Reputation Incongruence and the Preference of Stakeholder: Case of MBA Rankings

Abstract

1. Introduction

2. Theory and Hypotheses

2.1. Multidimensionality of Reputation

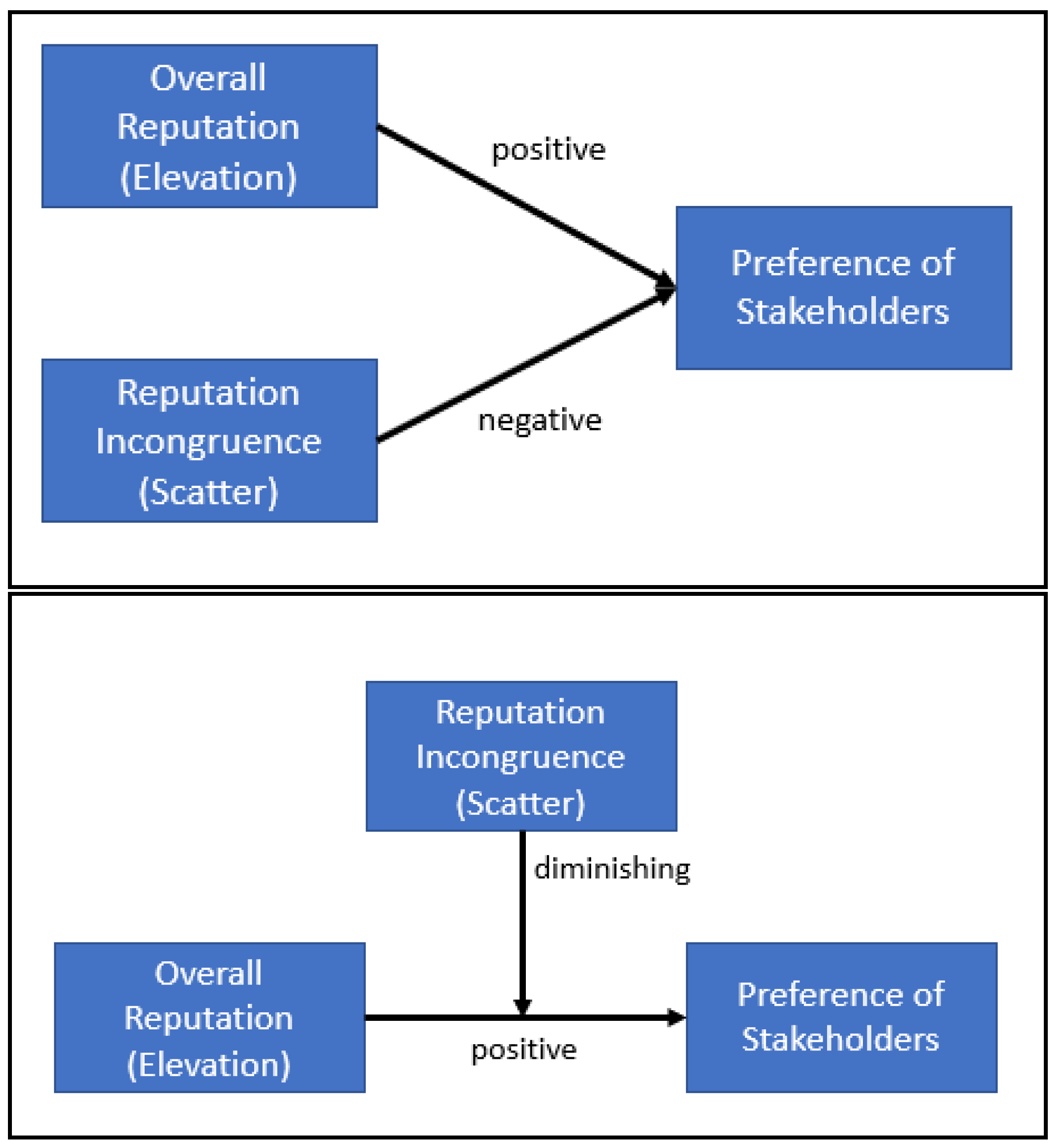

2.2. Effect of Elevation on the Preference of Stakeholders

2.3. Effect of Scatter: Reputation Incongruence

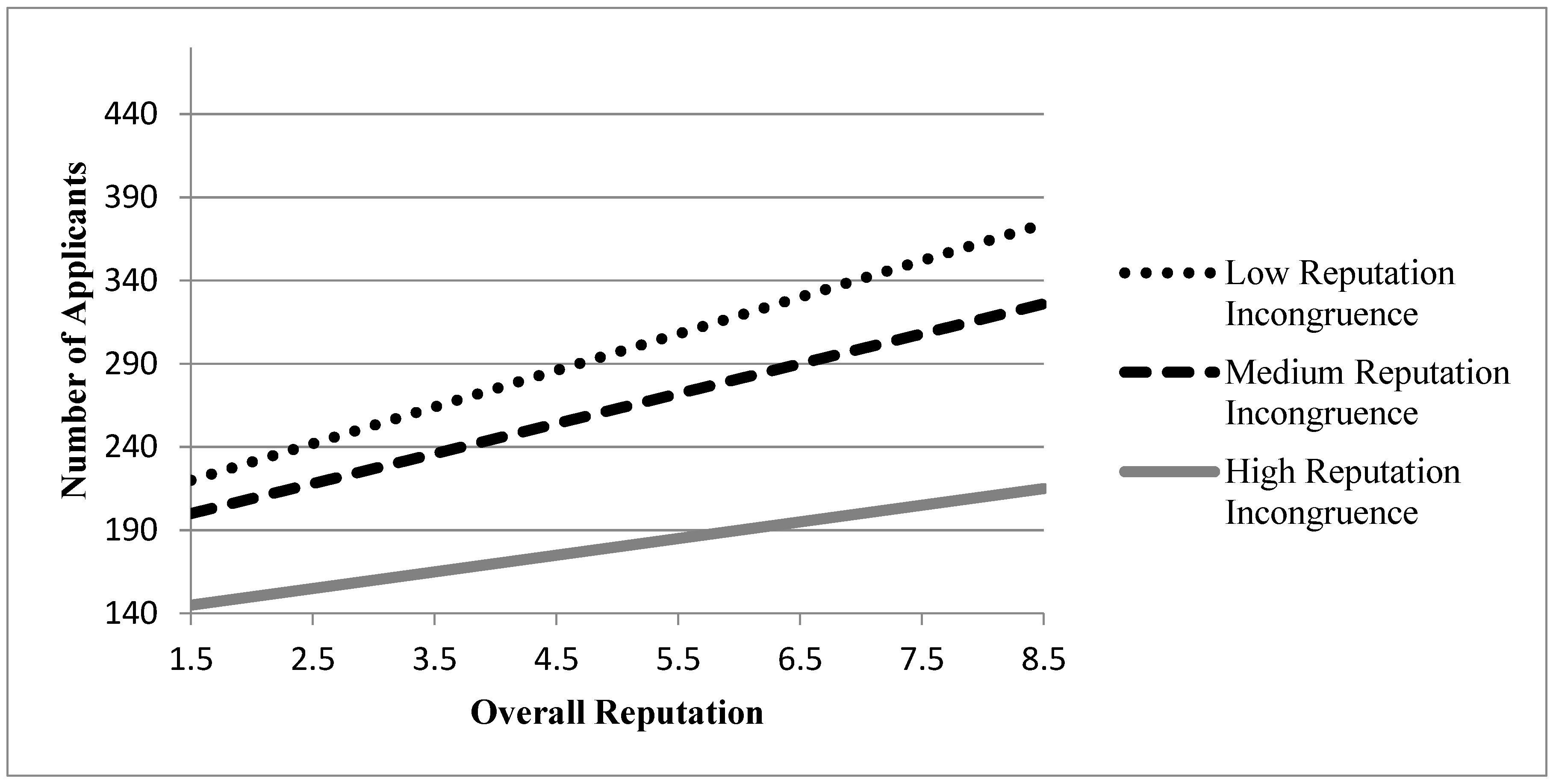

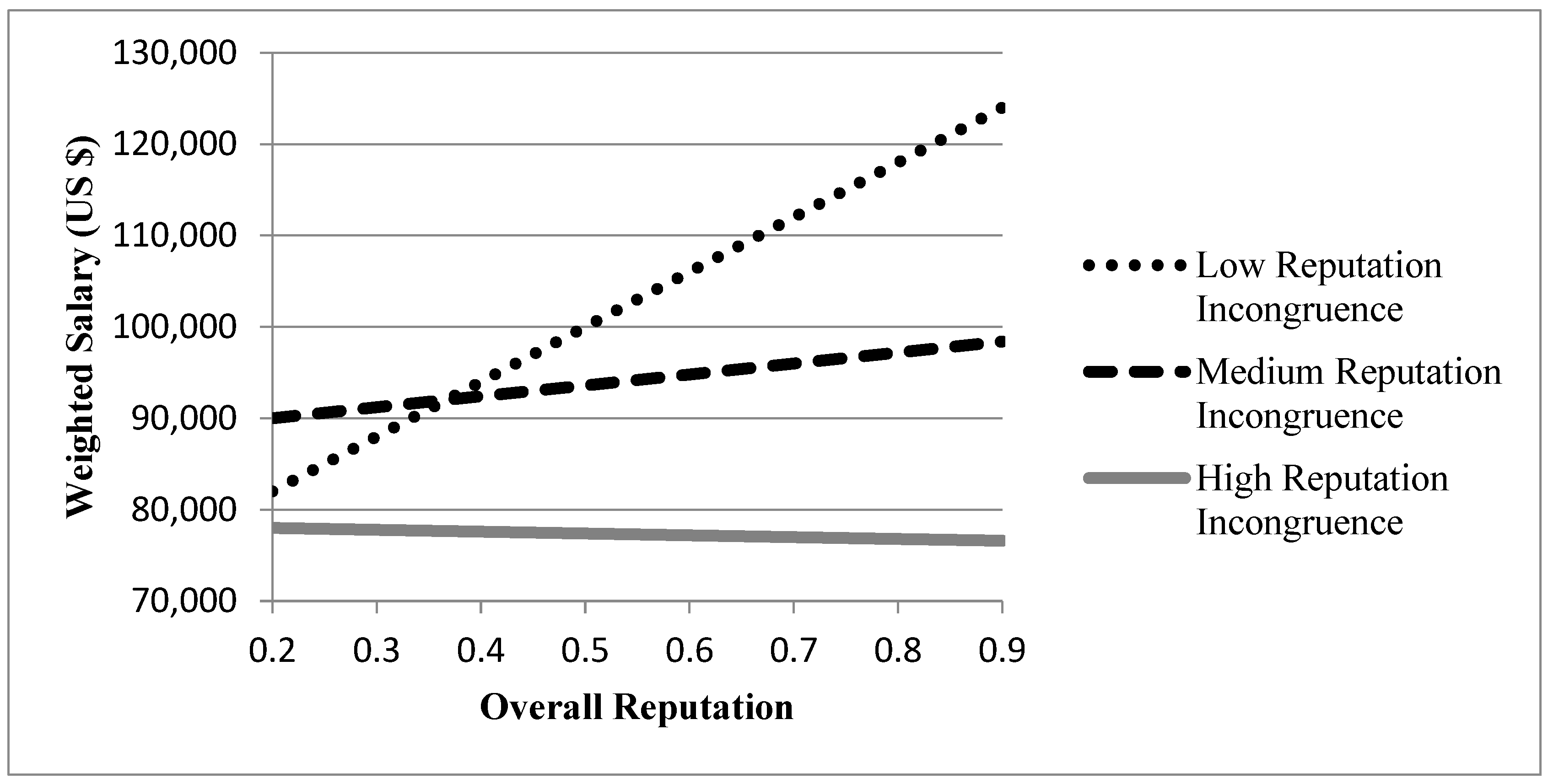

2.4. Moderating Effect of Reputation Incongruence

3. Methods

3.1. Data and Samples

3.2. Dependent Variables

3.3. Elevation of Reputation

- Dijt: is jth dimension’s reputation of i-th MBA program in the selected current year, t.

- Aijk: is a kth subcategory’s ranking of aggregated measure for jth dimension’s ranking.

3.4. Reputation Incongruence

3.5. Control Variables

3.6. Models

- OEi(t−1): is (t−1) year’s overall reputation of i-th MBA program.

- RIi(t−1): is (t−1) year’s reputation incongruence of i-th MBA program.

- Xi(t−1): is (t−1) year’s control variables of i-th MBA program.

- μit: is (t−1) year’s intercept of i-th MBA program.

4. Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ravasi, D.; Rindova, V.; Etter, M.; Cornelissen, J. The formation of organizational reputation. Acad. Manag. Ann. 2018, 12, 574–599. [Google Scholar] [CrossRef]

- Weigelt, K.; Camerer, C. Reputation and corporate strategy: A review of recent theory and applications. Strateg. Manag. J. 1988, 9, 443–454. [Google Scholar] [CrossRef]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate reputation: The definitional landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Ponzi, L.J.; Fombrun, C.J.; Gardberg, N.A. RepTrak™ Pulse: Conceptualizing and validating a short-form measure of corporate reputation. Corp. Rep. Rev. 2011, 14, 15–35. [Google Scholar] [CrossRef]

- Fombrun, C.J. Reputation: Realizing Value from the Corporate Image; Harvard Business Review Press: Boston, MA, USA, 1996. [Google Scholar]

- Boyd, B.K.; Bergh, D.D.; Ketchen, D.J. Reconsidering the reputation--performance relationship: A resource-based view. J. Manag. 2009, 36, 588–609. [Google Scholar] [CrossRef]

- Fombrn, C.J.; Shanley, M. What’s in a Name? Reputation Building and Corporate Strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar]

- Rhee, M.; Kim, Y.-C.; Han, J. Confidence in imitation: Niche-width strategy in the U.K. automobile industry. Manag. Sci. 2006, 52, 501–513. [Google Scholar] [CrossRef]

- Cronbach, L.J.; Gleser, G.C. Assessing similarity between profiles. Psychol. Bull. 1953, 50, 456–473. [Google Scholar] [CrossRef]

- Ellsberg, D. Risk, ambiguity, and the savage axioms. Q. J. Econ. 1963, 77, 336–342. [Google Scholar] [CrossRef]

- McGuire, J.B.; Alison, S.; Schneeweis, T. Corporate Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–972. [Google Scholar]

- Ganzach, Y. Attribute scatter and decision outcome: Judgment versus choice. Org. Behav. Hum. Dec. Proc. 1995, 1, 113–122. [Google Scholar] [CrossRef]

- Jagannathan, R.; Ma, T. Risk reduction in large portfolios: Why imposing the wrong constraints helps. J. Financ. 2003, 58, 1651–1684. [Google Scholar] [CrossRef]

