An Asset-Based Perspective of the Economic Contributions of Latinx Communities: An Illinois Case Study

Abstract

1. Introduction

2. Literature Review

2.1. An Asset-Based Approach

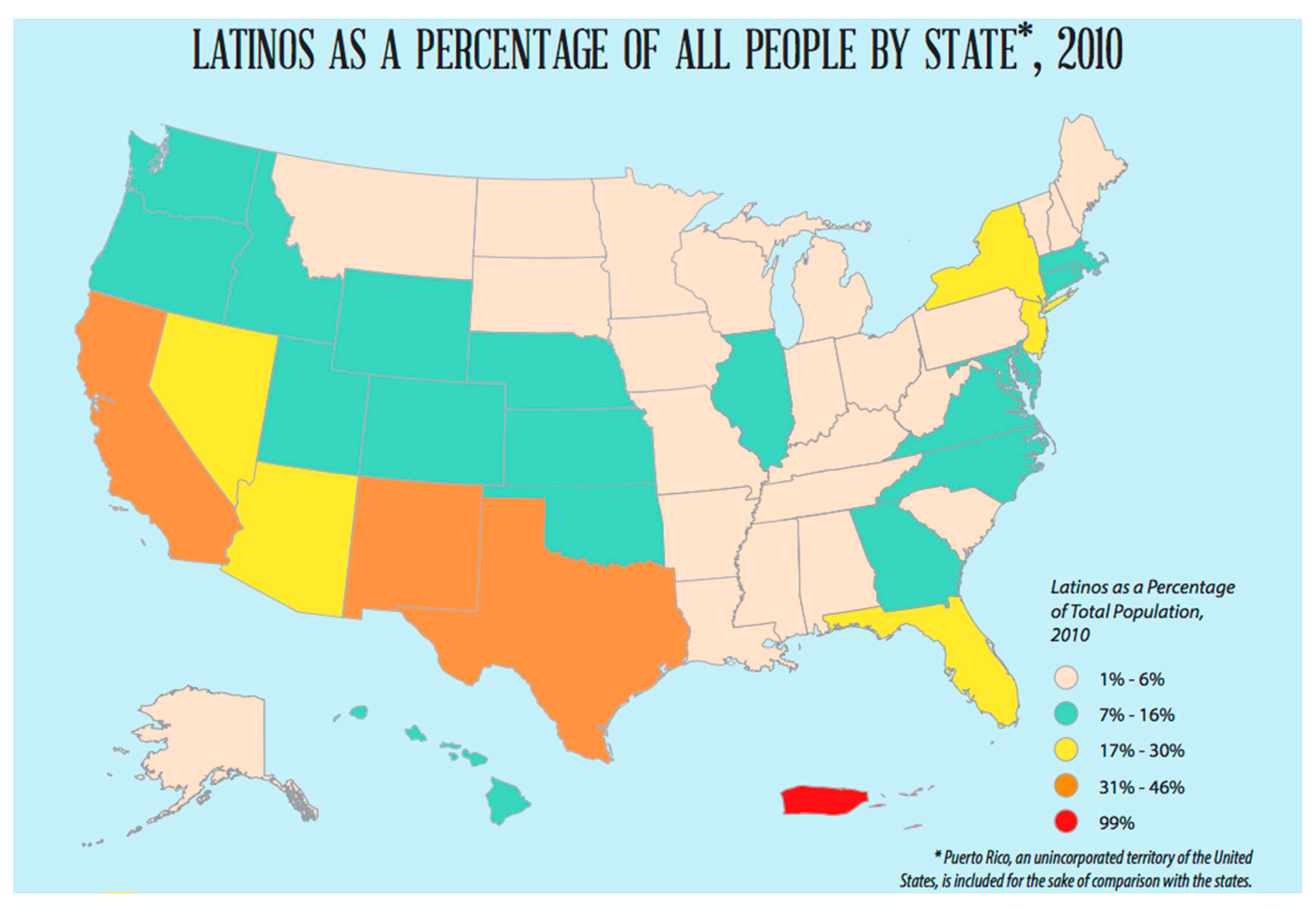

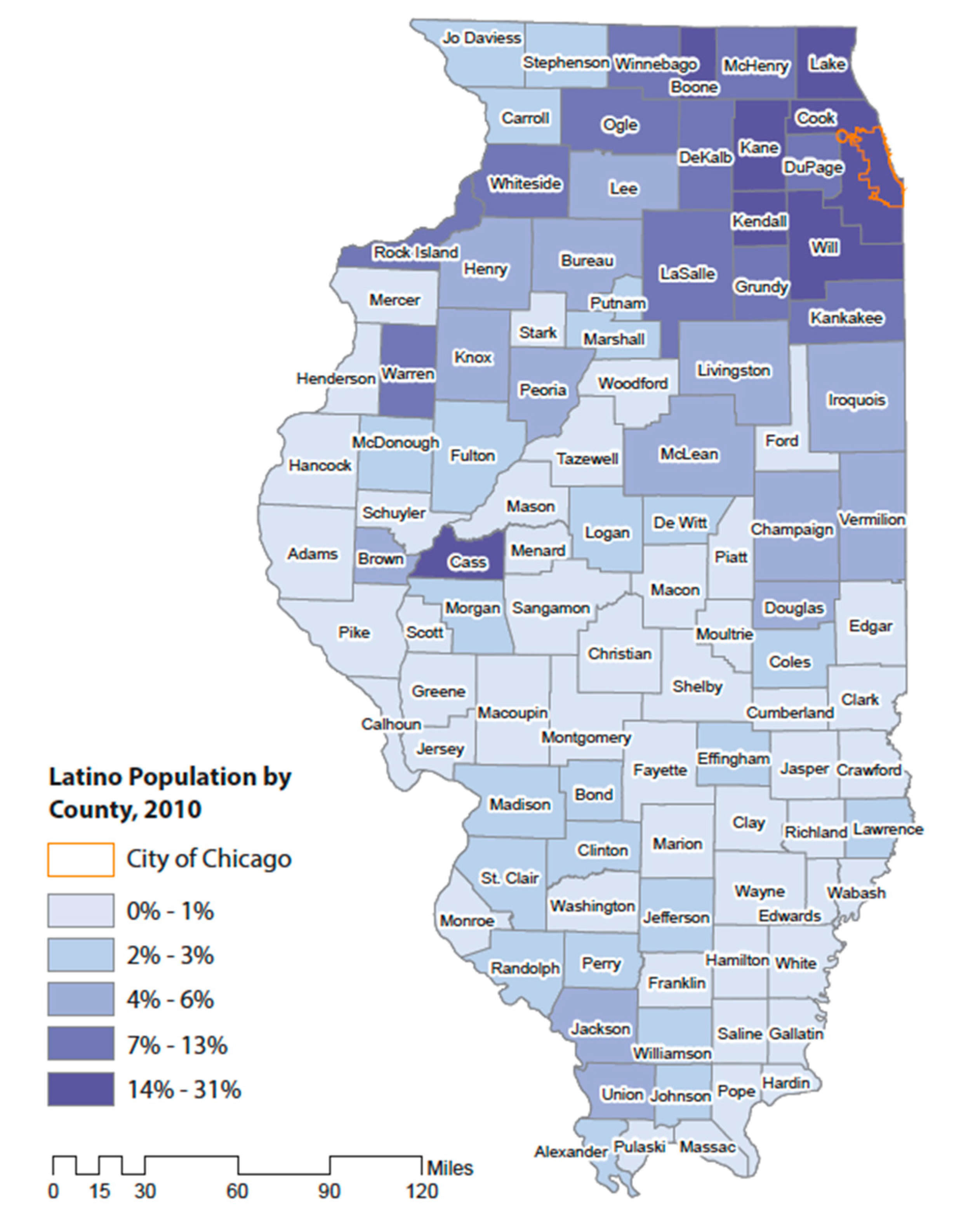

2.2. The Growth of Latinx in the State

3. Methods

3.1. Employment Analysis

3.2. Economic Multiplier of Latinx Employment

- Direct impact denotes the dollar value of Latinx employment by industry. For each employee in each sector, the model computes the total estimated value of industrial output.

- Indirect impact denotes the associated industrial activity at local firms that supply goods and services to those industries in which Latinx are employed.

- Induced impact denotes the industrial activity that occurs when Latinx households and households of employees of firms supplying goods and services to businesses that employ Latinx spend their paychecks. While direct and indirect impacts vary based on the types of goods and services being produced, induced impacts typically vary much less.

- Total impact denotes the cumulative effect of direct, indirect and induced effects.

- Identify new events (direct impacts) to be introduced into the model: The Latinx employment is the direct impacts.

