Decarbonizing the Skies: Evolution of EU Air Transport Efficiency and Carbon Emissions

Abstract

1. Introduction

2. Methodology

- NAT: the origin and destination airports are in the same country;

- EUR: the origin and destination airports are in different countries, but both belong to the EU;

- INT: the origin airport is in the EU, but the destination is not.

Methodological Limitations

3. Results

3.1. At Country Level

3.1.1. Traffic Structure

3.1.2. Fuel Uptake and CO2 Emissions

3.1.3. Airport Network Structure

3.2. Results at Airline Level

- TRAD: full-service carriers with a hub-and-spoke network, typically operating long-haul operations.

- LCCs: point-to-point carriers, with very limited use of interlining and often operating secondary airports.

3.2.1. Traffic Structure

3.2.2. Fuel Uptake and Efficiency

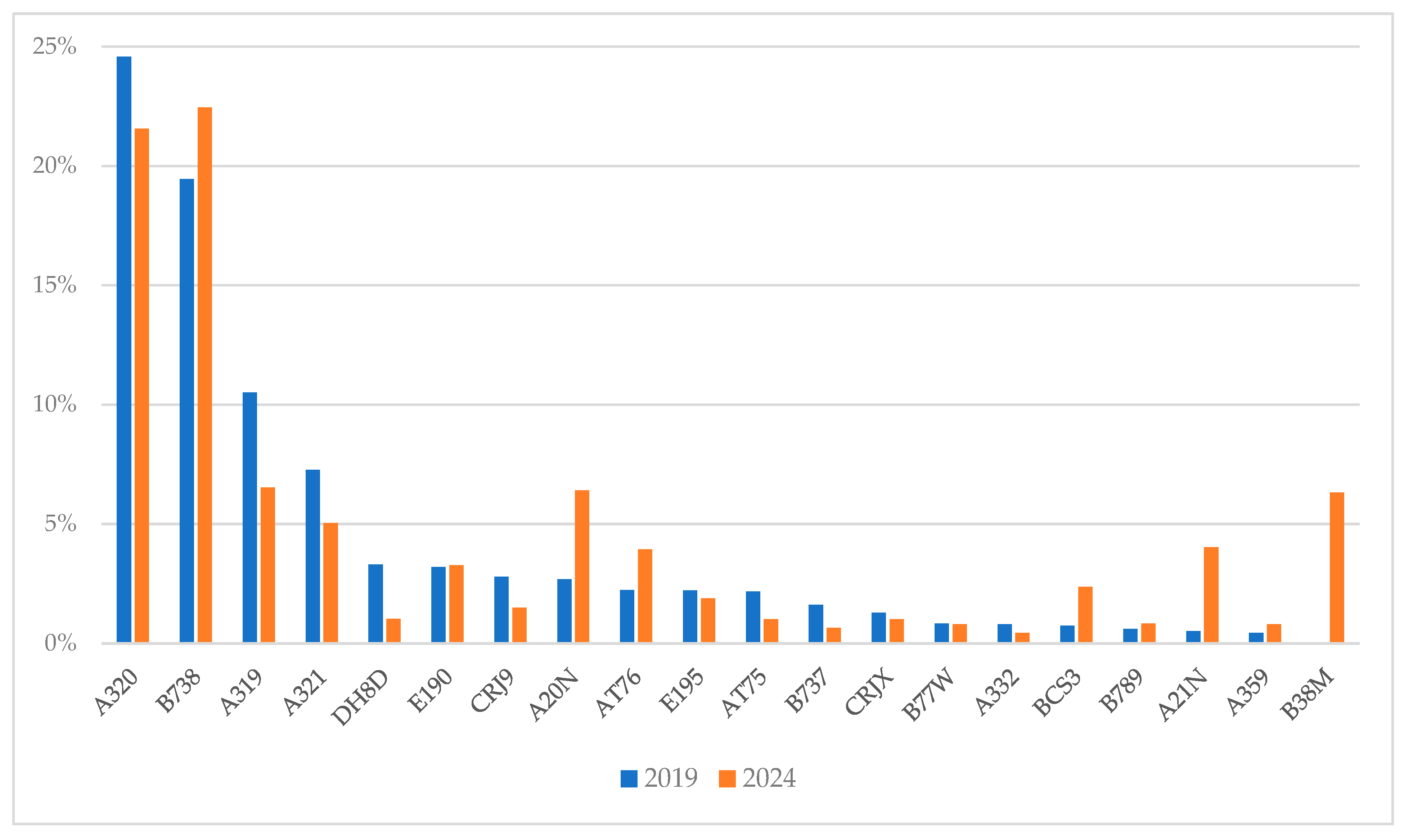

3.2.3. Fleet Structure

4. Discussion

4.1. Changes in the Period 2019–2024

4.2. Policy Implications

4.2.1. CORSIA and EU ETS

- NAT: EU ETS;

- EUR: both CORSIA and EU ETS;

- INT: CORSIA and part of EU ETS.

