Abstract

The estimation of the unknown parameters of Type II Half Logistic Weibull (TIIHLW) distribution was analyzed in this paper. The maximum likelihood and Bayes methods are used as estimation methods. These estimators are used to estimate the fuzzy reliability function and to choose the best estimator of the fuzzy reliability function by comparing the mean square error (MSE). The simulation’s results showed that fuzziness is better than reality for all sample sizes, and fuzzy reliability at Bayes predicted estimates is better than the maximum likelihood technique. It produces the lowest average MSE until a sample size of n = 50 is obtained. A simulated data set is applied to diagnose the performance of the two techniques applied here. A real data set is used as a practice for the model discussed and developed the maximum likelihood estimate alternative model of TIIHLW as Topp Leone inverted Kumaraswamy, modified Kies inverted Topp–Leone, Kumaraswamy Weibull–Weibull, Marshall–Olkin alpha power inverse Weibull, and odd Weibull inverted Topp–Leone. We conclude that the TIIHLW is the best distribution fit for this data.

Keywords:

type II half logistic Weibull distribution; reliability analysis; fuzzy numbers; MCMC; highest posterior density MSC:

62F10; 62F15; 62F40; 62N05; 62N86; 62-07

1. Introduction

The random variable was adopted for describing the objective randomness of such variable, in the conventional reliability analysis. As one of the objective facts, fuzziness exists in every problem related to real life. Fuzzy reliability theory is a new branch, which combines reliability with fuzzy mathematics. It is more reasonable that some variables and constraints are considered for the fuzziness from the point of view of engineering practice. In the analysis of fuzzy reliability, for obtaining the concrete data of reliability, the shape and values of parameters of membership function are adopted as a certainty function; therefore, the self-contradictory exists. In Ref. ([1]), the following point of views are pointed out: the books on Fuzzy Set Theory often describe a membership function on a basis of Common Set Theory and its characteristic function; it is found that the method has theoretical shortcomings of processing concept and definition absolutely. Many reliability theories and models assume that all of the parameters of the life-time probability function are strong. In real-world applications, it is necessary to generalise standard statistical estimation methods for fuzzy numbers. This is owing to the fact that the parameters of probability distributions can be represented incorrectly due to human error, personal judgement, estimation, or unexpected events. The lifetime distributions’ parameters are fuzzy. As a result, dealing with the function of traditional reliability may present difficulties for the system of reliability. As a result, we can deal with a larger definition of reliability than the traditional one. The degree of belonging is established by the function of a given membership, as well as the fuzzy likelihood of the vehicle or unit efficiently continuing to work for a specified period of time.

The theory of fuzzy reliability was proposed and developed by several authors; Ref. [2] discussed the Marshall-Model: Olkin’s comparison of interval estimations for , Ref. [3] introduced nonparametric reliability function estimation, [4] presented an overview of fuzzy sets, fuzzy logic, and fuzzy control systems. Furthermore, based on an exponential distribution, a fuzzy Bayesian system’s reliability is assessed in [5,6,7], presenting fuzzy probability and statistics, Ref. [8] discussed unrepairable systems with fuzzy random lifetimes: reliability and mean time to failure, Ref. [9] studied inference on reliability in a two-parameter exponential stress–strength model. Ref. [10] showed the most effective techniques for testing fuzzy hypotheses with conflicting data, Ref. [3] studied nonparametric estimation of a reliability function, Ref. [11] presented the use of median and ranked set sampling approaches, and stress–strength reliability for exponentiated Pareto distribution can be estimated. For the inverse Rayleigh distribution, inference of a fuzzy reliability model and fuzzy reliability estimation for Frechet distribution by using simulation is presented; see [12,13], respectively. In addition, reliability estimation in Rayleigh distribution based on fuzzy lifetime data has been studied by [14,15], introducing inferences for the stress–strength reliability model’s strength variable in the presence of a partially accelerated life test.

The rest of this paper is organized as follows: In Section 2, we describe the model and the formulation of fuzzy reliability. The fuzzy reliability of Type II half logistic Weibull distribution is given in Section 3. In Section 4, the ML estimators of the parameters and approximate confidence intervals are presented. We cover Bayes estimates and construction of credible intervals using the MCMC techniques in Section 5. In Section 6, we provide some simulation results in order to give an assessment of the performance of the different estimation methods. Numerical examples are presented in Section 7 for illustration.

