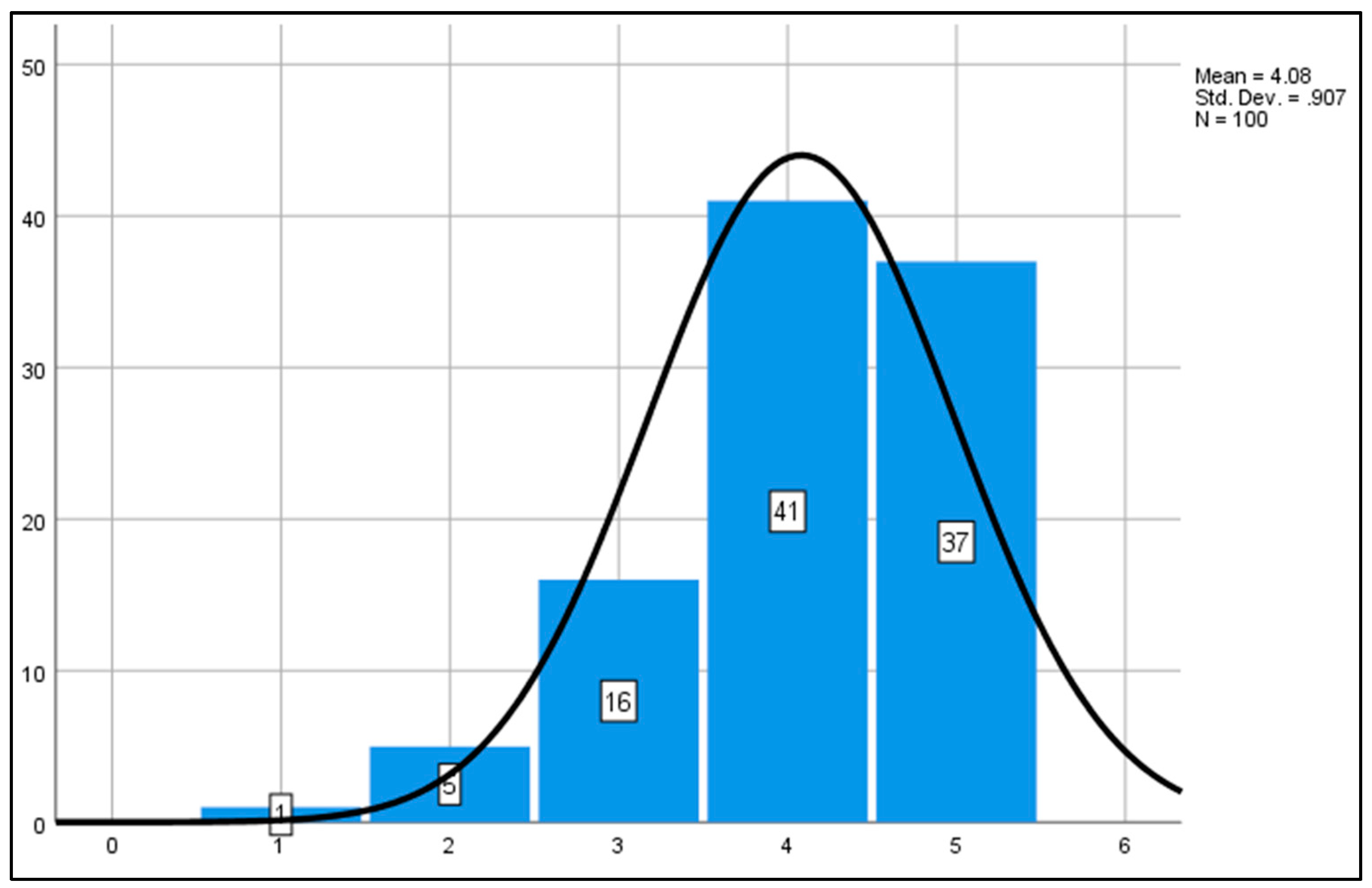

4.6. Competencies as a Function of Industry 4.0 Readiness

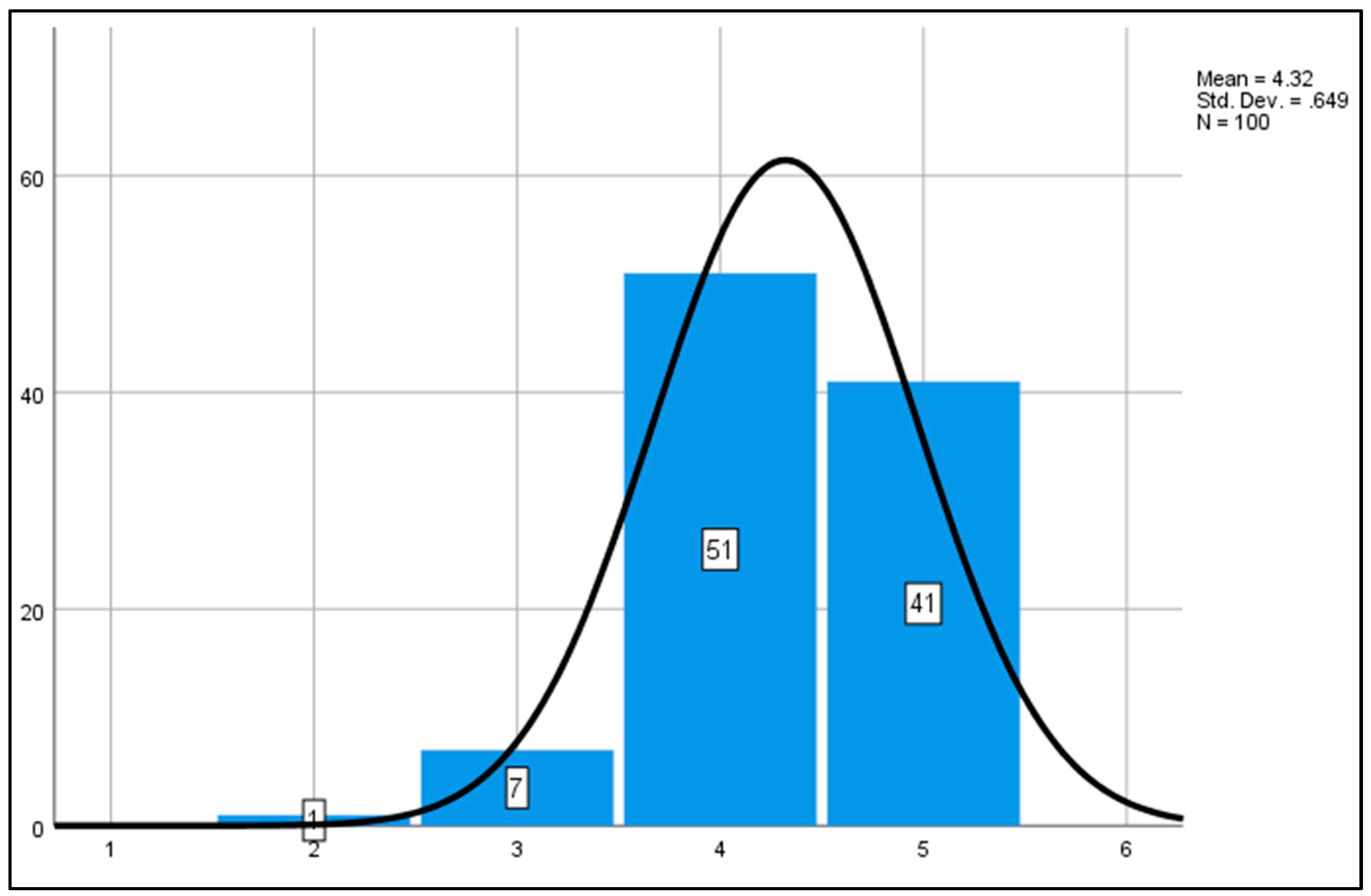

4.7. Motivation as a Function of Industry 4.0 Readiness

4.8. Freedom as a Function of Industry 4.0 Readiness

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aaker, David A., and Geoffrey Keppel. 2006. Design and Analysis: A Researcher’s Handbook. Journal of Marketing Research 13: 318. [Google Scholar] [CrossRef]

