Risk Identification and Spatiotemporal Evolution in Rural Land Trusteeship

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Qualitative Analysis

3.2. Spatial Analysis Methods

3.2.1. Ordinary Kriging

3.2.2. Standard Deviation Ellipse

3.2.3. Spatial Autocorrelation Analysis

4. Results

4.1. Identification of Land Trusteeship Risks in Rural China

4.1.1. Open Coding

4.1.2. Axial Coding

4.1.3. Selective Coding

4.2. Spatiotemporal Evolution of Land Trusteeship Risks in Rural China

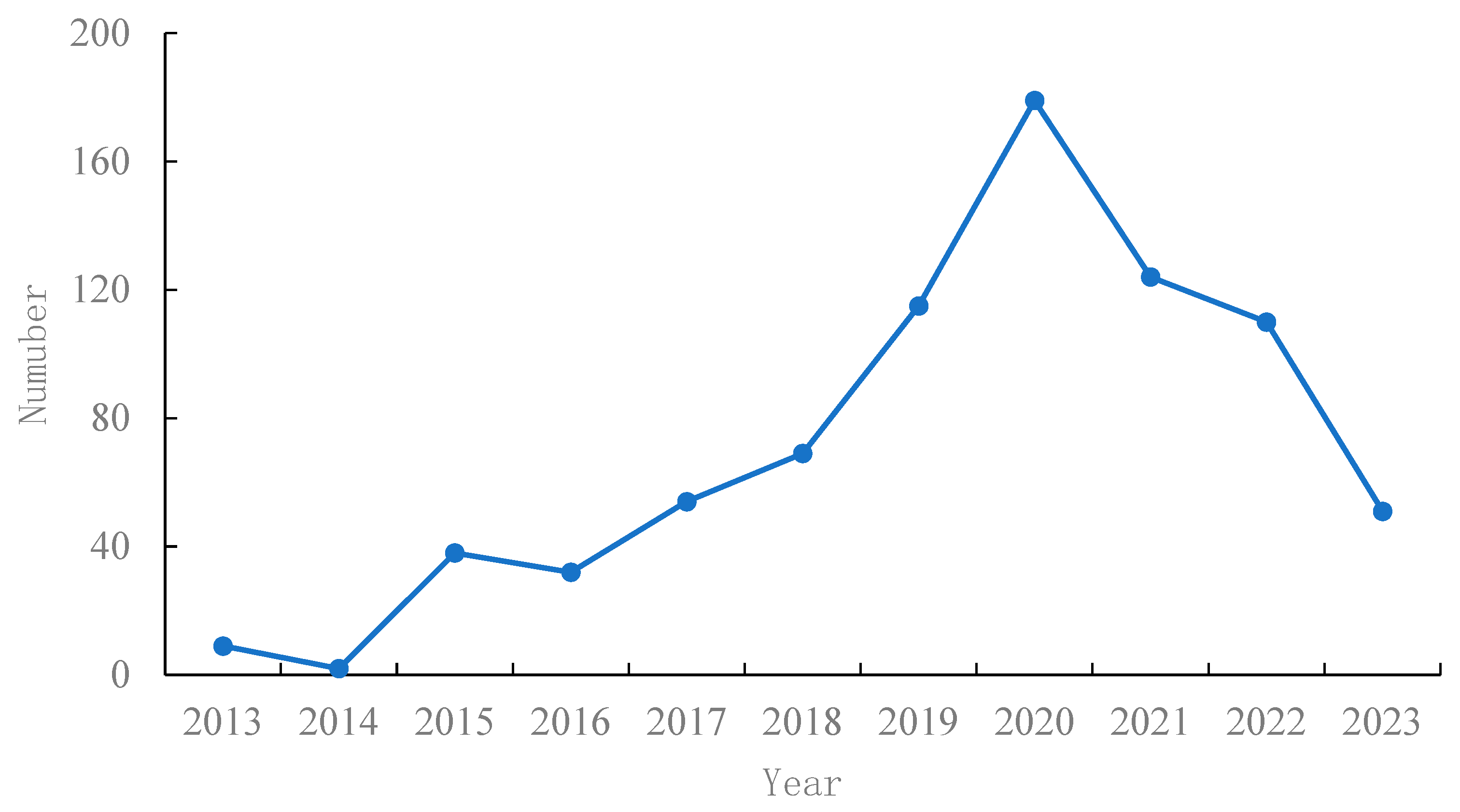

4.2.1. Temporal Characteristics of Land Trusteeship Risk Evolution

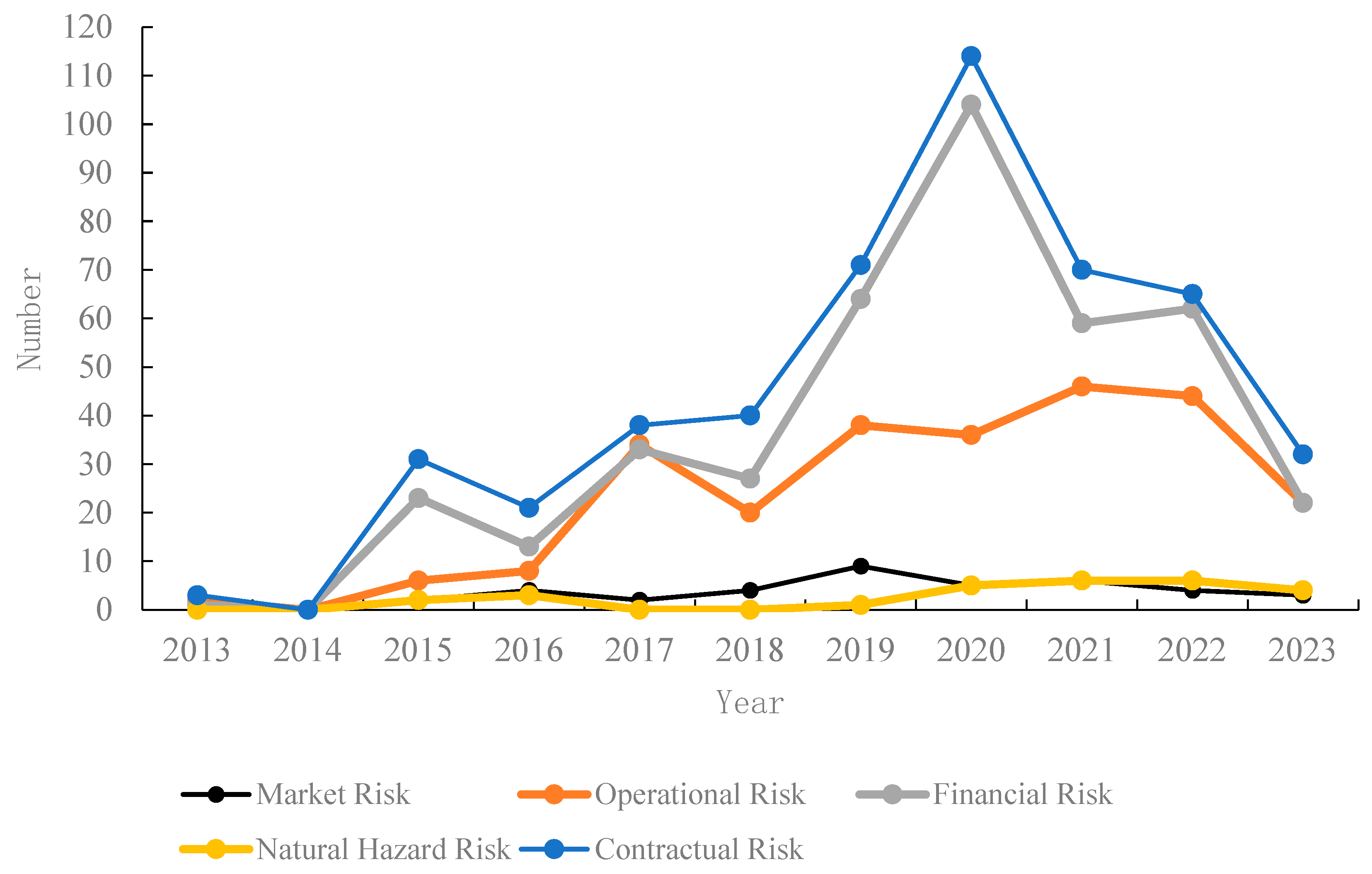

4.2.2. Temporal Evolution Characteristics of Different Types of Land Trusteeship Risks

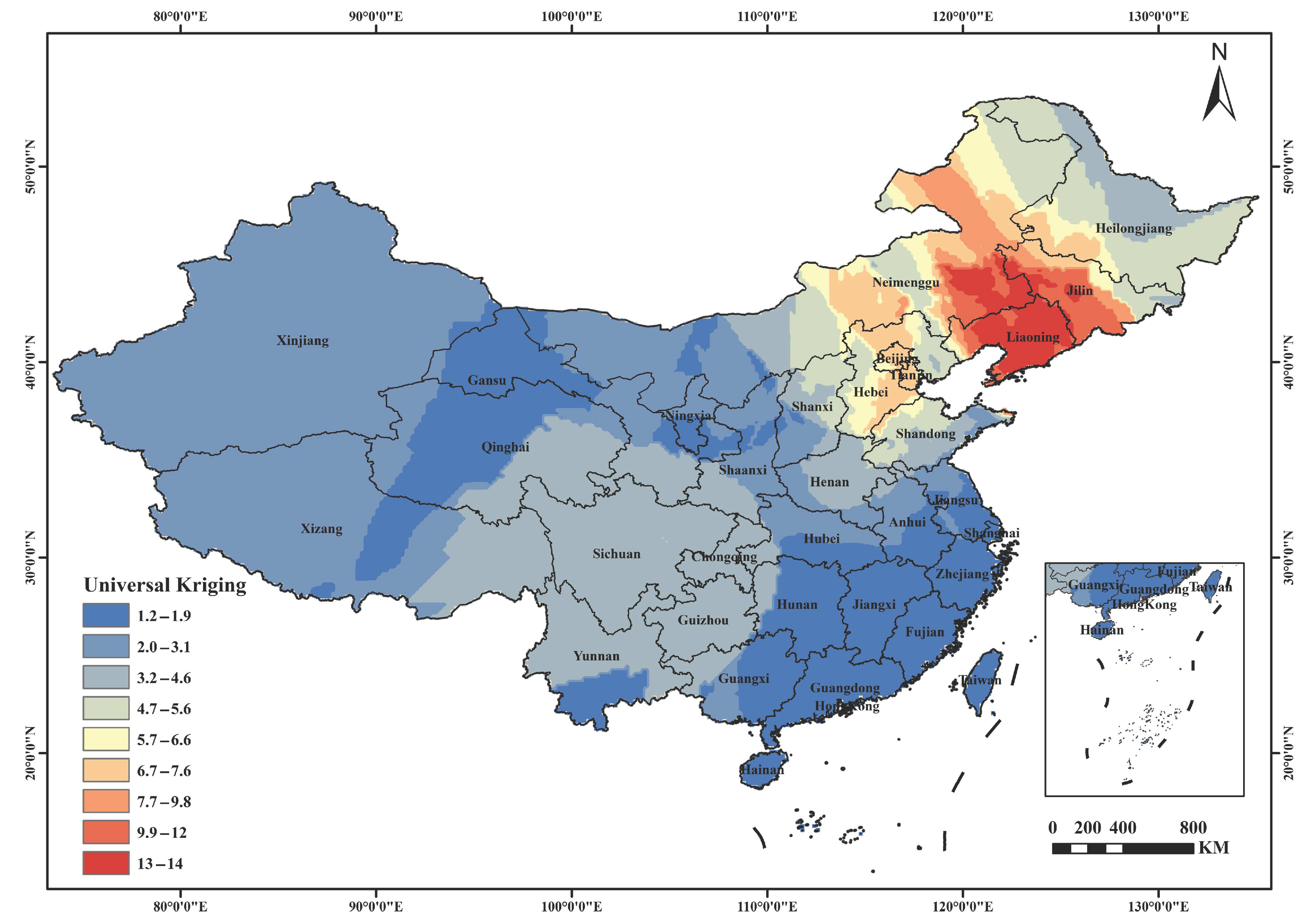

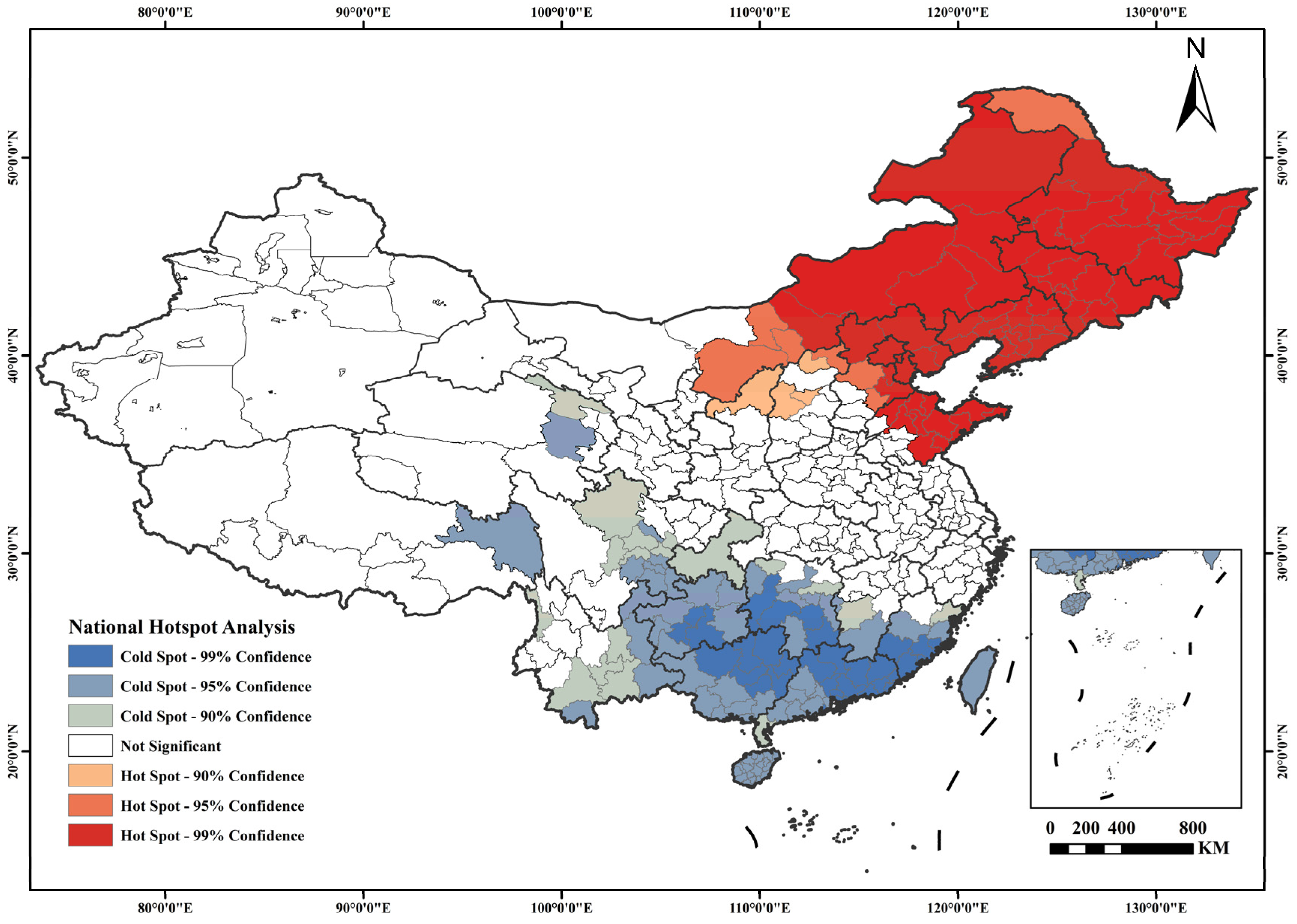

4.2.3. Spatial Evolution Characteristics of Land Trusteeship Risks in Rural China

4.2.4. Spatial Evolution Characteristics of Different Types of Land Trusteeship Risks

5. Discussion

5.1. Analysis of Rural Land Trusteeship Risk Types

5.2. Discussion on the Temporal Evolution of Rural Land Trusteeship Risks

5.3. Discussion on the Spatial Evolution of Rural Land Trusteeship Risks

