1. Introduction

Under the dual challenges of global response to ecological change and scarcity of land resources, it has become an international goal to improve land use efficiency and protect ecological green land [

1]. The United Nations’ 2030 Agenda for Sustainable Development clearly puts forward the goal of “sustainable cities”, requiring countries to optimize the spatial structure of land through capital allocation to enhance ecological adaptability. In 2023, the “National Land and Space Planning Outline” further required “strictly controlling the total amount of construction land and ensuring the bottom line of ecological security”. Land is an important carrier of the ecosystem, and its planning and development not only impact economic development but also relate to urban greening and ecological resilience. LF introduces market-based methods into land use, expanding the boundaries of land utilization. It is an important process for optimizing land resources and resource allocation. LF revitalizes land resources, strengthens the attributes of land as an urban ecological carrier, and has an impact on the ecological environment of the city. However, the mechanism through which LF affects urban ecological performance and security is still unclear. In this context, analyzing how LF enhances UER by improving land use efficiency and strategically allocating ecological land is not only a theoretical response to the global sustainable development agenda but also a practical strategy for China in balancing security and development needs.

Based on the particularity of China’s land system, land has both commodity and financial attributes. Local governments rely on land financing through two direct channels: land finance and land-based financing. The 1994 tax-sharing reform significantly changed the revenue structure of local governments. A large portion of value-added tax and income tax revenues, which were key sources of local government income, were transferred to the central government. This greatly reduced local fiscal revenue, placing immense financial pressure on local governments to invest in urban infrastructure [

2]. In order to alleviate the increasing financial pressure, local governments began to buy rural land at a low price in the primary land market and then transfer it to real estate developers at a high price, generating off-budget revenue [

3]. This model is called land finance. Before 2008, the land financing model of local governments was dominated by land finance, and land finance became an important source of funds for local government infrastructure investment and public expenditure [

4]. After 2008, under the influence of the international financial crisis and the four trillion stimulus plan, the Chinese government issued a series of policies to support local financing, and with the exhaustion of land resources in some areas and the improvement of compensation standards for land expropriation, some local governments have begun to reduce their reliance on land revenue while showing a greater preference for land-based financing [

5]. Thus, the financing model of local governments has changed to land-based financing [

6]. LF is the process of using land as a capital asset to realize the liquidity and value appreciation of land resources through market-oriented means [

7,

8]. The local financing platforms use state-owned resources and assets as collateral, borrow from banks and society through implicit guarantees from local governments to achieve financing purposes. Its essence is to further extend and raise the leverage ratio based on the “land finance” model of pure land transfer fees with “land-based financing” and “land credit”, thus leveraging social capital for infrastructure investment [

9]. Existing research has primarily focused on the economic effects of LF, such as its role in driving rapid local economic development, promoting urban expansion and industrial development [

10], and effectively supporting the improvement of infrastructure and the process of urban modernization [

11]. These studies have explored how it enhances local government fiscal revenue, fuels the growth of the real estate market, and strengthens market liquidity. However, few studies have explored the relationship between LF and UER, environmental protection, and social sustainability. Because land serves as an important foundation for urban ecological performance, how to guide the rational allocation and green utilization of land resources through market mechanisms in the process of land financialization realizing land value, how to leverage market influence to direct financial resources toward ecological and environmental protection fields, the impact of land financialization on industrial structure and agglomeration while improving economic benefits, and how to balance ecological protection and social equity have become urgent problems to be solved through research. This paper aims to combine LF with UER, explore how to promote green ecological construction through LF, improve the city’s environmental adaptability, and ensure social equity and sustainable ecological development. Furthermore, it is worth noting that land, as a core element of urban development, not only carries ecological functions but also serves as an important carrier for social equity and inclusive development. During the process of land financialization, the reallocation of land value inevitably involves the distribution of interests among different social groups. On one hand, land financialization may enhance residents’ well-being by improving infrastructure and ecological environmental quality; on the other hand, rising land values may exacerbate housing affordability issues and affect the housing rights of low-income groups. Therefore, when analyzing the impact of land financialization on urban ecological resilience, we must simultaneously pay attention to its social distribution effects, ensuring that the benefits of ecological improvements reach all citizens and achieving coordinated unity between ecological benefits and social equity.

Since the start of the 21st century, urbanization has rapidly evolved into a global phenomenon. The diversity in urban scale and development has reached an unprecedented level. According to United Nations data, by 2050, about 68% of the world’s population will live in cities [

12,

13]. In fact, the city is a complex system of social, economic, and ecological coupling. Urban expansion provides the basic conditions for socio-economic transformation. However, rapid urbanization also causes ecological degradation, resulting in ecological fragility and a loss of biodiversity [

14]. Many countries and regions face similar severe challenges during urban development [

