Project Cost Overrun Risk Prediction Using Hidden Markov Chain Analysis

Abstract

1. Introduction

2. Literature Review

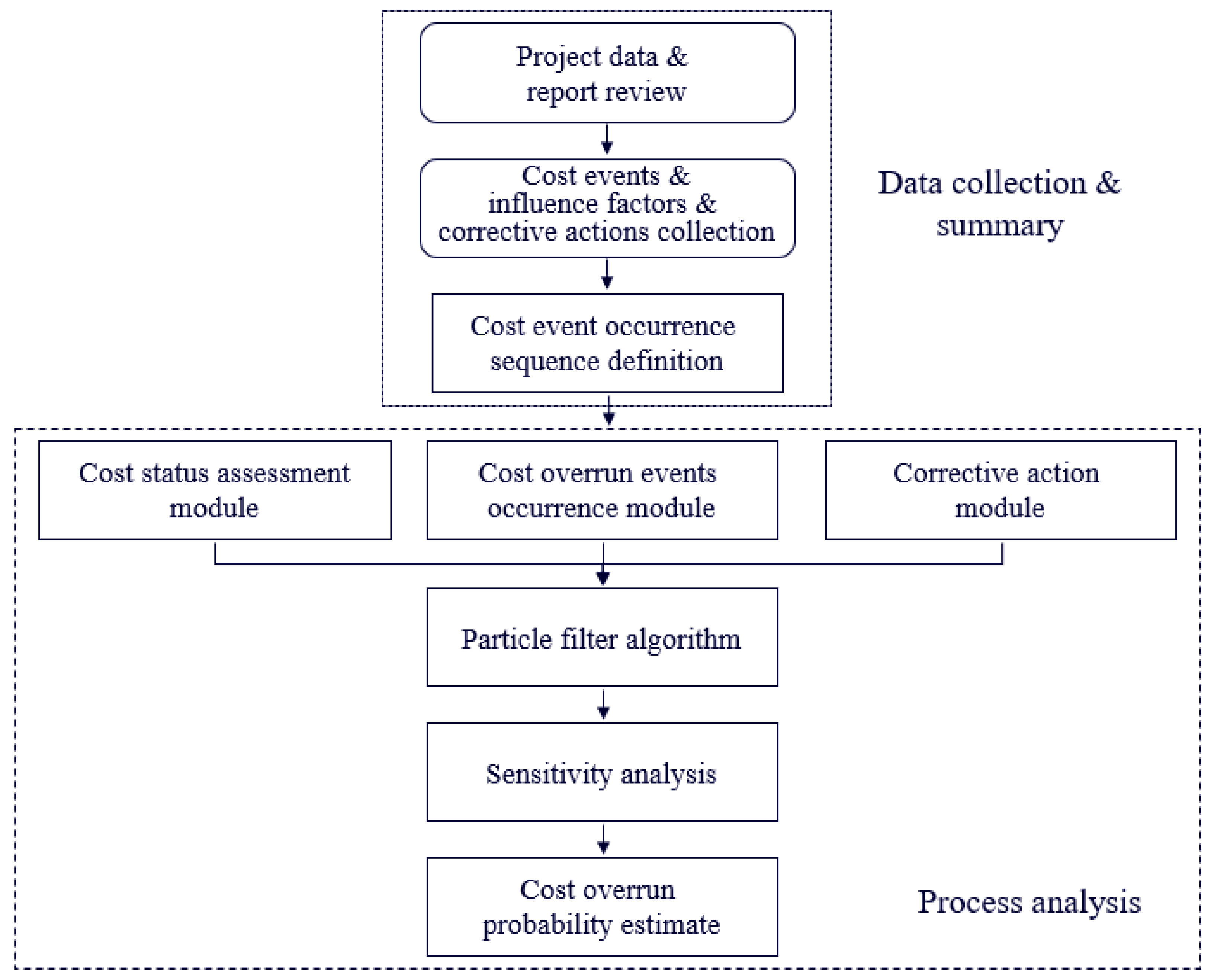

3. Real-Time Cost Overrun Prediction Method

3.1. Poisson Cost Overrun Model

3.1.1. Cost Overrun Events Occurrence Module

3.1.2. Corrective Action Module

3.1.3. Cost Status Assessment Module

