Examining Cash Usage Behavior in Metropolitan Greater Jakarta Societies

Abstract

1. Introduction

- RQ1.

- How do sociodemographic and economic factors influence the use of cash payments at physical stores?

- RQ2.

- How do psychological factors influence the intention to use cash?

2. Literature Review

2.1. Extant Research on Cash Payment

2.2. Hypothesis Development

3. Methodology

4. Results

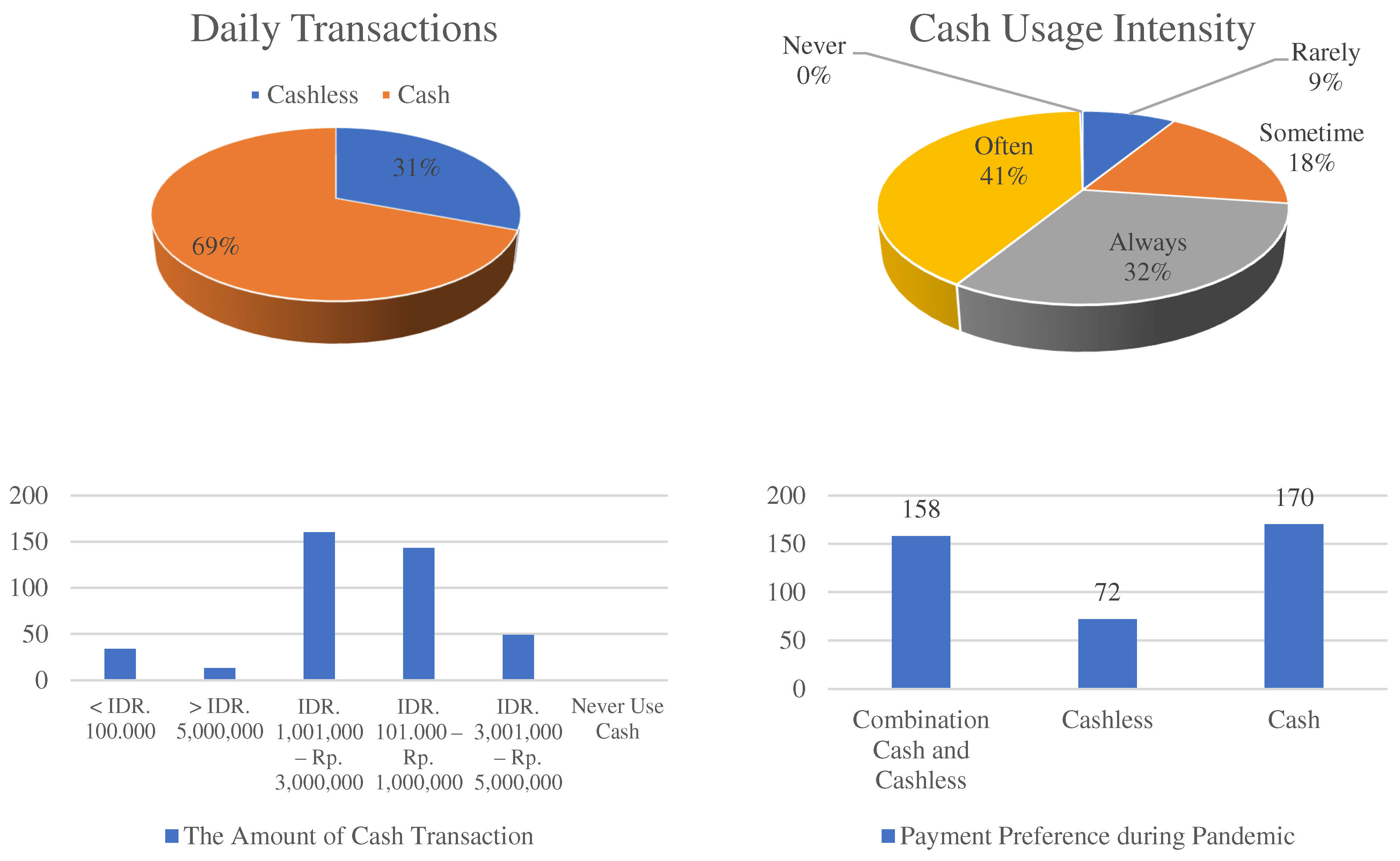

4.1. Descriptive Analysis

4.2. Determinant Factor of Cash Usage in Physical Stores

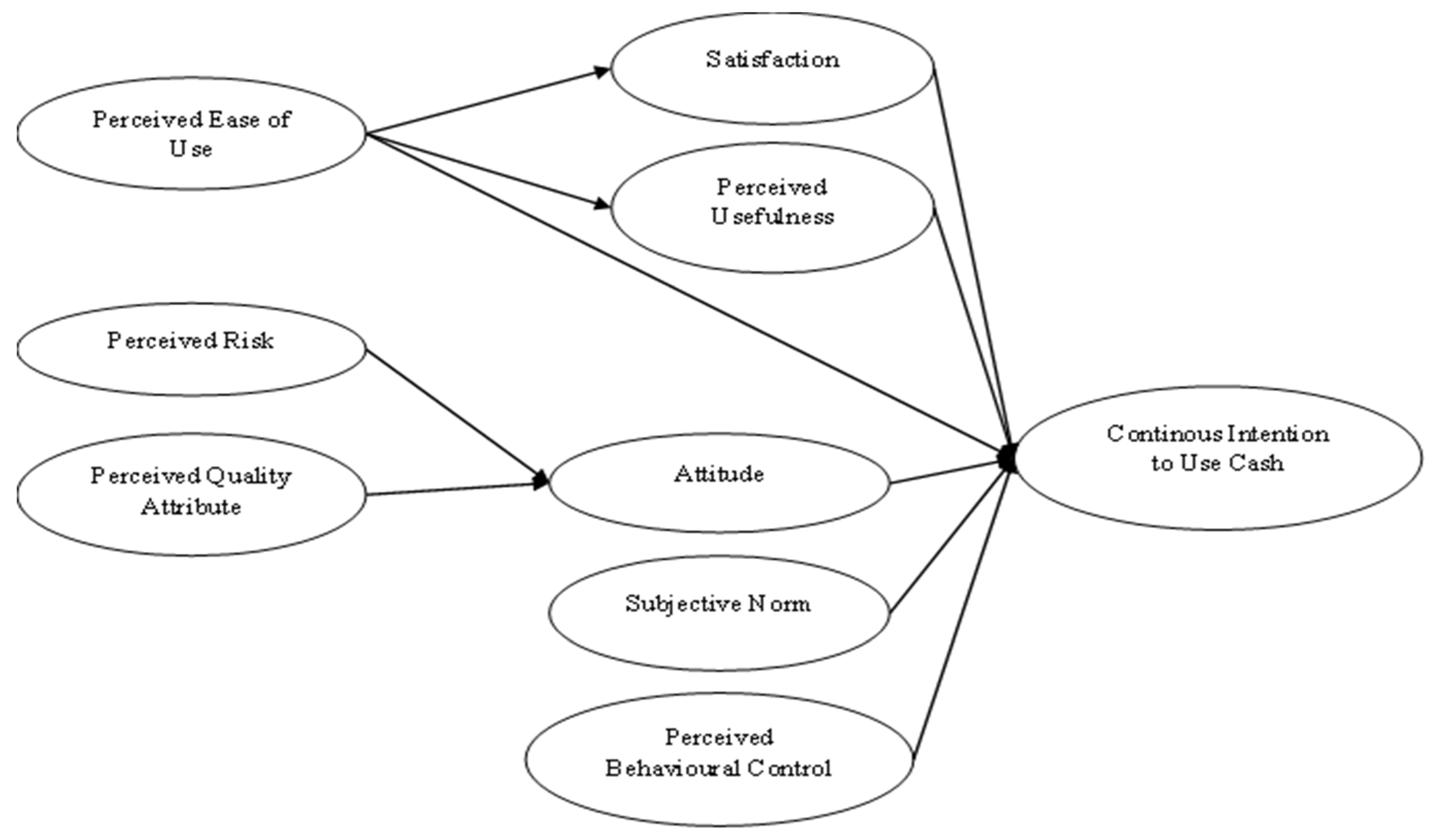

4.3. Determinant Factor of Continuous Intention to Use Cash

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Variables and Indicators

| Variable | Indicators |

| Perceived Ease of Use | I find cash transactions easy. I have never encountered any difficulty with cash transactions. I prefer cash over other payment methods because it is convenient. Cash is always readily available. Using cash allows me to maintain control over my spending. Transactions involving cash are faster and more practical. I am not concerned about security when using cash in transactions. |

