Abstract

Replacing traditional products with green products has become a key way to achieve decoupling between economic development and environmental pollution. As an incentive mechanism, subsidies can be provided by a government to facilitate the popularization and acceptance of green products. Subsidies play a significant role in encouraging the development of green products. We explored the proper optimal subsidy mechanism for green products from the angle of maximizing the net policy return, which cannot only encourage the development of green products but also do not aggravate financial burden for the government. In order to explore the optimal subsidy level for green products from the perspective of net policy benefit maximization, this paper established the optimal subsidy principal-agent models and a numerical example was presented to verify the effectiveness of the model we constructed. The results show that improving investors’ preference and eliminating asymmetric information contribute to reduce subsidy cost savings. Additionally, improving consumer environmental awareness, promoting the development and application of green technology, and reducing market risk reduce subsidy costs. This article provides policymakers with an effective subsidy scheme to accelerate the development of green products and achieve sustainable development goals.

1. Introduction

Environmental issues have long attracted worldwide attention. Rapid economic growth has always been accompanied by overuse and deterioration of natural resources [1]. Excessive consumption of natural resources results in serious damage to the environment. Green growth is a mode of economic growth which means environment-friendly and sustainable development [2]. Developing green products is an effective way to promote green growth [3].

There is no uniform definition of green products so far. To achieve the purpose of this study, we define the term “green” primarily from an environmental perspective. According to the existing literature, we have summarized that green products must meet the following three criteria for environmental quality: (1) the product will not harm the environment during use and saves more energy than a traditional product [4]; (2) the product will not damage the environment after it is discarded [5]; (3) the production process and supply chain management meet the requirements of environmental protection [6]. The term of “green products” can be applied to describe products that devote to improving the eco-environment and social quality [7].

Replacing traditional products with green products has received widespread attention as an important measure to solve economic development and environmental problems. For instance, electric vehicles, which are green products, contribute to reducing carbon emissions observably by 30 to 50 percent and increase the utilization efficiency of energy resources by 40 to 60 percent [8]. Electric vehicles are considered to an effective way to solve many environmental problems in China, for instance, energy crises and air pollution [9]. Furthermore, Chen and Song (2017) found that photovoltaics, a green product, could help reduce outnumber six billion tons of CO2 emission per annum by the year 2050, which is nearly equivalent to the total number of direct carbon dioxide emissions of the global transportation industry in 2014 [10].

However, compared with ordinary products, green products are usually more expensive. The production of green products tends require industrial raw materials that are biodegradable by microorganisms, harmless and packaged with recycled materials. Thus, compare to ordinary products, the selling price of green products is 20–25% higher in general [11]. If select green products instead of ordinary products, consumers may need to pay a premium, but the direct beneficiary is the eco-environment [12]. Some constraints on the production and promotion of green products remain: on the one hand, the production of green products requires higher-level production processes, technology and management experience; on the other hand, consumers pay a certain premium when buying green products.

The development and promotion of green products depend on three main conditions. The first condition is the environmental regulations, which state a set of minimum environmental requisites that products need to satisfy in most industrialized countries [13]. With strict environmental regulation, the production of green and high value-added products is promoted, while resource-intensive, heavily contaminated products decrease [14]. The second condition is the subjective intention and technical feasibility of enterprise green product research and development. The government hopes that enterprises will actively participate in research and development of new green technology and products, especially at the beginning of new green technology; however, these new technologies are not yet mature, and the market prospects of the new products are unclear. As profit-driven organizations, enterprises naturally have the characteristic of risk aversion. In this case, a reasonable and effective subsidy mechanism of the government for green products can reduce the market risk of new green technology and new products and help the government and enterprises form a long-term cooperative mechanism in green product research and development and promotion. The third condition is the public demand for green products, which depends mainly on the consumption level and environmental awareness among members of the public. Government subsidies for green products not only effectively stimulate the consumption demand of residents but also gradually cultivate awareness of environmental protection and the concept of green consumption among residents. The expansion of market demand and the growth of the sales volume of green products can provide financial support for R&D and promotion of green products and form a positive circular mechanism for the development of green industries [15,16,17].

Financial subsidies have become an effective way for the government to encourage and support the development of green products [18,19,20]. It is an incentive mechanism, which can stimulate enterprise to produce green products [3,21,22]. With the expansion of an industry, on the one hand, the demand for subsidy funds increases rapidly, and the gap to be filled by government subsidies becomes increasingly larger. On the other hand, disordered market subsidies may lead to excessive reliance on financial subsidies for the sale of green products, thus disrupting the effectiveness of market mechanisms [23]. Within a set budget, the government should fully consider the interests of enterprises and consumers and design a scientific and reasonable subsidy policy to correctly guide the development of green industries and to maximize the policy benefits and social welfare. It is a challenge task to design reasonable subside policy for green product development [24].