3.2. Real-Time Bayesian Updating Model

3.2.1. Real-Time Estimation and Prediction Algorithms

3.2.2. Real-Time Cost Overrun Probability

3.2.3. Future Cost Overrun Probability

3.2.4. Simulation Sampling

3.2.5. Model Revisited

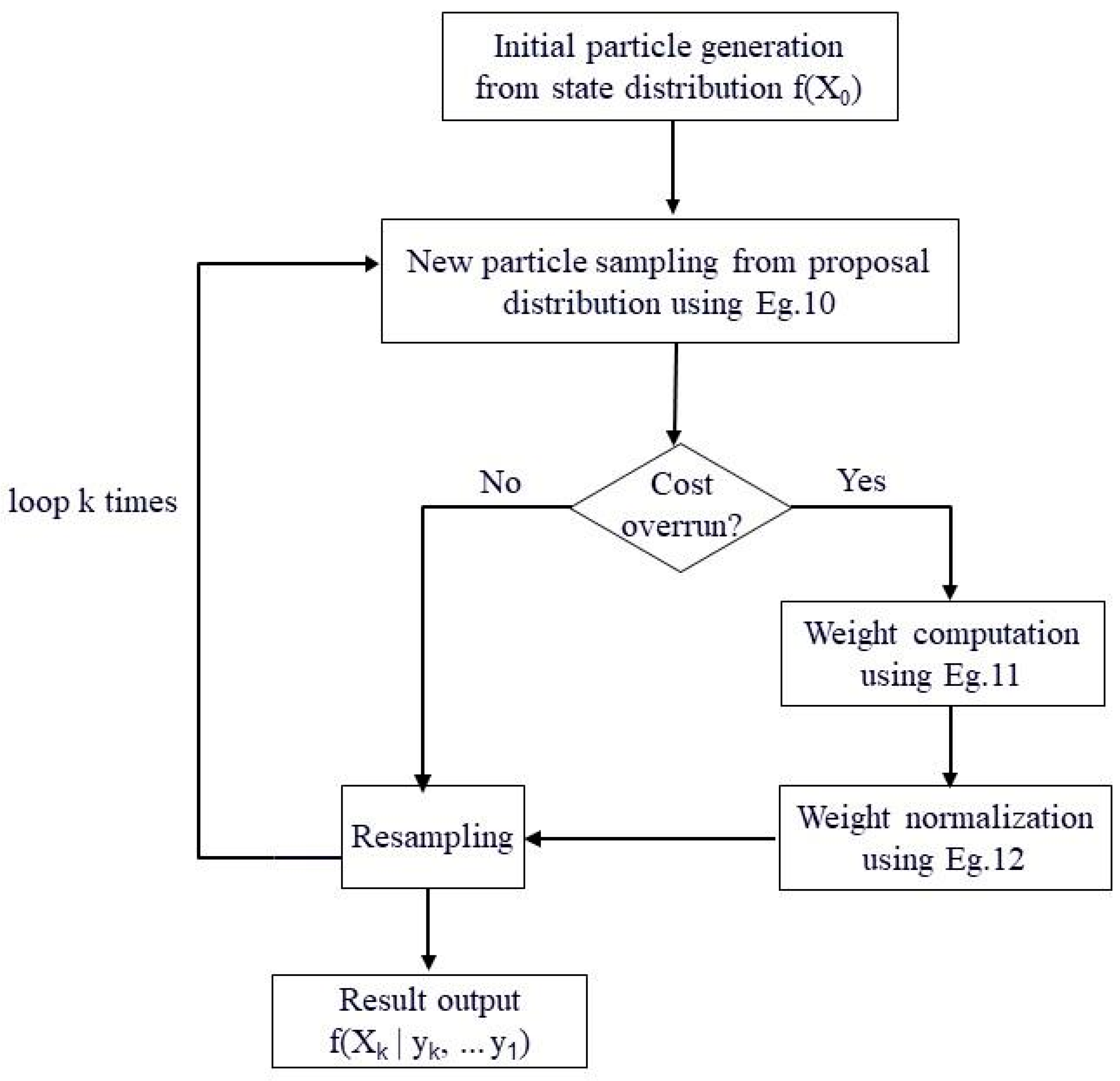

3.2.6. Particle Filter Approach and Process

3.2.7. Check for Corrective Actions