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bureau, J.-C.; Crombez, C.; Knops, L.; Matthews, A.; Swinnen, J.; Tangermann, S.; Viaggi, D. The Common Agricultural Policy after 2013. Intereconomics 2012, 47, 316–342. [Google Scholar] [CrossRef][Green Version]

- FAO. The Future of Food and Agriculture: Trends and Challenges; Food and Agriculture Organization of the United Nations: Rome, Italy, 2017; ISBN 978-92-5-109551-5. [Google Scholar]

- Matthews, A. The EU’s Farm to Fork Strategy: A Reform of the CAP or an Agroecological Illusion? Bio-Based Appl. Econ. 2021, 10, 133–148. [Google Scholar]

- Pingali, P.L. Green Revolution: Impacts, Limits, and the Path Ahead. Proc. Natl. Acad. Sci. USA 2012, 109, 12302–12308. [Google Scholar] [CrossRef] [PubMed]

- Kay, C. The Agrarian Question and the Neoliberal Rural Transformation in Latin America. Eur. Rev. Lat. Am. Caribb. Stud. 2015, 100, 73–83. [Google Scholar] [CrossRef]

- Berdegué, J.A.; Fuentealba, R. Latin America: The state of smallholders in agriculture. In IFAD Conference on New Directions for Smallholder Agriculture; IFAD: Rome, Italy, 2011; pp. 24–25. [Google Scholar]

