New Regulations on Medical Devices in Europe: Are They an Opportunity for Growth?

Abstract

1. Introduction

2. Theoretical Background

2.1. Specific Features of the Medical Device Industry

2.2. Linking Innovation and Regulation

2.3. Medical Device Market Regulations

- (a)

- Active Implantable Medical Devices (AIMDD), (EUR-Lex. 1990) (EUR-Lex-01990L0385-20071011-EN-EUR-Lex n.d.)

- (b)

- Medical Devices (MDD), (EUR-Lex. 1993)

- (c)

- In vitro Diagnostic Medical Devices (IVDMD), (EUR-Lex. 1998).

- (a)

- Technical capacity

- (b)

- Diagnostic accuracy

- (c)

- Diagnostic and therapeutic impact

- (d)

- Patient outcomes

3. Methodology and Objectives

3.1. Design of the Study

3.2. Data Analysis

- 20-year window: Publication date 1/1/1999–31/12/2019

- Czech applicant: [CZ] in Applicant

- ‘medical’ AND ‘device’ in Title, Abstract OR Claims

“medical device” OR “implantable device” OR “catheter” OR “cardiovascular device” OR “stent” OR “surgical device” OR “therapeutic patch” OR “medical instrument” OR “cardiovascular stent” OR “endovascular stent graft” OR implant OR “aneurysmal repair device” OR “catheter assembly” OR “bioabsorbable stent” OR “implantable structures” OR “luminal prosthesis” OR “gastrointestinal (GI) stents” OR “implant device” OR “plaque-trapping device” OR “intra-luminal device” OR “leadless cardiac pacemaker” OR “medical assembly” OR “implantable assembly” OR “flexible biodegradable material” OR “bioresorbable stent” OR “cardiac lead system” OR “non-implantable device” OR “electronic pill” OR “spine jack” OR “cannula” OR “implantable medical apparatus”.