2. Model and Notation

In this section, we discussed the model assumption and notation of TIIHLW distribution and fuzzy reliability analysis.

2.1. TIIHLW Distribution

Ref. [16] introduced modelling lifetime data from biomedical research and engineering. A variety of real data sets can properly be analyzed using the TIIHLW distribution since its density function can have various shapes (symmetric, right skewed, reversed J-shaped, and unimodal). Ref. [16] discusses the TIIHLW distribution and its features. When the cause of the failure is known or unknown, the maximum likelihood method is applied; see [17,18].

TIIHLW () has the cumulative distribution function

and the probability density function is

the survival rate function is

and the hazard rate function is

where and are shape parameters, and is the scale parameter.

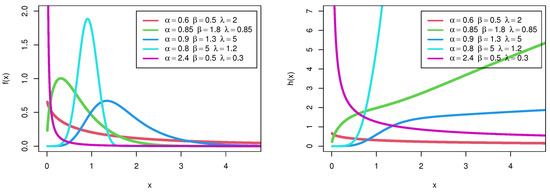

Figure 1 shows the probability density and hazard rate function with different shapes for the TIIHLW distribution. The behavior of the TIIHLW probability density curve may have varied shapes as seen in these illustrations. It could be skewed to the right or even to the left, or have an asymmetric or declining form, whereas the TIIHLW hazard rate curves could be falling, implying that the proposed model is a good lifetime model. As mentioned in the application section, the TIIHLW distribution has a lot of versatility when it comes to modeling skewed data, thus it is often used in domains like biology, biomedical trials, reliability, and survival studies.

Figure 1.

Probability density and hazard rate function with different shapes for the TIIHLW distribution.

2.2. Fuzzy Reliability

Let T be a continuous random variable that represents a system’s failure time. The fuzzy reliability can be calculated using the fuzzy probability formula proposed by [4],

where is a membership function that describes the degree to which each element of a given universe belongs to a fuzzy set.

Now, assume that is

where .

For by the computational method of the function of fuzzy numbers, the lifetime can be obtained corresponding to a certain value of as follows [4]: , then

Thus, for all values, fuzzy reliability values can be calculated as

and

3. Fuzzy Reliability of Type II Half Logistic Weibull Distribution

We consider fuzzy reliability of type II half logistic Weibull distribution depends on the definition of fuzzy reliability. Assume that in Equations (5) and (8)–(10) represent the pdf of Type II half logistic Weibull distribution as in Equation (2).

The fuzzy reliability definition,

where as in Equation (6) and as in Equation (7), then

and

4. Maximum Likelihood Estimation

In this section, we study type II half logistic Weibull parameters estimating problem using the maximum-likelihood estimators. Let X have the Type II half logistic Weibull three-parameter PDF distribution like Equation (2).

The maximum likelihood method is given by

By taking log function on both sides, we obtain

The type II half logistic Weibull distribution parameters and are obtained by the solution of the following equations with maximum likelihood estimator under fuzzy reliability. By differentiating the natural logarithm, partially with respect to and and then equating to zero,

and

Since Equations (17)–(19) cannot be solved analytically, some numerical methods such as Newton’s method must be employed to solve Equations (17)–(19) and obtain estimates of the parameters , and

The delta method is a result concerning the approximate probability distribution for a function of an asymptotically normal statistical estimator from the knowledge of the limiting variance of that estimator. Therefore, the delta method can be used to estimate the fuzzy reliability function of the Type II half logistic Weibull distribution, as follows:

and

4.1. Confidence Intervals

Along with the point estimator, another statistic of interest is the confidence interval estimator. The probability that the interval includes the parameter value is what we call the confidence level. Since the ML estimators of the parameters cannot be defined in analytic forms, the actual distributions of ML estimators cannot be derived.

Approximate Confidence Intervals

This subsection presents the obtaining of CI for the parameters using the asymptotic Fisher information matrix , which is given by

Therefore, the asymptotic variance-covariance matrix is given by

Hence, , , and have approximately normal distribution with mean vector and covariance matrix . Thus, the ACIs for , and are given by

where is the percentile of the standard normal distribution with right-tail probability .

