The Impact of Bancassurance Interaction on the Adoption Behavior of Green Production Technology in Family Farms: Evidence from China

Abstract

1. Introduction

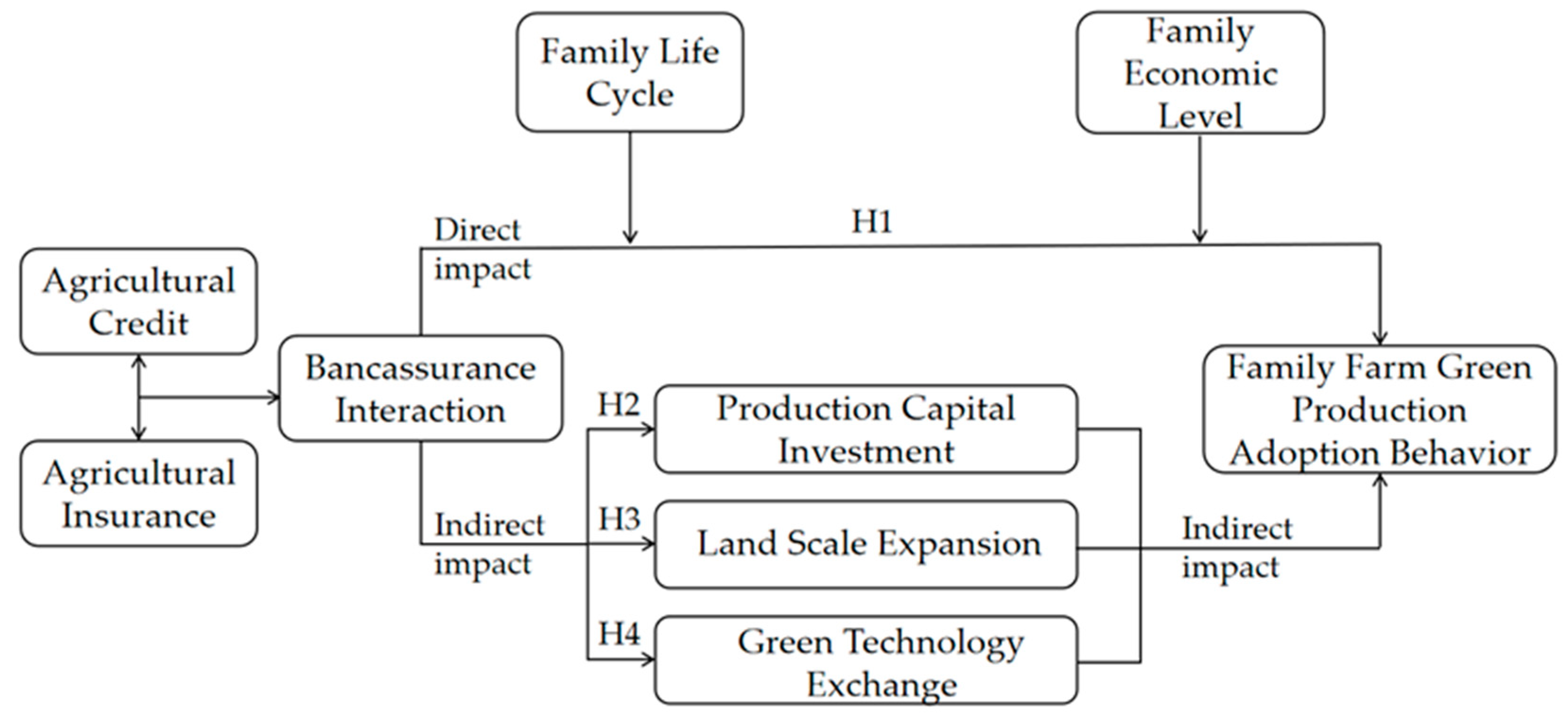

2. Theoretical Framework

2.1. The Direct Impact of the Bancassurance Interaction on Green Technology Adoption Behavior in Family Farms

2.2. The Indirect Impact of the Bancassurance Interaction on the Adoption of Green Technology in Family Farms

3. Materials and Methodology

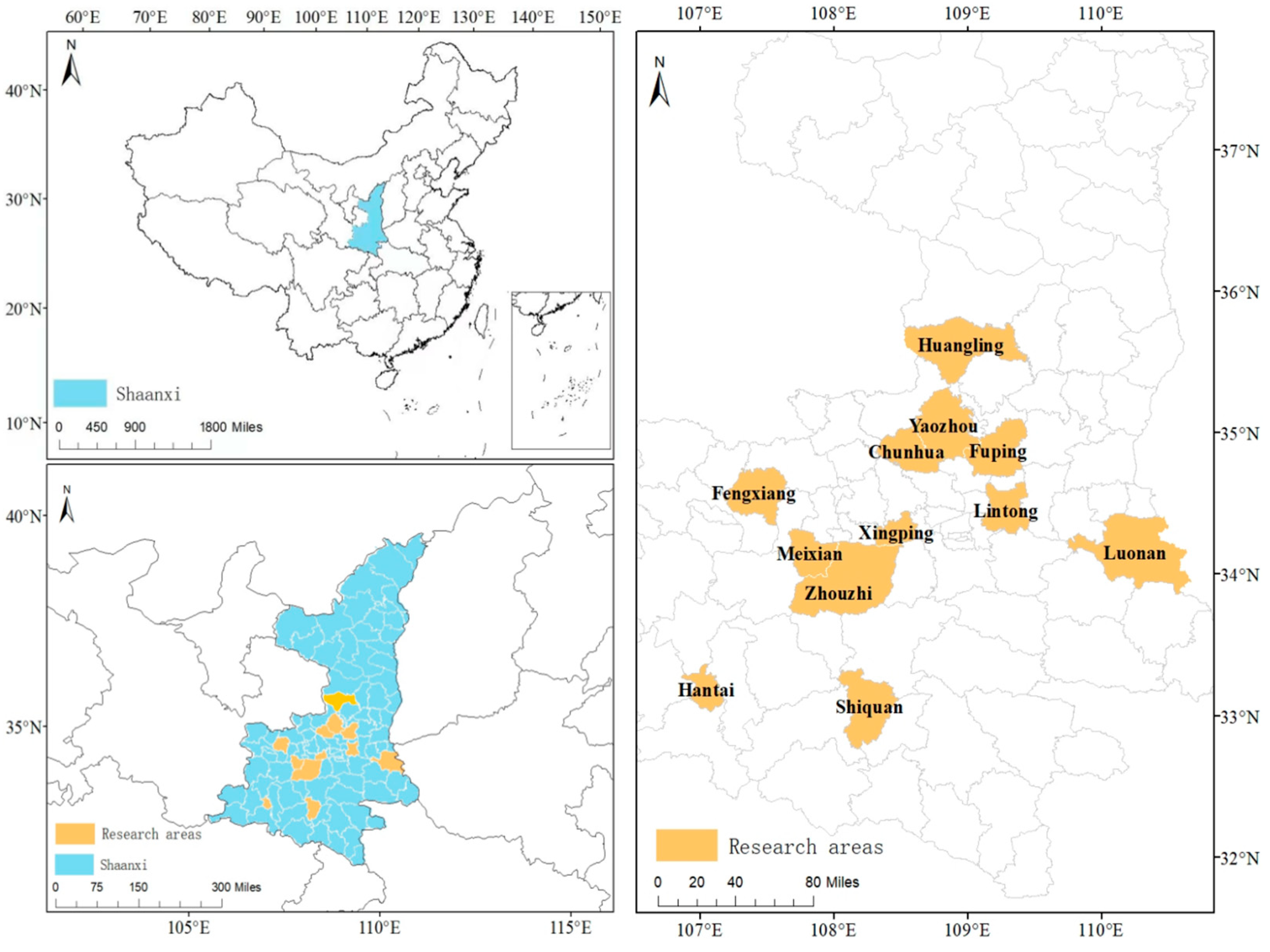

3.1. Data Source

3.2. Variable Measurement

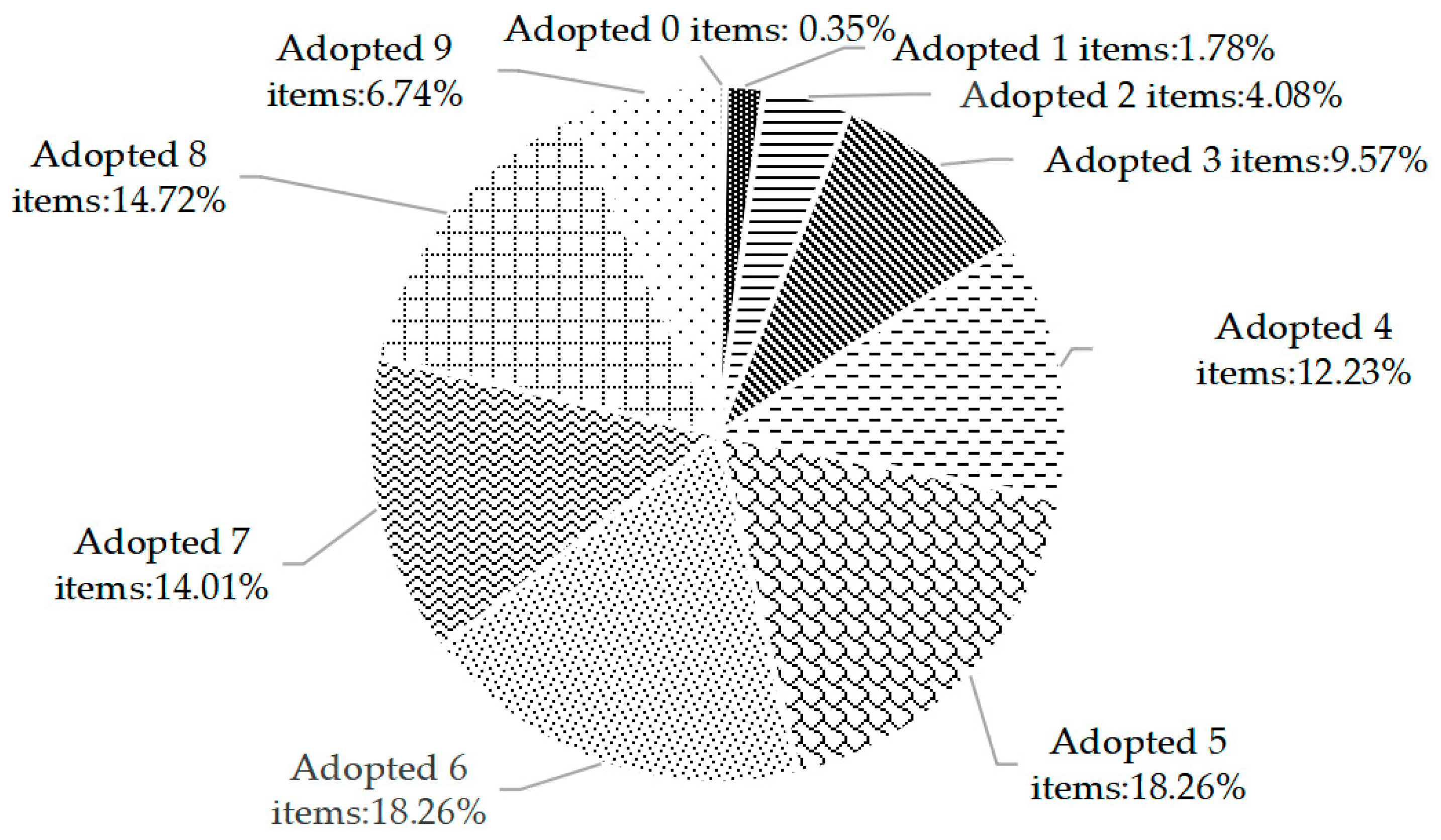

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Control Variables

3.2.4. Adjusted Variables

3.2.5. Intermediary Variables

3.3. Methodology

3.3.1. Ordered Probit Model

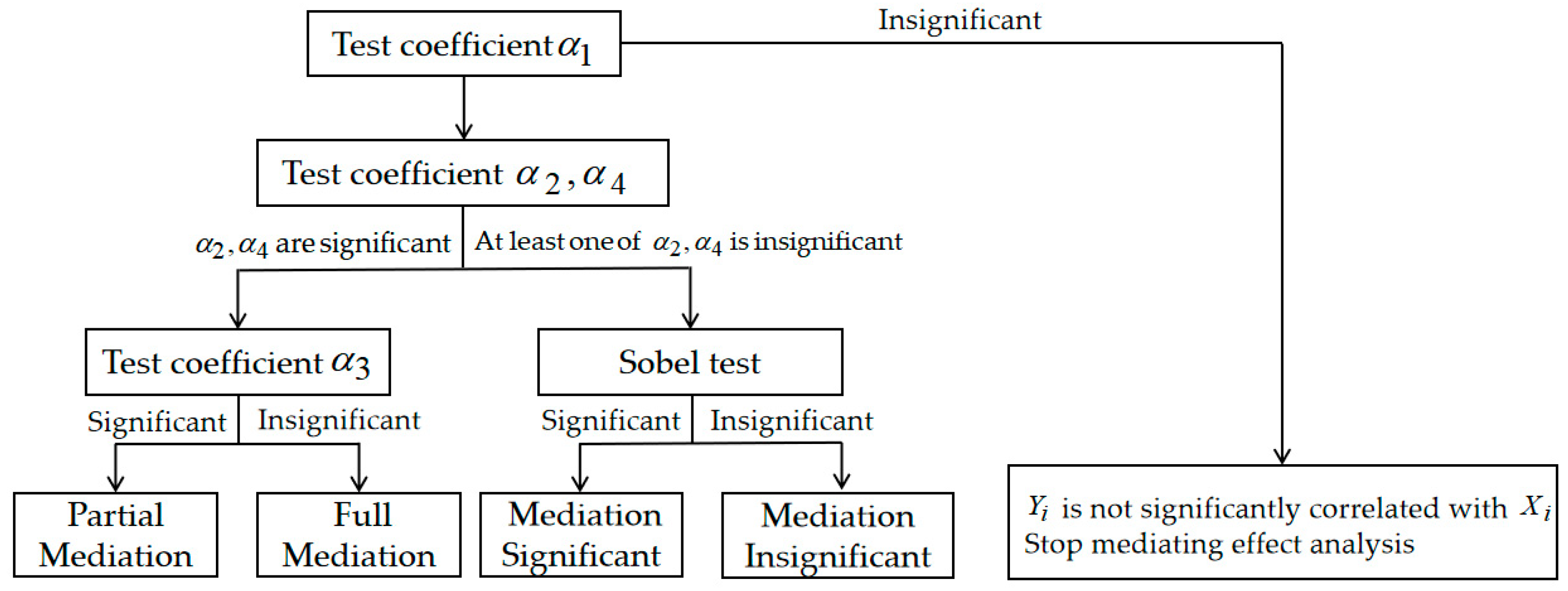

3.3.2. Mediation Effect Model

4. Results

4.1. The Impact of the Bancassurance Interaction on the Adoption of Green Production Technology

4.2. Endogenous Problem Handling

4.3. Robustness Test

4.3.1. PSM Test

4.3.2. A Multi-Attribute Decision Support System Approach Based on the Logit Model

4.4. Heterogeneity Analysis

4.4.1. Grouped by Family Life Cycle

4.4.2. Grouped by Family Economic Level

4.5. Mechanism Analysis

5. Discussion

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, Z.; Li, X.J.; Xia, X.L. Measurement and Spatial Convergence Analysis of China’s Agricultural Green Development Index. Environ. Sci. Pollut. Res. 2021, 28, 19694–19709. [Google Scholar] [CrossRef]