- Tuan, N.P. Contract Farming and Its Impact on Income and Livelihoods for Small-Scale Farmers: Case Study in Vietnam. J. Agribus. Rural. Dev. 2012, 26, 147–166. [Google Scholar]

- Gröbli, M.; del Pilar, M. Digital Farming, Invisible Farmers: Global Mergers and Smallholders in Latin America. Alternautas 2022, 9, 222–244. [Google Scholar] [CrossRef]

- Sims, B.G.; Kienzle, J. Sustainable agricultural mechanization for smallholders: What is it and how can we implement it? Agriculture 2017, 7, 50. [Google Scholar] [CrossRef]

- Seto, K.C.; Reenberg, A. Rethinking Global Land Use in an Urban Era; The MIT Press: London, UK, 2014; p. 83. [Google Scholar]

- Long, H. Land Use Transitions and Rural Restructuring in China; Springer: Cham, Switzerland, 2020. [Google Scholar]

- Cheng, L.; Shen, L.; Hu, Z. Spatiotemporal Evolution of the Coupling Coordination Between Agricultural Production Efficiency and Green Technology Innovation in China. China Agric. Resour. Reg. Plan. 2024, 1–13. Available online: http://kns.cnki.net/kcms/detail/11.3513.S.20241128.1048.008.html (accessed on 2 May 2025).

