1. Introduction

In economically developed countries, family businesses are a significant part of business entities, which make a considerable contribution to the creation of the country’s gross domestic product and creation of job opportunities. They play an important social role in creating jobs not only in economically developed regions of the country but also in disadvantaged ones. (

Lusnakova et al. 2019). In Europe, they represent the oldest form of business, which currently makes up the majority of its businesses.

In the Slovak Republic, family businesses represent a new developing form of business, which was reintroduced in the country after 1989 (

Strazovska et al. 2019;

Rafajova and Pafco 2017) and is associated with the onset of a market economy. Their creation was conditioned by the gradual disintegration of state-owned enterprises, which resulted in problems with ensuring work and income for former employees. Family businesses should help the stability and economic independence of families. In recent years, the Slovak governments have adopted several economic and political instruments supporting small and medium-sized enterprises; however, none of them focused exclusively on family businesses. Despite several initiatives of political movements, the legal definition of family businesses is still not part of the Slovak legislation (

Strazovska 2015).

Despite the absence of a legal definition of the term “family business”, it is possible to rely on the characteristics of economic theorists in our country as well as abroad. Collective of authors

Vilcekova et al. (

2018) proposed a legal definition of family businesses as “a set of tangible, intangible and personal components of the business of unmarried co-ownership of spouses or in the joint ownership of individual persons related in a direct or indirect way.” In scientific studies, authors use the definition of the European Commission to identify family businesses, “the majority of decision-making rights are in the possession of the natural person(s) who established the firm, or in the possession of the natural person(s) who has/have acquired the share capital of the firm, or in the possession of their spouses, parents, child, or children’s direct heirs. The majority of decision-making rights are indirect or direct. At least one representative of the family or kin is formally involved in the governance of the firm. Listed companies meet the definition of family enterprise if the person who established or acquired the firm (share capital) or their families or descendants possess 25 percent of the decision-making rights mandated by their share capital” (

Marques et al. 2020;

Strazovska et al. 2019;

Rau et al. 2019;

Moresova et al. 2017;

European Commission 2009).

In family businesses, therefore, work and family life blend, creating a specific business culture. Entrepreneurs are trying to provide a livelihood for the family and leave the company to their successors in the future (

Moresova et al. 2018). The motivation of employees of family businesses is, therefore, different from the motivation of employees in non-family businesses and public and local state administration (

Vlacsekova 2019). The focus of family business is often on the family interest, which is created by involving several family members in the business. Such a stronger family unit gives a better precondition for the transfer of experience from generation to generation. The personal factor is not only a source of stability but also a source of creation of tradition, which forms a strong basis for the continuity of the company and its future prosperity. The overlap between family and business can also lead to problems if the relationships between family members are not sincere. Conflicts can be transferred from business to family life, but also vice versa. These private disputes can affect the operation of the company and can also result in its bankruptcy. Therefore, it is appropriate to define the basic formal rules between individual family members before starting a business. The specifics of family business also reflect in the resolution of conflicts in labor relations, which are resolved in the family circle without the need to establish a labor compliance department as in non-family businesses (

Kiselyova 2020).

Even though one of the main characteristics of the family business is the transfer of ownership to descendants, research by author

Korenkova (

2016) showed that 81% of university students from business families do not plan to take over the family business. The author

Arz (

2019) observed the transfer of main family values into business in his case study of a German second-generation family business. The author identified the following main family values: preservation—a strong commitment of the family to the company and a long-term intention to keep the ownership of the company in the family; altruism—the act of family members in the best interests of other family members and long-term non-family employees.

The study of the author

Mura (

2017) showed further differences between family and non-family businesses operating in the Slovak Republic in their approach to business. For family businesses, the characteristics of acceptance of members, emotional bond, internal orientation, customer orientation, and work-life balance were proved to be important. On the contrary, in the case of non-family businesses, external orientation, and customer orientation were identified as important characteristics. Differences between family and non-family businesses also reflect in financing decisions. Although the loan is one of the most frequently used external sources of financing for family businesses, compared to non-family businesses, they show lower leverage, and the zero-leverage company tends to occur more often among family businesses. The authors

Michiels and Molly (

2017) explain this phenomenon by the stronger aversion of family businesses to financial risks. A comparison of large publicly traded companies in the United States has shown that family businesses are less market-oriented than non-family businesses (

Zachary et al. 2011). Not all companies disclose information about the family character of the company and act as a non-family business externally. The authors

Kolodko et al. (

2017) stated that Polish entrepreneurs often regard family involvement in the business to be unprofessional and unethical, as the qualification is traditionally regarded to be more important than family relationships.

Increasing the competitiveness of economies, economic growth, and employment growth, which are currently the main goals of the Member States of the European Union, cannot be achieved without innovation and increasing innovation performance. Innovation and creativity are also one of the domains contributing to corporate social responsibility (

Popescu et al. 2019). The level and intensity of innovation activity in individual companies does not only depend on the interest and ability of the company to engage in innovation but is also influenced by external factors. These include, for example, a sufficient number of skilled workers and a favorable business environment in the country, which would make it possible to introduce and use innovations to a greater extent in small and medium-sized enterprises as well.

According to the latest edition of the IMD World Competitiveness Ranking (

Institute for Management Development 2020), published annually by the Institute for Management Development in Switzerland, Slovakia is the 57th most competitive economy among the 63 countries evaluated. Compared to 2019, this means a drop of four positions and the worst position within the Central European region. The low share of innovative companies in the Slovak Republic is a consequence of the lack of comprehensive concepts of support for research, development, and innovations (

Fila 2017). A significant difference in the innovation activities of small and medium-sized enterprises is also noticeable when comparing the original Member States of the European Union and its new members, which joined after 2004. These are below the European Union average in terms of innovation activities (

Maros and Rybansky 2019). Every company aims to achieve sustainable growth, so its management must know the internal and external factors that affect the company’s growth. The study by

Marques et al. (

2020) structured and analyzed determinants of family business growth using a fuzzy cognitive mapping technique and system dynamic approach. The study also verified the impact of an increase in family business innovation and entrepreneurial spirit on the decision criteria aggregated into Business Strategies and Managerial cluster. The authors observed a positive impact on the creation of new business areas and ventures based on new technologies. The author

Mura (

2019) focused his research on the internationalization of Slovak family businesses and identified the most important motives for their internationalization: saturated domestic market, fierce competition on the domestic market, and the success of other companies in the same sector. In the Slovak Republic, the Slovak Investment and Trade Development Agency assists small and medium-sized enterprises with internationalization (

Vojtech et al. 2019).

