Which Offers Greater Techno-Economic Potential: Oil or Hydrogen Production from Light Oil Reservoirs?

Abstract

1. Introduction

2. Method

2.1. Reservoir Modeling

2.1.1. Reservoir Model

2.1.2. Fluid Model

2.1.3. Reaction Kinetics Model

2.1.4. Injection Strategy

2.1.5. Grid Size Selection Justification

2.1.6. Reservoir Model Validation

2.2. Economic Modeling

2.2.1. Injection Cost Components

Lease Equipment Costs for Injection Wells

Annual Operating and Maintenance Costs

CO2 Supply and Distribution Costs

Air Supply and Associated Costs

2.2.2. Carbon Dioxide (CO2) Cost Components

CO2 Sourcing and Cost Considerations

Calculation of Injection Pressure and CO2 Pressurizing Expenses

2.2.3. Production Cost Components

Production Equipment Costs

Fluid Lifting Cost

Synthesis Gas and Liquid Separation Costs

Oil–Water Separation Cost

Production Revenue, Taxes, and Royalties

2.2.4. Carbon Dioxide Recycling Cost Components

Gas Treatment: Separation and Compression

2.2.5. Economic Modeling Parameters

2.2.6. Reservoir Classification for Techno-Economic Simulations

3. Results and Discussion

