A Multivariate Analysis of the Interest in Starting Family Businesses within a Developing Economy

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Conceptual Background

2.1.1. The Closeness to Family Members

2.1.2. The Financial Support Expected from Family

2.1.3. The Individuals’ Independence Regarding the Desire to Start a Business on Their Own

2.1.4. The Intention to Form Business Partnerships with Family Members

2.2. Hypotheses Development

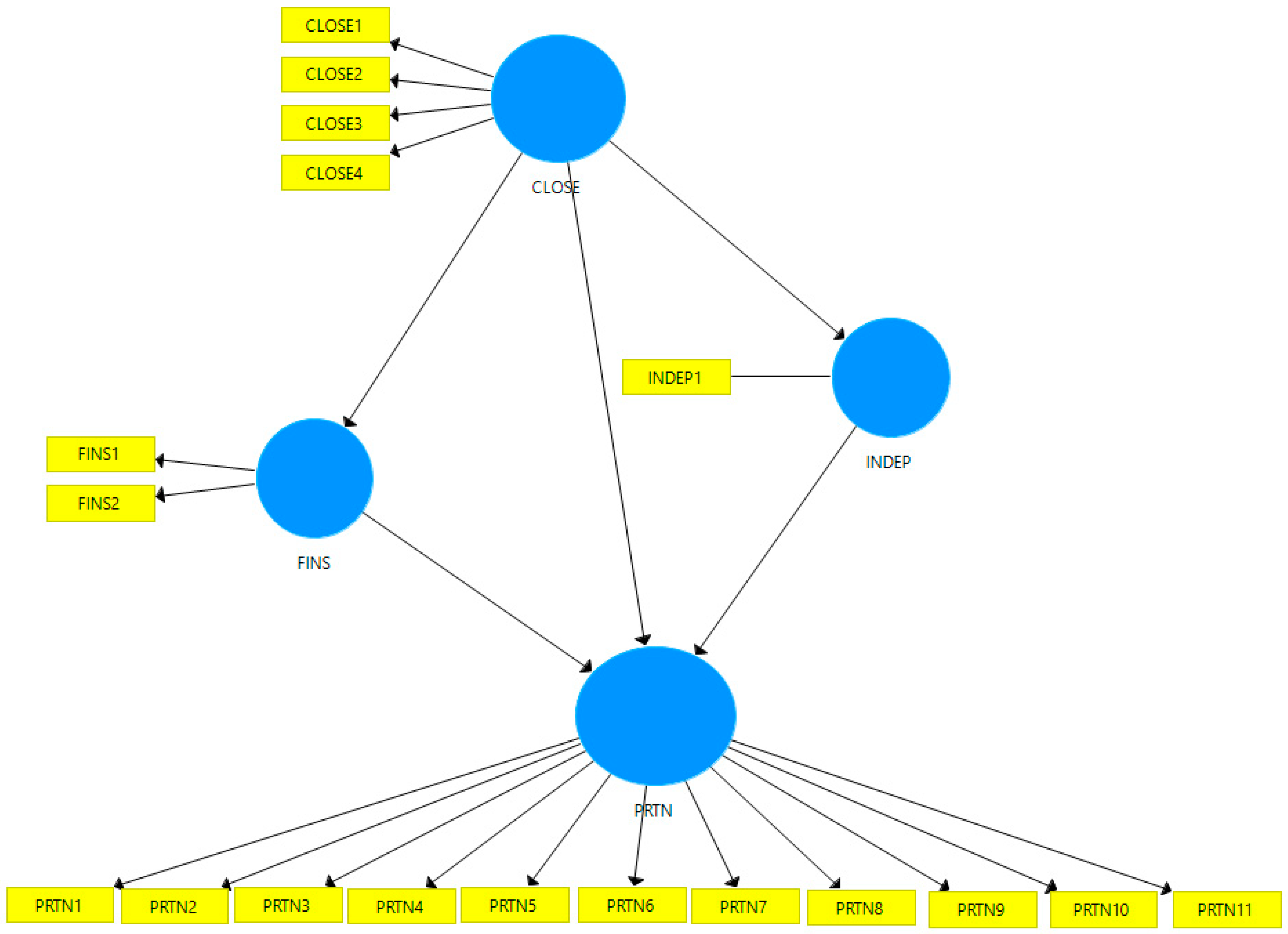

3. Research Methodology

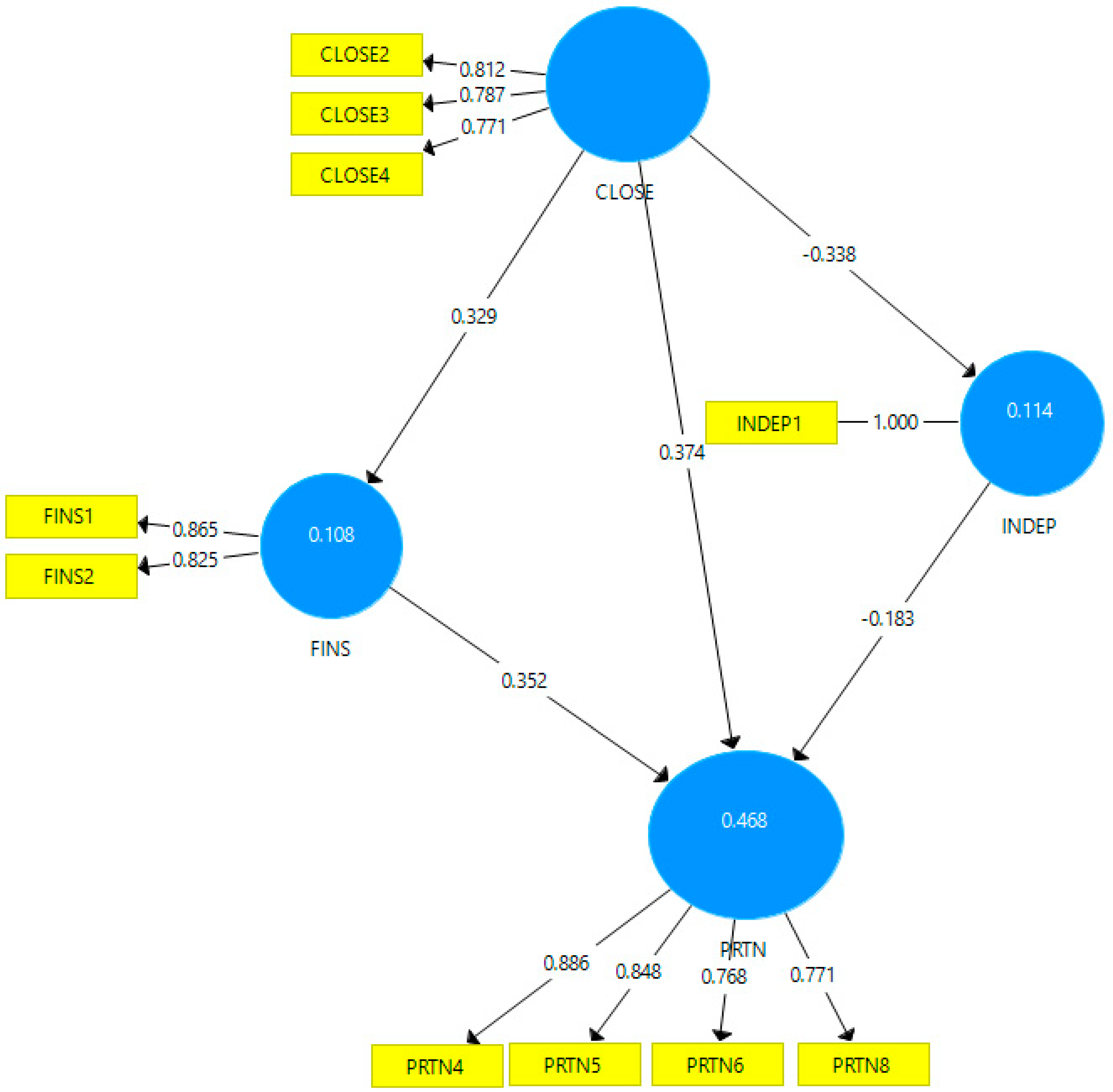

4. Results

5. Discussion

6. Conclusions

6.1. Theoretical and Practical Implications

6.2. Limitations and Future Research Directions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Fellnhofer, K.; Kraus, S. Examining attitudes towards entrepreneurship education: A comparative analysis among experts. Int. J. Entrep. Ventur. 2015, 7, 396–411. [Google Scholar] [CrossRef]