- Su, Y.; Huang, Q.; Meng, Q.; Zang, L.; Xiao, H. Socialized Farmland Operation—An Institutional Interpretation of Farmland Scale Management. Sustainability 2023, 15, 3818. [Google Scholar] [CrossRef]

- State Council. Guiding Opinions on Promoting Rural Industrial Revitalization. Agrotech. Serv. 2019, 36, 1–4. [Google Scholar]

- Li, G. Key Issues in Promoting Rural Industrial Revitalization: Interpretation of the Guiding Opinions. China Rural. Sci. Technol. 2019, 08, 8–11. [Google Scholar]

- Liu, B.; Tang, C.; Zhou, G.; Yi, C. Evolution Characteristics of Rural Innovation Policies and Implications for Rural Development. Econ. Geogr. 2024, 44, 147–159. [Google Scholar]

- Li, X.; Chen, H. Grassroots Party Building Leading Rural Governance: Logic, Evolution, Characteristics and Development Path. Guangxi Agric. J. 2024, 39, 41–53. [Google Scholar]

- State Council. The 14th Five-Year Plan for Promoting Agricultural and Rural Modernization. China Agric. Account. 2022, 04, 98. [Google Scholar]

- Wang, A. Press Conference on China’s Economic High-Quality Development: Situation of Consolidating Agriculture and Promoting Rural Revitalization. Available online: https://www.gov.cn/lianbo/fabu/202501/content_7000255.htm (accessed on 2 May 2025).

