1. Introduction

The public–private partnership (PPP) model is becoming the preferred procurement option used in public infrastructure projects, because the involvement of private capital offers an opportunity to relieve government financial burdens and to improve the quality of service compared to the conventional procurement method [

1,

2]. Following the global financial crises of 2007–2008, the PPP financial strategy has become widely acknowledged by governments in both developed and developing countries [

3].

Nevertheless, many PPP projects have failed because of the emergence of disputes between the public and private sectors. For instance, more than 1000 lawsuits in PPP projects occurred during the recent decade in China [

4]. Unlike the conventional bid–build construction projects, PPP projects often involve multiple stakeholders, long-term arrangements, and high values [

5,

6,

7]. There is a higher probability of dispute occurrence in PPPs than in traditional construction projects, because disputes may occur not only in the construction stage but also in the operation and transfer stages [

8]. Although effective dispute resolutions are also essential for PPP projects [

9,

10,

11,

12], this paper serves as a warning of the possibilities of a dispute in PPP projects by evaluating the likelihood of disputes occurring.

While the disputes are undoubtably destructive to PPP projects, how the interactions of dispute contributors affect the likelihood of a PPP dispute remains a puzzle to be solved. Some recent research on PPP disputes has focused on specific causes at the same level, such as unreasonable risk allocation, public opposition, inaccurate demand forecast, unexpected tariff changes, etc. [

13,

14,

15,

16]. This study moves beyond the consideration of individual PPP dispute causes and constructs a framework to illustrate how various drivers at different levels contribute to the likelihood of PPP disputes occurring.

The assessment of the likelihood of a complex PPP dispute occurring is often difficult when past data are inadequate. A fault tree analysis (FTA) provides a framework for qualitative or quantitative analysis of a system’s defects and weaknesses [

17]. Therefore, this study introduces the FTA approach as an effective tool used to quantify the possibility of an occurrence. The fault tree (FT) framework includes scenario modeling of PPP disputes whereby the various components are combined through logic gates and systematic processing of expert assessments. In this format, the development of PPP disputes can be depicted more intelligibly. The description of PPP disputes by proposing an FT approach will hopefully guide stakeholders in the successful implementation of PPPs by providing guidance to both government and private partners about the weakest part of a PPP project. Given the significant losses caused by disputes, an understanding and the quantitative assessment of the development of PPP disputes provided by this study offer a roadmap to investors and public authorities for generating the most suitable dispute prevention strategies. Furthermore, the results of this study provide a solid theoretical foundation for empirically investigating PPP disputes within the existing international PPP literature and contribute significantly to the body of knowledge on PPP.

In the following sections, first, various contributors to PPP disputes at different levels are identified. Next, they are arranged under an FT framework to illustrate the formation of PPP disputes. Then, a workshop was conducted to validate this framework. Furthermore, based on possibility theory, experts’ assessments with fuzzy sets are introduced to estimate the likelihood of PPP disputes occurring. Finally, the discussions and conclusions are presented.

2. Literature Review

2.1. Application of PPPs

The PPP procurement method has been widely used in the construction industry to serve the high demand for infrastructure development [

18]. A growing body of evidence suggests that PPP can be efficiently used on different types of large-scale projects of public importance, such as the transportation infrastructure of toll roads, bridges, or tunnels [

19] and the municipal infrastructure, as well as buildings and facilities intended for public housing and care and hospitals [

15].

A significant amount of studies have made great efforts in the application of PPPs in traditional infrastructures. Considering the existing transportation infrastructure is aging and the shortage of funds in the United States, Papajohn et al. [

20] demonstrated that the PPP financing method is a potential mechanism to help meet this looming need. In order to ensure tariff discipline and improve efficiency and governance in public water utilities, Ameyaw et al. [

21] investigated the critical factors for attracting private capital participation in public water utilities in developing countries. For relieving the government’s budgetary burden, European governments are increasingly cooperating with private sectors to construct and operate public hospitals and other healthcare facilities [

22]. In recent decades, the PPP approach has also been proven to be an effective financing tool to solve the problem of insufficient sewage treatment facilities and improve the efficiency of sewage treatment [

23].

There are also several important attempts to explore the application of PPPs in other sectors. Liu and Wilkinson [

24] evaluated PPP experiences in the prison sector and recommended strategies and measures for the development of PPPs for the prison. Yuan et al. [

25] indicated that the introduction of private capital into the development of public housing was promoted by the Chinese governments to improve the quality of public housing. Kirikkaleli and Adebayo [

26] recommended that private investment should be enhanced in renewable energy to achieve cleaner production processes. Under the need for sustainable urban development, Jayasena et al. [

27] conducted a holistic literature review to provide a basis for the introduction of the PPP method in the construction of smart infrastructure.

In conclusion, global support for different types of PPP projects has seemed stronger than ever before over the last two decades. However, disputes remain the biggest obstacle to the successful implementation of PPPs. Against this backdrop, this study aims to find a warning before PPP project initiation by exploring the occurrence of PPP disputes.

2.2. Occurrence of Disputes in PPPs

The characteristics of PPP projects make them prone to disputes. Resolving disputes is time-consuming and costly, and the damages caused by disputes are often destructive to PPP projects [

28]. Therefore, studies of PPP disputes are garnering more and more attention from researchers. Besides the identification of various causes of disputes, a holistic understanding of the formation of a dispute is also essential for preventing and resolving disputes. Thus, we need to understand the literature surrounding disputes.

2.2.1. Potential Dispute Causes

First, some studies in the literature have explored the causes of disputes in PPP projects. The literature review was conducted comprehensively to cover different types of countries. The potential dispute causes of PPP projects are summarized in

Table 1.

The literature summarized in

Table 1 shows that both developing and developed countries have similar potential causes of PPP disputes (i.e., delays in expropriation, unstable government, public opposition, etc.). What differs is the significance or probability of the causes within different territorial contexts. For instance, Debela [

36] compared the differences of the top five critical success factors (CSFs) of PPPs between Ethiopia and other developing countries (Uganda, Nigeria, Indonesia, Ghana, and China) based on the same list of CSFs. Ke et al. [

30] analyzed the risk allocation preferences in PPP projects of mainland China and the Hong Kong Special Administrative Region and then compared these preferences to those in the U.K. and Greece based on the same risk register.

2.2.2. The Development of Disputes

Other studies have attempted to explore the developmental process of disputes. Using the structural equation model (SEM), Molenaar et al. [

37] proved that project complexity and unfair risk sharing are two main contributors in the occurrence of disputes. Likewise, to explain the formation of a dispute, Mitropoulos and Howell [

38] applied a process model to present the combined effect of project uncertainty, contract problems, working relations, and problem-solving effectiveness. Cheung and Yiu [

39] proposed that disputes are the intersection of three basic artifacts: contract stipulations, dispute triggering events, and conflict. Sinha and Jha [

40] put forward successive stages to illustrate the development of PPP disputes: from unfair risks to conflicts and from unsolved conflicts to disputes. Furthermore, Tanriverdi et al. [

41] used the causal mapping approach to present the emergence of construction disputes and highlighted the impact of preconstruction studies, people factors, and contract terms.

