Abstract

Fiscal and land policies are important tools in developing agriculture in China. Understanding how agricultural subsidies and land fragmentation jointly affect agricultural Total Factor Productivity (TFP) is crucial for building a strong agricultural nation. This paper utilizes microdata from fixed observation points in rural China from 2003 to 2017 and employs panel bidirectional fixed-effect models and moderation-effect models to empirically analyze the impact of agricultural subsidies and land fragmentation on agricultural TFP. The research finds: (1) Agricultural subsidies positively affect agricultural TFP, while land fragmentation leads to decreased agricultural TFP. (2) Land fragmentation hinders the positive effects of agricultural subsidies on agricultural TFP. A 1% increase in land fragmentation could lead to approximately a 3% decrease in the enhancement effect of agricultural subsidies, with significant impacts on households in major grain-producing areas and those primarily engaged in agriculture. (3) There is no evidence that reforms in the “three agricultural subsidies” would alter the combined effect of agricultural subsidies and land fragmentation on agricultural TFP. The obstructive role of land fragmentation cannot be mitigated through the “three agricultural subsidies” reform. The study indicates that the incentivizing role of agricultural subsidies has not been fully realized, and land fragmentation remains a key bottleneck in agricultural development. Fiscal support for agriculture should be coupled with effective land reform policies for synergistic efforts.

1. Introduction

For the first time, the report delivered at the 20th Communist Party of China (CPC) National Congress included the goal of “building a strong agricultural country”. It proposed to comprehensively promote rural vitalization, adhere to the priority of agriculture and rural development, consolidate and expand the achievements of poverty alleviation, and accelerate the building of an agricultural power. The important position of agriculture in China has led to the continuous introduction and implementation of various policies to promote high-quality development of agriculture and rural areas. According to the “China Statistical Yearbook” data, since 2003, the scale of national fiscal expenditure on agriculture has grown from CNY 1754.45 billion in 2003 to CNY 22,034.50 billion in 2021. The proportion of agricultural expenditure in the national fiscal expenditure has increased from 7.12% to 8.97%. Notably, from 2018 to 2020, the proportion of agricultural expenditure in the total fiscal expenditure consistently exceeded 9.50%, reaching 9.75% in 2020. From 2004 to 2023, the CPC Central Committee has focused on agriculture, rural areas, and farmers for two decades, issuing the No. 1 central document on agriculture, rural areas, and farmers. Throughout this period, rural residents experienced an average annual real income growth of 6 percent, 1.24 percentage points higher than urban residents. The income ratio between urban and rural residents narrowed from 2.99:1 in 2010 to 2.56:1 in 2020. Grain production has achieved breakthrough growth, and the backward appearance of rural areas has been improved. By the end of 2020, 832 poverty-stricken counties in China were lifted out of poverty, and all 128,000 impoverished villages were removed from the list, achieving a miraculous reduction in poverty by eliminating absolute poverty.

However, while the effectiveness of fiscal support for agriculture policies is becoming evident, China’s various agricultural support policies still face issues regarding system, scale, structure, and other aspects. These problems have led to negative phenomena in agricultural development, such as rural marginalization, land idleness, and the last generation of farmers [1,2]. Among these issues, land fragmentation is a key factor hindering agricultural development. Fragmented land can directly lead to a waste of from 3% to 10% of arable land resources, significantly increasing agricultural production costs and severely reducing agricultural production efficiency [3,4,5]. The intensification of agricultural subsidies and the rise in agricultural production costs are two distinctly opposing factors in improving and increasing agriculture’s efficiency. The existence of land fragmentation inevitably negates the positive effects of fiscal support for agriculture. As a country with a long history of agriculture, China’s typical characteristics include a large agricultural population and relatively little arable land per capita. The rapid development of modern agriculture, the shift of rural labor to non-agricultural sectors, and an underdeveloped mechanism for urbanites to relinquish their land rights have all exacerbated the issue of land fragmentation. The Central No.1 Document of 2023 emphasizes the need to draw on local experiences of consolidating small plots into larger ones to enhance agricultural operations and combine farmland construction and land consolidation to address the fragmentation issue gradually. So, in the context of China’s national conditions with ‘small farmers in a large country,’ what exactly is the role of agricultural subsidies in agricultural development? Can mere agricultural subsidies be effective? Does land fragmentation lead to efficiency losses in agricultural subsidies? How should land policies and fiscal support for agriculture be coordinated? The answers to these questions are key to clarifying the relationship between fiscal support for agriculture and land reform and are also crucial for China to accelerate its transformation from a large agricultural country to a strong agricultural nation.

Accordingly, we must reassess the impact of agricultural subsidies and land fragmentation on agricultural development. This involves systematically addressing, theoretically and empirically, how agricultural subsidies and land fragmentation affect agricultural development, especially at the household level. Further analysis is conducted on the interactive effects of agricultural subsidies and land fragmentation and their heterogeneous impacts across household characteristics. This helps clarify effective collaborative pathways for land policies and agricultural fiscal support during the rural revitalization phase. Based on this, the paper constructs an input–output model for the agricultural sector that includes the impact of land fragmentation. It attempts to theoretically elucidate the mechanisms through which agricultural subsidies and land fragmentation affect agricultural development. Using microdata from national rural fixed observation points from 2003 to 2017, this study recalculates the Total Factor Productivity (TFP) at the household level and analyzes the individual, interactive, and heterogeneous effects of agricultural subsidies and land fragmentation on agricultural development through panel bidirectional fixed-effect models and moderation effect models. This provides theoretical and empirical support for achieving rural revitalization and accelerating the construction of a strong agricultural nation.

The marginal contribution of this paper is mainly reflected in three aspects: Firstly, this paper develops an input–output model of the agricultural sector, which includes the impact of land fragmentation. The goal is to theoretically explain how agricultural subsidies and land fragmentation affect agricultural total factor productivity. Secondly, land fragmentation is incorporated into the evaluation framework for the effect of agricultural subsidies, focusing on the impact of the economic characteristics of China’s smallholder farmers on policy implementation. This is done to provide necessary empirical evidence for subsequent policy formulation and reform. Thirdly, various heterogeneity analyses were conducted to comprehensively depict the interactive effects of agricultural subsidies and land fragmentation on agricultural total factor productivity, considering the characteristics of different regions and households in China. In summary, this paper enhances our theoretical understanding of the mechanisms behind agricultural subsidies and land fragmentation and provides valuable insights into the practical implications for policy development and reform. The heterogeneity analyses contribute to a nuanced understanding of how these factors interact in China’s diverse regional and household contexts.

2. Materials and Methods

2.1. Literature Review

From the perspective of international experience and industrial development, the agricultural industry is usually deprived and squeezed in the early stage of a country’s economic development and gradually transformed into a sector emphasizing protection in the middle and late stages of economic development [6]. China went through a period of negative agricultural protection (from the 1950s to the 1990s) and a period of agricultural granting balance (from the 1990s to the early 21st century). After 2004, China’s agricultural policy underwent a comprehensive transformation [7], and the agricultural tax was completely abolished in 2006. Various agricultural subsidy policies explored and practiced since then, such as subsidies for good crop varieties, direct subsidies for grain farmers, subsidies for farm machinery and tools, and comprehensive subsidies for agricultural supplies, have provided an important driving force for the development of agriculture, farmers and rural areas. Agricultural subsidies play a significant role in promoting agricultural added value and agricultural return on investment, and their role in increasing rural residents’ income and driving consumption has been tested many times [8,9,10].

