What’s inside the Mind of a CEO? The Effects of Discretionary Slack Resources on R&D Investment

Abstract

1. Introduction

2. Theoretical Background

2.1. Discretionary Slack and R&D Investment

2.2. CEO’s Psychological Traits

2.2.1. Regulatory Focus

2.2.2. Temporal Focus

2.2.3. Aspiration Level

3. Hypotheses Development

3.1. Effects of Discretionary Slack on R&D Investment

3.2. The Moderating Role of a CEO’s Cognition

3.2.1. CEO’s Promotion Focus

3.2.2. CEO’s Future Focus

3.2.3. CEO’s Aspiration Level

4. Method

4.1. Sample

4.2. Variables and Measurement

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Moderating Variables

4.2.4. Control Variables

4.2.5. Correction for Endogeneity Problem

4.3. Statistical Analysis

5. Results

6. Discussion

6.1. Theoretical Contributions and Practical Implications

6.2. Limitations and Future Studies

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Correction for Endogeneity

| β | S.E. | |

|---|---|---|

| Constant | 6.15 *** | (0.07) |

| Firm size | 0.90 *** | (0.06) |

| Firm age | −0.00 ** | (0.00) |

| Industry munificence | −4.89 *** | (1.17) |

| Industry dynamism | 12.03 ** | (3.72) |

| Industry concentration | −0.26 | (0.34) |

| Debt ratio | 0.00 | (0.00) |

| Wald Chi-Square (d.f.) | 342.05(8) *** | |

| Number of observations | 654 | |

References

- Chen, W.R. Determinants of firm’s backward-and forward-looking R&D search behaviore. Organ. Sci. 2008, 19, 609–622. [Google Scholar]

- Kim, H.; Kim, H.; Lee, P.M. Ownership structure and the relationship between financial slack and R&D investments: Evidence from Korean firms. Organ. Sci. 2008, 19, 404–418. [Google Scholar]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef]

- Greve, H.R. A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar]

- Cyert, R.M.; March, J.G. A Behavioral Theory of the Firm; Prentice Hall: Englewood Cliffs, NJ, USA, 1963. [Google Scholar]

- Barker, V.L.; Mueller, G.C. CEO characteristics and firm R&D spending. Manag. Sci. 2002, 48, 782–801. [Google Scholar]

- Finkelstein, S.; Hambrick, D.C.; Cannella, A.A. Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards; Oxford University Press: New York, NY, USA, 2009. [Google Scholar]

- Manner, M. The impact of CEO characteristics on corporate social performance. J. Bus. Ethics 2010, 93, 53–72. [Google Scholar] [CrossRef]

- Wu, S.; Levitas, E.; Priem, R.L. CEO tenure and company invention under differing levels of technological dynamism. Acad. Manag. J. 2005, 48, 859–873. [Google Scholar] [CrossRef]

- Benischke, M.H.; Martin, G.P.; Glaser, L. CEO equity risk bearing and strategic risk taking: The moderating effect of CEO personality. Strateg. Manag. J. 2019, 40, 153–177. [Google Scholar] [CrossRef]

- Chatterjee, A.; Hambrick, D.C. It’s all about me: Narcissistic chief executive officers and their effects on company strategy and performance. Adm. Sci. Q. 2007, 52, 351–386. [Google Scholar] [CrossRef]

- Gamache, D.L.; McNamara, G.; Mannor, M.J.; Johnson, R.E. Motivated to acquire? The impact of CEO regulatory focus on firm acquisitions. Acad. Manag. J. 2015, 58, 1261–1282. [Google Scholar] [CrossRef]

- Malhotra, S.; Reus, T.H.; Zhu, P.; Roelofsen, E.M. The acquisitive nature of extraverted CEOs. Adm. Sci. Q. 2018, 63, 370–408. [Google Scholar] [CrossRef]

- Scoresby, R.B.; Withers, M.C.; Ireland, R.D. The effect of CEO regulatory focus on changes to investments in R&D. J. Prod. Innov. Manag. 2021, 38, 401–420. [Google Scholar]

- Khanna, R.; Guler, I.; Nerkar, A. Fail often, fail big, and fail fast? Learning from small failures and R&D performance in the pharmaceutical industry. Acad. Manag. J. 2016, 59, 436–459. [Google Scholar]

- Lucas, G.J.; Knoben, J.; Meeus, M.T. Contradictory yet coherent? Inconsistency in performance feedback and R&D investment change. J. Manag. 2018, 44, 658–681. [Google Scholar]

- Ocasio, W. Towards an attention-based view of the firm. Strateg. Manag. J. 1997, 18, 187–206. [Google Scholar] [CrossRef]

- Felin, T.; Foss, N.J.; Ployhart, R.E. The microfoundations movement in strategy and organization theory. Acad. Manag. Ann. 2015, 9, 575–632. [Google Scholar] [CrossRef]