The innovation activities of companies are currently receiving close attention from academic researchers. Innovation is an integral part of economic growth and is an important factor in business success and competitiveness (

Vitezic and Vitezic 2015). Innovations can save employees’ time and effort, improve the customer experience, shorten delivery times, differentiate the company from the competition, and turn disadvantages into advantages (

Haddad et al. 2020). There are visible differences in the approach of large and small and medium-sized enterprises to innovation. Large companies cooperate to a greater extent with other companies in their group, professional training centers, and/or technical assistance centers in innovation activities. On the other hand, small and medium-sized enterprises cooperate to a greater extent with their clients/customers (

Cristo-Andrade and Franco 2020). The study by

Stanislawski (

2020) showed that the rate of use, and thus the importance of open innovations for the company increases with the size of the company. The study also showed that the use of the open innovation concept increases with the increasing territorial market scope of companies.

Collective of authors

Beynon et al. (

2020) examined the relationship between small and medium-sized enterprises’ strategies and their intention to drive future innovations. The results showed that business strategies focused on the internal environment, which the company can directly control, increase confidence in planning future innovations. An important part of the innovation activities of small and medium-sized enterprises is the implementation of business model innovation practices, which has a positive impact on necessary strategic and architectural changes in the business model, which will positively affect company’s innovation and overall performance (

Gatautis et al. 2019). The innovation potential and competitiveness of small and medium-sized enterprises increases with the increasing level of the controlling management of the company, especially with a focus on the future results of the company (

Pisar and Bilkova 2019). At present, companies are trying to achieve the goals of sustainable entrepreneurship and sustainable development, which are closely linked to ecological innovations, new values creation, and business transformation (

Soltysik et al. 2019). A study of micro-enterprises’ innovation activities by

Henley and Son (

2020) showed that innovation did not increase company’s productivity outcomes but increased company’s exports, and thus their positive effect was reflected in the internationalization strategy of companies. The innovation activities of small and medium-sized enterprises also focus on the area of IT solutions and the strategic use of big data. Their use enables small and medium-sized enterprises to generate new knowledge for the business organization, new business plan and/or new product, new customer pool, new decision-making rules, and new marketing materials. Successful small and medium-sized enterprises need to exploit big data using knowledge management systems (

Wang and Wang 2020).

Although family businesses are often described as conservative, devoted to their traditions, and reluctant to innovate, we find family businesses among the most innovative businesses. The innovation potential of family businesses can be increased by finding a match between the company’s attitude to innovation and the family system dimension, i.e., family goal diversity and family cohesion (

Rondi et al. 2019). Family owners can better understand the value and risks associated with research and development projects than minority shareholders, due to their information advantage. They see the company in a long-term horizon as an asset to be passed on to their descendants. They do not see it as a wealth to be consumed during their lives. This longer time horizon also allows family owners to tolerate an increased deficit to encourage company’s management to participate in research and development (R&D) investment strategies (

Asensio-Lopez et al. 2019). Research by authors

Peracek et al. (

2020) identified the following innovation factors within the family businesses: product quality and services, customer relationship management, customer requirements, proactive approaches in marketing, and employee qualification.

The antecedents and effects of technological innovation are different in family and non-family businesses; therefore, technological innovation in family businesses is a relevant and promising research area (

De Massis et al. 2013). Business strategies, level of control, investment horizons, social goals, and risk aversion differs for different types of owner structure (

Thomsen and Pedersen 2000).

Maintaining and strengthening the traditions of family businesses can be achieved by establishing innovations. Family businesses not only increase their competitiveness through appropriately chosen innovative strategies but can also help maintain their anchored traditions (

Erdogan et al. 2020). The authors

Diaz-Moriana et al. (

2020) identified three groups of motives for innovation in family businesses: conserving motives that reflect the importance of family traditions and reputations, persisting motives for long-term sustainability with a willingness to wait for a long-term return on investment, and legacy-building motives to continue the legacy that the previous generation had built while developing this legacy and ensuring its transfer to the next generation. Family businesses are more cautious in innovation activities due to risk aversion and reluctance to share leadership and control. However, their innovation potential is higher compared to non-family businesses, due to their long term horizons, long tenures, intimate knowledge of the business, and close network ties. In the innovation process, family businesses change their management strategies according to the current innovation cycle (

Dieleman 2019). The management of family businesses, formed by family members, pursues the long-term goals of growth and sustainability of the company and is therefore willing to invest in innovations with a long return. External managers, on the other hand, pursue short-term goals and therefore prefer investments with a quick return (

Schmid et al. 2014). The negative impact of risk aversion of family businesses on their innovation activities can be reduced in the case of demand-pull and technology-push innovation impulses. The authors

Migliori et al. (

2020) showed that the willingness to invest in innovation increases if the innovation impulse is based on market demand.

The process of generational change in the management structures of family businesses also changes the approach of companies to innovation. Companies that are run by the third and next-generations have fewer innovation activities compared to companies run by the first-generation. This effect is reduced in the case of management with a high degree of psychological ownership (

Rau et al. 2019). The study by

Cirillo et al. (

2019) showed that with the increase in family ownership of companies, the intensity of investment in research and development decreases. The study also showed that the presence of institutional shareholders in the form of private equity reduces this negative effect. Collective of authors

Frank et al. (

2019) identified eleven principles for successful family business innovation: innovate in manageable steps starting from a solid basis; observe the environment and yourself for innovation inspiration; use your values for your vision in the innovation process; consider quality in your innovation and use it to set yourself apart from others; take the unknown path, but stay authentic; invest in trusting relationships that enrich and facilitate innovation; regard innovation as a key task of the business family, and create the necessary freedom for it; communicate the importance of innovation internally and externally; combine innovation with sustainability in a way that fits your unique competencies; evaluate innovation projects with immediate feedback from multiple sources; learn through openness and creativity as well as structures and processes. Family businesses that are run by family members use management control systems to a lesser extent, which has a negative impact on the extent of technological innovation of companies, which negatively reflects in business results (

Ruiz-Palomo et al. 2019).

Based on the above, we can say that innovations have the potential to become a driving force for future family business opportunities. The paper aims to identify the innovation activities of family businesses in the Slovak Republic and to determine their impact on the economic results of the company based on an empirical survey. We also pay attention to barriers to innovation activities in family businesses and the impact of the current COVID-19 coronavirus pandemic on innovation activities in small and medium-sized family businesses in the Slovak Republic. Based on the answers from the questionnaire survey, we test hypotheses about the impact of selected factors on innovation activities.

3. Results

In this section, we describe and interpret the results of the questionnaire survey aimed at identifying innovation activities of small and medium-sized family businesses in Slovakia. We discuss the validity of formulated and tested research hypotheses.

