How a Short-Lived Rumor of Residential Redevelopment Disturbs a Local Housing Market: Evidence from Hangzhou, China

Abstract

1. Introduction

2. Background

2.1. Institutional Background

2.2. Literature Background

2.2.1. Previous Studies on Residential Redevelopment

2.2.2. Previous Studies on Price Overreaction and Rumors

2.2.3. A Short Summary

3. Methodology

3.1. Data Source and Variable Definitions

3.2. Empirical Design

4. Empirical Results and Discussion

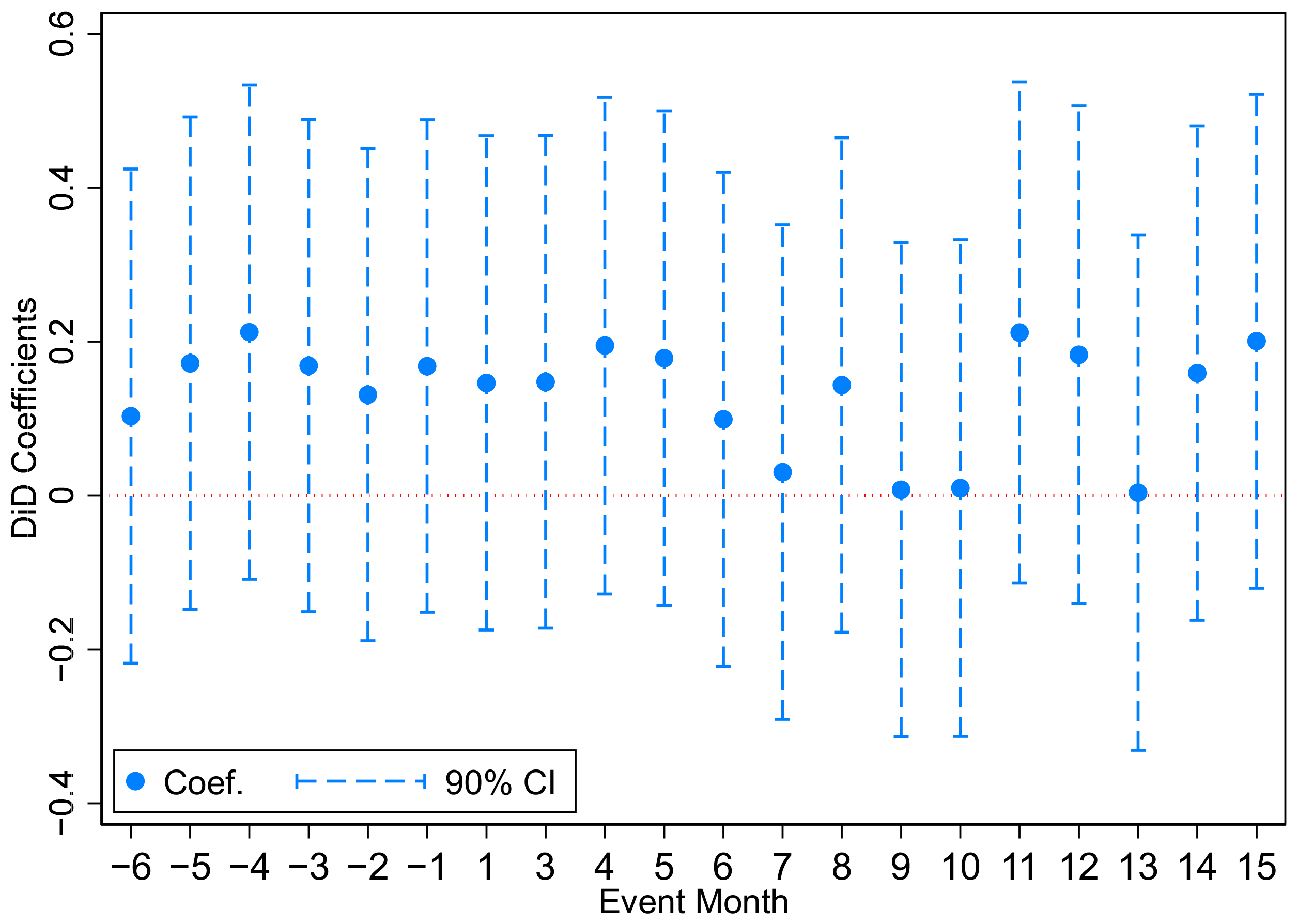

4.1. Results

4.2. Discussion

4.2.1. Market Efficiency

4.2.2. Wealth Effect

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Fuller, G.W.; Johnston, A.; Regan, A. Housing prices and wealth inequality in Western Europe. West Eur. Politics 2020, 43, 297–320. [Google Scholar] [CrossRef]