- Identify the industry sectors affected: North American Industry Classification System (NAICS) industry sectors in which Latinx are employed were found and all were allocated to appropriate IMPLAN industry codes.

4. Findings

4.1. Employment Analysis

4.2. Economic Multiplier of Latinx Employment

5. Discussion

6. Conclusions and Recommendations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Kretzmann, J.P.; McKnight, J.L. Building Communities from the Inside out: A Path toward Finding and Mobilizing a Community’s Assets; The Asset-Based Community Development Institute, Institute for Policy Research, Northwestern University: Evanston, IL, USA, 1993. [Google Scholar]

- García, I. Asset-Based Community Development (ABCD): Core principles. In Research Handbook on Community Development; Edward Elgar Publishing: Cheltenham, UK, 2020; pp. 67–75. [Google Scholar]

- Green, M.; Moore, H.; O’Brien, J. ABCD: When People Care Enough to Act, 1st ed.; O’Brien, J., Ed.; Inclusion Press: Toronto, ON, Canada, 2007. [Google Scholar]

- Griffin, D.; Farris, A. School counselors and collaboration: Finding resources through community asset mapping. Prof. Sch. Couns. 2010, 13. [Google Scholar] [CrossRef]

- Arnold, L.; Gallaher, J.; Garcia, M.; Head, B.; Hutcheson, H.; Khajehei, S.; Oswald, L.; Sheng, J.; Siracuse, B.; Wedekind, M.; et al. Community Engagement Techniques; ABCD Practitioner Series; University of Utah and ABCD Institute at DePaul University: Salt Lake City, UT, USA; Chicago, IL, USA, 2019. [Google Scholar]

- García, I. Cultural insights for planners: Understanding the terms Hispanic, Latino, and Latinx. J. Am. Plan. Assoc. 2020, 1–10. [Google Scholar] [CrossRef]

- Latino Policy Forum. IMPACTO Illinois! Latino Policy Forum. Available online: https://www.latinopolicyforum.org/get-involved/impacto (accessed on 19 July 2020).

- Cintrón, R.; Toro-Morn, M.; García, I.; Scott, E. 60 Years of Migration: Puerto Ricans in Chicagoland; Prepared for the Puerto Rican Agenda; Nathalie P. Voorhees Center for Neighborhood and Community Improvement at the College of Urban Planning and Policy (CUPPA) and University of Illinois at Chicago (UIC): Chicago, IL, USA, 2012; Available online: http://www.puertoricanchicago.org/ (accessed on 28 July 2020).

- García, I. Latino Demographic Profiles; Prepared for Illinois Latino Family Commission. Making the Case for Change; Nathalie, P. Voorhees Center for Neighborhood and Community Improvement at the College of Urban Planning and Policy (CUPPPA) and University of Illinois at Chicago (UIC): Chicago, IL, USA, 2014; Available online: https://doi.org/10.13140/RG.2.2.15481.21608 (accessed on 28 July 2020).

- Born, A. Open to All? Different Cultures, Same Communities; Voorhees Center and Interfaith Housing Center of the Northern Suburbs: Chicago, IL, USA, 2011; Available online: https://voorheescenter.red.uic.edu/wp-content/uploads/sites/122/2017/10/2011-Open-to-All-Different-cultures-same-communities.pdf (accessed on 28 July 2020).

- Delgado, M. Social Work with Latinos: A Cultural Assets Paradigm; Oxford University Press: New York, NY, USA, 2007. [Google Scholar]

- González, E.; Romero, C.S.; Urzua, A.S.; Luévano, S.C. The grassroots and new urbanism: A case from a southern California Latino community. International research on placemaking and urban sustainability. J. Urban. 2012, 5, 219–239. [Google Scholar] [CrossRef]

- García, I. Community participation as a tool for conservation planning and historic preservation: The case of community as a campus’ (CAAC). J. Hous. Built Environ. 2018, 33, 519–537. [Google Scholar] [CrossRef]

- Hoekveld, J.J. Time-space relations and the differences between shrinking regions. Built Environ. 2012, 38, 179–195. [Google Scholar] [CrossRef]

- García, I. Making the Case for Change: Report Series; Nathalie, P. Voorhees Center for Neighborhood and Community Improvement, and the Illinois Latino Family Commission. Tampico Press: Chicago, IL, USA, 2014; Available online: https://www.voorheescenter.com/publications (accessed on 28 July 2020).

