Inequity in Housing Welfare: Assessing the Inter-City Performance of China’s Housing Provident Fund Program

Abstract

1. Introduction

2. Literature Review

2.1. Housing Inequality and the Government-Designed Savings Program

2.2. China’s HPF Program and Its Inequity Controversy

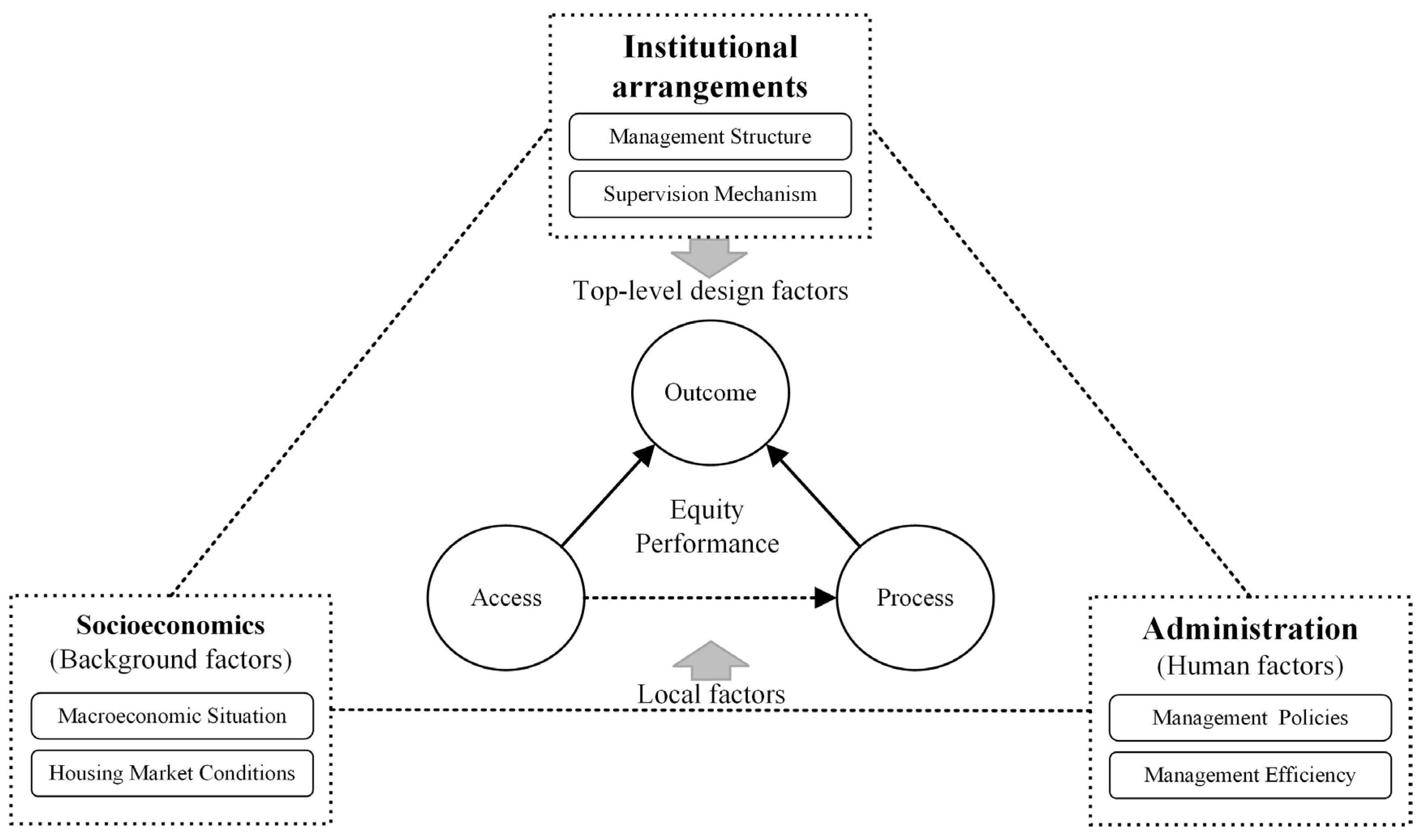

2.3. Research Framework and Hypotheses

3. Methodology

3.1. Indicators of the HPF Performance Evaluation

3.2. Spatial Agglomeration Analysis

3.3. Spatial Convergence Analysis

3.4. Regression Model

3.5. Descriptive Analysis