- Chen, X.; Liu, X. Research Status and Prospect of Rural Land Trusteeship in China. Hubei Agric. Sci. 2021, 60, 19–23. [Google Scholar]

- Daum, T.; Birner, R. Agricultural Mechanization in Africa: Myths, Realities and an Emerging Research Agenda. Glob. Food Secur. 2020, 26, 100393. [Google Scholar] [CrossRef]

- Ragasa, C.; Lambrecht, I.; Kufoalor, D.S. Limitations of Contract Farming as a Pro-Poor Strategy: The Case of Maize Outgrower Schemes in Upper West Ghana. World Dev. 2018, 102, 30–56. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, B.; Yi, F. Rural Digital Governance and Collective Action. China Rural. Rev. 2024, 06, 98–121. [Google Scholar]

- Chen, Y.; Huang, S. Impact of Risk Perception on Farmers’ Land Trusteeship Decisions. China Land Sci. 2022, 36, 21–30. [Google Scholar]

- Deng, J.; Dong, K. Organizational Models and Innovation in China’s Grain Production. Agric. Econ. 2023, 01, 3–7. [Google Scholar]

- Xiao, T.; Lu, J. Reconstructing the Conceptual Framework of ‘Government Trust’. J. Xiamen Univ. (Philos. Soc. Sci. Ed.) 2024, 74, 135–148. [Google Scholar]

- Yu, L.; Gao, Q.; Zheng, S. Why Does Village Collective Coordination Fail in Reducing Land Trusteeship Risk? China Land Sci. 2022, 36, 68–77. [Google Scholar]

- Chen, C.; Yu, L.; Chen, J. Impact of Land Trusteeship on Asset Income Poverty Alleviation. Econ. Geogr. 2019, 39, 198–206. [Google Scholar]

- Sun, X.; Su, X. Land Trusteeship, Total Income, and Grain Planting Willingness. Issues Agric. Econ. 2012, 33, 102–108+112. [Google Scholar]

- Hu, L.; Zhou, Y.; Wu, S. Land Trusteeship Model and Vertical Integration. China Rural. Rev. 2019, 02, 49–60. [Google Scholar]

- Du, H.; Chen, J.; Gong, J.; Liu, B. Agricultural Production Trusteeship: Models, Effects and Risk-Sharing Mechanisms. Price Theory Pract. 2020, 12, 10–13+74. [Google Scholar]

- Tian, Y.; Xia, R. High-Quality Development of Agricultural Socialized Services. Agric. Econ. Manag. 2024, 6, 1–11. [Google Scholar]

- Chen, X.; Lin, T.; Liu, X.; Wang, X. Risk Assessment of Rural Contracted Land Trusteeship. J. China Agric. Mech. 2022, 43, 178–184+212. [Google Scholar]

- Rust, I.W. Review of a Concept of Agribusiness. J. Farm Econ. 1957, 39, 1042–1045. [Google Scholar] [CrossRef]

- Besley, T.; Ghatak, M. Incentives, Choice, and Accountability in the Provision of Public Services. Oxf. Rev. Econ. Policy 2003, 19, 235–249. [Google Scholar] [CrossRef]

- Farrington, J.; Christoplos, I.; Kidd, A.; Beckman, M. Creating a Policy Environment for Pro-Poor Agricultural Extension: The Who? What? And How? Nat. Resour. Perspect. 2002, 80, 1356–9228. [Google Scholar]

- Lee, H.-L. Information Spaces and Collections: Implications for Organization. Libr. Inf. Sci. Res. 2003, 25, 419–436. [Google Scholar] [CrossRef]

- Cabrini, S.M.; Irwin, S.H.; Good, D.L. Style and Performance of Agricultural Market Advisory Services. Am. J. Agric. Econ. 2007, 89, 607–623. [Google Scholar] [CrossRef]

- Karami, E.; Rezaei-Moghaddam, K. Determinants of Agricultural Cooperatives’ Performance in Iran. Agric. Econ. 2005, 33, 305–314. [Google Scholar] [CrossRef]

- Vogelsang, I. Incentive Regulation and Competition in Public Utility Markets. J. Regul. Econ. 2002, 22, 5–27. [Google Scholar] [CrossRef]

- Cabrini, S.M.; Stark, B.G.; Önal, H.; Irwin, S.H.; Good, D.L.; Martines-Filho, J. Efficiency Analysis of Agricultural Market Advisory Services. MSOM 2004, 6, 237–252. [Google Scholar] [CrossRef]

- Hibbard, J.D.; Kumar, N.; Stern, L.W. Destructive Acts in Marketing Channel Relationships. J. Mark. Res. 2001, 38, 45–61. [Google Scholar] [CrossRef]

- Coase, R.H. The Nature of the Firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Wang, W.; Xu, Q.; Zhou, X. Land Trusteeship and Agricultural Service Scale Operation. J. Shandong Univ. Financ. Econ. 2017, 29, 87–95, 105. [Google Scholar]

- Hu, L.; Wu, S. The Connotation and Realization of Land Trusteeship. Economist 2019, 12, 68–77. [Google Scholar]

- Kong, X.; He, X. Reform of Supply and Marketing Cooperatives. J. Xinjiang Norm. Univ. 2023, 44, 77–88. [Google Scholar]

- Du, H.; Chen, J.; Li, Y. Agricultural Production Trusteeship and Interest Linkage. Rural. Econ. 2021, 1, 31–38. [Google Scholar]

- Mu, N.; Kong, X.; An, X. Risk-Sharing Mechanism of Land Trusteeship. Price China 2018, 03, 66–69. [Google Scholar]

- Chen, Y. Risk Perception and Land Trusteeship Decision-Making. Master’s Thesis, Northeast Agricultural University, Harbin, China, 2024. [Google Scholar]

- Wang, Y.; Xiao, J.; Huo, Y. Risk Identification Index System of Rural Land Trusteeship. Anhui Agric. Sci. 2023, 51, 218–223. [Google Scholar]

- Jiang, C. Four Relationships in Agricultural Production Trusteeship Services. Issues Agric. Econ. 2020, 09, 55–63. [Google Scholar]