- Zhang, C.; Kong, X.Z.; Qiu, H.G. Does the Expansion of Farm Size Contribute to the Reduction of Chemical Fertilizers? Empirical Analysis Based on 1274 Family Farms in China. J. Agrotechnical Econ. 2021, 4, 110–121. [Google Scholar]

- Gong, T.C.; Battese, G.E.; Villano, R.A. Family Farms plus Cooperatives in China: Technical Efficiency in Crop Production. J. Asian Econ. 2019, 64, 101129. [Google Scholar] [CrossRef]

- Peng, W.; Sun, Y.; Li, Y.; Yuchi, X. An Evaluation and Promotion Strategy of Green Land Use Benefits in China: A Case Study of the Beijing–Tianjin–Hebei Region. Land 2022, 11, 1158. [Google Scholar] [CrossRef]

- Yang, Q.; Zhu, Y.; Liu, L.; Wang, F. Land Tenure Stability and Adoption Intensity of Sustainable Agricultural Practices in Banana Production in China. J. Clean. Prod. 2022, 338, 130553. [Google Scholar] [CrossRef]

- Sun, X.; Lyu, J.; Ge, C. Knowledge and Farmers’ Adoption of Green Production Technologies: An Empirical Study on IPM Adoption Intention in Major Indica-Rice-Producing Areas in the Anhui Province of China. Int. J. Environ. Res. Public Health 2022, 19, 14292. [Google Scholar] [CrossRef]

- Luo, L.; Qiao, D.; Zhang, R.; Luo, C.; Fu, X.; Liu, Y. Research on the Influence of Education of Farmers’ Cooperatives on the Adoption of Green Prevention and Control Technologies by Members: Evidence from Rural China. Int. J. Environ. Res. Public Health 2022, 19, 6255. [Google Scholar] [CrossRef]