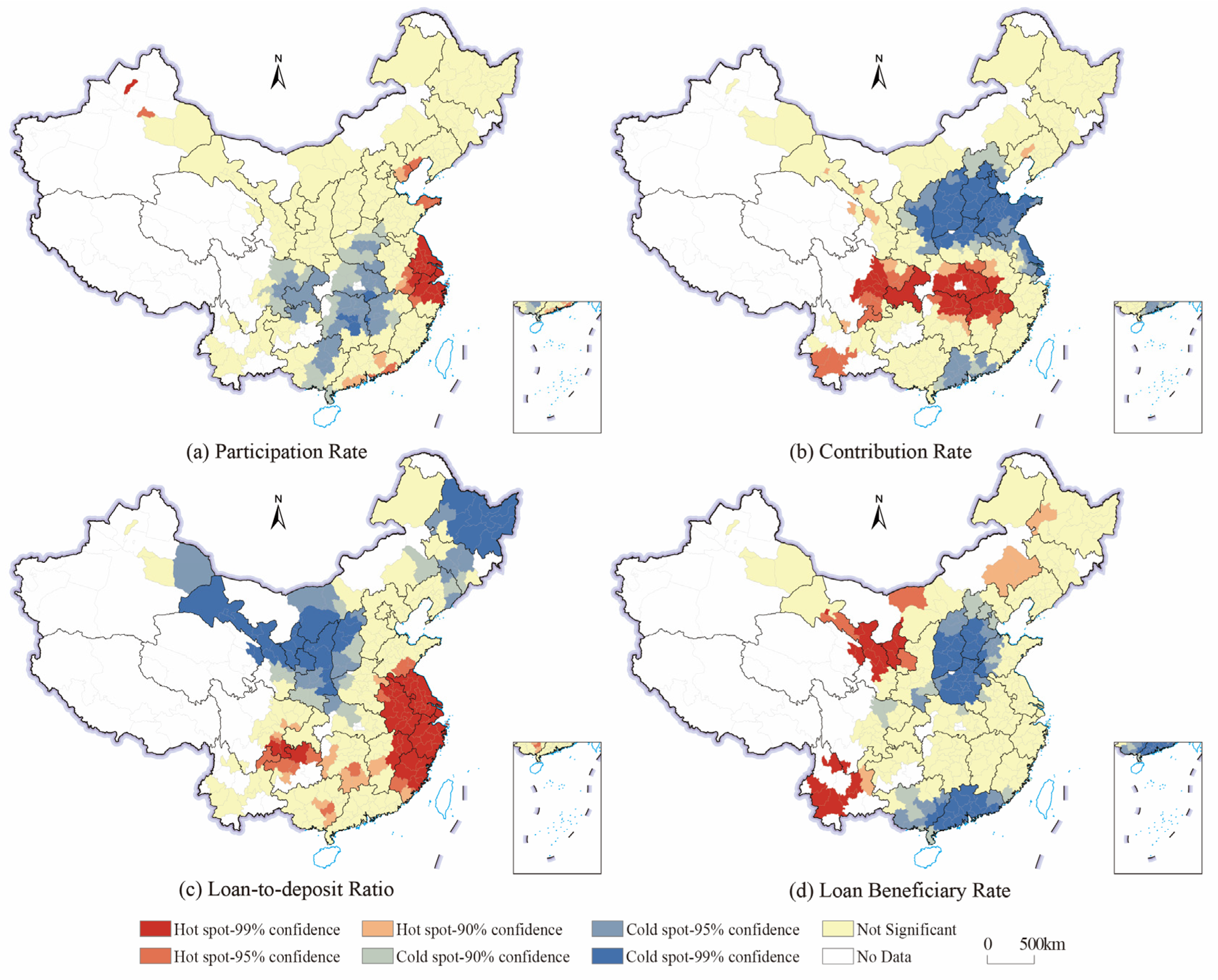

4. Spatial Equity Performance of HPF

4.1. Inter-City and Regional Heterogeneity

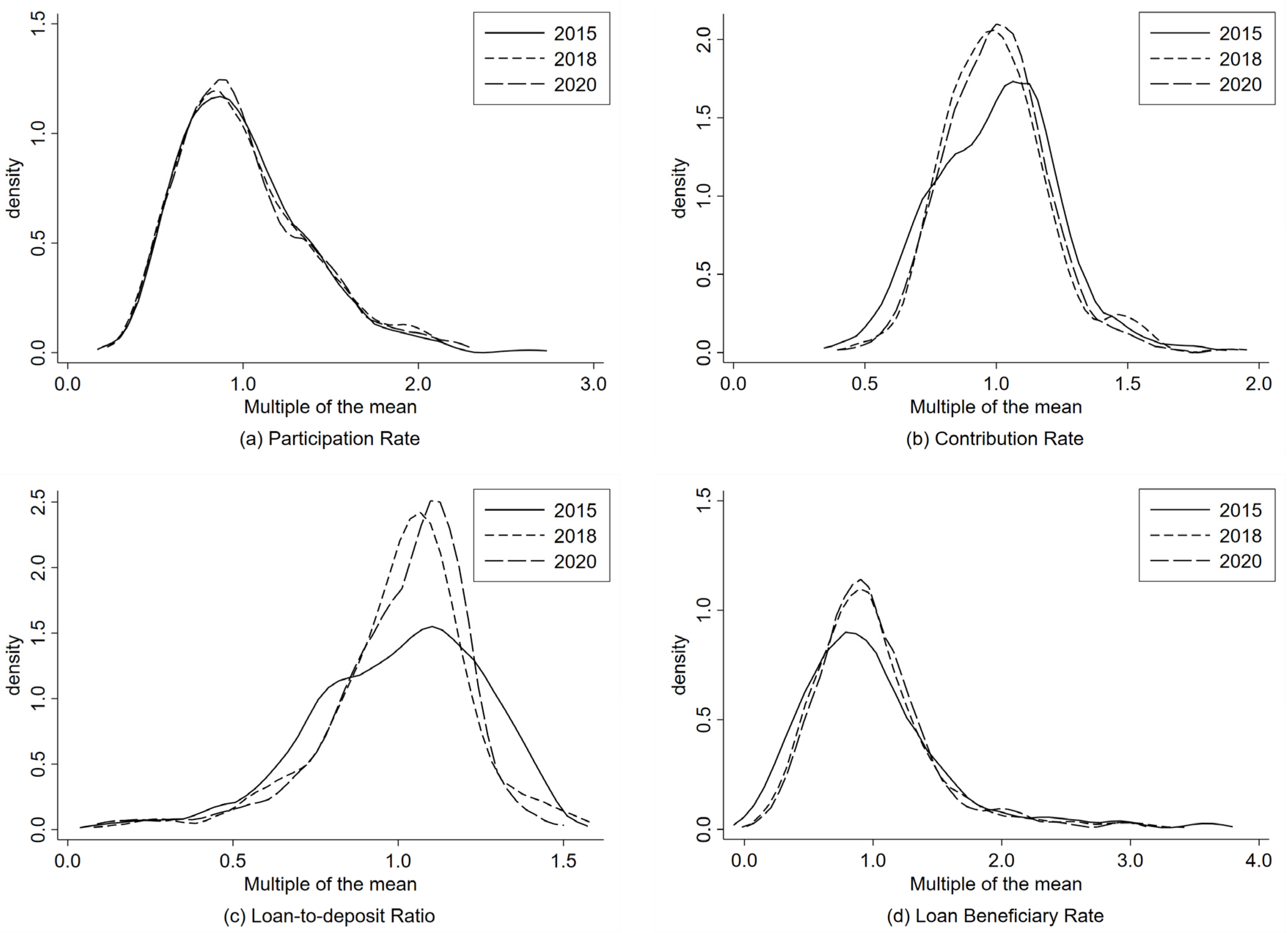

4.2. Differentiated Spatial Convergence Trend

5. Regression Results

6. Discussion

7. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | http://gjj.beijing.gov.cn/web/zwgk61/gjjndbb/10960899/index.html (accessed on 5 February 2023). |

References

- Foye, C.; Clapham, D.; Gabrieli, T. Home-ownership as a social norm and positional good: Subjective wellbeing evidence from panel data. Urban Stud. 2017, 55, 1290–1312. [Google Scholar] [CrossRef]

- Wang, Z.; Guo, M.; Ming, J. Effect of hometown housing investment on the homeownership of rural migrants in urban destinations: Evidence from China. Cities 2020, 105, 102619. [Google Scholar] [CrossRef]

- Fu, Y.; Tse, D.K.; Zhou, N. Housing Choice Behavior of Urban Workers in China’s Transition to a Housing Market. J. Urban Econ. 2000, 47, 61–87. [Google Scholar] [CrossRef]

- Lee, J. From Welfare Housing to Home Ownership: The Dilemma of China’s Housing Reform. Hous. Stud. 2000, 15, 61–76. [Google Scholar] [CrossRef]

