Abstract

This paper uses the idea of fractional order accumulation instead of the form of grey index, and applies the fractional order accumulation prediction model to the economic growth prediction of the member states of the Group of Seven from 1973 to 2016. By comparing different evaluation indexes such as , MAD and BIC, it is found that the prediction performance of fractional order cumulative grey prediction model (GM(,1)) is significantly improved in the medium and long term compared with the traditional grey prediction model (GM(1,1)).

MSC:

26A33

1. Introduction

In the real world, most of the data or information we get is often discrete and unregulated data. In order to solve such problems, the grey theory was was put forward by professor Deng [1]; this method is particularly suitable for prediction. Professor Deng thinks that the majority of current systems are “generalized energy systems”, noting that non-negative smooth discrete functions may be turned into sequences with approximate exponential laws, referred to as the “grey exponential law” [2]. However, GM(1,1) relies too much on historical data, and the prediction accuracy is not high when the data dispersion is large. The present GM(1,1) model cannot be utilized to accurately forecast the behavior of many practical systems, because system behavior is influenced by a variety of other factors, and its eigenvalues have never completely followed the grey index law [3].

Because of the limitations of GM(1,1) model prediction, different scholars have proposed different improvement measures, ref. [4] proposed an adaptive GM(1,1) model, and combined with back propagation grey model and support vector machine. By comparison, it is found that the improved grey model has better prediction effect. Zhu and Cao [5] successfully predicted the occurrence of El Nino events with annual data from 1980 to 1986. Tien proposed a grey model with convolution integral to indirectly measure the tensile strength of the material [6]. Then, Chen and Tien proposed different improved grey models, all of which got better prediction results [7,8,9,10,11,12,13,14]. Wu et al. [15,16] used the idea of fractional order accumulation to get a better short-term prediction model. However, they all only discussed the prediction accuracy in short-term situations.

In our work, we use Caputo fractional derivative instead of grey index effect and use time series data to analyze the economic development trend of the Group of Seven and predict the GDP growth trend. Then the fractional grey prediction model is used for medium and long-term prediction. The research shows that the proposed GM(,1) model has high performance not only in model fitting, but also in prediction.

The Group of Seven (G7)

The G7 is a platform for major industrial countries such as the United States (USA), the United Kingdom (GBR), Germany (DEU), France (FRA), Japan (JPN), Italy (ITA), Canada (CAN), and the European Union (EU) to meet and discuss policies (EUU). After the first oil crisis hit the western economy in the early 1970s, the six major industrial countries—the United States, the United Kingdom, Germany, France, Japan, and Italy—formed the G6 in November 1975, at the proposal of France. Since then, Canada has become a member of the Group of Seven (G7), which was formed the following year. In 1997, Russia was included to the G7, making it the G8. The Group of Seven (G7) was formed before the Group of Eight (G8). On the evening of 4 June 2014, the G7 leaders summit sponsored by the European Union began in Brussels, Belgium. Since joining the organization in 1997, Russia has been expelled for the first time. Foreign policy, economic, trade, and energy security problems will be discussed at the summit.

The G7 countries are the seven wealthiest advanced countries in the world. Consequently, studying the evolution of the GDP of these countries is interesting.

We collect data for the G7 countries for a total of 44 years, from 1973 to 2016, and use the data of GDP to create different grey models that characterize GDP changes in different countries.

2. Model Describes

2.1. GM(1,1) Prediction Model

Grey prediction refers to a forecast based on a grey system [1]. This method has no strict requirements on the sample size and data distribution. It requires single data, simple principle and strong applicability. It is suited not only for short-term data prediction, but also for medium and long-term data prediction, and may work effectively.

Set nonnegative sequence , use data sequence to build grey GM(1,1) model, the general steps of the grey GM(1,1) model are as follows:

Step 1: Generating accumulative sequence

First-order accumulated of is as follows

where .

Step 2: Constructing background value, and solving parameters .

The background value sequence is

where .

The following is the whitening differential equation for the GM(1,1) model

Equation (3) is discretized and the differential becomes difference, as reflected in the Equation (4)

The least square approach is then used to calculate the parameter .

where

and

Step 3: To create the GM(1,1) grey prediction formula. To solve the differential Equation (4), use to get the time response formula of the grey GM(1,1) model.