3.1. Technical Considerations for Hydrogen Production from Light Oil Reservoirs

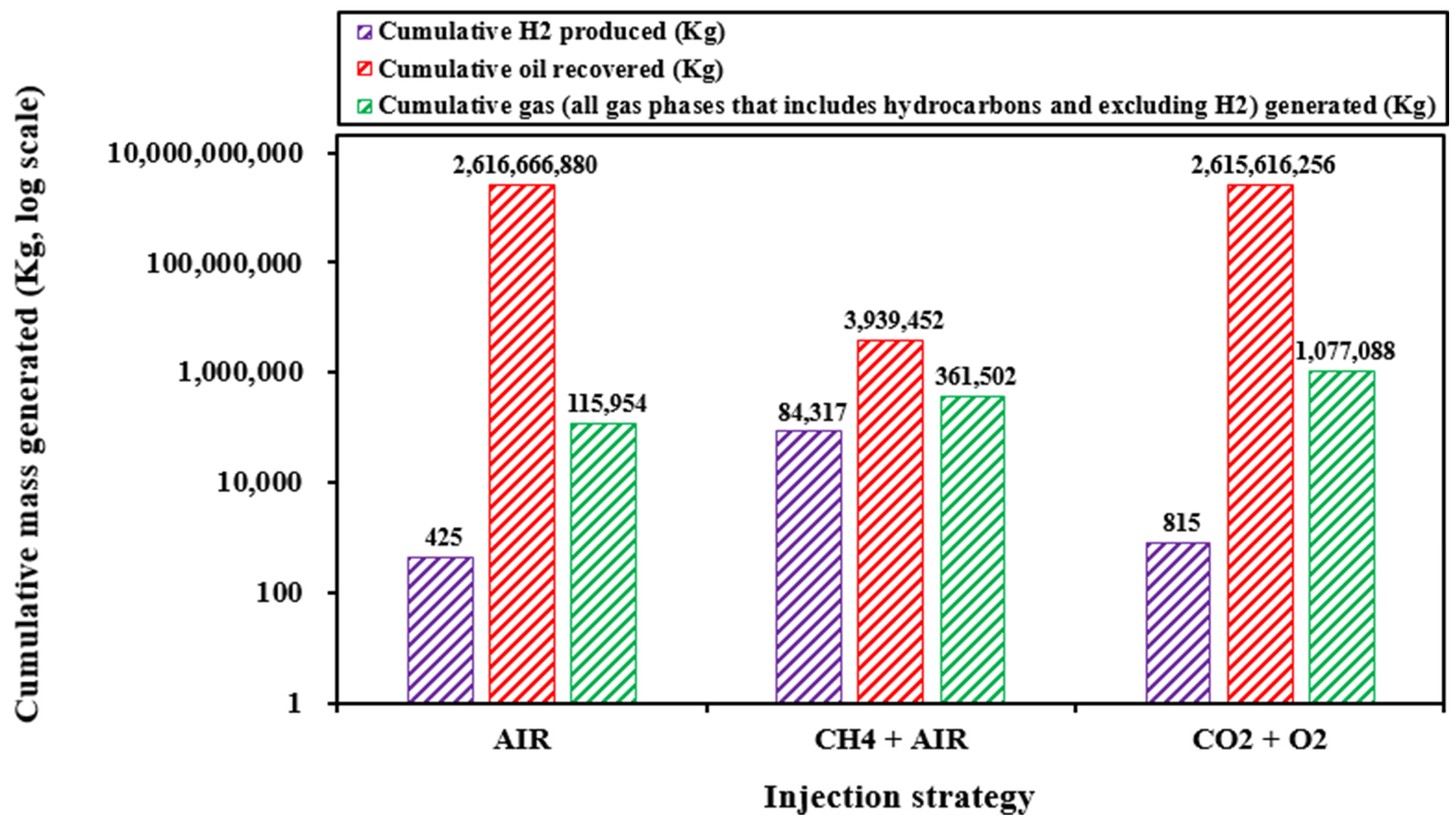

3.1.1. Influence of Injection Strategy on Hydrogen Production

3.1.2. Influence of Reservoir Characteristics and Well Configuration on Hydrogen Production

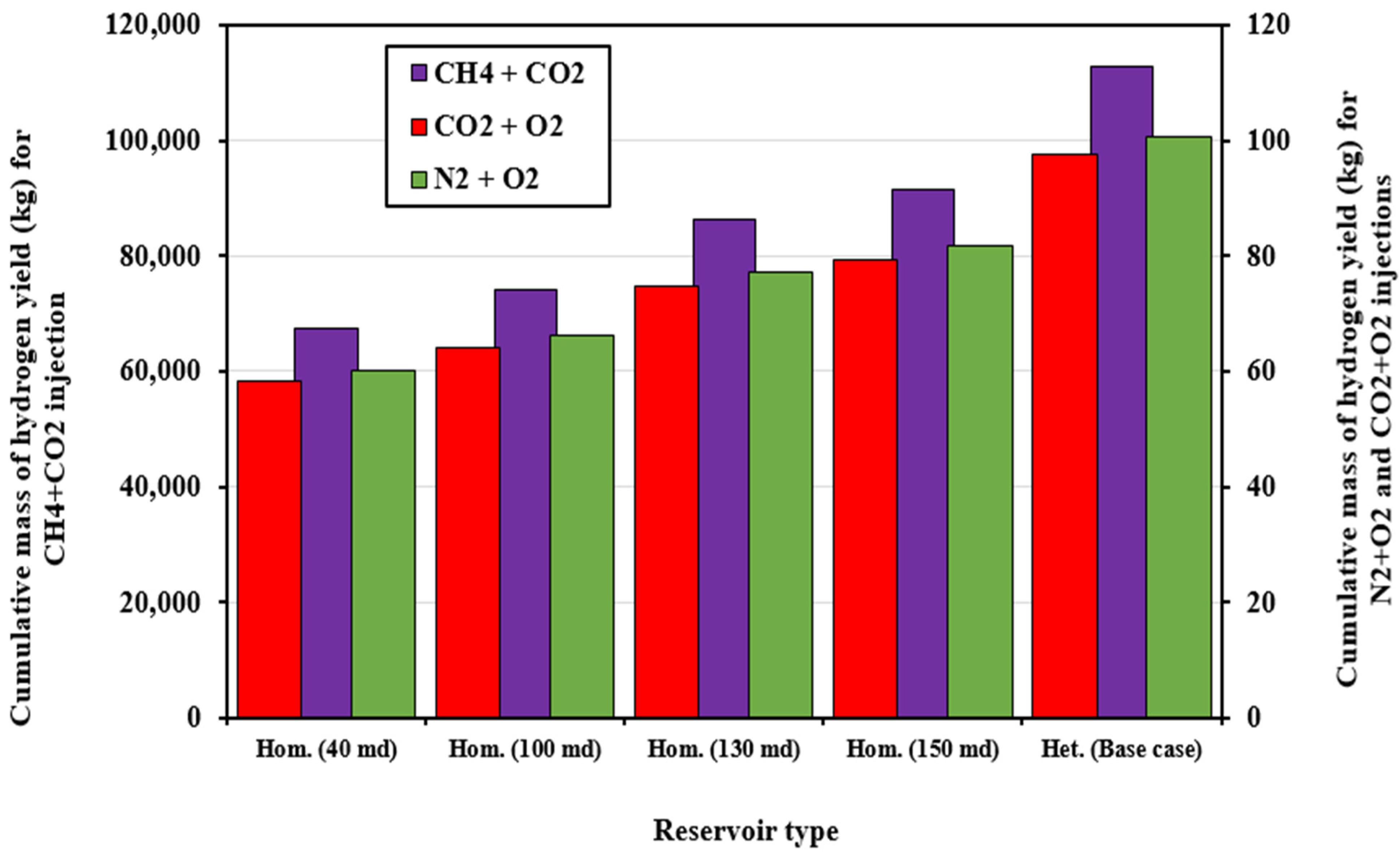

Impact of Reservoir Heterogeneity

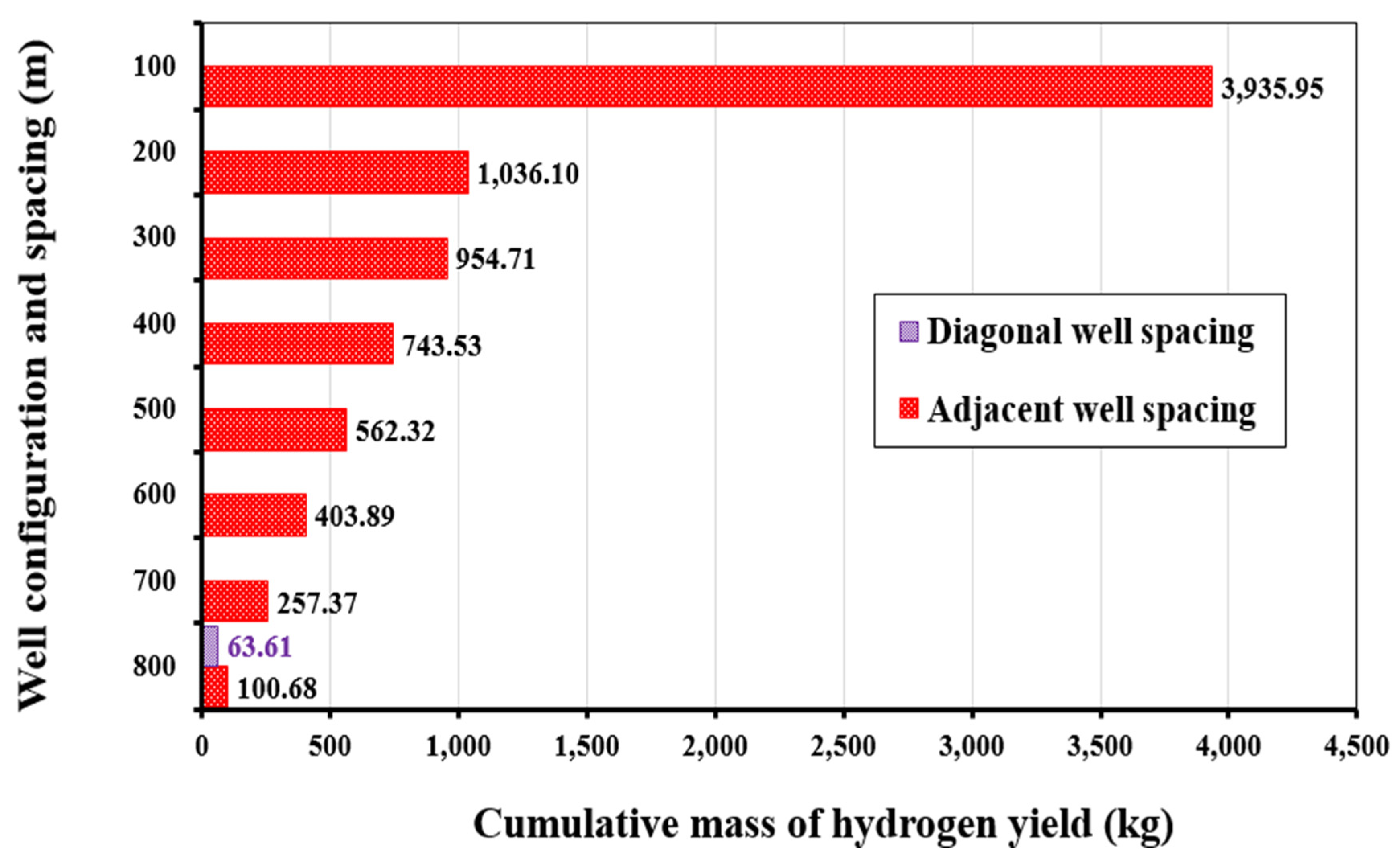

Impact of Well Configuration and Spacing

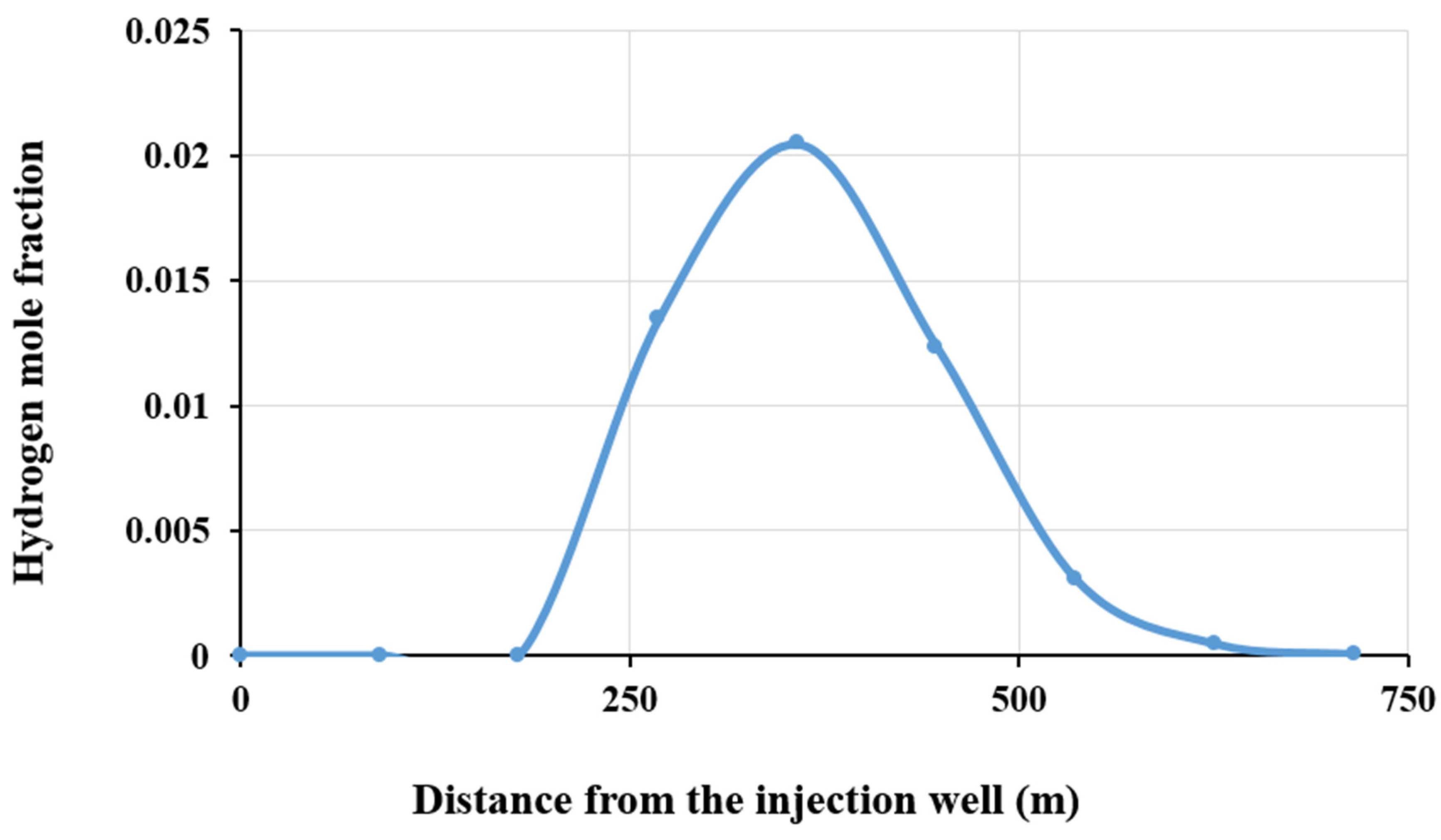

Hydrogen Distribution and Well Placement Optimization

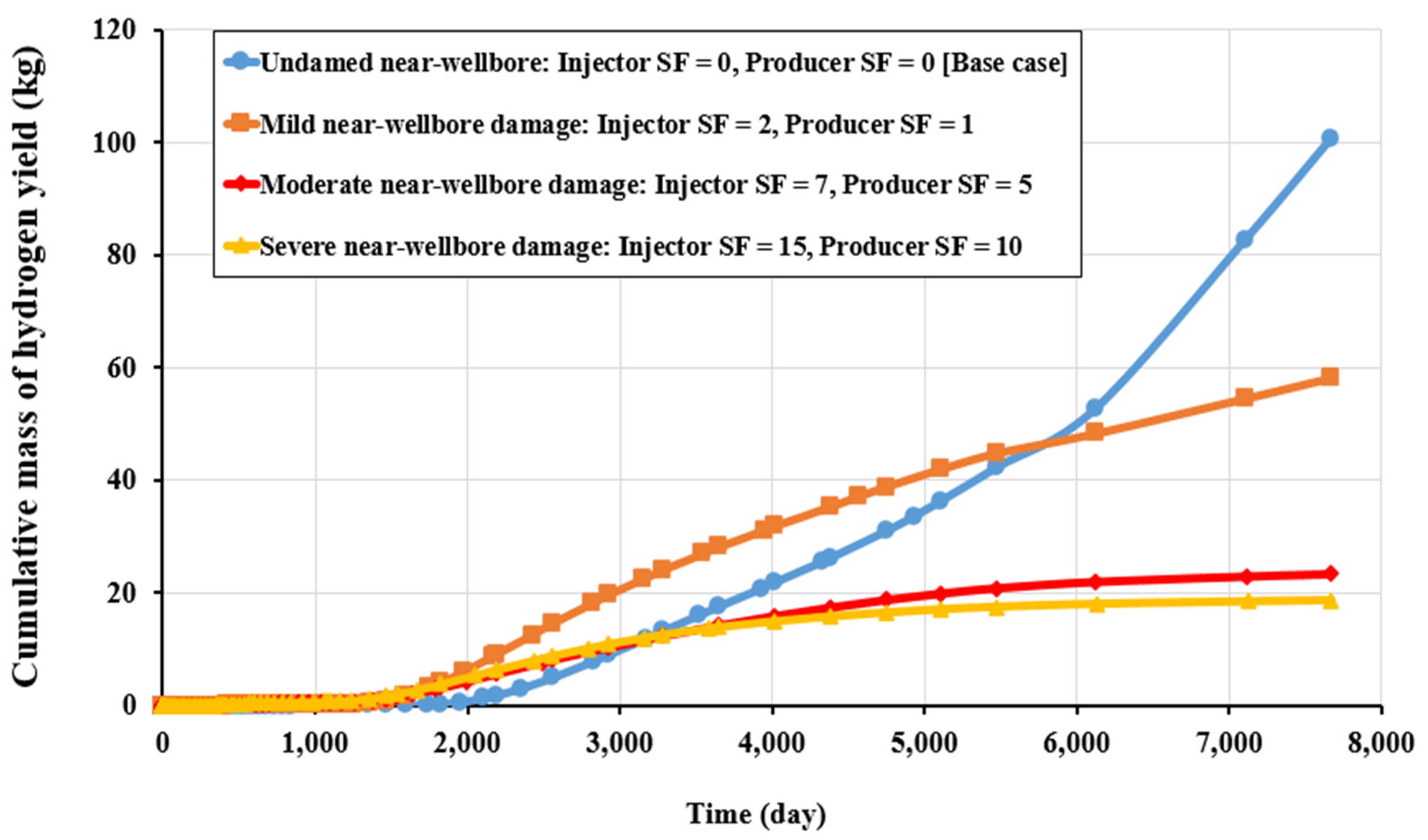

