Local Equivalence of the Black–Scholes and Merton–Garman Equations

Abstract

1. Introduction

2. The Black–Scholes Equation

- (1)

- The spot interest rate, r, is constant.

- (2)

- In order to create the hedged portfolio, , the stock is infinitely divisible, and it is possible to short-sell the stock.

- (3)

- The portfolio satisfies the no-arbitrage condition.

- (4)

- The portfolio, , can be re-balanced continuously.

- (5)

- There is no fee for the transaction.

- (6)

- The stock price has a continuous evolution.

2.1. Black–Scholes Hamiltonian Formulation

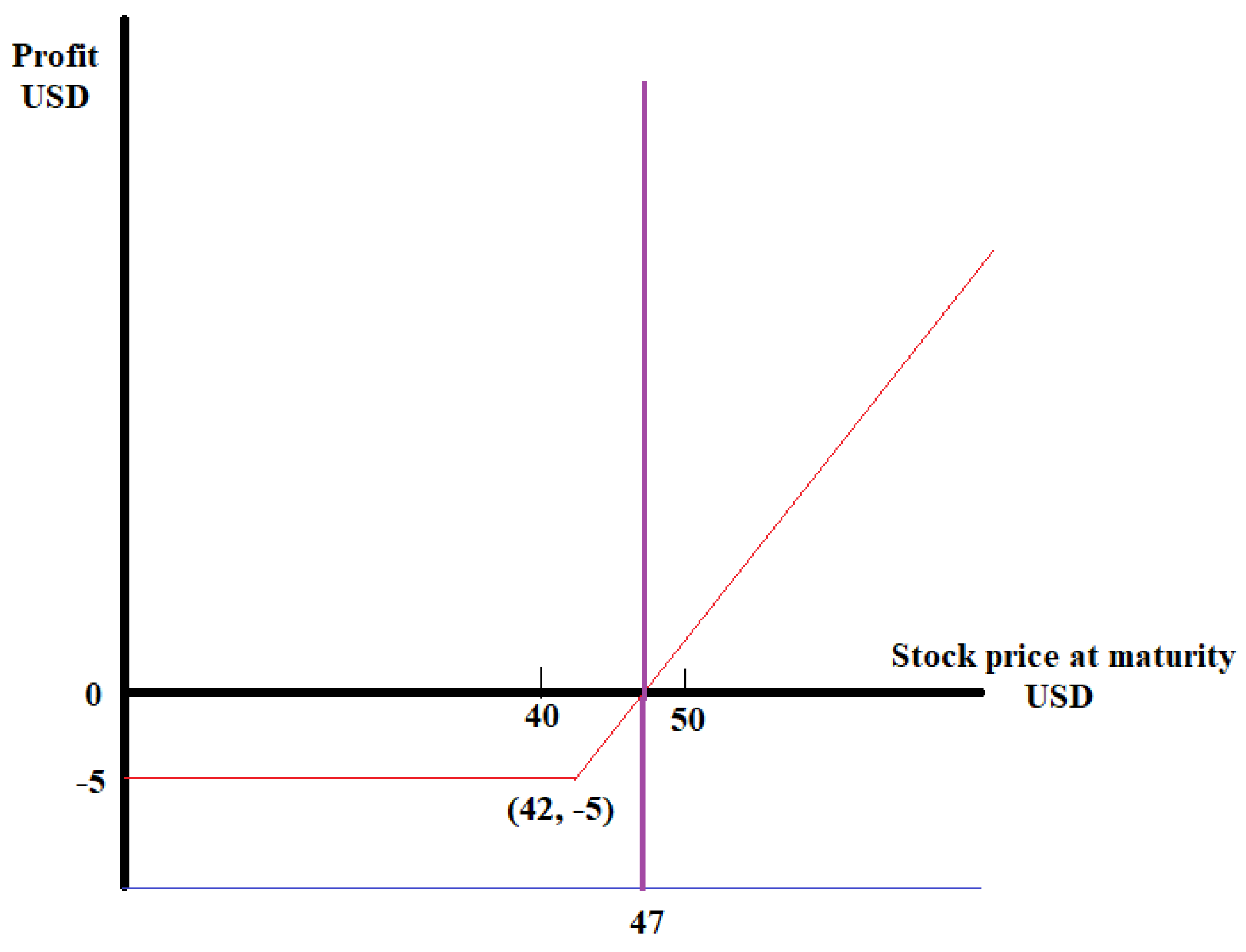

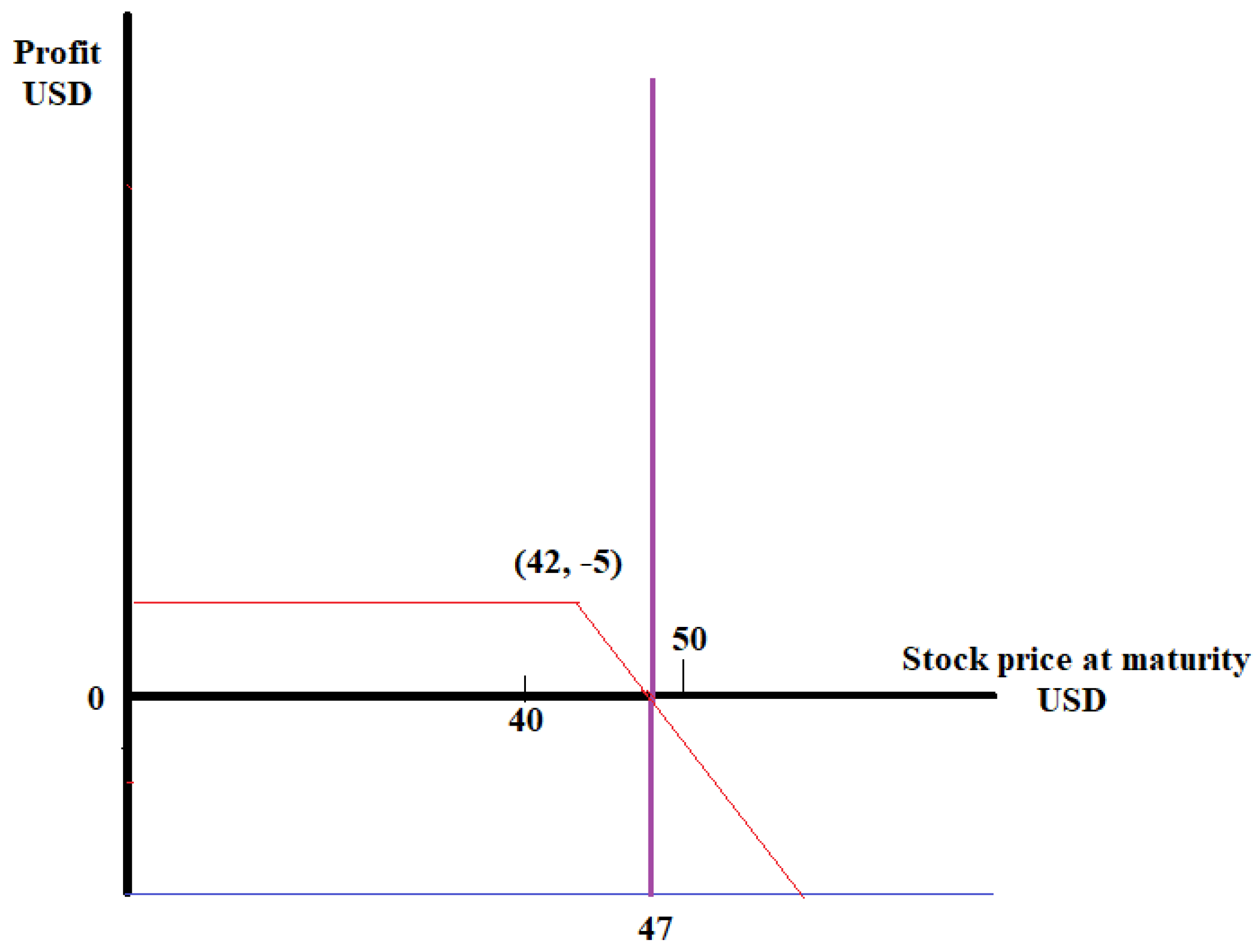

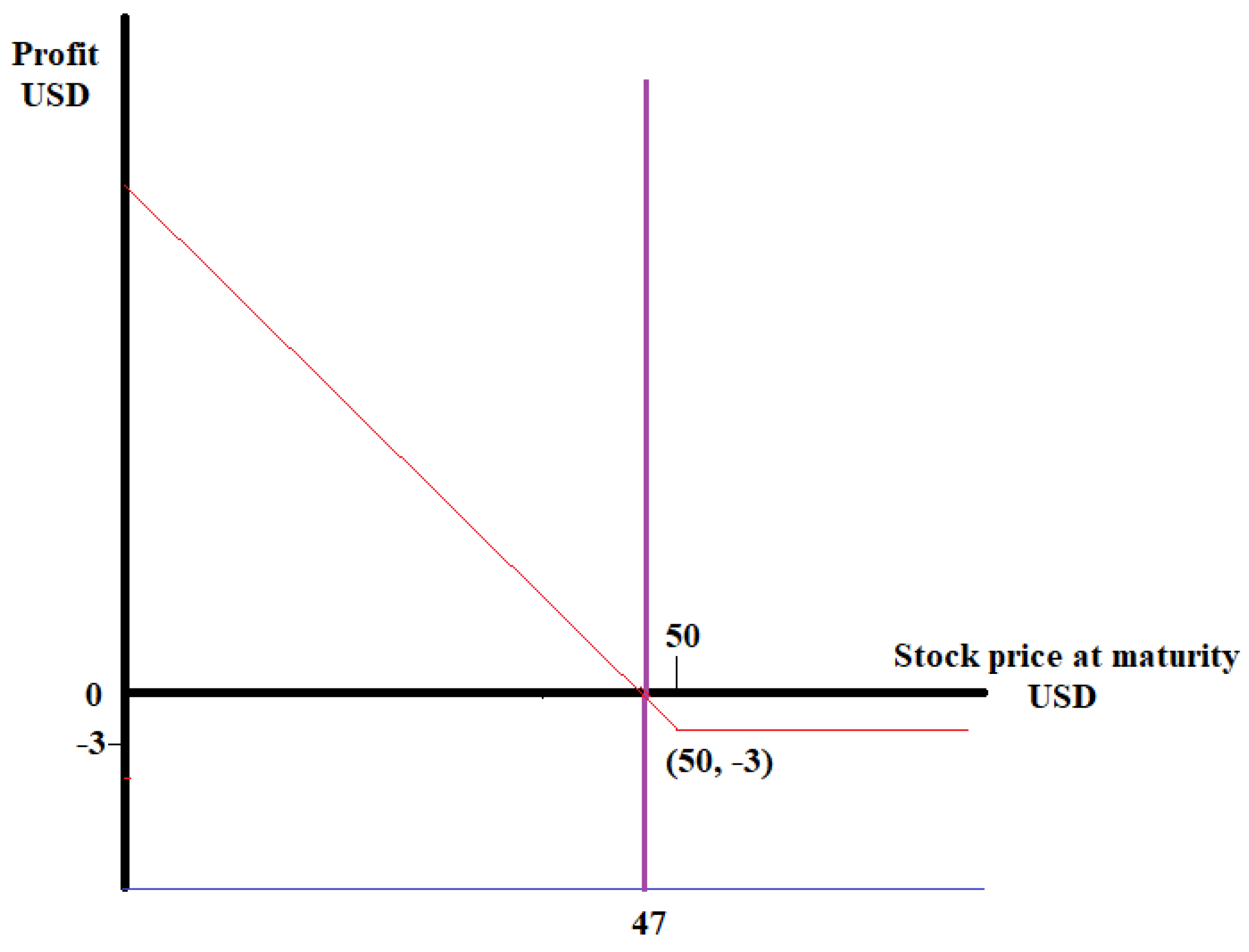

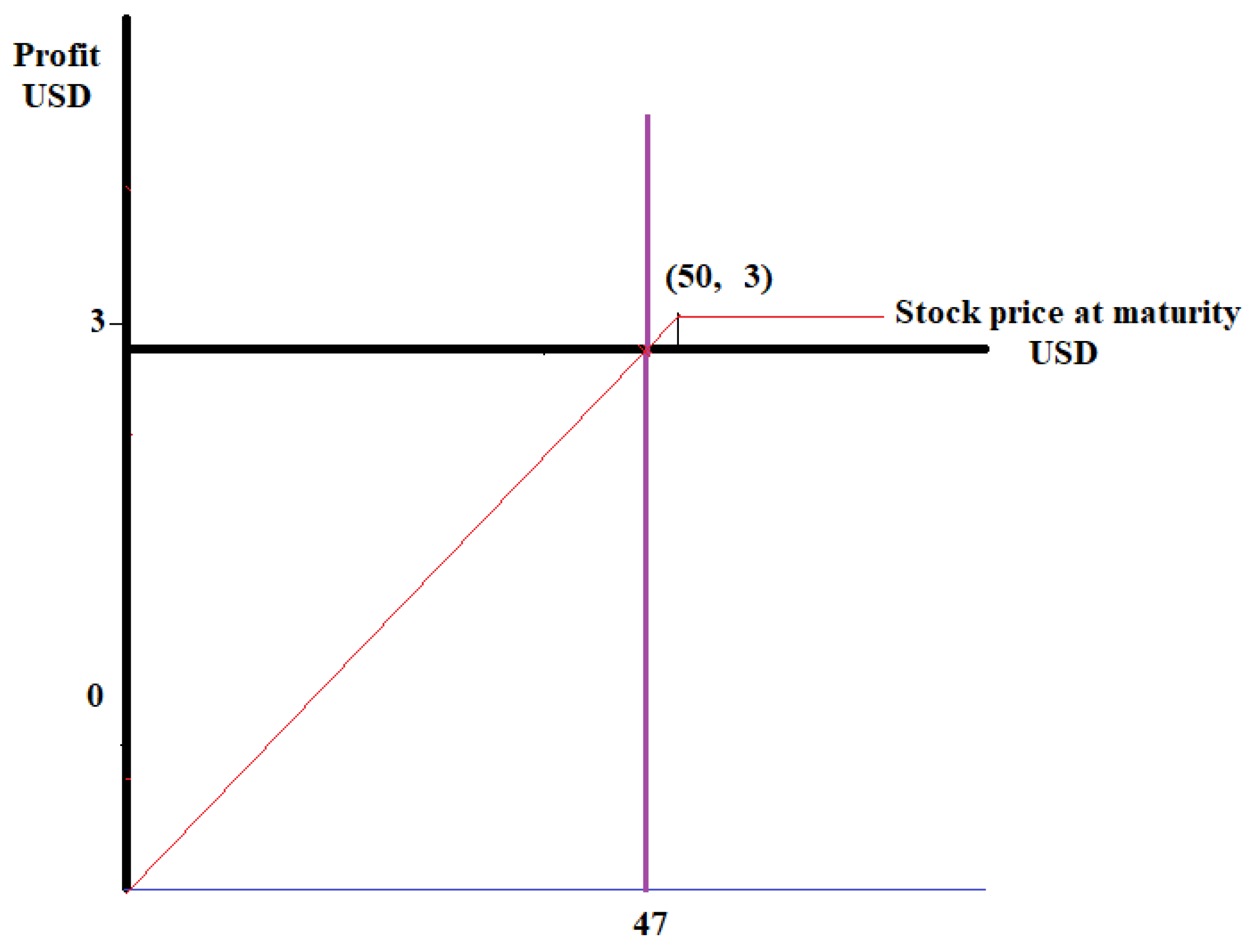