In order to compute the asymptotic CI of the fuzzy reliability function, we must first find the variance. To find approximate estimates of variance, the delta approach was applied. For MLE functions, the delta technique gives a general method for determining CIs [19]. It takes a function that is too complicated to calculate the variance analytically, makes a linear approximation of it, and then computes the variance of the smaller linear function that may be used for large sample inference; see [20]. We define

Then, the approximate estimates of are given, respectively, by

In addition, calculate the following statistic:

these results yield the approximate CIs for as

5. Bayesian Estimation

The Bayesian approach addresses the parameters randomly and uncertainties about the parameters are represented with a joint prior distribution, established before the failed data are collected. The flexibility to incorporate prior knowledge into the analyses makes the Bayesian approach very valuable in assessing reliability since the limited availability of data is one of the primary problems of reliability analysis.

The parameters , and are assumed to be independent and follow the gamma distributions. This is done accordingly

where the hyper-parameters and are assumed to be known and selected to reflect the prior assumption on the unknown parameters.

The posterior distribution of the parameters and denoted by up to proportionality can be obtained by combining the likelihood function Equation (15) with the prior via Bayes’ theorem, and it can be written as

The joint posterior to the proportionality can be written as

Now, according to Equations (12)–(14), we obtain

and

As a symmetric loss function, the squared error loss is

Then, we obtained

and

Both the integral in Equation (28) and the normalized constant Equation (27) have no analytical solutions. Bayesian analysis should be used to evaluate the underlying model using numerical methods. Among many methods to analyze it, we will choose the Markov Chain Monte Carlo (MCMC) simulation methodology. MCMC methods can be adjusted to obtain random drawings from the posterior distribution of density in Equation (27) without having to compute the normalized constant. After that, we can use random drawings to conduct any analysis. We need visibility and model parameters. Equation (34) contains the relation on how to estimate the fuzzy reliability after estimating the unknown parameters by using the Bayesian technique.

5.1. Markov Chain Monte Carlo Method

For estimating complex Bayesian models, Markov chain Monte Carlo is an effective technique. The Gibbs sampling and Metropolis–Hastings algorithms are two of the most widely used Markov chain Monte Carlo methods in statistics, statistical physics, digital communications, signal processing, and machine learning, among other fields. They have attracted the attention of researchers due to their efficiency, and remarkable results have been obtained. For more information and examples using MCMC, see [21,22,23].

The algorithm of Metropolis–Hastings to simulate random draws from the posterior distribution :

- (1)

- Start with initial guess

- (2)

- Set a size of trails M, and the random draws;

- (3)

- For , repeat the following steps:

- (i)

- Set

- (ii)

- Generate a candidate from a proposal distribution

- (iii)

- Evaluate the acceptance probability

- (iv)

- Generate a from a Uniform distribution.If , accept the proposal and set , else set .

Under some regularity conditions on the proposal density , the sequence of the simulated draws will converge to random draws that follow the posterior density . The highest posterior density (HPD) interval as the interval estimator in the Bayesian method is used to credible confidence intervals for MCMC estimates. For more information, see Turkkan and Pham-Gia [24] and Chen and Shao [25,26].

5.2. The Highest Posterior Density

The highest posterior density (HPD) intervals [25] discussed this technique to generate the HPD intervals of unknown parameters of the benefit distribution. In this study, samples drawn with the proposed MH algorithm should be used to generate time-lapse estimates. From the percentile tail points, for instance, a HPD interval can be obtained with two points for parameters of , from the MCMC sampling outputs. It is sometimes useful to present the posterior median to informally check for possible asymmetry in the posterior density of a parameter. According to [25,27], the BCIs of the parameters of the model of study can be obtained through the essential steps of the algorithm as follows: (i) Order the sample observations generated through the M–H algorithm as , , and , where A denotes the length of the generated MH algorithm.

(ii) The , symmetric Bayesian credible interval for , is given by , , and

.

6. Simulation

The performance of the MLE and Bayesian estimation of the parameters and fuzzy reliability of the TIIHLW distribution in terms of bias, mean square errors (MSE), and confidence intervals (CI) are evaluated in this section. For n sample size, we consider the values and 100. For n sample size, we consider the numbers and 100. We consider the following scenarios for the parameters and the interval of the membership function :

- Case 1

- : , and and ;

- Case 2

- : , , and and ;

- Case 3

- : , , and and ;

- Case 4

- : , , and and .

