Large-Scale Land Acquisition and Household Farm Investment in Northern Ghana

Abstract

1. Introduction

2. Definition and Historical Overview of Large-Scale Land Acquisition in Ghana

3. Agricultural Policies and the Rise of LSLA in Ghana

4. Literature Review

5. Methodology

5.1. Conceptual Framework

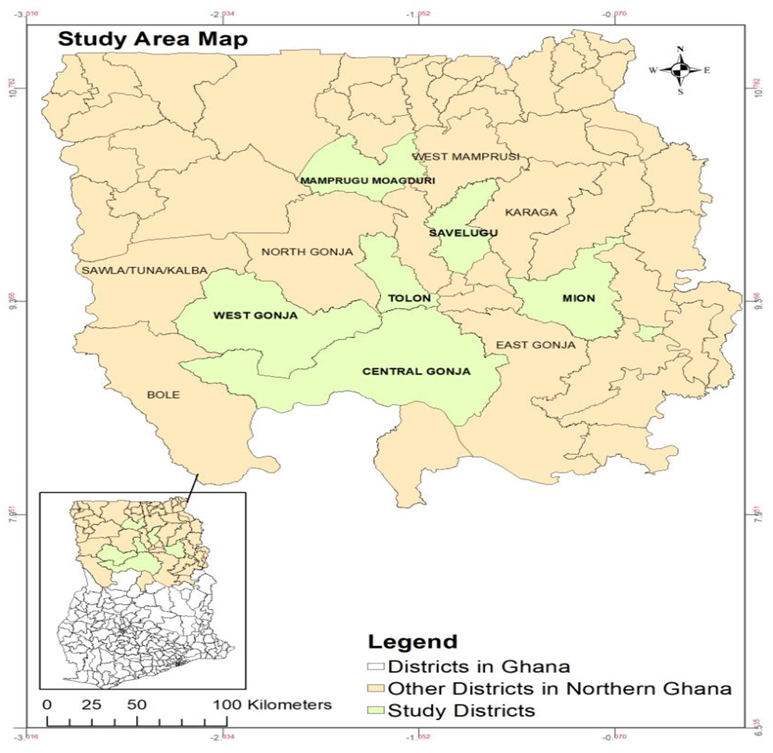

5.2. Data Information

5.3. Estimation Strategies

5.3.1. Model Identification

5.3.2. Estimating the Effect of LSLA on Investment Decisions

5.3.3. Identification of Farm Investment and Exposure to LSLA Equations

5.3.4. Estimating the Effect of LSLA on Level of Investment in Land-Improving Techniques

6. Results and Discussion

6.1. Effect of Exposure to LSLA

6.2. Farm Investments

6.3. Effect of LSLA on Level of Investments in Land-Improving Techniques

7. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | W | LC | DIF | I | MT | RR | NPK | SOA | Urea |

|---|---|---|---|---|---|---|---|---|---|

| Leadership_position | 0.128 * | 0.672 ** | 0.341 *** | 0.233 ** | 0.799 *** | −0.243 ** | 0.167 *** | −0.118 | 0.913 *** |

| (0.071) | (0.333) | (0.105) | (0.104) | (0.120) | (0.117) | (0.059) | (0.108) | (0.103) | |

| Gender | 0.00966 | −0.142 | 0.146 | 0.0117 | 0.117 | −0.181 | 0.0692 | 0.218 | −0.0924 |

| (0.161) | (0.205) | (0.169) | (0.166) | (0.199) | (0.183) | (0.168) | (0.182) | (0.162) | |

| Age_HHH | −0.355 *** | −0.102 * | −0.199 *** | 0.318 *** | 0.013 *** | 0.631 * | 0.505 ** | −0.153 *** | 0.009 ** |

| (0.113) | (0.050) | (0.041) | (0.048) | (0.004) | (0.357) | (0.218) | (0.043) | (0.004) | |

| HHsize | −0.006 | −0.009 | 0.005 | −0.00322 | −0.004 | −0.012 | 0.005 | −0.009 | −0.002 |

| (0.007) | (0.010) | (0.007) | (0.113) | (0.009) | (0.008) | (0.007) | (0.008) | (0.007) | |

| Education | −0.000 | 0.022 | 0.019 | −0.005 | 0.007 | 0.029 ** | −0.008 | 0.014 | −0.002 |

| (0.013) | (0.016) | (0.013) | (0.013) | (0.016) | (0.014) | (0.013) | (0.014) | (0.013) | |

| Know_anybodylossland | 0.217 ** | 0.180 *** | 0.266 ** | 0.014 * | 0.908 *** | 0.310 ** | 0.146 * | 0.682 *** | 0.340 *** |

| (0.106) | (0.045) | (0.109) | (0.007) | (0.131) | (0.130) | (0.087) | (0.119) | (0.112) | |

| Social_group | 0.188 * | 0.237 ** | 0.212 * | 0.536 *** | 0.120 *** | 0.121 * | 0.223 * | −0.146 * | 0.557 *** |

| (0.107) | (0.120) | (0.110) | (0.109) | (0.028) | (0.070) | (0.122) | (0.084) | (0.107) | |

| Access_good_roads | −0.0408 | 0.166 | 0.172 *** | 0.159 ** | 0.088 | 0.137 | 0.873 *** | −0.166 *** | 0.525 *** |

| (0.106) | (0.136) | (0.030) | (0.070) | (0.123) | (0.122) | (0.110) | (0.050) | (0.190) | |

| Credit_access | 0.035 | −0.013 | −0.089 | 0.083 | −0.167 | 0.038 | 0.042 | 0.057 | 0.002 |

| (0.111) | (0.140) | (0.114) | (0.108) | (0.126) | (0.123) | (0.110) | (0.113) | (0.107) | |

| Water_resource | 0.303 *** | 0.160 ** | 0.142 *** | −0.149 | −0.123 | −0.131 | 0.106 *** | 0.216 | 0.202 * |

| (0.109) | (0.074) | (0.030) | (0.132) | (0.154) | (0.146) | (0.033) | (0.141) | (0.120) | |

| Good_fertile 1 | 0.066 | −0.346 ** | 0.009 | 0.220 ** | −0.711 *** | −0.202 | 0.635 *** | −0.151 | 0.538 *** |

| (0.106) | (0.145) | (0.109) | (0.109) | (0.126) | (0.125) | (0.110) | (0.115) | (0.107) | |

| Moderate_fertile 1 | −0.351 ** | −0.140 | −0.135 *** | −0.268 * | 0.006 | 0.006 | 0.015 | 0.178 | −0.025 |

| (0.150) | (0.195) | (0.052) | (0.155) | (0.181) | (0.170) | (0.157) | (0.163) | (0.151) | |

