Institutional, Economic, and Socio-Economic Determinants of the Entrepreneurial Activity of Nations

Abstract

1. Introduction

2. Theoretical Framework and Hypothesis Development

2.1. Institutional Determinants

2.1.1. Corruption

2.1.2. Free Trade

2.2. Economic Determinants

2.2.1. Innovativeness

2.2.2. Foreign Direct Investment

2.3. Socio-Economic Determinants

2.3.1. Unemployment

2.3.2. Age

2.3.3. Households Consumption

2.3.4. Education

2.3.5. Life

3. Methodological Design

3.1. Period of Study, Data Sources, and Variables

3.2. Descriptive Statistics

4. Empirical Application

4.1. First Stage: Preliminary Analysis

4.2. Second Stage: Quantile Regression Model

4.2.1. Method

4.2.2. Model Specification

4.3. Empirical Evidence

4.3.1. Results of Estimation of the Models

4.3.2. Results of the Robustness Tests

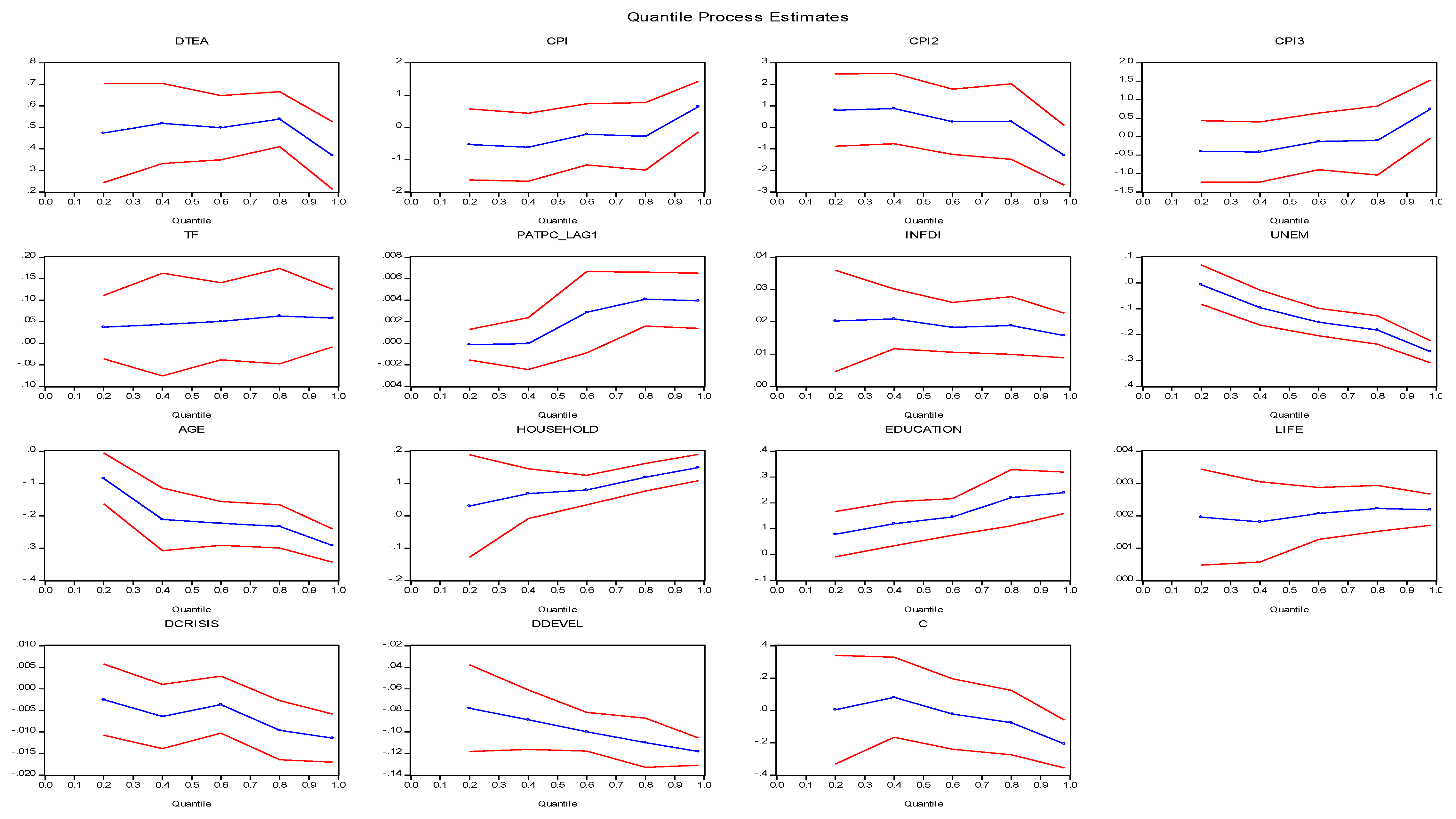

4.3.3. Estimates with Confidence Intervals

4.4. Discussion and Summary of the New Evidence

4.4.1. Contrasting Developed vs. Developing Countries

4.4.2. Evaluating the Quantile Regression

5. Concluding Remarks

5.1. Empirical Findings

5.2. Implications and Recommendations

5.3. Limitations

5.4. Future Research

- What are the effects of rising unemployment rates and the difficulties already felt in attracting FDI on entrepreneurial activity and technological innovation?

- What are the effects of government measures implemented in the course of the pandemic and the post-pandemic to help the survival of micro-firms and ensure new innovation clusters?

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Acs, Zoltan J., Erkko Autio, and László Szerb. 2014. National systems of entrepreneurship: Measurement issues and policy implications. Research Policy 43: 476–94. [Google Scholar] [CrossRef]

- Acs, Zoltan J., Saul Estrin, Tomasz Mickiewicz, and László Szerb. 2018. Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics 51: 501–14. [Google Scholar] [CrossRef]

- Afonso, Tiago L., António C. Marques, and José A. Fuinhas. 2019. Energy-growth nexus and economic development: A quantile regression for panel data. In The Extended Energy-Growth Nexus: Theory and Empirical Applications, 1st ed. London: Academic Press, pp. 1–25. [Google Scholar]

- Aidis, Ruta, Saul Estrin, and Tomasz Mickiewicz. 2008. Institutions and entrepreneurship development in Russia: A comparative perspective. Journal of Business Venturing 23: 656–72. [Google Scholar] [CrossRef]

- Aitken, Brian J., and Ann E. Harrison. 1999. Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review 89: 605–18. [Google Scholar] [CrossRef]

- Aiyar, Shekhar, Christian Ebeke, and Xiaobo Shao. 2016. The Impact of Workforce Aging on European Productivity. IMF Working Paper 16: 1–29. [Google Scholar] [CrossRef]

- Albulescu, Claudiu T., Matei Tămăşilă, and Ilie M. Tăucean. 2016. Entrepreneurship, Tax Evasion and Corruption in Europe. Procedia—Social and Behavioral Sciences 221: 246–53. [Google Scholar] [CrossRef]

- Aldieri, Luigi, and Concetto P. Vinci. 2017. Quantile Regression for Panel Data: An Empirical Approach for Knowledge Spillovers Endogeneity. International Journal of Economics and Finance 9: 106–11. [Google Scholar] [CrossRef]

- Alfaro, Laura, Sebnem Kalemli-Ozcan, and Selin Sayek. 2009. FDI, Productivity and Financial Development. The World Economy 32: 111–31. [Google Scholar] [CrossRef]

- Anokhin, Sergey, and William S. Schulze. 2009. Entrepreneurship, innovation, and corruption. Journal of Business Venturing 24: 465–76. [Google Scholar] [CrossRef]