- Loutskina, E.; Strahan, P.E. Financial integration, housing, and economic volatility. J. Financ. Econ. 2015, 115, 25–41. [Google Scholar] [CrossRef]

- Zhou, Z. Overreaction to policy changes in the housing market: Evidence from Shanghai. Reg. Sci. Urban Econ. 2016, 58, 26–41. [Google Scholar] [CrossRef]

- Galariotis, E.C.; Rong, W.; Spyrou, S.I. Herding on fundamental information: A comparative study. J. Bank. Financ. 2015, 50, 589–598. [Google Scholar] [CrossRef]

- Hott, C. The influence of herding behaviour on house prices. J. Eur. Real Estate Res. 2012, 5, 177–198. [Google Scholar] [CrossRef]

- Lan, T. Herding Behavior in China Housing Market. Int. J. Econ. Financ. 2014, 6, 115–124. [Google Scholar] [CrossRef]

- Nofsinger, J.R.; Sias, R.W. Herding and feedback trading by institutional and individual investors. J. Financ. 1999, 54, 2263–2295. [Google Scholar] [CrossRef]

- Rantala, V. How Do Investment Ideas Spread through Social Interaction? Evidence from a Ponzi Scheme. J. Financ. 2019, 74, 2349–2389. [Google Scholar] [CrossRef]

- Ahern, K.R.; Sosyura, D. Rumor Has It: Sensationalism in Financial Media. Rev. Financ. Stud. 2015, 28, 2050–2093. [Google Scholar] [CrossRef]

- Schmidt, D. Stock Market Rumors and Credibility. Rev. Financ. Stud. 2020, 33, 3804–3853. [Google Scholar] [CrossRef]

- Liu, Y.; Tang, S.; Geertman, S.; Lin, Y.; van Oort, F. The chain effects of property-led redevelopment in Shenzhen: Price-shadowing and indirect displacement. Cities 2017, 67, 31–42. [Google Scholar] [CrossRef]

- Chen, Y.; Chau, K.W.; Yang, L. How the combined use of non-negotiable and negotiable developer obligations affects land value capture: Evidence from market-oriented urban redevelopment in China. Habitat Int. 2022, 119, 102494. [Google Scholar] [CrossRef]

- Guo, Y.; Zhu, J.; Liu, X. Implication of rural urbanization with place-based entitlement for social inequality in China. Cities 2018, 82, 77–85. [Google Scholar] [CrossRef]

- Zhu, J.; Guo, Y. Social justice in spatial change: Transition from autonomous rural development to integrated urbanization in China. Cities 2022, 122, 103539. [Google Scholar] [CrossRef]

- Clapp, J.M.; Bardos, K.S.; Wong, S.K. Empirical estimation of the option premium for residential redevelopment. Reg. Sci. Urban Econ. 2012, 42, 240–256. [Google Scholar] [CrossRef]

- Ogas-Mendez, A.F.; Isoda, Y.; Nakaya, T. Strong, weak, or reversed: The spatial heterogeneities in the effects of squatter settlements on house prices. Cities 2021, 117, 103304. [Google Scholar] [CrossRef]

- Zheng, X.; Li, J.-x.; Zheng, L.; Lv, J. Multi-owned property, urban renewal and neighborhood property value externalities: Revisiting the Hong Kong case. Cities 2020, 107, 102915. [Google Scholar] [CrossRef]

- Mesthrige, J.W.; Wong, J.K.W.; Yuk, L.N. Conversion or redevelopment? Effects of revitalization of old industrial buildings on property values. Habitat Int. 2018, 73, 53–64. [Google Scholar] [CrossRef]

- Alonso, J.M.; Andrews, R.; Jorda, V. Do neighbourhood renewal programs reduce crime rates? Evidence from England. J. Urban Econ. 2019, 110, 51–69. [Google Scholar] [CrossRef]

- Givord, P.; Quantin, S.; Trevien, C. A long-term evaluation of the first generation of French urban enterprise zones. J. Urban Econ. 2018, 105, 149–161. [Google Scholar] [CrossRef]