- March, J.G.; Shapira, Z. Variable risk preferences and the focus of attention. Psychol. Rev. 1992, 99, 172–183. [Google Scholar] [CrossRef]

- Bourgeois, L.J. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- George, G. Slack resources and the performance of privately held firms. Acad. Manag. J. 2005, 48, 661–676. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Wolf, G.; Chase, R.B.; Tansik, D.A. Antecedents of organizational slack. Acad. Manag. J. 1988, 13, 601–614. [Google Scholar] [CrossRef]

- Richtnér, A.; Åhlström, P.; Goffin, K. “Squeezing R&D”: A study of organizational slack and knowledge creation in NPD, using the SECI model. J. Prod. Innov. Manag. 2021, 31, 1268–1290. [Google Scholar]

- Shaikh, I.A.; O’Brien, J.P.; Peters, L. Inside directors and the underinvestment of financial slack towards R&D-intensity in high-technology firms. J. Bus. Res. 2018, 82, 192–201. [Google Scholar]

- Lyandres, E.; Pallazzo, B. Cash holdings, competition, and innovation. J. Financ. Quant. Anal. 2016, 51, 1823–1861. [Google Scholar] [CrossRef]

- Almeida, H.; Hsu, P.H.; Li, D.; Tseng, K. More cash, less innovation: The effect of the American jobs creation act on patent value. J. Financ. Quant. Anal. 2021, 56, 1–28. [Google Scholar] [CrossRef]

- He, Z.; Wintoki, M.B. The cost of innovation: R&D and high cash holdings in US firms. J. Corp. Financ. 2016, 41, 280–303. [Google Scholar]

- Simsek, Z.; Veiga, J.F.; Lubatkin, M.H. The impact of managerial environmental perceptions on corporate entrepreneurship: Towards understanding discretionary slack’s pivotal role. J. Manag. Stud. 2007, 44, 1398–1424. [Google Scholar] [CrossRef]

- Iyer, D.N.; Miller, K.D. Performance feedback, slack, and the timing of acquisitions. Acad. Manag. J. 2008, 51, 808–822. [Google Scholar]

- Marlin, D.; Geiger, S.W. A reexamination of the organizational slack and innovation relationship. J. Bus. Res. 2015, 68, 2683–2690. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Higgins, E.T. Beyond pleasure and pain. Am. Psychol. 1997, 52, 1280–1300. [Google Scholar] [CrossRef]

- Crowe, E.; Higgins, E.T. Regulatory focus and strategic inclinations: Promotion and prevention in decision-making. Organ. Behav. Hum. Decis. Process. 1997, 69, 117–132. [Google Scholar] [CrossRef]

- Friedman, R.S.; Förster, J. The effects of promotion and prevention cues on creativity. J. Pers. Soc. Psychol. 2001, 81, 1001–1013. [Google Scholar] [CrossRef]

- Kashmiri, S.; Gala, P.; Nicol, C.D. Seeking pleasure or avoiding pain: Influence of CEO regulatory focus on firms’ advertising, R&D, and marketing controversies. J. Bus. Res. 2019, 105, 227–242. [Google Scholar]

- Higgins, E.T. How self-regulation creates distinct values: The case of promotion and prevention decision making. J. Consum. Psychol. 2002, 12, 177–191. [Google Scholar] [CrossRef]

- Brockner, J.; Higgins, E.T.; Low, M.B. Regulatory focus theory and the entrepreneurial process. J. Bus. Ventur. 2004, 19, 203–220. [Google Scholar] [CrossRef]

- Brockner, J.; Higgins, E.T. Regulatory focus theory: Implications for the study of emotions at work. Organ. Behav. Hum. Decis. Process. 2001, 86, 35–66. [Google Scholar] [CrossRef]

- Bryant, P.; Dunford, R. The influence of regulatory focus on risky decision-making. Appl. Psychol. 2008, 57, 335–359. [Google Scholar] [CrossRef]

- Chang, Y.K.; Lee, S.; Oh, W.Y. The impact of CEOs’ regulatory focus on CSR: The strengthening effects of industry-level dynamism and firm-level volatility. Eur. J. Int. Manag. 2021, 15, 511–538. [Google Scholar] [CrossRef]

- Higgins, E.T.; Spiegel, S. Promotion and prevention strategies for self-regulation: A motivated cognition perspective. In Handbook of Self-Regulation: Research, Theory, and Applications; Baumeister, R.F., Vohs, K.D., Eds.; Guilford Press: New York, NY, USA, 2004; pp. 171–187. [Google Scholar]

- Chen, J.; Nadkarni, S. It’s about time! CEO’s temporal dispositions, temporal leadership, and corporate entrepreneurship. Adm. Sci. Q. 2017, 62, 31–66. [Google Scholar] [CrossRef]