Furthermore, compared with direct administrative intervention, market-based means such as agricultural subsidies have a more obvious effect on farmers’ planting structure adjustment [11]. However, the specific implementation of agricultural subsidy policies has also caused many controversies. It is a common problem that agricultural subsidies cannot improve farmers’ willingness to grow grain, and the incentive effect on large-scale and high-income farmers is not obvious [12,13,14]. The policy evaluation results of Huang et al., 2019 [15] on direct grain subsidies indicate that the small scale of operation mainly caused the lack of enthusiasm of Chinese farmers to grow grain. Although direct grain subsidies would increase farmers’ grain planting area in the short term, the increase was limited, and the effect gradually disappeared over time. Even though China’s agricultural subsidy standards and total amount have greatly exceeded those of developed countries, there is still a situation of weak agriculture and poor farmers co-existing [16]. Therefore, agricultural development must explore how to make agricultural subsidies play an effective role in avoiding financial and resource waste. In 2016, China merged subsidies for good crop varieties, direct subsidies for grain farmers, and comprehensive subsidies for agricultural supplies into agricultural support and protection subsidies and adjusted the subsidies to actual grain farmers with land management rights (rather than contract rights) to support the protection of cultivated land capacity and appropriate scale grain management. However, concerning the specific policy adjustment of agricultural subsidy reform, Xu et al., 2020 [17] and Yang et al., 2022 [18] both made a comparative analysis of the data before and after the reform and found that the agricultural support and protection subsidy did not have a significant impact on farmers’ land transfer behavior on the whole, but only large-scale farmers expanded their land transfer scale. In addition, the planting structure of farmers did not change significantly, and the land rent transformed by subsidies increased the cost pressure of small farmers’ land transfer. From an economic perspective, due to the distribution effect between land contractors and operators, the benefits are equally distributed between them no matter to whom the subsidies are given [19]. In addition to this phenomenon in China’s agriculture, the agricultural policies of the United States, the European Union, and other countries or regions have had similar effects [20,21]. It can be seen that the effect of agricultural subsidies on agricultural development does not seem to be directly reflected in the promotion of land circulation and increase in land scale, and the reform of a fiscal agricultural support policy aimed only at the subsidy object has not produced the desired effect, so from what dimension to evaluate the policy effect of agricultural subsidies has become a key issue in the implementation process of fiscal agricultural support policy.

In the chapter promoting high-quality development, the 20th CPC National Congress emphasized the importance of “improving the total factor productivity.” Considering that China has completed the development status of the initial stage of the agricultural support industry, it is necessary to pay attention to the direct contribution of agriculture to food security and the long-term contribution of economic and social stability in the development process in the next period [22]. Therefore, the study of the effect of agricultural subsidy policies and the efficiency or level of agricultural development should not be limited to the standard of crop yield and the equivalent number of employees but should turn to the qualitative measurement of agricultural production mode, organization mode, and management mode, that is, agricultural total factor productivity. From 1978 to 2016, the annual growth rate of agricultural scientific and technological progress in China was about 3%, much higher than the international average of 1%. Agricultural TFP contributed more than 56% to the total agricultural output value, surpassing the contribution rate of various input factors and becoming an important engine for agricultural development [23]. In the study on agricultural subsidies and agricultural TFP, Li et al., 2021 [24] used provincial panel data from 2003 to 2018 to test the promoting effect of agricultural subsidies on grain TFP and tried to explain it through structural effects and technical effects, and found that the policy effect was better in non-grain-producing areas than in major grain-producing areas. Xu et al., 2023 [25] conducted an empirical study on the impact of the subsidies for farm machinery and tools on agricultural total factor productivity by using the data of fixed observation points in rural areas throughout China from 2007 to 2017 and found that a positive and significant impact does exist, and it is more obvious in plains areas and large-scale farms. Nevertheless, only examining the single effect of agricultural subsidies on agricultural TFP is still a glimpse. Regarding the mechanism of agricultural subsidies, land is an important factor of production closely related to its effect. Whether it is the good seeds, agricultural machinery, and equipment supported by agricultural subsidies or the labor and capital owned by rural residents, they must be combined with land as a factor of production. For farmers engaged in farming, forestry, animal husbandry, fishery, and other agricultural activities, in addition to owning the necessary land (including arable land, forest land, pasture, pond, etc.), the land fragmentation degree directly affects the use of agricultural machinery and tools, the application of agricultural technology and the production efficiency of various labor factors.

Looking back at the history of China’s agricultural development, the household contract responsibility system (HRS) divided the scale operation of the production team into small-scale family operations. Under the historical background and development needs at that time, this measure stimulated farmers’ enthusiasm for production and greatly improved the efficiency of agricultural production. However, over time, the segmental mode of production and operation undoubtedly hindered the wide use of agricultural machinery, increased agricultural production costs and transaction costs, and reduced the scale economies of agricultural production [26,27]. Drawing on the experience of global agricultural modernization, Germany, the Netherlands, and Japan, as the typical representatives of agricultural powers facing the contradiction between humans and land, have all experienced the development stage of serious land fragmentation and low agricultural production efficiency. Breaking the restriction of land fragmentation has become an important link in their agricultural take-off. Germany’s per capita arable land area is only 0.14 hectares (about 2.16 mu). Under the comprehensive management of a series of laws and regulations, from 1949 to 1994, the number of agricultural organizations of less than 10 hectares in Germany was reduced from 1.4 million to 280,000, and the average farm size reached 29.8 hectares, with a cumulative expansion of 3.73 times. It has improved the efficiency of agricultural production while effectively guaranteeing post-war food security1. Before the 1950s, the Netherlands could still not meet its demand for agricultural products and needed to import a large amount of food and other agricultural products. But by 2020, after large-scale land management, the number of agricultural operating entities in the Netherlands has dropped from more than 300,000 at the beginning of the 20th century to more than 4000, and the average size of family farms has reached the highest-level set in the European Union. It has promoted the Netherlands’ agriculture to a leading position globally [28]. The smallholder peasant economy dominates agricultural operations in Japan, which is close to China regarding resource endowment. In 1960, the average farmland operation scale per household was only 0.88 hectares. However, after implementing effective measures such as farmland construction and land transfer, the average farmland operation area per household reached 2.22 hectares in 2015, nearly three times larger than in 1960. The concentration of agricultural land made the average income of rural residents exceed the national average [29]. It can be found that, as the inevitable result of industrialization and urbanization, the moderate concentration of agricultural land management scale is an important exogenous variable for the development of agricultural industry and an irresistible trend [30,31]. Therefore, the degree of land fragmentation is undoubtedly the key factor affecting agricultural development. The cases of Germany, the Netherlands, and Japan have to some extent given us thoughts on land governance and scale management, but any policy or reform will inevitably have two sides. The national conditions and characteristics of each country determine that the costs and benefits of a certain reform coexist, and opportunities and challenges coexist. Limited by the purpose of this study, the problems and challenges encountered in the land reform process in these countries are also worth discussing in future research. Focusing on the actual situation in China, in 2003, China’s average household land management scale was 7.5 mu, the average number of land blocks was 5.7, and the average area of each land block was only 1.3 mu. As of 2018, the average land operation scale of Chinese households has been less than 7.5 mu, and the average number of land blocks per household has still reached 5.5, and even the average number of land blocks per household has reached 9 in mountainous and hilly areas such as Chongqing and Sichuan [32]. China’s biggest agricultural feature and national condition is the small-scale peasant economy, which will last a long time [33]. The main contradiction in China’s agriculture is the agricultural production mode and production efficiency, and the key is to solve the problem of land fragmentation, achieve scale management, and build a modern production mode to curb the phenomenon of diminishing returns on capital and declining return on investment [27]. Therefore, when exploring the impact of agricultural subsidies on agricultural total factor productivity, it is necessary to measure the degree of land fragmentation to judge how precise measures should be taken to maximize the effect of agricultural subsidies in accelerating the construction of agricultural power.

In summary, existing research has primarily focused on analyzing the impact of agricultural subsidies on single dimensions, such as grain yield, farmer income, land transfer, and land scale, without delving into how agricultural subsidies affect the Total Factor Productivity (TFP), which is critical for long-term agricultural development. Meanwhile, although current studies have identified the influence of both agricultural subsidies and land factors on agricultural development, few have examined the extent of land fragmentation within the context of the impact of agricultural subsidies on agricultural development. In an era where fiscal subsidies are increasing, and land reforms are vigorously underway, exploring the collaborative effect of agricultural subsidies and land fragmentation in agricultural development has clear, practical significance and theoretical value. Based on this, this paper constructs an agricultural sector input–output model that includes the impact of land fragmentation. It attempts to theoretically clarify the mechanisms by which agricultural subsidies and land fragmentation affect agricultural development. Using microdata from fixed observation points in rural China from 2003 to 2017, this study recalculates the TFP at the household level in agriculture. Employing panel bidirectional fixed- and moderation-effect models, it analyzes the individual, interactive, and heterogeneous effects of agricultural subsidies and land fragmentation on agricultural development. This provides theoretical and empirical support for achieving rural revitalization and accelerating the construction of a strong agricultural nation.

2.2. Theoretical Analysis and Research Hypotheses

Suppose that the input–output of the agricultural sector conforms to the Cobb–Douglas form:

where, is the total agricultural output in period t, is the actual total input of labor in period t, is the actual total input of land in period t, is the actual total input of capital in period t, is the actual total input of intermediate goods in period t, and is the number of peasant households in period t. Accordingly, the total factor productivity is obtained by subtracting the contribution of input factors from the total agricultural output in period t.