- Maheswaran, D.; Meyers-Levy, J. The influence of message framing and issue involvement. J. Mark. Res. 1990, 361–367. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P. Reputation as an intangible asset: Reflections on theory and methods in two empirical studies of business school reputations. J. Manag. 2010, 36, 610–619. [Google Scholar] [CrossRef]

- Fombrun, C.J.; Gardberg, N.A.; Sever, J.M. The reputation quotient: A multi-stakeholder measure of corporate reputation. J. Brand Manag. 2000, 7, 241–255. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P.; Sever, J.M. Being good or being known: An empirical examination of the dimensions, antecedents, and consequences of organizational reputation. Acad. Manag. J. 2005, 48, 1033–1049. [Google Scholar] [CrossRef]

- Feldstein, M.S. Mean-variance analysis in the theory of liquidity preference and portfolio selection. Rev. Econ. Stud. 1969, 36, 5–12. [Google Scholar] [CrossRef]

- Francés-Gómez, P.; Del Rio, A. Stakeholder’s preference and rational compliance: A comment on Sacconi’s ‚“CSR as a model for extended corporate governance II: Compliance, reputation and reciprocity”. J. Bus. Ethics 2008, 82, 59–76. [Google Scholar] [CrossRef]

- Okada, E.; Hoch, S. Spending time versus spending money. J. Consum. Res. 2004, 31, 313–323. [Google Scholar] [CrossRef]

- Igwe Paul, A.; Rahman, M.; Ohalehi, P.; Amaugo, A.; Anigbo Julian, A. Responsible education: What engages international postgraduate students–evidence from UK. J. Gl. Resp. 2020, 4, 363–376. [Google Scholar]

- Argenti, P. Branding b-schools: Reputation management for MBA programs. Corp. Reput. Rev. 2000, 3, 171–178. [Google Scholar] [CrossRef]

- Jia, J.; Luce, M.F.; Fischer, G.W. Consumer Preference Uncertainty: Measures of Attribute Conflict and Extremity; Project Paper; Wharton-SMU Research Center: Singapore, 2004; pp. 1–42. [Google Scholar]

- Von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 1953. [Google Scholar]

- Cabantous, L. Ambiguity aversion in the field of insurance: Insurers’ attitude to imprecise and conflicting probability estimates. Theory Decis. 2007, 62, 219–240. [Google Scholar] [CrossRef]

- Pratt, M.G. The good, the bad, and the ambivalent: Managing identification among Amway distributors. Adm. Sci. Q. 2000, 45, 456–493. [Google Scholar] [CrossRef]

- Guseva, A.; Rona-Tas, A. Uncertainty, risk, and trust: Russian and American credit card markets compared. Am. Sociol. Rev. 2001, 66, 623–646. [Google Scholar] [CrossRef][Green Version]

- Cabantous, L.; Hilton, D.; Kunreuther, H.; Michel-Kerjan, E. Is imprecise knowledge better than conflicting expertise? Evidence from insurers’ decisions in the United States. J. Risk Uncertain. 2011, 42, 211–232. [Google Scholar] [CrossRef]

- Chatterjee, S.; Kang, Y.S.; Mishra, D.P. Market signals and relative preference: The moderating effects of conflicting information, decision focus, and need for cognition. J. Bus. Res. 2005, 58, 1362–1370. [Google Scholar] [CrossRef]

- Spence, M. Job market signaling. Q. J. Econ. 1973, 87, 355. [Google Scholar] [CrossRef]

- Cronbach, L.J.; Rajaratnam, N.; Gleser, G.C. Theory of generalizability: A liberalization of reliability theory? Br. J. Stat. Psychol. 1963, 16, 137–163. [Google Scholar] [CrossRef]

- Snow, A. Ambiguity and the value of information. J. Risk Uncertain. 2010, 40, 133–145. [Google Scholar] [CrossRef]

- Financial Times. Global MBA Ranking 2013. Available online: http://rankings.ft.com/businessschoolrankings/global-mba-ranking-2013 (accessed on 10 January 2020).

- Fisher, D.M.; Kiang, M.; Fisher, S.A. A value-added approach to selecting the best Master of Business Administration (MBA) program. J. Educ. Bus. 2007, 83, 72–76. [Google Scholar] [CrossRef]

- Christensen, L.J.; Peirce, E.; Hartman, L.P.; Hoffman, W.M.; Carrier, J. Ethics, CSR, and sustainability education in the Financial Times top 50 global business schools: Baseline data and future research directions. J. Bus. Ethics 2007, 73, 347–368. [Google Scholar] [CrossRef]

- Altbach, P.G.; Knight, J. The internationalization of higher education: Motivations and realities. J. Stud. Int. Educ. 2007, 11, 290–305. [Google Scholar] [CrossRef]

- Cronbach, L.J. Statistical tests for moderator variables: Flaws in analyses recently proposed. Psychol. Bull. 1987, 102, 414–417. [Google Scholar] [CrossRef]

- Lewontin, R.C. On the measurement of relative variability. Syst. Zool. 1966, 15, 141–142. [Google Scholar] [CrossRef]