- Porteous, O. Trade and Agricultural Technology Adoption: Evidence from Africa. J. Dev. Econ. 2020, 144, 102440. [Google Scholar] [CrossRef]

- Guo, L.; Li, H.; Cao, X.; Cao, A.; Huang, M. Effect of Agricultural Subsidies on the Use of Chemical Fertilizer. J. Environ. Manag. 2021, 299, 113621. [Google Scholar] [CrossRef]

- Lu, Y.; Tan, Y.; Wang, H. Impact of Environmental Regulation on Green Technology Adoption by Farmers Microscopic Investigation Evidence From Pig Breeding in China. Front. Environ. Sci. 2022, 10, 885933. [Google Scholar] [CrossRef]

- Kudadze, S.; Ahado, S.; Donkoh, S. Agricultural Credit Accessibility and Rice Production in Savelugu-Nanton and Walewale Districts of Northern Ghana. Res. J. Financ. Account. 2016, 7, 126–136. [Google Scholar]

- Wang, X.; Ma, Y.; Li, H.; Xue, C. How Does Risk Management Improve Farmers’ Green Production Level? Organic Fertilizer as an Example. Front. Environ. Sci. 2022, 10, 946855. [Google Scholar] [CrossRef]

- Farrin, K.; Miranda, M.J. A Heterogeneous Agent Model of Credit-Linked Index Insurance and Farm Technology Adoption. J. Dev. Econ. 2015, 116, 199–211. [Google Scholar] [CrossRef]

- Cai, J. The Impact of Insurance Provision on Household Production and Financial Decisions. Am. Econ. J. Econ. Policy 2016, 8, 44–88. [Google Scholar] [CrossRef]

- Urruty, N.; Deveaud, T.; Guyomard, H.; Boiffin, J. Impacts of Agricultural Land Use Changes on Pesticide Use in French Agriculture. Eur. J. Agron. 2016, 80, 113–123. [Google Scholar] [CrossRef]