If the number of farmers producing a certain crop is fixed in period t, then there is:

In this case, , , , , represents agricultural output, labor input, land input, capital input and intermediate product input at the peasant household level, respectively; represents the productive capacity of farmer households and describes the total factor productivity level at farmer household level; the parameter describes the actual control degree by farmers on factors, indicating that farmers with higher productivity can have a higher factor control ability under ideal conditions; the parameters , , , represent the output elasticity of labor, land, capital and intermediate products in agricultural production, respectively.

From this, it can be obtained that the agricultural total factor productivity at the farmer household level is:

The premise of the Cobb–Douglas production function is the assumption that the return to scale of production is constant when the technical level and factor price are unchanged, that is, . At this time, it is assumed that the financial input implemented to the agricultural subsidies at the farmer’s level can achieve a multiple of the input growth of various factors. The total agricultural output level under the condition of agricultural subsidies should achieve times growth based on :

However, from the traditional small-scale peasant economy to the agricultural division of labor stage, there is the possibility of increasing returns to scale in agricultural production [34]. In agricultural production practice, agricultural subsidies will change the production level of farmers by affecting the use of agricultural machinery and equipment and the application of agricultural technology, leading to changes in the total factor productivity of farmers, namely:

At this time, the relationship between agricultural subsidies and the total factor productivity of farmers may be , or , that is, agricultural subsidies will increase or decrease the total factor productivity of farmers. Because of the research conducted by many scholars using provincial panel data or single subsidy policies, it is proven that agricultural subsidies have a significant positive effect on TFP [25,26]. This paper proposes hypothesis 1 for agricultural TFP at the farm household level:

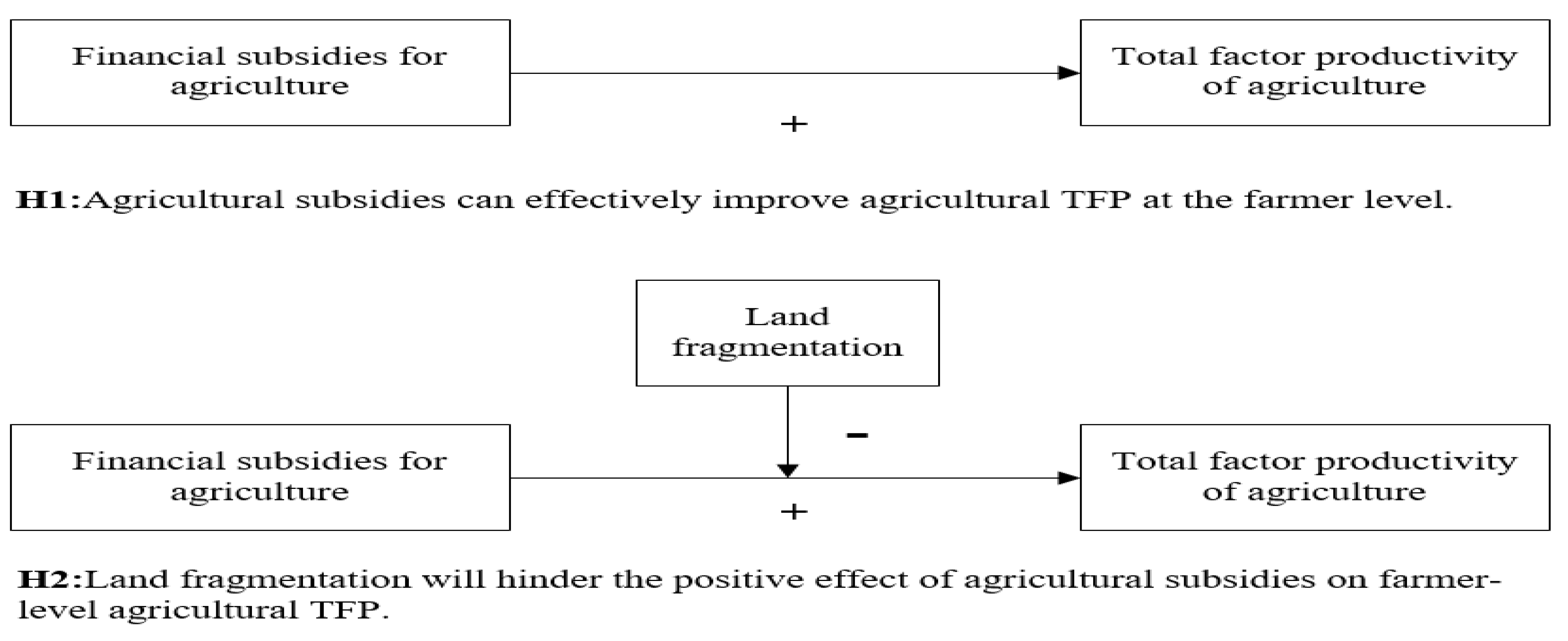

Hypothesis 1 (H1).

Agricultural subsidies can effectively improve agricultural TFP at the farmer level, that is, .

It can be seen that under the exogenous effect of agricultural subsidies, agricultural output is not only affected by the increase in factor input but also changes with the change in technical level, and the total agricultural output will increase by times compared with that of agricultural subsidies:

However, due to the existence of land fragmentation, farmers’ land input in most cases is not in the form of a complete piece of land but in the form of larger areas of land and smaller areas of land co-input agricultural production activities, namely:

where, ; total number of land blocks is . If expressed as the degree of land fragmentation, , that is, the proportion of small land area. The closer it is to 1, the more small-land-area farmers invest in land factors, and the land fragmentation problem is serious. The closer it is to 0, the larger the land area in farmers’ land factor input, and the land scale is stronger.

By substituting the degree of land fragmentation into Equation (5), land input can be expressed as:

By substituting Equation (9) into Equation (7), the total agricultural output, including the degree of land fragmentation, is:

where, , .

So, can be obtained based on Equation (10), that is, the higher the degree of land fragmentation, the lower the total agricultural output under the condition of agricultural subsidies, and the two are negatively correlated. According to the assumption that the return to scale of the production function is unchanged, the decline in the total agricultural output caused by the degree of land fragmentation comes from its negative effect on the total factor productivity, namely . At this time, due to the input of land fragmentation, the application of large-scale machinery and agricultural science and technology is affected to some extent, which destroys the original large-scale and agglomeration development and makes the total factor productivity at the farmer’s level fail to increase to the due degree, which may lead to the gap between the actual output and the theoretical output, that is, . Accordingly, hypothesis 2 is proposed in this paper:

Hypothesis 2 (H2).

Land fragmentation will hinder the positive effect of agricultural subsidies on farmer-level agricultural TFP, i.e., .

The specific mechanism is as follows Figure 1:

Figure 1.

Theoretical Analysis and Research Hypotheses.

2.3. Research Design

2.3.1. Data Source

The national rural fixed observation point data service used in this article is an annual farmer-level tracking survey database led by the Ministry of Agriculture and Rural Affairs of the People’s Republic of China. It has national representativeness and authority and is currently China’s largest sample size of farmer-level data.

To ensure the availability and continuity of data, this paper selects the data from fixed observation points in rural areas throughout China from 2003 to 2017 for empirical research. After cleaning, sorting, and matching the data of villages and farmers, only the farmers who participate in agricultural production are included in the analysis framework; that is, the agricultural output, labor input, land input, capital input, and intermediate product input all exist and are positive, and the samples with extreme values and abnormal values are reduced by 1%. Finally, 113,507 valid farmer samples are retained.

2.3.2. Model Setting

- (1)

- Model Setting for Measuring Agricultural Total Factor Productivity

The Solow residual accounting method of total factor productivity has experienced many developments. Olley and Pakes, 1996, [35] first proposed the two-step consistent estimation method of total factor productivity. Levinsohn and Petrin, 2003, [36] improved the OP method, enabling researchers to choose proxy variables more flexibly. Wooldridge, 2009, [37] improved the estimation methods of OP and LP, and proposed a one-step estimation method based on GMM, which also considered heteroscedasticity and sequence correlation and could obtain the total factor productivity under robust standard error. Therefore, the Wooldridge method was chosen in this paper to estimate agricultural TFP. Based on the Cobb–Douglas production function, the specific calculation model of agricultural total factor productivity is set as follows:

where, is the agricultural output of farmers in the year ; is the free variable, usually the variable that can change such as labor input; is the state variable, usually land, capital, and other variables that are not easy to change; is a proxy variable, which is used to represent the unobservable impact of production.