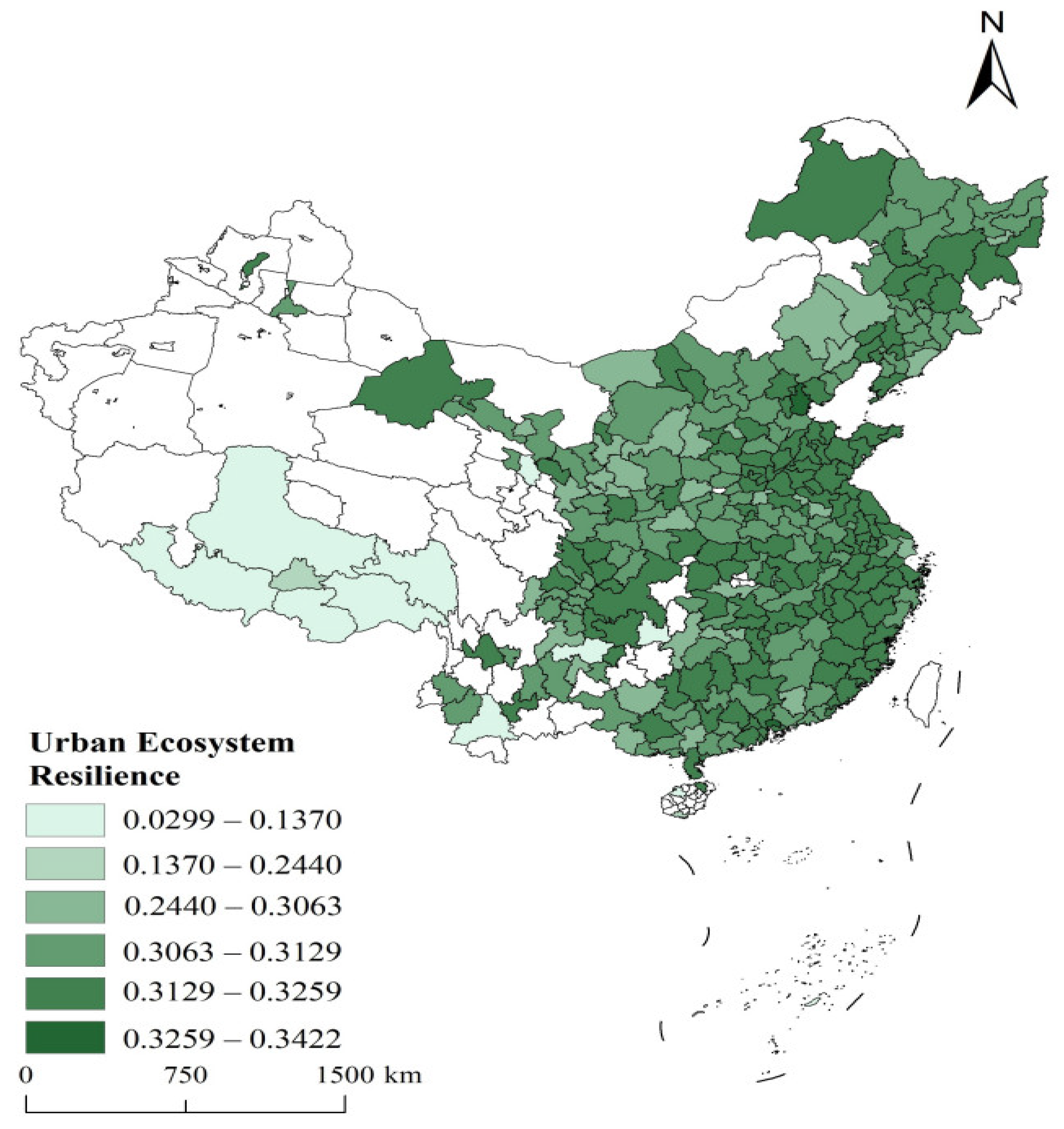

15]. As shown in

Figure 1, the average level of urban ecosystem resilience in China is very low. In this context, it is increasingly urgent to build resilient cities. Understanding how to maintain urban ecological stability and strengthen ecological self-recovery is crucial for ensuring ecological security and achieving sustainable urban development. The ecological self-recovery of urban ecosystems refers to the ability of urban ecological systems to gradually restore their original structure, function, and stable state through their own ecological processes and mechanisms after suffering external disturbances (such as pollution, extreme weather, human-induced damage, etc.). UER is the key ability of urban systems to maintain core functions and achieve self-regulation and recovery in response to natural disasters, climate change, and human disturbance. It is not only an important dimension of sustainable development but also the cornerstone of human well-being and urban security [

16,

17]. As the global urbanization process accelerates, issues like frequent extreme weather events and the fragmentation of ecological spaces continue to intensify. Enhancing UER has become a core issue in spatial governance for many countries. From a macro perspective, the National Bureau of Statistics of China points out that China’s urbanization rate will reach 66.16% in 2023. However, rapid urbanization is also accompanied by ecological risks, such as intensified heat island effects and biodiversity loss [

18]. In this context, many cities have proposed resilient city planning to address the impact of climate change [

19]. Additionally, the Chinese government is committed to developing low-carbon and sponge cities to improve natural ecosystems and enhance human well-being [

20,

21]. Globally, it is acknowledged that the environmental and socio-economic dimensions of urban sustainability are closely interconnected. Enhancing UER helps alleviate the pressures of urban development and fosters sustainable urban transformation [

22]. While the existing literature has investigated the influencing factors of UER from the perspectives of economic growth [

23], the digital economy [

24], green infrastructure [

25], industrial structure [

26], and urbanization [

27], it has generally overlooked the economic logic behind land resource allocation and its structural effects on UER. Consequently, the dynamic relationship between land resources and UER still lacks empirical support. In recent years, under the trend of LF, the attributes of land as assets and collateral have been continuously strengthened. It is increasingly common for local governments to obtain development funds through financial instruments, such as land transfer and securitization. This process not only activates urban economic momentum but also reshapes the layout logic of ecological space, as LF impacts UER by reallocating land and financial resources. The existing literature remains undecided on this issue and lacks an analysis mechanism for the “financialization-ecological resilience” transmission path.

This paper analyzes data from Chinese prefecture-level cities spanning from 2008 to 2017 to explore how LF influences resource distribution to improve its effect on enhancing UER. Several important findings emerge from this paper. First of all, this paper confirms that LF does have a positive impact on UER. In particular, LF enhances UER by increasing land liquidity, revitalizing land resource allocation, optimizing the distribution of financial resources, and improving the industrial structure. Secondly, this paper finds that LF has heterogeneous effects on UER through different degrees of land price distortion and in different regions. LF has a more significant role in promoting UER in areas with smaller cities and greater distortions in land prices, reflecting the inclusive characteristics of LF.

The contributions of this paper to the research are as follows. First, this paper reveals the ecological resilience value of LF and expands the research on the economic effects of LF. Previous studies have found that LF can promote regional economic development and promote urbanization [

28]. However, few studies pay attention to the ecological value of LF. As a carrier of regional ecosystems, LF guides land allocation through capital markets, effectively enhancing the ecological value of land and UER [

29]. LF integrates land elements into the capital market system, using financial tools to promote the flow of land resources, thereby enabling a more efficient transition of land from inefficient, high-pollution, traditional industries to eco-friendly and sustainable industries. In this process, LF optimizes the allocation efficiency of land resources, accelerates the green transformation of land resources, and also promotes the realization of higher environmental and social benefits in the market-oriented operation of land. Therefore, from the perspective of ecological resilience, this paper reveals the effect and mechanism of LF on UER and enriches the economic value of LF, especially in the theoretical system of ecological value.