- Fu, Y.; Qian, W. Speculators and price overreaction in the housing market. Real Estate Econ. 2014, 42, 977–1007. [Google Scholar] [CrossRef]

- Zheng, S.; Sun, W.; Kahn, M.E. Investor Confidence as a Determinant of China’s Urban Housing Market Dynamics. Real Estate Econ. 2016, 44, 814–845. [Google Scholar] [CrossRef]

- Bayer, P.; Mangum, K.; Roberts, J.W. Speculative Fever: Investor Contagion in the Housing Bubble. Am. Econ. Rev. 2021, 111, 609–651. [Google Scholar] [CrossRef]

- Andrei, D.; Cujean, J. Information percolation, momentum and reversal. J. Financ. Econ. 2017, 123, 617–645. [Google Scholar] [CrossRef]

- Fu, Y.; Qian, W.; Yeung, B. Speculative investors and transactions tax: Evidence from the housing market. Manag. Sci. 2016, 62, 3254–3270. [Google Scholar] [CrossRef]

- Golan, R. Do urban redevelopment incentives promote asset deterioration? A game-theoretic approach. J. Hous. Built Environ. 2020, 35, 879–896. [Google Scholar] [CrossRef]

- Han, L.; Lutz, C.; Sand, B.M.; Stacey, D. Do Financial Constraints Cool a Housing Boom? In Theory and Evidence from a Macroprudential Policy on Million Dollar Homes; Department of Economics, Ryerson University: Toronto, ON, Canada, 2017. [Google Scholar]

- Qian, W.; Tu, H.; Wu, J.; Xu, W. Unintended Consequences of Demand-Side Housing Policies: Evidence from Capital Reallocation. 2020. Available online: https://ssrn.com/abstract=3558307 (accessed on 16 February 2023).

- Liang, C.-M.; Lee, C.-C.; Lee, J.-W.; Yu, Z. The Effects of Government-Announced Soil Liquefaction Potential on Housing Prices in Reported Areas: A Two-Stage Spatial Quantile Regression Analysis. J. Real Estate Res. 2020, 42, 206–238. [Google Scholar] [CrossRef]

- Mense, A.; Kholodilin, K.A. Noise expectations and house prices: The reaction of property prices to an airport expansion. Ann. Reg. Sci. 2014, 52, 763–797. [Google Scholar] [CrossRef]

- Tan, X.; Altrock, U. Struggling for an adaptive strategy? Discourse analysis of urban regeneration processes—A case study of Enning Road in Guangzhou City. Habitat Int. 2016, 56, 245–257. [Google Scholar] [CrossRef]

- Tian, L.; Guo, Y. Peri-Urban China: Land Use, Growth, and Integrated Urban–Rural Development; Routledge: London, UK, 2019. [Google Scholar]

- Lin, S.; Wu, F.; Liang, Q.; Li, Z.; Guo, Y. From hometown to the host city? Migrants’ identity transition in urban China. Cities 2022, 122, 103567. [Google Scholar] [CrossRef]

- Yang, Q.; Ley, D. Residential relocation and the remaking of socialist workers through state-facilitated urban redevelopment in Chengdu, China. Urban Stud. 2019, 56, 2480–2498. [Google Scholar] [CrossRef]

- Bao, H.X.H.; Larsson, J.P.; Wong, V. Light at the end of the tunnel: The impacts of expected major transport improvements on residential property prices. Urban Stud. 2020, 58, 2971–2990. [Google Scholar] [CrossRef]

- Li, F.; Xiao, J.J. Losing the future: Household wealth from urban housing demolition and children’s human capital in China. China Econ. Rev. 2020, 63, 101533. [Google Scholar] [CrossRef]

- Cai, Y.; Xie, J.; Tian, C. Housing wealth change and disparity of indigenous villagers during urban village redevelopment: A comparative analysis of two resettled residential neighborhoods in Wuhan. Habitat Int. 2020, 99, 102162. [Google Scholar] [CrossRef]

- Chen, Y.; Chau, K.W.; Zhang, M.; Yang, L. Institutional innovations from state-dominated to market-oriented: Price premium differentials of urban redevelopment projects in Shenzhen, China. Cities 2022, 131, 103993. [Google Scholar] [CrossRef]

