Abstract

As a fundamental feature of green building cost forecasting, external support is crucial. However, minimal research efforts have been directed to developing practical models for determining the impact of external public and private support on green construction projects’ costs. To fill the gap, the current research aims to develop a mathematical model to explore the balance of supply and demand under deflationary conditions for external green construction support and the accompanying spending adjustment processes. The most current datasets from 3578 green projects across Northern America were collected, pre-processed, analyzed, post-processed, and evaluated via cutting-edge machine learning (ML) techniques to retrieve the deep parameters affecting the green construction cost prediction process. According to the findings, public and private investments in green construction are projected to decrease the cost of green buildings. Furthermore, the impact of public and private investment on green construction cost reduction during deflationary periods is more significant than its influence during inflation. As a result, decision-makers may utilize the suggested model to monitor and evaluate the yearly optimal external investment in green building construction.

1. Introduction

The building sector contributes to reducing the adverse impacts of climate change and natural resource diminution [1,2]. According to reports, green buildings account for up to 40% of overall energy use and 30% of greenhouse gas emissions. In the European Union (EU), for example, buildings account for 40% of total energy consumption during their life cycle, 36% of total greenhouse gas emissions, 50% of all raw materials exploited, and 33% of total water use [3]. Furthermore, over the previous decade, the overall number of households in the EU has expanded by 7%, with 195,000,000 homes by 2022 and residential structures accounting for 5.3% of gross domestic product (GDP). These data demonstrate that sustainable building development would considerably reduce greenhouse gas emissions from the construction sector into the atmosphere. Therefore, sustainable construction has been pushed and marketed as a driving paradigm for building industry development.

As a result, sustainable building (also known as green building) has been advocated and represented as a growth paradigm in the building business [4]. Green construction was described as the creation of buildings and the use of environmentally resource-efficient and conscientious methods all over the lifespan of a construction project. Therefore, green construction would significantly reduce adverse environmental consequences and create more effective resource usage [5]. Within the same vein, sustainable construction projects were also proposed as a leading paradigm for building green sector development [6].

Green buildings are critical construction initiatives that greatly influence social welfare [7] where they have a substantial influence on society and the economy globally [8]. A systematic approach to sustainable building considers the local climate and raw resources. Aside from that, sustainable construction projects employ modern technologies that decrease limited resource consumption, ecological footprints, and related life cycle costs [5,9,10,11]. The advantages of sustainable construction are classified into three categories: economic, environmental, and social [12]. Economic advantages include increased rent and sales returns, elevated residence levels and efficiency, and lower long-term expenses [13]. Additionally, the societal components are concerned with ecological biotechnology and the overall equilibrium of all involved parties [14].

Consequently, professionals in academia, industry, and society understand the importance of construction projects in making cities inclusive, resilient, and sustainable. In this environment, many nations confront the task of employing integrated policies, strategies, guidelines, and plans in their building stock to promote inclusivity, mitigation, resource efficiency, and climate change adaptation. However, regardless of these efficient schemes, one of the significant challenges in constructing this new-found paradigm of sustainable construction stock is the persistent worry about finance for long-term amortization, taxation, and house occupation [15].

The significant preliminary capital expenses and decreased market value, compared to traditional buildings, provide stakeholders with a quandary [16]. Implementation, on the other hand, lacks urgency because the present group of politicians will be set out when the severe impacts of climate change are realized. Furthermore, the dispersion of skills across multiple administration ranks (regional, central, and local governments) and many players delays the appropriate advancement of sustainable construction projects [17,18].

In this regard, the engagement of authorities (those accountable for strategy formation and enforcing prosecution procedures) is viewed as an efficient strategy for promoting the requirements of sustainability in the construction arena [19]. Previous study findings and global announcements highlight the social, environmental, and economic gains of green construction projects and the necessity for administration inducements to stimulate the implementation of sustainability principles in the construction industry [20,21]. Furthermore, stakeholders could share power over and affect development efforts, measures, and outcomes that directly affect them [22,23]. Accordingly, it is critical to consider all stakeholders’ expectations and demands when examining the policies governments might implement as efficient tools for decreasing the environmental effect of the green construction industry. As a result, there is still a lack of comprehensive understanding of governance supervision between the public and private sectors and their related legal conditions and terms in green construction projects [24]. Thus, it is suggested to provide a comprehensive analysis of external support’s influence on the green construction cost prediction. In the light of the provided future research recommendation, the current study aims to take the research within this area to the next step by providing an integrated model that considers all influential attributes. Additionally, the developed model is generic as it relies on the collected construction-related real data as a primary input for the prediction process.

From there, the primary objective of this study is to identify the stakeholders that governments may use to develop the sustainability of green construction projects. To accomplish this goal, a hybrid mathematical and machine learning model was utilized to analyze the government’s effect on the cost of green construction projects. Our findings are intriguing and innovative for governmental impacts to improve the home constructions’ sustainability and usage; they may assist nations paying attention to introducing governmental sustainable building policies. It is also critical to build a realistic and general model for regulating the financial interaction between the public and private sectors and researching an organizational investment. Thus, the current research aims to answer the subsequent research question.

How does the external support from the public and private sectors affect the green building construction cost?

2. Literature Review

Depending on the instrument utilized, the academic literature takes several approaches to the drivers (incentive measures) for designing sustainable buildings. Additionally, studies that are linked with the possibility of adopting fiscal incentives, which force compliance with specified conditions or regulations imposed by governments, are investigated [25]. The advantages of sustainable and green structures in implementing environmentally friendly construction techniques, on the other hand, were defended [26]. Thus, construction sustainability development depends on individuals in the industry being aware of the relevance and opportunities presented by green structures and having the capacity and motivation to act based on such information [27].

Incentives for sustainable buildings (e.g., loans, taxes, rebates, and grants) are accessible in Canada and evaluated in terms of energy performance [28]. The inducements to stimulate green and sustainable development in the private sector in the US, on the other hand, were briefly described [10]. In addition, sustainability drivers for real estate securities were investigated [29]. Furthermore, a study found inducements that drive contractors to implement green and sustainable building techniques [28]. However, no detailed explanation of incentives as a technique for driving the implementation of sustainable building has been provided [30].

Administrations in Europe (e.g., Spain) have developed financial support mechanisms and loans to build 9088 new green and sustainable construction and renovate energy proficiency features [31]. Additionally, in Poland, the National Fund for Environmental Protection and Water Management () provides inducement programs for building or acquiring more efficiency within residential buildings [32]. In addition, financial assistance is given in the shape of preferential repayment of a bank mortgage for the purchase/construction of a home. Additionally, regional schemes have been introduced in Hamilton/Canada, where a property exemption of the federal tax of up to 75% is projected to accumulate on a newly built green and sustainable construction [33]. Moreover, the Finnish Energy Certificate Act forces residential owners to get an energy certificate and follow permission processes before purchasing or renting a property [34].

Switzerland’s “Building program” incentivizes house restoration to enhance windows, walls, roofs, and floors [35]. Another representative example from Singapore that illustrates the role of external support in fostering the transformation into green construction, where the government established the Green Mark Scheme (GMS) 17 years ago to endorse green and sustainability in the erected setting and enhance ecological consciousness amongst designers, developers, and builders throughout the project life cycle, from scheme conception and design through completion. They have developed a series of incentives to promote the private sector to assemble green buildings that earn the highest GMS rating, reimbursing up to 50% of qualifying expenses to increase buildings’ energy efficiency [36]. A project is also ongoing to develop strategies for the National Sustainable Development Plan (), providing economic advantages and inducements to encourage green and sustainable construction in Colombia [37]. Lacking a special enticement for the construction process itself, the improved investment adjustment plan in the United Kingdom enables a 100% investment cost deduction in meeting the criteria for having equipment that can be used to save energy [38]. In the same vein, in Portugal, metropolitan buildings’ estate transfer taxes can be waived if the energy effectiveness of the building is improved. Additionally, metropolises might additionally lower community estate tax rates for inner-city houses deemed energy-effective, sustainable, and green depending on annual power usage [39].