| Perception_tenure_security | 0.179 *** | 0.106 | 0.352 *** | 0.135 | 0.117 | 0.195 *** | 0.203 * | 0.050 | 0.187 *** |

| (0.029) | (0.168) | (0.133) | (0.030) | (0.152) | (0.048) | (0.121) | (0.136) | (0.029) | |

| Fert_subsidy | 0.068 | 0.208 | −0.018 | 0.041 | 0.270 ** | −0.200 | −0.036 | −0.062 | 0.054 |

| (0.110) | (0.143) | (0.112) | (0.111) | (0.127) | (0.129) | (0.113) | (0.117) | (0.110) | |

| Farm_size | 0.082 | 0.224 | −0.003 | 0.072 | 0.091 | −0.133 | 0.033 | −0.237 * | −0.089 |

| (0.116) | (0.148) | (0.120) | (0.118) | (0.136) | (0.136) | (0.120) | (0.126) | (0.117) | |

| District_dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −0.666 * | −1.246 * | −0.756 * | 1.066 ** | −1.389 ** | −0.541 | −0.547 | −0.607 | −0.138 |

| (0.400) | (0.657) | (0.398) | (0.513) | (0.551) | (0.508) | (0.486) | (0.509) | (0.463) | |

| Observations | 659 | 655 | 661 | 661 | 651 | 650 | 657 | 661 | 657 |

| Variables | IEDE | DEDE | IEFE | DEFE |

|---|---|---|---|---|

| Leadership_position | −0.454 *** | −0.868 *** | −0.815 *** | −0.186 *** |

| (0.124) | (0.123) | (0.127) | (0.025) | |

| Gender | −0.190 *** | −0.284 *** | −1.089 *** | 0.831 *** |

| (0.014) | (0.011) | (0.184) | (0.247) | |

| Age_HHH | −0.242 *** | −0.149 *** | −0.181 *** | 0.177 *** |

| (0.004) | (0.004) | (0.009) | (0.002) | |

| HHsize | 0.008 | −0.006 | −0.006 | −0.001 |

| (0.009) | (0.008) | (0.009) | (0.009) | |

| Education | v0.210 *** | −0.167 *** | 0.018 | −0.000 |

| (0.017) | (0.016) | (0.016) | (0.016) | |

| Access_formal_landinstite | −1.404 *** | −1.111 *** | −1.206 *** | −1.312 *** |

| (0.253) | (0.193) | (0.216) | (0.225) | |

| Social_group | 0.696 *** | −0.130 ** | −0.597 *** | −0.205 * |

| (0.130) | (0.060) | (0.133) | (0.112) | |

| Access_good_roads | 0.157 | 0.243 * | −0.371 *** | −0.165 |

| (0.128) | (0.126) | (0.138) | (0.132) | |

| Perception_tenure_security | −0.311 ** | −0.372 ** | −0.240 * | −0.495 *** |

| (0.149) | (0.158) | (0.138) | (0.147) | |

| Fert_subsidy | −0.065 | 0.294 ** | 0.0221 | −0.355 ** |

| (0.135) | (0.129) | (0.135) | (0.141) | |

| Good_fertile 1 | 0.131 * | 0.187 *** | 0.353 *** | 0.132 *** |

| (0.04) | (0.028) | (0.129) | (0.016) | |

| Moderate_fertile 1 | 0.115 | 0.012 | 0.413** | 0.144 |

| (0.179) | (0.179) | (0.202) | (0.179) | |

| Farm_size | 0.017 | 0.008 | −0.143 | 0.082 |

| (0.141) | (0.157) | (0.144) | (0.153) | |

| Credit_access | −0.278 ** | −0.328 ** | −0.059 | −0.003 |

| (0.128) | (0.129) | (0.128) | (0.128) | |

| Water_resource | 0.247 | 0.187 | 0.306 ** | 0.217 * |

| (0.161) | (0.164) | (0.149) | (0.128) | |

| Constant | −1.844 *** | −1.005 * | 0.566 ** | −1.258 * |

| (0.705) | (0.563) | (0.226) | (0.712) | |

| District_dummies | Yes | Yes | Yes | Yes |

| Observations | 661 | 661 | 661 | 661 |

| District | Total Area under LSLA (ha) | % of Total Deals |

|---|---|---|

| Central Gonja | 30,989.92 | 43.17 |

| Mampurugu-Muagdure | 10,905.43 | 15.19 |

| Mion | 10,783.30 | 15.02 |

| Savelegu | 10,369.17 | 14.44 |

| Sagnarigu | 5,479.11 | 7.63 |

| North Gonja | 2452.26 | 3.42 |

| Bole | 466.82 | 0.65 |

| Tamale Metro | 173.24 | 0.24 |

| Gushiegu | 34.13 | 0.05 |

| Bunkpurugu-Yunyoo | 24.38 | 0.03 |

| Yendi Municipal | 23.1 | 0.03 |

| East Gonja | 20.32 | 0.03 |

| Nanumba South | 13.47 | 0.02 |

| Nanumba North | 13.36 | 0.02 |

| West Mampurisi | 12.59 | 0.02 |

| Saboba | 12.52 | 0.02 |

| Kpandai | 12.29 | 0.02 |

| Total | 71,785.41 | 100.00 |

References

- NEPAD. Comprehensive Africa Agriculture Development Programme. CODESRIA. 2003. Available online: http//www.nepad.org (accessed on 21 September 2017).

- MoFA. Food and Agriculture Sector Development Policy (FASDEP II) (Issue August). 2017. Available online: https://leap.unep.org/countries/gh/national-legislation/food-and-agriculture-sector-development-policy-fasdep-ii (accessed on 21 September 2017).

- Abdallah, A.-H.; Abdul-Rahaman, A.; Issahaku, G. Production and hidden hunger impacts of sustainable agricultural practices: Evidence from rural households in Africa. Agrekon 2020, 59, 440–458. [Google Scholar] [CrossRef]

- Jayne, T.S.; Sanchez, P.A. Agricultural productivity must improve in sub-Saharan Africa. Science 2022, 372, 1045–1048. [Google Scholar] [CrossRef] [PubMed]

- Feder, G.; Onchan, T. Land Ownership Security and Farm Investment in Thailand. Am. J. Agric. Econ. 1987, 69, 311–320. [Google Scholar] [CrossRef]

- Domeher, D.; Abdulai, R.; Yeboah, E. Secure property right as a determinant of SME’s access to formal credit in Ghana: Dynamics between Micro-finance Institutions and Universal Banks. J. ProPerty Res. 2016, 33, 162–188. [Google Scholar] [CrossRef]

- World Bank. Rising Global Interest in Farmland: Can it Yield Sustainable and Equitable Benefits? World Bank Publications: Washington, DC, USA, 2010. [Google Scholar] [CrossRef]

