1. Introduction

The incompleteness of the Eurozone design was well appreciated in the early 2000s by some of the founding fathers of the euro project. They failed to envision the coming euro crisis, yet their concerns were validated by the way that the ongoing euro crisis has been muddled through, with no end in sight.

1 While pundits agree that the status quo is unsustainable [

3], the road ahead remains unclear. Taking a historical perspective of economic changes, this paper notes that muddling through while introducing crises-induced reforms characterizes well the evolutionary process of forming currency unions. The Evolutionary Approach to the formation of a new currency area implies that the process is not unidirectional. Evolutionary pressure purges arrangements and institutions that do not survive the realized shocks. Yet, survival does not necessarily imply the ability to withstand future turbulences. Thus, convergence to “ever closer union” is not assured. Unions and Regional Cooperation arrangements are challenged by exogenous forces, testing the willingness and ability to persevere during bad times.

2 Market integration and cooperation may overshoot the willingness to integrate. The collapse of Yugoslavia, and the move towards more limited fiscal federalism in Canada provides vivid examples of these patterns. In the absence of flexibility of adjustment and investment in building the needed institutions, currency unions may fail. As there is no magic wand allowing the Eurozone to deal with all its distortions in one reform, the limited political capital of the euro’s leaders should be used to target the most important reforms first. Hence, the proper sequencing of the needed reforms may be the key for the survival of the euro. Which are the most critical distortions that should be fixed first?

Using the logic of market forces and political economy constraints, we argue that not all distortions are alike. Taking broad strokes, we divide the distortions affecting the euro into two groups—the structural and the financial. The structural distortions include labor and product market anomalies, providing ample protection for incumbents while imposing barriers to entry of new comers, inhibiting and stifling growth, and reducing the GDP/Capita below its full potential. The financial distortions include: the lack of a banking union and unified resolution procedures dealing with insolvent banks; the too close affinity between the sovereign state and its banking system, and the absence of credible and well-funded deposit insurance scheme supporting the euro banking system.

Both structural and financial distortions are costly and prevalent, yet they differ in fundamental ways. Financial distortions are moving at the speed of the Internet, and their welfare costs are determined more by the access to credit lines and leverage, than by the GDP of each country. In contrast, the structural distortions are moving at a glacial speed relative to the financial distortions, and their effects are determined by inter-generational dynamics. Unlike financial distortions, the damaging effects of the structural distortions are linked directly to the factors determining the GDP—the labor force, population, and the stock of productive capital.

These considerations suggest that the priority should be given to dealing with the financial distortions, while the structural distortions may be dealt more fully down the road, once the euro gains greater financial stability. Priority should be given to the formation of a Eurozone wide deposit insurance, the soundness of which is based on granting it the proper regulatory power, and the capacity to charge the needed risk premia.

2. Structural versus Financial Distortions

A manifestation of the structural distortions of the euro has been the rigid labor market, overprotecting the older workers at a growing cost to the younger workers and to the economy. Another dimension of structural rigidity includes limited product and service market competition, barriers to entry, and the like. The differential depth of the structural distortions in the Eurozone has been associated with divergent economic development between the northern and the southern Eurozone states, and has been exemplified by the differential real exchange and growth trends between the GIIPS (Greece, Ireland, Italy, Portugal and Spain) and Germany.

Are these differential growth trends the root cause of the euro crisis? Not really—it is the interaction between these trends and the incomplete financial design of the euro project. We illustrate this point by noting that similar divergent economic developments between states in other currency unions have not been associated with crises that threaten the stability of the union. Specifically, we look at the differential growth trends of the 50 US States.