- Nowiński, W.; Haddoud, M. The role of inspiring role models in enhancing entrepreneurial intention. J. Bus. Res. 2018, 96, 183–193. [Google Scholar] [CrossRef]

- Hessels, J.; Stel, A. Entrepreneurship, export orientation, and economic growth. Small Bus. Econ. 2009, 37, 255–268. [Google Scholar] [CrossRef] [Green Version]

- Audretsch, D.B.; Lehmann, E.E.; Paleari, S.; Vismara, S. Entrepreneurial finance and technology transfer. J. Technol. Transf. 2015, 41, 1–9. [Google Scholar] [CrossRef]

- North, D. Understanding the Process of Economic Change; Princeton University Press: Princeton, NJ, USA, 2005. [Google Scholar] [CrossRef] [Green Version]

- Ács, Z.J.; Varga, A. Entrepreneurship, Agglomeration and Technological Change. Small Bus. Econ. 2005, 24, 323–334. [Google Scholar] [CrossRef]

- Blanco González, A.; Díez-Martín, F.; Prado-Román, A. Entrepreneurship, Global Competitiveness and Legitimacy. In New Challenges in Entrepreneurship and Finance: Examining the Prospects for Sustainable Business Development, Performance, Innovation, and Economic Growth; Peris-Ortiz, M., Sahut, J.M., Eds.; Springer: Berlin/Heidelberg, Germany, 2015; pp. 57–69. [Google Scholar] [CrossRef]

- European Commission. SBA Fact Sheet ROMANIA. 2019. Available online: https://ec.europa.eu/docsroom/documents/38662/attachments/24/translations/en/renditions/native (accessed on 10 January 2022).

- Impact HUB Bucharest. Barometrul Afacerilor de Tip Startup din România, 3rd ed.; EY.com: Bucharest, Romania, 2019; Available online: https://www.impacthub.ro/wp-content/uploads/2020/09/public-EY_Barometrul-startup-urilor-din-Romania-2019.pdf (accessed on 10 January 2022).

- Astrachan, J.; Shanker, M. Family Businesses Contribution to the U.S. Economy: A Closer Look. Fam. Bus. Rev. 2003, 16, 211–219. [Google Scholar] [CrossRef] [Green Version]

- Zahra, S.A.; Sharma, P. Family Business Research: A Strategic Reflection. Fam. Bus. Rev. 2004, 17, 331–346. [Google Scholar] [CrossRef]

- European Commission. Family Business. Available online: https://ec.europa.eu/growth/smes/supporting-entrepreneurship/family-business_en (accessed on 10 January 2022).

- KPMG International. Mastering a Comeback: How Family Businesses Are Triumphing over COVID-19. 2021. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2021/03/family-business-survey-report.pdf (accessed on 10 January 2022).

- PwC Romania. PwC Global Family Business Survey 2016/2017. Available online: https://www.pwc.ro/en/publication/fbs.html (accessed on 12 January 2022).

- Demirova, S.; Ahmedova, S. Analytical study of family business in Bulgaria. Innovations 2020, 8, 18–20. [Google Scholar]

- Marjański, A.; Sułkowski, Ł. The evolution of family entrepreneurship in Poland: Main findings based on surveys and interviews from 2009–2018. Entrep. Bus. Econ. Rev. 2019, 7, 95–116. [Google Scholar] [CrossRef]

- Robila, M. Families in Eastern Europe: Context, Trends and Variations. In Families in Eastern Europe (Contemporary Perspectives in Family Research); Robila, M., Ed.; Emerald Group Publishing Limited: Bingley, UK, 2004; Volume 5, pp. 1–14. [Google Scholar] [CrossRef] [Green Version]

- Scott, M.; Twomey, D. Long-term supply of entrepreneurs: Student career aspirations in relation to entrepreneurship. J. Small Bus. Manag. 1988, 26, 5–13. [Google Scholar]

- Turker, D.; Senem, S.S. Which Factors Affect Entrepreneurial Intention of University Students? J. Eur. Ind. Train. 2009, 33, 142–159. [Google Scholar] [CrossRef]