3.1. Questionnaire Survey

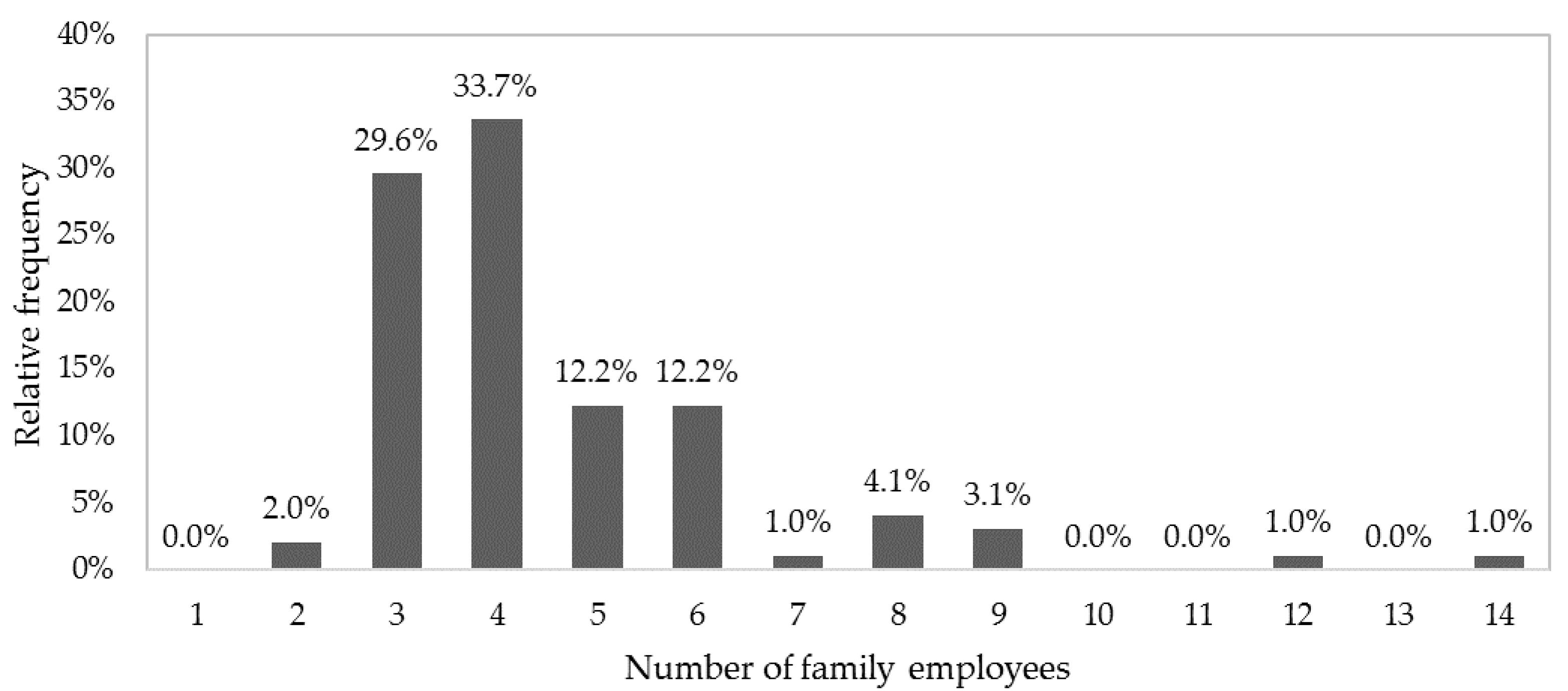

The survey addressed a total of 700 companies. The return rate of the questionnaire was 31%, as 217 of the questionnaires were returned. Based on the answers to the questions of whether the company meets the definition of a family business, how many employees does it have, and what were its gross sales in 2019, 45.2% of companies were identified as small and medium-sized family businesses. Of this, 67.4% are small-sized family businesses with 10–49 employees, and with gross sales not exceeding EUR 10 million in 2019. The remaining 32.7% are medium-sized family businesses with 50–249 employees, and with gross sales not exceeding EUR 50 million in 2019. In terms of spatial structures, 29.6% of participating companies operate in the Bratislava Region, 9.2% in the Trnava Region, 11.2% in the Nitra Region, 14.3% in the Trenčín Region, 13.3% in the Žilina Region, 8.2% in the Banská Bystrica Region, 8.2% in the Prešov Region, and 6.1% in the Košice Region. The free business has existed in the Slovak Republic for less than 30 years. We therefore examined the year of the establishment of family businesses. More than half of the companies included in the survey (62.2%) have been operating in Slovakia for more than 15 years. One of the characteristic features of family businesses is the employment of several family members.

Figure 1 shows the relative frequencies of the numbers of employed family members. Three–four family members most often work in the observed companies, which is stated by 63.3% of companies.

Looking at the generations that are active in the family business is also interesting. The second-generation runs 46.9% of family businesses and the first-generation runs 53.1% of them. The third and next-generation is not yet actively involved in the management of the company among our respondents. The family members own and manage 58.2% of the addressed companies, 41.8% of companies are owned by the family members and the management consists of family members and non-family employees. None of the companies included in the survey are owned by family members and managed only by non-family employees. From the above, we can state that family business in Slovakia takes place mainly in the family circle.

