Comparison of the Timber Management Expenses of Non-Industrial Private Forest Landowners in Mississippi, United States: Results from 1995–1997 and 2015

Abstract

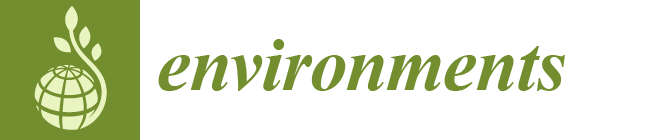

:1. Introduction

2. Materials and Methods

2.1. Survey and Data

2.2. Data Analysis

3. Results

3.1. Response Rates

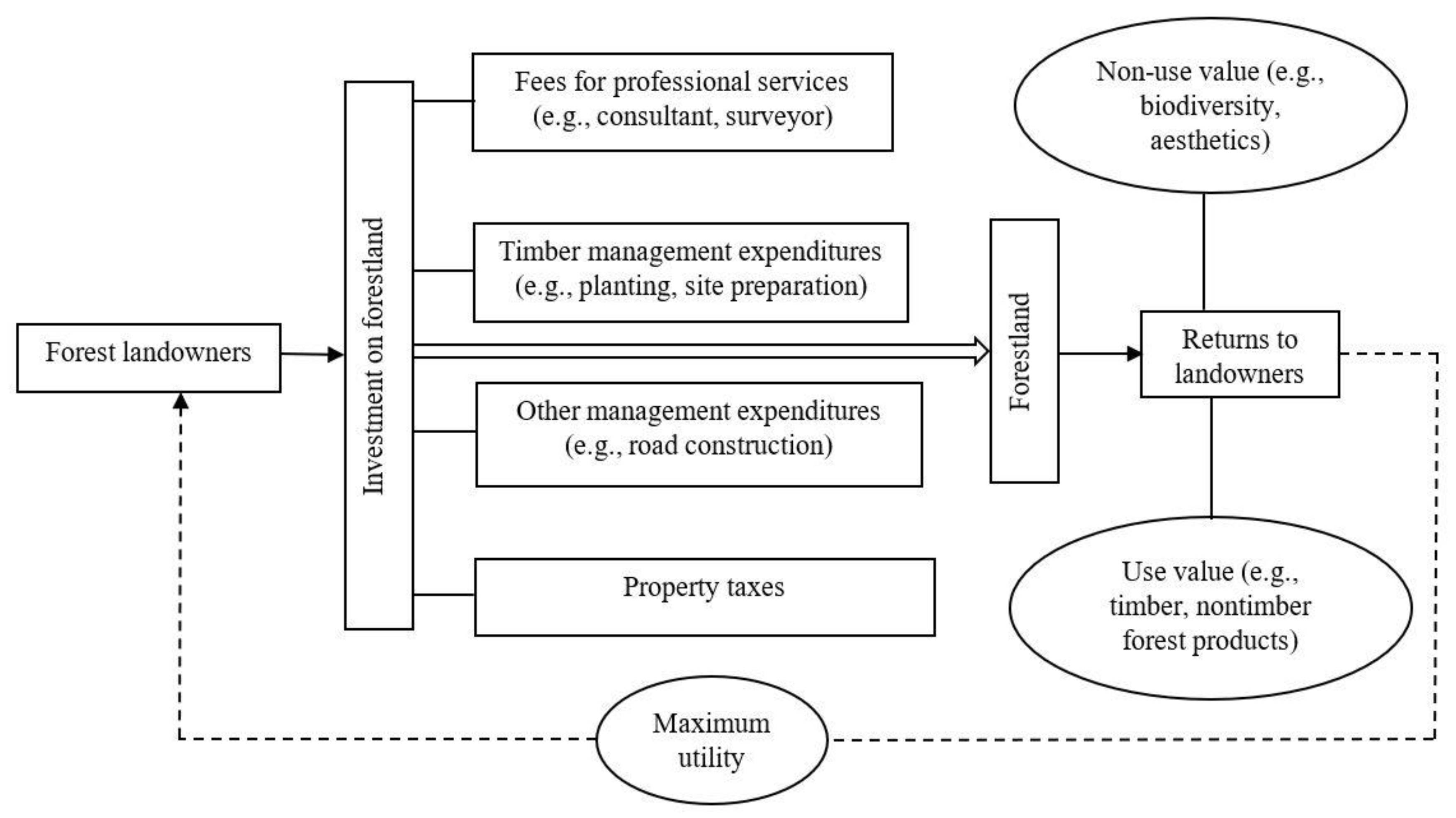

3.2. Parcel Size and Overall Participation and Expenditures for Forest Management

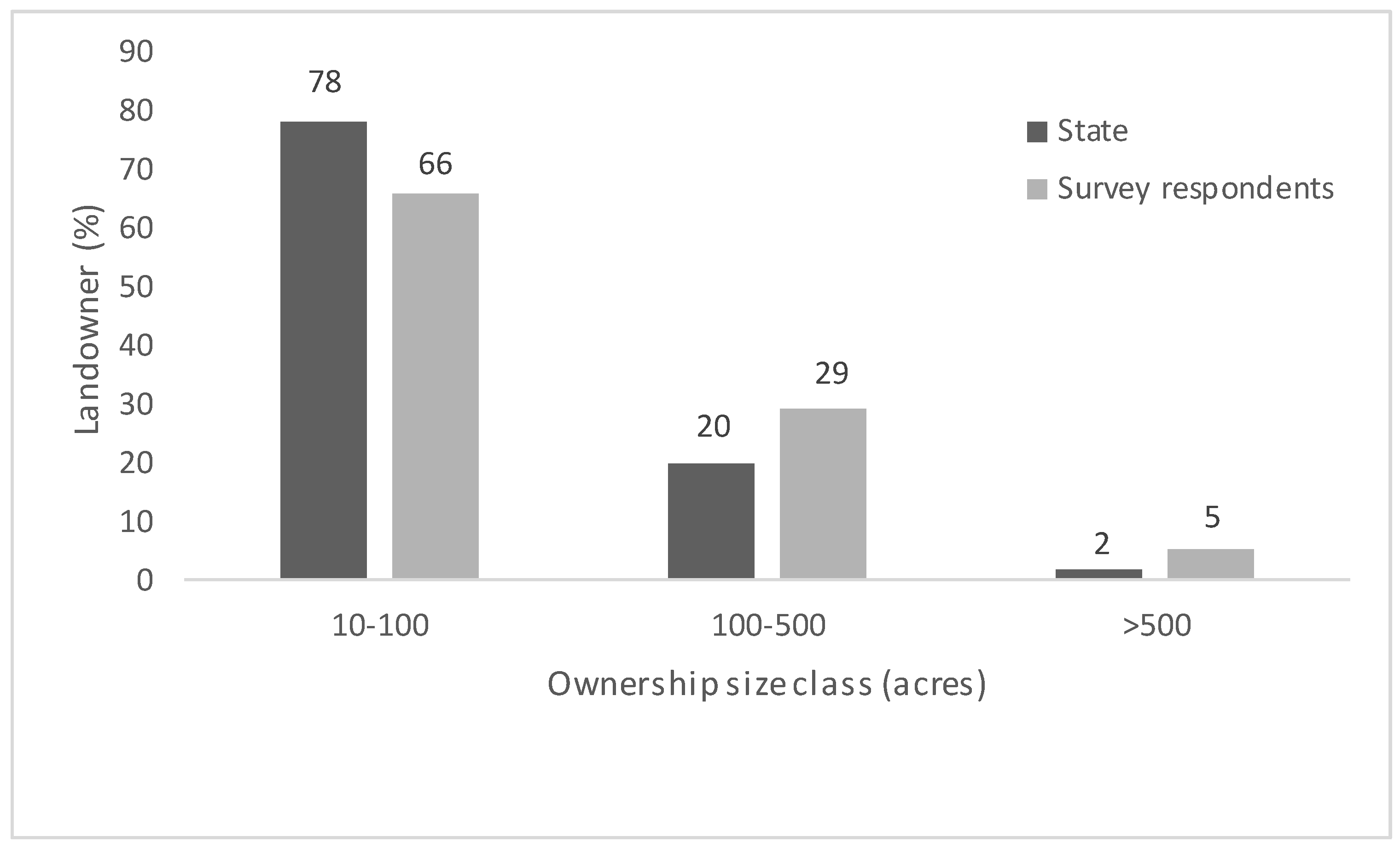

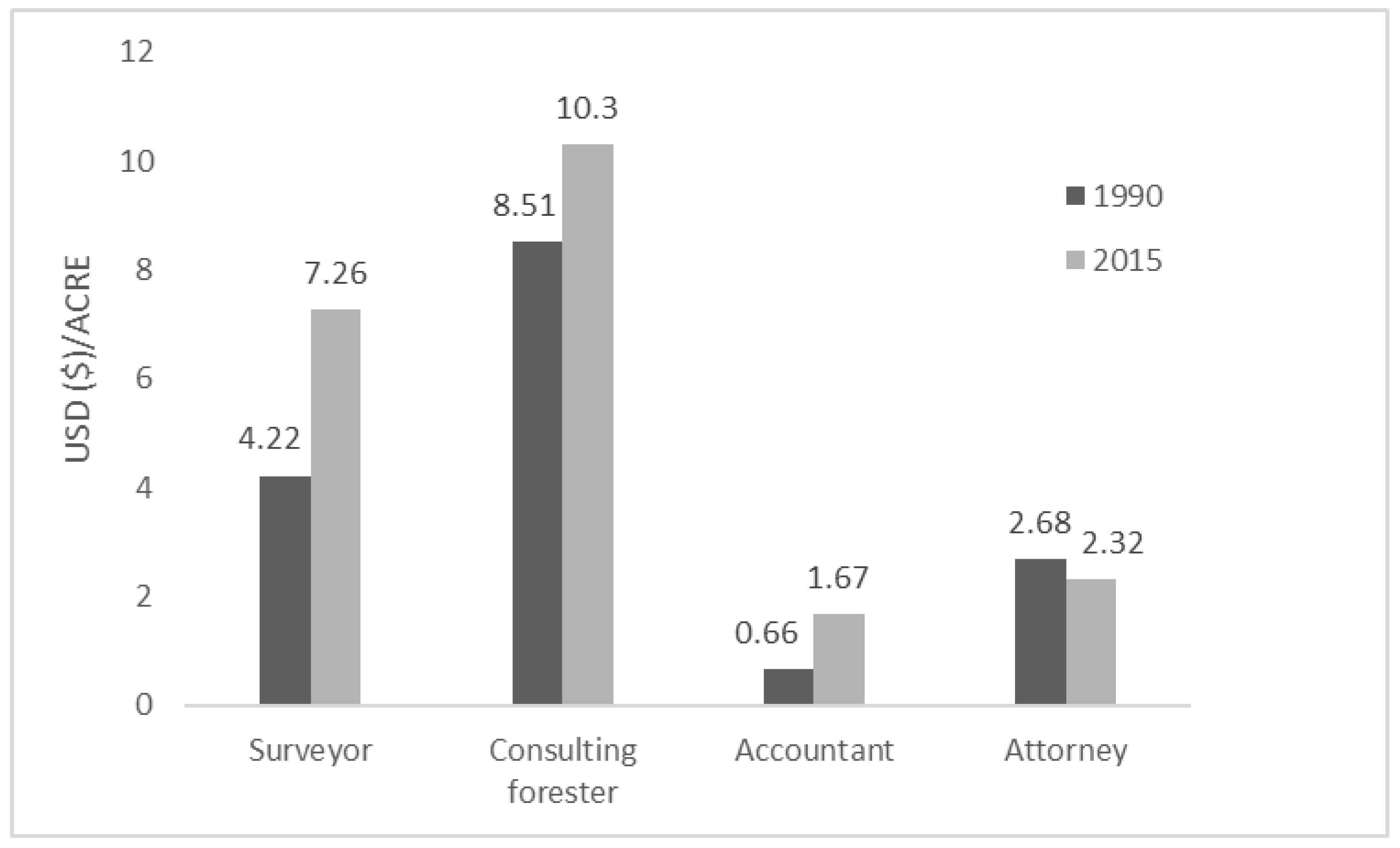

3.3. Fees for Professional Services

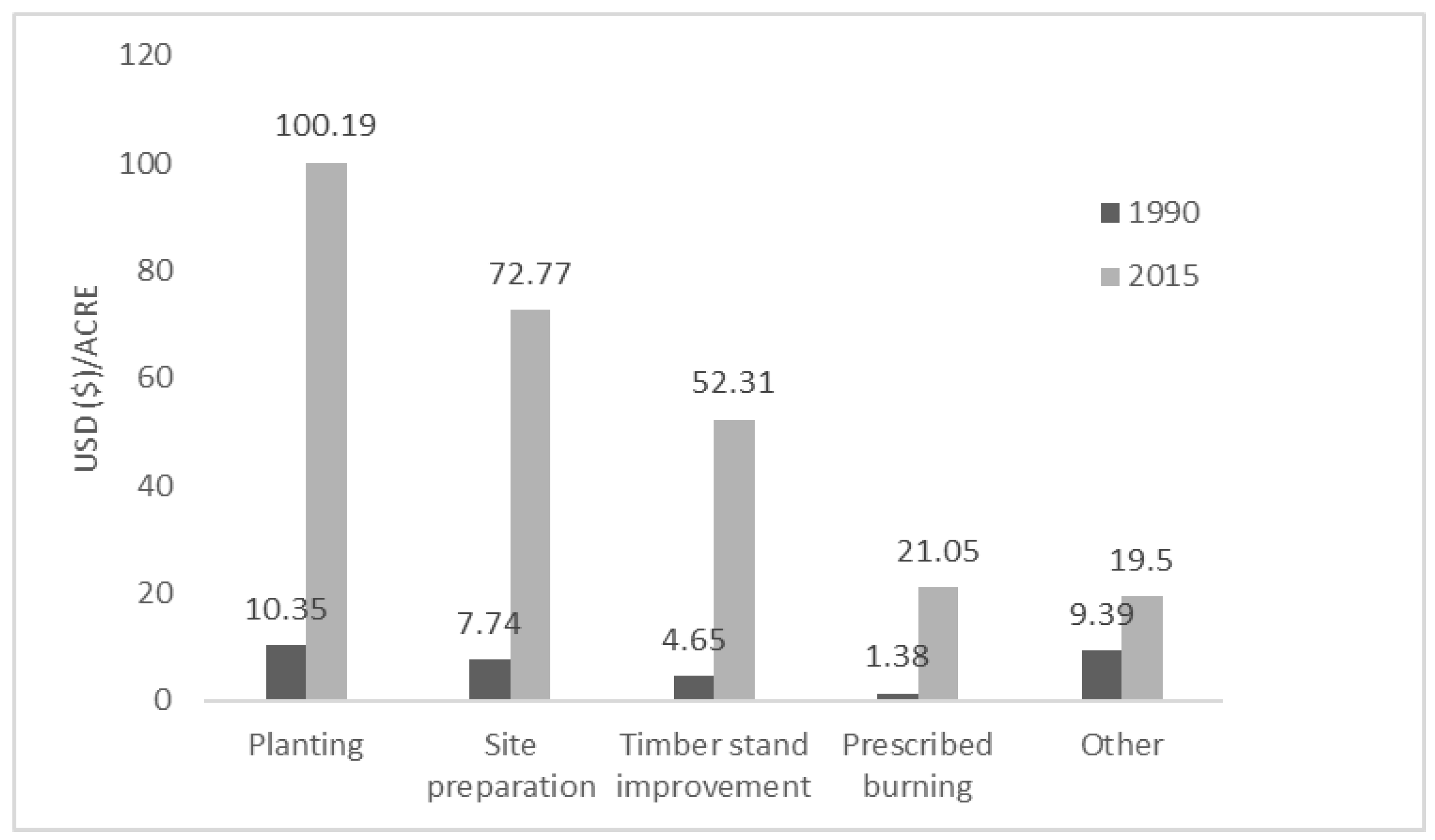

3.4. Timber Management Expenditures