Moreover, several incentives for the green building were circulated all over France. For instance, property taxes are partially or fully waived for structures that have earned low energy expenditure accreditation. Exemptions might reach 100%, varying based on the judgment of the municipal authorities deciding the exemption duration. Depreciation allowances occur in the Netherlands for ecologically friendly estates in random environmental investments’ depreciation. In addition to standard depreciation, up to 36% of capital investment can be deducted from taxable earnings [40].

The literature evaluation demonstrates work that improves sustainable building through various government incentives. However, most research and legislation have concentrated on sustainability without considering the influence of external support throughout the building’s life cycle (i.e., loans, taxes reduction, rebates, and grants). Furthermore, these developed models were created to account for financial aspects for a limited phase, particularly when main equilibrium targets, which is the economic scenario in which market demand and market supply are equal to one other, resulting in price level stability, are specified. Furthermore, earlier studies sought to quantify the impacts of government incentives on the green building construction industry; however, no existing research has simulated all potential instances to evaluate government assistance. As a result, further study is required to uncover legislative drivers, which are the policies and strategies related to green construction industry, given the many leadership levels that might make decisions and the vast range of tools accessible to assess the entire construction life cycle, which supports the current paper’s interest. The current study is one of a kind and will interest public investment legislators. As a result, it adds to the state-of-the-art on green construction project management by establishing a macroeconomic, financial mathematical model that calculates GDP changes for green project investment. The findings give developers valuable insights into improving public investment policies to enhance the private sector’s efficiency in green development.

3. Methodology

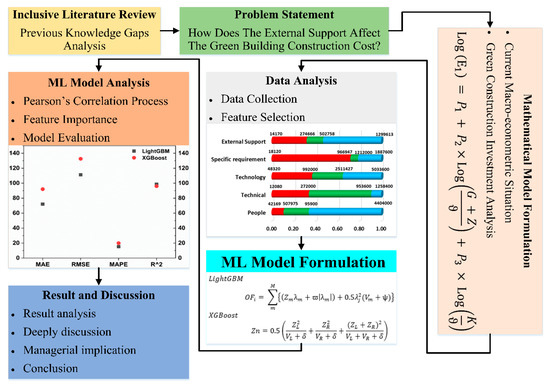

The present study consists of the following phases. The primary goal is to create a model for estimating green construction project costs based on external support impact. First, the current situation is examined using updated parameters of the traditional macro-econometric model to approximate fluctuations in domestic output because of green construction investment. The economic situation’s issues within the existing macro-econometric model are then included in the study to increase the model’s proficiency. Next, the implications of public finance on public investment (particularly the calculation of governmental bond equilibrium as a percentage of GDP) in the green building industry are investigated. Following that, data collection and feature selection were carried out. Finally, a machine learning algorithm discusses and simulates the applicability of the proposed model. Figure 1 represents a flowchart of the adopted research methodology.

Figure 1.

Flowchart methodology of the proposed model.

4. Mathematical Model Formulation

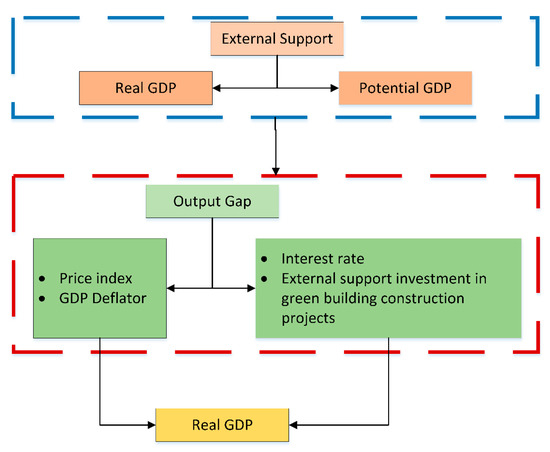

For solid mathematical representation, it is necessary to examine all current significant factors that impact the characterization of the best external investment in green building projects. It is also critical to explicitly state the fundamental assumptions and describe how they impact the current research outputs. Furthermore, it is thought that good econometric modeling is dependent on how stakeholders react to policy changes. Therefore, when analyzing the green building project investment, the present economic condition is considered, with a deflationary gap supposed to account for swings in interest rates caused by the investment. The output gap is utilized as an explanatory variable to address such constraints in the proposed model.

The economic technique used during the deflationary era analyses is depicted in Figure 2. It is demonstrated that the cost of building materials decreases while the value of capital grows, resulting in savings and debt payback. In this instance, demand falls while supply surpasses demand, resulting in a deflationary gap. As a result, for the period of deflationary, the production gap falls lower than 0, resulting in a gap of deflationary [41]. When the production gap exceeds 0, an inflation gap with a point is inflationary, which may be described as the difference between the present concentration of the real GDP and the GDP expected to happen if a financial system operates at a maximum employment rate [42]. Equation (1) expresses the output gap.

Figure 2.

Proposed model architecture, including the output gap.

As a result, the output gap is used as an explanatory feature to arrange the link between the price index, the output gap, and interest rates to include it in the model’s form. The model’s basic setup takes price declination effects into account. During a deflationary phase, when demand falls below supply, the GDP deflator and the consumer price index decline in proportion to the production gap level. Furthermore, if the economic stimulus is measured in financial expenditure, GDP on the demand side will rise, the output gap will narrow, and the GDP deflator and price index will enhance. Consequently, real GDP variations are estimated while considering price impacts. The fundamental setup of the developed mathematical model that investigates the impact of interest rates is also demonstrated. Because of a scarcity of cash in the market because of financial expenditure, it is believed that interest rates will rise, and green building investment will fall.

However, in a zero-interest-rate environment with no future initiatives from the private sector, the adverse effect of government expenditure on market interest rates is negligible. Preferably, the beneficial impact should be significant in demand generation [43]. As a result, this article modifies the impacts and functions of financial expenditure throughout the deflationary phase while contemplating the negative and positive consequences on interest rates. Furthermore, because availability is an essential aspect of the current research, the production function that was developed by has been created to estimate the GDP gap using accessibility indices, as shown in Equation (2) [44].

where is total factor productivity, is the unemployment rate, is the number of employees, is the operating rate, is capital stock, is the capital allocation rate, and is the accessibility factor for the green construction materials.

To mathematically represent the real potential GDP once the trend item is set to , the following equation Equation (3) is achieved.

where , , and are the parameter estimations of the production function, represents the capital stock of the private sector, is the rate of occupancy, is the working hours (non-agricultural and forestry), and is the labor population.

The generalized cost function amongst living zones is described as accessibility by considering the average living zones’ residents and given the reciprocal as represented in Equation (4).

where represents the living area, represents the living area accessibility of green building , is the generalized cost function between living zones of green building , and is the population of living area .

The economic model identifies defining attributes for the mathematical model’s fundamental structure and formulation. However, because green building development is a strategy attribute, an accessibility index is utilized as a production variable. Furthermore, the function of fiscal expenditure should be recognized by considering random factors of the deflationary phase and the private enterprises’ debt, which may trigger an awareness of the economic condition during deflation.