- Bedeian, A.G.; Mossholder, K.W. On the use of the coefficient of variation as a measure of diversity. Organ. Res. Methods 2000, 3, 285–297. [Google Scholar] [CrossRef]

- Trieschmann, J.S.; Dennis, A.R.; Northcraft, G.B.; Niemi, A.W., Jr. Serving multiple constituencies in business schools: M.B.A. Program versus research performance. Acad. Manag. J. 2000, 43, 1130–1141. [Google Scholar]

- Shropshire, C.; Hillman, A.J. A longitudinal study of significant change in stakeholder management. Bus. Soc. 2007, 46, 63–87. [Google Scholar] [CrossRef]

- Safón, V. Factors that influence recruiters’ choice of b-schools and their MBA graduates: Evidence and implications for b-schools. Acad. Manag. Learn. Educ. 2007, 6, 217–233. [Google Scholar] [CrossRef]

- Wilkins, A.L.; Ouchi, W.G. Efficient cultures: Exploring the relationship between culture and organizational performance. Adm. Sci. Q. 1983, 28, 468–481. [Google Scholar] [CrossRef]

- Choi, Y.R.; Shepherd, D.A. Stakeholder perceptions of age and other dimensions of newness. J. Manag. 2005, 31, 573–596. [Google Scholar] [CrossRef]

- Dreher, G.F.; Ryan, K.C. Evaluating mba-program admissions criteria: The relationship between pre-mba work experience and post-mba career outcomes. Res. High. Educ. 2002, 43, 727–744. [Google Scholar] [CrossRef]

- Graddy, K.; Pistaferri, L. Wage differences by gender: Evidence from recently graduated MBAs. Oxf. Bull. Econ. Stat. 2000, 62, 837–854. [Google Scholar] [CrossRef]

- Hubbard, A.E.; Ahern, J.; Fleischer, N.L.; de Laan, M.V.; Lippman, S.A.; Jewell, N.; Bruckner, T.; Satariano, W.A. To gee or not to gee: Comparing population average and mixed models for estimating the associations between neighborhood risk factors and health. Epidemiology 2010, 21, 467–474. [Google Scholar] [CrossRef] [PubMed]

- Liang, K.-Y.; Zeger, S.L. Longitudinal data analysis using generalized linear models. Biometrika 1986, 73, 13–22. [Google Scholar] [CrossRef]

- Belsley, D.A.; Kuh, E.; Welsch, R.E. Regression Diagnostics: Identifying Influential Data and Sources of Collinearity; John Wiley: New York, NY, USA, 1980. [Google Scholar]

- Hannan, M.T.; Freeman, J. Structural inertia and organizational change. Am. Sociol. Rev. 1984, 49, 149–164. [Google Scholar] [CrossRef]

- Parker, O.; Krause, R. The need for speed: How reputation incongruence impacts new product introduction. Acad. Manag. Best Pap. Proc. 2012, 1, 13142. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Dahlin, K.B. Aspiration performance and railroads’ patterns of learning from train wrecks and crashes. Organ. Sci. 2007, 18, 368–385. [Google Scholar] [CrossRef]

- Greve, H.R. Performance, aspirations, and risky organizational change. Adm. Sci. Q. 1998, 43, 58–86. [Google Scholar] [CrossRef]

- Shinzato, T. Minimal investment risk of a portfolio optimization problem with budget and investment concentration constraints. J. Stat. Mech. Theory Exp. 2017, 2, 023301. [Google Scholar] [CrossRef]

- Yue, P.; Gizem Korkmaz, A.; Zhou, H. Household Financial Decision Making Amidst the COVID-19 Pandemic. Emerg. Mark. Financ. Trade 2020, 56, 2363–2377. [Google Scholar] [CrossRef]

- Polkovnichenko, V. Household portfolio diversification: A case for rank-dependent preferences. Rev. Financ. Stud. 2005, 18, 1467–1502. [Google Scholar] [CrossRef]

- Fortune. World’s Most Admired Companies. Available online: https://fortune.com/worlds-most-admired-companies/ (accessed on 10 January 2020).

- Maclean, M.; Harvey, C.; Clegg, S.R. Conceptualizing historical organization studies. Acad. Manag. Rev. 2016, 41, 609–632. [Google Scholar] [CrossRef]

- Gyan, A.K.; Brahmana, R.; Bakri, A.K. Diversification strategy, efficiency, and firm performance: Insight from emerging market. Res. Int. Bus. Financ. 2017, 42, 1103–1114. [Google Scholar] [CrossRef]

- Hill, C.W.L.; Rothaermel, F.T. The performance of incumbent firms in the face of radical technological innovation. Acad. Manag. Rev. 2003, 28, 257–274. [Google Scholar] [CrossRef]

- Rosen, S. Markets and diversity. Am. Econ. Rev. 2002, 92, 1–15. [Google Scholar] [CrossRef]

- Chae, H.; Song, J.; Lange, D. Basking in reflected glory: Reverse status transfer from foreign to home markets. Strateg. Manag. J. 2020, 61, 1–31. [Google Scholar] [CrossRef]