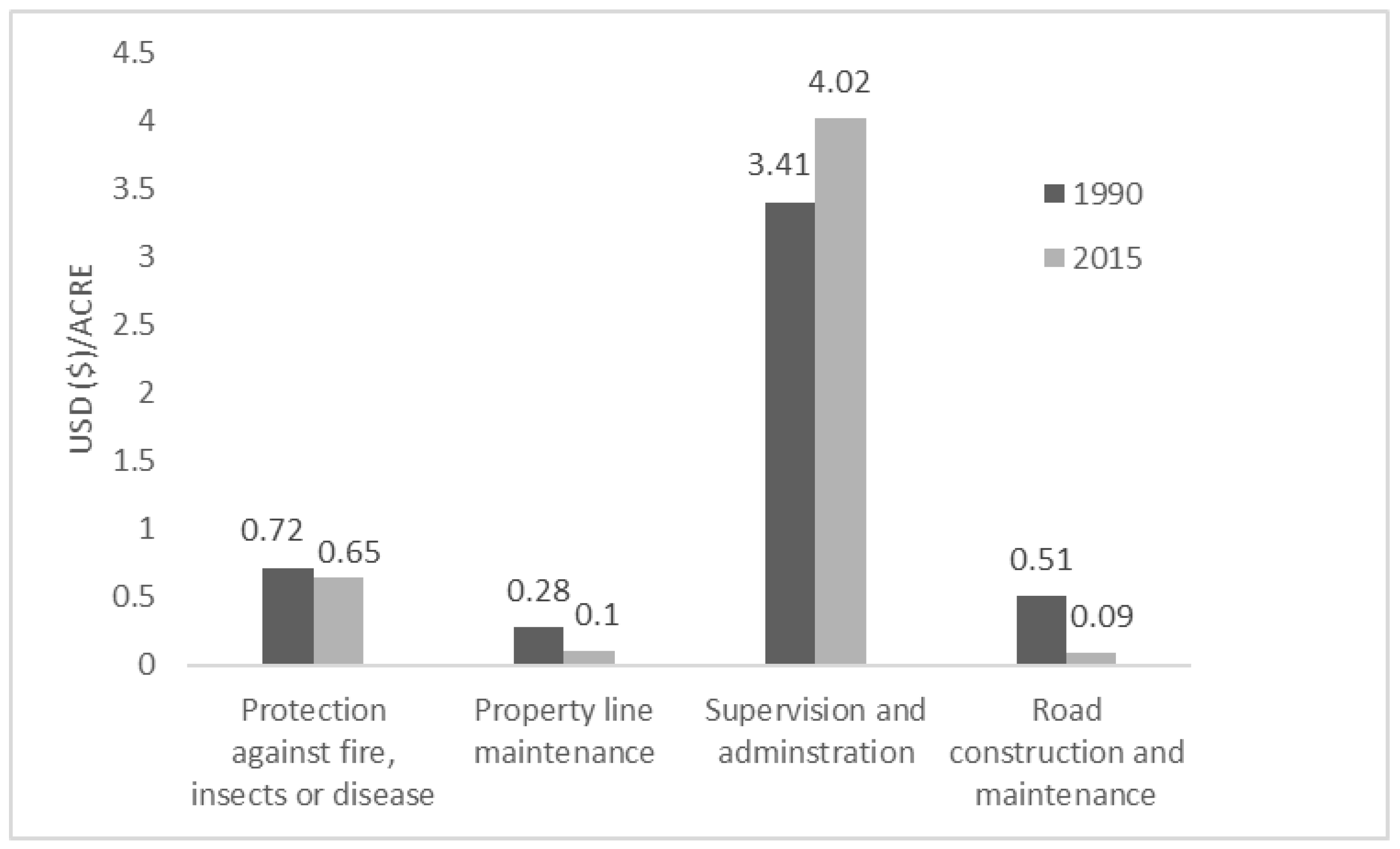

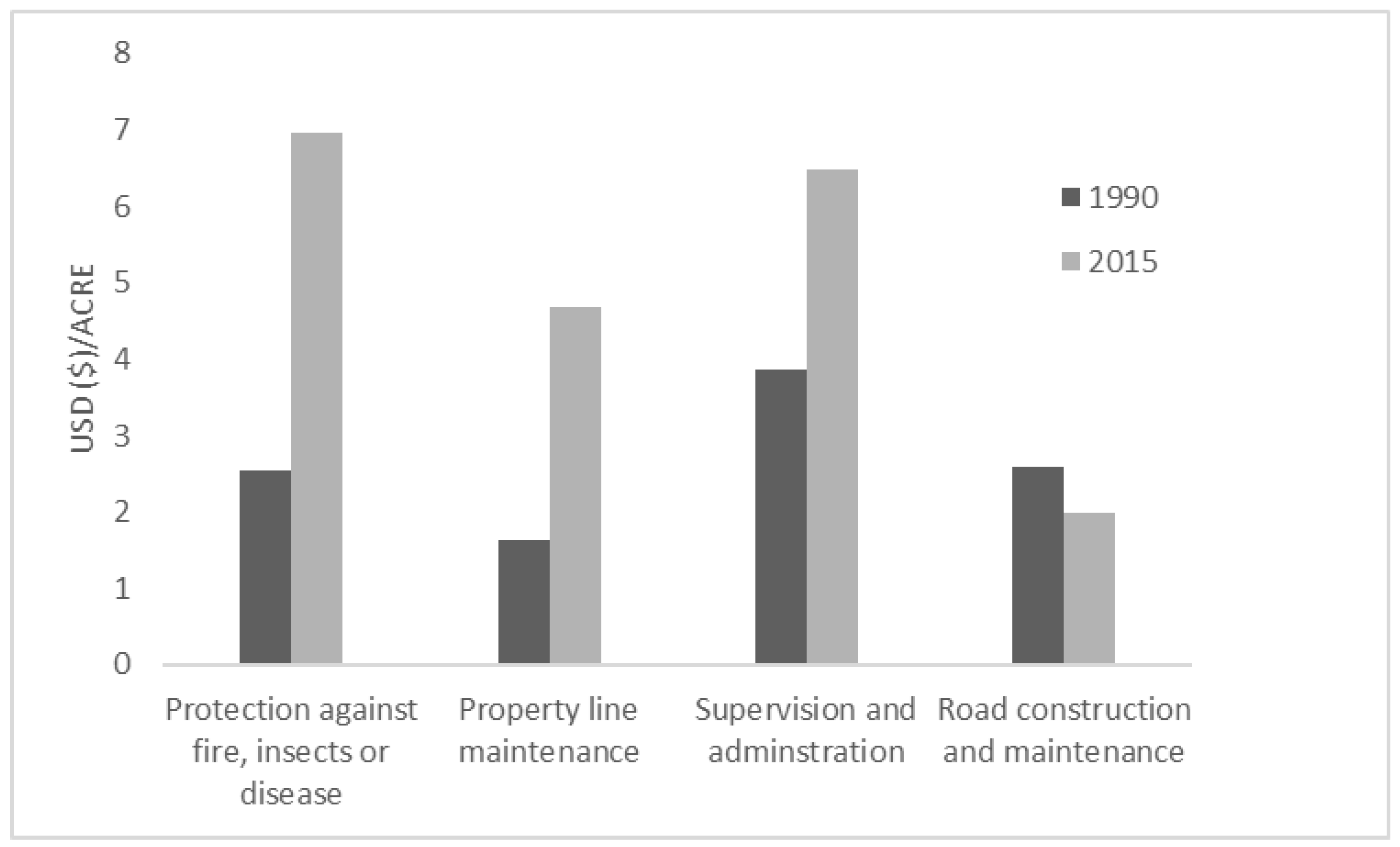

3.5. Other Management Expenditures

4. Discussion and Conclusions

5. Study Limitations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Oswalt, S.N.; Miles, P.D.; Pugh, S.A.; Smith, W.B. Forest Resources of the United States, 2017: A Technical Document Supporting the Forest Service 2020 Update of the RPA Assessment; General Technical Report; USDA Forest Service: Washington, DC, USA, 2018.

- Moffat, S.O.; Cubbage, F.W.; Cascio, A.J.; Sheffield, R.M. The future of forest management on NIPF lands in the South: Results of an expert opinion