Collaboration Enables Innovative Timber Structure Adoption in Construction

Abstract

1. Introduction

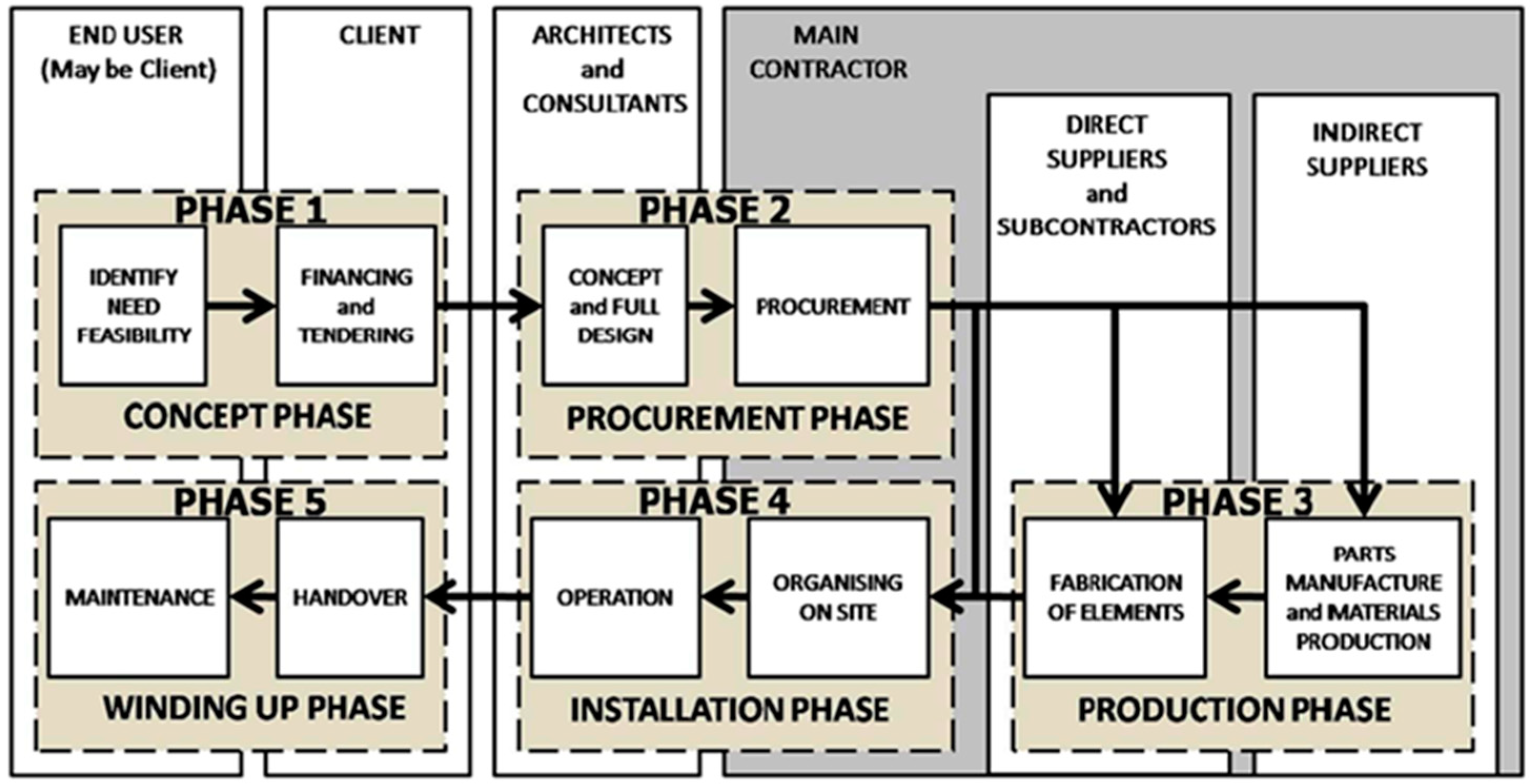

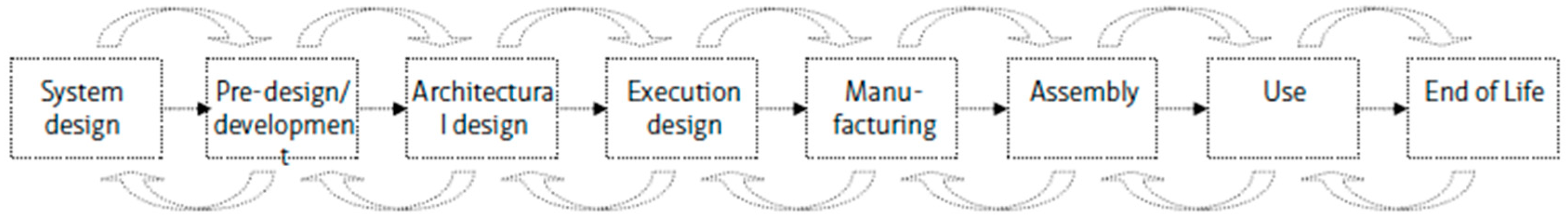

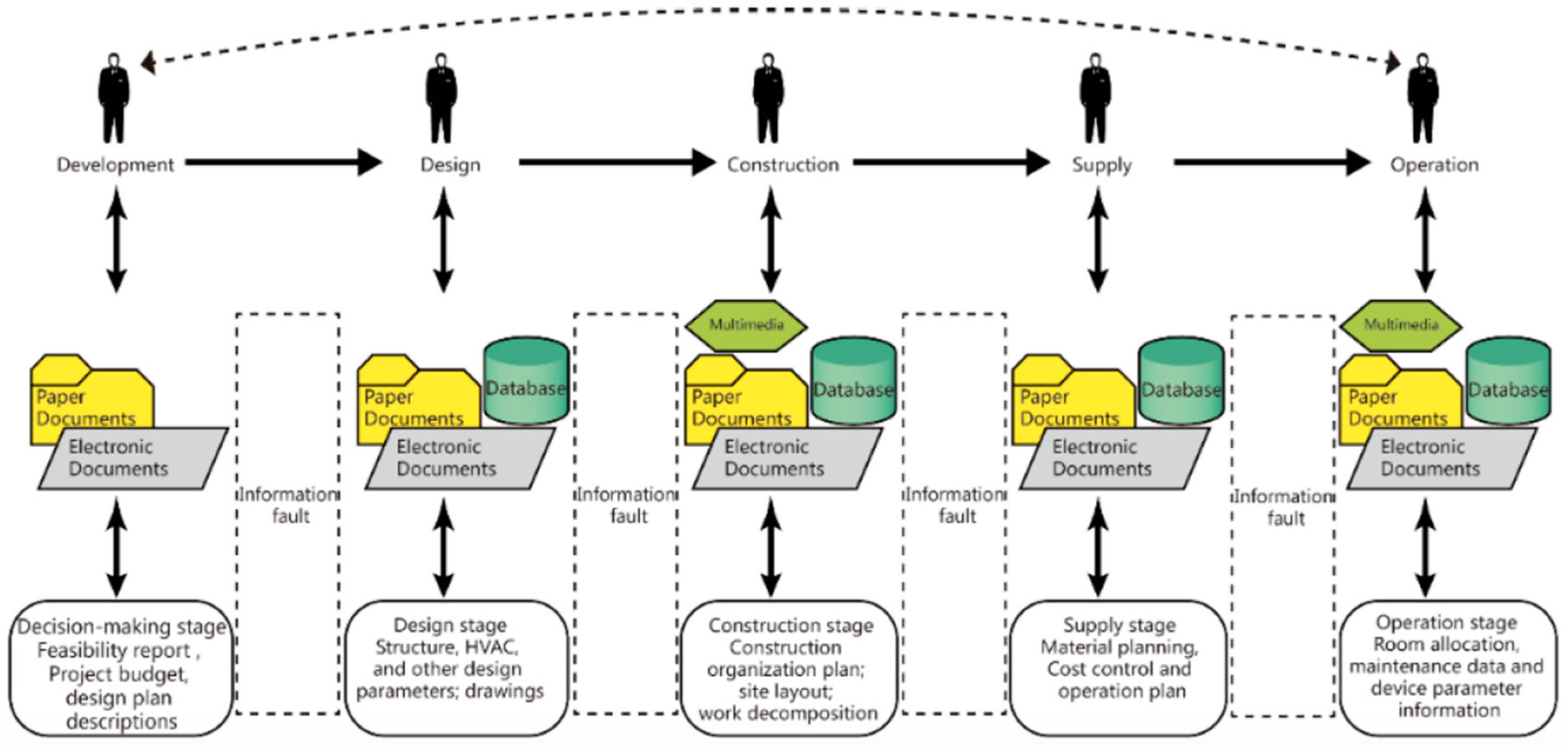

1.1. Defining a Construction Supply Chain

1.2. Defining a Typical Structural Timber Building Supply Chain

2. Methodology

2.1. Research Design and Data Collection

2.1.1. Sample

2.1.2. Semi-Structured Interviews

2.1.3. Participant Observation

2.1.4. Secondary Data

2.2. Qualitative Analysis

3. Results

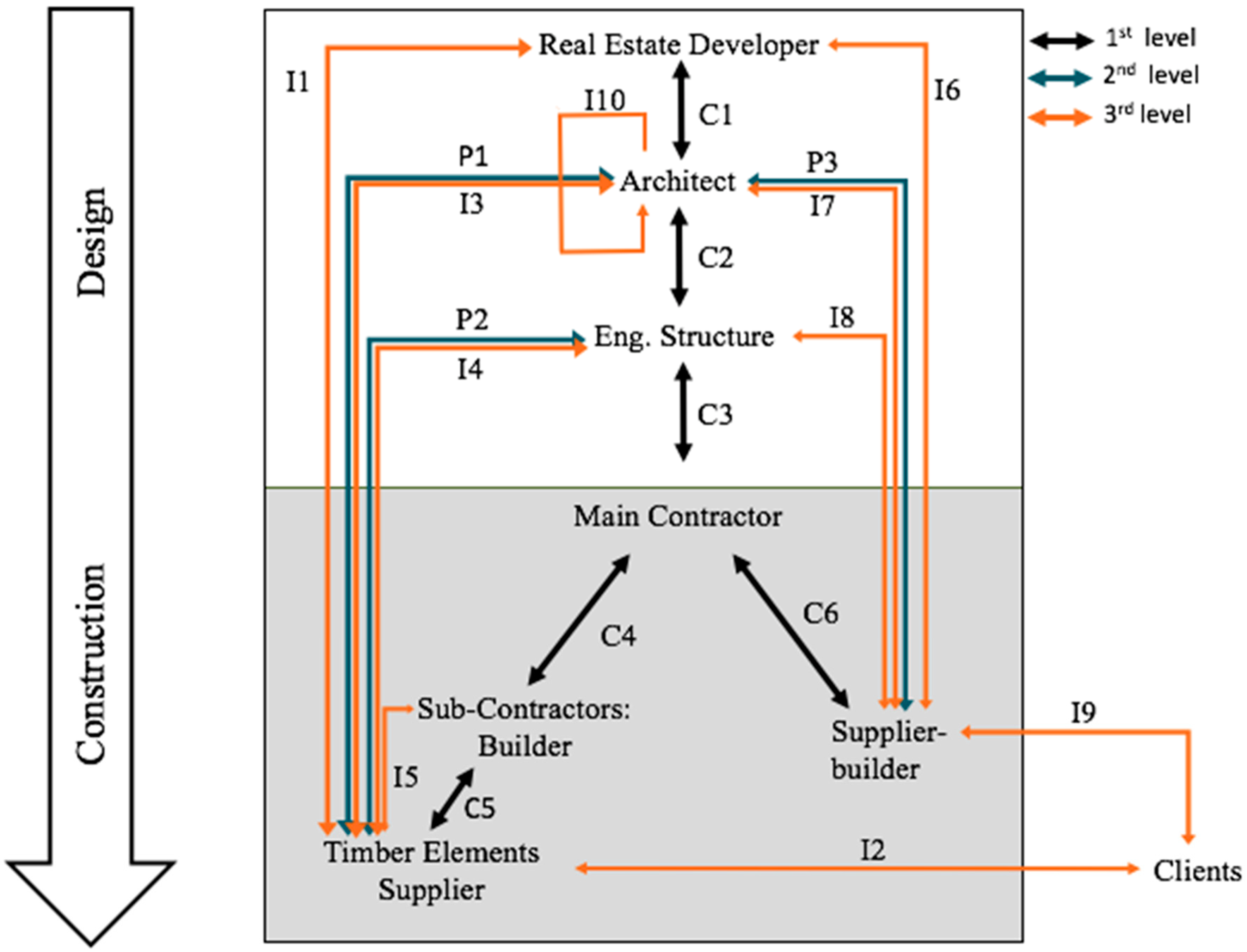

3.1. Relationships between Stakeholders in a Structural Timber Building Supply Chain

3.1.1. First Level—“Contractual (C)” Relationships

3.1.2. Second Level—“Timber Building Project (P)” Relationships

P1—Relations between Architects and Suppliers

P2—Relations between Structural Engineers and Suppliers

P3—Relations between Architects and Supplier-Builders

3.1.3. Third Level—“Structural Timber Building Industry Development (I)” Relationships

4. Discussion

4.1. A Cultural Mindset Switch Is Needed