4. Results: Patent Activity in the Medical Device Market

4.1. International Context

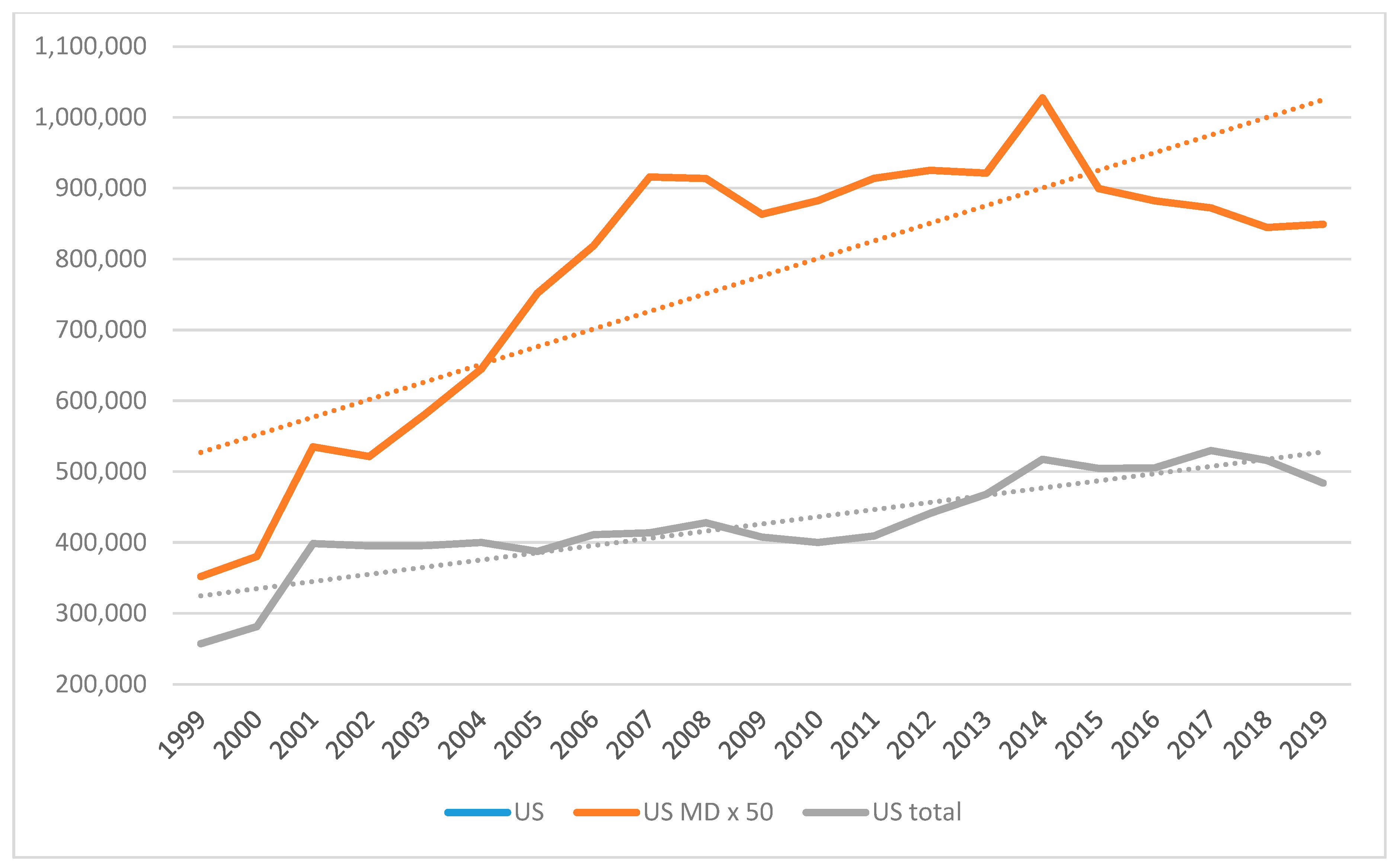

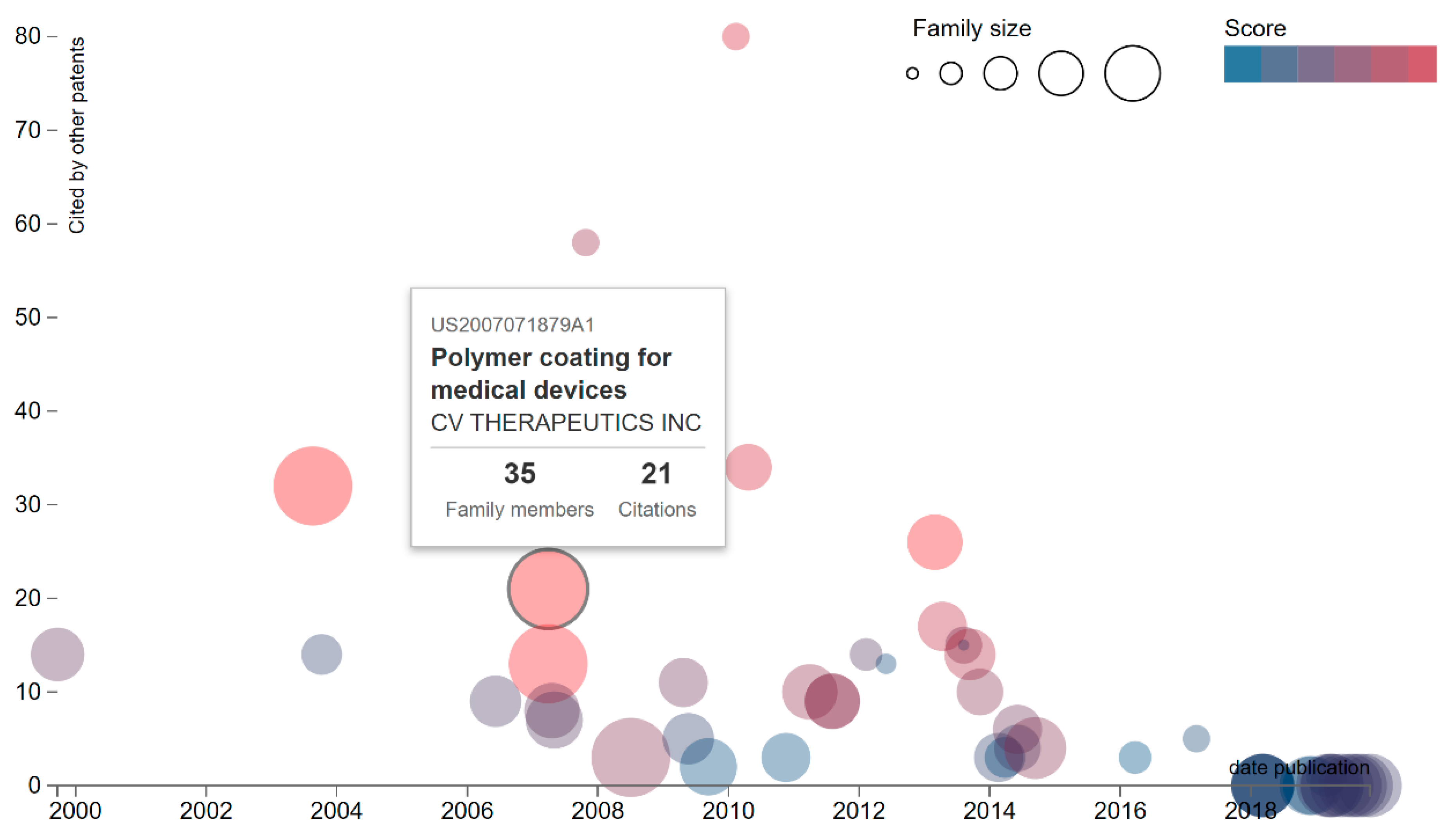

4.2. The United States Context

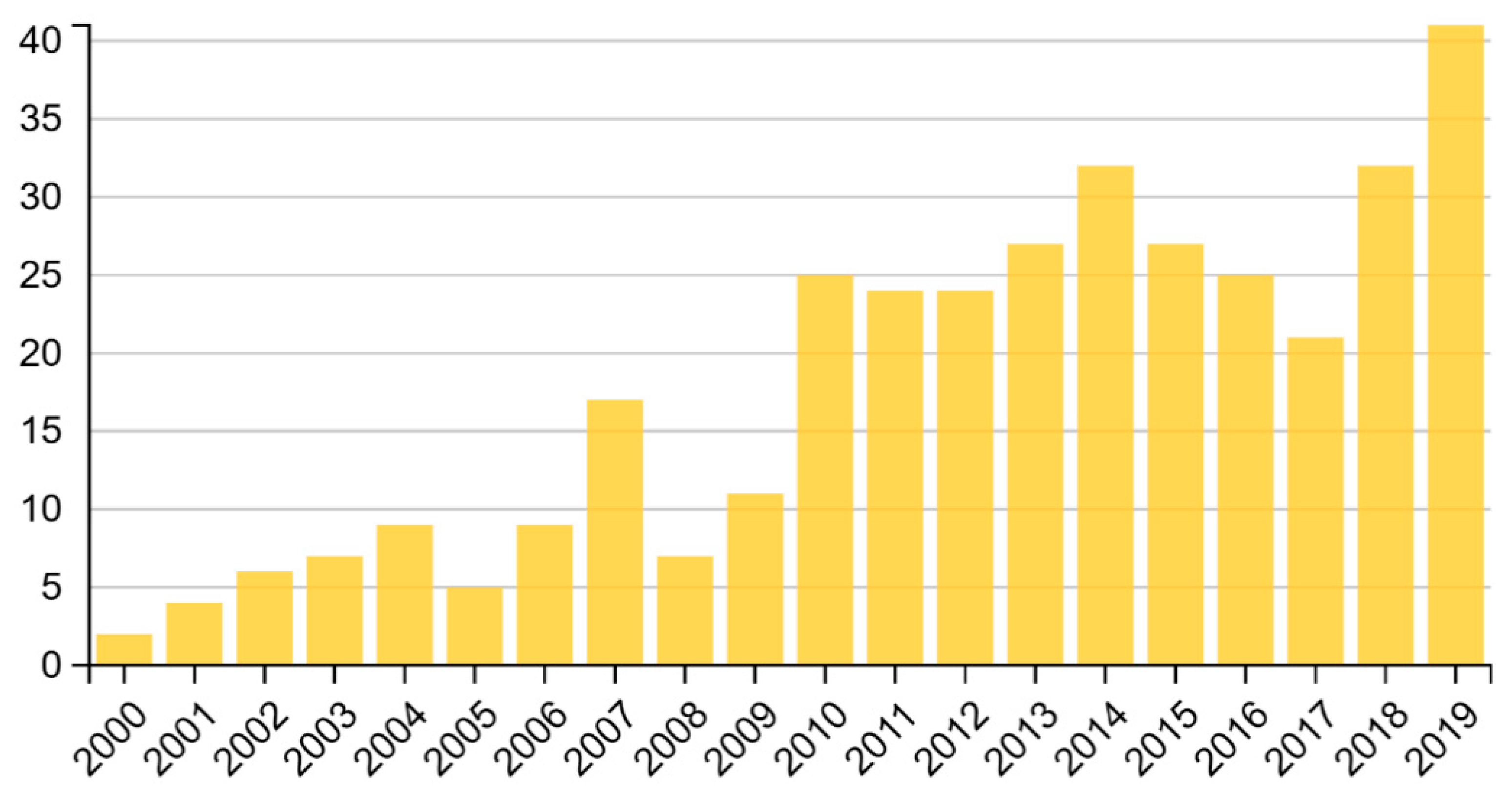

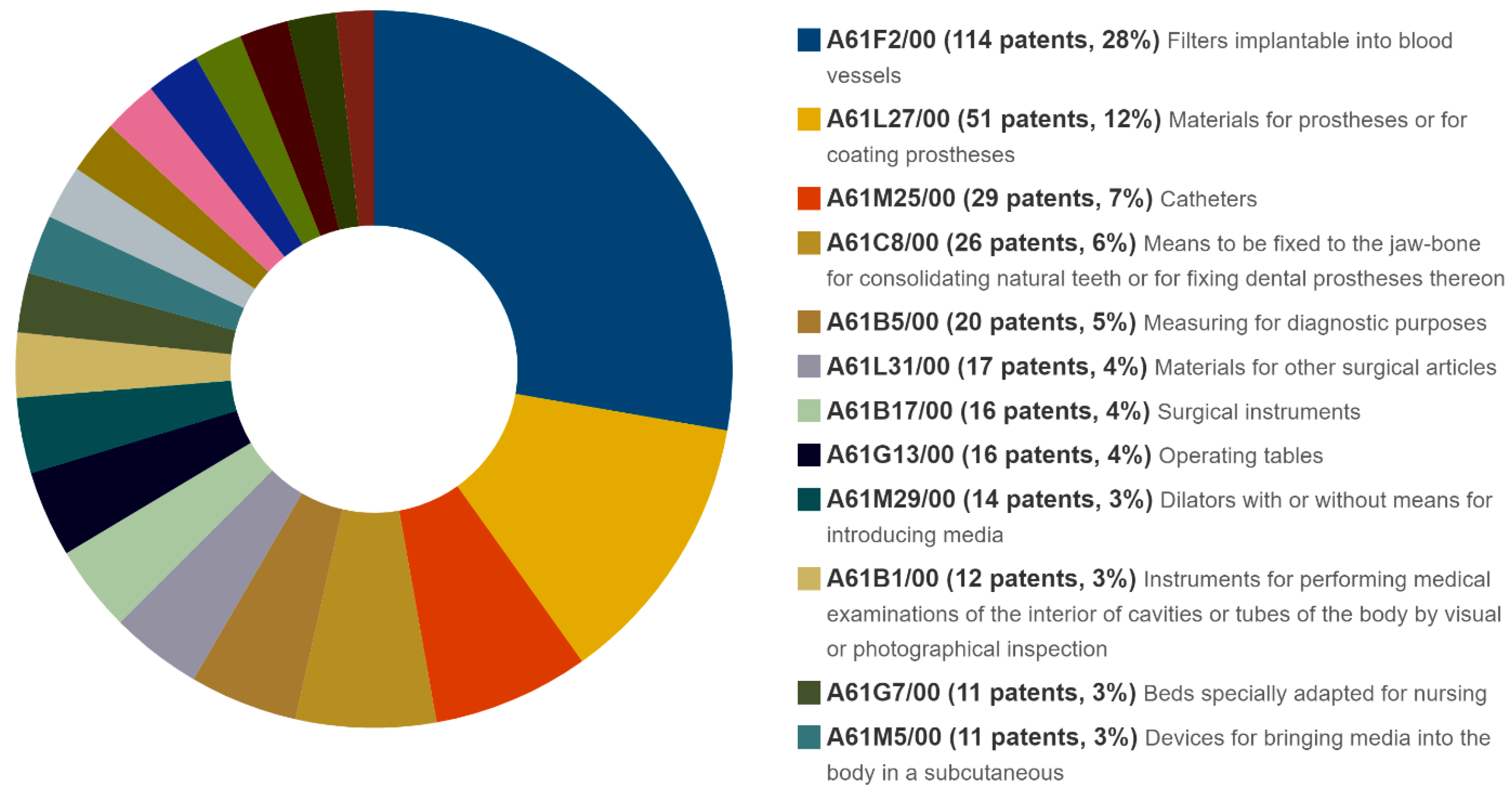

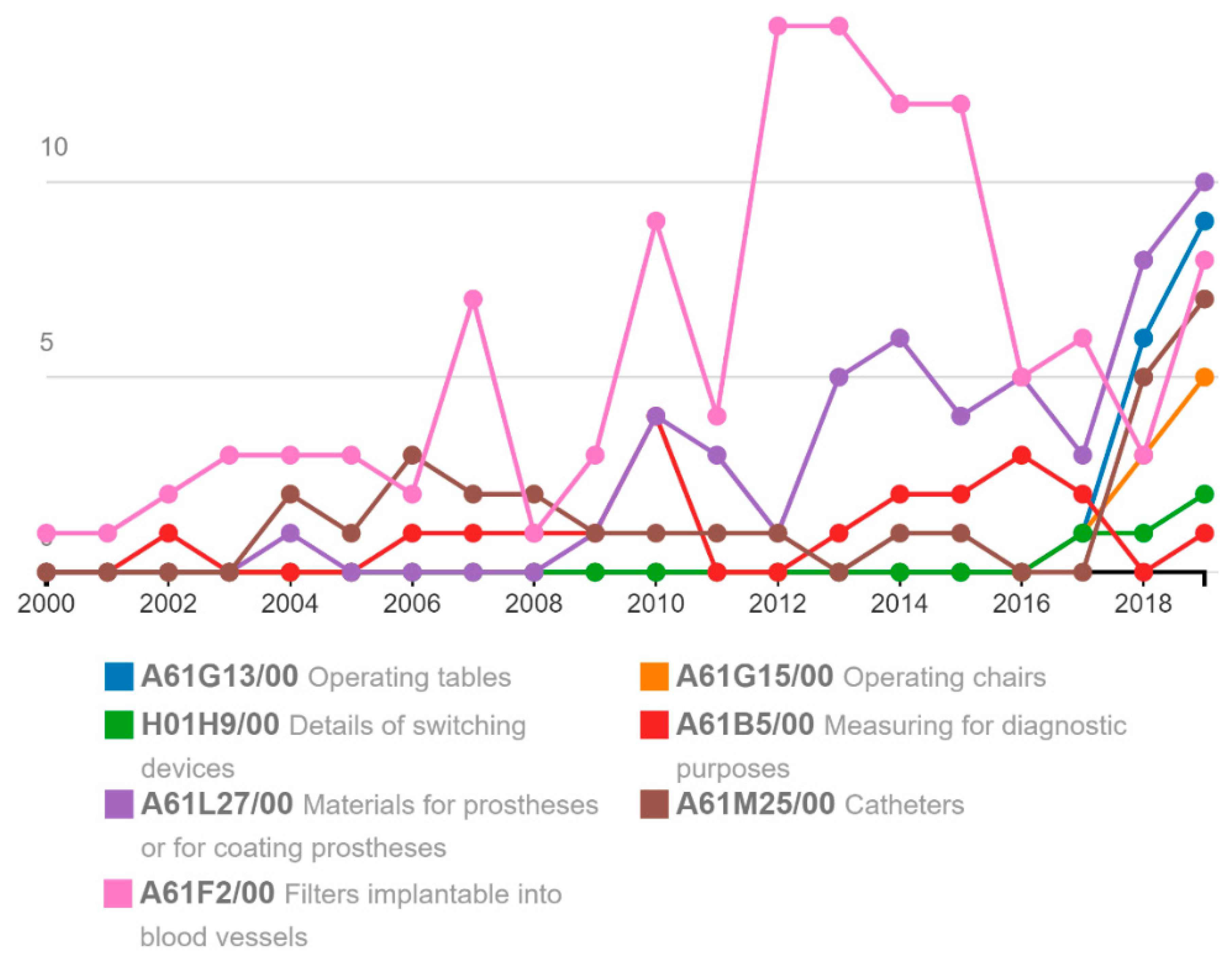

4.3. The Czech Republic situation

5. Discussion

6. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Aliabadi, Maryam Raiyat, Amita Ajith Kamath, Julien Gascon-Samson, and Karthik Pattabiraman. 2017. ARTINALI: Dynamic Invariant Detection for Cyber-Physical System Security. Available online: http://blogs.ubc.ca/karthik/files/2017/07/ARTINALI-FSE17.pdf (accessed on 29 October 2019).

- Ashford, R. W. 2000. The Leishmaniases as Emerging and Reemerging Zoonoses. International Journal for Parasitology 30: 1269–81. [Google Scholar] [CrossRef]

- Bernasconi, Serge. 2017. How MDR and IVDR Are Reshaping Europe’s Medtech Industry. Medical Technology Report 2017. Pulse of the Industry 2017. EY—Ernst Young. Available online: https://www.ey.com/Publication/vwLUAssets/ey-pulse-of-the-industry-2017/$FILE/ey-pulse-of-the-industry-2017.pdf (accessed on 29 October 2019).

- Center for Devices and Radiological Health. 2019. Overview of Device Regulation. FDA. Available online: http://www.fda.gov/medical-devices/device-advice-comprehensive-regulatory-assistance/overview-device-regulation (accessed on 8 February 2019).