- Dick, W.J.A.; Wang, W. Government Interventions in Agricultural Insurance. Agric. Agric. Sci. Procedia 2010, 1, 4–12. [Google Scholar] [CrossRef]

- Han, L.; Hare, D. The Link between Credit Markets and Self-Employment Choice among Households in Rural China. J. Asian Econ. 2013, 26, 52–64. [Google Scholar] [CrossRef]

- Makate, C.; Makate, M.; Mutenje, M.; Mango, N.; Siziba, S. Synergistic Impacts of Agricultural Credit and Extension on Adoption of Climate-Smart Agricultural Technologies in Southern Africa. Environ. Dev. 2019, 32, 100458. [Google Scholar] [CrossRef]

- Zhu, R.; Gu, X.S.; Qin, T.; Ren, T.C. The Effect and Mechanism of Bank-insurance Interactions on Farmers’ Income Increase: An Analysis Based on the Survey Data Collected from Shandong, Liaoning, Jiangxi and Sichuan Provinces. China Rural. Surv. 2023, 1, 96–115. [Google Scholar]

- Yanuarti, R.; Aji, J.; Rondhi, M. Risk Aversion Level Influence on Farmer’s Decision to Participate in Crop Insurance: A Review. Agric. Econ. Zemědělská Ekon. 2019, 65, 481–489. [Google Scholar] [CrossRef]

- King, M.; Singh, A.P. Understanding Farmers’ Valuation of Agricultural Insurance: Evidence from Vietnam. Food Policy 2020, 94, 101861. [Google Scholar] [CrossRef]

- Wong, H.L.; Wei, X.; Kahsay, H.B.; Gebreegziabher, Z.; Gardebroek, C.; Osgood, D.E.; Diro, R. Effects of Input Vouchers and Rainfall Insurance on Agricultural Production and Household Welfare: Experimental Evidence from Northern Ethiopia. World Dev. 2020, 135, 105074. [Google Scholar] [CrossRef]

- Goddard, J. The Economics of Microfinance by B. Armendariz & J. Morduch. J. Asia-Pac. Bus. 2009, 10, 97–106. [Google Scholar] [CrossRef]

- Du, J.; Zhang, W.K.; Fan, J.L. Double Characteristics Analysis of Influence of Rural Financial Development on Farmers’ Income. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2017, 6, 35–43+149. [Google Scholar]

- Giné, X.; Yang, D. Insurance, Credit, and Technology Adoption: Field Experimental Evidence from Malawi. J. Dev. Econ. 2009, 89, 1–11. [Google Scholar] [CrossRef]

- Yu, L.Y.; Liang, H.B.; Lu, Y.Y. The Impact of Credit Availability on Farmers’ Adoption of Green Production Technology: Based on the Moderating Effect of Farmers’ Participation in Cooperatives. J. Agro-For. Econ. Manag. 2023, 1, 1–13. [Google Scholar]

- Xie, Y.M.; Gao, J. Study on the effect of bank-insured interaction on income fluctuation of farm households in China. J. Zhongshan Univ. Soc. Sci. Ed. 2014, 54, 158–164. [Google Scholar]

- Dong, X.L.; Lv, S.; Tang, Y.M. Can the Credit and Insurance Interactions Alleviate the Farmers’ Credit Rationings:Evidence from a Choice Experiment. J. Agrotech. Econ. 2018, 6, 71–80. [Google Scholar]

- Goodwin, B.K.; Smith, V.H. What Harm Is Done By Subsidizing Crop Insurance? Am. J. Agric. Econ. 2013, 95, 489–497. [Google Scholar] [CrossRef]

- Möhring, N.; Dalhaus, T.; Enjolras, G.; Finger, R. Crop Insurance and Pesticide Use in European Agriculture. Agric. Syst. 2020, 184, 102902. [Google Scholar] [CrossRef]

- Adetiloye, K.A. Agricultural Financing in Nigeria: An Assessment of the Agricultural Credit Guarantee Scheme Fund (ACGSF) For Food Security in Nigeria (1978–2006). J. Econ. 2012, 3, 39–48. [Google Scholar] [CrossRef]

- Abate, G.T.; Rashid, S.; Borzaga, C.; Getnet, K. Rural Finance and Agricultural Technology Adoption in Ethiopia: Does the Institutional Design of Lending Organizations Matter? World Dev. 2016, 84, 235–253. [Google Scholar] [CrossRef]

- Yu, L.; Song, Y.; Wu, H.; Shi, H. Credit Constraint, Interlinked Insurance and Credit Contract and Farmers’ Adoption of Innovative Seeds-Field Experiment of the Loess Plateau. Land 2023, 12, 357. [Google Scholar] [CrossRef]

- Biffis, E.; Chavez, E.; Louaas, A.; Picard, P. Parametric Insurance and Technology Adoption in Developing Countries. Geneva Risk Insur. Rev. 2022, 47, 7–44. [Google Scholar] [CrossRef]

- Riaz, A.; Khan, G.A.; Ahmad, M. Utilization of Agriculture Credit by the Farming Community of Zarai Tariqiati Bank Limited (Ztbl) for Agriculture Development. Pak. J. Agric. Sci. 2012, 49, 557–560. [Google Scholar]

- Liao, P.; Lv, L.; He, Y.P. A Comparison Study on the Poverty Alleviation Effects of Credit, Insurance and “Credit + Insurance”. Insur. Stud. 2019, 2, 63–77. [Google Scholar]

- Mao, H.; Hu, R.; Zhou, L.; Sun, J. Crop Insurance and the Farmers’ Adoption of Green Technology: Empirical Analysis Based on Cotton Farmers. J. Agrotech. Econ. 2022, 11, 95–111. [Google Scholar]

- Li, R.; Yu, Y. Impacts of Green Production Behaviors on the Income Effect of Rice Farmers from the Perspective of Outsourcing Services: Evidence from the Rice Region in Northwest China. Agriculture 2022, 12, 1682. [Google Scholar] [CrossRef]

- Brick, K.; Visser, M. Risk Preferences, Technology Adoption and Insurance Uptake: A Framed Experiment. J. Econ. Behav. Organ. 2015, 118, 383–396. [Google Scholar] [CrossRef]

- Wang, F.; Du, L.; Tian, M. Does Agricultural Credit Input Promote Agricultural Green Total Factor Productivity? Evidence from Spatial Panel Data of 30 Provinces in China. Int. J. Environ. Res. Public Health 2023, 20, 529. [Google Scholar] [CrossRef]

