Public-Private Partnerships in Urban Regeneration Projects: The Brazilian Context and the Case of “Porto Maravilha” in Rio de Janeiro

Abstract

1. Introduction

- How are PPP arrangements understood and applied in urban regeneration projects in the Brazilian context?

- Which CSFs are most relevant in the Brazilian context? Which factors could be better addressed?

- Which CFSs are most relevant in the “Porto Maravilha” case study? Which factors could be better addressed?

2. Materials and Methods

- Favorable legal and regulatory framework: laws and regulations that follow the country’s legislation at its different levels and that facilitate the development of partnerships, protecting the rights and interests of all parties.

- Government support and guarantees: Government support in the form of guarantees ensures the project’s financial viability and creditworthiness.

- Leadership focus: the capacity of the public sector to exercise its leadership role in implementing the partnership.

- Political support and stability: political stability at different levels beyond the period of a political mandate that can guarantee the continuity of the partnership.

- Standardization procedure for PPP projects: standardization of the process to assure the public sector that the partnership is carried out in accordance with governmental and local objectives and to facilitate the private sector to prepare for the partnership.

- Well-organized and committed public agency: organized and committed public body, with technical capacity and experience in partnerships.

- Available financial and capital market: available financial and capital markets allow for low financing costs and offer a diversified range of financial products.

- Community support: The community’s acceptance, understanding, and participation are important to ensure the smooth running of the PPP, avoid delays, facilitate the hiring of local labor, provide projects valued by citizens, manage expectations, and mitigate disagreements.

- Favorable socio-economic factors: a favorable socio-economic scenario in which the public sector and the population have a robust payment capacity, creating an environment that encourages partnerships.

- Stable macroeconomic conditions and sound economic policy: sound economic policy capable of creating a stable and growing economic environment, allowing for a low cost of capital and greater certainty in the market, thus reducing risks.

- Availability of resources and a skilled and dedicated team of professionals: because these are long processes, it is necessary to guarantee resources for the PPP during the transition; furthermore, it is essential to have a dedicated and competent team of professionals to accompany the entire PPP.

- Clearly defined responsibilities and roles: the different roles and functions of the actors involved have been clearly defined already in the preparation phase.

- Clear project scope definition and documentation: clear definition, already in the preparation phase, of the project documentation, including objective, scope, geographical area, technical project, functional responsibilities, and previous experience in similar projects.

- Comprehensive and business viability of project feasibility study: a comprehensive business feasibility study of the project, including technical feasibility studies, financial and socio-economic analyses, and realistic assessments of costs and benefits.

- Good governance: managing the relationships between the actors involved is essential at all stages of the PPP, including the preparatory phase.

- Availability of resources and a skilled and dedicated team of professionals: just as in the preparatory phase, the availability of resources and a team to accompany the PPP is fundamental during the contracting phase.

- Competitive and standardized bidding process: a standardized process must define the rules a priori and present them to bidders, facilitating the preparation of bids and allowing them to be fairly compared; the competitive process, in turn, guarantees the best cost-benefit ratios.

- Transparent procurement process: a transparent procurement process that reduces transaction costs and shortens negotiation and contracting times.

- Trust and openness: openness between the parties to create trust and a solid relationship, increasing their willingness to cooperate.

- Commitment and responsibility of public and private sectors: the commitment of both parties to the objectives of the partnership and the project, including allocating their best resources.

- Effective conflict management: effective and efficient conflict management, as early as possible, and involving those responsible in both sectors, to avoid aggravating the conflict and compromising the partnership.

- Effective contract management: effective and efficient contract management by controlling costs, time, security, materials, techniques, and skills to avoid renegotiations and compromising the partnership.

- Good governance: managing the relationships between the different players involved is important at all stages of the PPP arrangements, including the contract management phase.

- Open and constant communication among stakeholders: openness and communication between all the actors involved—not just the public and private sectors—ensures that the interests and concerns of all parties are managed, increasing trust and commitment to project management.

