Which Expectations to Follow: The Impact of First- and Second-Order Beliefs on Strategy Choices in a Stag Hunt Game

Abstract

1. Introduction

2. Game Design and Hypotheses

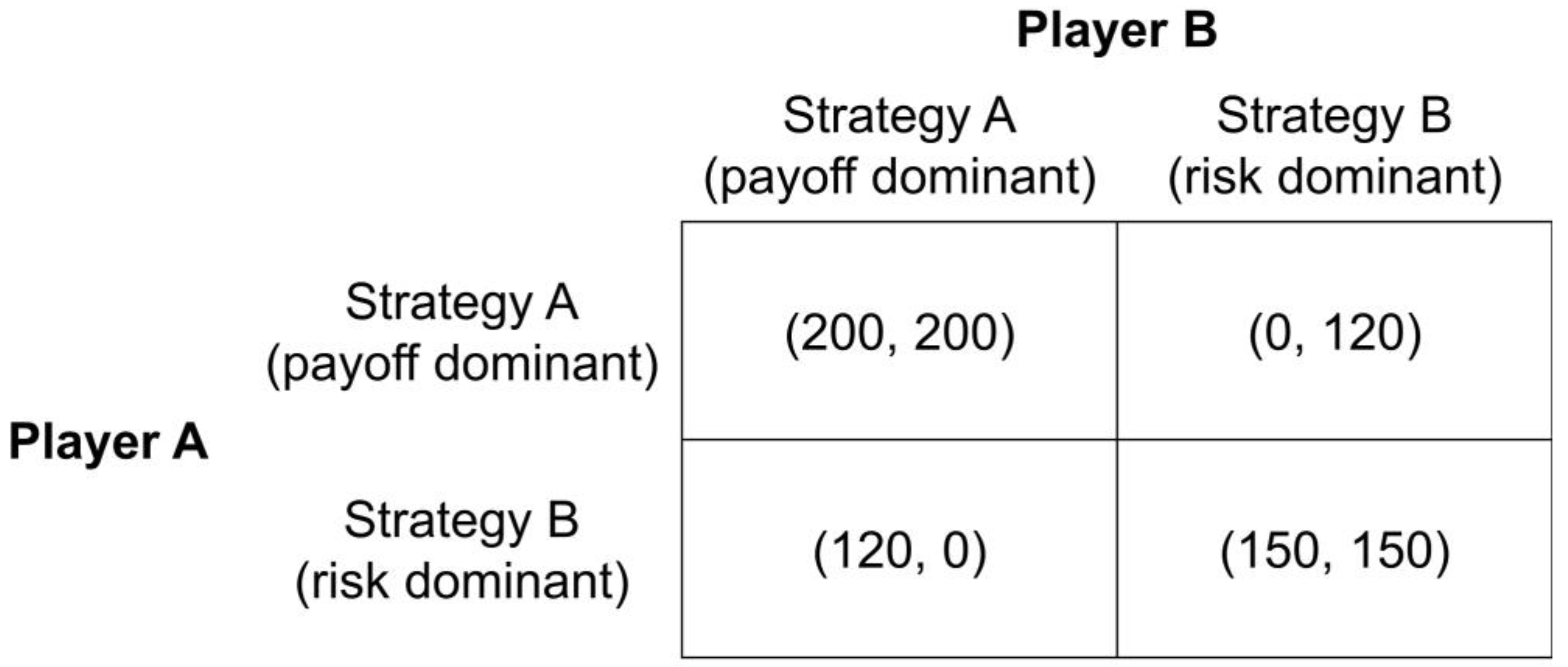

2.1. Equilibrium Selection in a Coordination Game

2.2. Belief Elicitation

- –

- If the player’s partner chooses the predicted strategy, the payoff is:

- –

- If the player’s partner does not choose the predicted strategy, the payoff is:

2.3. Lottery Choices

2.4. Research Hypotheses

3. The Experiment

4. Results

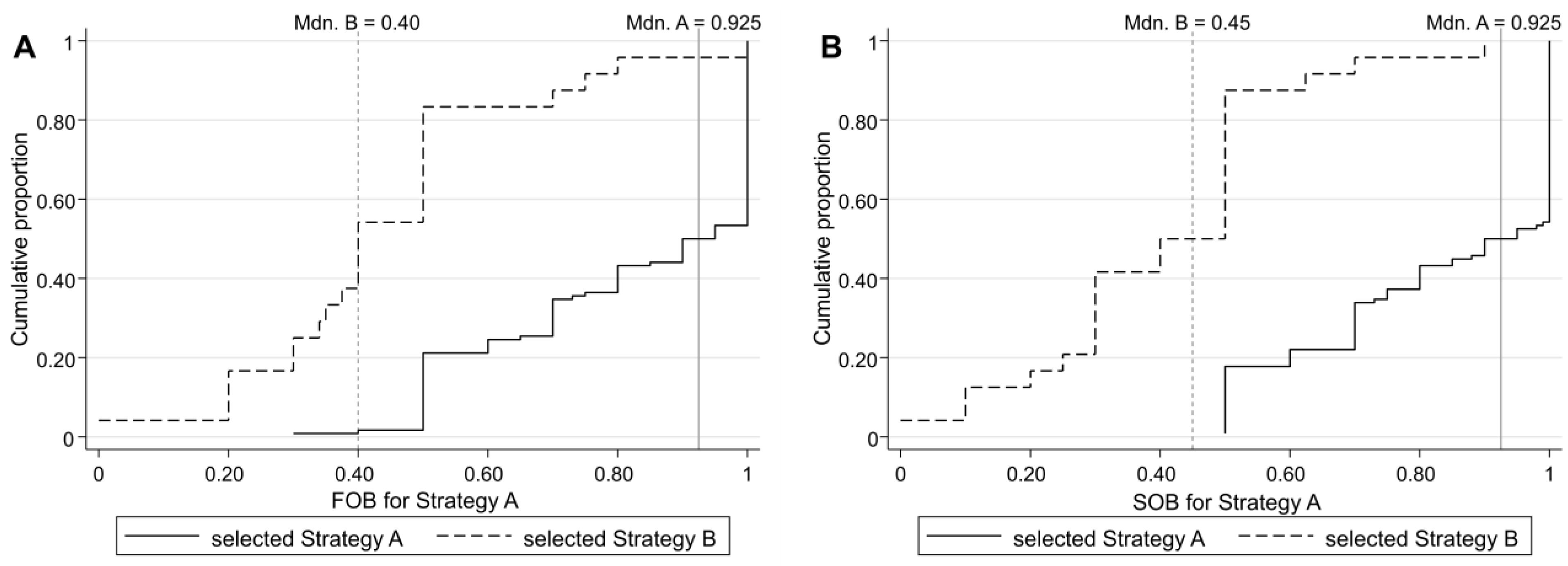

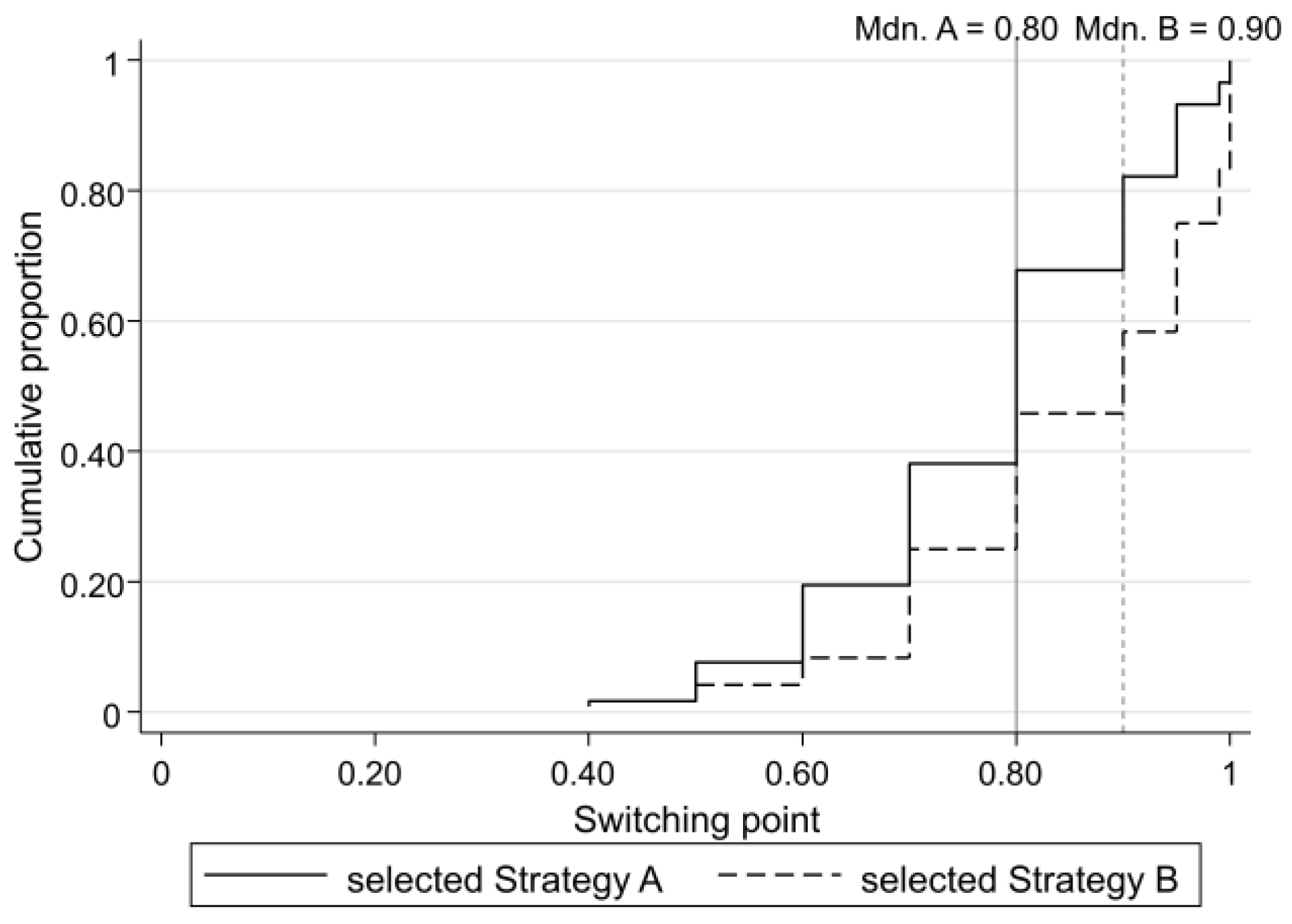

4.1. Descriptive Analysis

4.2. Determinants of the Players’ Strategy Choices

4.3. Best Response Behavior, Risk Attitudes, and Task-Order Effects

5. Discussion

5.1. Implications

5.2. Limitations and Directions for Future Research

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Experimental Instruction for the Strategy Selection Task

| Game matrix | Other player | ||||

| Strategy A | Strategy B | ||||

| You | Strategy A | 200/200 | 0/120 | ||

| Strategy B | 120/0 | 150/150 | |||

| Strategy A | Strategy B | ||||

| Which strategy do you prefer? | □ | □ | |||

Appendix A.2. Experimental Instruction for the First-Order Belief Elicitation Task

- (1)

- indicate your guess about what strategy the other player will choose and;

- (2)

- assign a number p between 0 (absolutely uncertain) and 100 (absolutely certain) that best describes how certain you are about your guess.

| Case 1: If your guess about the other player’s strategic choice is correct, your payoff will be determined by the following formula: | Example for the possible payoffs, if the guess is correct, as a function of the different values of p: | ||

| p = degree of certainty | p = 0 → 0 Points | p = 60 → 84 Points | |

| p = 10 → 19 Points | p = 70 → 91 Points | ||

| p = 20 → 36 Points | p = 80 → 96 Points | ||

| p = 30 → 51 Points | p = 90 → 99 Points | ||

| p = 40 → 64 Points | p = 100 → 100 Points | ||

| p = 50 → 75 Points | |||

| Case 2: If your guess about the other player’s strategic choice is wrong, your payoff will be determined by the following formula: | Example for the possible payoffs if the guess is wrong, as a function of the different values of p: | ||