- Huang, Y.; Jiang, L. Housing Inequality in Transitional Beijing. Int. J. Urban Reg. Res. 2009, 33, 936–956. [Google Scholar] [CrossRef]

- Zhang, L.; Ye, Y.; Chen, J. Urbanization, informality and housing inequality in indigenous villages: A case study of Guangzhou. Land Use Policy 2016, 58, 32–42. [Google Scholar] [CrossRef]

- Tang, B.S.; Ho, W.K.; Wong, S.W. Sustainable development scale of housing estates: An economic assessment using machine learning approach. Sustain. Dev. 2021, 29, 708–718. [Google Scholar] [CrossRef]

- Wang, Y.P. Urban Housing Reform and Finance in China. Urban Aff. Rev. 2001, 36, 620–645. [Google Scholar] [CrossRef]

- Zhang, X.Q. The restructuring of the housing finance system in urban China. Cities 2000, 17, 339–348. [Google Scholar] [CrossRef]

- Li, S.-M.; Yi, Z. Financing Home Purchase in China, with Special Reference to Guangzhou. Hous. Stud. 2007, 22, 409–425. [Google Scholar] [CrossRef]

- Xu, Y. Mandatory savings, credit access and home ownership: The case of the housing provident fund. Urban Stud. 2017, 54, 3446–3463. [Google Scholar] [CrossRef]

- Ni, P.F. Discussion focus and reform direction of housing accumulation fund system. People Trib. 2020, 23, 76–80. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-RMLT202023023.htm (accessed on 10 January 2022).

- Chen, J.; Deng, L. Financing Affordable Housing Through Compulsory Saving: The Two-Decade Experience of Housing Provident Fund in China. Hous. Stud. 2014, 29, 937–958. [Google Scholar] [CrossRef]

- Chen, J. An analysis of the institutional dilemma and reform outlet of China’s housing accumulation fund. J. Public Admin. 2010, 3, 91–119. Available online: http://rdbk1.ynlib.cn:6251/qw/Paper/414645 (accessed on 15 October 2021).

- Huang, S.A.; Cao, Y.Z. Evaluation of fairness and efficiency of China’s current housing provident fund system. J. Jianghai Acad. 2020, 4, 78–87. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-JHXK202004013.htm (accessed on 10 January 2022). [CrossRef]

- Burell, M. China’s housing provident fund: Its success and limitations. Hous. Financ. Int. 2006, 20, 38–49. Available online: https://www.researchgate.net/publication/242703774 (accessed on 15 October 2021).

- Wang, Y.P.; Murie, A. Social and Spatial Implications of Housing Reform in China. Int. J. Urban Reg. Res. 2000, 24, 397–417. [Google Scholar] [CrossRef]

- Deng, L.; Yan, X.; Chen, J. Housing affordability, subsidized lending and cross-city variation in the performance of China’s housing provident fund program. Hous. Stud. 2019, 36, 455–478. [Google Scholar] [CrossRef]

- Olanrewaju, A.; Tan, S.Y.; Abdul-Aziz, A.-R. Housing providers’ insights on the benefits of sustainable affordable housing. Sustain. Dev. 2018, 26, 847–858. [Google Scholar] [CrossRef]

- DeSilva, S.; Elmelech, Y. Housing Inequality in the United States: Explaining the White-Minority Disparities in Homeownership. Hous. Stud. 2012, 27, 1–26. [Google Scholar] [CrossRef]

- Tan, S.; Wang, S.; Cheng, C. Change of Housing Inequality in Urban China and Its Decomposition: 1989–2011. Soc. Indic. Res. 2015, 129, 29–45. [Google Scholar] [CrossRef]

- Yi, C.; Huang, Y. Housing Consumption and Housing Inequality in Chinese Cities During the First Decade of the Twenty-First Century. Hous. Stud. 2013, 29, 291–311. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Yin, M. Tax Deductions, Tax Credits and the Homeownership Rate of Young Urban Adults in the United States. Urban Stud. 2008, 45, 1141–1161. [Google Scholar] [CrossRef]

- Chiquier, L.; Lea, M. Housing Finance Policy in Emerging Markets; The World Bank: Washington, DC, USA, 2009. [Google Scholar] [CrossRef]

- Tu, Y. Public Homeownership, Housing Finance and Socioeconomic Development in Singapore. Rev. Urban Reg. Dev. Stud. 1999, 11, 100–113. [Google Scholar] [CrossRef]