- Taormina, R.; Lao, S.K.M. Measuring Chinese entrepreneurial motivation: Personality and environmental influences. Int. J. Entrep. Behav. 2007, 13, 200–221. [Google Scholar] [CrossRef]

- Zellweger, T.; Sieger, P.; Halter, F. Should I Stay or Should I Go? Career Choice Intentions of Students with Family Business Background. J. Bus. Ventur. 2011, 26, 521–536. [Google Scholar] [CrossRef]

- Laspita, S.; Breugst, N.; Heblich, S.; Patzelt, H. Intergenerational transmission of entrepreneurial intentions. J. Bus. Ventur. 2012, 27, 414–435. [Google Scholar] [CrossRef]

- Peterman, N.E.; Kennedy, J. Enterprise education: Influencing students’ perceptions of entrepreneurship. Entrep. Theory Pract. 2003, 28, 129–144. [Google Scholar] [CrossRef]

- Maphosa, F. Towards the sociology of Zimbabwean indigenous entrepreneurship. Zambezia 1998, 25, 173–190. [Google Scholar]

- Huber, F. On the Role and Interrelationship of Spatial, Social and Cognitive Proximity: Personal Knowledge Relationships of R&D Workers in the Cambridge Information Technology Cluster. Reg. Stud. 2012, 46, 1169–1182. [Google Scholar] [CrossRef] [Green Version]

- Adjei, E.; Eriksson, R.; Lindgren, U.; Holm, E. Familial relationships and firm performance: The impact of entrepreneurial family relationships. Entrep. Reg. Dev. 2018, 31, 357–377. [Google Scholar] [CrossRef] [Green Version]

- Shittu, A.; Dosunmu, Z. Family Background and Entrepreneurial Intention of Fresh Graduates in Nigeria. J. Poverty Invest. Dev. 2014, 5, 78–90. [Google Scholar]

- Denanyoh, R.; Adjei, K.; Nyemekye, G.E. Factors That Impact on Entrepreneurial Intention of Tertiary Students in Ghana. Int. J. Bus. Soc. Res. 2015, 5, 19–29. [Google Scholar]

- Bignotti, A.; le Roux, I. Unravelling the conundrum of entrepreneurial intentions, entrepreneurship education, and entrepreneurial characteristics. Acta Commer. 2016, 16, a352. [Google Scholar] [CrossRef] [Green Version]

- Laguía, A.; Moriano, J.A.; Gorgievski, M.J. A psychosocial study of self-perceived creativity and entrepreneurial intentions in a sample of university students. Think. Ski. Creat. 2019, 31, 44–57. [Google Scholar] [CrossRef]

- Georgescu, M.-A.; Herman, E. The Impact of the Family Background on Students’ Entrepreneurial Intentions: An Empirical Analysis. Sustainability 2020, 12, 4775. [Google Scholar] [CrossRef]

- Shen, T.; Osorio, A.E.; Settles, A. Does family support matter? The influence of support factors an entrepreneurial attitudes and intentions of college students. Acad. Entrep. J. 2017, 23, 23–43. [Google Scholar]

- Edelman, L.F.; Manolova, T.; Shirokova, G.; Tsukanova, T. The impact of family support on young entrepreneurs’ start-up activities. J. Bus. Ventur. 2016, 31, 428–448. [Google Scholar] [CrossRef]

- Bates, T. Entrepreneur Human Capital Endowments and Minority Business Viability. J. Hum. Resour. 1985, 20, 540–554. [Google Scholar] [CrossRef]

- Rodriguez, P.; Tuggle, C.S.; Hackett, S.M. An exploratory study of how potential family and household capital impacts new venture start-up rates. Fam. Bus. Rev. 2009, 22, 259–272. [Google Scholar] [CrossRef]

- Steier, L. Variants of agency contracts in family-financed ventures as a continuum of familial altruistic and market rationalities. J. Bus. Ventur. 2003, 18, 597–618. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Sharma, P. Defining the family business by behavior. Entrep. Theory Pract. 1999, 23, 19–39. [Google Scholar] [CrossRef]

- Aldrich, H.; Cliff, J. The pervasive effects of family on entrepreneurship: Towards a family embeddedness perspective. J. Bus. Ventur. 2003, 18, 573–596. [Google Scholar] [CrossRef]