| p = degree of certainty | p = 0 → 100 Points | p = 60 → 64 Points | |

| p = 10 → 99 Points | p = 70 → 51 Points | ||

| p = 20 → 96 Points | p = 80 → 36 Points | ||

| p = 30 → 91 Points | p = 90 → 19 Points | ||

| p = 40 → 84 Points | p = 100 → 0 Points | ||

| p = 50 → 75 Points | |||

| Game matrix | Other player | ||||

| Strategy A | Strategy B | ||||

| You | Strategy A | 200/200 | 0/120 | ||

| Strategy B | 120/0 | 150/150 | |||

| Strategy A | Strategy B | ||||

| Which strategy do you think the other player will choose? | □ | □ | |||

How confident (0–100) are you of your guess?  Please enter a number between 0 (absolutely uncertain) and 100 (absolutely certain). | |||||

Appendix A.3. Experimental Instruction for the second-Order Belief Elicitation Task

- (1)

- indicate your guess about what the other player believes about what strategy you will choose and;

- (2)

- assign a number p between 0 (absolutely uncertain) and 100 (absolutely certain) that best describes how certain you are about your guess.

| Case 1: If your guess about the other player’s strategic choice is correct, your payoff will be determined by the following formula: | Example for the possible payoffs, if the guess is correct, as a function of the different values of p: | ||

| p = degree of certainty | p = 0 → 0 Points | p = 60 → 84 Points | |

| p = 10 → 19 Points | p = 70 → 91 Points | ||

| p = 20 → 36 Points | p = 80 → 96 Points | ||

| p = 30 → 51 Points | p = 90 → 99 Points | ||

| p = 40 → 64 Points | p = 100 → 100 Points | ||

| p = 50 → 75 Points | |||

| Case 2: If your guess about the other player’s strategic choice is wrong, your payoff will be determined by the following formula: | Example for the possible payoffs if the guess is wrong, as a function of the different values of p: | ||

| p = degree of certainty | p = 0 → 100 Points | p = 60 → 64 Points | |

| p = 10 → 99 Points | p = 70 → 51 Points | ||

| p = 20 → 96 Points | p = 80 → 36 Points | ||

| p = 30 → 91 Points | p = 90 → 19 Points | ||

| p = 40 → 84 Points | p = 100 → 0 Points | ||

| p = 50 → 75 Points | |||

| Game matrix | Other player | ||||

| Strategy A | Strategy B | ||||

| You | Strategy A | 200/200 | 0/120 | ||

| Strategy B | 120/0 | 150/150 | |||

| Strategy A | Strategy B | ||||

| What do you think the other player believes you would choose? | □ | □ | |||

How confident (0–100) are you of your guess?  Please enter a number between 0 (absolutely uncertain) and 100 (absolutely certain). | |||||

Appendix A.4. Experimental Instruction for the Lottery Choice Task

| Lottery A | Lottery B | |||

| probability | p% | (100-p)% | p% | (100-p)% |

| payoff | G1A | G2A | G1B | G2A |

| Lottery A | Lottery B | |||

| probability | 10% | 90% | 90% | 10% |

| payoff | 300 | 100 | 500 | 0 |

References

- Barbera, S.; Jackson, M.O. A model of protests, revolution, and information. Q. J. Political Sci. 2020, 15, 297–335. [Google Scholar] [CrossRef]

- Chwe, M.S.-Y. Communication and coordination in social networks. Rev. Econ. Stud. 2000, 67, 1–16. [Google Scholar] [CrossRef]

- McAdams, R.H. Beyond the prisoners’ dilemma: Coordination, game theory, and law 82. S. Calif. Law Rev. 2009, 2, 245. [Google Scholar]

- Thomas, K.A.; DeScioli, P.; Haque, O.S.; Pinker, S. The psychology of coordination and common knowledge. J. Pers. Soc. Psychol. 2014, 107, 657–676. [Google Scholar] [CrossRef]

- Bhasin, T.; Butcher, C.; Gordon, E.; Hallward, M.; LeFebvre, R. Does Karen wear a mask? The gendering of COVID-19 masking rhetoric. Int. J. Socio. Soc. Policy 2020, 40, 929–937. [Google Scholar] [CrossRef]