- Kral, R. Strategies That Work: Techniques for Solutions in the Schools; Brieg Family Therapy Center: Milwaukee, WI, USA, 1989; p. 32. [Google Scholar]

- Duncan, D. Asset Mapping Toolkit Eight Steps to Increase Residential Engagement; Clear Impact: Florida, FL, USA, 2016; Available online: https://resources.depaul.edu/abcd-institute/resources/Documents/D.%20Duncan%20Asset%20Mapping%20Toolkit%20Eight%20Steps%20to%20Increase%20Residential%20Engagement.pdf (accessed on 28 July 2020).

- McKnight, J. Asset Mapping in Communities. In Health Assets in a Global Context: Theory, Methods, Action; Morgan, A., Davies, M., Ziglio, E., Eds.; Springer: New York, NY, USA, 2010; pp. 59–76. [Google Scholar] [CrossRef]

- García, T.; Garfinkel-Castro, A.; Pfeiffer, D. Planning with Diverse Communities; Planning Advisory Service (PAS) Report 593; American Planning Association: Chicago, IL, USA, 2019; Available online: https://www.planning.org/publications/report/9165143/ (accessed on 28 July 2020).

- García, I. Symbolism, collective identity, and community development. Societies 2018, 8, 81. [Google Scholar] [CrossRef]

- García, I. The two-income debt trap: Personal responsibility and the financialization of every day life. Special Issue Neoliberalism and Social Reproduction. Polygr. Int. J. Cult. Polit. 2019, 13, 31–49. Available online: https://polygraphjournal.files.wordpress.com/2019/02/polygraph-27_garcia.pdf (accessed on 28 July 2020).

- Baker, D. The Conservative Nanny State: How the Wealthy Use the Government to Stay Rich and Get Richer; LULU: Washington, DC, USA, 2006. [Google Scholar]

- García, I. Repurposing a historic school building as a teacher’s village: Exploring the connection between school closures, housing affordability, and community goals in a gentrifying neighborhood. J. Urban. Int. Res. Placemaking Urban. Sustain. 2019, 13, 153–169. [Google Scholar] [CrossRef]

- García, I. No Se Vende (Not for Sale): An anti-gentrification grassroots campaign of Puerto Ricans in Chicago. Am. Crít. 2020, 3, 35–61. Available online: http://ojs.unica.it/index.php/cisap/issue/view/130 (accessed on 28 July 2020).

- García, I.; Crookston, J. Connectivity and usership of two types of multi-modal transportation networks: A regional trail and a transit oriented commercial corridor. Urban. Sci. 2019, 3, 34. [Google Scholar] [CrossRef]

- García, I.; Ara, S. Active transportation and perceptions of safety: A case study of a regional trail and a transit corridor in Salt Lake City, Utah. J. Plan. Pract. Educ. 2018, 14, 37–43. Available online: http://digitalcommons.calpoly.edu/focus/vol14/iss1/14/ (accessed on 28 July 2020).

- Cutts, T.; Langdon, S.; Meza, F.R.; Hochwalt, R.; Pichardo-Geisinger, B.; Sowell, J.; Chapman, L.; Dorton, B.; Kennett, B.; Jones, M.T. Community Health Asset Mapping Partnership Engages Hispanic/Latino Health Seekers and Providers. N. C. Med. J. 2016, 77, 160–167. [Google Scholar] [CrossRef] [PubMed]

- Smokowski, P.R.; Bacallao, M.L. Acculturation and aggression in Latino adolescents: A structural model focusing on cultural risk factors and assets. J. Abnorm. Child Psychol. 2006, 34, 657–671. [Google Scholar] [CrossRef] [PubMed]

- U.S. Census Bureau. 1970 and 2010. Decennial Census. Available online: https://2020census.gov/ (accessed on 28 July 2020).

- Ceasar, S. Hispanic Population Tops 50 Million in U.S. Los Angeles Times. 24 March 2011. Available online: http://articles.latimes.com/2011/mar/24/nation/la-na-census-hispanic-20110325 (accessed on 28 July 2020).

- US Census Bureau. U.S. Census Bureau Projections Show a Slower Growing, Older, More Diverse Nation a Half Century from Now; Population-Newsroom-U.S. Census Bureau: Washington, DC, USA, 2012. Available online: https://www.census.gov/newsroom/releases/archives/population/cb12-243.html (accessed on 28 July 2020).