- Behrman, J.; Meinzen-Dick, R.; Quisumbing, A. The gender implications of large-scale land deals. J. Peasant. Stud. 2012, 39, 49–79. [Google Scholar] [CrossRef]

- Adams, E.A.; Kuusaana, E.D.; Ahmed, A.; Campion, B.B. Land dispossessions and water appropriations: Political ecology of land and water grabs in Ghana. Land Use Policy 2019, 87, 1–9. [Google Scholar] [CrossRef]

- Atuoye, K.N.; Luginaah, I.; Hambati, H.; Campbell, G. Who are the losers? Gendered-migration, climate change, and the impact of large scale land acquisitions on food security in coastal Tanzania. Land Use Policy 2021, 101, 105154. [Google Scholar] [CrossRef]

- Borras, S.M.; Franco, J.C.; Moreda, T.; Xu, Y.; Bruna, N.; Afewerk Demena, B. The value of so-called ‘failed’ large-scale land acquisitions. Land Use Policy 2022, 119, 106199. [Google Scholar] [CrossRef]

- Gyapong, A.Y. How and why large-scale agricultural land investments do not create long-term employment benefits: A critique of the ‘state’ of labour regulations in Ghana. Land Use Policy 2020, 95, 104651. [Google Scholar] [CrossRef]

- Rasva, M.; Jürgenson, E. Europe’s Large-Scale Land Acquisitions and Bibliometric Analysis. Agriculture 2022, 12, 850. [Google Scholar] [CrossRef]

- Adewumi, M.O.; Jimoh, A.; Omotesho, O.A. Analysis of The Effects of Zimbabwean White Farmers on Small Scale Farming in Nigeria. In Revista Acta Universitaria; Universidad de Guanajuato: Guanajuato, Mexico, 2013; Volume 23, pp. 3–7. [Google Scholar]

- Deininger, K.; Xia, F. Quantifying Spillover Effects from Large Land-based Investment: The Case of Mozambique. World Dev. 2016, 87, 227–241. [Google Scholar] [CrossRef]

- Aha, B.; Ayitey, J.Z. Biofuels and the hazards of land grabbing: Tenure (in)security and indigenous farmers’ investment decisions in Ghana. Land Use Policy 2017, 60, 48–59. [Google Scholar] [CrossRef]

- Hamenoo, S.V.Q.; Adjei, P.O.-W.; Obodai, J. Households’ Coping Dynamics in Response to Large-Scale Land Acquisition for Jatropha Plantations: Evidence from Asante Akim North District of Ghana. Glob. Soc. Welf. 2018, 5, 225–241. [Google Scholar] [CrossRef]

- Cotula, L.; Vermeulen, S.; Leonard, R.; Keeley, J. Land Grab or Development Opportunity? Agricultural Investment and International Land Deals in Africa; IIED: London, UK; FOA: London, UK; IFAD: Rome, Italy, 2009. [Google Scholar]

- Land Matrix. Deals|Land Matrix—An Online Public Database of Largescale Land Deals. Land Matrix. 2021. Available online: https://landmatrix.org/list/deals (accessed on 13 August 2019).

- Ayamga, M. Land Tenure Security, Farm Investment and Technical Efficiency in Ghana. Ph.D. Thesis, University of Ghana, Accra, Ghana, 2012. [Google Scholar]

- Wooldridge, J. Control Function Methods in Applied Econometrics. J. Hum. Resour. 2015, 50, 420–445. [Google Scholar] [CrossRef]

- StataCorp. Stata Extended Regression Models Reference Manual, 17th ed.; StataCorp LLC: College Station, TX, USA, 2021. [Google Scholar]

- De Schutter, O. Large-Scale Land Acquisitions and Leases: A set of Core Principles and Measures to Address the Human Rights Challenge; UN: New York, NY, USA, 2009. [Google Scholar]

- Lands Commission. Guidelines for Large Scale Land Transactions in Ghana (Issue May). 2016. Available online: https://www.colandef.org/lands-commission-guidelines (accessed on 8 November 2017).

- Abdallah, A.-H.; Michael, A.; Awuni, J.A. Impact of land grabbing on food security: Evidence from Ghana. Environ. Dev. Sustain. 2022. [Google Scholar] [CrossRef]

- Senu, P.M. Customary land tenure practices and land markets in Ghana. Kwame Nkrumah University of Science and Technology. 2014. Available online: http://ir.knust.edu.gh/xmlui/handle/123456789/6221?show=full (accessed on 11 November 2020).

- Nti, K. This Is Our Land: Land, Policy, Resistance, and Everyday Life in Colonial Southern Ghana, 1894–1897. J. Asian Afr. Stud. 2013, 48, 3–15. [Google Scholar] [CrossRef]

- Boamah, F. Competition Between biofuel and Food? The Case of a Jatropha Biodiesel Project and Its Effects on Food Security in the Affected Communities in Northern Ghana. Master’s Thesis, University of Bergen, Bergen, Norway, 2010. [Google Scholar]

- FAOSTAT. Selected Indicators. FAO. 2020. Available online: http://faostat.fao.org/static/syb/syb_5100.pdf (accessed on 18 May 2020).

- Scharlemann, J.P.W.; Brock, R.C.; Balfour, N.; Brown, C.; Burgess, N.D.; Guth, M.K.; Ingram, D.J.; Lane, R.; Martin, J.G.C.; Wicander, S.; et al. Towards understanding interactions between Sustainable Development Goals: The role of environment–human linkages. Sustain. Sci. 2020, 15, 1573–1584. [Google Scholar] [CrossRef]

- FAO; FAD; UNCTAD; World Bank. Principles for Responsible Agricultural Investment that Respects Rights, Livelihoods, and Resources. UNPRI Report (Issue January). 2010. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwib4tys5un7AhWWHOwKHWwpBvoQFnoECAwQAQ&url=https%3A%2F%2Fwww.fao.org%2Ffileadmin%2Ftemplates%2Fest%2FINTERNATIONAL-TRADE%2FFDIs%2FRAI_Principles_Synoptic.pdf&usg=AOvVaw27KQJrVmEdDhEhdYOVOa2D (accessed on 14 September 2014).

- Borras, J.S.; Franco, J. From Threat to Opportunity? Problems with the Idea of a “Code of Conduct” for Land- Grabbing. Yale Hum. Rights Dev. J. 2010, 13, 507–523. [Google Scholar]

- IFPRI. 2012 Global Food Policy Report. 2013. Available online: https://doi.org/10.2499/9780896295537 (accessed on 14 September 2014).