- Krupka, E.L.; Leider, S.; Jiang, M. A meeting of the minds: Informal agreements and social norms. Manag. Sci. 2017, 63, 1708–1729. [Google Scholar] [CrossRef]

- Krupka, E.L.; Weber, R.A. Identifying social norms using coordination games: Why does dictator game sharing vary? J. Eur. Econ. Assoc. 2013, 11, 495–524. [Google Scholar] [CrossRef]

- Bicchieri, C. Norms in the Wild: How to Diagnose, Measure, and Change Social Norms; Oxford University Press: New York, NY, USA, 2017; ISBN 9780190622046. [Google Scholar]

- Bhatt, M.; Camerer, C.F. Self-referential thinking and equilibrium as states of mind in games: fMRI evidence. Spec. Issue Honor Richard D. McKelvey 2005, 52, 424–459. [Google Scholar] [CrossRef]

- Bosworth, S.J. The importance of higher-order beliefs to successful coordination. Exp. Econ. 2017, 20, 237–258. [Google Scholar] [CrossRef]

- Dustan, A.; Koutout, K.; Leo, G. Second-order beliefs and gender. J. Econ. Behav. Organ. 2022, 200, 752–781. [Google Scholar] [CrossRef]

- Büyükboyacı, M. Risk attitudes and the stag-hunt game. Econ. Lett. 2014, 124, 323–325. [Google Scholar] [CrossRef]

- Berninghaus, S.K.; Haller, S.; Krüger, T.; Neumann, T.; Schosser, S.; Vogt, B. Risk attitude, beliefs, and information in a Corruption Game–An experimental analysis. J. Econ. Psychol. 2013, 34, 46–60. [Google Scholar] [CrossRef]

- Neumann, T.; Vogt, B. Do Players’ Beliefs or Risk Attitudes Determine the Equilibrium Selections in 2 × 2 Coordination Games? FEMM Working Paper Series No. 09024; Otto von Guericke University: Magdeburg, Germany, 2009; Available online: https://www.fww.ovgu.de/fww_media/femm/femm_2009/2009_24.pdf (accessed on 1 May 2021).

- Kölle, F.; Quercia, S. The influence of empirical and normative expectations on cooperation. J. Econ. Behav. Organ. 2021, 190, 691–703. [Google Scholar] [CrossRef]

- Heinemann, F.; Nagel, R.; Ockenfels, P. Measuring Strategic Uncertainty in Coordination Games. Rev. Econ. Stud. 2009, 76, 181–221. [Google Scholar] [CrossRef]

- Schmidt, D.; Shupp, R.; Walker, J.M.; Ostrom, E. Playing safe in coordination games: The role of risk dominance, payoff dominance, and history of play. Games Econ. Behav. 2003, 42, 281–299. [Google Scholar] [CrossRef]

- Barkoukis, V.; Lazuras, L.; Tsorbatzoudis, H. Beliefs about the causes of success in sports and susceptibility for doping use in adolescent athletes. J. Sport. Sci. 2014, 32, 212–219. [Google Scholar] [CrossRef]

- Cartwright, E. Guilt aversion and reciprocity in the performance-enhancing drug game. J. Sport. Econ. 2019, 20, 535–555. [Google Scholar] [CrossRef]

- Vanberg, C. Why do people keep their promises? An experimental test of two explanations. Econometrica 2008, 76, 1467–1480. [Google Scholar] [CrossRef]

- Manski, C.F.; Neri, C. First- and second-order subjective expectations in strategic decision-making: Experimental evidence. Games Econ. Behav. 2013, 81, 232–254. [Google Scholar] [CrossRef]

- Guarin, G.; Babin, J.J. Collaboration and gender focality in stag hunt bargaining. Games 2021, 12, 39. [Google Scholar] [CrossRef]

- Al-Ubaydli, O.; Jones, G.; Weel, J. Patience, cognitive skill, and coordination in the repeated stag hunt. J. Neurosci. Psychol. Econ. 2013, 6, 71–96. [Google Scholar] [CrossRef]

- Skyrms, B. The Stag Hunt and the Evolution of Social Structure; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2004; ISBN 978-0-511-18651-6. [Google Scholar]

