State Capacity to Influence Actor Relations within the Chinese Real Estate Market: An Analytical Framework

Abstract

1. Introduction

2. Literature Review

2.1. History of Chinese Real Estate Policy

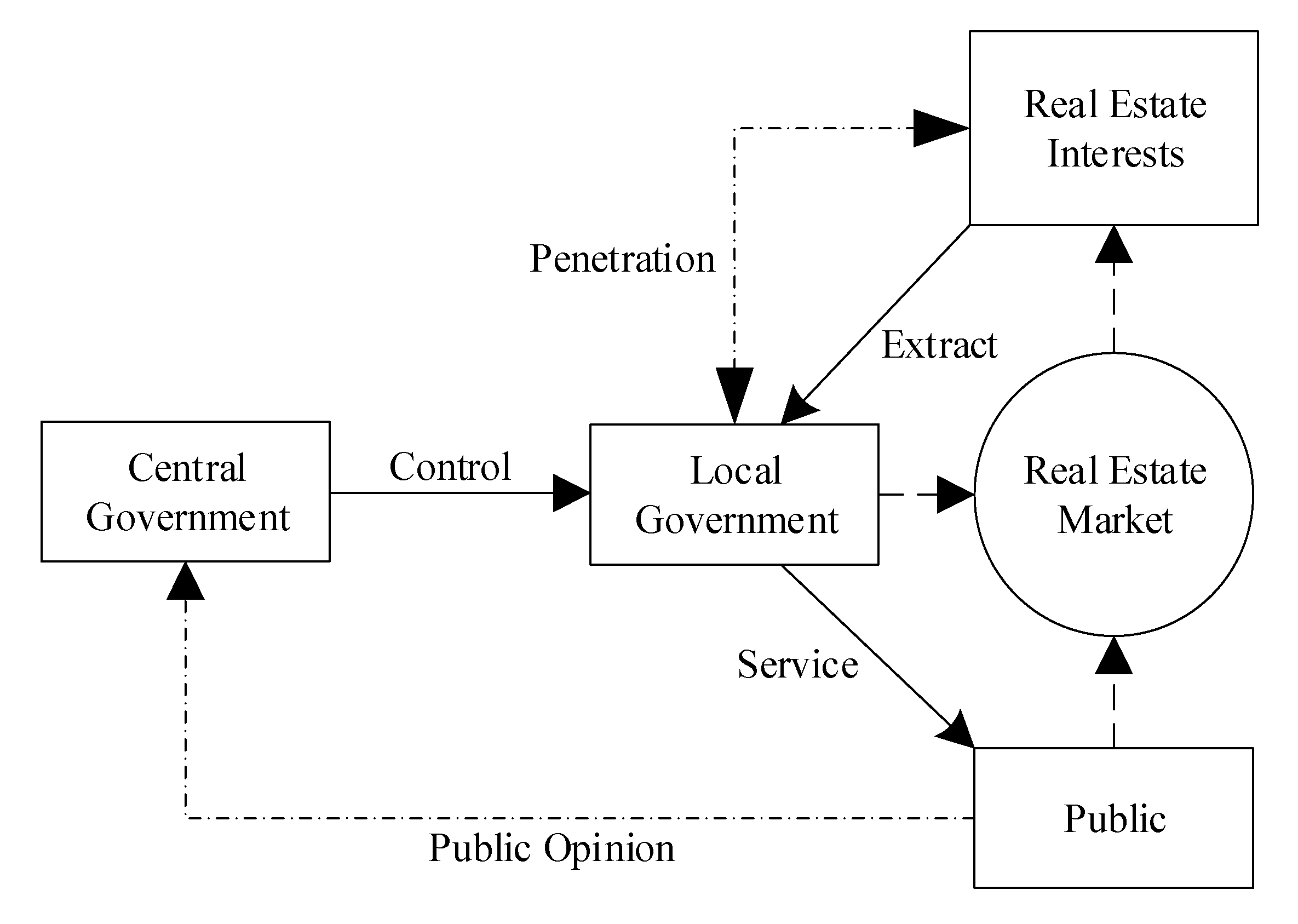

2.2. Position of the Real Estate Sector

2.3. Non-Fundamental Determinations of Price

2.4. Review

3. Methodology

4. Mechanisms Based on State Capacity

4.1. The Logical Thread of “State–Society”

4.2. Subjects and Institutional Provision

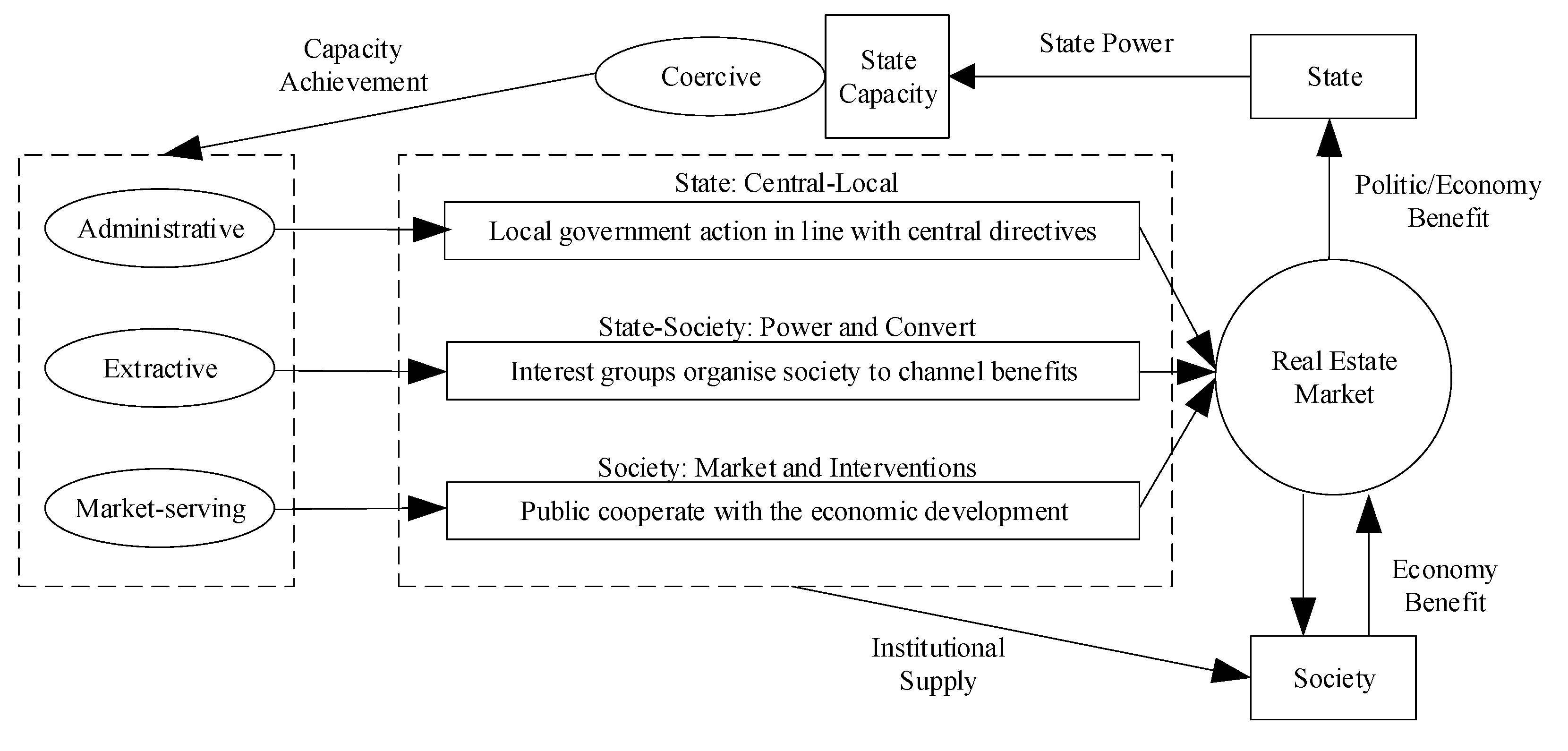

4.3. State Capacity

5. Analytical Framework as a Result

5.1. Mechanism of State Capacity

5.2. Validity of State Governance

5.3. A Framework for Country Capacity-Led Analysis

6. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Xinhua News Agency. Liu He addresses the fifth round of the China-EU Business Leaders and Former Senior Officials Dialogue [EB/OL] (15 December 2022). Available online: http://www.news.cn/world/2022-12/15/c_1129211785.htm (accessed on 26 June 2023). |

| 2 | Solid lines are formal institutional interventions, dashed lines are informal impacts and participation. |

| 3 | References [98,99] base on [100,101] using the logic of the ruler’s decision-making mechanism and the collective action of bureaucrats, deduce another important dimension of administrative capacity: The state’s ability to gather information and the leadership to make quality decisions. This paper highly endorses this judgement. However, in the case of the Chinese real estate market, information gathering on price trends, developments and related economic and social issues is not complicated and can even create a social impression. |

| 4 | “Chamber pot” is a funny nickname of Chinese real estate market, widely used by public opinion. Although the problems are very ‘smelly’, China still has to use it for economy. |