4.2.2. RefuelEU

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Supporting Data

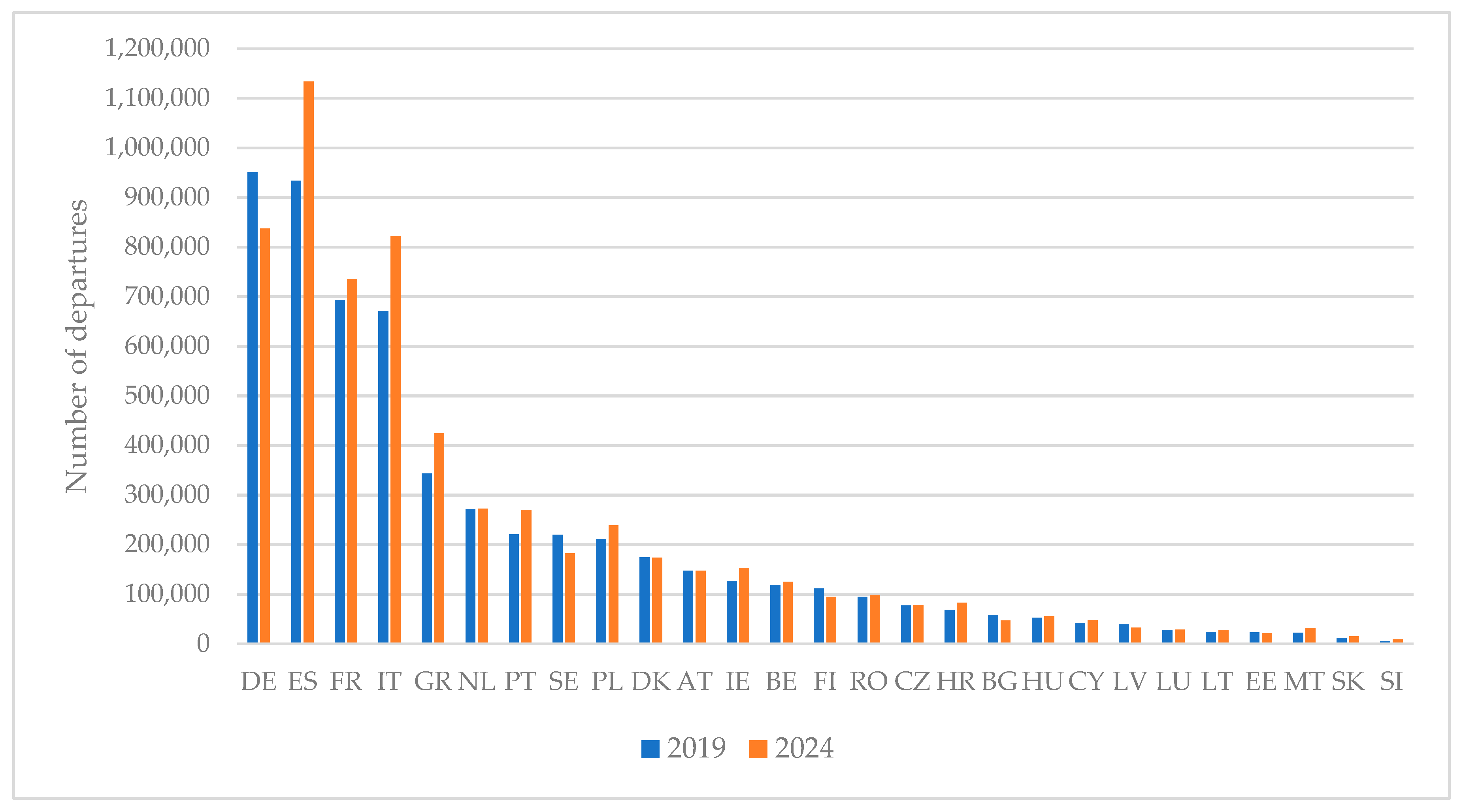

| Country | Number of Departures | % of Flights | |||||

|---|---|---|---|---|---|---|---|

| Name | Code | 2019 | 2024 | Var. (%) | 2019 | 2024 | Var. (%) |

| Austria | AT | 147,264 | 147,108 | −0.11 | 2.57 | 2.38 | −7.32 |

| Belgium | BE | 119,028 | 124,904 | 4.94 | 2.07 | 2.02 | −2.64 |

| Bulgaria | BG | 57,928 | 47,320 | −18.31 | 1.01 | 0.77 | −24.21 |

| Cyprus | CY | 42,328 | 47,892 | 13.14 | 0.74 | 0.77 | 4.97 |

| Czechia | CZ | 77,220 | 77,896 | 0.88 | 1.35 | 1.26 | −6.41 |

| Germany | DE | 949,936 | 837,252 | −11.86 | 16.55 | 13.54 | −18.23 |

| Denmark | DK | 174,408 | 173,680 | −0.42 | 3.04 | 2.81 | −7.61 |

| Estonia | EE | 22,984 | 21,320 | −7.24 | 0.40 | 0.34 | −13.94 |

| Spain | ES | 933,244 | 1,133,184 | 21.42 | 16.26 | 18.32 | 12.65 |

| Finland | FI | 111,852 | 94,952 | −15.11 | 1.95 | 1.54 | −21.24 |

| France | FR | 692,952 | 734,916 | 6.06 | 12.08 | 11.88 | −1.61 |

| Greece | GR | 343,200 | 424,736 | 23.76 | 5.98 | 6.87 | 14.82 |

| Croatia | HR | 68,640 | 82,836 | 20.68 | 1.20 | 1.34 | 11.96 |

| Hungary | HU | 53,040 | 55,952 | 5.49 | 0.92 | 0.90 | −2.13 |

| Ireland | IE | 126,152 | 152,412 | 20.82 | 2.20 | 2.46 | 12.09 |

| Italy | IT | 670,332 | 821,288 | 22.52 | 11.68 | 13.28 | 13.67 |

| Lithuania | LT | 24,232 | 28,028 | 15.67 | 0.42 | 0.45 | 7.31 |

| Luxembourg | LU | 27,664 | 28,548 | 3.20 | 0.48 | 0.46 | −4.26 |

| Latvia | LV | 39,468 | 32,448 | −17.79 | 0.69 | 0.52 | −23.73 |

| Malta | MT | 22,516 | 32,292 | 43.42 | 0.39 | 0.52 | 33.06 |

| Netherlands | NL | 271,388 | 272,532 | 0.42 | 4.73 | 4.41 | −6.83 |

| Poland | PL | 210,548 | 238,628 | 13.34 | 3.67 | 3.86 | 5.15 |

| Portugal | PT | 220,220 | 270,244 | 22.72 | 3.84 | 4.37 | 13.85 |

| Romania | RO | 94,848 | 98,592 | 3.95 | 1.65 | 1.59 | −3.56 |

| Sweden | SE | 219,856 | 182,416 | −17.03 | 3.83 | 2.95 | −23.02 |

| Slovenia | SI | 5200 | 8528 | 64.00 | 0.09 | 0.14 | 52.15 |

| Slovakia | SK | 11,856 | 15,184 | 28.07 | 0.21 | 0.25 | 18.82 |

| Total | 5,738,304 | 6,185,088 | 7.40 | ||||

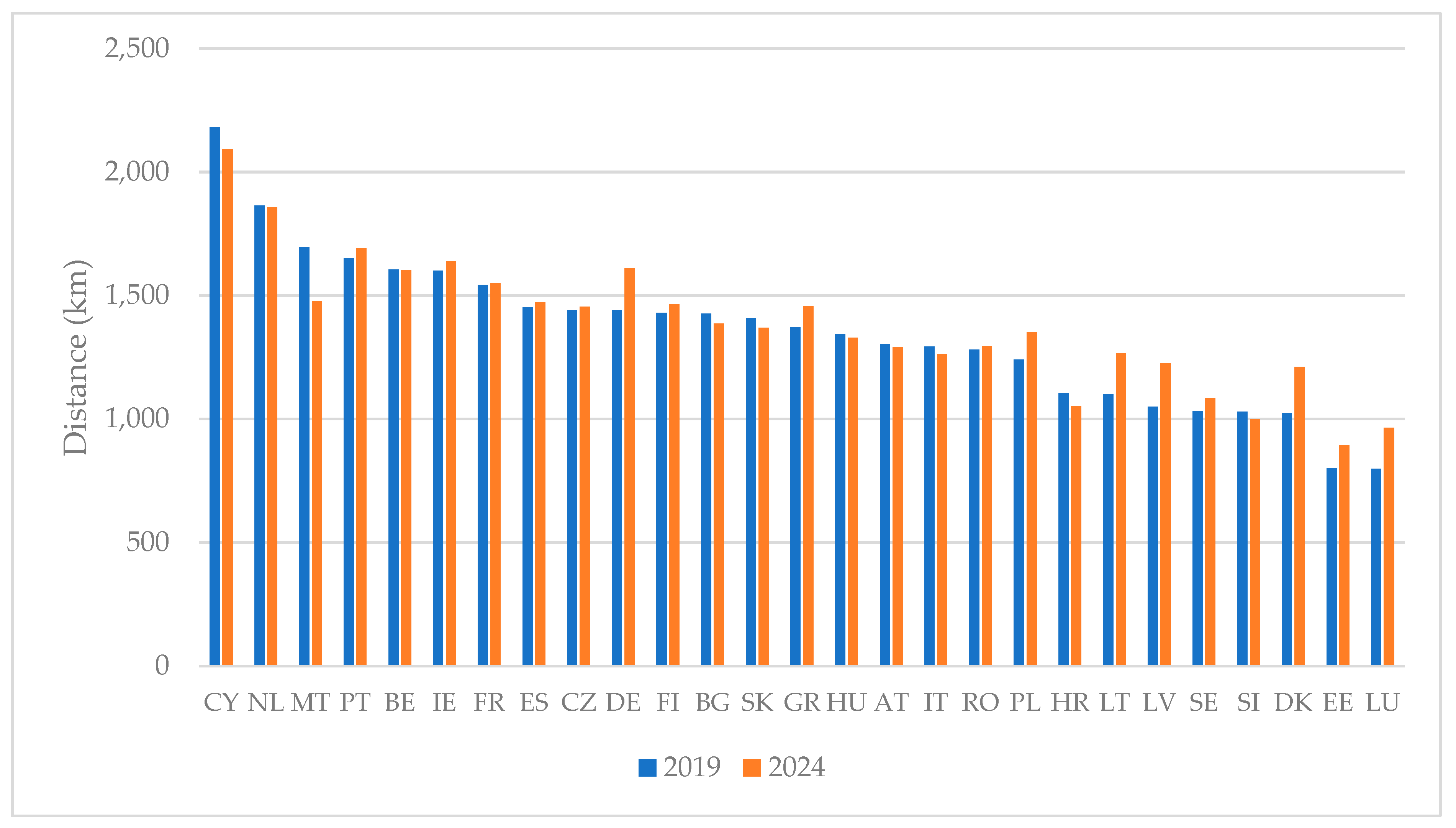

| Country Code | Average Distance (km) | Type of Flight | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2024 | ||||||||