4.1.1. From the Linear Construction Supply Chain to a Value Network

4.1.2. From Simple Relations … to Collaboration

4.2. Some Methods for Awarding Contracts Facilitate Collaboration and Innovation

4.3. Prefab: A Collaboration Accelerator

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Robichaud, F. L’utilisation du Bois en Construction Non Résidentielle au Québec: Enquête Auprès des Ingénieurs en Structure; FPInnovations: Pointe-Claire, QC, Canada, 2010. [Google Scholar]

- Chamberland, V.; Robichaud, F. Le Marché Pour les Bois de Structure Dans la Construction non Résidentielle au Québec; PInnovations: Pointe-Claire, QC, Canada, 2013. [Google Scholar]

- Drouin, M. Étude de Marché Pour les Bois de Structure Dans la Construction Non Résidentielle au Québec; PInnovations: Pointe-Claire, QC, Canada, 2015. [Google Scholar]

- Frühwald, A. The Ecology of Timber Utilization Life Cycle Assessment Carbon Management etc; Department of Wood Science and Technology, University of Hamburg: Doorn, Germany, 2007. [Google Scholar]

- Gaston, C.; Kozak, R.; O’Connor, J.; Fell, D. Potential for Increased Wood-Use in N. A. Non-Residential Markets; Project No. 2711; Forinteck Canada Corp.: Vancouver, BC, Canada, 2001. [Google Scholar]

- O’Connor, J.; Gaston, C. Potential for Increased Wood-Use in the N. A. Non-Residential Markets—Part II (Builder/Owner Survey); Forintek Cananda Corop.: Vancouver, BC, Canada, 2004. [Google Scholar]

- Gosselin, A.; Blanchet, P.; Lehoux, N.; Cimon, Y. Main Motivations and Barriers for Using Wood in Multi-Story and Non-Residential Construction Projects. BioResour. J. 2016, 12, 546–570. [Google Scholar] [CrossRef]

- Christopher, M. Logistics and Supply Chain Management: Creating Value-Adding Networks, 3rd ed.; Prentice Hall Financial Times: Harlow, UK, 2005; 305p. [Google Scholar]

- Peck, H. Reconciling supply chain vulnerability, risk and supply chain management. Int. J. Log. Appl. 2006, 9, 127–142. [Google Scholar] [CrossRef]

- Pryke, S. Construction Supply Chain Management: Concepts and Case Studies; Wiley-Blackwell: Oxford, UK, 2009; 230p. [Google Scholar]

- Blanchard, D. Supply Chain Management: Best Practices; John Wiley & Sons: Oxford, UK, 2010; 304p. [Google Scholar]

- Van Weele, A.J. Purchasing and Supply Chain Management: Analysis, Strategy, Planning and Practice; Cengage Learning EMEA: Andover, MA, USA, 2010; 418p. [Google Scholar]

- Fulford, R.; Standing, C. Construction industry productivity and the potential for collaborative practice. Int. J. Proj. Manag. 2014, 32, 315–326. [Google Scholar] [CrossRef]

- Behera, P.; Mohanty, R.P.; Prakash, A. Understanding Construction Supply Chain Management. Prod. Plan. Control 2015, 26, 1332–1350. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; The Free Press: New York, NY, USA, 1985; 557p. [Google Scholar]

- Meng, X.; Sun, M.; Jones, M. Maturity Model for Supply Chain Relationships in Construction. J. Manag. Eng. 2011, 97–105. [Google Scholar] [CrossRef]

- Latham, M. Constructing the Team; Her Majesty’s Stationary Office: London, UK, 1994. [Google Scholar]

- Egan, J. Rethinking Construction; Department of the Environment, Transport and the Regions: London, UK, 1998.

