Abstract

The aim of this theoretical research is to analyze the state of retail distribution nowadays, reviewing the dynamics of action that contribute to the move from a linear to an incipient circular retail model. The framework is based on the Retail Wheel Spins Theory and the Retail Life Cycle (RLC), with an extra review of Bauman’s liquid metaphor. We consider two questions. Firstly, are offline retailers ready to disappear as online commerce and digital marketing aggressively break into the retail industry? Secondly, could commercial spaces (in the fifth stage in the evolution of retail and territory) be in the decline stage in the RLC in the near future or can a circular connection take place? Thus, a desk research methodology based on secondary documentary material and sources issued leads to an interpretive analysis that reveals ten trends (e.g., solid retail vs. liquid retail; glocal retail; food sovereignty) and a wide diversity of changes that could involve offline stores recovering territory and entering a circular phase. Our findings suggest that digitalized physical stores are flourishing and our reflections augur changes in pace and the closure of the linear business cycle to recover territory, the city, its local market, and its symbolism, as well as a liquid business steeped in omnichannel formats developing an incipient circular movement. Conclusions indicate that it is possible to perceive a timid change back to territory and retail spaces which, along with phygitalization, will coexist with the digital world.

1. Introduction

The service sector and, above all, retail activities, as part of the total economic activity of any country, are clearly visible for the society and the territory. As consumers, influenced by cultural elements (Nayeem 2012) we are in charge of obtaining goods and services we need for ourselves, for fulfilling self-consumption, or for other consumers who depend on our purchasing decisions, as families or other social groups. That is why variety, quality and above all, nowadays, convenience and geographical proximity to the retail offer are crucial for the quality of the offline retail service (Kim and Kim 2012). However, consumers are increasingly inclined to purchase more goods online, avoiding the queues in retail stores, facilitating the identification of the best stores via search engines that can provide an infinite assortment of goods or the ability to exhaustively track the product during the delivery process (Kim et al. 2013). This phenomenon is happening around the world with different intensity depending on the country (Ashraf et al. 2014)

The guidelines for retail activity in recent decades have been ruled by the search for maximum competitiveness. Consequently, specific morphological areas of urban areas have been used during particular periods of time and subsequently abandoned once they were no longer profitable, convenient, or attractive for both retailers and consumers. In other words, a linear model of urban space occupancy has been used for retail purposes, without thinking of the consequences on urban degradation.

Focused on Western countries, the invasion-succession processes that took place in North American urban areas were not completely imitated in the majority of European cities and towns, which avoided the functional abandonment of urban centers and the systematic substitution of monospecific retail suburban areas devoted to retailing when becoming no longer competitive, the so called greyfields (Bottini 2005).

This is a time of profound change, and there is a gap in the literature about the forecast linearity when describing the future retail models in commercial distribution (the fifth stage). The strongest and most powerful global dynamics are dominating the market, albeit combined with local and regional experiences of bottom-up retail, which, while not being able to equate in volume terms with the dynamics leading the market, are slowly changing the global business activity perceptions of an increasing number of consumers (Dirlik 2018).

In this commercial context, examining current and future retail trends (Deloitte 2019) and based on the classic cyclical retail theories (McNair 1958; Hollander 1960, 1996) and the Retail Life Cycle (RLC) (Davidson et al. 1976), with the extra review of Bauman’s liquid metaphor as a framework, the aim of this conceptual paper is to reflect on the direction retail activities are moving towards nowadays and to look for signs of a new focus, considering the dynamics of action which contribute to a change from a linear to a circular retail model.

Our research questions are two. Firstly, are the offline retailers likely to disappear as online commerce and digital marketing aggressively break into the retail industry? Secondly, could the commercial spaces (fifth stage in the evolution of retail and territory) be in the decline stage in the RLC in the near future or can a circular connection take place? In this sense, the actions of symbiotic recovery between the city and offline retailers are experienced, with the emergence of phygitalization, following the digital tsunami that has led to the eruption of the online phenomenon, and are reviewed.

The paper is organized as follows: firstly, the connections between retail and territory are presented, showing the linear stages. Secondly, the retail offer, demand, and territory are reviewed: the new entrepreneurs and the new business models; the new active, committed, and responsible demand and territory. Next, reflecting on this, the traces of change from a linear commercial distribution model to a circular one are presented. Finally, conclusions and limitations are shown.

2. Connections between Retail and Territory: The Linear Stages

Throughout recent decades, Western countries have witnessed the implication of retail activities in the development of urban areas, being a true reflection of the latest urban dynamics (Espinosa 2011; Bae 2017). It is possible to distinguish four major stages running in parallel to the configuration of the new urban areas, and, above all, to the territorial reconstruction after the excesses and selective abandonment of areas promoted by the law of supply and demand and by the insatiable search for maximum competitiveness among urban spaces, especially those dedicated to retail activities.

In the initial stage, retailing had a markedly local character, formed by a dense and atomized network of small shops distributed throughout the city. Spatial proximity favored the direct and close treatment of consumers, enhanced by the active role that retailers played throughout the process of buying and selling their goods or services (Campesino 1999). Evidently, the urban compactness helped to create this network of shops throughout the city, although it was organized in a hierarchical way with the historic center enjoying full functionality and vitality (Schiller 1994). The progressive shift of retail from the historic center towards the hyper-central areas (Mérenne-Schoumaker 1996) and new suburban centers was forced by various urban, economic, and commercial factors (Dawson 1988).

In the second stage, the city’s legacy suffered a progressive social, economic, and architectural deterioration in addition to a clear functional and physical failure to adapt itself to the new retail requirements. This was characterized by a larger area to display products in stores and a gradual reduction in the functions of retailers in the collection and replacement of goods.

In the third stage, the increase in consumer car ownership, the reconfiguration of new retail areas led by great peripheral or commercial driving forces, the economic lethargy of the historic center (De la Calle 2000), and the relentless aging of the most traditional shops created a territorial map of retailing in which the large national and international companies bought up the majority of the commercial space in hyper-central urban areas, while local and regional shops slowly left their golden age phase. However, as De Mooij and Hofstede (2002) suggest converging technology and disappearing income differences across countries will not lead to homogenization of consumer behavior. Rather, consumer behavior can become even more heterogeneous because of cultural differences.

In this sense, the abandonment of retail activities in historic centers and peripheral districts and the almost exclusive occupation of commercial space by large companies in both suburban and hyper-central areas of cities (Mérenne-Schoumaker 1996; Espinosa 2004) coincided in time.

Despite these forceful, up-down dynamics, it is possible to detect a fourth stage, in which a cycle based on this purchase linear commercial growth is broken to restore the city and the human scale of the act between consumers and their local shops (Vural-Arslan et al. 2011), which is so vital in order to establish long-lasting, sustainable, ethical, and socially responsible relationships (Underhill 2009).

To contextualize this retail cycle, the final phase has a very uneven start. Firstly, from a temporary perspective, there is a large gap between the first actions carried out in North America nearly fifty years ago and the emergence of public and private partnerships in Europe in the past decades (Pattberg et al. 2012). Secondly, Latin America, Asia, and the Arab states for their part, reflect phases that can be placed at different stages (Dávila 2016; Beiró et al. 2018). In North America, urban recovery developed in parallel to suburban retail sprawl and was less rapid and sizeable than in previous times, whereas Western European countries responded more quickly to urban deterioration, due to the value of identity and symbolism of the city’s legacy (Turok and Mykhnenko 2007).