| 2019 | 2024 | Variation (%) | EUR | INT | NAT | EUR | INT | NAT | |

| AT | 1302 | 1292 | −0.75 | 63.38 | 31.43 | 5.19 | 68.22 | 28.63 | 3.15 |

| BE | 1605 | 1602 | −0.19 | 68.28 | 31.50 | 0.22 | 71.61 | 28.31 | 0.08 |

| BG | 1427 | 1386 | −2.87 | 58.80 | 34.20 | 7.00 | 67.03 | 28.13 | 4.84 |

| CY | 2183 | 2093 | −4.12 | 34.52 | 65.48 | 0.00 | 46.91 | 52.66 | 0.43 |

| CZ | 1441 | 1454 | 0.95 | 60.81 | 37.91 | 1.28 | 61.68 | 37.18 | 1.13 |

| DE | 1441 | 1611 | 11.77 | 46.74 | 29.75 | 23.51 | 52.88 | 31.53 | 15.58 |

| DK | 1023 | 1211 | 18.41 | 48.30 | 27.28 | 24.42 | 53.98 | 28.29 | 17.72 |

| EE | 800 | 893 | 11.69 | 72.40 | 14.93 | 12.67 | 74.39 | 13.90 | 11.71 |

| ES | 1452 | 1474 | 1.49 | 34.99 | 26.47 | 38.54 | 37.36 | 24.78 | 37.86 |

| FI | 1430 | 1464 | 2.36 | 45.75 | 21.34 | 32.91 | 58.54 | 16.27 | 25.19 |

| FR | 1543 | 1550 | 0.41 | 39.42 | 30.20 | 30.38 | 41.00 | 32.35 | 26.65 |

| GR | 1373 | 1457 | 6.16 | 39.30 | 24.27 | 36.42 | 43.25 | 24.00 | 32.75 |

| HR | 1106 | 1052 | −4.86 | 55.53 | 30.76 | 13.71 | 62.90 | 24.98 | 12.12 |

| HU | 1345 | 1329 | −1.19 | 60.88 | 38.73 | 0.39 | 66.26 | 33.55 | 0.19 |

| IE | 1600 | 1640 | 2.47 | 45.63 | 51.85 | 2.51 | 50.05 | 48.14 | 1.81 |

| IT | 1293 | 1262 | −2.40 | 41.37 | 23.85 | 34.78 | 44.49 | 21.25 | 34.26 |

| LT | 1101 | 1266 | 15.02 | 64.81 | 35.19 | 0.00 | 74.03 | 25.97 | 0.00 |

| LU | 799 | 964 | 20.68 | 80.08 | 19.92 | 0.00 | 79.05 | 20.95 | 0.00 |

| LV | 1050 | 1227 | 16.78 | 62.06 | 36.63 | 1.32 | 76.44 | 23.56 | 0.00 |

| MT | 1695 | 1478 | −12.81 | 63.05 | 36.95 | 0.00 | 73.27 | 26.73 | 0.00 |

| NL | 1865 | 1858 | −0.38 | 56.66 | 43.09 | 0.25 | 60.01 | 39.53 | 0.46 |

| PL | 1241 | 1353 | 9.02 | 52.36 | 33.19 | 14.45 | 56.29 | 32.34 | 11.38 |

| PT | 1651 | 1691 | 2.39 | 45.17 | 28.45 | 26.38 | 45.06 | 28.59 | 26.34 |

| RO | 1281 | 1295 | 1.10 | 55.04 | 27.74 | 17.21 | 57.91 | 28.53 | 13.55 |

| SE | 1032 | 1085 | 5.11 | 39.59 | 16.32 | 44.09 | 46.86 | 15.79 | 37.34 |

| SI | 1029 | 998 | −3.01 | 44.00 | 56.00 | 0.00 | 55.49 | 44.51 | 0.00 |

| SK | 1408 | 1369 | −2.77 | 46.93 | 52.19 | 0.88 | 51.71 | 47.60 | 0.68 |

| Total | 1418 | 1464 | 3.02 | 45.19 | 29.32 | 25.49 | 48.60 | 28.20 | 23.20 |

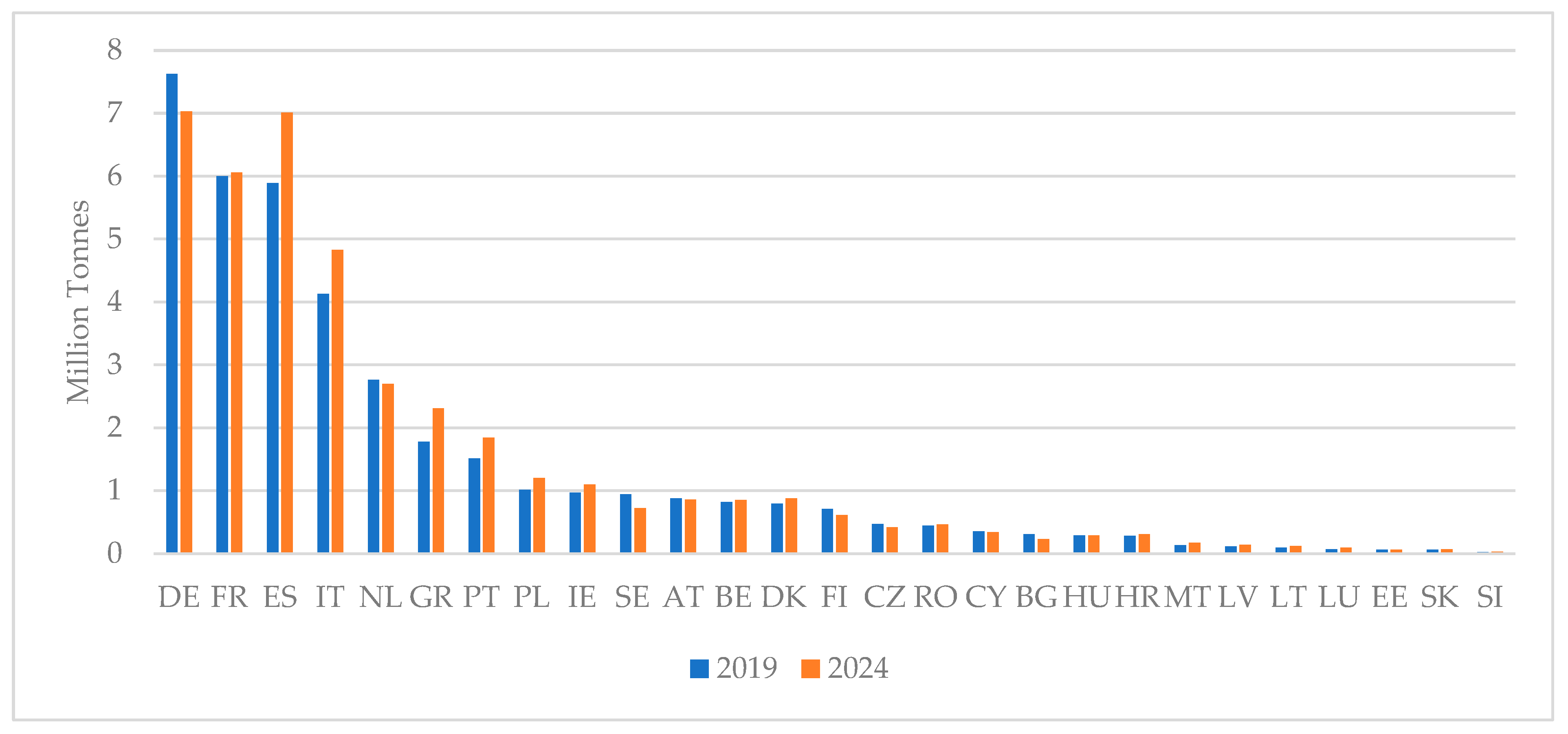

| Country Code | Fuel Uptake (Million Tonnes) | % of Total Uptake | Fuel Uptake per Type of Flight | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2024 | |||||||||||

| 2019 | 2024 | Var (%) | 2019 | 2024 | Var. | EUR | INT | NAT | EUR | INT | NAT | |

| AT | 0.88 | 0.86 | −2.25 | 2.28 | 2.11 | −0.17 | 34.73 | 64.42 | 0.85 | 41.89 | 57.54 | 0.57 |

| BE | 0.82 | 0.85 | 3.30 | 2.14 | 2.09 | −0.05 | 40.84 | 59.12 | 0.04 | 45.07 | 54.92 | 0.01 |

| BG | 0.31 | 0.23 | −24.35 | 0.80 | 0.57 | −0.23 | 55.27 | 42.23 | 2.49 | 62.78 | 35.45 | 1.76 |

| CY | 0.35 | 0.34 | −3.50 | 0.92 | 0.84 | −0.08 | 28.81 | 71.19 | 0.00 | 43.14 | 56.78 | 0.08 |

| CZ | 0.47 | 0.42 | −11.67 | 1.23 | 1.03 | −0.20 | 37.71 | 61.95 | 0.34 | 47.35 | 52.33 | 0.32 |

| DE | 7.62 | 7.03 | −7.77 | 19.80 | 17.25 | −2.55 | 23.08 | 70.70 | 6.22 | 26.38 | 69.71 | 3.90 |

| DK | 0.79 | 0.88 | 10.37 | 2.06 | 2.15 | 0.09 | 39.59 | 53.86 | 6.54 | 41.94 | 53.25 | 4.81 |

| EE | 0.06 | 0.06 | 13.69 | 0.15 | 0.16 | 0.01 | 64.40 | 34.66 | 0.94 | 69.46 | 29.16 | 1.38 |

| ES | 5.89 | 7.01 | 19.10 | 15.29 | 17.21 | 1.92 | 30.05 | 55.99 | 13.97 | 31.70 | 53.63 | 14.67 |

| FI | 0.71 | 0.61 | −13.11 | 1.83 | 1.50 | −0.33 | 33.56 | 59.36 | 7.08 | 41.96 | 52.43 | 5.61 |

| FR | 6.00 | 6.06 | 1.01 | 15.59 | 14.87 | −0.72 | 17.94 | 72.92 | 9.14 | 19.31 | 72.97 | 7.71 |

| GR | 1.78 | 2.31 | 30.02 | 4.62 | 5.68 | 1.06 | 48.02 | 44.03 | 7.95 | 47.52 | 45.28 | 7.20 |

| HR | 0.28 | 0.31 | 9.86 | 0.74 | 0.77 | 0.03 | 47.71 | 48.84 | 3.45 | 61.39 | 34.87 | 3.74 |

| HU | 0.29 | 0.29 | −0.47 | 0.76 | 0.71 | −0.05 | 43.08 | 56.80 | 0.11 | 50.95 | 49.00 | 0.05 |

| IE | 0.97 | 1.10 | 12.93 | 2.53 | 2.70 | 0.17 | 32.60 | 67.20 | 0.20 | 38.03 | 61.66 | 0.32 |

| IT | 4.13 | 4.83 | 16.97 | 10.72 | 11.85 | 1.13 | 26.51 | 58.13 | 15.36 | 30.09 | 53.98 | 15.92 |

| LT | 0.09 | 0.12 | 30.19 | 0.24 | 0.30 | 0.06 | 53.56 | 46.44 | 0.00 | 65.07 | 34.93 | 0.00 |

| LU | 0.07 | 0.09 | 32.90 | 0.17 | 0.22 | 0.05 | 81.88 | 18.12 | 0.00 | 76.50 | 23.50 | 0.00 |

| LV | 0.11 | 0.14 | 25.16 | 0.28 | 0.33 | 0.05 | 51.54 | 48.22 | 0.24 | 67.79 | 32.21 | 0.00 |

| MT | 0.13 | 0.17 | 22.42 | 0.35 | 0.41 | 0.06 | 58.03 | 41.97 | 0.00 | 67.57 | 32.43 | 0.00 |

| NL | 2.76 | 2.70 | −2.18 | 7.18 | 6.63 | −0.55 | 23.02 | 76.96 | 0.03 | 24.57 | 75.36 | 0.07 |

| PL | 1.01 | 1.20 | 19.76 | 2.61 | 2.95 | 0.34 | 42.52 | 54.70 | 2.77 | 46.54 | 50.34 | 3.12 |

| PT | 1.51 | 1.84 | 21.64 | 3.93 | 4.52 | 0.59 | 35.67 | 55.47 | 8.86 | 35.04 | 55.92 | 9.04 |

| RO | 0.44 | 0.46 | 5.71 | 1.13 | 1.13 | 0,00 | 57.69 | 37.68 | 4.63 | 60.68 | 35.68 | 3.64 |

| SE | 0.94 | 0.72 | −22.87 | 2.43 | 1.77 | −0.66 | 41.66 | 42.03 | 16.32 | 53.17 | 33.38 | 13.44 |

| SI | 0.02 | 0.03 | 51.81 | 0.05 | 0.07 | 0.02 | 36.52 | 63.48 | 0.00 | 49.53 | 50.47 | 0.00 |

| SK | 0.06 | 0.07 | 19.29 | 0.16 | 0.18 | 0.02 | 38.78 | 60.85 | 0.36 | 43.62 | 56.11 | 0.27 |

| Total | 38.49 | 40.74 | 5.86 | 29.42 | 62.56 | 8.02 | 32.87 | 59.45 | 7.68 | |||