- Jones, D.S. The central provident fund scheme in Singapore: Challenges and reform. Asian J. Polit. Sci. 2005, 13, 75–102. [Google Scholar] [CrossRef]

- Koh, B.S.; Mitchell, O.S.; Tanuwidjaja, T.; Fong, J. Investment patterns in Singapore’s Central Provident Fund System. SSRN Electron. J. 2008, 7, 37–65. [Google Scholar] [CrossRef]

- Chen, M.; Wu, Y.; Liu, G.; Wang, X. The effect of the housing provident fund on housing consumption and inequity risks. Cities 2020, 104, 102812. [Google Scholar] [CrossRef]

- Heeg, S.; García, M.V.I.; Arreortua, L.A.S. Financialization of Housing in Mexico: The Case of Cuautitlan Izcalli and Huehuetoca in the Metropolitan Region of Mexico City. Hous. Policy Debate 2020, 30, 512–532. [Google Scholar] [CrossRef]

- Aalbers, M.B. The Variegated Financialization of Housing. Int. J. Urban Reg. Res. 2017, 41, 542–554. [Google Scholar] [CrossRef]

- Renaud, B. The Financing of Social Housing in Integrating Financial Markets: A View from Developing Countries. Urban Stud. 1999, 36, 755–773. [Google Scholar] [CrossRef]

- Vasoo, S.; Lee, J. Singapore: Social development, housing and the Central Provident Fund. Int. J. Soc. Welf. 2001, 10, 276–283. [Google Scholar] [CrossRef]

- Janoschka, M.; Arreortua, L.S. Peripheral urbanisation in Mexico City. A comparative analysis of uneven social and material geographies in low-income housing estates. Habitat Int. 2017, 70, 43–49. [Google Scholar] [CrossRef]

- Soederberg, S. Subprime Housing Goes South: Constructing Securitized Mortgages for the Poor in Mexico. Antipode 2014, 47, 481–499. [Google Scholar] [CrossRef]

- Monkkonen, P. The housing transition in Mexico: Expanding access to housing finance. Urban Aff. Rev. 2011, 47, 672–695. [Google Scholar] [CrossRef]

- Logan, J.R.; Fang, Y.; Zhang, Z. The Winners in China’s Urban Housing Reform. Hous. Stud. 2010, 25, 101–117. [Google Scholar] [CrossRef]

- Shaw, V.N. Urban housing reform in China. Habitat Int. 1997, 21, 199–212. [Google Scholar] [CrossRef]

- Deng, L.; Shen, Q.; Wang, L. The Emerging Housing Policy Framework in China. J. Plan. Lit. 2011, 26, 168–183. [Google Scholar] [CrossRef]

- Ministry of Housing and Urban-Rural Development (MOHURD). Annual Report of National Housing Provident Fund Management 2020. The Official Website of MOHURD. Available online: https://www.mohurd.gov.cn/gongkai/fdzdgknr/zfhcxjsbwj/202107/20210716_761234.html (accessed on 15 October 2021).

- State Council of People’s Republic of China. Release of the Human Resources and Social Security Statistical Bulletin in 2020. 2021. Available online: http://www.gov.cn/shuju/2021-06/04/content_5615418.htm (accessed on 6 March 2023).

- Lu, Y.H.; Wan, H.Y. The impact of housing provident fund on income inequality in urban China. China Econ. Quart. 2020, 20, 87–106. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-JJXU202005006.htm (accessed on 15 October 2021). [CrossRef]

- Xie, S.; Chen, J. Beyond homeownership: Housing conditions, housing support and rural migrant urban settlement intentions in China. Cities 2018, 78, 76–86. [Google Scholar] [CrossRef]

- Chen, J. The history of China’s Housing Provident Fund and direction for future reform. J. Party Admin. Off. 2009, 4, 27–29. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-DGXK200904012.htm (accessed on 10 January 2022).

- Rawls, J. A Theory of Justice; Harvard University Press: Cambridge, MA, USA, 1971. [Google Scholar]

- Liu, H.Y. Research on Promoting and Improving Housing Provident Fund System; Science Press: Beijing, China, 2011. [Google Scholar]

- McDermott, M.; Mahanty, S.; Schreckenberg, K. Examining equity: A multidimensional framework for assessing equity in payments for ecosystem services. Environ. Sci. Policy 2013, 33, 416–427. [Google Scholar] [CrossRef]

- Zheng, Y.; Yang, Z.H. Theoretical analysis of the correlation between social security and social equity. Tax. Econ. 2011, 4, 51–55. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-SWYJ201104008.htm (accessed on 7 June 2021).