Secondly, this paper highlights the significant role of finance in UER and broadens the research on its influencing factors. UER is affected by factors like economic growth level, technological innovation, industrial structure, urbanization level, and the digital economy, while the role of the financial system is mainly focused on the field of green finance. Green credit reduces carbon emissions by increasing productivity levels [

30], and green bond markets improve regional ecological quality by financing green projects [

31]. However, these studies mainly focus on how capital markets promote environmental protection and sustainable development through green investment and pay less attention to the potential and contribution of LF in improving UER. LF reshapes the capital attribute of ecological space through market mechanisms. This transformation of capital attributes has not only activated the asset value of ecological space but also guided social capital to concentrate in areas like ecological protection and green infrastructure construction through the price discovery mechanism. This paper expands the relevant literature on the role of finance in the improvement of UER from the perspective of LF.

Third, this paper clarifies the promoting relationship between factor marketization and greening and enriches the relevant research on financial empowerment for green transformation. Factor marketization, as an important mechanism for promoting economic development, has received extensive research and attention [

32]. Previous studies have shown that factor marketization can not only promote economic growth but also support industrial transformation and optimize resource allocation [

33]. In the context of green growth, it is crucial to effectively guide factors of production to green sectors. In this process, factor marketization is the key, among which financialization serves as an important means. Financialization introduces factors like land into the market economic system through the capital market, enabling them to provide financial support for green industries and green projects by means of financial instruments and capital allocation [

34]. This not only provides a source of funds for enterprises and projects but also drives the rapid growth of green investment, promotes the development of green industries, and thus accelerates the pace of green transformation. Land is one of the core elements in production and ecosystems. With the transformation of economic development patterns and increasingly severe environmental problems, land has gradually been regarded as an important resource for enhancing urban sustainability and eco-friendly development. LF can improve the allocation efficiency of land resources and provide strong support for promoting green transformation. This paper reveals the potential of LF in improving UER and expands research on how marketization and financialization promote greening.

Fourth, this paper enriches the theoretical understanding of the relationship between LF and urban sustainable development from a social inclusivity perspective. Previous studies have predominantly explored the mechanisms of LF from the angle of economic efficiency, with relatively limited attention to its social distribution effects and inclusive development implications. By analyzing the impact of LF on UER, this paper reveals how market-based mechanisms affect social equity while promoting ecological improvements. This paper finds that LF has a more significant promoting effect in smaller cities and regions with greater land price distortions, reflecting its inclusive characteristics and providing new empirical evidence for understanding the relationship between land factor marketization and social equity. This finding has important reference value for formulating land policies that balance ecological protection with social equity and helps promote the comprehensive achievement of urban sustainable development goals.

The structure of this paper is as follows. The second section provides a theoretical analysis of LF and presents the research hypotheses. The third section introduces the design of the research model, along with the selection and construction of variables. The fourth section presents empirical analysis, including descriptive statistics, basic regression, and a series of robustness tests. The fifth section focuses on mechanism analysis, including tests for mediating mechanisms and moderating effects. The sixth section offers further analysis. Finally, the seventh section summarizes the research findings and provides policy recommendations.

2. Theoretical Analysis and Research Hypotheses

Local governments leverage land resources to mobilize financial resources and promote the urbanization process. This process not only affects the efficiency of land resource utilization but also reshapes urban spatial layouts and economic structures. UER, as the ability of urban systems to maintain core functions when responding to natural disasters, climate change, and human disturbances, is closely related to the efficiency and rationality of land resource allocation. In recent years, as environmental protection has become an evaluation criterion for urban leaders and eco-friendly cities can attract more production factors to drive economic development, local governments have taken greater account of the green ecological value of land and the efficiency of capital injection into green industries when financing through land [

35,

36].

