Evolution of the Structure of the Urban Land-Price System in China Based on the Rank-Size Law

Abstract

:1. Introduction

2. Materials and Methods

2.1. Calculation of Land Price

2.2. Land Price Revision

2.3. Spatial Autocorrelation Analysis

2.4. Rank-Size Law

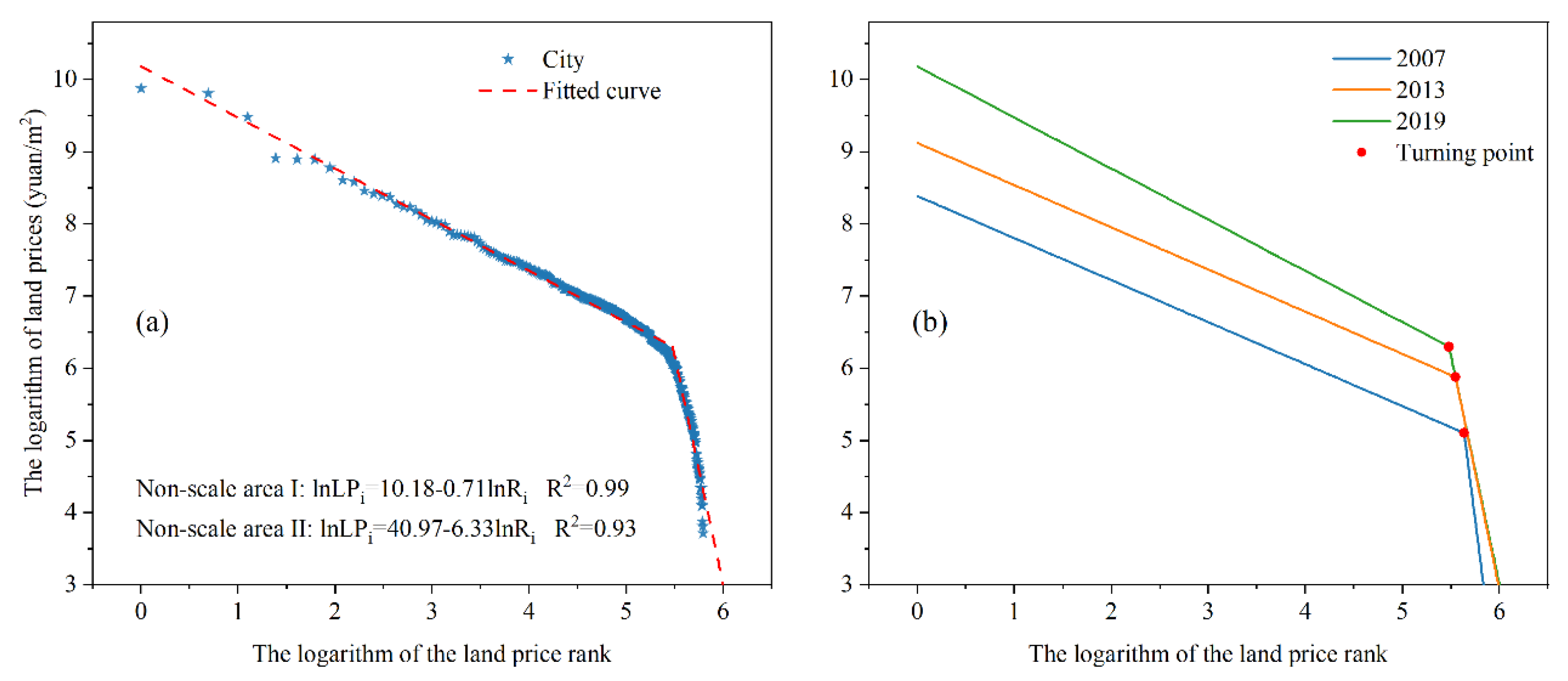

2.5. Fractal Theory