As a flow effect, the suggested model addressed the influence of private debt on private investment in the existing deflationary financial system. As a result, green building maintenance improves production efficiency as a stock impact. Furthermore, during an inflationary time, construction firms enhance potential capital expenditure to boost revenues and raise corporate debt. On the contrary, construction businesses cut investment expenditure and corporate debt during the deflationary era to lower corporate debt. The study revealed that the savings–investment disparities for enterprises and families are positive, implying no consumption or principal investment, while the general government’s debt remains constant. Creating enough demand promotes the fiscal cycle for the green building construction arena. As demonstrated in Equation (5), the function of private consumption represents the effect of the private construction business.

represents the difference from the previous period of variable , is the private company equipment, is the gross domestic product, is the government’s final consumption expenditure, is the permanent investment growth rate, is the interest rate for the long term, is the green construction material cost index, is the private enterprise equipment, and is the debt. The green construction material cost index is mathematically represented in .

represents the variables’ logarithm variation for the individual cycle, ϑ is the consumer price index, is the deflator, is the consumption tax, is the tax conversion factor in deflationary phase, and is the interest rate within the short term. Here, Equation (7) shows the mathematical representation of the final private consumption spending.

where is the final private consumption spending, represents the potential gains, is the economic asset equilibrium, is the stipend, and the describes the deflator of the and short-item interest rates.

Consequently, the slight impact of interest rates within the short term on the means that escalating the interest rates has not impacted the soaring green construction materials’ costs.

5. Data Collection and Feature Selection

The overall cost of green construction projects was acquired from various resources, involving the green building council internet site, periodicals, and other associated websites. Integrated cost datasets for 3579 LEED-certified green constructions beneath concern (located across Europe and Northern America) were acquired from different resources and incorporated into the built schemes. The internet sites of green building councils in Europe, Canada, and the United States were used as primary data sources for this study [45,46]. In preparation for the analytical method, the collected datasets covering the 2010–2021 period were recorded via MS Excel software. However, it took around three years to confirm that the data acquired was sufficient and valuable for the technique.

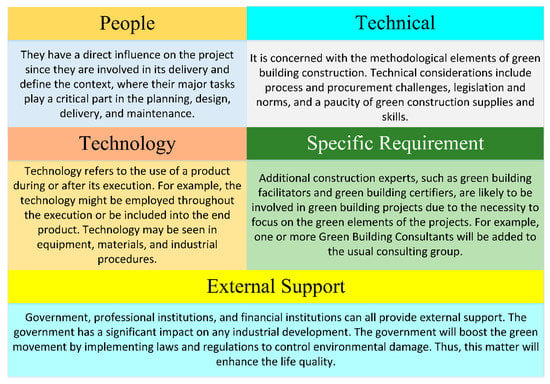

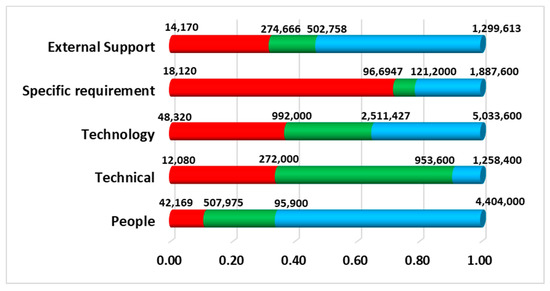

The financial functioning of each green construction project in the collected dataset was quantified and compared. The data were changed according to the location to provide consistent findings for comparison. Furthermore, the designs of the built buildings were examined to estimate and assess future costs. People, technical, technological, and requirements are the variables impacting the cost of green construction projects rather than external government help [47,48,49,50]. Figure 3 depicts a more detailed explanation of these aspects. Table 1 is also presented to understand better the features that influence the total price of green construction ventures. Figure 4 also shows the distributions of the datasets used.

Figure 3.

Feature description.

Table 1.

Description of green building cost influential factors.

Figure 4.

Statistical range of the collected data (USD).

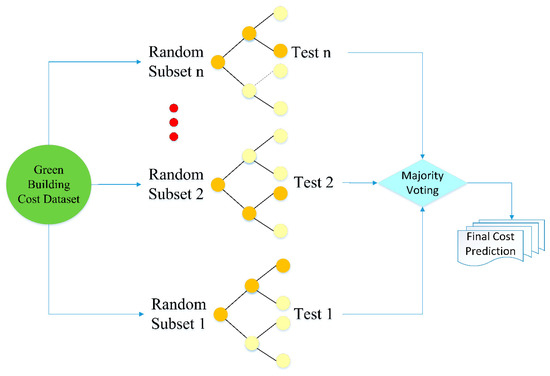

6. ML Models

6.1. Light Gradient Boosting Machine (LightGBM)

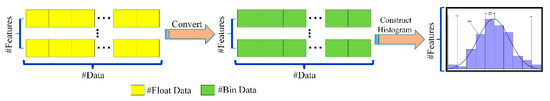

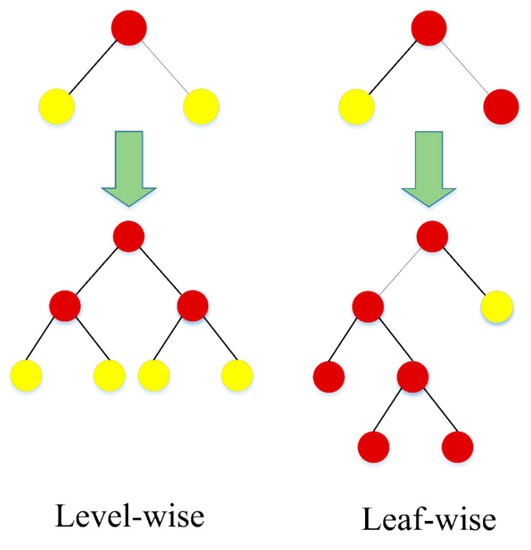

The algorithm is produced based on the decision-tree concept by Microsoft Research [51,52]. Additionally, it needs low memory space to be run with high accuracy; thus, it is considered an effective technique for solving regression and classification problems. The technique was formulated based on three algorithms [53]; (1) gradient-based one-side sampling () which is used to preserve all large gradients and implement random sampling on small gradients; (2) exclusive feature bundling () which is used to break features into fewer mutually incompatible packages; and (3) once the features are converted, the required quantity of statistics will be accumulated in the histogram to find the optimal division spot based on the detached value in the histogram as presented in Figure 5. Figure 5 also provides the histogram approach and tree leaf-wise growth technique used in the algorithm to develop the training procedure and reduce memory utilization. Level-wise and leaf-wise development methods were also illustrated in Figure 6 to explain that the leaves on the same layer are separated simultaneously. Optimizing several threads is preferable to maintain model complexity under control. Moreover, even though different amounts of information are absorbed, leaves on the same layer are processed uniformly.

Figure 5.

illustration of the proposed model.

Figure 6.

Learning process of .

Because the leaf-wise strategy only splits the leaf with the essential information gained on a similar layer, it has a better probability of succeeding, as seen in Figure 6. Additionally, trees with a high level of depth can be produced utilizing this method; accordingly, a maximum depth limitation is established through tree growth [54].

The ’s theory was illustrated as shown in the Equations below; thus, the green building cost can be predicted by the as shown in Equation (8).

Then, the loss function () was minimized to determine during the learning process. Therefore, Equation (9) is presented to calculate the .

where denotes the predicted green building cost by the , n denotes the decision tree’s number, denotes tree’s prediction of green building cost, denotes the input feature, and denotes the tree’s learned feature.

function was used to obtain the minimum value between the initial predicted value and the actual green building cost . As shown in Equation (10), the square error to estimate the model accuracy in case is more than one.

Loss function and regularization item (), presented in Equation (11), which expresses the model proficiency was integrated to formulate the objective function () as represented in Equation (12).

The learning stage is controlled by hyperparameters (i.e., ). The overall number of leaf nodes and the leaf node index are symbolized by and , respectively. Additionally, represented the estimation of the model at the leaf node. The objective function was estimated using the Taylor function of second order. In addition, the objective function is determined precisely by applying the learning results extracted from the () method, as shown in Equation (13).