- MoFA. Medium Term Agriculture Sector Investment Plan (Metasip); MoFA: Accra, Ghana, 2010. [Google Scholar]

- Benin, S.; Johnson, M.; Jimah, K.; Taabazuing, J.; Tenga, A.; Abokyi, E.; Nasser, G.; Ahorbo, G.; Owusu, V. Evaluation of Four Special Initiatives of the Ministry of Food and Agriculture, Government of Ghana. In Proceedings of the Transforming Agriculture Conference, Accra, Ghana, 8–9 November 2012; pp. 1–3. [Google Scholar]

- Ministry of Food and Agriculture. Ghana Commercial Agriculture Project: Responsible Agricultural Investment (Issue September); Ministry of Food and Agriculture, MoFA: Accra, Ghana, 2015. [Google Scholar]

- World Bank. Ghana-Land Administration Project (English) (Issue c). 2013. Available online: http://documents.worldbank.org/curated/en/609781474904597089/pdf/000020051-20140626113321.pdf (accessed on 19 August 2018).

- Civic Response. Assessing Community Consent in Large Scale Land Investments in Ghana. 2017. Available online: https://loggingoff.info/library/assessing-community-consent-in-large-scale-land-investments-in-ghana/ (accessed on 11 January 2020).

- Kovalyova, S.U.N. Food Agencies See Win-Win Farmland Deals. 2009. Reuters. Reuters. Available online: https://www.reuters.com/article/us-g8-farm-farmland/u-n-food-agencies-see-win-win-farmland-deals-idUSTRE53I10D20090419 (accessed on 11 January 2020).

- Benfica, R.; Tschirley, D.; Sambo, L. The Impact of Alternative Agro-Industrial Investments on Poverty Reduction in Rural Mozambique. In Research Paper N0.51E-Ministry of Agriculture and Rural Development of Mozambique; AgEcon Search: St. Paul, MI, USA, 2002; Volume 33, Issue 51. [Google Scholar]

- Boserup, E. The Conditions of Agricultural Growth: The Economics of Agrarian Change under Population Pressure; George Allen & Unwin Ltd.: London, UK, 1965; pp. 1–108. [Google Scholar]

- Behrman, J.A.; Meinzen-Dick, R.; Quisumbing, A.R. An Interpretation of Large-Scale Land Deals Using Boserup’s Theories of Agricultural Intensification, Gender and Rural Development. In Ester Boserup’s Legacy on Sustainability: Orientation for Contemporary Research, 4th ed; Fischer-Kowalski, M., Reenberg, A., Schaffartzik, A., Mayer, A., Eds.; Springer: Cham, Switzerland, 2014; pp. 189–202. [Google Scholar] [CrossRef]

- Dessy, S.; Gohou, G.; Vencatachellum, D. Foreign Direct Investments in Africa’s Farmlands: Threat or Opportunity for Local Populations? (January 24, 2012). CIRPEE Working Paper No. 12-03. Available online: https://ssrn.com/abstract=1991290 (accessed on 22 December 2020).

- Kleemann, L.; Thiele, R. Rural welfare implications of large-scale land acquisitions in Africa: A theoretical framework. Econ. Model. 2015, 51, 269–279. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics; Macmillan and Co., Ltd.: London, UK, 1890, 8th ed. Available online: https://www.econlib.org/library/Marshall/marP.html?chapter_num=32#book-reader (accessed on 22 December 2020).

- Ahmed, A.; Kuusaana, E.D.; Gasparatos, A. The role of chiefs in large-scale land acquisitions for jatropha production in Ghana: Insights from agrarian political economy. Land Use Policy 2018, 75, 570–582. [Google Scholar] [CrossRef]

- Hagos, F.; Holden, S. Tenure security, resource poverty, public programs, and household plot-level conservation investments in the highlands of northern Ethiopia. Agric. Econ. 2006, 34, 183–196. [Google Scholar] [CrossRef]

- Feder, G. Land ownership security and farm productivity: Evidence from Thailand. J. Dev. Stud. 1987, 24, 16–30. [Google Scholar] [CrossRef]

- Abdulai, A.; Owusu, V.; Goetz, R. Land tenure differences and investment in land improvement measures: Theoretical and empirical analyses. J. Dev. Econ. 2011, 96, 66–78. [Google Scholar] [CrossRef]

- Arezki, R.; Deininger, K.; Selod, H. What Drives the Global “Land Rush”? World Bank Econ. Rev. 2013, 29, 207–233. [Google Scholar] [CrossRef]

- MoFA. Agriculture in Ghana: Facts and Figures (2012) (Issue 8). Ministry of Food and Agriculture, Statistics, Research and Information Directorate (SRID). Available online: http://mofa.gov.gh/site/wp-content/uploads/2012/10/AGRICULTURE-IN-GHANA-FF-2012.pdf. (accessed on 28 June 2018).

- ISSER. Ghana Social Development Outlook 2012, 1st ed.; Bentsi-Enchill, N.-K., Ed.; Institute for Statistical, Social and Economic Research (ISSER): Accra, Ghana, 2013. [Google Scholar]

- Yamane, T. Statistics An Introductory Analysis. Harper Row, Second Edition. (1 January 1967). Available online: https://www.amazon.com/Statistics-Introductory-Analysis-Taro-Yamane/dp/B0000CNPXC (accessed on 19 July 2018).

- Bottazzi, P.; Crespo, D.; Omar, L.; Rist, S. Evaluating the livelihood impacts of a large-scale agricultural investment: Lessons from the case of a biofuel production company in northern Sierra Leone. Land Use Policy 2018, 73, 128–137. [Google Scholar] [CrossRef]

- Brasselle, A.S.; Gaspart, F.; Platteau, J.P. Land tenure security and investment incentives: Puzzling evidence from Burkina Faso. J. Dev. Econ. 2002, 67, 373–418. [Google Scholar] [CrossRef]

- Navarro-Casta, S.; Arranz, M.; Burguillo, M.; De, E.C.R. Land tenure security and agrarian investments in the Peruvian Highlands. Land Use Policy 2021, 109, 105651. [Google Scholar] [CrossRef]

- Place, F.; Migot-Adholla, S.E. The Economic Effects of Land Registration on Smallholder Farms in Kenya: Evidence from Nyeri and Kakamega Districts. Land Econ. 1998, 74, 360–373. [Google Scholar] [CrossRef]

- Caliendo, M.; Kopeinig, S. Some Practical Guidance for the Implementation of Propensity Score Matching. Discuss. Pap. Ser. 2005, 22, 31–72. [Google Scholar] [CrossRef]

- Amemiya, T. The Estimation of a Simultaneous Equation Generalized Probit Model. Econometrica 1978, 46, 1193–1205. [Google Scholar] [CrossRef]

- Rivers, D.; Vuong, Q.H. Limited information estimators and exogeneity tests for simultaneous probit models. J. Econom. 1988, 39, 347–366. [Google Scholar] [CrossRef]

- Kusunose, Y.; Thériault, V.; Alia, D. Can Customary Land Tenure Facilitate Agricultural Productivity Growth? Evid. Burkina Faso. Land Econ. 2020, 96, 441–455. [Google Scholar] [CrossRef]