2.3. Fault Tree Analysis

The FTA approach was first developed in the early 1960s to estimate the safety and reliability of the system [

42]. An FT framework is a logic diagram that describes the logical relationships between the top event in the system and the ingredients that make up this event [

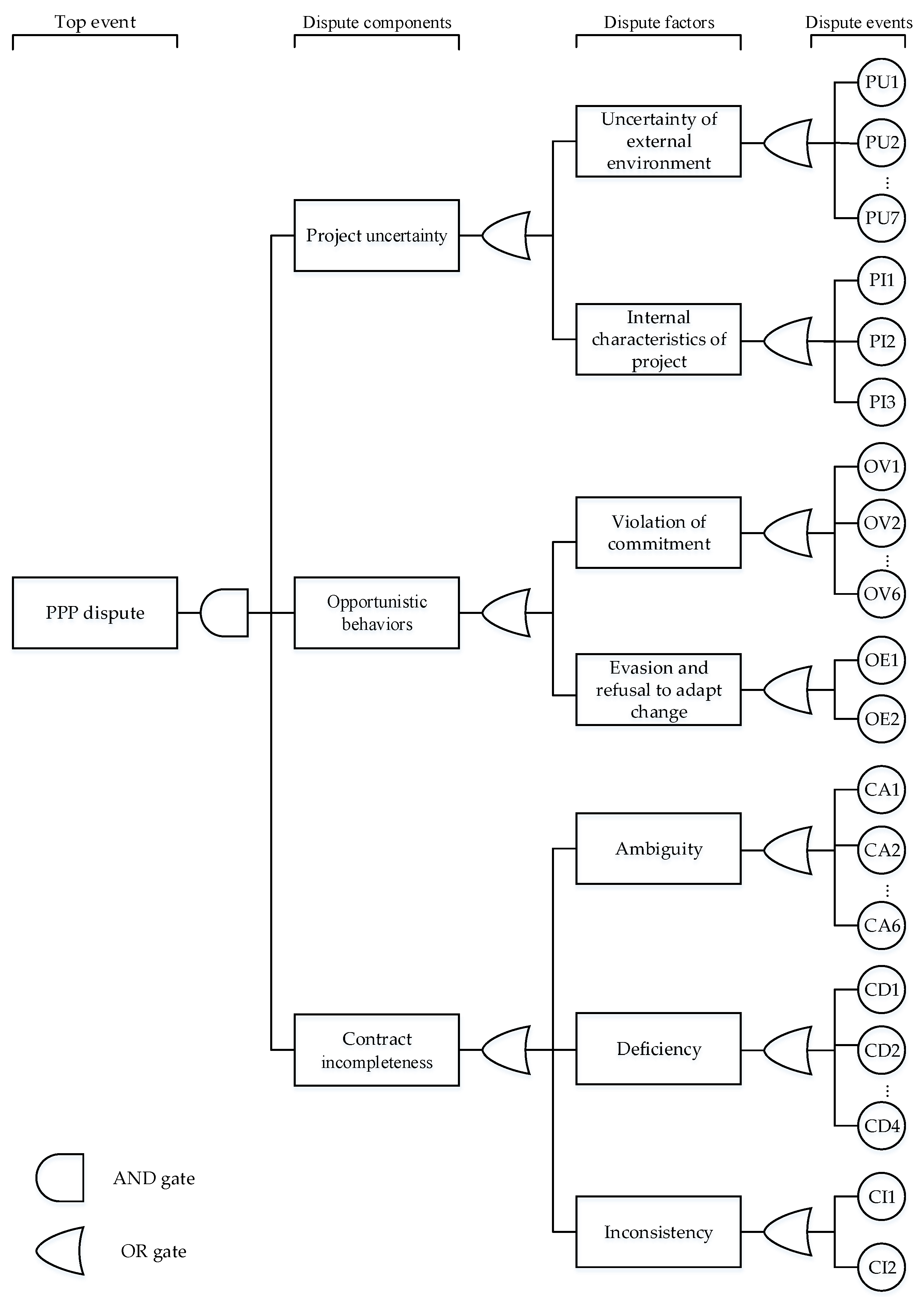

43]. The basic structure of an FT is shown in

Figure 1. The top event (TE), such as a loss, a failure, an accident, a dispute, or an undesirable event, is first arranged; then, the subevents/contributors that lead to this event are identified [

44]. The top or head event is further decomposed into subevents, until the basic events (BEs) are reached. The combination events (CE) are used to connect the BEs and the TE. Basic events are events that cannot be further decomposed.

The logic gates—AND (∩) and OR (∪)—are commonly used to represent the relationships among different levels of events. In FTA, if the probability of lower-level events occurring is given, a deterministic assessment of the likelihood of the top or higher-level event occurring can become available using algebraic operations.

The symbols in

Figure 1, as interpreted by Cheung [

45], the circle means that a basic event cannot be further decomposed; the rectangle describes an output event for basic events combined through logic gates. The AND gate (

![Buildings 12 00384 i001]()

) depicts a situation in which only the simultaneous existence of all input events can produce the output event; the OR gate (

![Buildings 12 00384 i002]()

) defines the logical operation in which the output event will occur if one or more of the input events occur.

FTA is a method that serves to identify and analyze the weakest part or the failure scenarios of a system. Considering that the relationships among various components of the top event can be clearly shown in an FTA, several studies and efforts have been conducted based on quantitative assessments using the FTA technique. For example, Thomas et al. [

46] put forward the risk occurrence assessment framework of BOT road projects based on the FTA approach when past data were not available. Based on the possibility theory, Pan [

47] assessed the building performance by combining fuzzy sets and FTA. In order to explore the different contributors to construction risk and to develop cost-efficient strategies, Abdelgawad and Fayek [

48] applied FTA to assess the risk in construction projects. Cheung and Pang [

49] proposed a framework of traditional bid–build project disputes using the FTA approach. Then, an example was used to evaluate the likelihood of a dispute occurring.

In practice, a dispute in the life cycle of PPP projects can be seen as a failure in a complex system. Thus, FTA is suitable for evaluating the probability of PPP disputes and for identifying the most significant drivers in the development of disputes. Then, more cost-efficient strategies can be developed based on the assessment to minimize the likelihood of a dispute occurring.

2.4. Knowledge Gap

Previous research on PPP disputes mostly focused on listing the potential causes of PPP disputes, which can hardly be used by public and private sectors to understand the logical relationships among these causes and how these causes intersect together to contribute to the formation of PPP disputes. In addition, the existing literature does not allow for a quantitative assessment of the likelihood of various factors contributing to a PPP dispute. Therefore, PPP disputes need to be regarded as a failure system to identify the weakest part of a PPP project.