- Anderson, A.R.; Jack, S.L.; Dodd, S.D. The role of family members in entrepreneurial networks: Beyond the boundaries of the family firm. Fam. Bus. Rev. 2005, 18, 135–154. [Google Scholar] [CrossRef]

- Au, K.; Kwan, H.K. Start–Up Capital and Chinese Entrepreneurs: The Role of Family. Entrep. Theory Pract. 2009, 33, 889–908. [Google Scholar] [CrossRef]

- Sieger, P.; Fueglistaller, U.; Zellweger, T. Student Entrepreneurship 2016: Insights from 50 Countries. International Report of the GUESSS Project 2016. Available online: http://www.guesssurvey.org/resources/PDF_InterReports/GUESSS_2016_INT_Report_final5.pdf (accessed on 12 January 2022).

- Rahim, A. Stress, strain and their moderators: An empirical comparison of entrepreneurs and managers. J. Small Bus. Manag. 1996, 34, 46–58. [Google Scholar]

- Dolinksy, A.L.; Caputo, R.K. Health and female self-employment. J. Small Bus. Manag. 2003, 41, 233–242. [Google Scholar]

- Rai, A.; Rai, C.; Adhikari, K.; Karki, M. What Motivate Youths to Start a Business: An Empirical Evidence from Eastern Nepal. J. Manag. 2021, 4, 1–15. [Google Scholar] [CrossRef]

- Le Nguyen Doan, K. Youth’s perceptions of innovation start-up business. Glob. J. Res. Anal. 2019, 8, 67–68. [Google Scholar] [CrossRef]

- Nordqvist, M.; Melin, L. Entrepreneurial families and family firms. Entrep. Reg. Dev. 2010, 22, 211–239. [Google Scholar] [CrossRef]

- Garcia, P.R.J.M.; Sharma, P.; De Massis, A.; Wright, M.; Scholes, L. Perceived parental behaviors and next-generation engagement in family firms: A social cognitive perspective. Entrep. Theory Pract. 2018, 43, 224–243. [Google Scholar] [CrossRef] [Green Version]

- Van Auken, H.; Werbel, J. Family dynamic and family business financial performance: Spousal commitment. Fam. Bus. Rev. 2006, 19, 49–63. [Google Scholar] [CrossRef]

- Ramadani, V.; Hoy, F. Context and Uniqueness of Family Businesses. In Family Businesses in Transition Economies; Dana, L.P., Ramadani, V., Eds.; Springer: Cham, Switzerland, 2015. [Google Scholar] [CrossRef]

- Davis, P. Realizing the potential of the family business. Organ. Dyn. 1983, 12, 47–56. [Google Scholar] [CrossRef]

- Zain, M.; Kassim, N.M. Strategies of family businesses in a newly globalized developing economy. J. Fam. Bus. Manag. 2012, 2, 147–165. [Google Scholar] [CrossRef]

- Ljubotina, P.; Vadnjal, J. Succeeding a family business in a transition economy: Is this the best that can happen to me? Kybernetes 2017, 46, 1366–1385. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3. Boenningstedt: SmartPLS GmbH. 2015. Available online: http://www.smartpls.com (accessed on 5 January 2022).

- Cornea, R. 1.58 Milioane de Angajaţi din România Lucrează pe Salariul Minim pe Economie. Ziarul Financiar. 2021. Available online: https://www.zf.ro/eveniment/statistica-1-58-milioane-angajati-romania-lucreaza-salariul-minim-19939492 (accessed on 15 January 2022).

- JASP Team. JASP, Version 0.16; JASP Team: Amsterdam, The Netherlands, 2021. [Google Scholar]

- Creswell, J.W. Educational Research—Planning, Conducting, and Evaluating Quantitative and Qualitative Research, 4th ed.; Pearson Merril Prentice Hall: Hoboken, NJ, USA, 2010. [Google Scholar]

- Van Griethuijsen, R.A.; van Eijck, M.W.; Haste, H.; den Brok, P.J.; Skinner, N.C.; Mansour, N.; Gencer, A.S.; BouJaoude, S. Global Patterns in Students’ Views of Science and Interest in Science. Res. Sci. Educ. 2015, 45, 581–603. [Google Scholar] [CrossRef]