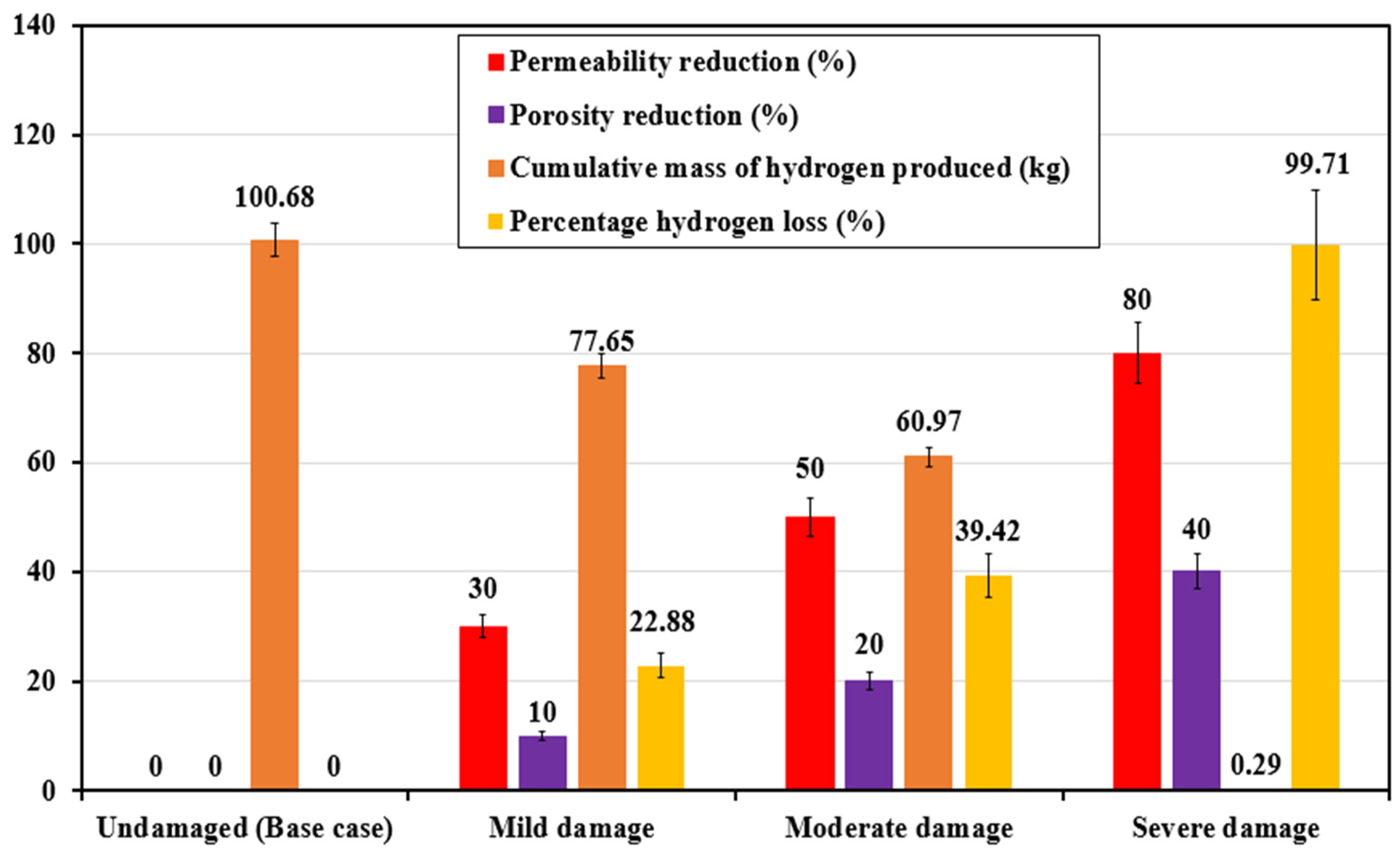

3.1.3. Influence of Formation Damage on Hydrogen Production

Impact of Solid-Phase Deposition

Impact of Near-Wellbore Damage

Impact of Combined Permeability and Porosity Reductions

3.2. Techno-Economic Analysis of Hydrogen and Oil Recovery Strategies

3.3. Discussion

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Jin, L.; Okere, C.J.; Guo, Q.; Zheng, L. Fuzzy-Ball Fluids: Fundamentals, Mechanisms, and Prospects for Clean Energy and Oilfield Applications. Energies 2025, 18, 1592. [Google Scholar] [CrossRef]