References

- Liu, C.; Xiong, W. China’s Real Estate Market; National Bureau of Economic Reserch: Cambridge, MA, USA, 2018. [Google Scholar]

- Han, Y.; Zhang, H.; Zhao, Y. Structural evolution of real estate industry in China: 2002–2017. Struct. Chang. Econ. Dyn. 2021, 57, 45–56. [Google Scholar] [CrossRef]

- Zhao, Y. Land Finance in China: History, Logic and Choice. Urban Dev. Stud. 2014, 21, 1–13. (In Chinese) [Google Scholar]

- Zhang, H.; Wang, X. Effectiveness of macro-regulation policies on housing prices: A spatial quantile regression approach. Hous. Theory Soc. 2016, 33, 23–40. [Google Scholar] [CrossRef]

- Wang, J.; Xia, B. 40 Years of Real Estate Reform in China: Market and Policy. Macroeconomics 2019, 10, 25–34+168. (In Chinese) [Google Scholar]

- Dokko, J.; Doyle, B.M.; Kiley, M.T.; Kim, J.; Sherlund, S.; Sim, J.; Van Den Heuvel, S.; L’Huillier, J.-P. Monetary policy and the global housing bubble. Econ. Policy 2011, 26, 237–287. [Google Scholar] [CrossRef]

- Yu, H. China’s house price: Affected by economic fundamentals or real estate policy? Front. Econ. China 2010, 5, 25–51. [Google Scholar] [CrossRef]

- Li, G.; Zhong, T. The Historical Evolution of China’s Housing System and Its Social Effects. Sociol. Stud. 2022, 37, 1–22+226. (In Chinese) [Google Scholar]

- Ang, A.; Bai, J.; Zhou, H. The great wall of debt: Real estate, political risk, and Chinese local government financing cost. J. Financ. Data Sci. 2023, 9, 100098. [Google Scholar] [CrossRef]

- Deng, Q.S.; Alvarado, R.; Cheng, F.N.; Cuesta, L.; Wang, C.B.; Pinzón, S. Long-run mechanism for house price regulation in China: Real estate tax, monetary policy or macro-prudential policy? Econ. Anal. Policy 2023, 77, 174–186. [Google Scholar] [CrossRef]

- Liu, J. Research on Measures for China’s Real Estate Enterprises under the Background of ‘Three Red Lines’ Policy. In Proceedings of the 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), Harbin, China, 21–23 January 2022. [Google Scholar]

- Zou, Y.; Meng, F.; Zhong, N.; Zhao, W. The diffusion of the housing purchase restriction policy in China. Cities 2022, 120, 103401. [Google Scholar] [CrossRef]

- Nie, H.; Li, Q. A New Economic Interpretation of theHigh Housing Price in China: From the Perspective of “Collusion between Local Governments and Enterprises”. Teach. Res. 2013, 1, 50–62. [Google Scholar]

- Sun, X.; Zhou, F. Land Finance and the Tax-sharing System: An Empirical Interpretation. Soc. Sci. Chin. 2013, 4, 40–59+205. (In Chinese) [Google Scholar]

- Yang, H.; Zhao, D. Performance legitimacy, state autonomy and China’s economic miracle. J. Contemp. China 2015, 24, 64–82. [Google Scholar] [CrossRef]

- Jiang, C. Empirical analysis of the speculative bubble in China’s real estate market. J. Manag. World 2005, 12, 71–84+171–172. (In Chinese) [Google Scholar]

- Feng, K.; Jiang, Z. State Capacity in China’s Innovation Subsidy Policy. China Rev. 2021, 21, 89–122. [Google Scholar]

- Li, V.J.; Cheng, A.W.W.; Cheong, T.S. Home purchase restriction and housing price: A distribution dynamics analysis. Reg. Sci. Urban Econ. 2017, 67, 1–10. [Google Scholar] [CrossRef]