We consider replicating the process 5000 iterations. In each setting, we obtain the bias of the estimates of the corresponding MSE and CI (lower and upper). We also obtain the corresponding coverage probabilities (CP) of MLE parameters and fuzzy reliability. These results are displayed in Table 1, Table 2, Table 3 and Table 4.

Table 1.

Bias, MSE, and CI for fuzzy reliability and parameters of model in case 1.

Table 2.

Bias, MSE, and CI for fuzzy reliability and parameters of the model in case 2.

Table 3.

Bias, MSE, and CI for fuzzy reliability and parameters of models in case 3.

Table 4.

Bias, MSE, and CI for fuzzy reliability and parameters of model in case 4.

- The MSEs decrease as the sample size increases in all of the cases;

- Additionally, as the sample size increases, the bias of estimates tends to zero values;

- Furthermore, as the sample size grows, the length of the CI of estimates tends to zero values, with the lower values of CI increasing and the upper values of CI decreasing to true values;

- Furthermore, in the estimation of fuzzy reliability, when the value of increases, the measures of performance are improved.

- These results indicate that the MLE and Bayesian estimation methods of the parameters , and fuzzy reliability are asymptotically unbiased and consistent.

- As expected, the estimates by using the Bayesian estimation method perform better than those by using the MLE method in terms of measures of performance.

- When values increase, then the measures of parameters get better for and where MSE decreases while does not get better where MSE increases.

- When values increase, then the measures of parameters do not get better for and where MSE increases, while does get better where MSE decreases.

- When values increase, then the measures of parameters do not get better for all parameters , and where MSE increases.

7. Application of Real Data

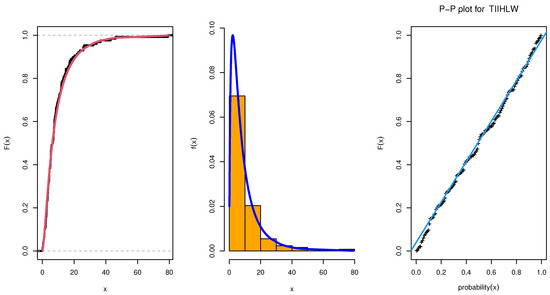

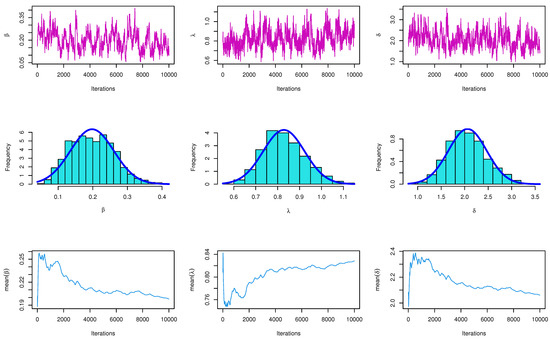

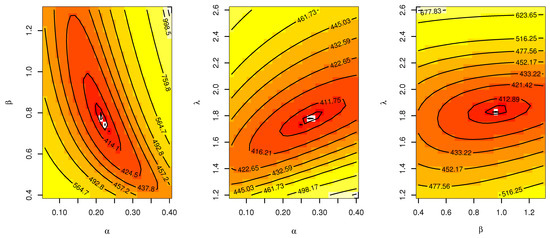

In this section, the flexibility and potentiality of the TIIHLW distribution are examined using two real data sets. We provide an application of the TIIHLW distribution with Fuzzy reliability. The cancer data set is given by [28], which represents remission times (in months) of a random sample of 128 bladder cancer patients. In Table 5, the TIIHLW model has the highest p-value and the lowest distance (D) of the Kolmogorov–Smirnov (K-S) value. Bayesian estimation methods have smaller stander error (SE). Table 6 discussed the MLE estimate alternative model of TIIHLW as Topp Leone inverted Kumaraswamy (TLIK) [29], modifed Kies inverted Topp–Leone (MKITL) [30], Kumaraswamy Weibull–Weibull (KW-W) [31], Marshall–Olkin alpha power inverse Weibull (MOAPIW) [32], and Odd Weibull ITL (OWITL) [33]. Table 7 shows that the TIIHLW fits the data by the Akaike information criterion (AIC), Anderson–Darling (AD), Bayesian information criterion (BIC), and Cramér–von Mises criterion (CVM) values. Figure 2 shows the fit of the empirical CDF, histogram, and PP-plot. Figure 3 shows convergence plots of MCMC for parameter estimates of TIIHLW distribution. Figure 4 shows the estimates exist and have maximum log-likelihood value. We conclude that the TIIHLW is the best distribution fit for this data.