- Aparicio, Sebastian, David Audretsch, and David Urbano. 2021. Why is export-oriented Entrepreneurship more prevalente in some countries than other? Contextual antecedentes and economic consequences. Journal of World Business 56: 101177. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, and Stephen G. Hall. 2011. Applied Econometrics, 2nd ed. New York: Palgrave Macmillan. [Google Scholar]

- Audretsch, David B., and Maryann P. Feldman. 1996. Innovative Clusters and the Industry Life Cycle. Review of Industrial Organization 11: 253–73. [Google Scholar] [CrossRef]

- Audretsch, David B., and Michael Fritscht. 1994. The Geography of Firm Births in Germany. Regional Studies 28: 359–65. [Google Scholar] [CrossRef]

- Audretsch, David B., and A. Roy Thurik. 2000. Capitalism and democracy in the 21st century: From the managed to the entrepreneurial economy. Journal of Evolutionary Economics 10: 17–34. [Google Scholar] [CrossRef]

- Bai, Jushan, and Serena Ng. 2005. Tests for skewness kurtosis and normality for time series data. Journal of Business and Economic Statistics 23: 49–60. [Google Scholar] [CrossRef]

- Baptista, Rui, and João Leitão. 2015. Entrepreneurship, Human Capital and Regional Development. Series: International Studies in Entrepreneurship; Berlin/Heidelberg: Springer. [Google Scholar]

- Barbosa, Natália, and Vasco Eiriz. 2009. The role of inward foreign direct investment on entrepreneurship. International Entrepreneurship and Management Journal 5: 319–39. [Google Scholar] [CrossRef]

- Baumol, William J. 2014. Stimulating growth amid recession: Entrepreneurship, innovation, and the Keynesian revolution. Journal of Policy Modeling 36: 629–35. [Google Scholar] [CrossRef]

- Beynon, Malcolm J., Paul Jones, and David G. Pickernell. 2019. The role of entrepreneurship, innovation, and urbanity-diversity on growth, unemployment, and income: US state-level evidence and an fsQCA elucidation. Journal of Business Research 101: 675–87. [Google Scholar] [CrossRef]

- Bohlmann, Clarissa, Andreas Rauch, and Hannes Zacher. 2017. A lifespan perspective on entrepreneurship: Perceived opportunities and skills explain the negative association between age and entrepreneurial activity. Frontiers in Psychology 8: 2015. [Google Scholar] [CrossRef]

- Boubker, Omar, Maryem Arroud, and Abdelaziz Ouajdouni. 2021. Entrepreneurship education versus management students´entrepreneurial intentions. A PLS-SEM approach. The International Journal of Management Education. Available online: https://www.sciencedirect.com/science/article/pii/S1472811720304171 (accessed on 19 January 2021).

- Breusch, Trevor S., and Adrian R. Pagan. 1980. The Lagrange multiplier test and its applications to model specification in econometrics. The Review of Economic Studies 47: 239–53. [Google Scholar] [CrossRef]

- Buchanan, Bonnie G., Quan V. Le, and Meenakshi Rishi. 2012. International Review of Financial Analysis Foreign Direct Investment and Institutional Quality: Some empirical evidence. International Review of Financial Analysis 21: 81–89. [Google Scholar] [CrossRef]

- Buchinsky, Moshe. 2012. Recent Advances in Quantile Regression Models: A Practical Guideline for Empirical Research. The Journal of Human Resources 33: 88–126. [Google Scholar] [CrossRef]

- Budsaratragoon, Pornanong, and Boonlert Jitmaneeroj. 2020. A critique on the Corruption Perceptions Index: An interdisciplinary approach. Socio-Economic Planning Sciences 70: 100768. [Google Scholar] [CrossRef]

- Bylund, Per L., and Matthew McCaffrey. 2017. A theory of entrepreneurship and institutional uncertainty. Journal of Business Venturing 32: 461–75. [Google Scholar] [CrossRef]

- Castaño, María-Soledad, María-Teresa Méndez, and María-Ángel Galindo. 2015. The effect of social, cultural, and economic factors on entrepreneurship. Journal of Business Research 68: 1496–500. [Google Scholar] [CrossRef]

- Castaño, María-Soledad, María-Teresa Méndez, and María-Ángel Galindo. 2016. The effect of public policies on entrepreneurial activity and economic growth. Journal of Business Research 69: 5280–85. [Google Scholar] [CrossRef]

- Chowdhury, Farzana, David B. Audretsch, and Maksim Belitski. 2019. Institutions and entrepreneurship quality. Entrepreneurship Theory and Practice 43: 51–81. [Google Scholar] [CrossRef]

- Cubico, Serena, Giuseppe Favretto, João Leitão, and Uwe Cantner, eds. 2018. Entrepreneurship along the Industry Life Cycle: The Changing Role of Entrepreneurial Activities and Knowledge Competencies. Series: Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Heidelberg: Springer. [Google Scholar]

- Cumming, Douglas, Sofia Johan, and Minjie Zhang. 2014. The economic impact of entrepreneurship: Comparing international datasets. Corporate Governance: An International Review 22: 162–78. [Google Scholar] [CrossRef]

- Dreher, Axel, and Martin Gassebner. 2013. Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice 155: 413–32. [Google Scholar] [CrossRef]

- Eren, Ozkan, Masayuki Onda, and Bulent Unel. 2019. Effects of FDI on entrepreneurship: Evidence from Right-to-Work and Non-Right-to-Work States. Labour Economics 58: 98–109. [Google Scholar] [CrossRef]

- Erum, Naila, and Shahzad Hussain. 2019. Corruption, natural resources and economic growth: Evidence from OIC countries. Resources Policy 63: 101429. [Google Scholar] [CrossRef]

- Estrin, Saul, Julia Korosteleva, and Tomasz Mickiewicz. 2013. Which institutions encourage entrepre- neurial growth aspirations? Journal of Business Venturing 28: 564–80. [Google Scholar] [CrossRef]

- Evans, David S., and Linda S. Leighton. 1990. Small Business Formation by Unemployed and Employed Workers. Small Business Economics 2: 319–30. [Google Scholar] [CrossRef]

- Faria, João R., Juna C. Cuestas, and Luis Gil-Alana. 2009. Unemployment and Entrepreneurship: A Cyclical Relation? Economics Letters 105: 318–20. [Google Scholar] [CrossRef]

- Galindo, Miguel-Ángel, and María T. Méndez. 2014. Entrepreneurship, economic growth, and innovation: Are feedback effects at work? Journal of Business Research 67: 825–29. [Google Scholar] [CrossRef]

- Galvão, Anderson, João J. Ferreira, and Carla Marques. 2018. Entrepreneurship education and training as facilitators of regional development: A systematic literature review. Journal of Small Business and Enterprise Development 25: 17–40. [Google Scholar] [CrossRef]

- Global Entrepreneurship Monitor (GEM). 2019/2020. Global Report. London: Global Entrepreneurship Research Association, London Business School. [Google Scholar]

- Glaeser, Edward L., and Raven E. Saks. 2006. Corruption in America. Journal of Public Economics 90: 1053–72. [Google Scholar] [CrossRef]

- Goh, Kim-Leng, and Maxwell L. King. 1996. Modified Wald tests for non-linear restrictions: A cautionary tale. Economic Letters 53: 133–38. [Google Scholar] [CrossRef]

- Guimarães, Silvana D., and Gisele F. Tiryaki. 2020. The impact of population aging on business cycles volatility: International evidence. The Journal of the Economics of Ageing 17: 100285. [Google Scholar] [CrossRef]