2.1. The Mechanism Effect of LF on UER

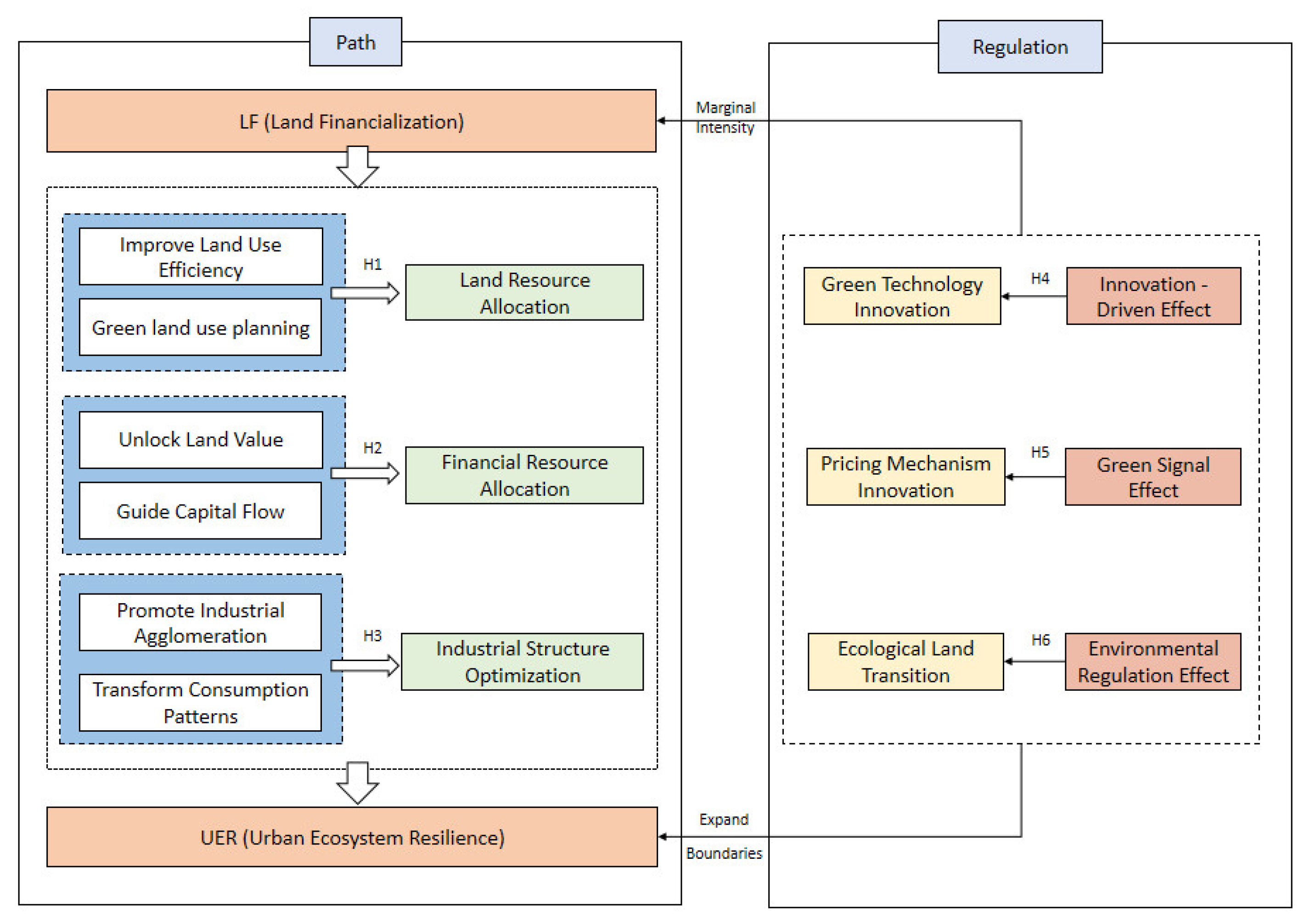

From the perspective of land resource allocation, land financialization incorporates land factors into the capital market, allocates land through market-oriented pricing mechanisms, guides land to be redirected to environmental protection, green industry land use, and ecological land use, and enhances the economic and ecological value of land. As shown in the first pathway under

Figure 2, through LF, cities can achieve efficient utilization and optimal allocation of land resources [

37,

38]. This process increases the economic value of land while avoiding excessive occupation of the ecological environment. Through land capitalization, composite function development, improvement of circulation mechanisms, and optimization of government policies, land use efficiency has been significantly enhanced, which is crucial for strengthening urban ecological resilience and promoting sustainable development. Furthermore, in planning for new land use, LF guides market capital toward green, low-carbon, and environmentally friendly industries through green orientation, ensuring green utilization of newly added land, enhancing urban green infrastructure construction, and, ultimately, improving urban green development quality and enhancing UER. Firstly, for existing land, redevelopment through financial means can improve the use value of land while reducing urban spatial expansion and avoiding excessive occupation of the natural environment. LF activates the liquidity of land resources, releases land from inefficient and high-pollution uses, and reallocates it to fields of ecological construction and those with higher social benefits, thereby mitigating the negative environmental externalities of land use [

39]. Secondly, LF promotes the design of land’s composite functions and multiple uses to improve land use efficiency. The improvement of land use efficiency allows for better monitoring of carbon footprints [

40], providing good indicators for urban ecological planning. Many regions in the process of urbanization are already facing the problem of tight land resources, but through composite development and cross-border integration, land can realize the superimposed use of more functions. Funds from LF can be used to develop green infrastructure, such as ecological parks, greenways, and rain gardens. At the same time, LF can also attract commercial investment to build commercial blocks, cultural centers, etc. While improving land use efficiency, it can also enhance urban ecological quality and realize the integration of ecological functions and economic functions. Thirdly, LF can significantly enhance the liquidity of land, prompting the circulation of land resources among different developers, thereby facilitating more efficient resource allocation. Under the traditional land management model, land cannot circulate efficiently due to property rights issues or administrative restrictions. In the process of LF, the right to use land can be used as a form of capital for long-term leasing or transfer, which improves the efficiency of land circulation and avoids long-term idleness. Finally, in the planning and development of newly added land, market allocation directs land resources toward eco-friendly uses, preventing their use for high-pollution and high-energy-consumption industries. This improves the flexibility and adaptability of land resources. Based on this, this paper proposes the first hypothesis:

H1. LF improves UER by optimizing the allocation of land resources.

Land, as an important ecological resource, effectively enhances UER through precise capital allocation and market-oriented resource guidance in the process of financialization. As shown in the second pathway under

Figure 2, LF can optimize capital allocation and fund transmission, providing systematic support for UER. On one hand, by unlocking the potential value of land, it offers a sustainable source of funding for ecological development; on the other hand, through precise resource allocation, it ensures that funds flow into ecologically critical regions and industries. This mechanism not only improves the urban ecological environment but also enhances cities’ adaptability in the face of risks, such as natural disasters and climate change. The primary mechanism of LF is to release the potential value of land. Land can provide financial support for ecological construction through land mortgage financing and land securitization. In particular, in the area of ecological protection and restoration, LF provides a sufficient source of funding for governments and enterprises to be able to invest in ecological projects, thereby avoiding the idleness of land resources. Secondly, LF can optimize the allocation of funds. Innovative financial instruments of LF, such as green credit, climate bonds, and environmental rights trading, guide capital to flow into fields related to UER [

41,

42]. By channeling funds to projects that enhance the resilience of urban ecosystems to external shocks, such as flood control, drought relief, water conservation, and climate-resilient infrastructure, to enhance cities’ resilience to risks, such as natural disasters and climate change, they provide a targeted channel for social funds. LF accurately allocates financial resources to key ecological areas to ensure the flow of funds to support ecosystem restoration and sustainable development. Another key role of LF is to promote the innovation of pricing mechanisms for ecological factors. LF can transform environmental costs into market prices by incorporating ecological factors into the land value assessment framework, establishing carbon trading markets, and implementing ecological compensation mechanisms. This provides financial support for the development of the green economy and encourages market participants to pay more attention to ecological protection and green development [

43]. Through a market-oriented pricing mechanism, the scale effect of capital inflows into the green industry has been formed, which further promotes the sustainable development of the green economy. Cities can introduce ecological functions into infrastructure construction, obtain support from ecosystems, and form a more diversified and comprehensive emergency response mechanism. Therefore, this paper puts forward the second hypothesis:

H2. LF promotes the improvement of UER by adjusting the allocation of financial resources.