- Yang, C.; Zeng, H.; Zhang, Y. Are Socialized Services of Agricultural Green Production Conducive to the Reduction in Fertilizer Input? Empirical Evidence from Rural China. Int. J. Environ. Res. Public Health 2022, 19, 14856. [Google Scholar] [CrossRef] [PubMed]

- Xu, Q.; Zhu, P.; Tang, L. Agricultural Services: Another Way of Farmland Utilization and Its Effect on Agricultural Green Total Factor Productivity in China. Land 2022, 11, 1170. [Google Scholar] [CrossRef]

- Huan, M.; Li, Y.; Chi, L.; Zhan, S. The Effects of Agricultural Socialized Services on Sustainable Agricultural Practice Adoption among Smallholder Farmers in China. Agronomy 2022, 12, 2198. [Google Scholar] [CrossRef]

- Feng, Y.; Liang, Z. How Does Green Credit Policy Affect Total Factor Productivity of the Manufacturing Firms in China? The Mediating Role of Debt Financing and the Moderating Role of Environmental Regulation. Environ. Sci. Pollut. Res. 2022, 29, 31235–31251. [Google Scholar] [CrossRef]

- Dercon, S.; Christiaensen, L. Consumption Risk, Technology Adoption and Poverty Traps: Evidence from Ethiopia. J. Dev. Econ. 2011, 96, 159–173. [Google Scholar] [CrossRef]

- Miranda, M.J.; Gonzalez-Vega, C. Systemic Risk, Index Insurance, and Optimal Management of Agricultural Loan Portfolios in Developing Countries. Am. J. Agric. Econ. 2011, 93, 399–406. [Google Scholar] [CrossRef]

- Zanardi, O.Z.; do Prado Ribeiro, L.; Ansante, T.F.; Santos, M.S.; Bordini, G.P.; Yamamoto, P.T.; Vendramim, J.D. Bioactivity of a Matrine-Based Biopesticide against Four Pest Species of Agricultural Importance. Crop Prot. 2015, 67, 160–167. [Google Scholar] [CrossRef]

- Hill, R.V.; Viceisza, A. A Field Experiment on the Impact of Weather Shocks and Insurance on Risky Investment. Exp. Econ. 2012, 15, 341–371. [Google Scholar] [CrossRef]

- Weng, F.; Liu, X.; Huo, X. Impact of Internet Use on Farmers’ Organic Fertilizer Investment: A New Perspective of Access to Credit. Agriculture 2023, 13, 219. [Google Scholar] [CrossRef]

- Chi, L.; Han, S.; Huan, M.; Li, Y.; Liu, J. Land Fragmentation, Technology Adoption and Chemical Fertilizer Application: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 8147. [Google Scholar] [CrossRef]

- Đokić, D.; Matkovski, B.; Jeremić, M.; Đurić, I. Land Productivity and Agri-Environmental Indicators: A Case Study of Western Balkans. Land 2022, 11, 2216. [Google Scholar] [CrossRef]

- George, T.-M.; Kwadzo; Kuwornu, J.; Amadu, I. Food Crop Farmers’ Willingness to Participate in Market-Based Crop Insurance Scheme: Evidence from Ghana. Res. Appl. Econ. 2013, 5, 1–21. [Google Scholar] [CrossRef]

- Fang, L.; Hu, R.; Mao, H.; Chen, S. How Crop Insurance Influences Agricultural Green Total Factor Productivity: Evidence from Chinese Farmers. J. Clean. Prod. 2021, 321, 128977. [Google Scholar] [CrossRef]

- Ahmed, N.; Hamid, Z.; Mahboob, F.; Rehman, K.U.; Ali, M.S.E.; Senkus, P.; Wysokińska-Senkus, A.; Siemiński, P.; Skrzypek, A. Causal Linkage among Agricultural Insurance, Air Pollution, and Agricultural Green Total Factor Productivity in United States: Pairwise Granger Causality Approach. Agriculture 2022, 12, 1320. [Google Scholar] [CrossRef]

- Adnan, N.; Md Nordin, S.; Rahman, I.; Noor, A. Adoption of Green Fertilizer Technology among Paddy Farmers: A Possible Solution for Malaysian Food Security. Land Use Policy 2017, 63, 38–52. [Google Scholar] [CrossRef]

- Gunnsteinsson, S. Experimental Identification of Asymmetric Information: Evidence on Crop Insurance in the Philippines. J. Dev. Econ. 2020, 144, 102414. [Google Scholar] [CrossRef]

- Karlan, D.; Osei, R.; Osei-Akoto, I.; Udry, C. Agricultural Decisions after Relaxing Credit and Risk Constraints. Q. J. Econ. 2014, 129, 597–652. [Google Scholar] [CrossRef]

- Wu, H.; Li, J. Risk Preference, Interlinked Credit and Insurance Contract and Agricultural Innovative Technology Adoption. J. Innov. Knowl. 2023, 8, 100282. [Google Scholar] [CrossRef]

- Willy, D.K.; Holm-Müller, K. Social Influence and Collective Action Effects on Farm Level Soil Conservation Effort in Rural Kenya. Ecol. Econ. 2013, 90, 94–103. [Google Scholar] [CrossRef]

- Wossen, T.; Berger, T.; Di Falco, S. Social Capital, Risk Preference and Adoption of Improved Farm Land Management Practices in Ethiopia. Agric. Econ. 2015, 46, 81–97. [Google Scholar] [CrossRef]

- Li, M.; Wang, J.; Zhao, P.; Chen, K.; Wu, L. Factors Affecting the Willingness of Agricultural Green Production from the Perspective of Farmers’ Perceptions. Sci. Total Environ. 2020, 738, 140289. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Liu, Y.; Zhao, X.; Zhang, L.; Yuan, K. Estimating Effects of Cooperative Membership on Farmers’ Safe Production Behaviors: Evidence from the Rice Sector in China. Environ. Sci. Pollut. Res. 2021, 28, 25400–25418. [Google Scholar] [CrossRef] [PubMed]

- Derrick, F.W.; Lehfeld, A.K. The Family Life Cycle: An Alternative Approach. J. Consum. Res. 1980, 7, 214–217. [Google Scholar] [CrossRef]

- Xu, D.; Ma, Z.; Deng, X.; Liu, Y.; Huang, K.; Zhou, W.; Yong, Z. Relationships between Land Management Scale and Livelihood Strategy Selection of Rural Households in China from the Perspective of Family Life Cycle. Land 2020, 9, 11. [Google Scholar] [CrossRef]