That is to say, after decades of suburban growth, but not looking at the degradation and adaptation of urban centers, especially in historic centers, many Western cities tried to bring back vitality to the most depressed historic commercial axes (Rovira et al. 2012). This recovery in the vitality and viability of European urban centers (Schiller 1994; Davoudi 2003) entailed the approach of compactness, which is committed to the development of local retail and the human and experiential scale of the act of purchase. Although there are urban commercial approaches which have decided, in their fourth stage, to wholly commit to this retail urban goal, there are many other examples in which the retail revitalization of central spaces was attempted but balanced with a desire to not limit suburban commercial growth (Ozuduru et al. 2014; Guimarães 2017).

3. Retail Offer, Demand, and Territory

Changes in the retail scene are manifested mainly from the supply and demand sides with substantial differences in retail entrepreneurship and among consumers, such as the impact of consumer green behavior (Dabija 2018) or in other sectors such as luxury retail (Park et al. 2010). In general, it can be said this evolution of the retail distribution sector has been motivated by the interrelated transformation of three indispensable elements: the commercial sector itself, consumers, and the territory. In fact, it is sometimes extremely difficult to know which of these three elements has enabled the paradigm shifts which have taken place in the retail distribution sector.

3.1. The Offer: New Entrepreneurs and New Business Models

The retail offer has experienced a decrease in the number of sales units and retail floor space (Goodman and Remaud 2015). As the consumption of goods and services in households increased, points of sale multiplied throughout the territory in order to better serve consumers, but now the opposite phenomenon is visible. This increase in retail floor space had much to do with the tertiarization of the economies of Western countries and the move from buying to “provision” to just “going shopping” (Roy Dholakia 1999) as a playful and hedonic activity linked, above all, to urban environments (Bell 1976; Shields 1992; Wynne et al. 1998). It was precisely in Western countries that retail expansion had its greatest floor space and economic growth. Moreover, the major companies in commercial distribution operating on a global scale mostly came from countries where they were clearly and successfully positioning themselves for retail in economic tertiarization.

The general trends within the retail distribution sector have been clear (Kaczmarek 2009): the internationalization of supply, the concentration of capital in large distribution chains (mostly of European and North American origin, and starting to be Asian, (Poole et al. 2002)), a decline in independent retailers’ market share (Coca-Stefaniak et al. 2005) and the greater presence of franchises and distribution chains in the commercial landscape (Baena 2015; Doherty 2009; Kärrholm et al. 2011; Chkanikova and Mont 2015), a combination of offline and online establishments, the creation of unique experiences in establishments, and the reinvention of the retail outlet through the latest technologies (Deloitte 2019).

Also, over the past two decades, increasingly fierce competition in the retail distribution sector has led to a multitude of acquisitions of small chains by larger distribution groups, causing a reduction in intervention agents in distribution and the disappearance of the weakest companies (Fuchs et al. 2009; Linneman and Moy 2002).

In such an important sector as food, the concentration of the main distribution groups’ sales shows the market share of formats such as supermarkets and discount stores (Deloitte 2019). The food sector deserves special attention because of its very frequent consumption and its necessary proximity, or geographical convenience, of the outlets with respect to the consumers (Lavorata and Sparks 2018). Thus, this sector has been made up of an oligopoly of the large food distribution groups controlling a large part of the market share, mainly of packaged food, where there has been a very significant decline of traditional retail outlets since the mid-1990s in all Western countries (Dewitte et al. 2018). The most direct consequence was the expansion of the “food desert” (Whelan et al. 2002) territorial problem and the increase in the turnover of medium-sized urban formats, especially supermarkets and discount stores (Wortmann 2004). The outstanding general trend that the retail sector is heading towards is e-commerce, which has dramatically transformed the traditional distribution channel. However, it is also possible to talk about new alternative commercial channels, such as direct selling from producers and farmers, concept stores and consumer cooperatives, in which the consumers themselves design their own offer (Sánchez-Hernández 2009), reinventing the commercial formats of retailing and e-tailing (Turban et al. 2017).

3.2. The Demand: Active, Committed and Responsible Consumers

Demand is the reason for the existence of retailing. Until three decades ago, consumers were perceived in Retail Geography research and Marketing (Spork 1987) as passive agents, although they had the choice of points of sale, taking into account various factors such as proximity to home, value for money, the assortment of goods, the ambience of the store, or the degree of interaction with the owner or sales assistant, being their guides in the act of purchase. In other words, the role of the consumer was limited to selecting the goods available in the stores they relied on for shopping. The explained shopping dynamic is well known, as it prevailed for decades. From the beginning of consumerism, a relationship of dependence evolved between supply and demand, in which the retail offer had to fulfil not just the basic needs of consumers (Baudrillard 2001) but also, create new needs and desires for seducing consumers (Crawford 2004). Moreover, it worked. Over the last few decades, the number of homo consumericus, as mentioned in Saad (2007) in Western societies has dramatically increased.

It is true that the growth in the frequency of purchase and the volume of goods consumed has been an important part of the market machinery, which required an ever faster output of manufactured goods for a faster and more ephemeral consumption (Bell 1976; Gottdiener 1991; Wynne et al. 1998; Farrell 2014). This was aided by the gradual acquisition of cultural capital by a larger number of consumers (Zukin 2004), who carefully studied fashion catalogues and new trends and used the Internet for finding information based on opinion forums and consumer reviews. Penz and Hogg (2011) investigate the multi-dimensional antecedents of approach-avoidance conflicts experienced. They compared online and offline consumers, testing the influence of the situation, product, and reference group on shoppers’ intentions shoppers in changing retail environments when purchasing in a particular shopping channel. In general, the crisis was a redefinition of consumer’s main features. In short, demand is undergoing a very significant change, meaning that there are more active, committed and responsible consumers who are not malleable by the global dynamics of the distribution sector. A number of consumers have also become sellers via platforms (C2C) and circular upcycling options. What they show by their consumption patterns is that they do not want to consume more, but better, faster, and more conveniently, and, moreover, more healthily.

3.3. The Territory: Location, Location, Location

One of the most universal recommendations shopkeepers receive before opening a retail store is that location is crucial to the success of the business. In fact, Salvaneschi (1996), in his book ‘Location, Location, Location’, reaffirms the importance of the territory in retail success. The modernization of retail distribution has had a strong spatial component, since the change from one retail paradigm to another implies the colonization of a new territory without a previous shopping vocation. Likewise, the urban-commercial recovery of the historic centers and central areas of the city has virtually been based on the importance and symbolism that the city has for the city and its inhabitants, the heritage city. As Bottini (2005) stated, when large retail areas were opened on the peripheries, the consumption share was considered, but not the congestion and traffic pollution it caused, nor the emptying of the old centers and offices. Sustainability and environmental aspects were also left aside from urban-retail projects and green marketing was not on the agenda (Groening et al. 2018). However, as pointed out by Fuentes (2011) marketing and consumption of green products has significantly grown in recent years. As a nexus between producers and consumers, retailing plays an important role for the distribution of green products.

In Western countries, and after a long period of excessive growth in which the territory has been exploited as an ephemeral vessel whereby to establish economic activities, a moment of reflection on the future awaiting the city’s most symbolic spaces has arrived, and how they could be improved to make them more habitable, functional, and experiential (Raco et al. 2018). Thanks to the great structuring power of the territory having commercial distribution, this reflection on the urban model has had commercial activity as its main support. The return of retail outlets to the historic center of the city represents a much more radical change than the mere transfer of commercial activities to the urban center, a consolidated city district, or to the historic center. It is a change that is about rethinking the social value of this economic activity and its power for the recovery of degraded spaces or those in crisis. It is of paramount importance to steer retail growth towards a better territorial balance and, above all, to restore the human scale of the acts of purchase and to retail in general (Pauwels and Neslin 2015).