| Perceived Risk | I feel the risk associated with cash transactions is lower than that of other payment systems. I feel that cash is more secure form of currency because it is tangible and can be physically held. I feel that the privacy of my transactions is protected when I use cash. I have not experienced any losses after conducting transactions with cash. I feel secure carrying sufficient cash to meet my daily needs. I generally do not worry about the risk of losing my cash or having it stolen. The use of cash saves me from the potential risks associated with digital payments. |

| Perceived Quality Attribute | I feel that the design and quality of the cash is satisfactory and aesthetically pleasing. The quality of the cash material ensures its suitability for daily transactions. I feel that the quality of cash printing is improving day by day. I feel that cash has a long shelf life and is not easily damaged. I feel that cash is widely accepted without any issues. |

| Satisfaction | My overall experience with cash has been very satisfactory. I find cash to be highly convenient in a variety of situations. I feel comfortable and satisfied that cash is a reliable and accessible payment method that does not require any additional devices. I am satisfied with the level of security that cash offers in maintaining my privacy and personal data. I am satisfied that there are no additional costs associated with using cash. |

| Perceived Usefulness | Cash is more suitable for meeting my needs. Cash is the most efficient method of making payments. I feel that cash has become an effective solution for payments. Cash is very useful for everyday transactions due to its universal acceptance. Cash is the most expeditious way to make transactions, bypassing the often time-consuming digital process. I feel that cash is useful because it does not incur additional costs. |

| Attitude | I feel that cash is the most suitable form of payment. I find cash to be an effective and efficient method of payment. I generally prefer to use cash for transactions everywhere. Cash remains important to me because its value cannot be replaced by technology. I have a positive view of cash as a reliable means of payment. |

| Subjective Norm | I use cash because it is the preferred method of payment of the people around me. My friends suggest that I use cash for transactions. My group physically suggests I use cash for transactions. My group virtually recommends that I use cash for transactions. The majority of the places I transact with still prefer to use cash for transactions. People around me expect that I will continue to rely on cash in my day-to-day transactions. I feel more socially accepted when I use cash for transactions. |

| Perceived Behavioral Control | I am more confident and skilled when using cash in transactions. I feel that cash is relatively efficient medium of exchange. I do not need support in obtaining cash. I have never had difficulty in obtaining cash for daily transactions. I find it easy to organize and control the use of cash in my daily transactions. I am confident in my ability to overcome any obstacles that may arise when using cash. |

| Intention to Continue to Use Cash | I intend to continue using cash for transactions at both physical stores and online stores. I would recommend others continue using cash for transactions. I intend to increase the number of transactions made through cash payments in comparison to other payment systems. I intend to maintain my use of cash, despite the growing popularity of alternative payment methods. I plan to continue using cash as a payment method in the long term. |

References

- Hanafi, W.N.W.; Toolib, S.N. Influences of Perceived Usefulness, Perceived Ease of Use, and Perceived Security on Intention to Use Digital Payment: A Comparative Study Among Malaysian Younger and Older Adults. Int. J. Bus. Manag. 2020, 3, 15–24. [Google Scholar]

- Najib, M.; Fahma, F. Investigating the adoption of digital payment system through an extended technology acceptance model: An insight from the Indonesian small and medium enterprises. Int. J. Adv. Sci. Eng. Inf. Technol. 2020, 10, 1702–1708. [Google Scholar] [CrossRef]

- Vinitha, K.; Vasantha, S. Determinants of customer intention to use digital payment system. J. Adv. Res. Dyn. Control Syst. 2020, 12, 168–175. [Google Scholar]

- ASPI. Berita Statistik Sistem Pembayaran Indonesia Triwulan I-2023 [Internet]. 2023. Available online: https://www.aspi-indonesia.or.id/buletin-statistik-aspi-triwulan-1-2023/ (accessed on 19 June 2024).