- Lu, F.; Kwan, H.K.; Ma, B. Carry the past into the future: The effects of CEO temporal focus on succession planning in family firms. Asia. Pac. J. Manag. 2021, 39, 763–804. [Google Scholar] [CrossRef]

- Nadkarni, S.; Chen, J. Bridging yesterday, today, and tomorrow: CEO temporal focus, environmental dynamism, and rate of new product introduction. Acad. Manag. J. 2014, 57, 1810–1833. [Google Scholar] [CrossRef]

- Das, T.K. Strategy and time: Really recognizing the future. In Managing the Future: Foresight in the Knowledge Economy; Tsoukas, H., Sheppard, J., Eds.; Blackwell Publishing: Malden, MA, USA, 2004; pp. 58–74. [Google Scholar]

- Lewin, K. Time perspective and morale. In Civilian Morale: Second Yearbook of the Society for Psychological Study of Social Issues; Watson, S., Ed.; Houghton Mifflin Company: New York, NY, USA, 1942; pp. 58–74. [Google Scholar]

- Clark, L.F.; Collins, J.E. Remembering old flames: How the past affects assessments of the present. Pers. Soc. Psychol. Bull. 1993, 19, 399–408. [Google Scholar] [CrossRef]

- Shipp, A.J.; Edwards, J.R.; Lambert, L.S. Conceptualization and measurement of temporal focus: The subjective experience of the past, present, and future. Organ. Behav. Hum. Decis. Process. 2009, 110, 1–22. [Google Scholar] [CrossRef]

- Bluedorn, A.C. The Human Organization of Time: Temporal Realities and Experience; Standford University Press: Standford, CA, USA, 2002. [Google Scholar]

- Greve, H.R. Performance, aspirations, and risky organizational change. Adm. Sci. Q. 1998, 43, 58–86. [Google Scholar] [CrossRef]

- Lant, T.K. Aspiration level adaptation: An empirical exploration. Manag. Sci. 1992, 38, 623–644. [Google Scholar] [CrossRef]

- Milliken, F.J.; Lant, T.K. The effect of an organization’s recent performance history on strategic persistence and change: The role of managerial interpretations. In Advances in Strategic Management; Dutton, J., Huff, A., Shrivastava, P., Eds.; JAI Press: Greenwich, UK, 1990. [Google Scholar]

- Lim, E. Attainment discrepancy and new geographic market entry: The moderating roles of vertical pay disparity and horizontal pay dispersion. J. Manag. Stud. 2019, 56, 1605–1629. [Google Scholar] [CrossRef]

- March, J.G.; Shapira, Z. Managerial perspectives on risk and risk taking. Manag. Sci. 1987, 33, 1404–1418. [Google Scholar] [CrossRef]

- Iyer, D.N.; Baù, M.; Chirico, F.; Patel, P.C.; Brush, T.H. The triggers of local and distant search: Relative magnitude and persistence in explaining acquisition relatedness. Long Range Plann. 2019, 52, 101825. [Google Scholar] [CrossRef]

- Ref, O.; Shapira, Z. Entering new markets: The effect of performance feedback near aspiration and well below and above it. Strateg. Manag. J. 2017, 38, 1416–1434. [Google Scholar] [CrossRef]

- Xu, D.; Zhou, K.Z.; Du, F. Deviant versus aspirational risk taking: The effects of performance feedback on bribery expenditure and R&D intensity. Acad. Manag. J. 2019, 62, 1226–1251. [Google Scholar]

- Chen, W.R.; Miller, K.D. Situational and institutional determinants of firms’ R&D search intensity. Strateg. Manag. J. 2007, 28, 369–381. [Google Scholar]

- Staw, B.M.; Sandelands, L.E.; Dutton, J.E. Threat rigidity effects in organizational behavior: A multilevel analysis. Adm. Sci. Q. 1981, 26, 501–524. [Google Scholar] [CrossRef]

- Ketchen, D.J., Jr.; Palmer, T.B. Strategic responses to poor organizational performance: A test of competing perspectives. J. Manag. 1999, 25, 683–706. [Google Scholar] [CrossRef]

- Kuusela, P.; Keil, T.; Maula, M. Driven by aspirations, but in what direction? Performance shortfalls, slack resources, and resource-consuming vs. resource-freeing organizational change. Strateg. Manag. J. 2017, 38, 1101–1120. [Google Scholar] [CrossRef]

- Dalziel, T.; Gentry, R.J.; Bowerman, M. An integrated agency-resource dependence view of the influence of directors’ human and relational capital on firms’ R&D spending. J. Manag. Stud. 2011, 48, 1217–1242. [Google Scholar]