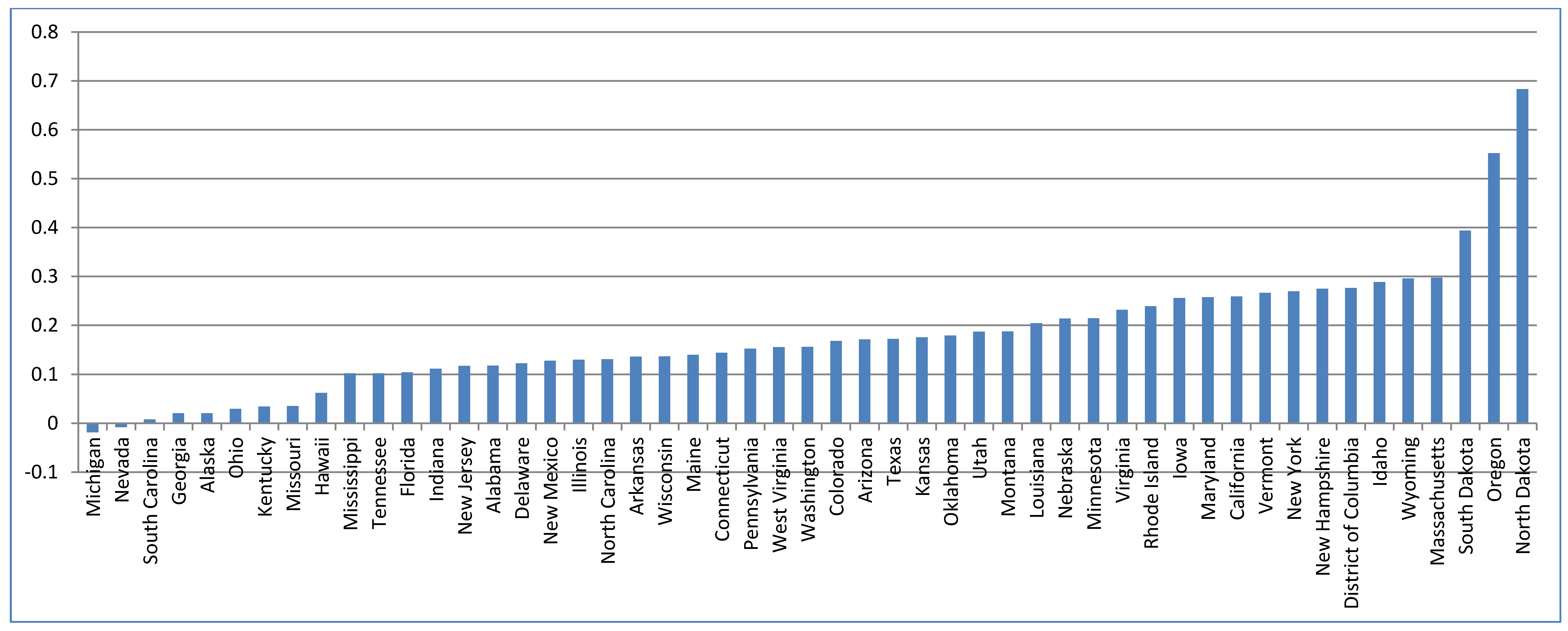

Figure 1 reports the per capita real GDP changes, 1997–2011, of all the US states. During that period, the per capita real GDP of the best preforming three states grew by 54%, while the bottom three by 0%. The gap between the per capita real GDP of these groups has diverged at about 4% annually during more than a decade. Hence, the divergent growth trends of the 50 US states may be comparable to that of the Eurozone. Yet, unlike the Eurozone, there is no existential crisis in the US union. The reason for the relative stability of the US union, despite the divergent growth patterns among the 50 US States is clear. The US is a mature union, with a significant stabilizing tax-cum-transfer system via the federal fiscal center, a strong banking union, labor mobility,

etc. Furthermore, the US had more than 200 years to move towards “a more perfect union.”

In contrast, the Eurozone is the opposite of all the above—so far, it is a shallow currency union among advanced welfare states, with no banking union, no fiscal union, strong links between national banks and the sovereign, and limited labor mobility. These fundamentals suggest that the formation of the Eurozone is akin to a Bungy jump without a rope, with the need to use parachutes and bailouts to prevent the crash. Is this a too harsh assessment of the Eurozone, reflecting

ex-post wisdom? Were the fault lines of the euro project expected? The short answer to these questions is that the key fault lines of the Eurozone were identified in the years leading to its formation, including the earlier concern of senior US economists [

7,

8]. This prediction turned out to take about 10 years to materialize. Was the ‘stability’ of the Eurozone project during its first decade expected? No, the length of the honeymoon of the Eurozone surprised most of the economists who were initially skeptical regarding the euro.

Figure 1.