- Wang, Q. Deepening Rural Property Rights Reform. Agric. Econ. 2024, 10, 107–109. [Google Scholar]

- Yu, H.; Zhang, Z. Mechanism, Conditions and Risk Avoidance of Land Trusteeship. Reform 2018, 04, 110–119. [Google Scholar]

- Guo, L.; Zhao, D.; Chen, G.; Yan, L.; Feng, P.; Wang, Y. Spatiotemporal Characteristics of Land Use in Zhengzhou (2000–2020). Reg. Res. Dev. 2023, 42, 149–154. [Google Scholar]

- Rehemanrukiya; Kasmu, A.; Duolat, X.; Wei, B.; Zhang, X.; Liang, H. Carbon Storage in Northern Tianshan Urban Agglomeration. China Environ. Sci. 2022, 42, 5905–5917. [Google Scholar]

- Xiaowei, Y.; Jie, Z.; Wangjun, L. Urbanization and Land Ecosystem Service Value in Wuhan. DBKXXB 2015, 31, 249–256. [Google Scholar]

- Feng, Y.; Ke, M.; Zhou, T. Non-Grain Production of Cultivated Land in China. Sustainability 2022, 14, 14286. [Google Scholar] [CrossRef]

- Anselin, L.; Bera, A.K.; Florax, R.; Yoon, M.J. Spatial Dependence Tests. Reg. Sci. Urban Econ. 1996, 26, 77–104. [Google Scholar] [CrossRef]

- Wen, Y.; Zhang, Z. Social Risks of Farmers’ Centralized Residence. China Land Sci. 2018, 32, 21–27. [Google Scholar]

- Qiu, Y.; Zhou, J.; Tang, L. Risk Forecast and Safety Management in Agricultural Outsourcing. Mob. Inf. Syst. 2022, 2022, 5489118. [Google Scholar]

- Anderson, E.; Monjardino, M. Contract Design in Agricultural Supply Chains. Eur. J. Oper. Res. 2019, 277, 1072–1082. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, S.; Chen, Y. Urban–Rural Equalized Development Patterns in China. J. Rural Stud. 2013, 32, 320–330. [Google Scholar] [CrossRef]

- Yang, L.; Bingpu, C.; Lanlan, H. Agricultural Socialized Service in China. J. Chin. Agric. Mech. 2022, 43, 229. [Google Scholar] [CrossRef]

- Zhang, M.; Tan, S.; Chen, E.; Li, J. Land Disputes in China: Spatio-Temporal Characteristics and Influencing Factors. Ecol. Indic. 2024, 160, 111938. [Google Scholar] [CrossRef]

- Wang, Y. Impact of Land Transfer Direction on Land Disputes. Ind. Innov. Res. 2020, 16, 9–13. [Google Scholar]

- Liu, F.; Li, Y.; Liu, X.; Yu, S. Spatial–temporal changes in meteorological and agricultural droughts in Northeast China: Change patterns, response relationships and causes. Nat. Hazards. 2021, 109, 2191–2212. [Google Scholar]

| Serial Number | Original Text | Initial Concept |

|---|---|---|

| 1 | In the first-instance judgment, the appellant was found to owe the appellee RMB 7102 in trusteeship service fees. The appellant argued that the court’s finding was inconsistent with the actual amount, asserting that the correct payable amount should be RMB 1803.50. | Disputes between trusteeship parties over the final trusteeship service price |

| 2 | The defendant Sun Fengxian contended that due to the poor quality of seeds provided by the plaintiff, her land experienced a reduced yield, producing only around 1200 jin per mu. The plaintiff also failed to inspect the field in person, ultimately resulting in lower revenue from the sale of her agricultural products. | Reduced agricultural yield caused by low-quality seeds, leading to decreased income from agricultural product sales |

| 3 | The plaintiff entrusted 15 mu of contracted farmland to a cooperative for trusteeship services. The seed and fertilizer fee was RMB 180 per mu for a three-year term, from 1 April 2019, to 31 March 2022. All inputs were centrally procured by the Jinhui Feng Cooperative. Later, due to rising input costs, the cooperative unilaterally decided to adjust the trusteeship price, but the parties failed to reach a new agreement. | Disputes over trusteeship pricing adjustments triggered by rising agricultural input costs and unilateral cost-cutting measures by cooperatives |

| 4 | In autumn, the plaintiff dispatched personnel to inspect the field and claimed that the land could yield 1700 jin per mu. However, due to the poor quality of the seeds provided by the plaintiff, actual yield was only about 1200 jin per mu. | Low-quality seed supply from the trusteeship provider resulted in yield reduction |

| 5 | Hua’ao Cooperative failed to fulfill its responsibilities throughout the entire farming period, including under-application of fertilizers and improper seed selection. Pesticide spraying was delayed by half a month compared to adjacent plots, and only occurred after repeated requests from the defendant. As a result, the autumn harvest was extremely poor due to inadequate field management. | Poor management by the trusteeship provider, including failure to implement large-scale operations, which led to crop losses and even total yield failure |

| 6 | The plaintiff’s claims regarding the contract and provision of seeds and fertilizer are factual. However, due to the poor quality of the seeds, our land yielded only around 1300 jin per mu instead of the normal 1600 jin. After on-site inspection, the plaintiff failed to take any remedial measures. Therefore, I only agree to pay RMB 900 for the seeds and fertilizer. | The farmer failed to fulfill the contractual obligation to pay for seeds and fertilizers |

