Goat Dairy Product Assortment in Different Sales Channels in Northwestern Italy

Simple Summary

Abstract

1. Introduction

2. Materials and Methods

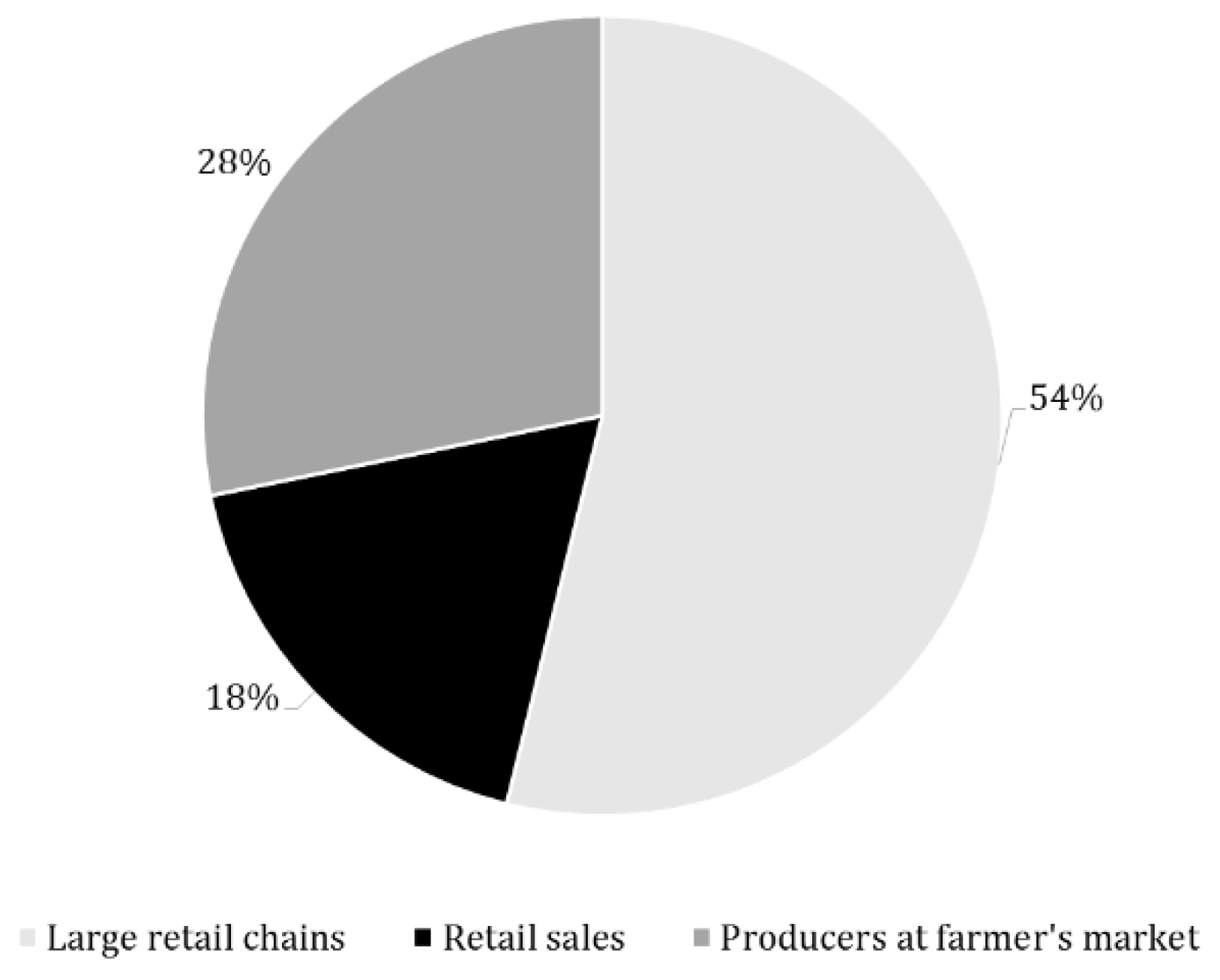