| ISO Code | 2019 | 2024 | ||||||

|---|---|---|---|---|---|---|---|---|

| Average CO2 (kg)/RPK | Average CO2 (kg)/RPK | Average CO2 (kg)/RPK | Average CO2 (kg)/RPK | |||||

| EUR | INT | NAT | EUR | INT | NAT | |||

| AT | 0.111 | 0.113 | 0.095 | 0.176 | 0.098 | 0.097 | 0.086 | 0.214 |

| BE | 0.103 | 0.103 | 0.103 | 0.429 | 0.093 | 0.093 | 0.090 | 0.643 |

| BG | 0.093 | 0.082 | 0.086 | 0.209 | 0.084 | 0.079 | 0.085 | 0.158 |

| CY | 0.086 | 0.081 | 0.089 | 0.077 | 0.070 | 0.083 | 0.270 | |

| CZ | 0.091 | 0.094 | 0.082 | 0.239 | 0.087 | 0.091 | 0.075 | 0.227 |

| DE | 0.120 | 0.107 | 0.101 | 0.172 | 0.101 | 0.093 | 0.088 | 0.152 |

| DK | 0.144 | 0.113 | 0.107 | 0.246 | 0.113 | 0.095 | 0.093 | 0.201 |

| EE | 0.160 | 0.151 | 0.113 | 0.266 | 0.159 | 0.164 | 0.078 | 0.219 |

| ES | 0.104 | 0.079 | 0.076 | 0.147 | 0.092 | 0.071 | 0.071 | 0.126 |

| FI | 0.130 | 0.114 | 0.103 | 0.170 | 0.115 | 0.112 | 0.088 | 0.138 |

| FR | 0.106 | 0.098 | 0.093 | 0.130 | 0.101 | 0.091 | 0.092 | 0.130 |

| GR | 0.116 | 0.076 | 0.078 | 0.184 | 0.104 | 0.071 | 0.071 | 0.170 |

| HR | 0.102 | 0.096 | 0.088 | 0.156 | 0.107 | 0.092 | 0.091 | 0.212 |

| HU | 0.092 | 0.095 | 0.084 | 0.208 | 0.081 | 0.084 | 0.075 | 0.139 |

| IE | 0.095 | 0.076 | 0.108 | 0.173 | 0.088 | 0.069 | 0.104 | 0.202 |

| IT | 0.107 | 0.096 | 0.090 | 0.131 | 0.091 | 0.085 | 0.085 | 0.104 |

| LT | 0.116 | 0.123 | 0.103 | 0.099 | 0.110 | 0.070 | ||

| LU | 0.134 | 0.137 | 0.120 | 0.097 | 0.098 | 0.096 | ||

| LV | 0.094 | 0.094 | 0.093 | 0.155 | 0.104 | 0.112 | 0.078 | |

| MT | 0.081 | 0.086 | 0.073 | 0.075 | 0.079 | 0.063 | ||

| NL | 0.108 | 0.104 | 0.110 | 0.400 | 0.102 | 0.097 | 0.106 | 0.435 |

| PL | 0.098 | 0.096 | 0.082 | 0.141 | 0.096 | 0.087 | 0.072 | 0.213 |

| PT | 0.117 | 0.082 | 0.080 | 0.217 | 0.106 | 0.075 | 0.075 | 0.192 |

| RO | 0.101 | 0.085 | 0.088 | 0.172 | 0.088 | 0.076 | 0.084 | 0.143 |

| SE | 0.129 | 0.101 | 0.098 | 0.166 | 0.111 | 0.093 | 0.093 | 0.140 |

| SI | 0.122 | 0.141 | 0.106 | 0.106 | 0.112 | 0.099 | ||

| SK | 0.089 | 0.103 | 0.076 | 0.189 | 0.083 | 0.096 | 0.068 | 0.137 |

| Total | 0.111 | 0.097 | 0.092 | 0.157 | 0.098 | 0.086 | 0.084 | 0.138 |

References

- Lee, D.S.; Fahey, D.W.; Skowron, A.; Allen, M.R.; Burkhardt, U.; Chen, Q.; Doherty, S.J.; Freeman, S.; Forster, P.M.; Fuglestvedt, J.; et al. The contribution of global aviation to anthropogenic climate forcing for 2000 to 2018. Atmos. Environ. 2021, 244, 117834. [Google Scholar] [CrossRef]

- Tait, K.N.; Khan, M.A.H.; Bullock, S.; Lowenberg, M.H.; Shallcross, D.E. Aircraft Emissions, Their Plume-Scale Effects, and the Spatio-Temporal Sensitivity of the Atmospheric Response: A Review. Aerospace 2022, 9, 355. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2022: Mitigation of Climate Change. Available online: https://www.ipcc.ch/report/ar6/wg3/ (accessed on 3 August 2025).

- Klöwer, M.; Allen, M.R.; Lee, D.S.; Proud, S.R.; Gallagher, L.; Skowron, A. Quantifying aviation’s contribution to global warming. Environ. Res. Lett. 2021, 16, 104027. [Google Scholar] [CrossRef]

- EUROCONTROL. Aviation Outlook 2050. Available online: https://www.eurocontrol.int/sites/default/files/2022-04/eurocontrol-aviation-outlook-2050-main-report.pdf (accessed on 3 August 2025).

- European Commission. Reducing Emissions from Aviation. Available online: https://climate.ec.europa.eu/eu-action/transport-decarbonisation/reducing-emissions-aviation_en#aviation-in-the-eu-emissions-trading-system (accessed on 3 August 2025).

- Hasan, A.; Al Mamun, A.; Rahman, S.M.; Malik, K.; Al Amran, I.U.; Khondaker, A.N.; Reshi, O.; Tiwari, S.P.; Alismail, F.S. Climate Change Mitigation Pathways for the Aviation Sector. Sustainability 2021, 13, 3656. [Google Scholar] [CrossRef]

- Lai, Y.; Christley, E.; Kulanovic, A.; Teng, C.; Björklund, A.; Nordensvärd, J.; Karakaya, E.; Urban, F. Analysing the opportunities and challenges for mitigating the climate impact of aviation: A narrative review. Renew. Sustain. Energy Rev. 2022, 156, 111972. [Google Scholar] [CrossRef]

- Rosskopf, M.; Lehner, S.; Gollnick, V. Economic–environmental trade-offs in long-term airline fleet planning. J. Air Transp. Manag. 2014, 34, 109–115. [Google Scholar] [CrossRef]

- Schäfer, A.W.; Evans, A.D.; Reynolds, T.G.; Dray, L. Costs of mitigating CO2 emissions from passenger aircraft. Nat. Clim. Change 2015, 6, 412–417. [Google Scholar] [CrossRef]

- IEA. Aviation Tracking. Available online: https://www.iea.org/energy-system/transport/aviation#tracking (accessed on 3 August 2025).

- Gössling, S.; Lyle, C. Transition policies for climatically sustainable aviation. Transp. Rev. 2021, 41, 643–658. [Google Scholar] [CrossRef]

- Larsson, J.; Elofsson, A.; Sterner, T.; Åkerman, J. International and national climate policies for aviation: A review. Clim. Policy 2019, 19, 787–799. [Google Scholar] [CrossRef]

- Mathys, F.; Wild, P.; Wang, J. CO2 Reduction Measures in the Aviation Industry: Current Measures and Outlook. Int. J. Aviat. Aeronaut. Aerosp. 2021, 8, 6. [Google Scholar] [CrossRef]

- ICAO. 37th Assembly Resolutions in Force (As of 8 October 2010) (No. Doc 9958). Available online: https://www2023.icao.int/Meetings/AMC/Assembly37/Pages/Reference-Documents.aspx (accessed on 3 August 2025).

- ICAO. Resolution A39-3: Consolidated Statement of Continuing ICAO Policies and Practices Related to Environmental Protection—Global Market-Based Measure (MBM) Scheme. Available online: https://www.icao.int/sites/default/files/sp-files/Meetings/a39/Documents/Resolutions/a39_res_prov_en.pdf (accessed on 3 August 2025).

- European Parliament. Directive 2008/101/EC of the European Parliament and of the Council of 19 November 2008 Amending Directive 2003/87/EC so as to Include Aviation Activities in the Scheme for Greenhouse Gas Emission Allowance Trading Within the Community. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32008L0101&from=EN (accessed on 3 August 2025).

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on Ensuring a Leve Playing Field for Sustainable Air Transport. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021PC0561&from=EN (accessed on 3 August 2025).

- European Commission. The European Green Deal. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 3 August 2025).

- European Commission. Delivering the European Green Deal. On the Path to a Climate-Neutral Europe by 2050. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en (accessed on 3 August 2025).

- European Commission. Fit for 55: Delivering on the Proposals. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal/fit-55-delivering-proposals_en (accessed on 3 August 2025).