To address these knowledge gaps, this study offers an alternative approach to understanding the development of PPP disputes and using FTA to evaluate the likelihood of PPP disputes occurring. Essentially, the FT framework of PPP disputes proposed provides important information to support decisions for decision-makers to assess the probability of a dispute in advance. Furthermore, the FT framework and evaluative tool used to assess PPP disputes in this study are generic. Therefore, they can be consulted or applied to suit different PPP projects in different territorial contexts with appropriate modifications.

3. Research Methodology

The aim of this paper is to estimate the likelihood of a dispute occurring in PPPs. First, the various contributors to PPP disputes at different levels are identified; then, they are arranged under an FT framework. This arrangement shows the logical relationships among various contributors and allows for a quantitative assessment of dispute events. Finally, the weakest part of the PPP project can be identified, which will help both public and private sectors understand and manage PPP disputes. The methodology is shown in

Figure 2.

3.1. Development of Fault Tree Model of PPP Disputes

Three steps are involved in the development of an FT model for PPP disputes:

Identifying the components of a PPP dispute,

Scenario modeling of PPP disputes using an FT approach, and

Validating the FT framework.

Identifying the components of a PPP dispute constitutes the first step towards framing an FT model. To ensure that all possible components are covered, a thorough literature review on the development of PPP disputes was conducted. The basic components based on Mitropoulos and Howell’s [

38] opinion were identified, and the three basic ingredients of dispute development are project uncertainty, opportunistic behaviors, and contractual incompleteness. Uncertainty often results in an unexpected situation, which is defined as a problem [

38]. The emergence of problems directly affects the behaviors of the public and private sectors. In PPP projects, contract parties may behave opportunistically to serve their self-interests [

50]. For example, the public sector may reject offering subsidies or adjusting the contract price/period for a revenue shortage caused by demand changes. Once opportunism appears, problems can easily escalate into conflicts. An incomplete contract may be unable to deal with conflicts [

51]. Thus, an unresolved conflict would stimulate disputes. The conceptual model of PPP dispute development is illustrated in

Figure 3.

Furthermore, project uncertainty falls into two subcategories: external and internal; opportunistic behaviors as the violation of commitment and evasion and refusal to adapt change [

52]; and contract incompleteness as ambiguity, deficiency, and inconsistency [

49]. The components of a PPP dispute and the references from which they were obtained are listed in

Table 2,

Table 3 and

Table 4.

Scenario modeling of PPP disputes using the FT approach depicts a clear structure of PPP disputes. The PPP dispute analysis, in general, deals with complex and uncertain systems. In this regard, probabilistic modeling is more effective and reasonable than the direct evaluation of dispute events. If a model that interconnects the top event with underlying factors is framed, the occurrence likelihood assessment of the top event can be more easily with greater confidence [

43]. Based on the literature findings, an initial FT framework was built to collect an expert panel’s comments.

A workshop with the participation of an expert panel (14 experts) was designed to validate the FT framework. The experts’ backgrounds are summarized in

Table 5. All panel members are experienced in PPP projects and dispute resolution. The first session of the workshop focused on the introduction of the research aim, methodology, and FT approach. A semi-structured discussion was designed to help experts to discuss and express their views on the occurrence of PPP disputes more clearly. Questions such as “In your experience, what’s the major role in triggering PPP disputes” and “What were the causes of the dispute you encountered in PPP projects?” were directed at the experts. Meanwhile, the laddering method [

57] was introduced to investigate the underlying causes, outcomes, and their relations. Hence, the question “In your opinion, how do you relate the underlying issues together to form a PPP dispute?” was presented to the experts. In the next session, an initial FT framework of PPP disputes was shown on a projection screen. Visual images provided a better approach for experts to express insightful opinions based on their previous experience. These experts offered an overall view on the correcting links between factors, eliminating reduplicative statements and irrelevant factors or events, as well as adding omissive concepts. The final FT framework of PPP disputes endorsed by the expert panel is exhibited in

Figure 4.

3.2. Fuzzy Occurrence Probability

3.2.1. Fuzzy Sets and Membership Function

- (1)

Fuzzy sets

The proposed FT model of PPP disputes provides an opportunity to quantify the likelihood of PPP disputes. Once the probabilities of the terminal event in the FT are available, the likelihood of the top event can be evaluated. In the proposed PPP dispute FT framework (

Figure 4), where the exact likelihood of the terminal dispute events occurring is not available, using classical probability to estimate the probability of a PPP dispute (top event) occurring is difficult. However, in general, the probability of an occurrence can be assessed by PPP experts with rich experiences and can be expressed in imprecise linguistic terms. Thus, a fuzzy set evaluation is more appropriate for modeling linguistic variables than discrete probabilities in this study.

Fuzzy sets can be a powerful tool used to quantify human judgmental variables. Zhao and Bose [

58] conducted a comparison of the performance of symmetrical membership functions with different variables and demonstrated that seven fuzzy sets represent the optimal case for a symmetrical triangular membership function. Seven linguistic variables—namely, extremely low, very low, low, medium, high, very high, and extremely high—were used to estimate the likelihood of terminal dispute events occurring in the proposed FT. The fuzzy restrictions and membership functions assumed are given in

Table 6.

- (2)

Membership function

In fuzzy sets, the degree of belief from the ‘‘belong to set” to the ‘‘not belong to set” of each fuzzy subset is gradual, and the transition is represented by membership function (MF). An MF with values in the interval [0, 1] is used to measure the degree of belief of every fuzzy subset. The triangular membership function (TMF) of the seven fuzzy subsets is presented in

Figure 5. The x-axis shows the probability, and the y-axis represents the membership functions.

3.2.2. Operations on Fuzzy Sets

Let

and

be two positive triangular fuzzy numbers. According to Kaufmann and Gupta [

59], the operations

are expressed as Equations (1)−(4):

where ⊕, ⊖, ⊗, and ⊙ represent the fuzzy operations addition, subtraction, multiplication, and division, respectively.

3.2.3. Aggregation and Defuzzification of Fuzzy Sets

- (1)

Aggregation

Aggregation means the integration of different membership functions [

47]. The experts’ fuzzy possibility scores indicate their opinions on the possibility that an event may occur. After collecting the experts’ fuzzy possibility scores, the respondents’ opinions need to be integrated into one [

60]. The most common method of aggregation is the fuzzy mean. The aggregated value is calculated through Equations (5)−(7):

where

is the first fuzzy parameter of linguistic variables in triangular membership functions, and n is the total number of experts/respondents:

where

is the second fuzzy parameter:

where

is the third fuzzy parameter.

- (2)

Defuzzification

The fuzzy set has to be represented by a nonfuzzy or crisp value to adequately illustrate the degree of impact of the aggregated fuzzy number, which means defuzzification [

61]. By defuzzifying the fuzzy possibility of the top event, the occurrence likelihood of a PPP dispute in the FT model can be assessed. Shaheen et al. [

62] demonstrated that the defuzzified possibility score (DFS) equals the expected value of a triangular probability distribution, which is given by Equation (8):

where

are the aggregated fuzzy parameters in the fuzzy set.