The 1st and 2nd derivatives of for were denoted by and , respectively. Thus, the objective function can be rewritten, as shown in Equation (14).

where, and are equal to and , respectively. Additionally, the sample index and the overall number of samples were expressed by and , respectively. The first derivation of for has to be zero to get the smallest , as shown in Equation (15).

Therefore, the objective function listed in Equation (14) was rewritten as shown in Equation (16).

where can be calculated as shown in Equation (17).

The evaluation function for leaf node effectiveness was introduced in Equation (18). Additionally, Equation (18) helps choose the most appropriate node for the further split. When new two leaf nodes are produced, the difference in following the split, denoted by , was computed as shown in Equation (19).

All terms in left and right were related to the values of on the new left and right nodes produced from the node, respectively. Thus, the model will obtain the largest by selecting the most appropriate features to separate from the leaf node.

6.2. Extreme Gradient Boosting (XGBoost)

is considered an ascendable tree optimization algorithm that has recently gained popularity in data analysis fields due to its ability to produce accurate prediction models [55,56]. The algorithm was presented as a unique applied gradient boosting machine, mainly in classification and regression trees (). It also has the ability to handle complex and varied variables even when the data distribution is highly unbalanced. Thus, over-fitting will be avoided, and mathematical ability will be developed. The structure is displayed in Figure 7.

Figure 7.

structure of the proposed model.

The ’s predicted scores were used to create a final score, which was then evaluated using additive functions, as shown in Equation (20). Where each leaf was taken a total score by .

where denotes the predicted green building cost, denotes the number of trees, denotes the independent leaf score, denotes the available training database (input features), and the ’s space is represented by . The objective function needs to be optimized, as shown in Equation (21).

The term of the is the regularization item that can be calculated as given in Equation (22).

where the constants (i.e., , ) were assigned to control the regularization’s degree, the leaf’s score, and the overall number of leaves were symbolized by , respectively [57]. Due to the use of additive training, the at step is written as shown in Equation (23).

Equation (24) also was provided to simplify Equation (23), as shown below.

Therefore, the objective function in Equation (21) can be reformulated, as shown in Equation (25).

Additionally, the objective function can be estimated using the Taylor function of second-order, as shown in Equation (26).

The and can be computed as shown in Equation (27) and Equation (28), respectively.

In addition, when the regularization item is substituted in Equation (26), the objective function can be rewritten as shown in Equation (29).

A simplified objective function without constants can be obtained, as shown in Equation (30).

More simplification for Equation (30) was performed, as shown in Equation (31).

Herein, the and can be calculated as shown in Equation (32) and Equation (33), respectively.

where denotes the data samples in leaf node . The partial derivative of the leaf node’s output is carried out to get the minimal value, as shown in Equation (34).

Equation (34) was solved as shown in Equation (35).

Equation (36) will be produced when Equation (34) is substituted in Equation (31) as follows:

Within the splitting process, the leaf node was scored by applying Equation (37) and which was symbolized by . On the other hand, R and L denote the score on the right and left leaves, respectively.

7. ML Model Analysis

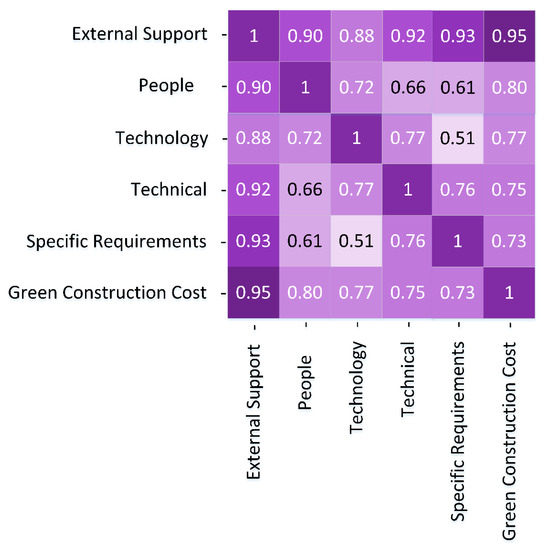

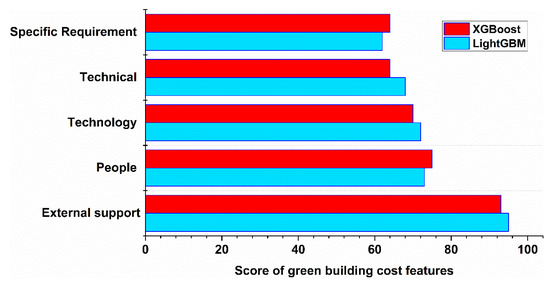

Figure 8 depicts the Pearson’s correlation process between chosen characteristics and the expense value of the green construction project to examine the effect of external support attributes on other features and the green building cost. Improved comprehension of the model’s properties aid decision-makers in efficiently planning and formulating policies. Consequently, a feature significance method was performed utilizing the and to determine the relevance of each feature included in projecting the green building cost. A feature scale, furthermore, a plot to produce a relative score for each variable was utilized. Additionally, as shown in Figure 9, the characteristics were prioritized in the following order: External support, People, Technology, Technical, and Specific demand. The analysis results imply that external support is critical in reducing the green construction project cost via an interconnected effect on all influential factors. The external support factor positively influenced the green construction cost, specific requirements, technical, people, and technological aspects in a descending manner with and respectively.

Figure 8.

Heated correlation matrix analyses.

Figure 9.

Representation of feature importance.

ML Model Performance Assessment

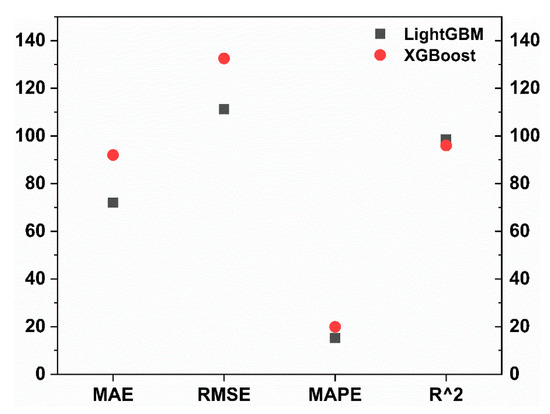

After testing the primary model assumptions, evaluating the suggested model’s effectiveness and prognostic capacity is vital. Therefore, the evaluation measured was employed to assess the developed model’s proficiency, where four statistical metrics (i.e., , , , and ) were applied to investigate the effectiveness of the proposed models as expressed in Equations (38)–(41).

where signifies the measured (actual) green construction cost, epitomizes the predicted result, represents the mean of the , signifies the number of the datasets utilized, and is the independent attribute. The prediction accuracy improves if approaches one as well as , , and measures approach zero. The findings of the evaluation metrics were calculated, as shown in Figure 10.

Figure 10.

Evaluation metrics analysis.

The comparison results present that and have higher measures of values (more than 0.90) and lower , , and values in the green building cost prediction. While all evaluation metrics calculations also reveal that had superb forecast capacity and had the maximum value of . Additionally, the lowest values for the remaining evaluation metrics (i.e., , , and ) were associated with the model, as shown in Figure 10. Furthermore, the predicted results of the model demonstrate that its forecast outcomes are highly close to the actual green construction projects’ costs. The ’s decisive value is 0.985, indicating that the prediction model is also mounted to the collected datasets because it was close to . Consequently, the model has a superior fit and minor deviation compared to the actual green construction cost. Accordingly, the is the most competent and efficient model in green construction cost prediction.