- Islam, A.; Islam, T.; Mahmud, H.; Raihan, O.; Islam, S.; Marwani, H.M.; Rahman, M.M.; Asiri, A.M.; Hasan, M.; Hasan, N.; et al. Accelerating the green hydrogen revolution: A comprehensive analysis of technological advancements and policy interventions. Int. J. Hydrogen Energy 2024, 67, 458–486. [Google Scholar] [CrossRef]

- Chipangamate, N.S.; Nwaila, G.T. Assessment of challenges and strategies for driving energy transitions in emerging markets: A socio-technological systems perspective. Energy Geosci. 2024, 5, 100257. [Google Scholar] [CrossRef]

- Opara, S.U.; Okere, C.J. A review of methane leakage from abandoned oil and gas wells: A case study in Lubbock, Texas, within the Permian Basin. Energy Geosci. 2024, 5, 100288. [Google Scholar] [CrossRef]

- Lu, H.; Xi, D.; Cheng, Y.F. Hydrogen production in integration with CCUS: A realistic strategy towards net zero. Energy 2025, 315, 134398. [Google Scholar] [CrossRef]

- Kannaiyan, K.; Lekshmi, G.S.; Ramakrishna, S.; Kang, M.; Kumaravel, V. Perspectives for the green hydrogen energy-based economy. Energy 2023, 284, 129358. [Google Scholar] [CrossRef]

- Okere, C.J.; Sheng, J.J. Review on clean hydrogen generation from petroleum reservoirs: Fundamentals, mechanisms, and field applications. Int. J. Hydrogen Energy 2023, 48, 38188–38222. [Google Scholar] [CrossRef]

- Yuan, C.; Afanasev, P.; Askarova, A.; Popov, E.; Cheremisin, A. In situ hydrogen generation in subsurface reservoirs of fossil fuels by thermal methods: Reaction mechanisms, kinetics, and catalysis. Appl. Energy 2025, 381, 125219. [Google Scholar] [CrossRef]

- Hassanpouryouzband, A.; Veshareh, M.J.; Wilkinson, M.; Nick, H.M.; Ngwenya, B.T.; Haszeldine, R.S. In situ hydrogen generation from underground fossil hydrocarbons. Joule 2025, 9, 101809. [Google Scholar] [CrossRef]

- Hu, Q.; Yan, L.; Cheng, Y.F. In-situ hydrogen production from petroleum reservoirs and the associated high temperature hydrogen attack: A review. Int. J. Hydrogen Energy 2024, 95, 1038–1051. [Google Scholar] [CrossRef]

- Smith, E.K.; Barakat, S.M.; Akande, O.; Ogbaga, C.C.; Okoye, P.U.; Okolie, J.A. Subsurface combustion and gasification for hydrogen production: Reaction mechanism, techno-economic and lifecycle assessment. Chem. Eng. J. 2023, 480, 148095. [Google Scholar] [CrossRef]

- Greaves, M.; Xia, T.X. Producing Hydrogen and Incremental Oil From Light Oil Reservoirs Using Downhole Gasification. In Proceedings of the Canadian International Petroleum Conference, Calgary, Alberta, 17–19 June 2008. [Google Scholar] [CrossRef]

- Greaves, M.; Xia, T.X. Laboratory Studies of Producing Hydrogen and Incremental Oil From Light Oil Reservoirs Using Downhole Gasification. J. Can. Pet. Technol. 2010, 49, 65–70. [Google Scholar] [CrossRef]

- Hanfi, M.A.; Alade, O.S.; Tanimu, A.; Mahmoud, M.; Alarifi, S.A. Catalytic and Noncatalytic in Situ Hydrogen Production from Heavy Oil: A Review of Experimental Studies. ACS Omega 2024, 9, 50118–50133. [Google Scholar] [CrossRef] [PubMed]

- Yang, M.; Chai, M.; Yuan, S.; Feng, T.; Wang, S.; Zhang, J.; Feng, Q.; Chen, Z.; Wei, T.; Wu, G.; et al. In-Situ Combustion for Heavy Oil and Oil Sands Recovery: Recent Progress, Field Applications, and Future Perspectives. Energy Fuels 2024, 38, 10395–10420. [Google Scholar] [CrossRef]

- Okere, C.J.; Sheng, J.J.; Ikpeka, P.M. Comparative Numerical Study on the Optimization of Double-Simultaneous Gas Injection Techniques for Enhanced Hydrogen Production from Depleted Light Oil Reservoirs. Energy Fuels 2024, 38, 16358–16370. [Google Scholar] [CrossRef]

- Okere, C.J.; Sheng, J.J.; Ikpeka, P.M. Maximizing Hydrogen Yield: Pioneering Gas Injection for Enhanced Light Oil Reservoir Utilization. In Proceedings of the SPE Western Regional Meeting Proceedings, Palo Alto, CA, USA, 16–18 April 2024. [Google Scholar] [CrossRef]

- Ikpeka, P.M.; Ugwu, J.O. In situ hydrogen production from hydrocarbon reservoirs—Modelling study. RSC Adv. 2023, 13, 12100–12113. [Google Scholar] [CrossRef]

- Newman, L.L. Oxygen in Production of Hydrogen or Synthesis Gas. Ind. Eng. Chem. 2002, 40, 559–582. [Google Scholar] [CrossRef]

- Parry, V.F.; Wagner, E.; Koth, A.; Goodman, J. Gasification of Subbituminous Coal and Lignite in Externally Heated Retorts. Ind. Eng. Chem. 2002, 40, 627–641. [Google Scholar] [CrossRef]

- Wright, C.C.; Barclay, K.M.; Mitchell, R.F. Production of Hydrogen and Synthesis Gas by Oxygen Gasification of Solid Fuel. Ind. Eng. Chem. 2002, 40, 592–600. [Google Scholar] [CrossRef]

- Eastman, D. Synthesis Gas by Partial Oxidation. Ind. Eng. Chem. 2002, 48, 1118–1122. [Google Scholar] [CrossRef]

- Eastman, D. The production of synthesis gas by partial oxidation. In Proceedings of the 5th World Petroleum Congress, New York, NY, USA, 50 May–5 June 1959; Volume 4, pp. 153–161. Available online: https://onepetro.org/WPCONGRESS/proceedings-abstract/WPC05/All-WPC05/WPC-8313/203365 (accessed on 4 June 2025).

