Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models

Abstract

1. Introduction

2. Research Process and Literature Review

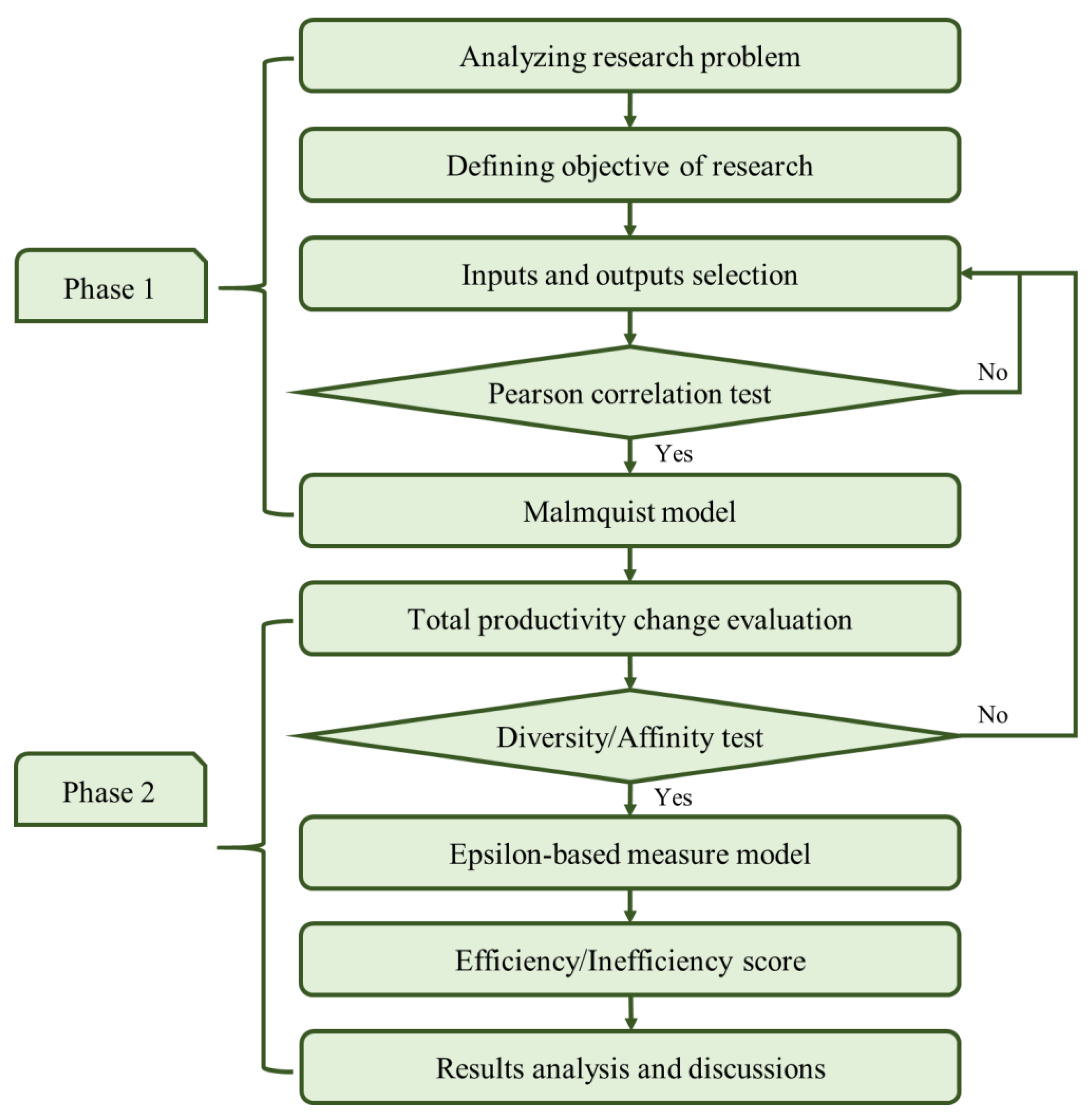

2.1. Research Process

2.2. Literature Review

3. Materials and Methods

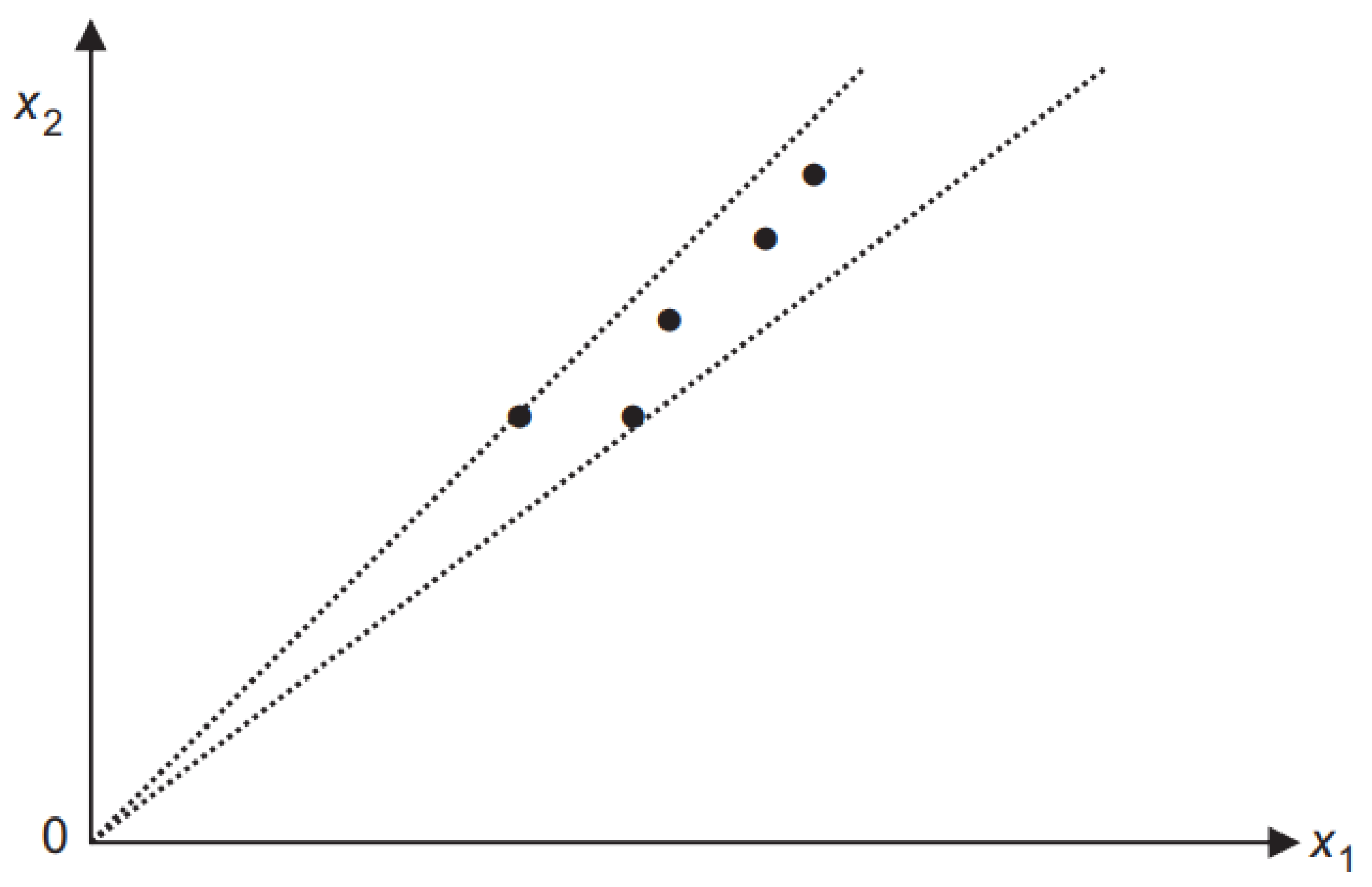

3.1. Theory of Malmquist Model

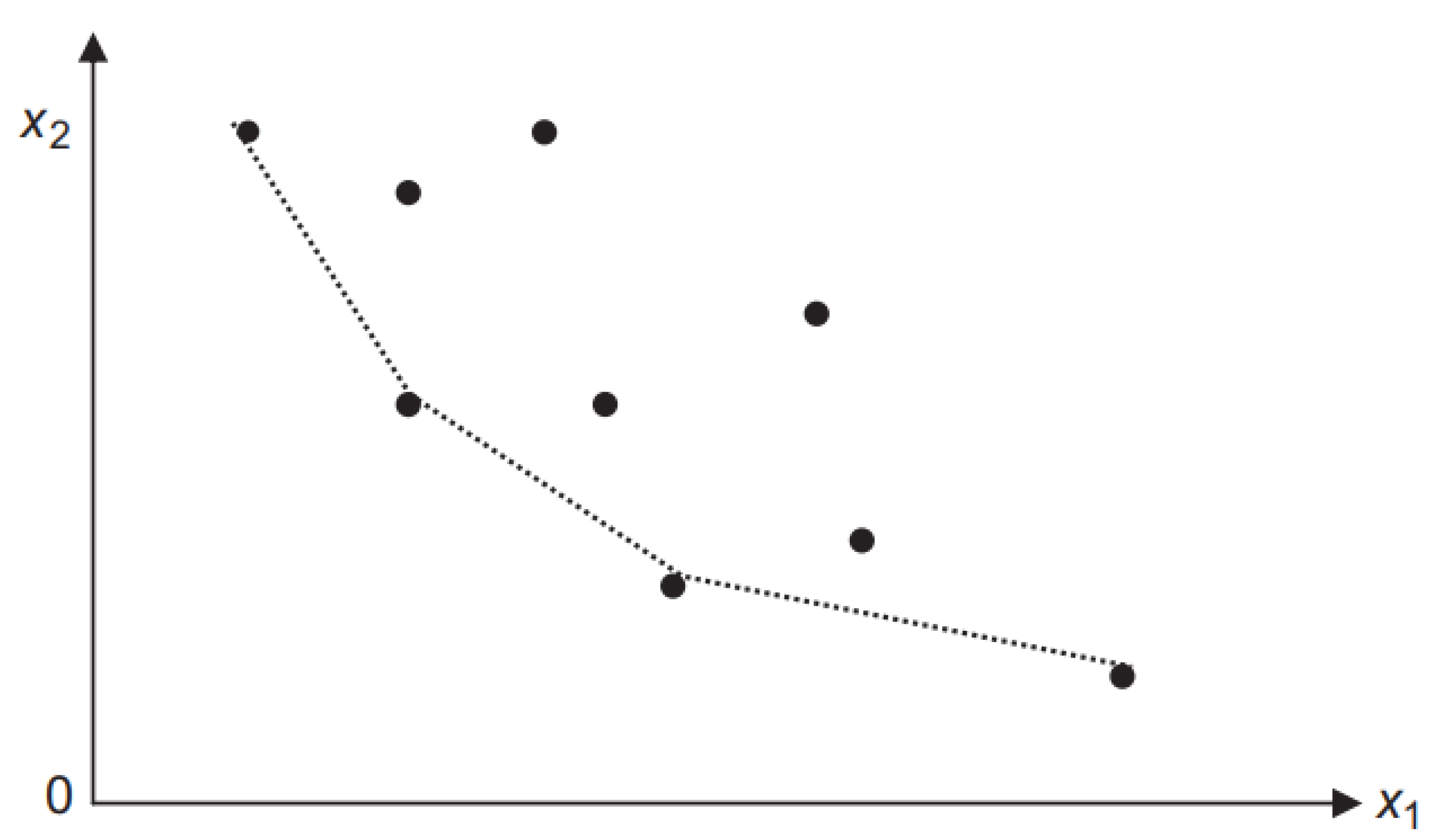

3.2. Theory of Epsilon-Based Measure Efficiency

4. Results and Discussions

4.1. Data Collection

4.2. Results of Malmquist Model

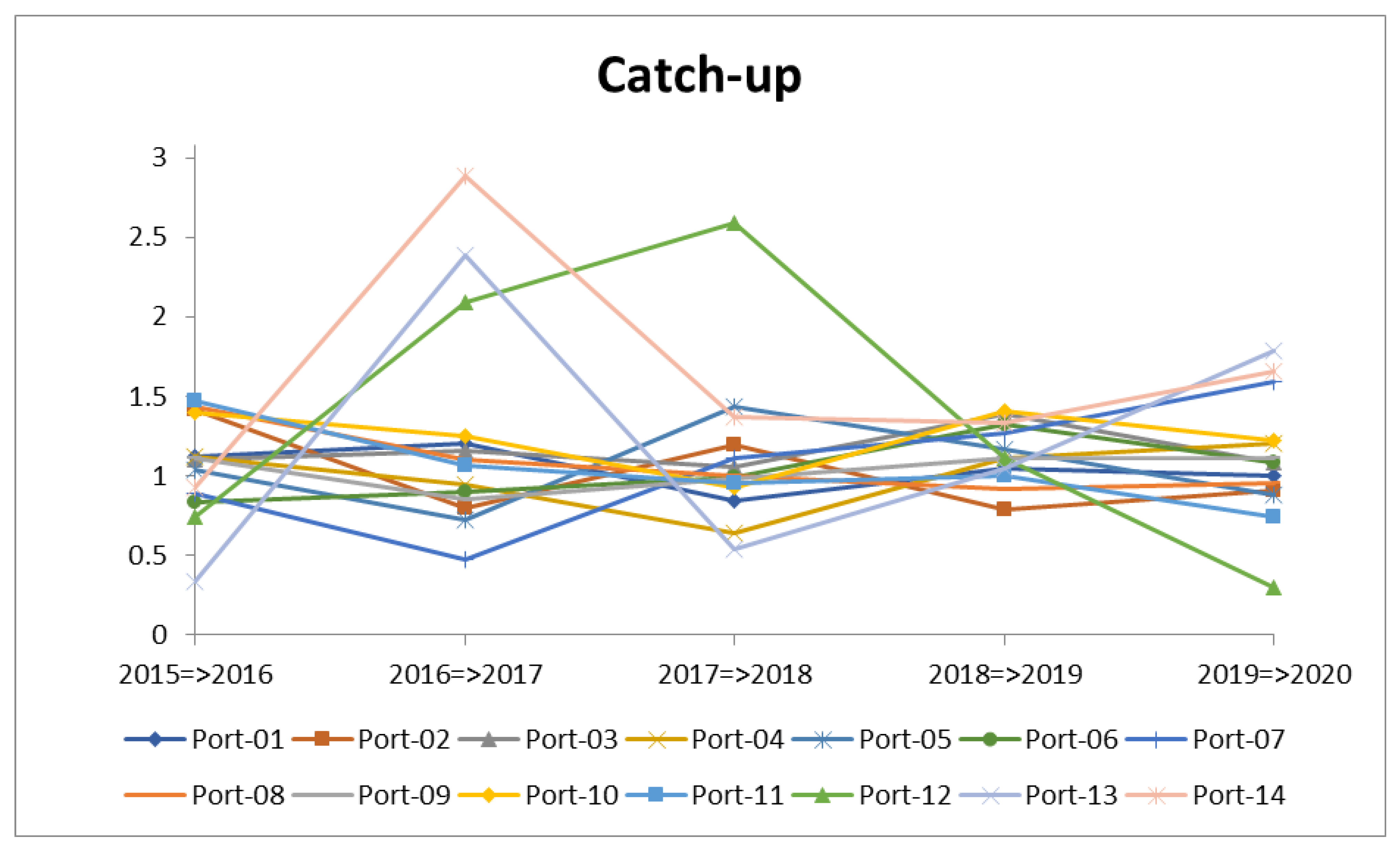

4.2.1. Technical Efficiency Change

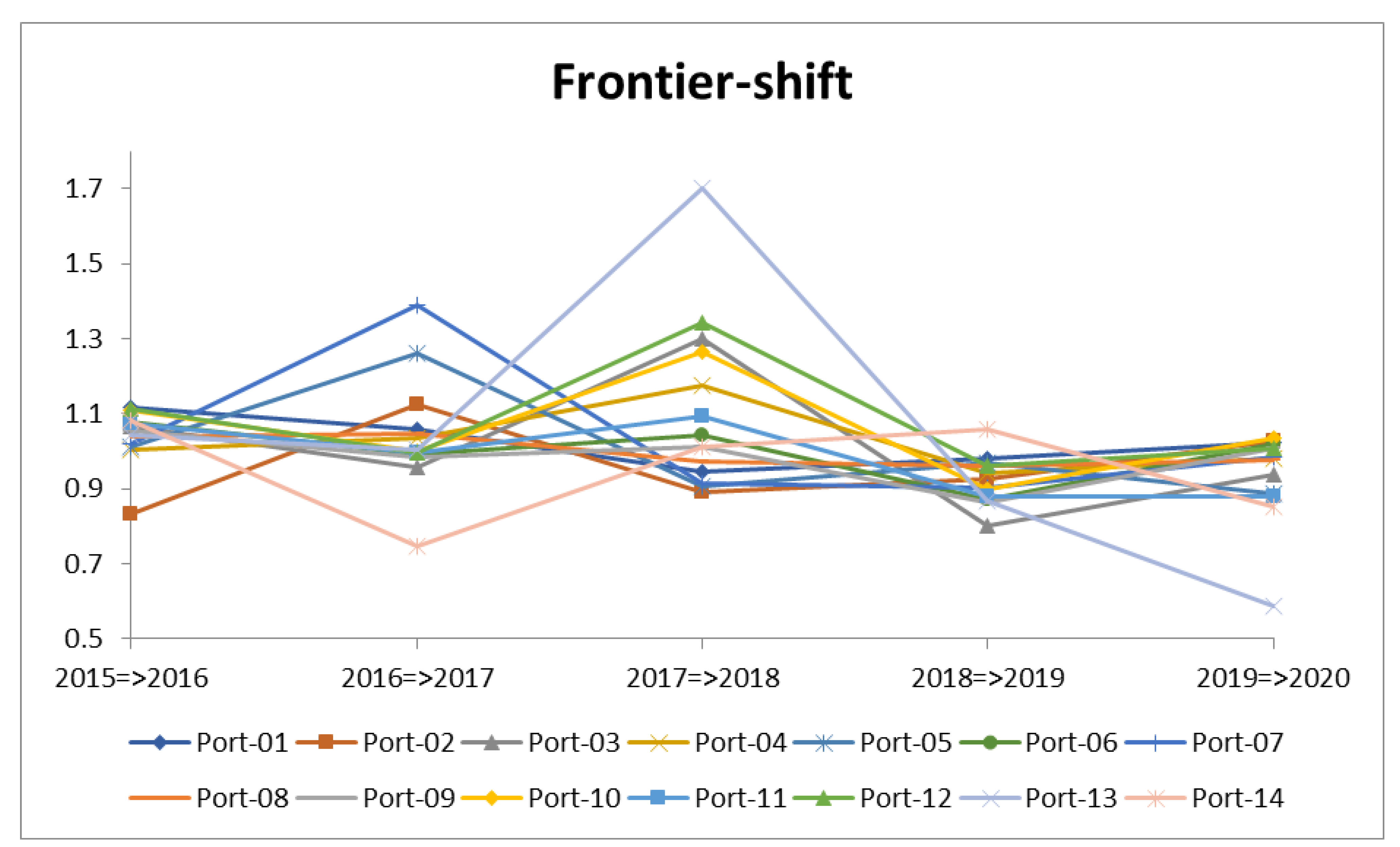

4.2.2. Technological Change

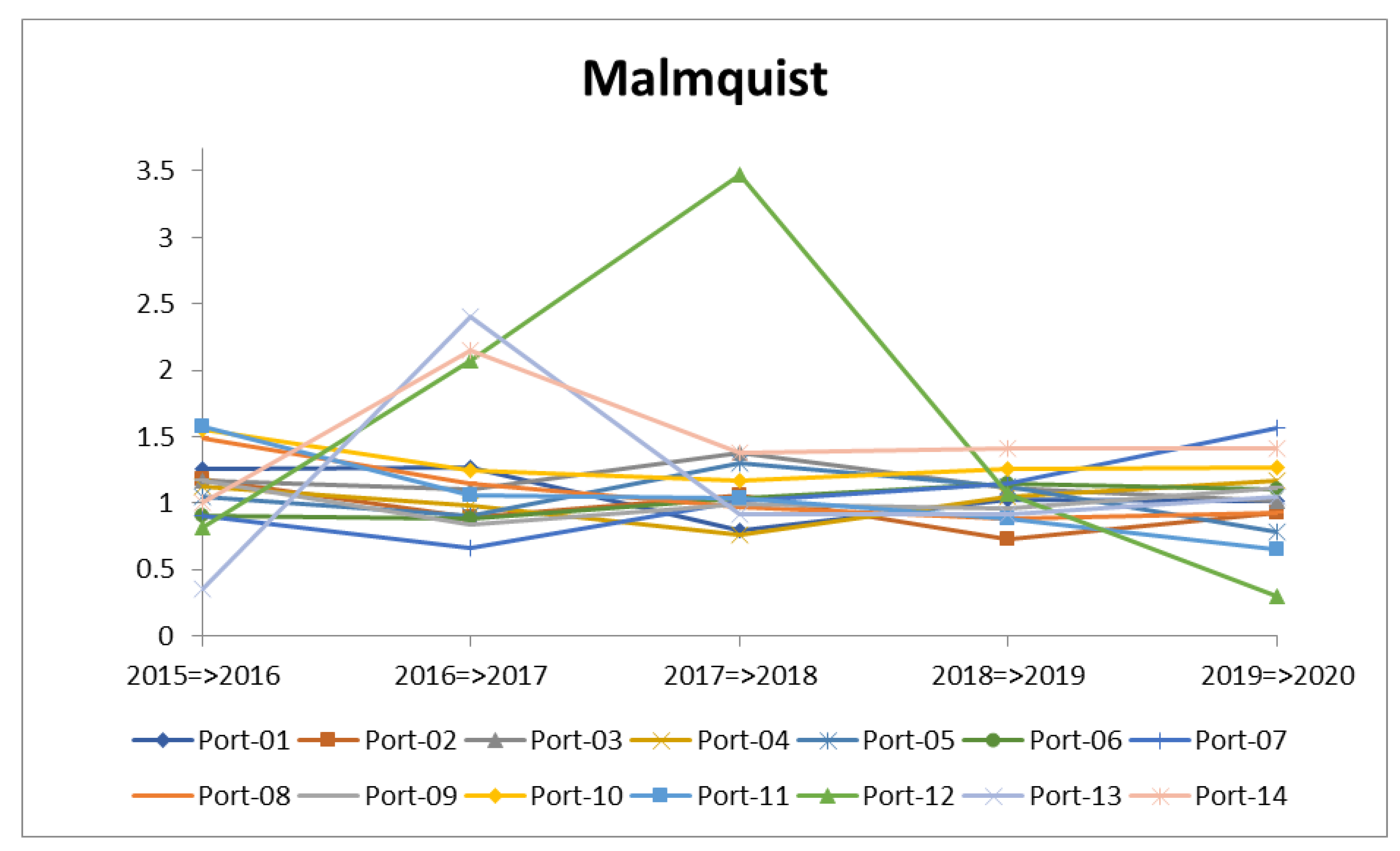

4.2.3. Total Productivity Change

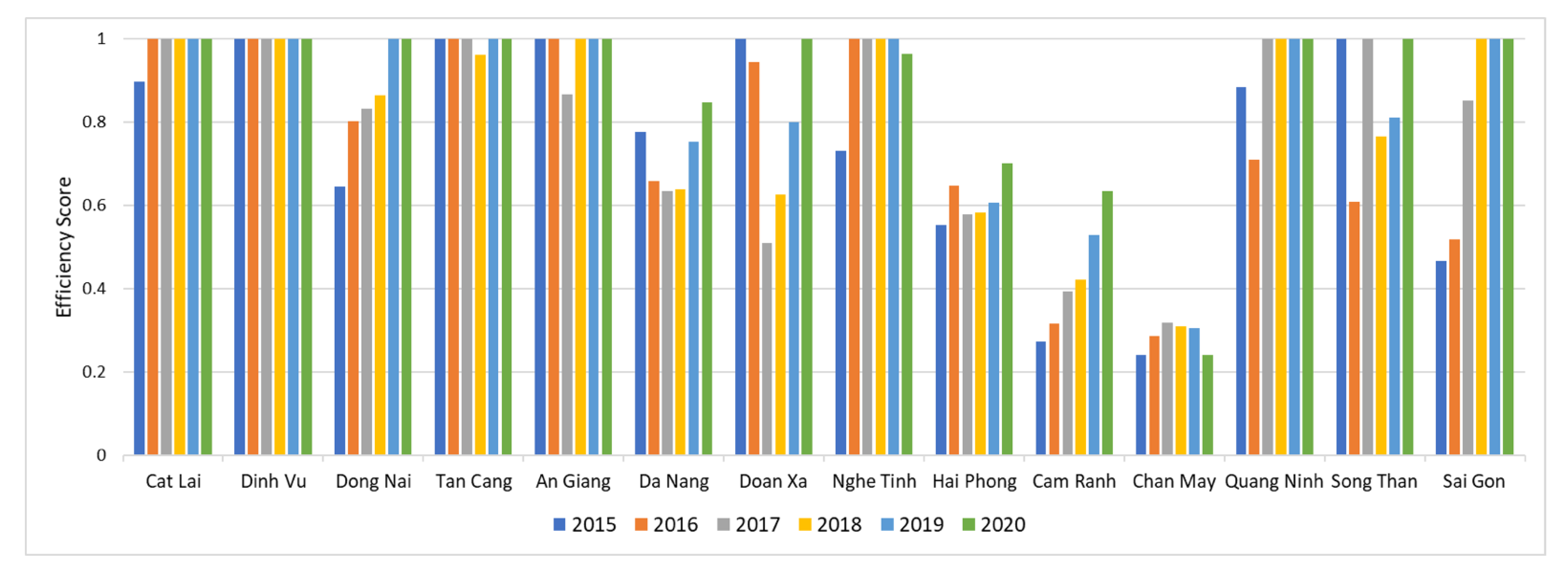

4.3. Results of Epsilon-Based Measure Efficiency

4.4. Discussions

5. Conclusions and Future Studies