Peng (2013) adopted a Stackelberg equilibrium to determine the optimal subsidy for green products. His study concluded that the more remarkable the energy or environmental performance or the higher the initial cost of green products, the higher the subsidy level should be; the optimal subsidy level decreases over time with increasing environmental awareness and the learning curve [25]. Bi et al. (2017) studied the use of subsidy policy to encourage enterprises to adopt green technologies. In addition, they found that the subsidy policy was affected by the level of green technology, the growth coefficient of unit per-unit cost and the coefficient of environmental improvement [26]. Guo and He (2016) investigated the influence of the government subsidies on social welfare, suppliers and manufactures’ profit [27]. They concluded that the sensitivity of consumers to price is the key factor that influences the government’s choice of subsidy policy. To explore the mutual effect between the subsidy policy and firms’ marketing regimes, Li and Li (2017) focused on a Stackelberg game framework. The government may implement a useless subsidy policy [28].

The existing literature has achieved a basic consensus on the importance of government’s role in the supply of green products. The government can use appropriate policy measures to stimulate the enthusiasm of enterprises for producing green products. The establishment of a scientific and effective subsidy policy for green products is a challenging task for the government. The current literature mainly discusses the influence of environmental awareness, green technology level and market risk on the design of government subsidy policies. However, previous studies have not considered the negative effect of asymmetric information between governments and firms in the design process of green product subsidy policies. In encouraging enterprises to develop and promote green products, the government must face the problem of how to determine the subsidy amount, no matter what direction it takes in designing the subsidy policy. On the one hand, an excessive subsidy amount will lead to excessive financial pressure on the government. On the other hand, with a small subsidy amount, it is difficult to produce effective incentives for green product production enterprises. In both cases, the government cannot achieve the established policy goals. The individual rationality of pursuing profit maximization and the collective rationality of government promoting green and sustainable economic development as a social organization aiming to profit have different interests and conflicts to a certain extent. The government is unable to monitor the specific actions of the enterprise in real time and therefore cannot comprehensively grasp them. The enterprise may adopt opportunistic actions such as “deception and compensation” to suit its own economic interests, thus failing to meet government policy objectives [29]. The principal-agent theory provides an effective analytical method for solving the problem.

Principal-agent theory has always been used to design optimal policies for agents under the conditions of information asymmetry and benefit conflict [30]. Many studies have discussed government incentive issues using the principal-agent theory. Zhang et al. (2018) discussed the government reward-penalty mechanism between two competing manufacturers and a recycler in a loop-locked supply chain under asymmetric information according to the dynamics game theory and principal-agent theory [31]. Wang et al. (2018) established a government optimal incentive model by combining reciprocal preference theory with a principal-agent model to ensure project benefits [32]. Altenburg and Engelmeier (2013) analyzed the principal-agent relationship between solar investors and the government based on the principal-agent theory, and pointed out that the design and implementation of government subsidies are of great significance for promoting solar investment [29].

We intend to design the optimal subsidy mechanism of green products from the perspective of government revenue maximization to fill the gaps in the literature. In the case of asymmetric information and perfect information, we construct an optimal subsidy principal-agent model for green products from a maximal policy benefit perspective to promote the development of green products, which less previous literature has studied. In addition, this study reveals benefit conflicts between policy makers and green product investors and examines how investors’ preference and relevant parameters (such as consumer environmental awareness parameter, green technology parameter and market risk parameter) affect the government’s benefit. Not all these factors have been taken into account in the existing studies [10,33]. Research on subsidy policies for green products has important theoretical and practical significance for emerging economies, represented here by China, to transform their traditional economic development mode of high-energy consumption, high materials consumption and high emissions and to realize social-economic green development and sustainable development.

This article is organized as: In Section 2, we construct principal-agent model. In Section 3, we discuss the optimal solution for models under the asymmetric information and complete information respectively. In Section 4, a numerical example is offered to show the effectiveness of the model and discuss the effect of different parameters. Section 5 presents the discussions and conclusions. All the proofs of lemmas and propositions are provided in the Appendix A.

2. Model Formulation

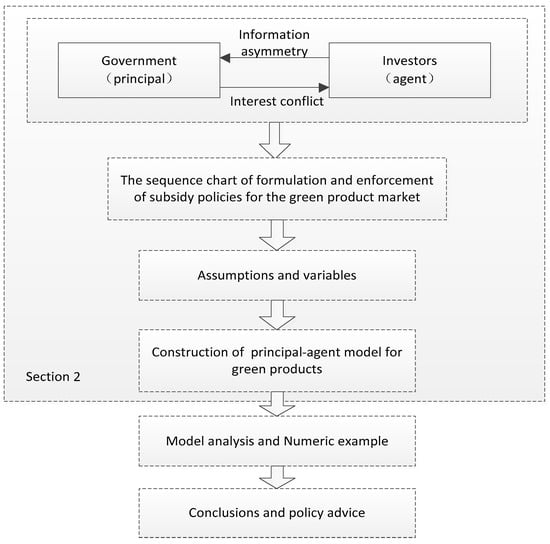

In Section 2, we discuss the principal-agent relationship between the government and inventors firstly. Then, we analyze the sequence chart of formulation and enforcement of subsidy policies for the green product market. According to these analyses, we obtain assumptions and variables to construct principal-agent model for green products. A flow-model depicting the principal-agent model for green products is shown in Figure 1.