- ICAO. Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis. Available online: https://www2023.icao.int/sustainability/Documents/Covid-19/ICAO_coronavirus_Econ_Impact.pdf (accessed on 3 August 2025).

- Dube, K. Emerging from the COVID-19 Pandemic: Aviation Recovery, Challenges and Opportunities. Aerospace 2022, 10, 19. [Google Scholar] [CrossRef]

- Alonso, G.; Benito, A.; Lonza, L.; Kousoulidou, M. Investigations on the Distribution of Air Transport Traffic and CO2 Emissions Within the European Union. J. Air Transp. Manag. 2014, 36, 85–93. [Google Scholar] [CrossRef]

- Amizadeh, F.; Alonso, G.; Benito, A.; Morales-Alonso, G. Analysis of the recent evolution of commercial air traffic CO2 emissions and fleet utilization in the six largest national markets of the European Union. J. Air Transp. Manag. 2016, 55, 9–19. [Google Scholar] [CrossRef]

- Noh, H.M.; Benito, A.; Alonso, G. Study of the current incentive rules and mechanisms to promote biofuel use in the EU and their possible application to the civil aviation sector. Transp. Res. Part D 2016, 46, 298–316. [Google Scholar] [CrossRef]

- EUROCONTROL. Demand Data Repository. Available online: https://www.eurocontrol.int/ddr (accessed on 22 June 2025).

- EEA. 1.A.3.a Aviation-Annex 1—Master Emisisons Calculator—2023—Protected_v1.3. Available online: https://www.eea.europa.eu/publications/emep-eea-guidebook-2023/part-b-sectoral-guidance-chapters/1-energy/1-a-combustion/1-a-3-a-aviation.3/view (accessed on 3 August 2025).

- EUROSTAT. Air Transport. Available online: https://ec.europa.eu/eurostat/web/transport/information-data/air-transport (accessed on 22 June 2025).

- Garrow, L.A. Discrete Choice Modelling and Air Travel Demand: Theory and Applications; Routledge: London, UK, 2016. [Google Scholar]

- European Parliament. Regulation (EU) 2023/2405 of the European Parliament and of the Council of 18 October 2023 on en-Suring a Level Playing Field for Sustainable Air Transport (ReFuelEU Aviation). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A02023R2405-20231031 (accessed on 25 May 2025).

- Lufthansa Group. Annual Report 2024. Available online: https://investor-relations.lufthansagroup.com/fileadmin/downloads/en/financial-reports/annual-reports/LH-AR-2024-e.pdf (accessed on 30 March 2025).

- RYANAIR Group. Annual Report 2025. Available online: https://investor.ryanair.com/wp-content/uploads/2025/05/Ryanair-2025-Annual-Report.pdf (accessed on 22 June 2025).

- EEA. 1.A.3.a Aviation 2023—Guidebook. Available online: https://www.eea.europa.eu/publications/emep-eea-guidebook-2023/part-b-sectoral-guidance-chapters/1-energy/1-a-combustion/1-a-3-a-aviation-2023/view (accessed on 27 August 2025).

- EUROSTAT. Reference Metadata. Air Transport Measurement—Passengers and Freight (avia_pa, avia_go). Available online: https://ec.europa.eu/eurostat/cache/metadata/en/avia_pa_esms.htm#stat_presDisseminated (accessed on 27 August 2025).

- EUROSTAT. Reference Manual on Air Transport Statistics. Available online: https://ec.europa.eu/eurostat/documents/29567/3217334/Aviation_+Manual_V16_07_2023.pdf/bd2843bd-8aaf-55f7-003d-2974ba992e68?t=1690443837837 (accessed on 27 August 2025).

- EUROSTAT. European Statistical System Handbook for Quality and Metadata Reports. Available online: https://ec.europa.eu/eurostat/documents/3859598/10501168/KS-GQ-19-006-EN-N.pdf (accessed on 2 September 2025).

- Council of the European Union. Council Regulation (EU) No 833/2014 of 31 July 2014 Concerning Restrictive Measures in View of Russia’s Actions Destabilising the Situation in Ukraine. Available online: https://eur-lex.europa.eu/eli/reg/2014/833/oj (accessed on 28 August 2025).

- Chiambaretto, P.; Mayenc, E.; Chappert, H.; Engsig, J.; Fernandez, A.-S.; Le Roy, F. Where does flygskam come from? The role of citizens’ lack of knowledge of the environmental impact of air transport in explaining the development of flight shame. J. Air Transp. Manag. 2021, 93, 102049. [Google Scholar] [CrossRef]

- Gössling, S.; Hanna, P.; Higham, J.; Cohen, S.; Hopkins, D. Can we fly less? Evaluating the ‘necessity’ of air travel. J. Air Transp. Manag. 2019, 81, 101722. [Google Scholar] [CrossRef]

- ICAO. 2022 Environmental Report. Innovation for a Green Transition. Available online: https://www.icao.int/sites/default/files/sp-files/environmental-protection/Documents/EnvironmentReport-2010/ICAO-ENV-Report-2022-F4.pdf (accessed on 26 August 2025).

- EUROCONTROL. European Aviation Overview 2024. Available online: https://www.eurocontrol.int/sites/default/files/2025-01/eurocontrol-european-aviation-overview-20250123-2024-review.pdf (accessed on 22 April 2025).

- IATA. German Aviation Policy. Available online: https://www.iata.org/contentassets/93bf461742084e8f9e0e378b9eb49483/brief-de-aviation-policy-en.pdf (accessed on 22 April 2025).

- IATA. French Domestic Flight Bans and Carbon Emissions Reductions. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/french-domestic-flight-bans-and-carbon-emissions-reductions/ (accessed on 5 September 2025).

- ICAO. Trends in Emissions that Affect Climate Change. Available online: https://www.icao.int/environmental-protection/Pages/ClimateChange_Trends.aspx (accessed on 3 August 2025).

- IATA. Net Zero Carbon 2050 Resolution. Available online: https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet----iata-net-zero-resolution/ (accessed on 3 August 2025).

- European Parliament. Directive (EU) 2023/958 of the European Parliament and of the Council of 10 May 2023 Amending Directive 2003/87/EC as Regards Aviation’s Contribution to the Union’s Economy-Wide Emission Reduction Target and the Ap-propriate Implementation of a Global Market-Based Measure. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023L0958 (accessed on 3 August 2025).

- IATA. Unveiling the Biggest Airline Costs. Available online: https://www.iata.org/en/publications/newsletters/iata-knowledge-hub/unveiling-the-biggest-airline-costs/ (accessed on 3 August 2025).

- Braun, M.; Grimme, W.; Oesingmann, K. Pathway to net zero: Reviewing sustainable aviation fuels, environmental impacts and pricing. J. Air Transp. Manag. 2024, 117, 102580. [Google Scholar] [CrossRef]

- EASA. State of the EU SAF Market in Fuel Reference Prices, SAF Capacity Assessments. Available online: https://www.easa.europa.eu/en/downloads/140675/en (accessed on 27 May 2025).

- Watson, M.; Machado, P.; da Silva, A.; Saltar, Y.; Ribeiro, C.; Nascimento, C.; Dowling, A. Sustainable aviation fuel technologies, costs, emissions, policies, and markets: A critical review. J. Clean. Prod. 2024, 449, 141472. [Google Scholar] [CrossRef]

- IATA. Chart of the Week. Slow Aircraft Deliveries Delay Renewal Benefits to Airlines. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/slow-aircraft-deliveries-delay-renewal-benefits-to-airlines/ (accessed on 13 May 2025).

- FAA. Updates on Boeing 737-9 MAX Aircraft. Available online: https://www.faa.gov/newsroom/updates-boeing-737-9-max-aircraft (accessed on 5 September 2025).

- IATA. Global Outlook for Air Transport. Protectionism on the Rise. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport-june-2025/ (accessed on 28 August 2025).

- Boeing. 737 MAX. Available online: https://www.boeing.com/commercial/737max#orders-deliveries (accessed on 28 August 2025).

- Airbus. A320neo. Creating Higher Customer Value. Available online: https://aircraft.airbus.com/en/newsroom/case-study/2024-10-a320neo-creating-higher-customer-value#:~:text=Superior%20by%20design,perfect%20example%20of%20this%20commitment (accessed on 28 August 2025).

- Scheelhaase, J.; Müller, L.; Ennen, D.; Grimme, W. Economic and Environmental Aspects of Aircraft Recycling. Transp. Res. Procedia 2022, 65, 3–12. [Google Scholar] [CrossRef]

- Habib, A.; Subeshan, B.; Kalyanakumar, C.; Asmatulu, R.; Rahman, M.M.; Asmatulu, E. Current Practices in Recycling and Reusing of Aircraft Materials and Equipment. Mater. Circ. Econ. 2025, 7, 12. [Google Scholar] [CrossRef]

- Yakovlieva, A.; Boichenko, S.; Kale, U.; Nagy, A. Holistic approaches and advanced technologies in aviation product recycling. Aircr. Eng. Aerosp. Technol. 2021, 93, 1302–1312. [Google Scholar] [CrossRef]

- ICAO. Report on the Feasibility of a Long-Term Aspirational Goal (LTAG) for International Civil Aviation CO2 Emission Reduc-tions. Available online: https://www2023.icao.int/environmental-protection/LTAG/Documents/REPORT%20ON%20THE%20FEASIBILITY%20OF%20A%20LONG-TERM%20ASPIRATIONAL%20GOAL_en.pdf (accessed on 3 August 2025).