- Alonso, J.; Ganga, H.; Lozano, J.; Álvaro, B.; Pablo, M.; Cristina, M.; Ana, T.P.; Adrián, R. The Use of Cash and Its Determinants; BBVA Research: Madrid, Spain, 2018. [Google Scholar]

- Pal, R.; Bhadada, S.K. Cash, currency and COVID-19. Postgrad. Med. J. 2020, 96, 427–428. [Google Scholar] [CrossRef] [PubMed]

- Mu, H.L.; Lee, Y.C. Will proximity mobile payments substitute traditional payments? Examining factors influencing customers’ switching intention during the COVID-19 pandemic. Int. J. Bank Mark. 2022, 40, 1051–1070. [Google Scholar] [CrossRef]

- Fujiki, H.; Nakashima, K. Cash Usage Trends in Japan: Evidence Using Aggregate and Household Survey Data. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Bennett, B.; Conover, D.; O’Brien, S.; Advincula, R. Cash Continues to Play a Key Role in Consumer Spending: Evidence from the Diary of Consumer Payment Choice; Board of Governors of the Federal Reserve System: San Francisco, CA, USA, 2014. [Google Scholar]

- Al-Najjar, B. The financial determinants of corporate cash holdings: Evidence from some emerging markets. Int. Bus. Rev. 2013, 22, 77–88. [Google Scholar] [CrossRef]

- Maheshwari, Y.; Rao, K.T.V. Determinant of Corporate Cash Holdings. Glob. Bus. Rev. 2017, 18, 416–427. [Google Scholar] [CrossRef]

- Opler, T.; Pinkowitz, L.; Stulz, R.; Williamson, R. The determinants and implications of corporate cash holdings. J. Financ. Econ. 1999, 52, 3–46. [Google Scholar] [CrossRef]

- Orlova, S.V. Culturaland macroeconomic determinants of cash holdings management. J. Int. Financ. Manag. Account. 2020, 31, 270–294. [Google Scholar] [CrossRef]

- Husillos Rodríguez, N.; Martínez-Ramírez, S.; Blanco-Varela, M.T.; Donatello, S.; Guillem, M.; Puig, J.; Fos, C.; Larrotcha, E.; Flores, J. The effect of using thermally dried sewage sludge as an alternative fuel on Portland cement clinker production. J. Clean. Prod. 2013, 52, 94–102. [Google Scholar] [CrossRef]

- Skibińska-Fabrowska, I. Demand for Cash and its Determinants—A Post-Crisis Approach1. J. Cent. Bank. Theory Pract. 2023, 12, 103–131. [Google Scholar] [CrossRef]

- Foroughi, B.; Iranmanesh, M.; Hyun, S.S. Understanding the determinants of mobile banking continuance usage intention. J. Enterp. Inf. Manag. 2019, 32, 1015–1033. [Google Scholar] [CrossRef]

- Kaniapan, S.; Hassan, S.; Ya, H.; Nesan, K.P.; Azeem, M. The utilisation of palm oil and oil palm residues and the related challenges as a sustainable alternative in biofuel, bioenergy, and transportation sector: A review. Sustainability 2021, 13, 3110. [Google Scholar] [CrossRef]

- Ly, H.T.N.; Khuong, N.V.; Son, T.H. Determinants Affect Mobile Wallet Continuous Usage in Covid 19 Pandemic: Evidence From Vietnam. Cogent Bus. Manag. 2022, 9, 2041792. [Google Scholar] [CrossRef]

- Mahran, A.F.A.; Enaba, H.M.L. Exploring Determinants Influencing the Intention to Use Mobile Payment Service. Int. J. Cust. Relatsh. Mark. Manag. 2011, 2, 17–37. [Google Scholar] [CrossRef]

- Oney, E.; Guven, G.O.; Rizvi, W.H. The determinants of electronic payment systems usage from consumers’ perspective. Econ. Res. Istraz. 2017, 30, 394–415. [Google Scholar] [CrossRef]

- Bagnall, J.; Bounie, D.; Huynh, K.P.; Kosse, A.; Schmidt, T.; Schuh, S.; Stix, H. Consumer cash usage: A cross-country comparison with payment diary survey data. Int. J. Cent. Bank. 2016, 12, 1–61. [Google Scholar] [CrossRef]

- Giammatteo, M.; Iezzi, S.; Zizza, R. Pecunia olet. Cash usage and the underground economy. J. Econ. Behav. Organ. 2022, 204, 107–127. [Google Scholar] [CrossRef]

- Kotkowski, R.; Manikowski, A. Cash usage in Poland in 2020: Insights into the role of the COVID-19 pandemic and spatial aspects. J. Bank. Financ. Econ. 2023, 2023, 85–113. [Google Scholar] [CrossRef]

- Seehaus, S.R.; Peracek, T. Lack of Risk Management at Insolvency Consulting Companies: An Empirical Study in Germany 2024. Adm. Sci. 2024, 14, 160. [Google Scholar] [CrossRef]