3.2.4. Evaluation of Likelihood of a Dispute in Fault Tree

Once the experts’ fuzzy possibility scores of the basic events become available, the probability of the top event (a PPP dispute) and the intermediate events (i.e., dispute factors) occurring can be assessed based on fuzzy set operations and the logical operators (AND and OR gates) in the FT. For a higher-level event

that has an output from the AND gate with basic events

as the inputs, the probability of a fuzzy occurrence of event

can be expressed as Equation (9):

Analogously, the probability of a fuzzy occurrence with an OR gate is determined using Equation (10):

where

is the triangular fuzzy probability.

4. Fuzzy Likelihood of PPP Dispute Occurring

4.1. Data Source

The data used to evaluate the likelihood of the 30 basic dispute events listed in

Table 2,

Table 3 and

Table 4 were collected from questionnaires. First, the FT framework of a PPP dispute was introduced to respondents. Then, the fuzzy linguistic rating scales presented in

Table 6 were used for respondents to assign the fuzzy occurrence likelihood. Notably, the results of the assessment mostly depend on the experts, so the respondents’ hands-on experiences with PPPs are essential to ensuring the quality of the judgment. Furthermore, a total of 110 questionnaires from China were received from (1) a panel from officials of central and local governments, (2) companies with PPP investment experience, (3) law firms, (4) consulting firms, and (5) construction companies. The sample size is close to that of Cheung and Yiu [

39]. Among these experts, 60% have more than 10 years of PPP experience.

Figure 6 lists the respondents’ roles.

The main data collection instruments in this study were face-to-face interviews and email. The interview method has been employed extensively in construction management studies to solicit participants’ comments on the topic, as it allows a deep interpretation of the subject matter [

63,

64]. Nevertheless, because it is difficult to collect all data through interviews, email is another efficient instrument to collect questionnaires in the construction industry [

65]. Questionnaires can be distributed via emails to respondents who are interested in the topic but are not available for an interview.

In this study, nearly 30 respondents were interviewed via face-to-face meetings. Before they assigned fuzzy scores of these 30 basic dispute events, a semi-structured questionnaire was adopted to solicit qualitative data for follow-up discussions. The key interview questions include:

Different types of disputes encountered in project development and the main reasons given to induce these disputes,

Assessment of the probabilities of these underlying reasons, and

Strategies or mechanisms proposed to avoid or mitigate the occurrence likelihood of disputes in PPP projects.

The other questionnaires were distributed via email. Finally, all the questionnaire data were summarized through Microsoft Excel for the result calculations.

4.2. Results

Following the aforementioned steps for assessing the probability of fuzzy occurrence indicated in Equations (5)–(8), we list the aggregation of 110 expert linguistic scores (fuzzy parameters) and the defuzzified occurrence values of the PPP dispute components in

Table 7,

Table 8 and

Table 9.

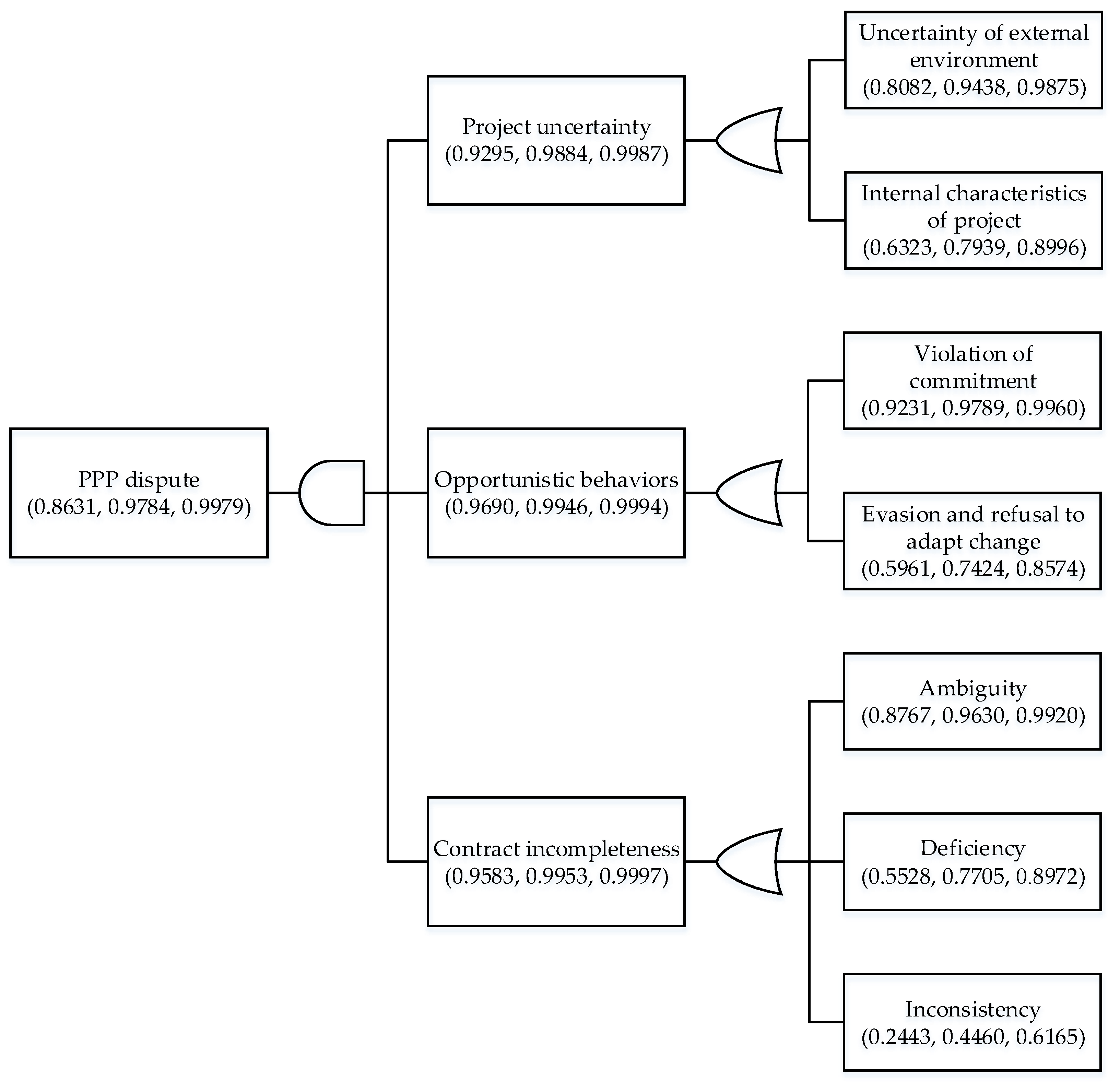

4.2.1. Fuzzy Probability of Project Uncertainty

The fuzzy probabilities for each PPP dispute component in

Table 7,

Table 8 and

Table 9 are used to calculate the likelihood of PPP dispute factors and dispute components (

Figure 4) using Equations (1)–(4), (9) and (10). The operation process is expressed as follows:

i.e., defuzzified value = (0.8082 + 0.9438 + 0.9875)/3 = 0.9132.

i.e., defuzzified value = (0.6323 + 0.7939 + 0.8996)/3 = 0.7753.