8. Proposed Model Results

This study was conducted to develop and expand the literature on the impact of external support in estimating green construction projects’ costs. Initially, the four primary attributes and the public and private external support factors that influence the green construction cost were comprehensively described, disaggregated, and examined to consider their core sub-features. Next, these attributes were assessed based on their obtained datasets to create the machine-learning-based forecast models in sequence with precision assessment metrics to emphasize the ambiguity combined with the cost prediction.

The analysis results indicate that external support is critical to ensure a smooth transition towards green constriction projects. The -based prediction outputs show that the external support attribute has a positive impact on the green construction cost reduction via progressively enhancing the influence of the critical features for green construction cost estimation. Additionally, the current study’s findings provide a concrete foundation for decision-makers in categorizing the impact of the external support, people, technological, technical, and the specific requirements aspects on green construction cost in descending order with and respectively. Additionally, green construction contractors should employ cutting-edge technological tools to smooth the utilization of effective practical construction-related methods essential for impartial green construction price optimization. Thus, it is vital to emphasize the significance of employing forecast machine-learning-based models to generate precise forecasts for the green construction cost. Consistent with the implemented research approach, the findings show the importance of investigated factors and their sub-groups (e.g., technology, people, external support, technical, and specific requirements), exhibiting the significance of green construction cost objective adjustment of substitutes. For instance, the green construction cost function was mediocre at 95% associated with external support, while it was influenced by the technical, technological, special requirements, and people at 75%, 77%, 73%, and 80%, respectively.

Additionally, the variant in the cost objective function is examined through a variety of sub-factors, indicating a high level of reliance, affecting the aptitude of the decision-making process. Subsequently, the developed cost forecast models for green construction projects employ the cost-efficient frontier methodology to influence this subject and rationalize the correct decision-making process. The founded cost forecast models also demonstrated that had surpassed the by . Hence, the prognostication model characterizes the most obvious choice for decision-makers from a sustainable and economic perspective to deliver the most precise cost prognostication with the slightest correlated risk and the optimal external support quantified.

The influence of the external support of green construction cost prediction was mathematically derived from the current research. As expressed in Equation (7), the short-term interest rates can be represented as a function of the money stock and the . The mathematical model proved that with the optimal quantity of the external support, the impact of money stock on green construction cost has decreased, whereas the supply impact and boosted tax returns support the reduction of green construction cost, which is vital to pave the road towards the green construction industry thriving. Though, subsequently, the is anticipated to expand, causing the taxation rates to diminish. Public investment is required to fill the deflationary gap in such a situation.

9. Discussion

Various investigations have been performed to determine if the price of green construction projects will rise or decline when external support varies [58]. Green structures are projected to cost 5–10% more than conventional ones, where the green construction expenses grow by 1–2%. However, according to other research findings, green construction costs are increased by fewer than 2% compared to conventional construction [59]. The ambiguous conclusions hindered the evaluation of green construction costs; hence, this is a troubling problem. As a result, the cost prediction models developed in this study provide an informative view of the relationship between influential factors and the green cost premium associated with green buildings.

Based on the information retrieved from 3578 green building projects evaluated in North America, the cost of each building was projected using cutting-edge machine learning algorithms to capture the cost function variance. Green construction designers, vendors, stakeholders, and decision-makers can use the presented models to forecast their innovative green structures’ green construction cost function based on the characteristics of the essential primary components. It should be noted that the current study is limited to green constructions in Canada, the EU, and the United States. It is also constrained regarding the amount of data gathered and the number of primary attributes examined. As a result, assessing the influence of both state and non-governmental external support is necessary.

The current research also examined how the external support from the public and private parties controls green construction and how much funding is expected to support and boost the green construction industry successfully. Numerous lucrative green construction projects are examined to evaluate the industry’s relevance and importance of technical and industrial tools for such a vital sector to flourish. Additionally, the findings of the current study state that the public and private sectors are required to fund the green construction industry via adopting robust financial inducements and endorsing green construction, especially those LEED-Certified. Such strategies are expected to create a beneficial financial setting and competitive market condition essential to drive the sponsorship of green construction.

Presently, the marketing and the research on green construction are highly complicated schemes. Such vital steps require integrated efforts from architects and civil engineers. They need to utilize green strategies and tools and the ecological consciousness of politicians, management interventions, public administrations, and end-users to contribute to the success of the whole progression. This multilevel collaboration necessitates creating a detailed assessment of the buildup ecosystem. Though, due to the complicated influence of the external funding throughout the building phase and the usage of green structures, various objective performance evaluation systems and modeling needs to be used to determine the optimal public and private external funding enlightened with accurate prediction models to provide the decision-makers with so-called “green construction communication”.

To improve and develop new effective policies within the construction management and engineering arena, policymakers increasingly depend on technology breakthroughs and practical decision support tools that are developed via cutting-edge technologies [60,61,62,63,64,65,66,67,68,69,70,71,72]. The currently available literature shows minimal attention directed towards evaluating the impact of external support while considering the other main influential factors (i.e., specific requirements, technical, people, and technological).

The current study intended to close the information gap in green construction cost prediction. As a result, the recommended models were created after thoroughly examining the already known comparable models. One of the major shortcomings, for example, is the absence of a combined portrayal of how the primary qualities impact the green building cost in an interrelated manner. The main biggest problem with the existing green construction cost prediction models is their deficiency of reliability. Not taking into consideration all the essential components of green building expenses has repercussions on the reliability of the established model. Some studies, for example, have concentrated on the characteristics of green building technologies while relaxing the personnel, technical, and criteria, which negatively influences the accuracy of green building cost projections because significant features are usually accompanied by a high level of uncertainty [73].

Furthermore, little work was invested into developing analytic or machine-learning-based techniques for predicting green building costs. Many current models address the practice case for green building expenses using survey and questionnaire approaches. However, more quantitative and objective methodologies for forecasting green construction costs are continually needed [74]. Moreover, some research attempts have presented models that estimate the cost of solely green-certified dwellings [75]. In addition, research studies have focused on green office building certification and the cost of equity capital for green buildings [76,77]. As a result, a comprehensive green construction cost that utilizes a hybrid mathematical and machine-learning-based approach prediction model is necessary to offer practitioners credible forecasting results for the green building construction cost.

Furthermore, historical data on green construction costs is sparse. Established data collection techniques and dataset inclusiveness also were key impediments for researchers in establishing trustworthy and universal prediction models, particularly for large-budget construction projects. As a result, several academics have tried to forecast green building costs; therefore, their findings were confined to a specific area while only a few significant factors were assessed [74,78].

Despite extensive study on drivers in the green building sector, little attention has been paid to the influence of external support on projecting green construction prices. Thus, a global and generic model for predicting green costs is necessary. As a result, the current model outcomes are very innovative and embody a significant improvement over available research because they aid in the investigation of the effect of external support attributes on other features (i.e., specific requirements, technical, people, and technological) and the green building cost to promote sustainability. Thus, the current research creates a robust hybrid mathematical and machine learning framework for estimating green building construction costs from collected datasets that can subsequently be used as a universal model to imitate all connected elements. Such lays the groundwork for future research into how various feature linkages may give insight into green building construction cost forecasts.

Furthermore, as modern machine-learning algorithms evolve, more complex forecast models emerge, paving the way for development of more effective and precise modeling for green building construction cost prediction, which many construction industry practitioners may employ. Conclusively, the authors are confident in the proposed models’ ability to provide practitioners with more accurate predictions to suit the available green constriction projects’ datasets as an advantage preceding acquaintance to fodder ML-based forecasting algorithms, which are in line with what is presently developing in the building manufacturing and management investigations. Furthermore, hybrid prediction models are adept short-operating models with high level of prediction accuracy, reduced memory consumption, and excellent performance.