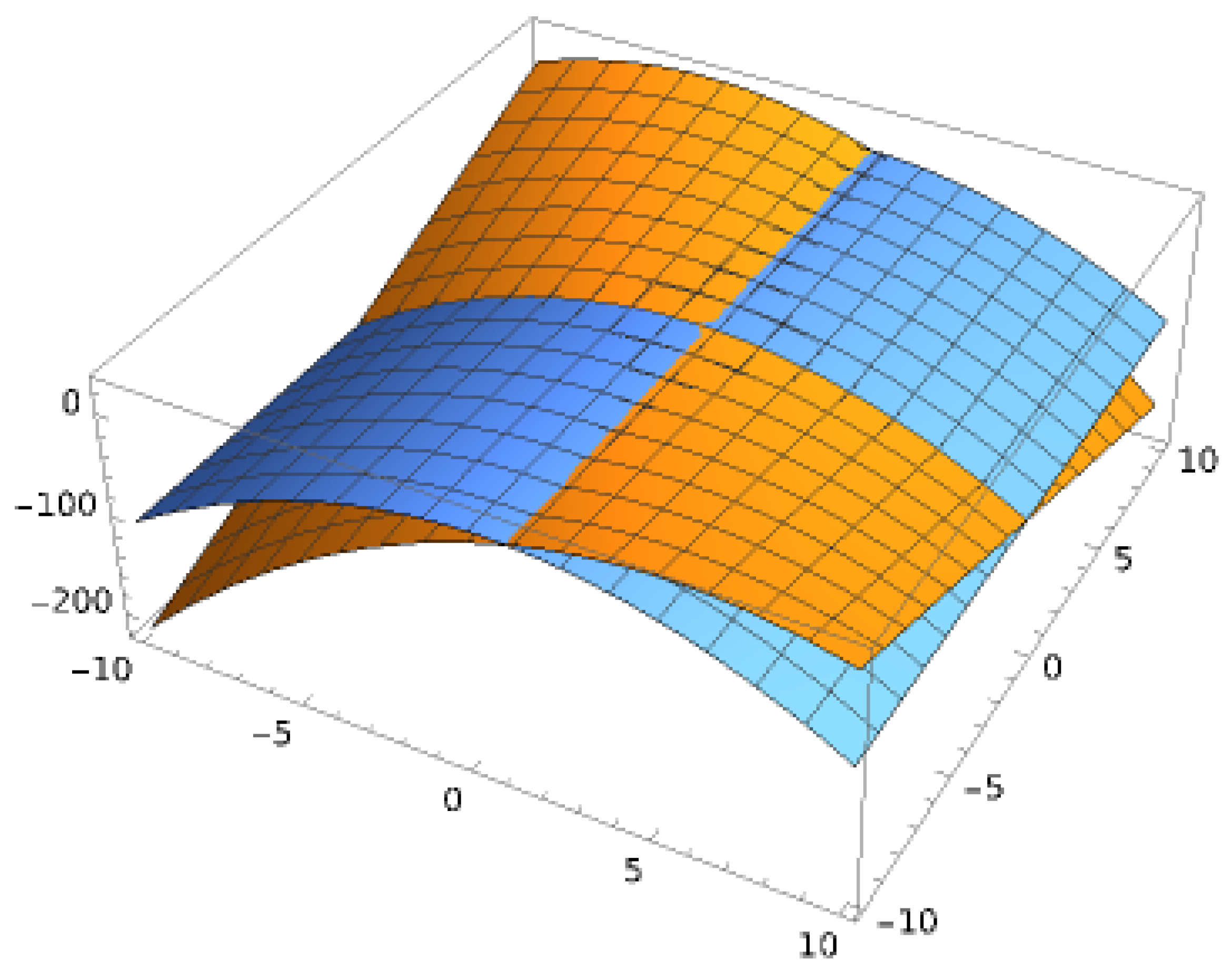

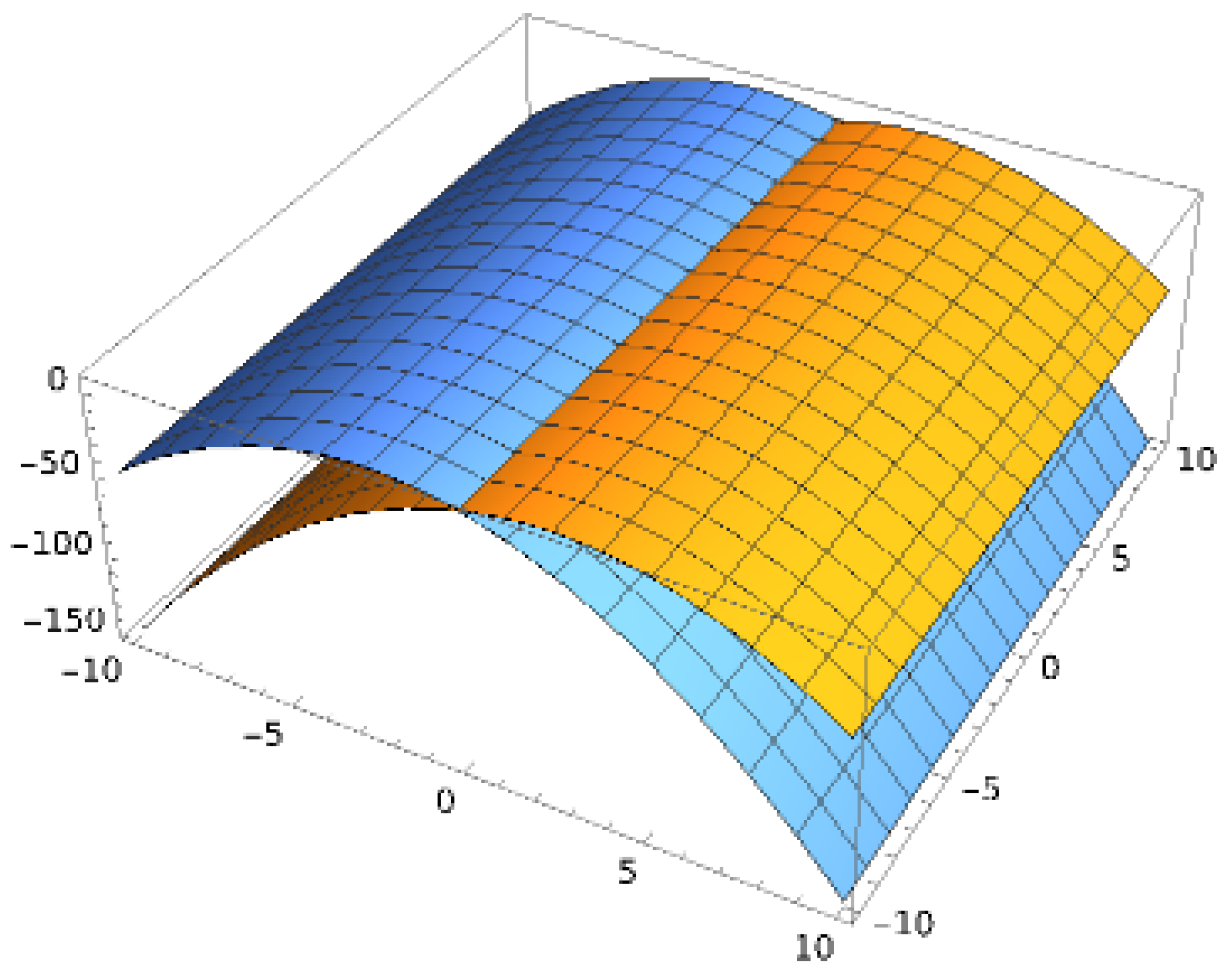

2.2. Volatility as a Parameter in Deciding Whether to Buy an Option

3. The Merton–Garman Equation

3.1. Derivation of the Merton–Garman Equation

3.2. Hamiltonian Form of the Merton–Garman Equation

3.3. Limitations of the Merton–Garman Equation

4. Symmetries of the Black–Scholes Hamiltonian

Local Equivalence of the Merton–Garman and Black–Scholes Equations: The Gauge Principle