Table 5.

MLE and Bayesian estimation for parameters of TIIHLW distribution.

Table 6.

MLE with SE for an alternative model of TIIHLW.

Table 7.

AIC, CAIC, KS test, CVM, and AD.

Figure 2.

Estimated CDF and empirical CDF, estimated PDF with histogram, Q-Q plot, and P-P plot for the TIIHLW distribution.

Figure 3.

Convergence plots of MCMC for parameter estimates of TIIHLW distribution.

Figure 4.

Contour plot of parameters and log-likelihood value for the TIIHLW distribution.

Table 8 shows fuzzy reliability by different values and different intervals of membership function. We note that, when the value of increases, the fuzzy reliability that is improved tends to 1. As expected, the estimates by using the Bayesian estimation method perform better than those by using the MLE method in terms of fuzzy reliability and SE.

Table 8.

Fuzzy reliability.

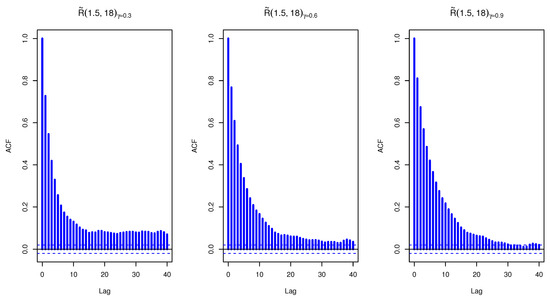

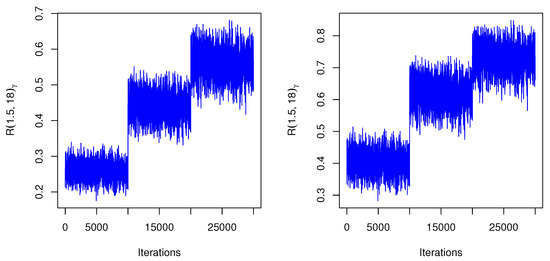

For Figure 5 and Figure 6, the proposed distribution (normal) of the MH algorithm and the prior distributions of the subsequent terms of the MCMC was the same as the posterior distribution. In both cases, problems seem to have been solved: the trace plots of the MCMC samples do not show any apparent anomaly. Figure 7 shows an auto-correlation plot for fuzzy reliability estimation of TIIHLW distribution by using MCMC results. In the graph, there is a vertical line corresponding to each lag. The height of each spike shows the value of the auto-correlation function for the lag. In this figure, the spikes are statistically significant for lags up to 40. This means that the fuzzy reliability estimation of TIIHLW distribution by using MCMC results are highly correlated with each other.

Figure 5.

The auto-correlation plot of MCMC for fuzzy reliability of TIIHLW distribution where lower is 2 and upper is 12.

Figure 6.

The auto-correlation plot of MCMC for fuzzy reliability of TIIHLW distribution where lower is 1.5 and upper is 18.

Figure 7.

The auto-correlation of fuzzy reliability by MCMC results of TIIHLW distribution.

8. Conclusions

In this paper, we introduced classical and Bayesian estimation approaches for fuzzy reliability estimation using the lifetime Type II Half Logistic Weibull distribution model, using it as a base. We calculated parameters and reliability fuzzy estimations using MLE and Bayesian procedures. In addition, the asymptotic confidence intervals were created. The MCMC method is used to create Bayesian credible intervals. We use Monte Carlo simulation to compare the results of different methods. The simulation results indicate that, in the case of point estimation, the performances of the classical and Bayesian estimators are nearly identical, especially for large sample sizes. The results of the simulation study indicated that the MSEs of Bayes estimates for informative priors were significantly lower than those of the others. In addition, the HPD credible intervals outperform the competition. The simulation results indicate that reliability under fuzzy is better than traditional reliability for all sample sizes, and that fuzzy reliability at Bayes estimates is better than the maximum likelihood method. The empirical study using a real data set for bladder cancer patients to evaluate the flexibility of the TIIHLW distribution fits well with the proposed distribution.