4. Traces of Change to a Circular Retail Distribution Model

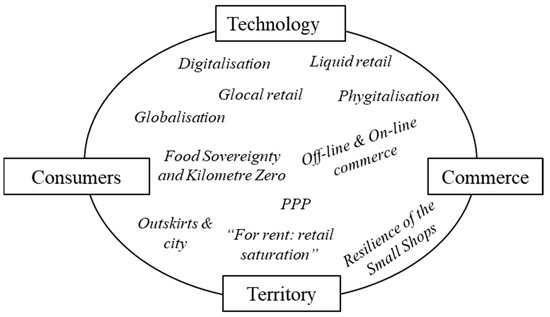

Countries must identify the stage of their retail landscape to avoid the setbacks that have already been experienced by other territories. The retail industry is showing multifaceted transformations that can be traced to the evolution of space and place (Borghini et al. 2009). When not reacting in time, adjustments to the retail scene and consumption habits will occur. In this sense, there are many initiatives trying to foster local or traditional retail stores as engines of economic and cultural growth and avoid historic urban wastelands. Figure 1 shows the proposed circular commercial distribution model with the trends that are promoting this movement.

Figure 1.

Territory, Commerce, and Consumers Technology circular movement. Source: own devising.

Future of offline retail: Phygitalization. Large retail players operate on an unprecedented global scale because the barriers separating different countries have been significantly reduced. To gain competitive advantage differently in all retail outlets, many innovations are evident from testers in shop windows, payment methods, kiosks, clothing rails that are both real and virtual, interactive touch screens for advertising, to virtual personalized customer experiences. To understand this phenomenon better, researchers have introduced a framework to describe the fusion of the physical and the virtual world in stores: phygitalization. Phygital refers to the concept of both the physical and digital synchronization of the marketing channels to create a different shopping experience (Vel et al. 2015). Lin and Hsieh (2011) explain the concept of phygitalization by bridging the physical store with information technology systems such as tablets and interactive kiosks. The purpose is to create a new-merchandise layout, to make products more accessible, as the customers will be able to order products directly with the digital elements of the store, but also, technology in-store increases the perceived convenience of buying-store, creating interactive and exciting shopping experiences (Blazquez 2014). According to Mitsostegiou et al. (2015), in 2030 retail will be about customer service, virtual stores, interactivity, purchase-home delivery, click & collect, and the traditional distinction between online and offline retail will no longer exist for all age groups and all social groups of the population. The effect of these trends on customer loyalty is beginning to be measured by the large companies. It is no longer a question of providing a service on different platforms, but of combining them. Through the use of technology, there is a fusion of supply, demand and territory.

Solid Retail vs. Liquid Retail. From a solid location to a virtual one:Berman (1983) notes that “everything solid disappears into the air”. The diffused city evolves towards the compact city. Online retail has inevitably entered into our homes and the solid retail location is virtualized. The point of sale becomes lighter, moves and becomes hybrid. Retail is customized and makes consumers become actors and subjects of its offer, interacting more and more with them, making them participate from start to finish. Retailing is increasingly ephemeral and the point of sale is irretrievably accelerating its life cycle. Shopping is more of a game and is hybridized with leisure, in other words, from ‘buying provisions’ to simply ‘enjoying shopping’. As Herbert et al. (2018) suggest the French food retail industry is experiencing an interregnum. At this point, it is also worth mentioning how virtual retail is looking for a more solid reality, especially in recent years. Warehouses belonging to the most important online retailers are gradually being located in the newly created distribution hubs, near big cities, with similar spatial dynamics to offline retailing.

Digitalization and Globalization in commerce: The changes in grocery stores have taken place with the supremacy of the nearby supermarket against the large hypermarket (Verhetsel 2005; Albecker 2010). This format has become a close geographical area and sensitive to the intra-specific relationship between competition and association, reconfiguring the urban space (Herbert et al. 2018). These places are enabling a reorganization of local stores allowing “chrono-mobility”, omnichannel retailing (Zorrilla 2016a), and the optimization of logistics. Sánchez (2012) has shown the changes that the retail sector is undergoing and that we, as consumers, have chosen our mindset when purchasing, and compiling the shopping list has changed. The more traditional stores are trying to reinvent themselves in order to adapt to the new consumer behavior.

One of the biggest risks is in re-inventing something that already exists, just by giving it a tweak of differentiation so that it is not so difficult to be competitive. Cities living in constant change are boosted by two phenomena: digitalization and globalization (Johansson and Öjerbrant 2018). The first has given a boost to many retail companies competing for a better location on the commercial axis of each city (and in SEO positioning). These companies are seeking “agglomeration economies”, which account for a massive number of consumers at the respective points of sale, such as shopping centers where an agglomeration of both people and shops can be seen (Rovira 2016). The second one is advancing in leaps and bounds, especially in larger cities. It is true that many medium- and small-sized cities are experiencing local growth and a consolidation of commercial areas, placing them among a large number of cities having commercial areas as poles of attraction (Van Duin et al. 2010). With the assertion of the phenomenon of consumption, the commercial spaces supporting these activities are multiplying. Since it is not possible to imagine a city without consumption, it is equally difficult to imagine consumption disassociated from the shopping center phenomenon.

Retailing on the outskirts vs. retailing in the center and vice versa. Superstores, “category killers” or hypermarkets unquestionably chose the outskirts of urban spaces because of their pressing need for space. However, it is observed that these formats are entering urban centers. A well-known German company decided to locate in city centers and an important French category killer specializing in sports followed in its footsteps. Therefore, it seems that there is a trend for smaller and larger space formats to coexist (Reynolds et al. 2007)). The outskirts model has begun to lose its strength and new projects in urban centers are increasingly being proposed. The appeal of the city is its diversity and multifunctionality (Atkinson and Bridge 2004). New, bohemian, attractive and lively residential neighborhoods which are being re-populated in the form of lofts and designer homes incorporated into the run-down areas and neighborhoods (Zukin et al. 2009).

Extending the commercial areas entails additional costs for the cities themselves which means that compact growth is often preferable (Chabrol et al. 2014). From the consumer’s point of view, there are various opinions on their preferences. For convenience, many prefer that all the shops are located in a space within everyone’s reach without having to make much effort when going shopping (Franzén 2004). This way of thinking makes compact growth a much more attractive proposal, although a totally opposite preference also exists, that is to say, many people, due to the bottleneck caused by all the shops being in a small area leading to a very stressful situation, prefer to travel elsewhere for their purchases or go online (Smith 2002).

‘Glocal’ (Global and Local) Retail. In the future, “no places” or cloned spaces will be in crisis. Consumers are aware of the fact that the retail offer is being replicated everywhere by the same brands, the same logos, and the same products, leading to a loss of differentiation and authenticity (Foglio and Stanevicius 2007). If consumers close their eyes and are taken to the central square of a shopping center in any city of any country and are asked where they are, the noises, smells, and the atmosphere may very well remind them of any similar shopping center in very disparate locations. If they open their eyes to ask where they are, they will probably be unable to recognize it and definitely confuse it with somewhere they have visited before (Firat 1997).

