Understanding Consumer Financial Trust Across National Levels of Interpersonal Trust †

Abstract

1. Introduction

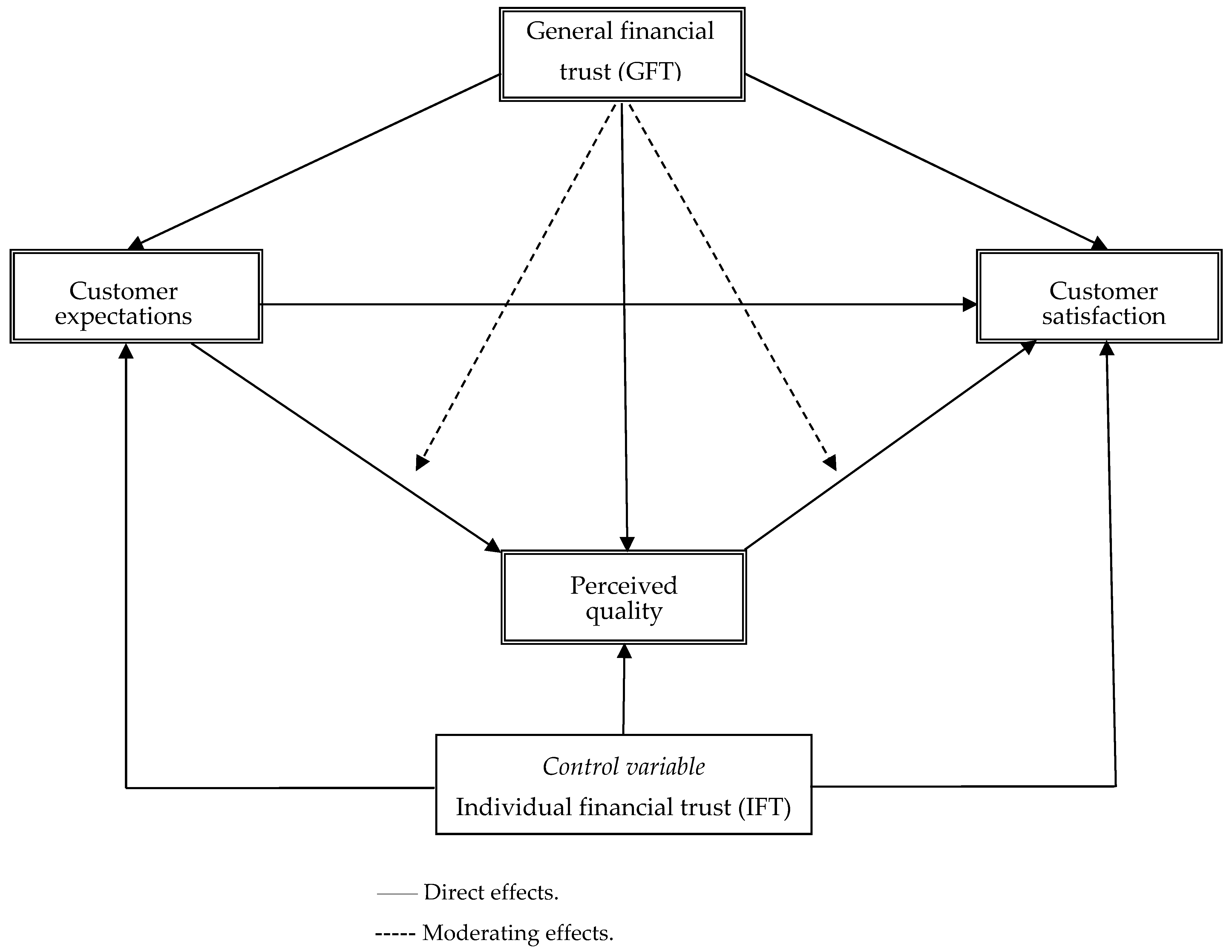

2. Conceptual Model and Research Hypotheses

2.1. Baseline Model

2.2. Hypothesis Development

3. Methodology

3.1. Data Collection

3.2. Measurements

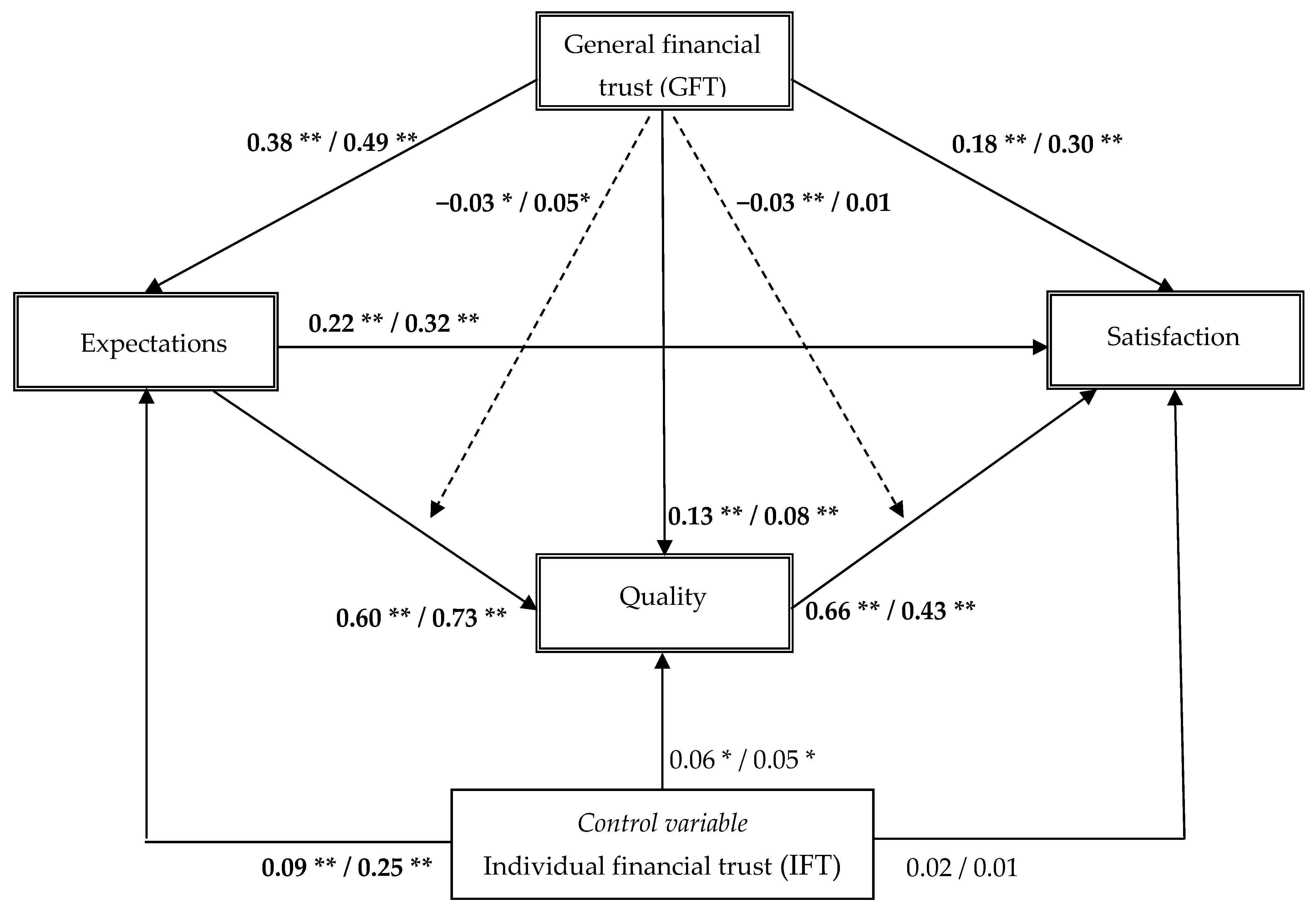

4. Results

5. Discussion

5.1. Implications for Theory

5.2. Implications for Practice

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Allison, S. T., Worth, L. T., & King, M. W. C. (1990). Group decisions as social inference heuristics. Journal of Personality and Social Psychology, 58(5), 801–811. [Google Scholar] [CrossRef]

- Anderson, E. W., & Fornell, C. (2000). Foundations of the American customer satisfaction index. Total quality Management, 11(7), 869–882. [Google Scholar] [CrossRef]

- Auh, S., & Johnson, M. D. (2005). Comparability effects in evaluations of satisfaction and loyalty. Journal of Economic Psychology, 26(1), 35–57. [Google Scholar] [CrossRef]

- Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94. [Google Scholar] [CrossRef]