Figure 1.

A flow-model depicting the principal-agent model for green products.

In addition to traditional sellers and producers, there is also a fund supplier for the production of green products. In this paper, the producers and fund suppliers of green products are referred to as “investors”. The investment preference of green product investors is directly related to product output Various social and economic factors (such as expected investors’ profits, environmental awareness, or market risk) affect investors’ investment preference. The government hopes to change the mode of economic growth, improve the environment, realize the sustainable development and improve the overall welfare of society by popularizing green products.

Consumers buy green products in the hope of meeting their own needs while enjoying the energy saving and environmental protection benefits brought by such products. However, the government is unable to directly provide the products and services that consumers need and can only entrust investors and encourage enterprises to produce and sell green products through green product subsidy policies. As rational economic actors, investors pursue the maximization of their investment income. Therefore, they dynamically adjust their investment preference according to changes in the green product subsidy policy and market economy environment while being entrusted by the government. However, the government cannot monitor and accurately grasp investors’ investment preference in real time [10]. Thus, there is a problem of information asymmetry and interest conflict between the government (principal) and the investors (agent). The rest of this paper establishes the principal-agent model, and investigates the government’s optimal subsidy policy for green products.

2.1. Basic Variables and Assumptions

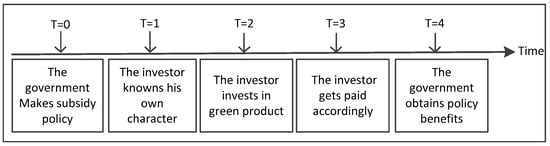

The sequence chart of formulation and enforcement of subsidy policies for the green product market is shown in Figure 2. After the government formulates the subsidy policy for green products, investors decide whether to invest in the production of green products according to the principle of maximizing their own interests. After the green products enter the market, investors can obtain the corresponding government subsidies and operating income. The government obtains policy benefits from the promotion and usage of green products, achieves its goals of ecological environmental protection, economic sustainable development and maximization of social welfare.

Figure 2.

Main activities in terms of subsidies for the green products market.

The significance of government subsidies for green products lies in improving the investment preference of investors and transferring enthusiasm for producing green products to the investors. The following aspects of the impact of the investment preference of the investors on the green product market can be considered.

- The investment preference for green products is the comprehensive performance of the environmental awareness, risk preference and expected return level of the investors. Considering the information equivalence between investors, investors with a higher investment preference for green products are more likely to achieve their business development goals by introducing advanced green production technology and producing innovative products.

- The government hopes that investors can show a high investment preference for green products. However, China, as the largest developing country in the world, has made a late start, and consumers in China have not yet formed an awareness of environmental protection and the concept of green consumption. In addition, the level of acceptance of the green product market is still low. It is necessary for the government to formulate green product subsidy policies to improve the investment preference of investors.

- From the perspective of consumers, a high investment preference of investors will expand the supply and audience scope of green products and affect consumers’ cognition of green products. Therefore, a high investment preference of investors will lead to an increase in the market recognition of green products.

Based on these descriptions, the following assumptions and variables are presented in this article.

Assumption 1: denotes the investors’ investment preference. is asymmetric information between government and investors. The government cannot accurately assess the real investment preference . The government’s estimate of the investment preference is characterized as a random variable supporting , and where . The distribution function and derivative function are and respectively, where and satisfy [33].

Assumption 2: The return that investors get from green product features is expressed as:

where is the investment that consumers pay for green products, and presents consumers’ environmental awareness. Because green products are more environmentally friendly, consumers with higher awareness of environmental protection are willing to pay a premium for green products [34]. In addition, denotes government unit subsidy cost under preference . presents the total yield of green products with the investors’ investment preference . not only presents the total government subsidy but also donates part of the investors’ revenue. represents the investors’ costs of quantity , is the market risk, such as an uncertain economic environment and policy changes; represents green technology. Moreover, for each , we assume that [35,36]

Assumption 3: The government’s policy benefits come from supporting and promoting green products, which is related to environmental production and energy conservation. denotes the government’s policy returns, which are influenced by the total production of green products . is an increasing and concave function, which satisfies , .