- Abbott, Bruce Barrington, and Kenneth S. Bordens. 2011. Research Design and Methods: A Process Approach, 8th ed. New York: McGraw-Hill Education. [Google Scholar] [CrossRef]

- Agarwal, Nivedita, and Alexander Brem. 2015. Strategic Business Transformation through Technology Convergence: Implications from General Electric’s Industrial Internet Initiative. International Journal of Technology Management 67: 196–214. [Google Scholar] [CrossRef]

- Ardito, Lorenzo, Antonio Messeni Petruzzelli, Umberto Panniello, and Achille Claudio Garavelli. 2018. Towards Industry 4.0: Mapping Digital Technologies for Supply Chain Management-Marketing Integration. Business Process Management Journal. [Google Scholar] [CrossRef]

- Azlina, Rahim, Atan Ruhaya, and Kamaluddin Amrizah. 2011. Intellectual Capital Reporting in Malaysian Technology Industry. Asian Journal of Accounting and Governance 2: 51–59. [Google Scholar] [CrossRef][Green Version]

- Basl, Josef. 2018. Companies on the Way to Industry 4.0 and Their Readiness. Journal of Systems Integration 3: 3. [Google Scholar] [CrossRef]

- Bauer, Wilhelm, Bastian Pokorni, and Stefanie Findeisen. 2019. Production Assessment 4.0—Methods for the Development and Evaluation of Industry 4.0 Use Cases. Basingstoke: Springer Nature, vol. 793, pp. 501–10. [Google Scholar] [CrossRef]

- Bryman, Alan. 2008. Social Research Method, 3rd ed. Oxford University Press: Oxford. [Google Scholar]

- Burns, C. Alvin, and F. Ronald Bush. 2010. Marketing Research, 6th ed. London: Pearson Prentise Hall. [Google Scholar]

- Cividino, Sirio, Gianluca Egidi, Ilaria Zambon, and Andrea Colantoni. 2019. Evaluating the Degree of Uncertainty of Research Activities in Industry 4.0. Future Internet 11: 196. [Google Scholar] [CrossRef]

- Cooper, Donald R., and Pamela S. Schindler. 2011. Business Research Methods, 11th ed. New York: McGraw Hill. [Google Scholar]

- Dassisti, Michele, Hervé Panetto, Mario Lezoche, Pasquale Merla, Antonio Giovannini, Michela Chimienti, and Michele Dassisti. 2017. Industry 4.0 Paradigm: The Viewpoint of the Small and Medium Enterprises. Paper Presented at 7th International Conference on Information Society and Technology ICIST 2017 Efficiency, Kopaonik, Serbia, March 12–15. [Google Scholar]

- De Felice, Fabio, Petrillo Antonella, and Zomparelli Federico. 2018. A Bibliometric Multicriteria Model on Smart Manufacturing from 2011 to 2018. IFAC-PapersOnLine 51: 1643–48. [Google Scholar] [CrossRef]

- Fayyaz, Ayesha, Beenish Neik Chaudhry, and Muhammad Fiaz. 2020. Upholding Knowledge Sharing for Organization Innovation Efficiency in Pakistan. Journal of Open Innovation: Technology, Market, and Complexity 7: 1–16. [Google Scholar] [CrossRef]

- Fuchs, Christian. 2018. Industry 4.0: The Digital German Ideology. TripleC 16: 280–89. [Google Scholar] [CrossRef]

- Ghauri, Pervez, and Kjell Grønhaug. 2010. Research Methods in Business Studies, 4th ed. Berlin: Prentice Hall Europe. [Google Scholar]

- Ghobakhloo, Morteza. 2019. Industry 4.0, Digitization, and Opportunities for Sustainability. Journal of Cleaner Production 252: 119869. [Google Scholar] [CrossRef]

- Govindarajan, Vijay, and Praveen K. Kopalle. 2006. Disruptiveness of Innovations: Measurement and an Assessment of Reliability and Validity. Strategic Management Journal 27: 189–99. [Google Scholar] [CrossRef]