survey. In Proceedings of the 1998 Southern Forest Economics Workshop; Abt, K., Abt, R.C., Eds.; Southern Research Station: Research Triangle Park, NC, USA, 1998; pp. 17–24. [Google Scholar]

- Mississippi Forestry Commission. Mississippi’s Assessment of Forest Resources and Forest Resource Strategy. 2010; 10p. Available online: https://www.mfc.ms.gov/sites/default/files/MS_Assessment_Resource_Strategy_2010.pdf (accessed on 16 February 2019).

- Oswalt, S.N. Mississippi’s Forests, 2013; Research Bulletin RB-SRS-204, Southern Research Station; USDA Forest Service: Asheville, NC, USA, 2015; 81p.

- Butler, B.J.; Hewes, J.H.; Dickinson, B.J.; Andrejczyk, K.; Butler, S.M.; Markowski-Lindsay, M. Family forest ownerships of the United States, 2013: Findings from the USDA forest service’s National Woodland Owner Survey. J. For. 2016, 114, 638–647. [Google Scholar] [CrossRef]

- Mutandwa, E.; Grala, R.K.; Grado, S.C.; Munn, I.A. Family forest owners’ familiarity with conservation programs in Mississippi, USA. Small Scale For. 2016, 15, 303–319. [Google Scholar] [CrossRef]

- Amacher, G.S.; Conway, M.C.; Sullivan, J. Econometric analyses of non-industrial forest landowners: Is there anything left to study? J. For. Econ. 2003, 9, 137–164. [Google Scholar] [CrossRef]

- Finley, A.O.; Kittredge, D.B., Jr.; Stevens, T.H.; Schweik, C.M.; Dennis, D.C. Interest in cross-boundary cooperation: Identification of distinct types of private forest owners. For. Sci. 2006, 52, 10–22. [Google Scholar]

- Kluender, R.A.; Walkingstick, T.L. Rethinking how non-industrial landowners view their lands. South. J. Appl. For. 2000, 24, 150–158. [Google Scholar] [CrossRef]

- Nakajima, T.; Shiraishi, N.; Hidesato, K.; Matsumoto, M. A method to maximize forest profitability through optimal rotation period selection under various economic, site and silvicultural conditions. N. Z. J. For. Sci. 2017, 47, 4. [Google Scholar] [CrossRef]