Author Contributions

Conceptualization, R.A.H.M. and D.A.R.; methodology, R.A.H.M., A.H.T., E.M.A. and D.A.R.; software, E.M.A.; validation, A.H.T., R.A.H.M. and D.A.R.; formal analysis, D.A.R. and E.M.A.; investigation, R.A.H.M. and A.H.T.; resources, R.A.H.M., A.H.T. and D.A.R.; data curation, R.A.H.M. and D.A.R.; writing—original draft preparation, A.H.T., E.M.A. and D.A.R.; writing—review and editing, A.H.T., R.A.H.M., E.M.A. and D.A.R.. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are available in this paper.

Acknowledgments

All thanks and appreciation to the editorial board and reviewers.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chaube, S.; Singh, S. Fuzzy reliability theory based on membership function. Int. J. Math. Eng. Manag. Sci. 2016, 1, 34. [Google Scholar] [CrossRef]

- Lee, I.S.; Cho, J.S.; Kang, S.G. Comparison of Interval Estimations for P (X < Y) in Marshall-Olkin’s Model. J. Korean Data Inf. Sci. Soc. 1996, 7, 93–104. [Google Scholar]

- Zardasht, V.; Zeephongsekul, P.; Asadi, M. On nonparametric estimation of a reliability function. Commun. Stat. Theory Methods 2012, 41, 983–999. [Google Scholar] [CrossRef]

- Chen, G.; Pham, T.T. Introduction to Fuzzy Sets, Fuzzy Logic, and Fuzzy Control Systems; CRC Press: Boca Raton, FL, USA, 2000. [Google Scholar]

- Wu, H.C. Fuzzy reliability estimation using Bayesian approach. Comput. Ind. Eng. 2004, 46, 467–493. [Google Scholar] [CrossRef]

- Wu, H.C. Fuzzy Bayesian system reliability assessment based on exponential distribution. Appl. Math. Model. 2006, 30, 509–530. [Google Scholar] [CrossRef]

- Buckley, J.J. Fuzzy Probability and Statistics; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Liu, Y.; Tang, W.; Zhao, R. Reliability and mean time to failure of unrepairable systems with fuzzy random lifetimes. IEEE Trans. Fuzzy Syst. 2007, 15, 1009–1026. [Google Scholar] [CrossRef]

- Krishnamoorthy, K.; Mukherjee, S.; Guo, H. Inference on reliability in two-parameter exponential stress–strength model. Metrika 2007, 65, 261. [Google Scholar] [CrossRef]

- Torabi, H.; Mirhosseini, S. The most powerful tests for fuzzy hypotheses testing with vague data. Appl. Math. Sci. 2009, 3, 1619–1633. [Google Scholar]

- Al-Omari, A.I.; Almanjahie, I.M.; Hassan, A.S.; Nagy, H.F. Estimation of the stress-strength reliability for exponentiated pareto distribution using median and ranked set sampling methods. Comput. Mater. Contin. 2020, 64, 835–857. [Google Scholar]

- Sabry, M.A.; Almetwally, E.M.; Alamri, O.A.; Yusuf, M.; Almongy, H.M.; Eldeeb, A.S. Inference of fuzzy reliability model for inverse Rayleigh distribution. AIMS Math. 2021, 6, 9770–9785. [Google Scholar] [CrossRef]

- Neamah, M.W.; Ali, B.K. Fuzzy reliability estimation for Frechet distribution by using simulation. Period. Eng. Nat. Sci. PEN 2020, 8, 632–646. [Google Scholar]

- Pak, A.; Parham, G.A.; Saraj, M. Reliability estimation in Rayleigh distribution based on fuzzy lifetime data. Int. J. Syst. Assur. Eng. Manag. 2014, 5, 487–494. [Google Scholar] [CrossRef]

- El-Sagheer, R.M.; Tolba, A.H.; Jawa, T.M.; Sayed-Ahmed, N. Inferences for Stress-Strength Reliability Model in the Presence of Partially Accelerated Life Test to Its Strength Variable. Comput. Intell. Neurosci. 2022, 2022, 4710536. [Google Scholar] [CrossRef] [PubMed]

- Hassan, A.S.; Elgarhy, M.; ul Haq, M.A.; Alrajhi, S. On Type II Half Logistic Weibull Distribution with Applications. Math. Theory Model. 2019, 9, 16. [Google Scholar]