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Correlation Coefficient | TOA | OWE | LIA | OPE | REV | NEP | |

|---|---|---|---|---|---|---|---|

| Total assets (TOA) | Pearson correlation | 1 | 0.927 ** | 0.841 ** | 0.775 ** | 0.673 ** | 0.822 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Owner’s equity (OWE) | Pearson correlation | 0.927 ** | 1 | 0.576 ** | 0.822 ** | 0.527 ** | 0.921 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Liabilities (LIA) | Pearson correlation | 0.841 ** | 0.576 ** | 1 | 0.502 ** | 0.704 ** | 0.462 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Operation expense (OPE) | Pearson correlation | 0.775 ** | 0.822 ** | 0.502 ** | 1 | 0.569 ** | 0.722 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Revenue (REV) | Pearson correlation | 0.673 ** | 0.527 ** | 0.704 ** | 0.569 ** | 1 | 0.484 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Net profit (NEP) | Pearson correlation | 0.822 ** | 0.921 ** | 0.462 ** | 0.722 ** | 0.484 ** | 1 |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample | 84 | 84 | 84 | 84 | 84 | 84 | |

| Period | Inputs | Total Assets | Owner’s Equity | Liabilities | Operation Expense |

|---|---|---|---|---|---|

| 2015 | Total assets | 0 | 0.2003 | 0.2285 | 0.2052 |

| Owner’s equity | 0.2003 | 0 | 0.2198 | 0.1677 | |

| Liabilities | 0.2285 | 0.2198 | 0 | 0.2493 | |

| Operation expense | 0.2052 | 0.1677 | 0.2493 | 0 | |

| 2016 | Total assets | 0 | 0.1932 | 0.2232 | 0.1370 |

| Owner’s equity | 0.1932 | 0 | 0.2162 | 0.1161 | |

| Liabilities | 0.2232 | 0.2162 | 0 | 0.2628 | |

| Operation expense | 0.1370 | 0.1161 | 0.2628 | 0 | |

| 2017 | Total assets | 0 | 0.2783 | 0.2995 | 0.2149 |