2.6. Data Sources and Processing

3. Results

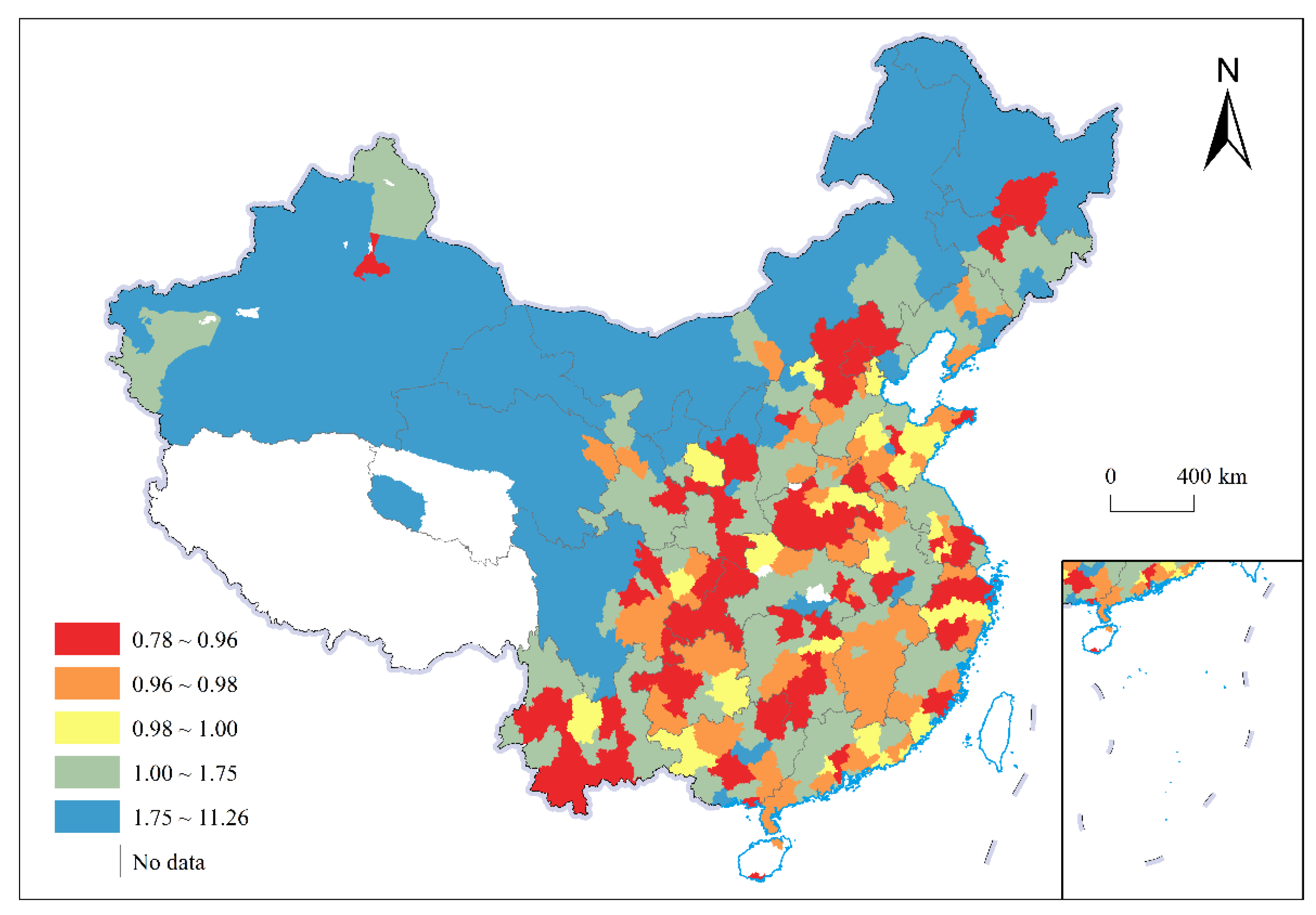

3.1. Temporal Evolution and Spatial Pattern of Urban Land Prices

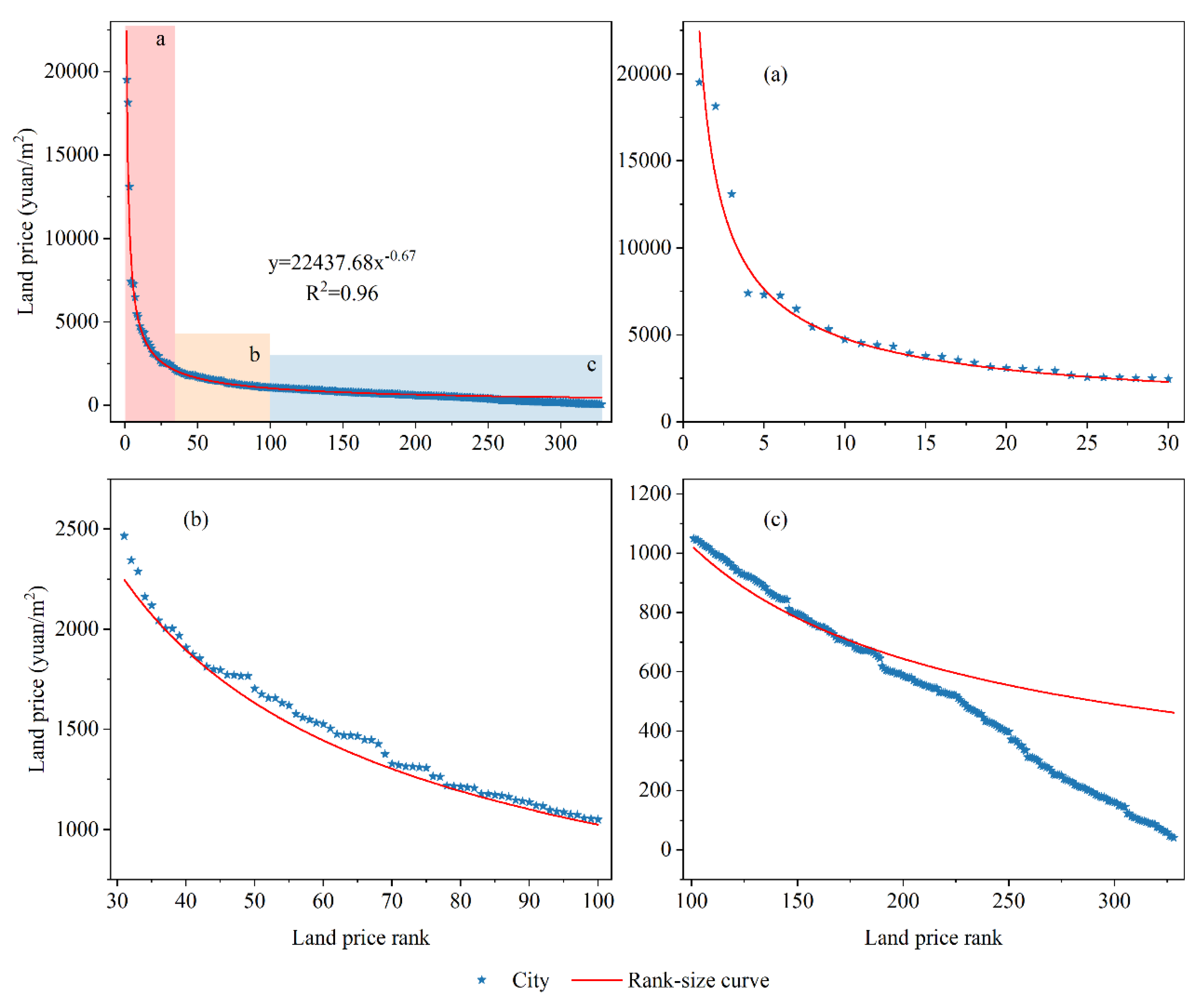

3.2. Rank-Size Distribution Characteristics of the Urban Land-Price System in China

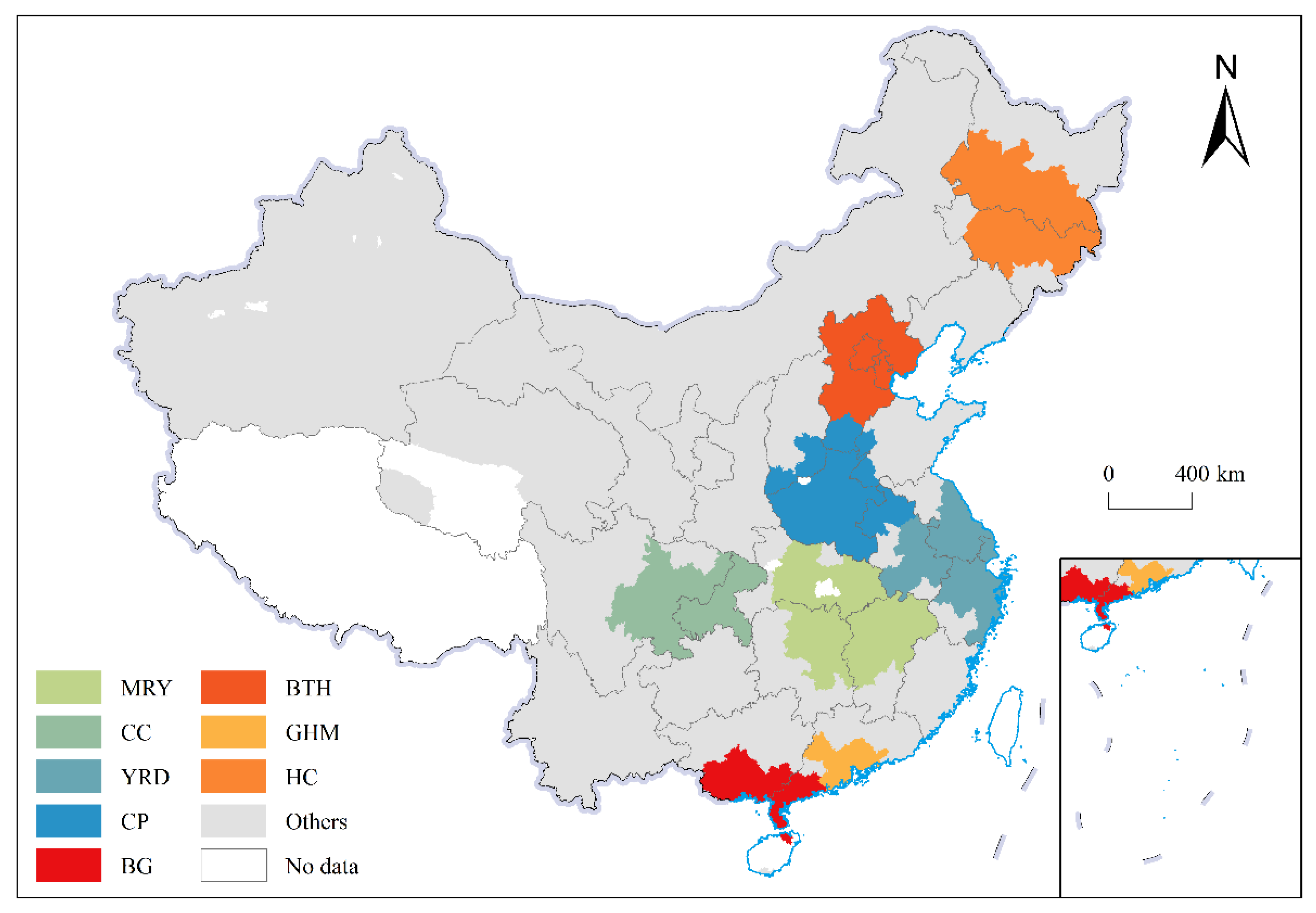

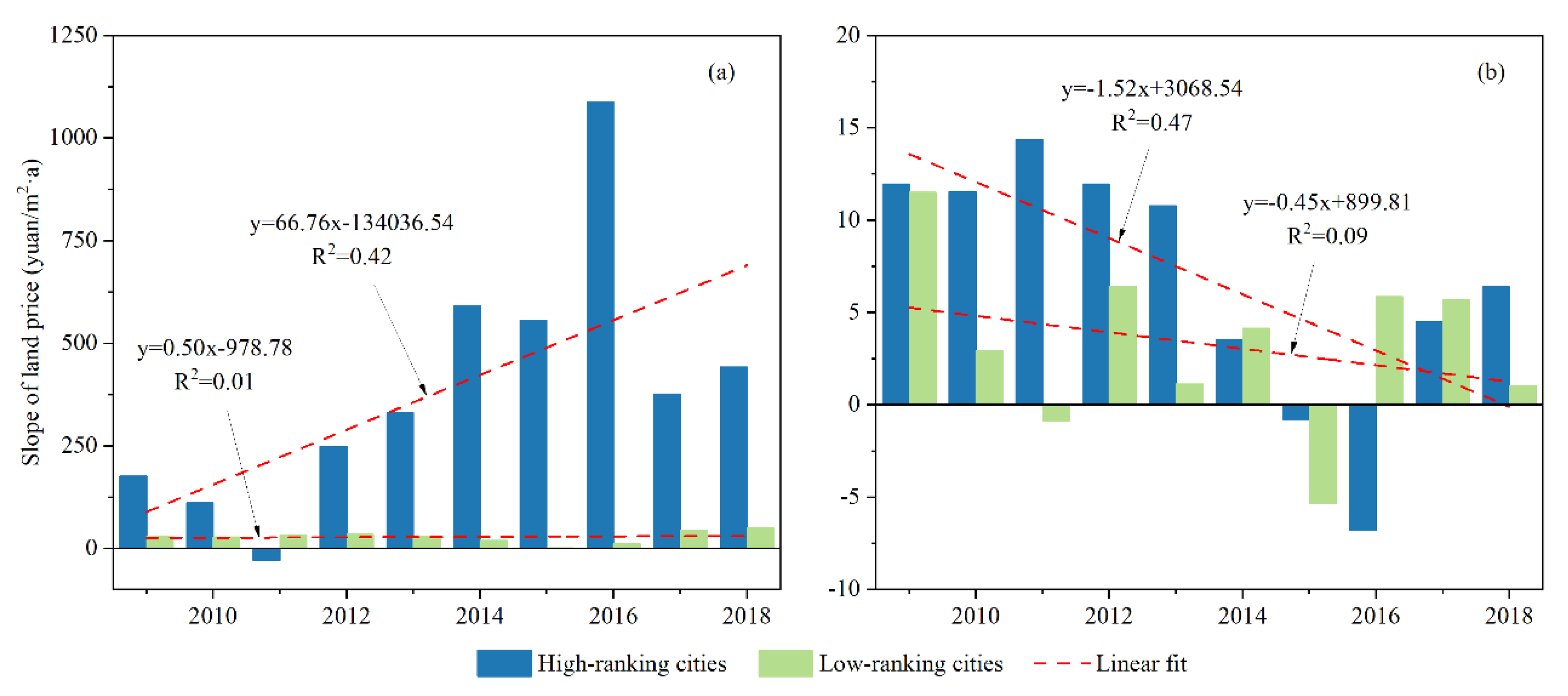

3.3. Rank-Size Characteristics of the Land-Price System in Urban Agglomerations

4. Discussion

5. Conclusions

- (1)

- From 2007–2019, the average urban land price in China showed a significant upward trend with an average growth rate of 80.73 yuan/(m2·a). It also shows a spatial clustering distribution.

- (2)