- Pichler, H. The Oil Gasification by Internal Heating in Continuous Process. In Proceedings of the 7th World Petroleum Congress, Mexico City, Mexico, 2–9 April 1967; Available online: https://onepetro.org/WPCONGRESS/proceedings-abstract/WPC07/All-WPC07/WPC-12422/198479 (accessed on 4 June 2025).

- Jones, J.M. Hydrogen Production by Partial Oxidation. In Proceedings of the 8th World Petroleum Congress, Moscow, USSR, 13–18 June 1971; Available online: https://onepetro.org/WPCONGRESS/proceedings-abstract/WPC08/All-WPC08/WPC-14311/199174 (accessed on 4 June 2025).

- Strelzoff, S. Partial oxidation for syngas and fuel. Hydrocarb. Process 1974, 53, 79–87. [Google Scholar]

- Reed, C.L.; Kuhre, C.J. Hydrogen production from partial oxidation of residual fuel oil. ACS Symp. Ser. 1980, 116, 95–121. [Google Scholar] [CrossRef]

- Punitkumar, R.K.; Michael, S.K.; Ian, D.G. Potential for hydrogen generation from in situ combustion of Athabasca bitumen. Fuel 2011, 90, 2254–2265. [Google Scholar] [CrossRef]

- Okere, C.J.; Sheng, J.J. Optimizing hydrogen generation from petroleum reservoirs: A dual-perspective approach for enhancing efficiency and cleaner production. Gas Sci. Eng. 2025, 136, 205576. [Google Scholar] [CrossRef]

- Sadeghbeigi, R. Fluid Catalytic Cracking Handbook: An Expert Guide to the Practical Operation, Design, and Optimization of FCC Units, 3rd ed.; Elsevier: Hoboken, NJ, USA, 2012; pp. 1–361. [Google Scholar] [CrossRef]

- Tayari, F.; Blumsack, S.; Dilmore, R.; Mohaghegh, S.D. Techno-economic assessment of industrial CO2 storage in depleted shale gas reservoirs. J. Unconv. Oil Gas Resour. 2015, 11, 82–94. [Google Scholar] [CrossRef]

- Tayari, F.; Blumsack, S.; Johns, R.T.; Tham, S.; Ghosh, S. Techno-economic assessment of reservoir heterogeneity and permeability variation on economic value of enhanced oil recovery by gas and foam flooding. J. Pet. Sci. Eng. 2018, 166, 913–923. [Google Scholar] [CrossRef]

- Sigurdardottir, S.B.; DuChanois, R.M.; Epsztein, R.; Pinelo, M.; Elimelech, M. Energy barriers to anion transport in polyelectrolyte multilayer nanofiltration membranes: Role of intra-pore diffusion. J. Memb. Sci. 2020, 603, 117921. [Google Scholar] [CrossRef]

- ProtonH2’s Patented ISHGTM Process—ProtonH2. n.d. Available online: https://protonh2.com/our-process/ (accessed on 10 June 2024).

- U.S. Energy Information Administration (EIA). AEO2014 Early Release Overview 2014; U.S. Energy Information Administration (EIA): Washington, DC, USA, 2014.

- Thermophysical Properties of Fluid Systems. n.d. Available online: https://webbook.nist.gov/chemistry/fluid/ (accessed on 15 June 2024).

- Lee, J.E.; Kim, M.K.; Lee, J.Y.; Lee, Y.M.; Zoh, K.D. Degradation kinetics and pathway of 1H-benzotriazole during UV/chlorination process. Chem. Eng. J. 2019, 359, 1502–1508. [Google Scholar] [CrossRef]

- Ling, H.; Liu, S.; Gao, H.; Liang, Z. Effect of heat-stable salts on absorption/desorption performance of aqueous monoethanolamine (MEA) solution during carbon dioxide capture process. Sep. Purif. Technol. 2019, 212, 822–833. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, S.; Fang, J.; Ding, L.X.; Wang, H. A nano-silica modified polyimide nanofiber separator with enhanced thermal and wetting properties for high safety lithium-ion batteries. J. Memb. Sci. 2017, 537, 248–254. [Google Scholar] [CrossRef]

- Chen, Y.-R.; Chen, L.-H.; Chen, C.-H.; Ko, C.-C.; Huang, A.; Li, C.-L.; Chuang, C.-J.; Tung, K.-L. Hydrophobic alumina hollow fiber membranes for sucrose concentration by vacuum membrane distillation. J. Membr. Sci. 2018, 555, 250–257. [Google Scholar] [CrossRef]

- Weijian, W.; Gianni, O.; Dachamir, H.; Majid, A.S.; Weng, F.; Yuan, G.; Guozhao, J. Inorganic membranes for in-situ separation of hydrogen and enhancement of hydrogen production from thermochemical reactions. Renew. Sustain. Energy Rev. 2022, 160, 112124. [Google Scholar] [CrossRef]

- Oil & Gas Market Analysis and Trends|S&P Global. n.d. Available online: https://www.spglobal.com/commodityinsights/en/ci/industry/oil-gas.html (accessed on 16 June 2024).

- Department of Energy. DOE National Clean Hydrogen Strategy and Roadmap. n.d. Available online: https://www.hydrogen.energy.gov/library/roadmaps-vision/clean-hydrogen-strategy-roadmap#:~:text=The%20Strategy%20and%20Roadmap%20also,Infrastructure%20Investment%20and%20Jobs%20Act (accessed on 8 February 2024).

- Vickers, J.; Peterson, D.; Randolph, K.; Irwin, L.; Desantis, D.; Hamdan, M.; Stetson, N.; Miller, E.; Satyapal, S. DOE Hydrogen and Fuel Cells Program Record Title: Cost of Electrolytic Hydrogen Production with Existing Technology. 2000. Available online: https://www.hydrogen.energy.gov/docs/hydrogenprogramlibraries/pdfs/20004-cost-electrolytic-hydrogen-production.pdf?Status=Master (accessed on 7 February 2025).