- Chau, K.W.; Wong, S.K. Externalities of Urban Renewal: A Real Option Perspective. J. Real Estate Financ. Econ. 2014, 48, 546–560. [Google Scholar] [CrossRef]

- Zahirovich-Herbert, V.; Gibler, K.M. The effect of new residential construction on housing prices. J. Hous. Econ. 2014, 26, 1–18. [Google Scholar] [CrossRef]

- Rosenthal, S.S. Old homes, externalities, and poor neighborhoods. A model of urban decline and renewal. J. Urban Econ. 2008, 63, 816–840. [Google Scholar] [CrossRef]

- Tse, R.Y.C. Impact of comprehensive development zoning on real estate development in Hong Kong. Land Use Policy 2001, 18, 321–328. [Google Scholar] [CrossRef]

- Davis, O.A.; Whinston, A. Externalities, welfare, and the theory of games. J. Political Econ. 1962, 70, 241–262. [Google Scholar] [CrossRef]

- Liu, D.; Li, Z.; Guo, Y. The impacts of neighbourhood governance on residents’ sense of community: A case study of Wuhan, China. Urban Res. Pract. 2022, 1–19. [Google Scholar] [CrossRef]

- Zhang, L.; Ye, Y.; Wang, J. Influential Factors and Geographical Differences in the Redevelopment Willingness of Urban Villagers: A Case Study of Guangzhou, China. Land 2022, 11, 233. [Google Scholar] [CrossRef]

- Lee, Y.B.; Jin, J. The Effect of Urban Regeneration Projects on the Nearby Housing Prices in Seoul: Using the Difference-in-Differences Model. J. Korea Plan. Assoc. 2021, 56, 120–136. [Google Scholar] [CrossRef]

- Bayer, P.; Geissler, C.; Roberts, J. Speculators and Middlemen: The Role of Flippers in the Housing Market; NBER Working Paper Series; National Bureau of Economic Research: Washington, DC, USA, 2011; Volume 16784. [Google Scholar]

- Chinco, A.; Mayer, C. Misinformed speculators and mispricing in the housing market. Rev. Financ. Stud. 2016, 29, 486–522. [Google Scholar] [CrossRef]

- DeFusco, A.A.; Nathanson, C.G.; Zwick, E. Speculative Dynamics of Prices and Volume; 0898-2937; National Bureau of Economic Research: Washington, DC, USA, 2017. [Google Scholar]

- He, Y.; Xia, F. Heterogeneous traders, house prices and healthy urban housing market: A DSGE model based on behavioral economics. Habitat Int. 2020, 96, 102085. [Google Scholar] [CrossRef]

- Kiel, K.A.; McClain, K.T. House Prices during Siting Decision Stages: The Case of an Incinerator from Rumor through Operation. J. Environ. Econ. Manag. 1995, 28, 241–255. [Google Scholar] [CrossRef]

- He, Z.; Manela, A. Information Acquisition in Rumor-Based Bank Runs. J. Financ. 2016, 71, 1113–1158. [Google Scholar] [CrossRef]

- Blaufus, K.; Möhlmann, A.; Schwäbe, A.N. Stock price reactions to news about corporate tax avoidance and evasion. J. Econ. Psychol. 2019, 72, 278–292. [Google Scholar] [CrossRef]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Flammer, C. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef]

- Sorescu, A.; Warren, N.L.; Ertekin, L. Event study methodology in the marketing literature: An overview. J. Acad. Mark. Sci. 2017, 45, 186–207. [Google Scholar] [CrossRef]

| Variable | Definition |

|---|---|

| Log(Price) | The logarithm of listing price per square meter of a housing unit; |

| Trans_Ratio | The ratio of number of transactions in each month to total units of each neighborhood, in ‰; |

| List_Ratio | The ratio of number of new listings in each month to total units of each neighborhood, in ‰; |

| Volatility | Volatility of listing prices for each neighborhood in each month; |

| Post | A binary variable that equals 1 if data observation is after the information shock, otherwise it equals 0; |

| Treat | A binary variable that equals 1 if a housing unit or neighborhood belongs to the treatment group (Zhaohui No. 6), 0 if a housing unit or neighborhood belongs to the control group (the other 8 Zhaohui projects); |