Today, there is an excessive concentration of chain stores and franchises in all cities, leading to a loss of commercial identity as emblematic and historical shops are disappearing, which irrevocably leads to an extreme similarity between different cities (Chinomona and Sibanda 2013). The competitiveness of small shops in the face of these powerful brands is decreasing and they are now in the background. According to Agustín Rovira (2016), it is an intermediate space for local and global retail, that is to say the so-called ‘glocal’ retail, in which there is an adaptation of the global businesses focused on the reality of local or regional markets. It is an idea put forward by some entrepreneurs who are innovating in the face of changes arising from the shopping habits and lifestyles of consumers.

‘For Rent’. Retailing saturation. Today, a quarter of retail premises in Western societies are empty (Saraiva et al. 2019) and an increasing rise in the empty retail surface is likely. It is a problem of saturation which, however, has not been reflected in prices. This will become a serious issue which needs to be managed. The future is committed to highly concentrated commercial spaces. It has become a fact that a proportion of shopping malls is entering a phase of decline in Western countries (Parlette and Cowen 2011).

Firstly in the United States of America, a country where shopping malls have a longer tradition, the so-called “dead malls” are a matter of interest due to their widespread presence (Schatzman 2013). Secondly, dead malls are also being mirrored in Europe and are also facing serious challenges in several countries such as Portugal (Ferreira and Paiva 2017), France (Soumagne et al. 2011), or Sweden (Kärrholm et al. 2011). As for whether there are any surplus stores, effectively there are, but they are missing. What a paradox. The future is committed to a correct adjustment of supply and not an unbalanced growth in it. The existing market is not big enough for the entire supply to be profitable.

The closure of many old premises has attracted a lot of attention and highlighted a reality that has been of concern to many survivors of traditional retail: the large expansion that franchise businesses are experiencing. This phenomenon can be seen in many cities and began to be seen most notably in the 1990s, gaining more strength with the crisis. It is true that nowadays franchises can offer greater stability compared to traditional businesses. That is to say, it is possible to take advantage of the brand’s know-how. Many traditional retailers, who were affected during the economic crisis by having to close their shops, and even being dismissed, decided to invest the compensation they received in other safer business sectors (Villaécija 2015).

Off-line Commerce vs. On-line Commerce: E-commerce is an indispensable ally for any company which wants to make its products reach any corner of the world. According to a study undertaken by eBay in 2016 “The Future of Retail”, Spain has a global retail growth rate of 27.5%, a not insignificant e-commerce figure (Voces 2016). Retail is determined by a series of political and technological factors which are key to the development of global retail, although both political and economic cooperation between countries has significantly gained weight in order to reduce retail barriers for continuous growth. It is possible to access new markets and remote areas, and often even areas that are somewhat cut off, so that they can consume products which, until now, they could not obtain. With just one click, in addition to being convenient when ordering products which are needed or wanted, costs and time are reduced too, distributors need fewer staff and even less stock, as consumers order the product when they need it and a large warehouse becomes unnecessary (Zorrilla 2016b). Due to our new pace of life and the amenities that online shopping can offer, our shopping habits have changed unexpectedly, in such a way that products are purchased very differently compared to years ago (Gazquez 2016). But what about the territorialization of traditional shops? The fact that online channels exist does not mean we have to neglect traditional retail. Just the opposite, since Amazon has already opened its first bricks and mortar site (Bensinger and Morris 2014). As Fariñas (2016) argues, one of the advantages that make small traditional shops special is the fact that you can touch, smell, and try the product you are thinking of buying. When buying in a physical store the closeness and customer attention received can change the final decision to purchase the product, due to the advice you receive from the staff. On the other hand, the offline retailer adjusts offers and discounts at different outlets to attract the public. Also, they can restructure into more original and specialized formats such as pop-up stores or concept stores.

The Role of Public-Private Partnerships (PPP): PPPs have been established as a mixed management model among private and public agents related to the promotion of central shopping areas, which can have its own legal form that not only affects retailing in a more efficient way but radiates towards virtually the entire public scene where commercial activity takes place (Osborne 2000). Taking as a reference point the stability and efficiency they have demonstrated in the management of urban-commercial space in North America and the countries of Northern and Central Europe, it is possible to reverse commercial decline while beautifying the public space and improving their image for consumers and potential investors (Warnaby et al. 2004; Espinosa and Hernandez 2016).

As The Economist (2013) argues, many retailers or entrepreneurs take on a variety of tasks ranging from cleaning up areas and their maintenance to security and safety itself. These are complementary services to those offered by town councils or governments on a local scale, thus increasing the perception of cleanliness, safety and the attractiveness of the area. The fact is that when a PPP is implemented, the public administration does not stop providing the public services it has to, but instead delegates some actions which are privatized and run in parallel to public actions. This is the main reason for PPPs being criticized as involving the latent privatization of public management of public spaces (Wieczorek 2004; Vollmer 2008).

More and more citizens are caring about their own cities and the spaces they frequent, thereby recognizing that implementing PPPs can be an important tool to revitalize areas and neighborhoods (Pellicer 2016), potentially attracting many more tourists and visitors, which will make the economy grow and the territory come alive.

The Resilience of Small Shops: Small shops need to implement new strategies to counteract the advance of large stores in cities (Contents 2016; Piqueras Gómez de Albacete 2016). As Fariñas (2016) shows, independent, small shops have many strong points in comparison with large stores: a close relationship with consumers thanks to tradition and character (Doern 2017) and a more flexible capacity of reaction for management and innovation. It should be kept in mind that a number of traditional shops remain “alive” in many urban areas, still having their traditional clientele and attracting new consumers willing to pay for a more individualized customer service (Williams and Vorley 2017). It cannot be denied that in some cases, these consumers are captive citizens unable to move longer distances or to more modern formats due to their own physical limitations or the limitations of the urban areas where they live.

Nevertheless, there is a new type of consumer who needs a homelier shop that does not sell mass-produced products, and, above all, is not pressurized by a shop assistant eager to earn a commission (Fariñas 2016). One of the advantages of traditional shops is the use of local capital which is reinvested at a local scale unlike large chains and franchises, where the money ends up outside these areas (Rosado-Serrano et al. 2018).

Food Sovereignty, zero miles food and local shopping: Sustainability has become a major issue in food production and distribution for a growing number of consumers, who are becoming aware of what is in their shopping basket, the origin of the product, and the environmental and social impacts of food production (Olivares 2017).

That is why a growing number of consumers are demanding their own food sovereignty, which is giving rise to the so-called consumer-led “short marketing channels” or short food supply which have entered into the commercial distribution landscape (Block et al. 2012). Consumers are demanding more local and seasonal products, which have not contributed to the pollution of the environment when they were produced, transported, stored, and commercialized. These include zero food miles products which can be tracked from production to final consumption (Weiler et al. 2014) without going against labor ethics and the environment.

5. Conclusions

Countries and companies, as well as managers and retailers, should consider whether or not they are facing a different commercial paradigm from the one experienced earlier and the effect on the retail wheel while it is still spinning. The commercial scenario is combining phygitalization, glocalization, and omnichannel retailing imbued with territoriality as the new actors of commercial distribution and also of a new space that is physical, but also virtual. Therefore, phygitalization allows digital technologies to act as interactive vehicles whereby consumers can be directly connected to the store itself. Managers must be aware of this, or they will be losing opportunities in the future.

Retail has become liquid. The classic suburban retail formats are pointing at urban centers, reducing their dimensions in order to fit into the central urban retail arena. The resilience of small shops is beginning to bear fruit in large cities where new commercial formats and public and private partnerships in commercial areas (PPPs) are appearing. Sustainability concerns are growing through new distribution formulas and new concepts to include in our shopping list, such as zero food miles and sustainable retail (Atkinson 2013), especially in food distribution, but also related to more ethical concepts such as slow fashion (Naidoo and Gasparatos 2018; Young et al. 2018).