- Hadi, Cholichul, Ismail S. Wekke, and Andi Cahaya. 2015. Entrepreneurship and Education: Creating Business Awareness for Students in East Java Indonesia. Procedia—Social and Behavioral Sciences 177: 459–63. [Google Scholar]

- Hausman, Jerry A. 1978. Specification tests in econometrics. Econometrica 46: 1251–71. [Google Scholar] [CrossRef]

- Herrera-Echeverri, Hernán, Jerry Haar, and Juan B. Estévez-Bretón. 2014. Foreign direct investment, institutional quality, economic freedom and entrepreneurship in emerging markets. Journal of Business Research 67: 1921–32. [Google Scholar] [CrossRef]

- Honig, Benson, and Tomas Karlsson. 2013. An Institutional Perspective on Business Planning Activities for Nascent Entrepreneurs in Sweden and the US. Administrative Sciences 3: 266–89. [Google Scholar] [CrossRef]

- Hoyos, Rafael De, and Vasilis Sarafidis. 2006. XTCSD: Stata Module to Test for Cross-Sectional Dependence in Panel Data Models. The Stata Journal 6: 482–96. [Google Scholar] [CrossRef]

- Im, Kyung S., Mohammad H. Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Jaba, Elisabeta, Christiana B. Balan, and Joan-Bogdan Robu. 2014. The relationship between life expectancy at birth and health expenditures estimated by a cross-country and time-series analysis. Procedia Economics and Finance 15: 108–14. [Google Scholar] [CrossRef]

- Jackson, Stephen. 2000. Age concern? The geography of greying Europe. Geography 85: 366–69. [Google Scholar]

- Junior, Edmundo I., Eduardo A. Dionisio, Bruno B. Fischer, Yanchao Li, and Dirk Meissner. 2020. The global entrepreneurship index as a benchmarking tool? Criticisms from an efficiency perspective. Journal of Intellectual Capital 22: 190–212. [Google Scholar] [CrossRef]

- Keho, Yaya. 2016. Non-Linear Effect of Remittances on Banking Sector Development: Panel Evidence from Developing Countries. Theoretical Economics Letters 6: 1096–104. [Google Scholar] [CrossRef]

- Kinsella, Kevin, and David R. Phillips. 2005. Global aging: The challenge of success. Population Bulletin 60: 3–40. [Google Scholar]

- Koenker, Roger, and Gilbert Bassett. 1978. Regression Quantiles. Econometrica 46: 33–50. [Google Scholar] [CrossRef]

- Koenker, Roger, and Kevin F. Hallock. 2001. Quantile Regression. Journal of Economic Perspectives 15: 143–56. [Google Scholar] [CrossRef]

- Koenker, Roger, and José A. F. Machado. 1999. Goodness of Fit and Related Inference Processes for Quantile Regression Goodness of Fit and Related Inference Processes for Quantile Regression. Journal of the American Statistical Association 94: 1296–310. [Google Scholar] [CrossRef]

- Konings, Jozef. 2001. The effects of foreign direct investment on domestic firms. Economics of Transition 9: 619–33. [Google Scholar] [CrossRef]

- Kurek, Slawomir, and Tomasz Rachwal. 2011. Development of Entrepreneurship in ageing populations of The European Union. Procedia Social and Behavioral Sciences 19: 397–405. [Google Scholar] [CrossRef]

- Leitão, João, and Rui Baptista. 2009. Public Policies for Fostering Entrepreneurship: A European Perpective. Series: International Studies in Entrepreneurship; New York: Springer. [Google Scholar]

- Leitão, João, and Rui Baptista. 2011. Inward FDI and ICT: Are They a Joint Technological Driver of Entrepreneurship? International Journal of Technology Transfer and Commercialization 10: 268–88. [Google Scholar] [CrossRef]

- Leitão, João, Frank Lasch, and Roy Thurik. 2011. Globalization, Entrepreneurship and Regional Environment. International Journal of Entrepreneurship and Small Business 12: 129–38. [Google Scholar] [CrossRef]

- Lévesque, Moren, and Maria Minniti. 2006. The effect of aging on entrepreneurial behavior. Journal of Business Venturing 21: 177–94. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang J. Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Ligthelm, André A. 2010. Entrepreneurship and small business sustainability. Southern African Business Review 14: 131–53. [Google Scholar]

- Maddala, Gangadharrao S., and Shaowen Wu. 1999. A Comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Minniti, Maria, William D. Bygrave, and Erkko Autio. 2005. Global Entrepreneurship Monitor: 2005 Executive Report. Wellesley, MA: Babson College. [Google Scholar]

- Moreno-Izquierdo, Luis, Antonio Rubia-Serrano, Jose F. Perles-Ribes, Ana B. Ramón-Rodríguez, and María J. Such-Devesa. 2020. Determining factors in the choice of prices of tourist rental accommodation. New evidence using the quantile regression approach. Tourism Management Perspectives 33: 100632. [Google Scholar] [CrossRef]

- Nandamuri, Purna P., and Ch Gowthami. 2013. The Impact of Household Income on Being A Potential Entrepreneur. SCMS Jounral of Indian Management 10: 75–85. [Google Scholar]

- North, Douglass C. 1990. Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press. [Google Scholar]

- Nunes, Paulo M., Zelia Serrasqueiro, and João Leitão. 2010. Are there nonlinear relationships between the profitability of Portuguese service SME and its specific determinants? The Service Industries Journal 30: 1313–41. [Google Scholar] [CrossRef]

- OECD. 2013. Household Consumption, in OECD Framework for Statistics on the Distribution of Household Income, Consumption and Wealth. Paris: OECD Publishing. [Google Scholar]

- OECD. 2019. Health at a Glance 2019: OECD Indicators. Paris: OECD Publishing. [Google Scholar]

- OECD. 2020. National Accounts of OECD Countries. Paris: OECD Publishing. [Google Scholar]

- Ojeka, Stephen, Alex Adegboye, Kofo Adegboye, Olaoluwa Umukoro, Olajide Dahunsi, and Emmanuel Ozordi. 2019. Corruption perception, institutional quality and performance of listed companies in Nigeria. Heliyon 5: e02569. [Google Scholar] [CrossRef]

- Pesaran, Mohammad H. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge: Cambridge Working Papers in Economics. [Google Scholar]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Pradhan, Rudra P., Mak B. Arvin, Mahendhiran Nair, and Sara E. Bennett. 2020. The dynamics among entrepreneurship, innovation, and economic growth in the Eurozone countries. Journal of Policy Modeling 42: 1106–122. [Google Scholar] [CrossRef]

- Radosevic, Slavo, and Esin Yoruk. 2013. Entrepreneurial propensity of innovation systems: Theory, methodology and evidence. Research Policy 42: 1015–38. [Google Scholar] [CrossRef]

- Riaz, Muhammad F., Nataliia I. Cherkas, and João Leitão. 2018. Corruption and Innovation: Mixed Evidences on bidirectional Causality. Journal of Applied Economic Sciences 8: 1–6. [Google Scholar]

- Rodriguez, Peter, Donald S. Siegel, Lorraine Eden, and Amy J. Hillman. 2006. Three Lenses on the Multinational Enterprise: Politics, Corruption and Corporate Social Responsibility. Journal of International Business Studies 37: 733–46. [Google Scholar] [CrossRef]

- Romer, Paul. 1997. The origins of endogenous growth. A Macroeconomics Reader 8: 3–22. [Google Scholar]

- Rusu, Valentina D., and Adina Dornean. 2019. The Quality of Entrepreneurial Activity and Economic Competitiveness in European Union Countries: A Panel Data Approach. Administrative Sciences 9: 35. [Google Scholar] [CrossRef]