- Zhao, R.; Chen, J.; Feng, C.; Zhong, S. The impact of anti-corruption measures on land supply and the associated implications: The case of China. Land Use Policy 2020, 95, 104605. [Google Scholar] [CrossRef]

- Liu, W. The Historical Evolution of China’s Housing System and the Construction of a Housing Security System. Study Pract. 2010, 9, 5–13. (In Chinese) [Google Scholar]

- Zhang, X. Risk and uncertainty in the Chinese housing market. J. Real Estate Lit. 2001, 9, 161–172. [Google Scholar] [CrossRef]

- Deng, Z.; Jing, Y. Building a Civil Society in China. Chin. Soc. Sci. Q. 1992, 1. (In Chinese) [Google Scholar]

- Deng, L.; Shen, Q.; Wang, L. Housing Policy and Finance in China: A Literature Review; US Department of Housing and Urban Development: Washington, DC, USA, 2009.

- Ping Wang, Y.; Murie, A. The process of commercialisation of urban housing in China. Urban Stud. 1996, 33, 971–989. [Google Scholar] [CrossRef]

- Wu, J.; Gyourko, J.; Deng, Y. Evaluating the risk of Chinese housing markets: What we know and what we need to know. China Econ. Rev. 2016, 39, 91–114. [Google Scholar] [CrossRef]

- Zhang, D.; Liu, Z.; Fan, G.-Z.; Horsewood, N. Price bubbles and policy interventions in the Chinese housing market. J. Hous. Built Environ. 2017, 32, 133–155. [Google Scholar] [CrossRef]

- An, H.; Wang, R. An Empirical Analysis of Influencing Factors in Real Estate Prices of China and The Current Real Estate Regulating Policy. Financ. Econ. 2013, 3, 115–124. (In Chinese) [Google Scholar]

- Cai, M.; Huang, X.; Zhao, D. Micro Analysis on Countercyclical Macro: Regulation Policy Performance in Housing Market. Econ. Res. J. 2011, 46, 80–89+126. (In Chinese) [Google Scholar]

- Chen, X.; Hu, C.; Hua, Y. The Spillover Effect of Extreme Risk between Banking and Real Estate. Syst. Eng. 2017, 35, 127–133. (In Chinese) [Google Scholar]

- He, Q.; Qian, Z.; Guo, J. Housing Prices and Business Cycle in China: A DSGE Model. Econ. Res. J. 2015, 50, 41–53. [Google Scholar]

- Ye, J.; Li, J. Study on Quaternity of “Housing-Land-Fiscal-Finance” Policies for Establishing the Long-term Real Estate Regulation Mechanism. China Soft Sci. 2018, 12, 67–86. [Google Scholar]

- Gao, P. The new Stage of Improving the Tax System. Econ. Res. J. 2015, 50, 4–15. (In Chinese) [Google Scholar]

- Wang, A.; Wang, J. Effect of the Macro-prudential Policy and the Relationshp between Monetary Policy and Macro-prudential Policy. Econ. Res. J. 2014, 49, 17–31. (In Chinese) [Google Scholar]

- Zhang, Z. Problems, obstacles to development and institutional construction of subsidized housing construction in China. Theory Reform 2011, 3, 72–75. [Google Scholar]

- Ye, J.; Li, J. Improving the rental market: An inevitable choice for the structural optimization of the housing market. Guizhou Soc. Sci. 2015, 3, 116–122. (In Chinese) [Google Scholar]

- Zhang, P.; Hou, Y. A Model for the Ability-to-pay Index of China’s Real Property Tax: Tax Burden Distribution and Redistributive Effects. Econ. Res. J. 2016, 51, 118–132. [Google Scholar]

- Zhang, P.; Jing, Y. Strategies in adopting unpopular policies in China: The case of property tax reform. J. Contemp. China 2020, 29, 387–399. [Google Scholar] [CrossRef]

- Jiang, Z. Real Estate Market Fluctuations, Effectiveness of Macroprudential Policy and Two-Pillar Policy Regulation. Stat. Res. 2023, 40, 101–116. (In Chinese) [Google Scholar]

- Zhou, L. Governing China’s Local Officials: An Analysis of Promotion Tournament Model. Econ. Res. J. 2007, 7, 36–50. [Google Scholar]

- Zhou, L. Administrative Subcontract. Chin. J. Sociol. 2014, 34, 1–38. (In Chinese) [Google Scholar]