Per capita real GDP change, 1997–2011, by state (chained 2005 dollars).

Figure 1.

Per capita real GDP change, 1997–2011, by state (chained 2005 dollars).

Date source: Bureau of Economic Analysis.

The figure reports ((Per capita real GDP 2011—Per capita real GDP 1997)/ Per capita real GDP 1997) of the 50 US states and DC.

Presently, the euro project faces grave risks if urgent modifications will not take place. The fundamental reason for the looming risks is in that the deepening financial integration of the Eurozone states, coupled with the under-regulation of the banking system and the absence of a tight banking union provides ample opportunities for financial instability. A manifestation of the unsustainability of the present Eurozone structure has been the sovereign credit risk crisis, impacting first the GIIPS, and spilling-over to other Eurozone members [

9,

10]. The bank-sovereign interdependence implies that in the absence of a credible deposit insurance scheme, heightened sovereign spreads may put in motion a run on the banking system of the affected countries [

11]. Furthermore, as many insurance companies across the Eurozone invested in GIIPS sovereign debt, higher sovereign spreads may destabilize insurance companies, and the entire shadow banking system in the Eurozone. These spillovers led to adverse externalities, further destabilizing the system, and imposing major challenges on regulators [

12,

13]. The resultant financial vulnerability is magnified by ignoring tail risks, and by exposure to moral hazard associated with the belief that the euro project is too big, and politically too important, to fail. The sector that is the fastest in exploiting perceived financial opportunities is the banking and the financial system. After all, the financial system lives by, and dies by arbitrage at the speed of the Internet [

14].

In the era of financial integration, the scale of financial rents in good times and the costly bailouts in bad times are determined by access to funds, credit and leverage, and are magnified by misguiding regulation—factors that may be delinked from the actual size of the economy. Iceland, Cyprus and Ireland illustrate vividly this point. Banks’ profits in good times were private, yet banks’ losses were socialized, saddling taxpayers with huge liabilities, transmitting a banking crisis into a fiscal crisis. The absence of a banking union in the Eurozone, the misguiding regulation of banks coupled with the underpricing of sovereign risk during the first 10 years of the euro, all magnified the ultimate exposure of the Eurozone countries to downside risks.

Needless to say, labor market and product market distortions and inefficiencies matter a lot in explaining low growth and poverty. Yet, as long as the financial regulations are tight, possibly by means of stifling financial repression and capital controls, real distortions do not lead to financial crises. This is illustrated by the record of India and other developing countries in the 1960s—they saw a prevalence of poverty, tepid growth, financial repression, and the absence of financial crises.

In contrast to the Eurozone experience, in a well-functioning banking union, stagnating states in a vibrant union are not a threat to the union. Illinois is in a fiscal mess, and South Carolina may stagnate, yet there is no banking crisis there. Spain and Ireland were in a much better fiscal position in 2007–8 than Illinois and California during that time, yet they were doomed to be exposed to a massive banking crisis, ending in a massive fiscal crisis. Nevertheless, a well-functioning banking union may be exposed to a deep banking crisis due to under-regulation and ignoring tail risks, without imposing an existential threat to the union, as has been the case in the US during the last five years. This follows from the risk pooling nature of a banking union, where the combination of union level deposit insurance, funded by proper risk assessments, mitigates bank runs and provides down the road the needed funding for bailing out consumers, and allowing for a more proper resolution and liquidation of insolvent banks.