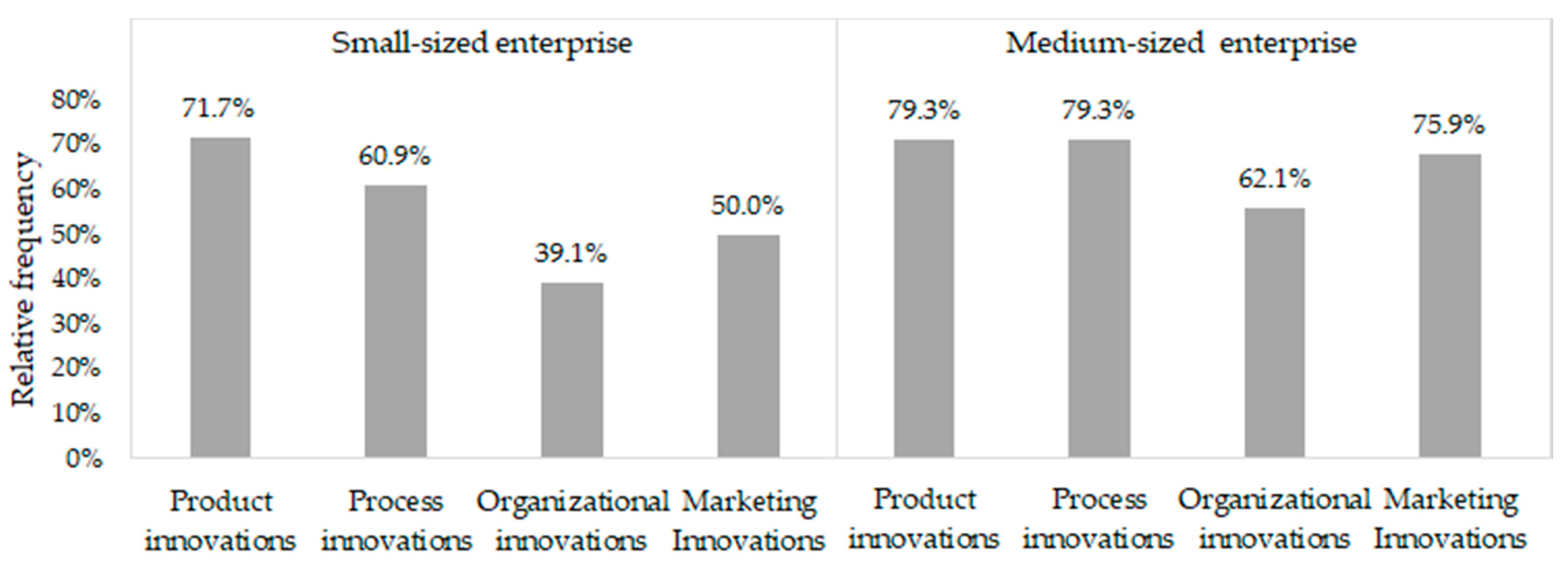

The second part of the questionnaire investigate innovations, innovation activities, and their impact on the company’s economic results. A company is considered to be implementing innovation activities if it has launched new, or significantly improved, products on the market, or introduced new, or significantly improved, processes within the company, or introduced organizational or marketing innovations. Of the small and medium-sized family businesses included in the survey, 76.5% of enterprises are actively implementing innovation activities.

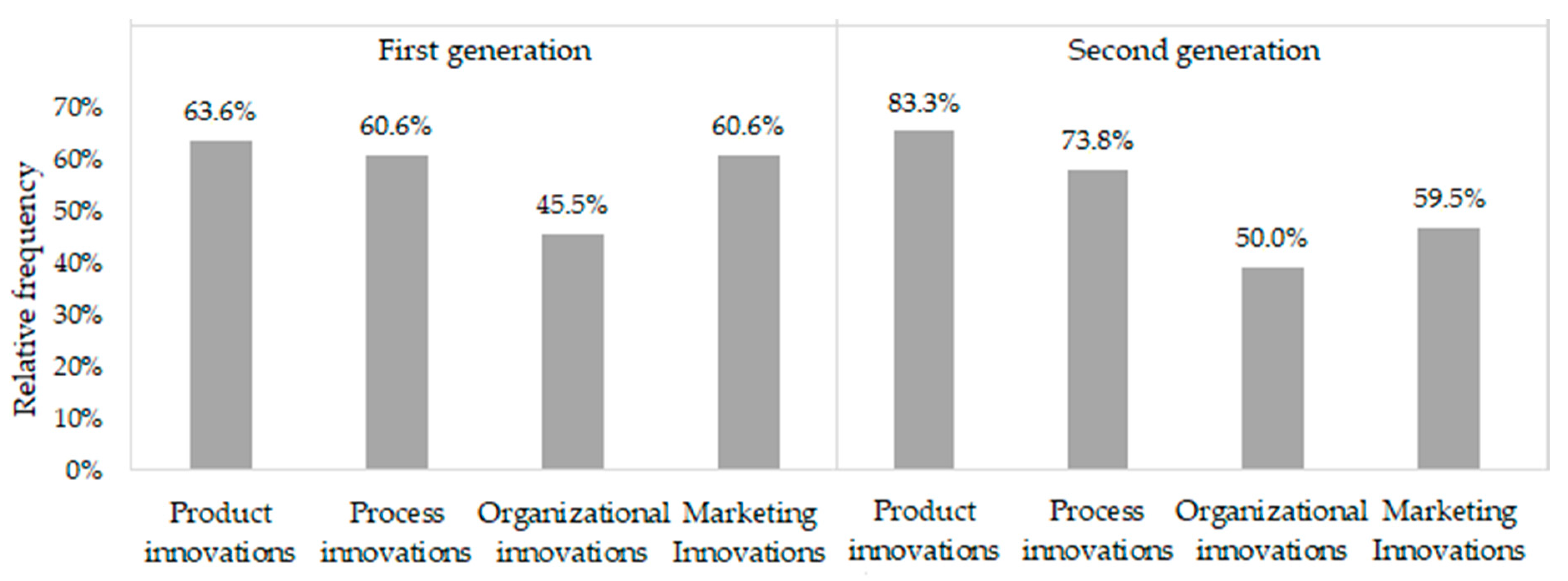

Figure 2 shows the relative frequencies of types of introduced innovations grouped by the size of the company, and

Figure 3 shows the relative frequencies of types of introduced innovations grouped by the generation running the company. The most common types of innovations are product and process innovations. Product innovations are introduced by 74.7% of innovative companies, 73.3% of innovative companies introduce process innovations. They are followed by marketing innovations introduced by 60% of companies, and the least used are organizational innovations introduced by 48% of companies.

Among the companies that successfully introduced product innovations, 45.5% of companies introduced a completely new product, 27.3% of companies significantly improved an existing product, and 27.3% of companies introduced a completely new product and also significantly improved an existing product. Among companies that successfully introduced technology innovations, 30.6% of companies introduced completely new technology, 67.4% of companies significantly improved existing technology, and 2% of companies introduced completely new technology and also significantly improved existing technology. In the questionnaire, we also examined cooperation in innovation activities. For this survey, innovation cooperation means active participation in joint research and development projects and other innovation projects with other companies or non-commercial institutions. Implemented innovations were developed independently by 50.7% of family businesses, 21.3% of family businesses cooperated on the development of innovations with other companies or institutions, 28% of family businesses developed innovations by modifying or changing products, services, or processes originally developed by another company or institution. Based on the answers, we can state that most of the Slovak small and medium-sized family businesses rely on their research and development in their innovation processes.