- Czech Republic—Overview of Device Industry and Healthcare Statistics. 2014. Emergo. 28 August 2014. Available online: https://www.emergobyul.com/resources/market-czech-republic (accessed on 29 October 2019).

- Database|Definition, Types, & Facts. n.d. Encyclopedia Britannica. Available online: https://www.britannica.com/technology/database (accessed on 26 December 2019).

- De Maria, Carmelo, Licia Di Pietro, Andrés Díaz Lantada, June Madete, Philippa Ngaju Makobore, Mannan Mridha, Alice Ravizza, Janno Torop, and Arti Ahluwalia. 2018. Safe Innovation: On Medical Device Legislation in Europe and Africa. Health Policy and Technology 7: 156–65. [Google Scholar] [CrossRef]

- Espacenet–Patent Search. n.d. Available online: https://worldwide.espacenet.com/ (accessed on 26 December 2019).

- EU MDR 2017/745 Gap Assessment and CE Transition Strategy for Medical Device Manufacturers. 2019. Emergo. Available online: https://www.emergobyul.com/mdr (accessed on 10 January 2019).

- EUCOMED-Medical Technology. 2013. Financial Impact of the Revision of the EU Medical Devices Directives on European SMEs and Industry. Factsheet. New Medtech Regulations. MedTechEurope. Available online: https://www.medtecheurope.org/wp-content/uploads/2015/07/20130910_MTE_Financial-impact-of-the-Revision-of-the-EU-Medical-Devices-Directives-on-European-SMEs-and-industry_factsheet.pdf (accessed on 29 October 2019).

- EUR-Lex-01990L0385-20071011-EN-EUR-Lex. n.d. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A01990L0385-20071011 (accessed on 25 December 2019).

- European Patent Office. n.d. European Companies and Inventors File More Patent Applications in 2018. Available online: https://www.epo.org/news-issues/news/2019/20190312.html (accessed on 23 September 2019).

- Five Trends to Watch in the Medical Device Industry. n.d. Mercer Capital. Available online: https://mercercapital.com/article/five-trends-to-watch-in-the-medical-device-industry/ (accessed on 26 December 2019).

- Committee on Technological Innovation in Medicine 1989) Gelijns, Annetine C., and Institute of Medicine (US) Committee on Technological Innovation in Medicine. 1989. Technological Innovation: Comparing Development of Drugs, Devices, and Procedures in Medicine. Washington, DC: National Academies Press (US). [Google Scholar]

- Hedvičáková, Martina, and Martin Král. 2019. Benefits of KPIs for Industry Sector Evaluation: The Case Study from the Czech Republic. E+M Ekonomie a Management 22: 97–113. [Google Scholar] [CrossRef]

- Inovacni Strategie-Nouvelle Lune. n.d. Available online: http://www.rishmp.cz/ (accessed on 25 December 2019).

- Jaskyte Bahr, Kristina. 2019. An Exploratory Study of Types of Innovation in US Foundations. Administrative Sciences 9: 93. [Google Scholar] [CrossRef]

- Kent, Julie, and Alex Faulkner. 2002. Regulating Human Implant Technologies in Europe–Understanding the New Era in Medical Device Regulation. Health, Risk & Society 4: 189–209. [Google Scholar] [CrossRef]

- Kramer, Daniel B., Yongtian T. Tan, Chiaki Sato, and Aaron S. Kesselheim. 2014. Ensuring Medical Device Effectiveness and Safety: A Cross-National Comparison of Approaches to Regulation. Food and Drug Law Journal 69: 1–i. [Google Scholar] [PubMed]

- Leiter, Valerie, and Shelley K. White. 2015. Enmeshed in Controversy: Claims about the Risks of Vaginal Mesh Devices. Health, Risk & Society 17: 64–80. [Google Scholar] [CrossRef]

- Marešová, Petra, and Kamil Kuča. 2014. Porter’s Five Forces on Medical Device Industry in Europe. MMSL: MMSL, 2014 (Volume 83), Issue 4. Military Medical Science Letters 83: 134–44. [Google Scholar] [CrossRef]

- Marešová, Petra, Marek Penhaker, Ali Selamat, and Kamil Kuča. 2015. The Potential of Medical Device Industry in Technological and Economical Context. Therapeutics and Clinical Risk Management 11: 1505. [Google Scholar] [CrossRef] [PubMed]

- Medical Devices in the EU: A Global Leader in Safety, Availability and Innovation. 2015. MedTech Europe. 12 November 2015. Available online: https://www.medtecheurope.org/news-and-events/default/medical-devices-in-the-eu-a-global-leader-in-safety-availability-and-innovation/ (accessed on 28 October 2019).