- Salman, Doaa M. 2016. What is the role of public policies to robust international entrepreneurial activities on economic growth? Evidence from cross country study. Future Business Journal 2: 1–14. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1934. The Theory of Economic Development: An Inquiry into Profits, Capital, Credits, Interest, and the Business Cycle. Cambridge, MA: Harvard University Press. [Google Scholar]

- Shah, Rajiv, Zhijie Gao, and Harini Mittal. 2014. Innovation, Entrepreneurship, and the Economy in the US, China, and India: Historical Prespectives and Future Trends, 1st ed. Cambridge, MA: Academic Press. [Google Scholar]

- Shapiro, Samuel S., and Martin B. Wilk. 1965. An analysis of variance test for normality (complete samples). Biometrika 52: 591–611. [Google Scholar] [CrossRef]

- Shapiro, Samuel S., and Martin B. Wilk. 1968. Approximations for the null distribution of the W statistic. Technometrics 10: 861–66. [Google Scholar] [CrossRef]

- Simón-Moya, Virginia, Lorenzo Revuelto-Taboada, and Rafael F. Guerrero. 2014. Institutional and economic drivers of entrepreneurship: An international perspective. Journal of Business Research 67: 715–21. [Google Scholar] [CrossRef]

- Sine, Wesley D., and Robert J. David. 2003. Environmental jolts, institutional change, and the creation of entrepreneurial opportunity in the US electric power industry. Research Policy 32: 185–207. [Google Scholar] [CrossRef]

- Sine, Wesley D., and Robert J. David. 2010. Institutions and entrepreneurship. Research in the Sociology of Work 21: 1–26. [Google Scholar]

- Smallbone, David, and Friederike Welter. 2020. A Research Agenda for Entrepreneurship Policy. Northampton, MA: Edward Elgar Publishing Ltd. [Google Scholar]

- Solow, Robert. 1956. A contribution to the theory of economic growth. Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Stam, Erik, Kashifa Suddle, Jolanda Hessels, and André V. Stel. 2009. High-Growth Entrepreneurs, Public Policies, and Economic Growth. Public Policies for Forestering Entrepreneurship chapter 5: 91–110. [Google Scholar]

- Stel, André V., Martin Carree, and Roy Thurik. 2005. The Effect of Entrepreneurial Activity on National Economic Growth. Small Business Economics 24: 311–21. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 2000. Capital Market Liberalization, Economic Growth, and Instability. World Development 28: 1075–86. [Google Scholar] [CrossRef]

- Tavares, Aida. 2004. As Causas Sócio-culturais e Político-económicas da Corrupção: uma análise para vários países. Notas Económicas 5: 58–67. [Google Scholar] [CrossRef]

- Teixeira, Aurora A. C., and Wei Heyuan. 2012. Is human capital relevnt in attracting innovative foreign direct investment to China? Asian Journal of Technology Innovation 20: 83–96. [Google Scholar] [CrossRef]

- Tiberius, Victor, Meike Rietz, and Ricarda B. Bouncken. 2020. Performance Analysis and Science Mapping of Institutional Entrepreneurship Research. Administrative Sciences 10: 69. [Google Scholar] [CrossRef]

- Tunali, Cigdem B., and Sefer Sener. 2019. The Determinants of Entrepreneurship in Turkey. Procedia Computer Science 158: 648–52. [Google Scholar] [CrossRef]

- Turró, Andreu, David Urbano, and Marta Peris-Ortiz. 2014. Culture and innovation: The moderating effect of cultural values on corporate entrepreneurship. Technological Forecasting and Social Change 88: 360–69. [Google Scholar] [CrossRef]

- WESP. 2014. World Economomic Situation and Prospects: Country classification: Data sources, country classifications and aggregation methodolology. United Nations 14: 144–46. [Google Scholar]

- Wooldridge, Jeffrey M. 2002. Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: The MIT Press. [Google Scholar]

- Youssef, Adel B., Sabri Boubaker, and Anis Omri. 2017. Entrepreneurship and sustainability: The need for innovative and institutional solutions. Technological Forecasting and Social Change 129: 232–41. [Google Scholar] [CrossRef]

- Zhang, Yue-Jun, Yan-Lin Jin, Julien Chevallier, and Bo Shen. 2016. The effect of corruption on carbon dioxide emissions in APEC countries: A panel quantile regression analysis. Technological Forecasting and Social Change 112: 220–27. [Google Scholar] [CrossRef]

| Developed Countries | Developing Countries |

|---|---|

| Germany | South Africa |

| Croatia | Argentina |

| Slovenia | Brazil |

| Spain | China |

| United States of America | Mexico |

| Finland | |

| France | |

| Greece | |

| Hungary | |

| Ireland | |

| Italy | |

| Japan | |

| Norway | |

| Netherlands | |

| United Kingdom | |

| Sweden |

| Variables | Determinants | Description | Data Sources |

|---|---|---|---|

| TEA | Rate of entrepreneurial activity in the initial state. | Global Entrepreneurship Monitor | |

| CPI | Institutional | Corruption perceptions index. | Transparency International |

| FT | A measure formed by the absence of tariff and non-tariff barriers that affect the import and export of goods and services. | Heritage Database | |

| PATPC_LAG1 | Economic | Lagged ratio of total number of patents (direct entries and national PCT) to gross domestic product per capita constant lcu. | WIPO Statistics Database and World Development Indicators |

| INFDI | Stock of foreign direct investment entries as % of GDP. | Unctadstat | |

| UNEM | Socio-economic | Total unemployment as a % of the total workforce. | World Development Indicators |

| AGE | People younger than 15 or older than 64 that are dependent of to the working-age population. Proportion of dependents per 100 working-age population. | World Development Indicators | |

| HOUSEHOLD | Households and NPISHs’ final consumption expenditure (% of GDP) | World Development Indicators | |

| EDUCATION | Education index is an average of mean years of schooling (of adults) and expected years of schooling (of children), both expressed as an index obtained by scaling with the corresponding maxima. | Human Development Data Center | |

| LIFE | Number of years a new-born infant could expect to live if prevailing patterns of age-specific mortality rates at the time of birth stay the same throughout the infant’s life. | Human Development Data Center | |

| DCRISIS | Dummies | Crisis dummy. | Own elaboration |

| DDEVEL | Development dummy. | Own elaboration |

| Variables | Descriptive Statistics | |||||||

|---|---|---|---|---|---|---|---|---|

| Obs | Mean | Coefficient of Variation | Min. | Max. | Jarque-Bera | Skewness | Kurtosis | |

| TEA | 336 | 0.0793 | 0.51198 | 0.0148 | 0.2401 | 122.933 | 1.2991 | 4.425 |

| DTEA | 315 | 0.00104 | 20 | −0.1138 | 0.0964 | 708.403 | −0.8562 | 10.1443 |

| CPI | 336 | 0.6175 | 0.329879 | 0.25 | 0.97 | 28.0846 | −0.0681 | 1.5902 |

| FT | 336 | 0.8133 | 0.094012 | 0.506 | 0.894 | 183.135 | −1.499 | 5.0232 |

| PATPC_LAG1 | 315 | 1.3844 | 2.278677 | 0.003028 | 23.67596 | 7273.265 | 4.2321 | 24.9661 |

| INFDI | 336 | 0.40798 | 0.981813 | 0.02014 | 3.05778 | 3953.74 | 3.4576 | 18.3164 |

| UNEM | 336 | 0.08957 | 0.660936 | 0.02445 | 0.32456 | 319.187 | 1.8461 | 6.0276 |

| AGE | 336 | 0.5121 | 0.103476 | 0.364897 | 0.674291 | 18.90305 | −0.386124 | 3.918622 |

| HOUSEHOLD | 336 | 0.5568 | 0.161422 | 0.310226 | 0.707723 | 18.8731 | −0.565471 | 2.601351 |

| EDUCATION | 336 | 0.8073 | 0.120401 | 0.522 | 0.943 | 35.51182 | −0.817561 | 2.81013 |

| LIFE | 336 | 78.1863 | 0.068162 | 53.4 | 84.5 | 1149.202 | −2.551263 | 10.8463 |

| CPI2 | 336 | 0.42269 | 0.593106 | 0.0625 | 0.9409 | 27.0296 | 0.2239 | 1.6846 |

| CPI3 | 336 | 0.31152 | 0.79706 | 0.0156 | 0.91267 | 28.15 | 0.5034 | 2.0014 |

| DCRISIS | 336 | 0.125 | 2.64968 | 0 | 1 | 426.286 | 2.2678 | 6.1428 |

| DDEVEL | 336 | 0.7619 | 0.55985 | 0 | 1 | 88.0272 | −1.2298 | 2.5125 |

| 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. | 11. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.TEA | 1.0000 | ||||||||||