- Wainaina, P.; Tongruksawattana, S.; Qaim, M. Tradeoffs and complementarities in the adoption of improved seeds, fertilizer, and natural resource management technologies in Kenya. Agric. Econ. 2016, 47, 351–362. [Google Scholar] [CrossRef]

- Long, J.S.; Freese, J. Regression Models for Categorical Dependent Variables Using Stata, 1st ed.; Stata Corporation: Lakeway Drive College, TX, USA, 2001. [Google Scholar]

- Suhardiman, D.; Giordan, M.; Keovilignavong, O.; Sotoukee, T. Revealing the hidden effect of land grabbing through better understanding of farmers’ strategies in dealing with land loss. Land Use Policy 2015, 49, 195–202. [Google Scholar] [CrossRef]

- Lee, L.F. Amemiya’s generalized least squares and tests of overidentification in simultaneous equation models with qualitative or limited dependent variables. Econom. Rev. 1992, 11, 319–328. [Google Scholar]

- Midingoyi, S.G.; Kassie, M.; Muriithi, B.; Diiro, G.; Ekesi, S. Do Farmers and the Environment Benefit from Adopting Integrated Pest Management Practices? Evidence from Kenya. J. Agric. Econ. 2019, 70, 452–470. [Google Scholar] [CrossRef]

- Teklewold, H.; Kassie, M.; Shiferaw, B. Adoption of multiple sustainable agricultural practices in rural Ethiopia. J. Agric. Econ. 2013, 64, 597–623. [Google Scholar] [CrossRef]

- Kim, J.; Mason, N.M.; Mather, D.; Wu, F. The effects of the national agricultural input voucher scheme (NAIVS) on sustainable intensification of maize production in Tanzania. J. Agric. Econ. 2021, 72, 857–877. [Google Scholar] [CrossRef]

- Boahene, K.; Snijders, T.A.; Folmer, H. An Integrated Socioeconomic Analysis of Innovation Adoption. J. Policy Model. 1999, 21, 167–184. [Google Scholar] [CrossRef]

- Abdallah, A.-H.; Ayamga, M.; Awuni, J.A.; Donkoh, S.A. The reality of market inefficiencies and technology adoption nexus: Evidence from Sub-Saharan Africa. Int. J. Agric. Resour. Gov. Ecol. 2018, 14, 287–307. [Google Scholar] [CrossRef]

| Deal Scope | Land Intended to Be Acquired (ha) | Land Acquired |

|---|---|---|

| LSLA by domestic actors | 186,163.00 | 95,872.79 |

| LSLA by transnational actors | 1,316,320.40 | 455,218.40 |

| Total | 1,502,483.00 | 551,091.18 |

| Variable | Definition/Measurement | Mean (SD) |

|---|---|---|

| Wells | Dummy (1 if the household had invested in construction of wells and 0 if otherwise) | 0.19 (0.39) |

| Local catchments | Dummy (1 if the household had invested in construction of local catchments/dugouts and 0 if otherwise) | 0.33 (0.47) |

| Drip irrigation facilities | Dummy (1 if the household had invested in irrigation facilities and 0 if otherwise) | 0.12 (0.33) |

| Intercropping | Dummy (1 if the household had invested in intercropping with nitrogen fixing crops and 0 if otherwise) | 0.41 (0.49) |

| Minimum tillage | Dummy (1 if the household had invested in minimum tillage and 0 if otherwise) | 0.21 (0.41) |

| Crop residue retention | Dummy (1 if the household had invested in crop residue retention and 0 if otherwise) | 0.28 (0.45) |

| NPK | Dummy (1 if the household had invested in NPK and 0 if otherwise) | 0.62 (0.49) |

| SOA | Dummy (1 if the household had invested in sulphate of ammonia (SOA) and 0 if otherwise) | 0.35 (0.48) |

| Urea | Dummy (1 if the household had invested in Urea and 0 if otherwise) | 0.49 (0.50) |

| Household income | Aggregate income from the farm, off-farm wages, salary, petty-trade, and other activities (in GH¢) | 5095.65 (21.03) |

| Fertilizer subsidy | Dummy (1 if farmer benefited from the 2017/2018 fertilizer subsidy programme, 0 if otherwise) | 0.75 (0.43) |

| Gender | Dummy (1 if household head is male, 0 if otherwise) | 0.93 (0.26) |

| Age | Age of household head (years) | 46.97 (2.87) |

| Household size | Number of people residing in a household | 12.44 (7.28) |

| Education | Number of years spent in formal education | 1.97 (3.86) |

| Farm size | All the land under the management and control of household without regard to title, legal form, size, or location (ha) | 6.39 (3.78) |

| Leadership | Dummy (1 if household head is in any leadership position; 0 if otherwise) | 0.26 (0.44) |

| Sagnarigu 1 | Dummy (1 if farmer is located in Sagnarigu district, 0 if otherwise) | 0.17 (0.38) |

| Mion 1 | Dummy (1 if farmer is located in Mion district, 0 if otherwise) | 0.09 (0.29) |

| Central Gonja 1 | Dummy (1 if farmer is located in Central Gonja district, 0 if otherwise) | 0.18 (0.39) |

| Savelegu 1 | Dummy (1 if farmer is located in Savelegu district, 0 if otherwise) | 0.36 (0.48) |

| Yagba-Kubori 1 | Dummy (1 if farmer is located in Yagba-Kubori district, 0 if otherwise) | 0.17 (0.38) |

| North Gonja 1 | Dummy (1 if a farmer is located in North Gonja district, 0 if otherwise) | 0.02 (0.15) |

| Water resources | Dummy (1 if there is available water resource in the village; 0 if otherwise) | 0.41 (0.49) |

| Road | Distance to the nearest weathered road (km) | 0.35 (0.48) |

| Credit | Dummy (1 if the household has access to credit; 0 if otherwise) | 0.33 (0.47) |

| Social group | Dummy (1 if farmer is a member of social group; 0 if otherwise) | 0.39 (0.49) |

| Knowledge | Dummy (1 if the household has prior knowledge of households affected by LSLA; 0 if otherwise) | 0.61 (0.49) |

| Good fertile 2 | Dummy (1 if the fertility of the soil is good; 0 if otherwise) | 0.38 (0.49) |

| Moderately fertile 2 | Dummy (1 if the fertility of the soil is moderate; 0 if otherwise) | 0.45 (0.50) |

| Poorly fertile 2 | Dummy (1 if the fertility of the soil is poor; 0 if otherwise) | 0.17 (0.38) |

| Land institution | Dummy (1 if a formal land institution such as Lands Commission, and Land Use and Spatial Planning Department is available; 0 if otherwise) | 0.34 (0.48) |