- Gven, Çaglar, Robert Y. Cavana, Jac A. M. Vennix, Etienne A. J. A. Rouwette, Margaret Stevenson-Wright, and Joy Candlish. 1999. Operational Research from a Critical Viewpoint. Paper Presented at the 17th International Conference of the System Dynamics Society and 5th Australian & New Zealand Systems Conference, Sydney, Australia, November 20–23. [Google Scholar]

- Haddara, Moutaz, and Ahmed Elragal. 2015. The Readiness of ERP Systems for the Factory of the Future. Procedia Computer Science 64: 721–28. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hermann, Mario, Tobias Pentek, and Boris Otto. 2016. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the Annual Hawaii International Conference on System Sciences. Berlin: IEEE, pp. 3928–37. [Google Scholar] [CrossRef]

- Hizam-Hanafiah, Mohd, Mansoor Ahmed Soomro, and Nor Liza Abdullah. 2020. Industry 4.0 Readiness Models: A Systematic Literature Review of Model Dimensions. Information 11: 364. [Google Scholar] [CrossRef]

- Ismail, Salim, Michael S. Malone, and Yuri van Geest. 2014. Exponential Organisations: Why New Organisations Are Ten Times Better, Faster, and Cheaper than Yours (and What to Do about It). New York: Diversion Publishing Corp. [Google Scholar]

- Johanson, George A., and Gordon P. Brooks. 2010. Initial Scale Development: Sample Size for Pilot Studies. Educational and Psychological Measurement 70: 394–400. [Google Scholar] [CrossRef]

- Kaltenbach, Fabian, Patrick Marber, Clarissa Gosemann, Tom Bolts, and Ansgar Kuhn. 2018. Smart Services Maturity Level in Germany. Paper Presented at 2018 IEEE International Conference on Engineering, Technology and Innovation (ICE/ITMC), Stuttgart, Germany, June 17–20; pp. 1–7. [Google Scholar] [CrossRef]

- Kamarul Bahrin, Mohd Aiman, Mohd Fauzi Othman, Nor Hayati Nor Azli, and Muhamad Farihin Talib. 2016. Industry 4.0: A Review on Industrial Automation and Robotic. Jurnal Teknologi 78. [Google Scholar] [CrossRef]

- Kane, Gerald C., Doug Palmer, Anh Philips Nguyen, David Kiron, and Natasha Buckley. 2015. Strategy, Not Technology, Drives Digital Transformation. Cambridge: MIT Sloan Management Review & Deloitte. [Google Scholar]

- Kang, Hyoung Seok, Ju Yeon Lee, Sangsu Choi, Hyun Kim, Jun Hee Park, Ji Yeon Son, Bo Hyun Kim, and Sang Do Noh. 2016. Smart Manufacturing: Past Research, Present Findings, and Future Directions. International Journal of Precision Engineering and Manufacturing—Green Technology 3: 111–28. [Google Scholar] [CrossRef]

- Kazancoglu, Yigit, and Yesim Deniz Ozkan-Ozen. 2018. Analyzing Workforce 4.0 in the Fourth Industrial Revolution and Proposing a Road Map from Operations Management Perspective with Fuzzy DEMATEL. Journal of Enterprise Information Management 31: 891–907. [Google Scholar] [CrossRef]

- Keramati, Abbas, Masoud Afshari-Mofrad, Iman Behmanesh, and Reihaneh Gholami. 2016. The Impact of Information Technology Maturity on Firm Performance Considering the Moderating Role of Relational Maturity: An Empirical Research. International Journal of Business Information Systems 23: 23–43. [Google Scholar] [CrossRef]

- Kim, Junmo. 2018. Are Countries Ready for the New Meso Revolution? Testing the Waters for New Industrial Change in Korea. Technological Forecasting and Social Change 132: 34–39. [Google Scholar] [CrossRef]

- Kuan, Kevin K. Y., and Patrick Y. K. Chau. 2001. A Perception-Based Model for EDI Adoption in Small Businesses Using a Technology-Organization-Environment Framework. Information and Management 38: 507–21. [Google Scholar] [CrossRef]

- Lee, Nick, and Ian Lings. 2010. Doing Business Research: A Guide to Theory and Practice. By Nick Lee and Ian Lings. Library and Information Science Research 3: 231. [Google Scholar] [CrossRef]