| 2.CPI | −0.4775 *** (0.0000) | 1.0000 | |||||||||

| 3.FT | −0.4668 *** (0.0000) | 0.5991 *** (0.000) | 1.0000 | ||||||||

| 4.PATPC_LAG1 | 0.2257 *** (0.0001) | −0.0464 (0.4118) | −0.1314 ** (0.0197) | 1.0000 | |||||||

| 5.INFDI | 0.0116 (0.8381) | 0.2713 *** (0.0000) | 0.3125 *** (0.0000) | −01878 *** (0.0008) | 1.0000 | ||||||

| 6.AGE | −0.2821 *** (0.0000) | 0.1968 *** (0.0004) | 0.1759 *** (0.0017) | −0.3948 *** (0.0000) | 0.0082 (0.8844) | 1.0000 | |||||

| 7.HOUSEHOLD | 0.0654 (0.2474) | −0.3976 *** (0.0000) | −0.1331 ** (0.0181) | −0.2283 *** (0.0000) | −0.4188 *** (0.0000) | 0.3396 *** (0.0000) | 1.0000 | ||||

| 8.EDUCATION | −0.4260 *** (0.0000) | 0.7720 *** (0.0000) | 0.6825 *** (0.0000) | −0.1497 *** (0.0078) | 0.3024 *** (0.0000) | 0.3232 *** (0.0000) | −0.1544 *** (0.0060) | 1.0000 | |||

| 9.LIFE | −0.3237 *** (0.0000) | 0.5017 *** (0.0000) | 0.5211 *** (0.0000) | −0.0069 (0.9031) | 0.0758 (0.1796) | 0.1858 *** (0.0009) | −0.1873 *** (0.0029) | 0.5708 *** (0.0000) | 1.0000 | ||

| 10.UNEM | −0.1230 ** (0.0290) | −0.2981 *** (0.0000) | −0.0772 (0.1714) | −0.2120 *** (0.0001) | 0.0152 (0.7878) | 0.0677 (0.2310) | 0.3210 *** (0.0000) | −0.1888 *** (0.0008) | −0.4707 *** (0.0000) | 1.0000 | |

| 11.DTEA | 0.2167 *** (0.0001) | 0.0453 (0.4225) | 0.0560 (0.3214) | −0.0492 (0.3843) | 0.0483 (0.3928) | −0.0192 (0.7339) | −0.0231 (0.6835) | 0.0131 (0.8164) | −0.0114 (0.8400) | 0.0010 (0.9852) | 1.0000 |

| Dependent Variable—TEA Variables | Variance Inflation Factor (VIF) | ||

|---|---|---|---|

| VIF | 1/VIF | Mean of VIF | |

| DTEA | 1.01 | 0.987490 | |

| CPI | 3.38 | 0.296039 | |

| FT | 2.23 | 0.447789 | |

| PATPC_LAG1 | 1.33 | 0.751282 | |

| INFDI | 1.56 | 0.640276 | |

| UNEM | 1.56 | 0.640261 | |

| AGE | 1.54 | 0.650561 | |

| HOUSEHOLD | 2.09 | 0.479042 | |

| EDUCATION | 3.68 | 0.271929 | |

| LIFE | 2.09 | 0.447789 | |

| 2.05 | |||

| Variables | Tests | ||

|---|---|---|---|

| LLC | IPS | PP | |

| TEA | −3.3110 *** | −1.476 * | 8.0564 *** |

| DTEA | −11.6089 *** | −10.8180 *** | 59.7210 *** |

| CPI | −3.5521 *** | −1.1299 | 0.8833 |

| FT | −21.9236 *** | −11.5725 *** | 6.7935 *** |

| PATPC_LAG1 | −2.8430 *** | 0.4492 | 3.9858 *** |

| INFDI | −2.3083 *** | 0.4278 | 3.4800 *** |

| UNEM | −4.5969 *** | −2.6966 ** | 0.6624 |

| AGE | −4.1563 *** | 1.3029 | 12.76 *** |

| HOUSEHOLD | −3.1904 *** | −0.3588 | −0.2789 |

| EDUCATION | −5.8857 *** | 0.0684 | 5.4550 *** |

| LIFE | −10.8124 *** | −4.6781 *** | 19.9759 *** |

| Tests | Statistics |

|---|---|

| Hausman Test | Chi2(11) = 34.77 *** |

| Modified Wald Test | Chi2(21) = 8972.23 *** |

| Wooldridge Test | F(1,20) = 74.200 *** |

| Pesaran’s Test | 46.57 *** |

| Breusch–Pagan/Cook–Weisberg Test | Chi2(1) = 59.76 *** |

| Variables | OBS | W | V | Z | Prob.> Z |

|---|---|---|---|---|---|

| TEA | 336 | 0.88658 | 26.723 | 7.754 | 0.00000 |

| DTEA | 315 | 0.90333 | 21.507 | 7.219 | 0.00000 |

| CPI | 336 | 0.93009 | 16.471 | 6.612 | 0.00000 |

| CPI2 | 336 | 0.92226 | 18.317 | 6.863 | 0.00000 |

| CPI3 | 336 | 0.90238 | 23.001 | 7.400 | 0.00000 |

| FT | 336 | 0.82514 | 41.199 | 8.776 | 0.00000 |

| PATPC_LAG1 | 315 | 0.47466 | 116.874 | 11.202 | 0.00000 |

| INFDI | 336 | 0.65474 | 81.348 | 10.381 | 0.00000 |

| UNEM | 336 | 0.78184 | 51.402 | 9.298 | 0.00000 |

| AGE | 336 | 0.97545 | 5.784 | 4.142 | 0.00002 |

| HOUSEHOLD | 336 | 0.96072 | 9.256 | 5.252 | 0.00000 |

| EDUCATION | 336 | 0.92455 | 17.777 | 6.792 | 0.00000 |

| LIFE | 336 | 0.73162 | 63.235 | 9.787 | 0.00000 |

| DCRISIS | 336 | 0.96230 | 8.883 | 5.155 | 0.00000 |

| DDEVEL | 336 | 0.99026 | 2.295 | 1.960 | 0.02499 |

| Variables | OBS | Pr(Skewness) | Pr(Kurtosis) | Adjchi2(2) | Prob > Chi2 |

|---|---|---|---|---|---|

| TEA | 336 | 0.0000 | 0.0003 | 56.91 | 0.0000 |

| DTEA | 315 | 0.0000 | 0.0000 | 65.01 | 0.0000 |

| CPI | 336 | 0.6034 | 0.0000 | . | . |

| CPI2 | 336 | 0.0907 | 0.0000 | . | 0.0000 |

| CPI3 | 336 | 0.0003 | 0.0000 | 58.29 | 0.0000 |

| FT | 336 | 0.0000 | 0.0000 | 70.70 | 0.0000 |

| PATPC_LAG1 | 315 | 0.0000 | 0.0000 | . | 0.0000 |

| INFDI | 336 | 0.0000 | 0.0000 | . | 0.0000 |

| UNEM | 336 | 0.0000 | 0.0000 | . | 0.0000 |

| AGE | 336 | 0.0122 | 0.0125 | 11.17 | 0.0038 |

| HOUSEHOLD | 336 | 0.0001 | 0.6588 | 15.99 | 0.0003 |

| EDUCATION | 336 | 0.0000 | 0.0000 | 25.00 | 0.0000 |

| LIFE | 336 | 0.0000 | 0.0000 | . | 0.0000 |

| DCRISIS | 336 | 0.0000 | 0.0000 | . | 0.0000 |

| DDEVEL | 336 | 0.0000 | 0.0231 | 48.05 | 0.0000 |

| Model 1 | Model 2 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | Quantile | ||||||||