4. Model Validation and Explanation

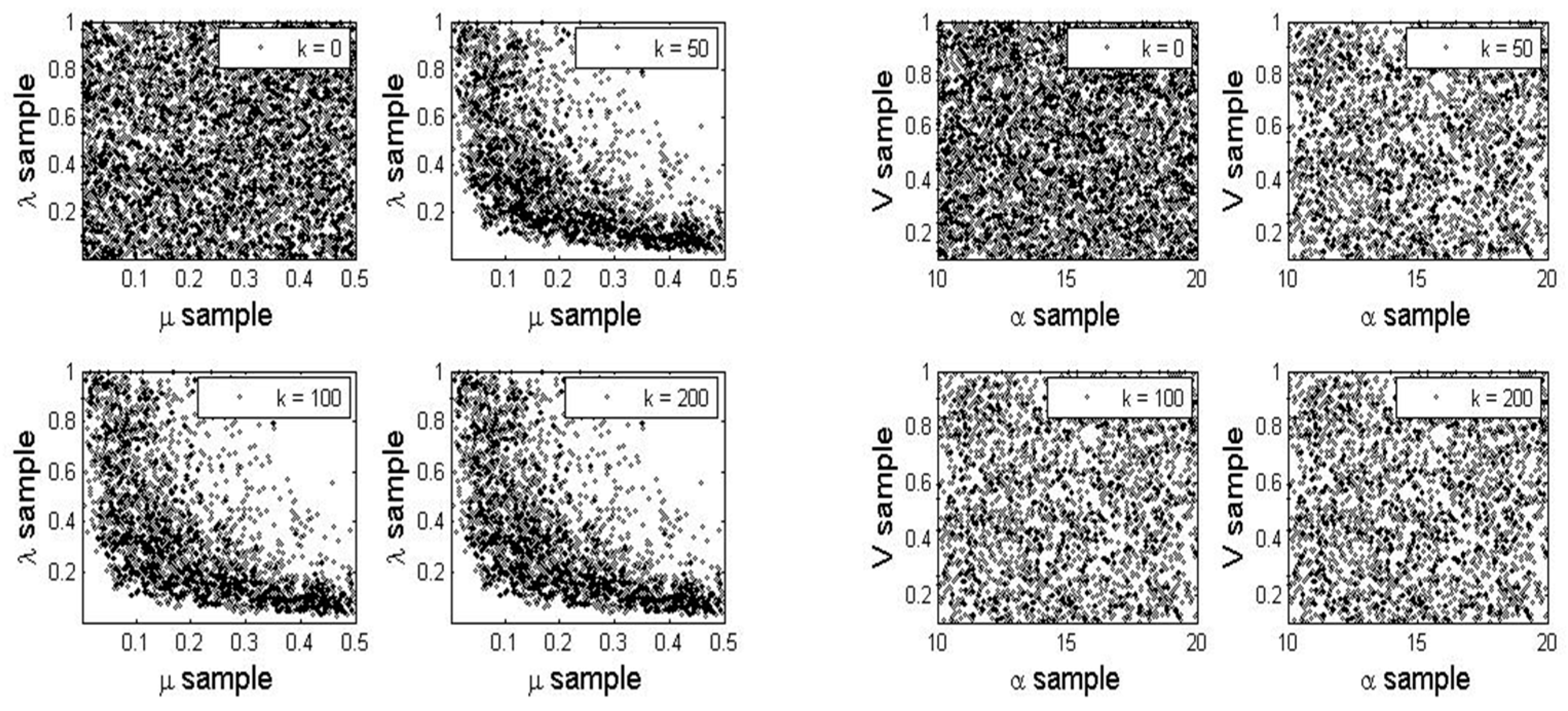

4.1. Parameter Tuning

4.2. SRC Building Project in Taiwan

5. Conclusions and Recommendations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Elinwa, A.; Buba, S. Construction cost factors in Nigeria. J. Constr. Eng. Manag. ASCE 1993, 119, 698–713. [Google Scholar] [CrossRef]