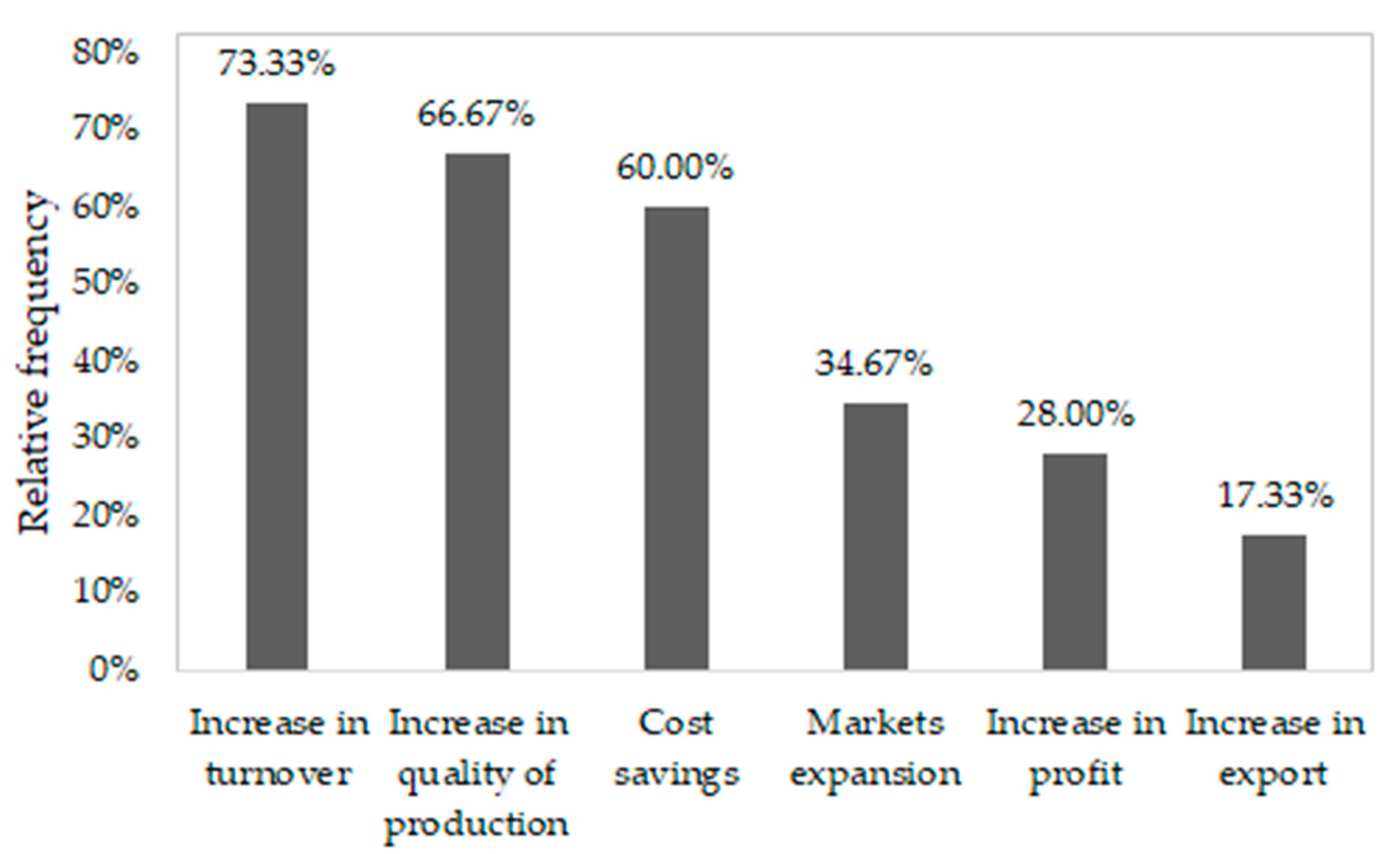

The next questionnaire questions concern the impact of innovation activities on the company’s economic results for the last five years. An increase in annual gross sales, an increase in quality of production, costs savings, market expansion, an increase in profit, and an increase in export are chosen as important indicators of the impact of innovation activities.

Figure 4 shows the companies’ responses.

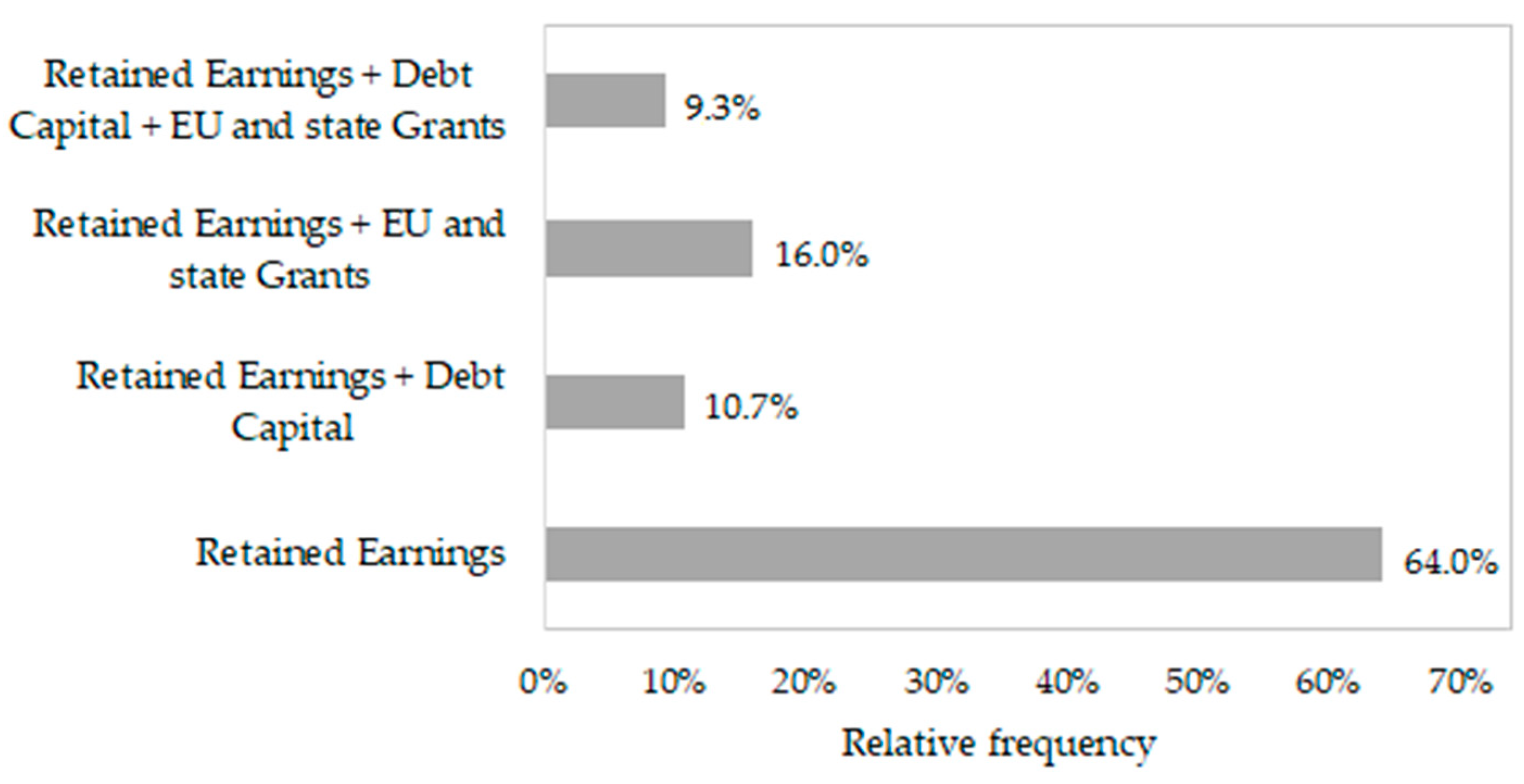

Expenditure on innovation includes all expenditure relating to the scientific, technological, and commercial steps that lead to the introduction of the innovation. In terms of the size of the family business, it is interesting to examine whether small-sized enterprises invest a smaller rate of annual gross sales in their innovation activities compared to medium-sized enterprises. Most of the addressed small-sized family businesses (82.6%) invested in innovation activities less than 10% of annual gross sales. In the range of 11–20% of annual gross sales invested 15.2% of small-sized enterprises, and only 2.2% of small-sized enterprises invested 31–40% of gross sales in innovation activities. Almost 38% of medium-sized family businesses invested in innovation activities less than 10% of annual gross sales, 31% of medium-sized enterprises invested 11–20% of annual gross sales in innovation activities, and 31% of medium-sized enterprises invested 21–30% of annual gross sales. When examining the costs of innovation activities, it is also necessary to determine the origin of financial resources. The addressed innovative companies invest primary their retained earnings in their innovation activities. Some companies use a combination of their retained earnings, debt capital, and EU and state grants, as shown in

Figure 5.