The rationalization of industrial structure refers to making the industrial structure more efficient and sustainable by optimizing the allocation of resources. Reasonable industrial structure can reduce excessive dependence on natural resources, improve the efficiency of resource utilization, and enhance the ability of cities to cope with environmental risks. As shown in the third pathway in

Figure 2, land financialization can guide capital flows toward green industries, promote green industrial clustering and synergy, improve productivity [

44,

45], and achieve economies of scale [

46] while protecting ecological space through the construction of relevant parks. Furthermore, industrial structure optimization brought about by land financialization also indirectly influences consumption patterns, supports the development of the circular economy and other industries, and promotes sustainable industrial transformation and the enhancement of residents’ environmental awareness. The specific analysis is as follows: LF provides financial support and market mechanisms for industrial structure optimization. First, LF can attract funds into different industrial fields, especially sustainable industries, such as green industries, low-carbon industries, and environmental protection. These green industries can not only reduce urban carbon emissions and improve resource utilization efficiency but also enhance the resilience of cities to cope with climate change and natural disasters. The flow of funds through market-oriented means can help optimize the industrial structure and promote the rapid development of eco-friendly industries [

47]. LF can encourage developers, enterprises, and investors to focus on green technology and innovation, driving the transformation and upgrading of traditional industries toward green industries and promoting the development of low-pollution, high-efficiency industries. This achieves coordinated digital–green transformation, enhancing urban economic resilience [

48] while reducing excessive consumption of natural resources and improving urban ecological quality and adaptive capacity. Second, LF provides flexible financing tools and market mechanisms, which can help different types of industries to agglomerate and develop synergistically. Through LF, cities can raise funds to build green industrial parks, ecological science and technology parks, and so on. These parks gather a large number of green enterprises and environmental protection technologies, promote the synergy and innovation of the industrial chain, and reduce the waste of resources. The new energy industrial park, green building industrial park, and ecological agricultural park use LF to obtain funds and promote the cluster development of green industry. By means of financialization, developers and enterprises are guided to give priority to industrial agglomeration areas. LF not only improves the economic benefits of land but also reduces the development pressure on other areas, thus protecting the ecological space of the city. The centralized development brought by LF also avoids the waste of resources and the ecological burden brought by urban decentralized construction. Industrial agglomeration helps to improve the efficiency of resource allocation and reduces the pressure of urban expansion on natural ecology. Third, LF can indirectly affect the city’s consumption patterns, promote social capital to enter low-carbon, environmental protection, and circular economy industries, and thus promote the sustainable transformation of urban industrial structures. An important role of LF is to provide financing support for the circular economy industry [

49]. The circular economy strategy aims to promote sustainable resource utilization and minimize waste to the greatest extent possible, effectively reducing greenhouse gas emissions [

50]. Cities can encourage the rise of the recycling industry, the waste treatment industry, and the green material industry through land redevelopment, land reuse, and land exchange. By guiding the flow of capital to these green industries, LF promotes the sustainable transformation of the industry and reduces the waste of resources and environmental pollution. With the development of green industry, consumers will gradually shift to more sustainable consumption patterns. In green building projects, LF funds can be used to build green shopping malls and environmentally friendly residential areas to attract green consumer groups. The transformation of consumption patterns helps drive the development of green industries, enhances urban residents’ awareness of environmental protection, and indirectly improves UER. Based on the above theoretical logic, research hypothesis 3 is proposed:

H3. LF improves UER by adjusting the industrial structure and enhancing the rationalization of the industrial structure.

2.2. The Regulation Mechanism of LF in UER

LF enhances UER, and this process is also significantly moderated by factors like innovation-driven factors, green signals, and environmental regulation. Therefore, the theoretical analysis further hypothesizes that green signals, innovation-driven factors, and environmental regulation play a moderating role in the impact of land financialization on urban ecosystem resilience.

As shown in the first effect of the regulation mechanism in

Figure 2, technological innovation plays a crucial role in modern land development, especially in terms of enhancing ecological resilience and reducing ecological footprints. Through green technologies, technological innovation can significantly improve the efficiency of resource utilization in the process of land development, thereby effectively reducing environmental pressure. Specifically, green building technologies and ecological restoration technologies have enhanced the sustainability of land development by optimizing resource usage. In addition, the application of digital technologies, such as GIS, helps to accurately plan ecological land use, avoiding excessive land development and thus preventing negative impacts on ecosystems. As a core resource, technological innovation can recombine the capital and ecological elements of LF and enhance the adaptability of the ecosystem. At the same time, technological innovation endows cities with stronger dynamic adjustment abilities in the process of land development. Through the collection and application of real-time environmental data, it optimizes land use decision making and enhances the ability of cities to cope with environmental changes. Therefore, technological innovation is the key path to enhance ecological resilience [

51]. However, the role of technological innovation is influenced by a variety of factors. For instance, the intensity and quality of technological innovation, as well as enterprises’ ability to absorb technologies, will all affect its effectiveness in the context of LF and environmental regulation. In this context, technological innovation can be regarded as a moderating variable between LF and UER. Specifically, the intensity and quality of technological innovation may affect the role of LF in promoting UER. If the level of technological innovation is high, the effect of LF on enterprise transformation and upgrading caused by pushing up environmental compliance costs will be more significant, thus more effectively improving UER. On the contrary, if the level of technological innovation is low, LF may not fully stimulate the innovation power of enterprises, thus weakening its role in promoting UER. Through the theory of moderating effects, it can be observed that the involvement of technological innovation will change the intensity and direction of the impact of LF on UER. This moderating effect is realized through a three-stage transmission mechanism of “environmental cost transformation—innovation response—resilience reconstruction”. It is worth noting that the emergence of green innovation has reconstructed the logic of capital allocation and promoted the accelerated concentration of funds released by LF in the field of environmental protection technology. This directional flow not only accelerates the transformation process from technology research and development to commercial application; more importantly, through the improvement of technological maturity, a positive cycle of “innovation verification-market recognition-capital addition” is formed. After market entities observe an increase in the commercial success rate of environmental protection technologies, their risk preference for ecological investment undergoes a structural shift, significantly expanding the market’s preferential demand for low-carbon technologies. This change in preference further strengthens the ecological allocation characteristics of LF funds, making the economic logic of internalizing environmental externalities more complete. Ultimately, through channels like the technology premium effect and ecological asset securitization, it multiplies the impact intensity of LF on UER. Therefore, this paper puts forward hypothesis 4:

H4. The quality and intensity of technological innovation expand the positive role of LF in promoting UER.