- Wang, C.; Tong, Q.; Xia, C.; Shi, M.; Cai, Y. Does Participation in E-Commerce Affect Fruit Farmers’ Awareness of Green Production: Evidence from China. J. Environ. Plan. Manag. 2022, 10, 1–21. [Google Scholar] [CrossRef]

- Lei, Z.; Tu, T.; Li, X. Will the Substitution of Capital for Labor Increase the Use of Chemical Fertilizer in Agriculture? Analysis Based on Provincial Panel Data in China. Environ. Sci. Pollut. Res. 2023, 30, 21052–21071. [Google Scholar] [CrossRef]

- Mao, H.; Zhou, L.; Ying, R.; Pan, D. Time Preferences and Green Agricultural Technology Adoption: Field Evidence from Rice Farmers in China. Land Use Policy 2021, 109, 105627. [Google Scholar] [CrossRef]

- Zang, D.; Yang, S.; Li, F. The Relationship between Land Transfer and Agricultural Green Production: A Collaborative Test Based on Theory and Data. Agriculture 2022, 12, 1824. [Google Scholar] [CrossRef]

- Shikuku, K.M. Information Exchange Links, Knowledge Exposure, and Adoption of Agricultural Technologies in Northern Uganda. World Dev. 2019, 115, 94–106. [Google Scholar] [CrossRef]

- Islam, Z.; Alauddin, M.; Sarker, M.A.R. Determinants and Implications of Crop Production Loss: An Empirical Exploration Using Ordered Probit Analysis. Land Use Policy 2017, 67, 527–536. [Google Scholar] [CrossRef]

- Iacobucci, D. Mediation Analysis and Categorical Variables: The Final Frontier. J. Consum. Psychol. 2012, 22, 582–594. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Kupper, L.; Nizam, A.; Rosenberg, E. Applied Regression Analysis and Other Multi-Variable Methods; Cengage Learning: Boston, MA, USA, 2013; ISBN 978-1-28505-108-6. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Press: New York, NY, USA, 1998; p. 354. ISBN 978-1-57230-336-2. [Google Scholar]

- Roodman, D. Fitting Fully Observed Recursive Mixed-Process Models with Cmp. Stata J. 2011, 11, 159–206. [Google Scholar] [CrossRef]

- Xu, L.; Yang, G.Y. Social Interaction, Pension Perceptions and Resident Participation in Commercial Pension Insurance. Wuhan Financ. 2023, 1, 43–50+81. [Google Scholar]

- Chyi, H.; Mao, S. The Determinants of Happiness of China’s Elderly Population. J. Happiness Stud. 2012, 13, 167–185. [Google Scholar] [CrossRef]

- Recio, B.; Rubio, F.; Criado, J.A. A Decision Support System for Farm Planning Using AgriSupport II. Decis. Support Syst. 2003, 36, 189–203. [Google Scholar] [CrossRef]

- Matthews, K.B.; Schwarz, G.; Buchan, K.; Rivington, M.; Miller, D. Wither Agricultural DSS? Comput. Electron. Agric. 2008, 61, 149–159. [Google Scholar] [CrossRef]

- Lu, H.; Hu, L.; Zheng, W.; Yao, S.; Qian, L. Impact of Household Land Endowment and Environmental Cognition on the Willingness to Implement Straw Incorporation in China. J. Clean. Prod. 2020, 262, 121479. [Google Scholar] [CrossRef]

- Wu, H.; Hao, H.; Lei, H.; Ge, Y.; Shi, H.; Song, Y. Farm Size, Risk Aversion and Overuse of Fertilizer: The Heterogeneity of Large-Scale and Small-Scale Wheat Farmers in Northern China. Land 2021, 10, 111. [Google Scholar] [CrossRef]

- Galt, R.E. Pesticides in Export and Domestic Agriculture: Reconsidering Market Orientation and Pesticide Use in Costa Rica. Geoforum 2008, 39, 1378–1392. [Google Scholar] [CrossRef]

- Zhu, Z.; Chen, Y.; Ning, K.; Liu, Z. Policy Setting, Heterogeneous Scale, and Willingness to Adopt Green Production Behavior: Field Evidence from Cooperatives in China. Environ. Dev. Sustain. 2022, 1–27. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Boucher, S.R.; Carter, M.R.; Guirkinger, C. Risk Rationing and Wealth Effects in Credit Markets: Theory and Implications for Agricultural Development. Am. J. Agric. Econ. 2008, 90, 409–423. [Google Scholar] [CrossRef]

- Lu, F.; Wang, W.; Liu, M.; Liu, M.; Qi, D. The Non-Linear Effect of Agricultural Insurance on Agricultural Green Competitiveness. Technol. Anal. Strateg. Manag. 2022, 7, 1–16. [Google Scholar] [CrossRef]

- Qin, L.; Liu, S.; Hou, Y.; Zhang, Y.; Wu, D.; Yan, D. The Spatial Spillover Effect and Mediating Effect of Green Credit on Agricultural Carbon Emissions: Evidence from China. Front. Earth Sci. 2023, 10, 1037776. [Google Scholar] [CrossRef]

- Horowitz, J.K.; Lichtenberg, E. Insurance, Moral Hazard, and Chemical Use in Agriculture. Am. J. Agric. Econ. 1993, 75, 926–935. [Google Scholar] [CrossRef]

- Zhou, X.; Chen, T.; Zhang, B. Research on the Impact of Digital Agriculture Development on Agricultural Green Total Factor Productivity. Land 2023, 12, 195. [Google Scholar] [CrossRef]

- Bowlus, A.J.; Sicular, T. Moving toward Markets? Labor Allocation in Rural China. J. Dev. Econ. 2003, 71, 561–583. [Google Scholar] [CrossRef]

- Wu, Y.; Nie, Y.; Hu, Z.H.; Du, H. Family Life Cycle, Land Fragmentation and Peasant Household Agricultural Productive Input: Data from Laohekou City in Hubei Province. J. Yunnan Univ. Financ. Econ. 2008, 24, 70–75. [Google Scholar]

- Greenwood, J.; Jovanovic, B. Financial Development, Growth, and the Distribution of Income. J. Polit. Econ. 1990, 98, 1076–1107. [Google Scholar] [CrossRef]