- Buriak, A., Vozňáková, I., Sułkowska, J., & Kryvych, Y. (2019). Social trust and institutional (bank) trust: Empirical evidence of interaction. Economics & Sociology, 12(4), 116–332. [Google Scholar] [CrossRef]

- Burke, J., & Hung, A. A. (2021). Trust and financial advice. Journal of Pension Economics & Finance, 20(1), 9–26. [Google Scholar]

- Carlin, B. I., Dorobantu, F., & Viswanathan, S. (2009). Public trust, the law, and financial investment. Journal of Financial Economics, 92(3), 321–341. [Google Scholar] [CrossRef]

- Chen, F., Lu, X., & Wang, W. (2022). Informal financial education and consumer financial capability: The mediating role of financial knowledge. Frontiers in Psychology, 13, 1042085. [Google Scholar] [CrossRef]

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Lawrence Erlbaum Associates. [Google Scholar]

- Diamantopoulos, A., Sarstedt, M., Fuchs, C., Wilczynski, P., & Kaiser, S. (2012). Guidelines for choosing between multi-item and single-item scales for construct measurement: A predictive validity perspective. Journal of the Academy of Marketing Science, 40(3), 434–449. [Google Scholar] [CrossRef]

- DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160. [Google Scholar] [CrossRef]

- Dimitriades, Z. S. (2006). Customer satisfaction, loyalty and commitment in service organizations. Management Research News, 29(12), 782–800. [Google Scholar] [CrossRef]

- Dixon, D. F., & Wilkinson, I. F. (1989). An alternative paradigm for marketing theory. European Journal of Marketing, 23(8), 59–69. [Google Scholar]

- Earle, T. C. (2009). Trust, confidence, and the 2008 global financial crisis. Risk Analysis, 29(6), 785–792. [Google Scholar] [CrossRef] [PubMed]

- Eisingerich, A. B., & Bell, S. J. (2007). Maintaining customer relationships in high credence services. Journal of Services Marketing, 21(4), 253–262. [Google Scholar] [CrossRef]

- EPSI Research Services. (2013). Pan European customer satisfaction—Report 2013. EPSI Research Services and International Foundation for Customer Focus (IFCF). [Google Scholar]

- Festinger, L. (1957). A theory of cognitive dissonance. Stanford University Press. [Google Scholar]

- Fornell, C., Johnson, M. D., Anderson, E. W., Cha, J., & Bryant, B. W. (1996). The American Customer Satisfaction Index: Nature, purpose and findings. Journal of Marketing, 60, 7–18. [Google Scholar]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. [Google Scholar] [CrossRef]

- Fowler, F. J., Jr. (2002). Survey research methods (3rd ed.). Sage Publications. [Google Scholar]

- Frambach, R. T., Prabhu, J., & Verhallen, T. M. M. (2003). The influence of business strategy on new product activity: The role of market orientation. International Journal of Research in Marketing, 20(4), 377–397. [Google Scholar] [CrossRef]

- Gotlieb, J. (2009). Justice in the classroom and students’ evaluations of marketing professors’ teaching effectiveness: An extension of prior research using attribution theory. Marketing Education Review, 19(2), 1–14. [Google Scholar] [CrossRef]

- Grayson, K., Johnson, D., & Chen, D.-F. R. (2008). Is firm trust essential in a trusted environment? How trust in the business context Influences customers. Journal of Marketing Research, XLV, 241–256. [Google Scholar] [CrossRef]

- Greene, W. H. (2000). Econometric analysis. Prentice Hall. [Google Scholar]

- Guo, L., Arnould, E. J., Gruen, T. W., & Tang, C. (2013). Socializing to co-produce: Pathways to consumers’ financial well-being. Journal of Service Research, 16(4), 549–563. [Google Scholar]

- Habel, J., Alavi, S., Schmitz, C., Schneider, J. V., & Wieseke, J. (2016). When do customers get what they expect? Understanding the ambivalent effects of customers’ service expectations on satisfaction. Journal of Service Research, 19(4), 361–379. [Google Scholar] [CrossRef]

- Haberstroh, K., Orth, U. R., Bouzdine-Chameeva, T., Cohen, J., Corsi, A. M., Crouch, R., & De Marchi, R. (2018). Through the lens of self-construal: Cross-cultural variation in consumers’ appreciation of harmony in marketing visuals. International Marketing Review, 35(3), 429–457. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate data analysis (8th ed.). Cengage Learning. [Google Scholar]