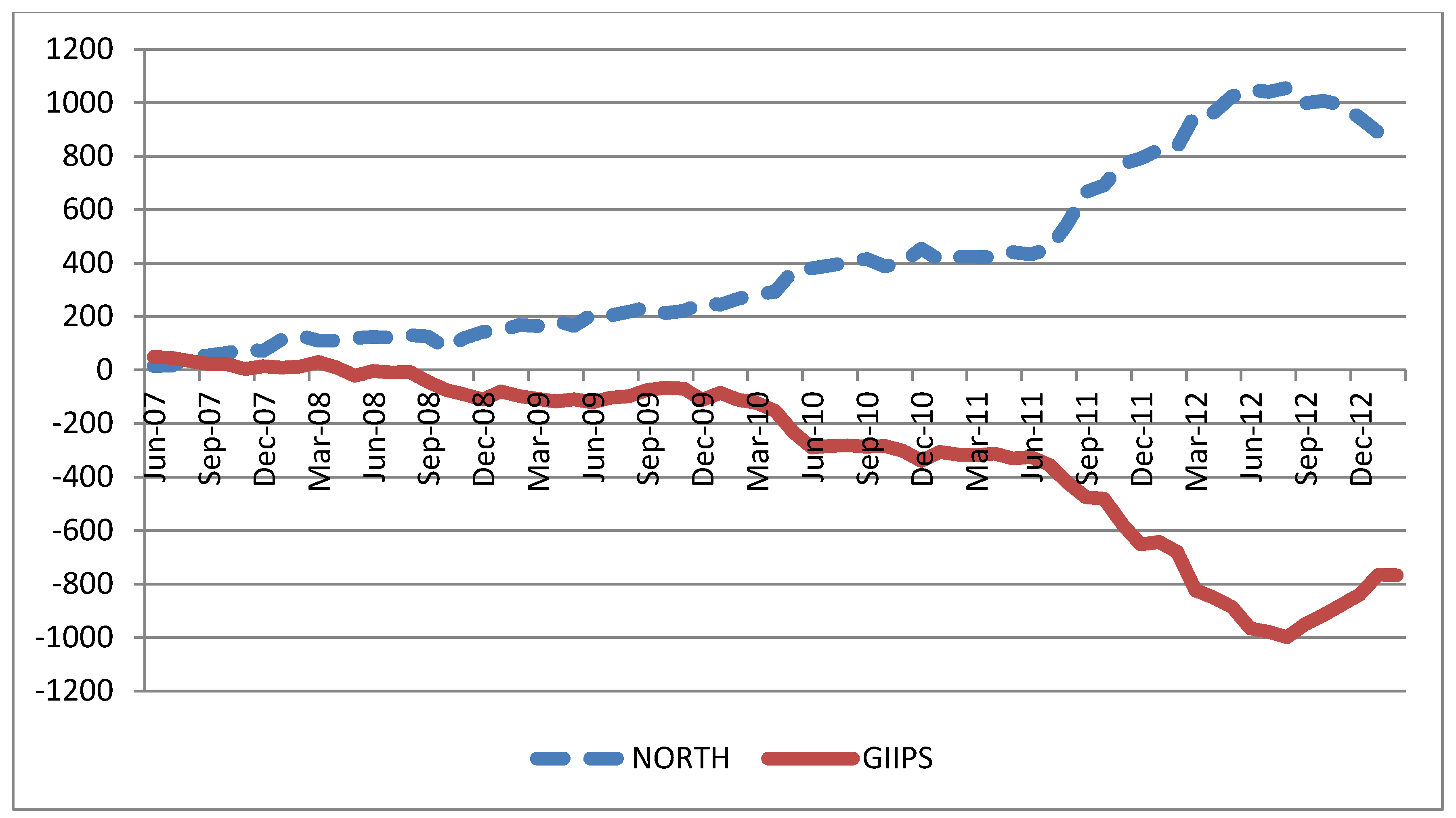

These observations beg an important question: if financial arbitrage is fast, how did the euro survive so far? A probable answer is: through the massive implicit bailout facilitated by the European Central Bank (ECB) and other supporting institutions, putting big fingers in the leaking Eurozone financial dyke, thereby preventing the euro’s collapse. This has been manifested in the TARGET 2 imbalances [

15]. To recall, TARGET 2 is a settlement system that clears payments between the regional Central Banks in the Eurozone [

16]. As of July 2007, the net TARGET 2 balance of Northern Eurozone (Germany, Netherlands, Luxemburg and Finland) and of the GIIPS were close to zero. By February 2013, the net credit of the TARGET 2 balance of Northern Eurozone increased to about 800 Billion euro (reflecting mostly Germany’s exposure), while the net balance of the GIIPS was a debit of about 800 Billion euros (see

Figure 2). The gap between the two is a crude proxy for the capital losses of the Northern Eurozone states if the euro would unravel in a disorderly manner.