Family businesses have encountered several problems in obtaining funding from EU grants. Up to 56% of innovative companies did not try to obtain funding from this source. Of the companies applying for funding from EU grants, 57.6% were successful. Companies that did not apply for these resources listed large bureaucracy (47.6%), excessive complexity of the process (35.7%), and lack of information on existing calls (16.7%) as reasons. Companies also encountered other barriers limiting their innovation activities. Entrepreneurs consider the lack of their financial resources (33.7%) and the lack of qualified employees (32.7%) as the most serious barriers. Other barriers are the difficulty of finding a partner for innovation (19.4%), markets dominated by established companies (18.4%), lack of financial resources outside the company (16.3%), too high innovation costs (15.3%), uncertain demand for innovated products or services (14.3%), lack of information on technologies (4.1%), and lack of information on markets (4.1%). Despite the mentioned barriers and COVID-19 coronavirus pandemic, 83.7% of the addressed Slovak family businesses state that continuous innovation activity is a part of their company’s long-term strategy. Family businesses realize that technological advances are one of the global trends that will change the way we do business in the world. Digitization and technology innovations are considered the most significant innovation activities in the next period by 89.8% of family businesses. Product innovations are considered the most significant innovation activities in the next period by 38.8% of family businesses, organizational innovations by 22.5% of companies, and marketing innovations by 17.6% of companies.

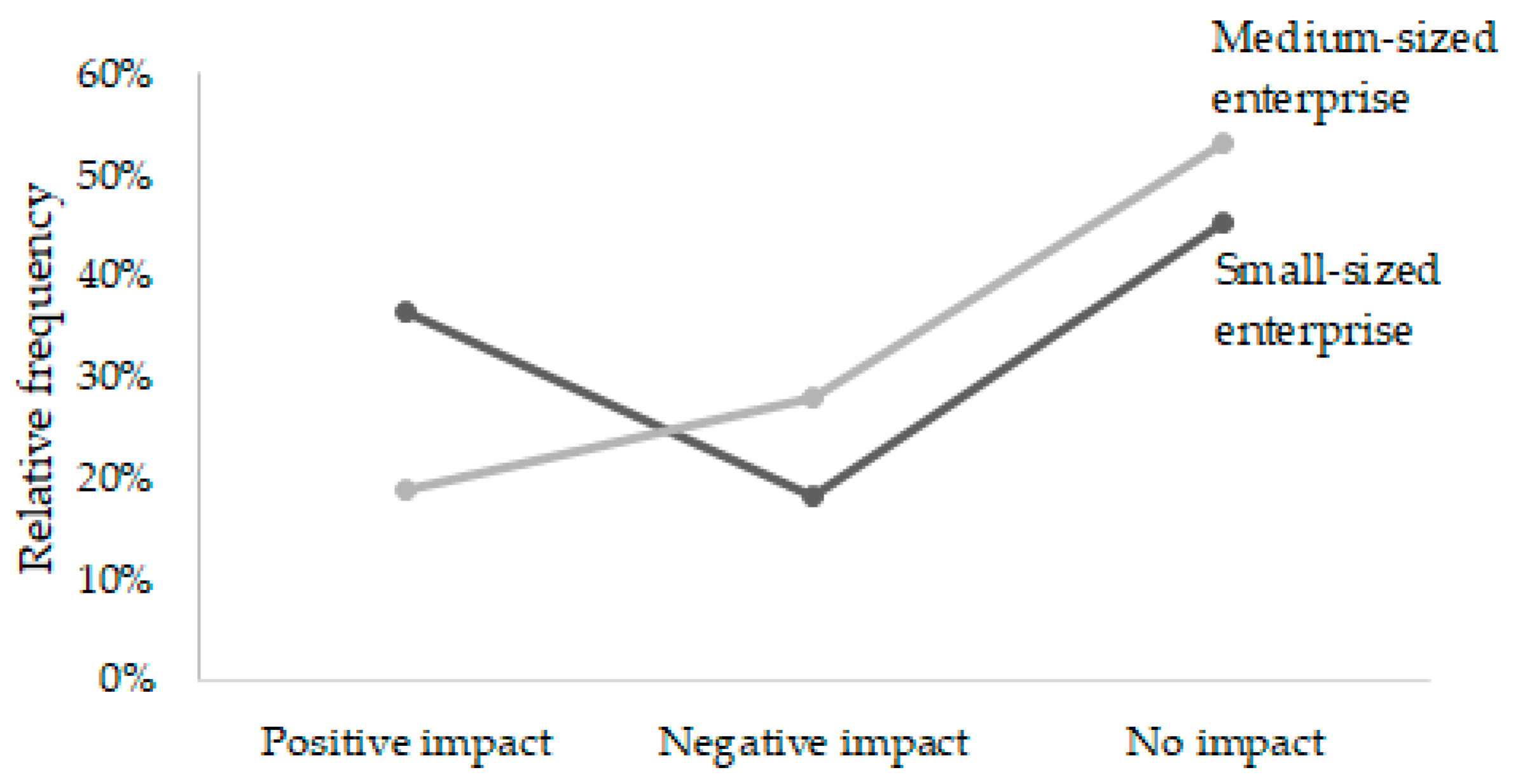

The COVID-19 coronavirus pandemic has shaken the business environment, and many family businesses also face the question of how to survive and restart their business. In the questionnaire, we asked whether the COVID-19 coronavirus pandemic affected their innovation activities. The COVID-19 coronavirus pandemic positively affected innovation activities of 30.6% of family businesses (they want to start innovating) and negatively affected 21.4% of family businesses (they had to stop innovating). The COVID-19 coronavirus pandemic did not affect innovation activities of 48% of family businesses. In the next part, we will examine the statistical relationship between the size of the company and the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities.

As part of innovation activities, 9.2% of family businesses plan to cooperate with secondary schools, and 22.5% of companies plan to cooperate with universities. Surprisingly, 74.5% of companies do not plan to cooperate with schools.