- Oh, W.Y.; Barker, V.L., III. Not all ties are equal: CEO outside directorships and strategic imitation in R&D investment. J. Manag. 2018, 44, 1312–1337. [Google Scholar]

- O’Brien, J.P. The capital structure implications of pursuing a strategy of innovation. Strateg. Manag. J. 2003, 24, 415–431. [Google Scholar] [CrossRef]

- Pham, M.T.; Higgins, E.T. Promotion and prevention in consumer decision-making: The state of the art and theoretical propositions. In Inside Consumption: Consumer Motives, Goals, and Desires; Ratneshwar, S., David, G., Eds.; Routledge: London, UK, 2005; pp. 8–43. [Google Scholar]

- Chandy, R.K.; Tellis, G.J. Organizing for radical product innovation: The overlooked role of willingness to cannibalize. J. Mark. Res. 1998, 35, 474–487. [Google Scholar] [CrossRef]

- Yadav, M.S.; Prabhu, J.C.; Chandy, R.K. Managing the future: CEO attention and innovation outcomes. J. Mark. 2007, 71, 84–101. [Google Scholar] [CrossRef]

- Argote, L.; Greve, H.R. A behavioral theory of the firm-40 years and counting: Introduction and impact. Org. Sci. 2007, 18, 337–349. [Google Scholar] [CrossRef]

- Miller, K.D.; Chen, W.R. Variable organizational risk preferences: Tests of the March-Shapira model. Acad. Manag. J. 2004, 47, 105–115. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Ireland, R.D.; Harrison, J.S. Effects of acquisitions on R&D inputs and outputs. Acad. Manag. J. 1991, 34, 693–706. [Google Scholar]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Crilly, D.; Hansen, M.; Zollo, M. The grammar of decoupling: A cognitive-linguistic perspective on firms’ sustainability claims and stakeholders’ interpretation. Acad. Manag. J. 2016, 59, 705–729. [Google Scholar] [CrossRef]

- Daly, J.P.; Pouder, R.W.; Kabanoff, B. The effects of initial differences in firms’ espoused values on their postmerger performance. J. Appl. Behav. Sci. 2004, 40, 323–343. [Google Scholar] [CrossRef]

- McClelland, P.L.; Liang, X.; Barker, V.L., III. CEO commitment to the status quo: Replication and extension using content analysis. J. Manag. 2010, 36, 1251–1277. [Google Scholar] [CrossRef]

- Nadkarni, S.; Barr, P.S. Environmental context, managerial cognition, and strategic action: An integrated view. Strateg. Manag. J. 2008, 29, 1395–1427. [Google Scholar] [CrossRef]

- Pennebaker, J.W.; Francis, M.E.; Booth, R.J. Linguistic Inquiry and Word Count: LIWC 2001; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 2015. [Google Scholar]

- Bromiley, P. Testing a causal model of corporate risk taking and performance. Acad. Manag. J. 1991, 34, 37–59. [Google Scholar] [CrossRef]

- Gomez-Mejia, L.R.; Patel, P.C.; Zellweger, T.M. In the horns of dilemma: Socioemotional wealth, financial wealth, and acquisitions in family firms. J. Manag. 2018, 44, 1369–1397. [Google Scholar] [CrossRef]

- Chen, H.L. CEO tenure and R&D investment: The moderating effect of board capital. J. Appl. Behav. Sci. 2013, 49, 437–459. [Google Scholar]

- Hundley, G.; Jacobson, C.K.; Park, S.H. Effects of profitability and liquidity on R&D intensity: Japanese and US companies compared. Acad. Manag. J. 1996, 39, 1659–1674. [Google Scholar]

- Keats, B.W.; Hitt, M.A. A causal model of linkages among environmental dimensions, macro organizational characteristics, and performance. Acad. Manag. J. 1988, 31, 570–598. [Google Scholar] [CrossRef]

- Kor, Y.Y. Direct and interaction effects of top management team and board compositions on R&D investment strategy. Strateg. Manag. J. 2006, 27, 1081–1099. [Google Scholar]

- Li, J.; Tang, Y.I. CEO hubris and firm risk taking in China: The moderating role of managerial discretion. Acad. Manag. J. 2010, 53, 45–68. [Google Scholar] [CrossRef]

- Graf-Vlachy, L.; Bundy, J.; Hambrick, D.C. Effects of an advancing tenure on CEO cognitive complexity. Organ. Sci. 2020, 31, 936–959. [Google Scholar] [CrossRef]

- Bliss, R.T.; Rosen, R.J. CEO compensation and bank mergers. J. Financ. Econ. 2001, 61, 107–138. [Google Scholar] [CrossRef]

- Seo, J.; Gamache, D.L.; Devers, C.E.; Carpenter, M.A. The role of CEO relative standing in acquisition behavior and CEO pay. Strateg. Manag. J. 2015, 36, 1877–1894. [Google Scholar] [CrossRef]