As shown in the second effect of the regulation mechanism in

Figure 2, the green signal effect mainly converts environmental value into clear economic signals through the market pricing mechanism of green financial instruments, and it establishes an “ecology-first” capital allocation orientation by leveraging differences in financing costs. On one hand, more funds can be invested in ecological protection and restoration projects in the process of LF through the value explicit mechanism of ecological products, such as carbon sink trading and ecological compensation; on the other hand, financial instruments, such as green bonds, clearly limit funds to projects that meet environmental standards, such as ecological corridor construction, wetland restoration, and pollution control. The precise orientation of the use of LF funds has formed a virtuous circle of ecological protection and economic development. Specifically, from the perspective of market expectation guidance mechanisms, the effective transmission of value signals can change investors’ preferences and encourage local governments and enterprises to pay attention to the long-term ecological benefits of land development, thus inhibiting speculative land hoarding behavior. According to the signal transmission theory, the clear policy signals of green financial policy and the ecological product trading market effectively reduce the information asymmetry of ecological investment and enhance the enthusiasm of social capital to participate in ecological protection. At the same time, the externality internalization theory emphasizes that the ecological cost brought by land development, such as ecological tax or ecological compensation, should be explicitly incorporated into the financial decision making system through ecological value pricing so as to further strengthen the ecological orientation of market behavior.

From the perspective of market practice, the green signal effect makes ecological risks explicit through tools like green insurance. Taking environmental pollution liability insurance as an example, it directly reflects the potential environmental risk in the premium cost of the enterprise, forcing the development enterprise to pay more attention to the environmental impact in the financing process. High-pollution projects face a higher premium burden, forcing companies to turn to environmentally friendly financing models. This mechanism not only significantly reduces the financing attraction of high-pollution projects but also guides capital to flow preferentially to ecological projects with low environmental risks through market signals and optimizes the efficiency of resource allocation in the process of LF. In addition, green bonds can effectively avoid the disorderly flow of funds by clarifying the direction of capital use and accurately investing in the field of ecological restoration and protection. Long-term stable funding support helps ensure the sustainability of ecological restoration projects, while market-based green bonds further enhance the attractiveness of ecological projects to the capital market, strengthening the positive impact of LF on UER. Finally, the continuous growth of the credit scale for environmental protection projects reflects the financial system’s positive response to the eco-priority strategy. Green credit policies reduce the financing costs of environmental protection projects, attracting more capital into pollution control and ecological restoration fields. This not only improves the implementation efficiency of ecological projects but also effectively promotes the overall enhancement of UER through the capital aggregation effect. Therefore, this paper puts forward the following hypothesis:

H5. The green signal effect strengthens the role of LF in promoting UER through cost dominance, income orientation, and scale agglomeration.

LF positions land as an investment and a transaction asset through marketization and capitalization. However, LF may lead to over-exploitation and uneven distribution of resources, which has a negative impact on the ecological environment. In this context, environmental regulation plays a key regulatory role. The Porter Hypothesis points out that appropriate environmental regulation can not only avoid the ecological damage caused by land development but also stimulate the compensation effect of innovation and promote the coordinated development of green technology and LF. The institutional theory emphasizes that through reasonable institutional design and social supervision, environmental regulation can effectively restrain the ecological destruction of land development and ensure that LF does not damage the ecological environment. Environmental regulation directly affects the behavior of LF through rigid constraints and incentive mechanisms. Rigid restraint mechanisms, such as the ecological red line system and the pollutant discharge permit system, can effectively limit high-pollution land development projects and promote the flow of LF funds to areas with low environmental impact. These regulations force developers to pay more attention to environmental costs and ecological benefits in the process of land development. Meanwhile, by establishing an incentive-compatible mechanism to encourage enterprises to carry out green technological innovation, land mortgages that meet ecological standards can enjoy preferential interest rates. This attracts more capital to flow into green projects and enhances the ecological benefits of land development.

As shown in the last effect of the regulation mechanism in

Figure 2, environmental regulation effects constrain land planning and capital utilization, promoting green transformation of land through hard requirements, such as laws and regulations, and thereby playing an important moderating role in the process of LF affecting UER [

52]. Specifically, environmental regulation makes environmental costs explicit by pushing up the holding cost of polluting land, forcing enterprises to turn to a land development model with low environmental impact. These regulations have prompted developers to reassess the environmental risks of land development, such as adopting ecological restoration priority development strategies or green building standards. The financing difficulty of high-polluting plots has increased, further compressing the living space of the traditional high-polluting development model and promoting the flow of funds released by LF in the direction of green development. On the other hand, environmental regulation has strengthened the number of administrative penalty cases, strengthened legal deterrents’ force, and compressed the gray operation space of “pollution first and repair later”. The strict environmental impact assessment system and the post-event supervision mechanism have significantly increased environmental compliance pressure on enterprises, forcing them to invest more resources in pollution prevention and control and ecological restoration in the early stages of development. The behavioral constraints brought by environmental regulation not only reduce the environmental risks in the development process but also improve the ecological level of land development through standardized operation processes. In addition, through construction restrictions, green building standards, and ecological compensation mechanisms, environmental regulations have effectively curbed the over-exploitation and ecological damage that may occur in the process of LF while promoting ecological restoration and natural resource protection. Therefore, environmental regulation can guide LF to develop in a more environmentally friendly and sustainable direction, enhance UER, reduce natural disaster losses, and enhance ecological service functions. Under the regulation of environmental regulation, LF not only promotes economic development but also realizes the sustainable development of cities and the improvement of ecological resilience by optimizing resource allocation and strengthening ecological protection. Based on this, the following assumptions are made:

H6. The effect of environmental regulation strengthens the role of LF in promoting UER.