- Hartley, J.R.; Okamoto, S. Concurrent Engineering: Shortening Lead Times, Raising Quality, and Lowering Costs; Productivity Press: Shelton, Conn, 1997. [Google Scholar]

- Teicholz, P. Forecasting final cost and budget of construction projects. J. Comput. Civ. Eng. ASCE 1993, 126, 511–529. [Google Scholar] [CrossRef]

- Baccarini, D. The maturing concept of estimating project cost contingency—A review. In Proceedings of the 31st Australasian University Building Educators Association Conference (AUBEA 2006): Building in Value, Sydney, Australia, 11–14 July 2006; pp. 2327–2337. [Google Scholar]

- Barraza, G.A.; Back, E.; Mata, F. Probabilistic monitoring of project performance using SS-curves. J. Constr. Eng. Manag. ASCE 2000, 126, 142–148. [Google Scholar] [CrossRef]

- Touran, A.; Lopez, R. Modeling cost escalation in large infrastructure projects. J. Constr. Eng. Manag. ASCE 2006, 132, 853–860. [Google Scholar] [CrossRef]

- Plebankiewicz, E.; Wieczorek, D. Prediction of cost overrun risk in construction projects. Sustainability 2020, 12, 9341. [Google Scholar] [CrossRef]

- Knight, K.; Fayek, A.R. Use of fuzzy logic for predicting design cost overruns on building projects. J. Constr. Eng. Manag. ASC 2002, 128, 503–512. [Google Scholar] [CrossRef]

- Touran, A. Probabilistic model for cost contingency. J. Constr. Eng. Manag. ASCE 2003, 129, 280–284. [Google Scholar] [CrossRef]

- Odeck, J. Cost overrun in road construction—what are their sizes and determinants? Transp. Policy 2004, 11, 43–53. [Google Scholar] [CrossRef]

- El-Kholy, A.M. Predicting Cost overrun in construction projects. J. Constr. Eng. Manag. ASCE 2015, 4, 95–105. [Google Scholar] [CrossRef]

- Ahiaga-Dagbui, D.D.; Smith, S.D. Dealing with construction cost overruns using data mining. J. Constr. Manag. Econ. 2014, 32, 682–694. [Google Scholar] [CrossRef]

- Huo, T.; Ren, H.; Cai, W.; Shen, G.Q. Measurement and dependence analysis of cost overruns in megatransport infrastructure projects: Case study in Hong Kong. J. Constr. Eng. Manag. ASCE 2018, 144, 05018001. [Google Scholar] [CrossRef]

- Ashtari, M.A.; Ansari, R.; Hassannayebi, E.; Jeong, J. Cost Overrun Risk assessment and prediction in construction projects: A Bayesian network classifier approach. Buildings 2022, 12, 1660. [Google Scholar] [CrossRef]

- Chen, H.; Chen, L.T.; Lin, Y.L. Earned value project management: Improving the predictive power of planned value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- Acebes, F.; Pereda, M.; Poza, D.; Pajares, J.; Galán, J.M. Stochastic earned value analysis using Monte Carlo simulation and statistical learning techniques. Int. J. Proj. Manag. 2015, 33, 1597–1609. [Google Scholar] [CrossRef]

- Sackey, S.; Lee, D.E.; Kim, B.S. Duration Estimate at Completion: Improving Earned Value Management Forecasting Accuracy. KSCE J. Civ. Eng. 2020, 24, 693–702. [Google Scholar] [CrossRef]

- Zhao, M.; Zi, X. Using earned value management with exponential smoothing technique to forecast project cost. J. Phys. Conf. Ser. 2021, 1955, 21–23. [Google Scholar] [CrossRef]

- Yu, F.; Chen, X.; Cory, C.A.; Yang, Z.; Hu, Y. An active construction dynamic schedule management model: Using the fuzzy earned value management and BP nural network. KSCE J. Civ. Eng. 2021, 25, 2335–2349. [Google Scholar] [CrossRef]