- Mulder, M. Economic Analysis of Energy Markets: An Introduction. Lect. Notes Energy 2021, 80, 1–11. [Google Scholar] [CrossRef]

- Marbán, G.; Valdés-Solís, T. Towards the hydrogen economy? Int. J. Hydrogen Energy 2007, 32, 1625–1637. [Google Scholar] [CrossRef]

- Bölük, G.; Kaplan, R. Effectiveness of renewable energy incentives on sustainability: Evidence from dynamic panel data analysis for the EU countries and Turkey. Environ. Sci. Pollut. Res. 2022, 29, 26613–26630. [Google Scholar] [CrossRef]

- Qadir, S.A.; Al-Motairi, H.; Tahir, F.; Al-Fagih, L. Incentives and strategies for financing the renewable energy transition: A review. Energy Rep. 2021, 7, 3590–3606. [Google Scholar] [CrossRef]

- Dilmore, R.M. An Assessment of Gate-to-Gate Environmental Life Cycle Performance of Water-Alternating-Gas CO2-Enhanced Oil Recovery in the Permian Basin; National Energy Technology Laboratory: Pittsburgh, PA, USA, 2010. [CrossRef]

- Ferguson, R.C.; Nichols, C.; Leeuwen TVan Kuuskraa, V.A. Storing CO2 with enhanced oil recovery. Energy Procedia 2009, 1, 1989–1996. [Google Scholar] [CrossRef]

- Robertson, E.P. Review of Ongoing CO2 Enhanced Oil Recovery Operations in Wyoming, USA. In Proceedings of the SPE Improved Oil Recovery Conference, Tulsa, OK, USA, 22–25 April 2024. [Google Scholar]

- McCollum, D.L.; Ogden, J.M. UC Davis Research Reports Title Techno-Economic Models for Carbon Dioxide Compression, Transport, and Storage & Correlations for Estimating Carbon Dioxide Density and Viscosity Permalink. Available online: https://escholarship.org/uc/item/1zg00532 (accessed on 7 February 2025).

- Chen, F.; Morosuk, T. Exergetic and Economic Evaluation of CO2 Liquefaction Processes. Energies 2021, 14, 7174. [Google Scholar] [CrossRef]

- Electricity Cost in Texas: 2024 Electric Rates|EnergySage. n.d. Available online: https://www.energysage.com/local-data/electricity-cost/tx/ (accessed on 15 June 2024).

- Dake, L.P. Fundamentals of Reservoir Engineering, 1st ed.; Elsevier: Amsterdam, The Netherlands, 1983; Volume 8, p. 464. [Google Scholar]

- Ahmed, T. Reservoir Engineering Handbook, 4th ed.; Elsevier: Amsterdam, The Netherlands, 2010. [Google Scholar]

- Green, D.W.; Willhite, G.P. Introduction to Eor Processes. In Enhanced Oil Recovery; Society of Petroleum Engineers: Calgary, AB, Canada, 2022; pp. 1–14. [Google Scholar] [CrossRef]

- Gluyas, J.G. Swarbrick REdward. In Petroleum Geoscience; Blackwell Pub.: Malden, MA, USA, 2004; p. 359. [Google Scholar]

- Toledo, M.; Arriagada, A.; Ripoll, N.; Salgansky, E.A.; Mujeebu, M.A. Hydrogen and syngas production by hybrid filtration combustion: Progress and challenges. Renew. Sustain. Energy Rev. 2023, 177, 113213. [Google Scholar] [CrossRef]

- Amin, M.; Butt, A.S.; Ahmad, J.; Lee, C.; Azam, S.U.; Mannan, H.A.; Naveed, A.B.; Farooqi, Z.U.R.; Chung, E.; Iqbal, A. Issues and challenges in hydrogen separation technologies. Energy Rep. 2023, 9, 894–911. [Google Scholar] [CrossRef]

- Xia, A.; Cheng, J.; Ding, L.; Lin, R.; Song, W.; Zhou, J.; Cen, K. Effects of changes in microbial community on the fermentative production of hydrogen and soluble metabolites from Chlorella pyrenoidosa biomass in semi-continuous operation. Energy 2014, 68, 982–988. [Google Scholar] [CrossRef]

- Song, R.; Wu, M.; Liu, J.; Yang, C. Pore scale modeling on microbial hydrogen consumption and mass transfer of multicomponent gas flow in underground hydrogen storage of depleted reservoir. Energy 2024, 306, 132534. [Google Scholar] [CrossRef]

- Ikpeka, P.; Alozieuwa, E.; Duru, U.I.; Ugwu, J. A parametric study on in-situ hydrogen production from hydrocarbon reservoirs—Effect of reservoir and well properties. Int. J. Hydrogen Energy 2024, 80, 733–742. [Google Scholar] [CrossRef]

- Wang, Y.; Zhou, Y.; Fan, S.; Lang, X.; Li, G. Influence of low temperature oxidation on heavy oil coking by thermal pyrolysis during in situ combustion process. Fuel 2022, 316, 123314. [Google Scholar] [CrossRef]

- Xu, Q.; Liu, Z.; Jiang, H.; Zhang, Q.; Zan, C.; Ma, D.; Shi, L. Chemical-structural properties of the coke produced by low temperature oxidation reactions during crude oil in-situ combustion. Fuel 2017, 207, 179–188. [Google Scholar] [CrossRef]

- Okere, C.J.; Sheng, J.J. Probing the Mechanism and Impact of Light Oil Oxidation on In Situ Hydrogen Production from Petroleum Reservoirs: A Combined SARA-Based Experimental and Numerical Investigation. Energy Fuels 2024, 38, 17649–17661. [Google Scholar] [CrossRef]

- Trommer, D.; Noembrini, F.; Fasciana, M.; Rodriguez, D.; Morales, A.; Romero, M.; Steinfeld, A. Hydrogen production by steam-gasification of petroleum coke using concentrated solar power—I. Thermodynamic and kinetic analyses. Int. J. Hydrogen Energy 2005, 30, 605–618. [Google Scholar] [CrossRef]

- Askarova, A.; Alekhina, T.; Popov, E.; Afanasev, P.; Mukhametdinova, A.; Smirnov, A.; Cheremisin, A.; Mukhina, E. Innovative technology for underground clean in situ hydrogen generation: Experimental and numerical insights for sustainable energy transition. Renew. Energy 2025, 240, 122259. [Google Scholar] [CrossRef]

- Adegbesan, K.O.; Donnelly, J.K.; Moore, R.G.; Bennion, D.W. Low-Temperature-Oxidation Kinetic Parameters for In-Situ Combustion: Numerical Simulation. SPE Reserv. Eng. 1987, 2, 573–582. [Google Scholar] [CrossRef]

- Yang, X.; Gates, I.D. Combustion kinetics of Athabasca bitumen from 1D combustion tube experiments. Natural Resources Research 2009, 18, 193–211. [Google Scholar] [CrossRef]