- Muse, A.H.; Tolba, A.H.; Fayad, E.; Abu Ali, O.A.; Nagy, M.; Yusuf, M. Modelling the COVID-19 mortality rate with a new versatile modification of the log-logistic distribution. Comput. Intell. Neurosci. 2021, 2021, 8640794. [Google Scholar] [CrossRef]

- Mahmood, Z.; Jawa, T.M.; Sayed-Ahmed, N.; Khalil, E.; Muse, A.H.; Tolba, A.H. An Extended Cosine Generalized Family of Distributions for Reliability Modeling: Characteristics and Applications with Simulation Study. Math. Probl. Eng. 2022, 2022, 3634698. [Google Scholar] [CrossRef]

- Greene, W. Estimating Econometric Models with Fixed Effects; Department of Economics, Stern School of Business, New York University: New York, NY, USA, 2001. [Google Scholar]

- Washington, S.; Karlaftis, M.; Mannering, F.; Anastasopoulos, P. Statistical and Econometric Methods for Transportation Data Analysis; Chapman and Hall/CRC: Boca Raton, FL, USA, 2020. [Google Scholar]

- Ramadan, D.A.; Almetwally, E.M.; Tolba, A.H. Statistical Inference to the Parameter of the Akshaya Distribution under Competing Risks Data with Application HIV Infection to AIDS. Ann. Data Sci. 2022, 1–27. [Google Scholar] [CrossRef]

- Sarhan, A.M.; El-Gohary, A.I.; Mustafa, A.; Tolba, A.H. Statistical analysis of regression competing risks model with covariates using Weibull sub-distributions. Int. J. Reliab. Appl. 2019, 20, 73–88. [Google Scholar]

- Sarhan, A.M.; El-Gohary, A.I.; Tolba, A.H. Statistical Analysis of a Competing Risks Model with Weibull Sub-Distributions. Appl. Math. 2017, 8, 1671. [Google Scholar] [CrossRef][Green Version]

- Turkkan, N.; Pham-Gia, T. Computation of the highest posterior density interval in Bayesian analysis. J. Stat. Comput. Simul. 1993, 44, 243–250. [Google Scholar] [CrossRef]

- Chen, M.H.; Shao, Q.M. Monte Carlo estimation of Bayesian credible and HPD intervals. J. Comput. Graph. Stat. 1999, 8, 69–92. [Google Scholar]

- Dalpatadu, R.; Gewali, L.; Singh, A. Computing the Bayesian highest posterior density credible sets for the lognormal mean. Env. Off. J. Int. Env. Soc. 2002, 13, 465–472. [Google Scholar] [CrossRef]

- Abushal, T.A.; Kumar, J.; Muse, A.H.; Tolba, A.H. Estimation for Akshaya Failure Model with Competing Risks under Progressive Censoring Scheme with Analyzing of Thymic Lymphoma of Mice Application. Complexity 2022, 2022, 5151274. [Google Scholar] [CrossRef]

- Lee, E.T.; Wang, J. Statistical Methods for Survival Data Analysis; John Wiley: Hoboken, NJ, USA, 2003. [Google Scholar]

- Behairy, S.; Refaey, R.; EL-Helbawy, A.; AL-Dayian, G. Topp Leone-inverted Kumaraswamy distribution: Properties, estimation and prediction. J. Appl. Probab. Stat. 2020, 15, 93–118. [Google Scholar]

- Almetwally, E.M.; Alharbi, R.; Alnagar, D.; Hafez, E.H. A new inverted topp-leone distribution: Applications to the COVID-19 mortality rate in two different countries. Axioms 2021, 10, 25. [Google Scholar] [CrossRef]

- Cordeiro, G.M.; Ortega, E.M.; Nadarajah, S. The Kumaraswamy Weibull distribution with application to failure data. J. Frankl. Inst. 2010, 347, 1399–1429. [Google Scholar] [CrossRef]

- Basheer, A.M.; Almetwally, E.M.; Okasha, H.M. Marshall-olkin alpha power inverse Weibull distribution: Non bayesian and bayesian estimations. J. Stat. Appl. Probab. 2021, 10, 327–345. [Google Scholar]

- Almetwally, E.M. The Odd Weibull Inverse Topp–Leone Distribution with Applications to COVID-19 Data. Ann. Data Sci. 2022, 9, 121–140. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).