It is expected that by 2025, the business fabric of territorial retail will endure, but will have to be revitalized. At this time, it is possible to say that there will be a crisis for some players and opportunities for others as never before in history. The wheel of retail is continuing to spin (Massad et al. 2011) and future lines of research are open in specific countries to analyze the stage they are at and the factors that will impact on their commercial aspect, trying to avoid earlier mistakes to ensure that commerce, the consumer, and territory co-exist in harmony.

Therefore, the offline retailers are not likely to disappear as online commerce and digital marketing have broken aggressively into the retail industry and commercial spaces—the fifth stage in the evolution of retail and territory—are not in the decline stage in the RLC but a circular connection seems to be taking place.

The limitations of this study are the intrinsic weaknesses of the theories chosen to interpret the traces of the incipient circular model, as well as the lack of empirical data to compare with the stated trends. This new circular model challenges the structure of conventional retailing procedures with bottom-up, local projects run by consumers and small entrepreneurs who defy and bet on a new retail model based on important and necessary sustainable-based values. Thus, environmental awareness, support of local networks of producers and consumers, the importance of retailing with the vitality and viability of symbolic urban areas, and a competitive environment for retailing in which many actors can co-exist are key points of this incipient new way of managing retail activities.

Future research and empirical work can establish if this circular movement is taking place in all countries and continents at the same time and what factors are the key to these trends.

Author Contributions

Conceptualisation: M.D.D.-J.-V. and A.I.E.S.; methodology: M.D.D.-J.-V. and A.I.E.S; investigation: M.D.D.-J.-V.; writing-original draft preparation: M.D.D.-J.-V.; writing-review and editing: M.D.D.-J.-V. and A.I.E.S.; visualization, M.D.D.-J.-V. supervision: M.D.D.-J.-V.; project administration: M.D.D.-J.-V.; funding acquisition (APC): M.D.D.-J.-V.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Albecker, Marie-Fleur. 2010. The effects of globalization in the first suburbs of Paris: From decline to revival? Berkeley Planning Journal 23: 102–31. [Google Scholar] [CrossRef]

- Ashraf, Abdul R., Narongsak Thongpapanl, and Seigyoung Auh. 2014. The application of the technology acceptance model under different cultural contexts: The case of online shopping adoption. Journal of International Marketing 22: 68–93. [Google Scholar] [CrossRef]

- Atkinson, Lucy. 2013. Smart shoppers? Using QR codes and ‘green’smartphone apps to mobilize sustainable consumption in the retail environment. International Journal of Consumer Studies 37: 387–93. [Google Scholar] [CrossRef]

- Atkinson, Rowland, and Gavin Bridge, eds. 2004. Gentrification in a Global Context: The New Urban Colonialism: Gentrification in a Global Perspective (Housing and Society). Abingdon: Routledge. [Google Scholar] [CrossRef]

- Bae, Chang-Hee Christine. 2017. Urban Sprawl in Western Europe and the United States. Abingdon: Routledge. [Google Scholar] [CrossRef]

- Baena, Verónica. 2015. European franchise expansion into Latin America: Evidence from the Spanish franchise system. Management Research Review 38: 149–65. [Google Scholar] [CrossRef]

- Baudrillard, Jean. 2001. Selected Writtings. Palo Alto: Stanford University Press. [Google Scholar]

- Beiró, Mariano G., Loreto Bravo, Diego Caro, Ciro Cattuto, Leo Ferres, and Eduardo Graells-Garrido. 2018. Shopping mall attraction and social mixing at a city scale. EPJ Data Science 7: 28. [Google Scholar] [CrossRef]

- Bell, Daniel. 1976. El Advenimiento de la Sociedad Postindustrial. Madrid: Alianza Editorial. [Google Scholar]

- Bensinger, Greg, and Keiko Morris. 2014. Amazon to open first brick-and-mortar site. The New York City Location to Handle Same-Day-Delivery Inventory, Product Returns. The Wall Street Journal. Available online: https://www.wsj.com/articles/amazon-to-open-first-store-1412879124 (accessed on 10 October 2019).

- Berman, Marshall. 1983. All That Is Solid Melts into Air: The Experience of Modernity. Harmondsworth: Penguin Books. [Google Scholar]

- Blázquez, Marta. 2014. Fashion shopping in multi-channel retail: The role of technology in enhancing the customer experience. International Journal of Electronic Commerce 18: 97–116. [Google Scholar] [CrossRef]

- Block, Daniel R., Noel Chávez, Erika Allen, and Dinah Ramirez. 2012. Food sovereignty, urban food access, and food activism: Contemplating the connections through examples from Chicago. Agriculture and Human Values 29: 203–15. [Google Scholar] [CrossRef]

- Borghini, Stefania, Nina Diamond, Robert V. Kozinets, Mary Ann McGrath, Albert M. Muñiz Jr., and John F. Sherry Jr. 2009. Why Are Themed Brandstores So Powerful? Retail Brand Ideology at American Girl Place. Journal of Retailing 85: 363–75. [Google Scholar] [CrossRef]

- Bottini, Fabrizio. 2005. I Nuovi Territori del Commercio: Società Locale, Grande Distribuzione Urbanistica. Florence: Alinea Editorial. [Google Scholar]

- Campesino, Fernández Antonio. 1999. El comercio en los centros históricos de las ciudades españolas. In Revitalización Funcional del Centro Histórico. Edited by Begoña Bernal Santa Olalla. Burgos: Universidad de Burgos, pp. 67–83. [Google Scholar]

- Chabrol, Marie, Antoine Fleury, and Mathieu Van Criekingen. 2014. Commerce et gentrification. Le commerce comme marqueur, vecteur ou frein de la gentrification. Regards croisés à Berlin, Bruxelles et Paris. Le commerce dans tous ses états. Espaces marchands et enjeux de société. Rennes: Presses Universitaires de Rennes, pp. 277–91. [Google Scholar]

- Chinomona, Richard, and Dennis Sibanda. 2013. When global expansion meets local realities in retailing: Carrefour’s glocal strategies in Taiwan. International Journal of Business and Management 8: 44–59. [Google Scholar] [CrossRef]

- Chkanikova, Olga, and Oksana Mont. 2015. Corporate supply chain responsibility: Drivers and barriers for sustainable food retailing. Corporate Social Responsibility and Environmental Management 22: 65–82. [Google Scholar] [CrossRef]

- Coca-Stefaniak, Andrés, Alan G. Hallsworth, Cathy Parkera, Stephen Bainbridge, and R. Yuste. 2005. Decline in the British small shop independent retail sector: Exploring European parallels. Journal of Retailing and Consumer Services 12: 357–71. [Google Scholar] [CrossRef]

- Contents, M. 2016. Tiendas tradicionales: Cómo ganarle a un centro comercial? Plus Empresarial. Available online: http://plusempresarial.com/tiendas-tradicionales-como-ganarle-a-un-centro-comercial/ (accessed on 27 May 2019).