- Akinci, B.; Fischer, M. Factors affecting contractors’ risk of cost overburden. J. Constr. Eng. Manag. ASCE 1998, 14, 67–76. [Google Scholar] [CrossRef]

- Dissanayaka, S.M.; Kumaraswamy, M.M. Evaluation of factors affecting time and cost performance in Hong Kong building project. Eng. Constr. Archit. Manag. 1999, 6, 287–298. [Google Scholar] [CrossRef]

- Elhag, T.M.S.; Boussabaine, A.H.; Ballal, T.M.A. Critical determinants of construction tendering costs: Quantity surveyors’ standpoint. Int. J. Proj. Manag. 2005, 23, 538–545. [Google Scholar] [CrossRef]

- Nassar, K.M.; Nassar, W.M.; Hegab, M.Y. Evaluating cost overruns of asphalt paving project using statistical process control methods. J. Constr. Eng. Manag. ASCE 2005, 7, 1173–1178. [Google Scholar] [CrossRef]

- Alshihri, S.; Al-Gahtani, K.; Almohsen, A. Risk factors that lead to time and cost overruns of building projects in Saudi Arabia. Buidlings 2022, 12, 902. [Google Scholar] [CrossRef]

- Wang, W.C.; Demsetz, L.A. Model for evaluating networks under correlated uncertainty—NETCOR. J. Constr. Eng. Manag. ASCE 2000, 126, 458–466. [Google Scholar] [CrossRef]

- Wang, W.C.; Demsetz, L.A. Application example for evaluating networks considering correlation. J. Constr. Eng. Manag. ASCE 2000, 126, 46–474. [Google Scholar] [CrossRef]

- Yeo, K.T. Risks, classification of estimates and contingency management. J. Constr. Eng. Manag. ASCE 1990, 6, 458–470. [Google Scholar] [CrossRef]

- Xie, W.; Deng, B.; Yin, Y.; Lv, X.; Deng, Z. Critical factors influencing cost overrun in construction projects: A fuzzy synthetic evaluation. Buildings 2022, 12, 2028. [Google Scholar] [CrossRef]

- Kaming, P.F.; Olomolaiye, P.O.; Holt, G.D.; Harris, F.C. Factors influencing construction time and cost overruns on high-rise projects in Indonesia. Constr. Manag. Econ. 1997, 15, 83–94. [Google Scholar] [CrossRef]

- Aljohani, A.; Ahiaga-Dagbui, D.; Moore, D. Construction projects cost overrun: What does the literature tell us? Int. J. Innov. Manag. Technol. 2017, 8, 137–143. [Google Scholar] [CrossRef]

- Monaka, M.; Xhu, L.; Babar, M.A.; Staples, M. Project cost overrun simulation in software product line development. In Proceedings of the Product-Focused Software Process Improvement, 8th International Conference, Riga, Latvia, 2–4 July 2007. [Google Scholar] [CrossRef]

- Barraza, G.A.; Back, E.; Mata, F. Probabilistic forecasting of project performance using stochastic S-curves. J. Constr. Eng. Manag. ASCE 2004, 130, 25–32. [Google Scholar] [CrossRef]