- Leyh, Christian, Stefan Martin, and Thomas Sch. 2018. Analyzing Industry 4.0 Models with Focus on Lean Production Aspects. Springer International 311: 114–30. [Google Scholar] [CrossRef]

- Madsen, Dag Øivind. 2019. The Emergence and Rise of Industry 4.0 Viewed through the Lens of Management Fashion Theory. Administrative Sciences 9: 71. [Google Scholar] [CrossRef]

- Manavalan, Ethirajan, and Kandasamy Jayakrishna. 2019. A Review of Internet of Things (IoT) Embedded Sustainable Supply Chain for Industry 4.0 Requirements. Computers and Industrial Engineering 127: 925–53. [Google Scholar] [CrossRef]

- Marwah, Nikhil, and Rajesh Sharma. 2015. Chapter-83 Research Methodology. In Textbook of Pediatric Dentistry. New Delhi: Jaypee Publishers. [Google Scholar] [CrossRef]

- Mittal, Sameer, Muztoba Ahmad Khan, David Romero, and Thorsten Wuest. 2018. A Critical Review of Smart Manufacturing & Industry 4.0 Maturity Models: Implications for Small and Medium-Sized Enterprises (SMEs). Journal of Manufacturing Systems 49: 194–214. [Google Scholar] [CrossRef]

- Neugebauer, Reimund, Sophie Hippmann, Miriam Leis, and Martin Landherr. 2016. Industrie 4.0—From the Perspective of Applied Research. Procedia CIRP 57: 2–7. [Google Scholar] [CrossRef]

- Nick, Gabor, and Ferenc Pongrácz. 2016. How To Measure Industry 4.0 Readiness of Cities. Scientific Proceedings International Conference on Industry 4.0 2016 2: 64–68. [Google Scholar]

- Nunnally, Jum C., and Ira H. Bernstein. 1994. Psychometric Theory, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Onufrey, Ksenia, and Anna Bergek. 2020. Transformation in a Mature Industry: The Role of Business and Innovation Strategies. Technovation, 102190. [Google Scholar] [CrossRef]

- Poór, Peter, Maja Trstenjak, and Josef Basl. 2020. Maintenance Ideal Model in Industry 4.0—A Transformation Strategy Roadmap to Readiness Factor Calculation. Hradec Economic Days 2020. [Google Scholar] [CrossRef]

- Powell, Daryl, David Romero, Paolo Gaiardelli, Chiara Cimini, and Sergio Cavalieri. 2018. Towards Digital Lean Cyber-Physical Production Systems: Industry 4.0 Technologies as Enablers of Leaner Production. Cham: Springer International Publishing, vol. 536. [Google Scholar] [CrossRef]

- Roblek, Vasja, Maja Meško, and Alojz Krapež. 2016. A Complex View of Industry 4.0. SAGE Open 6: 215824401665398. [Google Scholar] [CrossRef]

- Roblek, Vasja, Maja Meško, Mirjana Pejić Bach, Oshane Thorpe, and Polona Šprajc. 2020. The Interaction between Internet, Sustainable Development, and Emergence of Society 5.0. Data 5: 80. [Google Scholar] [CrossRef]

- Rodríguez-Abitia, Guillermo, and Graciela Bribiesca-Correa. 2021. Assessing Digital Transformation in Universities. Future Internet 13: 52. [Google Scholar] [CrossRef]

- Ruppert, Tamás, Szilárd Jaskó, Tibor Holczinger, and János Abonyi. 2018. Enabling Technologies for Operator 4.0: A Survey. Applied Sciences 8: 1650. [Google Scholar] [CrossRef]

- Saleh, Ali Salman, and Nelson Oly Ndubisi. 2006. An Evaluation of SME Development in Malaysia. International Review of Business Research Paper 2: 1–14. [Google Scholar] [CrossRef]

- Salkin, Ceren, Mahir Oner, Alp Ustundag, and Emre Cevikcan. 2018. A Conceptual Framework for Industry 4.0. Cham: Springer International Publishing, pp. 3–23. [Google Scholar] [CrossRef]

- Sandner, Philipp, Anna Lange, and Philipp Schulden. 2020. The Role of the CFO of an Industrial Company: An Analysis of the Impact of Blockchain Technology. Future Internet 12: 128. [Google Scholar] [CrossRef]

