Performance of Microfinance Institutions in Ethiopia: Integrating Financial and Social Metrics

Abstract

1. Introduction

2. Data and Estimation Strategy

2.1. The Data

2.2. Estimation Strategy

= X`itβ` + Ci + ε`it.

= X`itβ` + α + ηi + ε`it

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variables | Definition and Measurement of Variables 1 |

|---|---|

| Outcome indicators | |

| Performance score (Sj) | Indexes estimated from outcome indicators representing social performance(S1) and financial performance (S2). |

| Number of borrowers | Number of active borrowers (thousands) |

| Number of depositors | Number of active depositors (thousands) |

| GLP | Total outstanding principal due for all client loans (million birr) |

| FSS | = 1 if financially self-sufficient and 0 otherwise |

| ROA | = [Net operating income, less Taxes/Average assets] × 100 |

| ROE | = [Net operating income, less Taxes/Average equity] × 100 |

| Average loan | An average loan per client divided by GNI per capita |

| Women borrowers | Percentage of women borrowers |

| Explanatory variables | |

| Age | Firm age = 1 if new (1–4 years) |

| Firm age = 2 if young (5–8 years) and | |

| Firm age = 3 if matured (>8 years) | |

| Asset | Total asset (millions of birr) |

| Loan officer | The number of employees mainly managing client loans (thousands) |

| Loan officer productivity | Total number of borrowers divided by loan officers (thousands) |

| Personnel productivity | Total number of borrowers divided by total number of staff (thousands) |

| Yield on gross portfolio | = [Financial revenue/average gross loan portfolio] × 100 (%) |