2.2. Construction of the Model

The difference between the policy returns and the total subsidy costs constitutes the net policy benefit of the government. Thus, the government’s expected net policy gain can be expressed as:

2.2.1. Model under Asymmetric Information

Investors aim to maximize their profits by deciding whether to invest in green products. The government cannot accurately assess investors’ investment preference that is private information. To get a high subsidy or a high premium transfer, the investor claims his preference is , while his real preference is . To motivate the investor to be truthful, the incentive-compatible constraint of the investors is given as:

where indicates that the investor faithfully reports his preference to the public and provides green products under preference . represents that the investor expresses preference to obtain a high subsidy or a premium transfer , but he provides green products under preference in fact.

The assumption is that the investor have other options. The inventors are profit-driven, and their goal is to maximize profits. To ensure the investor’s participation in the green product market, the participation constraint is given as:

where π0 is the investor’s reserved profit. π0 could be positive or it could be negative. Hence, the investor may invest in green products unless the expected profit is higher than π0.

In the circumstance of asymmetric information, the principal-agent model for green products can be represented by the following formula:

2.2.2. Model under Complete Information

The government can monitor and accurately grasp investor’s investment preference in real time with perfect information. Thus, making a contract to satisfy the investor’s retained profit is enough. Under the condition of complete information, the optimal principal-agent subsidy model is:

3. Model Analysis

In this section, by analyzing the models (3) and (4) under the scenarios of asymmetric information and perfect information, we obtain optimal solutions. Concrete and intimate proofs are presented in the Appendix A.

It is quite difficult to get the solution of Model (3) which involves the optimization of triples. In addition, the incentive-compatibility constraint (1) is also an optimization problem. Therefore, to make this problem easier to solve, we intend to obtain the equivalent forms of incentive compatibility constraint (1) and participation constraint (2).

Lemma 1.

The incentive-compatible constraint (1) is equal to:

The lemma indicates that when the investor’s preference is high, he will increase his investment in green products; that is, the optimal production of green products increases with the investor’s preference. It means the existence of the optimal solution. According to Equation (5), we obtain

This equation indicates that the investor’s marginal benefit should be equal to the marginal cost, which lays the foundation of the following lemmas.

Lemma 2.

The participation constraint (2) is equal to:

Lemma 2 shows that if the participation constraint is binding at the minimum point 0. Then, any point in the interval is a binding constraint. It greatly simplifies the participation constraint (2).

The government aims to promote the development of the green products by providing subsidy policy. Thus, the participation constraint is binding, which means the expected return of inventors should be equal to their retained return . The governmentaims to maximize the net policy gain. The government’s net policy decreases with the green product subsidy . Therefore, it is necessary for the government to select the lowest pay to meet the participation constraint.

Lemma 3.

Model (3) can be represented as

We simplify the objective function decision variables only related to and independent of in this lemma to get the optimal solution of model (3).

Proposition 1.

We make the assumption that the optimal solution to model (3) is , thus the following equations exist:

Proposition 2.

Assumption that the optimal solution to model (4) is , the following equations exist:

Under the condition of perfect information, the investor’s optimal green products yield satisfies marginal cost equal to marginal benefit.

Propositions 1 and 2 indicate that the investor’s investment preference and parameters (such as the consumer environmental awareness parameter , green technology parameter and risk parameter ) all have important implications for the optimal solutions and . We will discuss these relationships through a practical example in Section 4.

4. A Numeric Example

We give a numeric example to testify the optimal solution of the models and verify their effectiveness in this section. We made the assumptions as follows for the sake of simplify without losing generality.

The assumption is that investors’ investment preference satisfies a linear uncertainty distribution. The density function of is: , and the distribution function is .

The transfer paid to the investor is . Let denotes the government’s policy gain function, where the variable balances the dimension; the cost function is . Therefore, the benefit function of the investors is:

Therefore, in the case of asymmetric information, the principal-agent model of the optimal subsidy policy issue about green products is:

According to the description above and Equation (7), the optimal green products yield and government subsidies under asymmetric information can be expressed as:

Similarly, under the condition of perfect information, the optimal green products yield and government subsidies are as follows:

We obtain ; thus, the optimal quantity of green products increases with investors’ preference , which satisfies the equivalent Model (6).

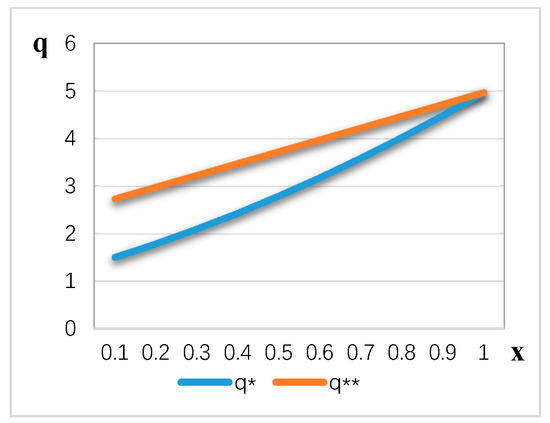

For simplicity, we set . The optimal quantities and subsidies trends of green products are described in Figure 3 and Figure 4.