- Wang, W.; Gan, C.; Chang, Z.; Cohen, D.A.; Li, Z. Homeownership in urban China: An empirical study of borrower characteristics and the Housing Provident Fund program in Kunming. J. Asia Bus. Stud. 2018, 12, 318–339. [Google Scholar] [CrossRef]

- Yang, H.S. The path of policy implementation-incentive analysis framework: Taking housing security policy as an example. J. Polit. Sci. 2014, 1, 80–94. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-POLI201401008.htm (accessed on 10 January 2022).

- Xiao, Z.P.; Yin, L.H. Determinants of housing accumulation fund deposits rate in China: Empirical evidence from 34 large and medium cities. Econ. Res. 2010, 129–142. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-JJYJ2010S1014.htm (accessed on 10 January 2022).

- Adabre, M.A.; Chan, A.P. The ends required to justify the means for sustainable affordable housing: A review on critical success criteria. Sustain. Dev. 2019, 27, 781–794. [Google Scholar] [CrossRef]

- Tang, M.; Coulson, N.E. The impact of China’s housing provident fund on homeownership, housing consumption and housing investment. Reg. Sci. Urban Econ. 2017, 63, 25–37. [Google Scholar] [CrossRef]

- Mitchell, A. The ESRI Guide to GIS Analysis; ESRI Press: Santa Barbara, CA, USA, 2005; Volume 2. [Google Scholar]

- Cowell, F. Measuring Inequality; Oxford University Press: New York, NY, USA, 2011. [Google Scholar]

- Silverman, B.W. Density Estimation for Statistics and Data Analysis; Chapman and Hall: London, UK, 1986. [Google Scholar]

- Zhang, M.; Rasiah, R. Institutional change and state-owned enterprises in China’s urban housing market. Habitat Int. 2014, 41, 58–68. [Google Scholar] [CrossRef]

- Wang, Y.P.; Wang, Y.; Bramley, G. Chinese Housing Reform in State-owned Enterprises and Its Impacts on Different Social Groups. Urban Stud. 2005, 42, 1859–1878. [Google Scholar] [CrossRef]

- Yeung, S.C.-W.; Howes, R. The role of the housing provident fund in financing affordable housing development in China. Habitat Int. 2006, 30, 343–356. [Google Scholar] [CrossRef]

- State Council of People’s Republic of China. Notice on Properly Responding to the COVID-19 Epidemic and Implementing the Phased Support Policy for Housing Provident Fund. Available online: http://www.gov.cn/zhengce/zhengceku/2020-02/24/content_5482678.htm (accessed on 23 October 2021).

- Ministry of Housing and Urban-Rural Development (MOHURD), the Notice on Regulating and periodically Reducing the Contribution Rate of the Housing Provident Fund. Available online: https://www.ndrc.gov.cn/xwdt/ztzl/gbmjcbzc/zfjsb/201801/t20180119_1209892.html?code=;state=123 (accessed on 5 October 2021).

- Wu, Y.D.; Wang, X.Z. Research on liquidity risk of housing provident: An empirical evidence from Shanghai. Stat. Inform. Forum 2018, 33, 58–65. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-TJLT201809010.htm (accessed on 23 October 2021).

- State Council of People’s Republic of China. Notice on Issues Related to Individual Housing Loan Policy. Available online: http://www.gov.cn/xinwen/2015-03/30/content_2840354.htm (accessed on 20 October 2021).

- Ministry of Housing and Urban-Rural Development (MOHURD), Integrated Development of Housing Provident Fund in the Yangtze River Delta. Available online: https://www.mohurd.gov.cn/xinwen/dfxx/202110/20211025_762621.html (accessed on 5 October 2021).

- Tan, R.; He, Q.; Zhou, K.; Song, Y.; Xu, H. Administrative hierarchy, housing market inequality, and multilevel determinants: A cross-level analysis of housing prices in China. J. Hous. Built Environ. 2019, 34, 845–868. [Google Scholar] [CrossRef]