- Martinez, M.; Ariosto, D. Hispanic Population Exceeds 50 Million, Firmly Nation’s No. 2 Group. 2011. Available online: http://www.cnn.com/2011/US/03/24/census.hispanics/ (accessed on 28 July 2020).

- Passel, J.S.; Cohn, D.V.; Gonzalez-Barrera, A. Net Migration from Mexico Falls to Zero—and Perhaps Less; Pew Research Center’s Hispanic Trends Project (blog): Washington, DC, USA, 2012. [Google Scholar]

- Brown, A. U.S. Hispanic and Asian Populations Growing, but for Different Reasons; Pew Research Center (blog), 2014; Available online: http://www.pewresearch.org/fact-tank/2014/06/26/u-s-hispanic-and-asian-populations-growing-but-for-different-reasons/html (accessed on 28 July 2020).

- Immigration Policy Center. The Economic and Political Impact of Immigrants, Latinos and Asians State by State. 2013. Available online: http://www.immigrationpolicy.org/just-facts/economic-and-political-impact-immigrants-latinos-and-asians-state-state (accessed on 28 July 2020).

- Garvey, D.L.; Espenshade, T.J.; Scully, J.M. Are immigrants a drain on the public fisc? State and local impacts in New Jersey. Soc. Sci. Q. 2002, 83, 537–553. [Google Scholar]

- Miller, S.; Martinez, R.; Fuan, A. Measuring the Economic and Fiscal Contributions of Michigan’s Latino Population; Julian Samora Reserach Institute: East Lansing, MI, USA, 2010. [Google Scholar]

- U.S. Census. American Community Survey; U.S. Census, 2008. Available online: https://www.census.gov/programs-surveys/acs/data.html (accessed on 28 July 2020).

- Bureau of Labor Statistics. Quarterly Census of Employment and Wages 2020. Available online: https://data.bls.gov/cew/apps/table_maker/v4/table_maker.htm#type=6&year=2019&qtr=A&own=5&area=US000&supp=0 (accessed on 28 July 2020).

- NAM. 2019 Indiana Manufacturing Facts. 2020. Available online: https://www.nam.org/state-manufacturing-data/2019-indiana-manufacturing-facts/ (accessed on 28 July 2020).

- Crompton, J.L.; Lee, S.; Shuster, T.J. A Guide for Undertaking Economic Impact Studies: The Springfest Example. J. Travel Res. 2001, 40, 79–87. [Google Scholar] [CrossRef]

- IMPLAN. IMPLAN Pro. Analysis Guide; IMPLAN: Hunterville, NC, USA, 2004; Available online: https://blog.implan.com/understanding-implan-application-and-data (accessed on 28 July 2020).

- Low, S.S.; Isserman, A.M. Ethanol and the local economy: Industry trends, location factors, economic impacts, and risks. Econ. Dev. Q. 2009, 23, 71–88. [Google Scholar] [CrossRef]

- Passel, J.; DeVera, C. Mexicans Decline to Less than Half the U.S. Unauthorized Immigrant Population for the First Time. 2019. Available online: https://www.pewresearch.org/fact-tank/2019/06/12/us-unauthorized-immigrant-population-2017/ (accessed on 28 July 2020).

- Migration Policy Institute. Profile of the Unauthorized Immigrant Population: Illinois. 2017. Available online: https://www.migrationpolicy.org/data/unauthorized-immigrant-population/state/IL (accessed on 28 July 2020).

- Passel, J. Measuring Illegal Immigration: Pew Research Center. Available online: https://www.pewresearch.org/fact-tank/2019/07/12/how-pew-research-center-counts-unauthorized-immigrants-in-us/ (accessed on 28 July 2020).

- Stimson, R.J.; Stough, R.R.; Roberts, B.H. Regional Economic Development: Analysis and Planning Strategy; Springer Science & Business Media: Berlin, Germany, 2006. [Google Scholar]

- Humphreys, J.M. The Multicultural Economy 2012. Selig Center for Economic Growth. 2012. Available online: http://www.terry.uga.edu/media/documents/multicultural_economy_2009.pdf (accessed on 28 July 2020).