To further reduce the bias of estimating agricultural total factor productivity effectively, we make a series of adjustments based on the Wooldridge method. Firstly, we draw on the study of Wang et al., 2020 [38] to relax the potential assumption that the total agricultural output value is consistent with the intermediate input coefficient and regards the intermediate input as an important factor input. Secondly, to avoid the short-term changes in agricultural total factor productivity caused by technological shocks, the Solow residual method is used to measure agricultural TFP over a long period to weaken the impact of macroeconomic shocks effectively. To sum up, we take the total crop output as the output index, the day of labor entry, the productive fixed assets of farmers and the expenditure of productive services of households as free variables, the actual cultivated land managed by farmers at the end of the year as the state variable, and the total input cost of intermediate goods as the proxy variable. The logarithm of each index is taken to calculate the agricultural total factor productivity at the peasant household level from 2003 to 2017.

- (2)

- Model Setting to Measure the Impact of Agricultural Subsidies and Land Fragmentation on Agricultural TFP

After estimating agricultural total factor productivity, we investigate the impacts of agricultural subsidies and land fragmentation on agricultural total factor productivity by constructing a two-way fixed effect model and a moderating effect model.

First, the two-way fixed effect model can solve the endogeneity problem caused by missing variables as much as possible by controlling some household characteristics that do not change with time but change with individuals and some random characteristics that do not change with individuals but are related to time. The two-way fixed effect model is specified as follows:

where, is the agricultural output of farmer in the year ; is the agricultural subsidies received by farmer in the year , is the degree of fragmentation of land owned by farmer in the year ; is a constant term, and represents the effects of agricultural subsidies and land fragmentation on agricultural total factor productivity, respectively, in two formulas; represents a series of control variables, and is the corresponding coefficient of each control variable; , , respectively, represents individual fixed effect and time fixed effect; represents random interference items.

On this basis, to investigate the interaction between agricultural subsidies and land fragmentation, we introduce the interaction term between agricultural subsidies and land fragmentation based on the two-way fixed effect model and investigate the impact of their interaction on agricultural total factor productivity. The moderating effect model is set as follows:

where, denotes the interaction item between agricultural subsidies and land fragmentation, namely . , represents the effect of agricultural subsidies and land fragmentation on agricultural total factor productivity, and is the interaction effect coefficient of the two. The meanings of other symbols are consistent with the previous ones.

As for possible endogeneity problems, we analyze and deal with them as follows: first, there may be some unobservable characteristics at the level of farmers receiving agricultural subsidies, which may lead to endogeneity problems caused by sample self-selection; second, the acquisition of agricultural subsidies will affect the change in total factor productivity of farmers, but the increase in total factor productivity of farmers may also make it easier to obtain agricultural subsidies, so there may be endogenous problems caused by reverse causality. Based on this, to deal with the endogenous problem as much as possible, we construct the average subsidy amount at the provincial level as an instrumental variable and use two-stage least-squares estimation (2SLS). The specific approach is to divide the amount of financial subsidies for agriculture at the provincial level by the effective agricultural irrigation area of the whole province to calculate the amount of average subsidies for the whole province and multiply the actual cultivated land area of households at the end of the year at the farmer’s level to obtain the new amount of agricultural subsidies at the farmer’s level, and use this as the instrumental variable (IV) to perform two-stage least-squares estimation. Since provincial financial agricultural subsidies are coordinated with the agricultural development status of each province, the implementation situation in previous years, and the needs of rural residents, and the fact that the comprehensive situation in the same region will not change significantly, the number of agricultural subsidies over the years has a certain correlation [25], so the instrumental variable meets the correlation requirements. The acquisition of agricultural subsidies at the farmer’s level may be related to farmers’ production capacity and factor input. However, there is a large gap between the average amount of subsidies at the provincial level and the level of farmers’ production capacity, and there is no significant correlation between the two, so this instrumental variable meets the exogenous requirements. In addition, we replace the estimation method of agricultural total factor productivity in the robustness test to avoid the endogenous problems caused by measurement errors. At the same time, by adding the time dummy variable to characterize the policy impact, we examine whether the exogenous impact of the reform of the three subsidies for agriculture changes the effect of land fragmentation on agricultural subsidies on agricultural total factor productivity.

2.4. Variable Description

2.4.1. Variables Related to Agricultural Total Factor Productivity

Regarding the studies of Ayerst et al., 2020 [39] and Adamopoulos et al., 2022 [40], to obtain the agricultural total factor productivity that represents agricultural development, the following variables are selected for measurement in this paper: (1) Agricultural output. The output index is the total output of crops, mainly wheat, rice, corn, soybean, potato, cotton, oil, sugar, hemp, tobacco, vegetables, fruits, and other planting crops; (2) Land input. Compared with the area contracted by farmers, the area of cultivated land under management at the end of the year decreased the amount of cultivated land transferred and leased to others and increased the amount of cultivated land leased by others, which can more accurately reflect the actual land input of rural households. (3) Labor input. The labor input is measured by labor input day, including the labor days of domestic labor engaged in production activities and labor input by external labor. (4) Capital input. It is composed of the expenditure of farmers’ productive fixed assets (such as livestock, large and medium-sized iron and wood farm tools, power machinery for agriculture, forestry, animal husbandry, and fishery, large and medium-sized tractors for transportation, etc.) and household productive services (such as animal power costs, small farm tools purchase and repair costs, machinery operation costs and fixed assets depreciation and repair costs), using the perpetual inventory method to process the original value to get each year’s capital input value and taking 2003 as the base period, using the price index of agricultural means of production to carry out the capital input reduction treatment; (5) Input of intermediate goods. It mainly includes the expenditure of intermediate goods related to agricultural activities, such as seeds, seedlings, farm manure, fertilizer, agricultural film, pesticides, water, electricity irrigation, etc. After adding up all kinds of expenses, the CPI index is adjusted to 2003 as the base period.

The descriptive statistics of the variables used to calculate agricultural total factor productivity are shown in Table 1.

Table 1.

Describes the descriptive statistics of variables used to measure agricultural total factor productivity.

2.4.2. Core Explanatory and Control Variables

- (1)

- Agricultural subsidies. The annual income received by farmers from state finance includes various kinds of relief, disaster relief, pensions, subsidies related to agricultural activities, as well as subsidies for household appliances to the countryside, subsidies for cars and motorcycles to the countryside, survey subsidies, and other living subsidies. Based on the research needs of this paper, we sum up the agricultural subsidies received by farmers at the level of returning farmland to forest (grass) subsidies, direct grain subsidies, subsidies for good seeds, comprehensive subsidies for the purchase of means of production, subsidies for the purchase and renewal of large agricultural machinery and tools, to obtain agricultural subsidy indicators at the farmer level.

- (2)

- Land fragmentation. There are many indicators in the literature to characterize land fragmentation [41,42]. The single index includes the number of plots, the average area of plots, the average distance between plots, etc. Simpson’s index represents the composite index. Since the database does not provide relevant indicators of the specific area of each plot and the distance between different plots, Simpson’s index at the farmer’s level cannot be calculated. Therefore, combined with the existing research and data characteristics, we integrate the number of plots owned by farmers with the average plot size and measure the degree of land fragmentation at the farmer level with the proportion of land plots less than one mu in the total land plots of farmers.

- (3)

- Control variables. The control variables selected in this paper mainly include family characteristics and village characteristic variables. The family characteristic variables include household grain consumption2, annual net income, and income from going out to work. Village characteristic variables include total village population and village land scale.

In addition, all income variables (such as agricultural subsidies, annual household net income, and household income from migrant workers) are treated logarithmically, and the CPI index is deflated based on 2003.

The descriptive statistics of variables are shown in Table 2.

Table 2.

Descriptive statistics of variables.