3. Results

3.1. Brazilian Context

3.1.1. Enabling Environment in Brazil

3.1.2. Exogenous Factors in Brazil

3.2. “Porto Maravilha” Case Study

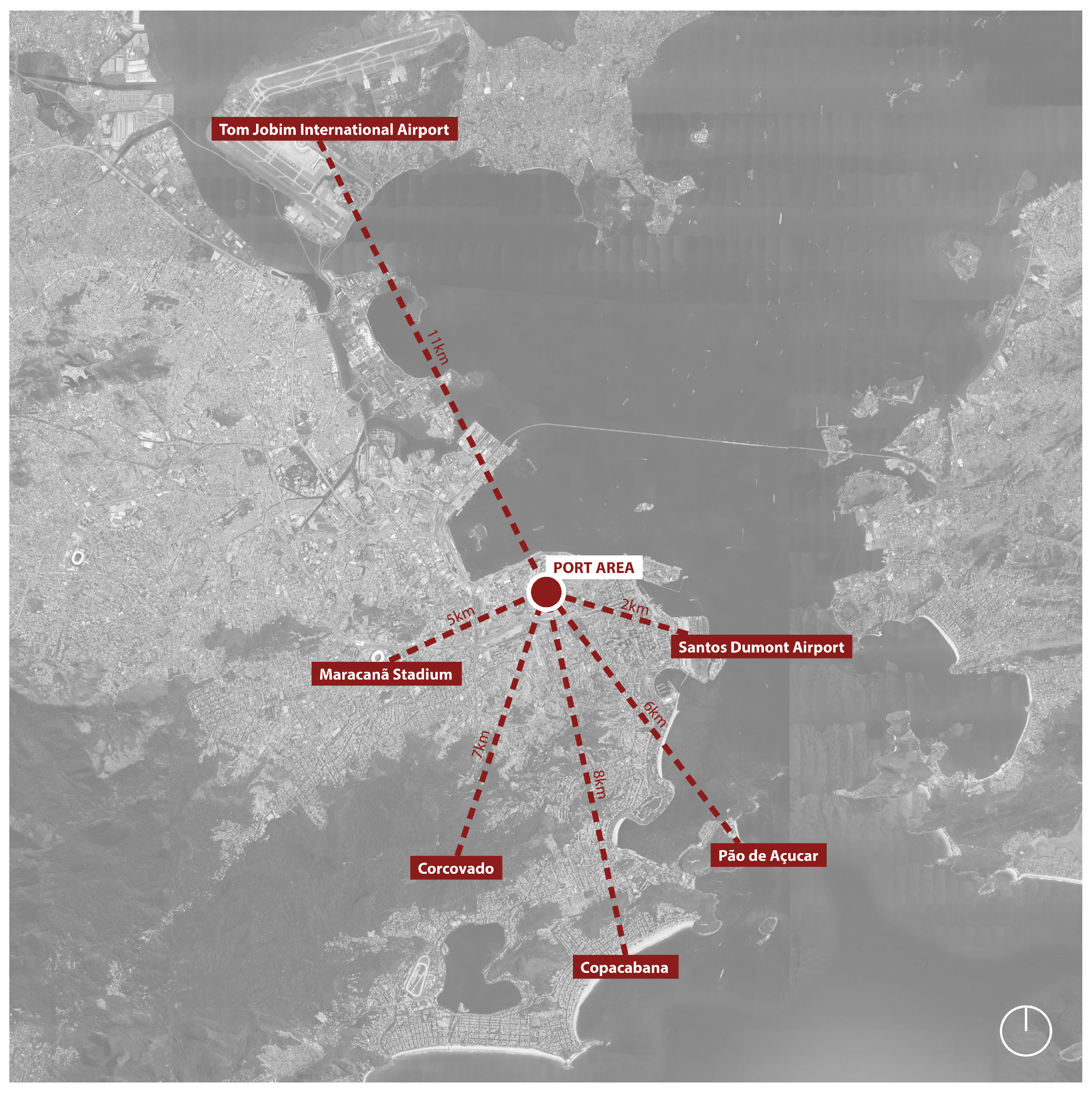

3.2.1. Context of Rio de Janeiro and the Port

3.2.2. Porto Maravilha Proposed Project

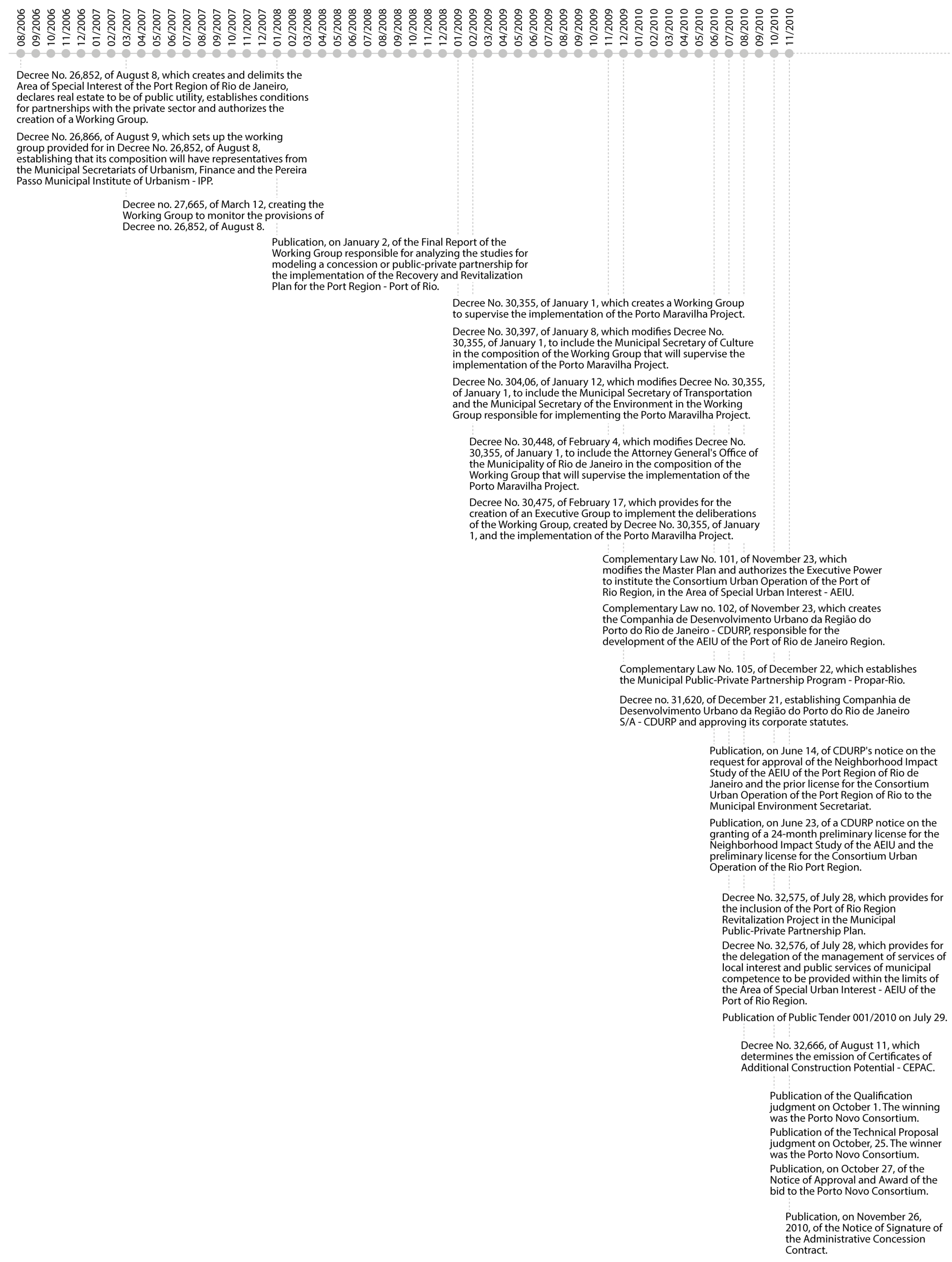

3.2.3. OUC Porto Maravilha

3.2.4. OUC and Project Porto Maravilha

4. Discussion

4.1. Brazilian Context

4.2. “Porto Maravilha” Case Study

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| How was Rio de Janeiro’s port area before the project? |

| What was the context of the Porto Maravilha OUC and PPP? |

| Which external entities were involved? |

| How do you evaluate the urban results obtained through the area’s regeneration? What aspects do you see as positive, and what could be addressed better? |