The overall logical framework diagram of the theoretical analysis and research hypotheses of this paper is shown in

Figure 2. The impact mechanism of land financialization on urban ecosystem resilience can be developed through two mechanisms: mediating pathways and moderating pathways. Specifically, the mediating mechanism is mainly developed based on the definition and connotation of land financialization, involving the allocation of both land and financial resources. While land financialization utilizes land for financing to obtain financial support, it simultaneously optimizes the allocation of land resources through market guidance, enabling land to develop toward more efficient and cleaner utilization. Meanwhile, the funds brought by land financialization are also invested in green infrastructure construction and other industries that promote urban green and sustainable development, further enhancing urban ecosystem resilience. Additionally, under the optimized allocation of land and financial resources, industrial structure also generates mediating effects during this process. Land financialization promotes green industrial clustering, creating scale effects that multiply green development efficiency. Due to the promotion of green environmental protection industries, consumer consumption patterns gradually shift toward low-carbon and environmentally friendly products, thereby driving the development of related industries and achieving positive cycles.

From the perspective of moderating mechanisms, environmental regulations increase land use costs for heavily polluting enterprises, prompting enterprises to undergo green transformation and thus promoting green technology innovation. In the process of land financialization affecting urban ecosystem resilience, enterprise technological innovation has a moderating effect. Furthermore, because land financialization involves incorporating land into the market, through the market pricing mechanism of green financial instruments, environmental value is transformed into economic signals, making the value of ecological products explicit and directing more land financialization funds toward ecological projects. Finally, environmental regulations add hard constraints and legal deterrence to land financialization, encouraging enterprises to give more consideration to ecological land construction in land utilization.

6. Further Analysis

This paper further discusses the heterogeneous effects of LF’s positive impact on UER across regions with different resource characteristics and administrative resources. Regarding resource characteristics, LF can release the value signal of land and activate local resources that are otherwise difficult to mobilize, thereby playing a more significant role in UER and “bridging the gap” in resource endowments. Following Paez et al. (2001) [

72] and Lin and Xu (2024) [

73], this paper examines heterogeneity at the resource characteristic level from two perspectives: the degree of land price distortion and whether the prefecture-level city is an old industrial city. Land price distortion directly leads to a misrepresentation of resource allocation signals. In the process of LF, local governments attract investment by transferring industrial land at low prices, creating a competitive model of “attracting investment with land.” When land prices are suppressed, low-productivity enterprises can more easily acquire land resources at a low cost, encroaching on ecological spaces (such as green areas and wetlands) and leading to a decline in ecological carrying capacity. Regions with high price distortion often exhibit an over-reliance on land mortgage financing, where land is repeatedly pledged as collateral, creating a financial leverage bubble. Once the land market fluctuates, the funding chain for ecological restoration may break, exacerbating the vulnerability of the ecosystem. Meanwhile, old industrial cities have an industrial structure heavily skewed toward traditional manufacturing, and their LF is often tied to a “land financing + production capacity expansion” model. Such cities tend to use land mortgage financing to support the upgrading of outdated production facilities rather than transitioning to eco-friendly industries. The cost of land pollution control in old industrial zones is high, yet funds from LF are mostly allocated to the construction of new development zones rather than ecological restoration. This has led to the superimposition of historical pollution problems and newly added ecological pressures.

In terms of administrative characteristics, LF can release the fiscal signal of land, drive the development of cities with weak fiscal support capabilities, and thus play a more significant role in urban ecological resilience, functioning as a “supplement to weak links” in administrative characteristics. This paper examines heterogeneity at the administrative characteristic level from two perspectives: the city’s administrative hierarchy and its regional characteristics. Smaller cities have weaker fiscal self-sufficiency and rely more heavily on LF to obtain development funds. However, their land markets have lower liquidity, which limits the scale of mortgage financing and leads to insufficient investment in ecological infrastructure (such as sewage treatment and green space systems). Furthermore, in smaller cities, financial resources are concentrated in land mortgage loans, which crowds out the space for green credit [

74]. For non-central cities, which are situated on the periphery of the regional economic landscape, LF is often combined with a “land for investment” strategy. To attract industrial relocation, local governments may lower ecological entry barriers, causing a systematic weakening of ecological resilience. Peripheral cities are more lacking in the technological spillover effect from central cities, with insufficient ecological governance technologies and management capabilities. Consequently, the funds brought about by LF can hardly be efficiently converted into ecological protection projects. Nevertheless, driven by LF, green technological innovation can more significantly promote green development in these peripheral cities [

75], thereby enhancing their UER.

In this paper, the median grouping method is adopted for the distortion of land price, and the remaining results naturally conform to the setting logic of 0–1 variables. The results of the heterogeneity test of resource characteristics and administrative characteristics are shown in

Table 11. Columns (1)–(8) represent high land price distortion, low land price distortion, old industrial cities, non-old industrial cities, large and medium-sized cities, small cities, central cities, and peripheral cities, respectively. The regression results show that the promotion effect of LF on UER is more significant in the samples with poor resource characteristics and administrative resources, that is, the promotion effect of LF on UER is more significant in the samples with high land price distortion, old industrial cities, small cities, and peripheral cities. In particular, LF reflects the inclusive characteristics. In regions with relatively backward economic development, LF helps to optimize resource allocation and enhance regional ecological resilience. This inclusive feature is manifested in attracting more social capital into resource-poor areas through the LF mechanism, thus promoting the improvement of ecological environment and sustainable development in these areas.

In summary, this paper examines the micro-level mechanisms through which land financialization affects urban ecosystem resilience from two perspectives: mediating effects and moderating effects. The regression results indicate that land financialization plays a green-oriented role in land and financial resource allocation, as well as in the industrial structure, ultimately enhancing urban ecosystem resilience. In this process, corporate green technological innovation, market-based green pricing mechanisms, and environmental policy regulation play key positive amplifying and moderating roles. Heterogeneity analysis reveals that the positive promoting effect of land financialization on urban ecosystem resilience is more significant in cities with lower administrative levels and poorer resource endowments, reflecting the inclusive characteristics of land financialization.