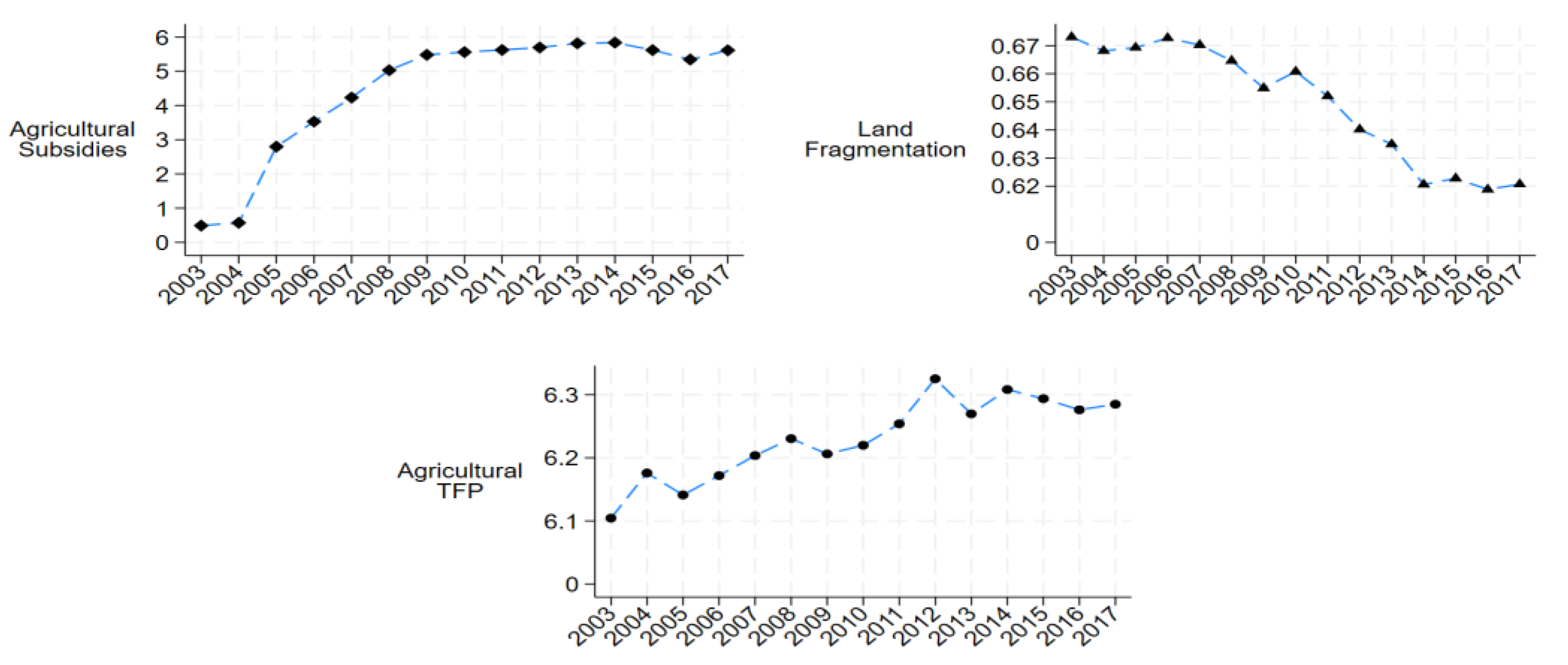

2.4.3. Trends of Agricultural Subsidies, Land Fragmentation, and Agriculture Total Factor Productivity

The change trends of three major indicators from 2003 to 2017 are plotted in Figure 2. It can be seen that agricultural subsidies from 2003 to 2017 did not show significant changes from 2003 to 2004. Since the No. 1 central document in 2003 paid attention to the issues of agriculture, rural areas, and farmers, and the official agricultural policy transformation began in 2004, agricultural subsidies have had an obvious upward trend. The overall trend of land fragmentation decreased significantly, but the decrease was small, only from about 0.67 to about 0.62; that is, more than 60% of the land in rural households was less than one mu; China’s agriculture total factor productivity at the peasant household level shows a fluctuating upward trend, and its growth rate has slowed down in recent years. Although there are some differences in the values due to the selection of measurement methods and indicators, this changing trend is consistent with the changing trend measured by Wang et al., 2020 [38] using the data of fixed observation points in rural areas across China.

Figure 2.

Descriptive Statistics on the Trend of Changes in Main Indicators.

3. Results

3.1. Benchmark Model Regression Results

To clarify the relationship between agricultural subsidies, land fragmentation, and agricultural TFP, we use the two-way fixed effect model and the moderating effect model to identify the single and interactive effects of agricultural subsidies and land fragmentation by controlling the provinces where the households reside and the year of the data survey.

First, Columns 1 and 2 of Table 3 use agricultural subsidies and land fragmentation as single explanatory variables, and the two-way fixed effect model is used to identify the effects of agricultural subsidies and land fragmentation on agricultural TFP. Column 1 reports the effects of agricultural subsidies as an explanatory variable alone. According to the regression results, agricultural subsidies significantly positively affect agricultural TFP, and a 1% increase in agricultural subsidies will increase agricultural TFP by 0.4%. Column 2 presents the separate effect of land fragmentation. Land fragmentation leads to a significant decrease in agricultural TFP, with each 1% increase in land fragmentation leading to a 33.3% decrease in agricultural TFP. This benchmark result indicates that acquiring agricultural subsidies can promote agricultural development and increase the TFP at the farmer level. Hypothesis 1 is supported, but the typical fact is that land fragmentation plays a negative role in agricultural development. On this basis, column 3 is constructed to incorporate both agricultural subsidies and the degree of land fragmentation into the analytical framework. The regression results of column 3 show that adding land fragmentation reduces the influence coefficient of agricultural subsidies on agricultural total factor productivity, and the significance of agricultural subsidies is only marginal, which provides preliminary evidence for the negative effect of land fragmentation on agricultural subsidies.

Table 3.

Agricultural subsidies, land fragmentation, and agricultural total factor productivity.

Considering that agricultural subsidies and land fragmentation have opposite effects on agricultural TFP, to analyze the impact of land fragmentation on agricultural subsidies, we construct the interaction term of agricultural subsidies and land fragmentation and identify the impact of the interaction between the two on agricultural TFP. As can be seen from the results of column 4, the direction of the main effect of agricultural subsidies and land fragmentation is the same as that of the single effect, and there is no significant change in the direction of the influence due to adding another core explanatory variable. At the same time, the interaction term of the two is significantly negative, indicating that at a certain level of financial support for agriculture, the higher the degree of land fragmentation, the more significant the negative reduction effect on agricultural total factor productivity. Specifically, when the degree of land fragmentation increases by 1%, the promoting effect of agricultural subsidies on agricultural TFP decreases by about 3%. Based on the results of the above analysis, hypothesis 2 is supported by sufficient evidence that the degree of land fragmentation will significantly affect the positive role of agricultural subsidies in promoting agricultural development.

Based on the above results, agricultural subsidies significantly positively affect agricultural total factor productivity. However, when land fragmentation is included in the analysis framework, agricultural total factor productivity will decrease significantly. In addition, the interaction between agricultural subsidies and land fragmentation is negative; that is, land fragmentation hinders the positive effect of agricultural subsidies on agricultural TFP. It can be seen that land fragmentation is an important obstacle to agricultural development and the improvement of agricultural total factor productivity. To increase fiscal input for agriculture, it is necessary to combine powerful land reform policies with concerted efforts to give full play to the positive role of fiscal policy in the agricultural field and avoid the low-level utilization of financial resources and land factors.

3.2. Endogeneity Problem Handling and Robustness Test

In the existing literature, few empirical studies combine agricultural subsidies and land fragmentation degrees to examine their impact on agricultural total factor productivity. Therefore, the robustness of the results needs to be further tested to ensure their authenticity and reliability. Because of data structure and index selection and possible endogeneity problems, we adopt three methods: the instrumental variable method, changing the estimation method of explained variables, and adding the time dummy variable to characterize the policy impact to conduct a robustness test.

- (1)

- Instrumental variable method. Since agricultural subsidies at the farmer’s level may be affected by unobservable individual characteristics of farmers, as well as possible reverse-causality problems, we use provincial-level equalization subsidies to replace the farmer-level subsidies and adopt the two-stage least-squares method to eliminate the influence of such endogenous problems as far as possible. The specific approach is as follows: the amount of provincial financial subsidies for agriculture is divided by the effective agricultural irrigation area of the whole province to calculate the amount of provincial average subsidies, and the amount of farmer-level agricultural subsidies is multiplied by the actual cultivated land area of the family at the end of the year, to obtain the new amount of farmer-level agricultural subsidies, replacing the original farmer-level subsidies data. The instrumental variables selected in this paper have passed the necessary tests, and the specific regression results are shown in column 5 of Table 4.

Table 4. Endogeneity Problem Handling and Robustness Test.

Table 4. Endogeneity Problem Handling and Robustness Test.

- (2)

- Replace the explained variables. In the procedures of the LP and OP estimation methods mentioned above, labor may not be able to vary independently of changes in the nonparametric function. To avoid such function dependence problems, Ackerberg et al., 2015 [43] proposed an estimation method that allows for exogenous, series-dependent, unobservable shocks to labor or adjustment costs to labor inputs and more general dynamic effects of labor. The ACF method relies on the same moment conditions compared to the LP and OP methods. However, it controls unobservable productivity through the inverse function of the “conditional” input demand function, which results in the coefficients of variable inputs (e.g., labor) not being identified in the first stage and all input factor coefficients being estimated in the second stage. Accordingly, we use the ACF method to re-estimate farm-level TFP, replacing the explained variables originally estimated by the Wooldridge method. Specific results are shown in column 6 and column 7 in Table 4.