Figure 3.

Functional image of , q* and q** denote the optimal quantity of green products under asymmetric information and complete information respectively.

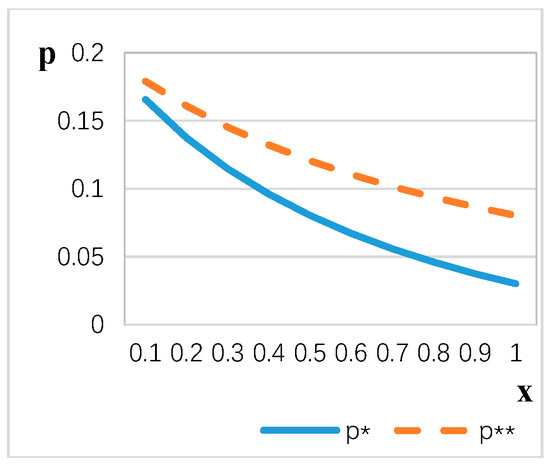

Figure 4.

Functional image of unit subsidy , p* and p** denote the optimal unit subsidy price under asymmetric information and complete information respectively.

As shown in Figure 3, with the increase in investment preference level , the output of green products and increases gradually, which indicates that the higher the investment preference of investors, the higher the output of green products is, whether information symmetry or information asymmetry exists. In addition, with the increase in investment preference level , the difference between output under information asymmetry and output under information symmetry gradually shrinks, indicating that with the increase in the investment preference, investors are less likely to falsely report their investment preference. As shown in Figure 4, under the circumstances of asymmetry information and perfect information, the government subsidies for green products decrease with the increase in the investment preference of investors. When the investment preference is high, investors will choose to invest in the production of green products even if the policy incentive is small, and the government can then achieve the established policy goals with less fiscal expenditure. According to the principal-agent theory, due to the existence of information costs, the government must pay a certain cost to obtain more real information. Under the same level of investment preference, the unit subsidy price () under the condition of information symmetry is higher than the unit subsidy price () under the condition of information asymmetry.

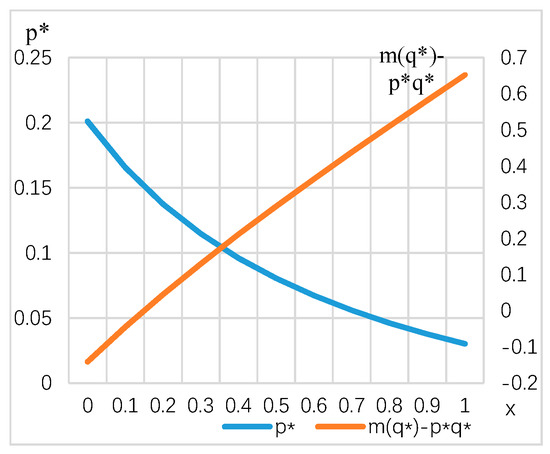

In actual economic activities, the investment preference of investors is often difficult to obtain accurately. As agents, investors have information advantages over the government. Therefore, to describe the relationship between government subsidies, policy returns and the preference of investors, we choose the three relations under the condition of information asymmetry to conduct further analysis (as shown in Figure 5). When the investment preference of investors is low, higher government subsidies are needed to play an incentive role. In this case, the policy returns of government are low. When the investment preference of investors increases, the subsidies of government will decrease, and the policy returns of government will increase accordingly. Therefore, it is a rational choice of the government to improve the production preference of investors for green products. However, as private information, investment preference cannot be accurately obtained by the government. Under the condition of information asymmetry, effective government propaganda and guidance and public awareness of environmental protection will help improve the investment preference of investors. At the same time, the government should build a series of regulatory systems to prevent investors from falsely reporting their investment preference to fraudulently obtain government subsidies.

Figure 5.

The influence of investor preference on the optimal subsidy and government revenue under the condition of information asymmetry, p* denotes optimal unit subsidy price under asymmetry information; m(q*)-p*q* denotes the optimal policy returns under asymmetry information.

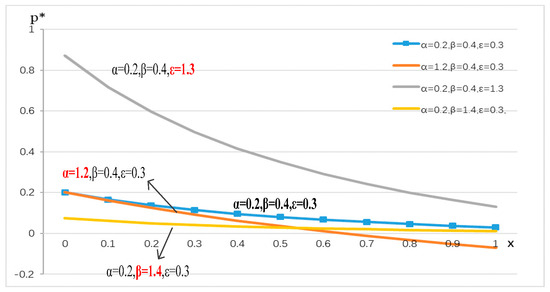

Equation (7) has an intuitive interpretation that investors’ preference , consumer environmental awareness , green technology and market risk all affect the optimal subsidy level. Let , and we choose , , . Figure 6 describes the effect under different parameters with the same investor’s investment preference. As shown in Figure 6, a lower parameter and a higher parameter and reduce the government’s unit subsidy. According to the analysis above, we can find that accelerating green technology innovation will be the breakthrough point to reduce costs, but the investor’s investment preference is the key factor in the short term. Moreover, the government could reduce investment risk and provide the investors with a stable environment. This will demonstrate higher potential for success in investing to green products and enhance investors’ confidence in the green product market to absorb more capital.