| How do you evaluate the partnership between the public sector and the Porto Novo Consortium? What aspects do you see as positive, and what could be addressed better? |

| Were there any conflicts observed during the development of the Porto Maravilha partnership and project? How were these conflicts managed? |

| How did the local population receive the Porto Maravilha partnership and project? Was there support or opposition? |

| If the process was done again, what could be done differently? |

References

- Amirtahmasebi, R.; Orloff, M.; Wahba, S.; Altman, A. Regenerating Urban Land: A Practitioner’s Guide to Leveraging Private Investment; World Bank Publications: Washington, DC, USA, 2016. [Google Scholar]

- de Paula, P.V.; Marques, R.C.; Gonçalves, J.M. Public–Private Partnerships in Urban Regeneration Projects: A Review. J. Urban Plan. Dev. 2023, 149, 04022056. [Google Scholar] [CrossRef]

- Berrone, P.; Ricart, J.E.; Duch, A.I.; Bernardo, V.; Salvador, J.; Piedra Peña, J.; Rodríguez Planas, M. EASIER: An Evaluation Model for Public–Private Partnerships Contributing to the Sustainable Development Goals. Sustainability 2019, 11, 2339. [Google Scholar] [CrossRef]

- Habitat, U.N. Public-Private Partnerships in Housing and Urban Developments; UN-HABITAT: Nairobi, Kenya, 2011. [Google Scholar]

- Brasil. Lei No. 11.079, de 30 de Dezembro de 2004—Institui Normas Gerais Para Licitação e Contratação de Parceria Público Privada No Âmbito Da Administração Pública. 2004. Available online: https://www.planalto.gov.br/ccivil_03/_ato2004-2006/2004/lei/l11079.htm (accessed on 1 September 2024).

- Brasil. Lei No. 10.257, de 10 de Julho de 2001—Regulamenta Os Arts. 182 e 183 da Constituição Federal, Estabelece Diretrizes Gerais da Política Urbana e dá Outras Providências. 2001. Available online: https://www.planalto.gov.br/ccivil_03/leis/leis_2001/l10257.htm (accessed on 1 September 2024).

- World Bank. Porto Maravilha—Case Study. Urban Regeneration KSB; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Fortune, J.; White, D. Framing of Project Critical Success Factors by a Systems Model. Int. J. Proj. Manag. 2006, 24, 53–65. [Google Scholar] [CrossRef]

- Leidecker, J.K.; Bruno, A.V. Identifying and Using Critical Success Factors. Long Range Plan. 1984, 17, 23–32. [Google Scholar] [CrossRef]

- Vale de Paula, P.; Cunha Marques, R.; Gonçalves, J.M. Critical Success Factors for Public–Private Partnerships in Urban Regeneration Projects. Infrastructures 2024, 9, 195. [Google Scholar] [CrossRef]

- Brasil. Lei No. 8.987, de 13 de Fevereiro de 1995—Dispõe Sobre o Regime de Concessão e Permissão da Prestação de Serviços Públicos Previsto No Art. 175 da Constituição Federal, e dá Outras Providências. 1995. Available online: https://www.planalto.gov.br/ccivil_03/leis/l8987compilada.htm (accessed on 1 September 2024).

- Brasil. Lei No. 9.074, de 7 de Julho de 1995—Estabelece Normas Para Outorga e Prorrogações das Concessões e Permissões de Serviços Públicos e dá Outras Providências. 1995. Available online: https://www.planalto.gov.br/ccivil_03/leis/l9074cons.htm (accessed on 1 September 2024).

- Brasil. Lei n. 8.666, de 21 de Junho de 1993—Regulamenta o Art. 37, Inciso XXI, da Constituição Federal, Institui Normas Para Licitações e Contratos da Administração Pública e dá Outras Providências. 1993. Available online: https://www.gov.br/saude/pt-br/acesso-a-informacao/banco-de-precos/legislacao/lei-no-8-666-de-21-de-junho-de-1993.pdf/view (accessed on 1 September 2024).

- Brasil. Lei n. 14.133 de 1 de Abril de 2021—Lei de Licitações e Contratos Administrativos. 2021. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2021/lei/l14133.htm (accessed on 1 September 2024).