10. Conclusions

By introducing pricing into the macro-econometric framework, where the present financial situation of deflationary periods can be thoroughly evaluated to determine the optimal external funding for green construction cost reduction, an advanced model was constructed to represent the link between green construction projects’ cost objective function and fiscal development. Furthermore, the suggested model is intended to statistically examine the financial system when the crowding-out event happens, evaluating each relevant element.

The proposed hybrid evaluation methodology proved its ability to demonstrate that policy shocks have a massive influence on the GDP, economy, consumption, and green construction cost in the case of construction market shock compared to the public and private spending. Additionally, the simulation findings demonstrate that the only variable that positively increased GDP and consumption was the technological shock. Furthermore, despite a momentary decline, each economic measure responds positively. Furthermore, executing an investment strategy with a deflationary economy demonstrated that the suggested investment policy is adequate for a deflationary financial system and can provide optimal market circumstances to ensure the green construction prosperity.

The study provided clear answers to the following critical questions that link the external support influence to the green construction cost prediction. First, what is the optimal external support for green construction cost reduction? Second, how can the current market’s financial characteristics be considered when forecasting green construction costs? Third, is the cost of technology, people, and specialized requirements measurable and predictable when the external support is considered? Fourth, are sub-factors affecting this objective green construction cost function? Do the produced prediction models accommodate for ambiguity in the cost function? Finally, do the cost forecasting models developed assist practitioners in making cost-effective decisions? To decrease cost-related risk, the above-stated research problems can be addressed by constructing accurate and resilient machine-learning-based models for cost prediction. The proposed model was demonstrated to provide decision-makers with a decision-support tool for estimating future green building construction costs and opening the road for green structures to be -certified based on economic and sustainability criteria. Five key green building cost aspects and 22 sub-features were evaluated, as well as numerous possible green construction choices, employing complete cutting-edge forecasting models for cost prediction and risk avoidance.

-based cost prediction modeling methodologies increased decision-making supremacy among best practices. and prediction models were created, and their performance was assessed using , , , and R2. The evaluation findings show that and prediction are superior, with low values for all performance assessment criteria suggesting outstanding performance. The , on the other hand, had a lower prediction precision. It, however, has a reasonable degree of accuracy. Machine learning methods can forecast the optimum green building costs.

According to the current study, green construction costs may be correctly forecasted using techniques and seamlessly compared to conventional building prices. In addition, the critical factors that impact the cost of green building were reviewed. Furthermore, the created models are suitable for developed economies, while future studies may focus on emerging economies. Furthermore, the model built may be upgraded to target other infrastructure projects. Furthermore, the established cost prediction algorithms will likely simplify the path toward certification.

Additionally, the current research has substantial theoretical contributions to the body of knowledge. Namely, the developed mathematical model represents a solid foundation for analysis the status quo of the external support directed towards the green construction industry via robust prediction of the cost objective function considering the supply and demand within the market. Furthermore, decision-makers are given decision-support tools to anticipate the overall operating and life-cycle costs of green buildings.

Future study efforts should include more accurate data collecting, pre- and post-processing, larger datasets, and different types of buildings in diverse places. As a result, the external support characteristic must be evaluated because it is projected to impact the cost of the green building substantially. Furthermore, as a future research recommendation, the financial evaluation of certification may be broadened further than construction costs to include the impact on the entire life cycle cost analysis.

Author Contributions

Methodology, O.A., A.S., G.A., R.E.A.M. and A.S.A.; software, O.A., A.S., G.A. and R.E.A.M.; validation, G.A., R.E.A.M. and A.S.A.; writing—original draft, O.A., A.S. and A.S.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Large Groups Project at King Khalid University, grant number RGP. 2/178/43.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Acknowledgments

The authors thank the Deanship of Scientific Research at King Khalid University for funding this work through the Large Groups Project.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wen, Q.; Chen, Y.; Hong, J.; Ni, D.; Shen, Q. Spillover effect of technological innovation on CO2 emissions in China’s construction industry. Build. Environ. 2020, 171, 106653. [Google Scholar] [CrossRef]

- Hurlimann, A.C.; Warren-Myers, G.; Browne, G.R. Is the Australian construction industry prepared for climate change? Build. Environ. 2019, 153, 128–137. [Google Scholar] [CrossRef]

- European Commission. European Union Level(s): Taking action on the Total Impact of the Construction Sector; Publications Office of the European Union: Luxembourg, 2019; p. 16. [Google Scholar]

- Hwang, B.-G.; Zhu, L.; Tan, J.S.H. Green business park project management: Barriers and solutions for sustainable development. J. Clean. Prod. 2017, 153, 209–219. [Google Scholar] [CrossRef]

- Díaz-López, C.; Carpio, M.; Martín-Morales, M.; Zamorano, M. Defining strategies to adopt Level(s) for bringing buildings into the circular economy. A case study of Spain. J. Clean. Prod. 2020, 287, 125048. [Google Scholar] [CrossRef]

- Zhang, X.; Shen, L.; Wu, Y. Green strategy for gaining competitive advantage in housing development: A China study. J. Clean. Prod. 2011, 19, 157–167. [Google Scholar] [CrossRef]

- Forsberg, M.; de Souza, C.B. Implementing Regenerative Standards in Politically Green Nordic Social Welfare States: Can Sweden Adopt the Living Building Challenge? Sustainability 2021, 13, 738. [Google Scholar] [CrossRef]

- López, C.D.; Carpio, M.; Martín-Morales, M.; Zamorano, M. A comparative analysis of sustainable building assessment methods. Sustain. Cities Soc. 2019, 49, 101611. [Google Scholar] [CrossRef]

- Thomas, T.; Praveen, A. Emergy parameters for ensuring sustainable use of building materials. J. Clean. Prod. 2020, 276, 122382. [Google Scholar] [CrossRef]

- Leoto, R.; Lizarraldea, G. Challenges in evaluating strategies for reducing a building’s environmental impact through Integrated Design. Build. Environ. 2019, 155, 34–46. [Google Scholar] [CrossRef]

- AbouHamad, M.; Abu-Hamd, M. Framework for construction system selection based on life cycle cost and sustainability assessment. J. Clean. Prod. 2019, 241, 118397. [Google Scholar] [CrossRef]

- Wen, B.; Musa, S.N.; Onn, C.C.; Ramesh, S.; Liang, L.; Wang, W.; Ma, K. The role and contribution of green buildings on sustainable development goals. Build. Environ. 2020, 185, 107091. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bottero, M. Green premium in buildings: Evidence from the real estate market of Singapore. J. Clean. Prod. 2020, 286, 125327. [Google Scholar] [CrossRef]

- Dirisu, J.; Adegoke, D.; Azeta, J.; Ishola, F.; Okokpujie, I.; Aworinde, A. Ergonomics of domestic building structure on occupants’ health. Procedia Manuf. 2019, 35, 1262–1266. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Darko, A.; Ameyaw, E.E. Strategies for Promoting Green Building Technologies Adoption in the Construction Industry—An International Study. Sustainability 2017, 9, 969. [Google Scholar] [CrossRef]

- Salem, D.; Bakr, A.; El Sayad, Z. Post-construction stages cost management: Sustainable design approach. Alex. Eng. J. 2018, 57, 3429–3435. [Google Scholar] [CrossRef]

- Borg, R.; Gonzi, R.D.; Borg, S. Building Sustainably: A Pilot Study on the Project Manager’s Contribution in Delivering Sustainable Construction Projects—A Maltese and International Perspective. Sustainability 2020, 12, 10162. [Google Scholar] [CrossRef]

- Campisi, D.; Gitto, S.; Morea, D. Shari’ah-Compliant Finance: A Possible Novel Paradigm for Green Economy Investments in Italy. Sustainability 2018, 10, 3915. [Google Scholar] [CrossRef]