| Q20 | Q40 | Q60 | Q80 | Q98 | Q20 | Q40 | Q60 | Q80 | Q98 | |

| DTEA | 0.3522 *** | 0.4578 *** | 0.5290 *** | 0.5590 *** | 0.5840 *** | 0.3519 ** | 0.4662 *** | 0.5093 *** | 0.5408 *** | 0.5228 *** |

| CPI | −2.0770 *** | −1.9419 *** | −2.0776 *** | −0.8181 | −2.2347 ** | −2.0287 *** | −1.9954 *** | −2.4926 *** | −1.1001 | −2.4623 ** |

| CPI2 | 3.1368 *** | 2.7842 *** | 2.9450 *** | 0.7033 | 2.2830 * | 3.0583 *** | 2.8965 *** | 3.6198 *** | 1.1862 | 3.2224 * |

| CPI3 | −1.5430 *** | −1.3041 *** | −1.3688 *** | −0.1264 | −1.1220 | −1.4983 *** | −1.3727 *** | −1.7156 *** | −0.3758 | −1.3290 |

| TF | 0.0659 | −0.0089 | −0.0255 | −0.1466 | −0.2269 *** | 0.0693 | −0.0145 | −0.0043 | −0.1471 | −0.2116 *** |

| PATPC_LAG1 | 0.0011 | 0.0011 | 0.0029 * | 0.0055 *** | 0.0042 *** | 0.0012 | 0.0011 | 0.0026 | 0.0048 *** | 0.0037 *** |

| INFDI | 0.0153 | 0.0181 *** | 0.0216 *** | 0.0223 *** | 0.0323 *** | 0.0169 * | 0.0186 *** | 0.0198 *** | 0.0238 *** | 0.0300 *** |

| UNEM | 0.0089 | −0.0398 | −0.1043 *** | −0.1527 *** | −0.2128 *** | 0.0213 | −0.0390 | −0.0974 *** | −0.1525 *** | −0.2177 *** |

| AGE | −0.0182 | −0.0816 ** | −0.1278 *** | −0.1871 *** | −0.2826 *** | −0.0380 | −0.1053 *** | −0.1502 *** | −0.2080 *** | −0.3001 *** |

| HOUSEHOLD | −0.0625 | −0.0110 | 0.0662 ** | 0.0836 ** | 0.1993 *** | −0.0398 | 0.0027 | 0.0630 ** | 0.1004 *** | 0.2133 *** |

| EDUCATION | −0.0263 | 0.0133 | 0.0655 | 0.0997 ** | 0.1043 ** | −0.0326 | 0.0225 | 0.0572 | 0.0584 | 0.1014 * |

| LIFE | −0.0008 * | −0.0009 ** | −0.0010 *** | −0.00005 | 0.0006 | −0.0006 | −0.0009 ** | −0.0011 *** | −0.0003 | −0.00008 |

| DCRISIS | − | − | − | − | − | −0.0054 | −0.0053 | −0.0096 ** | −0.0153 *** | −0.0033 |

| DDEVEL | − | − | − | − | − | − | − | − | − | − |

| Constant | 0.5578 | 0.6073 | 0.6233 | 0.4704 | 0.7860 | 0.5333 | 0.6163 | 0.7095 | 0.5422 | 0.8298 |

| N | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 |

| Pseudo R2 | 0.2281 | 0.2991 | 0.3893 | 0.4928 | 0.6409 | 0.2303 | 0.3019 | 0.3977 | 0.5015 | 0.6432 |

| Adjusted R2 | 0.1975 | 0.2713 | 0.3650 | 0.4727 | 0.6266 | 0.1971 | 0.2718 | 0.3717 | 0.4800 | 0.6278 |

| Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | Quantile | ||||||||

| Q20 | Q40 | Q60 | Q80 | Q98 | Q20 | Q40 | Q60 | Q80 | Q98 | |

| DTEA | 0.4830 *** | 0.4735 *** | 0.5127 *** | 0.5571 *** | 0.4627 *** | 0.4738 *** | 0.5184 *** | 0.4986 *** | 0.5387 *** | 0.3696 *** |

| CPI | −0.5827 | −0.3301 | −0.0185 | −0.4404 | 0.3074 | −0.5288 | −0.6176 | −0.2156 | −0.2753 | 0.6378 |

| CPI2 | 0.8982 | 0.4294 | −0.0735 | 0.5417 | −0.6254 | 0.8013 | 0.8733 | 0.2590 | 0.2691 | −1.2928 * |

| CPI3 | −0.4547 | −0.1985 | 0.0473 | −0.2432 | 0.3289 | −0.4014 | −0.4175 | −0.1300 | −0.1065 | 0.7432 * |

| TF | 0.0362 | 0.0136 | 0.0355 | 0.0700 | 0.0477 | 0.0372 | 0.0434 | 0.0509 | 0.0631 | 0.0584 *** |

| PATPC_LAG1 | −0.0002 | −0.0002 | 0.0030 | 0.0040 *** | 0.0023 | −0.0001 | −0.00004 | 0.0029 | 0.0041 *** | 0.0039 *** |

| INFDI | 0.0195 *** | 0.0219 *** | 0.0193 *** | 0.0171 *** | 0.0122 ** | 0.0202 ** | 0.0209 *** | 0.0183 *** | 0.0188 *** | 0.0157 *** |

| UNEM | −0.0052 | −0.0906 ** | −0.1447 *** | −0.1735 *** | −0.2638 *** | −0.0067 | −0.0954 *** | −0.1517 *** | −0.1821 *** | −0.2662 *** |

| AGE | −0.0889 ** | −0.2014 *** | −0.2029 *** | −0.2358 *** | −0.3172 *** | −0.0843 ** | −0.2112 *** | −0.2236 *** | −0.2328 *** | −0.2923 *** |

| HOUSEHOLD | 0.0278 | 0.0661 | 0.0819 *** | 0.1239 *** | 0.1523 *** | 0.0305 | 0.0686 * | 0.0797 *** | 0.1195 *** | 0.1493 *** |

| EDUCATION | 0.0770 * | 0.1115 ** | 0.1466 *** | 0.2171 *** | 0.2833 *** | 0.0786 * | 0.1195 *** | 0.1456 *** | 0.2203 *** | 0.2392 *** |

| LIFE | 0.0020 *** | 0.0022 *** | 0.0022 *** | 0.0021 *** | 0.0022 *** | 0.0020 ** | 0.0018 *** | 0.0021 *** | 0.0022 *** | 0.0022 *** |