- Crawford, Michael. 2004. El mundo en un centro comercial. In Variaciones Sobre un Parque Temático: La Nueva Ciudad Americana y el Fin del Espacio Público. Edited by Michael Sorky. Barcelona: Ediciones Gustavo Gili SA, pp. 25–46. [Google Scholar]

- Dabija, Dan-Cristian. 2018. Enhancing green loyalty towards apparel retail stores: A cross-generational analysis on an emerging market. Journal of Open Innovation: Technology, Market, and Complexity 4: 8. [Google Scholar] [CrossRef]

- Davidson, William R., Albert D. Bates, and Stephen J. Bass. 1976. The Retail Life Cycle. Cap. 13. En Retailing. Critical Concepts. Edited by Anne M. Findlay and Leigh Sparks. Chicago: Homewood Publishing Company, pp. 264–77. [Google Scholar]

- Dávila, Arlene. 2016. El Mall: The Spatial and Class Politics of Shopping Malls in Latin America, 1st ed. Berkeley: California University of California Press. [Google Scholar]

- Davoudi, Simin. 2003. European briefing: Polycentricity in European spatial planning: From an analytical tool to a normative agenda. European Planning Studies 11: 979–99. [Google Scholar] [CrossRef]

- Dawson, John. 1988. The changing High Street. The Geographical Journal 154: 1–22. [Google Scholar] [CrossRef]

- De la Calle, Vaquero Manuel. 2000. La Ciudad Histórica Como Destino Turístico. Barcelona: Editorial Ariel. [Google Scholar]

- De Mooij, Marieke, and Geert Hofstede. 2002. Convergence and divergence in consumer behaviour: Implications for international retailing. Journal of Retailing 78: 61–69. [Google Scholar] [CrossRef]

- Deloitte. 2019. Global Powers of Retailing 2019, 22nd ed. Available online: https://www2.deloitte.com/global/en/pages/consumer-business/articles/global-powers-of-retailing.html (accessed on 21 October 2019).

- Dewitte, Adam, Sebastian Billows, and Xavier Lecocq. 2018. Turning regulation into business opportunities: A brief history of French food mass retailing (1949–2015). Business History 60: 1004–25. [Google Scholar] [CrossRef]

- Dirlik, Arif. 2018. The Postcolonial Aura: Third World Criticism in the Age of Global Capitalism. Abingdon: Routledge. [Google Scholar]

- Doern, Rachel. 2017. Strategies for resilience in entrepreneurship: Building resources for small business survival after a crisis. In Creating Resilient Economies: Entrepreneurship, Growth and Development in Uncertain Times. Edited by Williams Nick and Vorley Tim. Cheltenham: Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Doherty, Anne Marie. 2009. Market and partner selection processes in international retail franchising. Journal of Business Research 62: 528–34. [Google Scholar] [CrossRef]

- Espinosa, Seguí Ana. 2004. Amenazas y nuevas estrategias del comercio de centro urbano. El caso de Alicante. Boletín de Geógrafos Españoles 38: 153–74. [Google Scholar]

- Espinosa, Seguí Ana. 2011. La evolución comercial en la ciudad. Las Actividades Industriales y Comerciales. Implicaciones territoriales. Available online: http://hdl.handle.net/10045/16301 (accessed on 21 October 2019).

- Espinosa, Ana, and Tony Hernandez. 2016. A comparison of public and private partnership models for urban commercial revitalization in Canada and Spain. The Canadian Geographer/Le Géographe Canadien 60: 107–22. [Google Scholar] [CrossRef]

- Fariñas, Aránzazu. 2016. Tiendas Online vs. Tiendas Tradicionales. Available online: http://noticias.infocif.es/noticia/tiendas-online-vs-tiendas-tradicionales (accessed on 17 June 2019).

- Farrell, James J. 2014. One Nation under Goods: Malls and the Seductions of American Shopping. Washington, DC: Smithsonian Institution. [Google Scholar]

- Ferreira, Daniela, and Daniel Paiva. 2017. The death and life of shopping malls: An empirical investigation on the dead malls in Greater Lisbon. The International Review of Retail, Distribution and Consumer Research 27: 317–33. [Google Scholar] [CrossRef]

- Firat, A. Fuat. 1997. Educator Insights: Globalization of Fragmentation. A Framework for Understanding Contemporary Global Markets. Journal of International Marketing 5: 77–86. [Google Scholar] [CrossRef]

- Foglio, Antonio, and V. Stanevicius. 2007. Scenario of Glocal Marketing and Glocal Marketing as an Answer to the Globalization and Localization: Action on Glocal Market and Marketing Strategy. Vadyba/Management 3: 16–17. [Google Scholar]

- Franzén, Markus. 2004. Retailing in the Swedish City: The Move towards the Outskirts. Insights on Outskirts. p. 93. Available online: https://orbi.uliege.be/bitstream/2268/62476/1/dynamics.pdf#page=91 (accessed on 21 October 2019).

- Fuchs, Doris, Agni Kalfagianni, and Maarten Arentsen. 2009. Retail power, private standards, and sustainability in the global food system. In Corporate Power in Global Agrifood Governance. Edited by Clapp Jennifer and Fuchs Doris. Cambridge: MIT Press, pp. 29–59. [Google Scholar]

- Fuentes, Christian. 2011. Green Retailing-A Socio-Material Analysis. Lund: Lund University. [Google Scholar]

- Gazquez, Javier. 2016. Las Ventas ‘on Line’ en España, en la Cuarta Posición Mundial. El Mundo Newspaper. Available online: http://www.elmundo.es/economia/2015/02/12/54db4eeeca4741ad788b456c.html (accessed on 13 May 2019).

- Goodman, Steve, and Hervé Remaud. 2015. Store choice: How understanding consumer choice of ‘where’to shop may assist the small retailer. Journal of Retailing and Consumer Services 23: 118–24. [Google Scholar] [CrossRef]

- Gottdiener, Mark. 1991. Postmodern Semiotics: Material Culture and the Forms of Postmodern Life. Oxford: Blackwell Publishers. [Google Scholar]

- Groening, Christopher, Josheph Sarkis, and Qingyun Zhu. 2018. Green marketing consumer-level theory review: A compendium of applied theories and further research directions. Journal of Cleaner Production 172: 1848–66. [Google Scholar] [CrossRef]

- Guimarães, Pedro Porfírio Coutinho. C. 2017. An evaluation of urban regeneration: The effectiveness of a retail-led project in Lisbon. Urban Research and Practice 10: 350–66. [Google Scholar] [CrossRef]

- Herbert, Maud, Isabelle Robert, and Florent Saucède. 2018. Going liquid: French food retail industry experiencing an interregnum. Consumption Markets & Culture 21: 445–74. [Google Scholar] [CrossRef]

- Hollander, Stanley C. 1960. The wheel of retailing. The Journal of Marketing 24: 37–42. [Google Scholar] [CrossRef]

- Hollander, Stanley. 1996. The wheel of retailing. Marketing Management 5: 63–66. [Google Scholar]

- Johansson, Elin, and Frida Öjerbrant. 2018. Mash It Up! Exploring the Phenomenon of Retail Mash-Up and the Survival of the Physical Retail Place in a Digitalized World. Available online: http://lup.lub.lu.se/student-papers/record/8945310 (accessed on 21 October 2019).