- Saucedo-Martínez, Jania Astrid, Magdiel Pérez-Lara, José Antonio Marmolejo-Saucedo, Tomás Eloy Salais-Fierro, and Pandian Vasant. 2018. Industry 4.0 Framework for Management and Operations: A Review. Journal of Ambient Intelligence and Humanized Computing 9: 789–801. [Google Scholar] [CrossRef]

- Saunders, By Mark, and Paul Tosey. 2012. The Layers of Research Design. Rapport: The Magazine for NLP Professionals 4: 58–59. [Google Scholar]

- Schindler, John R. 2005. Defeating the Sixth Column: Intelligence and Strategy in the War on Islamist Terrorism. Orbis 49: 695–712. [Google Scholar] [CrossRef]

- Schwab, Klaus. 2016. The Fourth Industrial Revolution: World Economic Forum. Zulfu Dicleli: The Optimist Publications 91: 15. [Google Scholar]

- Sharma, Suresh, and Pankaj Jayantilal Gandhi. 2018. Journey Readiness of Industry 4.0 from Revolutionary Idea to Evolutionary Implementation: A Lean Management Perspective. International Journal of Information and Communication Sciences 3: 96–103. [Google Scholar] [CrossRef][Green Version]

- Silva, Felipe, David Resende, Marlene Amorim, and Monique Borges. 2020. A Field Study on the Impacts of Implementing Concepts and Elements of Industry 4.0 in the Biopharmaceutical Sector. Journal of Open Innovation: Technology, Market, and Complexity, 1–8. [Google Scholar] [CrossRef]

- Slusarczyk, Beata. 2018. Industry 4.0—Are We Ready? Polish Journal of Management Studies 17: 232–48. [Google Scholar] [CrossRef]

- Sommer, Lutz. 2015. Industrial Revolution—Industry 4.0: Are German Manufacturing SMEs the First Victims of This Revolution? Journal of Industrial Engineering and Management 8: 1512–32. [Google Scholar] [CrossRef]

- Sony, Michael. 2019. Key Ingredients for Evaluating Industry 4.0 Readiness for Organizations: A Literature Review. Benchmarking: An International Journal. [Google Scholar] [CrossRef]

- Soomro, Mansoor Ahmed, Mohd Hizam-Hanafiah, and Nor Liza Abdullah. 2020a. Top-Down Orientation on Fourth Industrial Revolution: A Literature Review. Systematic Reviews in Pharmacy 11: 872–78. [Google Scholar]

- Soomro, Mansoor Ahmed, Mohd Hizam-Hanafiah, and Nor Liza Abdullah. 2020b. Digital Readiness Models: A Systematic Literature Review. Compusoft 9: 3596–605. [Google Scholar]

- Srivastava, Shirish C., and Thompson S. H. Teo. 2006. Facilitators for E-Government Development: An Application of the Technology-Organization-Environment Framework. Paper Presented at Association for Information Systems—12th Americas Conference On Information Systems, AMCIS 2006, Acapulco, Mexico, August 4–6. [Google Scholar]

- Stentoft, Jan, Kent Adsbøll Wickstrøm, Kristian Philipsen, and Anders Haug. 2020. Drivers and Barriers for Industry 4.0 Readiness and Practice: Empirical Evidence from Small and Medium-Sized Manufacturers. Production Planning and Control, 1–18. [Google Scholar] [CrossRef]

- Stentoft, Jan, Kent Wickstrøm Jensen, Kristian Philipsen, and Anders Haug. 2019. Drivers and Barriers for Industry 4.0 Readiness and Practice: A SME Perspective with Empirical Evidence. Paper Presented at 52nd Hawaii International Conference on System Sciences, Maui, HI, USA, January 8–11, vol 6, pp. 5155–64. [Google Scholar] [CrossRef]

- Taylor, Kevin, Sarah Nettleton, Geoffrey Harding, and St Bartholomew’s. 2010. Social Research Methods. In Sociology for Pharmacists. London: Taylor & Francis Group. [Google Scholar] [CrossRef]