- Goodwin, B.K. Problems with Market Insurance in Agriculture. Am. J. Agric. Econ. 2001, 83, 643–649. [Google Scholar] [CrossRef]

| Variables | Definition | Mean | S.D. |

|---|---|---|---|

| Bancassurance interaction | No = 0; Yes = 1 | 0.213 | 0.41 |

| Credit | No = 0; Yes = 1 | 0.516 | 0.5 |

| Insurance | No = 0; Yes = 1 | 0.39 | 0.488 |

| Green technology adoption | The number of green production adopted by family farms | 5.649 | 1.994 |

| Age | The actual age of the farmer | 48.782 | 9.067 |

| Gender | Female = 0; male = 1 | 0.879 | 0.326 |

| Education | Years of education | 11.174 | 2.849 |

| Workforce | Total household labor force | 3.014 | 1.134 |

| Financial member | No = 0; Yes = 1 | 0.145 | 0.353 |

| Government support | No = 0; Yes = 1 | 0.317 | 0.466 |

| Planting income | Take the logarithm of the total planting income of the year plus 1 | 11.232 | 4.027 |

| Green cognition | Very little = 1; less = 2; general = 3; More = 4; very much = 5 | 3.417 | 1.193 |

| Business information | Very little = 1; less = 2; general = 3; More = 4; very much = 5 | 3.576 | 0.963 |

| Natural disasters | Very infrequently = 1; less infrequently = 2; general = 3; more frequently = 4; very frequently = 5 | 3.225 | 1.341 |

| Family life cycle | Start-up period = 1; Dependency period =2; Burden period = 3; Support period = 4 | 2.321 | 0.792 |

| Family economic level | Total household agricultural income (million yuan) | 108.210 | 231.387 |

| Production capital investment | The logarithm of all productive expenditures plus 1 | 12.1 | 1.384 |

| Land scale expansion | Take the logarithm after adding 1 to the net transferred land | 3.934 | 1.674 |

| Green technology exchange | Very infrequently = 1; less infrequently = 2; general = 3; more frequently = 4; very frequently = 5 | 4.316 | 1.189 |

| Variables | Green Technology Adoption | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Bancassurance Interaction | 0.2676 ** (0.1070) | ||

| Credit | 0.1547 * (0.0876) | ||

| Insurance | 0.2159 ** (0.0882) | ||

| Age | −0.0185 *** (0.0048) | −0.0175 *** (0.0048) | −0.0189 *** (0.0048) |

| Gender | 0.0571 (0.1205) | 0.0389 (0.1216) | 0.0563 (0.1221) |

| Education | 0.0477 *** (0.0152) | 0.0491 *** (0.0153) | 0.0462 *** (0.0152) |

| Workforce | 0.0414 (0.0366) | 0.0401 (0.0368) | 0.0355 (0.0364) |

| Financial professionals | 0.3738 *** (0.1304) | 0.3635 *** (0.1301) | 0.3762 *** (0.1321) |

| Government support | 0.0158 (0.0928) | 0.0379 (0.0928) | 0.0294 (0.0925) |

| Planting income | 0.0538 *** (0.0113) | 0.0532 *** (0.0113) | 0.0543 *** (0.0113) |

| Green cognition | 0.1618 *** (0.0375) | 0.1706 *** (0.0372) | 0.1586 *** (0.0374) |

| Business information | 0.1438 *** (0.0435) | 0.1438 *** (0.0436) | 0.1456 *** (0.0436) |

| Natural disasters | −0.0062 (0.0336) | −0.0008 (0.0341) | −0.0145 (0.0337) |

| N | 564 | 564 | 564 |

| Variables | The First Stage: Bancassurance Interaction | The Second Stage: Green Technology Adoption |

|---|---|---|

| Bancassurance interaction | 1.4095 *** (0.3757) | |

| Frequency of communication with bank and insurance company staff | 0.0778 *** (0.0158) | |

| Control variables | Controlled | Controlled |

| Insig_2 | −0.9233 *** (0.0297) | |

| atanhrho | −0.5323 ** (0.2084) | |

| F-value | 24.264 | |

| N | 564 | |

| Matching Method | Bancassurance Interaction | Credit | Insurance | |||

|---|---|---|---|---|---|---|

| ATT | T | ATT | T | ATT | T | |

| Before matching | 0.5518 *** (0.2040) | 2.70 | 0.2780 * (0.1677) | 1.66 | 0.4712 *** (0.1711) | 2.75 |

| K-nearest neighbor matching (k = 4) | 0.5934 *** (0.2040) | 2.63 | 0.3790 ** (0.1858) | 2.04 | 0.3751 ** (0.1882) | 1.99 |

| Caliper matching | 0.5907 *** (0.2258) | 2.62 | 0.3802 ** (0.1860) | 2.04 | 0.3751 ** (0.1882) | 1.99 |

| K-nearest neighbor matching within caliper | 0.5343 *** (0.2032) | 2.63 | 0.2883 * (0.1707) | 1.69 | 0.4856 *** (0.1731) | 2.80 |

| Kernel matching | 0.5841 *** (0.2020) | 2.89 | 0.3065 * (0.1688) | 1.82 | 0.4838 *** (0.1706) | 2.84 |

| Spline matching | 0.5620 *** (0.2000) | 2.81 | 0.3125 * (0.1738) | 1.80 | 0.4663 *** (0.1767) | 2.64 |

| Average after matching | 0.5729 | - | 0.3333 | - | 0.4371 | - |

| Elements | Variable Category | Variables | Green Technology Adoption | ||

|---|---|---|---|---|---|

| (1) | (2) | (3) | |||

| Internal Elements | Human Capital | Farmers‘ health status | −0.1281 (0.1174) | −0.1399 (0.1171) | −0.1281 (0.1177) |

| Cultural level | 0.1118 *** (0.0273) | 0.1134 *** (0.0274) | 0.1091 *** (0.0273) | ||

| Number of farm-owned laborers | 0.0890 * (0.0505) | 0.0841 * (0.0502) | 0.0928 * (0.0507) | ||

| Natural Capital | Owned arable land area | −0.0035 (0.0041) | −0.0032 (0.0041) | −0.0044 (0.0041) | |

| Physical Capital | Family farm farming income | 0.0851 *** (0.0202) | 0.0842 *** (0.0201) | 0.0842 *** (0.0201) | |

| Value of owned agricultural machinery | 0.0892 *** (0.0223) | 0.0886 *** (0.0225) | 0.0924 *** (0.0222) | ||

| Social Capital | Join a professional farmers’ cooperative | 0.2377 (0.1566) | 0.2638 * (0.1561) | 0.2441 (0.1561) | |

| Join the family farm alliance | −0.0859 (0.1791) | −0.0774 (0.1789) | −0.1001 (0.1791) | ||