- Van Huyck, J.B.; Battalio, R.C.; Beil, R.O. Tacit Coordination, Strategic Uncertainty, and Coordination Failure. Am. Econ. Rev. 1990, 80, 234–248. [Google Scholar] [CrossRef]

- Brunnlieb, C.; Nave, G.; Camerer, C.F.; Schosser, S.; Vogt, B.; Münte, T.F.; Heldmann, M. Vasopressin increases human risky cooperative behavior. Proc. Natl. Acad. Sci. USA 2016, 113, 2051–2056. [Google Scholar] [CrossRef] [PubMed]

- Harsanyi, J.C.; Selten, R. A General Theory of Equilibrium Selection in Games; MIT Press: Cambridge, MA, USA, 1988. [Google Scholar]

- Nyarko, Y.; Schotter, A. An experimental study of belief learning using elicited beliefs. Econometrica 2002, 70, 971–1005. [Google Scholar] [CrossRef]

- Gerber, A. Learning In and About Games; Working Paper Series No. 234; University of Zurich: Zurich, Switzerland, 2006. [Google Scholar]

- Rey-Biel, P. Equilibrium play and best response to (stated) beliefs in normal form games. Games Econ. Behav. 2009, 65, 572–585. [Google Scholar] [CrossRef]

- Charness, G.; Gneezy, U.; Rasocha, V. Experimental methods: Eliciting beliefs. J. Econ. Behav. Organ. 2021, 189, 234–256. [Google Scholar] [CrossRef]

- Selten, R. Axiomatic characterization of the quadratic scoring rule. Exp. Econ. 1998, 1, 43–62. [Google Scholar] [CrossRef]

- Gächter, S.; Renner, E. The effects of (incentivized) belief elicitation in public goods experiments. Exp. Econ. 2010, 13, 364–377. [Google Scholar] [CrossRef]

- Trautmann, S.T.; van de Kuilen, G. Belief elicitation: A horse race among truth serums. Econ. J. 2015, 125, 2116–2135. [Google Scholar] [CrossRef]

- Palfrey, T.R.; Wang, S.W. On eliciting beliefs in strategic games. J. Econ. Behav. Organ. 2009, 71, 98–109. [Google Scholar] [CrossRef]

- Schotter, A.; Trevino, I. Belief elicitation in the laboratory. Annu. Rev. Econ. 2014, 6, 103–128. [Google Scholar] [CrossRef]

- Croson, R.T. Thinking like a game theorist: Factors affecting the frequency of equilibrium play. J. Econ. Behav. Organ. 2000, 41, 299–314. [Google Scholar] [CrossRef]

- Costa-Gomes, M.A.; Weizsäcker, G. Stated beliefs and play in normal-form games. Rev. Econ. Stud. 2008, 75, 729–762. [Google Scholar] [CrossRef]

- Neumann, T.; Vogt, B. Equilibrium selection in coordination games: An experimental study of the role of higher order beliefs in strategic decisions. In Operations Research Proceedings 2016: Selected Papers of the Annual International Conference of the German Operations Research Society (GOR), 1st ed.; Fink, A., Fügenschuh, A., Geiger, M.J., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 209–215. [Google Scholar]

- Schlag, K.H.; Tremewan, J.; van der Weele, J. A penny for your thoughts: A survey of methods for eliciting beliefs. Exp. Econ. 2015, 18, 457–490. [Google Scholar] [CrossRef]

- Hoffmann, T. The Effect of Belief Elicitation Game Play; ZBW—Deutsche Zentralbibliothek für Wirtschaftswissenschaften: Kiel, Germany; Leibniz-Informationszentrum Wirtschaft: Hamburg, Germany, 2014; Available online: https://www.econstor.eu/bitstream/10419/100483/1/VfS_2014_pid_174.pdf (accessed on 1 February 2022).