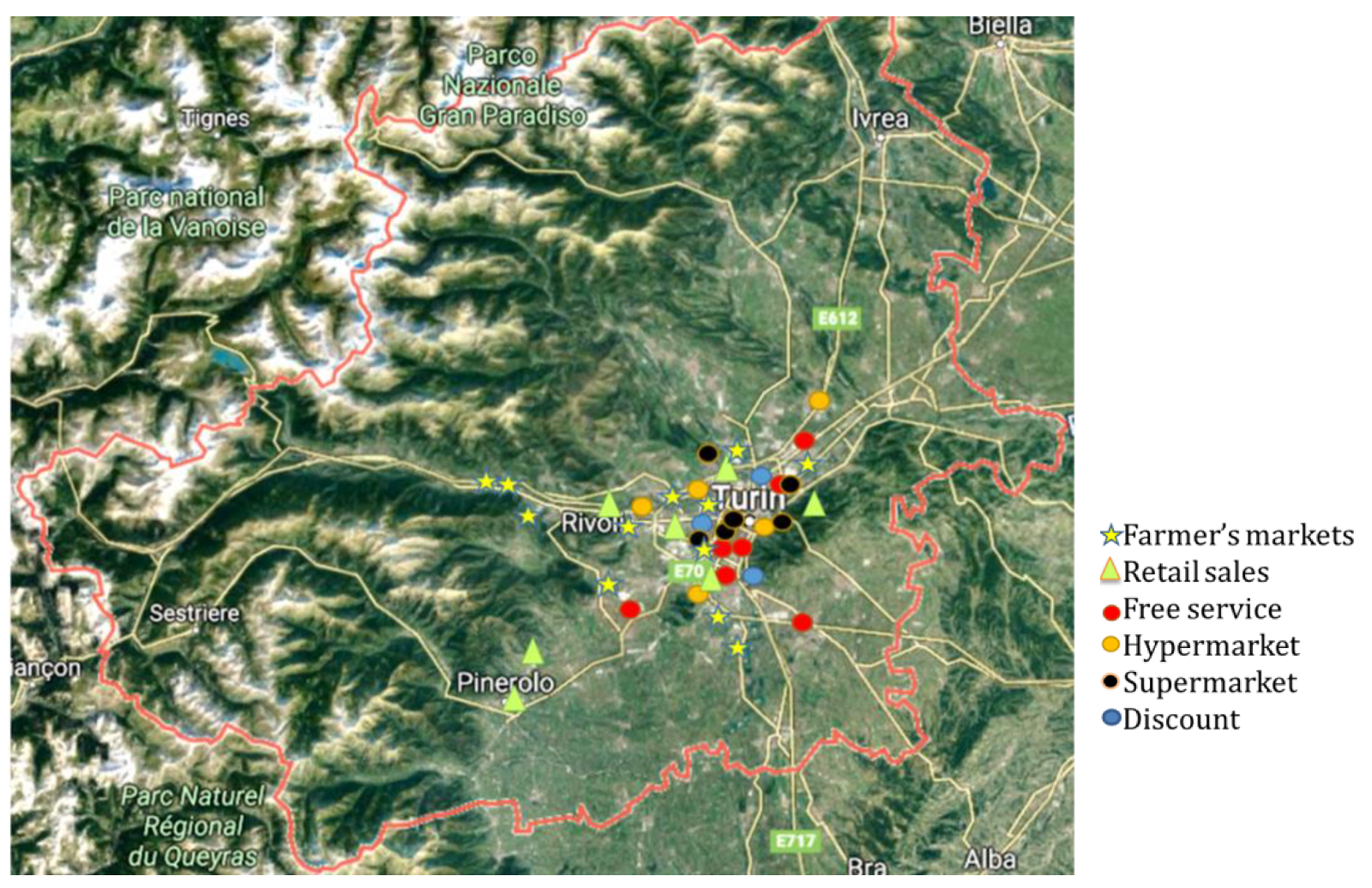

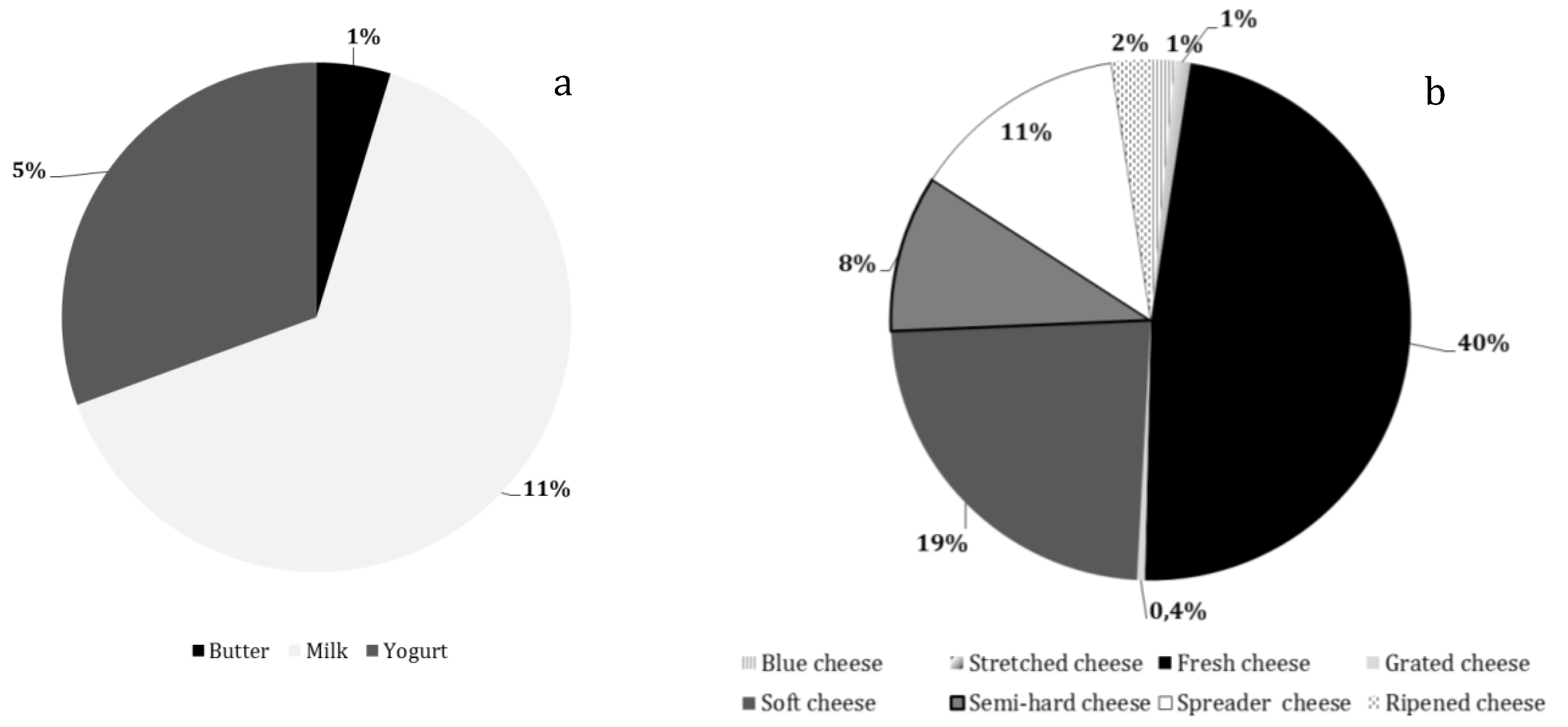

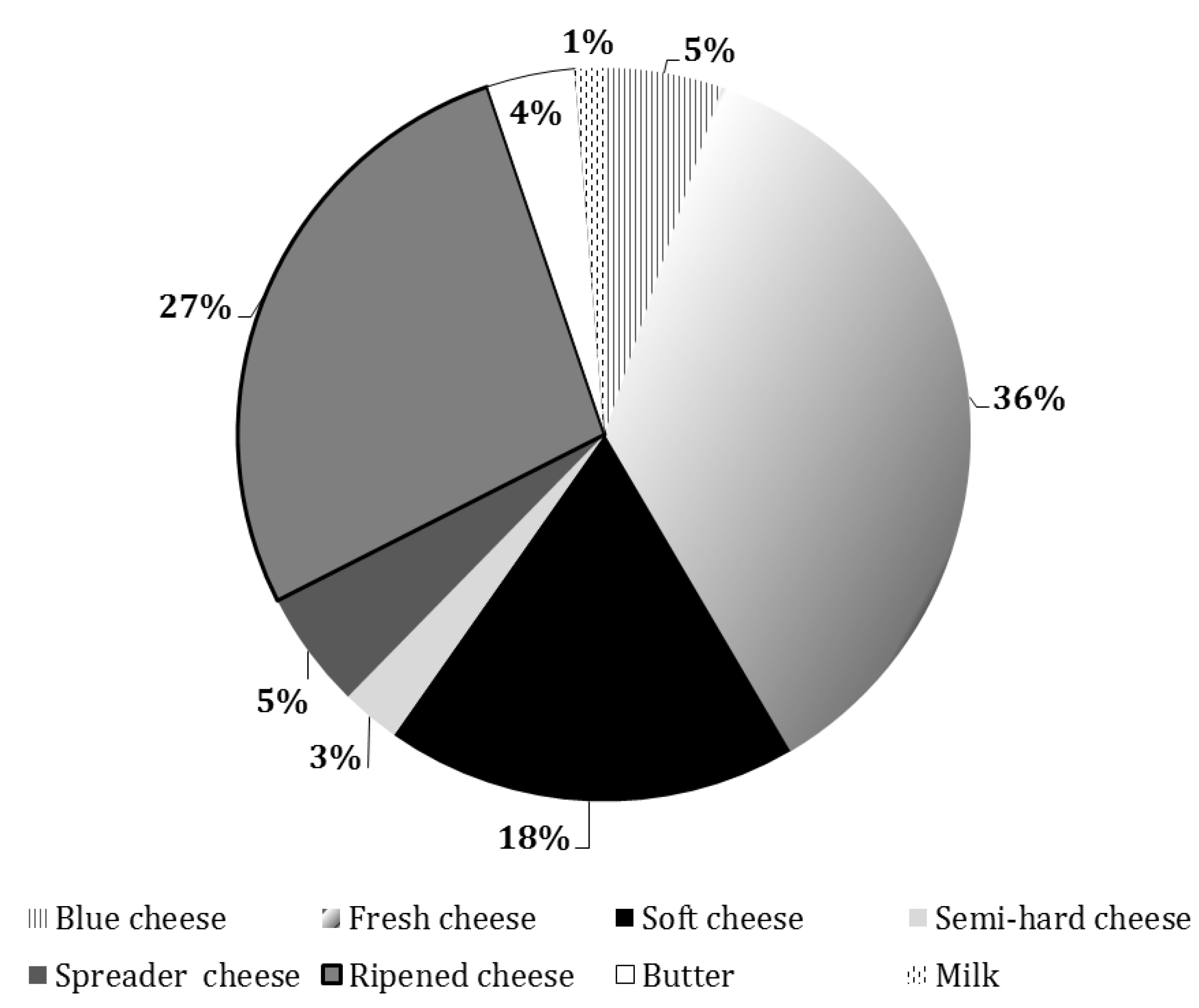

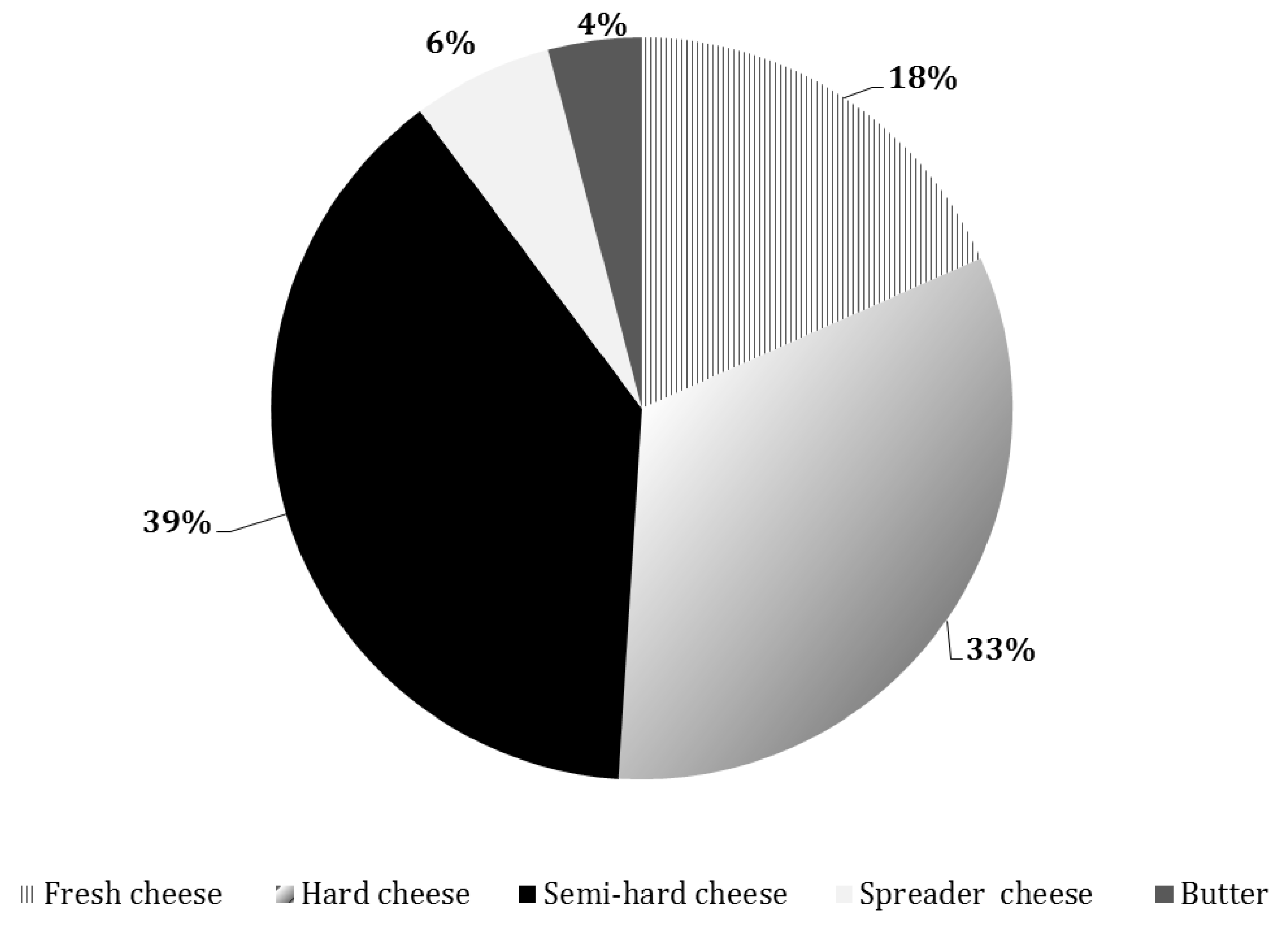