- Brasil. Lei n. 9.307, de 23 de Setembro de 1996—Dispõe Sobre a Arbitragem. 1996. Available online: https://www.planalto.gov.br/ccivil_03/leis/l9307.htm (accessed on 1 September 2024).

- Rolnik, R.; Saule Júnior, N. Estatuto da Cidade: Guia Para Implementação Pelos Municípios e Cidadãos; Polis: Brasília, Brazil, 2001. [Google Scholar]

- Guilhen, A.J. A Parceria Público-Privada Como Instrumento Urbanístico: O Caso do Município de São Paulo-SP; UFSCAR: São Carlos, Brazil, 2014. [Google Scholar]

- ANBIMA. Capital Markets in Brazil. 2024. Available online: https://international.anbima.com.br/reports/brazilian-industry (accessed on 1 September 2024).

- Chambers and Partners. BRAZIL: An Introduction to Capital Markets Law. 2024. Available online: https://chambers.com/content/item/5398 (accessed on 1 September 2024).

- Thamer, R.; Lazzarini, S.G. Projetos de Parceria Público-Privada: Fatores Que Influenciam o Avanço Dessas Iniciativas. Rev. Adm. Pública 2015, 49, 819–846. [Google Scholar] [CrossRef]

- Itaparica, A.L.M. Transparência Em Parcerias Público-Privadas No Brasil: Uma Análise dos Desafios e Perspectivas da Produção Técnico-Científica; Instituto Serzedello Corrêa, Escola Superior do Tribunal de Contas da União: Brasílila, Brazil, 2023. [Google Scholar]

- Melo-Silva, G.; Lourenço, R.L.; Angotti, M. Parcerias Público-Privadas: Modernização Administrativa e Relacionamentos Econômicos Imersos Em Conflitos de Interesse e Corrupção. Rev. Adm. Pública 2021, 55, 538–558. [Google Scholar] [CrossRef]

- Balakrishnan, R.; ToSCANI, F.; Vargas, M. Poverty and Inequality in Brazil and Latin America. In Brazil: Boom, Bust, and the Road to Recovery; World Bank: Washington, DC, USA, 2018; pp. 139–169. [Google Scholar]

- World Bank. The World Bank in Brazil. 2024. Available online: https://www.worldbank.org/en/country/brazil/overview (accessed on 1 September 2024).

- World Bank. Brazil Poverty and Equity Assessment: Looking Ahead of Two Crises; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Raymundo, G. Towards Urban Waterfront Redevelopment. The Case of Rio de Janeiro; Cogitatio Press: Lisbon, Portugal, 2006. [Google Scholar]

- Sampaio, M.M. Operação Urbana Consorciada Porto Maravilha: Estudo de Caso de Uma Parceria Público-Privada; Universidade Federal do Rio de Janeiro, Instituto de Economia: Rio de Janeiro, Brazil, 2014. [Google Scholar]

- Davies, M.; Pontes Nogueira, J. A Wonderful Global City? Resisting Urban Regeneration in Olympic Rio. J. Int. Relat. Dev. (Ljubl) 2023, 26, 530–556. [Google Scholar] [CrossRef]

- Rossi, B.S.d.C. Dependência e Gestão Urbana: Analisando a Presença do Capital Estrangeiro No Porto Maravilha; Universidade Federal do Rio de Janeiro, Instituto de Pesquisa e Planejamento Urbano e Regional: Rio de Janeiro, Brazil, 2022. [Google Scholar]

- Rodrigues, J.V. Camadas de Memória Entre o Mar e o Morro: Da Pequena África Ao Porto Maravilha; Universidade de Brasília: Brasília, Brazil, 2013. [Google Scholar]

- Werneck, M. Porto Maravilha: Agentes, Coalizões de Poder e Neoliberalização No Rio de Janeiro; Universidade Federal do Rio de Janeiro: Rio de Janeiro, Brazil, 2016. [Google Scholar]

- Rio de Janeiro. 2023. Available online: https://www.ccpar.rio/projeto/porto-maravilha/operacao-urbana/ (accessed on 1 September 2024).