| 7 | We did not pay the trusteeship fee of RMB 3600 on the grounds that the crop yield was too low. The corn yield was only 500 jin per mu, whereas the plaintiff had promised an expected yield of 2000 jin per mu. We believe we owe nothing to the plaintiff and instead, the plaintiff should compensate us for economic losses. | The farmer refused to pay the trusteeship fee on the grounds that the land management was substandard |

| 8 | Although the defendant, Dongnong Ecological Family Farm of Fuxin Mongol Autonomous County, agreed and expressed appreciation for the arrangement, it has yet to make payment. Except for RMB 10,000 in interest paid by Liaoning Gerui Agricultural Technology Service Co., Ltd. on its behalf, the principal and remaining interest are still outstanding. | The trusteeship provider defaulted on the payment of agreed compensation for losses |

| 9 | After negotiating with the two defendants, they initially agreed to compensate for the yield losses. However, after the plaintiff harvested the corn and brought it home, the Jinnongfeng Cooperative refused to compensate, and defendant Zhang Qishun also denied his prior commitment. Thus, the plaintiff initiated civil litigation. | The trusteeship provider breached its promise and refused to compensate for yield losses |

| 10 | The defendant fully and properly performed its contractual obligations within the contract period. However, due to the exceptionally high rainfall in June, July, and August 2022—reportedly the most in nearly 30 years in both Liaoning Province and Xinmin City—the reduced corn yield in low-lying areas with poor drainage was fundamentally caused by force majeure. | Reduced crop yield due to meteorological disasters |

| 11 | We orally agreed that the plaintiff would ensure a yield of 1500 jin per mu. However, due to pest infestation, actual yield dropped significantly to around 1200 jin per mu. The plaintiff did not send anyone for on-site inspection or to address the issue. | Reduced crop yield caused by pest and disease outbreaks |

| 12 | During contract performance, the appellee, Jinhui Feng Cooperative, provided the appellant with agricultural inputs such as fertilizer and seeds, but failed to fulfill other obligations including sowing and autumn harvest. | The trusteeship provider fulfilled only part of the agreed trusteeship obligations |

| 13 | On 10 April 2013, the plaintiff and defendant signed a rural land transfer (equity-based trusteeship) contract. The defendant undertook agricultural production via equity-based land trusteeship. The 2013 profit-sharing payment was made in full. However, the 2014 payment of RMB 5679, due on 1 December 2014, has remained unpaid. | Discrepancies between the two parties regarding the classification of the trusteeship contract |

| 14 | The appellee, Jinhui Feng Cooperative, claimed to have renegotiated the contract into a partial trusteeship agreement with the appellant Qin Fengmin, but Qin denied this. Furthermore, the appellee failed to provide sufficient evidence to support its claim. Therefore, the appellee should be deemed in breach of contract and bear corresponding liability. | The trusteeship provider subcontracted land use without the consent of the other party |

| 15 | In 2020 and again on 25 February 2021, the defendant, without approval from the village committee and the sixth group of villagers, unilaterally subleased 405.63 mu and 240 mu of contracted farmland to unrelated third parties, Li Jianwei and Li Dongbao, for corn cultivation. | The plaintiff initiated litigation due to the defendant’s failure to pay rent on time as stipulated in the contract |

| 16 | The plaintiff Zhang signed a land lease agreement with the defendant to lease 2.19 mu of contracted farmland. The 2013 rent was paid, but the 2014 lease payment of RMB 1971, due on 1 December 2014, remains unpaid despite multiple requests by the plaintiff and various excuses by the defendant. | The trusteeship provider failed to perform contractual obligations and unilaterally abandoned land management |

| 17 | In the contract dispute between plaintiff Jia Jinbao and defendant Liaoning Sanrui Agricultural Science and Technology Development Co., Ltd., the plaintiff provided 120 mu of land and a trusteeship fee of RMB 33,120 according to the agreement, but the defendant essentially abandoned management of the field. | The defendant failed to pay for agricultural products at the contractually agreed sale price, breaching the contract |

| 18 | During the autumn harvest, the plaintiff only received 16,800 jin of produce, and the defendant failed to pay at the agreed protective price of RMB 4.5 per jin. | The contract was deemed invalid due to the presence of a party lacking civil capacity in the trusteeship agreement |

| 19 | The defendant’s breach of contract caused the plaintiff significant financial losses. The plaintiff claimed a sunflower payment of RMB 75,600, compensation for losses totaling RMB 91,320, and other damages amounting to RMB 8475, for a total claim of RMB 175,395. | Reduced crop yield due to meteorological disasters |

| 20 | The plaintiff requested the court to order the defendant Deng Qingyi to pay RMB 6000 in trusteeship service fees, along with interest and liquidated damages as specified in the contract. However, Deng Qingyi is both deaf and mute, and unable to communicate normally. According to the law, he should be considered lacking civil capacity. Therefore, the three contracts signed by Deng Qingyi should be deemed invalid. | Reduced crop yield caused by pest and disease outbreaks |

| 21 | … | … |

| Conceptualization (Open Coding) | Categorization (Open Coding) | Axial Coding | Selective Coding |