| 1 | Year 2018 is the latest year for which employment data for four quarters by ethnicity and detailed industry levels (4-digit NAICS) are available from the U.S. Census’ Quarterly Workforce Indicators (QWI) database. |

| 2 | This sector estimates what owner/occupants would pay in rent if they rented rather than owned their homes. This sector creates an industry out of owning a home, and its production function represents the repair and maintenance of that home. Its sole product (output) is ownership and is purchased entirely by personal consumption expenditures—i.e., the household sector. There is no employment or employee compensation for this industry. Indirect business taxes for this sector are largely made up of property taxes paid by the homeowner, while other property income is the difference between the rental value of the home and the costs of home ownership. Interest payments and mortgage payments are a transfer in the SAM and are not part of the production function for this sector. This sector is included in the database to ensure consistency in the flow of funds. It captures the expenses of home ownership, such as repair and maintenance construction, various closing costs, and other expenditures related to the upkeep of the space in the same way expenses are captured for rental properties. |

| Industry Sector | Employment | Share of Total Latinx Employment |

|---|---|---|

| Restaurants and Other Eating Places | 86,855 | 9.9% |

| Employment Services | 49,251 | 5.6% |

| Elementary and Secondary Schools | 34,543 | 4.0% |

| Services to Buildings and Dwellings | 28,198 | 3.2% |

| General Medical and Surgical Hospitals | 24,236 | 2.8% |

| Grocery Stores | 17,828 | 2.0% |

| Traveler Accommodation | 14,102 | 1.6% |

| Department Stores | 12,563 | 1.4% |

| Warehousing and Storage | 12,552 | 1.4% |

| Offices of Physicians | 12,500 | 1.4% |

| Top 10 Sectors | 292,628 | 33.5% |

| Total (all sectors) | 873,312 | 100.0% |

| Industry Sector | Illinois Employment | Latinx Employment | Share | LQ |

|---|---|---|---|---|

| Animal Slaughtering and Processing | 18,828 | 6618 | 35.1% | 2.36 |

| Converted Paper Product Manufacturing | 18,180 | 6088 | 33.5% | 2.24 |

| Bakeries and Tortilla Manufacturing | 22,575 | 7538 | 33.4% | 2.24 |

| Services to Buildings and Dwellings | 85,520 | 28,198 | 33.0% | 2.21 |

| Plastics Product Manufacturing | 36,715 | 11,363 | 30.9% | 2.07 |

| Traveler Accommodation | 51,209 | 14,102 | 27.5% | 1.85 |

| Grocery and Related Product Merchant Wholesalers | 42,774 | 11,491 | 26.9% | 1.80 |

| Special Food Services | 36,559 | 9082 | 24.8% | 1.66 |

| Clothing Stores | 36,437 | 8775 | 24.1% | 1.61 |

| Building Finishing Contractors | 28,532 | 6742 | 23.6% | 1.58 |

| Total | 5,852,376 | 873,312 | 14.9% | - |

| Concentrated | Evenly Distributed | Unconcentrated | Total | ||||

|---|---|---|---|---|---|---|---|

| Employment | 410,872 | 47.0% | 230,354 | 26.4% | 232,086 | 26.6% | 873,312 |

| Number of Industries | 95 | 30.7% | 84 | 27.2% | 130 | 42.1% | 309 |

| Industry Sector | LQ | Employment | Wage Ratio |

|---|---|---|---|

| Animal Slaughtering and Processing | 2.36 | 6618 | 0.84 |

| Converted Paper Product Manufacturing | 2.24 | 6088 | 0.78 |

| Bakeries and Tortilla Manufacturing | 2.24 | 7538 | 0.95 |

| Services to Buildings and Dwellings | 2.21 | 28,198 | 0.95 |

| Plastics Product Manufacturing | 2.07 | 11,363 | 0.69 |

| Traveler Accommodation | 1.85 | 14,102 | 0.92 |

| Grocery and Related Product Merchant Wholesalers | 1.80 | 11,491 | 0.72 |

| Special Food Services | 1.66 | 9082 | 0.91 |

| Clothing Stores | 1.61 | 8775 | 0.87 |

| Building Finishing Contractors | 1.58 | 6742 | 0.99 |

| Total | - | 873,312 | 0.70 |

| 1990 * | 2000 * | 2009 * | 2014 | |

|---|---|---|---|---|

| Latinx | 8,824,148 | 22,617,086 | 42,994,645 | 57,428,795 |

| Total | 208,084,531 | 340,995,806 | 485,733,773 | 582,666,550 |

| Percent | 4.2% | 6.6% | 8.9% | 9.9% |

| Impact Type | Employment | Labor Income ($ Thousands) | GDP ($ Thousands) | Output ($ Thousands) | Local & State Tax ($ Thousands) |