- Miller, S.R.; Eden, L.; Li, D. CSR Reputation and Firm Performance: A Dynamic Approach. J. Bus. Ethics 2020, 163, 619–636. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Gray, E.R.; Balmer, J.M.T. Managing corporate image and corporate reputation. Long Range Plan. 1998, 31, 695–702. [Google Scholar] [CrossRef]

- Rhee, M.; Valdez, M.E. Contextual factors surrounding reputation damage with potential implications for reputation repair. Acad. Manag. Rev. 2009, 34, 146–168. [Google Scholar] [CrossRef]

- Corley, K.; Gioia, D. The rankings game: Managing business school reputation. Corp. Reput. Rev. 2000, 3, 319–333. [Google Scholar] [CrossRef]

- Gioia, D.A.; Corley, K.G. Being good versus looking good: Business school rankings and the circean transformation from substance to image. Acad. Manag. Learn. Educ. 2002, 1, 107–120. [Google Scholar] [CrossRef]

- Din, S.; Ishfaq, M.; Khan, M.I.; Khan, M.A. A study of role stressors and job satisfaction: The case of mncs in collectivist context. Behav. Sci. 2019, 9, 49. [Google Scholar] [CrossRef] [PubMed]

- Rhee, M.; Kim, T. After the collapse: A behavioral theory of reputation repair. In The Oxford Handbook of Corporate Reputation; Barnett, M.L., Pollock, T.G., Eds.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Moch, M.K. Structure and organizational resource allocation. Adm. Sci. Q. 1976, 661–674. [Google Scholar] [CrossRef]

| Variable | Measure | Source | Model | |

|---|---|---|---|---|

| Dependent variable | Preference of recruiters | First year salary of graduates | Financial Times | For recruiters |

| Preference of prospective students | Number of annual applications | Princeton Review | For students | |

| Independent variable | Overall reputation | Aggregated reputation from rankings | Financial Times | For both |

| Reputation incongruence | Variation of reputation among sub-rankings | Financial Times | For both | |

| Control variables | Nationality of a program | U.S. or non-U.S. based | Princeton Review | For both |

| Public entity | Public or private program | Princeton Review | For both | |

| Annual tuition | Tuition in U.S. dollar | Princeton Review | For both | |

| Size of a program | Number of annual enrollments | Princeton Review | For both | |

| Location of a program | Village, town, city, or metro area | Princeton Review | For both | |

| History of a program | Age of a program | Princeton Review | For both | |

| Weighted salary | Salary of graduates (excluded in analysis) | Financial Times | For recruiters | |

| Current students’ work experience | Average working years before a program | Princeton Review | For both | |

| Current students’ female ratio | Reported ratio of female to male students | Financial Times | For both | |

| Current students’ GMAT score | Average GMAT score | Princeton Review | For both | |

| Mean | S.D. | Min | Max | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Log(number of applicants) | 2.98 | 0.42 | 1.63 | 3.96 | 1 | ||||||||||||||

| 2. | U.S. school | 0.56 | 0.50 | 0 | 1 | 0.33 ** | 1 | |||||||||||||

| 3. | Private | 0.45 | 0.50 | 0 | 1 | 0.32 ** | 0.21 ** | 1 | ||||||||||||

| 4. | Village | 0.06 | 0.23 | 0 | 1 | −0.05 | 0.13 ** | 0.07 * | 1 | |||||||||||

| 5. | Town | 0.11 | 0.32 | 0 | 1 | −0.13 ** | 0.11 ** | −0.14 ** | −0.09 * | 1 | ||||||||||

| 6. | City | 0.32 | 0.47 | 0 | 1 | 0.03 | 0.08 * | −0.08 * | −0.16 ** | −0.24 ** | 1 | |||||||||

| 7. | Log(annual tuition) | 4.47 | 0.17 | 3.79 | 4.86 | 0.29 ** | −0.11 ** | 0.31 ** | 0.09 * | −0.13 ** | −0.04 | 1 | ||||||||

| 8. | Log(weighted salary) | 5.03 | 0.09 | 4.49 | 5.26 | 0.74 ** | 0.21 ** | 0.35 ** | 0.08 * | −0.01 | 0.04 | 0.54 ** | 1 | |||||||

| 9. | Log(program size) | 2.21 | 0.32 | 1.48 | 3.00 | 0.67 ** | 0.31 ** | 0.39 ** | −0.05 | −0.14 ** | −0.01 | 0.30 ** | 0.60 ** | 1 | ||||||

| 10. | Log(history) | 0.00 | 0.29 | −1.72 | 0.55 | 0.14 ** | 0.48 ** | 0.09 * | 0.06 | −0.06 | 0.04 | −0.02 | 0.05 | 0.20 ** | 1 | |||||

| 11. | Log(work experience) | 0.70 | 0.10 | 0.30 | 1.00 | −0.03 | −0.61 ** | −0.17 ** | 0.00 | −0.06 | −0.14 ** | 0.18 ** | 0.00 | −0.16 ** | −0.34 ** | 1 | ||||