- Medicem s. r. o. n.d. Available online: https://www.medicem.com/contact-medicem-institute (accessed on 26 December 2019).

- Nelkin, Dorothy. 1989. Communicating Technological Risk: The Social Construction of Risk Perception. Annual Review of Public Health 10: 95–113. [Google Scholar] [CrossRef] [PubMed]

- OECD.Org-OECD. n.d. Available online: http://www.oecd.org/ (accessed on 22 February 2019).

- Parisio, Carmen, Elena Lucarini, Laura Micheli, Alessandra Toti, Lorenzo Di Cesare Mannelli, Giulia Antonini, Elena Panizzi, Anna Maidecchi, Emiliano Giovagnoni, Jacopo Lucci, and et al. 2020. Researching New Therapeutic Approaches for Abdominal Visceral Pain Treatment: Preclinical Effects of an Assembled System of Molecules of Vegetal Origin. Nutrients 12: 22. [Google Scholar] [CrossRef] [PubMed]

- Porter, Michael E., and Claas van der Linde. 1995. Toward a New Conception of the Environment-Competitiveness Relationship. Journal of Economic Perspectives 9: 97–118. [Google Scholar] [CrossRef]

- 2017/745 of the European Parliament and of the Council of 5 April 2017 on Medical Devices, Amending Directive 2001/83/EC, Regulation (EC) No 178/2002 and Regulation (EC) No 1223/2009 and Repealing Council Directives 90/385/EEC and 93/42/EEC (Text with EEA Relevance) 2017) Regulation (EU) 2017/745 of the European Parliament and of the Council of 5 April 2017 on Medical Devices, Amending Directive 2001/83/EC, Regulation (EC) No 178/2002 and Regulation (EC) No 1223/2009 and Repealing Council Directives 90/385/EEC and 93/42/EEC (Text with EEA Relevance). 2017. OJ L. Volume 117. Available online: http://data.europa.eu/eli/reg/2017/745/oj/eng (accessed on 25 October 2019).

- Schmitt, Sophie. 2012. Comparative Approaches to the Study of Public Policy-Making. In Routledge Handbook of Public Policy. New York: Routledge. [Google Scholar] [CrossRef]

- Search and Analyze Patents-PatentInspiration. n.d. Available online: https://www.patentinspiration.com/ (accessed on 26 December 2019).

- The Largest Presentation of Czech Medical Technology in Britain in Recent Years. n.d. Available online: https://www.mzv.cz/london/en/trade_and_economy/the_largest_presentation_of_czech.html (accessed on 25 December 2019).

- Velenturf, Anne P. M., Paul D. Jensen, Phil Purnell, Juliet Jopson, and Norman Ebner. 2019. A Call to Integrate Economic, Social and Environmental Motives into Guidance for Business Support for the Transition to a Circular Economy. Administrative Sciences 9: 92. [Google Scholar] [CrossRef]

- Wagner, Marcus. 2004. The Porter Hypothesis Revisited: A Literature Review of Theoretical Models and Empirical Tests. 0407014. Public Economics. Munich: University Library of Munich. Available online: https://ideas.repec.org/p/wpa/wuwppe/0407014.html (accessed on 25 October 2019).

- White, Shelley K., and Abigail N. Walters. 2018. Assessing Risk by Analogy: A Case Study of Us Medical Device Risk Management Policy. Health, Risk & Society 20: 358–78. [Google Scholar] [CrossRef]

- World Intellectual Property Organization, Tomasz Sierotowicz, and Rafał Wisła. n.d. Innovation in the Pharmaceutical and Medical Technologies Industries of Poland. Geneva: WIPO.

- World Population Prospects-Population Division-United Nations. n.d. Available online: https://population.un.org/wpp/DataQuery/ (accessed on 25 December 2019).

- Yamaue, Hiroki. 2017. Innovation of Diagnosis and Treatment for Pancreatic Cancer. Berlin: Springer. [Google Scholar]