- Wade, J.B.; O’Reilly, C.A.; Pollock, T.G. Overpaid CEOs and underpaid managers: Fairness and executive compensation. Organ. Sci. 2006, 17, 527–544. [Google Scholar] [CrossRef]

- Barlow, M.A.; Verhaal, J.C.; Angus, R.W. Optimal distinctiveness, strategic categorization, and product market entry on the Google Play app platform. Strateg. Manag. J. 2019, 40, 1219–1242. [Google Scholar] [CrossRef]

- Gupta, A.; Misangyi, Y.F. Follow the leader (or not): The influence of peer CEOs’ characteristics on interorganizational imitation. Strateg. Manag. J. 2018, 39, 1437–1472. [Google Scholar] [CrossRef]

- Liang, K.Y.; Zeger, S.L. Longitudinal data analysis using generalized linear models. Biometrika 1986, 73, 13–22. [Google Scholar] [CrossRef]

- Ndofor, H.A.; Sirmon, D.G.; He, X. Firm resources, competitive actions and performance: Investigating a mediated model with evidence from the in-vitro diagnostics industry. Strateg. Manag. J. 2011, 32, 640–657. [Google Scholar] [CrossRef]

- Neter, J.; Wasserman, W.; Kutner, M.H. Applied Linear Statistical Models; McGraw·Hill: Homewood, IL, USA, 1985. [Google Scholar]

- Resick, C.J.; Whitman, D.S.; Weingarden, S.M.; Hiller, N.J. The bright-side and the dark-side of CEO personality: Examining core self-evaluations, narcissism, transformational leadership, and strategic influence. J. Appl. Psychol. 2009, 92, 1365–1381. [Google Scholar] [CrossRef]

- Petrenko, O.V.; Aime, F.; Ridge, J.; Hill, A. Corporate social responsibility or CEO narcissism? CSR motivations and organizational performance. Strateg. Manag. J. 2016, 37, 262–279. [Google Scholar] [CrossRef]

- Hayward, M.L.; Hambrick, D.C. Explaining the premiums paid for large acquisitions: Evidence of CEO hubris. Adm. Sci. Q. 1997, 42, 103–127. [Google Scholar] [CrossRef]

- Gamache, D.L.; McNamara, G. Responding to bad press: How CEO temporal focus influences the sensitivity to negative media coverage of acquisitions. Acad. Manag. J. 2019, 62, 918–943. [Google Scholar] [CrossRef]

- Harrison, J.S.; Thurgood, G.R.; Boivie, S.; Pfarrer, M.D. Measuring CEO personality: Developing, validating, and testing a linguistic tool. Strateg. Manag. J. 2019, 40, 1316–1330. [Google Scholar] [CrossRef]

- Hur, K.S.; Kim, D.H.; Cheung, J.H. Managerial overconfidence and cost behavior of R&D expenditures. Sustainability 2019, 11, 4878. [Google Scholar]

- Izadi, Z.D.J.; Ziyadin, S.; Palazzo, M.; Sidhu, M. The evaluation of the impact of innovation management capability to organizational performance. Qual. Mark. Res. Int. J. 2020, 23, 697–723. [Google Scholar] [CrossRef]

- Yousaf, Z.; Mihai, D.; Tanveer, U.; Brutu, M.; Toma, S.; Zahid, S.M. Organizational innovativeness in the circular economy: The interplay of innovation networks, frugal innovation, and organizational readiness. Sustainability 2022, 14, 6501. [Google Scholar] [CrossRef]

- Zhen, Z.; Yousaf, Z.; Radulescu, M.; Yasir, M. Nexus of digital organizational culture, capabilities, organizational readiness, and innovation: Investigation of SMEs operating in the digital economy. Sustainability 2021, 13, 720. [Google Scholar] [CrossRef]

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. R&D investment | 0.00 | 5.49 | ||||||||||||||||||||||

| 2. Firm age | 84.88 | 47.00 | −0.24 | |||||||||||||||||||||

| 3. Firm size | 8.78 | 1.10 | 0.06 | 0.18 | ||||||||||||||||||||

| 4. Return on equity | 0.22 | 3.33 | 0.07 | −0.02 | −0.01 | |||||||||||||||||||

| 5. Debt ratio | −0.16 | 26.57 | −0.01 | 0.00 | −0.02 | 0.78 | ||||||||||||||||||

| 6. Advertising intensity | 0.01 | 0.03 | −0.03 | 0.16 | 0.16 | 0.05 | −0.01 | |||||||||||||||||

| 7. Industry concentration | 0.33 | 0.15 | 0.00 | −0.06 | −0.16 | 0.00 | 0.01 | −0.05 | ||||||||||||||||