- Zhou, X. Administrative Subcontract and the Logic of Empire: Commentary on Zhou Li’An’s Article. Chin. J. Sociol. 2014, 34, 39–51. [Google Scholar]

- Liu, S. Risks and Reform of Land-Based Development Model. Int. Econ. Rev. 2012, 2, 92–109+7. (In Chinese) [Google Scholar]

- Liu, S.; Wang, Z.; Zhang, W.; Xiong, X. The Exhaustion of China’s “Land-Driven Development” Mode: An Analysis Based on Threshold Regression. J. Manag. World 2020, 36, 80–92+119+246. [Google Scholar]

- Jiang, X.; Liu, S.; Li, Q. Land system reform and national economic growth. J. Manag. World 2007, 9, 1–9. (In Chinese) [Google Scholar]

- Huang, S.; Chen, B.; Liu, Z. Rent-Tax Substitution, Fiscal Revenue and Government Real Estate Development Strategy. Econ. Res. J. 2012, 47, 93–106+160. [Google Scholar]

- Zhang, Y. Land Financing Risk and Its Management in Local Government. Chin. Public Adm. 2013, 1, 89–92. (In Chinese) [Google Scholar]

- Zheng, S.; Sun, W.; Wu, J.; Wu, Y. Infrastructure Investment, Land Leasing and Real Estate Price: A Unique Financing and Investment Channel for Urban Development in Chinese Cities. Econ. Res. J. 2014, 49, 14–27. (In Chinese) [Google Scholar]

- Ji, Y.; Fu, W.; Yang, Y. Land Financing, Unbalanced Urbanization and the Risk of Local Government Debt. Stat. Res. 2019, 36, 91–103. [Google Scholar]

- Pan, Y.; Ning, B.; Xiao, J. Local Political Power Transition and Reconstruction of Government-business Relations: Evidence from Local Officials’ Trunover and Executives’ Changes. China Ind. Econ. 2015, 6, 135–147. (In Chinese) [Google Scholar]

- Peng, Z.; Li, L.; Wen, L. Macroeconomic Control, Corporate Governance and Financial Risk: Based on Panel Data of Listed Real Estate Companies. J. Cent. Univ. Financ. Econ. 2014, 5, 52–59. [Google Scholar]

- Yang, S.; Wen, T. The Economic Fluctuations, the Change in Taxation Institution, and the Capitalization of Land Resources: A Case Study on the Problems with “the Three Times of Enclosing Land” since China’s Reform. J. Manag. World 2010, 4, 32–41+187. (In Chinese) [Google Scholar]

- Zhang, L.; Nian, Y.; Liu, J. Land Market Fluctuations and Local Government Debts: Evidence from the Municipal Investment Bonds in China. China Econ. Q. 2018, 17, 1103–1126. (In Chinese) [Google Scholar]

- Chen, B.; Zhang, C. Human Capitals and Housing Prices in Chinese Cities. Soc. Sci. China 2016, 5, 43–64+205. (In Chinese) [Google Scholar]

- Wang, L. Land Supply, Housing Price and Spatial Allocation Efficiency of Labor. China Econ. Q. 2023, 23, 500–516. (In Chinese) [Google Scholar]

- Wu, F.; Zhang, F.; Liu, Y. Beyond growth machine politics: Understanding state politics and national political mandates in China’s urban redevelopment. Antipode 2022, 54, 608–628. [Google Scholar] [CrossRef]

- Ren, R.; Yue, G. The role of the real estate sector in the national economy from the perspective of final demand. Macroeconomics 2023, 1, 61–69+127. (In Chinese) [Google Scholar]

- Xu, X.; Jia, H.; Li, J.; Li, J. On the Role Played by Real Estate in the Growth of China’s National Economy. Soc. Sci. China 2015, 1, 84–101+204. (In Chinese) [Google Scholar]

- Hofman, A.; Aalbers, M.B. A finance-and real estate-driven regime in the United Kingdom. Geoforum 2019, 100, 89–100. [Google Scholar] [CrossRef]

- Duan, Z.; Zeng, L. An empirical test of the impact of macroeconomic fundamentals on property prices. Stat. Decis. 2010, 15, 110–114. [Google Scholar]

- Al-Masum, M.A.; Lee, C.L. Modelling housing prices and market fundamentals: Evidence from the Sydney housing market. Int. J. Hous. Mark. Anal. 2019, 12, 746–762. [Google Scholar] [CrossRef]