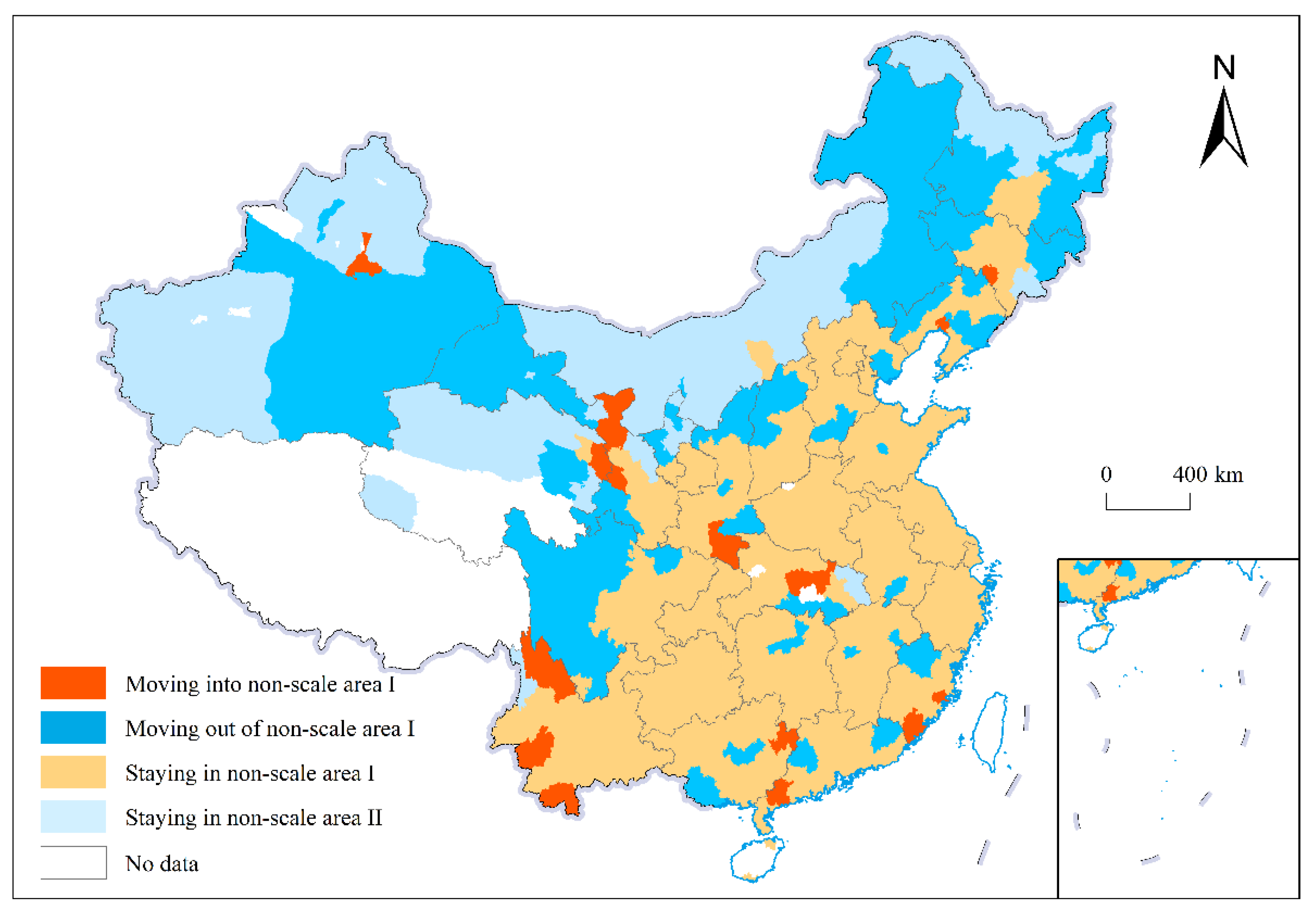

- The rank-size law describes the distribution of the urban land-price system in China. The rank-size distribution of land prices is balanced with more low-ranking cities and less high-ranking cities. The degree of equilibrium of the land-price system changed, showing a “balanced–unbalanced” development trend in general. The r of cities was low in the southeast and high in the northwest, with low values concentrated in the eastern region, especially in urban agglomerations. High values were concentrated in the northwest region, mostly in small and medium-sized low-ranking cities, indicating that the cities in northwest China still have more development space.

- (3)

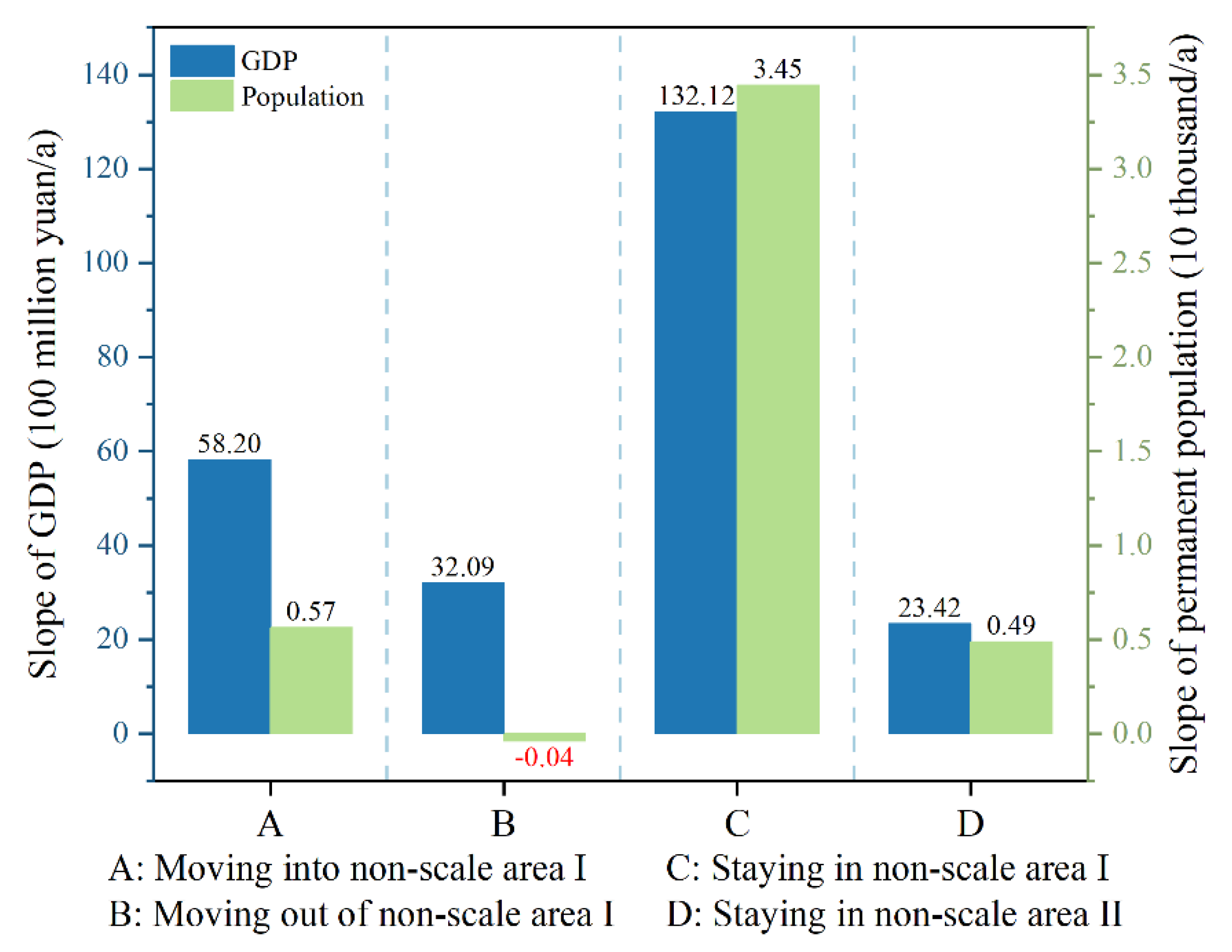

- Double fractal structures of China’s land price rank-size distribution were found during 2007–2019. During the study period, these fractal structures showed a steep slope of the fitted curve for non-scale area I; the position of the turning point between non-scale areas I and II shifted forward, and the gap between slopes of the fitted curve of non-scale areas I and II reduced. This is mainly related to the uneven growth of urban land prices. The polarization effect leads to the concentration of industries, capital, and labor in cities in the high order of development, which continuously increases the demand for land and causes land prices to rise, and the rise in land prices will further attract the concentration of population and capital. The outflow of population and industry from cities in the lower order causes a decrease in the growth rate of land demand in these cities. In addition, the lower-ranked cities have little change in land prices because of their lower level of development.