- Offerman, T.; Sonnemans, J.; van de Kuilen, G.; Wakker, P.P. A truth serum for non-bayesians: Correcting proper scoring rules for risk attitudes. Rev. Econ. Stud. 2009, 76, 1461–1489. [Google Scholar] [CrossRef]

- Schlag, K.; Tremewan, J. Simple belief elicitation: An experimental evaluation. J. Risk Uncertain. 2021, 62, 137–155. [Google Scholar] [CrossRef]

- Charness, G.; Dufwenberg, M. Promises and partnership. Econometrica 2006, 74, 1579–1601. [Google Scholar] [CrossRef]

- Holt, C.A.; Laury, S.K. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef]

- Bock, O.; Baetge, I.; Nicklisch, A. hroot: Hamburg registration and organization online tool. Eur. Econ. Rev. 2014, 71, 117–120. [Google Scholar] [CrossRef]

- Fischbacher, U. z-Tree: Zurich toolbox for ready-made economic experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef]

- Farrar, D.E.; Glauber, R.R. Multicollinearity in regression analysis: The problem revisited. Rev. Econ. Stat. 1967, 49, 92. [Google Scholar] [CrossRef]

- Belloc, M.; Bilancini, E.; Boncinelli, L.; D’Alessandro, S. Intuition and deliberation in the stag hunt game. Sci. Rep. 2019, 9, 14833. [Google Scholar] [CrossRef] [PubMed]

- Jansson, F.; Eriksson, K. Cooperation and shared beliefs about trust in the assurance game. PLoS ONE 2015, 10, e0144191. [Google Scholar] [CrossRef] [PubMed]

- Ibanez, L.; Saadaoui, H. An experimental investigation on the dark side of emotions and its aftereffects. PLoS ONE 2022, 17, e0274284. [Google Scholar] [CrossRef] [PubMed]

- Born, M.; Akkerman, A.; Thommes, K. Peer influence on protest participation: Communication and trust between co-workers as inhibitors or facilitators of mobilization. Soc. Sci. Res. 2016, 56, 58–72. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. Between trust and control: Developing confidence in partner cooperation in alliances. Acad. Manag. Rev. 1998, 23, 491–512. [Google Scholar] [CrossRef]

- Sitkin, S.B.; Roth, N.L. Explaining the limited effectiveness of legalistic “remedies” for trust/distrust. Organ. Sci. 1993, 4, 367–392. [Google Scholar] [CrossRef]

- Nakayachi, K.; Ozaki, T.; Shibata, Y.; Yokoi, R. Why do Japanese people use masks against COVID-19, even though masks are unlikely to offer protection from infection? Front. Psychol. 2020, 11, 1918. [Google Scholar] [CrossRef]

- Zumaeta, J.N. Meta-analysis of seven standard experimental paradigms comparing student to non-student. JEBS 2021, 13, 22–33. [Google Scholar] [CrossRef]

- Cooper, D.J. Are experienced managers experts at overcoming coordination failure? B.E. J. Econ. Anal. Policy 2007, 6. [Google Scholar] [CrossRef]

- Danz, D.; Vesterlund, L.; Wilson, A.J. Belief elicitation and behavioral incentive compatibility. Am. Econ. Rev. 2022, 112, 2851–2883. [Google Scholar] [CrossRef]