- (3)

- Add the time dummy variable to represent the policy impact. In 2016, the reform of the three subsidies for agriculture was comprehensively extended to the whole country after the pilot implementation. This reform changed the basis of agricultural subsidy payment from the original land contract right to the actual management right, aiming to increase the operating income of farmers who transferred to the land and encourage land transfer behavior among farmers. To further determine whether the adjustment and implementation of national policies will have a substantial impact on the above-estimated results and basic conclusions, we introduce a time dummy variable representing the policy impact, assigning a value of 0 from 2003 to 2015 and 1 from 2016 to 2017, construct a triple interaction term and examine the impact of the policy impact. The specific results are shown in column 8 of Table 4.

To sum up, after adopting the instrumental variable method, changing the estimation method of explained variables, and adding the time dummy variable representing policy impact for the robustness test, the influence direction and magnitude of the interaction terms of agricultural subsidies and land fragmentation did not change. When the degree of land fragmentation increased by 1%, the promoting effect of agricultural subsidies on agricultural total factor productivity would decrease by about 3%. The analysis results and basic conclusions of all kinds of robustness tests are consistent with the previous ones. It is worth noting that after adding the time dummy variable to represent the policy impact, the main effect term or interaction term related to the time dummy variable was only marginally significant or insignificant, indicating that there is no evidence to support that agricultural subsidy reform will affect the joint effect of agricultural subsidy and land fragmentation on agricultural total factor productivity. The obstructive effect of land fragmentation cannot be effectively resolved through the reform of the three subsidies for agriculture, and the effective connection between fiscal policy and land reform still needs to be further explored.

4. Discussion

In the previous analysis, we conducted an analysis based on the data from fixed observation points in rural China from 2003 to 2017 and utilized the two-way fixed effects model and the moderating effect model to examine the impacts of agricultural subsidies and land fragmentation on the total factor productivity of agriculture. In the resulting analysis, it can be found that both Hypothesis 1 and Hypothesis 2 have been confirmed, and the robustness and credibility of the results have been demonstrated using an instrumental variable method and various robustness analyses. We have conducted a comprehensive examination of the fiscal support for agriculture policy, with a focus on observing the overall effect of the policy on farmers. However, our research differs from the studies of Li et al., 2021 [24] and Xu et al., 2023 [25] from the research perspective. Li’s research focuses on grain production, while Xu’s research focuses on agricultural machinery purchase subsidies. However, we still examine the positive effects of fiscal support policies on agricultural development from an overall perspective. The different research perspectives lead to differences in estimated coefficients, but there is a certain degree of similarity in the basic conclusions. At the same time, our research incorporated land fragmentation into the analysis framework at the farmer level and constructed a moderating effect model. Such research is still rare, and in this paper, our research has obtained further meaningful conclusions.

In further discussion, we will divide it into two parts: mechanism testing and heterogeneity analysis.

4.1. Mechanism Testing

In our research, we incorporated land fragmentation as a factor into the analysis of the effectiveness of fiscal agricultural subsidies, and thus obtained some new conclusions: land fragmentation will become an important factor hindering the effectiveness of fiscal agricultural subsidies. In order to explain the mechanism by which land fragmentation hinders fiscal subsidies for agriculture, we attempt to include the analysis of the mechanism by incorporating the land transfer area at the farmer level. We calculate the difference between the land area obtained by farmers through land transfer and the land area lost through transfer, in order to obtain the net value of land transfer for farmers, which is the actual land transfer area for farmers.

In theory, due to the fact that moderate scale management in agriculture is a common law of agricultural development in various countries around the world [30,31], positive land transfer can promote the scale and agglomeration development of agriculture. Scale effects can reduce agricultural production costs, improve agricultural production efficiency, and thus improve total factor productivity in agriculture. Based on our research, fiscal subsidies for agriculture may increase the willingness of farmers to transfer land, and having more funds will make them more willing to obtain more land through transfer, thereby engaging in larger-scale agricultural production activities and improving agricultural total factor productivity. However, land fragmentation will increase the production and operation costs and land transfer costs of farmers, reduce their willingness to engage in agricultural production, and hinder the further expansion of production paths, thereby reducing agricultural production efficiency and total factor productivity.

In Table 5, we first examined the impact of land transfer on agricultural total factor productivity (column 9), and then examined the effects of fiscal subsidies for agriculture and land fragmentation on land transfer (column 10 and 11). Through the results, it can be found that an increase in land transfer area will significantly enhance the total factor productivity of agriculture at the farmer level. For every 1 acre increase in land transfer area, the total factor productivity of agriculture will increase by 1.5%. Focusing on the fiscal agricultural subsidies and land fragmentation that this paper focuses on, it can be found that fiscal agricultural subsidies have a significant positive effect on the area of land transfer, while land fragmentation will have a significant hindering effect on land transfer. This result is consistent with the findings of Xu et al., 2023 [25] and Wu et al., 2016 [3], who also believe that fiscal subsidies for agriculture will promote land transfer, while land fragmentation is an important factor hindering land transfer.

Table 5.

Mechanism Testing.

Based on this, we can explain that the mechanism by which land fragmentation hinders fiscal agricultural subsidies may be due to the fact that fiscal agricultural subsidies could have improved the total factor productivity of farmers by promoting land circulation. However, the existence of land fragmentation can hinder the realization of land circulation among farmers, thereby reducing the original policy effect of fiscal agricultural subsidies; as a result, the promotion effect of fiscal subsidies on agricultural development has decreased.

4.2. Heterogeneity Analysis

In the No.1 central document released in 2022, the government clearly stated that it must firmly uphold the two bottom lines of ensuring national food security and preventing large-scale poverty. Through the formulation and implementation of various policies and regulations, China has invested a lot of human resources, material, and financial resources to strictly adhere to the two bottom lines, among which the issuance of fiscal subsidies for agricultural production is of great significance to food production and the prevention of poverty. However, based on previous research, it can be found that land fragmentation does hinder the policy effect of agricultural subsidies. To determine whether this negative effect harms safeguarding the two bottom lines, we will continue to examine farmers’ regional heterogeneity and main activity heterogeneity to provide useful references for policy formulation and adjustment.

4.2.1. Grouping by Regions

Based on the overall characteristics of grain planting, production, and consumption in different provinces and taking into account the differences in grain farming traditions and resource endowments in different regions, the Opinions of The State Council on Further Deepening the Reform of the Grain Circulation System in 2001 divided 31 provinces (autonomous regions and municipalities) into main grain producing areas, main marketing areas, and balanced production and marketing areas3. At the same time, differences in topography, climate, temperature, and ecological environment between China’s northern and southern regions have also led to different characteristics of regional agricultural development. To investigate the heterogeneity of agricultural subsidies, land fragmentation, and agricultural total factor productivity in different characteristic regions, we divided the main grain-producing areas and non-major grain-producing areas (including the main grain-selling areas and the production–marketing balance areas), the northern regions and the southern regions. Fisher’s Permutation test was used to test the differences in the coefficient of interaction terms of the groups.

As can be seen from column 12 and column 13 in Table 6, although the interaction between agricultural subsidies and land fragmentation was significant in both types of regions, the obstruction of land fragmentation to agricultural subsidies was more obvious in major grain-producing regions than in non-major grain-producing regions, where a 1% increase in land fragmentation in major grain-producing areas can reduce the effect of agricultural subsidies on agricultural total factor productivity to 4.1%, which is 2.2% higher than that in non-major grain-producing areas. Columns 14 and 15 in Table 6 compare the effects between the southern and northern regions. In the southern region, the degree of land fragmentation has a more significant inhibitory effect on agricultural subsidies. A 1% increase in land fragmentation will reduce the impact of agricultural subsidies on agricultural TFP by 3.2%, which is higher than the 2.6% in the northern region. However, the difference in the interaction term coefficients between the two is not statistically significant. It can be seen that in different regions, the degree of land fragmentation still shows the inhibitory effect of agricultural subsidies on the improvement of agricultural total factor productivity, especially in the main grain-producing areas, which to a certain extent affects the effective realization of firmly safeguarding the bottom line of national food security.

Table 6.

Effects of regional heterogeneity of different rural households.