| 12. | Log(Female ratio) | 1.46 | 0.11 | 0.85 | 1.75 | 0.19 ** | 0.07 * | −0.04 | −0.07 * | −0.10 ** | −0.03 | 0.20 ** | −0.01 | 0.18 ** | 0.03 | 0.03 | 1 | |||

| 13. | Log(GMAT score) | 2.82 | 0.02 | 2.72 | 2.86 | 0.68 ** | 0.21 ** | 0.20 ** | −0.03 | −0.09 * | 0.15 ** | 0.32 ** | 0.67 ** | 0.52 ** | 0.06 | −0.09 * | 0.06 | 1 | ||

| 14. | Overall reputation | 0.00 | 0.46 | −1.54 | 0.67 | 0.58 ** | 0.46 ** | 0.03 | −0.04 | 0.01 | 0.12 ** | 0.13 ** | 0.42 ** | 0.56 ** | 0.20 ** | −0.20 ** | 0.12 ** | 0.45 ** | 1 | |

| 15. | Reputation incongruence | 0.00 | 0.06 | −0.03 | 0.77 | −0.15 ** | 0.33 ** | 0.03 | −0.01 | 0.04 | 0.14 ** | −0.25 ** | −0.05 | −0.08 * | 0.16 ** | −0.27 ** | −0.10 ** | −0.01 | 0.11 ** | 1 |

| Mean | S.D | Min. | Max. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Log(weighted salary) | 5.02 | 0.09 | 4.49 | 5.26 | 1 | |||||||||||||

| 2. | U.S. school | 0.56 | 0.50 | 0 | 1 | 0.21 ** | 1 | ||||||||||||

| 3. | Private | 0.45 | 0.50 | 0 | 1 | 0.35 ** | 0.21 ** | 1 | |||||||||||

| 4. | Village | 0.06 | 0.23 | 0 | 1 | −0.08 * | 0.13 ** | 0.07 * | 1 | ||||||||||

| 5. | Town | 0.11 | 0.32 | 0 | 1 | −0.01 | 0.11 ** | −0.14 ** | −0.14 ** | 1 | |||||||||

| 6. | City | 0.32 | 0.46 | 0 | 1 | 0.04 | 0.08 * | −0.08 * | −0.08 * | −0.16 ** | 1 | ||||||||

| 7. | Log(annual tuition) | 4.47 | 0.17 | 3.79 | 4.86 | 0.54 ** | −0.11 ** | 0.31 ** | 0.31 ** | 0.09 * | −0.13 ** | 1 | |||||||

| 8. | Log(program size) | 2.21 | 0.32 | 1.48 | 3.00 | 0.60 ** | 0.31 ** | 0.39 ** | 0.39 ** | −0.05 | −0.14 ** | −0.01 | 1 | ||||||

| 9. | Log(History) | 0.00 | 0.29 | −1.72 | 0.55 | 0.05 | 0.48 ** | 0.09 * | 0.09 * | 0.06 | −0.06 | 0.04 | −0.02 | 1 | |||||

| 10. | Log(work experience) | 0.70 | 0.10 | 0.30 | 1.00 | 0.00 | −0.61 ** | −0.17 ** | −0.17 ** | 0.00 | −0.06 | −0.14 ** | 0.18 ** | −0.16 ** | 1 | ||||

| 11. | Log(Femaleratio) | 1.46 | 0.11 | 0.85 | 1.75 | −0.01 | 0.07 * | −0.04 | −0.04 * | −0.07 * | −0.10 ** | −0.03 | 0.20 ** | 0.18 ** | 0.03 | 1 | |||

| 12. | Log(GMAT score) | 2.82 | 0.02 | 2.72 | 2.86 | 0.67 ** | 0.21 ** | 0.2 ** | 0.20 ** | −0.03 | −0.09 * | 0.15 ** | 0.32 ** | 0.52 ** | 0.06 | −0.09 * | 1 | ||

| 13. | Overall reptuation | 0.00 | 13.5 | −36.9 | 35.12 | 0.58 ** | −0.07 | 0.25 ** | −0.05 | −0.09 * | 0.00 | 0.4 ** | 0.59 ** | 0.02 | 0.11 ** | 0.05 | 0.57 ** | 1 | |

| 14. | Reputation incontruence | 0.00 | 0.57 | −3.57 | 1.23 | −0.26 ** | 0.09 * | −0.08 * | −0.08 * | −0.12 * | −0.01 | −0.07 * | −0.21 ** | −0.21 ** | 0.18 ** | −0.11 ** | −0.08 * | −0.30 ** | 1 |