- Hansen, T. (2012a). The moderating influence of broad-scope trust on customer-seller relationships. Psychology & Marketing, 29(5), 350–364. [Google Scholar]

- Hansen, T. (2012b). Understanding trust in financial services: The influence of financial healthiness, knowledge, and satisfaction. Journal of Service Research, 15(3), 280–295. [Google Scholar]

- Hansen, T. (2014). The role of trust in financial customer-seller relationships before and after the financial crisis. Journal of Consumer Behaviour, 13, 442–452. [Google Scholar]

- Hansen, T. (2024, January 18–20). Understanding consumer financial trust across national levels of interpersonal trust. Proceedings of International Marketing Trends Conference (IMTC), Venice, Italy. [Google Scholar]

- Hansen, T., & Thomsen, T. U. (2013). I know what I know, but I will probably fail anyway: How learned helplessness moderates the knowledge calibration-dietary choice relationship. Psychology & Marketing, 30(11), 1008–1028. [Google Scholar]

- Heider, F. (1946). Attitudes and cognitive organization. Journal of Psychology, 21, 107–112. [Google Scholar]

- Heider, F. (1979). On balance and attribution. In P. W. Holland, & S. Leinhardt (Eds.), Perspectives on social network research. Academic Press. [Google Scholar]

- Jeong, I., Gong, Y., & Zhong, B. (2023). Does an employee-experienced crisis help or hinder creativity? An integration of threat-rigidity and implicit theories. Journal of Management, 49(4), 1394–1429. [Google Scholar]

- Jiao, Y., Ertz, M., Jo, M.-S., & Sarigollu, E. (2018). Social value, content value, and brand equity in social media brand communities: A comparison of Chinese and US consumers. International Marketing Review, 35(1), 18–41. [Google Scholar]

- Jing, Y., Yuki, M., & Takemura, K. (2021). Interpersonal trust and ecocultural environments: A cross-cultural perspective. Journal of Personality and Social Psychology, 121(4), 789–804. [Google Scholar]

- Johnson, M. D., Herrmann, A., & Gustafsson, A. (2002). Comparing customer satisfaction across industries and countries. Journal of Economic Psychology, 23(6), 749–769. [Google Scholar] [CrossRef]

- Johnson-George, C., & Swap, W. C. (1982). Measurement of specific interpersonal trust: Construction and validation of a scale to assess trust in a specific other. Journal of Personality and Social Psychology, 43(6), 1306–1317. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 363–391. [Google Scholar] [CrossRef]

- Kumar, V., & Pansari, A. (2016). National culture, economy, and customer lifetime value: Assessing the relative impact of the drivers of customer lifetime value for a global retailer. Journal of International Marketing, 24(1), 1–21. [Google Scholar] [CrossRef]

- Lee, S. T., & Hanna, S. D. (2022). What, me worry? Financial knowledge overconfidence and the perception of emergency fund needs. Journal of Financial Counseling and Planning, 33(1), 140–155. [Google Scholar] [CrossRef]

- Little, T. D., Bovaird, J. A., & Widaman, K. F. (2006). On the merits of orthogonalizing powered and interaction terms: Implications for modeling interactions among latent variables. Structural Equation Modeling: A Multidisciplinary Journal, 13(4), 497–519. [Google Scholar] [CrossRef]

- Martensen, A., & Grønholdt, L. (2010). Measuring and managing brand equity: A study with focus on product and service quality in banking. International Journal of Quality and Service Sciences, 2(3), 300–316. [Google Scholar]

- McClelland, G. H., & Judd, C. M. (1993). Statistical difficulties of detecting interactions and moderator effects. Psychological Bulletin, 114(2), 376–390. [Google Scholar] [CrossRef]

- Meyer, J. W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340–363. [Google Scholar]

- Morgan, R. M., & Hunt, S. D. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), 20–38. [Google Scholar]

- Nanda, A. P., & Banerjee, R. (2021). Consumer’s subjective financial well-being: A systematic review and research agenda. International Journal of Consumer Studies, 45(4), 750–776. [Google Scholar] [CrossRef]

- Newcomb, T. M. (1953). An approach to the study of communicative acts. Psychological Review, 60, 393–404. [Google Scholar] [CrossRef] [PubMed]

- O’Connor, G. E. (2019). Exploring the interplay of cognitive style and demographics in consumers’ financial knowledge. Journal of Consumer Affairs, 53(2), 382–442. [Google Scholar] [CrossRef]

- Ortiz-Ospina, E., Roser, M., & Arriagada, P. (2023). Trust: Our world in data. Available online: https://ourworldindata.org/trust (accessed on 5 January 2024).