| Owner’s equity | 0.2783 | 0 | 0.2914 | 0.1478 | |

| Liabilities | 0.2995 | 0.2914 | 0 | 0.2309 | |

| Operation expense | 0.2149 | 0.1478 | 0.2309 | 0 | |

| 2018 | Total assets | 0 | 0.2123 | 0.2675 | 0.1528 |

| Owner’s equity | 0.2123 | 0 | 0.2429 | 0.1425 | |

| Liabilities | 0.2675 | 0.2429 | 0 | 0.1845 | |

| Operation expense | 0.1528 | 0.1425 | 0.1845 | 0 | |

| 2019 | Total assets | 0 | 0.2253 | 0.2633 | 0.1477 |

| Owner’s equity | 0.2253 | 0 | 0.2402 | 0.1396 | |

| Liabilities | 0.2633 | 0.2402 | 0 | 0.1775 | |

| Operation expense | 0.1477 | 0.1396 | 0.1775 | 0 | |

| 2020 | Total assets | 0 | 0.2518 | 0.2808 | 0.1234 |

| Owner’s equity | 0.2518 | 0 | 0.2684 | 0.1313 | |

| Liabilities | 0.2808 | 0.2684 | 0 | 0.1553 | |

| Operation expense | 0.1234 | 0.1313 | 0.1553 | 0 |

| Period | Inputs | Total Assets | Owner’s Equity | Liabilities | Operation Expense |