- Köves, A.; Bajmócy, Z. The end of business-as-usual?—A critical review of the air transport industry’s climate strategy for 2050 from the perspectives of Degrowth. Sustain. Prod. Consum. 2022, 29, 228–238. [Google Scholar] [CrossRef]

- Dray, L.; Schäfer, A.W.; Grobler, C.; Falter, C.; Allroggen, F.; Stettler, M.E.J.; Barrett, S.R.H. Cost and emissions pathways towards net-zero climate impacts in aviation. Nat. Clim. Change 2022, 12, 956–962. [Google Scholar] [CrossRef]

- Grimme, W. The Introduction of Sustainable Aviation Fuels—A Discussion of Challenges, Options and Alternatives. Aerospace 2023, 10, 218. [Google Scholar] [CrossRef]

- Jaume, J.; Alonso, G.; Benito, A. Evaluating the impact of the new environmental regulations on airlines’ business results. Aircr. Eng. Aerosp. Technol. 2024, 97, 108–119. [Google Scholar] [CrossRef]

- ICAO. Annex 16 to the Convention on International Civil Aviation—Volume IV: Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA); ICAO: Montreal, QC, Canada, 2023. [Google Scholar]

- IATA. CORSIA Handbook. Available online: https://www.iata.org/contentassets/fb745460050c48089597a3ef1b9fe7a8/corsia-handbook.pdf (accessed on 22 June 2025).

- European Commission. List of Union Airports in-Scope of ReFuelEU Aviation for the Reporting Period 2024. Available online: https://transport.ec.europa.eu/document/download/ce8eae01-435e-4313-8d46-42463c3027ce_en?filename=ReFuelEU_list_airports.pdf (accessed on 25 May 2025).

- European Commission. List of Aircraft Operators in-Scope of ReFuelEU Aviation for the Reporting Period 2024. Available online: https://transport.ec.europa.eu/document/download/8b972ae2-0236-4bbd-ad63-8368f3cceaa9_en?filename=ReFuelEU_list_operators.pdf (accessed on 25 May 2025).

- EASA. EASA 2025 Briefing Note. 2024 Aviation Fuels Reference Prices for ReFuelEU Aviation. Available online: https://www.easa.europa.eu/en/downloads/141675/en (accessed on 1 June 2025).

- European Commission. COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying the Pro-posal for a Regulation of the European Parliament and of the Council on Ensuring a Level Playing Field for Sustainable Air Transport. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=SWD:2021:633:FIN (accessed on 31 August 2025).

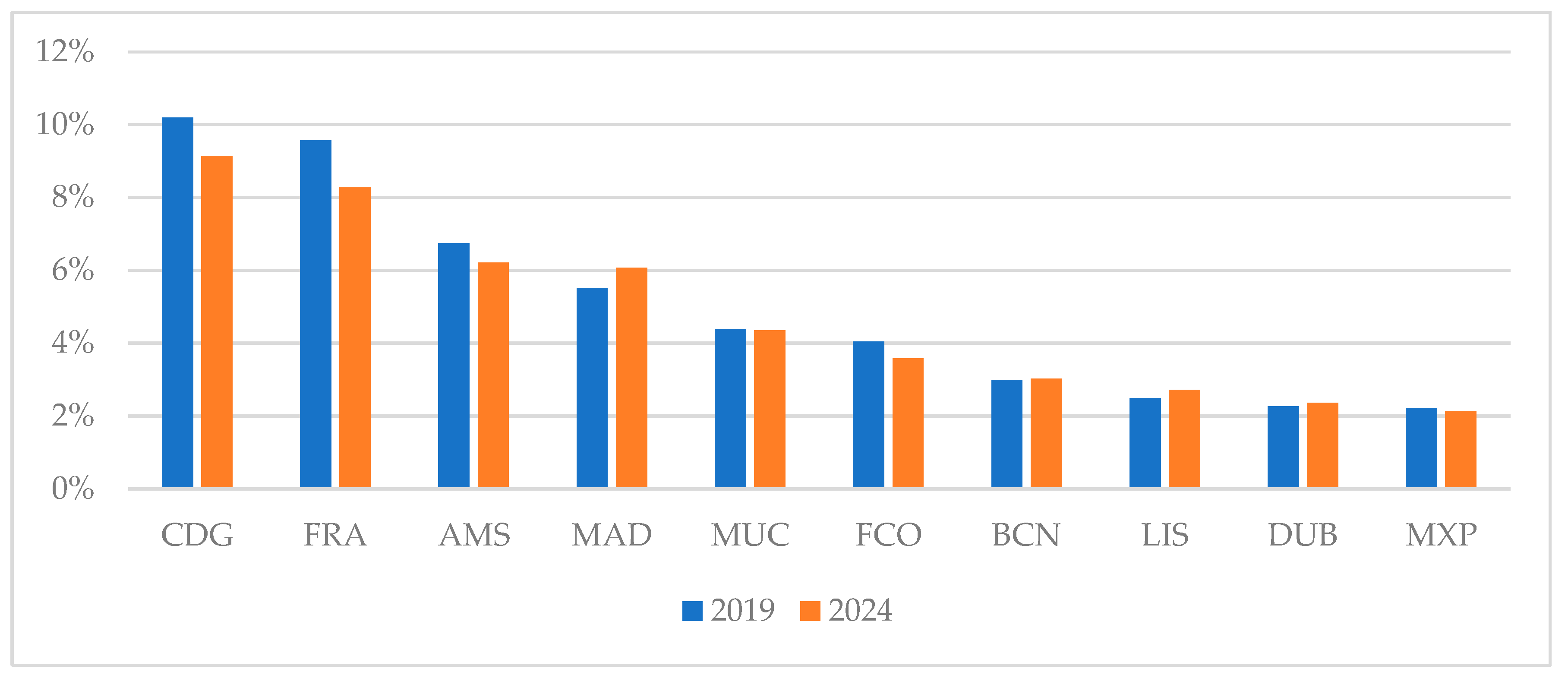

| Country Code | Main Airport (IATA Code) | % of Country’s Fuel Uptake | % of Total Fuel Uptake | ||||

|---|---|---|---|---|---|---|---|

| 2019 | 2024 | Var. (%) | 2019 | 2024 | Var. (%) | ||

| AT | VIE | 93.93 | 93.71 | −0.23 | 2.14% | 1.97% | −0.14 |

| BE | BRU | 87.73 | 79.91 | −8.91 | 1.88% | 1.67% | −0.17 |

| BG | BOJ | 41.48 | 59.61 | 43.7 | 0.33% | 0.34% | 0 |

| CY | LCA | 75.85 | 67.9 | −10.48 | 0.70% | 0.57% | −0.1 |

| CZ | PRG | 92.66 | 84.32 | −8.99 | 1.14% | 0.87% | −0.22 |

| DE | FRA | 48.31 | 47.92 | −0.8 | 9.56% | 8.27% | −1.05 |

| DK | CPH | 84.91 | 84.45 | −0.54 | 1.75% | 1.82% | 0.04 |

| EE | TLL | 99.22 | 98.7 | −0.52 | 0.15% | 0.16% | 0.01 |

| ES | MAD | 35.93 | 35.24 | −1.93 | 5.50% | 6.06% | 0.39 |

| FI | HEL | 94.67 | 94.06 | −0.65 | 1.74% | 1.42% | −0.25 |

| FR | CDG | 65.43 | 61.44 | −6.1 | 10.20% | 9.14% | −0.88 |

| GR | ATH | 34.58 | 37.44 | 8.28 | 1.60% | 2.13% | 0.39 |

| HR | ZAG | 31.55 | 25.17 | −20.21 | 0.19% | 0.22% | −0.01 |

| HU | BUD | 95.89 | 97.9 | 2.1 | 0.73% | 0.70% | −0.03 |

| IE | DUB | 89.43 | 87.34 | −2.34 | 2.26% | 2.36% | 0.05 |

| IT | FCO | 37.64 | 36.69 | −2.52 | 4.04% | 4.35% | 0.2 |

| LT | VNO | 78.49 | 73.86 | −5.9 | 0.19% | 0.22% | 0.02 |

| LU | LUX | 100 | 100 | 0 | 0.17% | 0.22% | 0.03 |

| LV | RIX | 99.88 | 100 | 0.12 | 0.28% | 0.33% | 0.04 |

| MT | MLA | 100 | 100 | 0 | 0.35% | 0.41% | 0.04 |

| NL | AMS | 93.98 | 93.59 | −0.41 | 6.74% | 6.21% | −0.46 |

| PL | WAW | 49.89 | 43.82 | −12.18 | 1.30% | 1.29% | −0.02 |

| PT | LIS | 63.17 | 59.93 | −5.11 | 2.48% | 2.71% | 0.15 |

| RO | OTP | 64.37 | 63.46 | −1.4 | 0.73% | 0.72% | −0.01 |

| SE | ARN | 67.75 | 71.68 | 5.81 | 1.65% | 1.27% | −0.3 |

| SI | LJU | 99.59 | 100 | 0.41 | 0.05% | 0.07% | 0.02 |

| SK | BTS | 75.99 | 68.54 | −9.8 | 0.12% | 0.12% | 0 |

| Total | 57.97 | 55.59 | −1.89 | ||||

| Airline | Type | Departure Airports | Departure Flights (%) | Departure Flights per Type (%) | Average Distance (km) | Average Distance (km) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| EUR | INT | NAT | EUR | INT | NAT | |||||

| Lufthansa | TRAD | 113 | 8.16 | 58.69 | 14.89 | 26.42 | 1207 | 883 | 3931 | 389 |

| Ryanair | LCC | 171 | 7.54 | 56.79 | 28.10 | 15.11 | 1305 | 1405 | 1389 | 773 |