- Kaczmarek, Tomasz. 2009. Global leaders of retailing and their impact to regional scale. Geoscape Alternative Approaches to Middle European Geography 4: 150–66. [Google Scholar]

- Kärrholm, Mattias, Katarina Nylund, and Paulina Prieto de la Fuente. 2011. Retail Resilience in a Swedish Urban Landscape: An Investigation of Three Different Kinds of Retail Places. In Retail Planning for the Resilient City. Consumption and Urban Regeneration. Edited by Teresa Barata-Salgueiro and Cachinho Herculano. Lisboa: Centro de Estudos Geográficos, Universidade de Lisboa, pp. 45–62. [Google Scholar]

- Kim, Jae-Eun, and Jien Kim. 2012. Human factors in retail environments: A review. International Journal of Retail & Distribution Management 40: 818–41. [Google Scholar] [CrossRef]

- Kim, Jiyoung, Kiseol Yang, and Bu Yong Kim. 2013. Online retailer reputation and consumer response: Examining cross cultural differences. International Journal of Retail & Distribution Management 41: 688–705. [Google Scholar] [CrossRef]

- Lavorata, Laure, and Leigh Sparks, eds. 2018. Food Retailing and Sustainable Development: European Perspectives. Bradford: Emerald Publishing Limited. [Google Scholar]

- Lin, Jiun-Sheng Chris, and Pei-Ling Hsieh. 2011. Assessing the Self-Service Technology Encounters: Development and Validation of SSTQUAL Scale. Journal of Retailing 87: 194–206. [Google Scholar] [CrossRef]

- Linneman, Peter, and Deborah C. Moy. 2002. The Evolution of Retailing in the United States. University of Pennsylvania, Wharton School of Business Working Paper, Volume 443. Available online: http://realestate.wharton.upenn.edu/wp-content/uploads/2017/03/443.pdf (accessed on 21 October 2019).

- Massad, Víctor J., Mary Beth Nein, and Joanne M. Tucker. 2011. The Wheel of Retailing revisited: Toward a “Wheel of e-Tailing?”. Journal of Management and Marketing Research 8: 1–11. [Google Scholar]

- McNair, Malcom P. 1958. Significant Trends and Developments in the Post War Period. In Competitive Distribution in a Free High-Level Economy and Its Implications for the University. Edited by Albert B. Smith. Pittsburg: University of Pittsburg Press, pp. 1–25. [Google Scholar]

- Mérenne-Schoumaker, Bernadette. 1996. La Localization des Services. Paris: Nathan Université. [Google Scholar]

- Mitsostegiou, Eri, Lydia Brissy, and Alice Marwick. 2015. Retailing in 2025: What Lies Ahead European Shopping Streets and Malls? London: Savills World Research Europe. [Google Scholar]

- Naidoo, Merle, and Alexandros Gasparatos. 2018. Corporate Environmental Sustainability in the retail sector: Drivers, strategies and performance measurement. Journal of Cleaner Production 203: 125–42. [Google Scholar] [CrossRef]

- Nayeem, Tahmid. 2012. Cultural influences on consumer behavior. International Journal of Business and Management 7: 78–91. [Google Scholar] [CrossRef]

- Olivares, Fernando. 2017. Marcas Negras: Cuando el Fabricante no es Quien Pensamos. El Confidencial. Tribuna. Available online: http://blogs.elconfidencial.com/economia/tribuna/2017-05-27/consumo-marcas-negras-fabricantes-compra-supermercado_1389600/ (accessed on 15 April 2019).

- Osborne, Setephen. 2000. Public-Private Partnerships: Theory and Practice in International Perspective. London: Routledge. [Google Scholar]

- Ozuduru, Burcu H., Cigdem Varol, and Ozge Yalciner Ercoskun. 2014. Do shopping centers abate the resilience of shopping streets? The co-existence of both shopping venues in Ankara. Turkey. Cities 36: 145–57. [Google Scholar] [CrossRef]

- Park, Jina, Eunju Ko, and Sookhyun Kim. 2010. Consumer behavior in green marketing for luxury brand: A cross-cultural study of US, Japan and Korea. Journal of Global Academy of Marketing 20: 319–33. [Google Scholar] [CrossRef]

- Parlette, Vanessa, and Deborah Cowen. 2011. Dead Malls: Suburban Activism, Local Spaces, Global Logistics. International Journal of Urban and Regional Research 35: 794–811. [Google Scholar] [CrossRef]

- Pattberg, Philipp, Frank Biermann, Sander Chan, and Ayşem Mert, eds. 2012. Public-Private Partnerships for Sustainable Development: Emergence, Influence and Legitimacy. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Pauwels, Koen, and Scott A. Neslin. 2015. Building with bricks and mortar: The revenue impact of opening physical stores in a multichannel environment. Journal of Retailing 91: 182–97. [Google Scholar] [CrossRef]

- Pellicer, Lluís. 2016. El Gobierno Planea Abrir la Gestión de los Barrios a Entidades Privadas. El País Newspaper. Available online: http://sociedad.elpais.com/sociedad/2014/06/23/actualidad/1403549621_457228.html (accessed on 16 April 2019).

- Penz, Elfriede, and Margaret K. Hogg. 2011. The role of mixed emotions in consumer behavior: Investigating ambivalence in consumers’ experiences of approach-avoidance conflicts in online and offline settings. European Journal of Marketing 45: 104–32. [Google Scholar] [CrossRef]

- Piqueras Gómez de Albacete, César. 2016. Los Nuevos Comercios y los que Pronto Desaparecerán. November 4. Available online: https://www.cesarpiqueras.com/los-nuevos-comercios-y-los-que-van-a-desaparecer/ (accessed on 21 October 2019).

- Poole, Rachel, Graham P. Clarke, and David B. Clarke. 2002. Growth, concentration and regulation in European food retailing. European Urban and Regional Studies 9: 167–86. [Google Scholar] [CrossRef]

- Raco, Mike, Daniel Durrant, and Nicola Livingstone. 2018. Slow cities, urban politics and the temporalities of planning: Lessons from London. Environment and Planning C: Politics and Space 36: 1176–94. [Google Scholar] [CrossRef]

- Reynolds, Jonathan, Elizabeth Howard, Christine Cuthbertson, and Latchezar Hristov. 2007. Perspectives on retail format innovation: Relating theory and practice. International Journal of Retail & Distribution Management 35: 647–60. [Google Scholar] [CrossRef]

- Rosado-Serrano, Alexander, Justin Paul, and Desislava Dikova. 2018. International franchising: A literature review and research agenda. Journal of Business Research 85: 238–57. [Google Scholar] [CrossRef]

- Rovira, Agustín. 2016. El Comercio Nuestro de Cada Día: Un Sector Estratégico Que Hace Ciudad. El Diario. Available online: http://www.eldiario.es/cv/arguments/comercio-sector-estrategico-hace-ciudad_6_478812122.html (accessed on 15 April 2019).

- Rovira, Agustín, D. Forés, and C. Hernández. 2012. Gestión Innovadora de Centros Comerciales Urbanos. Modelos y Experiencias. Gijón: Ediciones Trea. [Google Scholar]

- Roy Dholakia, Ruby. 1999. Going shopping: Key determinants of shopping behaviors and motivations. International Journal of Retail & Distribution Management 27: 154–65. [Google Scholar] [CrossRef]

- Saad, Gad. 2007. The Evolutionary Bases of Consumption. Abingdon: Routledge. [Google Scholar]

- Salvaneschi, Luigi. 1996. Location, Location, Location: How to Select the Best Site for Your Business. Edited by Cem Akin. Lembang: Oasis Press/PSI Research. [Google Scholar]

- Sánchez, S. 2012. Nuevos Formatos, Productos Olvidados y Promociones Para Tirar del Comercio. El Mundo Newspaper. Available online: http://www.elmundo.es/elmundo/2012/09/14/economia/1347626084.html (accessed on 15 April 2019).