- Rio de Janeiro. Lei Complementar No. 101, de 23/11/2009, Que Modifica o Plano Diretor e Autoriza o Poder Executivo a Instituir a Operação Urbana Consorciada da Região do Porto do Rio, Na Área de Especial Interesse Urbanístico—AEIU; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 26852, de 08/08/2006, Que Cria e Delimita a Área de Especial Interesse da Região Portuária do Rio de Janeiro Para Que Indica, Declara de Utilidade Pública Imóveis, Estabelece Condições Para Parceria Com o Setor Privado e Autoriza a Cons-Tituição de Grupo de Trabalho; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2006. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 26866, de 09/08/2006, Que Constitui o Grupo de Trabalho Previsto No Decreto n.o 26852, de 08/08/2006, Esta-Belecendo Que a Sua Composição Terá Representantes das Secretarias Municipais de Urbanismo, Fazenda e do Instituto Municipal de Urbanismo Pereira Passo—IPP; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2006. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 27665, de 12/03/2007, Que Cria o Grupo de Trabalho Para Acompanhar as Disposições Constantes No Decreto n.o 26852, de 08/08/2006. Fica Estabelecida a Data de 10/09/2007 Como Limite Para Entrega dos Estudos Relacionados Ao Projeto; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2007. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 30355, de 01/01/2009, Que Cria Grupo de Trabalho Para Supervisionar a Implantação do Projeto Porto Mara-Vilha; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 30397, de 08/01/2009, Que Altera o Decreto Municipal n.o 30355, de 01/01/2009, Para Incluir a Secretaria Mu-Nicipal de Cultura Na Composição do Grupo de Trabalho Que Supervisionará a Implantação do Projeto Porto Maravilha; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 30406, de 12/01/2009, Que Altera o Decreto Municipal n.o 30355, de 01/01/2009, Para Incluir a Secretaria Mu-Nicipal de Transportes e a Secretaria Municipal de Meio Ambiente No Grupo de Trabalho Que Cuida Da Implantação do Projeto Porto Maravilha; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 30448, de 04/02/2009, Que Altera o Decreto Municipal n.o 30355, de 01/01/2009, Para Incluir a Procuradoria Geral Do Município do Rio de Janeiro Na Composição Do Grupo de Trabalho Que Supervisionará a Implantação do Projeto Porto Maravilha; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto Municipal No. 30475, de 17/02/2009, Que Dispõe Sobre a Criação de Grupo Executivo Para Implementação das Deliberações Do Grupo de Trabalho, Criado Pelo Decreto Municipal n.o 30355, de 01/01/2009, e Implantação do Projeto Porto Maravilha; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Barandier, H.; Machado, D.P. “Porto Maravilha” e o Destino Da Área Portuária No Rio de Janeiro. In Proceedings of the III Encontro da Associação Nacional de Pesquisa e Pós-Graduação em Arquitetura e Urbanismo, São Paulo, Brazil, 20–24 October 2024; Volume 3. [Google Scholar]

- Rio de Janeiro. Lei Complementar No. 102, de 23/11/2009, Que Cria a Companhia de Desenvolvimento Urbano Da Região Do Porto Do Rio de Janeiro—CDURP, Responsável Pelo Desenvolvimento da AEIU Da Região do Porto do Rio de Janeiro; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Lei Complementar No. 105, de 22/12/2009, Que Institui o Programa Municipal de Parcerias Público-Privadas—Propar-Rio; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Rio de Janeiro. Decreto No. 31620, de 21/12/2009, Que Institui a Companhia de Desenvolvimento Urbano da Região do Porto do Rio de Janeiro S/A—CDURP e Aprova Seu Estatuto Social; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2009. [Google Scholar]

- Amaro, G.O. O Poder Público Como Stakeholder Das Empresas: A Iniciativaprivada e o Estado No Projeto Porto Maravilha; Fundação Getúlio Vargas: Rio de Janeiro, Brazil, 2017. [Google Scholar]

- Rio de Janeiro. Decreto No. 32575, de 28/07/2010, Que Dispõe Sobre a Inclusão do Projeto de Revitalização da Região do Porto do Rio No Plano Municipal de Parcerias Público-Privadas; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2010. [Google Scholar]