7. Conclusions and Recommendations

In recent years, with the acceleration of the global urbanization process, the conflict between the efficient use of land resources and ecological protection has become increasingly prominent [

76]. As a core element of urban development, the efficiency of land resource allocation not only affects economic sustainability but also directly determines the resilience and risk-resistance capacity of the urban ecosystem. While the market-based allocation of resources can significantly enhance efficiency, ignoring ecological value may lead to resource mismatch and environmental degradation [

77]. Against this backdrop, LF, as an innovative resource allocation tool, offers new possibilities for urban ecological construction by unlocking the capital attributes of land. However, existing research has largely focused on the economic benefits of LF, while a systematic exploration of its effect on ecological resilience remains insufficient. This paper aims to fill this gap by exploring how LF enhances UER through the optimization of land, financial resources, and the industrial structure, thereby providing a theoretical basis and practical guidance for sustainable urban development.

Through comprehensive empirical analysis of Chinese prefecture-level cities from 2008 to 2017, this research successfully addresses its primary objective of exploring how LF influences UER through optimized resource allocation mechanisms. Based on theoretical analysis and empirical testing, this paper draws the following main conclusions.

First, LF significantly promotes the enhancement of UER. By releasing inefficiently used land and converting it into ecological functional areas, such as green spaces and wetlands, LF provides buffering and self-healing capacity to the urban ecosystem. Second, LF optimizes the allocation of both the stock and increment of land resources, creating a virtuous cycle of “pollution reduction—ecological expansion—spatial value appreciation”, which markedly improves UER. Third, by unlocking land value, attracting social capital, and guiding capital flows toward green industries, LF provides systematic support for urban ecological construction. Fourth, LF drives the transformation of the industrial structure toward being greener, more high-end, and more intensive. Through the reconstruction of green industrial chains and the promotion of mixed-use spatial functions, it further enhances UER. In summary, LF plays a crucial role in promoting UER through mechanisms spanning the three dimensions of land, finance, and industry, offering a multi-dimensional path for sustainable urban development. Fifth, technological innovation, value signals, and environmental regulation play significant moderating roles in the relationship between LF and UER. Green innovation technologies reduce the ecological footprint by improving resource use efficiency in land development. The green signaling effect optimizes the impact of LF by promoting capital flows to eco-friendly projects through market pricing mechanisms for ecological products. Environmental regulations, through hard constraints and incentive mechanisms, have adjusted the impact of LF on UER. They not only promote the development of ecological protection and restoration projects but also reduce the risk of over-development through strict supervision measures, ensuring the green orientation of LF. Sixth, the heterogeneity analysis indicates that the positive effect of LF on UER is more pronounced in cities with poorer resource endowments, lower administrative capacity, and less favorable geographical locations, demonstrating an inclusive characteristic of LF for weaker regions.

The scientific contributions of this research are manifested in four aspects. First, it expands the theoretical understanding of LF beyond its traditional economic effects to encompass ecological resilience value, revealing how financialization mechanisms can serve environmental sustainability goals. Second, it broadens the research on UER influencing factors by highlighting the significant yet previously underexplored role of financial systems in ecological resilience enhancement. Third, it clarifies the promoting relationship between factor marketization and green transformation, demonstrating how LF serves as an important pathway for the financial empowerment of sustainable development. Fourth, it introduces the analytical dimension of social inclusivity. By focusing on the social distribution effects of land financialization, this paper provides a new theoretical perspective for evaluating the equity of market-based ecological improvement mechanisms, revealing its differentiated impacts across regions with different urban scales and degrees of land price distortion.

Based on the study’s conclusions, LF can effectively enhance UER through the three-dimensional collaborative mechanism of land, finance, and industry. Accordingly, the following policy recommendations are put forward. First, governments should strengthen the optimal allocation of land resources, particularly in converting inefficiently used land into ecological functional areas, to enhance the buffering and self-healing capacity of urban ecosystems. At the same time, policies should guide funds from LF to flow preferentially into green industries, support the construction of ecological infrastructure, and create a virtuous cycle of “pollution reduction—ecological expansion—spatial value appreciation” to promote the improvement of UER. Second, LF should be combined with the green transformation of industrial structures to promote the development of industrial chains toward greenization, high-endization, and intensification. This will not only enhance UER but also promote the gradual elimination of traditional high-pollution industries. Governments should enact policies that support the growth of green industries, further optimizing industrial chains and reducing reliance on traditional polluting sectors. Furthermore, governments should increase support for green innovation technologies to improve resource use efficiency during the land development process and reduce the ecological footprint. Through the green signaling effect, the market pricing mechanism for ecological products should be optimized to guide capital toward eco-friendly projects. Simultaneously, it is necessary to strengthen hard constraints and incentive mechanisms, enhance policy coordination and supervision, and establish a linkage mechanism between land financialization and ecological construction. This will ensure that a larger proportion of the gains from LF are used for the development of ecological resilience and prevent ecological damage caused by excessive profit-seeking of capital. Finally, considering the regional heterogeneity of cities, policies should pay special attention to those with poorer resource endowments, lower administrative capacity, and relatively remote geographical locations. For these cities, LF should exert its inclusive characteristics, attract social capital, and optimize resource allocation, thereby enhancing UER. These regions can achieve the goals of green and sustainable development through the LF mechanism, driving improvement of the regional ecological environment.

However, this paper also has several scientific limitations that warrant consideration. The analysis is constrained to Chinese prefecture-level cities within a specific temporal framework (2008–2017), which may limit the generalizability of findings to other institutional contexts or more recent periods. The complexity of urban ecosystem dynamics means that some ecological feedback mechanisms may operate over longer time horizons than captured in this dataset. Additionally, while the study identifies heterogeneous effects across different city types and regions, the underlying mechanisms driving these variations require more nuanced investigation.

Future research directions should explore several promising avenues. First, cross-national comparative studies could examine how different institutional frameworks and land ownership systems influence the LF–UER relationship. Second, longer-term longitudinal analyses would better capture the delayed and cumulative effects of land financialization on ecological systems. Third, investigation of the optimal thresholds and boundary conditions for LF’s positive ecological impacts could inform more precise policy design. Fourth, integration of remote sensing and big data technologies could enable more granular analysis of spatial–temporal patterns in the financialization–resilience nexus. Finally, research into the social equity dimensions of LF’s ecological benefits would provide a more comprehensive understanding of sustainable urban development pathways.