| 8. Industry munificence | 1.05 | 0.04 | 0.00 | 0.01 | 0.07 | 0.03 | 0.06 | 0.07 | −0.26 | |||||||||||||||

| 9. Industry dynamism | 1.02 | 0.10 | 0.00 | 0.04 | 0.01 | −0.01 | 0.00 | −0.01 | 0.30 | −0.51 | ||||||||||||||

| 10. Operating income growth | 1.14 | 0.42 | 0.12 | −0.16 | 0.01 | 0.01 | 0.01 | −0.08 | 0.00 | 0.23 | −0.09 | |||||||||||||

| 11. Operating income fluctuation | 1.06 | 0.17 | 0.05 | −0.09 | −0.09 | −0.02 | 0.01 | −0.05 | 0.10 | −0.01 | 0.08 | 0.31 | ||||||||||||

| 12. Proportion of outside directors | 0.87 | 0.06 | −0.03 | 0.01 | 0.10 | 0.00 | 0.06 | −0.14 | −0.01 | −0.07 | 0.08 | −0.02 | 0.02 | |||||||||||

| 13. CEO age | 55.50 | 5.59 | 0.06 | 0.08 | 0.12 | −0.01 | −0.04 | 0.00 | 0.05 | −0.07 | 0.11 | 0.01 | 0.05 | 0.08 | ||||||||||

| 14. CEO tenure | 6.10 | 4.17 | 0.04 | −0.06 | −0.02 | −0.02 | −0.01 | −0.03 | −0.02 | 0.00 | −0.02 | 0.00 | 0.02 | −0.01 | 0.37 | |||||||||

| 15. CEO duality | 0.96 | 0.19 | −0.17 | 0.14 | 0.09 | −0.09 | 0.01 | −0.15 | 0.05 | −0.10 | 0.14 | −0.02 | 0.03 | 0.06 | 0.14 | 0.04 | ||||||||

| 16. CEO gender | 0.97 | 0.16 | 0.05 | −0.05 | −0.18 | −0.01 | −0.01 | −0.03 | 0.05 | 0.06 | −0.12 | 0.01 | 0.03 | −0.02 | 0.11 | 0.02 | −0.03 | |||||||

| 17. CEO compensation | 7.06 | 0.47 | −0.02 | 0.07 | 0.60 | −0.01 | −0.03 | 0.16 | −0.13 | 0.10 | −0.06 | −0.01 | −0.06 | 0.05 | 0.13 | 0.02 | 0.07 | −0.08 | ||||||

| 18. CEO prevention focus | 0.19 | 0.21 | 0.04 | 0.04 | 0.14 | −0.04 | −0.06 | −0.12 | 0.01 | 0.02 | 0.01 | 0.02 | 0.01 | 0.06 | 0.09 | 0.01 | 0.07 | 0.02 | 0.06 | |||||

| 19. Endogeneity control | 6.15 | 0.99 | 0.13 | −0.06 | 0.94 | −0.01 | −0.03 | 0.10 | −0.10 | −0.16 | 0.21 | 0.01 | −0.05 | 0.11 | 0.12 | 0.00 | 0.10 | −0.19 | 0.55 | 0.13 | ||||

| 20. CEO promotion focus | 1.19 | 0.48 | −0.10 | 0.04 | −0.14 | −0.03 | −0.03 | −0.04 | 0.02 | −0.06 | 0.02 | −0.08 | −0.06 | 0.02 | 0.01 | 0.07 | −0.07 | −0.04 | −0.09 | −0.03 | −0.14 | |||

| 21. CEO future focus | 1.07 | 0.47 | −0.03 | 0.02 | 0.03 | −0.01 | −0.03 | −0.02 | 0.02 | −0.01 | −0.04 | −0.02 | −0.08 | 0.01 | −0.07 | 0.01 | −0.01 | −0.02 | 0.05 | −0.03 | 0.03 | 0.03 | ||

| 22. Negative attainment discrepancy | 0.02 | 0.05 | 0.13 | −0.07 | −0.05 | 0.03 | 0.02 | −0.02 | 0.11 | −0.04 | 0.02 | 0.02 | −0.02 | −0.02 | 0.01 | 0.01 | 0.05 | 0.02 | 0.00 | 0.00 | −0.02 | −0.06 | −0.08 | |

| 23. Discretionary slack | 6.11 | 1.46 | 0.33 | −0.02 | 0.71 | 0.00 | −0.01 | 0.10 | −0.11 | −0.06 | 0.07 | 0.07 | −0.01 | 0.03 | 0.10 | −0.01 | 0.02 | −0.15 | 0.44 | 0.13 | 0.74 | −0.15 | 0.02 | 0.08 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| β | S.E. | β | S.E. | β | S.E. | β | S.E. | β | S.E. | |