3 In the words of Keynes, “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has” [

18]. In the case of the euro, the ultimate stake holders of “the bank” are the northern taxpayers. Ironically, the ECB provided

de facto the bailout of the banking system of the periphery, thereby mitigating the run on the banking system there, as is the classical role of deposit insurance. Nevertheless, the incompleteness on the euro project prevents the Eurozone from reaping the full benefits of stabilization and coordination associated with of a well-functioning banking union.

Figure 2.

Net TARGET2 balance, bn €. Northern Eurozone, (Germany, Netherlands, Luxemburg and Finland) and of the GIIPS.

Figure 2.

Net TARGET2 balance, bn €. Northern Eurozone, (Germany, Netherlands, Luxemburg and Finland) and of the GIIPS.

Data source: Euro Crisis Monitor, Institute of Empirical Economic Research, Osnabrück University.

The growing exposure of Northern Eurozone countries to the cost of unwinding the euro puts the future of the Eurozone on a knife-edge path. It increases the risk that the Northern European tax payers be unwilling to go on bailing out Southern European countries if there are no sufficient commitments for deep financial and structural reforms. The hope is that the rising threat to Eurozone’s stability will put in motion a good faith bargaining, where the growing cost of unwinding the euro to the Northern taxpayers and to the GIIPS population will induce ‘a grand bargain.’ Such a bargain may include fast convergence towards a banking union with a deep commitment to deal sequentially with the remaining distortions. Moving successfully on the knife-edge path towards a more perfect Eurozone may require voters’ recognition of the growing opposition among the Northern European tax payers, as well as the growing awareness of Northern European tax payers that at this stage, all options are costly, and that unwinding the euro may be costlier than a ‘grand bargain.’ The rising cost of unwinding the Eurozone calls for greater investment in institution building, even if this entails deeper transfers to the GIIPS in the short-run. The upside of this process is moving towards a more stable union, and avoiding testing the depth of the downside economic and social risks of unwinding the Eurozone.

4To understand the needed institutional modifications, we turn now to analyze the process leading to the Eurozone crisis.

3. Dynamics of Financial Crises, and the Perils of Weak Currency Unions

Dornbusch’s 1997 discussion on financial crises remains fresh today: “The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought” [

20]. It goes back to his reflections on the Mexican crisis of 1994–1995, the first modern financial crisis inflicting emerging markets following their financial liberalization in the early 1990s. The Mexican crisis was followed by a long sequence of financial meltdowns, hitting East Asia, Russia, Brazil, Argentina, and more recently the global and the euro crises. Dornbuch’s statement lucidly summarizes the tendency to ignore tail risks. These are the risks that frequently run below the radar screen of policy makers and households, underweighted in the economic decision making, allowing distortions to ripe over long periods, frequently longer than the Cassandras of the day expected. Yet, once the tail risk materializes, things tend to unravel fast, at an accelerating speed.

In this vein, the global crisis of 2007–2008 is the delayed but predicted reaction to the massive financial liberalization and under-regulation trends going back to the 1980s. Similarly, the euro crisis is the delayed reaction to the fault lines of the euro. Importantly, the notion ‘predicted crisis’ deals not with the timing, but with identifying the fault lines causing the ultimate fracture. This follows from the observation that we are clumsy at predicting the timing of financial crises. This is not due to a lack of talent or effort, but to the logic of market forces. If you can predict the timing of a future crisis, you can earn a massive rent. Moreover, the attempt to exploit this prediction by large players may trigger a crisis, thereby destroying the initial prediction. Furthermore, markets are subject to forces that may lead to multiple equilibria. The euro gained credibility during its first ten years, probably due to the Great Moderation and the presumption that the euro project is too big and politically too important to fail. The growing credibility of the euro induced an attitude of Happy-Go-Lucky, a complacency of the market and policy makers, and probably brought a deeper crisis when the tail risk was realized.

To put the euro crisis in economic perspective, the skeptical viewers of the euro noted that the economic gains of the euro are minor, and they come with a large exposure to downside risks. This is probably in sharp contrast to the formation of the EU, which has been associated with large economic gains. Thus, the Euro project is mostly a political venture, explained by the complex history of Europe during the 20th Century. The design of the euro and the Maastricht treaty was incomplete, as was the design of the US union in 1776. In both cases, when one builds an empire, optimism helps in galvanizing the political support. The limited horizon of the principal (the “empire builder”) and the agents (states, citizens), frequently is manifested in an overly optimistic assessment and fiscal myopia [

21]. Both may help at the stages of nation building, but down the road it requires rapid adaptation to the evolving challenges of the day.