| Portfolio to asset | = [Gross loan portfolio/total asset] × 100 (%) |

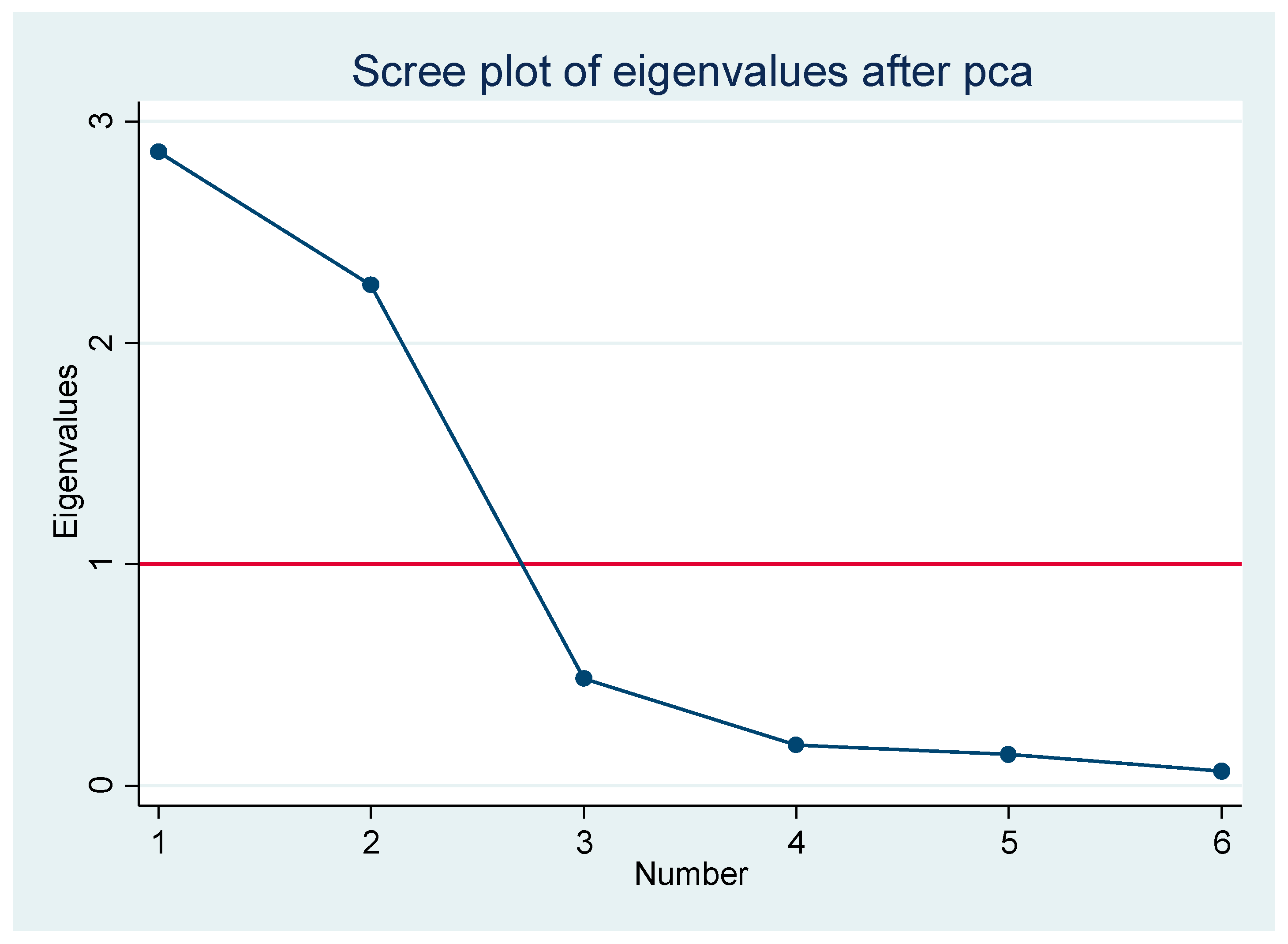

| Components | Eigenvalue | Proportion Explained | Rotated Components 1 | KMO | |

|---|---|---|---|---|---|

| Component 1 | Component 2 | ||||

| Number of borrowers | 2.86 | 0.48 | 0.569 | 0.84 | |

| Number of depositors | 2.26 | 0.38 | 0.577 | 0.74 | |

| Gross loan portfolio | 0.48 | 0.08 | 0.585 | 0.69 | |

| FSS | 0.18 | 0.03 | 0.592 | 0.64 | |

| ROA | 0.14 | 0.02 | 0.607 | 0.61 | |

| ROE | 0.07 | 0.01 | 0.529 | 0.84 | |

| Rho | 0.85 | ||||

| Overall KMO | 0.72 | ||||

| Country 1 | Borrowers 2 | GLP (million $) | Average Loan/GNI | Female Borrowers | OSS |

|---|---|---|---|---|---|

| Angola | 9798 | 7.40 | 27.74% | 56.76% | 113.40% |

| Congo, Dem. Republic | 5980 | 13.59 | 57.61% | 47.86% | 89.36% |

| Cote d’Ivoire | 4850 | 8.90 | 109.13% | 27.37% | 90.98% |

| Ethiopia | 86,213 | 14.84 | 58.22% | 45.76% | 145.73% |

| Ghana | 11,463 | 8.54 | 41.92% | 59.31% | 108.26% |

| Kenya | 45,304 | 80.26 | 120.10% | 46.33% | 124.72% |

| Nigeria | 47,844 | 47.83 | 15.00% | 75.00% | 132.94% |

| South Africa | 96,472 | 127.00 | 5.47% | 36.76% | 116.33% |

| Sudan | 8673 | 11.33 | 46.50% | 57.66% | 141.00% |

| Tanzania | 20,523 | 54.73 | 80.67% | 62.25% | 122.38% |

| Variables | VIF |

|---|---|

| Age | |

| Young | 3.40 |

| Matured | 5.36 |

| Asset | 4.51 |

| Loan officer | 4.37 |

| Loan officer productivity | 1.39 |

| Personnel productivity | 1.21 |

| Yield on gross portfolio | 1.08 |

| Portfolio to asset | 1.34 |

| Fiscal year | 2.53 |

| Total | 2.80 |

References

- Abate, Gashaw Tadesse, Carlo Borzaga, and Kindie Getnet. 2014. Cost-Efficiency and Outreach of Microfinance Institutions: Trade-Offs and the Role of Ownership. Journal of International Development 26: 923–32. [Google Scholar] [CrossRef]

- Ahlin, Christian, Jocelyn Lin, and Michael Maio. 2011. Where Does Microfinance Flourish? Microfinance Institution Performance in Macroeconomic Context. Journal of Development Economics 95: 105–20. [Google Scholar] [CrossRef]

- Assefa, Esubalew, Niels Hermes, and Aljar Meesters. 2013. Competition and the Performance of Microfinance Institutions. Applied Financial Economics 23: 767–82. [Google Scholar] [CrossRef]

- Barres, Isabelle, Tillman Bruett, Lynne Curran, Ana Escalona, Elena Nelson, Dan Norell, Beth Porter, Blaine Stephens, and Maria Stephens. 2005. Measuring the Performance of Microfinance Institutions: A Framework for Reporting, Analysis, and Monitoring. Edited by Tillman Bruett. The SEEP Network. Washington: The SEEP Network. [Google Scholar]