5. The Martingale Condition with Stochastic Volatility

6. Interpretations from the Perspective of Physical Systems

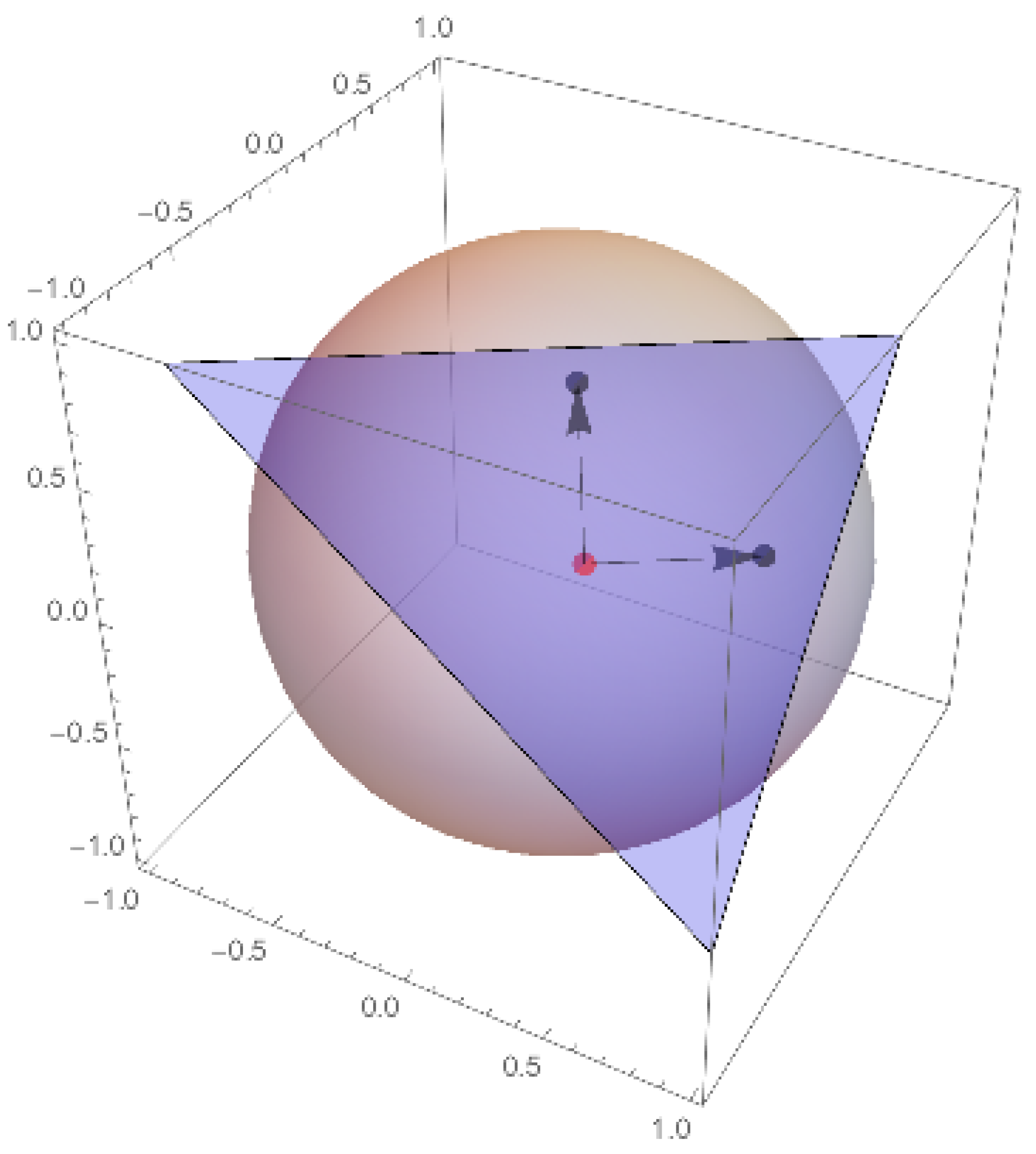

6.1. Analogy with Relativity

6.2. Analogy with Quantum Electrodynamics

7. Alternative Models: The Origin of Stochastic Volatility

7.1. The Bachelier Model

7.2. The Displaced Black–Scholes Model

7.3. General Analysis of Alternative Models

8. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Black, F.; Scholes, M. The pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637. [Google Scholar] [CrossRef]

- de Weert, F. An Introduction to Options Trading; John Wiley and Sons, LTD: Hoboken, NJ, USA, 2006; ISBN-13 978-0-470-02970-1 (PB); ISBN-10 0-470-02970-6 (PB). [Google Scholar]

- Merton, R.C. The theory of rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Merton, R.C. Option pricing when underlying stock returns are discontinous. J. Financ. Econ. 1976, 3, 125. [Google Scholar] [CrossRef]

- Arraut, I. Gauge symmetries and the Higgs mechanism in Quantum Finance. arXiv 2023, arXiv:2306.03237. [Google Scholar] [CrossRef]

- Arraut, I.; Au, A.; Tse, A.C. Spontaneous symmetry breaking in quantum finance. Europhys. Lett. 2020, 131, 68003. [Google Scholar] [CrossRef]

- Carrol, S. Spacetime and Geometry: An Introduction to General Relativity; Addison-Wesley: San Francisco, CA, USA, 2019; ISBN 978-0-8053-8732-2. [Google Scholar]

- Peskin, M.E.; Schroeder, D.V. An Introduction to Quantum Field Theory; CRC Press; Taylor and Francis Group: Boca Raton, FL, USA, 2018. [Google Scholar]