In

Figure 4, either an uncertain external environment or the internal characteristics of the project would result in project uncertainty. Therefore, the fuzzy probability of project uncertainty is expressed as the project uncertainty = uncertain external environment ∪ internal characteristics of a project:

i.e., defuzzified value = (0.9295 + 0.9884 + 0.9987)/3 = 0.9722.

4.2.2. Fuzzy Probability of Opportunistic Behaviors

Analogously, with reference to

Figure 4, either the violation of commitment or the evasion and refusal to adapt to change would cause opportunistic behaviors. The fuzzy probability of opportunistic behaviors is therefore expressed as opportunistic behaviors = violation of commitment ∪ evasion and refusal to adapt to change:

i.e., defuzzified value = (0.9690, 0.9946, 0.9994)/3 = 0.9876.

4.2.3. Fuzzy Probability of Contract Incompleteness

Similarly, either ambiguity, deficiency, or inconsistency of a PPP contract would stimulate the contract incompleteness factor. Thus, the fuzzy probability of contract incompleteness is expressed as contract incompleteness = ambiguity ∪ deficiency ∪ inconsistency:

i.e., defuzzified value = (0.9583 + 0.9953 + 0.9997)/3 = 0.9844.

4.2.4. Fuzzy Probability of PPP Dispute

The likelihood of the fuzzy occurrence of a PPP dispute is expressed as follows: PPP dispute = project uncertainty ∩ opportunistic behaviors ∩ contract incompleteness, which means that the intersection of project uncertainty, opportunistic behaviors, and contract incompleteness would result in a PPP dispute. The fuzzy probability of a PPP dispute is as follows:

i.e., defuzzified value = (0.8631 + 0.9784 + 0.9979)/3 = 0.9464.

Figure 7 presents the likelihood of the fuzzy occurrence of a PPP dispute, the dispute components, and the dispute factors.

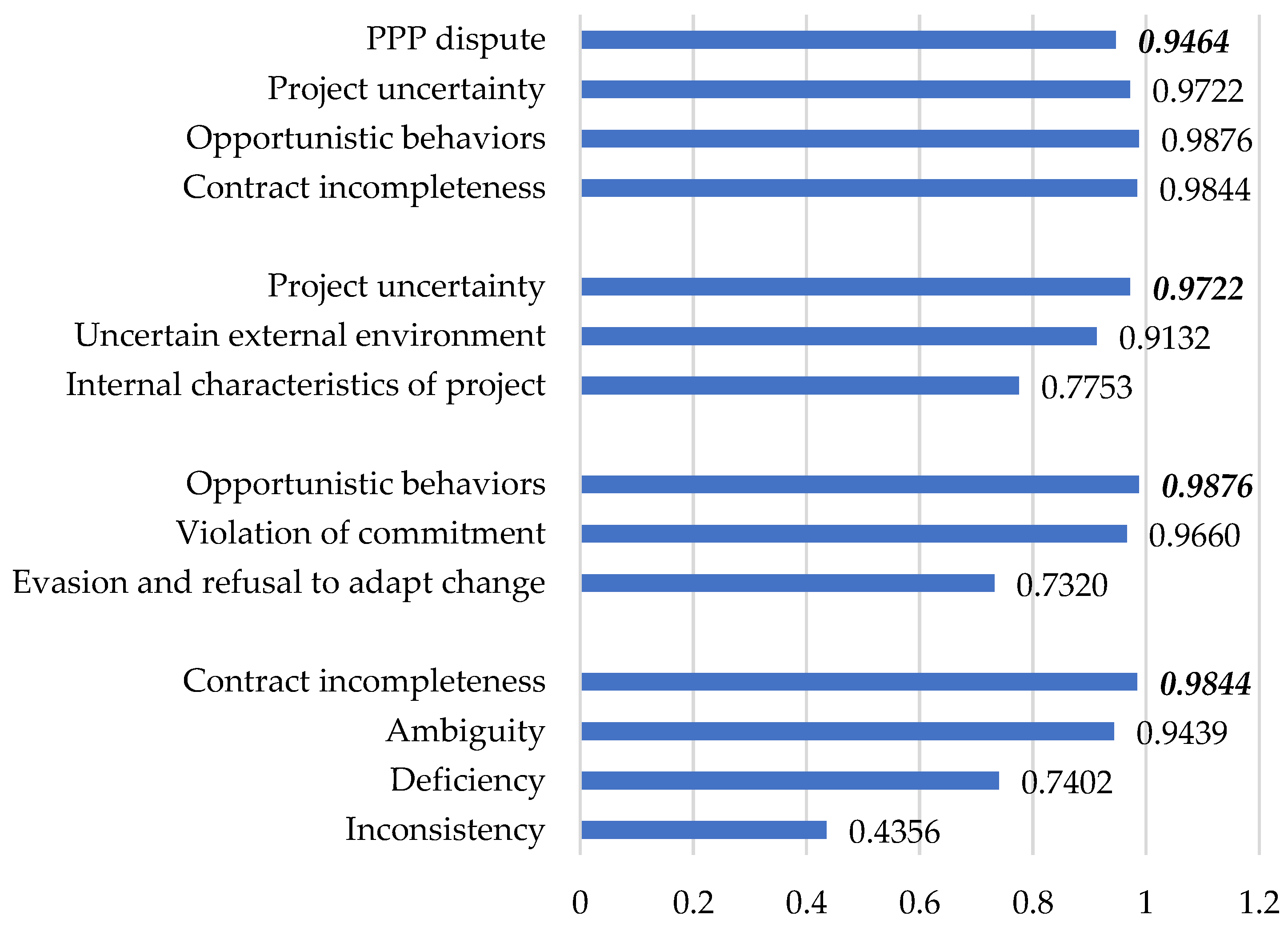

4.3. Discussions

For a clearer comparison and analysis, the defuzzified likelihood of a PPP dispute components and dispute factors contributing to the PPP dispute are presented in

Figure 8. The defuzzified values of the top event (PPP dispute) and dispute components (project uncertainty, opportunistic behaviors, and contract incompleteness) are marked in italics and bold.

First, the likelihood of the fuzzy occurrence of a PPP dispute (top event in the FT) is 0.9464, which indicates that a dispute is inevitable in PPP projects. Although most previous studies shared the view that PPP disputes are common and inevitable due to the characteristics of a long-term agreement, the high value, and the multiple stakeholders [

14,

15,

16], the findings based on the FT model provide an empirical analysis to support this perception. In this regard, our findings in fact provide a positive direction for PPP management. The inevitability of PPP disputes suggests that both public and private practitioners should be proactive in dispute prevention during the whole life cycle of a PPP project. An efficient mechanism of preventing PPP disputes is crucial to ensuring the success of a PPP project and reducing losses.