4.2.2. Grouping by Main Occupations

Under the background of new-type urbanization and all-around deepening of rural reform, the production activities that rural residents participate in are no longer limited to agriculture. In the data of fixed observation points in rural areas across China, the industry in which operating income (or the amount of labor invested) accounts for the proportion of household operating income (or the amount of labor invested in household operation) is identified as the main occupation of household operation. It is especially emphasized that since the sample selection above ensured that all samples were effectively involved in agricultural activities, only agricultural activities accounted for a relatively low proportion of non-agricultural farmers. The typical difference from agricultural-based farmers was whether they depended more on agricultural production or land factors. Data show that there are still 13% of China’s rural households mainly based on agricultural production and operation, including many large-scale farmers and vulnerable farmers who are unable to engage in other production and operation activities; this part of vulnerable farmers is also the focus of attention to firmly prevent the large-scale return to poverty.

Comparing column 16 and 17 reveal that compared to households primarily engaged in non-agricultural activities (Table 7), land fragmentation has a more severe obstructive effect on agricultural subsidies in households primarily engaged in agriculture, with a statistically significant difference between the two. Further exploration into different agricultural sectors, distinguishing between households primarily engaged in crop farming and those in forestry, fishery, or animal husbandry (i.e., non-crop farming), reveals that column 18 and 19 show no significant differences in the coefficients of the interaction terms. This indicates that agriculture as a whole is universally affected by land fragmentation. This type of impact does not vary with different agricultural sub-sectors. It can be inferred that land fragmentation severely hampers the effectiveness of agricultural subsidies, affecting the livelihoods of households primarily engaged in agriculture, and is prevalent in various agricultural sub-sectors, including crop farming, forestry, fishery, and animal husbandry. This phenomenon adversely impacts the goal of achieving moderate-scale operation in agriculture and firmly preventing large-scale relapse into poverty.

Table 7.

Heterogeneous effects of different farmers’ main occupations.

5. Conclusions

In China’s new journey towards comprehensively building a socialist modernized nation, the 20th CPC National Congress explicitly put forward the core requirement of enhancing Total Factor Productivity (TFP). Given agriculture’s foundational and comprehensive significance in China, improving agricultural TFP is imperative. As an important fiscal policy tool supporting agricultural development, whether it is the complete abolition of agricultural tax, the provision of various agricultural subsidies such as subsidies for high-quality crop seeds, direct subsidies to grain farmers, subsidies for agricultural machinery purchases, comprehensive input subsidies, or the implementation of the “three agricultural subsidies” reform, all reflect the significant role of fiscal support for agriculture in the process of agricultural modernization. However, due to the widespread issue of land fragmentation in China, the full potential of seeds, fertilizers, large machinery, and other scientific technologies is not realized on many fragmented lands, and the scale of farmers’ landholdings limits the effectiveness of agricultural subsidies. Thus, in the context of China’s national conditions with “small farmers in a large country,” what exactly is the role of agricultural subsidies in agricultural development? Can mere agricultural subsidies be effective? Does land fragmentation lead to efficiency losses in agricultural subsidies? How should land policies and fiscal support for agriculture be coordinated? The answers to these questions are key to clarifying the relationship between fiscal support for agriculture and land reform and are also crucial for China to accelerate its transformation from a large agricultural country to a strong agricultural nation.

This paper is based on the data from fixed observation points in rural China from 2003 to 2017 and utilizes the two-way fixed-effects model and the moderating-effect model to examine the impacts of agricultural subsidies and land fragmentation on the total factor productivity of agriculture. The results show: first, agricultural subsidies have a positive effect on the total factor productivity of agriculture, while land fragmentation leads to a decline in agricultural total factor productivity; second, land fragmentation impedes the effect of agricultural subsidies in improving agricultural total factor productivity. A 1% increase in land fragmentation leads to about a 3% decrease in the enhancement effect of agricultural subsidies, particularly affecting households in major grain-producing areas and those primarily engaged in agriculture; third, there is no evidence to support that the reform of the “three agricultural subsidies” will change the combined effect of agricultural subsidies and land fragmentation on agricultural total factor productivity. The hindering effect of land fragmentation cannot be resolved by reforming the “three agricultural subsidies”.

The above basic conclusions are of significant theoretical and practical significance for addressing major issues in the coordinated implementation of agricultural subsidies and land reform in China. They also provide useful references for improving the agricultural support policy system and transitioning from a largely agricultural country to a strong agricultural nation. In this study, there are still some shortcomings that will be improved in subsequent research. For example, due to limitations in data availability, this article uses data from 2003 to 2017. If it is possible to obtain the latest data in subsequent research, we will further enrich the research results and conclusions of this article. At the same time, the model selection in this paper only examined the moderating effect of land fragmentation on the fiscal support for agriculture policy, and only used instrumental variables to examine causal identification to a certain extent. In future research, we will optimize identification strategies and use more convincing models to test causal effects.

Based on the research findings, this paper summarizes the following important policy implications:

Firstly, the incentivizing role of agricultural subsidies remains to be fully unleashed. While the scale of China’s fiscal support for agriculture continues to expand, the current reform measures have yet to address fundamental issues, often resulting in inefficient outcomes. Agricultural subsidies play a crucial role in pursuing the policy objectives of building a strong agricultural nation and firmly holding the bottom lines. However, there is still room for enhancing their effectiveness. On top of increasing fiscal expenditure, fiscal policies supporting agriculture should focus on integrating and distributing basic elements. It is essential to leverage the multiplier effect of policy implementation effectively. Active use of fund allocation should guide traditional elements like labor and land, as well as higher-order elements like management and data. This approach aims to break through various institutional mechanisms and resource distribution flaws, focusing on enhancing the Total Factor Productivity of agricultural households. Such measures would ensure that agricultural subsidies fully exert their intended role and continue to play an increasingly significant part.

Secondly, land fragmentation is a key bottleneck in agricultural development. Compared to systemic and institutional issues such as corruption and elite capture, the widespread presence of land fragmentation requires more attention due to its obstructive role. Land fragmentation prevents agricultural production from effectively leveraging economies of scale and agglomeration advantages, significantly impeding the transformation of agricultural subsidies into agricultural productivity. This presents a considerable challenge to achieving various urgent targets in China. The solution to the problem of land fragmentation lies in land consolidation and land transfer. Strengthening land consolidation and promoting land transfer not only can fully realize the positive effects of agricultural subsidies, enhance farmers’ operational scale, and improve Total Factor Productivity in agriculture, but also can aid in advancing agricultural modernization and accelerating the development of a strong agricultural nation. This contributes to steadfastly maintaining the fundamental goals of ensuring national food security and preventing a large-scale relapse into poverty.

Thirdly, increasing fiscal support for agriculture must be combined with powerful land reform policies to achieve synergistic efforts. Efficiency losses, caused by inherent mechanisms that have not been precisely identified, make relying solely on fiscal policy akin to a tree without roots or a stream without a source. While it may seem effective, the potential for efficiency improvement remains vast. To address these inherent systemic issues, such as land fragmentation, it is necessary for agricultural policies beyond fiscal investment to enhance institutional innovation and reform efforts, thereby clearing obstacles to the effective allocation and functioning of fiscal funds. In agricultural production, land reform not only unleashes the productivity of idle or fragmented land but also sharpens the focus and objectives of agricultural subsidies. This approach helps fully realize fiscal policy’s positive impact on the agricultural sector and avoids the inefficient consumption of fiscal resources and land elements.

Author Contributions

Conceptualization, W.Z.; Funding acquisition, W.Z.; Methodology, Z.Z.; Supervision, W.Z.; Visualization, F.Y.; Writing—original draft, Z.Z.; Writing—review and editing, W.Z., Z.Z. and F.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was supported by the National Social Science Foundation of China (NSSFC), “Research on the long-term mechanism of supporting the will and wisdom to solve relative poverty” (Grant No. 20 & ZD168), and the National Natural Science Foundation of China (NNSFC), “Intergenerational Transmission, Neighborhood Effect, and Educational Poverty: Based on the Perspective of Social Network Economics” (Grant No. 71973102).

Data Availability Statement

Data are available from the authors upon request. The data are not publicly available due to [This data is sourced from the Ministry of Agriculture and Rural Affairs of the People’s Republic of China. Any individual or organization using this data must apply to the Ministry of Agriculture and Rural Affairs of the People’s Republic of China, and we have no right to disclose this data].

Acknowledgments

The authors are grateful to the Editor and the anonymous referees for their helpful comments and suggestions.