| Non-exposure | 1 if households did not lose land directly or indirectly to domestic or foreign entities; 0 if otherwise | 0.21 |

| Exposure to LSLA by domestic entities | ||

| Direct exposure | 1 if households lost farmland, labour, and farmland-based resources to domestic entities; 0 if otherwise | 0.20 |

| Indirect exposure | 1 if household live nearby affected households or lost uncultivated land; have limited land and cannot practice fallowing, monocropping because the land has become scarce due to enclosures; 0 if otherwise | 0.20 |

| Exposure to LSLA by foreign entities | ||

| Direct exposure | 1 if households lost farmland, labour, and farmland-based resources to foreign entities; 0 if otherwise | 0.20 |

| Indirect exposure | 1 if household live nearby affected households or lost uncultivated land; have limited land and cannot practice fallowing, monocropping due to scarcity of land caused by foreign enclosures; 0 if otherwise | 0.20 |

| Variable | Indirect Exposure to LSLA by FE | Direct Exposure to LSLA by FE | Indirect Exposure to LSLA by DE | Direct Exposure to LSLA by DE | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | SE | Coef. | SE | Coef. | SE | Coef. | SE | |

| Well | −2.40 | 1.31 | −1.91 | 1.33 | −1.43 | 1.34 | −2.48 * | 1.30 |

| Local_catchments | −0.20 | 0.12 * | −0.27 | 0.13 ** | −0.29 | 0.04 *** | −0.10 | 0.05 ** |

| Drip_irrigation_facilities | −0.51 | 0.20 *** | 0.68 | 0.08 *** | −0.39 | 0.03 *** | 0.78 | 0.37 ** |

| Intercropping | −0.48 | 0.16 *** | 0.35 | 0.07 *** | −0.22 | 0.03 *** | −0.15 | 0.04 *** |

| Minimum tillage | −0.17 | 0.02 *** | −0.82 | 0.14 *** | −0.24 | 0.01 *** | −0.66 | 0.08 *** |

| Residue_retention | −0.02 | 0.01 ** | −0.04 | 0.02 ** | −0.03 | 0.01 *** | −0.24 | 0.09 ** |

| NPK | −0.71 | 0.17 *** | −0.75 | 0.21 *** | −0.29 | 0.15 * | 7.33 | 0.96 *** |

| SOA | −2.25 ** | 1.07 | −2.25 ** | 1.08 | −2.29 ** | 1.08 | −1.79 * | 1.08 |

| Urea | −1.50 | 1.01 | 1.93 * | 1.02 | 1.951 * | 1.04 | 1.02 | 1.60 |

| gr2_wells | 0.39 | 0.22 * | 0.71 | 0.26 ** | 0.57 | 0.20 *** | −0.40 | 0.14 *** |

| gr2_local_catchments | −0.18 | 0.10 * | −0.15 | 0.05 *** | 0.57 | 0.20 *** | 1.85 | 1.15 |

| gr2_drip_irrigation_facilities | −0.68 | 0.20 *** | 0.72 | 0.16 *** | −0.40 | 0.14 *** | 0.27 | 0.43 |

| gr2_intercropping | −0.42 | 0.12 *** | −0.17 | 0.39 | −0.14 | 0.09 | −0.12 | 0.38 |

| gr2_minimum_tillage | −0.40 | 0.16 ** | −1.62 | 1.66 | −0.01 | 0.01 | 0.20 | 0.02 *** |

| gr2_residue_retention | −0.26 | 0.16 * | −1.43 | 0.18 *** | 1.17 | 0.39 *** | −0.01 | 0.21 |

| gr2_npk | −0.38 | 0.19 ** | −0.71 | 0.17 *** | −0.75 | 0.21 *** | −0.29 | 0.15 * |

| gr2_soa | 0.01 | 0.01 | 1.27 | 0.60 ** | 3.77 | 1.29 *** | 2.86 | 1.23 ** |

| gr2_urea | −0.25 | 0.09 *** | 6.63 | 0.92 *** | −0.01 | 0.00 *** | 0.56 | 0.38 |

| HH_income | −0.08 | 0.13 | 0.21 | 0.21 | −0.01 | 0.01 | 0.01 | 0.12 |

| Leadership position | −0.04 | 0.01 *** | −0.20 | 0.12 * | −0.04 | 0.02 ** | −0.11 | 0.06 ** |

| Gender | −0.01 | 0.01 * | −0.11 | 0.03 *** | −0.41 | 0.17 ** | −0.02 | 0.12 |

| Age | −0.26 | 0.17 | −0.04 | 0.27 | 0.21 | 0.17 | 0.08 | 0.12 |

| Household size | 0.12 | 0.44 | 0.17 | 0.77 | −0.33 | 0.41 | −0.13 | 0.12 |

| Education | −0.05 | 0.00 *** | −0.09 | 0.00 *** | −0.35 | −0.22 | −0.12 | −0.16 |

| Farm size | −0.03 | 0.12 | 0.03 | 0.19 | −0.28 | 0.35 | 0.19 | 0.24 |

| Land institution | −0.01 | 0.01 * | −0.07 | 0.00 *** | −0.12 | 0.07 * | −0.28 | 0.12 ** |

| Social group | −0.15 | 0.09 * | −0.55 | 0.17 *** | −1.18 | 0.69 * | −0.28 | 0.15 * |

| Road | 0.18 | 0.30 | 0.48 | 0.55 | −0.45 | 0.57 | 0.44 | 0.39 |

| Credit | −0.11 | 0.74 | −0.35 | 0.50 | −0.50 | 0.11 *** | −0.17 | 0.04 *** |

| Water source | 0.29 | 0.02 *** | 0.21 | 0.03 *** | 0.11 | 0.23 | 0.43 | 0.55 |

| Good fertile 1 | 0.52 | 0.04 *** | 0.16 | 0.00 *** | 0.38 | 0.05 *** | 0.64 | 0.33 * |

| Moderate fertile 1 | 1.20 | 0.04 *** | 0.38 | 0.14 ** | −0.76 | 0.33 ** | 0.47 | 0.28 * |

| _cons | −1.04 | 0.08 *** | −0.40 | 0.08 *** | −1.99 | 1.07 * | −0.56 | 0.13 *** |

| Joint significance of location variables: χ2 (6) | 65.55 *** | |||||||

| χ2 (9)- joint significance test of residuals | 6.45 *** | |||||||

| Test of significance of instrument | 0.28 (0.99) | |||||||

| No. of observations | 636 | |||||||

| 1 | |||||||||

| −0.436 (0.07) *** | 1 | ||||||||

| −0.177 (0.062) *** | −0.351 (0.077) *** | 1 | |||||||

| 0.016 (0.063) | 0.333 (0.071) *** | 0.126 (0.065) * | 1 | ||||||

| 0.018 (0.072) | 0.482 (0.075) *** | −0.087 (0.075) | −0.198 (0.073) *** | 1 | |||||