- (4)

- Among the eight urban agglomerations, there was a large gap in land prices between high-ranking and low-ranking cities in BTH and GHM. In contrast, the land prices of high-ranking and low-ranking cities were balanced in CC and CP. There is still a large difference between urban agglomeration land-price systems and this difference tends to continue to grow, reflecting the widening gap in development levels between urban agglomerations in China.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zeng, G.; Ma, Y. A study on the impact of land price on urban industrial structure upgrading: An empirical analysis based on urban data of 105 prefecture-level and above prefecture-level cities. Macroeconomics 2019, 95–107. [Google Scholar]

- Yan, X.; Zhang, P. Land price, land finance, and macroeconomic fluctuations. J. Financ. Res. 2019, 471, 1–18. [Google Scholar]

- Yang, S.; Hu, S.; Qu, S. Spatial analysis of the relationship between urban land price and urbanization rate: An empirical study of 80 counties in Hubei. Resour. Sci. 2017, 39, 325–334. [Google Scholar]

- Deng, X.; Liang, L.; Wu, F.; Wang, Z.; He, S. Chinese balanced regional development strategy from the perspective of development geography. Acta Geogr. Sin. 2021, 76, 261–276. [Google Scholar]

- Chai, Z.; Zhao, S.; Li, Z.; Wu, L. Empirical analysis on relationship between land price and economic growth: A case of eastern region. China Land Sci. 2009, 23, 9–13. [Google Scholar]

- Perroux, F. Economic space: Theory and applications. Q. J. Econ. 1950, 64, 89–104. [Google Scholar] [CrossRef]

- Yuan, S.; Zhu, C.; Yang, L. Spatial Analysis of Various Land Price and Its Influencing Factors in Yangtze River Delta Agglomeration. Resour. Environ. Yangtze Basin 2017, 26, 1538–1546. [Google Scholar]

- Zhao, S.; Tian, Y.; Zhou, G.; Wu, R.; Chai, Z. Study on the Urban Land Price of Various Land Uses. China Land Sci. 2011, 25, 4–9. [Google Scholar]

- Zhou, P.; Zeng, Z. Study on Relationship Between Urbanization and Urban Land Price—Panel Data Analysis from 31 Provinces in China. Resour. Dev. Mark. 2013, 29, 44–47+63. [Google Scholar]

- Zhang, H.; Jin, J. Spatial Variation of Urban Land Price in China: A Case Study of Kunming. China Land Sci. 2007, 24–30. [Google Scholar]

- Song, J.; Jin, X.; Tang, J.; Zhang, Z.; Ding, N.; Zhou, Y. Analysis of Influencing Factors for Urban Land Price and Its Changing Trend in China in Recent Years. Acta Geogr. Sin. 2011, 66, 1045–1054. [Google Scholar]

- Wang, Y.; Wang, D.; Liu, L.; Yan, M.; Wang, S. Spatial Differentiation of Urban Housing Prices and Its Impacts on Land Market in China. China Land Sci. 2015, 29, 33–40. [Google Scholar]

- Zhang, L.; Yang, H.; Ge, J.; Liang, Y. Research on Land Price Gravity Movement and Its Driving Factors of Major Cities in China. Geogr. Geo-Inf. Sci. 2014, 30, 70–74. [Google Scholar]

- Kaldor, N. Causes of the Slow Rate of Economic Growth of the United Kingdom: An Inaugural Lecture; Cambridge UP: London, UK, 1966. [Google Scholar]

- Thirlwall, A.P. Growth And Development: With Special Reference To Developing: With Special Reference to Developing Economies; Macmillan International Higher Education: Basingstoke, UK, 1994. [Google Scholar]

- Fujita, M.; Thisse, J.-F. Economics of agglomeration. J. Jpn. Int. Econ. 1996, 10, 339–378. [Google Scholar] [CrossRef] [Green Version]

- Krugman, P. Increasing returns and economic geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Moran, P.A. The interpretation of statistical maps. J. R. Stat. Society. Ser. B (Methodol.) 1948, 10, 243–251. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Econometrics: Methods and Models; Springer Science & Business Media: Berlin, Germany, 1988; Volume 4. [Google Scholar]

- Wang, S.; Wang, Y.; Lin, X.; Zhang, H. Spatial differentiation patterns and influencing mechanism of housing prices in China: Based on data of 2872 counties. Acta Geogr. Sin. 2016, 71, 1329–1342. [Google Scholar]

- Mo, Y.; Liu, Y.; Zhu, L. Spatial Differentiation Patterns and Influencing Factors of Urban Land Prices in Yangtze River Economic Belt. Resour. Environ. Yangtze Basin 2020, 29, 13–22. [Google Scholar]

- Yang, K. Research on Tempo-Spatial Characteristics of Urban Land Value in China from the Perspective of Urban Systems; China University of Mining and Technology: Xuzhou, China, 2014. [Google Scholar]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Taylor, P.J. Specification of the world city network. Geogr. Anal. 2001, 33, 181–194. [Google Scholar] [CrossRef]

- Herbert, D.T.; Thomas, C.J. Urban Geography: A First Approach; Wiley: Hoboken, NJ, USA, 1982. [Google Scholar]

- Jiang, H.; Cai, S.; Li, B. The rank-size distribution of civil airport system and its mechanism in the Yangtze River Delta. Sci. Geogr. Sin. 2021, 41, 615–624. [Google Scholar]

- Guo, J.; He, Y.; Wang, S.; Wu, L. Rank-size distribution changes and transportation network connections of the coastal container port system in Chinese mainland since 1985. Geogr. Res. 2019, 38, 869–883. [Google Scholar]

- Li, T.; Cao, X.; Yang, W. Rank-size distribution and evolution of passenger and freight flows in the Pearl River Delta. Prog. Geogr. 2016, 35, 108–117. [Google Scholar]