| Green Awareness | Farmers’ knowledge of green production | 0.2675 *** (0.0706) | 0.2824 *** (0.0707) | 0.2665 *** (0.0705) | |

| External Elements | Financial Support | Bancassurance interaction | 0.4155 ** (0.1856) | ||

| Credit | 0.2761 * (0.1504) | ||||

| Insurance | 0.3783 ** (0.1556) | ||||

| Government Regulation | Incentive regulation (subsidies) | 0.0046 (0.0701) | −0.0004 (0.0702) | −0.0122 (0.0698) | |

| Binding regulation (punishment) | 0.1445 ** (0.0659) | 0.1453 ** (0.0661) | 0.1421 ** (0.0659) | ||

| Market Orientation | Reactive market orientation (consumer demand) | −0.0864 (0.1031) | 0.1377 (0.0992) | −0.0823 (0.1032) | |

| Pioneering market orientation (green development future expectations) | 0.1408 (0.0991) | 0.1377 (0.0992) | 0.1481 (0.0992) | ||

| Statistical test | Log likelihood | −1099.9864 | −1100.8095 | −1099.5336 | |

| LR chi2 | 127.93 | 126.28 | 128.83 | ||

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | ||

| Pseudo R2 | 0.0550 | 0.0542 | 0.0553 | ||

| N | 564 | 564 | 564 | ||

| Variables | Start-Up Period | Dependency Period | Burden Period | Support Period |

|---|---|---|---|---|

| Bancassurance Interaction | 0.1712 (0.2627) | 0.4823 *** (0.1620) | 0.0104 (0.1926) | 0.3468 (0.4281) |

| Credit | 0.1000 (0.2630) | 0.1862 (0.1322) | 0.1071 (0.1612) | 0.1685 (0.4305) |

| Insurance | 0.2018 (0.2615) | 0.2784 ** (0.1253) | 0.0569 (0.1664) | 0.4249 (0.3883) |

| N | 77 | 267 | 182 | 38 |

| Variables | Low-Income Level | Middle-Income Level | High-Income Level |

|---|---|---|---|

| Bancassurance Interaction | 0.3741 * (0.1940) | 0.1843 (0.1882) | 0.2699 (0.1801) |

| Credit | 0.2140 (0.1553) | 0.2895 * (0.1632) | 0.1250 (0.1480) |

| Insurance | 0.2075 (0.1611) | 0.0971 (0.1510) | 0.2785 * (0.1548) |

| N | 191 | 183 | 190 |

| Variables | Production Capital Investment | Green Technology Adoption | Land Scale Expansion | Green Technology Adoption | Green Technology Exchange | Green Technology Adoption |

|---|---|---|---|---|---|---|

| Bancassurance Interaction | 0.6638 *** (0.1307) | 0.1856 * (0.1108) | 0.3355 ** (0.1580) | 0.2462 ** (0.1092) | 0.1931 * (0.1086) | 0.2453 ** (0.1080) |

| Production capital investment | 0.1260 *** (0.0336) | |||||

| Land scale expansion | 0.0637 ** (0.0307) | |||||

| Green Technology Exchange | 0.1321 *** (0.0441) | |||||

| Age | −0.0191 *** (0.0083) | −0.0163 *** (0.0048) | −0.0024 (0.0076) | −0.0184 *** (0.0048) | −0.0062 (0.0052) | −0.0179 *** (0.0047) |

| Gender | −0.1722 (0.1713) | 0.0797 (0.1212) | −0.0615 (0.1829) | 0.0597 (0.1196) | 0.1201 (0.1365) | 0.0431 (0.1231) |

| Education | 0.0817 *** (0.0207) | 0.0379 ** (0.0152) | 0.1032 *** (0.0223) | 0.0413 *** (0.0152) | 0.0546 *** (0.0183) | 0.0405 *** (0.0154) |

| Workforce | 0.0515 (0.0582) | 0.0351 (0.0372) | −0.0516 (0.0538) | 0.0448 (0.0369) | 0.0282 (0.0442) | 0.0366 (0.0367) |

| Financial professionals | 0.2309 (0.1583) | 0.3501 *** (0.1311) | 0.0999 (0.1642) | 0.3691 *** (0.1298) | 0.6262 *** (0.1283) | 0.3060 ** (0.1313) |

| Government support | −0.0171 (0.1209) | 0.0195 (0.0931) | −0.0570 (0.1299) | 0.0202 (0.0931) | 0.1572 (0.1029) | 0.0039 (0.0929) |

| Planting income | 0.0306 * (0.0166) | 0.0508 *** (0.0114) | 0.1707 *** (0.0199) | 0.0433 *** (0.0124) | 0.0164 (0.0117) | 0.0521 *** (0.0114) |

| Green cognition | 0.0678 (0.0455) | 0.1550 *** (0.0375) | 0.0965 * (0.0511) | 0.1563 *** (0.0376) | 0.2376 *** (0.0414) | 0.1339 *** (0.0383) |

| Business information | 0.1201 ** (0.0578) | 0.1308 *** (0.0439) | 0.0204 (0.0656) | 0.1430 *** (0.0438) | 0.1417 *** (0.0519) | 0.1267 *** (0.0437) |

| Natural disasters | −0.0565 (0.0446) | 0.0006 (0.0333) | −0.0477 (0.0473) | −0.0033 (0.0334) | 0.1050 *** (0.0367) | −0.0191 (0.0343) |

| N | 564 | 564 | 564 | 564 | 564 | 564 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Hu, Y.; Kong, R. The Impact of Bancassurance Interaction on the Adoption Behavior of Green Production Technology in Family Farms: Evidence from China. Land 2023, 12, 941. https://doi.org/10.3390/land12050941

Wang L, Hu Y, Kong R. The Impact of Bancassurance Interaction on the Adoption Behavior of Green Production Technology in Family Farms: Evidence from China. Land. 2023; 12(5):941. https://doi.org/10.3390/land12050941

Chicago/Turabian StyleWang, Linwei, Yixin Hu, and Rong Kong. 2023. "The Impact of Bancassurance Interaction on the Adoption Behavior of Green Production Technology in Family Farms: Evidence from China" Land 12, no. 5: 941. https://doi.org/10.3390/land12050941

APA StyleWang, L., Hu, Y., & Kong, R. (2023). The Impact of Bancassurance Interaction on the Adoption Behavior of Green Production Technology in Family Farms: Evidence from China. Land, 12(5), 941. https://doi.org/10.3390/land12050941