| Lottery Pair No. | Lottery A | Lottery B |

|---|---|---|

| [1 − p, 200; p, 0] | [p, 150; 1 − p, 120] | |

| 1 | [0.99, 200; 0.01, 0] | [0.01, 150; 0.99, 120] |

| 2 | [0.95, 200; 0.05, 0] | [0.05, 150; 0.95, 120] |

| 3 | [0.90, 200; 0.10, 0] | [0.10, 150; 0.90, 120] |

| 4 | [0.80, 200; 0.20, 0] | [0.20, 150; 0.80, 120] |

| 5 | [0.70, 200; 0.30, 0] | [0.30, 150; 0.70, 120] |

| 6 | [0.60, 200; 0.40, 0] | [0.40, 150; 0.60, 120] |

| 7 | [0.50, 200; 0.50, 0] | [0.50, 150; 0.50, 120] |

| 8 | [0.40, 200; 0.60, 0] | [0.60, 150; 0.40, 120] |

| 9 | [0.30, 200; 0.70, 0] | [0.70, 150; 0.30, 120] |

| 10 | [0.20, 200; 0.80, 0] | [0.80, 150; 0.20, 120] |

| 11 | [0.10, 200; 0.90, 0] | [0.90, 150; 0.10, 120] |

| 12 | [0.05, 200; 0.95, 0] | [0.95, 150; 0.05, 120] |

| 13 | [0.01, 200; 0.99, 0] | [0.99, 150; 0.01, 120] |

| Strategy Selection | FOB Elicitation | SOB Elicitation | Lottery Choices | |

|---|---|---|---|---|

| Possible payoffs (100 Points = €6) | ||||

| Minimum payoff | €0.00 | €0.00 | €0.00 | €0.00 |

| Riskless payoff | €7.20 | €4.50 | €4.50 | €7.20 |

| Maximum payoff | €12.00 | €6.00 | €6.00 | €12.00 |

| Task order 1 | 1 | 2 | 3 | 4 |

| Task order 2 | 1 | 3 | 2 | 4 |

| Task order 3 | 3 | 1 | 2 | 4 |

| Task order 4 | 3 | 2 | 1 | 4 |

| Game Behavior | Number of Players |

|---|---|

| Strategy selection | |

| Strategy A (payoff dominant) | 118 (83.10%) |

| Strategy B (risk dominant) | 24 (16.90%) |

| Qualitative FOB | |

| Strategy A | 119 (83.80%) |

| Strategy B | 23 (16.20%) |

| Qualitative SOB | |

| Strategy A | 123 (86.62%) |

| Strategy B | 19 (13.38%) |

| N= | 142 |

| Model 1a | Model 1b | |||||

|---|---|---|---|---|---|---|

| B (S.E.) | OR | Wald (p-Value) | B (S.E.) | OR | Wald (p-Value) | |

| prob. FOB | −7.894 (1.704) | 0.00004 | 21.44 (<0.001) | - | - | |

| prob. SOB | - | - | −11.110 (2.566) | 0.00002 | 18.70 (<0.001) | |

| Risk attitude | 2.011 (1.978) | 7.477 | 1.04 (0.309) | 2.829 (2.378) | 16.921 | 1.41 (0.234) |

| Constant | 1.653 (1.928) | 5.222 | 0.86 (0.391) | 2.690 (2.390) | 14.724 | 1.28 (0.261) |

| N | 142 | 142 | ||||

| LR χ2 (2) | 49.19 (p < 0.001) | 65.18 (p < 0.001) | ||||

| McFadden’s R2 | 0.381 | 0.505 | ||||

| Log-L. | −39.92 | −31.92 | ||||

| Model 2a (DV = pr. FOB) | Model 2b (DV = pr. SOB) | |||

|---|---|---|---|---|

| B (S.E.) | t (p-Value) | B (S.E.) | t (p-Value) | |

| Risk attitude | −0.351 (0.143) | −2.45 (0.016) | −0.357 (0.144) | −2.48 (0.014) |

| Constant | 1.034 (0.115) | 8.98 (<0.001) | 1.038 (0.115) | 9.01 (<0.001) |

| N | 142 | 142 | ||

| F(1, 140) | 6.00 (p < 0.001) | 6.17 (p < 0.001) | ||

| R2 | 0.041 | 0.042 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Neumann, T.; Bengart, P.; Vogt, B. Which Expectations to Follow: The Impact of First- and Second-Order Beliefs on Strategy Choices in a Stag Hunt Game. Behav. Sci. 2023, 13, 228. https://doi.org/10.3390/bs13030228

Neumann T, Bengart P, Vogt B. Which Expectations to Follow: The Impact of First- and Second-Order Beliefs on Strategy Choices in a Stag Hunt Game. Behavioral Sciences. 2023; 13(3):228. https://doi.org/10.3390/bs13030228

Chicago/Turabian StyleNeumann, Thomas, Paul Bengart, and Bodo Vogt. 2023. "Which Expectations to Follow: The Impact of First- and Second-Order Beliefs on Strategy Choices in a Stag Hunt Game" Behavioral Sciences 13, no. 3: 228. https://doi.org/10.3390/bs13030228

APA StyleNeumann, T., Bengart, P., & Vogt, B. (2023). Which Expectations to Follow: The Impact of First- and Second-Order Beliefs on Strategy Choices in a Stag Hunt Game. Behavioral Sciences, 13(3), 228. https://doi.org/10.3390/bs13030228