- Maifan, D.; Lele, F.; Qigeng, Z.; Sibo, Z.; Xiangcen, X.; Botao, Q. Spatial and temporal evolution of tar during ex-situ underground coal gasification. Fuel 2022, 317, 123423. [Google Scholar] [CrossRef]

- Hajdo, L.E.; Hallam, R.J.; Vorndran, L.D.L. Hydrogen Generation During In-Situ Combustion. In Proceedings of the SPE California Regional Meeting, Bakersfield, CA, USA, 27–29 March 1985; pp. 675–689. [Google Scholar] [CrossRef]

- Babushok, V.I.; Dakdancha, A.N. Global kinetic parameters for high-temperature gas-phase reactions. Combust Explos Shock Waves 1993, 29, 464–489. [Google Scholar] [CrossRef]

- Bureau of Labor Statistics Data. n.d. Available online: https://data.bls.gov/pdq/SurveyOutputServlet# (accessed on 12 June 2024).

| Grid Configuration | Number of Active Blocks | Cumulative Hydrogen Produced (kg) | Cumulative Carbon Dioxide Produced (m3) | Average Temperature at Combustion Front (°C) |

|---|---|---|---|---|

| 7 × 7 × 3 | 147 | 42,300.45 | 1850.22 | 695.5 |

| 9 × 9 × 4 | 324 | 45,682.43 | 1925.75 | 698.2 |

| 10 × 10 × 5 | 500 | 46,000 | 1930.5 | 700.1 |

| 12 × 12 × 6 | 864 | 46,120.7 | 1935 | 701.4 |

| 15 × 15 × 7 | 1575 | 46,200.9 | 1936.25 | 702.5 |

| Injection Component | Production Component | CO2 Recycling Component |

|---|---|---|

| Equipment leasing costs | Production costs

| Gas compression and processing costs

|

| Annual operation and maintenance expenses | ||

| CO2 distribution costs | ||

| Air supply and associated costs | Taxation, royalties, social obligations, and revenue | |

| CO2 sourcing and associated expenses |

| Component | Computation Technique |

|---|---|

| Injection | |

| Equipment cost (USD) | 127,259.01 * |

| Annual operating and maintenance costs | |

| 34,183.79 * |

| 44,578.04 * |

| 61,474.96 * |

| CO2 supply and distribution costs | USD 200,000 |

| Air source and cost | USD 50,000 with USD 5000 per year operating cost |

| CO2 purchase cost (USD/Mscf) | 2.5 percent of oil price |

| CO2 pressurizing costs | |

| 258,524,838.4, where Wp = 133,127.6 kW (for CO2 flowrate of 1000 tonnes/day) |

| 13 cents per kWh |

| Production | |

| Production equipment cost | 1,619,000 * |

| Fluid lifting cost | USD 0.25 per barrel of produced fluids |

| Synthesis gas and liquid separation cost | USD 1000 per square meter with 10% annual maintenance cost |

| Oil–water separation cost | USD 1.917 per barrel |

| Production revenue, taxes, and royalties | |

| 2% of produced hydrogen value |

| 10% of produced hydrogen value |

| CO2 recycling costs | |

| Gas treatment: separation and compression (USD) | USD 500 of gas production rate |

| Compression costs | |

| USD 2500 per horsepower |

| 13 cents per kWh |

| Reservoir Property | Ultra-Low-Quality Reservoirs (ULQRs) | Low-Quality Reservoirs (LQRs) | Moderate-Quality Reservoirs (MQRs) | High-Quality Reservoirs (HQRs) |

|---|---|---|---|---|

| Permeability | <0.1 | 0.1–1 md | 1–10 md | >10 md |

| Porosity | <5% | 5–10% | 10–20% | >20% |

| Injection Strategy | Reservoir | Cum. Mass of H2 Prod. (kg) | Cum. Mass of Oil Prod. (kg) | Cum. Mass of CO2 Prod. (kg) | Cum. Mass of CO2 Inj. (kg) | Total Revenue from H2 (USD) | Total Revenue from Oil (USD) | Total Cost for New CO2 Procurement (USD) |

|---|---|---|---|---|---|---|---|---|

| Air | ULQRs | 24.37 | 5106.84 | 8.92 | 0 | 73.11 | 2574.36 | 0 |

| LQRs | 51.42 | 7098.53 | 12.58 | 0 | 154.26 | 3569.37 | 0 | |

| MQRs | 428.65 | 1,236,547.21 | 2365.78 | 0 | 1285.96 | 621,785.23 | 0 | |

| HQRs | 3715.84 | 2,613,645,287.45 | 19,547.62 | 0 | 11,147.52 | 27,086,492.17 | 0 | |

| CO2 + O2 | ULQRs | 39.62 | 5094.23 | 36.74 | 321.57 | 118.86 | 2569.57 | 7.89 |

| LQRs | 83.79 | 7085.92 | 51.36 | 1524.63 | 251.37 | 3564.92 | 29.53 | |

| MQRs | 813.27 | 1,234,982.64 | 4521.96 | 24,987.36 | 2439.81 | 620,943.25 | 732.85 | |

| HQRs | 6924.51 | 2,615,616,895.38 | 18,362.79 | 362,517,298.92 | 20,773.52 | 21,416,532.84 | 8,648,371.23 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Okere, C.J.; Sheng, J.J.; Ikpeka, P.M. Which Offers Greater Techno-Economic Potential: Oil or Hydrogen Production from Light Oil Reservoirs? Geosciences 2025, 15, 214. https://doi.org/10.3390/geosciences15060214

Okere CJ, Sheng JJ, Ikpeka PM. Which Offers Greater Techno-Economic Potential: Oil or Hydrogen Production from Light Oil Reservoirs? Geosciences. 2025; 15(6):214. https://doi.org/10.3390/geosciences15060214

Chicago/Turabian StyleOkere, Chinedu J., James J. Sheng, and Princewill M. Ikpeka. 2025. "Which Offers Greater Techno-Economic Potential: Oil or Hydrogen Production from Light Oil Reservoirs?" Geosciences 15, no. 6: 214. https://doi.org/10.3390/geosciences15060214

APA StyleOkere, C. J., Sheng, J. J., & Ikpeka, P. M. (2025). Which Offers Greater Techno-Economic Potential: Oil or Hydrogen Production from Light Oil Reservoirs? Geosciences, 15(6), 214. https://doi.org/10.3390/geosciences15060214