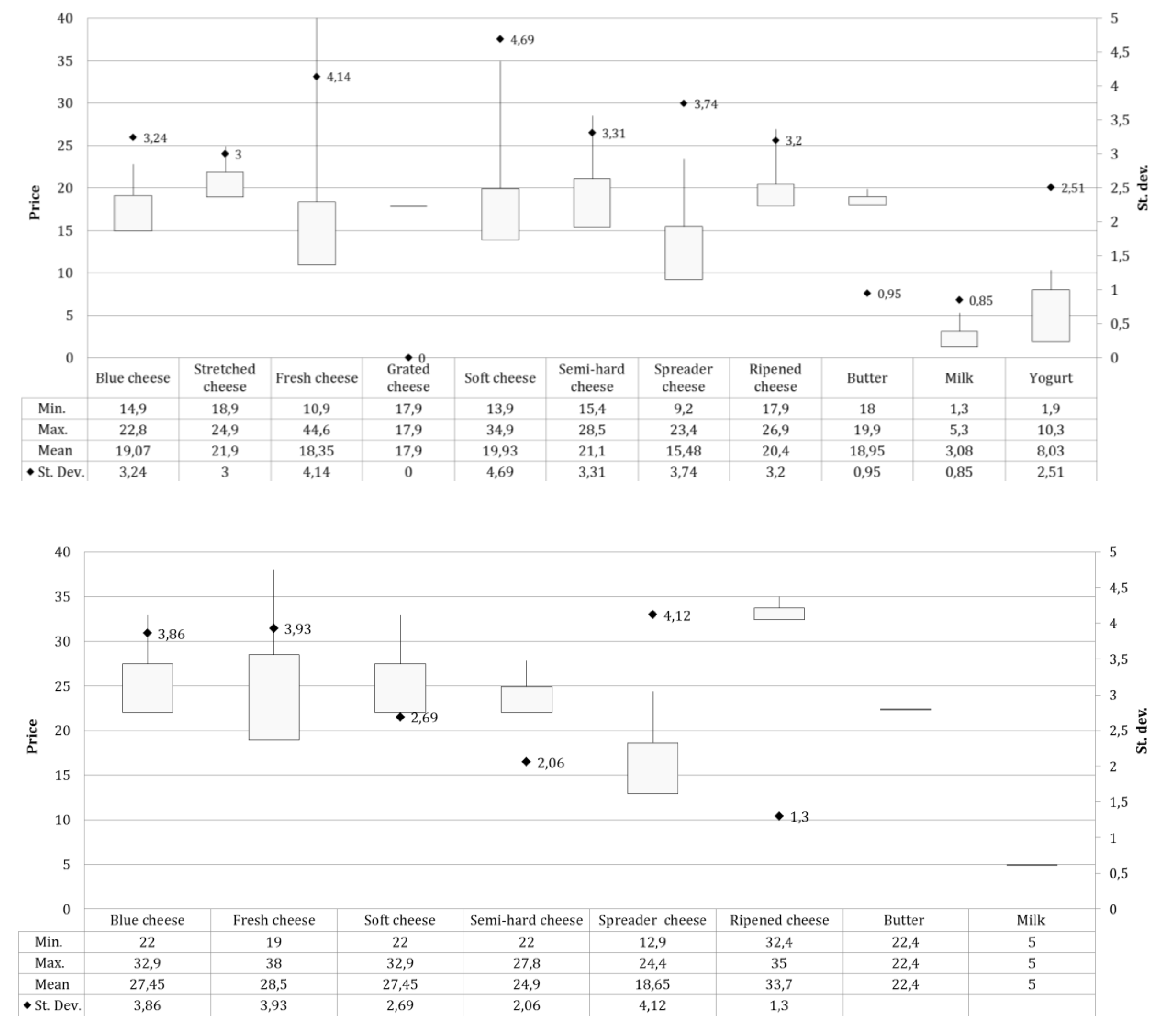

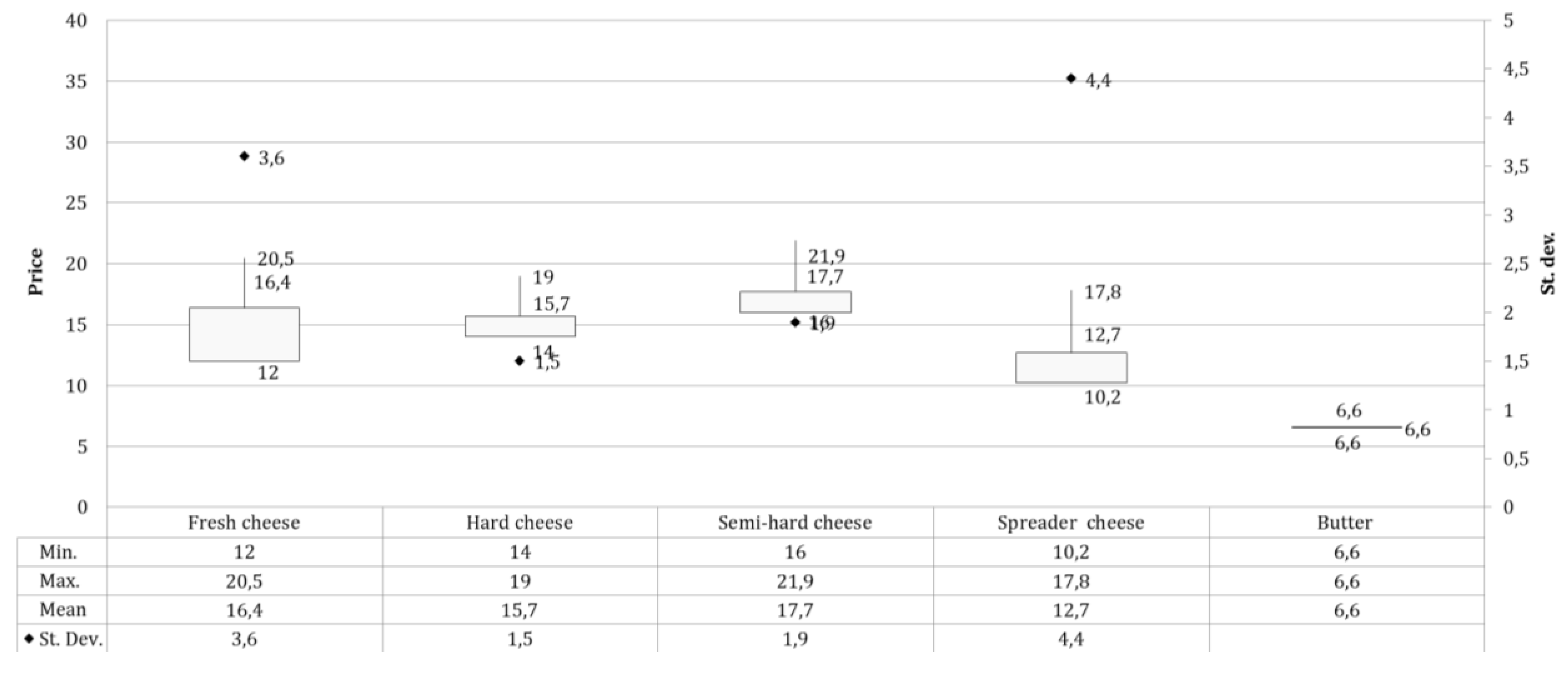

3. Results

4. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- FAOSTAT. Livestock Primary. 2019. Available online: http://www.fao.org/faostat/en/#data/QL/visualize (accessed on 17 October 2019).

- ASSOLATTE. Rapporto ASSOLATTE. 2017. Available online: http://report.assolatte.it/2017/ (accessed on 17 October 2019).

- ASSOLATTE. Rapporto ASSOLATTE. 2016. Available online: http://report.assolatte.it/2016/ (accessed on 17 October 2019).