Figure 6.

The effect of parameters , , and on the subsidy level, denotes consumer environmental awareness; denotes green technology; denotes market risk; the changed parameters are indicated in red in the figure.

Briefly, improving investors’ preference for green products and consumer environmental awareness, promotes the development and application of green technology, lowering market risk and contributing to subsidy cost savings. Therefore, in the long run, any improvement of these factors will be contribute to the realization of the government’s target of maximal policy benefit without heavy financial burden, and will be conducive to the market-oriented development of green products.

5. Discussions and Conclusions

With the aggravation of the energy crisis and the deterioration of the eco-environment during global economic development, green products with the characteristics of energy conservation and environmental protection have attracted extensive attention from all countries in the world. In China, the largest developing country in the world, green products are still in the initial stage of development. As their prices are generally higher than those of traditional products, green consumption has not yet been popularized in the public consciousness. Currently, the government’s subsidy policy is very important in promoting the development of green products. Consumers’ levels of acceptance and recognition of green products are still low. An appropriate government subsidy policy will not only stimulate the development of green products but also reduce the financial burden for the government. Therefore, we build a principal-agent model between the government and investors for the development of green products from the perspective of maximizing government net policy gain. The results of the research show that the higher the investment preference level of investors for green products, the stronger the environmental awareness, the better the green technology of green products and the smaller the market investment risk, the more conducive the situation is to reducing the subsidy cost for green products and improving the policy returns of the government. The research conclusion provides beneficial policy enlightenment for the government to realize its goals of maximizing the returns of its green product subsidy policy and promoting the healthy development of green products and green industry. The results show that improving investors’ preference and eliminating asymmetric information reduce subsidy costs. Additionally, improving consumer environmental awareness, promoting the development and application of new green technology, and lowering market risk all reduce government’s policy subsidies. This article provides policymakers with an effective subsidy scheme to accelerate the development of green products and achieve sustainable development goals.

- In the developing countries represented by China, the imbalance of regional economic development is prominent, and significant regional differences in the residents’ consumption level, green technology development level and recognition of green product markets lead to significant regional differences in production costs, sales prices and the investment preference for green products. Therefore, the government should fully consider the regional differences in key factors when formulating the subsidy policy for green products.

- The government should strengthen subsidy policy propaganda for green products, improve the transparency and credibility of the subsidy policy, and strengthen the green products propaganda in terms of economic benefits and environmental protection to stimulate the investment interests of investors and improve their investment preference. In a long-term effective subsidy mechanism, the government should also perfect a series of regulatory systems to prevent investors from falsely reporting their investment preference to the government to fraudulently obtain subsidies.

- The government, non-governmental organizations and investors should jointly undertake the tasks of improving public awareness of environmental protection and establishing the concept of green consumption through propaganda and education, public welfare activities and free experiences so that consumers can truly realize the advantages of green products in saving energy and protecting the environment. Consumers’ overall cognition and demand for green products can further promote the development of green industry and increase the investment preference of investors to gradually weaken the dependence of green products on government subsidies and realize the healthy and orderly development of green products by relying on market forces.

- The green production technology level of green products has an important impact on reducing the cost of government subsidies. Green technology innovation can effectively reduce the production cost of green products and has a vital effect on the popularization and promotion of green products. Therefore, the government should encourage the R&D and promotion of green technology through tax incentives and policy support to improve the technical level and innovation capability of green industries. In addition, when green technology makes significant progress in saving costs, policy makers should develop exit mechanisms.

- The government should create a stable investment environment for green product investors to ensure the realization of green product subsidy policy. Frequent changes in policy will reduce the investment confidence of green product investors. Due to the hysteresis of policy effect, the effect of policy enforcement will often not show up until a certain period. At the same time, it will take a certain period to evaluate the effect of policy enforcement. During this period, the government should avoid drastic fluctuations in policy and create a stable operating environment for green product investors.

The government subsidy and incentive policy for green products is quite important to stimulate the development of green products. Good incentive mechanism and scientific and reasonable government subsidy policy cannot only effectively promote the development of green products, but also will not bring excessive financial burden to the government. In the long term, effective subsidy mechanism can gradually reduce the dependence of green product investors on government subsidies, which contribute to the marketization development of green products.