| Log(Size) | The logarithm of the size of the listed housing unit; |

| Bedroom | Number of bedrooms; |

| Living_room | Number of living rooms; |

| Furnished | A dummy variable that equals 1 if the observed housing unit is well furnished, otherwise it equals 0; |

| Floor | A vector of dummy variables indicating whether the observed housing unit is at the lower, middle or high floor level; |

| Panel A: Individual-Level Dataset | |||||

| Variable | Obs. | Mean | Std. | Min. | Max. |

| Treat = 1 | |||||

| Log(Price) | 139 | 10.73 | 0.1 | 10.52 | 11.02 |

| Post | 139 | 0.44 | 0.5 | 0 | 1 |

| Log(Size) | 139 | 4.03 | 0.16 | 3.72 | 4.3 |

| Bedroom | 139 | 2.13 | 0.38 | 1 | 3 |

| Living_room | 139 | 1.02 | 0.35 | 0 | 2 |

| Furnished | 139 | 0.35 | 0.48 | 0 | 1 |

| Floor | 139 | 1.14 | 0.78 | 0 | 2 |

| Treat = 0 | |||||

| Log(Price) | 859 | 10.62 | 0.08 | 10.37 | 11.26 |

| Post | 859 | 0.58 | 0.49 | 0 | 1 |

| Log(Size) | 859 | 4.04 | 0.15 | 3.71 | 4.31 |

| Bedroom | 859 | 2.1 | 0.46 | 1 | 3 |

| Living_room | 859 | 1.06 | 0.34 | 0 | 2 |

| Furnished | 859 | 0.33 | 0.47 | 0 | 1 |

| Floor | 859 | 1.13 | 0.77 | 0 | 2 |

| Panel B: Neighborhood-Level Dataset | |||||

| Variable | Obs. | Mean | Std. | Min. | Max. |

| Treat = 1 | |||||

| Trans_Ratio | 22 | 1.02 | 1.75 | 0 | 8.04 |

| List_Ratio | 22 | 2.05 | 1.53 | 0.28 | 6.93 |

| Post | 22 | 0.68 | 0.48 | 0 | 1 |

| Volatility | 21 | 0.23 | 0.06 | 0.07 | 0.33 |

| Treat = 0 | |||||

| Trans_Ratio | 176 | 1.21 | 1.33 | 0 | 6.43 |

| List_Ratio | 176 | 2.44 | 1.52 | 0 | 7.55 |

| Post | 176 | 0.68 | 0.47 | 0 | 1 |

| Volatility | 176 | 0.18 | 0.13 | 0.01 | 0.91 |

| Time Window | (1) | (2) | (3) |

|---|---|---|---|

| Trans_Ratio | Log(Price) | List_Ratio | |

| (June 2020) Pre6 Treat | 0.4069 | 0.0523 | −0.1235 |

| (0.310) | (1.445) | (0.071) | |

| (July 2020) Pre5 Treat | 0.3080 | 0.0658 * | −0.1125 |

| (0.235) | (1.923) | (0.065) | |

| (August 2020) Pre4 Treat | 0.3500 | 0.0727 * | −1.1186 |

| (0.267) | (1.956) | (0.642) | |

| (September 2020) Pre3 Treat | 0.4500 | 0.0406 | 1.4536 |

| (0.343) | (1.236) | (0.834) | |

| (October 2020) Pre2 Treat | −0.0015 | 0.0337 | 2.5622 |

| (0.001) | (1.112) | (1.470) | |

| (November 2020) Pre1 Treat | 0.1710 | 0.0450 | −0.9466 |

| (0.130) | (1.243) | (0.543) | |

| (January 2021) Post1 Treat | 2.1775 * | 0.0264 | −0.8259 |

| (1.661) | (0.710) | (0.474) | |

| (February 2021) Post2 Treat | 0.2816 | 0.0890 | −1.8984 |

| (0.215) | (1.208) | (1.089) | |

| (March 2021) Post3 Treat | 6.1369 *** | 0.1944 *** | −2.9245 * |

| (4.681) | (5.080) | (1.678) | |

| (April 2021) Post4 Treat | −1.8179 | 0.2613 *** | 0.2804 |

| (1.387) | (7.160) | (0.161) | |

| (May 2021) Post5 Treat | −0.5724 | 0.1408 ** | −2.3331 |

| (0.437) | (2.532) | (1.338) | |

| (June 2021) Post6 Treat | 0.5359 | 0.2485 *** | −1.6222 |

| (0.409) | (5.206) | (0.930) | |

| (July 2021) Post7 Treat | −0.1393 | 0.1311 *** | −0.6469 |

| (0.106) | (3.162) | (0.371) | |