Does this imply the coming end of the Euro? Not-necessarily, while the formation of the Eurozone might have been a mistake, unwinding it today may also be a mistake. As long as the Eurozone core states (Germany, Netherlands, France, etc.) are willing to push it, and to bank the euro project in the short-run, it will mature and survive, though in a different form. Yet, ‘never-say-never,’ as predicting political-will is hazardous.

Turning to the political economy of the crisis, key questions are “How long will it take to reform the euro?”; “How will it happen?” Insight can be gained by looking at the history of the US union. The banking union in the US, and the formation of the FDIC (Federal Deposit Insurance Corporation) were the outcome of the Great Depression. It took more than 150 years of financial instability in the US, with numerous banking crises, to lead to the formation of the FDIC in 1933. Yet, things are moving much faster today: it will take less time for the euro to upgrade itself, or to collapse.

5 Ironically, the rapidly growing exposure of Northern states to the indebtedness of the Southern states in the Eurozone may provide the impetus for deep financial reforms of the euro project. It may force the Eurozone to evolve. Greater financial stability may come by moving fast towards a banking union, forming a Eurozone institution akin the FDIC, buffered by the risk premia and regulations needed to provide effective deposit insurance. US history suggests that the funding costs of these services in the long-run are well below 0.5% of the GDP [

22], a cost that may be more acceptable politically in the Eurozone today than Eurozone’s debt mutualization. Down the road, a banking union will require cutting the links between the sovereign states in the Eurozone and their banking system, so that the stability of the banking system will be de-linked from the fiscal stability of the state [

3].

This can be done, but requires deep restructuring. How to reform? History suggests “no pain—no gain.” Crises generate creative destruction, re-shuffling bargaining clouts, changing positions and alliances. With luck and political skill, crises may induce learning by doing, as more of the bad options are eliminated. The formation of the FDIC in the US provides a good case study of such dynamics, transforming an unstable banking system to a more resilient one. Importantly, the formation of the FDIC took place in the 1930s, at times when the federal government of the US union was lean, commanding less than 5% of the GDP. The written history of the FDIC provides a vivid testimony of convergence towards a more efficient system, the outcome of an evolutionary, trial and error process, propagated by history [

22]. The disruption caused by bank failures was a recurrent problem during the 19th century and the first third of the 20th century. Numerous plans were proposed or adopted by various states to address this problem. Many embodied the insurance principle. These schemes were challenged overtime by irregular deep recessions, and by the changing dynamics of the banking system, including the emergence of national, cross states banks.

Insurance of bank obligations by the states occurred during two distinct episodes. The first goes back to 1829, starting with the adoption of an insurance plan by the State of New York, and was followed during the next three decades by five other states. While these plans worked well at first, they were challenged by the changing structure of the banking industry. A volatile chapter in the US banking history was the ‘free banking’ period, 1837–1863, when many states enacted laws designed to ease bank entry restrictions. Subsequently, the free banking period was associated with a rapid increase in the number of banks, and consequent bank failures. Some blamed the bank failures on the emergence of ‘Wildcat Banking,’ specializing in predatory practices. Yet, other sources of bank failures were the substantial drop in the price of the state bonds that made up a large part of the banks’ portfolios [

23]. The growing banking instability during the ‘free banking’ period led to the National Bank Act, passed by the US Congress in 1863–1864. The act provided for a system of banks to be chartered by the federal government. A by-product of the National Bank Act was the termination of the state insurance systems. Curiously, these dynamics are akin to the present challenges facing the Eurozone banking system, the outcome of the bank-sovereign interdependence, and the deepening financial integration in the Eurozone prior to 2010.