| DCRISIS | − | − | − | − | − | −0.0025 | −0.0064 * | −0.0036 | −0.0096 *** | −0.0114 *** |

| DDEVEL | −0.0782 *** | −0.0913 *** | −0.1010 *** | −0.1118 *** | −0.1216 *** | −0.0779 *** | −0.0887 *** | −0.0998 *** | −0.1010 *** | −0.1182 *** |

| Constant | 0.0197 | 0.0193 | −0.0721 | −0.0359 | −0.1669 | 0.0048 | 0.0815 | −0.0222 | −0.0752 | −0.2075 |

| N | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 |

| Pseudo R2 | 0.3416 | 0.4057 | 0.4950 | 0.5992 | 0.7244 | 0.3430 | 0.4097 | 0.4971 | 0.6040 | 0.7342 |

| Adjusted R2 | 0.3132 | 0.3801 | 0.4732 | 0.5819 | 0.7125 | 0.3123 | 0.3822 | 0.4736 | 0.5855 | 0.7217 |

| Symmetry Tests | ||||||

|---|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | |||||

| Q2 = Q98 | Q20 = Q80 | Q40 = Q60 | Q2 = Q98 | Q20 = Q80 | Q40 = Q60 | |

| DTEA | −0.0782 | −0.1060 | −0.0304 | −0.3152 | −0.0192 | −0.0147 |

| CPI | 0.8650 | 1.3432 | 0.2188 | 0.5952 | 0.3976 | 0.3686 |

| CPI2 | −1.5376 | −2.2022 | −0.3131 | −1.1453 | −0.5989 | −0.5370 |

| CPI3 | 0.9204 | 1.1479 | 0.1443 | 0.6913 | 0.2788 | 0.2392 |

| TF | −0.1839 | −0.0993 | −0.0529 | 0.0266 | −0.0033 | −0.0092 |

| PATPC_LAG1 | 0.0022 | 0.0017 | −0.0009 | 0.0035 | 0.0037 ** | 0.0025 * |

| INFDI | 0.0134 | −0.0033 | −0.0012 | −0.0177 * | −0.0067 | −0.0066 * |

| UNEM | 0.2071 * | −0.0177 | −0.0181 | 0.0840 | 0.0533 | −0.0050 |

| AGE | −0.0395 | −0.0139 | −0.0180 | −0.1044 | 0.1080 | −0.0096 |

| HOUSEHOLD | 0.1292 | −0.0397 | −0.0055 | −0.0709 | −0.0429 | −0.0446 |

| EDUCATION | −0.0217 | 0.0003 | 0.0057 | 0.1034 | 0.0753 | 0.0416 |

| LIFE | 0.0002 | 0.0007 | 0.00007 | −0.0005 | −0.0002 | −0.0005 |

| DCRISIS | − | − | − | −0.0052 | −0.0037 | −0.0017 |

| DDEVEL | − | − | − | −0.0038 | −0.0022 | −0.0016 |

| Constant | −0.0556 | −0.1956 | 0.0067 | −0.0702 | −0.1607 | −0.0311 |

| Nº of tests | 5 | 5 | 5 | 5 | 5 | 5 |

| Wald test | 35.17 | 35.17 | 35.17 | 60.97 * | 60.97 * | 60.97 * |

| Equality Tests | ||||||||

|---|---|---|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | |||||||

| Q20 = Q40 | Q40 = Q60 | Q60 = Q80 | Q80 = Q98 | Q20 = Q40 | Q40 = Q60 | Q60 = Q80 | Q80 = Q98 | |

| DTEA | −0.1056 | −0.0712 | −0.0300 | −0.0251 | −0.0446 | 0.0198 | −0.0401 | 0.1690 * |

| CPI | −0.1350 | 0.1356 | −1.2595 | 1.4166 | 0.0887 | −0.4020 | 0.05971 | −0.9130 |

| CPI2 | 0.3526 | −0.1608 | 2.2417 | −2.1265 | −0.0720 | 0.6143 | −0.0101 | 1.5619 |

| CPI3 | −0.2389 | 0.0648 | −1.2425 * | 0.9956 | 0.0161 | −0.2875 | −0.0235 | −0.8497 |

| TF | 0.0747 | 0.0166 | 0.1212 | 0.0802 | −0.0062 | −0.0075 | −0.0122 | 0.0047 |

| PATPC_LAG1 | 0.00005 | −0.0019 | −0.0026 * | 0.0012 | −0.00009 | −0.0029 * | −0.0012 | 0.0001 |

| INFDI | −0.0028 | −0.0034 | −0.0007 | −0.0101 * | −0.0007 | 0.0026 | −0.0006 | 0.0031 |

| UNEM | 0.0487 | 0.0645 ** | 0.0484 | 0.0601 | 0.0887 ** | 0.0563 ** | 0.0304 | 0.0840 *** |

| AGE | 0.0634 * | 0.0462 | 0.0593 | 0.0955 * | 0.1269 *** | 0.0124 | 0.0093 | 0.0594 |

| HOUSEHOLD | −0.0515 | −0.0772 ** | −0.0174 | −0.1157 *** | −0.0381 | −0.0111 | −0.0398 * | −0.0299 |

| EDUCATION | −0.0397 | −0.0521 | −0.0343 | −0.0046 | −0.0410 | −0.0261 | −0.0747 | −0.0189 |

| LIFE | 0.0001 | 0.0002 | −0.0006 | −0.0005 | 0.0001 | −0.0003 | −0.0002 | 0.00004 |

| DCRISIS | − | − | − | − | 0.0039 | −0.0028 | 0.0060 * | 0.0018 |

| DDEVEL | − | − | − | − | 0.0107 | 0.0111 | 0.0102 | 0.0082 |

| Constant | − | − | − | − | − | − | − | − |

| Nº of tests | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| Wald test | 259.70 *** | 259.70 *** | 259.70 *** | 259.70 *** | 328.92 *** | 328.92 *** | 328.92 *** | 328.92 *** |

| Hypotheses | Description | Evidence |

|---|---|---|

| H1 | Control of corruption has a negative and significant effect on entrepreneurial activity. | Negative & S |

| H2 | Free trade has a positive and significant effect on entrepreneurial activity. | Positive & S |

| H3 | Innovation intensity has a positive and significant effect on entrepreneurial activity. | Positive & S |

| H4 | FDI has a positive and significant effect on entrepreneurial activity. | Positive & S |

| H5 | Unemployment has a negative and significant effect on entrepreneurial activity. | Negative & S |

| H6 | Age dependency ratio has a negative and significant effect on entrepreneurial activity. | Negative & S |

| H7 | Households and NPISHs’ final consumption expenditure have a positive and significant effect on entrepreneurial activity. | Positive & S |

| H8 | Education index has a positive and significant effect on entrepreneurial activity. | Positive & S |

| H9 | Life expectancy at birth has a negative and significant effect on entrepreneurial activity. | Negative & S |

| Model 5 | Model 6 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | Quantile | ||||||||

| Q20 | Q40 | Q60 | Q80 | Q98 | Q20 | Q40 | Q60 | Q80 | Q98 | |

| DTEA | 0.4732 *** | 0.5272 *** | 0.5082 *** | 0.5322 *** | 0.4096 *** | 0.4379 *** | 0.4581 *** | 0.4525 *** | 0.5070 *** | 0.3696 *** |