Second,

Figure 8 presents the fuzzy probability values of the three basic components (project uncertainty, opportunistic behaviors, and contract incompleteness): 0.9722, 0.9876, and 0.9844, respectively. The results indicate that opportunistic behavior is the dominant driver of PPP disputes. In PPP projects, governments and private partners are in pursuit of different objectives and values. Hence, one party may behave opportunistically to increase their own interests or to reduce the other party’s revenue. As Williamson [

66] explained, opportunism refers to a lack of honesty or candor. For example, to attract a private partner to participate in a PPP project, the public sector may conceal its true financial affordability and make excessive guarantees. Once a revenue shortage appears, the public sector would reject payment of fees or subsidies to the private sector. Additionally, the results revealed that contract incompleteness is a relatively significant PPP dispute contributor. Due to information asymmetry and bounded rationality of humans, contracts are invariably incomplete [

67]. Consequently, whenever unforeseeable dispute events occur ex post and are not fully explicit ex ante, such a situation predictably stimulates dispute. Therefore, efforts should be made to minimize contract incompleteness during the investigation phase before signing the contract. Finally, project uncertainty is less detrimental to PPP projects in comparison with opportunistic behaviors and contract incompleteness. The more complex the PPP project, the more uncertainty it faces. In response to the uncertainty involved in the preparation, construction, operation, and transfer stages of PPP projects, the stipulations of PPP contracts need to allow for changes when adapting to contingencies. Therefore, Cruz and Marques [

68] proposed that contract flexibility can be used to cope with project uncertainty in PPPs.

Third, our evaluation of the fuzzy probability of dispute events occurring indicates that an uncertain external environment (fuzzy probability of 0.9132) is more pernicious than project internal characteristics in project uncertainty issues. Analogously, a violation of commitment (fuzzy probability of 0.9660) appears to be quite readily involved in a long-term PPP project. Ambiguity (fuzzy probability of 0.9439) is a common problem in PPP contracts.

Finally, our assessment of the likelihood of dispute events occurring illustrates that a change in regulations (PU1) and economic downturns or upturns (PU5) is most likely to result in an uncertain external environment; a breakdown in the public sector’s commitment to exclusive guarantee (OV2), government payment default (OV3) or insufficient capital from the private sector (OV5), and refusal to adjust the contract price/period in response to revenue shortage (OE1) are common opportunistic behaviors in PPPs; and unclear conditions and procedures for termination (CA1) and unclear repurchasing procedures (CA4) in PPP contracts are common manifestations of contract incompleteness. The fuzzy probabilities of these dispute factors are all above 0.5.

5. Conclusions

The findings of this paper provide a number of important theoretical bases for the study of PPP disputes. First, various contributors to PPP disputes at different levels are identified. The three basic components that drive the development of PPP disputes are project uncertainty, opportunistic behaviors, and contractual incompleteness. Furthermore, they can be categorized into seven factors: uncertain external environment, internal characteristics of the project, violation of commitment, evasion and refusal to adapt to change, ambiguity, deficiency, and inconsistency. These factors are conceptualized by their respective dispute events. In this format, PPP disputes can be depicted more intelligibly. Second, the components of a PPP dispute are described under an FT structure, whereby the various contributors are combined through logic gates. This arrangement offers a holistic understanding of how the various contributors influence the formation of PPP disputes and provides an opportunity to quantify its likelihood. Then, the fuzzy set evaluation method is employed to compute the likelihood of the fuzzy occurrence of PPP a dispute. Third, with this FT framework and assessment approach, both government and private partners can identify the weakest part of a PPP project and generate the most suitable dispute prevention strategies. The findings show that opportunistic behavior is the dominant dispute inducer in PPPs.

For the policy implications of this study, the outputs empirically support disputes inevitable (with an occurrence likelihood of 0.9464) in PPP projects. Certainly, this provides a positive direction in PPP management. Both public and private practitioners should be proactive in minimizing the occurrence of disputes during a PPP project. In the preparation stage, public and private partners can use the case-based reasoning (CBR) method to retrieve similar past projects to improve the completeness of the PPP contract. In the signing stage, flexible contracts can be used to cope with project uncertainty. During the contract execution stage, Guasch and Straub [

69] demonstrated that the existence of a specialized regulator can act as a barrier against opportunistic behaviors.

Additionally, this study adds significant value to enhancing empirical studies on PPPs. First, our checklist of the various contributors to the development of PPP disputes provides a solid foundation for formulating hypotheses in future empirical research. Second, the FT framework of PPP dispute provides empirical evidence for quantitative assessments of the likelihood of a dispute occurring. Essentially, the research outputs improve the chances of successfully preventing disputes in PPPs, which is vital to the sustainable development of a PPP model.

Besides the significance of the proposed FT framework and assessment approach, like any other research, this study also has some limitations. First, the sample size is relatively low; thus, the responses may not represent all the PPP experts. Second, all of the respondents came from China, which will affect the generalizability of the research findings. It is therefore suggested that future studies should interview respondents from different countries to compare the differences of PPP dispute occurrences. Finally, the dependence between occurrences of basic events (terminal events) in the FT is not considered, because the basic events are assumed independent when the FT is initially built [

70]. Other approaches can be considered in conjunction with the FT analysis to make the assessment more scientifically applicable in further research. Significantly, the results of an assessment of the likelihood of a fuzzy occurrence are based on opinions provided by PPP professionals, which are inevitably influenced by human subjectiveness. The objective frequency of PPP disputes in actual cases can be investigated in future studies.

Author Contributions

Conceptualization, X.Z. and Y.L.; Data curation, X.Z., Y.L., and J.J.; Formal analysis, X.Z.; Investigation, X.Z., J.J., and N.S.; Methodology, X.Z., J.J., and N.S.; Writing—original draft preparation, X.Z.; Writing—review and editing, X.Z. and N.S.; Project administration, X.Z. and Y.L.; and Funding acquisition, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 71841022.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Almarri, K.; Abuhijleh, B. A qualitative study for developing a framework for implementing public–private partnerships in developing countries. J. Facil. Manag. 2017, 15, 170–189. [Google Scholar] [CrossRef]

- Carrillo, P.; Robinson, H.; Foale, P.; Anumba, C.; Bouchlaghem, D. Participation, barriers, and opportunities in PFI: The United Kingdom experience. J. Manag. Eng. 2008, 24, 138–145. [Google Scholar] [CrossRef] [Green Version]

- Osei-Kyei, R.; Chan, A.P. Review of studies on the Critical Success Factors for Public–Private Partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- China Judgements Online. Available online: http://wenshu.court.gov.cn/ (accessed on 10 January 2022).