- Taber, K.S. The Use of Cronbach’s Alpha When Developing and Reporting Research Instruments in Science Education. Res. Sci. Educ. 2018, 48, 1273–1296. [Google Scholar] [CrossRef]

- Geisser, S. A Predictive Approach to the Random Effect Model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Stone, M. An Asymptotic Equivalence of Choice of Model by Cross-Validation and Akaike’s Criterion. J. R. Stat. Soc. Ser. B (Methodol.) 1977, 39, 44–47. Available online: http://www.jstor.org/stable/2984877 (accessed on 9 January 2022). [CrossRef]

- Csákné Filep, J.; Karmazin, G. Financial characteristics of family businesses and financial aspects of succession. Vez.-Bp. Manag. Rev. 2016, 47, 46–58. [Google Scholar] [CrossRef] [Green Version]

- Grote, J. Conflicting generations: A new theory of family business rivalry. Fam. Bus. Rev. 2003, 16, 113–124. [Google Scholar] [CrossRef]

- Ainsworth, S.; Cox, J.W. Families divided: Culture and control in small family business. Organ. Stud. 2003, 24, 1463–1485. [Google Scholar] [CrossRef]

- Ward, J.; Dolan, C. Defining and describing family business ownership configurations. Fam. Bus. Rev. 1998, 11, 305–310. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Kellermanns, F.W.; Matherne Iii, C.F.; Debicki, B.J. Management journals as venues for publication of family business research. Entrep. Theory Pract. 2008, 32, 927–934. [Google Scholar] [CrossRef]

- Miller, D.; Steier, L.; Le Breton-Miller, I. Lost in time: Intergenerational succession, change, and failure in family business. J. Bus. Ventur. 2003, 18, 513–531. [Google Scholar] [CrossRef]

- Sieger, P.; Minola, T. The family’s financial support as a “poisoned gift”: A family embeddedness perspective on entrepreneurial intentions. J. Small Bus. Manag. 2017, 55, 179–204. [Google Scholar] [CrossRef]

- Basu, A.; Parker, S.C. Family finance and new business start-ups. Oxf. Bull. Econ. Stat. 2001, 63, 333–358. [Google Scholar] [CrossRef]

- Osorio, A.E.; Settles, A.; Shen, T. The Influence of Support Factors on Entrepreneurial Attitudes and Intentions of College Students. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2017; Volume 2017, p. 10901. [Google Scholar] [CrossRef]

- Polin, B.; Golla, S. Entrepreneurship in Developed and Developing Nations: Contrasting the Entrepreneurs and their Contributions. In Proceedings of International Academic Conferences; no. 3305685; International Institute of Social and Economic Sciences: Prague, Czech Republic, 2016. [Google Scholar]

- Cucculelli, M. Family Firms, Entrepreneurship and Economic Development. Econ. Marche J. Appl. Econ. 2012, 31, 1–8. [Google Scholar]

- Fitzgerald, M.A.; Muske, G. Family businesses and community development: The role of small business owners and entrepreneurs. Community Dev. 2016, 47, 412–430. [Google Scholar] [CrossRef]

- Galván, R.S.; Martínez, A.B.; Rahman, M.H. Impact of family business on economic development: A study of Spain’s family-owned supermarkets. J. Bus. Econ. 2017, 5, 243–259. [Google Scholar]

- Osunde, C. Family Businesses and Its Impact on the Economy. J. Bus. Financ. Aff. 2017, 6, 1–3. [Google Scholar] [CrossRef] [Green Version]

- Meghisan-Toma, M.; Puiu, S.; Florea, N.M.; Meghisan, F.; Doran, D. Generation Z’s Young Adults and the M-Commerce Use in Romania. J. Theory Appl. Electron. Commer. Res. 2021, 16, 1458–1471. [Google Scholar] [CrossRef]

- INS. Romania in Numbers. 2019. Available online: https://insse.ro/cms/sites/default/files/field/publicatii/romania_in_cifre_2019_2.pdf (accessed on 18 January 2022).

- Ministry of Agriculture and Rural Development. Strategia Pentru Dezvoltarea Sectorului Agroalimentar pe Termen Mediu și Lung: Orizont 2020–2030. Available online: https://www.madr.ro/docs/agricultura/strategia-agroalimentara-2020-2030.pdf (accessed on 30 May 2022).