Accumulating and restoring , the prediction formula of is

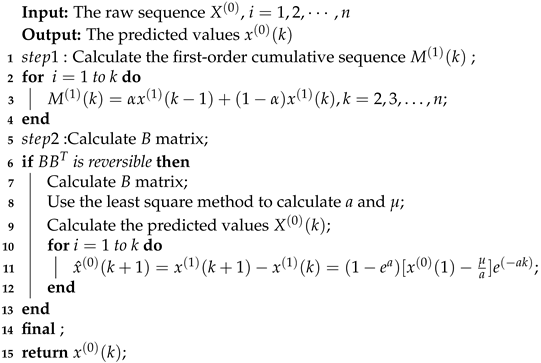

The pseudocode of GM(1,1) is given by Algorithm 1, as shown below:

| Algorithm 1: GM(1,1) model. |

|

2.2. Grey Model of Caputo Type Fractional Derivative

The fractional form of grey model was proposed by Liu et al. [15] in 2013. The goal of this model is to address several of the flaws in classic grey prediction models. For example, the existing GM(1,1) model cannot be utilized to accurately predict many real-world systems since the system behavior is influenced by other factors, and its eigenvalues do not fully obey the grey exponential law. To compare economic growth in Nigeria and Kenya, Awe et al. [16] use a fractional integration approach.

Let us take a quick look at the grey model’s fractional order accumulation.

Set nonnegative sequence , the grey model of the order equation with one variable GM(, 1) is

where , represents the -order difference of . The least square estimation of GM(, 1) model parameters satisfies

where

and

The whitening equation of GM(,1) model is

Let , by fractional Laplace transform, the solution of Formula (9) is

Thus the fitting value of GM(,1) model is

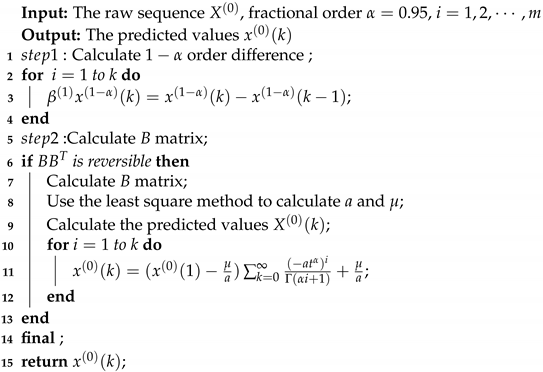

The pseudocode of GM(,1) is given by Algorithm 2, as shown below:

| Algorithm 2: GM(,1) model. |

|

2.3. Accuracy Testing of GM(1,1) and GM(0.95,1)

Extrapolating the projected value can be done using a model with excellent fitting accuracy. If this is not the case, residual correction must be performed first. To verify the accuracy of GM(1,1) and GM(,1), the posterior error detection approach is usually utilized. The posterior error ration (C) and small error probability (P) are two fitting testing measures.

The ratio of residual standard deviation () to data standard deviation () is known as the posterior error ration (C). Obviously, the prediction accuracy improves as the residual standard deviation decreases. The following is the exact formula:

The small error probability is shown in (13), for a given , when , the model is called a qualified model with small error probability:

According to the above two indicators, the forecast level is divided into four levels (see Table 1).

Table 1.

Accuracy grade reference table.

To make it easier to compare GDP between years, the GDP used here was transformed into an unchangeable local currency. The training sample consisted of data from 1973 to 2011, whereas the test sample consisted of data from 2012 to 2016. Furthermore, we evaluated the model using the average absolute deviation (MAD) and the coefficient of determination (), and we compared the model’s prediction effect using the absolute error criterion. Keep the following definitions in mind:

and

and

To compare the quality of models, we commonly utilize the Akaike information criterion (AIC) and Bayesian information criterion (BIC). The better the model, the lower the AIC and BIC values. AIC criterion has an overfitting problem when compared to BIC criterion. As a result, we use the following BIC standards:

3. Main Results

The data in this section comes from the World Bank’s records from 1973 to 2016. Calculate the MAD, , and BIC index values in the training sample set (see Table 2).

Table 2.

Different values of grey model.

As can be seen from Table 2, the value and value of fractional grey prediction models in various countries are smaller than those of traditional grey prediction models, and is closer to 1, so the fitting effect is better.

Table 3 indicates that the grade of prediction accuracy is first-level for all posterior error ratios and tiny error probabilities . As a result, the constructed model can be utilized to forecast in the medium and long future.

Table 3.

Accuracy testing values.

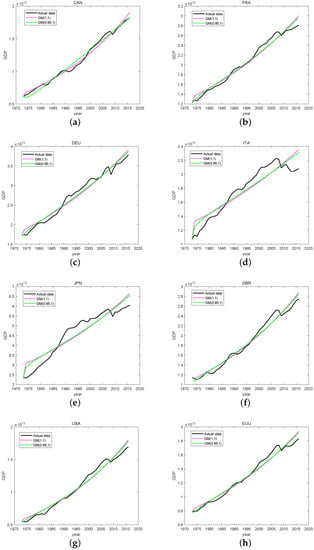

3.1. Fitting Result

To make it easier to compare the GM(1,1) and GM(0.95,1) models, the prediction results of the two models, as well as the original data, are presented as a line graph using Python and MATLAB, respectively, as shown in Figure 1. The trends and errors between them can be readily noticed using the graphical comparison.

Figure 1.