- Henjewele, C.; Fewings, P.; Rwelamila, P.D. De-marginalising the public in PPP projects through multi-stakeholders management. J. Financ. Manag. Prop. Constr. 2013, 18, 210–231. [Google Scholar] [CrossRef]

- Zheng, J.; Roehrich, J.K.; Lewis, M.A. The dynamics of contractual and relational governance: Evidence from long-term public–private procurement arrangements. J. Purch. Supply Manag. 2008, 14, 43–54. [Google Scholar] [CrossRef] [Green Version]

- Kumaraswamy, M.M.; Anvuur, A.M. Selecting sustainable teams for PPP projects. Build Environ. 2008, 43, 999–1009. [Google Scholar] [CrossRef] [Green Version]

- Chou, J.S.; Lin, C. Predicting disputes in public-private partnership projects: Classification and ensemble models. J. Comput. Civ. Eng. 2013, 27, 51–60. [Google Scholar] [CrossRef]

- Jones, D. Construction project dispute resolution: Options for effective dispute avoidance and management. J. Prof. Issues Eng. Educ. Pract. 2006, 132, 225–235. [Google Scholar] [CrossRef]

- Abednego, M.P.; Ogunlana, S.O. Good project governance for proper risk allocation in public-private partnerships in Indonesia. Int. J. Proj. Manag. 2006, 24, 622–634. [Google Scholar] [CrossRef]

- Gebken, R.J.; Gibson, G.E. Quantification of costs for dispute resolution procedures in the construction industry. J. Prof. Issues Eng. Educ. Pract. 2006, 132, 264–271. [Google Scholar] [CrossRef]

- El-Sayegh, S.; Ahmad, I.; Aljanabi, M.; Herzallah, R.; Metry, S.; El-Ashwal, O. Construction disputes in the UAE: Causes and resolution methods. Buildings 2020, 10, 171. [Google Scholar] [CrossRef]

- Song, J.; Hu, Y.; Feng, Z. Factors influencing early termination of PPP projects in China. J. Manag. Eng. 2018, 34, 05017008. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C.; Yu, Y.; Chen, C.; Dansoh, A. Root causes of conflict and conflict resolution mechanisms in public private partnerships: Comparative study between Ghana and China. Cities 2019, 87, 185–195. [Google Scholar] [CrossRef]

- Zheng, X.; Liu, Y.; Jiang, J.; Thomas, L.M.; Su, N. Predicting the litigation outcome of PPP project disputes between public authority and private partner using an ensemble model. J. Bus. Econ. Manag. 2021, 22, 320–345. [Google Scholar] [CrossRef]

- Zheng, X.; Liu, Y.; Sun, R.; Tian, J.; Yu, Q. Understanding the decisive causes of PPP project disputes in China. Buildings 2021, 11, 646. [Google Scholar] [CrossRef]

- Lindhe, A.; Rosén, L.; Norberg, T.; Bergstedt, O. Fault tree analysis for integrated and probabilistic risk analysis of drinking water systems. Water Res. 2009, 43, 1641–1653. [Google Scholar] [CrossRef] [PubMed]

- Osei-Kyei, R.; Chan, A.P. Implementing public–private partnership (PPP) policy for public construction projects in Ghana: Critical success factors and policy implications. Int. J. Constr. Manag. 2017, 17, 113–123. [Google Scholar] [CrossRef]

- Poznanić, V.; Milosavljević, M. Hybrid private-public partnership models. Manag.-J. Theory Pract. Manag. 2011, 58, 59–64. [Google Scholar]

- Papajohn, D.; Cui, Q.; Bayraktar, M.E. Public-private partnerships in US transportation: Research overview and a path forward. J. Manag. Eng. 2011, 27, 126–135. [Google Scholar] [CrossRef]

- Ameyaw, E.E.; Chan, A.P.; Owusu-Manu, D.G. A survey of critical success factors for attracting private sector participation in water supply projects in developing countries. J. Facilities Manag. 2017, 15, 35–61. [Google Scholar] [CrossRef]

- Barlow, J.; Roehrich, J.; Wright, S. Europe sees mixed results from public-private partnerships for building and managing health care facilities and services. Health Affair. 2013, 32, 146–154. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Tang, Y.; Liu, M.; Zhang, B. Can public-private partnerships (PPPs) improve the environmental performance of urban sewage treatment? J. Environ. Manag. 2021, 291, 112660. [Google Scholar] [CrossRef]

- Liu, T.; Wilkinson, S. Critical factors affecting the viability of using public-private partnerships for prison development. J. Manag. Eng. 2015, 31, 05014020. [Google Scholar] [CrossRef]

- Yuan, J.; Guang, M.; Wang, X.; Li, Q.; Skibniewski, M.J. Quantitative SWOT analysis of public housing delivery by public–private partnerships in China based on the perspective of the public sector. J. Manag. Eng. 2012, 28, 407–420. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Do public-private partnerships in energy and renewable energy consumption matter for consumption-based carbon dioxide emissions in India? Environ. Sci. Pollut. Res. 2021, 28, 30139–30152. [Google Scholar] [CrossRef] [PubMed]

- Jayasena, N.S.; Chan, D.W.; Kumaraswamy, M. A systematic literature review and analysis towards developing PPP models for delivering smart infrastructure. Built Environ. Proj. Asset Manag. 2020, 11, 121–137. [Google Scholar]

- Marques, R.C. Is arbitration the right way to settle conflicts in PPP arrangements? J. Manag. Eng. 2018, 34, 05017007. [Google Scholar] [CrossRef]

- Bing, L.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. The allocation of risk in PPP/PFI construction projects in the UK. Int. J. Proj. Manag. 2005, 23, 25–35. [Google Scholar] [CrossRef]

- Ke, Y.J.; Wang, S.Q.; Chan, A.P.C. Risk allocation in public-private partnership infrastructure projects: Comparative study. J. Infrastruct. Syst. 2010, 16, 343–351. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Endogenous determinants for renegotiating concessions: Evidence from local infrastructure. Local Gov. Stud. 2013, 39, 352–374. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Exogenous determinants for renegotiating public infrastructure concessions: Evidence from Portugal. J. Constr. Eng. Manag. 2013, 139, 1082–1090. [Google Scholar] [CrossRef]

- e Neto, D.D.C.S.; Cruz, C.O.; Sarmento, J.M. Renegotiation of transport public private partnerships: Policy implications of the Brazilian experience in the Latin American context. Case Stud. Transp. Policy 2019, 7, 554–561. [Google Scholar] [CrossRef]

- Muhammad, Z.; Johar, F. Critical success factors of public–private partnership projects: A comparative analysis of the housing sector between Malaysia and Nigeria. Int. J. Constr. Manag. 2019, 19, 257–269. [Google Scholar] [CrossRef]

- Rafaat, R.; Osman, H.; Georgy, M.; Elsaid, M. Preferred risk allocation in Egypt’s water sector PPPs. Int. J. Constr. Manag. 2020, 20, 585–597. [Google Scholar] [CrossRef]

- Debela, G.Y. Critical success factors (CSFs) of public–private partnership (PPP) road projects in Ethiopia. Int. J. Constr. Manag. 2019, 22, 489–500. [Google Scholar] [CrossRef]

- Molenaar, K.; Washington, S.; Diekmann, J. Structural equation model of construction contract. J. Constr. Eng. Manag. 2000, 126, 268–277. [Google Scholar] [CrossRef]

- Mitropoulos, P.; Howell, G. Model for understanding, preventing, and resolving project disputes. J. Constr. Eng. Manag. 2001, 127, 223–231. [Google Scholar] [CrossRef]

- Cheung, S.O.; Yiu, T.W. Are construction disputes inevitable? IEEE Trans. Eng. Manag. 2006, 53, 456–470. [Google Scholar] [CrossRef]

- Sinha, A.K.; Jha, K.N. Dispute resolution and litigation in PPP road projects: Evidence from select cases. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2020, 12, 05019007. [Google Scholar] [CrossRef]

- Tanriverdi, C.; Atasoy, G.; Dikmen, I.; Birgonul, M.T. Causal mapping to explore emergence of construction disputes. J. Civ. Eng. Manag. 2021, 27, 288–302. [Google Scholar] [CrossRef]

- Vesely, W.E.; Goldberg, F.F.; Roberts, N.H.; Haasl, D.F. Fault Tree Handbook; Nuclear Regulatory Commission: Washington, DC, USA, 1981.