- Klimek, L.; Funta, R. Data and E-commerce: An Economic Relationship. Danube 2021, 12, 33–44. [Google Scholar] [CrossRef]

- Politronacci, E.; Moret, A.; Bounie, D.; François, A. Use of Cash in France: The Payment Method of Choice for Low-Value Purchases. Q. Sel. Artic. la Banq. Fr. Banq. Fr. 2018, 220, 1–9. [Google Scholar]

- Świecka, B.; Terefenko, P.; Paprotny, D. Transaction factors’ influence on the choice of payment by Polish consumers. J. Retail. Consum. Serv. 2021, 58, 102264. [Google Scholar] [CrossRef]

- Kawamoto, C. Do sociodemographic factors impact in the use of cash in retail transactions? Rev. Pensamento Contemp. Adm. 2021, 15, 15–32. [Google Scholar] [CrossRef]

- Park, G.H.; Nam, C.; Hong, S.; Park, B.; Kim, H.; Lee, T.; Kim, K.; Lee, J.H.; Kim, M.H. Socioeconomic factors influencing cosmetic usage patterns. J. Expo. Sci. Environ. Epidemiol. 2018, 28, 242–250. [Google Scholar] [CrossRef]

- Zha, X.; Zhang, J.; Li, L.; Yang, H. Exploring the adoption of digital libraries in the mobile context: The effect of psychological factors and mobile context factors. Inf. Dev. 2016, 32, 1155–1167. [Google Scholar] [CrossRef]

- Aakko, M.; Niinimäki, K. Quality matters: Reviewing the connections between perceived quality and clothing use time. J. Fash. Mark. Manag. 2022, 26, 107–125. [Google Scholar] [CrossRef]

- Fuchs, G.; Reichel, A. An exploratory inquiry into destination risk perceptions and risk reduction strategies of first time vs. repeat visitors to a highly volatile destination. Tour. Manag. 2011, 32, 266–276. [Google Scholar] [CrossRef]

- Zhang, J.; Mao, E. Cash, credit, or phone? An empirical study on the adoption of mobile payments in the United States. Psychol. Mark. 2020, 37, 87–98. [Google Scholar] [CrossRef]

- Cham, T.H.; Cheah, J.H.; Cheng, B.L.; Lim, X.J. I Am Too Old for This! Barriers Contributing to the Non-Adoption of Mobile Payment. Int. J. Bank Mark. 2022, 40, 1017–1050. [Google Scholar] [CrossRef]

- Al Mamun, A.; Naznen, F.; Yang, M.; Yang, Q.; Wu, M.; Masukujjaman, M. Predicting the intention and adoption of wearable payment devices using hybrid SEM-neural network analysis. Sci. Rep. 2023, 13, 11217. [Google Scholar] [CrossRef]

- Oladejo, M.O.; Oluwaseun, Y. Socio Economic Factors Influencing E-Payments Adoption by the Nigerian Deposits Money Banks (DMBS): Perspective of the Bankers. Int. J. Manag. Sci. 2015, 5, 747–758. [Google Scholar]

- Ajzen, I. The theory of planned behaviour: Reactions and reflections. Psychol. Health 2011, 26, 1113–1127. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior: Frequently asked questions. Hum. Behav. Emerg. Technol. 2020, 2, 314–324. [Google Scholar] [CrossRef]

- Abu-Taieh, E.M.; AlHadid, I.; Abu-Tayeh, S.; Masa’deh, R.; Alkhawaldeh, R.S.; Khwaldeh, S.; Alrowwad, A. Continued Intention to Use of M-Banking in Jordan by Integrating UTAUT, TPB, TAM and Service Quality with ML. J. Open Innov. Technol. Mark. Complex. 2022, 8, 120. [Google Scholar] [CrossRef]

- Dhiman, N.; Sarmah, R.; Jamwal, M. Consumers’ Continuance Intentions to Consume Green Tea: An Extended Theory of Planned Behaviour Perspective. Vision 2023. [Google Scholar] [CrossRef]

- Conner, M. Extending not retiring the theory of planned behaviour: A commentary on Sniehotta, Presseau and Araújo-Soares. Health Psychol. Rev. 2015, 9, 141–145. [Google Scholar] [CrossRef]