|---|---|---|---|---|---|

| 2015 | Total assets | 1 | 0.5995 | 0.5431 | 0.5897 |

| Owner’s equity | 0.5995 | 1 | 0.5604 | 0.6646 | |

| Liabilities | 0.5431 | 0.5604 | 1 | 0.5015 | |

| Operation expense | 0.5897 | 0.6646 | 0.5015 | 1 | |

| 2016 | Total assets | 1 | 0.6136 | 0.5537 | 0.7259 |

| Owner’s equity | 0.6136 | 1 | 0.5677 | 0.7678 | |

| Liabilities | 0.5537 | 0.5677 | 1 | 0.4745 | |

| Operation expense | 0.7259 | 0.7678 | 0.4745 | 1 | |

| 2017 | Total assets | 1 | 0.4433 | 0.4011 | 0.5702 |

| Owner’s equity | 0.4433 | 1 | 0.4172 | 0.7045 | |

| Liabilities | 0.4011 | 0.4172 | 1 | 0.5381 | |

| Operation expense | 0.5702 | 0.7045 | 0.5381 | 1 | |

| 2018 | Total assets | 1 | 0.5754 | 0.4651 | 0.6944 |

| Owner’s equity | 0.5754 | 1 | 0.5142 | 0.7150 | |

| Liabilities | 0.4651 | 0.5142 | 1 | 0.6311 | |

| Operation expense | 0.6944 | 0.7150 | 0.6311 | 1 | |

| 2019 | Total assets | 1 | 0.5493 | 0.4734 | 0.7047 |

| Owner’s equity | 0.5493 | 1 | 0.5196 | 0.7209 | |

| Liabilities | 0.4734 | 0.5196 | 1 | 0.6450 | |

| Operation expense | 0.7047 | 0.7209 | 0.6450 | 1 | |

| 2020 | Total assets | 1 | 0.4965 | 0.4384 | 0.7532 |

| Owner’s equity | 0.4965 | 1 | 0.4633 | 0.7373 | |

| Liabilities | 0.4384 | 0.4633 | 1 | 0.6894 | |

| Operation expense | 0.7532 | 0.7373 | 0.6894 | 1 |

References

- UNCTAD. Review of Maritime Transport 2018. Available online: https://unctad.org/webflyer/review-maritime-transport-2018 (accessed on 20 February 2021).

- Rodrigue, J.-P.; Debrie, J.; Fremont, A.; Gouvernal, E. Functions and actors of inland ports: European and North American dynamics. J. Transp. Geogr. 2010, 18, 519–529. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nhieu, N.-L.; Chung, Y.-C.; Pham, H.-T. Multi-objective optimization models for sustainable perishable intermodal multi-product networks with delivery time window. Mathematics 2021, 9, 379. [Google Scholar] [CrossRef]

- Wang, C.-N.; Dang, T.-T.; Le, T.Q.; Kewcharoenwong, P. Transportation optimization models for intermodal networks with fuzzy node capacity, detour factor, and vehicle utilization constraints. Mathematics 2020, 8, 2109. [Google Scholar] [CrossRef]

- Karam, A.; Eltawil, A.; Hegner, B.; Reinau, K. Energy-efficient and integrated allocation of berths, quay cranes, and internal trucks in container terminals. Sustainability 2020, 12, 3202. [Google Scholar] [CrossRef]

- Sayareh, J.; Iranshahi, S.; Golfakhrabadi, N. Service quality evaluation and ranking of container terminal operators. Asian, J. Shipp. Logist. 2016, 32, 203–212. [Google Scholar] [CrossRef]

- Hemalatha, S.; Dumpala, L.; Balakrishna, B. Service quality evaluation and ranking of container terminal operators through hybrid multi-criteria decision making methods. Asian J. Shipp. Logist. 2018, 34, 137–144. [Google Scholar] [CrossRef]

- Pham, T.Y.; Yeo, G.T. Evaluation of transshipment container terminals’ service quality in Vietnam: From the shipping com-panies’ perspective. Sustainability 2019, 11, 1503. [Google Scholar] [CrossRef]

- Da Cruz, M.R.P.; Ferreira, J.J.; Azevedo, S.G. Key factors of seaport competitiveness based on the stakeholder perspective: An Analytic Hierarchy Process (AHP) model. Marit. Econ. Logist. 2013, 15, 416–443. [Google Scholar] [CrossRef]

- Heejung, Y.E.O. Participation of private investors in container terminal operation: Influence of global terminal operators. Asian J. Shipp. Logist. 2015, 31, 363–383. [Google Scholar]

- Yeo, G.T.; Thai, V.V.; Roh, S.Y. An analysis of port service quality and customer satisfaction: The case of Korean container ports. Asian J. Shipp. Logist. 2015, 31, 437–447. [Google Scholar] [CrossRef]

- da Cruz, M.R.P.; de Matos Ferreira, J.J. Evaluating Iberian seaport competitiveness using an alternative DEA approach. Eur. Transp. Res. Rev. 2016, 8, 1–9. [Google Scholar] [CrossRef]

- Min, H.; Ahn, S.-B.; Lee, H.-S.; Park, H. An integrated terminal operating system for enhancing the efficiency of seaport terminal operators. Marit. Econ. Logist. 2017, 19, 428–450. [Google Scholar] [CrossRef]

- Statista. Maritime Industry in Vietnam. Available online: https://www.statista.com/topics/5936/maritime-industry-in-vietnam/ (accessed on 20 February 2021).

- Statista. Leading Sea Ports in Vietnam in 2018. Available online: https://www.statista.com/statistics/1045072/vietnam-leading-sea-ports-by-throughput/#:~:text=Vietnam%20has%20320%20ports%20of,in%20Ho%20Chi%20Minh%20City (accessed on 20 February 2021).

- Tan Cang Logistics; Stevedoring JSC. TCL—Sustainable Development. Available online: http://tancanglogistics.com/en/introduction/Pages/tcl-sustainable-development-140420170403.aspx (accessed on 20 February 2021).

- Tone, K.; Tsutsui, M. An epsilon-based measure of efficiency in DEA—A third pole of technical efficiency. Eur. J. Oper. Res. 2010, 207, 1554–1563. [Google Scholar] [CrossRef]

- Munim, Z.H.; Schramm, H.-J. The impacts of port infrastructure and logistics performance on economic growth: The mediating role of seaborne trade. J. Shipp. Trade 2018, 3, 1. [Google Scholar] [CrossRef]

- Dong, G.; Zhu, J.; Li, J.; Wang, H.; Gajpal, Y. Evaluating the environmental performance and operational efficiency of container ports: An application to the maritime silk road. Int. J. Environ. Res. Public Health 2019, 16, 2226. [Google Scholar] [CrossRef]

- Sałabun, W.; Wątróbski, J.; Shekhovtsov, A. Are MCDA methods benchmarkable? A comparative study of TOPSIS, VIKOR, COPRAS, and PROMETHEE II methods. Symmetry 2020, 12, 1549. [Google Scholar] [CrossRef]

- Shekhovtsov, A.; Sałabun, W. A comparative case study of the VIKOR and TOPSIS rankings similarity. Procedia Comput. Sci. 2020, 176, 3730–3740. [Google Scholar] [CrossRef]

- Kizielewicz, B.; Wątróbski, J.; Sałabun, W. Identification of relevant criteria set in the MCDA process—Wind farm location case study. Energies 2020, 13, 6548. [Google Scholar] [CrossRef]

- Shekhovtsov, A.; Kozlov, V.; Nosov, V.; Sałabun, W. Efficiency of methods for determining the relevance of criteria in sus-tainable transport problems: A comparative case study. Sustainability 2020, 12, 7915. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Barros, C.P. A Benchmark analysis of Italian seaports using data envelopment analysis. Marit. Econ. Logist. 2006, 8, 347–365. [Google Scholar] [CrossRef]