- Case, K.E.; Shiller, R.J. Forecasting prices and excess returns in the housing market. Real Estate Econ. 1990, 18, 253–273. [Google Scholar] [CrossRef]

- Clapp, J.M.; Giaccotto, C. The influence of economic variables on local house price dynamics. J. Urban Econ. 1994, 36, 161–183. [Google Scholar] [CrossRef]

- Donald, J.G.; Winkler, D. The dynamics of metropolitan housing prices. J. Real Estate Res. 2002, 23, 29–46. [Google Scholar] [CrossRef]

- Maynou, L.; Monfort, M.; Morley, B.; Ordonez, J. Club convergence in European housing prices: The role of macroeconomic and housing market fundamentals. Econ. Model. 2021, 103, 105595. [Google Scholar] [CrossRef]

- Potepan, M.J. Explaining intermetropolitan variation in housing prices, rents and land prices. Real Estate Econ. 1996, 24, 219–245. [Google Scholar] [CrossRef]

- Ren, M.; Su, G. Housing Price Macro-control: Based on Empirical Study since 2003. J. Cent. Univ. Financ. Econ. 2010, 6, 55–60. (In Chinese) [Google Scholar]

- Shen, Y.; Liu, H. Housing Prices and Economic Fundamental: A Cross City Analysis of China for 1995–2002. Econ. Res. J. 2004, 6, 78–86. (In Chinese) [Google Scholar]

- Liang, Y.; Gao, T. Empirical Analysis on Real Estate Price Fluctuation in Different Provinces of China. Econ. Res. J. 2007, 8, 133–142. (In Chinese) [Google Scholar]

- Peng, W.; Tam, D.C.; Yiu, M.S. Property market and the macroeconomy of mainland China: A cross region study. Pac. Econ. Rev. 2008, 13, 240–258. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, Q. Fundamental factors in the housing markets of China. J. Hous. Econ. 2014, 25, 53–61. [Google Scholar] [CrossRef]

- Chen, C.; Fu, Y. The Determination of High House Prices in China: Fundamentals and Bubble Decomposition—An Empirical Study Based on Panel Data (1999–2009). World Econ. Pap. 2013, 2, 50–66. (In Chinese) [Google Scholar]

- An, L.; Li, B.; Shen, Y. House Price, Financing Constraints and Industrial Enterprise Innovation: From the Perspective of the Decomposition of Economic Fundamentals and Bubbles of House Prices. Manag. Rev. 2022, 34, 92–107. (In Chinese) [Google Scholar]

- Braid, R.M. The short-run comparative statics of a rental housing market. J. Urban Econ. 1981, 10, 286–310. [Google Scholar] [CrossRef]

- Coskun, Y. The establishment of the real estate regulation and supervision agency of Turkey (RERSAT). Hous. Financ. Int. 2011, 25, 42–51. [Google Scholar]

- Kimura, T.; Kurozumi, T. Effectiveness of history-dependent monetary policy. J. Jpn. Int. Econ. 2004, 18, 330–361. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, D.; Zhao, J.; Zheng, X.; Zhang, L. Effect of the housing purchase restriction policy on the Real Estate Market: Evidence from a typical suburb of Beijing, China. Land Use Policy 2020, 94, 104528. [Google Scholar] [CrossRef]

- Wang, M.; Huang, Y. The impact of purchase restrictions and real estate tax on housing prices: An analysis based on long-term dynamic equilibrium. J. World Econ. (Shijie Jingji) 2013, 1, 141–159. [Google Scholar]

- Wu, H. The Effect of the Land Policy on the Real Estate Regulation. J. Zhongnan Univ. Econ. Law 2011, 6, 23–27+49+142–143. [Google Scholar]

- Chen, S.; Wang, X. Financial Costs, Housing Prices Fluctuation and Monetary Policy Transmission. J. Financ. Res. 2016, 3, 1–14. [Google Scholar]

- Zhang, H.; Li, Y. A Study of Regional Differences in the Transmission Effect of Real Estate Market on Monetary Policy—An Empirical Analysis Based on GVAR Model. J. Financ. Res. 2013, 2, 114–128. (In Chinese) [Google Scholar]

- Jia, J.; Zhang, C.; Qin, C.; Feng, J. Vertical Fiscal Imbalance, Political Promotion and Land Finance. China Soft Sci. 2016, 9, 144–155. [Google Scholar]

- Luo, D.; Huang, X.; Nie, C. Property Rights, Political Connection and Real Estate Company Financing. Financ. Trade Res. 2010, 21, 112–119. (In Chinese) [Google Scholar]

- Yang, F.; Lu, Z. How “Special Interest Groups” Influence Local Government Decisions in China: The Case of Real Estate Interest Groups. J. Manag. World 2010, 6, 65–73+108. (In Chinese) [Google Scholar]

- Zachariadis, M.; Scott, S.V.; Barrett, M.I. Exploring Critical Realism as the Theoretical Foundation of Mixed-Method Research: Evidence from the Economies for IS Innovations, University of Cambridge: Cambridge, UK, 2010.