| Air France | TRAD | 72 | 4.32 | 38.74 | 20.30 | 40.96 | 1554 | 950 | 4655 | 587 |

| Eurowings | LCC | 100 | 4.17 | 62.86 | 7.69 | 29.44 | 953 | 1137 | 1356 | 455 |

| Vueling | LCC | 89 | 3.94 | 48.75 | 6.55 | 44.70 | 937 | 1097 | 1193 | 725 |

| EasyJet Europe | LCC | 100 | 3.92 | 57.17 | 10.33 | 32.50 | 945 | 1077 | 1193 | 635 |

| KLM | TRAD | 65 | 3.55 | 72.48 | 27.52 | 0.00 | 1390 | 843 | 2830 | 0 |

| SAS | TRAD | 90 | 3.26 | 55.04 | 18.68 | 26.28 | 939 | 1024 | 1425 | 416 |

| Alitalia | TRAD | 58 | 3.18 | 22.95 | 11.07 | 65.98 | 972 | 942 | 3598 | 541 |

| Wizz Air | LCC | 94 | 2.74 | 67.32 | 32.52 | 0.17 | 1392 | 1324 | 1540 | 176 |

| Austrian | TRAD | 77 | 2.15 | 77.09 | 16.72 | 6.19 | 1021 | 767 | 2465 | 281 |

| Finnair | TRAD | 77 | 2.09 | 55.07 | 15.05 | 29.88 | 1374 | 1288 | 3639 | 392 |

| LOT Airlines | TRAD | 61 | 1.96 | 56.02 | 17.41 | 26.57 | 994 | 829 | 2591 | 296 |

| TAP Portugal | TRAD | 48 | 1.89 | 60.99 | 17.90 | 21.11 | 1651 | 1486 | 3344 | 694 |

| Air Europa | TRAD | 48 | 1.62 | 25.36 | 8.23 | 66.41 | 1079 | 1209 | 5536 | 476 |

| Air Nostrum | TRAD | 58 | 1.42 | 25.77 | 1.72 | 72.51 | 511 | 970 | 782 | 342 |

| Olympic Air | TRAD | 32 | 1.32 | 7.12 | 0.00 | 92.88 | 318 | 956 | 0 | 269 |

| Iberia | TRAD | 36 | 1.30 | 44.25 | 21.81 | 33.94 | 1995 | 1316 | 5752 | 465 |

| Volotea | LCC | 85 | 1.23 | 40.59 | 0.37 | 59.04 | 883 | 1133 | 1319 | 709 |

| Brussels Airlines | TRAD | 74 | 1.20 | 84.71 | 15.21 | 0.08 | 1259 | 1118 | 2048 | 309 |

| Total/Average | 309 | 60.96 | 53.30 | 16.41 | 30.29 | 1163 | 1085 | 2610 | 516 | |

| Airline | Type | Departure Airports | Departure Flights (%) | Departure Flights per Type (%) | Average Distance (km) | Average Distance (km) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| EUR | INT | NAT | EUR | INT | NAT | |||||

| Ryanair | LCC | 189 | 16.57 | 61.95 | 19.10 | 18.95 | 1200 | 1308 | 1329 | 720 |

| Lufthansa | TRAD | 101 | 6.28 | 59.53 | 15.24 | 25.23 | 1258 | 947 | 3902 | 397 |

| Air France | TRAD | 78 | 3.92 | 43.05 | 21.02 | 35.92 | 1595 | 938 | 4695 | 569 |

| EasyJet Europe | LCC | 83 | 3.72 | 59.47 | 16.24 | 24.29 | 1036 | 1110 | 1292 | 684 |

| Vueling | LCC | 74 | 3.51 | 46.90 | 7.94 | 45.15 | 991 | 1108 | 1221 | 830 |

| KLM | TRAD | 70 | 3.34 | 73.43 | 26.39 | 0.18 | 1400 | 879 | 2860 | 131 |

| Eurowings | LCC | 102 | 2.77 | 87.35 | 9.31 | 3.34 | 1278 | 1341 | 995 | 418 |

| SAS | TRAD | 81 | 2.61 | 55.28 | 20.26 | 24.46 | 1062 | 1061 | 1808 | 446 |

| ITA | TRAD | 36 | 2.09 | 24.23 | 9.15 | 66.61 | 964 | 855 | 4172 | 562 |

| Austrian | TRAD | 85 | 2.00 | 82.33 | 13.93 | 3.73 | 1003 | 818 | 2301 | 242 |

| Aegean | TRAD | 99 | 1.89 | 41.86 | 10.30 | 47.85 | 979 | 1638 | 1460 | 299 |

| Finnair | TRAD | 71 | 1.71 | 67.62 | 12.14 | 20.25 | 1436 | 1294 | 3802 | 493 |

| Wizz Air Malta | LCC | 83 | 1.70 | 67.23 | 29.21 | 3.56 | 1429 | 1441 | 1472 | 848 |

| TAP Portugal | TRAD | 45 | 1.66 | 59.34 | 20.66 | 20.00 | 1838 | 1462 | 3982 | 739 |

| Volotea | LCC | 100 | 1.64 | 45.31 | 2.25 | 52.43 | 914 | 1184 | 1012 | 677 |

| LOT Airlines | TRAD | 76 | 1.62 | 58.64 | 16.66 | 24.70 | 1109 | 942 | 2919 | 285 |

| Wizz Air | LCC | 77 | 1.48 | 69.05 | 30.32 | 0.62 | 1447 | 1423 | 1525 | 213 |

| Iberia | TRAD | 47 | 1.44 | 51.73 | 24.05 | 24.22 | 2225 | 1362 | 5879 | 440 |

| Transavia France | LCC | 77 | 1.33 | 62.17 | 22.89 | 14.94 | 1457 | 1481 | 1910 | 660 |

| Air Nostrum | TRAD | 51 | 1.33 | 26.19 | 2.53 | 71.28 | 514 | 973 | 845 | 334 |

| Total/Average | 381 | 62.63 | ||||||||

| Airline | Fuel Loaded (MTn) * | % of Total EU Fuel | Fuel Burnt per Type of Flight (%) | Average CO2 (kg)/RPK | Average CO2 (kg)/RPK | ||||

|---|---|---|---|---|---|---|---|---|---|

| EUR | INT | NAT | EUR | INT | NAT | ||||

| Lufthansa | 3.57 | 9.27 | 26.93 | 65.67 | 7.40 | 0.133 | 0.117 | 0.106 | 0.183 |

| Ryanair | 2.15 | 5.58 | 60.23 | 29.11 | 10.67 | 0.081 | 0.076 | 0.079 | 0.101 |

| Air France | 2.48 | 6.45 | 14.05 | 75.12 | 10.84 | 0.113 | 0.107 | 0.098 | 0.125 |

| Eurowings | 0.88 | 2.30 | 69.19 | 13.64 | 17.17 | 0.109 | 0.090 | 0.112 | 0.149 |

| Vueling | 0.86 | 2.23 | 54.92 | 7.65 | 37.43 | 0.095 | 0.082 | 0.092 | 0.111 |

| EasyJet Europe | 0.83 | 2.16 | 62.53 | 12.15 | 25.32 | 0.094 | 0.086 | 0.084 | 0.111 |

| KLM | 1.54 | 3.99 | 30.58 | 69.42 | 0.00 | 0.122 | 0.124 | 0.117 | 0.000 |

| SAS | 0.67 | 1.74 | 53.18 | 33.07 | 13.76 | 0.134 | 0.119 | 0.112 | 0.183 |

| Alitalia | 0.88 | 2.28 | 16.60 | 49.58 | 33.82 | 0.131 | 0.109 | 0.106 | 0.143 |

| Wizz Air | 0.84 | 2.19 | 65.37 | 34.58 | 0.05 | 0.075 | 0.076 | 0.071 | 0.209 |

| Austrian | 0.55 | 1.42 | 50.73 | 47.91 | 1.36 | 0.116 | 0.115 | 0.095 | 0.176 |

| Finnair | 0.72 | 1.86 | 43.86 | 49.58 | 6.57 | 0.131 | 0.118 | 0.101 | 0.171 |

| LOT Airlines | 0.42 | 1.09 | 35.77 | 57.99 | 6.23 | 0.124 | 0.123 | 0.101 | 0.141 |

| TAP Portugal | 0.72 | 1.87 | 44.51 | 46.35 | 9.13 | 0.102 | 0.088 | 0.090 | 0.152 |

| Air Europa | 0.47 | 1.22 | 23.70 | 50.51 | 25.78 | 0.131 | 0.085 | 0.072 | 0.156 |

| Air Nostrum | 0.12 | 0.31 | 43.14 | 2.45 | 54.41 | 0.162 | 0.106 | 0.124 | 0.182 |

| Olympic Air | 0.12 | 0.31 | 20.24 | 0.00 | 79.76 | 0.163 | 0.089 | 0.000 | 0.169 |

| Iberia | 0.89 | 2.32 | 18.42 | 73.80 | 7.78 | 0.099 | 0.085 | 0.084 | 0.127 |

| Volotea | 0.23 | 0.60 | 48.10 | 0.49 | 51.42 | 0.107 | 0.098 | 0.088 | 0.114 |

| Brussels Airlines | 0.34 | 0.87 | 68.59 | 31.38 | 0.03 | 0.102 | 0.102 | 0.106 | 0.150 |

| Total/Average | 19.27 | 50.06 | 38.84 | 48.46 | 12.71 | 0.113 | 0.100 | 0.095 | 0.145 |