- Dobrovolskienė, N.; Pozniak, A.; Tvaronavičienė, M. Assessment of the Sustainability of a Real Estate Project Using Multi-Criteria Decision Making. Sustainability 2021, 13, 4352. [Google Scholar] [CrossRef]

- Adabre, M.A.; Chan, A.P.; Darko, A.; Osei-Kyei, R.; Abidoye, R.; Adjei-Kumi, T. Critical barriers to sustainability attainment in affordable housing: International construction professionals’ perspective. J. Clean. Prod. 2020, 253, 119995. [Google Scholar] [CrossRef]

- Martek, I.; Hosseini, M.R.; Shrestha, A.; Edwards, D.J.; Durdyev, S. Barriers inhibiting the transition to sustainability within the Australian construction industry: An investigation of technical and social interactions. J. Clean. Prod. 2018, 211, 281–292. [Google Scholar] [CrossRef]

- Fan, K.; Wu, Z. Incentive mechanism design for promoting high-level green buildings. Build. Environ. 2020, 184, 107230. [Google Scholar] [CrossRef]

- Yang, R.J.; Zou, P.X.W. Stakeholder-associated risks and their interactions in complex green building projects: A social network model. Build. Environ. 2014, 73, 208–222. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, J.; Shen, G.Q.; Yan, Y. Incentives for green retrofits: An evolutionary game analysis on Public-Private-Partnership reconstruction of buildings. J. Clean. Prod. 2019, 232, 1076–1092. [Google Scholar] [CrossRef]

- Perkins, M.; McDonagh, J.; Ziermans, B. New Zealand local government initiatives and incentives for sustainable design in commercial buildings. In Proceedings of the 19th Annual European Real Estate Society Conference, Edinburgh, Scotland, 13–16 June 2012. [Google Scholar] [CrossRef]

- Love, P.E.D.; Niedzweicki, M.; Bullen, P.A.; Edwards, D.J. Achieving the Green Building Council of Australia’s World Leadership Rating in an Office Building in Perth. J. Constr. Eng. Manag. 2012, 138, 652–660. [Google Scholar] [CrossRef]

- Andelin, M.; Sarasoja, A.-L.; Ventovuori, T.; Junnila, S. Breaking the circle of blame for sustainable buildings—Evidence from Nordic countries. J. Corp. Real Estate 2015, 17, 26–45. [Google Scholar] [CrossRef]

- Qi, G.Y.; Shen, L.Y.; Zeng, S.X.; Jorge, O.J. The drivers for contractors’ green innovation: An industry perspective. J. Clean. Prod. 2010, 18, 1358–1365. [Google Scholar] [CrossRef]

- Falkenbach, H.; Lindholm, A.-L.; Schleich, H. Review Articles: Environmental Sustainability: Drivers for the Real Estate Investor. J. Real Estate Lit. 2010, 18, 201–223. [Google Scholar] [CrossRef]

- Zuo, J.; Zhao, Z.-Y. Green building research–current status and future agenda: A review. Renew. Sustain. Energy Rev. 2014, 30, 271–281. [Google Scholar] [CrossRef]

- New Green Savings Programme—SFŽP ČR. Available online: https://www.sfzp.cz/en/administered-programmes/new-greensavings-programme/ (accessed on 25 April 2022).

- Woźniak, J.; Krysa, Z.; Dudek, M. Concept of government-subsidized energy prices for a group of individual consumers in Poland as a means to reduce smog. Energy Policy 2020, 144, 111620. [Google Scholar] [CrossRef]

- Sustainability-Hamilton City Council. Available online: https://www.hamilton.govt.nz/our-services/environment-andhealth/Pages/Sustainability.aspx (accessed on 10 April 2021).

- Åkerman, M.; Halonen, M.; Wessberg, N. Lost in building design practices: The intertwining of energy with the multiple goals of home building in Finland. Energy Res. Soc. Sci. 2019, 61, 101335. [Google Scholar] [CrossRef]

- Promoting the Swiss Federal Building Program. Available online: https://www.ebp.ch/en/node/1190 (accessed on 29 April 2021).

- Chiu, P.-H.; Raghavan, V.S.G.; Poh, H.J.; Tan, E.; Gabriela, O.; Wong, N.-H.; Van Hooff, T.; Blocken, B.; Li, R.; Leong-Kok, S.M. CFD Methodology Development for Singapore Green Mark Building Application. Procedia Eng. 2017, 180, 1596–1602. [Google Scholar] [CrossRef]

- Zabaloy, M.F.; Recalde, M.Y.; Guzowski, C. Are energy efficiency policies for household context dependent? A comparative study of Brazil, Chile, Colombia and Uruguay. Energy Res. Soc. Sci. 2019, 52, 41–54. [Google Scholar] [CrossRef]

- Malinauskaite, J.; Jouhara, H.; Ahmad, L.; Milani, M.; Montorsi, L.; Venturelli, M. Energy efficiency in industry: EU and national policies in Italy and the UK. Energy 2019, 172, 255–269. [Google Scholar] [CrossRef]

- OECD. Taxing Energy Use 2019; OECD: Paris, France, 2019. [Google Scholar] [CrossRef]

- Majcen, D.; Itard, L.; Visscher, H. Actual heating energy savings in thermally renovated Dutch dwellings. Energy Policy 2016, 97, 82–92. [Google Scholar] [CrossRef]

- Jašová, M.; Moessner, R.; Takáts, E. Domestic and global output gaps as inflation drivers: What does the Phillips curve tell? Econ. Model. 2019, 87, 238–253. [Google Scholar] [CrossRef]

- Cogley, T.; Primiceri, G.E.; Sargent, T.J. Inflation-Gap Persistence in the US. Am. Econ. J. Macroecon. 2010, 2, 43–69. [Google Scholar] [CrossRef]

- Jobst, A.; Lin, H. Negative Interest Rate Policy (NIRP): Implications for Monetary Transmission and Bank Profitability in the Euro Area. IMF Work. Pap. 2016, 2016, 48. [Google Scholar] [CrossRef]

- Tatom, J.A. Public Capital and Private Sector Performance. Review 1991, 73, 3–15. [Google Scholar] [CrossRef]

- US Green Building Council (USGBC). 2021. Available online: https://www.usgbc.org/ (accessed on 5 March 2022).

- Canada Green Building Council (CAGBC). 2021. Available online: https://www.cagbc.org/ (accessed on 3 March 2022).

- Mathur, V.; Price, A.; Austin, S.; Moobela, C. Defining, identifying and mapping stakeholders in the assessment of urban sus-tainability. In Proceedings of the SUE-MoT Conference 2007: International Conference on Whole Life Sustainability and its Assessment, Glasgow, Scotland, 27–29 June 2007; Horner, M., Hardcastle, C., Price, A., Bebbington, J., Eds.; Citeseer: Princeton, NJ, USA, 2007. [Google Scholar]

- Häkkinen, T.; Belloni, K. Barriers and drivers for sustainable building. Build. Res. Inf. 2011, 39, 239–255. [Google Scholar] [CrossRef]

- Du Plessis, C. A strategic framework for sustainable construction in developing countries. Constr. Manag. Econ. 2007, 25, 67–76. [Google Scholar] [CrossRef]

- Azizi, N.Z.M.; Abidin, N.Z.; Raofuddin, A. Identification of Soft Cost Elements in Green Projects: Exploring Experts’ Experience. Procedia-Soc. Behav. Sci. 2015, 170, 18–26. [Google Scholar] [CrossRef][Green Version]

- Alshboul, O.; Shehadeh, A.; Mamlook, R.E.A.; Almasabha, G.; Almuflih, A.S.; Alghamdi, S.Y. Prediction Liquidated Damages via Ensemble Machine Learning Model: Towards Sustainable Highway Construction Projects. Sustainability 2022, 14, 9303. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, T. Application of Improved LightGBM Model in Blood Glucose Prediction. Appl. Sci. 2020, 10, 3227. [Google Scholar] [CrossRef]