Fitting results for grey forecasting model for the G7 countries: (a) Canada (b), France (c), Germany (d), Italy (e), Japan (f), the United Kingdom (g), the United States (h), European Union.

It can be seen from Figure 1 that the fractional grey prediction model accurately shows the fluctuation law of data, and the error is small, while the fitting effect of the traditional grey prediction model is poor.

3.2. Predicted Results

The test data in this study is for GDP statistics from G7 countries from 2012 to 2016. The errors of the two prediction models are calculated and the errors are calculated using the absolute error as the error evaluation method. Table 4 shows the error pair of the prediction model in a summary comparison. The GM(0.95,1) model has a substantially lower prediction error for the data, as can be observed.

Table 4.

Grey prediction model for G7 countries GDP data from 2012–2016.

4. Conclusions

Because most systems in real life are fractional order, in order to improve the accuracy and application scope of grey prediction, this paper uses fractional order accumulation to replace the traditional grey index effect, and then gives the pseudo codes of the two models, which are applied to the economic growth prediction of the Group of Seven. The results show that, compared with the classical grey prediction model, the fractional prediction model has better prediction effect in medium and long-term prediction. Finally, we give the GDP forecast of G7 countries from 2012 to 2016, and compare it with the actual data to further prove the prediction effect of the fractional grey prediction model.

Author Contributions

The contributions of all authors (Y.L., X.W. and J.W.) are equal. All the main results were developed together. All authors have read and agreed to the published version of the manuscript.

Funding

This work is partially supported by the National Natural Science Foundation of China (12001131) and Department of Science and Technology of Guizhou Province ((Fundamental Research Program [2018]1118)).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Available at: https://github.com/UExtremadura/, 3 March 2022.

Acknowledgments

The authors are grateful to the referees for their careful reading of the manuscript and valuable comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Deng, J. Control problems of grey systems. Syst. Control. Lett. 1982, 1, 288–294. [Google Scholar]

- Deng, J. Essential Topics on Grey Systems: Theory and Applications; China Ocean Press: Beijing, China, 1988. [Google Scholar]

- Tien, T. A research on the grey prediction model GM(1,n). Appl. Math. Comput. 2012, 218, 4903–4916. [Google Scholar] [CrossRef]

- Li, D.; Chang, C.; Chen, C.; Kilicman, A. Forecasting short-term electricity consumption using the adaptive grey-based approach-An Asian case. Omega 2012, 40, 767–773. [Google Scholar] [CrossRef]

- Zhu, Z.; Cao, H. A fractional calculus based model for the simulation of an outbreak of dengue fever. J. Trop. Meteorol. 1998, 4, 359–365. [Google Scholar]

- Tien, T. The indirect measurement of tensile strength of material by the grey prediction model GMC(1, n). Meas. Sci. Technol. 2005, 16, 1322–1328. [Google Scholar] [CrossRef]

- Chen, C.; Tien, T. A new forecasting method for time continuous model of dynamic system. Appl. Math. Comput. 1996, 80, 225–244. [Google Scholar] [CrossRef]

- Chen, C.; Tien, T. A new transfer function model: The grey dynamic model GDM(2,2,1). Int. J. Syst. Sci. 1996, 27, 1371–1379. [Google Scholar] [CrossRef]

- Chen, C.; Tien, T. The indirect measurement of tensile strength by the deterministic grey dynamic model DGDM(1,1,1). Int. J. Syst. Sci. 1997, 28, 683–690. [Google Scholar] [CrossRef]

- Chen, C.; Tien, T. A new forecasting method of discrete dynamic system. Appl. Math. Comput. 1997, 86, 61–84. [Google Scholar] [CrossRef]

- Tien, T. A research on the prediction of machining accuracy by the deterministic grey dynamic model DGDM (1,1,1). Appl. Math. Comput. 2005, 161, 923–945. [Google Scholar] [CrossRef]

- Tien, T. The deterministic grey dynamic model with convolution integral DGDMC(1,n). Appl. Math. Model. 2009, 33, 3498–3510. [Google Scholar] [CrossRef] [Green Version]

- Tien, T. The indirect measurement of tensile strength for a higher temperature by the new model IGDMC(1,n). Measurement 2008, 41, 662–675. [Google Scholar] [CrossRef]

- Tien, T.; Chen, C. Forecasting CO2 output from gas furnace by a new transfer function model GDM(2,2,1). Syst. Anal. Model. Simul. 1998, 30, 265–287. [Google Scholar]

- Wu, L.; Liu, S.; Yao, L.; Yan, S.; Liu, D. Grey system model with the fractional order accumulation. Commun. Nonlinear Sci. Numer. Simul. 2013, 18, 1775–1785. [Google Scholar] [CrossRef]

- Awe, O.O.; Mudida, R.; Gil-Alana, L.A. Comparative analysis of economic growth in Nigeria and Kenya: A fractional integration approach. Int. J. Financ. Econ. 2021, 26, 1197–1205. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).