- Ding, Z.-Y.; Jo, G.-S.; Wang, Y.; Yeo, G.-T. The relative efficiency of container terminals in small and medium-sized ports in China. Asian J. Shipp. Logist. 2015, 31, 231–251. [Google Scholar] [CrossRef]

- Périco, A.E.; Ribeiro da Silva, G. Port performance in Brazil: A case study using data envelopment analysis. Case Stud. Transp. Policy 2020, 8, 31–38. [Google Scholar] [CrossRef]

- Quintano, C.; Mazzocchi, P.; Rocca, A. Examining eco-efficiency in the port sector via non-radial data envelopment analysis and the response based procedure for detecting unit segments. J. Clean. Prod. 2020, 259, 120979. [Google Scholar] [CrossRef]

- Zhou, G.; Min, H.; Xu, C.; Cao, Z. Evaluating the comparative efficiency of Chinese third-party logistics providers using data envelopment analysis. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 262–279. [Google Scholar] [CrossRef]

- Falsini, D.; Fondi, F.; Schiraldi, M.M. A logistics provider evaluation and selection methodology based on AHP, DEA and linear programming integration. Int. J. Prod. Res. 2012, 50, 4822–4829. [Google Scholar] [CrossRef]

- Park, H.G.; Lee, Y.J. The efficiency and productivity analysis of large logistics providers services in Korea. Asian J. Shipp. Logist. 2015, 31, 469–476. [Google Scholar] [CrossRef]

- Hamdan, A.; Rogers, K. Evaluating the efficiency of 3PL logistics operations. Int. J. Prod. Econ. 2008, 113, 235–244. [Google Scholar] [CrossRef]

- Wang, G.; Li, K.X.; Xiao, Y. Measuring marine environmental efficiency of a cruise shipping company considering corporate social responsibility. Mar. Policy 2019, 99, 140–147. [Google Scholar] [CrossRef]

- Bjurek, H. The Malmquist Total Factor Productivity Index. Scand. J. Econ. 1996, 98, 303. [Google Scholar] [CrossRef]

- Wang, C.-N.; Dang, T.-T.; Tibo, H.; Duong, D.-H. Assessing renewable energy production capabilities using DEA window and fuzzy TOPSIS model. Symmetry 2021, 13, 334. [Google Scholar] [CrossRef]

- Wang, C.-N.; Dang, T.-T.; Nguyen, N.-A.-T.; Le, T.-T.-H. Supporting better decision-making: A combined grey model and data envelopment analysis for efficiency evaluation in e-commerce marketplaces. Sustainability 2020, 12, 10385. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nguyen, T.-L.; Dang, T.-T. Analyzing operational efficiency in real estate companies: An application of GM (1,1) and DEA malmquist model. Mathematics 2021, 9, 202. [Google Scholar] [CrossRef]

- Tavana, M.; Mirzagoltabar, H.; Mirhedayatian, S.M.; Saen, R.F.; Azadi, M. A new network epsilon-based DEA model for supply chain performance evaluation. Comput. Ind. Eng. 2013, 66, 501–513. [Google Scholar] [CrossRef]

- Cui, Q.; Arjomandi, A. Airline energy efficiency measures based on an epsilon-based Range-Adjusted Measure model. Energy 2021, 217, 119354. [Google Scholar] [CrossRef]

- IET Stock. Vietstock Market. Available online: https://finance.vietstock.vn/VNM/tai-chinh.htm (accessed on 20 February 2021).

- Barykin, S.; Kapustina, I.; Kirillova, T.; Yadykin, V.; Konnikov, Y. Economics of digital ecosystems. J. Open Innov. Technol. Mark. Complex. 2020, 6, 124. [Google Scholar] [CrossRef]

- Barykin, S.Y.; Kapustina, I.V.; Sergeev, S.M.; Yadykin, V.K. Algorithmic foundations of economic and mathematical modeling of network logistics processes. J. Open Innov. Technol. Mark. Complex. 2020, 6, 189. [Google Scholar] [CrossRef]

- Logistics Vietnam in 2021. Available online: https://www.bsc.com.vn/tin-tuc/tin-chi-tiet/747986-ssi-research-trien-vong-nganh-cang-bien-va-logistics-nam-2021-ky-vong-phuc-hoi-toan-cau (accessed on 22 March 2021).

- Raconteur. How Technology Is Creating the Digital Ports of the Future. Available online: https://www.raconteur.net/technology/technology-digital-port/ (accessed on 22 March 2021).

- WorkBoat. Maritime Industry Plays Key Role in Covid-19 Response. Available online: https://www.workboat.com/coastal-inland-waterways/maritime-industry-plays-key-role-in-covid-19-response (accessed on 20 February 2021).

- Wang, C.-N.; Dang, T.-T.; Nguyen, N.-A.-T. Outsourcing reverse logistics for e-commerce retailers: A two-stage fuzzy optimization approach. Axioms 2021, 10, 34. [Google Scholar] [CrossRef]

- Sałabun, W.; Urbaniak, K. A new coefficient of rankings similarity in decision-making problems. In Computational Science—ICCS 2020, Proceedings of the 20th International Conference, Amsterdam, The Netherlands, 3–5 June 2020; Krzhizhanovskaya, V.V., Závodszky, G., Lees, M.H., Dongarra, J.J., Sloot, P.M.A., Brissos, S., Teixeira, J., Eds.; Springer International Publishing: Cham, Switzerland, 2020; Volume 12138. [Google Scholar] [CrossRef]

| Authors [Reference] | Inputs/Criteria | Outputs/Responses | Methodologies | Applied Areas |

|---|---|---|---|---|

| Barros [25], 2006 | Number of employees Capital investment Size of operating costs | Total sales Number of passengers Number of containers Number of ships | CCR BCC | Container port |

| Zhou et al. [29], 2008 | Net fixed asset Salaries and wages Operating expenses Current liabilities | Operating income | CCR BCC | Logistics |

| Hamdan and Rogers [32], 2008 | Labor hours Warehouse space Technology investment MHE | Shipping volume Order filling Space utilization | CCR | Warehouse |

| Falsini et al. [30], 2012 | Industry sectors Perishable products Consumer’s goods | Quantitative benefits Efficiency score | AHP CCR LP | Logistics |

| Ding et al. [26], 2015 | Terminal length MHE Staff quantity | Number of containers | Malmquist Regression | Container port |

| Park and Lee [31], 2015 | Assets Capital Number of employees | Total revenue | CCR BCC Malmquist | Logistics |

| Wang et al. [33], 2019 | Number of employees Energy consumption Water consumption | Revenue Total solid waste | Malmquist SBM | Shipping |

| Périco and Silva [27], 2020 | Waiting time to dock Number of berths Dock areas Storage area | Total load handle | PCA | Container port |

| Quintano et al. [28], 2020 | Labor Energy products | Emissions relevant Total gross weight | SBM | Container port |

| This paper | Total assets Owner’s equity Liabilities Operating expense | Revenue Net profit | Malmquist EBM | Seaport |

| DMUs | Seaport Terminal Company | Symbol | Code | Profit |

|---|---|---|---|---|

| Port-01 | Cat Lai Port Joint Stock Company | Cat Lai | CLL | 4041 |

| Port-02 | Dinh Vu Port Investment and Development JSC | Dinh Vu | DVP | 10,327 |

| Port-03 | Dong Nai Port JSC | Dong Nai | PDN | 5696 |

| Port-04 | Tan Cang Port Logistics and Stevedoring JSC | Tan Cang | TCL | 4219 |