- Tan, L.; Lou, C. Research on the Central-Local Governments Relations in the Policy Process of Social Housing: Analyzing and Application of Policy Network Theory. J. Public Manag. 2012, 9, 52–63+124–125. (In Chinese) [Google Scholar]

- Guo, K. Demand and regulation mechanisms in China’s real estate market: An analytical framework for dealing with the relationship between government and market. J. Manag. World 2017, 2, 97–108. [Google Scholar]

- Mann, M. The autonomous power of the state: Its origins, mechanisms and results. Eur. J. Sociol. Arch. Eur. De Sociol. 1984, 25, 185–213. [Google Scholar] [CrossRef]

- Mann, M. Infrastructural power revisited. Stud. Comp. Int. Dev. 2008, 43, 355–365. [Google Scholar] [CrossRef]

- Besley, T.; Persson, T. The origins of state capacity: Property rights, taxation, and politics. Am. Econ. Rev. 2009, 99, 1218–1244. [Google Scholar] [CrossRef]

- Evans, P.B. Embedded Autonomy: States and Industrial Transformation; Princeton University Press: Princeton, NJ, USA, 1995. [Google Scholar]

- Fukuyama, F. Trust: The Social Virtues and the Creation of Prosperity; Simon and Schuster: New York, NY, USA, 1996. [Google Scholar]

- Huntington, S.P. Political Order in Changing Societies; Yale University Press: London, UK, 2006. [Google Scholar]

- Migdal, J.S. Strong Societies and Weak States: State-Society Relations and State Capabilities in the Third World; Princeton University Press: Princeton, NJ, USA, 1988. [Google Scholar]

- Soifer, H. State infrastructural power: Approaches to conceptualization and measurement. Stud. Comp. Int. Dev. 2008, 43, 231–251. [Google Scholar] [CrossRef]

- Tilly, C. Coercion, Capital, and European States, AD 990–1992; Blackwell: Oxford, UK, 1992. [Google Scholar]

- Wang, S. National governance and foundational state capacity. J. Huazhong Univ. Sci. Technol. (Soc. Sci. Ed.) 2014, 28, 8–10. (In Chinese) [Google Scholar]

- Zhou, L. Administrative Contracting System and State Capacity with Chinese Characteristics. Open Times 2022, 4, 28–50+25–26. (In Chinese) [Google Scholar]

- Tang, S. On Social Evolution: Phenomenon and Paradigm; Routledge: Oxford, UK, 2020. [Google Scholar]

- Andrews, M.; Pritchett, L.; Woolcock, M. Building State Capability: Evidence, Analysis, Action; Oxford University Press: Oxford, UK, 2017. [Google Scholar] [CrossRef]

- Nordlinger, E.A. On the Autonomy of the Democratic State; Harvard University Press: Cambridge, MA, USA, 1981. [Google Scholar]

- Olson, M. Power and prosperity: Outgrowing communist and capitalist dictatorships. Sci. Soc. 2002, 66, 420–423. [Google Scholar]

- Dincecco, M.; Prado, M. Warfare, fiscal capacity, and performance. J. Econ. Growth 2012, 17, 171–203. [Google Scholar] [CrossRef]

- Lin, J.Y. An economic theory of institutional change: Induced and imposed change. Cato J. 1989, 9, 1. [Google Scholar]

- North, D.C.; Weingast, B.R. Constitutions and commitment: The evolution of institutions governing public choice in seventeenth-century England. J. Econ. Hist. 1989, 49, 803–832. [Google Scholar] [CrossRef]

- Tsebelis, G. Veto Players: How Political Institutions Work; Princeton University Press: Princeton, NJ, UK, 2002. [Google Scholar]