- Xu, Q.; Huang, T.; Chen, J.; Wan, Z.; Qin, Q.; Song, L. Port rank-size rule evolution: Case study of Chinese coastal ports. Ocean Coast. Manag. 2021, 211, 105803. [Google Scholar] [CrossRef]

- Liu, L.; Chen, J. Difference and influncing factors of inboound tourism scale: Evidence from the key provinces in China along the Belt and Road. Econ. Geogr. 2020, 40, 191–201. [Google Scholar]

- Yang, X.; Peng, F.; Zhang, Q.; Hu, W. The rank-size distribution and influencing factors of foreign trade in China’s border from 2000 to 2017. World Reg. Stud. 2020, 29, 1102–1112. [Google Scholar]

- Zhu, H.; Sun, G. Has the domestic tourism of Hubei province been distributed balancedly: An analysis by applying the rank-size rule to high priority regions. J. Zhejiang Univ. (Sci. Ed. ) 2020, 47, 244–252. [Google Scholar]

- Wang, Y.; Zhu, M.; Zhao, Y. Scale system and dynamic change characteristics of natural gas flow in China. World Reg. Stud. 2019, 28, 153–164. [Google Scholar]

- Zhao, Y.; Niu, H.; Yang, Z. Study on the rank-size distribution and variation of crude oil flow in China. Geogr. Res. 2010, 29, 2121–2131. [Google Scholar]

- Auerbach, F. Das gesetz der bevölkerungskonzentration. Petermanns Geogr. Mitt. 1913, 59, 74–76. [Google Scholar]

- Singer, H.W. The“ courbe des populations.” A parallel to Pareto’s Law. Econ. J. 1936, 46, 254–263. [Google Scholar] [CrossRef]

- Grachev, G.A. Size Distribution of States, Counties, and Cities in the USA: New Inequality Form Information. Phys. A: Stat. Mech. Its Appl. 2020, 592, 126831. [Google Scholar] [CrossRef]

- Kundak, S.; Dökmeci, V. A rank-size rule analysis of the city system at the country and province level in Turkey. ICONARP Int. J. Archit. Plan. 2018, 6, 77–98. [Google Scholar] [CrossRef] [Green Version]

- Taubenböck, H.; Weigand, M.; Esch, T.; Staab, J.; Wurm, M.; Mast, J.; Dech, S. A new ranking of the world’s largest cities—Do administrative units obscure morphological realities? Remote Sens. Environ. 2019, 232, 111353. [Google Scholar] [CrossRef]

- Yu, T.; Liu, Y.; Zhu, L.; Hu, Z.; Mo, Y. Coupling Analysis of Spatial Features of Urban Land Price and Nighttime Light Intensity in China. Territ. Nat. Resour. Study 2021, 5, 57–64. [Google Scholar]

- Luo, J.; Zhang, X.; Wu, Y.; Shen, J.; Shen, L.; Xing, X. Urban land expansion and the floating population in China: For production or for living? Cities 2018, 74, 219–228. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, P.; Zha, T. Land-price dynamics and macroeconomic fluctuations. Econometrica 2013, 81, 1147–1184. [Google Scholar]

- Du, X.; Huang, Z.; Wu, C. Land finance and economic growth in China—An analysis based on Inter-Provincial panel data. Financ. Trade Econ. 2009, 60–64. [Google Scholar]

- Zhao, A.; Lan, J.; Ma, X.; Xu, S. The impact of land price marketization on factor input and technology choice in China’s industrial sector. J. Financ. Econ. 2016, 42, 85–96. [Google Scholar]

- Chen, Y. Monofractal, multifractals, and self-affine fractals in urban studies. Prog. Geogr. 2019, 38, 38–49. [Google Scholar]

- Wu, Z.; Dai, X.; Yang, W. On reconstruction of parato formula and its relationship with development of urban system. Hum. Geogr. 2000, 15–19. [Google Scholar]

- National Bureau of Statistics, C. 2017 Zoning Codes and Urban-Rural Division Codes for Statistics. Available online: http://www.stats.gov.cn/tjsj/tjbz/tjyqhdmhcxhfdm/2017/index.html (accessed on 19 January 2022).

- Hirschman, A. The Strategy of Economic Development; Yale University Press: London, UK, 1958. [Google Scholar]

- Liu, A.; Ma, R.; Wang, M.; Yang, K. A new economic geography explanation for urban and regional development differences in China—An empirical study based on the variable payoffs of scale hypothesis. Inq. Into Econ. Issues 2016, 88–96. [Google Scholar]

- Liu, A.; Li, Q. A research of progressive rewark increase, path dependence and endogenous regional growth difference. Econ. Surv. 2007, 60–63. [Google Scholar]

| Urban Agglomeration | Number of Cities | List of Cities in Urban Agglomeration |

|---|---|---|

| CP | 29 | Zhengzhou, Luoyang, Kaifeng, Nanyang, Anyang, Shangqiu, Xinjiang, Pingdingshan, Xuchang, Jiaozuo, Zhoukou, Xinyang, Zhumadian, Hebi, Puyang, Luohe, Sanmenxia, Changzhi, Jincheng, Yuncheng, Xingtai, Handan, Liaocheng, Heze, Suzhou, Huaibei, Bengbu, Fuyang, and Bozhou |

| MRY | 28 | Wuhan, Huangshi, Ezhou, Huanggang, Xiaogan, Xianning, Xiangyang, Yichang, Jinzhou, Jinmen, Changsha, Zhuzhou, Xiangtan, Yueyang, Yiyang, Changde, Hengyang, Loudi, Nanchang, Jiujiang, Jingdezhen, Yingtan, Xinyu, Yichun, Pingxiang, Shangrao, Fuzhou, and Ji’an |