| Port-05 | An Giang Port Joint Stock Company | An Giang | CAG | 199 |

| Port-06 | Da Nang Port Joint Stock Company | Da Nang | CDN | 9098 |

| Port-07 | Doan Xa Port Joint Stock Company | Doan Xa | DXP | 2463 |

| Port-08 | Nghe Tinh Port Holding Joint Stock Company | Nghe Tinh | NAP | 484 |

| Port-09 | Port of Hai Phong Joint Stock Company | Hai Phong | PHP | 24,587 |

| Port-10 | Cam Ranh Port Joint Stock Company | Cam Ranh | CCR | 1054 |

| Port-11 | Chan May Port Joint Stock Company | Chan May | CMP | 605 |

| Port-12 | Quang Ninh Port | Quang Ninh | CQN | 2946 |

| Port-13 | Port of Song Than ICD JSC | Song Than | IST | 1769 |

| Port-14 | Saigon Port Join Stock Company | Sai Gon | SGP | 10,115 |

| Period | Statistics | Total Assets | Owner’s Equity | Liabilities | Operation Expense | Revenue | Net Profit |

|---|---|---|---|---|---|---|---|

| 2015 | Max | 252,071 | 186,043 | 82,043 | 9866 | 102,116 | 22,654 |

| Min | 7281 | 4270 | 597 | 394 | 2480 | 273 | |

| Average | 48,932 | 33,001 | 15,930 | 2356 | 22,338 | 4277 | |

| SD | 64,662 | 44,725 | 24,200 | 2789 | 25,375 | 5908 | |

| 2016 | Max | 222,840 | 167,177 | 89,137 | 10,616 | 104,362 | 26,007 |

| Min | 7028 | 5976 | 413 | 446 | 3574 | 354 | |

| Average | 48,104 | 32,551 | 15,553 | 2533 | 23,099 | 4495 | |

| SD | 59,260 | 40,028 | 24,372 | 3127 | 26,427 | 6705 | |

| 2017 | Max | 227,516 | 174,128 | 114,430 | 9120 | 89,895 | 20,955 |

| Min | 6655 | 6323 | 331 | 478 | 2948 | 136 | |

| Average | 55,455 | 35,113 | 20,342 | 2093 | 25,400 | 5507 | |

| SD | 65,434 | 42,466 | 30,449 | 2151 | 24,399 | 6619 | |

| 2018 | Max | 237,577 | 177,990 | 118,048 | 8834 | 218,995 | 22,407 |

| Min | 6602 | 6332 | 269 | 363 | 2882 | 138 | |

| Average | 62,999 | 37,826 | 25,173 | 2019 | 38,326 | 5082 | |

| SD | 70,335 | 43,874 | 36,725 | 2064 | 54,828 | 5827 | |

| 2019 | Max | 252,576 | 202,502 | 114,750 | 7816 | 88,232 | 24,587 |

| Min | 6671 | 6409 | 262 | 257 | 2483 | 199 | |

| Average | 63,485 | 43,741 | 19,701 | 1959 | 28,147 | 5543 | |

| SD | 72,302 | 50,418 | 29,293 | 1843 | 25,060 | 6281 | |

| 2020 | Max | 252,576 | 202,502 | 114,750 | 7816 | 88,232 | 24,587 |

| Min | 6671 | 6409 | 262 | 257 | 2483 | 199 | |

| Average | 63,485 | 43,741 | 19,701 | 1959 | 28,147 | 5543 | |

| SD | 72,302 | 50,418 | 29,293 | 1843 | 25,060 | 6281 |

| Catch-up | Symbol | 2015⇒2016 | 2016⇒2017 | 2017⇒2018 | 2018⇒2019 | 2019⇒2020 | Average |

|---|---|---|---|---|---|---|---|

| Port-01 | Cat Lai | 1.1225 | 1.1994 | 0.8453 | 1.0451 | 0.9971 | 1.0419 |

| Port-02 | Dinh Vu | 1.4148 | 0.7964 | 1.1960 | 0.7919 | 0.9040 | 1.0206 |

| Port-03 | Dong Nai | 1.1002 | 1.1552 | 1.0571 | 1.3845 | 1.0805 | 1.1555 |

| Port-04 | Tan Cang | 1.1163 | 0.9465 | 0.6440 | 1.1141 | 1.1989 | 1.0040 |

| Port-05 | An Giang | 1.0371 | 0.7213 | 1.4307 | 1.1643 | 0.8803 | 1.0467 |

| Port-06 | Da Nang | 0.8374 | 0.8951 | 0.9903 | 1.3193 | 1.0833 | 1.0251 |

| Port-07 | Doan Xa | 0.8894 | 0.4770 | 1.1121 | 1.2718 | 1.5925 | 1.0685 |

| Port-08 | Nghe Tinh | 1.4381 | 1.0974 | 1.0029 | 0.9198 | 0.9531 | 1.0823 |

| Port-09 | Hai Phong | 1.1134 | 0.8553 | 0.9807 | 1.1131 | 1.1089 | 1.0343 |

| Port-10 | Cam Ranh | 1.3970 | 1.2485 | 0.9228 | 1.4027 | 1.2224 | 1.2387 |

| Port-11 | Chan May | 1.4715 | 1.0622 | 0.9521 | 1.0002 | 0.7385 | 1.0449 |

| Port-12 | Quang Ninh | 0.7377 | 2.0892 | 2.5855 | 1.1107 | 0.2974 | 1.3641 |

| Port-13 | Song Than | 0.3390 | 2.3894 | 0.5416 | 1.0505 | 1.7831 | 1.2207 |

| Port-14 | Sai Gon | 0.9243 | 2.8818 | 1.3660 | 1.3342 | 1.6563 | 1.6325 |

| Average | 1.0670 | 1.2725 | 1.1162 | 1.1444 | 1.1069 | 1.1414 | |

| Max | 1.4715 | 2.8818 | 2.5855 | 1.4027 | 1.7831 | 1.6325 | |

| Min | 0.3390 | 0.4770 | 0.5416 | 0.7919 | 0.2974 | 1.0040 | |

| SD | 0.3142 | 0.6898 | 0.4858 | 0.1808 | 0.3860 | 0.1759 | |

| Frontier | Symbol | 2015⇒2016 | 2016⇒2017 | 2017⇒2018 | 2018⇒2019 | 2019⇒2020 | Average |