- Barker, K. Barker Review of Land Use Planning Final Report—Recommandations; Her Majesty’s Stationery Office: London, UK, 2006. [Google Scholar]

- Cabinet Office. Government Construction Strategy; UK Government: London, UK, 2011.

- Farmer, M. The Farmer Review of the UK Construction Labour Model; Construction Leadership Council: London, UK, 2016. [Google Scholar]

- Holti, R.; Nicolini, D.; Smalley, M. The Handbook of Supply Chain Management: The Essentials; Construction Industry Reasearch and Information Association and the Tavistock Institute: London, UK, 2000; 95p. [Google Scholar]

- Saada, M.; Jonesb, M.; James, P. A review of the progress towards the adoption of supply chain management (SCM) relationships in construction. Eur. J. Purchasing Supply Manag. 2002, 8, 173–183. [Google Scholar] [CrossRef]

- Meng, X. The effect of relationship management on project performance in construction. Int. J. Proj. Manag. 2012, 30, 188–198. [Google Scholar] [CrossRef]

- Akintoye, A.; McIntosh, G.; Fitzgerald, E. A survey of supply chain collaboration and management in the UK construction industry. Eur. J. Purchasing Supply Manag. 2000, 6, 159–168. [Google Scholar] [CrossRef]

- Briscoe, G.; Dainty, A. Construction supply chain integration: An elusive goal? Supply Chain Manag. Int. J. 2005, 10, 319–326. [Google Scholar] [CrossRef]

- Rimmers, B. Slough Estates in the 1990s—Client Driven SCM. In Construction Supply Chain Management: Concepts and Case Studies; Pryke, S., Ed.; Wiley-Blackwell: Oxford, UK, 2009; pp. 137–159. [Google Scholar]

- Briscoe, G.H.; Dainty, A.R.J.; Millett, S.J.; Neale, R.H. Client-led strategies for construction supply chain improvement. Constr. Manag. Econ. 2004, 22, 193–201. [Google Scholar] [CrossRef]

- Wood, G.D.; Ellis, R.C.T. Main contractor experiences of partnering relationships on UK construction projects. Constr. Manag. Econ. 2005, 23, 317–325. [Google Scholar] [CrossRef]

- Akintoye, A.; Main, J. Collaborative relationships in construction: The UK contractors’ perception. Eng. Constr. Archit. Manag. 2007, 14, 597–617. [Google Scholar] [CrossRef]

- Bygballe, L.E.; Jahre, M.; Swärd, A. Partnering relationships in construction: A literature review. J. Purchasing Supply Manag. 2010, 16, 239–253. [Google Scholar] [CrossRef]

- Kantola, M.; Saari, A. Project delivery systems for nZEB projects. Facilities 2016, 34, 85–100. [Google Scholar] [CrossRef]

- Broft, R.; Badi, S.M.; Pryke, S. Towards supply chain maturity in construction. Built Environ. Proj. Asset Manag. 2016, 6, 187–204. [Google Scholar] [CrossRef]

- Klein, T. Integral Façade Construction: Towards a New Product Architecture for Curtain walls; Universiteit Delft: Wesel, Duistland, 2013. [Google Scholar]

- Hui, Z.; Weishuang, X. Research on BIM-based building information value chain reengineering. In Proceedings of the 3rd International Conference on Energy Materials and Environment Engineering, Bangkok, Thailand, 10–12 March 2017. [Google Scholar]

- Denzin, N.K.; Lincoln, Y.S. The Discipline and Pratice of Qualitative Research. In The Sage Handbook of Qualitative Research, 3rd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; Sage Publications: Thousand Oaks, CA, USA, 2005; p. 1210. [Google Scholar]

- Heckathorn, D.D. Comment: Snowball versus respondent-driven sampling. Sociol. Methodol. 2011, 41, 355–366. [Google Scholar] [CrossRef]

- Mucchielli, A. Dictionnaire des Méthodes Qualitatives en Sciences Humaines et Sociales; Colin: Paris, France, 1996; 303p. [Google Scholar]

- Poupart, J.; Deslauriers, J.-P.; Groulx, L.H.; Mayer, R.; Pires, A. La Recherche Qualitative: Enjeux Épistémologiques et Méthodologiques; Gaëtan Morin: Montréal, QC, Canada, 1997; 405p. [Google Scholar]