- Bibi, Uzma, Hatice Ozer Balli, Claire D. Matthews, and David W. L. Tripe. 2018. New Approaches to Measure the Social Performance of Microfinance Institutions (MFIs). International Review of Economics and Finance 53: 88–97. [Google Scholar] [CrossRef]

- Christen, Robert. 2001. Commercialization and Mission Drift: Transformation in Latin America. No. 5. Washington: CGAP (Consultative Group to Assist the Poor), p. 24. [Google Scholar]

- Coad, Alex, Agustí Segarra, and Mercedes Teruel. 2013. Like Milk or Wine: Does Firm Performance Improve with Age? Structural Change and Economic Dynamics 24: 173–89. [Google Scholar] [CrossRef]

- Cull, Robert, Asli Demirgüç-kunt, and Jonathan Morduch. 2007. Financial Performance and Outreach: A Global Analysis of Leading Microbanks. The Economic Journal 117: 107–33. [Google Scholar] [CrossRef]

- Cull, Robert, Asli Demirgüç-Kunt, and Jonathan Morduch. 2011. Does Regulatory Supervision Curtail Microfinance Profitability and Outreach? World Development 39: 949–65. [Google Scholar] [CrossRef]

- Daher, Lâma, and Erwan Le Saout. 2013. Microfinance and Financial Performance. Strategic Change 22: 31–45. [Google Scholar] [CrossRef]

- Daher, Lâma, and Erwan Le Saout. 2015. The Determinants of the Financial Performance of Microfinance Institutions: Impact of the Global Financial Crisis. Strategic Change 24: 131–48. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. Washington: The World Bank. [Google Scholar] [CrossRef]

- Green, H. William. 2008. Econometric Analysis, 6th ed. Upper Saddle River: Pearson Prentice Hall. [Google Scholar]

- Hermes, Niels, and Robert Lensink. 2007. The Empirics of Microfinance: What Do We Know? The Economic Journal 117: 1–10. [Google Scholar] [CrossRef]

- Hermes, Niels, Robert Lensink, and Aljar Meesters. 2011. Outreach and Efficiency of Microfinance Institutions. World Development 39: 938–48. [Google Scholar] [CrossRef]

- Kebede, Hundanol Atnafu, and Wassie Berhanu. 2012. How Efficient Are the Ethiopian Microfinance Institutions in Extending Financial Services to the Poor? A Comparison with the Commercial Banks. Journal of African Economies 22: 112–35. [Google Scholar] [CrossRef]

- Kereta, Befekadu B. 2007. Outreach and Financial Performance Analysis of Microfinance Institutions in Ethiopia. In African Economic Conference. Addis Ababa: United Nations Conference Center, pp. 1–30. [Google Scholar]

- Kipesha, Erasmus Fabian. 2013. Impact of Size and Age on Firm Performance: Evidences from Microfinance. Research Journal of Finance and Accounting 4: 105–17. [Google Scholar]

- Luzzi, Giovanni Ferro, and Sylvain Weber. 2006. Measuring the Performance of Microfinance Institutions. Geneva: CRAG—Centre de Recherche Appliquée En Gestion. [Google Scholar]

- Mersland, Roy, and Reidar Øystein Strøm. 2008. Performance and Trade-offs in Microfinance Organisations—Does Ownership Matter? Journal of International Development 20: 598–612. [Google Scholar] [CrossRef]

- Mersland, Roy, and R. Øystein Strøm. 2010. Microfinance Mission Drift? World Development 38: 28–36. [Google Scholar] [CrossRef]

- Pinz, Alexander, and Bernd Helmig. 2014. Success Factors of Microfinance Institutions: State of the Art and Research Agenda. Voluntas 26: 488–509. [Google Scholar] [CrossRef]

- Postelnicu, Luminita, and Niels Hermes. 2018. Microfinance Performance and Social Capital: A Cross-Country Analysis. Journal of Business Ethics 153: 427–45. [Google Scholar] [CrossRef]

- Rosenberg, Richard. 2009. Measuring Results of Microfinance Institutions Minimum Indicators That Donors and Investors Should Track. Washington: CGAP (Consultative Group to Assist the Poor). [Google Scholar] [CrossRef]

- Servin, Roselia, Robert Lensink, and Marrit van den Berg. 2012. Ownership and Technical Efficiency of Microfinance Institutions: Empirical Evidence from Latin America. Journal of Banking & Finance 36: 2136–44. [Google Scholar] [CrossRef]

- Shu, Cletus Ambe, and Bilge Oney. 2014. Outreach and Performance Analysis of Microfinance Institutions in Cameroon. Economic Research-Ekonomska Istrazivanja 27: 107–19. [Google Scholar] [CrossRef]