- Glashow, S. The renormalizability of vector meson interactions. Nucl. Phys. 1959, 10, 107. [Google Scholar] [CrossRef]

- Salam, A.; Ward, J.C. Weak and electromagnetic interactions. Nuovo C. 1959, 11, 568–577. [Google Scholar] [CrossRef]

- Weinberg, S. A Model of Leptons. Phys. Rev. Lett. 1957, 19, 1264–1266. [Google Scholar] [CrossRef]

- Arraut, I. The origin of the mass of the Nambu–Goldstone bosons. Int. J. Mod. Phys. A 2018, 33, 1850041. [Google Scholar] [CrossRef]

- Arraut, I. The Nambu-Goldstone theorem in non-relativistic systems. Int. J. Mod. Phys. A 2017, 32, 1750127. [Google Scholar]

- Arraut, I. The Quantum Yang Baxter conditions: The fundamental relations behind the Nambu-Goldstone theorem. Symmetry 2019, 11, 803. [Google Scholar] [CrossRef]

- Baaquie, B.E. Quantum Finance: Path Integrals and Hamiltonians for Options and Interestrates; Cambridge University Press: Cambridge, UK, 2004; pp. 52–75. [Google Scholar]

- Bichteler, K. Stochastic Integration with Jumps, 1st ed.; Cambridge University Press: Cambridge, UK, 2002; ISBN 0-521-81129-5. [Google Scholar]

- Cohen, S.; Elliott, R. Stochastic Calculus and Applications, 2nd ed.; Birkhaueser: Berlin, Germany, 2015; ISBN 978-1-4939-2867-5. [Google Scholar]

- Kleinert, H. Path Integrals in Quantum Mechanics, Statistics, Polymer Physics, and Financial Markets, 4th ed.; World Scientific (Singapore): Singapore, Paperback Fifth Edition Available Online: PDF-Files, with Generalizations of Itô’s Lemma for Non-Gaussian Processes; ISBN 981-238-107-4. Available online: https://www.amazon.com/Integrals-Quantum-Mechanics-Statistics-Financial/dp/9812700080 (accessed on 11 March 2025).