- Tornatzky, Louis, and Mitchell Fleischer. 1990. The Process of Technology Innovation. Lexington: Lexington Books. [Google Scholar] [CrossRef]

- Tortorella, Guilherme Luz, and Diego Fettermann. 2017. Implementation of Industry 4.0 and Lean Production in Brazilian Manufacturing Companies. International Journal of Production Research 7543: 1–13. [Google Scholar] [CrossRef]

- Uygun, Yilmaz. 2018. Human Resources Requirements for Industry 4.0. Journal of Open Innovation: Technology, Market, and Complexity 3: 1–20. [Google Scholar]

- Voleti, Sudhir. 2019. Data Collection. In International Series in Operations Research and Management Science. Cham: Springer. [Google Scholar] [CrossRef]

- Wamba, Samuel Fosso, and Maciel M. Queiroz. 2020. Blockchain in the Operations and Supply Chain Management: Benefits, Challenges and Future Research Opportunities. International Journal of Information Management. [Google Scholar] [CrossRef]

- Zikmund, William G. 1984. Business Research Methods. Cengage: Thomson Learning. [Google Scholar]

- Zikmund, William G. 2003. Business Research Methods/William G. Zikmund. Nashville: South-Western Publishing. [Google Scholar]

| No. | Questions/Items | Adopted From |

|---|---|---|

| 1 | Our organization experiences a pressure to work on Industry 4.0 from market. | (Stentoft et al. 2019, 2020) |

| 2 | Our organization has the willingness to take risks to experiment on Industry 4.0. | (Stentoft et al. 2019, 2020) |

| 3 | Our organization has the necessary knowledge about Industry 4.0. | (Stentoft et al. 2019, 2020) |

| 4 | Our organization has the necessary support from top management to work on Industry 4.0. | (Stentoft et al. 2019, 2020) |

| 5 | Our organization has the competencies to work on Industry 4.0. | (Stentoft et al. 2019, 2020) |

| 6 | Our organization has the motivation to work on Industry 4.0. | (Stentoft et al. 2019, 2020) |

| 7 | Our organization has the freedom to work on Industry 4.0. | (Stentoft et al. 2019, 2020) |

| No. | Questions/Items | Mean |

|---|---|---|

| 1 | Our organization experiences a pressure to work on Industry 4.0 from market. | 3.82 |

| 2 | Our organization has the willingness to take risks to experiment on Industry 4.0. | 4.16 |

| 3 | Our organization has the necessary knowledge about Industry 4.0. | 4.09 |

| 4 | Our organization has the necessary support from top management to work on Industry 4.0. | 4.31 |

| 5 | Our organization has the competencies to work on Industry 4.0. | 4.08 |

| 6 | Our organization has the motivation to work on Industry 4.0. | 4.32 |

| 7 | Our organization has the freedom to work on Industry 4.0. | 4.07 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Soomro, M.A.; Hizam-Hanafiah, M.; Abdullah, N.L.; Ali, M.H.; Jusoh, M.S. Industry 4.0 Readiness of Technology Companies: A Pilot Study from Malaysia. Adm. Sci. 2021, 11, 56. https://doi.org/10.3390/admsci11020056

Soomro MA, Hizam-Hanafiah M, Abdullah NL, Ali MH, Jusoh MS. Industry 4.0 Readiness of Technology Companies: A Pilot Study from Malaysia. Administrative Sciences. 2021; 11(2):56. https://doi.org/10.3390/admsci11020056

Chicago/Turabian StyleSoomro, Mansoor Ahmed, Mohd Hizam-Hanafiah, Nor Liza Abdullah, Mohd Helmi Ali, and Muhammad Shahar Jusoh. 2021. "Industry 4.0 Readiness of Technology Companies: A Pilot Study from Malaysia" Administrative Sciences 11, no. 2: 56. https://doi.org/10.3390/admsci11020056

APA StyleSoomro, M. A., Hizam-Hanafiah, M., Abdullah, N. L., Ali, M. H., & Jusoh, M. S. (2021). Industry 4.0 Readiness of Technology Companies: A Pilot Study from Malaysia. Administrative Sciences, 11(2), 56. https://doi.org/10.3390/admsci11020056