- Zhao, Y.; Bourassa, S.C. China’s Urban Housing Reform: Recent Achievements and New Inequities. Hous. Stud. 2003, 18, 721–744. [Google Scholar] [CrossRef]

| Variable | Mean | Median | Std. Dev | Expected Relationship |

|---|---|---|---|---|

| Dependent variable | ||||

| Loan beneficiary rate (LBR) | 41.484 | 38.492 | 21.615 | |

| Key explanatory variables | ||||

| Participation rate (PR) | 31.235 | 29.065 | 11.340 | Positive |

| Contribution rate (CR) | 9.989 | 9.948 | 2.135 | Positive |

| Loan-to-deposit ratio (LDR) | 81.729 | 84.305 | 18.704 | Positive |

| Socioeconomic variables | ||||

| Urban housing price (LnHP) | 8.633 | 8.534 | 0.491 | Negative |

| Average annual salary of employees (lnAS) | 11.101 | 11.095 | 0.236 | Positive |

| Loan interest rate_5over (LIR) | 4.958 | 4.875 | 0.321 | Negative |

| Administration control variables | ||||

| Proportion of non-public contributors (NPC) | 28.108 | 23.470 | 19.134 | Positive |

| HPF maximum loan amounts (LnML) | 4.018 | 4.007 | 0.264 | Positive |

| Management expense rate (MER) | 15.418 | 13.619 | 8.228 | Negative |

| Indicators | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|

| Participation rate | 30.67 | 30.75 | 30.72 | 31.17 | 31.51 | 32.59 |

| Contribution rate | 10.24 | 10.12 | 10.04 | 9.86 | 9.88 | 9.79 |

| Loan-to-deposit ratio | 74.38 | 82.75 | 83.79 | 83.36 | 83.12 | 82.98 |

| Loan beneficiary rate | 34.08 | 36.57 | 40.54 | 43.59 | 45.77 | 48.35 |

| Classification | Participation Rate | Contribution Rate | Loan-to-Deposit Ratio | Loan Beneficiary Rate | ||||

|---|---|---|---|---|---|---|---|---|

| 2015 | 2020 | 2015 | 2020 | 2015 | 2020 | 2015 | 2020 | |

| Overall mean | 30.67 | 32.59 | 10.24 | 9.79 | 74.38 | 82.98 | 34.08 | 48.35 |

| Region | ||||||||

| Eastern cities | 31.91 | 35.86 | 9.72 | 8.88 | 83.07 | 88.00 | 32.34 | 41.33 |

| Central cities | 28.98 | 29.27 | 10.22 | 10.28 | 70.57 | 80.36 | 30.93 | 47.67 |

| Western cities | 32.00 | 33.92 | 11.03 | 10.23 | 68.56 | 80.40 | 42.54 | 60.07 |

| Scale rank | ||||||||

| Megacities (>10 million) | 46.13 | 52.67 | 7.42 | 6.70 | 80.44 | 83.68 | 21.01 | 24.54 |

| Supercities (5–10 million) | 39.66 | 42.95 | 8.97 | 8.25 | 92.00 | 88.76 | 27.38 | 32.37 |

| Large cities (1–5 million) | 33.86 | 35.54 | 9.64 | 9.06 | 81.68 | 87.76 | 28.82 | 39.09 |

| Mid-sized cities (0.5–1 million) | 28.39 | 30.98 | 10.32 | 10.20 | 74.73 | 83.67 | 32.24 | 47.41 |

| Small cities (<0.5 million) | 29.28 | 30.31 | 10.81 | 10.16 | 67.11 | 78.37 | 40.90 | 58.37 |

| Year | Participation Rate | Contribution Rate | Loan-to-Deposit Ratio | Loan Beneficiary Rate | ||||

|---|---|---|---|---|---|---|---|---|

| CV | G | CV | G | CV | G | CV | G | |

| 2015 | 0.352 | 0.195 | 0.229 | 0.128 | 0.253 | 0.141 | 0.590 | 0.301 |

| 2016 | 0.362 | 0.198 | 0.205 | 0.114 | 0.236 | 0.128 | 0.549 | 0.284 |

| 2017 | 0.360 | 0.198 | 0.243 | 0.138 | 0.223 | 0.120 | 0.525 | 0.269 |

| 2018 | 0.364 | 0.202 | 0.203 | 0.111 | 0.217 | 0.116 | 0.491 | 0.251 |

| 2019 | 0.368 | 0.203 | 0.199 | 0.109 | 0.213 | 0.113 | 0.470 | 0.241 |

| 2020 | 0.366 | 0.202 | 0.193 | 0.107 | 0.212 | 0.112 | 0.449 | 0.234 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | p | Coef. | p | Coef. | p | Coef. | p | |