| Constant | −0.22 | (3.27) | −0.05 | (3.24) | −0.09 | (3.24) | −0.10 | (3.24) | −0.10 | (3.24) |

| Firm age | −0.04 *** | (0.01) | −0.04 *** | (0.01) | −0.04 *** | (0.01) | −0.04 *** | (0.01) | −0.04 *** | (0.01) |

| Firm size | 0.48 | (0.99) | 0.40 | (1.02) | 0.58 | (1.01) | 0.42 | (1.02) | 0.38 | (1.01) |

| Return on equity | 0.13 *** | (0.03) | 0.13 *** | (0.03) | 0.14 *** | (0.03) | 0.14 *** | (0.03) | 0.13 *** | (0.03) |

| Debt ratio | −0.01 *** | (0.00) | −0.02 *** | (0.00) | −0.02 *** | (0.00) | −0.02 *** | (0.00) | −0.02 *** | (0.00) |

| Advertising intensity | 15.33 † | (8.87) | 13.13 | (9.08) | 13.07 | (8.97) | 13.39 | (9.08) | 13.69 | (8.98) |

| Industry concentration | −0.94 | (0.98) | −1.01 | (1.02) | −1.24 | (1.00) | −1.07 | (1.02) | −1.01 | (1.00) |

| Industry munificence | 1.50 | (6.27) | 1.72 | (6.49) | 0.86 | (6.38) | 1.62 | (6.49) | 1.64 | (6.38) |

| Industry dynamism | 16.30 | (17.37) | 17.18 | (17.98) | 19.35 | (17.67) | 17.62 | (18.00) | 16.85 | (17.69) |

| Operating income growth | 0.46 *** | (0.14) | 0.45 ** | (0.14) | 0.45 ** | (0.14) | 0.46 *** | (0.14) | 0.46 *** | (0.14) |

| Operating income fluctuation | −1.11 ** | (0.42) | −1.12 ** | (0.43) | −1.15 ** | (0.43) | −1.14 ** | (0.43) | −1.24 ** | (0.43) |

| Proportion of outside directors | −1.15 | (1.29) | −0.97 | (1.33) | −1.07 | (1.31) | −1.11 | (1.36) | −1.03 | (1.31) |

| CEO age | −0.03 | (0.02) | −0.03 | (0.02) | −0.03 | (0.02) | −0.03 | (0.02) | −0.02 | (0.02) |

| CEO tenure | 0.02 | (0.02) | 0.02 | (0.02) | 0.03 | (0.02) | 0.02 | (0.02) | 0.02 | (0.02) |

| CEO duality | −0.46 | (0.37) | −0.51 | (0.39) | −0.46 | (0.38) | −0.49 | (0.39) | −0.47 | (0.38) |

| CEO gender | −0.07 | (0.82) | −0.11 | (0.84) | −0.05 | (0.83) | −0.09 | (0.84) | −0.15 | (0.83) |

| CEO compensation | 0.19 | (0.17) | 0.15 | (0.18) | 0.13 | (0.17) | 0.14 | (0.18) | 0.17 | (0.17) |

| CEO prevention focus | −0.17 | (0.32) | −0.16 | (0.33) | −0.15 | (0.32) | −0.16 | (0.33) | −0.17 | (0.32) |

| Endogeneity control | −0.06 | (1.09) | −0.09 | (1.12) | −0.24 | (1.11) | −0.11 | (1.13) | −0.09 | (1.11) |

| CEO promotion focus | 0.13 | (0.12) | 0.12 | (0.12) | 0.17 | (0.12) | 0.13 | (0.12) | 0.13 | (0.12) |

| CEO future focus | −0.10 | (0.12) | −0.08 | (0.12) | −0.07 | (0.12) | −0.08 | (0.12) | −0.08 | (0.12) |

| Negative attainment discrepancy | −1.17 | (0.90) | −1.27 | (0.93) | −1.35 | (0.92) | −1.29 | (0.94) | −0.73 | (0.96) |

| Discretionary slack | 0.18 * | (0.09) | 0.17 * | (0.09) | 0.18 * | (0.09) | 0.17 † | (0.09) | ||