Insurance of bank obligations by the states was attempted again only in the early 1900s, when eight states established deposit guaranty funds from 1908 to 1917. These insurance plans were hard hit by the agricultural depression that followed World War I. The bank failures induced by that depression depleted overtime these insurance funds. By the mid-1920s, all of the state insurance programs were in difficulty, and the onset of the great depression was the last blow—by early 1930 none remained in operation. Beginning in the 1860s, following the emergence of national banks, the federal government sought to secure the safety of the circulating medium of exchange through a direct guaranty by the Treasury of national bank notes. Yet, the subsequent rapid growth of bank deposits relative to bank notes raised concerns regarding the safety of the circulating medium in the event of a bank failure. Subsequently, between 1886 and 1932, about 150 proposals for deposit insurance were introduced in the US Congress. While all these proposals did not pass, the principles of the future federal deposit insurance system were developed in these bills, and in the experience of the various states that adopted insurance programs.

6Bank failures were quite rampant between 1921 and 1929, but their closings induced few macro concerns. They primarily involved small, rural banks, many of which were badly managed and weak, and they took place during expansionary times. The prevailing view was that the disappearance of these banks served to strengthen the banking system. The Great Depression and the resultant collapse of about a third of the banks in the US made the cost of banking instability transparent, unleashing forces that led to the formation of a banking union buffered by the FDIC, an outcome that was opposed by the majority in the US congress for more than a hundred years of banking instability. This vivid example illustrates that crises generate creative distraction, a re-shuffling of bargaining clouts and positions, and changing alliances. With luck and political skill, crises may induce learning by doing, as more of the bad options are eliminated.

7The FDIC example begs the question how did the US union survive without a banking union for about 150 years? Does it suggest that the Eurozone can survive without a banking union? Probably not, as the US union moved early on in its history towards debt mutualization, buffered by the needed taxes as part of the Hamiltonian resolution of serving the debt associated with the American Revolutionary War (1775–1783).

8 The next major institutional building in the US happened after the defaults of 8 states in 1842. This massive sovereign default took place after decades of economic boom, a time when states created and expanded their transportation infrastructure, investing heavily in their canals and railroads, relying deeply on debt financing. In response, states’ constitutions in the 1840s created procedures requiring state governments to raise taxes before they borrowed, and made those taxes irrevocable until the debt had been repaid. The success and the stability of the US dollar union were attributed to these institutional changes, where following the fiscal crisis of the early 1840s, states changed their constitutions to eliminate taxless finance in the future [

27]. The combination of debt mutualization and restraints on states’ borrowing probably explains the ability of the US Union to delay the formation of a Banking Union. In contrast, at present there is no political will in the Eurozone to move fast towards debt mutualization, or towards deep fiscal reforms linking sovereign borrowing to future tax commitments. Needless to say, following these changes in the Eurozone will help in stabilizing the euro. These reforms require hefty political support, lacking so far in the Eurozone.

The evolutional interpretation of the formation of institutions discussed above does not imply, however, that the Eurozone’s path will resemble that of the US, nor does it provide a blueprint for the future. There are several fundamental differences between the US union dynamics and those of the Eurozone. The US union started among States whose population was dominated mostly by recent immigrants and their offsprings, with limited institutional history, relaxed attitudes towards the continuation of immigration, with a limited role of taxes, and the absence of a state funded safety net. This is in sharp contrast to the core of the Eurozone, formed by mature national states, with functioning institutions and state-funded safety nets.

Chances are that the first steps of unification had been easier among the young states of the US than among the states that formed the Eurozone. Having a common perceived adversary [the British and the indigenous Indians], and similar development challenges presumably helped the US states in forming their Federal Union. Yet, as the US Civil War (1861–1865) illustrated, pivotal differences among the Northern and the Southern states, and the wish for local autonomy led to bloody conflicts, putting the young US Union in peril.

In contrast, the tumultuous history of Europe during the past centuries set in motion the forces leading to the formation of the EU, and down the road to the Eurozone. While the US union formation was enhanced by the self-perception of its residents of being one people, forming the European identity among the Eurozone citizens remains a work in progress. Though mobility of labor remains limited in the Eurozone in comparison to that of the US, it increased substantially in the recent decades (though mostly among the young and the immigrants). Chances are though, that the ageing and potentially uneven shrinking of the Eurozone states’ population may induce greater acceptance of labor mobility. Yet, the growing labor mobility in the Eurozone is far from being a harmonious process; it will keep testing the viability of the Eurozone and the EU [

19].