|---|---|---|---|---|---|

| Direct Effect | 873,312 | 44,080,246 | 69,211,940 | 133,691,577 | 5,491,411 |

| Indirect Effect | 292,612 | 20,436,681 | 32,650,373 | 59,161,246 | 2,610,171 |

| Induced Effect | 379,793 | 20,556,216 | 36,976,670 | 61,156,059 | 3,767,726 |

| Total Effect | 1,545,717 | 85,073,142 | 138,838,983 | 254,008,882 | 11,869,308 |

| Impact Multiplier | 1.77 | 1.93 | 2.01 | 1.90 | 2.16 |

| Industry Sector | Employment | Labor Income ($ Thousands) | GDP ($ Thousands) | Output ($ Thousands) |

|---|---|---|---|---|

| Retail | 165,611 | 4,976,752 | 8,170,405 | 12,966,840 |

| Restaurants and other food & drinking places | 158,574 | 3,806,782 | 5,751,551 | 9,650,710 |

| Employment services | 78,626 | 2,754,648 | 4,390,221 | 6,716,835 |

| Hospitals | 47,864 | 3,326,298 | 4,132,840 | 7,450,676 |

| Real estate | 41,419 | 1,893,965 | 4,841,270 | 10,008,722 |

| Elementary and secondary schools | 39,390 | 1,266,612 | 1,096,076 | 1,361,686 |

| Construction | 34,267 | 2,056,222 | 3,171,557 | 6,562,122 |

| Services to buildings | 30,014 | 887,475 | 917,780 | 1,468,205 |

| Management of companies and enterprises | 27,124 | 3,353,686 | 3,869,586 | 5,377,372 |

| Warehousing and storage | 23,362 | 1,066,711 | 1,226,081 | 2,381,377 |

| Subtotal (top 10) | 646,252 | 25,389,149 | 37,567,366 | 63,944,545 |

| Total | 1,545,717 | 85,073,142 | 138,838,983 | 254,008,882 |

| Industry Sector | Employment | Labor Income ($ Thousands) | GDP ($ Thousands) | Output ($ Thousands) |

|---|---|---|---|---|

| Retail | 165,611 | 4,976,752 | 8,170,405 | 12,966,840 |

| Real estate | 41,419 | 1,893,965 | 4,841,270 | 10,008,722 |

| Restaurants and other food & drinking places | 158,574 | 3,806,782 | 5,751,551 | 9,650,710 |

| Hospitals | 47,864 | 3,326,298 | 4,132,840 | 7,450,676 |

| Monetary authorities and depository credit intermediation | 20,727 | 1,845,548 | 4,630,261 | 7,188,669 |

| Employment services | 78,626 | 2,754,648 | 4,390,221 | 6,716,835 |

| Construction | 34,267 | 2,056,222 | 3,171,557 | 6,562,122 |

| Owner-occupied dwellings2 [45] | 0 | 0 | 5,089,127 | 6,430,052 |

| Management of companies and enterprises | 27,124 | 3,353,686 | 3,869,586 | 5,377,372 |

| Oilseed farming | 809 | 790,971 | 1,888,596 | 4,741,561 |

| Subtotal (top 10) | 575,021 | 24,804,870 | 45,935,415 | 77,093,558 |

| Total | 1,545,717 | 85,073,142 | 138,838,983 | 254,008,882 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

García, I.; Sönmez, Z. An Asset-Based Perspective of the Economic Contributions of Latinx Communities: An Illinois Case Study. Societies 2020, 10, 59. https://doi.org/10.3390/soc10030059

García I, Sönmez Z. An Asset-Based Perspective of the Economic Contributions of Latinx Communities: An Illinois Case Study. Societies. 2020; 10(3):59. https://doi.org/10.3390/soc10030059

Chicago/Turabian StyleGarcía, Ivis, and Zafer Sönmez. 2020. "An Asset-Based Perspective of the Economic Contributions of Latinx Communities: An Illinois Case Study" Societies 10, no. 3: 59. https://doi.org/10.3390/soc10030059

APA StyleGarcía, I., & Sönmez, Z. (2020). An Asset-Based Perspective of the Economic Contributions of Latinx Communities: An Illinois Case Study. Societies, 10(3), 59. https://doi.org/10.3390/soc10030059