- Zhang, Xiang, Lei Zhang, Ka Y. Fung, Gade Pandu Rangaiah, and Ka Ming Ng. 2018. Product Design: Impact of Government Policy and Consumer Preference on Company Profit and Corporate Social Responsibility. Computers & Chemical Engineering 118: 118–31. [Google Scholar] [CrossRef]

| Basic (Medical Device) | Stemming (Medical Device) | Enhanced Medical Device (MD) and Stemming | |

|---|---|---|---|

| Electrical engineering | |||

| Electrical machinery, apparatus, energy | 7 | 7 | 6 |

| Telecommunications | 5 | 5 | 5 |

| Digital Communication | 1 | 1 | |

| Basic Communication processes | 2 | 2 | 2 |

| Computer technology | 10 | 10 | 8 |

| IT methods for management | 2 | 2 | 3 |

| Semiconductors | 2 | ||

| Instruments | |||

| Analysis of biological materials | 9 | ||

| Control | 4 | 4 | 3 |

| Medical technology | 62 | 71 | 300 |

| Chemistry | |||

| Organic fine chemistry | 3 | 4 | 6 |

| Biotechnology | 1 | 9 | |

| Pharmaceuticals | 5 | 9 | 27 |

| Macromolecular chemistry, polymers | 3 | 7 | 23 |

| Materials, metallurgy | 1 | 1 | 12 |

| Surface technology, coating | 5 | 5 | 11 |

| Environmental technology | 2 | 2 | |

| Micro-structural and nano-technology | 6 | ||

| Mechanical engineering | |||

| Engines, pumps, turbines | 1 | 1 | |

| Textile and paper machines | 1 | 1 | 7 |

| Other special machines | 2 | 3 | 14 |

| Mechanical elements | 3 | 3 | |

| Other fields | |||

| Furniture, games | 4 | 4 | 4 |

| TOTAL | 85 | 97 | 359 |

| Data quality (used patents) | 98.82% | 98.97% | 96.66% |

| CZ (10.6 Million People) | PL (38 Million People) | AT (8.8 Million People) | DE (82.8 Million People) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| patents | % | Patent/1 Million Population | patents | % | Patent/1 Million Population | patents | % | Patent/1 Million Population | patents | % | Patent/1 Million Population | |

| total | 359 | 33.87 | 615 | 16.18 | 3290 | 373.86 | 39,896 | 481.84 | ||||

| granted | 208 | 19.62 | 264 | 6.95 | 1671 | 189.89 | 18,678 | 225.58 | ||||

| A61F2/00 | 114 | 21 | 10.75 | 164 | 18 | 4.32 | 360 | 8 | 40.91 | 7372 | 14 | 89.03 |

| A61B17/00 | 16 | 3 | 1.51 | 88 | 10 | 2.32 | 262 | 5 | 29.77 | 4618 | 9 | 55.77 |

| A61L27/00 | 51 | 10 | 4.81 | 106 | 12 | 2.79 | 2364 | 4 | 28.55 | |||

| A61B5/00 | 20 | 4 | 1.89 | 35 | 4 | 0.92 | 199 | 4 | 22.61 | 3545 | 7 | 42.81 |

| A61N1/00 | 927 | 19 | 105.34 | |||||||||

| A61M25/00 | 30 | 6 | 2.83 | 41 | 5 | 1.08 | 2303 | 4 | 27.81 | |||

| A61C8/00 | 26 | 5 | 2.45 | 51 | 6 | 1.34 | ||||||

| H01L21/00 | 286 | 6 | 32.50 | 2146 | 4 | 25.92 | ||||||

| H04R25/00 | 412 | 9 | 46.82 | |||||||||

| A61L31/00 | 17 | 3 | 1.60 | 33 | 4 | 0.87 | ||||||

| A61F11/00 | 269 | 6 | 30.57 | |||||||||

| H01L29/00 | 259 | 5 | 29.43 | |||||||||

| A61M5/00 | 2388 | 4 | 28.84 | |||||||||

| A61C1/00 | 174 | 4 | 19.77 | |||||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maresova, P.; Hajek, L.; Krejcar, O.; Storek, M.; Kuca, K. New Regulations on Medical Devices in Europe: Are They an Opportunity for Growth? Adm. Sci. 2020, 10, 16. https://doi.org/10.3390/admsci10010016

Maresova P, Hajek L, Krejcar O, Storek M, Kuca K. New Regulations on Medical Devices in Europe: Are They an Opportunity for Growth? Administrative Sciences. 2020; 10(1):16. https://doi.org/10.3390/admsci10010016

Chicago/Turabian StyleMaresova, Petra, Ladislav Hajek, Ondrej Krejcar, Michael Storek, and Kamil Kuca. 2020. "New Regulations on Medical Devices in Europe: Are They an Opportunity for Growth?" Administrative Sciences 10, no. 1: 16. https://doi.org/10.3390/admsci10010016

APA StyleMaresova, P., Hajek, L., Krejcar, O., Storek, M., & Kuca, K. (2020). New Regulations on Medical Devices in Europe: Are They an Opportunity for Growth? Administrative Sciences, 10(1), 16. https://doi.org/10.3390/admsci10010016