- Upadhaya, S.; Dwivedi, P. The role and potential of blueberry in increasing deforestation in southern Georgia, United States. Agric. Syst. 2019, 173, 39–48. [Google Scholar] [CrossRef]

- Jacobson, M. Keeping Records of Forest Management Activities. Penn State Cooperative Extension; The Pennsylvania State University: University Park, PA, USA, 2009; p. 10. [Google Scholar]

- Arano, K.G.; Munn, I.A. Non-Industrial Private Forest Landowners’ Forest Management Activities and Expenditures in Mississippi, 1998–2000 Data; Bulletin FO-249 Mississippi State University; Forest and Wildlife Research Center: Starkville, MS, USA, 2004; p. 13. [Google Scholar]

- Moak, J.E. Forest practices cost trends in the south. South. J. Appl. For. 1982, 6, 130–132. [Google Scholar] [CrossRef]

- Kuhn, J.F., III. Cost Trends of Selected Forest Management Activities in the Southern United States from 1961–1982. Master’s Thesis, Mississippi State University, Starkville, MS, USA, 1984; 48p. [Google Scholar]

- Dubois, M.R.; Watson, W.F.; Straka, T.J.; Belli, K.L. Costs and cost trends for forestry practices in the South. For. Farmer. 1991, 50, 26–32. [Google Scholar]

- Dubois, M.R.; McNabb, K.; Straka, T.J.; Watson, W.F. Costs and cost trends for forestry practices in the South. For. Landowner 1999, 58, 3–8. [Google Scholar]

- Belli, M.L.; Straka, T.J.; Dubois, M.R.; Watson, W.F. Costs and cost trends for forestry practices in the South. For. Farmer. 1993, 52, 25–31. [Google Scholar]

- Arano, K.G.; Cushing, T.L.; Munn, I.A. Forest management expenses of Mississippi’s non-industrial private forest landowners. South. J. Appl. For. 2002, 26, 93–98. [Google Scholar] [CrossRef]

- Maggard, A.; Barlow, R. 2016 costs and trends for southern forestry practices. For. Landowner 2017, 76, 31–39. [Google Scholar]

- Oswalt, S.N.; Smith, W.B. U.S. Forest Resource Facts and Historical Trends. FS-1035; USDA Forest Service: Washington, DC, USA, 2014.

- Conner, R.C.; Hartsell, A.J. Forest area and conditions. In Southern Forest Resource Assessment; General Technical Report GTR-SRS-53, Southern Research Station; Wear, D.N., Greis, J.G., Eds.; USDA Forest Service: Asheville, NC, USA, 2002; 635p. [Google Scholar]

- Alabama Cooperative Extension System. Cost for Common Forestry Practices in the South. 2018. Available online: www.aces.edu/natural-resources/forestry/economics-management/forestrypractice.php (accessed on 21 October 2018).

- Kingsley, N.P.; Birch, T.W. The Forest-Land Owners of New Hampshire and Vermont; Research Bulletin RB-NE- 51, Northeastern Forest Experiment Station; USDA Forest Service: Upper Darby, PA, USA, 1977; 47p.

- Thompson, M.T. A Forested Tract-Size Profile of Florida’s NIPF Landowners; Res. Pap. RP-SRS-15, Southern Research Station; USDA Forest Service: Asheville, NC, USA, 1999; 10p.

- Adams, D.M.; Hayes, R.W.; Dutrow, G.F.; Barber, R.F.; Vasievich, J.M. Private investment in forest management and the long-term supply of timber. Am. J. Agric. Econ. 1982, 64, 232–241. [Google Scholar] [CrossRef]

- Rogers, W.R.; Munn, I.A. Forest management intensity: A comparison of timber investment management organizations and industrial landowners in Mississippi. For. Policy Econ. 2003, 27, 83–91. [Google Scholar] [CrossRef]

- Dillman, D.A.; Smyth, J.D.; Christina, L.M. Internet, Mail, and Mixed-Mode Surveys: The Tailored Design Method, 3rd ed.; John Wiley and Sons: Hoboken, NJ, USA, 2009; 499p. [Google Scholar]

- Nagubadi, R.V.; Zhang, D. Determinants of timberland use by ownership and forest type in Alabama and Georgia. J. Agric. Appl. Econ. 2005, 37, 173–186. [Google Scholar] [CrossRef]

- Khanal, P.N.; Grebner, D.L.; Munn, I.A.; Grado, S.C.; Grala, R.K.; Henderson, J.E.; Measells, M.K. Nonindustrial private forest landowner beliefs toward climate change and carbon sequestration in the Southern United States. J. For. 2016, 114, 524–531. [Google Scholar] [CrossRef]

- Pokharel, R.; Grala, R.K.; Grebner, D.L. Woody residue utilization for bioenergy by primary forest products manufacturers: An exploratory analysis. For. Policy Econ. 2017, 85, 161–171. [Google Scholar] [CrossRef]

- Pokharel, R.; Grala, R.K.; Grebner, D.L.; Grado, S.C. Factors affecting utilization of woody residues to produce bioenergy in the southern United States. Biomass Bioenergy 2017, 105, 278–287. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Butler, B.J. Family Forest Owners of the United States, 2006; General Technical Report GTR-NRS-27, Northern Research Station; USDA Forest Services: Newtown Square, PA, USA, 2008; 72p.