| −0.082 (0.071) | 0.135 (0.084) | 0.087 (0.072) | −0.051 (0.072) | 0.063 (0.082) | 1 | ||||

| 0.499 (0.052) *** | 0.246 (0.075) *** | −0.124 (0.067) * | −0.012 (0.066) | 0.189 (0.071) *** | 0.279 (0.069) *** | 1 | |||

| 0.101 (0.066) | 0.002 (0.086) | 0.062 (0.069) | 0.092 (0.069) | 0.094 (0.073) | 0.119 (0.074) | 0.014 (0.068) | 1 | ||

| 0.253 (0.059) *** | 0.023 (0.079) | −0.160 (0.064) ** | 0.331 (0.060) *** | 0.048 (0.071) | −0.245 (0.068) *** | 0.218 (0.063) *** | −0.062 (0.067) | 1 | |

| Likelihood ratio test of Χ2(36) = 302.435, Prob > chi2 = 0.0000 | |||||||||

| VARIABLES | W | LC | DIF | I | MT | RR | NPK | SOA | Urea |

|---|---|---|---|---|---|---|---|---|---|

| Indirect_Foreign | −0.434 *** | −1.165 *** | −1.100 * | −0.085 | −0.276 * | −0.496 *** | 1.192 *** | −0.017 | 1.057 * |

| (0.132) | (0.317) | (0.660) | (0.742) | (0.140) | (0.190) | (0.442) | (0.780) | (0.600) | |

| Direct_Foreign | −0.363 ** | −0.624 *** | −0.617 ** | −0.281 | −0.746 * | −0.506 * | 0.448 * | −0.733 * | 1.073 ** |

| (0.148) | (0.210) | (0.263) | (0.271) | (0.398) | (0.297) | (0.239) | (0.412) | (0.435) | |

| Indirect_Domestic | −1.280 ** | −1.585 *** | −0.625 * | −0.259 | −0.370 *** | −0.191 *** | 0.391 ** | −0.557 ** | 2.039 ** |

| (0.582) | (0.465) | (0.367) | (0.272) | (0.146) | (0.020) | (0.178) | (0.273) | (1.023) | |

| Direct_Domestic | −0.589 *** | −0.679 *** | −0.923 *** | −0.474 | −1.430 *** | −1.586 * | 2.722 *** | −1.262 *** | 1.344 * |

| (0.191) | (0.158) | (0.212) | (0.801) | (0.417) | (0.886) | (0.829) | (0.243) | (0.800) | |

| gr2_DEDE | −0.900 * | 0.558 | 0.183 * | 0.635 ** | 0.624 | 0.822 | 1.363 *** | 0.051 | −0.114 |

| (0.469) | (0.581) | (0.094) | (0.291) | (0.557) | (0.536) | (0.496) | (0.512) | (0.477) | |

| gr2_IEDE | 0.915 ** | 0.906 ** | −0.286 | 0.580 *** | −0.616 *** | −0.604 *** | −0.589 *** | 0.575 | 1.285 ** |

| (0.376) | (0.382) | (0.595) | (0. 226) | (0.059) | (0.131) | (0. 137) | (0.379) | (0.625) | |

| gr2_IEFE | −0.0554 | −0.405 *** | −0.721 *** | 0.428 *** | 0. 476 *** | 0. 459 | 0.435 | 0. 460 *** | 0. 426 *** |

| (0.417) | (0.129) | (0.247) | (0.073) | (0.147) | (0.354) | (0. 582) | (0.082) | (0.106) | |

| gr2_DEFE | 0.491 *** | −0.334 | 0.897 *** | −0.018 | −0.673 | −0.487 ** | −0.446 *** | −0.394 | −0.412 *** |

| (0.145) | (0.589) | (0.259) | (0.455) | (0.560) | (0. 220) | (0.031) | (0.468) | (0.143) | |

| Household_income | 0.115 *** | 0.147 *** | 0.119 * | 0.249 ** | 0.134 * | 0.263 ** | 0.117 *** | −0.121 *** | 0.154 * |

| (0.011) | (0.019) | (0.071) | (0.117) | (0. 073) | (0.128) | (0. 012) | (0.019) | (0.081) | |

| Fert_subsidy | 0.0142 | 0.297 | −0.091 | 0.129 | 0.165 | 0.005 | 0.443 *** | −0.025 | 0.142 * |

| (0.142) | (0.182) | (0.145) | (0.146) | (0.146) | (0.160) | (0.164) | (0.149) | (0.081) | |

| Gender | 0.270 ** | 0.236 ** | 0.511 *** | 0.332 *** | −0.379 *** | −0.339 ** | 0.543 *** | 0.076 | 0.259 * |

| (0.119) | (0.113) | (0.136) | (0.089) | (0.074) | (0.150) | (0.133) | (0.351) | (0.091) | |

| Age_HHH | 0.003 | 0.000 | 0.000 | −0.005 | 0.012 ** | 0.005 | −0.003 | −0.002 | 0.011 |

| (0.004) | (0.005) | (0.004) | (0.004) | (0.005) | (0.005) | (0.004) | (0.004) | (0.015) | |

| HHsize | −0.000 | 0.001 | 0.006 | 0.013 | −0.009 | −0.013 | 0.005 | −0.007 | 0.000 |

| (0.008) | (0.011) | (0.008) | (0.008) | (0.009) | (0.009) | (0.008) | (0.009) | (0.008) | |

| Education | −0.006 | 0.104 *** | −0.016 | 0.007 | 0.003 | 0.033 ** | 0.011 ** | −0.023 | 0.190 ** |

| (0.015) | (0.019) | (0.015) | (0.016) | (0.018) | (0.016) | (0.004) | (0.016) | (0.085) | |

| Farm_size | 0.117 | 0.034 | 0.003 | 0.112 | 0.179 | 0.024 | 0.285 | −0.145 | 0.007 |

| (0.149) | (0.156) | (0.153) | (0.151) | (0.172) | (0.168) | (0.352) | (0.158) | (0.150) | |

| Compensation | 0.361 | 0.493 | 0.518 | −0.710 | −0.369 | −0.366 | 0.371 | −0.136 | −0.356 |

| (0.400) | (0.565) | (0.423) | (0.463) | (0.424) | (0.430) | (0.403) | (0.411) | (0.399) | |

| 0.166 *** | 0.381 ** | 0.023 | 0.103 | 0.125 *** | 0.045 | 0.006 | 0.114 | 0.261 *** | |

| (0.042) | (0.189) | (0.126) | (0.124) | (0.044) | (0.139) | (0.125) | (0.129) | (0.062) | |