3.2. Testing of Research Hypotheses

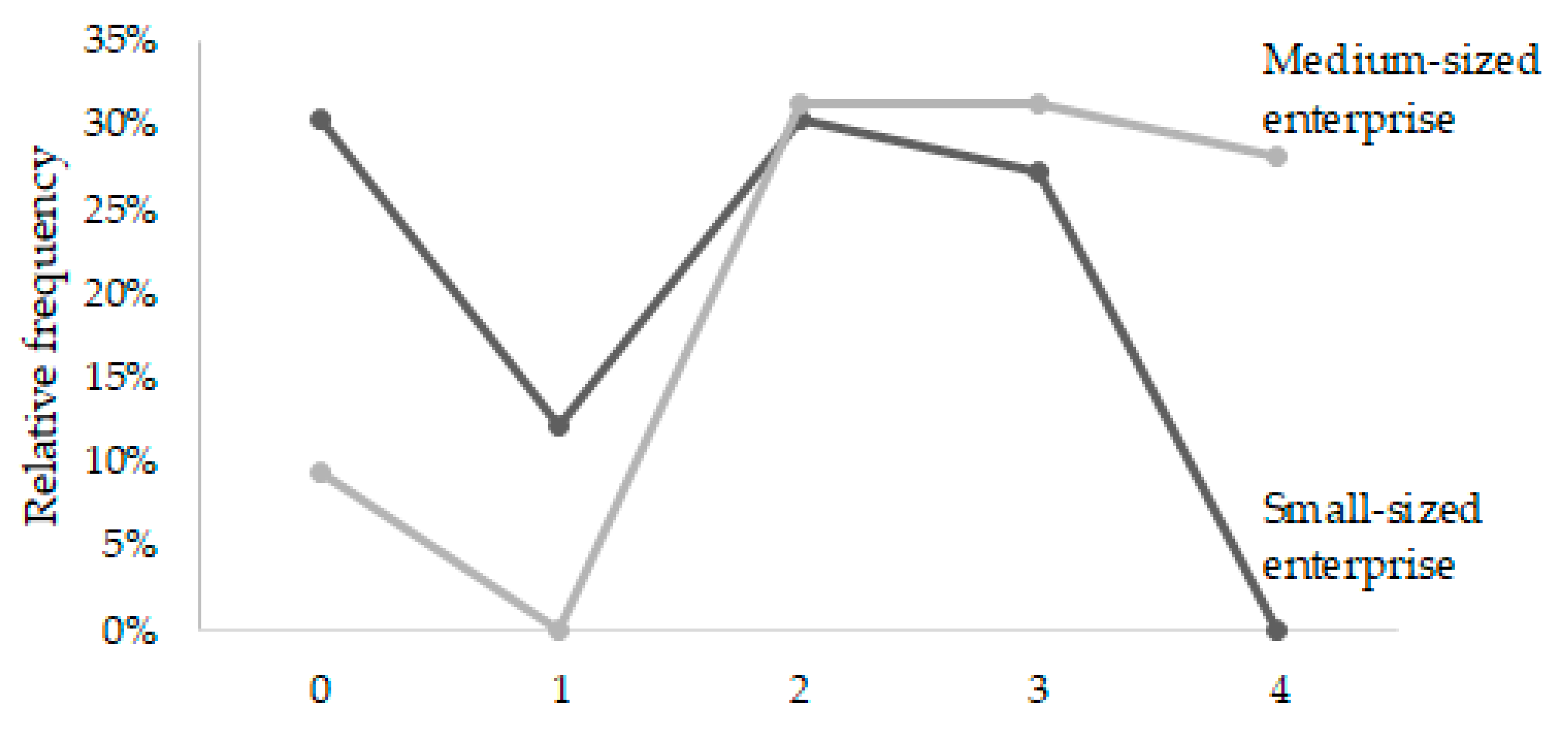

The next part of our research is the verification of formulated research hypotheses. We verified the statistical relationship between the size of family businesses and the number of types of introduced innovations by testing the hypothesis H1: There is no statistical dependence between the size of the company and the number of types of introduced innovations. Of the small-sized family businesses included in the survey, 69.7% of companies introduced at least one type of innovation, and of the medium-sized family businesses included in the survey, 90.6% of companies introduced at least one type of innovation.

Figure 6 shows an interaction plot of the relative frequencies of the number of types of introduced innovation in small-sized family businesses and medium-sized family businesses. We use the Kruskal–Wallis test to verify the tested hypothesis. The test statistic is

and at the

level of significance is

p-

. Since

p-

we reject the hypothesis H1 at the

level of significance. We can state that there is a statistically significant relationship between the size of the company and the number of types of introduced innovations. It is clear from

Figure 6 that medium-sized family businesses introduced more types of innovations and can, therefore, be considered more innovative than small-sized family businesses.

We verified the statistical relationship between the generation running the family business and the number of types of introduced innovations by testing the hypothesis H2: There is no statistical dependence between the generation running the company and the number of types of introduced innovations. Of the first-generation family businesses included in the survey, 63.5% of enterprises introduced at least one type of innovation, and of the second-generation family businesses included in the survey, 91.3% of enterprises introduced at least one type of innovation. Among the family businesses included in the survey, there are no enterprises managed by the third and next-generation, which can be explained by the reestablishment of a free enterprise economy system in the Slovak Republic after 1989.

Figure 7 shows an interaction plot of the relative frequencies of the number of types of introduced innovation in first-generation family businesses and second-generation family businesses. We use the Kruskal–Wallis test to verify the tested hypothesis. The test statistic is

and at the

level of significance is

p-

. Since

p-

we reject the hypothesis H2 at the

level of significance. We can state that there is a statistically significant relationship between the generation running the family business and the number of types of introduced innovations. It is clear from

Figure 7 that second-generation family businesses introduced more types of innovations and can, therefore, be considered more innovative than first-generation family businesses.

We analyzed the innovation activities of the family business and its economic results by examining the relationship between the amount of costs incurred for innovation activities and the level of improvement of the company’s economic results. An increase in annual gross sales and the amount of cost savings are selected from the company’s economic results. The amount of costs incurred and the decrease in costs are expressed as a ratio of annual gross sales, the increase in gross sales is expressed as a percentage. We verified the statistical relationship between the amount of costs incurred for innovations and the increase in annual gross sales by testing the hypothesis H3: There is no statistical dependence between the amount of costs incurred for innovations and the increase in annual gross sales. We calculated the values of Spearman’s rank correlation coefficient and Kendall’s rank correlation coefficient. We tested the statistical significance of these coefficients at the

level of significance.

Table 2 shows the results of the correlation analysis.

The p- of the statistical significance testing of both Spearman’s rank correlation coefficient and Kendall’s rank correlation coefficient are less than . For both correlation coefficients, we rejected the hypothesis H3 at the level of significance. We can state that although the values of both correlation coefficients are low, this measured relationship is statistically significant.

We verified the statistical relationship between the amount of costs incurred for innovations and the amount of cost savings by testing the hypothesis H4: There is no statistical dependence between the amount of costs incurred for innovations and the amount of cost savings. We calculated the values of Spearman’s rank correlation coefficient and Kendall’s rank correlation coefficient. We tested the statistical significance of these coefficients at the

level of significance.