- Rio de Janeiro. Decreto No. 32576, de 28/07/2010, Que Dispõe Sobre a Delegação Da Gestão Dos Serviços de Interesse Local e Serviços Públicos de Competência Municipal a Serem Prestados Nos Limites da Área de Especial Interesse Urbanístico—AEIU Da Região do Porto Do Rio; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2010. [Google Scholar]

- Rio de Janeiro. Edital de Licitação—Concorrência Pública No. 001/2010 Para Contratação, Em Regime de Parceria Público Privada, Modalidade Concessão Administrativa, da Revitalização, Operação e Manutenção da AEIU da Região Portuária do Rio de Janeiro; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2010. [Google Scholar]

- Rio de Janeiro. Decreto No. 32666, de 11/08/2010, Que Determina a Emissão dos Certificados de Potencial Adicional de Construção—CEPAC; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2010. [Google Scholar]

- Radar PPP. Porto Maravilha (Município do Rio de Janeiro)—Radar PPP. 2010. Available online: https://radarppp.com/resumo-de-contratos-de-ppps/porto-maravilha-municipio-do-rio-de-janeiro/ (accessed on 1 September 2024).

- Rio de Janeiro. 1o. Termo Aditivo Ao Contrato da Parceria Público-Privada—PPP Na Modalidade de Concessão Administrativa, Celebrado Entre a Companhia de Desenvolvimento Urbano da Região do Porto do Rio, Como Contratante, e a Concessionária Porto Novo S/A, Como Contratada; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2012. [Google Scholar]

- Rio de Janeiro. Lei Complementar No. 147/2014, de 24/10/2014, Que Altera a Redação Do Art. 24 da Lei Complementar n.o 105, de 22/12/2009, Para Alterar o Limite Percentual Para Contratação de Parceria Público-Privada, de 3% (Por Cento) Para 5% (Cinco Por Cento) da Receita Corrente Líquida do Exercício e da Receita Corrente Líquida Projetada; Cria o Parágrafo Único Para Vincular a Alteração dos Limites à Modificação da Lei Federal n.o 11.079, de 30/12/2004; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2014. [Google Scholar]

- Rio de Janeiro. Decreto No. 46787, de 07/11/2019, Que Cria Grupo de Trabalho Com a Finalidade de Analisar Documentação e Apurar Possíveis Dis-Torções Na Execução do Contrato de Concessão Administrativa Contrato PPP-01; Câmara Municipal do Rio de Janeiro: Rio de Janeiro, Brazil, 2019. [Google Scholar]

| Interviewee 1 | Former president of the public company responsible for Porto Maravilha |

| Interviewee 2 | Former employee of the Private Consortium |

| Interviewee 3 | Employee of the Port Authority of Rio de Janeiro |

| Interviewee 4 | Representative of the local community (Morro da Providencia) |

| Interviewee 5 | Academic and researcher on the Porto Maravilha project |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vale de Paula, P.; Cunha Marques, R.; Gonçalves, J.M. Public-Private Partnerships in Urban Regeneration Projects: The Brazilian Context and the Case of “Porto Maravilha” in Rio de Janeiro. Land 2025, 14, 1055. https://doi.org/10.3390/land14051055

Vale de Paula P, Cunha Marques R, Gonçalves JM. Public-Private Partnerships in Urban Regeneration Projects: The Brazilian Context and the Case of “Porto Maravilha” in Rio de Janeiro. Land. 2025; 14(5):1055. https://doi.org/10.3390/land14051055

Chicago/Turabian StyleVale de Paula, Paula, Rui Cunha Marques, and Jorge Manuel Gonçalves. 2025. "Public-Private Partnerships in Urban Regeneration Projects: The Brazilian Context and the Case of “Porto Maravilha” in Rio de Janeiro" Land 14, no. 5: 1055. https://doi.org/10.3390/land14051055

APA StyleVale de Paula, P., Cunha Marques, R., & Gonçalves, J. M. (2025). Public-Private Partnerships in Urban Regeneration Projects: The Brazilian Context and the Case of “Porto Maravilha” in Rio de Janeiro. Land, 14(5), 1055. https://doi.org/10.3390/land14051055