|---|---|---|---|

| Disputes between trusteeship parties over service pricing; yield reduction leading to fluctuations in agricultural product revenues; trusteeship pricing disputes triggered by fluctuations in input costs | 1 Disputes over trusteeship service pricing 2 Fluctuations in agricultural product sales prices due to quality or yield issues 3 Variations in agricultural input prices affecting trusteeship fees | 1 Fluctuations in agricultural input prices 2 Trusteeship service pricing 3 Market demand volume 4 Fluctuations in agricultural product prices | Market Risk |

| Poor seed quality supplied by the trusteeship provider caused yield reduction; mismanagement by the trusteeship provider due to technical limitations or lack of large-scale operations, resulting in reduced or failed crop yields | 4 Yield reduction or crop failure caused by inadequate capacity or poor management by the trusteeship provider 5 Economic losses to farmers due to lack of technical expertise and operational experience of the trusteeship provider 6 High costs and low returns caused by inappropriate scale of trusteeship operations | 5 Insufficient operational qualifications and capabilities 6 Underdeveloped agricultural infrastructure 7 Lack of professional technical personnel 8 Scale of land trusteeship | Operational Risk |

| Farmer failed to fulfill contractual payment obligations for seeds and fertilizers; trusteeship provider breached commitment and refused to compensate for yield losses; farmer refused to pay the trusteeship fee, citing substandard land management; trusteeship provider defaulted on agreed compensation payments | 7 Disputes arising from farmers failing to pay trusteeship fees on time 8 Farmers’ refusal to pay land rent 9 Partial or complete refusal to pay trusteeship fees due to dissatisfaction with service outcomes 10 Trusteeship provider’s unwillingness to compensate for economic losses 11 Trusteeship provider’s prolonged failure to settle outstanding payments | 9 Poor cash flow 10 Payment of trusteeship fees 11 Difficulty in loan financing | Financial Risk |

| Extreme rainfall or pest and disease outbreaks resulted in agricultural yields or profits falling short of contractual expectations | 12 Yield reduction caused by meteorological disasters 13 Yield reduction caused by geological disasters 14 Yield reduction caused by pest or disease outbreaks | 12 Impact of natural disasters | Natural Hazard Risk |

| Partial fulfillment of trusteeship obligations; trusteeship provider defaulted on dividend payments for land equity participation; inconsistencies between parties in defining the type of trusteeship contract; trusteeship provider unilaterally subcontracted land use without consent; the existence of a party lacking civil capacity rendered the signed contract invalid | 15 Trusteeship provider cut corners and failed to deliver services in accordance with contractual terms 16 Trusteeship provider failed to pay profit returns as stipulated in the contract 17 Breach of contract due to unilateral changes in the type of trusteeship by the provider 18 Trusteeship provider violated the contract by subleasing the land to third parties without consent 19 The contract was rendered invalid due to the presence of a party lacking civil capacity | 13 Insufficient contract performance capacity of the trusteeship provider 14 Lack of civil capacity on the part of the trusteeship provider | Contractual Risk |

| Year | Central Longitude | Central Latitude | Short Axis/Long Axis | Azimuth Angle (°) |

|---|---|---|---|---|

| 2021 | 115.65 | 37.47 | 1.95 | 62.54 |

| 2022 | 118.98 | 40.94 | 2.37 | 64.96 |

| 2023 | 115.70 | 37.95 | 1.88 | 67.60 |

| Category | Moran’s I | Z-Value | p-Value | Spatial Autocorrelation |

|---|---|---|---|---|

| Total Number of Disputes | 0.300 | 4.41 | 0.000 | Significantly Positive Correlation |

| Risk Type | Central Longitude | Central Latitude | Short Axis/Long Axis | Azimuth Angle (°) |

|---|---|---|---|---|

| Market Risk | 115.01 | 38.62 | 0.47 | 73.64 |

| Operational Risk | 115.14 | 37.35 | 0.63 | 79.28 |

| Financial Risk | 115.14 | 37.35 | 0.63 | 79.28 |

| Natural Hazard Risk | 118.17 | 41.06 | 0.62 | 72.35 |

| Contractual Risk | 113.63 | 35.84 | 0.66 | 78.72 |

| Category | Moran’s I | Z-Value | p-Value | Spatial Autocorrelation |

|---|---|---|---|---|

| Market Risk | 0.025 | 4.259 | 0.000 | Significantly Positive Correlation |

| Operational Risk | 0.086 | 13.233 | 0.000 | Significantly Positive Correlation |

| Financial Risk | 0.124 | 4.670 | 0.000 | Significantly Positive Correlation |

| Natural Hazard Risk | 0.031 | 5.524 | 0.000 | Significantly Positive Correlation |

| Contractual Risk | 0.056 | 9.073 | 0.000 | Significantly Positive Correlation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiao, J.; Fang, X. Risk Identification and Spatiotemporal Evolution in Rural Land Trusteeship. Land 2025, 14, 1132. https://doi.org/10.3390/land14061132

Xiao J, Fang X. Risk Identification and Spatiotemporal Evolution in Rural Land Trusteeship. Land. 2025; 14(6):1132. https://doi.org/10.3390/land14061132

Chicago/Turabian StyleXiao, Jianying, and Xinran Fang. 2025. "Risk Identification and Spatiotemporal Evolution in Rural Land Trusteeship" Land 14, no. 6: 1132. https://doi.org/10.3390/land14061132

APA StyleXiao, J., & Fang, X. (2025). Risk Identification and Spatiotemporal Evolution in Rural Land Trusteeship. Land, 14(6), 1132. https://doi.org/10.3390/land14061132