- Costa, M.P.; Monteiro, M.L.G.; Frasao, B.S.; Silva, V.L.; Rodrigues, B.L.; Chiappini, C.C.; Conte-Junior, C.A. Consumer perception, health information, and instrumental parameters of cupuassu (Theobroma grandiflorum) goat milk yogurts. J. Dairy Sci. 2017, 100, 157–168. [Google Scholar] [CrossRef] [PubMed]

- Güney, O.İ. Consumer Attitudes towards Goat Milk and Goat Milk Products: A Pilot Survey in South East of Turkey. Turk. J. Agric.-Food Sci. Technol. 2019, 7, 314–319. [Google Scholar]

- Verruck, S.; Balthazar, C.F.; Rocha, R.S.; Silva, R.; Esmerino, E.A.; Pimentel, T.C.; Freitas, M.Q.; Silva, M.C.; Prudencio, E.S. Dairy foods and positive impact on the consumer’s health. Adv. Food Nutr. Res. 2019, 89, 95–164. [Google Scholar] [PubMed]

- Ranadheera, C.S.; Naumovski, N.; Ajlouni, S. Non-bovine milk products as emerging probiotic carriers: Recent developments and innovations. Curr. Opin. Food Sci. 2018, 22, 109–114. [Google Scholar] [CrossRef]

- Szajewska, H.; Shamir, R. Evidence-Based Research in Pediatric Nutrition; Karger Medical and Scientific Publishers: Basel, Switzerland, 2013; ISBN 978-3-318-02457-9. [Google Scholar]

- Turck, D. Cow’s milk and goat’s milk. World Rev. Nutr. Diet. 2013, 108, 56–62. [Google Scholar]

- Mendonça, Á.; Sousa, F.; Fernandes, A.; Carvalho, M.; Neto, I.; Gomes, S. Consumers’ perception about sensorial characteristics of the Extra Long Maturation Transmontano Goat Cheese. Rev. De Ciências Agrárias (Port.) 2017, 40, 309–320. [Google Scholar]

- De Barros, C.P.; Rosenthal, A.; Walter, E.H.M.; Deliza, R. Consumers’ attitude and opinion towards different types of fresh cheese: An exploratory study. Food Sci. Technol. 2016, 36, 448–455. [Google Scholar] [CrossRef]

- Pearson, D.; Henryks, J.; Trott, A.; Jones, P.; Parker, G.; Dumaresq, D.; Dyball, R. Local food: Understanding consumer motivations in innovative retail formats. Br. Food J. 2011, 113, 886–899. [Google Scholar] [CrossRef]

- Aschemann, J.; Hamm, U.; Naspetti, S.; Zanoli, R. The organic market. Org. Farming: Int. Hist. 2007, 123–151. [Google Scholar]

- Lee, J.; Gereffi, G.; Beauvais, J. Global value chains and agrifood standards: Challenges and possibilities for smallholders in developing countries. Proc. Natl. Acad. Sci. USA 2012, 109, 12326–12331. [Google Scholar] [CrossRef]

- González-Benito, Ó.; Martos-Partal, M.; Garrido-Morgado, Á. Retail store format decisions. In Handbook of Research on Retailing; Edward Elgar Publishing: Cheltenham, UK, 2018. [Google Scholar]

- PIANISETTORE. 2019. Available online: http://www.pianidisettore.it/flex/cm/pages/ServeAttachment.php/L/IT/D/2%252Ff%252F0%252FD.786025e999e6177c2cfb/P/BLOB%3AID%3D1033 (accessed on 17 October 2019).

- Cox, R. Consumer convenience and the retail structure of cities. J. Mark. 1959, 23, 355–362. [Google Scholar] [CrossRef]

- Škubna, O.; Homol, J.; Belova, A.V. Domestic and Foreign Origin Foodstuff Prices Comparison in Selected Retail Chains. Agris-Line Pap. Econ. Inf. 2017, 9, 99–108. [Google Scholar]

- Brown, C.; Miller, S. The Impacts of Local Markets: A Review of Research on Farmers Markets and Community Supported Agriculture (CSA). Am. J. Agric. Econ. 2008, 90, 1296–1302. [Google Scholar] [CrossRef]

- Corsi, A.; Barbera, F.; Dansero, E.; Peano, C. Alternative Food Networks; Springer: Berlin, Germany, 2018. [Google Scholar]

- Kamran-Disfani, O.; Mantrala, M.K.; Izquierdo-Yusta, A.; Martínez-Ruiz, M.P. The impact of retail store format on the satisfaction-loyalty link: An empirical investigation. J. Bus. Res. 2017, 77, 14–22. [Google Scholar] [CrossRef]

- Husen, S. The Mediating Role of Product Positioning Quality and Product Attractiveness Advantage. Int. J. Bus. Manag. Sci. 2017, 7. [Google Scholar]

- Aliagha, G.U.; Qin, Y.G.; Ali, K.N.; Abdullah, M.N. Analysis of shopping mall attractiveness and customer loyalty. J. Teknol. 2015, 74, 15–21. [Google Scholar] [CrossRef]

- Kvam, G.-T.; Magnus, T.; Petter Straete, E. Product strategies for growth in niche food firms. Br. Food J. 2014, 116, 723–732. [Google Scholar] [CrossRef]

- Loureiro, M.L.; Hine, S. Discovering niche markets: A comparison of consumer willingness to pay for local (Colorado grown), organic, and GMO-free products. J. Agric. Appl. Econ. 2002, 34, 477–487. [Google Scholar] [CrossRef]

- Trobe, H.L. Farmers’ markets: Consuming local rural produce. Int. J. Consum. Stud. 2001, 25, 181–192. [Google Scholar] [CrossRef]

- Curtis, K.R.; Salisbury, K.; Ward, R.; Durward, C. Targeting Farmers’ Markets in Utah: Understanding Fresh Produce Pricing; Utah State University Extension: Logan, UT, USA, 2019. [Google Scholar]

- Diamond, A.; Barham, J. Moving Food along the Value Chain: Innovations in Regional Food Distribution. Available online: https://ageconsearch.umn.edu/record/145618 (accessed on 5 June 2019).