| Act | Pred. | Description | Dur (Days) | Cost (USD) | Work (%) |

|---|---|---|---|---|---|

| 1 | Mobilization | 30 | 9000 | 1.4 | |

| 2 | Girder casting yard | 30 | 12,600 | 2.0 | |

| 3 | 1 | Drive piles in Abutment A | 24 | 7800 | 1.3 |

| 4 | 9 | Drive piles in Abutment B | 24 | 8100 | 1.3 |

| 5 | 7, 12 | Drive piles in Pier no. 1 | 23 | 8100 | 1.0 |

| 6 | 8, 13 | Drive piles in Pier no. 2 | 23 | 6000 | 1.0 |

| 7 | 3 | Cofferdam—install at Abutment A | 15 | 16,000 | 2.9 |

| 8 | 5, 16 | Cofferdam remove—install Pier 1 | 20 | 21,000 | 3.3 |

| 9 | 6, 17 | Cofferdam remove—install Pier 2 | 20 | 21,000 | 3.3 |

| 10 | 4, 19 | Cofferdam remove—install Abut. B | 20 | 21,000 | 3.3 |

| 11 | 21 | Cofferdam remove from Abut. B | 15 | 3000 | 0.5 |

| 12 | 1 | Erect falsework in Span 1 | 25 | 12,000 | 1.9 |

| 13 | 12 | Erect falsework in Span 2 | 25 | 12,000 | 1.9 |

| 14 | 13 | Erect falsework in Span 3 | 25 | 12,000 | 1.9 |

| 15 | 28 | Remove falsework, all spans | 20 | 6000 | 0.9 |

| 16 | 7, 12 | Reinforced concrete, Abutment A | 20 | 15,000 | 2.4 |

| 17 | 8, 13 | Reinforced concrete, Pier 1 (1/2) | 20 | 16,500 | 2.6 |

| 18 | 17 | Reinforced concrete, Pier 1 (1/2) | 20 | 16,500 | 2.6 |

| 19 | 9, 14 | Reinforced concrete, Pier 2 (1/2) | 20 | 16,500 | 2.6 |

| 20 | 18, 19 | Reinforced concrete, Pier 2 (1/2) | 20 | 16,500 | 2.6 |

| 21 | 10, 16 | Reinforced concrete, Abutment B | 20 | 15,000 | 2.4 |

| 22 | 2 | Manufacture PC Girders, Span 1 | 70 | 96,000 | 15.2 |

| 23 | 22 | Manufacture PC Girders, Span 2 | 65 | 96,000 | 15.2 |

| 24 | 23 | Manufacture PC Girders, Span 3 | 65 | 96,000 | 15.2 |

| 25 | 18, 22 | Erection of PC Girders, Span 1 | 15 | 144,400 | 2.3 |

| 26 | 20, 23, 25 | Erection of PC Girders, Span 2 | 15 | 150,000 | 2.3 |

| 27 | 11, 24, 26 | Erection of PC Girders, Span 3 | 15 | 156,000 | 2.4 |

| 28 | 27 | In situ concrete deck, Span 3 | 15 | 9000 | 1.4 |

| 29 | 27 | Approaches, handrails, etc | 30 | 21,000 | 3.3 |

| 30 | 29 | Clean up and move out | 10 | 6000 | 0.9 |

| Time (Days) | Planning Cost (USD) | Actual Cost (USD) | Barraza et al. [32] | Our Model |

|---|---|---|---|---|

| 50 | 65,616 | 65,621 | 0.115 | 0.968 |

| 100 | 204,914 | 206,620 | 0.579 | 0.116 |

| 289 | 632,669 | 635,367 | 0.893 | 0.468 |

| Time (Month) | Activity | Status | Time (Month) | Activity | Status |

|---|---|---|---|---|---|

| 1 | Diaphragm wall finished 30% | Underrun | 19 | 8F, 9F structure finished | Underrun |

| 2 | Diaphragm wall finished 50% | Overrun | 20 | 10F structure finished | Underrun |

| 3 | Diaphragm wall finished 70% | Overrun | 21 | 11F, 12F structure finished | Underrun |

| 4 | Diaphragm wall finished | Overrun | 22 | RF structure finished | Underrun |

| 5 | Excavation finished30% | Overrun | 23 | PHF structure finished | Underrun |

| 6 | Excavation finished 60% | Overrun | 24 | Interior partition, door frame, windows frame finished 50% | Underrun |

| 7 | Excavation finished | Overrun | 25 | Interior partition, door frame, windows frame finished | Underrun |

| 8 | Floating raft pump concrete finished (FS plate) | Overrun | 26 | Exterior decoration under coating varnish, roof water resist, insulation layer finished 51% | Underrun |

| 9 | B2F plate RC finished | Underrun | 27 | Exterior decoration under coating varnish, roof water resist, insulation layer finished | Underrun |

| 10 | B1F plate RC finished | Overrun | 28 | Exterior shelf, frame, railing, brick wall finished 50% | Underrun |

| 11 | Platform construction | Underrun | 29 | Exterior shelf, frame, railing, brick wall finished | Underrun |

| 12 | Steel-reinforced erection construction (Section 1) | Underrun | 30 | Occupation license | Underrun |