- Osgood, C. E., & Tannenbaum, P. H. (1955). The principle of congruity in the prediction of attitude change. Psychological Review, 62, 42–55. [Google Scholar] [CrossRef] [PubMed]

- Partington, R., Makortoff, K., & Helmore, E. (2023, March 14). Silicon Valley Bank: Global banking shares slide as fallout spreads. The Guardian. [Google Scholar]

- Pérez, M. S., & Descals, A. M. (1999). Insights into closeness of relationship as determinant of trust within marketing channels. Journal of Marketing Channels, 7(1–2), 29–51. [Google Scholar] [CrossRef]

- Rotter, J. B. (1980). Interpersonal trust, trustworthiness, and gullibility. American Psychologist, 35(1), 1–7. [Google Scholar] [CrossRef]

- Royo-Vela, M., Frau, M., & Ferrer, A. (2024). The role of value co-creation in building trust and reputation in the digital banking era. Cogent Business & Management, 11(1), 2375405. [Google Scholar] [CrossRef]

- Sapienza, P., & Zingales, L. (2012). A trust crisis. International Review of Finance, 12(2), 123–131. [Google Scholar] [CrossRef]

- Scott, W. R. (2005). Institutional theory: Contributing to a theoretical research program. Great Minds in Management: The Process of Theory Development, 37(2), 460–484. [Google Scholar]

- Shiu, E. M. K., Walsh, G., Hassan, L. M., & Shaw, D. (2011). Consumer uncertainty, revisited. Psychology & Marketing, 28(6), 584–607. [Google Scholar] [CrossRef]

- Siegrist, M., & Cvetkovich, G. (2000). Perception of hazards: The role of social trust and knowledge. Risk Analysis: An International Journal, 20(5), 713–720. [Google Scholar]

- Siegrist, M., Gutscher, H., & Earle, T. C. (2005). Perception of risk: The influence of general trust, and general confidence. Journal of Risk Research, 8(2), 145–156. [Google Scholar] [CrossRef]

- Sirdeshmukh, D., Singh, J., & Sabol, B. (2002). Consumer trust, value and loyalty in relational exchanges. Journal of Marketing, 66(1), 15–37. [Google Scholar] [CrossRef]

- Sjöberg, L. (2001). Limits of knowledge and the limited importance of trust. Risk Analysis, 21(1), 189–198. [Google Scholar] [CrossRef] [PubMed]

- Tedja, B., Al Musadieq, M., Kusumawati, A., & Yulianto, E. (2024). Systematic literature review using PRISMA: Exploring the influence of service quality and perceived value on satisfaction and intention to continue relationship. Future Business Journal, 10(1), 39. [Google Scholar] [CrossRef]

- Todd, P. M., & Gigerenzer, G. (2003). Bounding rationality to the world. Journal of Economic Psychology, 24(2), 143–165. [Google Scholar] [CrossRef]

- Tomlinson, E. C., & Mayer, R. C. (2009). The role of causal attribution dimensions in trust repair. Academy of Management Review, 34(1), 85–104. [Google Scholar] [CrossRef]

- Tran, V. D. (2020). Assessing the effects of service quality, experience value, relationship quality on behavioral intentions. Journal of Asia-Pacific Business, 7(3), 167–186. [Google Scholar] [CrossRef]

- Tschannen-Moran, M., & Hoy, M. W. K. (2000). A multidisciplinary analysis of the nature, meaning, and measurement of trust. Review of Educational Research, 70(4), 547–593. [Google Scholar] [CrossRef]

- Van der Cruijsen, C., de Haan, J., & Roerink, R. (2021). Financial knowledge and trust in financial institutions. Journal of Consumer Affairs, 55(2), 680–714. [Google Scholar] [CrossRef]

- Van der Cruijsen, C., De Haan, J., & Roerink, R. (2023). Trust in financial institutions: A survey. Journal of Economic Surveys, 37(4), 1214–1254. [Google Scholar] [CrossRef]