- Sanfey, A.G. Social decision-making: insights from game theory and neuroscience. Science 2007, 318, 598–602. [Google Scholar] [CrossRef] [PubMed]

- Upadhaya, S.; Dwivedi, P. Blue over green? Defining typologies of rural landowners growing blueberry in place of forests in Georgia, United States. Hum. Ecol 2019, 1–11. [Google Scholar] [CrossRef]

- Hodges, D.G.; Hartsell, A.J.; Brandeis, C.; Brandeis, T.J.; Bentley, J.W. Recession effects on the forests and forest products industries of the South. For. Prod. J. 2012, 61, 614–624. [Google Scholar] [CrossRef]

- Mundell, J.; Taff, S.; Kilgore, M.; Snyder, S. Assessing Trends in Forest Parcelization and Development in Minnesota: An Itasca County Case Study; University of Minnesota: St. Paul, MN, USA, 2007. [Google Scholar]

- Hatcher, J.E., Jr.; Straka, T.J.; Greene, J.L. The size of forest holding/parcelization problem in forestry: A literature review. Resources 2013, 2, 39–57. [Google Scholar] [CrossRef]

- Mundell, J.; Taff, S.; Kilgore, M.; Snyder, S. Using real estate records to assess forest land parcelization and development: A Minnesota case study. Landsc. Urban Plann. 2010, 94, 71–76. [Google Scholar] [CrossRef]

- Kilgore, M.A.; Snyder, S.A. Exploring the relationship between parcelization metrics and natural resource managers’ perceptions of forest land parcelization intensity. Landsc. Urban Plann. 2016, 149, 43–48. [Google Scholar] [CrossRef]

- Butler, B.J.; Leatherberry, E.C. America’s family forest owners. J. For. 2004, 102, 4–9. [Google Scholar] [CrossRef]

- Londo, A.M.; Grebner, D.L. Economies of scale and forest management in Mississippi. In Proceedings of the 12th Biennial Southern Silvicultural Research Conference; Connor, K.F., Ed.; General Technical Report GTR-SRS-71, Southern Research Station; USDA Forest Service: Asheville, NC, USA, 2004; 594p. [Google Scholar]

- Wear, D.N.; Greis, J.G. Southern Forest Resource Assessment; General Technical Report, Southern Research Station-053; USDA Forest Service: Asheville, NC, USA, 2013; 635p.

- Bair, L.S.; Alig, R.J. Regional Cost Information for Private Timberland Conversion and Management; General Technical Report GTR-PNW-684, Pacific Northwest Research Station; USDA Forest Service: Portland, OR, USA, 2006; 26p.

- Hannah, M.J.; Leslie, T. Historical Perspective on the Relationship between Demand and Forest Productivity in the US South; Forest2market, Inc.: Charlotte, NC, USA, 2017. [Google Scholar]

- Mississippi Forestry Commission. 2009–2013 Forest Stewardship Program; Mississippi Forestry Commission: Jackson, MI, USA, 2008; p. 27.

- Pokharel, R.; Grala, R.K.; Grebner, D.L.; Cooke, W.H. Mill willingness to utilize logging residues to produce electricity: a spatial logistic regression approach. For. Sci. 2019, 65, 277–288. [Google Scholar] [CrossRef]

- Parajuli, R.; Tanger, S.; Henderson, J.E. Timber prices: Supply, Demand and Extenuating Circumstances. For. Landowner 2018, 78, 36–38. [Google Scholar]

- Callaghan, D.W.; Khanal, P.N.; Straka, T.J. An analysis of costs and cost trends for southern forestry practices. J. For. 2018, 117, 21–29. [Google Scholar] [CrossRef]

- Natural Resource Canada. The State of Canada’s Forests; Annual Report; Natural Resource Canada: Ottawa, ON, Canada, 2017.

- European Forest Institute. Best Practices of Fire Use-Prescribed Burning and Suppression Fire Programmes in Selected Case-Study Regions in Europe; European Forest Institute Research Report; European Forest Institute: Joensuu, Finland, 2010; 169p. [Google Scholar]

- Whiteman, A.; Wickramasinghe, A.; Pina, L. Global trends in forest ownership, public income and expenditure on forestry and forestry employment. For. Ecol. Manag. 2015, 352, 99–108. [Google Scholar] [CrossRef] [Green Version]

- Cubbage, F.W. Economics of Forest Tract Size: Theory and Literature; General Technical Report SO-GTR-41; USDA Forest Service: Asheville, NC, USA, 1983.

- Row, C. Economics of trace size and growing timber. J. For. 1978, 76, 576–582. [Google Scholar]

- Greene, W.D.; Harris, T.G., Jr.; DeForest, C.E.; Wang, J. Harvesting cost implications of changes in the size of timber sales in Georgia. South. J. Appl. For. 1997, 21, 193–198. [Google Scholar] [CrossRef]

- Cubbage, F.W.; Davis, J.W. Historical and regional stumpage price trends in Georgia. For. Prod. J. 1986, 36, 33–39. [Google Scholar]

- Straka, T.J.; Wisdom, H.W.; Moak, J.E. Size of forest holding and investment behavior of nonindustrial private owners. J. For. 1984, 82, 495–496. [Google Scholar] [CrossRef]

- Romm, J.; Tuazon, R.; Washburn, C. Relating forestry investment to the characteristics of nonindustrial private forestland owners in northern California. For. Sci. 1987, 33, 197–209. [Google Scholar] [CrossRef]