| Airline | Fuel Loaded (MTn) * | % of Total EU Fuel | Fuel Burnt per Type of Flight (%) | Average CO2 (kg)/RPK | Average CO2 (kg)/RPK | ||||

|---|---|---|---|---|---|---|---|---|---|

| EUR | INT | NAT | EUR | INT | NAT | ||||

| Ryanair | 4.48 | 11.00 | 66.01 | 20.47 | 13.51 | 0.076 | 0.072 | 0.075 | 0.091 |

| Lufthansa | 2.97 | 7.30 | 28.69 | 64.37 | 6.94 | 0.114 | 0.102 | 0.097 | 0.151 |

| Air France | 2.37 | 5.81 | 15.01 | 76.03 | 8.96 | 0.114 | 0.104 | 0.097 | 0.135 |

| EasyJet Europe | 0.88 | 2.15 | 62.56 | 18.94 | 18.50 | 0.083 | 0.079 | 0.079 | 0.094 |

| Vueling | 0.84 | 2.06 | 51.55 | 9.24 | 39.21 | 0.085 | 0.076 | 0.076 | 0.096 |

| KLM | 1.53 | 3.75 | 30.93 | 69.02 | 0.05 | 0.114 | 0.113 | 0.117 | 0.319 |

| Eurowings | 0.78 | 1.91 | 90.80 | 7.59 | 1.61 | 0.084 | 0.080 | 0.099 | 0.166 |

| SAS | 0.62 | 1.52 | 47.24 | 41.69 | 11.07 | 0.111 | 0.103 | 0.096 | 0.142 |

| ITA | 0.61 | 1.50 | 16.52 | 48.59 | 34.89 | 0.111 | 0.100 | 0.091 | 0.118 |

| Austrian | 0.55 | 1.34 | 60.31 | 38.78 | 0.90 | 0.109 | 0.107 | 0.090 | 0.215 |

| Aegean | 0.43 | 1.05 | 63.64 | 14.04 | 22.32 | 0.112 | 0.072 | 0.079 | 0.154 |

| Finnair | 0.67 | 1.64 | 50.25 | 44.83 | 4.92 | 0.120 | 0.121 | 0.093 | 0.131 |

| Wizz Air Malta | 0.56 | 1.38 | 67.36 | 30.36 | 2.28 | 0.067 | 0.064 | 0.073 | 0.076 |

| TAP Portugal | 0.75 | 1.84 | 39.01 | 52.84 | 8.15 | 0.097 | 0.089 | 0.088 | 0.128 |

| Volotea | 0.35 | 0.86 | 54.48 | 2.42 | 43.10 | 0.095 | 0.083 | 0.099 | 0.104 |

| LOT Airlines | 0.43 | 1.05 | 40.69 | 51.68 | 7.63 | 0.133 | 0.111 | 0.083 | 0.219 |

| Wizz Air | 0.49 | 1.21 | 68.84 | 30.96 | 0.20 | 0.067 | 0.067 | 0.066 | 0.178 |

| Iberia | 1.08 | 2.66 | 20.66 | 74.73 | 4.61 | 0.085 | 0.074 | 0.073 | 0.121 |

| Transavia France | 0.43 | 1.07 | 62.91 | 28.44 | 8.65 | 0.080 | 0.073 | 0.075 | 0.121 |

| Air Nostrum | 0.12 | 0.29 | 44.20 | 3.77 | 52.03 | 0.147 | 0.097 | 0.115 | 0.166 |

| Total/Average | 20.94 | 51.39 | 45.78 | 42.99 | 11.23 | 0.095 | 0.087 | 0.085 | 0.123 |

| Airline | Emissions Covered by Each Mechanism (%) | ||

|---|---|---|---|

| EU ETS | CORSIA | EU ETS + CORSIA | |

| Ryanair | 13.51 | 3.80 | 82.68 |

| Lufthansa | 6.94 | 61.70 | 31.36 |

| Air France | 8.96 | 74.73 | 16.32 |

| EasyJet Europe | 18.50 | 4.94 | 76.56 |

| Vueling | 39.21 | 2.11 | 58.67 |

| KLM | 0.05 | 63.60 | 36.35 |

| Eurowings | 1.61 | 3.06 | 95.33 |

| SAS | 11.07 | 26.54 | 62.39 |

| ITA | 34.89 | 46.79 | 18.32 |

| Austrian | 0.90 | 35.13 | 63.97 |

| Aegean | 22.32 | 8.14 | 69.54 |

| Finnair | 4.92 | 38.89 | 56.18 |

| Wizz Air Malta | 2.28 | 21.36 | 76.36 |

| TAP Portugal | 8.15 | 47.85 | 44.00 |

| Volotea | 43.10 | 2.13 | 54.78 |

| LOT Airlines | 7.63 | 48.78 | 43.59 |

| Wizz Air | 0.20 | 17.19 | 82.61 |

| Iberia | 4.61 | 71.69 | 23.70 |

| Transavia France | 8.65 | 27.68 | 63.67 |

| Air Nostrum | 52.03 | 2.22 | 45.76 |

| Country | Airport | % Fuel 2024 | 2025 (2%) | 2030 (5%) | 2035 (20%) | 2040 (32%) | 2045 (38%) | 2050 (63%) |

|---|---|---|---|---|---|---|---|---|

| AT | VIE | 93.71 | 2.13 | 5.34 | 21.34 | 34.15 | 40.55 | 67.23 |

| BE | BRU | 79.91 | 2.50 | 6.26 | 25.03 | 40.05 | 47.55 | 78.84 |

| BG | BOJ | 59.61 | 3.36 | 8.39 | 33.55 | 53.68 | 63.75 | 105.69 |

| CY | LCA | 67.9 | 2.95 | 7.36 | 29.46 | 47.13 | 55.96 | 92.78 |

| CZ | PRG | 84.32 | 2.37 | 5.93 | 23.72 | 37.95 | 45.07 | 74.72 |

| DE | FRA | 47.92 | 4.17 | 10.43 | 41.74 | 66.78 | 79.30 | 131.47 |

| DK | CPH | 84.45 | 2.37 | 5.92 | 23.68 | 37.89 | 45.00 | 74.60 |

| EE | TLL | 98.7 | 2.03 | 5.07 | 20.26 | 32.42 | 38.50 | 63.83 |

| ES | MAD | 35.24 | 5.68 | 14.19 | 56.75 | 90.81 | 107.83 | 178.77 |

| FI | HEL | 94.06 | 2.13 | 5.32 | 21.26 | 34.02 | 40.40 | 66.98 |

| FR | CDG | 61.44 | 3.26 | 8.14 | 32.55 | 52.08 | 61.85 | 102.54 |

| GR | ATH | 37.44 | 5.34 | 13.35 | 53.42 | 85.47 | 101.50 | 168.27 |

| HR | ZAG | 25.17 | 7.95 | 19.86 | 79.46 | 127.14 | 150.97 | 250.30 |

| HU | BUD | 97.9 | 2.04 | 5.11 | 20.43 | 32.69 | 38.82 | 64.35 |

| IE | DUB | 87.34 | 2.29 | 5.72 | 22.90 | 36.64 | 43.51 | 72.13 |

| IT | FCO | 36.69 | 5.45 | 13.63 | 54.51 | 87.22 | 103.57 | 171.71 |

| LT | VNO | 73.86 | 2.71 | 6.77 | 27.08 | 43.33 | 51.45 | 85.30 |

| LU | LUX | 100 | 2.00 | 5.00 | 20.00 | 32.00 | 38.00 | 63.00 |

| LV | RIX | 100 | 2.00 | 5.00 | 20.00 | 32.00 | 38.00 | 63.00 |

| MT | MLA | 100 | 2.00 | 5.00 | 20.00 | 32.00 | 38.00 | 63.00 |

| NL | AMS | 93.59 | 2.14 | 5.34 | 21.37 | 34.19 | 40.60 | 67.31 |

| PL | WAW | 43.82 | 4.56 | 11.41 | 45.64 | 73.03 | 86.72 | 143.77 |

| PT | LIS | 59.93 | 3.34 | 8.34 | 33.37 | 53.40 | 63.41 | 105.12 |

| RO | OTP | 63.46 | 3.15 | 7.88 | 31.52 | 50.43 | 59.88 | 99.28 |

| SE | ARN | 71.68 | 2.79 | 6.98 | 27.90 | 44.64 | 53.01 | 87.89 |

| SI | LJU | 100 | 2.00 | 5.00 | 20.00 | 32.00 | 38.00 | 63.00 |

| SK | BTS | 68.54 | 2.92 | 7.30 | 29.18 | 46.69 | 55.44 | 91.92 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nieto, A.; Alonso, G.; Cubas, J.; Benito, A. Decarbonizing the Skies: Evolution of EU Air Transport Efficiency and Carbon Emissions. Environments 2025, 12, 332. https://doi.org/10.3390/environments12090332

Nieto A, Alonso G, Cubas J, Benito A. Decarbonizing the Skies: Evolution of EU Air Transport Efficiency and Carbon Emissions. Environments. 2025; 12(9):332. https://doi.org/10.3390/environments12090332

Chicago/Turabian StyleNieto, Ana, Gustavo Alonso, Javier Cubas, and Arturo Benito. 2025. "Decarbonizing the Skies: Evolution of EU Air Transport Efficiency and Carbon Emissions" Environments 12, no. 9: 332. https://doi.org/10.3390/environments12090332

APA StyleNieto, A., Alonso, G., Cubas, J., & Benito, A. (2025). Decarbonizing the Skies: Evolution of EU Air Transport Efficiency and Carbon Emissions. Environments, 12(9), 332. https://doi.org/10.3390/environments12090332