- Shoar, S.; Banaitis, A. Application of fuzzy fault tree analysis to identify factors influencing construction labor productivity: A high-rise building case study. J. Civ. Eng. Manag. 2019, 25, 41–52. [Google Scholar] [CrossRef]

- Bedford, T.; Cooke, R. Probabilistic Risk Analysis Foundations and Methods; Cambridge University Press: Cambridge, UK, 2001. [Google Scholar]

- Cheung, S.O. Project Dispute Resolution Satisfaction of Construction Clients in Hong Kong. Ph.D. Thesis, University of Wolverhampton, Wolverhampton, UK, 1998. [Google Scholar]

- Thomas, A.V.; Kalidindi, S.N.; Ganesh, L.S. Modelling and assessment of critical risks in BOT road projects. Constr. Manag. Econ. 2006, 24, 407–424. [Google Scholar] [CrossRef]

- Pan, N.F. Evaluation of building performance using fuzzy FTA. Constr. Manag. Econ. 2006, 24, 1241–1252. [Google Scholar] [CrossRef]

- Abdelgawad, M.; Fayek, A.R. Fuzzy reliability analyzer: Quantitative assessment of risk events in the construction industry using fuzzy fault-tree analysis. J. Constr. Eng. Manag. 2011, 137, 294–302. [Google Scholar] [CrossRef]

- Cheung, S.O.; Pang, K.H.Y. Anatomy of construction disputes. J. Constr. Eng. Manag. 2013, 139, 15–23. [Google Scholar] [CrossRef]

- Judge, W.Q.; Dooley, R. Strategic alliance outcomes: A transaction-cost economics perspective. Br. J. Manag. 2006, 17, 23–37. [Google Scholar] [CrossRef]

- Cheung, S.O.; Yiu, T.W. Catastrophic transitions of construction contracting behaviour. In Construction Dispute Research; Springer: Cham, Germany, 2014; pp. 53–73. [Google Scholar]

- Wathne, K.H.; Heide, J.B. Opportunism in interfirm relationships: Forms, outcomes, and solutions. J. Mark. 2000, 64, 36–51. [Google Scholar] [CrossRef]

- Shrestha, A.; Chan, T.K.; Aibinu, A.A.; Chen, C.; Martek, I. Risk allocation inefficiencies in Chinese PPP water projects. J. Constr. Eng. Manag. 2018, 144, 04018013. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.; Cheung, E. Understanding the risks in China’s PPP projects: Ranking of their probability and consequence. Eng. Constr. Archit. Manag. 2011, 18, 481–496. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.; Lam, P.T. Preferred risk allocation in China’s public–private partnership (PPP) projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Marques, R.C.; Berg, S. Risks, contracts, and private-sector participation in infrastructure. J. Constr. Eng. Manag. 2011, 137, 925–932. [Google Scholar] [CrossRef]

- Vygotsky, L.S. Mind in Society: The Development of Higher Psychological Processes; Harvard University Press: Boston, MA, USA, 1978. [Google Scholar]

- Zhao, J.; Bose, B.K. Evaluation of membership functions for fuzzy logic controlled induction motor drive. IEEE Trans. Power Electron. 2003, 1, 229–234. [Google Scholar]

- Kaufmann, A.; Gupta, M.M. Introduction to Fuzzy Arithmetic Theory and Application; Van Nostrand Reinhold: New York, NY, USA, 1991. [Google Scholar]

- Singh, D.; Tiong, L.K. A fuzzy decision framework for contractor selection. J. Constr. Eng. Manag. 2005, 131, 62–70. [Google Scholar] [CrossRef]

- Juan, Y.K. A hybrid approach using data envelopment analysis and case-based reasoning for housing refurbishment contractors selection and performance improvement. Expert Syst. Appl. 2009, 36, 5702–5710. [Google Scholar] [CrossRef]

- Shaheen, A.A.; Fayek, A.R.; AbouRizk, S.M. Fuzzy numbers in cost range estimating. J. Constr. Eng. Manag. 2007, 133, 325–334. [Google Scholar] [CrossRef]

- Wong, T.K.M.; Man, S.S.; Chan, A.H.S. Critical factors for the use or non-use of personal protective equipment amongst construction workers. Saf. Sci. 2020, 126, 104663. [Google Scholar] [CrossRef]

- Tezel, A.; Papadonikolaki, E.; Yitmen, I.; Hilletofth, P. Preparing construction supply chains for blockchain technology: An investigation of its potential and future directions. Front. Eng. 2020, 7, 547–563. [Google Scholar] [CrossRef]

- Alaloul, W.S.; Liew, M.S.; Zawawi, N.A.W.A.; Kennedy, I.B. Industrial Revolution 4.0 in the construction industry: Challenges and opportunities for stakeholders. Ain Shams Eng. J. 2020, 11, 225–230. [Google Scholar] [CrossRef]

- Williamson, O.E. Markets and Hierarchies: Analysis and Antitrust Implications; Free Press: New York, NY, USA, 1975. [Google Scholar]

- Yates, D.J. Conflict and Dispute in the Development Process: A transaction Cost Economic Perspective. 1998. Available online: http://www.prres.net/proceedings/proceedings1998/Papers/Yates3Ai.PDF (accessed on 10 January 2022).

- Cruz, C.O.; Marques, R.C. Flexible contracts to cope with uncertainty in public–private partnerships. Int. J. Proj. Manag. 2013, 31, 473–483. [Google Scholar] [CrossRef]

- Guasch, J.L.; Straub, S. Corruption and concession renegotiations: Evidence from the water and transport sectors in Latin America. Util. Policy 2009, 17, 185–190. [Google Scholar] [CrossRef]

- Wang, D.; Zhang, Y.; Jia, X.; Jiang, P.; Guo, B. Handling uncertainties in fault tree analysis by a hybrid probabilistic–possibilistic framework. Qual. Reliab. Eng. Int. 2016, 32, 1137–1148. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

) depicts a situation in which only the simultaneous existence of all input events can produce the output event; the OR gate (

) depicts a situation in which only the simultaneous existence of all input events can produce the output event; the OR gate (  ) defines the logical operation in which the output event will occur if one or more of the input events occur.

) defines the logical operation in which the output event will occur if one or more of the input events occur.