- Santos, J.F.; Ribeiro, J.C. Product attribute saliency and region of origin: Some empirical evidence from Portugal. In Proceedings of the 2005 International Congress, Copenhagen, Denmark, 23–27 August 2005. [Google Scholar]

- Norris, A.; Cranfield, J. Consumer Preferences for Country-of-Origin Labeling in Protected Markets: Evidence from the Canadian Dairy Market. Appl. Econ. Perspect. Policy 2019, 41, 391–403. [Google Scholar] [CrossRef]

- Bentivoglio, D.; Savini, S.; Finco, A.; Bucci, G.; Boselli, E. Quality and origin of mountain food products: The new European label as a strategy for sustainable development. J. Mt. Sci. 2019, 16, 428–440. [Google Scholar] [CrossRef]

- Smith, A.; Raven, R. What is protective space? Reconsidering niches in transitions to sustainability. Res. Policy 2012, 41, 1025–1036. [Google Scholar] [CrossRef]

- Massaglia, S.; Borra, D.; Peano, C.; Sottile, F.; Merlino, V.M. Consumer Preference Heterogeneity Evaluation in Fruit and Vegetable Purchasing Decisions Using the Best–Worst Approach. Foods 2019, 8, 266. [Google Scholar] [CrossRef] [PubMed]

- Elberg, A.; Gardete, P.M.; Macera, R.; Noton, C. Dynamic effects of price promotions: Field evidence, consumer search, and supply-side implications. Quant. Mark. Econ. 2019, 17, 1–58. [Google Scholar] [CrossRef]

- Sinha, I.; Smith, M.F. Consumers’ perceptions of promotional framing of price. Psychol. Mark. 2000, 17, 257–275. [Google Scholar] [CrossRef]

- Andrée, P.; Dibden, J.; Higgins, V.; Cocklin, C. Competitive Productivism and Australia’s Emerging ‘Alternative’Agri-food Networks: Producing for farmers’’ markets in Victoria and beyond. Aust. Geogr. 2010, 41, 307–322. [Google Scholar] [CrossRef]

- Banerjee, S.; Joglekar, A.; Kundle, S. Consumer awareness about convenience food among working and non-working women. Ijsr Int. J. Sci. Res. 2013, 2, 1–4. [Google Scholar] [CrossRef]

- Accorsi, R.; Manzini, R.; Pini, C. How Logistics Decisions Affect the Environmental Sustainability of Modern Food Supply Chains: A Case Study from an Italian Large-scale Retailer. Sustain. Chall. Agrofood Sect. 2017, 175. [Google Scholar]

- Sckokai, P.; Soregaroli, C.; Moro, D. Estimating market power by retailers in a dynamic framework: The Italian PDO cheese market. J. Agric. Econ. 2013, 64, 33–53. [Google Scholar] [CrossRef]

- Berti, G.; Mulligan, C. Competitiveness of small farms and innovative food supply chains: The role of food hubs in creating sustainable regional and local food systems. Sustainability 2016, 8, 616. [Google Scholar] [CrossRef]

- Colonna, A.; Durham, C.; Meunier-Goddik, L. Factors affecting consumers’ preferences for and purchasing decisions regarding pasteurized and raw milk specialty cheeses. J. Dairy Sci. 2011, 94, 5217–5226. [Google Scholar] [CrossRef] [PubMed]

- Gracia, A. Consumers’ preferences for a local food product: A real choice experiment. Empir. Econ. 2014, 47, 111–128. [Google Scholar] [CrossRef]

- Blasi, E.; Cicatiello, C.; Pancino, B.; Franco, S. Alternative food chains as a way to embed mountain agriculture in the urban market: The case of Trentino. Agric. Food Econ. 2015, 3, 3. [Google Scholar] [CrossRef]

- Fontecha, J.; Peláez, C.; Juárez, M.; Requena, T.; Gómez, C.; Ramos, M. Biochemical and microbiological characteristics of artisanal hard goat’s cheese. J. Dairy Sci. 1990, 73, 1150–1157. [Google Scholar] [CrossRef]

- Emaldi, G.C. Hygienic quality of dairy products from ewe and goat milk. In Proceedings of the Production and utilization of ewe and goat milk, Crete, Greece, 19–21 October 1995; International Dairy Federation: Brussels, Belgium, 1996. [Google Scholar]

- ASSOLATTE. L’andamento delle vendite dei mercati. 2018. Available online: http://mercati.assolatte.it/201803/ (accessed on 17 October 2019).

- Lee, C.K.C.; Levy, D.S.; Yap, C.S.F. How does the theory of consumption values contribute to place identity and sustainable consumption? Int. J. Consum. Stud. 2015, 39, 597–607. [Google Scholar] [CrossRef]

- Cornale, P.; Renna, M.; Lussiana, C.; Bigi, D.; Chessa, S.; Mimosi, A. The Grey Goat of Lanzo Valleys (Fiurinà): Breed characteristics, genetic diversity, and quantitative-qualitative milk traits. Small Rumin. Res. 2014, 116, 1–13. [Google Scholar] [CrossRef]

- Xie, K.; Wu, Y.; Xiao, J.; Hu, Q. Value co-creation between firms and customers: The role of big data-based cooperative assets. Inf. Manag. 2016, 53, 1034–1048. [Google Scholar] [CrossRef]

- Schröck, R. Valuing country of origin and organic claim: A hedonic analysis of cheese purchases of German households. Br. Food J. 2014, 116, 1070–1091. [Google Scholar] [CrossRef]

- Ribeiro, A.C.; Ribeiro, S.D.A. Specialty products made from goat milk. Small Rumin. Res. 2010, 89, 225–233. [Google Scholar] [CrossRef]

- de Asís Ruiz Morales, F.; Genís, J.M.C.; Guerrero, Y.M. Current status, challenges and the way forward for dairy goat production in Europe. Asian-Australas. J. Anim. Sci. 2019, 32, 1256–1265. [Google Scholar]

- Anagrafe Nazionale Zootecnica. 2019. Available online: https://www.vetinfo.it/j6_statistiche/#/ (accessed on 17 October 2019).