- Lessard-Hébert, M.; Goyette, G.; Boutin, G. La Recherche Qualitative, Fondements et Pratiques; Éditions Nouvelles: Montréal, QC, Canada, 1995; 124p. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: New York, NY, USA, 2010; 288p. [Google Scholar]

- Fortin, A. L’observation participante: Au coeur de l’altérité. In Les Méthodes de la Recherche Qualitative; Deslauriers, J.-P., Ed.; Presses de l’université du Québec: Quebec, QC, Canada, 1987; pp. 23–33. [Google Scholar]

- Herbert, J. Using Unpublished Data: Error and Remedies; SAGE Publications: Newbury Park, CA, USA, 1984; 65p. [Google Scholar]

- L’Écuyer, R. Méthodologie de L’analyse Développementale de Contenu: Méthode GPS et Concept de Soi; Presses de l’Université du Québec: Sillery, QC, Canada, 1990; 472p. [Google Scholar]

- Silverman, D. Analysing Talk and Text. In Handbook of Qualitative Research, 2nd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications Inc.: Thousand Oaks, CA, USA, 2008; pp. 821–834. [Google Scholar]

- Ghauri, P.; Gronhaug, K. Research Methods in Business Studies; FT Prentice Hall: Harlow, UK, 2005. [Google Scholar]

- Lincoln, Y.S.; Guba, E.G. Paradigmatic controversies, contradictions, and emerging confluencies. In Handbook of Qualitative Research, 2nd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications Ltd.: Thousand Oaks, CA, USA, 2008; pp. 163–188. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson Education Limited: Harlow, UK, 2012. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2015. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage Publications: Beverly Hills, CA, USA, 1979. [Google Scholar]

- Cooper, H.; Hedges, L.V.; Valentine, J.C. The Handbook of Research Synthesis and Meta-Analysis; Russell Sage Foundation: New York, NY, USA, 2009. [Google Scholar]

- Johnston, M.P. Secondary Data Analysis: A Method of which the Time Has Come. Qual. Quant. Methods Librairies 2014, 3, 619–626. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis, 2nd ed.; SAGE Publications: Thousand Oaks, CA, USA, 1994; 408p. [Google Scholar]

- London, K.; Kenley, R.; Agapiou, A. Theoretical supply chain network modelling in the building industry. In Proceedings of the 14th Annual ARCOM Conference, Reading, UK, 9–11 September 1998. [Google Scholar]