- Ke, G.; Meng, Q.; Finley, T.; Wang, T.; Chen, W.; Ma, W.; Ye, Q.; Liu, T.-Y. LightGBM: A highly efficient gradient boosting decision tree. In Proceedings of the 31st International Conference on Neural Information Processing Systems, Long Beach, CA, USA, 4–9 December 2017; Curran Associates Inc.: Long Beach, CA, USA, 2017; pp. 3149–3157. [Google Scholar]

- Zeng, H.; Yang, C.; Zhang, H.; Wu, Z.; Zhang, J.; Dai, G.; Babiloni, F.; Kong, W. A LightGBM-Based EEG Analysis Method for Driver Mental States Classification. Comput. Intell. Neurosci. 2019, 2019, 3761203. [Google Scholar] [CrossRef] [PubMed]

- Friedman, J.H. Greedy function approximation: A gradient boosting machine. Ann. Stat. 2001, 29, 1189–1232. [Google Scholar] [CrossRef]

- Adam-Bourdarios, C.; Cowan, G.; Germain-Renaud, C.; Guyon, I.; Kégl, B.; Rousseau, D. The Higgs Machine Learning Challenge. J. Phys. Conf. Ser. 2015, 664, 072015. [Google Scholar] [CrossRef]

- Chen, T.; Guestrin, C. XGBoost: A Scalable Tree Boosting System. In Proceedings of the 22nd ACM SIGKDD International Con-ference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, 13–17 August 2016; Association for Computing Machinery: San Francisco, CA, USA; pp. 785–794. [Google Scholar]

- Tatari, O.; Kucukvar, M. Cost premium prediction of certified green buildings: A neural network approach. Build. Environ. 2011, 46, 1081–1086. [Google Scholar] [CrossRef]

- Alshboul, O.; Shehadeh, A.; Almasabha, G.; Almuflih, A.S. Extreme Gradient Boosting-Based Machine Learning Approach for Green Building Cost Prediction. Sustainability 2022, 14, 6651. [Google Scholar] [CrossRef]

- Alshboul, O.; Shehadeh, A.; Tatari, O.; Almasabha, G.; Saleh, E. Multiobjective and multivariable optimization for earthmoving equipment. J. Facil. Manag. 2022. ahead of print. [Google Scholar] [CrossRef]

- Shehadeh, A.; Alshboul, O.; Tatari, O.; Alzubaidi, M.A.; Salama, A.H.E.-S. Selection of heavy machinery for earthwork activities: A multi-objective optimization approach using a genetic algorithm. Alex. Eng. J. 2022, 61, 7555–7569. [Google Scholar] [CrossRef]

- Shehadeh, A.; Alshboul, O.; Al Mamlook, R.E.; Hamedat, O. Machine learning models for predicting the residual value of heavy construction equipment: An evaluation of modified decision tree, LightGBM, and XGBoost regression. Autom. Constr. 2021, 129, 103827. [Google Scholar] [CrossRef]

- Alshboul, O.; Shehadeh, A.; Al-Kasasbeh, M.; Al Mamlook, R.E.; Halalsheh, N.; Alkasasbeh, M. Deep and machine learning approaches for forecasting the residual value of heavy construction equipment: A management decision support model. Eng. Constr. Arch. Manag. 2021. ahead of print. [Google Scholar] [CrossRef]

- Alshboul, O.; Shehadeh, A.; Hamedat, O. Development of integrated asset management model for highway facilities based on risk evaluation. Int. J. Constr. Manag. 2021, 1–10. [Google Scholar] [CrossRef]

- Shehadeh, A.; Alshboul, O.; Hamedat, O. A Gaussian mixture model evaluation of construction companies’ business acceptance capabilities in performing construction and maintenance activities during COVID-19 pandemic. Int. J. Manag. Sci. Eng. Manag. 2021, 17, 112–122. [Google Scholar] [CrossRef]

- Alshboul, O.; Shehadeh, A.; Hamedat, O. Governmental Investment Impacts on the Construction Sector Considering the Liquidity Trap. J. Manag. Eng. 2022, 38, 04021099. [Google Scholar] [CrossRef]

- Shehadeh, A.; Alshboul, O.; Hamedat, O. Risk Assessment Model for Optimal Gain–Pain Share Ratio in Target Cost Contract for Construction Projects. J. Constr. Eng. Manag. 2022, 148, 04021197. [Google Scholar] [CrossRef]

- Alshboul, O.; Alzubaidi, M.A.; Al Mamlook, R.E.; Almasabha, G.; Almuflih, A.S.; Shehadeh, A. Forecasting Liquidated Damages via Machine Learning-Based Modified Regression Models for Highway Construction Projects. Sustainability 2022, 14, 5835. [Google Scholar] [CrossRef]

- Almasabha, G.; Alshboul, O.; Shehadeh, A.; Almuflih, A.S. Machine Learning Algorithm for Shear Strength Prediction of Short Links for Steel Buildings. Buildings 2022, 12, 775. [Google Scholar] [CrossRef]

- Alshboul, O.; Almasabha, G.; Shehadeh, A.; Al Hattamleh, O.; Almuflih, A.S. Optimization of the Structural Performance of Buried Reinforced Concrete Pipelines in Cohesionless Soils. Materials 2022, 15, 4051. [Google Scholar] [CrossRef]

- Samy, M.; Almamlook, R.E.; Elkhouly, H.I.; Barakat, S. Decision-making and optimal design of green energy system based on statistical methods and artificial neural network approaches. Sustain. Cities Soc. 2022, 84, 104015. [Google Scholar] [CrossRef]

- Alshboul, O.; Almasabha, G.; Shehadeh, A.; Mamlook, R.E.A.; Almuflih, A.S.; Almakayeel, N. Machine Learning-Based Model for Predicting the Shear Strength of Slender Reinforced Concrete Beams without Stirrups. Buildings 2022, 12, 1166. [Google Scholar] [CrossRef]

- Tran, Q.; Nazir, S.; Nguyen, T.-H.; Ho, N.-K.; Dinh, T.-H.; Nguyen, V.-P.; Nguyen, M.-H.; Phan, Q.-K.; Kieu, T.-S. Empirical Examination of Factors Influencing the Adoption of Green Building Technologies: The Perspective of Construction Developers in Developing Economies. Sustainability 2020, 12, 8067. [Google Scholar] [CrossRef]

- Fan, K.; Chan, E.H.W.; Chau, C.K. Costs and Benefits of Implementing Green Building Economic Incentives: Case Study of a Gross Floor Area Concession Scheme in Hong Kong. Sustainability 2018, 10, 2814. [Google Scholar] [CrossRef]

- Sun, C.-Y.; Chen, Y.-G.; Wang, R.-J.; Lo, S.-C.; Yau, J.-T.; Wu, Y.-W. Construction Cost of Green Building Certified Residence: A Case Study in Taiwan. Sustainability 2019, 11, 2195. [Google Scholar] [CrossRef]

- Plebankiewicz, E.; Juszczyk, M.; Kozik, R. Trends, Costs, and Benefits of Green Certification of Office Buildings: A Polish-Perspective. Sustainability 2019, 11, 2359. [Google Scholar] [CrossRef]

- Hsieh, H.-C.; Claresta, V.; Bui, T. Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts. Sustainability 2020, 12, 3680. [Google Scholar] [CrossRef]

- Najini, H.; Nour, M.; Al-Zuhair, S.; Ghaith, F. Techno-Economic Analysis of Green Building Codes in United Arab Emirates Based on a Case Study Office Building. Sustainability 2020, 12, 8773. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).