Based our research, inventors’ preference, consumer environmental awareness, new green technology, and the market risk have significant effect on the government’s subsidy policy. In fact, further research should pay attention to distinct green levels (i.e., the higher green level of products are, the more environmental friendly they are) of green products, industrial difference and region difference on more detail conditions in green products market. In addition, empirical analysis would be one of the directions of our future research to support our study once the date of green products is statistically available.

Author Contributions

L.Z. and Y.C. made contribution to conceiving and designing the article; Y.C. was responsible for the model analysis and manuscript drafting. L.Z. supervised the whole process. All authors read and approved the final manuscript.

Funding

The National Social Science Fund of China (Major Program), China, No. 13&ZD162, supports this article.

Acknowledgments

The National Social Science Fund of China (Major Program), China, No. 13&ZD162, supports this article. We are grateful to all reviewers and editors who devote much time to reading this article and give us valuable and helpful advice. We would like to thank Dr. Yanfei Lan for his guidance on the modification of the model.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Lemma 1.

We make assumption that , which presents the benefits of the investor with investment preference but choosing investment preference , where , . Inequality (1) can be presented as , where . To guarantee the inequality is established, need to satisfy the first-order conditions , and the second-order condition , where .

Then, we can obtain first-order condition:

The second-order condition, we can get:

By differentiating (A1) with respect to , we can obtain:

Applying (A3) and (A2) yields . According to assumption 2, ; Thus,

Additionally, according to and ,

When y > x, we can obtain

Similarly, when , inequality (A6) still holds. Thus, the inequality (1) is established. □

Proof of Lemma 2.

Since , differentiating it with respect to . Thus, we can get:

It follows from (1) and from assumption 2, that

Equation (A8) indicates that is increasing with respect to investment preference . Consequently,

Then, the participation constraint is equal to

□

Proof of Lemma 3.

Integrating (A8) from , we can obtain

By (A10), we can yield

The Model (3) objective function can be presented as

According lemmas above, we simplify the objective function decision variables to be only related to and independent of . Thus, we can present Model (3) as:

□

Proof of Proposition 1.

According to the objective function (A11), we make Equation (A12) as follow:

The second-order variation of (A12) with respect to is:

It follows from assumptions (2)–(3) that . The optimal yield of green products satisfies , i.e.,

Thus, we can get :

Let . The derivation of (A12) with respect to can be presented as:

According to assumptions (2)–(3), we can obtain . Therefore, is the optimal solution of Model (3) under the condition of asymmetric information. □

Proof of Proposition 2.

Under perfect information, investors’ preference is completely transparent; thus, guaranteeing the participation constraint is enough. If the participation restrictions are not equal, the government can adjust the subsidies to investors. Then, Model (4) is equivalent to

Thus, by taking participation constraint (A17) into object function (A16), we obtain . We can yield the first-order condition:

and satisfy

Therefore, the proof is completed. □

References

- Wiedmann, T.O.; Schandl, H.; Lenzen, M.; Moran, D.; Suh, S.; West, J.; Kanemoto, K. The material footprint of nations. Proc. Natl. Acad. Sci. USA 2013, 112, 6271–6276. [Google Scholar] [CrossRef] [PubMed]

- Simonis, U.E. Decoupling natural resource use and environmental impacts from economic growth. Int. J. Soc. Econ. 2013, 40, 385–386. [Google Scholar] [CrossRef]

- Fraccascia, L.; Giannoccaro, I.; Albino, V. Green product development: What does the country product space imply? J. Clean. Prod. 2018, 170, 1076–1088. [Google Scholar] [CrossRef]

- Azevedo, S.G.; Carvalho, H.; Machado, V.C. The influence of green practices on supply chain performance: A case study approach. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 850–871. [Google Scholar] [CrossRef]

- Kivimaa, P.; Mickwitz, P. The challenge of greening technologies—Environmental policy integration in finnish technology policies. Res. Policy 2006, 35, 729–744. [Google Scholar] [CrossRef]

- Sabaghi, M.; Mascle, C.; Baptiste, P.; Rostamzadeh, R. Sustainability assessment using fuzzy-inference technique (SAFT): A methodology toward green products. Expert Syst. Appl. 2016, 56, 69–79. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- Fernández, R.Á. A more realistic approach to electric vehicle contribution to greenhouse gas emissions in the city. J. Clean. Prod. 2018, 172, 949–959. [Google Scholar] [CrossRef]

- Chen, W.; Song, H. Optimal subsidies for distributed photovoltaic generation: Maximizing net policy benefits. Mitig. Adapt. Strat. Glob. Chang. 2017, 22, 503–518. [Google Scholar] [CrossRef]

- Lin, Y.C.; Chang, C.A. Double standard: The role of environmental consciousness in green product usage. J. Mark. 2012, 76, 125–134. [Google Scholar] [CrossRef]