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1 | The data is sourced from an article on the Chinese land rule of law research website titled “Rural Land Systems in the UK and Germany” (30 October 2010). Available online: https://illss.gdufs.edu.cn/info/1024/8140.htm (accessed on 30 October 2010). |

| 2 | Due to the lack of continuity and completeness in the statistics of the “number of household labor force” indicator in the database since 2009, we use household grain consumption as a proxy variable for household labor force size. |

| 3 | There are a total of 13 major grain production areas, 7 major grain sales areas, and 11 balanced production and sales areas in China. Among them, the natural conditions such as geography, soil, and climate in the main grain producing areas are suitable for planting grain crops, ensuring self-sufficiency while also transferring a large amount of commercial grain, including Heilongjiang, Jilin, Liaoning, Inner Mongolia, Hebei, Henan, Shandong, Jiangsu, Anhui, Jiangxi, Hubei, Hunan, and Sichuan. The main grain sales areas have relatively developed economies, but with a large population and limited land, there is a significant gap in grain production and demand, including Beijing, Tianjin, Shanghai, Zhejiang, Fujian, Guangdong, and Hainan. The production and marketing balance area has made limited contribution to the national grain output, but it can basically maintain self-sufficiency, including Shanxi, Ningxia, Qinghai, Gansu, Xizang, Yunnan, Guizhou, Chongqing, Guangxi, Shaanxi and Xinjiang. |

References

- Xing, X.; Xu, J. The Development Stage of Industrialization and the Adjustment of Domestic Agricultural Support Policy in China. Economist 2004, 5, 33–37. [Google Scholar]

- Wang, F. Problems and Countermeasures of Agricultural Development in Our Country under the Background of Industrialization and Urbanization. Res. Agric. Mod. 2012, 33, 397–401. [Google Scholar]

- Wu, S.; Li, Y.; Lu, X.; Kuang, B.; Zhao, W. Research Progress on the Adjustment of Ownership Relationship of Farmland Improvement under the Balance of Interests. China Land Sci. 2016, 30, 88–96. [Google Scholar]

- Wen, G.; Yang, G. Mechanism and Empirical Evidence of the Impact of Cultivated Land Fragmentation on Farmers’ Cultivated Land Productivity. China Popul. Resour. Environ. 2019, 29, 138–148. [Google Scholar]

- Song, H.; Luan, J.; Zhang, S.; Jiang, Q. Land Fragmentation, Diversified Planting and Technical Efficiency of Agricultural Production: An Empirical Study based on Stochastic Frontier Production Function and Intermediary Effect Model. J. Agrotech. Econ. 2021, 2, 18–29. [Google Scholar]

- Gao, Y.; Lin, G. Agricultural Subsidies Abroad: Research Review and FutureProspects. Reform Econ. Syst. 2015, 4, 167–172. [Google Scholar]

- Cheng, G.; Zhu, M. Agricultural Subsidy System and Policy Choice in the Middle Stage of China’s Industrialization. Manag. World 2012, 220, 9–20. [Google Scholar]

- Indalmanie, S.P. The Impact of Government Expenditure on the Agricultural Sector in Jamaica: 1962–2011. SSRN Electron. J. 2012, 35, 2588695. [Google Scholar] [CrossRef]

- Luo, D.; Jiao, J. Empirical Study on the Impact of National Financial Support Funds on Farmers’ Income. Issues Agric. Econ. 2014, 35, 48–53. [Google Scholar]

- Stads, G.J.; Beintema, N. Agricultural R&D Expenditure in Africa: An Analysis of Growth and Volatility. Eur. J. Dev. Res. 2015, 27, 391–406. [Google Scholar]

- Gai, Q.; Wang, M.; Shi, B. Land Comparative Advantage, Peasant Household Behavior and Agricultural Production Efficiency: An Investigation from the Adjustment of Planting Structure. Econ. Res. J. 2022, 57, 138–155. [Google Scholar]

- Huang, J.; Wang, X.; Zhi, H.; Huang, Z.; Rozelle, S. Impact of Direct Grain Subsidies and Comprehensive Agricultural Subsidies on Agricultural Production. J. Agrotech. Econ. 2011, 1, 4–12. [Google Scholar]

- Huang, J.; Wang, X.; Rozelle, S. The Subsidization of Farming Households in China’s Agriculture. Food Policy 2013, 41, 124–132. [Google Scholar] [CrossRef]

- Gao, M.; Song, H.; Carter, M. Do Subsidies Reduce Efficiency Losses in Food Production? Based on Dynamic Asset Poverty Theory. Manag. World 2017, 9, 85–100. [Google Scholar]

- Huang, S.; Guo, D.; Wu, J. Evaluation on Effect of Direct Grain Subsidy Policy. China Rural. Econ. 2019, 1, 17–31. [Google Scholar]

- Quan, S.; Yu, X. Chinese Agricultural Policy System and ItsInternational Competitiveness. Reform 2016, 11, 130–138. [Google Scholar]

- Xu, Q.; Lu, Y.; Zhang, H. Do Agricultural Support Protection Subsidies Promote Large-scale Farmers to Grow Grain? Based on the Survey Data of Fixed Observation Points in Rural China. China Rural. Econ. 2020, 4, 15–33. [Google Scholar]

- Yang, Q.; Peng, C.; Xu, Q. Does the Reform of the Three Subsidies for Agricultural Promote Farmers’ Land Transfer. China Rural. Econ. 2022, 5, 89–106. [Google Scholar]

- Leng, B.; Li, G.; Feng, Z. Talking about the Fact that Farmers Who Do not Farm Can also Receive Agricultural Subsidies: On the Distribution of Agricultural Subsidies after the Reform of the Three Subsidies for Agricultural. Issues Agric. Econ. 2021, 5, 54–65. [Google Scholar]

- Ciaian, P.; Kancs, D.A. The Capitalization of Area Payments into Farmland Rents: Micro Evidence from the New EU Member States. Can. J. Agric. Econ. 2012, 60, 517–540. [Google Scholar] [CrossRef]

- Hendricks, P.N.; Janzen, P.J.; Dhuyvetter, C.K. Subsidy Incidence and Inertia in Farmland Rental Markets: Estimates from a Dynamic Panel. J. Agric. Resour. Econ. 2012, 37, 361–378. [Google Scholar]

- Quan, S. On the Evolution Logic of Agricultural Policy: On the Key Issues and Potential Risks of China’s Agricultural Transformation. China Rural. Econ. 2022, 2, 15–35. [Google Scholar]

- Huang, J.; Hu, R.; Yi, H.; Yu, S.; Wang, J.; Bao, M.; Liu, X. China’s Agricultural Development Vision and Countermeasures towards 2050. Eng. Sci. 2022, 24, 11–19. [Google Scholar]

- Li, Z.; Li, X.; Sun, Q. Can Fiscal Agricultural Subsidies Effectively Improve Grain Total Factor Productivity: Taking into Account the Regulatory Role of Agricultural Technical Environment. J. China Agric. Univ. 2021, 26, 236–252. [Google Scholar]

- Xu, Q.; Jia, J.; Zhou, T. How Do Agricultural Machinery Purchase Subsidies Affect Agricultural Total Factor Productivity. Res. Financ. Econ. 2023, 49, 109–123. [Google Scholar]

- Lv, T.; Ji, Y.; Yi, Z. Plot Economies of Scale in Rice Production: Based on Research and Analysis of Jintan in Changzhou, Jiangsu Province. J. Agrotech. Econ. 2014, 2, 68–75. [Google Scholar]

- Cai, F.; Wang, M. From Poor Economy to Scale Economy: Challenges Posed by Changes in Development Stage to China’s Agriculture. Econ. Res. 2016, 51, 14–26. [Google Scholar]

- Liu, T.; Qian, L. Experience and Enlightenment of Farmland Fragmentation Management in Developed Countries: A Case Study of Germany, France, Netherlands and Japan. J. Zhongzhou 2023, 7, 58–66. [Google Scholar]

- Ye, X.; Weng, N. Agricultural Land Concentration Delayed for Half a Century: The Difficult Process and Enlightenment of the Transition from Small-scale Farmers’ Production to Large-scale Management in Japan. China Rural. Econ. 2018, 1, 124–137. [Google Scholar]

- Lucas, R.E., Jr. Life Earnings and Rural-Urban Migration. J. Political Econ. 2004, 112, 29–59. [Google Scholar] [CrossRef]

- Ni, G.; Cai, F. What Scale of Farmland Operation Do Farmers Need: Study on Decision-making Map of Agricultural Land Management Scale. Econ. Res. J. 2015, 50, 159–171. [Google Scholar]

- Xu, Q.; Tian, S.; Shao, T.; Wang, X. Land Fragmentation and Farmer Income: An Empirical Study from China. J. Agrotech. Econ. 2007, 6, 67–72. [Google Scholar]

- Wei, H.; Yuan, P.; Lu, Q. Historical Evolution and Theoretical Innovation of Agricultural and Rural Development Research in China. Reform 2020, 10, 5–18. [Google Scholar]