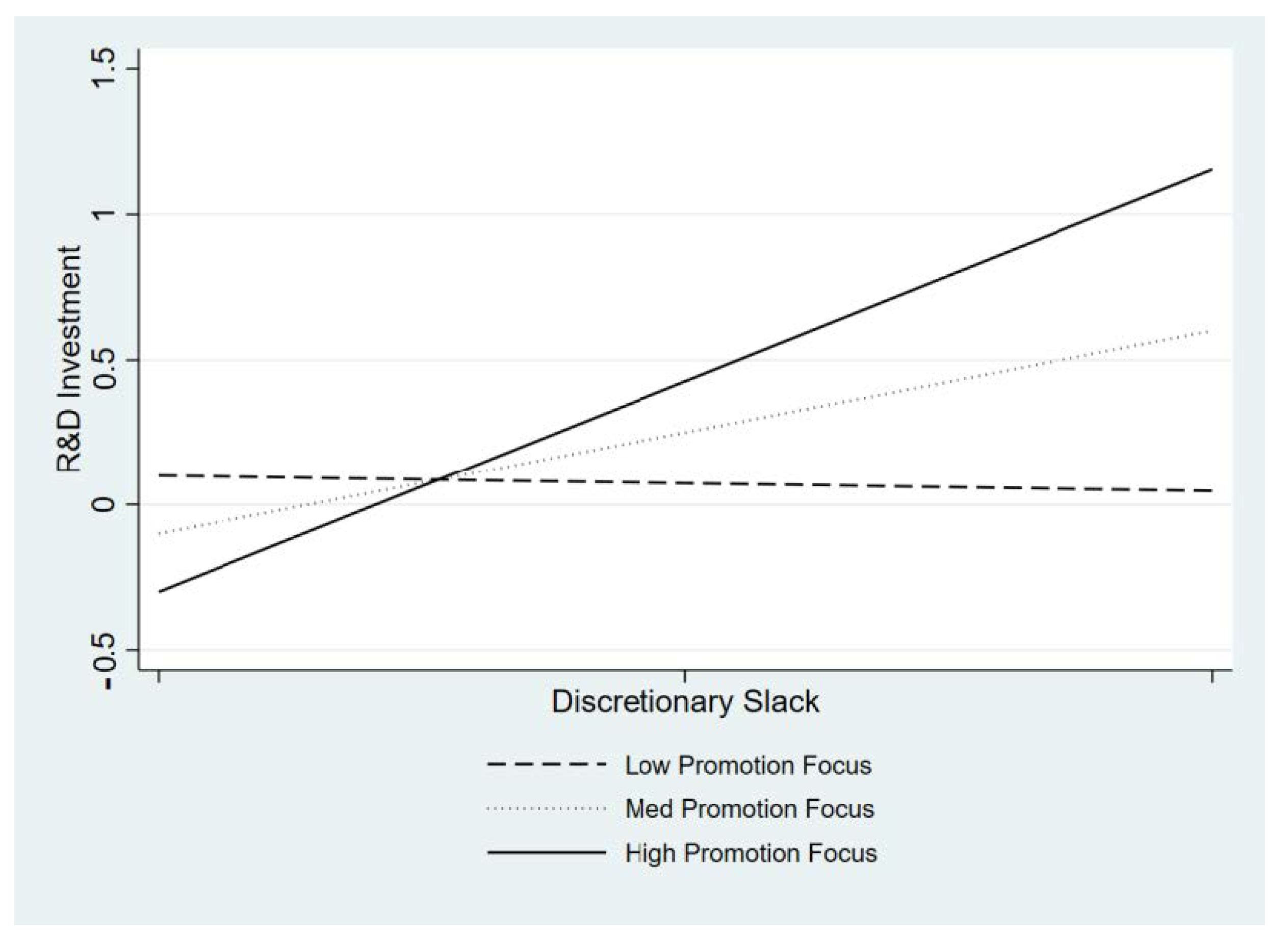

| Discretionary slack × CEO promotion focus | 0.19 * | (0.08) | ||||||||

| Discretionary slack × CEO future focus | 0.11 | (0.09) | ||||||||

| Discretionary slack × Negative attainment discrepancy | −1.59 * | (0.79) | ||||||||

| Wald Chi-Square (d.f.) | 99.86(39) *** | 99.22(40) *** | 107.84(41) *** | 100.75(41) *** | 105.66(41) *** | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.; Oh, W.-Y.; Chang, Y.K. What’s inside the Mind of a CEO? The Effects of Discretionary Slack Resources on R&D Investment. Behav. Sci. 2023, 13, 247. https://doi.org/10.3390/bs13030247

Lee S, Oh W-Y, Chang YK. What’s inside the Mind of a CEO? The Effects of Discretionary Slack Resources on R&D Investment. Behavioral Sciences. 2023; 13(3):247. https://doi.org/10.3390/bs13030247

Chicago/Turabian StyleLee, Seunghye, Won-Yong Oh, and Young Kyun Chang. 2023. "What’s inside the Mind of a CEO? The Effects of Discretionary Slack Resources on R&D Investment" Behavioral Sciences 13, no. 3: 247. https://doi.org/10.3390/bs13030247

APA StyleLee, S., Oh, W.-Y., & Chang, Y. K. (2023). What’s inside the Mind of a CEO? The Effects of Discretionary Slack Resources on R&D Investment. Behavioral Sciences, 13(3), 247. https://doi.org/10.3390/bs13030247