| ROI | 0.148 | 0.029 | 0.114 ** | 0.256 | 0.169 | 0.014 | 0.259 * | 0.353 ** | 0.241 * |

| (0.148) | (0.185) | (0.045) | (0.247) | (0.224) | (0.160) | (0.151) | (0.154) | (0.143) | |

| Credit_access | −0.110 | −0.265 | −0.352 ** | −0.436 *** | −0.147 | −0.114 | −0.002 | −0.039 | −0.225 * |

| (0.160) | (0.188) | (0.159) | (0.156) | (0.174) | (0.168) | (0.154) | (0.161) | (0.130) | |

| Access_good_roads | 0.035 | −0.079 | 0.402 ** | −0.012 | 0.144 | 0.211 | 0.399 ** | 0.169 * | 0.302 * |

| (0.156) | (0.161) | (0.197) | (0.159) | (0.178) | (0.173) | (0.157) | (0.100) | (0.156) | |

| Tenure_security | 0.118 | 0.977 ** | 0.028 | 0.186 * | 0.215 ** | 0.251 ** | 0.115 * | 0.111 | 0.183 *** |

| (0.234) | (0.472) | (0.191) | (0.101) | (0.086) | (0.104) | (0.063) | (0.194) | (0.028) | |

| Good_fertile | −0.019 | −0.580 *** | −0.011 | −0.192 | −0.092 | −0.238 ** | −0.137 * | −0.185 | −0.135 *** |

| (0.135) | (0.178) | (0.138) | (0.137) | (0.156) | (0.105) | (0.078) | (0.145) | (0.023) | |

| Moderate_fertile | −0.089 | −0.312 | −0.219 | −0.240 | 0.115 | 0.034 | −0.090 | 0.197 | −0.019 |

| (0.173) | (0.211) | (0.172) | (0.176) | (0.202) | (0.188) | (0.175) | (0.186) | (0.170) | |

| Water_resource | 0.069 | 0.087 | −0.195 | −0.185 | 0.024 | −0.202 | −0.416 ** | 0.218 | 0.163 |

| (0.170) | (0.219) | (0.173) | (0.173) | (0.201) | (0.186) | (0.173) | (0.182) | (0.174) | |

| District_dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −0.359 | −1.804 ** | −1.233 * | 1.573 ** | −1.402 ** | −0.232 | −0.946 | −0.766 | −0.446 |

| (0.635) | (0.875) | (0.650) | (0.670) | (0.702) | (0.670) | (0.644) | (0.654) | (0.624) | |

| Joint significance of residuals: χ2 (4) | 25.23 *** | 31.45 *** | 28.27 *** | 42.23 *** | 19.80 *** | 27.11 *** | 34.56 *** | 21.33 *** | 22.45 *** |

| Joint significance of instruments: χ2 (1) | 1.497 [0.471] | 3.442 [0.121] | 1.691 [0.515] | 1.630 [0.110] | 0.982 [0.663] | 2.334 [0.348] | 2.22 [0.123] | 0.21 [0.100] | 1.89 [0.981] |

| Observations | 636 | 636 | 636 | 636 | 636 | 636 | 636 | 636 | 636 |

| Parameter | Coefficient | Robust std. err. |

|---|---|---|

| corr(e.Direct_Foreign, e.oderedLIT) | 0.416 | 0.159 *** |

| corr(e.Indirect_Foreign, e.oderedLIT) | 0.505 | 0.203 ** |

| corr(e.Direct_Domestic,e.oderedLIT) | 0.855 | 0.162 *** |

| corr(e.Indirect_Domestic,e.oderedLIT) | 0.533 | 0.184 *** |

| ATET-PrLI | Direct Exposure to LSLA by FE | Indirect Exposure to LSLA by FE | Direct Exposure to LSLA by DE | Indirect Exposure to LSLA by DE |

|---|---|---|---|---|

| ATET_Pr0 | 0.021 (0.022) | 0.152 (0.035) *** | 0.101 (0.102) | 0.056 (0.023) ** |

| ATET_Pr1 | −0.108 (0.035) *** | −0.235 (0.044) *** | −0.140 (0.038) *** | −0.390 (0.036) *** |

| ATET_Pr2 | −0.136 (0.055) ** | −0.047 (0.067) | −0.267 (0.046) *** | −0.198 (0.065) *** |

| ATET_Pr3 | −0.121 (0.049) ** | −0.032 (0.065) | −0.117 (0.039) *** | −0.197 (0.090) ** |

| ATET_Pr4 | −0.029 (0.041) | −0.098 (0.037) *** | −0.006 (0.040) | −0.006 (0.042) |

| ATET_Pr5 | −0.316 (0.113) *** | −0.304 (0.159) * | −0.631 (0.103) *** | −0.283 (0.149) * |

| Variables | oderedLIT |

|---|---|

| 1.Perception_tenure_security#0b.Direct_Foreign | 0.577 *** |

| (0.230) | |

| 1.Perception_tenure_security#1.Direct_Foreign | −0.157 * |

| (0.093) | |

| Observations | 661 |

| Variables | oderedLIT |

|---|---|

| 1.Perception_tenure_security#0b.Indirect_Foreign | 0.635 *** |

| (0.113) | |

| 1.Perception_tenure_security#1.Indirect_Foreign | −0.117 |

| (0.274) | |

| Observations | 661 |

| Variables | oderedLIT |

|---|---|

| 1.Perception_tenure_security#0b.Direct_Domestic | 0.843 *** |

| (0.113) | |

| 1.Perception_tenure_security#1.Direct_Domestic | −0.311 *** |

| (0.111) | |

| Observations | 661 |

| Variables | oderedLIT |

|---|---|

| 1.Perception_tenure_security#0b.Indirect_Domestic | 0.839 *** |

| (0.115) | |

| 1.Perception_tenure_security#1.Indirect_Domestic | −0.414 * |

| (0.250) | |

| Observations | 661 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abdallah, A.-H.; Ayamga, M.; Awuni, J.A. Large-Scale Land Acquisition and Household Farm Investment in Northern Ghana. Land 2023, 12, 737. https://doi.org/10.3390/land12040737

Abdallah A-H, Ayamga M, Awuni JA. Large-Scale Land Acquisition and Household Farm Investment in Northern Ghana. Land. 2023; 12(4):737. https://doi.org/10.3390/land12040737

Chicago/Turabian StyleAbdallah, Abdul-Hanan, Michael Ayamga, and Joseph Agebase Awuni. 2023. "Large-Scale Land Acquisition and Household Farm Investment in Northern Ghana" Land 12, no. 4: 737. https://doi.org/10.3390/land12040737

APA StyleAbdallah, A.-H., Ayamga, M., & Awuni, J. A. (2023). Large-Scale Land Acquisition and Household Farm Investment in Northern Ghana. Land, 12(4), 737. https://doi.org/10.3390/land12040737