| YRD | 27 | Shanghai, Nanjing, Wuxi, Changzhou, Suzhou, Nantong, Yangzhou, Zhenjiang, Yancheng, Taizhou (in Jiangsu), Hangzhou, Ningbo, Wenzhou, Huzhou, Jiaxing, Shaoxing, Jinhua, Zhoushan, Taizhou (in Zhejiang), Hefei, Wuhu, Ma’anshan, Tongling, Anqing, Chuzhou, Chizhou, and Xuanchng |

| CC | 16 | Chengdu, Chongqing, Zigong, Luzhou, Deyang, Suijing, Neijiang, Leshan, Nanchong, Meishan, Yibin, Guang’an, Ziyang, Mianyang, Dazhou, and Ya’an |

| BTH | 11 | Beijing, Tianjin, Shijiazhuang, Tangshan, Baoding, Qinhuangdao, Langfang, Cangzhou, Chengde, Zhangjiakou, and Hengshui |

| GHM | 11 | Guangzhou, Shenzhen, Foshan, Dongguan, Zhongshan, Zhuhai, Jiangmen, Zhaoqing, Huizhou, Hongkang *, and Macau * |

| HC | 11 | Harbin, Daqing, Tsitsihar, Suihua, Mudanjiang, Changchun, Jilin, Siping, Liaoyuan, Songyuan, and Yanbian |

| BG | 10 | Nanning, Beihai, Qinzhou, Fangchenggang, Yulin, Chongzuo, Zhanjiang, Maoming, Yangjiang, and Haikou |

| Year | Rank-Size Function | Primary City | R2 | D |

|---|---|---|---|---|

| 2007 | Xiamen | 0.97 | 1.90 | |

| 2008 | Xiamen | 0.93 | 2.00 | |

| 2009 | Xiamen | 0.97 | 1.59 | |

| 2010 | Sanya | 0.96 | 1.88 | |

| 2011 | Wenzhou | 0.95 | 2.06 | |

| 2012 | Sanya | 0.91 | 2.11 | |

| 2013 | Beijing | 0.93 | 1.79 | |

| 2014 | Beijing | 0.96 | 1.60 | |

| 2015 | Beijing | 0.97 | 1.31 | |

| 2016 | Shenzhen | 0.93 | 1.37 | |

| 2017 | Shenzhen | 0.98 | 1.23 | |

| 2018 | Shenzhen | 0.97 | 1.52 | |

| 2019 | Shenzhen | 0.96 | 1.45 |

| Year | Non-Scale Area I | Non-Scale Area II | Land-Price Rank of the Turning Point | Land Price of the Turning Point (yuan/m2) | ||

|---|---|---|---|---|---|---|

| Fitted Function | R2 | Fitted Function | R2 | |||

| 2007 | 0.97 | 0.85 | 280.42 | 165.06 | ||

| 2008 | 0.96 | 0.75 | 287.48 | 184.30 | ||

| 2009 | 0.98 | 0.70 | 276.54 | 194.46 | ||

| 2010 | 0.98 | 0.85 | 240.52 | 288.27 | ||

| 2011 | 0.95 | 0.80 | 269.44 | 284.64 | ||

| 2012 | 0.95 | 0.88 | 264.58 | 305.35 | ||

| 2013 | 0.99 | 0.80 | 256.48 | 358.31 | ||

| 2014 | 0.98 | 0.85 | 262.53 | 356.26 | ||

| 2015 | 0.98 | 0.93 | 259.31 | 333.13 | ||

| 2016 | 0.99 | 0.89 | 262.57 | 335.20 | ||

| 2017 | 0.99 | 0.89 | 249.54 | 382.59 | ||

| 2018 | 0.98 | 0.86 | 244.57 | 525.85 | ||

| 2019 | 0.99 | 0.93 | 239.63 | 546.37 | ||

| Urban Agglomerations | Rank-Size Function | Primary City | R2 | D |

|---|---|---|---|---|

| GHM | Shenzhen | 0.99 | 0.78 | |

| BTH | Beijing | 0.99 | 0.48 | |

| YRD | Shanghai | 0.89 | 1.54 | |

| MRY | Wuhan | 0.97 | 1.47 | |

| BG | Haikou | 0.96 | 1.09 | |

| CC | Chengdu | 0.90 | 2.29 | |

| CP | Zhengzhou | 0.96 | 2.41 | |

| HC | Harbin | 0.87 | 1.06 |

| Urban Agglomeration | q | D | |

|---|---|---|---|

| BTH | 0.168 | −0.083 | 1724.846 |

| GHM | 0.063 | −0.063 | 1686.245 |

| BG | 0.055 | −0.083 | 342.308 |

| HC | 0.031 | −0.069 | 96.638 |

| YRD | 0.024 | −0.059 | 765.020 |

| MRY | 0.022 | −0.079 | 309.772 |

| CP | 0.007 | −0.036 | 168.481 |

| CC | −0.006 | 0.019 | 194.159 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Xin, L. Evolution of the Structure of the Urban Land-Price System in China Based on the Rank-Size Law. Land 2022, 11, 284. https://doi.org/10.3390/land11020284

Liu X, Xin L. Evolution of the Structure of the Urban Land-Price System in China Based on the Rank-Size Law. Land. 2022; 11(2):284. https://doi.org/10.3390/land11020284

Chicago/Turabian StyleLiu, Xiaoyu, and Liangjie Xin. 2022. "Evolution of the Structure of the Urban Land-Price System in China Based on the Rank-Size Law" Land 11, no. 2: 284. https://doi.org/10.3390/land11020284

APA StyleLiu, X., & Xin, L. (2022). Evolution of the Structure of the Urban Land-Price System in China Based on the Rank-Size Law. Land, 11(2), 284. https://doi.org/10.3390/land11020284