- Griskevicius, V.; Tybur, J.M.; Van den Bergh, B. Going green to be seen: Status, reputation, and conspicuous conservation. J. Personal. Soc. Psychol. 2010, 98, 343–355. [Google Scholar] [CrossRef] [PubMed]

- Fargnoli, M.; Costantino, F.; Tronci, M.; Bisillo, S. Ecological profile of industrial products over the environmental compliance. Int. J. Sustain. Eng. 2013, 6, 117–130. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Zeng, H. The effect of environmental regulation on external trade: Empirical evidences from Chinese economy. J. Clean. Prod. 2016, 114, 55–61. [Google Scholar] [CrossRef]

- Maichum, K.; Parichatnon, S.; Peng, K.-C. Application of the extended theory of planned behavior model to investigate purchase intention of green products among Thai consumers. Sustainability 2016, 8, 1077. [Google Scholar] [CrossRef]

- Maniatis, P. Investigating factors influencing consumer decision-making while choosing green products. J. Clean. Prod. 2016, 132, 215–228. [Google Scholar] [CrossRef]

- Suki, N.M. Consumer environmental concern and green product purchase in Malaysia: Structural effects of consumption values. J. Clean. Prod. 2016, 132, 204–214. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How different policy instruments affect green product innovation: A differentiated perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

- Zhang, Q.; Tang, W.; Zhang, J. Green supply chain performance with cost learning and operational inefficiency effects. J. Clean. Prod. 2016, 112, 3267–3284. [Google Scholar] [CrossRef]

- Luo, C.; Leng, M.; Huang, J.; Liang, L. Supply chain analysis under a price-discount incentive scheme for electric vehicles. Eur. J. Oper. Res. 2014, 235, 329–333. [Google Scholar] [CrossRef]

- Gazheli, A.; van den Bergh, J.; Antal, M. How realistic is green growth? Sectoral-level carbon intensity versus productivity. J. Clean. Prod. 2016, 129, 449–467. [Google Scholar] [CrossRef]

- Nesta, L.; Vona, F.; Nicolli, F. Environmental policies, competition and innovation in renewable energy. J. Environ. Econ. Manag. 2014, 67, 396–411. [Google Scholar] [CrossRef]

- Zheng, X.; Lin, H.; Liu, Z.; Li, D.; Llopis-Albert, C.; Zeng, S. Manufacturing decisions and government subsidies for electric vehicles in China: A maximal social welfare perspective. Sustainability 2018, 10, 672. [Google Scholar] [CrossRef]

- Potts, T. The natural advantage of regions: Linking sustainability, innovation, and regional development in Australia. J. Clean. Prod. 2010, 18, 713–725. [Google Scholar] [CrossRef]

- Peng, H. Optimal subsidy policy for accelerating the diffusion of green products. J. Ind. Eng. Manag. 2013, 6, 626–641. [Google Scholar] [CrossRef]

- Bi, G.; Jin, M.; Ling, L.; Yang, F. Environmental subsidy and the choice of green technology in the presence of green consumers. Ann. Oper. Res. 2017, 255, 547–568. [Google Scholar] [CrossRef]

- Guo, D.; He, Y.; Wu, Y.; Xu, Q. Analysis of supply chain under different subsidy policies of the government. Sustainability 2016, 8, 1290. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. On green market segmentation under subsidy regulation. Supply Chain Manag. 2017, 22, 284–294. [Google Scholar] [CrossRef]

- Altenburg, T.; Engelmeier, T. Boosting solar investment with limited subsidies: Rent management and policy learning in India. Energy Policy 2013, 59, 866–874. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J. Evaluation of the excess revenue sharing ratio in PPP projects using principal–agent models. Int. J. Proj. Manag. 2015, 33, 1317–1324. [Google Scholar] [CrossRef]

- Zhang, X.; Su, Y.; Yuan, X. Government reward-penalty mechanism in closed-loop supply chain based on dynamics game theory. Discret. Dyn. Nat. Soc. 2018, 1–10. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, P.; Liu, J. Analysis of the risk-sharing ratio in PPP projects based on government minimum revenue guarantees. Int. J. Proj. Manag. 2018, 36, 899–909. [Google Scholar] [CrossRef]

- Chen, W.; Hong, X. Design of effective subsidy policy to develop green buildings: From the perspective of policy benefit. Clean Technol. Envir. Policy 2015, 17, 1029–1038. [Google Scholar] [CrossRef]

- Yu, Y.; Han, X.; Hu, G. Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef]

- Chen, W.; Yin, H. Optimal subsidy in promoting distributed renewable energy generation based on policy benefit. Clean Technol. Environ. Policy 2017, 19, 1–9. [Google Scholar] [CrossRef]

- Lan, Y.; Zhao, R.; Tang, W. A bilevel fuzzy principal-agent model for optimal nonlinear taxation problems. Fuzzy Optim. Decis. Mak. 2011, 10, 211–232. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).