- ISMEA. Analisi dei Regolamenti Comunali in Materia di Farmers’ Market; ISMEA: Roma, Italy, 2011. [Google Scholar]

- Barbera, F.; Dagnes, J.; Di Monaco, R. Quality and Price Setting by Producers in AFNs. In Alternative Food Networks; Springer: Berlin, Germany, 2018; pp. 215–243. [Google Scholar]

- Garanti, Z.; Berberoglu, A. Cultural Perspective of Traditional Cheese Consumption Practices and Its Sustainability among Post-Millennial Consumers. Sustainability 2018, 10, 3183. [Google Scholar] [CrossRef]

- Kühl, S.; Gassler, B.; Spiller, A. Labeling strategies to overcome the problem of niche markets for sustainable milk products: The example of pasture-raised milk. J. Dairy Sci. 2017, 100, 5082–5096. [Google Scholar] [CrossRef] [PubMed]

- Mowlem, A. Marketing goat dairy produce in the UK. Small Rumin. Res. 2005, 60, 207–213. [Google Scholar] [CrossRef]

| General Information | Product Information |

|---|---|

|

|

| Origin | References (Number) | ||

|---|---|---|---|

| Large-Scale Retail Chains | Retail sales | Farmers’ Market | |

| Italy | |||

| Piedmont | 130 | 62 | 49 |

| District | |||

| Turin | 21 | 30 | 38 |

| Cuneo | 56 | 21 | |

| Asti | 22 | 2 | 2 |

| Biella | 22 | 4 | |

| Novara | 2 | 5 | 9 |

| Alexandria | 7 | ||

| Lombardy | 115 | 1 | |

| Sardinia | 92 | 2 | |

| Lazio | 20 | 1 | |

| Val D’Aosta | 6 | 2 | |

| European Countries | |||

| United Kingdom | 31 | 2 | |

| Belgium | 10 | 1 | |

| France | 82 | 7 | |

| Total | 494 | 78 | 49 |

| Sign | Regional (Piedmont) Products | Other Origin | Total | % of Regional Products |

|---|---|---|---|---|

| a | 5 | 6 | 11 | 45% |

| b | 9 | 0 | 9 | 100% |

| c | 9 | 1 | 10 | 90% |

| d | 11 | 4 | 15 | 73% |

| e | 13 | 2 | 15 | 87% |

| f | 12 | 0 | 12 | 100% |

| g | 3 | 3 | 6 | 50% |

| Total | 62 | 16 | 78 | 79% |

| Country of Origin | Refrigerated Counter | Lane | Total |

|---|---|---|---|

| France | 12 | 70 | 82 |

| Lombardy | 53 | 62 | 115 |

| Piedmont | 92 | 38 | 130 |

| Sardinia | 49 | 43 | 92 |

| Other | 25 | 50 | 75 |

| Total | 231 | 263 | 494 |

| LRC types | References (no.) | Producers (no.) | No. References/No. Producers | Mean Price (€/kg or €/l) | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Mean | Min | Max | |||

| Hypermarket | 20.2 | 9 | 36 | 11.4 | 4 | 17 | 1.8 | 15.87 |

| Supermarket | 9 | 1 | 22 | 5.7 | 1 | 12 | 1.6 | 16.99 |

| Free service | 7 | 2 | 15 | 5.1 | 2 | 9 | 1.4 | 18.28 |

| Discount | 0.7 | 0 | 2 | 0.7 | 0 | 2 | 1 | 14.43 |

| Product type | Producer | Total | ||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| Cheeses | ||||||

| Fresh | 6 | 1 | - | - | 2 | 9 |

| Soft | 4 | - | - | 6 | 6 | 16 |

| Semi-hard | 14 | - | - | 3 | 2 | 19 |

| Spreader | 2 | - | 1 | - | - | 3 |

| Other products | ||||||

| Custard | 2 | - | - | - | - | 2 |

| Total | 28 | 1 | 1 | 9 | 10 | 49 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Massaglia, S.; Borra, D.; Merlino, V.M. Goat Dairy Product Assortment in Different Sales Channels in Northwestern Italy. Animals 2019, 9, 823. https://doi.org/10.3390/ani9100823

Massaglia S, Borra D, Merlino VM. Goat Dairy Product Assortment in Different Sales Channels in Northwestern Italy. Animals. 2019; 9(10):823. https://doi.org/10.3390/ani9100823

Chicago/Turabian StyleMassaglia, Stefano, Danielle Borra, and Valentina Maria Merlino. 2019. "Goat Dairy Product Assortment in Different Sales Channels in Northwestern Italy" Animals 9, no. 10: 823. https://doi.org/10.3390/ani9100823

APA StyleMassaglia, S., Borra, D., & Merlino, V. M. (2019). Goat Dairy Product Assortment in Different Sales Channels in Northwestern Italy. Animals, 9(10), 823. https://doi.org/10.3390/ani9100823