- Sánchez-Hernández, José Luis. 2009. Redes alimentarias alternativas: Concepto, tipología y adecuación a la realidad española. Boletín de Geógrafos Españoles 49: 185–207. [Google Scholar]

- Saraiva, Miguel, Teresa Sá Marques, and Paulo Pinho. 2019. Vacant Shops in a Crisis Period. A Morphological Analysis in Portuguese Medium-Sized Cities. Planning Practice & Research 34: 255–87. [Google Scholar] [CrossRef]

- Schatzman, Laura. 2013. Metabolizing Obsolescence: Strategies for the Dead Mall. Master’s thesis, University of Illinois at Urbana-Champaign, Champaign, IL, USA. Available online: https://core.ac.uk/download/pdf/17355587.pdf (accessed on 21 October 2019).

- Schiller, Russell. 1994. Vitality and viability: Challenge to the town center. International Journal or Retail and Distribution Management 22: 46–50. [Google Scholar] [CrossRef]

- Shields, Rob. 1992. Lifestyle Shopping: The Subject of Consumption. London: Routledge. [Google Scholar]

- Smith, Neil. 2002. New globalism, new urbanism: Gentrification as global urban strategy. Antipode 34: 427–50. [Google Scholar] [CrossRef]

- Soumagne, Jean, R. -P. Desse, and A. Grellier. 2011. Commercial Crises and Resilience in French Urban Peripheries. In Retail Planning for the Resilient City. Consumption and Urban Regeneration. Edited by Teresa Barata-Salgueiro and Cachinho Cachinho. Lisbon: Centro de Estudos Geográficos, pp. 81–104. [Google Scholar]

- Spork, J. A. 1987. Vingt-Cinq ans D’étude de Géographie Commerciale au Seminaire de Geógraphie de l’Université. Actas del Coloquio Internacional Le commerce de detail face aux mutations actuelles. Liège: Les Faits et Leur Analyze. [Google Scholar]

- The Economist. 2013. Bid for Victory. Available online: http://www.economist.com/news/britain/21583704-companies-are-stepping-provide-services-councils-are-cutting-bid-victory (accessed on 17 August 2013).

- Turban, Efraim, Jon Outland, David King, Jae Kyu Lee, Ting-Peng Liang, and Deborah C. Turban. 2017. Electronic Commerce 2018: A Managerial and Social Networks Perspective. Berlin: Springer. [Google Scholar]

- Turok, Ivan, and Vlad Mykhnenko. 2007. The trajectories of European cities, 1960–2005. Cities 24: 165–82. [Google Scholar] [CrossRef]

- Underhill, Paco. 2009. Why We Buy: The Science of Shopping-Updated and Revized for the Internet, the Global Consumer, and Beyond. New York: Simon and Schuster Paperbacks. [Google Scholar]

- Van Duin, J. H. Ron, Hans Quak, and Jesús Muñuzuri. 2010. New challenges for urban consolidation centers: A case study in The Hague. Procedia-Social and Behavioral Sciences 2: 6177–88. [Google Scholar] [CrossRef]

- Vel, K. Prakash, Collins Agyapong Brobbey, Abdalrhman Salih, and Hafsa Jaheer. 2015. Data, Technology & Social Media: Their Invasive Role in Contemporary Marketing. Brazilian Journal of Marketing 14: 421–37. [Google Scholar] [CrossRef]

- Verhetsel, Ann. 2005. Effects of neighborhood characteristics on store performance supermarkets versus hypermarkets. Journal of Retailing and Consumer Services 12: 141–50. [Google Scholar] [CrossRef]

- Villaécija, Raquel. 2015. Del Negocio Tradicional a la Invasión de Las ‘Ciudades Franquicia’. El Mundo Newspaper. Available online: http://www.elmundo.es/economia/2015/08/10/55c77e1f268e3e1f308b4581.html (accessed on 8 October 2019).

- Voces, Susana. 2016. El Futuro del Comercio, Según eBay. Revista Inforetail. Available online: http://www.revistainforetail.com/noticiadet/el-futuro-del-comercio-segun-ebay/adf8e53a9c90fe19225aed91ff840c0e (accessed on 27 October 2018).

- Vollmer, Annette. 2008. Öffentliche und private Interesen in Business Improvement Districts-Zur Frage der demokratischen Einbindung von BIDs in den USA und Deutschland. In Business Improvement Districts. Ein Neues Governance-Modell aus Perspecktive von Praxis und Stadtforschung. Edited by Robert Pütz. Berlin: Geographische Handelsforschung, pp. 35–60. [Google Scholar]

- Vural-Arslan, Tülin, Neslihan Dostoğlu, Özlem Köprülü-Bağbanci, and Nilüfer Akıncıtürk. 2011. Sustainable revitalization as a tool for regenerating the attractiveness of an inner-city historic commercial district:’Han District’as a case. Urban Design International 16: 188–201. [Google Scholar] [CrossRef]

- Warnaby, Gary, David Bennison, Barry J. Davies, and Howard Hughes. 2004. People and partnerships: Marketing urban retailing. International Journal of Retail & Distribution Management 32: 545–56. [Google Scholar] [CrossRef]

- Weiler, Anelyse M., Chris Hergesheimer, Ben Brisbois, Hannah Wittman, Annalee Yassi, and Jerry M. Spiegel. 2014. Food sovereignty, food security and health equity: A meta-narrative mapping exercise. Health Policy and Planning 30: 1078–92. [Google Scholar] [CrossRef]

- Whelan, Amanda, Neil Wrigley, Daniel Warm, and Elizabeth Cannings. 2002. Life in a ‘Food Desert’. Urban Studies 39: 2083–100. [Google Scholar] [CrossRef]

- Wieczorek, Elena. 2004. Business Improvement Districts. Revitalisierung von Geschäfszentren durch Anwendung des Nordamerikanischen Modells in Deutschland? Berlin: Technische Uni Berlin, p. 208. [Google Scholar]

- Williams, N., and T. Vorley, eds. 2017. Creating Resilient Economies: Entrepreneurship, Growth and Development in Uncertain Times. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Wortmann, Michael. 2004. Aldi and the German model: Structural change in German grocery retailing and the success of grocery discounters. Competition & Change 8: 425–41. [Google Scholar] [CrossRef]

- Wynne, Derek, Justin O’Connor, and Dianne Phillips. 1998. Consumption and the postmodern city. Urban Studies 35: 841–64. [Google Scholar] [CrossRef]

- Young, C. William, Sally V. Russell, Cheryl A. Robinson, and Phani Kumar Chintakayala. 2018. Sustainable retailing–influencing consumer behavior on food waste. Business Strategy and the Environment 27: 1–15. [Google Scholar] [CrossRef]

- Zorrilla, Pilar. 2016a. El abismo Omnicanal? Para el Pequeño Comercio. Secretos Para Triunfar. Trending Marketing. Available online: https://trendingmarketing.wordpress.com/2015/07/08/el-abismo-omnicanal-para-el-pequeno-comercio-secretos-para-triunfar/ (accessed on 14 April 2019).

- Zorrilla, P. 2016b. Ciudades Comercialmente Clonadas o la Muerte de la Diversidad. Trending Marketing. Available online: https://trendingmarketing.wordpress.com/2016/05/22/ciudades-comercialmente-clonadas-o-la-muerte-de-la-diversidad/ (accessed on 14 April 2019).

- Zukin, Sharon. 2004. Point of Purchase: How Shopping Changed American Culture. New York: Routledge. [Google Scholar]

- Zukin, Sharon, Valerie Trujillo, Peter Frase, Danielle Jackson, Tim Decuber, and Abraham Walker. 2009. New retail capital and neighborhood change: Boutiques and gentrification in New York City. City & Community 8: 47–64. Available online: https://eportfolios.macaulay.cuny.edu/benediktsson2013/files/2013/04/Boutiques-and-Gentrification-in-New-York-City.pdf (accessed on 21 October 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).