| CPI | −0.5548 | −0.4752 | −0.4366 | −0.6368 | 0.8971 * | −0.8834 * | −0.6598 * | −0.3137 | −0.1155 | 1.1336 *** |

| CPI2 | 0.9510 | 0.9703 | 0.9140 | 1.0518 | −1.8665 * | 1.3460 | 0.9925 | 0.3564 | −0.0815 | −2.2213 *** |

| CPI3 | −0.4777 | −0.4845 | −0.4613 | −0.5368 | 1.0415 * | −0.6699 | −0.4842 | −0.1523 | 0.1114 | 1.2367 *** |

| TF | 0.0421 | 0.0137 | 0.0637 | 0.0970 * | 0.0471 | 0.1108 *** | 0.1105 *** | 0.1302 ** | 0.0922 | 0.0366 |

| PATPC_LAG1 | −0.0007 | −0.0012 | 0.0021 | 0.0039 ** | 0.0038 *** | −0.0009 | −0.0017 | −0.0024 ** | −0.0023 *** | 0.0007 |

| INFDI | 0.0160 * | 0.0192 *** | 0.0176 *** | 0.0169 *** | 0.0147 *** | −0.1674 * | −0.1901 *** | −0.1290 ** | −0.0846 | −0.0980 |

| UNEMP | −0.0820 | −0.3282 ** | −0.4140 *** | −0.3559 ** | −0.2454 *** | −0.0143 | −0.0676 ** | −0.1033 *** | −0.1128 *** | −0.1970 *** |

| HOUSEHOLD | −0.0085 | 0.0542 | 0.0722 *** | 0.1071 *** | 0.1484 *** | 0.0614 | 0.0807 ** | 0.0488 * | 0.0138 | −0.0171 |

| AGE | −0.0672 | −0.1550 *** | −0.1560 *** | −0.2013 *** | −0.3040 *** | −0.0910 ** | −0.1628 *** | −0.1913 *** | −0.2280 *** | −0.2629 *** |

| EDUCATION | 0.1022 * | 0.1338 *** | 0.1524 *** | 0.2105 *** | 0.2416 *** | 0.0995 ** | 0.0492 | 0.0944 ** | 0.1824 *** | 0.2413 *** |

| LIFE | 0.0017 | 0.0008 | 0.0001 | 0.0003 | 0.0022 *** | 0.0007 | 0.0004 | 0.0015 ** | 0.0023 *** | 0.0033 *** |

| DCRISIS | −0.0016 | −0.0059 | −0.0061 * | −0.0091 ** | −0.0131 *** | −0.0023 | −0.0047 | −0.0051 | −0.0084 ** | −0.0107 *** |

| DDEVEL | −0.0581 | −0.0509 | −0.0542 | −0.1046 | −0.1562 * | −0.1263 *** | −0.1387 *** | −0.1416 *** | −0.1438 *** | −0.1003 *** |

| CPI*DDEVEL | −0.0795 | −0.1748 | −0.1845 | −0.0653 | 0.1009 | − | − | − | − | − |

| TF*DDEVEL | 0.0928 | 0.2849 * | 0.3331 * | 0.2429 | −0.0204 | − | − | − | − | − |

| PATPC_LAG1*DDEVEL | − | − | − | − | − | −0.0011 | 0.0003 | 0.0075 *** | 0.0109 *** | 0.0094 |

| INFDI*DDEVEL | − | − | − | − | − | 0.1853 ** | 0.2134 *** | 0.1480 ** | 0.0983 | −0.0855 |

| Constant | 0.1870 | 0.1195 | 0.1310 | 0.0528 | −0.1175 | 0.1397 | 0.2001 | 0.0649 | −0.0110 | −0.2964 |

| N | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 | 315 |

| Pseudo R2 | 0.3539 | 0.4316 | 0.5116 | 0.6129 | 0.7380 | 0.3726 | 0.4403 | 0.5331 | 0.6233 | 0.7497 |

| Adjusted R2 | 0.3192 | 0.4011 | 0.4854 | 0.5921 | 0.7239 | 0.3389 | 0.4102 | 0.5080 | 0.6031 | 0.7363 |

| Model 7 | |||||

|---|---|---|---|---|---|

| Dependent Variable: TEA Independent Variables | Quantile | ||||

| Q20 | Q40 | Q60 | Q80 | Q98 | |

| DTEA | 0.4696 *** | 0.4465 *** | 0.4480 *** | 0.4983 *** | 0.4951 *** |

| CPI | −0.7743 | −0.7114 ** | −0.8254 ** | −1.2895 * | −0.5908 |

| CPI2 | 1.2951 | 1.2263 ** | 1.4334 ** | 2.1860 ** | 0.8792 |

| CPI3 | −0.6883 | −0.6727 ** | −0.7857 *** | −1.1735 ** | −0.4908 |

| TF | 0.0840 *** | 0.1078 ** | 0.1090 ** | 0.1082 * | 0.0451 |

| PATPC_LAG1 | −0.0028 *** | −0.0040 *** | −0.0035 *** | −0.0002 | 0.0042 |

| INFDI | 0.0190 *** | 0.0210 *** | 0.0204 *** | 0.0184 *** | 0.0101 ** |

| UNEM | −0.0360 | −0.0623 | −0.1200 | −0.0671 | −0.2768 *** |

| HOUSEHOLD | 0.1675 ** | 0.0247 | 0.0430 | 0.1162 | 0.2389 *** |

| AGE | −0.7703 *** | −0.5985 *** | −0.5761 *** | −0.5320 ** | −0.4867 *** |

| EDUCATION | 0.1601 | 0.2723 *** | 0.2680 *** | 0.2129 * | 0.2919 *** |

| LIFE | 0.0018 | 0.0029 * | 0.0023 * | 0.0030 | 0.0008 |

| DCRISIS | −0.0026 | −0.0047 | −0.0052 | −0.0053 | −0.0064 * |

| DDEVEL | −0.0710 | 0.1379 | 0.1279 | 0.2073 | −0.0227 |

| UNEM*DDEVEL | 0.1034 | 0.0650 | 0.0785 | −0.0103 | 0.1208 |

| HOUSEHOLD*DDEVEL | −0.1115 | 0.0733 | 0.0678 | 0.0452 | −0.1940 |

| AGE*DDEVEL | 0.8467 *** | 0.6695 *** | 0.5958 *** | 0.4764 ** | 0.2937 *** |

| EDUCATION*DDEVEL | −0.0357 | −0.1628 ** | −0.1578 ** | −0.0026 | 0.0314 |

| LIFE*DDEVEL | −0.0048 ** | −0.0067 *** | −0.0061 *** | −0.0075 *** | −0.0061 |

| Constant | 0.2507 | 0.0804 | 0.1335 | 0.1478 | 0.1217 |

| N | 315 | 315 | 315 | 315 | 315 |

| Pseudo R2 | 0.4851 | 0.5364 | 0.5836 | 0.6592 | 0.7596 |

| Adjusted R2 | 0.4519 | 0.5065 | 0.5567 | 0.6373 | 0.7441 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leitão, J.; Capucho, J. Institutional, Economic, and Socio-Economic Determinants of the Entrepreneurial Activity of Nations. Adm. Sci. 2021, 11, 26. https://doi.org/10.3390/admsci11010026

Leitão J, Capucho J. Institutional, Economic, and Socio-Economic Determinants of the Entrepreneurial Activity of Nations. Administrative Sciences. 2021; 11(1):26. https://doi.org/10.3390/admsci11010026

Chicago/Turabian StyleLeitão, João, and João Capucho. 2021. "Institutional, Economic, and Socio-Economic Determinants of the Entrepreneurial Activity of Nations" Administrative Sciences 11, no. 1: 26. https://doi.org/10.3390/admsci11010026

APA StyleLeitão, J., & Capucho, J. (2021). Institutional, Economic, and Socio-Economic Determinants of the Entrepreneurial Activity of Nations. Administrative Sciences, 11(1), 26. https://doi.org/10.3390/admsci11010026