- Bell, S.; Hindmoor, A. Rethinking Governance: The Centrality of the State in Modern Society; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Fukuyama, F. Political Order and Political Decay: From the Industrial Revolution to the Globalization of Democracy; Macmillan: New York, NY, USA, 2014. [Google Scholar]

- Balla, E.; Johnson, N.D. Fiscal crisis and institutional change in the Ottoman Empire and France. J. Econ. Hist. 2009, 69, 809–845. [Google Scholar] [CrossRef]

- Huang, Z.; Li, L.; Ma, G.; Xu, L.C. Hayek, local information, and commanding heights: Decentralizing state-owned enterprises in China. Am. Econ. Rev. 2017, 107, 2455–2478. [Google Scholar] [CrossRef]

- Luong, P.J.; Weinthal, E. Contra coercion: Russian tax reform, exogenous shocks, and negotiated institutional change. Am. Political Sci. Rev. 2004, 98, 139–152. [Google Scholar] [CrossRef]

- Acemoglu, D.; Robinson, J.A. The Narrow Corridor: How Nations Struggle for Liberty; Penguin: London, UK, 2019. [Google Scholar]

- Weiss, L.; Hobson, J.M. States and Economic Development: A Comparative Historical Analysis; Polity Press: Cambridge, UK, 1995. [Google Scholar]

- Acemoglu, D. Why not a political Coase theorem? Social conflict, commitment, and politics. J. Comp. Econ. 2003, 31, 620–652. [Google Scholar] [CrossRef]

- Coate, S.; Morris, S. Policy persistence. Am. Econ. Rev. 1999, 89, 1327–1336. [Google Scholar] [CrossRef]

- North, D.C. A transaction cost theory of politics. J. Theor. Politics 1990, 2, 355–367. [Google Scholar] [CrossRef]

- North, D.C.; Thomas, R.P. The Rise of the Western World: A New Economic History; Cambridge University Press: Cambridge, UK, 1973. [Google Scholar]

- Yao, Y. The System of Farmland in China: An Analytical Framework. Soc. Sci. China 2000, 2, 54–65. (In Chinese) [Google Scholar]

- Heilmann, S.; Perry, E.J. Embracing uncertainty: Guerrilla policy style and adaptive governance in China. In Mao’s Invisible Hand; Harvard University Asia Center: Cambridge, MA, USA, 2011; pp. 1–29. [Google Scholar]

- Lipset, S.M. Some social requisites of democracy: Economic development and political legitimacy1. Am. Political Sci. Rev. 1959, 53, 69–105. [Google Scholar] [CrossRef]

- Zhou, X. From the “Law of Huang Zongxi” to the Logic of the Empire: The Historical Lead of the Logic of Chinese State Governance. Open Times 2014, 4, 108–132. (In Chinese) [Google Scholar]

- Zhou, X. Authoritarian Institutions and Effective Governance: The Institutional Logic of State Governance in Contemporary China. Open Times 2011, 10, 67–85. (In Chinese) [Google Scholar]

- Dixit, A.K. The Making of Economic Policy: A Transaction-Cost Politics Perspective; MIT Press: Cambridge, MA, USA, 1998. [Google Scholar]

- Zhou, L. “Bureaucratic & Economic Markets” and China’s Growth Story. Chin. J. Sociol. 2018, 38, 1–45. (In Chinese) [Google Scholar]

- Cheng, X. From political enchantment to legal logic—A discursive analysis of contentious labor politics in Central China. J. Contemp. China 2017, 26, 549–563. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, H.; de Vries, W.T.; Zheng, M.; Ye, J. State Capacity to Influence Actor Relations within the Chinese Real Estate Market: An Analytical Framework. Land 2023, 12, 1601. https://doi.org/10.3390/land12081601

Gao H, de Vries WT, Zheng M, Ye J. State Capacity to Influence Actor Relations within the Chinese Real Estate Market: An Analytical Framework. Land. 2023; 12(8):1601. https://doi.org/10.3390/land12081601

Chicago/Turabian StyleGao, He, Walter Timo de Vries, Minrui Zheng, and Jianping Ye. 2023. "State Capacity to Influence Actor Relations within the Chinese Real Estate Market: An Analytical Framework" Land 12, no. 8: 1601. https://doi.org/10.3390/land12081601

APA StyleGao, H., de Vries, W. T., Zheng, M., & Ye, J. (2023). State Capacity to Influence Actor Relations within the Chinese Real Estate Market: An Analytical Framework. Land, 12(8), 1601. https://doi.org/10.3390/land12081601