- Arunachalam, T. An investigation on the role of perceived ease of use, perceived use and self efficacy in determining continuous usage intention towards an e-learning system. Online J. Distance Educ. e-Learning 2019, 7, 268–276. [Google Scholar]

- Pereira, F.A.D.M.; Ramos, A.S.M.; Gouvêa, M.A.; Da Costa, M.F. Satisfaction and continuous use intention of e-learning service in Brazilian public organizations. Comput. Human Behav. 2015, 46, 139–148. [Google Scholar] [CrossRef]

- Sharabati, A.A.A.; Al-Haddad, S.; Al-Khasawneh, M.; Nababteh, N.; Mohammad, M.; Abu Ghoush, Q. The Impact of TikTok User Satisfaction on Continuous Intention to Use the Application. J. Open Innov. Technol. Mark. Complex. 2022, 8, 125. [Google Scholar] [CrossRef]

- Wang, E.S.T.; Lin, R.L. Perceived quality factors of location-based apps on trust, perceived privacy risk, and continuous usage intention. Behav. Inf. Technol. 2017, 36, 2–10. [Google Scholar] [CrossRef]

- Yuan, S.; Liu, Y.; Yao, R.; Liu, J. An investigation of users’ continuance intention towards mobile banking in China. Inf. Dev. 2016, 32, 20–34. [Google Scholar] [CrossRef]

- Wilson, N.; Keni, K.; Tan, P.H.P. The role of perceived usefulness and perceived ease-of-use toward satisfaction and trust which influence computer consumers’ loyalty in china. Gadjah Mada Int. J. Bus. 2021, 23, 262. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Despotović, J.; Rodić, V.; Caracciolo, F. Factors affecting farmers’ adoption of integrated pest management in Serbia: An application of the theory of planned behavior. J. Clean. Prod. 2019, 228, 1196–1205. [Google Scholar] [CrossRef]

- Wang, S.; Fan, J.; Zhao, D.; Yang, S.; Fu, Y. Predicting consumers’ intention to adopt hybrid electric vehicles: Using an extended version of the theory of planned behavior model. Transportation 2016, 43, 123–143. [Google Scholar] [CrossRef]

- Arora, A.K.; Panchal, A.; Gupta, V.P.; Sharma, D. Digital payment apps: Perception and adoption—A study of higher education students. Int. J. Enterp. Netw. Manag. 2023, 14, 122–138. [Google Scholar] [CrossRef]

- Franciska, A.M.; Sahayaselvi, S. An Overview On Digital Payments. Artic. Int. J. Res. 2017, 4, 2101–2111. [Google Scholar]

- Zhu, L.; Chen, J.; Hwang, H. The effect of college students’ motivation to use Ifland on satisfaction and continuous Use Intention: Moderating effect of innovation. J. Internet Comput. Serv. 2024, 25, 93–100. [Google Scholar]

- Arvidsson, N. Building a Cashless Society. The Swedish Route to the Future of Cash Payments; Springer Nature: Cham, Switzerland, 2019. [Google Scholar]

- Tamele, B.; Zamora-Pérez, A.; Litardi, C.; Howes, J.; Steinmann, E.; Todt, D. Catch Me (If You Can): Assessing the Risk of SARS-CoV-2 Transmission Via Euro Cash. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