- Liu, S.T.; Geidenberger, C. Comparing Incentives to Increase Response Rates Among African Americans in the Ohio Pregnancy Risk Assessment Monitoring System. Matern. Child Health J. 2010, 15, 527–533. [Google Scholar] [CrossRef] [PubMed]

- Biemer, P.P.; Groves, R.M.; Lyberg, L.E.; Mathiowetz, N.A.; Sudman, S. Measurement Errors in Surveys; Wiley: New York, NY, USA, 1991. [Google Scholar]

- Fox, R.J.; Crask, M.R.; Kim, J. Mail survey response rate: A meta-analysis of selected techniques for inducing response. Pub. Opin. Quart. 1988, 52, 467–491. [Google Scholar] [CrossRef]

- Sinclair, M.; O’Toole, J.; Malawaraarachchi, M.; Karin, L. Comparison of response rates and cost-effectiveness for a community-based survey: postal, internet and telephone modes with generic or personalised recruitment approaches. BMC Med. Res. Methodol. 2012, 12, 132. [Google Scholar] [CrossRef] [PubMed]

- Vanderford, E.F.; Gordon, J.S.; Londo, A.J.; Munn, I.A. Using focus groups to assess educational programming needs in forestry. J. Ext. 2014, 52, 3EFA9. [Google Scholar]

| Demographic Characteristics | Survey Sample | National Woodland Owner Survey * |

|---|---|---|

| Age (mean years) | 68 | 65–74 years |

| Predominant gender | Male | Male |

| Income (mean per annum) | $60,000–$79,999 | $50,000–$99,999 |

| Education (majority) | Bachelor’s degree | Bachelor’s degree |

| Total land size (mean) | 157 acres | 100 acres–499 acres |

| Statistic | Forest Acres (1990s) | Forest Acres (2015) |

|---|---|---|

| Mean | 231 | 157 |

| Median | 80 | 75 |

| Minimum | 1 | 2 |

| Maximum | 44,617 | 2500 |

| Expense Category | 1995–1997 (Percent) (N = 1075) | 2015 (Percent) (N = 386) |

|---|---|---|

| Fees for Professional Services | 17.4 | 6.27 |

| Consulting forester | 6.9 | 2.5 |

| Attorney | 5.7 | 1.5 |

| Accountant | 8.4 | 1.8 |

| Surveyor | 4.9 | 2.5 |

| Timber Management Expenditures | 20.3 | 9.4 |

| Timber stand improvement | 3.6 | 1.1 |

| Prescribed burning | 3.4 | 2.8 |

| Site preparation | 5.6 | 6.2 |

| Planting | 12.1 | 4.1 |

| Other | 3.7 | 2.8 |

| Other Management Expenditures | 27.2 | 8.2 |

| Property line maintenance | 12.1 | 5.4 |

| Protection against fire, insects, or disease | 7.9 | 2.3 |

| Road construction and maintenance | 10.9 | 6.6 |

| Supervision and administration | 12.3 | 6.3 |

| Property Taxes | 73.0 | 68.9 |

| Mean Expenditure of the Entire Sample ($/ac.) | Mean Expenditures of Landowners Who Incurred Expenses ($/ac.) | |||

|---|---|---|---|---|

| 1990s | 2015 | 1990s | 2015 | |

| Fees for Professional Services | 2.89 | 1.30 | 16.05 | 21.55 |

| Range | 6.51–28.39 | |||

| Standard Error | 0.17 | 2.06 | ||

| Confidence Interval (95%) | 0.57 | 6.55 | ||

| Timber Management Expenditures | 5.71 | 2.83 | 24.11 | 246.32 |

| Range | 41.66–1235 | |||

| Standard Error | 0.28 | 16.69 | ||

| Confidence Interval (95%) | 0.88 | 53.13 | ||

| Other Management Expenditures | 1.91 | 1.18 | 9.39 | 19.50 |

| Range | 0.85–100.00 | |||

| Standard Error | 0.29 | 6.26 | ||

| Confidence Interval (95%) | 0.42 | 13.44 | ||

| Property Taxes | 3.41 | 4.02 | 3.86 | 6.49 |

| Range | 0.03–40.00 | |||

| Standard Error | 0.41 | 0.42 | ||

| 95% Confidence Interval (95%) | 0.81 | 0.83 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Godar Chhetri, S.; Gordon, J.; Munn, I.; Henderson, J. Comparison of the Timber Management Expenses of Non-Industrial Private Forest Landowners in Mississippi, United States: Results from 1995–1997 and 2015. Environments 2019, 6, 107. https://doi.org/10.3390/environments6090107

Godar Chhetri S, Gordon J, Munn I, Henderson J. Comparison of the Timber Management Expenses of Non-Industrial Private Forest Landowners in Mississippi, United States: Results from 1995–1997 and 2015. Environments. 2019; 6(9):107. https://doi.org/10.3390/environments6090107

Chicago/Turabian StyleGodar Chhetri, Sagar, Jason Gordon, Ian Munn, and James Henderson. 2019. "Comparison of the Timber Management Expenses of Non-Industrial Private Forest Landowners in Mississippi, United States: Results from 1995–1997 and 2015" Environments 6, no. 9: 107. https://doi.org/10.3390/environments6090107

APA StyleGodar Chhetri, S., Gordon, J., Munn, I., & Henderson, J. (2019). Comparison of the Timber Management Expenses of Non-Industrial Private Forest Landowners in Mississippi, United States: Results from 1995–1997 and 2015. Environments, 6(9), 107. https://doi.org/10.3390/environments6090107