| Variable | Model 1 | Model 2-1 | Model 2-2 |

|---|---|---|---|

| U.S. school | 0.2622 ** | 0.2253 ** | 0.1927 ** |

| (0.0641) | (0.0504) | (0.0522) | |

| Private school | 0.0294 | 0.0266 | 0.0730 |

| (0.0485) | (0.0307) | (0.0295) | |

| Village | −0.0773 | −0.0499 | −0.0517 |

| (0.0600) | (0.0472) | (0.0490) | |

| Town | −0.1120 * | −0.0624 | −0.0280 |

| (0.0573) | (0.0427) | (0.0440) | |

| City | −0.0476 | 0.0535 | 0.1268 ** |

| (0.0450) | (0.0316) | (0.0319) | |

| weighted salary | 1.2450 ** | 1.3621 ** | 0.3510 * |

| (0.2089) | (0.1927) | (0.1782) | |

| Annual tuition | −0.1840 * | −0.1492 * | 0.0454 |

| (0.0842) | (0.0631) | (0.0551) | |

| Program size | 0.1319 ** | 0.3068 ** | 0.4916 ** |

| (0.0337) | (0.0408) | (0.0398) | |

| Work experience | 0.1272 | 0.0020 | −0.1253 |

| (0.0865) | (0.1062) | (0.1004) | |

| Female student | −0.0748 | −0.0315 | −0.0882 |

| (0.0752) | (0.0698) | (0.0571) | |

| GMAT | 4.6125 ** | 4.1258 ** | 3.0295 ** |

| (0.5222) | (0.5110) | (0.4491) | |

| History | 0.0217 | 0.1242 | 0.1261 |

| (0.1058) | (0.0682) | (0.0669) | |

| Overall elevation (H1) | 0.9083 ** | 1.2400 ** | |

| (0.2933) | (0.2530) | ||

| Reputation Incongruence (H2) | −0.4706 ** | −0.6422 ** | |

| (0.1422) | (0.2431) | ||

| OE X RI (H3) | −4.0899 ** | ||

| (1.6115) | |||

| Constant | −1.6030 ** | −1.5669 ** | −0.8642 ** |

| (0.1608) | (0.1380) | (0.1291) | |

| Wald Chi-square | 289.17 ** | 685.11 ** | 711.97 ** |

| D.f. | 11 | 13 | 14 |

| N | 465 | 465 | 465 |

| VIF | 1.92 | 2.70 | 2.87 |

| Variable | Model 6 | Model 7-1 | Model 7-2 |

|---|---|---|---|

| U.S. school | 0.0423 * | 0.0012 | 0.0454 ** |

| (0.0208) | (0.0221) | (0.0204) | |

| Private school | −0.0581 ** | −0.0288 * | −0.0893 ** |

| (0.0140) | (0.0155) | (0.0152) | |

| Village | −0.0280 * | 0.0010 | 0.0236 |

| (0.0148) | (0.0189) | (0.0193) | |

| Town | −0.0265 * | 0.0072 | 0.0178 |

| (0.0124) | (0.0142) | (0.0173) | |

| City | 0.0034 | 0.0155 | 0.0430 ** |

| (0.0079) | (0.0106) | (0.0105) | |

| Annual tuition | 0.0336 ** | 0.0173 | 0.0518 ** |

| (0.0119) | (0.0122) | (0.0149) | |

| Program size | 0.0218 | 0.0604 ** | 0.0482 ** |

| (0.0121) | (0.0127) | (0.0120) | |

| History | 0.0871 ** | −0.0013 | 0.1025 ** |

| (0.0328) | (0.0376) | (0.0355) | |

| Work experience | −0.0201 | 0.0016 | 0.1012 ** |

| (0.0273) | (0.0242) | (0.0283) | |

| Female student | −0.0160 | −0.0081 | −0.0207 |

| (0.0217) | (0.0166) | (0.0214) | |

| GMAT | 0.0525 | 0.2980 ** | 0.0469 |

| (0.1281) | (0.0961) | (0.1411) | |

| Overall elevation (H1) | 0.0014 ** | 0.0007 ** | |

| (0.0002) | (0.0003) | ||

| Reputation Incongruence (H2) | −0.0127 ** | −0.0145 ** | |

| (0.0041) | (0.0038) | ||

| OE X RI (H3) | −0.0015 ** | ||

| (0.0003) | |||

| Constant | 0.4814 ** | 0.5886 ** | 0.4774 ** |

| (0.0345) | (0.0274) | (0.0386) | |

| Wald Chi-square | 57.79 ** | 107.48 ** | 165.85 ** |

| D.f. | 11 | 13 | 14 |

| N | 504 | 429 | 429 |

| VIF | 1.44 | 1.72 | 1.70 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J.S.; Rhee, M. Reputation Incongruence and the Preference of Stakeholder: Case of MBA Rankings. Behav. Sci. 2021, 11, 10. https://doi.org/10.3390/bs11010010

Park JS, Rhee M. Reputation Incongruence and the Preference of Stakeholder: Case of MBA Rankings. Behavioral Sciences. 2021; 11(1):10. https://doi.org/10.3390/bs11010010

Chicago/Turabian StylePark, Jin Suk, and Mooweon Rhee. 2021. "Reputation Incongruence and the Preference of Stakeholder: Case of MBA Rankings" Behavioral Sciences 11, no. 1: 10. https://doi.org/10.3390/bs11010010

APA StylePark, J. S., & Rhee, M. (2021). Reputation Incongruence and the Preference of Stakeholder: Case of MBA Rankings. Behavioral Sciences, 11(1), 10. https://doi.org/10.3390/bs11010010