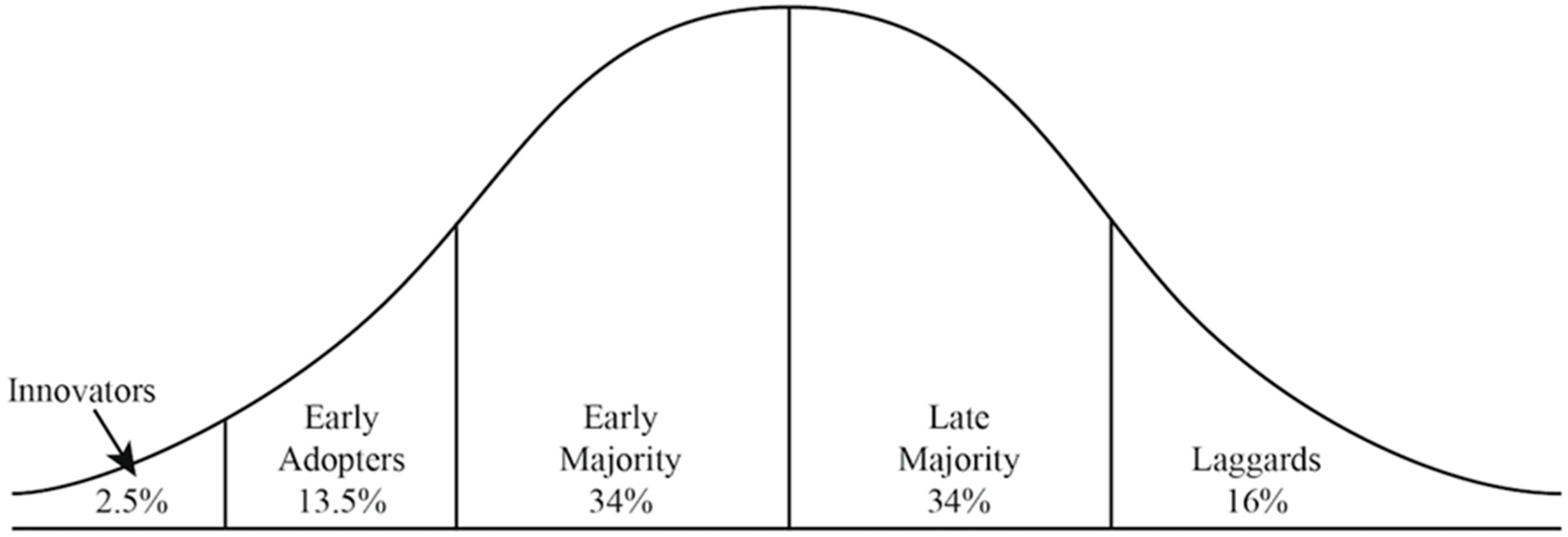

- Rogers, E.M. Diffusion of innovations; The Free Press: New York, NY, USA, 2003; 453p. [Google Scholar]

- Dubois, A.; Gadde, L.-E. The construction industry as a loosely coupled system: Implications for productivity and innovation. Constr. Manag. Econ. 2002, 20, 621–631. [Google Scholar] [CrossRef]

- Miozzo, M.; Dewick, P. Building competitive advantage: Innovation and corporate governance in European construction. Res. Policy 2002, 31, 989–1008. [Google Scholar] [CrossRef]

- Blayse, A.M.; Manley, K. Key Influences on Construction Innovation. Constr. Innov. 2004, 4, 143–154. [Google Scholar] [CrossRef]

- Bresnen, M.; Marshall, N. Partnering in construction: A critical review of issues, problems and dilemmas. Constr. Manag. Econ. 2000, 18, 229–237. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Chan, D.W.M.; Ho, K.S.K. Partnering in Construction: Critical Study of Problems for Implementation. J. Manag. Eng. 2003, 19, 126–135. [Google Scholar] [CrossRef]

- Morgan, G. Images of Organization; SAGE Publications: Thousand Oaks, CA, USA, 1997; 485p. [Google Scholar]

- Ledbetter, S. Communicating Down the Cladding Supply Chain; Facade Design and Procurement; Center for Windows and Cladding Technology: Bath, UK, 2003. [Google Scholar]

- Tennant, S.; Fernie, S. An emergat form of client-led supply chain governance in UK construction: Clans. Int. J. Constr. Supply Chain Manag. 2012, 2, 1–16. [Google Scholar] [CrossRef]

- Ouchi, W.G. Markets, Bureaucraties, and Clans. Adm. Sci. Q. 1980, 25, 129–141. [Google Scholar] [CrossRef]

- Brusoni, S.; Prencipe, A.; Pavitt, K. Knowledge Specialization, Organizational Coupling, and the Boundaries of the Firm: Why Do Firms Know More Than They Make? Admn. Sci. Q. 2001, 46, 597–621. [Google Scholar] [CrossRef]

- Barratt, M. Understanding the meaning of collaboration in the supply chain. Supply Chain Manag. Int. J. 2004, 9, 30–42. [Google Scholar] [CrossRef]

- Meng, X. Change in UK construction: Moving toward supply chain collaboration. J. Civ. Eng. Manag. 2013, 19, 422–432. [Google Scholar] [CrossRef]

- Gadde, L.-E.; Dubois, A. Partnering in the construction industry—Problems and opportunities. J. Purchasing Supply Manag. 2010, 12, 254–263. [Google Scholar] [CrossRef]

- Plusquellec, T.; Lehoux, N.; Cimon, Y. Design-Build Framework for SMEs in the Construction Industry. In Proceedings of the CCSBE/CCPME Conference—The Development of SMEs and Entrepreneurship in the New Context of Globalisation, Quebec, QC, Canada, 11–13 May 2017. [Google Scholar]

- Rosner, J.W.; Thal, A.E., Jr.; West, C.J. Analysis of the Design-Build Delivery Method in Air Force Construction Projects. J. Constr. Eng. Manag. 2009, 135, 710–717. [Google Scholar] [CrossRef]

- Blayse, A.; Karen, M. Influences on Construction Innovation: A Brief Overview of Recent Literature; The BRITE Project—Building Research, I., Technology, Environment; Cooperative Research Centre for Construction Innovation: Brisbane, Australia, 2003. [Google Scholar]