- Rehman, M.Z.; Karimullah, K. Black swan events and stock market behavior in Gulf countries: A comparative analysis of financial crisis (2008) and COVID-19 pandemic. Arab Gulf J. Sci. Res. 2024, 42, 805–824. [Google Scholar] [CrossRef]

- Al-Raeei, M. Numerical simulation of the force of infection and the typical times of SARS-CoV-2 disease for different location countries. Model. Earth Syst. Environ. 2022, 8, 1443–1448. [Google Scholar] [CrossRef]

- Khan, N.; Ahmad, Z.; Ahmad, H.; Tchier, F.; Zhang, X.Z.; Murtaza, S. Dynamics of chaotic system based on image encryption through fractal-fractional operator of non-local kernel. Aip Adv. 2022, 12, 055129. [Google Scholar] [CrossRef]

- Griffiths, D.J. Introduction to Quantum Mechanics; Prentice Hall: Upper Saddle River, NJ, USA, 1995. [Google Scholar]

- Heston, S.L. A Closed-Form Solution for Options with Stochastic Volatility with Application to Bond and Currency Options. Rev. Financ. Stud. 1993, 6, 327. [Google Scholar] [CrossRef]

- Baldwin, R.; Taglioni, D. Trade effects of the euro: A comparison of estimators. J. Econ. Int. 2007, 22, 780–818. [Google Scholar] [CrossRef]

- Calmet, X.; Shaw, N.W. An analytical perturbative solution to the Merton Garman model using symmetries. J. Futur. Mark. 2020, 40, 3–22. [Google Scholar] [CrossRef]

- Ryder, L.H. Quantum Field Theory, 2nd ed.; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Lee, J.M. Introduction to Topological Manifolds, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2000. [Google Scholar]

- Bachelier, L. Theorie de la Speculation. Ann. Sci. L’Ecole Norm. Super. 1990, 17, 21–88. [Google Scholar] [CrossRef]

- Choi, J.; Kwak, M.; Wen Tee, C.; Wang, Y. A Black–Scholes user’s guide to the Bachelier model. J. Futur. Mark. 2022, 42, 959–980. [Google Scholar] [CrossRef]

- Rubinstein, M. Displaced Diffusion Option Pricing. J. Financ. 1983, 38, 213–217. [Google Scholar] [CrossRef]

- Joshi, M.S.; Rebonato, R. A displaced-diffusion stochastic volatility LIBOR market model: Motivation, definition and implementation. Quant. Financ. 2003, 3, 458–469. [Google Scholar] [CrossRef]

- Vasquez, A.; Xiao, X. Default Risk and Option Returns. 2020. Available online: https://ssrn.com/abstract=2667930 (accessed on 11 March 2025).

- Marzilli Ericson, K.M. When consumers do not make an active decision: Dynamic default rules and their equilibrium effects. Games Econ. Behav. 2020, 124, 369–385. [Google Scholar] [CrossRef]

- Yang, H.; Luo, S. A dark side to options trading? Evidence from corporate default risk. Rev. Quant. Financ. Account. 2023, 60, 531–564. [Google Scholar] [CrossRef]

- Zaevski, T.S.; Kim, Y.S.; Fabozzi, F.J. Option pricing under stochastic volatility and tempered stable Levy jumps. Int. Rev. Financ. Anal. 2014, 31, 104–108. [Google Scholar] [CrossRef]

- Zaevski, T.S.; Kounchev, O.; Savov, M. Two frameworks for pricing defaultable derivatives. Chaos Solitons Fractals 2019, 123, 309–319. [Google Scholar] [CrossRef]

- Bates, D.S. Jumps and Stochastic volatility: Exchange Rate Processes Implicity in Deutsche Mark Options. Rev. Financ. Stud. 1996, 9, 69–107. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arraut, I. Local Equivalence of the Black–Scholes and Merton–Garman Equations. Axioms 2025, 14, 215. https://doi.org/10.3390/axioms14030215

Arraut I. Local Equivalence of the Black–Scholes and Merton–Garman Equations. Axioms. 2025; 14(3):215. https://doi.org/10.3390/axioms14030215

Chicago/Turabian StyleArraut, Ivan. 2025. "Local Equivalence of the Black–Scholes and Merton–Garman Equations" Axioms 14, no. 3: 215. https://doi.org/10.3390/axioms14030215

APA StyleArraut, I. (2025). Local Equivalence of the Black–Scholes and Merton–Garman Equations. Axioms, 14(3), 215. https://doi.org/10.3390/axioms14030215