- Eurostat. Farming: Profession with Relatively Few Young Farmers. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20180719-1 (accessed on 30 May 2022).

- Carlsson, C. Motivation within a Family Business. Master’s Thesis, Jönköping University, Jönköping, Sweden, May 2012. Available online: https://www.diva-portal.org/smash/get/diva2:532228/FULLTEXT01.pdf (accessed on 18 January 2022).

- Toska, A.; Ramadani, V.; Dana, L.P.; Rexhepi, G.; Zeqiri, J. Family business successors’ motivation and innovation capabilities: The case of Kosovo. J. Fam. Bus. Manag. 2021. [Google Scholar] [CrossRef]

- Statista. Share of Entrepreneurs in Romania in 2019, by Gender. Available online: https://www.statista.com/statistics/1106416/businessmen-by-gender-romania/ (accessed on 30 May 2022).

- CEED. Romania. Available online: https://ceed-global.org/romania/ (accessed on 30 May 2022).

- García, I.J.; Garvey, A.M. Economic and Social Interactions in Business Students during COVID-19 Confinement: Relationship with Sleep Disturbance. Behav. Sci. 2022, 12, 100. [Google Scholar] [CrossRef] [PubMed]

- Vo, T.T.D.; Tuliao, K.V.; Chen, C.-W. Work Motivation: The Roles of Individual Needs and Social Conditions. Behav. Sci. 2022, 12, 49. [Google Scholar] [CrossRef] [PubMed]

| Constructs (Code) | Items | Item Codes |

|---|---|---|

| Closeness to family members (CLOSE) | My family is near me and supports me by all means. | CLOSE1 |

| When I make decisions, I ask for my family’s advice. | CLOSE2 | |

| When I have problems, I share them with my family. | CLOSE3 | |

| In order to start something, I need the support from my family. | CLOSE4 | |

| The financial support expected from family (FINS) | I can convince my family to offer me financial support to start a business on their own. | FINS1 |

| If my family members are suppliers for my business, they support me financially. | FINS2 | |

| The individuals’ independence regarding the desire to start a business on their own (INDEP) | I would like to have a completely independent business, without any interaction with my family. | INDEP1 |

| The intention to form business partnerships with family members (PRTN) | I would feel safer if my family members would be suppliers for my business. | PRTN1 |

| I would include my family members in my plans to start a business on their own. | PRTN2 | |

| Having good business relations with my family would reduce the stress for me. | PRTN3 | |

| I would prefer to have an intergenerational family business with my relatives than a completely independent business. | PRTN4 | |

| I would prefer to have a family business with my parents. | PRTN5 | |

| I would prefer to have a joint business with my relatives. | PRTN6 | |

| I would involve my parents in my business as employees. | PRTN7 | |

| I would involve my parents in my business as subcontractors. | PRTN8 | |

| If I started a business, I would use the competencies of my family members. | PRTN9 | |

| I would develop a business with my grandparents (the first generation). | PRTN10 | |