| PR | −0.296 | 0.000 | −0.173 | 0.000 | ||||

| CR | 1.874 | 0.000 | 1.673 | 0.000 | ||||

| LDR | 0.151 | 0.000 | 0.151 | 0.000 | ||||

| lnHP | −3.377 | 0.001 | −4.477 | 0.000 | −4.519 | 0.000 | −4.875 | 0.000 |

| lnAS | 0.319 | 0.890 | 18.303 | 0.000 | −0.669 | 0.770 | 14.372 | 0.000 |

| LIR | −17.157 | 0.000 | −9.661 | 0.000 | −16.470 | 0.000 | −10.490 | 0.000 |

| NPC | −0.099 | 0.000 | −0.071 | 0.000 | −0.149 | 0.000 | −0.076 | 0.000 |

| lnML | 2.250 | 0.013 | 0.935 | 0.264 | 3.353 | 0.000 | 1.343 | 0.076 |

| MER | −0.084 | 0.000 | −0.062 | 0.001 | −0.086 | 0.000 | −0.041 | 0.014 |

| Cons. | 162.862 | 0.000 | −89.467 | 0.006 | 155.921 | 0.000 | −44.343 | 0.135 |

| R2 | 0.684 | 0.730 | 0.687 | 0.781 | ||||

| LogL | −4568.456 | −4433.489 | −4560.415 | −4254.370 | ||||

| AIC | 9160.913 | 8890.979 | 9144.83 | 8536.741 | ||||

| BIC | 9226.327 | 8956.394 | 9210.245 | 8613.058 | ||||

| Obs | 1722 | 1722 | 1722 | 1722 | ||||

| Variables | (1) Region | (2) Scale Rank | ||||||

|---|---|---|---|---|---|---|---|---|

| Eastern Cities | Central and Western Cities | Large Cities | Mid-Sized and Small Cities | |||||

| Coef. | p | Coef. | p | Coef. | p | Coef. | p | |

| PR | −0.086 | 0.004 | −0.174 | 0.000 | −0.083 | 0.029 | −0.209 | 0.000 |

| CR | 2.434 | 0.000 | 1.483 | 0.000 | 1.565 | 0.000 | 1.641 | 0.000 |

| LDR | 0.084 | 0.000 | 0.175 | 0.000 | 0.143 | 0.000 | 0.145 | 0.000 |

| lnHP | −8.581 | 0.000 | −1.634 | 0.165 | −4.932 | 0.001 | −3.347 | 0.003 |

| lnAS | 15.315 | 0.000 | 15.264 | 0.000 | 8.953 | 0.049 | 15.279 | 0.000 |

| LIR | −10.500 | 0.000 | −9.537 | 0.000 | −10.622 | 0.000 | −10.483 | 0.000 |

| NPC | −0.071 | 0.003 | −0.060 | 0.008 | −0.037 | 0.190 | −0.094 | 0.000 |

| lnML | 0.847 | 0.491 | 0.765 | 0.406 | 0.522 | 0.692 | 1.346 | 0.139 |

| MER | −0.028 | 0.380 | −0.027 | 0.153 | −0.114 | 0.009 | −0.026 | 0.155 |

| Cons. | −28.939 | 0.608 | −82.227 | 0.019 | 12.535 | 0.841 | −62.888 | 0.065 |

| R2 | 0.732 | 0.814 | 0.716 | 0.804 | ||||

| LogL | −1354.088 | −2820.746 | −1180.633 | −3035.106 | ||||

| AIC | 2736.176 | 5669.491 | 2389.266 | 6098.212 | ||||

| BIC | 2797.451 | 5739.96 | 2448.382 | 6169.681 | ||||

| Obs | 588 | 1134 | 504 | 1218 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.; Song, J.; Jiang, H. Inequity in Housing Welfare: Assessing the Inter-City Performance of China’s Housing Provident Fund Program. Land 2023, 12, 653. https://doi.org/10.3390/land12030653

Chen H, Song J, Jiang H. Inequity in Housing Welfare: Assessing the Inter-City Performance of China’s Housing Provident Fund Program. Land. 2023; 12(3):653. https://doi.org/10.3390/land12030653

Chicago/Turabian StyleChen, Hongyan, Jinping Song, and Huaxiong Jiang. 2023. "Inequity in Housing Welfare: Assessing the Inter-City Performance of China’s Housing Provident Fund Program" Land 12, no. 3: 653. https://doi.org/10.3390/land12030653

APA StyleChen, H., Song, J., & Jiang, H. (2023). Inequity in Housing Welfare: Assessing the Inter-City Performance of China’s Housing Provident Fund Program. Land, 12(3), 653. https://doi.org/10.3390/land12030653