| 13 | Steel-reinforced erection construction (Section 2) | Underrun | 31 | Interior decorations finished, inspection and turn over | Underrun |

| 14 | Steel-reinforced erection construction (Section 3 and Section 4) | Underrun | 32 | Interior decorations finished, inspection and turn over | Underrun |

| 15 | 1F structure finished | Underrun | 33 | The interior decorations finished, inspection and turn over | Underrun |

| 16 | 2F, 3F structure finished | Underrun | 34 | Interior decorations finished, inspection and turn over | Underrun |

| 17 | 4F, 5F structure finished | Underrun | 35 | Interior decorations finished, inspection and turn over | Underrun |

| 18 | 6F, 7F structure finished | Underrun |

| Month | Influence Factor Status | ||||

|---|---|---|---|---|---|

| Weather | Productivity | Material | Equipment | Management | |

| 1 | −1 | −1 | −1 | −1 | −1 |

| 2 | −1 | 1 | 1 | 1 | 1 |

| 3 | −1 | 1 | 1 | 1 | 1 |

| 4 | −1 | 1 | 1 | 1 | 1 |

| 5 | 1 | −1 | −1 | −1 | 1 |

| 6 | 1 | −1 | −1 | −1 | 1 |

| 7 | 1 | −1 | −1 | −1 | 1 |

| 8 | 1 | 1 | 1 | −1 | −1 |

| 9 | −1 | −1 | −1 | −1 | −1 |

| 10 | −1 | 1 | 1 | −1 | −1 |

| Combination | Factor Considered | Combination | Factor Considered |

|---|---|---|---|

| 1 | Management | 11 | Management and productivity |

| 2 | Management | 12 | Management and productivity |

| 3 | Weather | 13 | Management and weather |

| 4 | Weather | 14 | Management and weather |

| 5 | Productivity | 15 | Management and material |

| 6 | Productivity | 16 | Management and material |

| 7 | Material | 17 | Management and equipment |

| 8 | Material | 18 | Management and equipment |

| 9 | Equipment | 19 | management, Productivity and weather |

| 10 | Equipment | 20 | management, Productivity and weather |

| Combination | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stage | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | Real Value |

| 1 | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U |

| 2 | U | O | U | U | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 3 | O | O | U | U | O | O | O | O | O | O | O | O | U | O | O | O | O | O | U | O | O |

| 4 | O | O | U | U | O | O | O | O | O | O | O | O | U | O | O | O | O | O | U | O | O |

| 5 | U | O | U | U | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | U | U |

| 6 | O | O | O | U | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | U | U |

| 7 | O | O | O | U | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | U | U |

| 8 | U | O | O | U | O | O | O | O | U | O | U | O | U | O | U | O | U | O | U | O | O |

| 9 | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U | U |

| 10 | U | O | U | O | O | O | O | O | U | O | U | O | U | O | U | O | U | O | U | O | O |

| 11 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | U | O |

| 12 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | O |

| 13 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 14 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 15 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 16 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 17 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 18 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| 19 | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U | O | U |

| Our Model | EVM | |

|---|---|---|

| Total number matched | 29 | 27 |

| Total prediction number | 35 | 35 |

| Percentage of accuracy (%) | 82.9 | 77.2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leu, S.-S.; Liu, Y.; Wu, P.-L. Project Cost Overrun Risk Prediction Using Hidden Markov Chain Analysis. Buildings 2023, 13, 667. https://doi.org/10.3390/buildings13030667

Leu S-S, Liu Y, Wu P-L. Project Cost Overrun Risk Prediction Using Hidden Markov Chain Analysis. Buildings. 2023; 13(3):667. https://doi.org/10.3390/buildings13030667

Chicago/Turabian StyleLeu, Sou-Sen, Yanni Liu, and Pei-Lin Wu. 2023. "Project Cost Overrun Risk Prediction Using Hidden Markov Chain Analysis" Buildings 13, no. 3: 667. https://doi.org/10.3390/buildings13030667

APA StyleLeu, S.-S., Liu, Y., & Wu, P.-L. (2023). Project Cost Overrun Risk Prediction Using Hidden Markov Chain Analysis. Buildings, 13(3), 667. https://doi.org/10.3390/buildings13030667