- Tsegaye, Anduanbessa. 2009. Statistical Analysis of the Performance of Microfinance Institutions: The Ethiopian Case. Saving and Development 33: 183–98. [Google Scholar]

- Vanroose, Annabel, and Bert D’Espallier. 2013. Do Microfinance Institutions Accomplish Their Mission? Evidence from the Relationship between Traditional Financial Sector Development and Microfinance Institutions’ Outreach and Performance. Applied Economics 45: 1965–82. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, Jacob Yaron, and Michele Meoli. 2017. Assessing the Financial and Outreach Efficiency of Microfinance Institutions: Do Age and Size Matter? Journal of Multinational Financial Management 40: 63–76. [Google Scholar] [CrossRef]

- Wolday, Amha. 2004. Managing Growth of Microfinance Institutions (MFIs): Balancing Sustainability and Reaching Large Number of Clients in Ethiopia. Ethiopian Journal of Economics 13: 62–101. [Google Scholar]

| 1 | Organizational performance can be measured either using a goal-attainment perspective or a system approach (Pinz and Helmig 2014). In the context of this paper, the success of a firm is measured by its effort to attain its organizational goal—in this case, using social and financial metrics. |

| 2 | This research is part of our project on evaluating the performance of agricultural marketing and financial institutions in Ethiopia. As described in Section 2, while the data used in this paper is primarily from the Microfinance Information Exchange (MIX) database, the paper has benefited from the data collected by the Association of Ethiopian Microfinance Institute for treating missing values. |

| 3 | The performance of MFIs is non-negligibly driven by the surrounding macroeconomic and institutional environment. Thus, MFIs should be judged in context (Ahlin et al. 2011). In this regard, this study suffers less from unobservable country-level factors, yet we acknowledge the associated shortcoming in terms of understanding the issue from a broader perspective. |

| 4 |

| Variables | Obs. | Mean | Std. Dev | Minimum | Maximum | Median |

|---|---|---|---|---|---|---|

| Outcome indicators | ||||||

| Number of borrowers | 153 | 86.3 | 159.6 | 0.27 | 775.4 | 22.3 |

| Number of depositors | 153 | 88.5 | 238.0 | 0 | 2213.8 | 21.0 |

| GLP (Gross Loan Portfolio) | 153 | 192.3 | 483.8 | 0.18 | 3646.5 | 32.2 |

| FSS (Financial Self-Sufficiency) | 153 | 0.64 | 0.47 | 0 | 1 | 1 |

| ROA (Returns on Asset) | 153 | 1.37 | 7.19 | −69.7 | 16.7 | 2.07 |

| ROE (Returns on Equity) | 153 | 3.95 | 20.54 | −101.02 | 60.69 | 5.6 |

| Average loan | 152 | 57.56 | 28.58 | 2.62 | 189.4 | 59.1 |

| Women borrowers | 153 | 52.36 | 20.11 | 9.64 | 100 | 54.5 |

| Explanatory variables | ||||||

| Age | 153 | |||||

| New | 0.147 | 0 | 1 | 0 | ||

| Young | 0.337 | 0 | 1 | 0 | ||

| Matured | 0.516 | 0 | 1 | 1 | ||

| Asset | 153 | 270.3 | 709.9 | 0.68 | 5485.1 | 38.7 |

| Loan officer | 149 | 0.207 | 0.39 | 0.002 | 2.32 | 0.06 |

| Loan officer productivity | 144 | 0.496 | 0.74 | 0 | 9.06 | 0.37 |

| Personnel productivity | 152 | 0.179 | 0.16 | 0 | 2.05 | 0.16 |

| Yield on gross portfolio | 153 | 3.39 | 37.57 | 0 | 65.24 | 5.3 |

| Portfolio to asset | 153 | 69.7 | 16.01 | 4.08 | 128.04 | 72.4 |

| Country/Region | Number of Borrowers 1 | GLP (million $) | Average Loan/GNI | % Female Borrower | OSS |

|---|---|---|---|---|---|

| Ethiopia | 86,213 | 14.84 | 58.22% | 45.76% | 145.73% |

| Africa | 22,383 | 21.61 | 72.58% | 45.01% | 116.66% |

| East Asia and Pacific | 84,489 | 103.56 | 55.26% | 43.65% | 109.22% |

| Eastern Europe and Central Asia | 10,875 | 35.84 | 101.53% | 39.88% | 114.89% |