| (August 2021) Post8 Treat | 0.0491 | 0.1965 *** | 0.0668 |

| (0.037) | (5.187) | (0.038) | |

| (September 2021) Post9 Treat | 0.6724 | 0.1800 *** | −1.3150 |

| (0.513) | (3.224) | (0.754) | |

| (October 2021) Post10 Treat | −0.1155 | 0.1042 ** | 0.2651 |

| (0.088) | (2.300) | (0.152) | |

| (November 2021) Post11 Treat | −1.5269 | 0.1236 ** | 0.0108 |

| (1.165) | (2.179) | (0.006) | |

| (December 2021) Post12 Treat | 0.3884 | 0.0876 * | 0.1439 |

| (0.296) | (1.936) | (0.083) | |

| (January 2022) Post13 Treat | 0.4557 | 0.0886 | −0.2566 |

| (0.348) | (1.489) | (0.147) | |

| (February 2022) Post14 Treat | −0.5063 | 0.1287 *** | −1.4335 |

| (0.386) | (2.670) | (0.822) | |

| (March 2022) Post15 Treat | 0.0141 | 0.1022 ** | −0.5642 |

| (0.011) | (2.471) | (0.324) | |

| Furnished | 0.0332 *** | ||

| (7.033) | |||

| Log(size) | −0.0650 *** | ||

| (3.318) | |||

| Bedroom | 0.0039 | ||

| (0.653) | |||

| Living_Room | 0.0178 ** | ||

| (2.520) | |||

| Cons. | 1.1474 *** | 10.8598 *** | 2.4586 *** |

| (9.701) | (154.822) | (15.634) | |

| Floor | / | YES | / |

| Project FE | YES | YES | YES |

| Year_Month FE | YES | YES | YES |

| N | 198 | 998 | 198 |

| R-squared | 0.601 | 0.426 | 0.415 |

| Event Window | Average Price Difference of Zhaohui No. 6 (Number of Transactions) | Average Price Difference of Other Residential Projects in Zhaohui Street (Number of Transactions) | Mean Diff. | p Value |

|---|---|---|---|---|

| [1 January 2021–31 January 2021] | 1.085 (8) | 1.074 (12) | 0.012 | 0.748 |

| [1 March 2021–31 March 2021] | 1.087 (23) | 1.056 (17) | 0.031 | 0.238 |

| [1 April 2021–31 May 2021] | 1.173 (6) | 1.050 (23) | 0.124 *** | 0.0012 |

| The Housing Purchase Time | Gains (Chinese Yuan) |

|---|---|

| (January 2021) | 112,778 |

| (February 2021) | −249,007 |

| (March 2021) | −396,027 |

| (April 2021) | −593,907 |

| (May 2021) | −290,407 |

| (June 2021) | −436,795 |

| (July 2021) | −295,999 |

| (August 2021) | −384,795 |

| (September 2021) | −313,177 |

| (October 2021) | −115,111 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Fan, H.; Liu, Q.; Yu, X.; Yang, S. How a Short-Lived Rumor of Residential Redevelopment Disturbs a Local Housing Market: Evidence from Hangzhou, China. Land 2023, 12, 518. https://doi.org/10.3390/land12020518

Zhang Y, Fan H, Liu Q, Yu X, Yang S. How a Short-Lived Rumor of Residential Redevelopment Disturbs a Local Housing Market: Evidence from Hangzhou, China. Land. 2023; 12(2):518. https://doi.org/10.3390/land12020518

Chicago/Turabian StyleZhang, Yanjiang, Hongyi Fan, Qingling Liu, Xiaofen Yu, and Shangming Yang. 2023. "How a Short-Lived Rumor of Residential Redevelopment Disturbs a Local Housing Market: Evidence from Hangzhou, China" Land 12, no. 2: 518. https://doi.org/10.3390/land12020518

APA StyleZhang, Y., Fan, H., Liu, Q., Yu, X., & Yang, S. (2023). How a Short-Lived Rumor of Residential Redevelopment Disturbs a Local Housing Market: Evidence from Hangzhou, China. Land, 12(2), 518. https://doi.org/10.3390/land12020518