| Variable | Mean | Median | Maximum | Minimum | Std.Dev |

|---|---|---|---|---|---|

| PAY | 0.563 | 1.000 | 1.000 | 0.000 | 0.497 |

| AGE | 34.623 | 31.000 | 72.000 | 18.000 | 12.596 |

| EDUCATION | 3.063 | 3.000 | 5.000 | 1.000 | 0.858 |

| WORKST | 1.728 | 2.000 | 2.000 | 1.000 | 0.446 |

| MARD | 1.680 | 2.000 | 4.000 | 1.000 | 0.623 |

| EXPEND | 3,154,813 | 3,000,000 | 55,000,000 | 25,000 | 3,616,460 |

| JAB | 1.480 | 1.000 | 8.000 | 0.000 | 1.163 |

| AGE | EDU | WORK | MAR | EXPEND | ABA | |

|---|---|---|---|---|---|---|

| AGE | 1.000 | |||||

| EDU | 0.021 | 1.000 | ||||

| WORK | −0.155 | −0.209 | 1.000 | |||

| MAR | −0.624 | 0.173 | 0.235 | 1.000 | ||

| EXPEND | −0.190 | −0.142 | −0.059 | −0.034 | 1.000 | |

| ABA | 0.152 | −0.071 | −0.205 | −0.010 | −0.242 | 1.000 |

| Variable | Coefficient (B) | Standard Error (S.E) |

|---|---|---|

| CONSTANT | 3.110 *** | 0.890 |

| AGEi | 0.037 | 0.016 |

| EDUi | −1.322 *** | 0.222 |

| WORKi | 0.692 ** | 0.312 |

| MARi | −0.364 | 0.366 |

| EXPENDi | 0.000 | 0.000 |

| ABAi | −0.756 *** | 0.150 |

| Nagelkerke R-square | 0.428 | |

| Hosmer and Lemeshow test (Chi-square) | 10.810 |

| Variable | Composite Reliability (rho_c) | Average Variance Extracted (AVE) |

|---|---|---|

| Attitude | 0.934 | 0.738 |

| Continuous Intention to Use Cash | 0.936 | 0.744 |

| Perceived Behavioral Control | 0.932 | 0.694 |

| Perceived Ease of Use | 0.917 | 0.648 |

| Perceived Quality Attribute | 0.903 | 0.651 |

| Perceived Risk | 0.910 | 0.593 |

| Perceived Usefulness | 0.943 | 0.736 |

| Satisfaction | 0.930 | 0.727 |

| Subjective Norm | 0.941 | 0.694 |

| Saturated Model | Estimated Model | |

|---|---|---|

| SRMR | 0.072 | 0.112 |

| d_ULS | 7.140 | 17.354 |

| d_G | 1.959 | 2.437 |

| Chi-square | 4332.566 | 4881.368 |

| NFI | 0.781 | 0.754 |

| Variable | Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p-Values |

|---|---|---|---|---|---|

| ATD → CIUC | 0.395 | 0.399 | 0.093 | 4.256 | 0.000 |

| PBC → CIUC | 0.115 | 0.116 | 0.090 | 1.278 | 0.201 |

| PEU → CIUC | 0.064 | 0.061 | 0.068 | 0.940 | 0.347 |

| PEU → PU | 0.809 | 0.810 | 0.020 | 39.635 | 0.000 |

| PEU → SATS | 0.755 | 0.756 | 0.024 | 31.457 | 0.000 |

| PQA → ATD | 0.218 | 0.220 | 0.053 | 4.150 | 0.000 |

| PR → ATD | 0.585 | 0.585 | 0.054 | 10.877 | 0.000 |

| PU → CIUC | 0.012 | 0.011 | 0.086 | 0.138 | 0.890 |

| SATS → CIUC | −0.153 | −0.153 | 0.075 | 2.051 | 0.040 |

| SN → CIUC | 0.431 | 0.431 | 0.055 | 7.886 | 0.000 |

| Variable | Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-Statistics (|O/STDEV|) | p-Values |

|---|---|---|---|---|---|

| PQA → ATD → CIUC | 0.086 | 0.088 | 0.030 | 2.854 | 0.004 |

| PR → ATD → CIUC | 0.231 | 0.233 | 0.058 | 3.969 | 0.000 |

| PEU → SATS → CIUC | −0.116 | −0.116 | 0.056 | 2.061 | 0.039 |

| PEU → PU → CIUC | 0.010 | 0.009 | 0.070 | 0.138 | 0.891 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bahri, S.; Suroso, A.I.; Suhendi; Sari, L.K. Examining Cash Usage Behavior in Metropolitan Greater Jakarta Societies. Societies 2025, 15, 120. https://doi.org/10.3390/soc15050120

Bahri S, Suroso AI, Suhendi, Sari LK. Examining Cash Usage Behavior in Metropolitan Greater Jakarta Societies. Societies. 2025; 15(5):120. https://doi.org/10.3390/soc15050120

Chicago/Turabian StyleBahri, Saiful, Arif Imam Suroso, Suhendi, and Linda Karlina Sari. 2025. "Examining Cash Usage Behavior in Metropolitan Greater Jakarta Societies" Societies 15, no. 5: 120. https://doi.org/10.3390/soc15050120

APA StyleBahri, S., Suroso, A. I., Suhendi, & Sari, L. K. (2025). Examining Cash Usage Behavior in Metropolitan Greater Jakarta Societies. Societies, 15(5), 120. https://doi.org/10.3390/soc15050120