- Ward, P. R., Mamerow, L., & Meyer, S. B. (2014). Interpersonal trust across six Asia-Pacific countries: Testing and extending the ‘high trust society’ and ‘low trust society’ theory. PLoS ONE, 9(4), e95555. [Google Scholar] [CrossRef]

- Weiner, B. (1986). An attributional model of motivation and emotion. Springer. [Google Scholar]

- Weiner, B. (2000). Attributional thoughts about consumer behavior. Journal of Consumer Research, 27, 382–387. [Google Scholar] [CrossRef]

- Williamson, O. (1993). Calculativeness, trust, and economic organization. Journal of Law and Economics, 36(1), 453–486. [Google Scholar] [CrossRef]

- Ye, J., Marinova, D., & Singh, J. (2007). Strategic change implementation and performance loss in the front lines. Journal of Marketing, 71(4), 156–171. [Google Scholar] [CrossRef]

- Zak, P., & Knack, S. (2001). Trust and growth. The Economic Journal, 111, 295–321. [Google Scholar] [CrossRef]

| Construct/Measures | Standardized Factor Loading (Sw./Sp.) | Critical Ratio (χ2) (Sw./Sp.) | Composite Reliability (Sw./Sp.) | Extracted Variance (Sw./Sp.) |

|---|---|---|---|---|

| Customer expectations | 0.91/0.92 | 0.71/0.73 | ||

| 1. Products offered | 0.88/0.89 | -/- | ||

| 2. Personal service and advice | 0.83/0.82 | 82.09/64.69 | ||

| 3. Reliable and accurate service | 0.82/0.90 | 74.16/35.51 | ||

| 4. Added functions offered | 0.84/0.81 | 77.07/30.73 | ||

| Perceived quality | 0.92/0.92 | 0.74/0.74 | ||

| 5. The personnel’s commitment | 0.83/0.89 | -/- | ||

| 6. Politeness and friendliness of the personnel | 0.85/0.78 | 80.15/32.56 | ||

| 7. Advice and information given by the personnel | 0.89/0.90 | 86.42/43.29 | ||

| 8. Banking products offered | 0.86/0.87 | 82.23/40.45 | ||

| Customer satisfaction | 0.85/0.88 | 0.65/0.70 | ||

| 9. Overall satisfaction | 0.82/0.81 | -/- | ||

| 10. Fulfilment of expectations | 0.78/0.85 | 65.17/30.91 | ||

| 11. Close to “ideal” bank | 0.81/0.85 | 64.73/30.85 |

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Construct | Sw./Sp. | Sw./Sp. | Sw./Sp. | Sw./Sp. | Sw./Sp. |

| 1. Customer expectations | 0.71/0.73 | ||||

| 2. Perceived quality | 0.43/0.64 | 0.74/0.74 | |||

| 3. Customer satisfaction | 0.52/0.66 | 0.73/0.67 | 0.65/0.70 | ||

| 4. General financial trust (GFT) | 0.15/0.28 | 0.13/0.22 | 0.25/0.45 | n.a. | |

| 5. Individual financial trust (IFT) | 0.01/0.13 | 0.02/0.11 | 0.02/0.20 | 0.01/0.08 | n.a. |

| Mean | 8.01/6.51 | 8.24/6.74 | 7.58/5.88 | 6.36/4.58 | 7.57/6.39 |

| SD | 1.55/2.07 | 1.52/2.01 | 1.55/2.15 | 1.95/2.49 | 1.95/2.66 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Hansen, T.; Varnes, C. Understanding Consumer Financial Trust Across National Levels of Interpersonal Trust. Behav. Sci. 2026, 16, 62. https://doi.org/10.3390/bs16010062

Hansen T, Varnes C. Understanding Consumer Financial Trust Across National Levels of Interpersonal Trust. Behavioral Sciences. 2026; 16(1):62. https://doi.org/10.3390/bs16010062

Chicago/Turabian StyleHansen, Torben, and Claus Varnes. 2026. "Understanding Consumer Financial Trust Across National Levels of Interpersonal Trust" Behavioral Sciences 16, no. 1: 62. https://doi.org/10.3390/bs16010062

APA StyleHansen, T., & Varnes, C. (2026). Understanding Consumer Financial Trust Across National Levels of Interpersonal Trust. Behavioral Sciences, 16(1), 62. https://doi.org/10.3390/bs16010062