| I would develop a business with my parents (the second generation). | PRTN11 |

| Age | Frequency | Percent | Mean | Minimum | Maximum |

|---|---|---|---|---|---|

| 19–29 years old | 123 | 61.5 | 29.625 | 19 | 55 |

| 30–55 years old | 77 | 38.5 |

| Item Codes | Outer Loadings | Outer VIF Values |

|---|---|---|

| CLOSE1 | 0.612 | 1.202 |

| CLOSE2 | 0.811 | 1.606 |

| CLOSE3 | 0.716 | 1.446 |

| CLOSE4 | 0.723 | 1.289 |

| FINS1 | 0.845 | 1.227 |

| FINS2 | 0.846 | 1.227 |

| INDEP1 | 1.000 | 1.000 |

| PRTN1 | 0.632 | 1.760 |

| PRTN2 | 0.674 | 2.292 |

| PRTN3 | 0.679 | 1.940 |

| PRTN4 | 0.828 | 3.061 |

| PRTN5 | 0.834 | 3.361 |

| PRTN6 | 0.735 | 2.433 |

| PRTN7 | 0.619 | 1.585 |

| PRTN8 | 0.735 | 2.029 |

| PRTN9 | 0.631 | 1.686 |

| PRTN10 | 0.489 | 1.513 |

| PRTN11 | 0.695 | 2.121 |

| Construct | Cronbach’s Alpha | rho_A | Composite Reliability | AVE |

|---|---|---|---|---|

| CLOSE | 0.699 | 0.702 | 0.833 | 0.624 |

| FINS | 0.601 | 0.607 | 0.833 | 0.714 |

| INDEP | 1.000 | 1.000 | 1.000 | 1.000 |

| PRTN | 0.836 | 0.843 | 0.891 | 0.671 |

| Construct | CLOSE | FINS | INDEP | PRTN |

|---|---|---|---|---|

| CLOSE | 0.790 | |||

| FINS | 0.329 | 0.845 | ||

| INDEP | −0.338 | −0.300 | 1.000 | |

| PRTN | 0.552 | 0.530 | −0.415 | 0.819 |

| T Statistics | p–Values | Confidence Interval Bias Corrected | |

|---|---|---|---|

| CLOSE- > FINS | 5.017 | 0.000 | (0.186, 0.447) |

| CLOSE- > INDEP | 4.983 | 0.000 | (−0.469, −0.201) |

| CLOSE- > PRTN | 6.191 | 0.000 | (0.228, 0.475) |

| INDEP- > PRTN | 2.704 | 0.007 | (−0.304, −0.054) |

| FINS- > PRTN | 5.589 | 0.000 | (0.244, 0.480) |

| Hypothesis | Results |

|---|---|

| CLOSE- > FINS (H1) | Accepted |

| CLOSE- > INDEP (H2) | Accepted |

| CLOSE- > PRTN (H3) | Accepted |

| INDEP- > PRTN (H4) | Accepted |

| FINS- > PRTN (H5) | Accepted |

| Construct | SSO | SSE | Q2 (=1-SSE/SSO) |

|---|---|---|---|

| CLOSE | 600.000 | 600.000 | |

| FINS | 400.000 | 370.483 | 0.074 |

| INDEP | 200.000 | 179.665 | 0.102 |

| PRTN | 800.000 | 557.987 | 0.303 |

| Item Codes | Mean | Standard Deviation | Outer Loading |

|---|---|---|---|

| CLOSE2 | 3.675 | 1.371 | 0.812 |

| CLOSE3 | 3.455 | 1.424 | 0.787 |

| CLOSE4 | 2.855 | 1.433 | 0.771 |

| FINS1 | 3.495 | 1.393 | 0.865 |

| FINS2 | 3.895 | 1.136 | 0.825 |

| INDEP1 | 3.335 | 1.461 | 1.000 |

| PRTN4 | 3.085 | 1.318 | 0.886 |

| PRTN5 | 3.360 | 1.378 | 0.848 |

| PRTN6 | 2.545 | 1.352 | 0.768 |

| PRTN8 | 3.160 | 1.405 | 0.771 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Puiu, S.; Bădîrcea, R.M.; Manta, A.G.; Doran, N.M.; Meghisan-Toma, G.-M.; Meghisan, F. A Multivariate Analysis of the Interest in Starting Family Businesses within a Developing Economy. Behav. Sci. 2022, 12, 181. https://doi.org/10.3390/bs12060181

Puiu S, Bădîrcea RM, Manta AG, Doran NM, Meghisan-Toma G-M, Meghisan F. A Multivariate Analysis of the Interest in Starting Family Businesses within a Developing Economy. Behavioral Sciences. 2022; 12(6):181. https://doi.org/10.3390/bs12060181

Chicago/Turabian StylePuiu, Silvia, Roxana Maria Bădîrcea, Alina Georgiana Manta, Nicoleta Mihaela Doran, Georgeta-Madalina Meghisan-Toma, and Flaviu Meghisan. 2022. "A Multivariate Analysis of the Interest in Starting Family Businesses within a Developing Economy" Behavioral Sciences 12, no. 6: 181. https://doi.org/10.3390/bs12060181

APA StylePuiu, S., Bădîrcea, R. M., Manta, A. G., Doran, N. M., Meghisan-Toma, G.-M., & Meghisan, F. (2022). A Multivariate Analysis of the Interest in Starting Family Businesses within a Developing Economy. Behavioral Sciences, 12(6), 181. https://doi.org/10.3390/bs12060181