| Middle East and North Africa | 40,025 | 20.85 | 18.50% | 57.63% | 119.87% |

| South Asia | 217,941 | 45.15 | 16.86% | 78.18% | 120.58% |

| World | 68,211 | 51.44 | 50.19% | 51.82% | 115.99% |

| Variable | (1) SUR Estimation | (2) Social Performance (RE) 1 | (3) Financial Performance (FE) 1 | |

|---|---|---|---|---|

| Social Performance | Financial Performance | |||

| Age (reference = New) | ||||

| Young | −0.09 (0.09) | 0.42 (0.46) | −0.12 (0.09) | 0.93 (0.45) ** |

| Matured | −0.03 (0.11) | −0.62 (0.55) | −0.11 (0.12) | 0.82 (0.64) |

| Asset | 0.001 (0.00) *** | 0.0004 (0.0003) | 0.001 (0.00) *** | 0.0008 (0.0004) * |

| Loan officer | 1.40 (0.11) *** | 0.07 (0.56) | 1.58 (0.17) *** | −1.55 (1.39) |

| Loan officer productivity | 0.21 (0.07) *** | −0.56 (0.34) | 0.16 (0.08) ** | −0.17 (0.41) |

| Personnel productivity | 0.36 (0.15) ** | −0.28 (0.74) | 0.32 (0.15) ** | 0.20 (0.65) |

| Yield on gross portfolio | 0.002 (0.001) *** | 0.01 (0.003) *** | 0.002 (0.00) *** | 0.006 (0.003) * |

| Portfolio to asset | 0.002 (0.002) | 0.01 (0.006) * | 0.02 (0.02) | 0.01 (0.01) |

| Fiscal year | 0.002 (0.01) | −0.04 (0.05) | 0.12 (0.11) | −0.14 (0.06) ** |

| Constant | −4.45 (19.74) | 79.97 (99.69) | −25.06 (23.32) | 284.0 (121.2) ** |

| Observations | 140 | 140 | 140 | 140 |

| Chi2 | 5379.7 *** | 35.61 *** | 3185.33 *** | 25.80 *** |

| R-square | 0.91 | 0.21 | 0.95 | 0.16 |

| Breusch–Pagan test of independence (Chi2) | 0.043 | |||

| Variable | (1) Average Loan/GNI | (2) Percentage of Woman Borrowers | ||

|---|---|---|---|---|

| Coeff. | Std. Err | Coeff. | Std. Err | |

| FSS | −8.22 | 10.36 | −19.44 ** | 8.28 |

| Age (reference = New) | ||||

| Young | 11.98 | 10.75 | −15.02 * | 8.50 |

| Matured | 3.17 | 13.01 | −23.32 ** | 9.64 |

| FSS # Age | ||||

| FSS × Young | −1.36 | 12.07 | 11.40 | 9.68 |

| FSS × Matured | 13.65 | 11.99 | 22.67 ** | 9.52 |

| GLP (measure of size) | 0.02 ** | 0.01 | 0.01 | 0.01 |

| FSS × GLP | −0.05 | 0.01 | −0.009 | 0.007 |

| Portfolio to asset | 0.49 *** | 0.13 | −0.23 ** | 0.10 |

| Fiscal year | −4.92 *** | 0.90 | 0.49 | 0.64 |

| Constant | 9897.5 *** | 1820.3 | −889.9 | 1281.1 |

| Observations | 153 | 154 | ||

| Wald Chi2 | 7.35 *** | 21.10 ** | ||

| Joint test of FSS = 0 (Chi2) | 0.08 | 1.73 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wassie, S.B.; Kusakari, H.; Sumimoto, M. Performance of Microfinance Institutions in Ethiopia: Integrating Financial and Social Metrics. Soc. Sci. 2019, 8, 117. https://doi.org/10.3390/socsci8040117

Wassie SB, Kusakari H, Sumimoto M. Performance of Microfinance Institutions in Ethiopia: Integrating Financial and Social Metrics. Social Sciences. 2019; 8(4):117. https://doi.org/10.3390/socsci8040117

Chicago/Turabian StyleWassie, Solomon Bizuayehu, Hitoshi Kusakari, and Masahiro Sumimoto. 2019. "Performance of Microfinance Institutions in Ethiopia: Integrating Financial and Social Metrics" Social Sciences 8, no. 4: 117. https://doi.org/10.3390/socsci8040117

APA StyleWassie, S. B., Kusakari, H., & Sumimoto, M. (2019). Performance of Microfinance Institutions in Ethiopia: Integrating Financial and Social Metrics. Social Sciences, 8(4), 117. https://doi.org/10.3390/socsci8040117