- Höök, M. Timber Volume Element Prefabrication-Production and Market Aspects. Ph.D. Thesis, Luleå University of Technology, Luleå, Sweden, 2005. [Google Scholar]

- Walford, G. Multistorey timber building in UK and Sweden. NZ Timber Des. J. 2006, 2, 6–13. [Google Scholar]

- Pan, W.; Gibb, A.G.F.; Dainty, A.R.J. Perspectives of house-builders on the use of offsite production in housebuilding. Constr. Manag. Econ. 2007, 25, 183–194. [Google Scholar] [CrossRef]

- Cox, A.G.; Piroozfar, P. Prefabrication as a source for co-creation: An investigation into potentials for large-scale prefabrication in the UK. In Proceedings of the 6th Nordic Conference on Construction Economics and Organisation, Copenhagen, Denmark, 13–15 April 2011. [Google Scholar]

- Van De Kuilen, J.W.G.; Ceccotti, A.; Xia, Z.; He, M. Very Tall Wooden Buildings with Cross Laminated Timber. Procedia Eng. 2011, 14, 1621–1628. [Google Scholar] [CrossRef]

- Pan, W.; Goodier, C. House-Building Business Models and off-Site Construction Take-up. J. Archit. Eng. 2012, 18, 84–93. [Google Scholar] [CrossRef]

- Manninen, H. Long-Term Outlook for Engineered Wood Products in Europe; European Forest Institute: Joensuu, Finland, 2014. [Google Scholar]

- Waugh, A. From the first to the forefront: Waugh Thistleton’s journey from the world’s first timber tower to the disruption of construction. In Proceedings of the Woodrise 2017, Bordeau, France, 12–15 September 2017. [Google Scholar]

- Asad, S.; Fuller, P.; Pan, W.; Dainty, A.R.J. Learning to innovate in construction: A case study. In Proceedings of the 21st Annual ARCOM Conference, SOAS, London, UK, 7–9 September 2005. [Google Scholar]

| Building Number | Building Name | Country | Type of Building |

|---|---|---|---|

| 1 | Tamedia Headquarters | Switzerland | Offices |

| 2 | Esmarchstrasse 3 | Germany | Multi-family |

| 3 | H8 Bad Aibling | Germany | Multi-family |

| 4 | Lifecycle Tower One | Austria | Offices |

| 5 | Stadthaus Murray Groove | England | Multi-family |

| 6 | Bridport House | England | Multi-family |

| 7 | Limnologen | Sweden | Multi-family |

| 8 | Via Cenni | Italy | Social housing |

| 9 | Forté Building | Australia | Multi-family |

| 10 | Treet | Norway | Multi-family |

| 11 | Vannesla Library & Cultural Centre | Norway | Library |

| 12 | City Academy | England | School |

| 13 | Dalston Lane | England | Multi-family |

| 14 | Dougrie Drive | Scotland | Social housing |

| 15 | Tennishall Södra Climate Arena | Sweden | Tennis hall |

| Expert Categories | Number of Interviews |

|---|---|

| Architects | 9 |

| Structural engineers | 6 |

| Builders | 3 |

| Timber elements suppliers | 3 |

| Suppliers-builders | 3 |

| Timber board supplier | 1 |

| Timber building technology developers | 2 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gosselin, A.; Blanchet, P.; Lehoux, N.; Cimon, Y. Collaboration Enables Innovative Timber Structure Adoption in Construction. Buildings 2018, 8, 183. https://doi.org/10.3390/buildings8120183

Gosselin A, Blanchet P, Lehoux N, Cimon Y. Collaboration Enables Innovative Timber Structure Adoption in Construction. Buildings. 2018; 8(12):183. https://doi.org/10.3390/buildings8120183

Chicago/Turabian StyleGosselin, Annie, Pierre Blanchet, Nadia Lehoux, and Yan Cimon. 2018. "Collaboration Enables Innovative Timber Structure Adoption in Construction" Buildings 8, no. 12: 183. https://doi.org/10.3390/buildings8120183

APA StyleGosselin, A., Blanchet, P., Lehoux, N., & Cimon, Y. (2018). Collaboration Enables Innovative Timber Structure Adoption in Construction. Buildings, 8(12), 183. https://doi.org/10.3390/buildings8120183