|---|---|---|---|---|---|---|---|

| Port-01 | Cat Lai | 1.1181 | 1.0576 | 0.9471 | 0.9807 | 1.0225 | 1.0252 |

| Port-02 | Dinh Vu | 0.8320 | 1.1264 | 0.8898 | 0.9266 | 1.0262 | 0.9602 |

| Port-03 | Dong Nai | 1.0673 | 0.9572 | 1.3018 | 0.8027 | 0.9383 | 1.0135 |

| Port-04 | Tan Cang | 1.0050 | 1.0362 | 1.1758 | 0.9402 | 0.9794 | 1.0273 |

| Port-05 | An Giang | 1.0099 | 1.2621 | 0.9066 | 0.9706 | 0.8885 | 1.0075 |

| Port-06 | Da Nang | 1.0783 | 0.9908 | 1.0433 | 0.8717 | 1.0180 | 1.0004 |

| Port-07 | Doan Xa | 1.0189 | 1.3883 | 0.9124 | 0.9028 | 0.9851 | 1.0415 |

| Port-08 | Nghe Tinh | 1.0388 | 1.0451 | 0.9710 | 0.9601 | 0.9757 | 0.9981 |

| Port-09 | Hai Phong | 1.0543 | 0.9857 | 1.0117 | 0.8627 | 1.0059 | 0.9840 |

| Port-10 | Cam Ranh | 1.1095 | 1.0002 | 1.2640 | 0.8977 | 1.0351 | 1.0613 |

| Port-11 | Chan May | 1.0740 | 0.9969 | 1.0919 | 0.8785 | 0.8787 | 0.9840 |

| Port-12 | Quang Ninh | 1.1129 | 0.9946 | 1.3431 | 0.9594 | 1.0092 | 1.0839 |

| Port-13 | Song Than | 1.0429 | 1.0036 | 1.7014 | 0.8676 | 0.5851 | 1.0401 |

| Port-14 | Sai Gon | 1.0814 | 0.7475 | 1.0133 | 1.0594 | 0.8536 | 0.9510 |

| Average | 1.0460 | 1.0423 | 1.1124 | 0.9200 | 0.9429 | 1.0127 | |

| Max | 1.1181 | 1.3883 | 1.7014 | 1.0594 | 1.0351 | 1.0839 | |

| Min | 0.8320 | 0.7475 | 0.8898 | 0.8027 | 0.5851 | 0.9510 | |

| SD | 0.0717 | 0.1475 | 0.2266 | 0.0644 | 0.1187 | 0.0372 | |

| Malmquist | Symbol | 2015⇒2016 | 2016⇒2017 | 2017⇒2018 | 2018⇒2019 | 2019⇒2020 | Average |

|---|---|---|---|---|---|---|---|

| Port-01 | Cat Lai | 1.2551 | 1.2684 | 0.8006 | 1.0249 | 1.0195 | 1.0737 |

| Port-02 | Dinh Vu | 1.1771 | 0.8970 | 1.0643 | 0.7337 | 0.9278 | 0.9600 |

| Port-03 | Dong Nai | 1.1742 | 1.1058 | 1.3762 | 1.1114 | 1.0139 | 1.1563 |

| Port-04 | Tan Cang | 1.1218 | 0.9808 | 0.7572 | 1.0475 | 1.1742 | 1.0163 |

| Port-05 | An Giang | 1.0474 | 0.9103 | 1.2971 | 1.1301 | 0.7821 | 1.0334 |

| Port-06 | Da Nang | 0.9030 | 0.8869 | 1.0332 | 1.1500 | 1.1028 | 1.0152 |

| Port-07 | Doan Xa | 0.9062 | 0.6621 | 1.0147 | 1.1483 | 1.5687 | 1.0600 |

| Port-08 | Nghe Tinh | 1.4939 | 1.1469 | 0.9738 | 0.8831 | 0.9299 | 1.0855 |

| Port-09 | Hai Phong | 1.1739 | 0.8430 | 0.9921 | 0.9603 | 1.1154 | 1.0170 |

| Port-10 | Cam Ranh | 1.5500 | 1.2487 | 1.1664 | 1.2591 | 1.2653 | 1.2979 |

| Port-11 | Chan May | 1.5803 | 1.0589 | 1.0396 | 0.8787 | 0.6489 | 1.0413 |

| Port-12 | Quang Ninh | 0.8210 | 2.0780 | 3.4727 | 1.0656 | 0.3001 | 1.5475 |

| Port-13 | Song Than | 0.3536 | 2.3981 | 0.9215 | 0.9114 | 1.0434 | 1.1256 |

| Port-14 | Sai Gon | 0.9996 | 2.1542 | 1.3841 | 1.4135 | 1.4138 | 1.4730 |

| Average | 1.1112 | 1.2599 | 1.2352 | 1.0513 | 1.0218 | 1.1359 | |

| Max | 1.5803 | 2.3981 | 3.4727 | 1.4135 | 1.5687 | 1.5475 | |

| Min | 0.3536 | 0.6621 | 0.7572 | 0.7337 | 0.3001 | 0.9600 | |

| SD | 0.3225 | 0.5438 | 0.6712 | 0.1734 | 0.3145 | 0.1788 | |

| Period | Weight to Input/Output | Epsilon | |||

|---|---|---|---|---|---|

| Total Assets | Owner’s Equity | Liabilities | Operation Expense | ||

| 2015 | 0.2503 | 0.2602 | 0.2360 | 0.2534 | 0.4226 |

| 2016 | 0.2545 | 0.2602 | 0.2221 | 0.2632 | 0.3795 |

| 2017 | 0.2353 | 0.2561 | 0.2272 | 0.2815 | 0.4827 |

| 2018 | 0.2445 | 0.2516 | 0.2301 | 0.2738 | 0.3975 |

| 2019 | 0.2428 | 0.2492 | 0.2324 | 0.2756 | 0.3944 |

| 2020 | 0.2415 | 0.2420 | 0.2298 | 0.2867 | 0.3970 |

| DMUs | Symbol | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| Port-01 | Cat Lai | 0.8964 | 1 | 1 | 1 | 1 | 1 |

| Port-02 | Dinh Vu | 1 | 1 | 1 | 1 | 1 | 1 |

| Port-03 | Dong Nai | 0.6445 | 0.8008 | 0.8313 | 0.8652 | 1 | 1 |

| Port-04 | Tan Cang | 1 | 1 | 1 | 0.9611 | 1 | 1 |

| Port-05 | An Giang | 1 | 1 | 0.8665 | 1 | 1 | 1 |

| Port-06 | Da Nang | 0.7770 | 0.6574 | 0.6344 | 0.6394 | 0.7521 | 0.8476 |

| Port-07 | Doan Xa | 1 | 0.9448 | 0.5094 | 0.6252 | 0.7992 | 1 |

| Port-08 | Nghe Tinh | 0.7317 | 1 | 1 | 1 | 1 | 0.9640 |

| Port-09 | Hai Phong | 0.5515 | 0.6465 | 0.5778 | 0.5827 | 0.6060 | 0.6998 |

| Port-10 | Cam Ranh | 0.2717 | 0.3149 | 0.3920 | 0.4219 | 0.5281 | 0.6333 |

| Port-11 | Chan May | 0.2409 | 0.2859 | 0.3171 | 0.3100 | 0.3043 | 0.2406 |

| Port-12 | Quang Ninh | 0.8840 | 0.7102 | 1 | 1 | 1 | 1 |

| Port-13 | Song Than | 1 | 0.6076 | 1 | 0.7646 | 0.8107 | 1 |

| Port-14 | Sai Gon | 0.4655 | 0.5171 | 0.8513 | 1 | 1 | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-N.; Nguyen, N.-A.-T.; Fu, H.-P.; Hsu, H.-P.; Dang, T.-T. Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models. Axioms 2021, 10, 48. https://doi.org/10.3390/axioms10020048

Wang C-N, Nguyen N-A-T, Fu H-P, Hsu H-P, Dang T-T. Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models. Axioms. 2021; 10(2):48. https://doi.org/10.3390/axioms10020048

Chicago/Turabian StyleWang, Chia-Nan, Ngoc-Ai-Thy Nguyen, Hsin-Pin Fu, Hsien-Pin Hsu, and Thanh-Tuan Dang. 2021. "Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models" Axioms 10, no. 2: 48. https://doi.org/10.3390/axioms10020048

APA StyleWang, C.-N., Nguyen, N.-A.-T., Fu, H.-P., Hsu, H.-P., & Dang, T.-T. (2021). Efficiency Assessment of Seaport Terminal Operators Using DEA Malmquist and Epsilon-Based Measure Models. Axioms, 10(2), 48. https://doi.org/10.3390/axioms10020048