Table 3 shows the results of the correlation analysis.

The p- of the statistical significance testing of both Spearman’s rank correlation coefficient and Kendall’s rank correlation coefficient are less than . For both correlation coefficients, we rejected the hypothesis H4 at the level of significance. We can state that although the values of both correlation coefficients are low, this measured relationship is statistically significant.

We verified the statistical relationship between the size of the family business and the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities by testing the hypothesis H5: There is no statistical dependence between the size of the company and the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities.

Figure 8 shows an interaction plot of the relative frequencies of the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities in small-sized family businesses and medium-sized family businesses. Among the small-sized family businesses included in the survey, 36.4% reported a positive impact, 18.2% a negative impact, and 45.5% no impact of the COVID-19 coronavirus pandemic on their innovation activities. Among medium-sized family businesses, 18.8% reported a positive impact, 28.1% a negative impact, and 53.1% no impact of the COVID-19 coronavirus pandemic on their innovation activities. We use the

test of independence to verify the hypothesis H5. The test statistic is

and at the

level of significance is

p-

. Since

p-

we do not reject the hypothesis H5 at the

level of significance. We can state that there is no statistically significant dependence between the size of the family business and the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities.

4. Discussion

Based on the analysis of empirical data, we manage to obtain information about the innovation activities of Slovak family businesses, formulate, and test research hypotheses concerning their innovation activities. More than half of the family businesses included in the survey (62.2%) have been established more than 15 years ago. We can, therefore, state that they are established companies. The higher stability of companies is related, as

Arz (

2019) argued in his study, to the transfer of the main family values into business.

Three–four family members most often work in the surveyed family businesses, and 53.1% of family businesses are still run by the first-generation, 46.9% of family businesses are run by the second-generation. The third and next-generation is not yet actively involved in the management of the company among our respondents. The situation of family businesses in the world, for example in the USA or Germany, is different than in Slovakia. In Western countries, the fourth-generation exchange has already taken place in some family businesses (

Hudakova et al. 2015). The trend of only owning a family business comes to the fore in the world. The number of family businesses planning to transfer ownership but not management to the next-generation has increased. The professionalization of family businesses is often reflected in the hiring of external managers. It is often the right decision, especially if the company reaches a certain critical dimension, which can be a difficult moment for the company. The situation is different in Slovakia. Family members own and manage 58.2% of the addressed companies, the remaining 41.8% of companies are owned by the family members, and the management consists of family members and non-family employees. None of the companies included in the survey is owned by family members and managed only by non-family employees. From the above, we can state that family business in Slovakia takes place mainly in the family circle. It may be because companies have not yet reached a critical dimension, or to the fact that small and medium-sized family businesses can hardly compete in the labor market for multinational corporations that offer career advancement and foreign experience.

Innovation activities are actively implemented by 76.5% of the surveyed small and medium-sized family businesses. We were pleasantly surprised by this, as several researches (

Fabova 2013;

Fila 2017) recorded a low share of innovative companies in the Slovak Republic. The high percentage of innovative companies can be explained by the fact that the questions about innovation activities were more willing to be answered by innovative companies that successfully implemented such innovation activities and were, therefore, willing to share their attitudes to innovation and their results.

The most common types of innovations are product and process innovations. Based on the testing of research hypotheses, we can state that medium-sized family businesses introduce more types of innovations and can, therefore, be considered more innovative than small-sized family businesses. The process of generational change in the management structures of family businesses also changes the approach of companies to innovation. According to

Rau et al. (

2019), companies that are run by the third and next-generations show lesser innovation activities compared to companies run by the first-generation. Our research does not confirm this statement, and based on the test of the research hypothesis, we can state that second-generation family businesses introduce more types of innovation and can, therefore, be considered more innovative than first-generation family businesses.

Based on the answers to the questionnaire survey, we can state that most of the Slovak small and medium-sized family businesses rely on their research and development in their innovation processes. We recommend the state to create a suitable scientific-research base cooperating with companies and to support cooperation between the public and private sectors, which would help increase the country’s innovation performance. Most of the addressed small-sized family businesses (82.6%) invested in innovation activities less than 10% of annual gross sales. On the contrary, 62.1% of medium-sized family businesses invested in innovation activities 11–30% of annual gross sales. We confirm the statistical dependence between the amount of costs incurred for innovations and the increase in the company’s gross sales, and the statistical dependence between the amount of costs incurred for innovations and the decrease in the company’s total costs.

The addressed innovative companies invest primary their retained earnings in their innovation activities. We can agree with the statement of the authors

Michiels and Molly (

2017) that family businesses show lower leverage compared to non-family businesses and the zero-leverage company tends to occur more often among family businesses. This phenomenon is explained by the stronger aversion of family businesses to financial risks. When obtaining funding from EU grants, companies faced mainly barriers in the form of large bureaucracy and excessive complexity of the process. For this reason, we recommend the government to simplify the process of obtaining funds from EU grants or to create an advisory service at the regional level. Family businesses also encountered other barriers limiting their innovation activities. Entrepreneurs consider the lack of their financial resources and the lack of qualified employees as the most serious barriers. The system of dual education and vocationally oriented study programs of universities could solve the problem with qualified employees. It is striking that up to 74.5% of the surveyed small and medium-sized family businesses do not plan to cooperate with schools. In further research, it would be interesting to find out what causes this lack of interest.

Despite the mentioned barriers and COVID-19 coronavirus pandemic, 83.7% of the addressed Slovak family businesses state that continuous innovation activity is a part of their company’s long-term strategy. Family businesses realize that technological advances are one of the global trends that will change the way we do business in the world. Almost 90% of the surveyed family businesses consider digitization and technology innovation to be the most important innovation activities in the next period.

The COVID-19 coronavirus pandemic significantly suppressed domestic and foreign demand for Slovak goods and services and changed consumer behavior. Many family businesses face the question of how to survive, how to restart their business, how to adapt to the new norm, and how to prosper in the “post-coronavirus” world. Therefore, we are interested in whether the pandemic has affected the innovation activities of family businesses. Based on empirical data, we can state that companies are aware of the need to innovate, and in 30.6% of family businesses the COVID-19 coronavirus pandemic has positively affected their innovation activities. Based on the hypothesis testing, we can also state that there is no statistically significant dependence between the size of the family business and the impact of the COVID-19 coronavirus pandemic on the company’s innovation activities.

Although the business sector and the associated required frequency of innovations can be significant factors influencing family businesses’ innovation activities, the used questionnaire survey does not investigate the business sector of companies. We consider this fact to be a limitation of our research. In future research, it would therefore be appropriate to focus on examining the innovation activities of family businesses in the context of the business sector. In our future research, we also plan to pay attention to the relationship between innovation activities and corporate social responsibility of Slovak family businesses.